|

|

市場調査レポート

商品コード

1622840

波長可変半導体レーザーアナライザー(TDLA)の世界市場:ガスアナライザー別、デバイス別、手法別、技術別、動作別、コンポーネント別 - 予測(~2031年)Tunable Diode Laser Analyzer (TDLA) Market by Gas Analyzer (Oxygen, Ammonia, COx, Hx, Moisture, CxHx, NxOx), Device (Portable, Fixed), Methodology (In Situ, Extractive), Technology (Absorption, Emission), Operation, Component - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| 波長可変半導体レーザーアナライザー(TDLA)の世界市場:ガスアナライザー別、デバイス別、手法別、技術別、動作別、コンポーネント別 - 予測(~2031年) |

|

出版日: 2024年12月18日

発行: MarketsandMarkets

ページ情報: 英文 292 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の波長可変半導体レーザーアナライザー(TDLA)の市場規模は、先進の環境モニタリングのニーズの高まりにより、2024年の5億4,620万米ドルから2031年までに8億8,440万米ドルに達すると予測され、2024年~2031年にCAGRで7.1%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2031年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2031年 |

| 単位 | 10億米ドル |

| セグメント | 手法、ガスアナライザータイプ、デバイスタイプ、技術、用途、最終用途産業、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「工業・医療部門での酸素濃度計の使用の拡大が酸素濃度計セグメントの市場成長を促進します。」

酸素濃度計は、気体中の酸素濃度を正確に測定するさまざまな産業において重要なデバイスです。酸素濃度計の一般的な用途には、医療、食品・飲料、環境モニタリングなどがあります。医療分野では、機器や貯蔵容器に含まれる酸素濃度を評価することで、ガスが厳しい基準に適合しているかどうかをチェックし、安全性と有効性を確認します。製造では、製品の品質を決定する重大な要因として、包装のヘッドスペース内の酸素レベルをチェックすることで、製品の保存期間を延長します。化学品の貯蔵や鉱業など、より危険な環境では、酸素濃度計が空気質をモニターし、危険な状態を回避します。酸素濃度計は、それぞれの用途に合わせてさまざまな形で製造および設計されています。もっとも一般的なタイプには、微量、ポータブル、連続、酸素欠乏計などがあります。微量酸素濃度計は非常に低いレベルの酸素を測定するもので、天然ガスや多くの工業プロセスで重要な用途です。ポータブル濃度計はセンサーを設置することなく外出先でも測定が可能で便利であり、一方、連続濃度計は固定された場所で継続的にモニタリングを行い、施設のプロセス制御をサポートします。酸素欠乏計は、酸素レベルが低いと重大な危険性が生じる研究室やトンネルなどの閉鎖空間に不可欠です。これらの濃度計は、常磁性、電気化学、熱伝導性などのさまざまな手法を用いて正しく測定します。

「予測期間にIn-Situ手法セグメントが最大のシェアを占める見込みです。」

In-Situ TDLA手法の第一の利点は、高温、高圧、腐食性環境といったハードな工業条件下での測定能力です。そのため、In-Situ TDLAシステムで使用される洗練されたアルゴリズムと技術は、プロセスの変動や他のガス種からの干渉による変化を補正することができます。これにより、石油化学プロセス、発電産業、最適化プロセスやコンプライアンスにとってリアルタイムのデータ利用が重要な環境モニターにおいて、高精度で信頼性の高い測定が可能になります。In-situ手法は、ガス分析システムの全体的な費用対効果を大幅に削減しました。サンプル調整システムが不要になり、メンテナンスの必要性が減ることで、運用コストが削減されます。その上、測定はプロセス制御からの迅速な応答を提供し、無駄の少ないより効率的なプロセスを実現します。この手法の非侵襲的な性質は、設置やメンテナンスの際にプロセスに大きな障害を与えないため、工業用途で非常に人気があります。

「予測期間に最大の市場シェアを占めるプロセスモニタリング用途市場」

TDLAを使用したプロセスモニタリングは、プロセスの制御と最適化に使用するガス測定値をリアルタイムで正確に提供するため、工業業務において重要な役割を果たしています。化学処理活動は、反応物と生成物の両方が最適な反応条件と収率を達成できるよう、TDLAによってモニターされます。TDLAは、ほぼすべての石油化学プラントで使用され、炭化水素の組成と水分レベル、さまざまなプロセスの流れを通して微量汚染物質をモニターします。これらの濃度計は、半導体製造プロセスにおける製品品質を保証するために、超高純度ガス中の微量の水分や酸素を追跡します。この技術は非接触で迅速な測定が可能なため、高炉内のCOやO2ガスレベルのモニタリングのような重要なプロセスを制御することで製鋼に応用され、燃焼効率と製品品質を高めます。

当レポートでは、世界の波長可変半導体レーザーアナライザー(TDLA)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 波長可変半導体レーザーアナライザー(TDLA)市場の企業にとって魅力的な機会

- 波長可変半導体レーザーアナライザー(TDLA)市場:ガスアナライザータイプ別

- 波長可変半導体レーザーアナライザー(TDLA)市場:技術別

- 波長可変半導体レーザーアナライザー(TDLA)市場:手法別

- 波長可変半導体レーザーアナライザー(TDLA)市場:デバイスタイプ別

- 北米の波長可変半導体レーザーアナライザー(TDLA)市場:最終用途産業別、国別

- 波長可変半導体レーザーアナライザー(TDLA)市場:最終用途産業別

- 波長可変半導体レーザーアナライザー(TDLA)市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格:ガスアナライザータイプ別(2024年)

- ガスアナライザーの価格動向

- 平均販売価格の動向:地域別

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 波長可変半導体レーザーアナライザー(TDLA)市場に対するAI/生成AIの影響

- イントロダクション

- 主なユースケースと市場の将来性

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 波長可変半導体レーザーアナライザー(TDLA)のユースケースとケーススタディ

- 貿易分析

- 輸入シナリオ(HSコード902710)

- 輸出シナリオ(HSコード902710)

- 関税と規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- 政府規制

- 規制と法律

- 特許分析(2012年~2023年)

- 主な会議とイベント(2024年~2025年)

第6章 波長可変半導体レーザーアナライザー(TDLA)市場:タイプ別

- イントロダクション

- 単一波長

- 複数波長

第7章 波長可変半導体レーザーアナライザー(TDLA)市場:コンポーネント別

- イントロダクション

- レーザーダイオード

- 光学コンポーネント

- 検出器/光検出器

- 分光計

- サンプルセル

- データ収集システム

- 校正デバイス

- その他のコンポーネント

第8章 波長可変半導体レーザーアナライザー(TDLA)市場:動作方式別

- イントロダクション

- 連続波

- パルス波

- チャープ波

- 変調波

- その他の動作方式

第9章 波長可変半導体レーザーアナライザー(TDLA)市場:手法別

- イントロダクション

- IN SITU

- 抽出

第10章 波長可変半導体レーザーアナライザー(TDLA)市場:ガスアナライザータイプ別

- イントロダクション

- 酸素濃度計

- アンモニア濃度計

- COX濃度計

- 水分計

- HX濃度計

- CXHX濃度計

- その他の濃度計

第11章 波長可変半導体レーザーアナライザー(TDLA)市場:デバイスタイプ別

- イントロダクション

- 移動式

- 固定式

第12章 波長可変半導体レーザーアナライザー(TDLA)市場:技術別

- イントロダクション

- 吸収

- 排出

第13章 波長可変半導体レーザーアナライザー(TDLA)市場:用途別

- イントロダクション

- 環境モニタリング

- プロセスモニタリング

- 産業排出モニタリング

第14章 波長可変半導体レーザーアナライザー(TDLA)市場:最終用途産業別

- イントロダクション

- 石油・ガス

- 金属・鉱業

- エネルギー・電力

- 廃棄物・水処理

- 建設

- 化学品・医薬品

- パルプ・紙

- 半導体・電子

第15章 波長可変半導体レーザーアナライザー(TDLA)市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 南米

- 中東

- アフリカ

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 主要企業の収益分析

- 市場シェア分析

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較分析

- 企業の評価マトリクス:主要企業(2023年)

- スタートアップ/中小企業の評価マトリクス(2023年)

- 競合情勢・動向

- 製品の発売

- 取引

第17章 企業プロファイル

- 主要企業

- EMERSON ELECTRIC CO.

- SPECTRIS

- METTLER TOLEDO

- AMETEK.INC.

- YOKOGAWA ELECTRIC CORPORATION

- ENDRESS+HAUSER GROUP SERVICES AG

- ABB

- SICK AG

- SIEMENS

- SENSIT TECHNOLOGIES

- PERGAM-SUISSE AG

- TOKYO GAS ENGINEERING SOLUTIONS CORPORATION

- HEATH CONSULTANTS INCORPORATED

- HANWEI ELECTRONICS GROUP CORPORATION

- BAKER HUGHES COMPANY

- その他の企業

- HONEYWELL INTERNATIONAL, INC.

- FPI GROUP

- TELEDYNE TECHNOLOGIES INCORPORATED

- KIMOINSTRUMENTS.COM

- BRUKER

- METROHM AG

- PERKINELMER INC.

- TESTO INDUSTRIAL SERVICES GMBH

- HORIBA, LTD.

- FUJI ELECTRIC CO., LTD.

- ENVEA

- INFRARED CAMERAS INC.

第18章 付録

List of Tables

- TABLE 1 TUNABLE DIODE LASER ANALYZERS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 TUNABLE DIODE LASER ANALYZERS MARKET: RISK ASSESSMENT

- TABLE 3 ECOSYSTEM: TUNABLE DIODE LASER ANALYZERS

- TABLE 4 AVERAGE SELLING PRICE OF TUNABLE DIODE LASER ANALYZERS, BY GAS ANALYZER TYPE (USD THOUSAND), 2024

- TABLE 5 INDICATIVE PRICING, BY GAS ANALYZER TYPE (USD THOUSAND)

- TABLE 6 INDICATIVE PRICING TREND OF GAS ANALYZERS, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 7 TUNABLE DIODE LASER ANALYZER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END-USE INDUSTRIES (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 10 IMPORT DATA FOR HS CODE 902710, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 902710, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 MFN TARIFF FOR HS CODE 902710-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 13 MFN TARIFF FOR HS CODE 902710-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 14 MFN TARIFF FOR HS CODE 902710-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 TUNABLE DIODE LASER ANALYZERS MARKET: KEY PATENTS

- TABLE 20 TUNABLE DIODE LASER ANALYZERS MARKET: CONFERENCES AND EVENTS, 2024-2025

- TABLE 21 TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 22 TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 23 IN SITU TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 24 IN SITU TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 25 EXTRACTIVE TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 26 EXTRACTIVE TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 27 TDLA MARKET: BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 28 TDLA MARKET: BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 29 TDLA MARKET: BY GAS ANALYZER TYPE, UNIT SHIPMENT, 2020-2023 (UNITS)

- TABLE 30 TDLA MARKET: BY GAS ANALYZER TYPE, UNIT SHIPMENT, 2024-2031 (UNITS)

- TABLE 31 OXYGEN ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 32 OXYGEN ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 33 OXYGEN ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 34 OXYGEN ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 35 AMMONIA ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 36 AMMONIA ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 37 AMMONIA ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 38 AMMONIA ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 39 COX ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 40 COX ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 41 COX ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 42 COX ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 43 MOISTURE ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 44 MOISTURE ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 45 MOISTURE ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 46 MOISTURE ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 47 HX ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 48 HX ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 49 HX ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 50 HX ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 51 CXHX ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 52 CXHX ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 53 CXHX ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 54 CXHX ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 55 OTHER ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 56 OTHER ANALYZERS: TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 57 OTHER ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2020-2023 (USD MILLION)

- TABLE 58 OTHER ANALYZERS: TDLA MARKET, BY METHODOLOGY, 2024-2031 (USD MILLION)

- TABLE 59 TDLA MARKET: BY DEVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 60 TDLA MARKET, BY DEVICE TYPE, 2024-2031 (USD MILLION)

- TABLE 61 TDLA MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 62 TDLA MARKET, BY TECHNOLOGY, 2024-2031 (USD MILLION)

- TABLE 63 TDLA MARKET: BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 64 TDLA MARKET, BY APPLICATION, 2024-2031 (USD MILLION)

- TABLE 65 TDLA MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 66 TDLA MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 67 OIL & GAS: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 OIL & GAS: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 69 OIL & GAS: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 70 OIL & GAS: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 71 OIL & GAS: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 72 OIL & GAS: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 73 OIL & GAS: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 74 OIL & GAS: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 75 OIL & GAS: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 76 OIL & GAS: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 77 OIL & GAS: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 78 OIL & GAS: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 79 METALS & MINING: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 METALS & MINING: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 81 METALS & MINING: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 82 METALS & MINING: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 83 METALS & MINING: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 84 METALS & MINING: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 85 METALS & MINING: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 86 METALS & MINING: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 87 METALS & MINING: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 88 METALS & MINING: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 89 METALS & MINING: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 90 METALS & MINING: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 91 ENERGY & POWER: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 ENERGY & POWER: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 93 ENERGY & POWER: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 94 ENERGY & POWER: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 95 ENERGY & POWER: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 96 ENERGY & POWER: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 97 ENERGY & POWER: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 98 ENERGY & POWER: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 99 ENERGY & POWER: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 100 ENERGY & POWER: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 101 ENERGY & POWER: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 102 ENERGY & POWER: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 103 WATER & WASTE TREATMENT: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 WATER & WASTE TREATMENT: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 105 WATER & WASTE TREATMENT: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 106 WATER & WASTE TREATMENT: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 107 WATER & WASTE TREATMENT: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 108 WATER & WASTE TREATMENT: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 109 WATER & WASTE TREATMENT: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 110 WATER & WASTE TREATMENT: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 111 WATER & WASTE TREATMENT: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 112 WATER & WASTE TREATMENT: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 113 WATER & WASTE TREATMENT: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 114 WATER & WASTE TREATMENT: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 115 CONSTRUCTION: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 116 CONSTRUCTION: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 117 CONSTRUCTION: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 118 CONSTRUCTION: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 119 CONSTRUCTION: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 120 CONSTRUCTION: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 121 CONSTRUCTION: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 122 CONSTRUCTION: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 123 CONSTRUCTION: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 124 CONSTRUCTION: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 125 CONSTRUCTION: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 126 CONSTRUCTION: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 127 CHEMICALS & PHARMACEUTICALS: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 128 CHEMICALS & PHARMACEUTICALS: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 129 CHEMICALS & PHARMACEUTICALS: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 130 CHEMICALS & PHARMACEUTICALS: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 131 CHEMICALS & PHARMACEUTICALS: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 132 CHEMICALS & PHARMACEUTICALS: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 133 CHEMICALS & PHARMACEUTICALS: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 134 CHEMICALS & PHARMACEUTICALS: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 135 CHEMICALS & PHARMACEUTICALS: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 136 CHEMICALS & PHARMACEUTICALS: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 137 CHEMICALS & PHARMACEUTICALS: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 138 CHEMICALS & PHARMACEUTICALS: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 139 PULP & PAPER: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 140 PULP & PAPER: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 141 PULP & PAPER: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 142 PULP & PAPER: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 143 PULP & PAPER: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 144 PULP & PAPER: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 145 PULP & PAPER: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 146 PULP & PAPER: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 147 PULP & PAPER: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 148 PULP & PAPER: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 149 PULP & PAPER: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 150 PULP & PAPER: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 151 SEMICONDUCTOR & ELECTRONICS: TDLA MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 152 SEMICONDUCTOR & ELECTRONICS: TDLA MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 153 SEMICONDUCTOR & ELECTRONICS: TDLA MARKET, BY GAS ANALYZER TYPE, 2020-2023 (USD MILLION)

- TABLE 154 SEMICONDUCTOR & ELECTRONICS: TDLA MARKET, BY GAS ANALYZER TYPE, 2024-2031 (USD MILLION)

- TABLE 155 SEMICONDUCTOR & ELECTRONICS: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 156 SEMICONDUCTOR & ELECTRONICS: NORTH AMERICAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 157 SEMICONDUCTOR & ELECTRONICS: EUROPEAN TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 158 SEMICONDUCTOR & ELECTRONICS: EUROPEAN TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 159 SEMICONDUCTOR & ELECTRONICS: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 160 SEMICONDUCTOR & ELECTRONICS: ASIA PACIFIC TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 161 SEMICONDUCTOR & ELECTRONICS: ROW TDLA MARKET, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 162 SEMICONDUCTOR & ELECTRONICS: ROW TDLA MARKET, BY COUNTRY, 2024-2031 (USD THOUSAND)

- TABLE 163 TUNABLE DIODE LASER ANALYZERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 164 TUNABLE DIODE LASER ANALYZERS MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 165 NORTH AMERICA: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 166 NORTH AMERICA: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 167 NORTH AMERICA: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 168 NORTH AMERICA: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 169 EUROPE: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 EUROPE: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 171 EUROPE: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 172 EUROPE: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 173 ASIA PACIFIC: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 174 ASIA PACIFIC: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 175 ASIA PACIFIC: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 177 ROW: TUNABLE DIODE LASER ANALYZERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 178 ROW: TUNABLE DIODE LASER ANALYZERS MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 179 ROW: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 180 ROW: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY, 2024-2031 (USD MILLION)

- TABLE 181 MIDDLE EAST: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST: TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 183 TUNABLE DIODE LASER ANALYZERS MARKET: DEGREE OF COMPETITION

- TABLE 184 TUNABLE DIODE LASER ANALYZERS MARKET: REGION FOOTPRINT

- TABLE 185 TUNABLE DIODE LASER ANALYZERS MARKET: GAS ANALYZER TYPE FOOTPRINT

- TABLE 186 TUNABLE DIODE LASER ANALYZERS MARKET: DEVICE TYPE FOOTPRINT

- TABLE 187 TUNABLE DIODE LASER ANALYZERS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 188 TUNABLE DIODE LASER ANALYZERS MARKET: KEY STARTUPS/SMES

- TABLE 189 TUNABLE DIODE LASER ANALYZERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 TUNABLE DIODE LASER ANALYZERS MARKET: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2024

- TABLE 191 TUNABLE DIODE LASER ANALYZERS MARKET: DEALS, JANUARY 2020-NOVEMBER 2024

- TABLE 192 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 193 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 195 EMERSON ELECTRIC CO.: DEALS

- TABLE 196 SPECTRIS: COMPANY OVERVIEW

- TABLE 197 SPECTRIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 SPECTRIS: PRODUCT LAUNCHES

- TABLE 199 SPECTRIS: DEALS

- TABLE 200 METTLER TOLEDO: BUSINESS OVERVIEW

- TABLE 201 METTLER TOLEDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 METTLER TOLEDO: DEALS

- TABLE 203 AMETEK.INC.: COMPANY OVERVIEW

- TABLE 204 AMETEK.INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 AMETEK.INC.: PRODUCT LAUNCHES

- TABLE 206 AMETEK.INC.: DEALS

- TABLE 207 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 208 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 210 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 211 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 212 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES

- TABLE 214 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

- TABLE 215 ABB: COMPANY OVERVIEW

- TABLE 216 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 ABB: DEALS

- TABLE 218 SICK AG: COMPANY OVERVIEW

- TABLE 219 SICK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 SICK AG: DEALS

- TABLE 221 SIEMENS: BUSINESS OVERVIEW

- TABLE 222 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 SIEMENS: DEALS

- TABLE 224 SENSIT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 225 SENSIT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 PERGAM-SUISSE AG: BUSINESS OVERVIEW

- TABLE 227 PERGAM-SUISSE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 TOKYO GAS ENGINEERING SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 229 TOKYO GAS ENGINEERING SOLUTIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 HEATH CONSULTANTS INCORPORATED: COMPANY OVERVIEW

- TABLE 231 HEATH CONSULTANTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HANWEI ELECTRONICS GROUP CORPORATION: BUSINESS OVERVIEW

- TABLE 233 HANWEI ELECTRONICS GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 BAKER HUGHES COMPANY: BUSINESS OVERVIEW

- TABLE 235 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 BAKER HUGHES COMPANY: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 TUNABLE DIODE LASER ANALYZERS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TUNABLE DIODE LASER ANALYZERS MARKET: RESEARCH DESIGN

- FIGURE 3 TUNABLE DIODE LASER ANALYZERS MARKET: RESEARCH APPROACH

- FIGURE 4 TUNABLE DIODE LASER ANALYZERS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 TUNABLE DIODE LASER ANALYZERS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 TUNABLE DIODE LASER ANALYZERS MARKET: TOP-DOWN APPROACH

- FIGURE 7 TUNABLE DIODE LASER ANALYZERS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 TUNABLE DIODE LASER ANALYZERS MARKET: DATA TRIANGULATION

- FIGURE 9 TUNABLE DIODE LASER ANALYZERS MARKET: RESEARCH LIMITATIONS

- FIGURE 10 OXYGEN ANALYZERS TO WITNESS HIGHEST CAGR IN TDLA MARKET DURING FORECAST PERIOD

- FIGURE 11 IN SITU SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 12 PORTABLE DEVICES SEGMENT TO DOMINATE TDLA MARKET

- FIGURE 13 PROCESS MONITORING TO BE LARGEST APPLICATION SEGMENT

- FIGURE 14 OIL & GAS TO BE DOMINANT END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INCREASED ADOPTION OF TDLA FOR ENVIRONMENTAL AND SAFETY CONCERNS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 17 OXYGEN ANALYZERS TO LEAD DURING FORECAST PERIOD

- FIGURE 18 ABSORPTION TECHNOLOGY TO DOMINATE DURING FORECAST PERIOD

- FIGURE 19 IN SITU METHODOLOGY TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 20 FIXED DEVICE TYPE TO COMMAND MARKET DURING FORECAST PERIOD

- FIGURE 21 OIL & GAS AND US HELD LARGEST SHARE IN NORTH AMERICAN MARKET IN 2023

- FIGURE 22 OIL & GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2031

- FIGURE 23 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 TUNABLE DIODE LASER ANALYZERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 DRIVERS AND THEIR IMPACT ON TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 26 RESTRAINTS AND THEIR IMPACT ON TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 27 OPPORTUNITIES AND THEIR IMPACT ON TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 28 CHALLENGES AND THEIR IMPACT ON TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 29 VALUE CHAIN ANALYSIS OF TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 30 ECOSYSTEM OF TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 REVENUE SHIFT IN TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 33 AVERAGE SELLING PRICE TREND OF GAS ANALYZERS OFFERED BY KEY PLAYERS

- FIGURE 34 INDICATIVE PRICING, BY GAS ANALYZER TYPE, 2020-2023 (USD THOUSAND)

- FIGURE 35 AVERAGE SELLING PRICE TREND OF GAS ANALYZERS IN DIFFERENT REGIONS, 2020-2023 (USD THOUSAND)

- FIGURE 36 IMPACT OF AI/GEN AI ON TUNABLE DIODE LASER ANALYZERS MARKET

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END-USE INDUSTRIES

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 40 IMPORT DATA FOR HS CODE 902710, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 41 EXPORT DATA FOR HS CODE 902710, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 42 NUMBER OF PATENTS GRANTED FOR TUNABLE DIODE LASER ANALYZER PRODUCTS, 2012-2023

- FIGURE 43 IN SITU SEGMENT TO DOMINATE TDLA MARKET DURING FORECAST PERIOD

- FIGURE 44 OXYGEN ANALYZERS SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 45 PORTABLE DEVICE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 ABSORPTION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 ENVIRONMENTAL MONITORING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 CHEMICALS & PHARMACEUTICALS INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC TO CLAIM LARGEST MARKET SHARE BY 2031

- FIGURE 50 NORTH AMERICA: TUNABLE DIODE LASER ANALYZERS MARKET SNAPSHOT

- FIGURE 51 US TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 EUROPE: TUNABLE DIODE LASER ANALYZERS MARKET SNAPSHOT

- FIGURE 53 GERMANY TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC: TUNABLE DIODE LASER ANALYZERS MARKET SNAPSHOT

- FIGURE 55 CHINA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 56 ROW: TUNABLE DIODE LASER ANALYZERS MARKET SNAPSHOT

- FIGURE 57 MIDDLE EAST TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 58 TUNABLE DIODE LASER ANALYZERS MARKET REVENUE ANALYSIS, 2019-2023 (USD MILLION)

- FIGURE 59 TUNABLE DIODE LASER ANALYZERS MARKET SHARE ANALYSIS (2023)

- FIGURE 60 COMPANY VALUATION, 2024

- FIGURE 61 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 62 TUNABLE DIODE LASER ANALYZERS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 63 TUNABLE DIODE LASER ANALYZERS MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 64 TUNABLE DIODE LASER ANALYZERS MARKET: COMPANY FOOTPRINT

- FIGURE 65 TUNABLE DIODE LASER ANALYZERS MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 66 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 67 SPECTRIS: COMPANY SNAPSHOT

- FIGURE 68 METTLER TOLEDO: COMPANY SNAPSHOT

- FIGURE 69 AMETEK.INC.: COMPANY SNAPSHOT

- FIGURE 70 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- FIGURE 72 ABB: COMPANY SNAPSHOT

- FIGURE 73 SICK AG: COMPANY SNAPSHOT

- FIGURE 74 SIEMENS: COMPANY SNAPSHOT

- FIGURE 75 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

The tunable diode laser analyzer (TDLA) market is projected to grow from USD 546.2 million in 2024 and is projected to reach USD 884.4 million by 2031; it is expected to grow at a CAGR of 7.1% from 2024 to 2031 due to growing need for advanced environmental monitoring

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Units Considered | Value (USD Billion) |

| Segments | By methodology, gas analyzer type, device type, technology, application, end-user industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Growing use of oxygen analyzers in industrial and medical sectors to boost the market growth of Oxygen analyzer segment"

Oxygen analyzers are important devices in various industries that accurately determine oxygen concentration in gases. Common applications of oxygen analyzers include the medical industry, the food and beverage, and environmental monitoring. In the medical field, they check whether gases comply with strict standards by evaluating the level of oxygen present in equipment and storage containers to guarantee safety and effectiveness. In manufacturing, they extend shelf life of products through checking oxygen levels in the headspace of packaging as a critical determinant of product quality. For more dangerous use in environments, such as chemical storage and mining, oxygen analyzers monitor quality of air to avoid unsafe conditions. Many forms of oxygen analyzers are made and designed for respective applications. Some of the most common types include trace, portable, continuous, and oxygen deficiency analyzers. Trace oxygen analyzers measure oxygen at very low levels, an important natural gas application and many industrial processes. Portable analyzers provide convenient on-the-go measurements with no installed sensors, whereas continuous analyzers provide ongoing monitoring in fixed locations, supporting process control in facilities. Oxygen deficiency analyzers are essential for confined spaces like labs and tunnels, where low oxygen levels pose a significant risk of danger. These analyzers use various techniques, including paramagnetic, electrochemical, and thermal conductivity methods, to measure correctly.

"Market for In-Situ methodology segment is projected to hold for largest share during the forecast timeline."

The first benefit of the In-Situ TDLA methodology is the ability of the measurement to perform in hardline industrial conditions, such as high temperature, pressure, and corrosive environment. Therefore, sophisticated algorithms and techniques used by In-Situ TDLA systems can compensate for changes caused by process variations and interferences from other gas species. This leads to highly precise and reliable measurements, within the petrochemical-processing, and power-generating industries, and for environmental monitors where real-time data availability is critical for the optimization process and compliance. In-situ methodology has drastically reduced the overall cost-effectiveness of gas analysis systems. Operational costs are decreased through eliminating sample conditioning systems and the reduced maintenance requirement. Besides, the measurements provide fast response from process control to achieve a more efficient process with less waste. The non-invasive nature of the methodology doesn't cause much disturbance in the process during installation and maintenance, which is very popular in industrial applications.

"Market for process monitoring application for largest market share during the forecast period."

Process monitoring using TDLA plays a vital role in industrial operations due to its real-time accuracy in providing gas measurements for the control and optimization of processes. Chemical processing activities are monitored by the TDLAs to help both reactants and products attain optimal reaction conditions and yields. It is used in nearly all petrochemical plants to monitor hydrocarbon composition and moisture levels as well as trace contaminants through various process streams. These analyzers track ultra-pure gases for trace amounts of moisture or oxygen to ensure product quality in the semiconductor manufacturing process. Because this technology can take rapid non-contact measurements, it finds applications in steel manufacturing by controlling critical processes like monitoring the CO and O2 gas levels in a blast furnace, which enhances combustion efficiency and product quality.

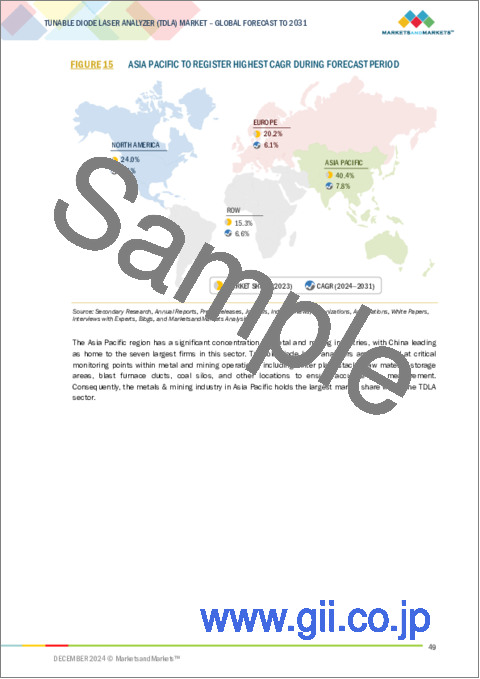

"Asia Pacific is expected to have the highest market share during the forecast period."

Asia Pacific is poised to have the largest share in the market for the Tunable Diode Laser Analyzer in the near future primarily due to fast and growing industrialization, harsh environmental regulations, and enhanced uses of advanced process monitoring technologies. Rising demands for the gas analysis in the operation optimizations and emission standard compliances drive the growth of the region's petrochemical, power generation, and manufacturing industries. Countries like China and India, which have been investing in infrastructure and industrial development, are major contributors to the market growth. Increased environmental concern towards sustainability and strict policies about emission control in Japan and South Korea also lead the market towards the increased utilization of TDLAs. With an increasing trend in the use of TDLAs in oil and gas, chemical processing, and power plant industries along with technological advancements in TDLAs, which provides real-time, non-invasive monitoring of gases, the Asia Pacific region has a stronghold on this market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the tunable diode laser analyzer (TDLA) marketplace. The break-up of the profile of primary participants in the Tunable diode laser analyzer (TDLA) market:

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C Level - 40%, Director Level - 30%, Others-30%

- By Region: North America - 35%, Europe - 35%, Asia Pacific - 20%, ROW- 10%

Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), Spectris (UK), AMETEK.Inc. (US), Endress+Hauser Group Services AG (Switzerland), METTLER TOLEDOv (US), ABB (Switzerland), SICK AG (Germany), Siemens (Germany), SENSIT Technologies (US), Pergam-Suisse AG (Switzerland), Tokyo Gas Engineering Solutions Corporation (Japan), Heath Consultants Incorporated (US), Hanwei Electronics Group Corporation (China), and Baker Hughes Company (US) are some of the key players in the Tunable diode laser analyzer (TDLA) Market.

The study includes an in-depth competitive analysis of these key players in the tunable diode laser analyzer (TDLA) market, with their company profiles, recent developments, and key market strategies. Research Coverage: This research report categorizes the tunable diode laser analyzer (TDLA) market by methodology (In Situ, Extractive), by gas analyzer type (Oxygen analyzers, Ammonia analyzers, COx analyzers, Moisture analyzers, Hx analyzers, CxHx analyzers, Others), by device type (Portable, Fixed), by technology (Absorption Spectroscopy, Emission Spectroscopy), by application (Environmental Monitoring, Process Monitoring, Industrial Emission Monitoring), by end-user industry (oil & gas, chemical & pharmaceutical, energy & power, metal & mining, construction, pulp & paper, waste & water treatment, and semiconductor electronics), and by region (North America, Europe, Asia Pacific, and RoW).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the tunable diode laser analyzer (TDLA) market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the tunable diode laser analyzer (TDLA) market have been covered in the report. This report covers a competitive analysis of upcoming startups in the tunable diode laser analyzer (TDLA) market ecosystem.

Reasons to buy this report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall tunable diode laser analyzer (TDLA) market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key benefits of buying the report:

- Analysis of key drivers (Rising industrialization and development of new power plants, Advanced features of TDLAs and ROIs on installations, Increased process automation in various end-use industries, Growing applications in the pharmaceutical and healthcare sectors for enhanced process optimization and quality control, and Increasing focus on environmental monitoring and adherence to regulatory standards), restraints (Availability of low-price competitive technologies, Calibration and regular maintenance of TDLA systems, and Technical Limitations in Detecting Some Gases), opportunities (Modernization and migration services, Growing need for advanced environmental monitoring, Technological Integration with Ilot and Industry 4.0.) and challenges (Impact of lead time and Challenges in Harsh Industrial Environments) influencing the growth of the tunable diode laser analyzer (TDLA) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Tunable diode laser analyzer (TDLA) market.

- Market Development: Comprehensive information about lucrative markets - the report analysis the Tunable diode laser analyzer (TDLA) market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the tunable diode laser analyzer (TDLA) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), Spectris (UK), Endress+Hauser Group Services AG (Switzerland), AMETEK.Inc. (US), ABB (Switzerland), METTLER TOLEDO (US), SICK AG (Germany), Siemens (Germany), SENSIT Technologies (US), Pergam-Suisse AG (Switzerland), Tokyo Gas Engineering Solutions Corporation (Japan), Heath Consultants Incorporated (US), Hanwei Electronics Group Corporation (China), and Baker Hughes Company (US) among others in the tunable diode laser analyzer (TDLA) market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants in primary interviews

- 2.1.3.2 Key primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key data from primary sources

- 2.1.3.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TUNABLE DIODE LASER ANALYZERS MARKET

- 4.2 TUNABLE DIODE LASER ANALYZERS MARKET, BY GAS ANALYZER TYPE

- 4.3 TUNABLE DIODE LASER ANALYZERS MARKET, BY TECHNOLOGY

- 4.4 TUNABLE DIODE LASER ANALYZERS MARKET, BY METHODOLOGY

- 4.5 TUNABLE DIODE LASER ANALYZERS MARKET, BY DEVICE TYPE

- 4.6 NORTH AMERICA: TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.7 TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY

- 4.8 TUNABLE DIODE LASER ANALYZERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising industrialization and development of new power plants

- 5.2.1.2 Advanced features of TDLAs and RoI on installation

- 5.2.1.3 Increased process automation in various end-use industries

- 5.2.1.4 Growing application in pharmaceuticals and healthcare for enhanced process optimization and quality control

- 5.2.1.5 Increasing focus on environmental monitoring and adherence to regulatory standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of low-priced competitive technologies

- 5.2.2.2 Calibration and regular maintenance of TDLA systems

- 5.2.2.3 Technical limitations in detecting some gases

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Modernization and migration services

- 5.2.3.2 Growing need for advanced environmental monitoring

- 5.2.3.3 Technological integration with IIoT and Industry 4.0

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of lead time

- 5.2.4.2 Challenges in harsh industrial environments

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY GAS ANALYZER TYPE (USD THOUSAND), 2024

- 5.7.2 PRICING TREND OF GAS ANALYZERS, BY GAS ANALYZER TYPE (USD THOUSAND)

- 5.7.3 AVERAGE SELLING PRICE TREND, BY REGION (USD THOUSAND)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Integrated cavity output spectroscopy

- 5.8.1.2 Quantum cascade laser

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Raman analyzers

- 5.8.2.2 Cavity ring-down spectroscopy

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Gas chromatography and mass spectrometry

- 5.8.1 KEY TECHNOLOGIES

- 5.9 IMPACT OF AI/GEN AI ON TUNABLE DIODE LASER ANALYZERS MARKET

- 5.9.1 INTRODUCTION

- 5.9.2 TOP USE CASES AND MARKET POTENTIAL

- 5.9.2.1 Smart combustion optimization

- 5.9.2.2 Proactive maintenance in petrochemicals

- 5.9.2.3 Real-time emission alerts

- 5.9.2.4 Hydrogen safety in fuel cells

- 5.9.2.5 Air quality management

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 USE CASES AND CASE STUDIES OF TUNABLE DIODE LASER ANALYZERS

- 5.12.1 REAL-TIME O2 MEASUREMENT AT GARBAGE INCINERATORS FOR ENHANCED COMBUSTION EFFICIENCY AND REDUCED EMISSIONS

- 5.12.2 ENHANCED COMBUSTION EFFICIENCY AND ENVIRONMENTAL COMPLIANCE IN FIRED HEATERS WITH TDLS TECHNOLOGY

- 5.12.3 HYDROGEN BLENDING FOR NATURAL GAS TURBINES AT LONG RIDGE ENERGY

- 5.12.4 MOISTURE MEASUREMENT IN NATURAL GAS PIPELINES USING TDLAS TECHNOLOGY

- 5.12.5 QUANTIFYING N2O EMISSIONS AT WASTEWATER TREATMENT PLANT USING ADVANCED GAS ANALYZERS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 902710)

- 5.13.2 EXPORT SCENARIO (HS CODE 902710)

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.14.2.1 Restriction of Hazardous Substances

- 5.14.2.2 Atmosphere Explosible

- 5.14.2.3 Edison Testing Laboratories

- 5.14.2.4 International Electrotechnical Commission

- 5.14.2.5 Safety Integrity Level 1

- 5.14.2.6 National Ambient Air Quality Standards

- 5.14.3 GOVERNMENT REGULATIONS

- 5.14.3.1 EPA Methane Emission Rules

- 5.14.3.2 Canadian Environmental Protection Act (CEPA), 1999

- 5.14.3.3 Clean Air Act (US), 1963

- 5.14.3.4 European Agency for Safety and Health at Work Directives

- 5.14.3.5 Germany's Federal Immission Control Act

- 5.14.3.6 Japan's Long-term Low-Carbon Vision 2050

- 5.14.4 REGULATIONS AND LAWS

- 5.14.4.1 Regulations and Laws

- 5.15 PATENT ANALYSIS, 2012-2023

- 5.16 KEY CONFERENCES AND EVENTS, 2024-2025

6 TUNABLE DIODE LASER ANALYZERS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 SINGLE-WAVELENGTH

- 6.3 MULTI-WAVELENGTH

7 TUNABLE DIODE LASER ANALYZERS MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 LASER DIODES

- 7.3 OPTICAL COMPONENTS

- 7.4 DETECTORS/PHOTODETECTORS

- 7.5 SPECTROMETERS

- 7.6 SAMPLE CELLS

- 7.7 DATA ACQUISITION SYSTEMS

- 7.8 CALIBRATION EQUIPMENT

- 7.9 OTHER COMPONENTS

8 TUNABLE DIODE LASER ANALYZERS MARKET, BY MODE OF OPERATION

- 8.1 INTRODUCTION

- 8.2 CONTINUOUS WAVE

- 8.3 PULSED WAVE

- 8.4 CHIRPED WAVE

- 8.5 MODULATED WAVE

- 8.6 OTHER MODES OF OPERATION

9 TUNABLE DIODE LASER ANALYZERS MARKET, BY METHODOLOGY

- 9.1 INTRODUCTION

- 9.2 IN SITU

- 9.2.1 REAL-TIME, COST-EFFECTIVE GAS ANALYSIS FOR INDUSTRIAL APPLICATIONS TO BOOST SEGMENT

- 9.3 EXTRACTIVE

- 9.3.1 RELATIVE EASE OF MAINTENANCE AND CALIBRATION TO DRIVE MARKET

10 TUNABLE DIODE LASER ANALYZERS MARKET, BY GAS ANALYZER TYPE

- 10.1 INTRODUCTION

- 10.2 OXYGEN ANALYZERS

- 10.2.1 GROWING USE IN INDUSTRIAL AND MEDICAL SECTORS TO BOOST MARKET GROWTH

- 10.3 AMMONIA ANALYZERS

- 10.3.1 ENHANCED INDUSTRIAL SAFETY AND PREVENTION OF HAZARDOUS INCIDENTS TO BOOST SEGMENT

- 10.4 COX ANALYZERS

- 10.4.1 BROAD APPLICATIONS ACROSS CEMENT, PULP & PAPER, AND OIL & GAS SECTORS TO PROPEL MARKET GROWTH

- 10.5 MOISTURE ANALYZERS

- 10.5.1 RISING USE IN FOOD & BEVERAGE INDUSTRY TO ACCELERATE MARKET GROWTH

- 10.6 HX ANALYZERS

- 10.6.1 GROWING USE IN CEMENT KILNS, BOILERS, AND INCINERATORS TO PROPEL MARKET GROWTH

- 10.7 CXHX ANALYZERS

- 10.7.1 MANAGEMENT OF CO2 EMISSIONS AMID RISING INDUSTRIAL DEMANDS TO FUEL MARKET GROWTH

- 10.8 OTHER ANALYZERS

11 TUNABLE DIODE LASER ANALYZERS MARKET, BY DEVICE TYPE

- 11.1 INTRODUCTION

- 11.2 PORTABLE 124 11.2.1 HANDHELD TDLA

- 11.2.1.1 Flexibility and accessibility for wide range of users to drive market

- 11.2.2 AERIAL TDLA

- 11.2.2.1 Advanced gas detection for large-scale monitoring and inspection to boost segment

- 11.3 FIXED

- 11.3.1 ENHANCED CONTINUOUS GAS MONITORING AND PROCESS CONTROL TO FUEL MARKET

12 TUNABLE DLA MARKET, BY TECHNOLOGY

- 12.1 INTRODUCTION

- 12.2 ABSORPTION

- 12.2.1 ADVANCED ANALYTICAL TECHNIQUES FOR PRECISION GAS MONITORING THROUGH ABSORPTION

- 12.3 EMISSION

- 12.3.1 IMPROVED SIGNAL PROCESSING ALGORITHMS FOR BETTER ACCURACY TO FUEL MARKET GROWTH

13 TUNABLE DIODE LASER ANALYZERS MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 ENVIRONMENTAL MONITORING

- 13.2.1 ADVANCEMENTS IN TDLA DESIGN TO PROPEL MARKET GROWTH

- 13.3 PROCESS MONITORING

- 13.3.1 USE IN CHEMICAL, SEMICONDUCTOR, AND PHARMACEUTICAL INDUSTRIES TO BOOST MARKET GROWTH

- 13.4 INDUSTRIAL EMISSION MONITORING

- 13.4.1 USE TO MEET ENVIRONMENTAL COMPLIANCE REQUIREMENTS TO PROPEL GROWTH

14 TUNABLE DIODE LASER ANALYZERS MARKET, BY END-USE INDUSTRY

- 14.1 INTRODUCTION

- 14.2 OIL & GAS

- 14.2.1 OPTIMIZED OPERATION IN OIL REFINERIES TO DRIVE MARKET

- 14.2.2 UPSTREAM

- 14.2.3 DOWNSTREAM

- 14.2.4 OFFSHORE

- 14.2.5 PIPELINE

- 14.3 METALS & MINING

- 14.3.1 DETECTION OF HAZARDOUS GASES TO DRIVE SEGMENT

- 14.3.2 COKE OVENS

- 14.3.3 EMISSIONS COMPLIANCE

- 14.3.4 FOUNDRY & METAL PRODUCTION FURNACES

- 14.3.5 KILNS

- 14.3.6 STEEL PRODUCTION

- 14.4 ENERGY & POWER

- 14.4.1 EFFICIENT EMISSION MONITORING TO FUEL MARKET

- 14.4.2 THERMAL

- 14.4.3 COMBINED CYCLE

- 14.4.4 COGENERATION

- 14.4.5 NUCLEAR

- 14.5 WASTE & WATER TREATMENT

- 14.5.1 STRINGENT GOVERNMENT REGULATIONS FOR INDUSTRIAL WASTEWATER TREATMENT TO DRIVE DEMAND

- 14.5.2 WATER TREATMENT

- 14.5.3 DESALINATION

- 14.5.4 WATER PIPELINES

- 14.5.5 WATER DISTRIBUTION

- 14.5.6 WASTEWATER TREATMENT

- 14.5.7 INDUSTRIAL WATER

- 14.6 CONSTRUCTION

- 14.6.1 ENHANCED QUALITY CONTROL AND ENVIRONMENTAL SUSTAINABILITY TO BOOST GROWTH

- 14.6.2 EMISSION COMPLIANCE

- 14.6.3 KILNS & COMBUSTION EQUIPMENT

- 14.6.4 POWER & STEAM BOILERS

- 14.7 CHEMICALS & PHARMACEUTICALS

- 14.7.1 WIDELY USED TO IMPROVE PROCESS MONITORING AND CONTROL

- 14.7.2 BASE CHEMICALS

- 14.7.3 SPECIALTY & FINE CHEMICALS

- 14.7.4 BIOFUEL

- 14.7.5 BULK & PETROCHEMICALS

- 14.7.6 STERILIZATION

- 14.7.7 MEDICAL GAS MONITORING

- 14.8 PULP & PAPER

- 14.8.1 PROCESS OPTIMIZATION, SAFETY, AND ENVIRONMENT MONITORING TO BOOST GROWTH

- 14.8.2 COMBUSTION

- 14.8.3 LIME KILNS

- 14.9 SEMICONDUCTOR & ELECTRONICS

- 14.9.1 USE IN TRACE MEASUREMENT TO DRIVE SEGMENT GROWTH

- 14.9.2 SEMICONDUCTOR EQUIPMENT

- 14.9.3 SEMICONDUCTOR TOOLS FOR PROTOTYPING AND SMALL-VOLUME PRODUCTION

15 TUNABLE DIODE LASER ANALYZERS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.2.2 US

- 15.2.2.1 Surge in oil production to accelerate market growth

- 15.2.3 CANADA

- 15.2.3.1 Stringent environmental regulations to drive market growth

- 15.2.4 MEXICO

- 15.2.4.1 Rise in industrialization and urbanization to accelerate adoption

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.3.2 UK

- 15.3.2.1 Thriving market driven by stringent emission and workplace safety regulations

- 15.3.3 GERMANY

- 15.3.3.1 Rising investments in chemical & pharmaceutical industry to accelerate market growth

- 15.3.4 FRANCE

- 15.3.4.1 Increasing adoption of laser technology in healthcare to fuel market growth

- 15.3.5 ITALY

- 15.3.5.1 Expanding applications in industrial and environmental sectors to boost market

- 15.3.6 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 CHINA

- 15.4.2.1 Robust industrial infrastructure and surging oil extraction to boost market

- 15.4.3 JAPAN

- 15.4.3.1 Growing government-driven efforts to reduce air pollution

- 15.4.4 SOUTH KOREA

- 15.4.4.1 Rapid industrialization and environmental regulations to drive market

- 15.4.5 INDIA

- 15.4.5.1 Government-led initiatives to boost market growth

- 15.4.6 REST OF ASIA PACIFIC

- 15.5 ROW

- 15.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 15.5.2 SOUTH AMERICA

- 15.5.2.1 Critical mineral boom presents opportunities for market growth

- 15.5.3 MIDDLE EAST

- 15.5.3.1 Strong demand from oil & gas sector to fuel market growth

- 15.5.3.2 GCC

- 15.5.3.3 Rest of Middle East

- 15.5.4 AFRICA

- 15.5.4.1 Increasing focus on environmental regulations present growth opportunities

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS OF TOP COMPANIES

- 16.4 MARKET SHARE ANALYSIS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 16.6 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Gas analyzer type footprint

- 16.7.5.4 Device type footprint

- 16.7.5.5 End-use industry footprint

- 16.8 STARTUP/SME EVALUATION MATRIX, 2023

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 16.8.5.1 List of key startups/SMEs

- 16.8.5.2 Competitive benchmarking

- 16.9 COMPETITIVE SITUATIONS AND TRENDS

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 KEY COMPANIES

- 17.1.1 EMERSON ELECTRIC CO.

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 SPECTRIS

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 METTLER TOLEDO

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Deals

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 AMETEK.INC.

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 YOKOGAWA ELECTRIC CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.6 ENDRESS+HAUSER GROUP SERVICES AG

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.7 ABB

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.8 SICK AG

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Deals

- 17.1.9 SIEMENS

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.10 SENSIT TECHNOLOGIES

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.11 PERGAM-SUISSE AG

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 TOKYO GAS ENGINEERING SOLUTIONS CORPORATION

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.13 HEATH CONSULTANTS INCORPORATED

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.14 HANWEI ELECTRONICS GROUP CORPORATION

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.15 BAKER HUGHES COMPANY

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product launches

- 17.1.1 EMERSON ELECTRIC CO.

- 17.2 OTHER PLAYERS

- 17.2.1 HONEYWELL INTERNATIONAL, INC.

- 17.2.2 FPI GROUP

- 17.2.3 TELEDYNE TECHNOLOGIES INCORPORATED

- 17.2.4 KIMOINSTRUMENTS.COM

- 17.2.5 BRUKER

- 17.2.6 METROHM AG

- 17.2.7 PERKINELMER INC.

- 17.2.8 TESTO INDUSTRIAL SERVICES GMBH

- 17.2.9 HORIBA, LTD.

- 17.2.10 FUJI ELECTRIC CO., LTD.

- 17.2.11 ENVEA

- 17.2.12 INFRARED CAMERAS INC.

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS