|

|

市場調査レポート

商品コード

1158142

低温粉体塗装の世界市場:基材別 (金属、非金属)・樹脂別 (ハイブリッド、ポリエステル、エポキシ)・エンドユース別 (家具、家電製品、自動車、医療、小売業、エレクトロニクス)・地域別の将来予測 (2027年まで)Low Temperature Powder Coatings Market by Substrate (Metal, Non-metal), Resin (Hybrid, Polyester, Epoxy), and End-Use (Furniture, Appliances, Automotive, Medical, Retail, Electronics), and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 低温粉体塗装の世界市場:基材別 (金属、非金属)・樹脂別 (ハイブリッド、ポリエステル、エポキシ)・エンドユース別 (家具、家電製品、自動車、医療、小売業、エレクトロニクス)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月17日

発行: MarketsandMarkets

ページ情報: 英文 259 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の低温粉体塗装の市場規模は、2021年に9,700万米ドルに達し、予測期間中に3.0%のCAGRで成長し、2027年には1億1,600万米ドルに達すると予測されています。

"非金属基材は予測期間中、量的に最も高いCAGRを記録する"

低温粉体塗装は、木材やMDF (中密度繊維板)、プラスチック、ガラス、複合材などの非金属表面に使用することができます。液体塗料と比較した場合、粉体塗料は優れた密着性、優れた耐久性、液だれのなさ、塗布時のVOCの低さで知られています。このような市場の拡大は、この地域の家具産業からの強い需要に起因しています。家具分野は予測期間中に成長することが予想され、これが非金属基材向け低温粉体塗装の市場を牽引するものと思われます。

"エンドユース産業別では家具分野が、予測期間中に最も高いCAGRを記録する"

この分野の市場促進要因は、各国のインフラ成長や、オフィス家具・ガーデン家具・キッチン家具などの利用拡大などが挙げられます。アジア太平洋、特に中国・インド・タイ・インドネシア・マレーシアなどの新興国では強い需要が生じています。

"欧州市場は、予測期間中に2番目に大きな市場シェアを獲得する"

2021年の低温粉体塗装の市場規模は、欧州が第2位となりました。低/無VOC塗装の使用に関する規制がますます厳しくなり、塗装技術の切り替えが低温粉体塗装の需要に影響を与える可能性があります。欧州市場は、大手企業の存在や技術進歩により、より速く成長すると予想されます。また、この技術によってもたらされる年間費用の削減効果を認識する人が増えるにつれて、徐々に上昇すると予想されます。

当レポートでは、世界の低温粉体塗装の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、基材別・樹脂別・エンドユース産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- バリューチェーン分析

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 産業動向

- 世界の自動車産業の動向と予測

- 塗料・塗装のエコシステムと相互接続された市場

- 低温粉体塗装メーカーの収益シフトと新たな収益ポケット

- 顧客のビジネスに影響を与える動向/混乱

- 世界の家電産業の動向と予測

- 動向の家具産業の動向と予測

- 世界の建設動向と予測

- 技術分析

- 価格分析

- 特許分析

- パンデミック以降のサプライチェーンの危機

- 世界のシナリオ

- ロシア・ウクライナ戦争

- 中国

- 欧州

- 輸出入分析

- 国際的な規制枠組み

- 主な会議とイベント (2022年~2023年)

第6章 低温粉体塗装市場:基材別

- イントロダクション

- 非金属

- 木材

- プラスチック・複合材・ガラス

- 金属

第7章 低温粉体塗装市場:樹脂別

- イントロダクション

- ハイブリッド

- ポリエステル

- エポキシ

- その他の樹脂

- アクリル

- ポリウレタン

第8章 低温粉体塗装市場:エンドユース産業別

- イントロダクション

- 家具

- 家電製品

- 自動車

- 医療

- 小売業

- エレクトロニクス

- その他のエンドユース産業

第9章 低温粉体塗装市場:地域別

- イントロダクション

- 欧州

- ポーランド

- ドイツ

- スペイン

- フランス

- 英国

- ルーマニア

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- 韓国

- ベトナム

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 他の国々 (RoW)

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 市場シェア分析

- 市場ランキング分析

- 企業収益分析

- 競合リーダーシップマッピング (2021年)

- 中小企業マトリックス (2021年)

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合ベンチマーキング

- 競合シナリオ

- 戦略展開

- 資本取引

- その他の動向

第11章 企業プロファイル

- 主要企業

- PPG INDUSTRIES

- SHERWIN-WILLIAMS COMPANY

- AKZONOBEL N.V.

- AXALTA COATING SYSTEMS LLC

- JOTUN A/S

- TEKNOS GROUP

- CIN INDUSTRIAL COATINGS

- ALLNEX

- その他の企業

- TIGER COATINGS GMBH & CO. KG

- ARSONSISI TECHNOLOGICAL COATINGS

- PLATINUM PHASE SDN BHD

- TULIP PAINTS

- PROTECH-OXYPLAST GROUP

- KEYLAND POLYMER MATERIALS SCIENCES

- IGP PULVERTECHNIK AG

- ANHUI MEIJIA NEW MATERIAL CO., LTD

- EMIL FREI GMBH & CO. KG

- IFS COATINGS

- PRIMATEK COATINGS OU

- RAPID ENGINEERING CO. PVT. LTD.

- MODERN SAK FACTORY FOR POWDER PAINT

第12章 隣接/関連市場

- イントロダクション

- 制限事項

- 塗料・塗装のエコシステム

- 粉体塗装市場

第13章 付録

The global low temperature powder coatings market size was USD 97 million in 2021 and is projected to grow at a CAGR of 3.0% during the forecast period to reach USD 116 million by 2027. Due to their lower cure temperature, low temperature powder coatings can meet the same performance standards as conventional high performance coatings while using less energy.

"The Non-metal substrate is expected to register the highest CAGR of the overall low temperature powder coatings market during the forecast period, in terms of volume."

Low temperature powder coating can be used on nonmetallic surfaces such as wood and MDF, plastics, glass, and composites. When compared to liquid paints, powder coating is known for its excellent adherence, good durability, lack of runs, and low VOCs during application. This expansion can be attributed to the region's strong demand from the furniture sector. Wood and MDF are also great substrates for low temperature powder coatings. This coating utilizes far less heat and has a very short processing time. The furniture sector is expected to grow in the forecast period and this will drive the non-metal substrate low temperature powder coatings market in the forecast period.

"The furniture segment of the end use industry is projected to register the highest CAGR during the forecast period."

Market drivers in this segment are infrastructural growth in various countries, and growth in applications, including office furniture, garden furniture, and kitchen furniture. There is strong demand for these applications from the Asia Pacific region, especially from developing countries such as China, India, Thailand, Indonesia, and Malaysia. Global low temperature powder coating manufacturers are establishing their manufacturing facilities or sales offices in these emerging regions to cater to the increasing demand.

Europe low temperature powder coatings market is projected to register the second largest market share during the forecast period.

Europe was the second-largest market for low temperature powder coatings in 2021. The increasingly stringent regulations regarding the use of low/no VOC coatings and the switching of coating technologies may affect the demand for low temperature powder coatings. The low temperature powder coatings market in Europe is expected to grow faster due to the presence of top player and technology advancement. It is expected to rise gradually as more people become aware of the yearly cost reductions offered by this technology.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the waterborne coatings market, and information was gathered from secondary research to determine and verify the market size of several segments and subsegments.

- By Company Type: Tier 1 - 43%, Tier 2 - 24%, and Tier 3 - 33%

- By Designation: C Level - 26%, D Level - 36%, and Others - 38%

- By Region: Europe - 45%, North America - 27%, APAC - 18%, and RoW 9%

The key companies profiled in this report are PPG Industries Inc. (US), and Sherwin-Williams Company (US).

Research Coverage:

This report provides detailed segmentation of the low temperature powder coatings market based on substrate, resin, end - use industry, and region. Based on substrate, low temperature powder coatings market has been segmented into metal and Non-metal. Based on resin, the market has been segmented into hybrid, polyester, epoxy, and others. Based on end - use industry market has been segmented into furniture, appliances, automotive, medical, retail, electronics, and others. Based on region, the market has been segmented into Asia Pacific, Europe, North America, and Rest of the world.

Key Benefits of Buying the Report

From an insights perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market share analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET INCLUSIONS & EXCLUSIONS, BY RESIN

- 1.4 MARKET INCLUSIONS & EXCLUSIONS, BY END-USE INDUSTRY

- 1.5 STUDY SCOPE

- 1.5.1 MARKET SCOPE

- FIGURE 1 LOW TEMPERATURE POWDER COATINGS: MARKET SEGMENTATION

- 1.5.2 REGIONAL SCOPE

- 1.5.3 YEARS CONSIDERED

- 1.6 CURRENCY

- 1.7 UNITS CONSIDERED

- 1.8 LIMITATIONS

- 1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 LOW TEMPERATURE POWDER COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 LOW TEMPERATURE POWDER COATINGS MARKET SIZE ESTIMATION: BY VALUE

- FIGURE 5 LOW TEMPERATURE POWDER COATINGS MARKET ESTIMATION, BY REGION

- FIGURE 6 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 7 LOW TEMPERATURE POWDER COATINGS MARKET ESTIMATION, BY END-USE INDUSTRY

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY-SIDE FORECAST

- FIGURE 8 LOW TEMPERATURE POWDER COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF LOW TEMPERATURE POWDER COATINGS MARKET

- 2.3.2 DEMAND-SIDE FORECAST

- FIGURE 10 LOW TEMPERATURE POWDER COATINGS MARKET: DEMAND-SIDE FORECAST

- 2.4 FACTOR ANALYSIS

- FIGURE 11 FACTOR ANALYSIS OF LOW TEMPERATURE POWDER COATINGS MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 12 LOW TEMPERATURE POWDER COATINGS MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- 2.7 STUDY LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 LOW TEMPERATURE POWDER COATINGS MARKET SNAPSHOT, 2021 VS. 2027

- FIGURE 13 NON-METAL SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2021

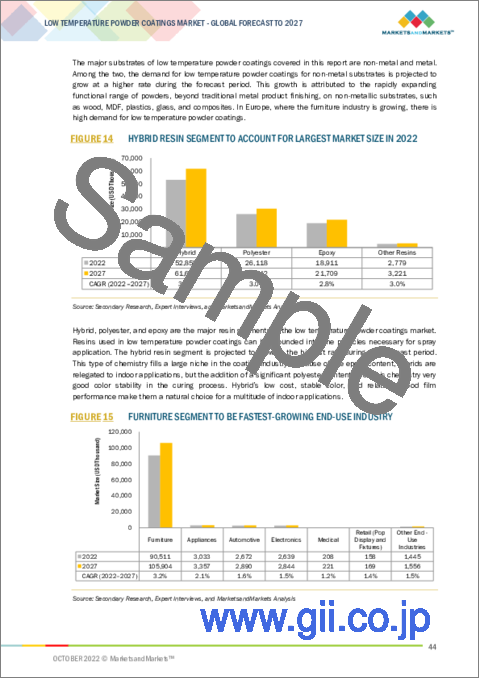

- FIGURE 14 HYBRID RESIN SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

- FIGURE 15 FURNITURE SEGMENT TO BE FASTEST-GROWING END-USE INDUSTRY

- FIGURE 16 APAC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN LOW TEMPERATURE POWDER COATINGS MARKET

- FIGURE 17 HIGH DEMAND FROM FURNITURE INDUSTRY TO DRIVE MARKET

- 4.2 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE

- FIGURE 18 NON-METAL SEGMENT TO DOMINATE OVERALL LOW TEMPERATURE POWDER COATINGS MARKET

- 4.3 LOW TEMPERATURE POWDER COATINGS MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

- FIGURE 19 MARKETS IN DEVELOPED COUNTRIES TO GROW FASTER THAN DEVELOPING COUNTRIES

- 4.4 LOW TEMPERATURE POWDER COATINGS MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 20 POLAND TO ACCOUNT FOR LARGEST MARKET SHARE IN EUROPE

- 4.5 LOW TEMPERATURE POWDER COATINGS MARKET, BY KEY COUNTRY

- FIGURE 21 SPAIN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 VALUE CHAIN ANALYSIS

- FIGURE 22 LOW TEMPERATURE POWDER COATINGS: VALUE CHAIN ANALYSIS

- TABLE 2 LOW TEMPERATURE POWDER COATINGS MARKET: SUPPLY CHAIN ECOSYSTEM

- 5.3 MARKET DYNAMICS

- FIGURE 23 OVERVIEW OF FACTORS GOVERNING LOW TEMPERATURE POWDER COATINGS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in energy savings due to reduction in cure temperature

- 5.3.1.2 Increasing adoption for low temperature powder coating across end-use sectors

- 5.3.2 RESTRAINTS

- 5.3.2.1 High-priced product in price-competitive market

- 5.3.2.2 Difficulty in maintaining storage stability while enabling low temperature curing

- 5.3.2.3 Requirement of refrigerated storage or transport to extend shelf life

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Low temperature powder coatings suitable for temperature-sensitive components

- 5.3.3.2 Increasing demand for composites in automotive and aerospace industries

- 5.3.3.3 Technological advancements

- 5.3.4 CHALLENGES

- 5.3.4.1 High humidity and complex shape of substrates affect performance of coatings

- 5.3.4.2 Mature market of MDF in developed regions to stymie demand for low temperature powder coatings

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 LOW TEMPERATURE POWDER COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 LOW TEMPERATURE POWDER COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT FROM SUBSTITUTES

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 THREAT FROM NEW ENTRANTS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP INDUSTRIES (%)

- 5.5.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR LOW TEMPERATURE POWDER COATINGS

- TABLE 5 KEY BUYING CRITERIA FOR LOW TEMPERATURE POWDER COATINGS

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECASTS

- TABLE 6 GDP TRENDS AND FORECASTS, PERCENTAGE CHANGE

- 5.7 INDUSTRY TRENDS

- 5.7.1 TRENDS AND FORECASTS OF GLOBAL AUTOMOTIVE INDUSTRY

- TABLE 7 TRENDS AND FORECASTS OF GLOBAL AUTOMOTIVE INDUSTRY

- 5.8 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

- TABLE 8 POWDER COATINGS MARKET: SUPPLY CHAIN

- FIGURE 27 PAINTS & COATINGS: ECOSYSTEM

- 5.9 REVENUE SHIFT AND NEW REVENUE POCKETS FOR LOW TEMPERATURE POWDER COATING MANUFACTURERS

- FIGURE 28 REVENUE SHIFT IN LOW TEMPERATURE POWDER COATINGS MARKET

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10.1 TRENDS AND FORECASTS OF GLOBAL APPLIANCES INDUSTRY

- FIGURE 29 TRENDS AND FORECASTS OF GLOBAL APPLIANCES INDUSTRY, 2018-2025 (USD TRILLION)

- FIGURE 30 TRENDS AND FORECASTS OF GLOBAL APPLIANCES DISTRIBUTION CHANNEL

- 5.10.2 TRENDS AND FORECASTS OF GLOBAL FURNITURE INDUSTRY

- FIGURE 31 TRENDS AND FORECASTS OF GLOBAL FURNITURE INDUSTRY, 2018-2025 (USD BILLION)

- FIGURE 32 TRENDS AND FORECASTS OF GLOBAL FURNITURE INDUSTRY DISTRIBUTION CHANNEL

- 5.10.3 TRENDS AND FORECASTS OF GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 33 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2018-2035 (USD TRILLION)

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 PRICING ANALYSIS

- FIGURE 34 PRICING ANALYSIS OF LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2021 (USD/KG)

- 5.12.1 AVERAGE SELLING PRICES, BY END-USE INDUSTRY

- FIGURE 35 AVERAGE SELLING PRICES, BY END-USE INDUSTRY, 2021 (USD/KG)

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 PUBLICATION TRENDS

- FIGURE 36 PUBLICATION TRENDS, 2013-2022

- 5.13.3 INSIGHTS

- 5.13.4 JURISDICTION ANALYSIS

- FIGURE 37 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2013-2022

- 5.13.5 TOP APPLICANTS

- FIGURE 38 NUMBER OF PATENTS, BY COMPANY, 2013-2022

- 5.14 SUPPLY CHAIN CRISES SINCE PANDEMIC

- 5.15 GLOBAL SCENARIOS

- 5.15.1 RUSSIA-UKRAINE WAR

- 5.15.2 CHINA

- 5.15.2.1 China's debt problem

- 5.15.2.2 Australia-China trade war

- 5.15.2.3 Environmental commitments

- 5.15.3 EUROPE

- 5.15.3.1 Political instability in Germany

- 5.15.3.2 Energy crisis in Europe

- 5.15.3.3 Manpower issues in the UK

- 5.16 IMPORT-EXPORT ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORT DATA FOR PAINTS AND VARNISHES, 2021

- TABLE 10 COUNTRY-WISE EXPORT DATA FOR PAINTS AND VARNISHES, 2021

- 5.17 GLOBAL REGULATORY FRAMEWORK

- 5.17.1 LEGISLATIVE & REGULATORY POLICY UPDATE

- TABLE 11 INTERNATIONALLY RECOGNIZED TEST METHODS

- TABLE 12 LIST OF RELEVANT STANDARDS

- 5.18 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 13 LOW TEMPERATURE POWDER COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE

- 6.1 INTRODUCTION

- FIGURE 39 NON-METAL SEGMENT TO BE LARGEST SUBSTRATE SEGMENT

- TABLE 14 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 15 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 16 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 17 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 6.2 NON-METAL

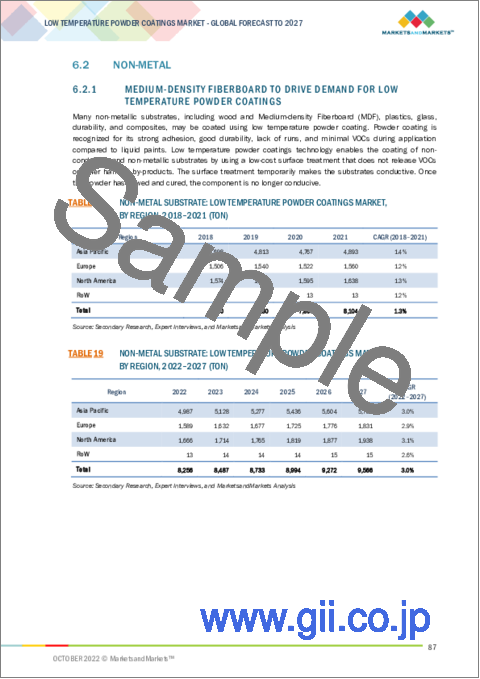

- 6.2.1 MEDIUM-DENSITY FIBERBOARD TO DRIVE DEMAND FOR LOW TEMPERATURE POWDER COATINGS

- TABLE 18 NON-METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 19 NON-METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 20 NON-METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 21 NON-METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 6.2.2 WOOD

- TABLE 22 WOOD SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 23 WOOD SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 24 WOOD SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 25 WOOD SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 6.2.3 PLASTICS, COMPOSITES, AND GLASS

- TABLE 26 PLASTICS, COMPOSITES, AND GLASS SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 27 PLASTICS, COMPOSITES, AND GLASS SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 28 PLASTICS, COMPOSITES, AND GLASS SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 29 PLASTICS, COMPOSITES, AND GLASS SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 6.3 METAL

- 6.3.1 ASIA PACIFIC REGION TO DRIVE DEMAND FOR LOW TEMPERATURE POWDER COATINGS

- TABLE 30 METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 31 METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 32 METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 33 METAL SUBSTRATE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

7 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN

- 7.1 INTRODUCTION

- FIGURE 40 HYBRID SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 7.1.1 THERMOSETTING POWDER COATING CHEMISTRY

- TABLE 34 THERMOSETTING POWDER COATING CHEMISTRY

- 7.1.2 UV CURABLE POWDER COATING CHEMISTRY

- TABLE 35 UV CURABLE POWDER COATING CHEMISTRY

- TABLE 36 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (TON)

- TABLE 37 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (TON)

- TABLE 38 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (THOUSAND USD)

- TABLE 39 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (THOUSAND USD)

- 7.2 HYBRID

- 7.2.1 FEWER DURABILITY REQUIREMENTS TO DRIVE DEMAND FOR HYBRID DESIGNS FOR INDOOR APPLICATIONS

- TABLE 40 HYBRID: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 41 HYBRID: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 42 HYBRID: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 43 HYBRID: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 7.3 POLYESTER

- 7.3.1 GOOD-TO-EXCELLENT OUTDOOR DURABILITY AND BALANCE OF CHEMICAL AND WEAR RESISTANCE

- TABLE 44 POLYESTER: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 45 POLYESTER: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 46 POLYESTER: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 47 POLYESTER: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 7.4 EPOXY

- 7.4.1 EXCELLENT CHEMICAL RESISTANCE, HARDNESS, AND WEAR RESISTANCE

- TABLE 48 EPOXY: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 49 EPOXY: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 50 EPOXY: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 51 EPOXY: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 7.5 OTHER RESINS

- TABLE 52 OTHER RESINS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 53 OTHER RESINS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 54 OTHER RESINS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 55 OTHER RESINS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 7.5.1 ACRYLIC

- 7.5.2 POLYURETHANE

8 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 41 FURNITURE SEGMENT TO BE LARGEST END USER OF LOW TEMPERATURE POWDER COATINGS

- TABLE 56 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 57 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 58 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (THOUSAND USD)

- TABLE 59 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (THOUSAND USD)

- 8.2 FURNITURE

- 8.2.1 HIGH DEMAND FOR MDF-BASED FURNITURE

- TABLE 60 FURNITURE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 61 FURNITURE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 62 FURNITURE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 63 FURNITURE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 8.3 APPLIANCES

- 8.3.1 INCREASE IN PER CAPITA INCOME AND CONSUMER SPENDING ON APPLIANCES

- TABLE 64 APPLIANCES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 65 APPLIANCES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 66 APPLIANCES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 67 APPLIANCES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 8.4 AUTOMOTIVE

- 8.4.1 GREATER DEMAND FOR COMPOSITES IN AUTOMOTIVE INDUSTRY TO OFFER LUCRATIVE OPPORTUNITIES

- TABLE 68 AUTOMOTIVE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 69 AUTOMOTIVE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 70 AUTOMOTIVE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 71 AUTOMOTIVE: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 8.5 MEDICAL

- 8.5.1 NEW APPLICATIONS IN MEDICAL INDUSTRY TO BOOST DEMAND FOR LOW TEMPERATURE POWDER COATINGS

- TABLE 72 MEDICAL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 73 MEDICAL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 74 MEDICAL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 75 MEDICAL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 8.6 RETAIL

- 8.6.1 HIGHER USE OF POP DISPLAYS AND STORE FIXTURES TO FUEL MARKET IN RETAIL INDUSTRY

- TABLE 76 RETAIL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 77 RETAIL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 78 RETAIL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 79 RETAIL: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 8.7 ELECTRONICS

- 8.7.1 DEMAND FOR HIGHLY EFFICIENT PROTECTIVE COATING TO SPUR MARKET GROWTH

- TABLE 80 ELECTRONICS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 81 ELECTRONICS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 82 ELECTRONICS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 83 ELECTRONICS: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 8.8 OTHER END-USE INDUSTRIES

- TABLE 84 OTHER END-USE INDUSTRIES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 85 OTHER END-USE INDUSTRIES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 86 OTHER END-USE INDUSTRIES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 87 OTHER END-USE INDUSTRIES: LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

9 LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC COUNTRIES TO EMERGE AS STRATEGIC LOCATIONS FOR LOW TEMPERATURE POWDER COATINGS MARKET

- TABLE 88 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 89 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 90 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 91 LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- TABLE 92 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (TON)

- TABLE 93 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (TON)

- TABLE 94 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (THOUSAND USD)

- TABLE 95 LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (THOUSAND USD)

- TABLE 96 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 97 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 98 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (THOUSAND USD)

- TABLE 99 LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (THOUSAND USD)

- TABLE 100 LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (TON)

- TABLE 101 LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (TON)

- TABLE 102 LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2018-2021 (THOUSAND USD)

- TABLE 103 LOW TEMPERATURE POWDER COATINGS MARKET, BY REGION, 2022-2027 (THOUSAND USD)

- 9.2 EUROPE

- FIGURE 43 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET SNAPSHOT

- TABLE 104 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 105 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 106 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 107 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- TABLE 108 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (TON)

- TABLE 109 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (TON)

- TABLE 110 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (THOUSAND USD)

- TABLE 111 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (THOUSAND USD)

- TABLE 112 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 113 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 114 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (THOUSAND USD)

- TABLE 115 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (THOUSAND USD)

- TABLE 116 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 117 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 118 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2018-2021 (THOUSAND USD)

- TABLE 119 EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2022-2027 (THOUSAND USD)

- 9.2.1 LIST OF MEDIUM-DENSITY FIBERBOARD MANUFACTURERS

- 9.2.2 POLAND

- 9.2.2.1 Increase in exports of furniture to fuel market growth

- TABLE 120 POLAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 121 POLAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 122 POLAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 123 POLAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.3 GERMANY

- 9.2.3.1 Developments and investments by manufacturers to boost growth

- TABLE 124 GERMANY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 125 GERMANY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 126 GERMANY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 127 GERMANY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.4 SPAIN

- 9.2.4.1 Recovery of economy, rising domestic demand, and exports to drive market

- TABLE 128 SPAIN: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 129 SPAIN: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 130 SPAIN: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 131 SPAIN: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.5 FRANCE

- 9.2.5.1 Expected growth in construction sector to boost market

- TABLE 132 FRANCE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 133 FRANCE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 134 FRANCE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 135 FRANCE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.6 UK

- 9.2.6.1 Economic growth, increase in consumer spending, and changing consumer preference to drive demand

- TABLE 136 UK: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 137 UK: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 138 UK: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 139 UK: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.7 ROMANIA

- 9.2.7.1 Strong investments to boost market

- TABLE 140 ROMANIA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 141 ROMANIA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 142 ROMANIA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 143 ROMANIA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.8 ITALY

- 9.2.8.1 Growth in GDP and domestic demand to drive market

- TABLE 144 ITALY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 145 ITALY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 146 ITALY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 147 ITALY: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.2.9 REST OF EUROPE

- TABLE 148 REST OF EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 149 REST OF EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 150 REST OF EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 151 REST OF EUROPE: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.3 ASIA PACIFIC

- FIGURE 44 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET SNAPSHOT

- TABLE 152 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 153 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 154 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 155 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- TABLE 156 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (TON)

- TABLE 157 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (TON)

- TABLE 158 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (THOUSAND USD)

- TABLE 159 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (THOUSAND USD)

- TABLE 160 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 161 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 162 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (THOUSAND USD)

- TABLE 163 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (THOUSAND USD)

- TABLE 164 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 165 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 166 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2018-2021 (THOUSAND USD)

- TABLE 167 ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2022-2027 (THOUSAND USD)

- 9.3.1 CHINA

- 9.3.1.1 High demand from furniture, appliances, and automotive industries to drive market

- TABLE 168 CHINA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 169 CHINA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 170 CHINA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 171 CHINA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.3.2 SOUTH KOREA

- 9.3.2.1 Stable economic growth and global integration to help boost market growth

- TABLE 172 SOUTH KOREA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 173 SOUTH KOREA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 174 SOUTH KOREA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 175 SOUTH KOREA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.3.3 VIETNAM

- 9.3.3.1 High economic growth and high-tech industrialized economy to drive growth

- TABLE 176 VIETNAM: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 177 VIETNAM: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 178 VIETNAM: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 179 VIETNAM: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.3.4 AUSTRALIA & NEW ZEALAND

- 9.3.4.1 Improvement in residential construction to propel demand in architectural industry

- TABLE 180 AUSTRALIA & NEW ZEALAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 181 AUSTRALIA & NEW ZEALAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 182 AUSTRALIA & NEW ZEALAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 183 AUSTRALIA & NEW ZEALAND: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.3.5 REST OF ASIA PACIFIC

- TABLE 184 REST OF ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 185 REST OF ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 186 REST OF ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 187 REST OF ASIA PACIFIC: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.4 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET SNAPSHOT

- TABLE 188 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 189 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 190 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 191 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- TABLE 192 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (TON)

- TABLE 193 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (TON)

- TABLE 194 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (THOUSAND USD)

- TABLE 195 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (THOUSAND USD)

- TABLE 196 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 197 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 198 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (THOUSAND USD)

- TABLE 199 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (THOUSAND USD)

- TABLE 200 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 201 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 202 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2018-2021 (THOUSAND USD)

- TABLE 203 NORTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY COUNTRY, 2022-2027 (THOUSAND USD)

- 9.4.1 US

- 9.4.1.1 Mature US market to witness steady growth rate

- TABLE 204 US: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 205 US: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 206 US: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 207 US: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.4.2 CANADA

- 9.4.2.1 Proximity to US to support market growth

- TABLE 208 CANADA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 209 CANADA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 210 CANADA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 211 CANADA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.4.3 MEXICO

- 9.4.3.1 Changing monetary and fiscal policies to support market growth

- TABLE 212 MEXICO: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 213 MEXICO: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 214 MEXICO: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 215 MEXICO: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.5 REST OF THE WORLD

- FIGURE 46 ROW: LOW TEMPERATURE POWDER COATINGS MARKET SNAPSHOT

- TABLE 216 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 217 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 218 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 219 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- TABLE 220 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (TON)

- TABLE 221 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (TON)

- TABLE 222 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2018-2021 (THOUSAND USD)

- TABLE 223 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY RESIN, 2022-2027 (THOUSAND USD)

- TABLE 224 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 225 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 226 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2018-2021 (THOUSAND USD)

- TABLE 227 ROW: LOW TEMPERATURE POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2022-2027 (THOUSAND USD)

- 9.5.1 SOUTH AMERICA

- TABLE 228 SOUTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 229 SOUTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 230 SOUTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 231 SOUTH AMERICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

- 9.5.1.1 Brazil

- 9.5.1.1.1 Fast-growing automotive industry to support market growth

- 9.5.1.2 Argentina

- 9.5.1.2.1 Changing lifestyles to support market growth

- 9.5.1.3 Rest of South America

- 9.5.1.1 Brazil

- 9.5.2 MIDDLE EAST & AFRICA

- TABLE 232 MIDDLE EAST & AFRICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (TON)

- TABLE 233 MIDDLE EAST & AFRICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (TON)

- TABLE 234 MIDDLE EAST & AFRICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2018-2021 (THOUSAND USD)

- TABLE 235 MIDDLE EAST & AFRICA: LOW TEMPERATURE POWDER COATINGS MARKET, BY SUBSTRATE, 2022-2027 (THOUSAND USD)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 236 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF LOW TEMPERATURE POWDER COATINGS

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 10.3 MARKET RANKING ANALYSIS

- FIGURE 48 RANKING OF KEY PLAYERS

- 10.4 COMPANY REVENUE ANALYSIS

- FIGURE 49 REVENUE ANALYSIS FOR KEY COMPANIES DURING PAST FIVE YEARS

- 10.5 COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 EMERGING COMPANIES

- FIGURE 50 LOW TEMPERATURE POWDER COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.6 SME MATRIX, 2021

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 STARTING BLOCKS

- 10.6.4 RESPONSIVE COMPANIES

- FIGURE 51 LOW TEMPERATURE POWDER COATINGS MARKET: EMERGING COMPANIES' COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.7 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN LOW TEMPERATURE POWDER COATINGS MARKET

- 10.8 BUSINESS STRATEGY EXCELLENCE

- FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN LOW TEMPERATURE POWDER COATINGS MARKET

- 10.9 COMPETITIVE BENCHMARKING

- TABLE 237 LOW TEMPERATURE POWDER COATINGS MARKET: DETAILED LIST OF KEY PLAYERS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 MARKET EVALUATION FRAMEWORK

- TABLE 238 STRATEGIES ADOPTED

- TABLE 239 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 10.10.2 MARKET EVALUATION MATRIX

- TABLE 240 COMPANY INDUSTRY FOOTPRINT

- TABLE 241 COMPANY REGION FOOTPRINT

- 10.11 STRATEGIC DEVELOPMENTS

- 10.11.1 DEALS

- TABLE 242 DEALS, 2018-2022

- 10.11.2 OTHER DEVELOPMENTS

- TABLE 243 OTHERS, 2019-2022

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 11.1 KEY COMPANIES

- 11.1.1 PPG INDUSTRIES

- TABLE 244 PPG INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 54 PPG INDUSTRIES: COMPANY SNAPSHOT

- 11.1.2 SHERWIN-WILLIAMS COMPANY

- TABLE 245 SHERWIN WILLIAMS COMPANY: BUSINESS OVERVIEW

- FIGURE 55 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- 11.1.3 AKZONOBEL N.V.

- TABLE 246 AKZONOBEL N.V.: BUSINESS OVERVIEW

- FIGURE 56 AKZONOBEL N.V.: COMPANY SNAPSHOT

- 11.1.4 AXALTA COATING SYSTEMS LLC

- TABLE 247 AXALTA COATING SYSTEMS LLC: BUSINESS OVERVIEW

- FIGURE 57 AXALTA COATING SYSTEMS LLC: COMPANY SNAPSHOT

- 11.1.5 JOTUN A/S

- TABLE 248 JOTUN A/S: BUSINESS OVERVIEW

- FIGURE 58 JOTUN A/S: COMPANY SNAPSHOT

- 11.1.6 TEKNOS GROUP

- TABLE 249 TEKNOS GROUP: BUSINESS OVERVIEW

- FIGURE 59 TEKNOS GROUP: COMPANY SNAPSHOT

- 11.1.7 CIN INDUSTRIAL COATINGS

- TABLE 250 CIN INDUSTRIAL COATINGS: BUSINESS OVERVIEW

- 11.1.8 ALLNEX

- TABLE 251 ALLNEX: BUSINESS OVERVIEW

- FIGURE 60 ALLNEX: COMPANY SNAPSHOT

- 11.2 OTHER KEY PLAYERS

- 11.2.1 TIGER COATINGS GMBH & CO. KG

- TABLE 252 TIGER COATINGS GMBH & CO. KG

- 11.2.2 ARSONSISI TECHNOLOGICAL COATINGS

- TABLE 253 ARSONSISI TECHNOLOGICAL COATINGS

- 11.2.3 PLATINUM PHASE SDN BHD

- TABLE 254 PLATINUM PHASE SDN BHD

- 11.2.4 TULIP PAINTS

- TABLE 255 TULIP PAINTS

- 11.2.5 PROTECH-OXYPLAST GROUP

- TABLE 256 PROTECH-OXYPLAST GROUP

- 11.2.6 KEYLAND POLYMER MATERIALS SCIENCES

- TABLE 257 KEYLAND POLYMER MATERIALS SCIENCES

- 11.2.7 IGP PULVERTECHNIK AG

- TABLE 258 IGP PULVERTECHNIK AG

- 11.2.8 ANHUI MEIJIA NEW MATERIAL CO., LTD

- TABLE 259 ANHUI MEIJIA NEW MATERIAL CO., LTD

- 11.2.9 EMIL FREI GMBH & CO. KG

- TABLE 260 EMIL FREI GMBH & CO. KG

- 11.2.10 IFS COATINGS

- TABLE 261 IFS COATINGS

- 11.2.11 PRIMATEK COATINGS OU

- TABLE 262 PRIMATEK COATINGS OU

- 11.2.12 RAPID ENGINEERING CO. PVT. LTD.

- TABLE 263 RAPID ENGINEERING CO. PVT. LTD.

- 11.2.13 MODERN SAK FACTORY FOR POWDER PAINT

- TABLE 264 MODERN SAK FACTORY FOR POWDER PAINTS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 PAINTS & COATINGS ECOSYSTEM

- 12.4 POWDER COATING MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.3 POWDER COATING MARKET, BY RESIN TYPE

- TABLE 265 POWDER COATINGS MARKET, BY RESIN TYPE, 2016-2019 (KILOTON)

- TABLE 266 POWDER COATINGS MARKET, BY RESIN TYPE, 2020-2025 (KILOTON)

- TABLE 267 POWDER COATINGS MARKET, BY RESIN TYPE, 2016-2019 (USD MILLION)

- TABLE 268 POWDER COATINGS MARKET, BY RESIN TYPE, 2020-2025 (USD MILLION)

- 12.4.4 POWDER COATING MARKET, BY END-USE INDUSTRY

- TABLE 269 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 270 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2020-2025(KILOTON)

- TABLE 271 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 272 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

- 12.4.5 POWDER COATING MARKET, BY REGION

- TABLE 273 POWDER COATINGS MARKET, BY REGION, 2016-2019 (KILOTON)

- TABLE 274 POWDER COATINGS MARKET, BY REGION, 2020-2025 (KILOTON)

- TABLE 275 POWDER COATINGS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 276 POWDER COATINGS MARKET, BY REGION, 2020-2025 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS