|

|

市場調査レポート

商品コード

1811750

炭素回収・利用・貯留市場:サービス別、技術別、最終用途産業別、地域別 - 2030年までの予測Carbon Capture, Utilization, and Storage Market by Service, Technology, End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 炭素回収・利用・貯留市場:サービス別、技術別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月09日

発行: MarketsandMarkets

ページ情報: 英文 318 Pages

納期: 即納可能

|

概要

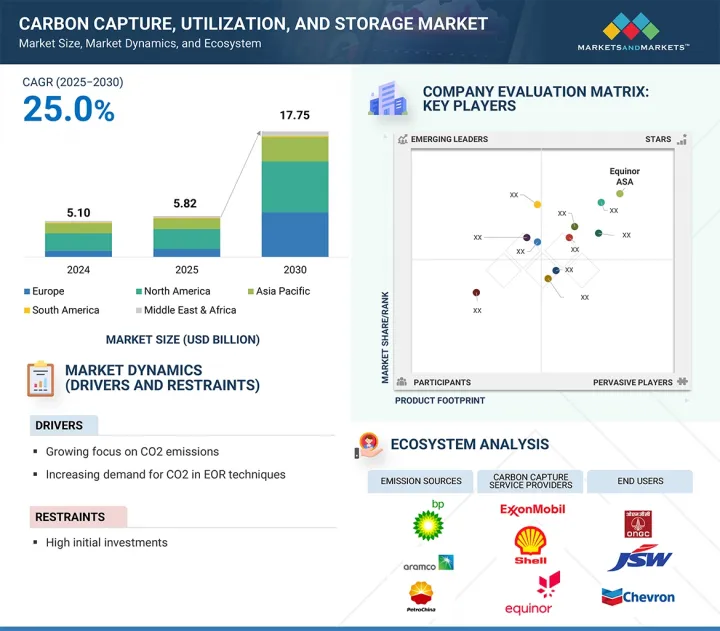

炭素回収・利用・貯留(CCUS)の市場規模は、2025年に58億2,000万米ドルと推定され、25.0%のCAGRで拡大し、2030年には177億5,000万米ドルに達すると予測されています。

CO2の回収は、バリューチェーンにおいて最も困難で資本集約的かつ不可欠なステップであり、利用や貯蔵活動につながる主要なゲートウェイであるため、回収サービスがCCUS市場の最大シェアを占めています。この需要形成は、最もコストのかかるセグメントであり、既存の産業プロセスへの統合は言うに及ばず、燃焼後、燃焼前、酸素燃料などの特殊なシステムや技術への多額の投資を必要とします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(キロトン) |

| セグメント | サービス別、技術別、最終用途産業別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、南米 |

したがって、発電、セメント、鉄鋼、化学など、排出目標や規制を達成し、低炭素ラベルを獲得しようとする産業から需要が生まれます。

ケミカル・ループは、従来の捕捉プロセスと比べてエネルギー効率が改善され、運転コストが低いことから、最も急速に成長している技術であり、燃料燃焼のための酸素シャトルとして金属酸化物を利用するため、非常に高価な溶剤再生を使用することなく、本質的にCO2を分離することができます。これが、この技術が低いエネルギー・ペナルティーを維持し、さまざまな燃料(石炭、天然ガス、バイオマスなど)の統合を可能にする理由であり、電力と産業用途の両方で水素のような価値ある出力の一部を共同生産できる場合には魅力的でさえあります。研究開発やパイロットから商業規模への実証で見られる劇的な成長の傾向や、厳しい脱炭素化目標を達成する能力が、その世界的な普及を促進しています。

石炭火力発電所とガス火力発電所は、世界的に大きなCO2排出源であり、強化される気候政策とネットゼロ目標を遵守するための回収装置による改修の最良の候補であるため、発電分野はCCUS市場で2番目に急成長している最終用途分野です。一方、電力会社は、既存の資産を存続させ、再生可能エネルギーとともに低炭素ベースロード発電を促進するために、CCUSへの投資を行っています。さらに、発電施設内でのCCUSの大規模な利用は、即座に高レベルの排出削減を実現するため、開発の遅い産業用電源と比較して、迅速な導入が促進されます。

欧州は、EUグリーンディールや法的拘束力のある2050年ネットゼロ目標などの積極的な気候政策により、電力、セメント、鉄鋼、化学セクターにおける炭素回収イニシアチブの大規模な展開を促しており、CCUS市場内で2番目に高いCAGRを記録すると予測されています。この分野は、強力な国家支援、EU排出量取引制度におけるカーボンプライシング、回収・輸送・貯蔵施設を組み合わせたオーロラ・ベンチャーやポルトス・ベンチャーのような国境を越えた協力的なプロジェクトが有利です。欧州の確立された産業基盤、支援的な規制状況、低炭素技術革新の焦点は、爆発的なCCUS拡大のための肥沃な土壌を提供します。

当レポートでは、世界の炭素回収・利用・貯留市場について調査し、サービス別、技術別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- エコシステム分析

- 価格分析

- バリューチェーン分析

- 技術分析

- AI/生成AIがCCUS市場に与える影響

- マクロ経済見通し

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響- 炭素回収・利用・貯留市場

第6章 炭素回収・利用・貯留市場(サービス別)

- イントロダクション

- 回収

- 輸送

- 利用

- 貯留

第7章 炭素回収・利用・貯留市場(技術別)

- イントロダクション

- ケミカルループ

- 溶剤と吸着剤

- 膜

- その他

第8章 炭素回収・利用・貯留市場(最終用途産業別)

- イントロダクション

- 石油・ガス

- 発電

- 化学・石油化学

- セメント

- 鉄鋼

- その他

第9章 炭素回収・利用・貯留市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ノルウェー

- 英国

- フランス

- オランダ

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他

- 中東・アフリカ

- GCC諸国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- FLUOR CORPORATION

- EXXON MOBIL CORPORATION

- SHELL PLC

- EQUINOR ASA

- TOTALENERGIES SE

- LINDE PLC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- JGC HOLDINGS CORPORATION

- SCHLUMBERGER LIMITED

- AKER SOLUTIONS

- HONEYWELL INTERNATIONAL

- HITACHI, LTD.

- SIEMENS AG

- GE VERNOVA

- HALLIBURTON

- その他の市場参入企業

- CLIMEWORKS AG

- CARBON CLEAN SOLUTIONS

- OCCIDENTAL

- GREEN MINERALS

- CARBICRETE

- CARBONFREE

- SVANTE TECHNOLOGIES INC.

- GREEN POWER INTERNATIONAL PVT. LTD.

- WOLF MIDSTREAM

- BABCOCK & WILCOX

第12章 新興技術

- 微生物電気合成(MES)

- 吸着技術別CO2回収(吸着剤としてゼオライトを使用)

- その他の新興技術