|

|

市場調査レポート

商品コード

1769084

燃料電池の世界市場:タイプ別、コンポーネント別、規模別、燃料タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測Fuel Cell Market by Type, Application, End User, Size, Fuel Type, Component and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 燃料電池の世界市場:タイプ別、コンポーネント別、規模別、燃料タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月08日

発行: MarketsandMarkets

ページ情報: 英文 349 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の燃料電池の市場規模は、2025年の56億6,000万米ドルから2030年には181億6,000万米ドルに達し、26.3%のCAGRで拡大すると予測されています。

世界の燃料電池市場は、輸送、発電、産業用途の低排出で持続可能なエネルギー・ソリューションへの転換が進む傾向に牽引され、成長軌道に乗っています。現在の支持的な広範な政治環境、脱炭素化目標、水素インフラが、導入レベルの拡大を可能にしています。燃料電池技術は進歩しており、効率の向上、新素材の開発、コスト削減につながっています。この進歩により、燃料電池は先進国だけでなく、他の地域にも拡大していくと思われます。需要が高まるにつれ、大手企業は製造、パートナーシップ、より包括的なサービス・オプションを通じて世界のプレゼンスを高めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(100万米ドル)/数量(MW) |

| セグメント別 | タイプ別、コンポーネント別、規模別、燃料タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

固体酸化物セグメントは、消費者がより低排出ガスで高効率の発電代替品や長期間使用可能な据置型エネルギーシステムを求めるにつれて拡大しています。固体酸化物燃料電池は、その高い電気効率と柔軟な燃料オプションにより、商業用、産業用、大規模ユーティリティ用途において、長時間、分散型、継続的な電力を供給する鍵となります。この成長分野では、セラミック材料、熱管理、システム設計の開発によって耐久性と運転コストが改善され、その恩恵を受けています。さらに、脱炭素化への世界の動きの中で、再生可能な水素源を利用できる熱電併給(CHP)システムと統合できるようになったため、これらの発電システムはより広く採用されるようになっています。これらの燃料電池は、水素、天然ガス、バイオガスなど、さまざまな種類の燃料で作動させることができます。これらの燃料電池は、エネルギー転換を支援する効果的な技術であると同時に、よりクリーンで強靭な電力インフラを提供します。

燃料電池市場のスタック・セグメントは、水素と酸素が電気化学反応を起こして電気、水、熱を生成するため、極めて重要です。スタック・セグメントの主要コンポーネントには、膜電極アセンブリ(MEA)、バイポーラ・プレート、ガス拡散層、シーラントが含まれ、これらはすべて導電性、耐久性、熱管理を最適化するように設計されています。この分野は、据置型、移動型、携帯型用途向けの、統合された効率的で高性能なシステムに対する需要の高まりにより急速に拡大しています。この需要は、クリーンエネルギー技術の開発、商業化、スケールアップに関連しており、それにより世界のクリーンエネルギー移行における燃料電池市場全体を強化しています。スタック部門は、高い材料費と加工費から生じる資本支出(CAPEX)、およびライフサイクル・メンテナンスとスタック交換を含む運用支出の大部分を占めています。さらに、スタック製品の性能は、燃料電池システムの効率、寿命、コスト競争力に影響を与える重要な要因です。

アジア太平洋は、世界の燃料電池市場において主要な地域に開拓されつつあります。同地域では、エネルギー需要、クリーンエネルギー技術に対する政府の積極的な支援、水素インフラへの投資が一体となっています。輸送、プロセス、分散型電源システムの脱炭素化への関心が高まっており、燃料電池市場は急成長を遂げています。日本、韓国、中国はいずれも、国家水素戦略を策定し、住宅・モビリティ分野での活動から商業分野での大規模利用へとつなげる燃料電池ロードマップの実施に着手しています。日本は現在、この分野をリードしており、住宅への燃料電池システムの配備や、国家的なエネファーム・プログラムが、エンドユーザーへの適用成功を実証しています。韓国は、公共施設規模の燃料電池発電所と公共交通機関用の水素エネルギーに多額の投資を準備しています。一方、中国は、さまざまな補助金やパイロット・プログラムを通じて燃料電池自動車(FCV)の大幅な普及に向けた準備を進めており、同国を同産業の主要製造拠点として位置づけています。インドは、さまざまな政策や研究開発努力を通じて政府の自信を示す「国家グリーン水素ミッション」などのイニシアティブにより、このチャンスをつかむことを目指しています。地域協力、新たな政策枠組み、官民投資の増加によってもたらされる機会を総合すると、アジア太平洋地域は燃料電池の商業化と技術革新の原動力となることが期待されます。

Bloom Energy(米国)、Plug Power Inc.(米国)、AISIN CORPORATION(日本)、Ballard Power Systems(カナダ)、FuelCell Energy, Inc.(米国)、KYOCERA Corporation(日本)、Doosan Fuel Cell(韓国)、Cummins Inc.(日本)、ElringKlinger AG(ドイツ)、TOSHIBA CORPORATION(日本)、Nedstack Fuel Cell Technology BV(オランダ)、PowerCell Sweden AB(スウェーデン)、SFC Energy AG(ドイツ)、AFC Energy(英国)、Fuji Electric (日本)、Intelligent Energy Limited(英国)、Horizon Fuel Cell Technologies(シンガポール)、Hyster-Yale Materials Handling, Inc.(米国)、AVL(オーストリア)、ADELAN(英国)、Ecospray Technologies S.r.l.(イタリア)、Special Power Sources(米国)が燃料電池市場の主要参入企業です。当調査では、燃料電池市場におけるこれら主要企業の企業プロファイル、最近の動向、主な市場戦略など、詳細な競合分析を行っています。

当レポートでは、燃料電池市場をタイプ別(プロトン交換膜、固体酸化物、リン酸、アルカリ、微生物、ダイレクトメタノール、その他)、燃料タイプ別(水素、アンモニア、メタノール、エタノール、その他)、コンポーネント別(スタック、バランス・オブ・プラント)、用途別(ポータブル、据置型、燃料電池車)、規模別(小、大)、エンドユーザー別(住宅、商業・工業、輸送、データセンター、軍事・防衛、公益事業、政府・自治体機関)、地域別(北米、欧州、アジア太平洋、その他の地域)に分析しています。当レポートの調査範囲は、燃料電池市場の成長に影響を与える促進要因・課題、市場促進要因・課題などの主な要因に関する詳細情報を網羅しています。主な業界参入企業を徹底的に分析することで、その事業概要、ソリューション、サービス、契約、パートナーシップ、合意、拡大、製品発売、提携、買収などの主要戦略、燃料電池市場に関連する最近の動向に関する洞察を提供しています。当レポートは、燃料電池市場のエコシステムにおける今後の新興企業の競合分析をカバーしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- AI/生成AIが燃料電池市場に与える影響

- 世界マクロ経済見通し

- 2025年の米国関税が燃料電池市場に与える影響

第6章 燃料電池市場(タイプ別)

- イントロダクション

- プロトン交換膜

- 固体酸化物

- リン酸

- アルカリ

- 微生物

- 直接メタノール

- その他

第7章 燃料電池市場(コンポーネント別)

- イントロダクション

- スタック

- バランス・オブ・プラント(BOS)

第8章 燃料電池市場(規模別)

- イントロダクション

- 小規模(200kW未満)

- 大規模(200kW以上)

第9章 燃料電池市場(燃料タイプ別)

- イントロダクション

- 水素

- アンモニア

- メタノール

- その他

第10章 燃料電池市場(用途別)

- イントロダクション

- 可動型

- 据置型

- 燃料電池車

第11章 燃料電池市場(エンドユーザー別)

- イントロダクション

- 住宅

- 商業および工業

- 輸送

- データセンター

- 軍事・防衛

- 公益事業および政府/地方自治体機関

第12章 燃料電池市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- その他

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- イタリア

- その他

- その他の地域

- 中東・アフリカ

- ラテンアメリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

第14章 企業プロファイル

- 主要参入企業

- BLOOM ENERGY

- PLUG POWER INC.

- AISIN CORPORATION

- DOOSAN FUEL CELL CO., LTD.

- SFC ENERGY AG

- BALLARD POWER SYSTEMS

- FUELCELL ENERGY, INC.

- KYOCERA CORPORATION

- CUMMINS INC.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- TOSHIBA CORPORATION

- NEDSTACK FUEL CELL TECHNOLOGY

- ELRINGKLINGER AG

- POWERCELL SWEDEN AB

- AFC ENERGY

- FUJI ELECTRIC CO., LTD.

- その他の企業

- INTELLIGENT ENERGY LIMITED

- HORIZON FUEL CELL TECHNOLOGIES

- HYSTER-YALE MATERIALS HANDLING, INC.

- ADELAN

- MICRORGANIC TECHNOLOGIES

- AVL

- WATT FUEL CELL

- PROTON MOTOR FUEL CELL GMBH

- ECOSPRAY TECHNOLOGIES S.R.L.

- SPECIAL POWER SOURCES

- GENCELL LTD.

- VERSOGEN

- AQUACYCL

- SOLYDERA SPA

第15章 付録

List of Tables

- TABLE 1 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 2 KEY DATA FROM PRIMARY SOURCES

- TABLE 3 FUEL CELL MARKET SNAPSHOT

- TABLE 4 POLICIES TO STIMULATE HYDROGEN USE IN MAJOR ECONOMIES

- TABLE 5 AVERAGE SELLING PRICE TREND OF FUEL CELLS, BY TYPE, 2020-2024 (USD/KW)

- TABLE 6 PRICING RANGE OF FUEL CELLS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KW)

- TABLE 7 AVERAGE SELLING PRICE TREND OF FUEL CELLS, BY REGION, 2020-2024 (USD/KW)

- TABLE 8 COST SUMMARY FOR PROTON-EXCHANGE MEMBRANE (PEM) STACK COMPONENTS, 2018-2022 (USD)

- TABLE 9 COST SUMMARY FOR PEM BALANCE OF PLANT (BOP) COMPONENTS, 2018-2022 (USD)

- TABLE 10 COST SUMMARY FOR 80-KW FUEL CELL VEHICLES, 2018-2024 (USD)

- TABLE 11 COST SUMMARY FOR 160-KW MEDIUM-DUTY FUEL CELL VEHICLES, 2018-2024 (USD)

- TABLE 12 ROLE OF COMPANIES IN FUEL CELL MARKET ECOSYSTEM

- TABLE 13 LIST OF KEY PATENTS, 2024-2025

- TABLE 14 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REGULATIONS

- TABLE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 24 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 27 FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 28 FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 30 FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 31 PROTON-EXCHANGE MEMBRANE: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 PROTON-EXCHANGE MEMBRANE: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 PROTON-EXCHANGE MEMBRANE: FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 34 PROTON-EXCHANGE MEMBRANE: FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 35 PROTON-EXCHANGE MEMBRANE: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 36 PROTON-EXCHANGE MEMBRANE: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 SOLID OXIDE: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 SOLID OXIDE: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 SOLID OXIDE: FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 40 SOLID OXIDE: FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 41 SOLID OXIDE: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 42 SOLID OXIDE: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 PHOSPHORIC ACID: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 PHOSPHORIC ACID: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 PHOSPHORIC ACID: FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 46 PHOSPHORIC ACID: FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 47 PHOSPHORIC ACID: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 48 PHOSPHORIC ACID: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 ALKALINE: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 ALKALINE: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 ALKALINE: FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 52 ALKALINE: FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 53 ALKALINE: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 54 ALKALINE: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 MICROBIAL: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 MICROBIAL: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MICROBIAL: FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 58 MICROBIAL: FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 59 MICROBIAL: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 60 MICROBIAL: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 DIRECT METHANOL: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 DIRECT METHANOL: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 DIRECT METHANOL: FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 64 DIRECT METHANOL: FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 65 DIRECT METHANOL: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 66 DIRECT METHANOL: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 FUEL CELL MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 68 FUEL CELL MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 69 STACK: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 STACK: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 BALANCE OF PLANT (BOS): FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 BALANCE OF PLANT (BOS): FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 74 FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 75 SMALL-SCALE (UP TO 200 KW): FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 SMALL-SCALE (UP TO 200 KW): FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 LARGE-SCALE (ABOVE 200 KW): FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 LARGE-SCALE (ABOVE 200 KW): FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 FUEL CELL MARKET, BY FUEL TYPE, 2020-2024 (USD MILLION)

- TABLE 80 FUEL CELL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 81 FUEL CELL MARKET: BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 82 FUEL CELL MARKET: BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 PORTABLE: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 PORTABLE: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 STATIONARY: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 STATIONARY: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 STATIONARY: FUEL CELL MARKET, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 88 STATIONARY: FUEL CELL MARKET, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 89 STATIONARY: FUEL CELL MARKET FOR PRIMARY POWER GENERATION SYSTEMS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 STATIONARY: FUEL CELL MARKET FOR PRIMARY POWER GENERATION SYSTEMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 STATIONARY: FUEL CELL MARKET FOR BACKUP POWER SYSTEMS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 STATIONARY: FUEL CELL MARKET FOR BACKUP POWER SYSTEMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 STATIONARY: FUEL CELL MARKET FOR CHP SYSTEMS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 STATIONARY: FUEL CELL MARKET FOR CHP SYSTEMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 FUEL CELL VEHICLES: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 FUEL CELL VEHICLES: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 FUEL CELL VEHICLES: FUEL CELL MARKET, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 98 FUEL CELL VEHICLES: FUEL CELL MARKET, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 99 PASSENGER LIGHT-DUTY FUEL CELL VEHICLES: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 PASSENGER LIGHT-DUTY FUEL CELL VEHICLES: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 FUEL CELL BUSES: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 FUEL CELL BUSES: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 FUEL CELL TRUCKS: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 FUEL CELL TRUCKS: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 OTHER FUEL CELL VEHICLES: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 OTHER FUEL CELL VEHICLES: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 108 FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 RESIDENTIAL: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 RESIDENTIAL: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 COMMERCIAL & INDUSTRIAL: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 COMMERCIAL & INDUSTRIAL: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 TRANSPORTATION: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 TRANSPORTATION: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 DATA CENTERS: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 116 DATA CENTERS: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 MILITARY & DEFENSE: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 MILITARY & DEFENSE: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 UTILITIES & GOVERNMENT/MUNICIPAL INSTITUTES: FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 120 UTILITIES & GOVERNMENT/MUNICIPAL INSTITUTES: FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 FUEL CELL MARKET, BY REGION, 2020-2024 (MW)

- TABLE 122 FUEL CELL MARKET, BY REGION, 2025-2030 (MW)

- TABLE 123 FUEL CELL MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 124 FUEL CELL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 126 ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 127 ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: FUEL CELL MARKET, BY COUNTRY, 2020-2024 (MW)

- TABLE 140 ASIA PACIFIC: FUEL CELL MARKET, BY COUNTRY, 2025-2030 (MW)

- TABLE 141 ASIA PACIFIC: FUEL CELL MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: FUEL CELL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 CHINA: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 144 CHINA: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 145 CHINA: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 146 CHINA: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 CHINA: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 148 CHINA: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 149 CHINA: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 150 CHINA: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 CHINA: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 152 CHINA: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 154 JAPAN: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 155 JAPAN: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 156 JAPAN: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 JAPAN: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 158 JAPAN: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 159 JAPAN: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 160 JAPAN: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 161 JAPAN: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 162 JAPAN: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH KOREA: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 164 SOUTH KOREA: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 165 SOUTH KOREA: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 166 SOUTH KOREA: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 168 SOUTH KOREA: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 170 SOUTH KOREA: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH KOREA: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 172 SOUTH KOREA: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 174 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 175 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 184 NORTH AMERICA: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 185 NORTH AMERICA: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 186 NORTH AMERICA: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 188 NORTH AMERICA: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 190 NORTH AMERICA: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 191 NORTH AMERICA: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 192 NORTH AMERICA: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 194 NORTH AMERICA: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 195 NORTH AMERICA: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 196 NORTH AMERICA: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 197 NORTH AMERICA: FUEL CELL MARKET, BY COUNTRY, 2020-2024 (MW)

- TABLE 198 NORTH AMERICA: FUEL CELL MARKET, BY COUNTRY, 2025-2030 (MW)

- TABLE 199 NORTH AMERICA: FUEL CELL MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 200 NORTH AMERICA: FUEL CELL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 US: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 202 US: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 203 US: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 204 US: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 205 US: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 206 US: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 207 US: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 208 US: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 209 US: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 210 US: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 CANADA: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 212 CANADA: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 213 CANADA: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 214 CANADA: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 215 CANADA: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 216 CANADA: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 217 CANADA: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 218 CANADA: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 219 CANADA: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 220 CANADA: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 221 EUROPE: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 222 EUROPE: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 223 EUROPE: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 224 EUROPE: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 225 EUROPE: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 226 EUROPE: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 227 EUROPE: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 228 EUROPE: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 229 EUROPE: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 230 EUROPE: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 231 EUROPE: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 232 EUROPE: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 233 EUROPE: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 234 EUROPE: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 235 EUROPE: FUEL CELL MARKET, BY COUNTRY, 2020-2024 (MW)

- TABLE 236 EUROPE: FUEL CELL MARKET, BY COUNTRY, 2025-2030 (MW)

- TABLE 237 EUROPE: FUEL CELL MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 238 EUROPE: FUEL CELL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 239 UK: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 240 UK: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 241 UK: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 242 UK: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 243 UK: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 244 UK: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 245 UK: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 246 UK: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 247 UK: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 248 UK: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 GERMANY: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 250 GERMANY: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 251 GERMANY: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 252 GERMANY: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 253 GERMANY: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 254 GERMANY: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 255 GERMANY: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 256 GERMANY: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 257 GERMANY: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 258 GERMANY: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 259 ITALY: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 260 ITALY: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 261 ITALY: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 262 ITALY: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 263 ITALY: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 264 ITALY: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 265 ITALY: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 266 ITALY: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 267 ITALY: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 268 ITALY: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 269 REST OF EUROPE: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 270 REST OF EUROPE: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 271 REST OF EUROPE: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 272 REST OF EUROPE: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 273 REST OF EUROPE: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 274 REST OF EUROPE: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 275 REST OF EUROPE: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 276 REST OF EUROPE: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 277 REST OF EUROPE: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 278 REST OF EUROPE: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 279 ROW: FUEL CELL MARKET, BY TYPE, 2020-2024 (MW)

- TABLE 280 ROW: FUEL CELL MARKET, BY TYPE, 2025-2030 (MW)

- TABLE 281 ROW: FUEL CELL MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 282 ROW: FUEL CELL MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 283 ROW: FUEL CELL MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 284 ROW: FUEL CELL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 285 ROW: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 286 ROW: FUEL CELL MARKET FOR STATIONARY, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 287 ROW: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2020-2024 (USD MILLION)

- TABLE 288 ROW: FUEL CELL MARKET FOR FUEL CELL VEHICLES, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 289 ROW: FUEL CELL MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 290 ROW: FUEL CELL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 291 ROW: FUEL CELL MARKET, BY SIZE, 2020-2024 (USD MILLION)

- TABLE 292 ROW: FUEL CELL MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 293 FUEL CELL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, APRIL 2020-MAY 2025

- TABLE 294 FUEL CELL MARKET: DEGREE OF COMPETITION, 2024

- TABLE 295 FUEL CELL MARKET: REGION FOOTPRINT

- TABLE 296 FUEL CELL MARKET: TYPE FOOTPRINT

- TABLE 297 FUEL CELL MARKET: APPLICATION FOOTPRINT

- TABLE 298 FUEL CELL MARKET: END USER FOOTPRINT

- TABLE 299 FUEL CELL MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 300 FUEL CELL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 301 FUEL CELL MARKET: PRODUCT LAUNCHES, APRIL 2020-MAY 2025

- TABLE 302 FUEL CELL MARKET: DEALS, APRIL 2020-MAY 2025

- TABLE 303 FUEL CELL MARKET: EXPANSIONS, APRIL 2020-MAY 2025

- TABLE 304 FUEL CELL MARKET: OTHER DEVELOPMENTS, APRIL 2020-MAY 2025

- TABLE 305 BLOOM ENERGY: COMPANY OVERVIEW

- TABLE 306 BLOOM ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 BLOOM ENERGY: PRODUCT LAUNCHES

- TABLE 308 BLOOM ENERGY: DEALS

- TABLE 309 BLOOM ENERGY: OTHER DEVELOPMENTS

- TABLE 310 PLUG POWER INC.: COMPANY OVERVIEW

- TABLE 311 PLUG POWER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 PLUG POWER INC.: PRODUCT LAUNCHES

- TABLE 313 PLUG POWER INC.: DEALS

- TABLE 314 PLUG POWER INC.: EXPANSIONS

- TABLE 315 PLUG POWER INC.: OTHER DEVELOPMENTS

- TABLE 316 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 317 AISIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 AISIN CORPORATION: DEALS

- TABLE 319 DOOSAN FUEL CELL CO., LTD.: COMPANY OVERVIEW

- TABLE 320 DOOSAN FUEL CELL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 DOOSAN FUEL CELL CO., LTD.: DEALS

- TABLE 322 DOOSAN FUEL CELL CO., LTD.: EXPANSIONS

- TABLE 323 DOOSAN FUEL CELL CO., LTD.: OTHER DEVELOPMENTS

- TABLE 324 SFC ENERGY AG: COMPANY OVERVIEW

- TABLE 325 SFC ENERGY AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 SFC ENERGY AG: DEALS

- TABLE 327 SFC ENERGY AG: OTHER DEVELOPMENTS

- TABLE 328 BALLARD POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 329 BALLARD POWER SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 BALLARD POWER SYSTEMS: PRODUCT LAUNCHES

- TABLE 331 BALLARD POWER SYSTEMS: DEALS

- TABLE 332 BALLARD POWER SYSTEMS: OTHER DEVELOPMENTS

- TABLE 333 FUELCELL ENERGY, INC.: COMPANY OVERVIEW

- TABLE 334 FUELCELL ENERGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 FUELCELL ENERGY, INC.: DEALS

- TABLE 336 FUELCELL ENERGY, INC.: OTHER DEVELOPMENTS

- TABLE 337 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 338 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 CUMMINS INC.: COMPANY OVERVIEW

- TABLE 340 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 CUMMINS INC.: DEALS

- TABLE 342 CUMMINS INC.: EXPANSIONS

- TABLE 343 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 344 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 345 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEVELOPMENTS

- TABLE 346 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 347 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 TOSHIBA CORPORATION: DEALS

- TABLE 349 TOSHIBA CORPORATION: OTHER DEVELOPMENTS

- TABLE 350 NEDSTACK FUEL CELL TECHNOLOGY: COMPANY OVERVIEW

- TABLE 351 NEDSTACK FUEL CELL TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 NEDSTACK FUEL CELL TECHNOLOGY: DEALS

- TABLE 353 ELRINGKLINGER AG: COMPANY OVERVIEW

- TABLE 354 ELRINGKLINGER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 ELRINGKLINGER AG: DEALS

- TABLE 356 ELRINGKLINGER AG: OTHER DEVELOPMENTS

- TABLE 357 POWERCELL SWEDEN AB: COMPANY OVERVIEW

- TABLE 358 POWERCELL SWEDEN AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 POWERCELL SWEDEN AB: PRODUCT LAUNCHES

- TABLE 360 POWERCELL SWEDEN AB: DEALS

- TABLE 361 POWERCELL SWEDEN AB: OTHER DEVELOPMENTS

- TABLE 362 AFC ENERGY: COMPANY OVERVIEW

- TABLE 363 AFC ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 AFC ENERGY: DEALS

- TABLE 365 AFC ENERGY: EXPANSIONS

- TABLE 366 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 367 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 368 INTELLIGENT ENERGY LIMITED: COMPANY OVERVIEW

- TABLE 369 HORIZON FUEL CELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 370 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY OVERVIEW

- TABLE 371 ADELAN: COMPANY OVERVIEW

- TABLE 372 MICRORGANIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 373 AVL: COMPANY OVERVIEW

- TABLE 374 WATT FUEL CELL: COMPANY OVERVIEW

- TABLE 375 PROTON MOTOR FUEL CELL GMBH: COMPANY OVERVIEW

- TABLE 376 ECOSPRAY TECHNOLOGIES S.R.L.: COMPANY OVERVIEW

- TABLE 377 SPECIAL POWER SOURCES: COMPANY OVERVIEW

- TABLE 378 GENCELL LTD.: COMPANY OVERVIEW

- TABLE 379 VERSOGEN: COMPANY OVERVIEW

- TABLE 380 AQUACYCL: COMPANY OVERVIEW

- TABLE 381 SOLYDERA SPA: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FUEL CELL MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FUEL CELL MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 FUEL CELL MARKET: BOTTOM-UP APPROACH

- FIGURE 7 FUEL CELL MARKET: TOP-DOWN APPROACH

- FIGURE 8 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR FUEL CELLS

- FIGURE 9 REGIONAL ANALYSIS

- FIGURE 10 COUNTRY ANALYSIS

- FIGURE 11 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF FUEL CELLS

- FIGURE 12 FUEL CELL MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 13 INDUSTRY CONCENTRATION, 2024

- FIGURE 14 FUEL CELL MARKET: DATA TRIANGULATION

- FIGURE 15 FUEL CELL MARKET: RESEARCH LIMITATIONS

- FIGURE 16 ASIA PACIFIC HELD LARGEST SHARE OF FUEL CELL MARKET IN 2024

- FIGURE 17 SOLID OXIDE SEGMENT TO DOMINATE FUEL CELL MARKET DURING FORECAST PERIOD

- FIGURE 18 STATIONARY APPLICATION TO HOLD LARGEST SHARE OF FUEL CELL MARKET IN 2030

- FIGURE 19 TRANSPORTATION SEGMENT TO DOMINATE FUEL CELL MARKET FROM 2025 TO 2030

- FIGURE 20 SMALL-SCALE (UP TO 200 KW) SEGMENT TO EXHIBIT HIGHER CAGR BETWEEN 2025 AND 2030

- FIGURE 21 GOVERNMENT SUBSIDIES TO IMPROVE CLEAN ENERGY INFRASTRUCTURE TO BOOST FUEL CELL MARKET GROWTH BETWEEN 2025 AND 2030

- FIGURE 22 ASIA PACIFIC TO RECORD HIGHEST CAGR IN FUEL CELL MARKET DURING FORECAST PERIOD

- FIGURE 23 SOLID OXIDE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 24 STATIONARY SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 25 TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 26 SMALL-SCALE (UP TO 200 KW) SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 27 STATIONARY SEGMENT AND CHINA HOLD LARGEST SHARES OF ASIA PACIFIC FUEL CELL MARKET IN 2025

- FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

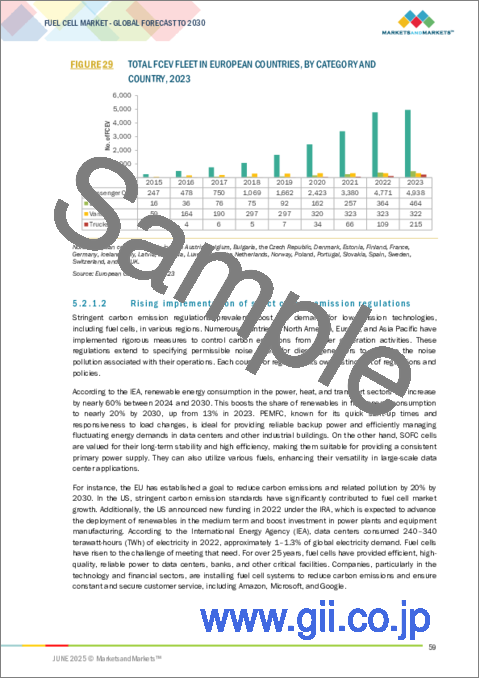

- FIGURE 29 TOTAL FCEV FLEET IN EUROPEAN COUNTRIES, BY CATEGORY AND COUNTRY, 2023

- FIGURE 30 PLATINUM PRICES IN US, 2024

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 AVERAGE SELLING PRICE TREND OF FUEL CELLS, BY TYPE, 2020-2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF FUEL CELLS, BY REGION, 2020-2024

- FIGURE 34 SUPPLY CHAIN ANALYSIS

- FIGURE 35 FUEL CELL ECOSYSTEM

- FIGURE 36 PATENT APPLIED AND GRANTED, 2015-2024

- FIGURE 37 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 38 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 39 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 41 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 42 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 43 IMPACT OF AI/GEN AI ON FUEL CELL SUPPLY CHAIN, BY REGION

- FIGURE 44 SOLID OXIDE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 45 BALANCE OF PLANT (BOP) SEGMENT CAPTURED LARGEST SHARE OF FUEL CELL MARKET IN 2024

- FIGURE 46 SMALL-SCALE (UP TO 200 KW) SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 47 HYDROGEN SEGMENT HELD LARGEST MARKET SHARE IN 2024

- FIGURE 48 STATIONARY SEGMENT HELD LARGEST SHARE OF FUEL CELL MARKET IN 2024

- FIGURE 49 TRANSPORTATION SEGMENT HELD LARGEST SHARE OF FUEL CELL MARKET IN 2024

- FIGURE 50 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN FUEL CELL MARKET FROM 2025 TO 2030

- FIGURE 51 FUEL CELL MARKET SHARE, BY REGION, 2024

- FIGURE 52 ASIA PACIFIC: FUEL CELL MARKET SNAPSHOT

- FIGURE 53 EUROPE: FUEL CELL MARKET SNAPSHOT

- FIGURE 54 MARKET SHARE ANALYSIS OF COMPANIES OFFERING FUEL CELL TECHNOLOGIES, 2024

- FIGURE 55 FUEL CELL MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 56 COMPANY VALUATION

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 58 PRODUCT COMPARISON

- FIGURE 59 FUEL CELL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 60 FUEL CELL MARKET: MARKET FOOTPRINT

- FIGURE 61 FUEL CELL MARKET: COMPANY FOOTPRINT

- FIGURE 62 FUEL CELL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 BLOOM ENERGY: COMPANY SNAPSHOT

- FIGURE 64 PLUG POWER INC.: COMPANY SNAPSHOT

- FIGURE 65 AISIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 DOOSAN FUEL CELL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 SFC ENERGY AG: COMPANY SNAPSHOT

- FIGURE 68 BALLARD POWER SYSTEMS: COMPANY SNAPSHOT

- FIGURE 69 FUELCELL ENERGY, INC.: COMPANY SNAPSHOT

- FIGURE 70 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 CUMMINS INC.: COMPANY SNAPSHOT

- FIGURE 72 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 73 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 ELRINGKLINGER AG: COMPANY SNAPSHOT

- FIGURE 75 POWERCELL SWEDEN AB: COMPANY SNAPSHOT

- FIGURE 76 AFC ENERGY: COMPANY SNAPSHOT

- FIGURE 77 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

The global fuel cell market is projected to reach USD 18.16 billion by 2030 from USD 5.66 billion in 2025, registering a CAGR of 26.3%. The global fuel cell market is on a growth trajectory driven by the increasing trend of switching to low-emission and sustainable energy solutions for transportation, power generation, and industrial uses. The current supportive broader political environment, decarbonization targets, and hydrogen infrastructure are enabling expansion in the level of adoption. Fuel cell technology is advancing, leading to improved efficiencies, the development of new materials, and reduced costs. This progress will allow it to expand beyond industrialized nations into other regions. As demand rises, major organizations are increasing their global presence through manufacturing, partnerships, and more comprehensive service options.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million)/Volume (MW) |

| Segments | by type, Fuel type, Component, Application, Size, and End User |

| Regions covered | North America, Europe, Asia Pacific, RoW |

"Solid oxide segment, by type, to be fastest-growing market from 2025 to 2030"

The solid oxide segment, by type, is expanding as consumers seek more low-emission, high-efficiency power generation alternatives and stationary energy systems that can last a prolonged duration. Solid oxide fuel cells are key to providing long-duration, distributed, and continual power in commercial, industrial, and large utility applications because of their high electrical efficiency and flexible fuel options. This growing vertical benefits from developments in ceramic materials, thermal management, and system design that have improved durability and operating costs. Furthermore, these power systems are being more widely adopted as they can now be integrated with combined heat and power (CHP) systems, which can use renewable sources of hydrogen, in the context of a global move to decarbonization. These fuel cells can operate on various fuel types, such as hydrogen, natural gas, and biogas. They are effective technologies to support the energy transition while providing cleaner and more resilient power infrastructure.

"Stack segment, by component, was second-largest market in 2024"

The stack segment of the fuel cell market is crucial because hydrogen and oxygen undergo an electrochemical reaction to produce electricity, water, and heat. Key components of the stack segment include the membrane electrode assembly (MEA), bipolar plates, gas diffusion layers, and sealants, all designed to optimize conductivity, durability, and heat management. This segment rapidly expands due to the growing demand for integrated, efficient, high-performance systems for stationary, mobile, and portable applications. This demand is linked to developing, commercializing, and scaling clean energy technologies, thereby enhancing the overall fuel cell market in the global clean energy transition. The stack segment represents a significant portion of capital expenditures (CAPEX), which arise from higher material and fabrication costs, and operational expenditures, including lifecycle maintenance and stack replacements. Additionally, the performance of stack products is a critical factor influencing the efficiency, lifetime, and cost competitiveness of fuel cell systems.

"Asia Pacific to account for largest share of fuel cell market throughout forecast period"

The Asia Pacific (APAC) region is developing into a major player in the global fuel cell market. It brings together energy demand, positive government support for clean energy technologies, and investment in hydrogen infrastructure in the region. Interest in the shift toward decarbonizing transportation, processes, and distributed power systems is increasing, and the fuel cell market is experiencing rapid growth. Japan, South Korea, and China have all begun to develop their national hydrogen strategies and implement fuel cell roadmaps that connect activities across residential and mobility sectors to large-scale utilization in the commercial sector. Japan is currently leading in this area, with the deployment of fuel cell systems in residences and the national ENE-FARM program demonstrating successful end-user applications. South Korea is preparing to invest heavily in utility-scale fuel cell power plants and hydrogen energy for public transportation. Meanwhile, China is gearing up for substantial rollouts of fuel cell vehicles (FCVs) through various subsidies and pilot programs, positioning the country as a major manufacturing hub in the industry. India aims to seize this opportunity with initiatives such as the National Green Hydrogen Mission, signaling governmental confidence through various policies and R&D efforts. Collectively, the opportunities presented by regional cooperation, emerging policy frameworks, and increasing public-private investment position the Asia Pacific region to become a driving force in the commercialization and innovation of fuel cells.

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 57%, Tier 2 - 29%, and Tier 3 - 14%

By Designation: C-level Executives - 35%, Directors - 20%, and Others - 45%

By Region: North America - 20%, Europe - 15%, Asia Pacific - 30%, Middle East & Africa - 25%, and South America - 10%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million. Others include sales managers, engineers, and regional managers.

Bloom Energy (US), Plug Power Inc. (US), AISIN CORPORATION (Japan), Ballard Power Systems (Canada), FuelCell Energy, Inc. (US), KYOCERA Corporation (Japan), Doosan Fuel Cell Co., Ltd. (South Korea), Cummins Inc. (US), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), ElringKlinger AG (Germany), TOSHIBA CORPORATION (Japan), Nedstack Fuel Cell Technology BV (Netherlands), PowerCell Sweden AB (Sweden), SFC Energy AG (Germany), AFC Energy (UK), Fuji Electric Co., Ltd. (Japan), Intelligent Energy Limited (UK), Horizon Fuel Cell Technologies (Singapore), Hyster-Yale Materials Handling, Inc. (US), AVL (Austria), ADELAN (UK), Ecospray Technologies S.r.l. (Italy), and Special Power Sources (US) are key players in the fuel cell market. The study includes an in-depth competitive analysis of these key players in the fuel cell market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report defines, describes, and forecasts the fuel cell market market, by type (proton exchange membrane, solid oxide, phosphoric acid, alkaline, microbial, direct methanol, other fuel cell types), fuel type (hydrogen, ammonia, methanol, ethanol, other fuel types), component (stack and balance of plant (bop), application (portable, stationary, and fuel cell vehciles), size (small-scale (up to 200 kw) and large-scale (above 200 kw)), end user (residential, commercial & industrial, transportation, data centers, military & defense, utilities & government/municipal institutes), and region (North America, Europe, Asia Pacific, and RoW). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing fuel cell market growth. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, expansions, product launches, collaborations, and acquisitions; and recent developments associated with the fuel cell market. This report covers the competitive analysis of upcoming startups in the fuel cell market ecosystem.

Key Benefits of Buying the Report:

- The report includes the analysis of key drivers (Burgeoning adoption of low-carbon vehicles to address climate change, rising implementation of strict carbon emission regulations, quicker refueling time and more extended range of FCEVs than BEVs, and growing emphasis on decarbonizing maritime industry), restraints (Requirement for expensive materials and complex manufacturing processes, high flammability of hydrogen), opportunities (Implementation of incentive programs to support distributed power generation, governments' focus on initiating hydrogen programs), and challenges (High adoption of BEVs with increasing investment in lithium-ion batteries, supply chain bottlenecks, and lack of infrastructure for hydrogen production and refueling.)

- Product Development/Innovation: Fuel cell manufacturers continually capitalize on new materials, automated production, and modular systems to optimize performance and cost. We see several new advancements in the fuel cell market, including AI-based performance monitoring, digital twin models to check stacks, and predictive maintenance to improve reliability and lifespan. The market is embracing emerging catalysts, low-platinum and non-platinum options, and advanced membranes to produce higher levels of efficiency and decreased environmental impact. These possibilities enable fuel cell companies to deliver high levels of performance, scalable and clean energy solutions in response to global decarbonization and distributed energy expectations.

- Market Development: In February 2025, Bloom Energy and Equinix signed a partnership deal for over 100 megawatts of fuel cell capacity across 19 Equinix data centers in six US states. Starting from a 1 MW pilot in 2015, the partnership now includes 75 MW operational and 30 MW under construction, providing cleaner, on-site power to meet the growing energy demands of AI-driven computing. Bloom's fuel cells offer reliable electricity with minimal environmental impact, enhancing Equinix's sustainability efforts and reducing reliance on traditional grid power. This report provides a detailed analysis of fuel cell manufacturers' strategies critical for project success, providing stakeholders with actionable insights into trends and opportunities for growth in the fuel cell market.

- Market Diversification: The report offers a comprehensive analysis of the strategies employed by manufacturers to facilitate market diversification. It outlines innovative products, operating models, and new partnership frameworks across various regions, which are underpinned by technology-driven business lines. The findings emphasize opportunities for expansion beyond traditional operations, identifying geographical areas and customer segments that are currently served but remain underserved and are suitable for strategic entry.

- Competitive Assessment: The report provides in-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Bloom Energy (US), Plug Power Inc. (US), AISIN CORPORATION (Japan), Ballard Power Systems (Canada), FuelCell Energy, Inc. (US), KYOCERA Corporation (Japan), Doosan Fuel Cell Co., Ltd. (South Korea), Cummins Inc. (US), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), ElringKlinger AG (Germany), TOSHIBA CORPORATION (Japan), Nedstack Fuel Cell Technology BV (Netherlands), PowerCell Sweden AB (Sweden), among others, in the fuel cell market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 SECONDARY AND PRIMARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key industry insights

- 2.2.2.3 Breakdown of primaries

- 2.2.2.4 Key data from primary sources

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Demand-side assumptions

- 2.3.3.2 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.4 FORECAST

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FUEL CELL MARKET

- 4.2 FUEL CELL MARKET, BY REGION

- 4.3 FUEL CELL MARKET, BY TYPE

- 4.4 FUEL CELL MARKET, BY APPLICATION

- 4.5 FUEL CELL MARKET, BY END USER

- 4.6 FUEL CELL MARKET, BY SIZE

- 4.7 FUEL CELL MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Burgeoning adoption of low-carbon vehicles to address climate change

- 5.2.1.2 Rising implementation of strict carbon emission regulations

- 5.2.1.3 Quicker refueling time and longer range of FCEVs than BEVs

- 5.2.1.4 Growing emphasis on decarbonizing maritime industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for expensive materials and complex manufacturing processes

- 5.2.2.2 High flammability of hydrogen

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Implementation of incentive programs to support distributed power generation

- 5.2.3.2 Governments' focus on initiating hydrogen programs

- 5.2.4 CHALLENGES

- 5.2.4.1 High adoption of BEVs with increasing investment in lithium-ion batteries

- 5.2.4.2 Supply chain bottlenecks and lack of infrastructure for hydrogen production and refueling

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF FUEL CELLS, BY TYPE, 2020-2024

- 5.4.2 PRICING RANGE OF FUEL CELLS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF FUEL CELLS, BY REGION, 2020-2024

- 5.4.4 PRICING TREND OF FUEL CELLS, BY COMPONENT, 2018-2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Reversible fuel cells

- 5.7.1.2 Anion-exchange membrane fuel cells

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Electrolyzers

- 5.7.2.2 Hydrogen refueling stations

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Battery electric vehicles

- 5.7.3.2 Hydrogen internal combustion engines (H2-ICE)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 WALMART IMPLEMENTS BLOOM ENERGY SERVER FUEL CELLS TO ADVANCE RENEWABLE ENERGY TARGETS

- 5.8.2 SOUTHERN LINC PARTNERS WITH PLUG POWER TO DEPLOY GENSURE HYDROGEN FUEL CELL BACKUP SYSTEMS TO PROVIDE CONTINUOUS SERVICES DURING OUTAGES

- 5.8.3 ENVIRONMENT AGENCY ADOPTS EFOY PRO DIRECT METHANOL FUEL CELL TO ENSURE POWER RELIABILITY

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 280410)

- 5.10.2 EXPORT SCENARIO (HS CODE 280410)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON FUEL CELL MARKET

- 5.16.1 IMPACT ON MANUFACTURING & PROCESS OPTIMIZATION

- 5.16.2 IMPACT ON SYSTEM MONITORING & OPERATION

- 5.16.3 IMPACT ON MAINTENANCE & LIFECYCLE MANAGEMENT

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 GOVERNMENT POLICIES AND SUBSIDIES

- 5.17.3 ENERGY TRANSITION AND DECARBONIZATION GOALS

- 5.17.4 INVESTMENT TRENDS AND PRIVATE SECTOR ACTIVITIES

- 5.17.5 ECONOMIC CHALLENGES AND RISKS

- 5.18 IMPACT OF 2025 US TARIFF ON FUEL CELL MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON APPLICATIONS

6 FUEL CELL MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 PROTON-EXCHANGE MEMBRANE

- 6.2.1 HIGH PREFERENCE IN TRANSPORTATION, PORTABLE POWER, AND SMALL-SCALE STATIONARY POWER APPLICATIONS TO DRIVE MARKET

- 6.3 SOLID OXIDE

- 6.3.1 HIGH EFFICIENCY AND LOW EMISSIONS TO ACCELERATE SEGMENTAL GROWTH

- 6.4 PHOSPHORIC ACID

- 6.4.1 DURABILITY AND HIGH EFFICIENCY IN COGENERATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.5 ALKALINE

- 6.5.1 MINIMAL THERMAL DEGRADATION OF COMPONENTS AND HIGH ELECTRICAL EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 6.6 MICROBIAL

- 6.6.1 ABILITY TO TREAT WASTEWATER WHILE SIMULTANEOUSLY GENERATING POWER TO BOOST SEGMENTAL GROWTH

- 6.7 DIRECT METHANOL

- 6.7.1 USE IN PORTABLE AND SMALL-SCALE POWER APPLICATIONS TO FOSTER SEGMENTAL GROWTH

- 6.8 OTHER FUEL CELL TYPES

7 FUEL CELL MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 STACK

- 7.2.1 PRECISE DESIGN AND QUALITY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.2.2 INTERCONNECTS

- 7.2.3 END PLATES

- 7.2.4 SEALINGS

- 7.2.5 OTHER STACK COMPONENTS

- 7.3 BALANCE OF PLANT (BOS)

- 7.3.1 ABILITY TO OPTIMIZE PERFORMANCE, SAFETY, AND RELIABILITY OF FUEL CELLS TO FOSTER SEGMENTAL GROWTH

- 7.3.2 HEAT TRANSFER COMPONENTS

- 7.3.3 POWER ELECTRONICS & CONTROL SYSTEMS

- 7.3.4 INSTRUMENTS & SENSORS

- 7.3.5 FUEL REFORMERS & DESULFURIZERS

- 7.3.6 OTHER BOP COMPONENTS

8 FUEL CELL MARKET, BY SIZE

- 8.1 INTRODUCTION

- 8.2 SMALL-SCALE (UP TO 200 KW)

- 8.2.1 COMPACT FOOTPRINT, EFFICIENT OPERATION, AND ABILITY TO FUNCTION IN OFF-GRID OR BACKUP SCENARIOS TO DRIVE MARKET

- 8.3 LARGE-SCALE (ABOVE 200 KW)

- 8.3.1 EMPHASIS ON ALIGNING WITH NATIONAL ENERGY STRATEGIES TO FOSTER SEGMENTAL GROWTH

9 FUEL CELL MARKET, BY FUEL TYPE

- 9.1 INTRODUCTION

- 9.2 HYDROGEN

- 9.2.1 EMERGENCE AS ENVIRONMENT-FRIENDLY ALTERNATIVE TO COMBUSTION-BASED POWER SOURCE TO SPUR DEMAND

- 9.3 AMMONIA

- 9.3.1 ZERO CARBON EMISSIONS AND COST-EFFICIENCY FEATURES TO AUGMENT SEGMENTAL GROWTH

- 9.4 METHANOL

- 9.4.1 EASY STORAGE AND TRANSPORTATION DUE TO HIGH ENERGY DENSITY TO EXPEDITE SEGMENTAL GROWTH

- 9.5 OTHER FUEL TYPES

10 FUEL CELL MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PORTABLE 136 10.2.1 HIGHER ENERGY DENSITY THAN CONVENTIONAL BATTERIES TO FUEL SEGMENTAL GROWTH

- 10.3 STATIONARY

- 10.3.1 PRIMARY POWER GENERATION SYSTEMS

- 10.3.1.1 Rising deployment to supply baseload electricity and CHP to contribute to segmental growth

- 10.3.2 BACKUP POWER SYSTEMS

- 10.3.2.1 Global push for low-emission technologies to accelerate segmental growth

- 10.3.3 CHP SYSTEMS

- 10.3.3.1 Strong focus on addressing global warming and conserving energy to augment segmental growth

- 10.3.1 PRIMARY POWER GENERATION SYSTEMS

- 10.4 FUEL CELL VEHICLES

- 10.4.1 PASSENGER LIGHT-DUTY FUEL CELL VEHICLES

- 10.4.1.1 Increasing sales of passenger light-duty vehicles to fuel segmental growth

- 10.4.2 FUEL CELL BUSES

- 10.4.2.1 Rising emphasis on decarbonizing public transport networks to boost segmental growth

- 10.4.3 FUEL CELL TRUCKS

- 10.4.3.1 Increasing availability of zero-emission vehicles for heavy-duty transport to drive market

- 10.4.4 OTHER FUEL CELL VEHICLES

- 10.4.1 PASSENGER LIGHT-DUTY FUEL CELL VEHICLES

11 FUEL CELL MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 SURGING CLEAN ENERGY DEMAND FOR SPACE HEATING AND COOLING TO FUEL SEGMENTAL GROWTH

- 11.3 COMMERCIAL & INDUSTRIAL

- 11.3.1 HIGH EFFICIENCY AND SUITABILITY OF FUEL CELLS FOR BASE-LOAD POWER TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.4 TRANSPORTATION

- 11.4.1 GOVERNMENTAL SUPPORT FOR ZERO-EMISSION VEHICLES TO BOOST SEGMENTAL GROWTH

- 11.5 DATA CENTERS

- 11.5.1 MOUNTING ADOPTION OF FUEL CELLS AS CLEAN AND RELIABLE POWER SOURCE TO AUGMENT SEGMENTAL GROWTH

- 11.6 MILITARY & DEFENSE

- 11.6.1 RISING NEED FOR RELIABLE POWER SOURCES FOR COMMUNICATION SYSTEMS AND SURVEILLANCE SENSORS TO DRIVE MARKET

- 11.7 UTILITIES & GOVERNMENT/MUNICIPAL INSTITUTES

- 11.7.1 GROWING FOCUS ON MEETING LOCAL OR STATE-MANDATED EMISSION TARGETS TO BOLSTER SEGMENTAL GROWTH

12 FUEL CELL MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Rising implementation of policies to reach carbon neutrality to boost market growth

- 12.2.2 JAPAN

- 12.2.2.1 Growing focus on climate change mitigation to augment market growth

- 12.2.3 SOUTH KOREA

- 12.2.3.1 Increasing use of green hydrogen to curb carbon emissions to accelerate market growth

- 12.2.4 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Growing network of hydrogen refueling stations to contribute to market growth

- 12.3.2 CANADA

- 12.3.2.1 Strategic commitment to expand hydrogen and fuel cell usage as part of climate targets to drive market

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 UK

- 12.4.1.1 Increasing financial aid for clean technology deployment to boost market growth

- 12.4.2 GERMANY

- 12.4.2.1 Escalating hydrogen energy production to accelerate market growth

- 12.4.3 ITALY

- 12.4.3.1 Rising implementation of subsidies for hydrogen initiatives to fuel market growth

- 12.4.4 REST OF EUROPE

- 12.4.1 UK

- 12.5 ROW

- 12.5.1 MIDDLE EAST & AFRICA

- 12.5.1.1 Rising exploration of hydrogen to diversify energy portfolio to accelerate market growth

- 12.5.2 LATIN AMERICA

- 12.5.2.1 Increasing investment to build green hydrogen economy to boost market growth

- 12.5.1 MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End user footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.8.6 COMPETITIVE SCENARIO

- 13.8.6.1 Product launches

- 13.8.6.2 Deals

- 13.8.6.3 Expansions

- 13.8.6.4 Others developments

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 BLOOM ENERGY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 PLUG POWER INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.3.4 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 AISIN CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 DOOSAN FUEL CELL CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.3.3 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 SFC ENERGY AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 BALLARD POWER SYSTEMS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Other developments

- 14.1.7 FUELCELL ENERGY, INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.3.2 Other developments

- 14.1.8 KYOCERA CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 CUMMINS INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Expansions

- 14.1.10 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Developments

- 14.1.11 TOSHIBA CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Other developments

- 14.1.12 NEDSTACK FUEL CELL TECHNOLOGY

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 ELRINGKLINGER AG

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Other developments

- 14.1.14 POWERCELL SWEDEN AB

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Deals

- 14.1.14.3.3 Other developments

- 14.1.15 AFC ENERGY

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Expansions

- 14.1.16 FUJI ELECTRIC CO., LTD.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.1 BLOOM ENERGY

- 14.2 OTHER PLAYERS

- 14.2.1 INTELLIGENT ENERGY LIMITED

- 14.2.2 HORIZON FUEL CELL TECHNOLOGIES

- 14.2.3 HYSTER-YALE MATERIALS HANDLING, INC.

- 14.2.4 ADELAN

- 14.2.5 MICRORGANIC TECHNOLOGIES

- 14.2.6 AVL

- 14.2.7 WATT FUEL CELL

- 14.2.8 PROTON MOTOR FUEL CELL GMBH

- 14.2.9 ECOSPRAY TECHNOLOGIES S.R.L.

- 14.2.10 SPECIAL POWER SOURCES

- 14.2.11 GENCELL LTD.

- 14.2.12 VERSOGEN

- 14.2.13 AQUACYCL

- 14.2.14 SOLYDERA SPA

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS