|

|

市場調査レポート

商品コード

1318147

自動車用シートの世界市場:タイプ別、技術別、シートトリム別、販売チャネル別、コンポーネント別、車両別 - 予測(~2030年)Automotive Seats Market by Type & Technology , Seat Trim OE & Aftermarket , Frame, Component, Vehicle EV, OHV, ATV, LSV - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用シートの世界市場:タイプ別、技術別、シートトリム別、販売チャネル別、コンポーネント別、車両別 - 予測(~2030年) |

|

出版日: 2023年07月21日

発行: MarketsandMarkets

ページ情報: 英文 328 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用シートの市場規模は、2023年の537億米ドルから2030年までに584億米ドルに達し、CAGRで1.2%の成長が予測されています。

市場の促進要因は、特に発展途上国におけるSUVと高級車の需要の増加や、柔軟な荷室と乗員のスペースを可能にするSUVにおける折りたたみ式や調節可能なシート構成へのニーズ、マッサージシート、メモリシート、車載エンターテインメントシステムなどの進歩です。また、EVの販売の増加により、航続距離を伸ばすためのシート構造への軽量材料の採用が増加しています。

"バケットシートが最大のシートタイプ市場となっています。"

MarketsandMarketsの分析によると、自動車全体の生産台数の増加に伴い、バケットシートの市場シェアは2023年に金額ベースで55%超を占めます。さらに、2019年に自動車の販売台数全体の約27%であったSUVの販売台数は、2022年に約38%に増加しました。フルサイズSUVの販売の増加に伴い、バケットシートの需要もここ数年で伸びています。アジア太平洋は、世界の自動車業界への生産と販売の貢献がもっとも大きいことから、市場をリードすると予想されます。

"本革は、2030年までに市場でもっとも成長するトリム材料です。"

高級車への需要の高まりが、市場における本革セグメントの成長を促進しています。国際自動車工業連合会(OICA)によると、主要国のプレミアムカーの販売台数(SUV DとSUV E)は、2019年の1,250万台から2022年に1,510万台へと順調に伸びています。自動車における本革は、その他のファブリックよりも高いリセールバリューを持っています。本革は主にハイエンドの高級車に使用され、各ブランドで提供されています。本革を使用している車の例としては、Tesla Model 3、Audi A4、Mercedes Benz C class、Volvo XC90などがあります。

"欧州は自動車シート市場でもっとも急成長している市場です。"

欧州自動車工業会(ACEA)によると、2022年のEUの乗用車の総販売台数に占めるSUVの割合は49%で、2019年比で44%増加し、乗用車の登録台数は2019年比で12%減少しました。この動向は今後も続くと予想されます。厳しい排ガス目標のため、いくつかの国では2025年からディーゼル車の販売に税金を上乗せし、電気乗用車やSUVの販売を促進します。例えば、ノルウェー政府はハイブリッド車の購入に最高2,203米ドルの補助金を提供しています。またフランスでは、CO2排出量に応じたボーナスマルス制度を導入することで、ハイブリッド車やセミハイブリッド車に対する減税措置を開始しています。2021年7月、欧州政府はEUで販売されるすべての新車とバンを2035年までにゼロエミッションにするという規制を提案しました。これはEVへのシフトを加速させるため、自動車業界に大きな影響を与えています。EVは従来のガソリン車とは異なるシートを必要とするため、このEVの販売の増加は自動車用シートの販売を促進すると予想されます。EVはふつう重いバッテリーを搭載しているため、機能を損なうことなく、より大きな重量を支えるためにシートの設計を変える必要があります。

当レポートでは、世界の自動車用シート市場について調査分析し、市場力学、地域とセグメントの分析、企業プロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- 自動車用シート市場の企業にとっての魅力的な機会

- 自動車用シート市場:シートタイプ別

- 自動車用シート市場:材料別

- 自動車用シート市場:トリム材料別

- 自動車用シート市場:技術別

- 自動車用シート市場:コンポーネント別

- 自動車用シート市場:車両タイプ別

- 電気自動車用シート市場:推進タイプ別

- オフハイウェイ用シート市場:車両タイプ別

- ATV用シート市場:座席数別

- LSV用シート市場:車両タイプ別

- 自動車用シートトリム市場:販売チャネル別

- 自動車用シート市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステムマッピング

- 顧客のビジネスに影響を与える動向/混乱

- 平均販売価格分析

- バリューチェーン分析

- 貿易分析

- 特許分析

- ケーススタディ分析

- 規制情勢

- 技術動向

- 主なステークホルダーと購入基準

- 主な会議とイベント(2023年~2024年)

第6章 自動車用シート市場:技術別

- イントロダクション

- スタンダードシート

- パワーシート

- ヒーター付きパワーシート

- ヒーター付きシート

- パワー・ヒーター付き・メモリシート

- パワー・ヒーター付き・ベンチレーテッドシート

- パワー・ヒーター付き・ベンチレーテッド・メモリシート

- パワー・ヒーター付き・ベンチレーテッド・マッサージ・メモリシート

第7章 トリム自動車用シート市場:材料別

- イントロダクション

- 合成皮革

- 本革

- ファブリック

- ポリウレタンフォーム

第8章 自動車用シート市場:コンポーネント別

- イントロダクション

- アームレスト

- 空気圧システム

- シートベルト

- シートフレーム・構造

- シートヘッドレスト

- シート高さ調整装置

- シートリクライナー

- シートトラック

- サイドカーテンエアバッグ

第9章 自動車用シート市場:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型トラック

- バス

第10章 電気自動車用シート市場:推進タイプ別

- イントロダクション

- バッテリー電気自動車

- プラグインハイブリッド電気自動車

- 燃料電池電気自動車

第11章 自動車用シート市場:シートタイプ別

- イントロダクション

- バケット

- スプリットベンチ

第12章 自動車用シート市場:材料別

- イントロダクション

- 鉄鋼

- アルミニウム

- カーボンアミドメタル

第13章 オフハイウェイ車両用シート市場:車両タイプ別

- イントロダクション

- 建設・鉱山機械

- 農業用トラクター

第14章 LSV用シート市場:車両タイプ別

- イントロダクション

- ゴルフカート

- 商業用芝ユーティリティビークル

- 工業用車両

- パーソナルモビリティ車両

第15章 ATV用シート市場:座席数別

- イントロダクション

- 1人乗り

- 2人乗り

第16章 自動車用シートトリム市場:販売チャネル別

- イントロダクション

- OEM

- アフターマーケット

第17章 自動車用シート市場:地域別

- イントロダクション

- 米国

- アメリカ:不況の影響

- 米国

- メキシコ

- カナダ

- ブラジル

- アルゼンチン

- その他の国々

- アジア太平洋

- アジア太平洋:不況の影響

- 中国

- インド

- インドネシア

- 日本

- 韓国

- タイ

- その他のアジア太平洋

- 欧州

- 欧州:不況の影響

- フランス

- ドイツ

- イタリア

- ロシア

- スペイン

- トルコ

- 英国

- その他の欧州

- 中東・アフリカ

- 中東・アフリカ:不況の影響

- イラン

- 南アフリカ

- その他の中東・アフリカ

第18章 競合情勢

- 概要

- 主要企業の収益の分析(2020年・2022年)

- 企業の評価マトリクス

- 企業の評価マトリクス:自動車用シートコンポーネントメーカー

- 競合シナリオ

- 主要企業が採用した戦略(2022年~2023年)

- 競合ベンチマーキング

第19章 企業プロファイル

- 主要企業

- ADIENT PLC

- FAURECIA

- LEAR CORPORATION

- TOYOTA BOSHOKU CORPORATION

- MAGNA INTERNATIONAL

- TS TECH CO., LTD.

- AISIN CORPORATION

- NHK SPRING CO., LTD.

- TACHI-S CO., LTD.

- GENTHERM

- その他の企業

- BROSE FAHRZEUGTEILE SE & CO. KG

- GRAMMER AG

- C.I.E.B. KAHOVEC

- PHOENIX SEATING LIMITED

- IG BAUERHIN GMBH

- SABELT

- GUELPH MANUFACTURING

- CAMACO-AMVIAN

- FREEDMAN SEATING COMPANY

- DAE WON KANG UP

- TATA AUTOCOMP SYSTEMS

- SUMMIT AUTO SEATS

- HARITA SEATING SYSTEMS LTD.

- DELTA KOGYO CO. LTD.

- BHARAT SEATS LIMITED (BSL)

第20章 推奨事項

- アジア太平洋が自動車用シートの主要市場となる

- SUVへのパワーシートの統合の進行が成長を促進する

- 結論

第21章 付録

The automotive seat market is projected to grow from USD 53.7 billion in 2023 to USD 58.4 billion by 2030, at a CAGR of 1.2%. The factors driving the automotive seats market are - an increase in demand for SUVs & luxury cars, especially in developing countries, the need for foldable & adjustable seating configurations in SUVs which allow for flexible cargo and passenger space, increasing advancements such as massage seats, memory seats, built-in entertainment systems, and others. The rise in sales of EVs has also increased the adoption of lightweight materials in seat structures to raise the vehicle range.

"Bucket Seats is the largest seat type market."

The demand for performance vehicles, including sports cars and high-performance variants, has grown globally. The increasing use of bucket seats has also increased due to the higher adoption of these seats in performance-oriented vehicles. The rising demand for full-size SUVs and the growing share of passenger cars globally drive the bucket seats market. According to the International Organization of Motor Vehicle Manufacturers (OICA), the share of passenger car production in the top regions is as below:

According to MarketsandMarkets analysis, with the increase in overall vehicle production, the market share of bucket seats accounts for >55% in value in 2023. These bucket seats provide better support and lateral confinement, essential for performance driving. Furthermore, the sales of SUVs, which was around ~27% of total car sales in the year 2019, increased to ~38% in 2022 because the SUVs are more rugged, spacious, and have higher ground clearance suitable for all terrains. With the increase in full-size SUV sales, the demand for bucket seats has also grown in the last few years.

The purchasers of new and used cars frequently look for methods to customize their vehicles, which is only possible with bucket seats because they offer various options for colors, materials, and finishes that allow purchasers to select the ideal seats based on their requirements. The Asia Pacific region is expected to lead the bucket seats market, considering it has the largest production and sales contribution to the global car industry.

"Genuine leather is the fastest growing trim material in the automotive seats market by 2030."

Genuine leather is used in car seat upholstery, particularly in higher end luxury models. The increasing demand for luxury vehicles drives the growth of the genuine leather segment in the automotive seat market. According to the International Organization of Motor Vehicle Manufacturers (OICA), the key country's premium car sales (SUV D and SUV E) grew steadily from 12.5 million units in 2019 to 15.1 million units in 2022. Genuine leather in automotive has a higher resale value than other fabrics. Genuine leather is primarily used in high-end luxury vehicles and is offered in the brands. A few examples of vehicles using genuine leather are Tesla Model 3, Audi A4, Mercedes Benz C class, and Volvo XC90.

"Europe is the fastest growing market in the automotive seat market."

According to European Automobile Manufacturers' Association (ACEA) 2022, SUVs accounted for 49% of total EU passenger car sales in 2022, which has increased by 44% compared to 2019, and passenger car registrations fell by 12% in 2022, compared to 2019. This trend is expected to continue in the coming years. Owing to the stringent emission targets, a few countries will add taxes on the sales of diesel vehicles from the year 2025, promoting the sales of electric passenger cars and SUVs. For instance, the Norway government offers a grant of up to USD 2,203 for purchasing a hybrid vehicle. Also, France has started offering a tax break for hybrid and semi-hybrid vehicles by introducing a bonus-malus system for cars based on their CO2 emissions. In July 2021, the European government proposed a regulation that all the new cars and vans sold in the EU will be zero-emission by 2035, which has significantly impacted the automotive industry, as it will accelerate the shift towards EVs. This increase in EV sales will boost the sales of automotive seats, as EVs will require different seats than traditional gasoline-powered vehicles. EVs usually have heavy batteries, which require seats to be designed differently to support more weight without compromising features. Some of the major automotive seat industry players are operating from Europe - Adient Plc, with production facilities in Germany, France, Italy, & the United Kingdom, and Faurecia, with facilities in Germany, France, Spain, & the Czech Republic.

The break-up of the profile of primary participants in the passenger car seats market:

- By Company Type: Tier 1 - 80%, Tier 2 - 20 %.

- By Designation: Director Level - 10%, C Level - 60%, Others - 30%.

- By Region: Asia Pacific - 90%. Europe - 0%, America - 10.0%, MEA-0%.

Prominent companies include Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada) are the leading manufacturers of passenger car seats in the global market.

Research Coverage:

This research report categorizes the automotive seats market by technology type (heated seats; heated and powered seats; standard seats; powered seats; powered, heated and memory seats; powered, heated, and ventilated seats; powered, heated, ventilated, and memory seats; powered, heated, ventilated, massage and memory seats), by seat type (bucket and split bench), by component (armrests, pneumatic systems, seat belts, seat frames and structures, seat headrests, seat height adjusters, seat recliners, seat tracks, and side curtain airbags), by vehicle type (passenger cars, light commercial vehicles, heavy trucks, and buses), by material (steel, aluminum, and carbon-amide-metal), by trim material (genuine leather, synthetic leather, and fabric), off-highway vehicle, by vehicle type (construction and mining equipment, and agricultural tractors), Electric vehicle seats market, by propulsion type (battery electric vehicle, fuel cell electric vehicle and plug-in hybrid electric vehicle), LSV seats market, by vehicle type (golf carts, commercial turf utility vehicles, industrial utility vehicles, and personal mobility vehicles), seat trim material, by sales channel (OEM and aftermarket), ATV seats market, by seating capacity (one-seater and two-seater), and by region (Asia Pacific, Europe, Americas, and the Middle East & Africa). The report's scope covers detailed information regarding the major factors, such as influencing factors for the growth of the automotive seat market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, recession impact, and recent developments associated with the automotive seats market. This report covers the competitive analysis of upcoming automotive seat market startups.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive seats market and their subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for premium vehicles, Rising adoption of powered seats in mid-segment cars & SUVs), restraints (High cost of advanced modular seats compared to conventional seats), opportunities (Growing focus on autonomous cars and increased preference for ride sharing, Increasing demand for lightweight seating materials in electric vehicles), and challenges (Costing and investment on lightweight material for right composition in automotive seats) influencing the growth of the automotive seats market.

- Product Development/Innovation: Detailed insights on new products such as, Zero Gravity Captain Chairs by Faurecia in April 2023, and ReNewKnit Sueded Material launched by Adient Plc in October 2022.

- Market Development: The growing demand for premium cars, and rising demand for powered seats in mid segment and SUVs is driving the market - the report analyses the automotive seat market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive seat market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada) among others in the automotive seat market.

The report also helps stakeholders understand the pulse of the automotive seats market & electric vehicle market by providing information on recent trends and technologies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AUTOMOTIVE SEATS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for vehicle production

- 2.1.1.2 Key secondary sources for market sizing

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 Sampling techniques and data collection methods

- 2.1.2.2 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH, BY TECHNOLOGY

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH, BY COMPONENT

- FIGURE 7 TOP-DOWN APPROACH, BY TRIM MATERIAL

- FIGURE 8 TOP-DOWN APPROACH, BY MATERIAL

- 2.3 FACTOR ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- TABLE 1 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 10 REPORT SUMMARY

- FIGURE 11 AUTOMOTIVE SEATS MARKET, BY REGION, 2023 VS. 2030 (THOUSAND UNITS)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE SEATS MARKET

- FIGURE 12 GROWING CUSTOMER INCLINATION TOWARD COMFORT AND LUXURY FEATURES

- 4.2 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE

- FIGURE 13 BUCKET SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY VALUE IN 2023

- 4.3 AUTOMOTIVE SEATS MARKET, BY MATERIAL

- FIGURE 14 STEEL TO BE LARGEST SEGMENT BY VALUE DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL

- FIGURE 15 SYNTHETIC LEATHER TO SECURE LEADING MARKET POSITION BY VALUE IN 2023

- 4.5 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY

- FIGURE 16 STANDARD SEATS TO SURPASS OTHER SEGMENTS BY VOLUME DURING FORECAST PERIOD

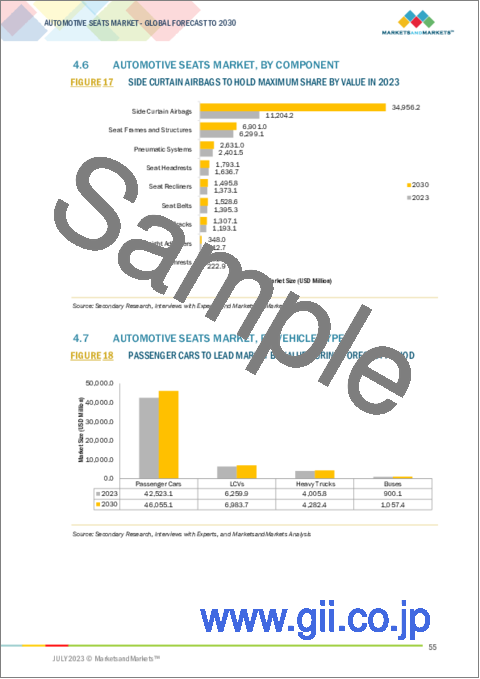

- 4.6 AUTOMOTIVE SEATS MARKET, BY COMPONENT

- FIGURE 17 SIDE CURTAIN AIRBAGS TO HOLD MAXIMUM SHARE BY VALUE IN 2023

- 4.7 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE

- FIGURE 18 PASSENGER CARS TO LEAD MARKET BY VALUE DURING FORECAST PERIOD

- 4.8 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE

- FIGURE 19 BEVS TO EXCEED OTHER SEGMENTS BY VOLUME BETWEEN 2023 AND 2030

- 4.9 OFF-HIGHWAY SEATS MARKET, BY VEHICLE TYPE

- FIGURE 20 AGRICULTURAL TRACTORS TO HOLD MAJORITY SHARE BY VOLUME IN 2030

- 4.10 ATV SEATS MARKET, BY SEATING CAPACITY

- FIGURE 21 ONE-SEATER TO BE LARGEST SEGMENT BY VALUE DURING FORECAST PERIOD

- 4.11 LSV SEATS MARKET, BY VEHICLE TYPE

- FIGURE 22 GOLF CARTS TO DOMINATE MARKET BY VOLUME IN 2030

- 4.12 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL

- FIGURE 23 AFTERMARKET TO BE FASTEST-GROWING SEGMENT BY VALUE DURING FORECAST PERIOD

- 4.13 AUTOMOTIVE SEATS MARKET, BY REGION

- FIGURE 24 ASIA PACIFIC TO BE LARGEST MARKET IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 AUTOMOTIVE SEATS MARKET: DRIVER, CHALLENGES, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for premium passenger cars

- FIGURE 26 GLOBAL PREMIUM PASSENGER CAR PRODUCTION, 2018-2022 (MILLION UNITS)

- TABLE 2 VEHICLES OFFERING GENUINE LEATHER SEATS, 2022

- 5.2.1.2 Growing preference for SUVs

- FIGURE 27 NEW REGISTRATIONS OF SUVS, BY COUNTRY, 2018-2022 (MILLION UNITS)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced modular seats compared with conventional seats

- TABLE 3 AVERAGE COST OF SEATS, BY TECHNOLOGY, 2022 (USD)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising emphasis on autonomous cars and ridesharing services

- 5.2.3.2 Growing demand for lightweight seating materials in electric vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 High investment in lightweight materials for automotive seats

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN SUPPLY CHAIN

- 5.4 ECOSYSTEM MAPPING

- FIGURE 29 AUTOMOTIVE SEATS MARKET ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 AUTONOMOUS CAR AND RIDESHARING PRESENT NEW REVENUE SHIFT FOR AUTOMOTIVE SEAT MANUFACTURERS

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- TABLE 5 AVERAGE PRICE TREND OF AUTOMOTIVE SEATS, BY REGION, 2022 (USD)

- TABLE 6 AVERAGE PRICE TREND OF AUTOMOTIVE SEATS, BY TRIM MATERIAL, 2022 (USD/METER)

- TABLE 7 AVERAGE PRICE TREND OF AUTOMOTIVE SEATS, BY SEAT FRAME MATERIAL, 2022 (USD/METRIC TON)

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA

- TABLE 8 US: IMPORT, BY COUNTRY (%)

- TABLE 9 FRANCE: IMPORT, BY COUNTRY (%)

- TABLE 10 GERMANY: IMPORT, BY COUNTRY (%)

- TABLE 11 MEXICO: IMPORT, BY COUNTRY (%)

- TABLE 12 BELGIUM: IMPORT, BY COUNTRY (%)

- 5.8.2 EXPORT DATA

- TABLE 13 GERMANY: EXPORT, BY COUNTRY (%)

- TABLE 14 POLAND: EXPORT, BY COUNTRY (%)

- TABLE 15 CZECH REPUBLIC: EXPORT, BY COUNTRY (%)

- TABLE 16 CHINA: EXPORT, BY COUNTRY (%)

- TABLE 17 MEXICO: EXPORT, BY COUNTRY (%)

- 5.9 PATENT ANALYSIS

- TABLE 18 INNOVATION AND PATENT REGISTRATIONS, 2018-2022

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CASE STUDY 1

- 5.10.2 CASE STUDY 2

- 5.10.3 CASE STUDY 3

- 5.10.4 CASE STUDY 4

- 5.11 REGULATORY LANDSCAPE

- TABLE 19 SAFETY REGULATIONS, BY COUNTRY/REGION

- 5.12 TECHNOLOGY TRENDS

- 5.12.1 ADIENT AI18 SEATING SOLUTION FOR RIDESHARING

- 5.12.2 GENTHERM CLIMATE CONTROL SEAT

- 5.12.3 FORD RECONFIGURABLE SEAT

- 5.12.4 LEAR CONFIGURE+

- 5.12.5 LEAR PROACTIVE POSTURE

- 5.12.6 ADIENT COMFORTTHIN SEAT

- 5.12.7 ADIENT PRE-ADJUST SEAT

- 5.12.8 LEAR INTU INTELLIGENT SEATING SYSTEM

- 5.12.9 MERCEDES-BENZ MBUX INTERIOR ASSISTANT

- 5.12.10 FORD KINETIC SEAT

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AUTOMOTIVE SEATS

- 5.13.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR AUTOMOTIVE SEATS

- TABLE 21 KEY BUYING CRITERIA FOR AUTOMOTIVE SEATS

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 22 KEY CONFERENCES AND EVENTS, 2023-2024

6 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.1.1 INDUSTRY INSIGHTS

- FIGURE 33 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023 VS. 2030 (THOUSAND UNITS)

- TABLE 23 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 24 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 6.2 STANDARD SEATS

- 6.2.1 WIDESPREAD ADOPTION IN LOW AND MID-VARIANT CARS TO DRIVE GROWTH

- TABLE 25 STANDARD SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 26 STANDARD SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.3 POWERED SEATS

- 6.3.1 RISING INSTALLATION IN SUVS TO DRIVE GROWTH

- TABLE 27 SELECT MODELS WITH POWERED SEATS, 2022

- TABLE 28 POWERED SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 29 POWERED SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.4 HEATED AND POWERED SEATS

- 6.4.1 INCREASING DEMAND FOR COMFORT AND CONVENIENCE TO DRIVE GROWTH

- TABLE 30 SELECT MODELS WITH HEATED AND POWERED SEATS, 2022

- TABLE 31 HEATED AND POWERED SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 32 HEATED AND POWERED SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.5 HEATED SEATS

- 6.5.1 COLD WEATHER CONDITIONS IN AMERICAS AND EUROPE TO DRIVE GROWTH

- TABLE 33 SELECT MODELS WITH HEATED SEATS, 2022

- TABLE 34 HEATED SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 35 HEATED SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.6 POWERED, HEATED, AND MEMORY SEATS

- 6.6.1 LARGE-SCALE INTEGRATION IN PREMIUM VEHICLES TO DRIVE GROWTH

- TABLE 36 SELECT MODELS WITH POWERED, HEATED, AND MEMORY SEATS, 2022

- TABLE 37 POWERED, HEATED, AND MEMORY SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 38 POWERED, HEATED, AND MEMORY SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.7 POWERED, HEATED, AND VENTILATED SEATS

- 6.7.1 EXPANDING INSTALLATION IN MID AND HIGH-END PASSENGER CARS TO DRIVE GROWTH

- TABLE 39 SELECT MODELS WITH POWERED, HEATED, AND VENTILATED SEATS, 2022

- TABLE 40 POWERED, HEATED, AND VENTILATED SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 41 POWERED, HEATED, AND VENTILATED SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.8 POWERED, HEATED, VENTILATED, AND MEMORY SEATS

- 6.8.1 EXTENSIVE USE IN PREMIUM COUPES TO DRIVE GROWTH

- TABLE 42 SELECT MODELS WITH POWERED, HEATED, VENTILATED, AND MEMORY SEATS, 2022

- TABLE 43 POWERED, HEATED, VENTILATED, AND MEMORY SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 44 POWERED, HEATED, VENTILATED, AND MEMORY SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.9 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS

- 6.9.1 RAPID DEPLOYMENT IN LUXURY VEHICLES TO DRIVE GROWTH

- TABLE 45 SELECT MODELS WITH POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS, 2022

- TABLE 46 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 47 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

7 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL

- 7.1 INTRODUCTION

- 7.1.1 INDUSTRY INSIGHTS

- FIGURE 34 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL, 2023 VS. 2030 (USD MILLION)

- TABLE 48 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 49 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 50 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL, 2018-2022 (USD MILLION)

- TABLE 51 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL 2023-2030 (USD MILLION)

- 7.2 SYNTHETIC LEATHER

- 7.2.1 FLEXIBILITY AND BETTER AESTHETIC APPEAL TO DRIVE GROWTH

- TABLE 52 MODELS WITH SYNTHETIC LEATHER SEATS, 2022

- TABLE 53 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 54 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 55 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

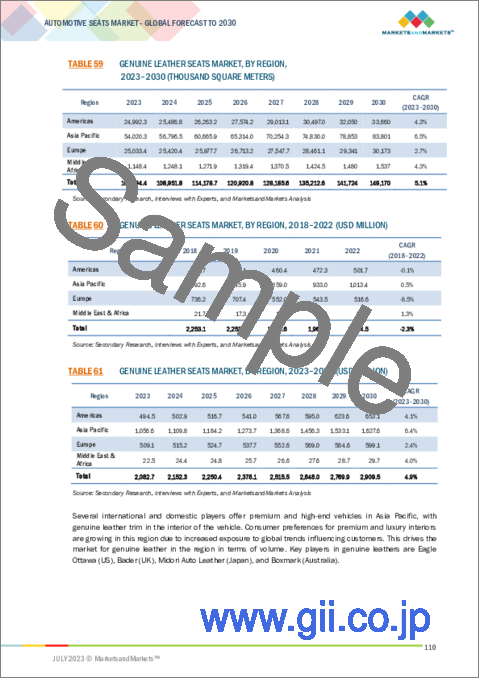

- 7.3 GENUINE LEATHER

- 7.3.1 INCREASING DEPLOYMENT IN PREMIUM AND HIGH-END VEHICLES TO DRIVE GROWTH

- TABLE 57 MODELS WITH GENUINE LEATHER SEATS, 2022

- TABLE 58 GENUINE LEATHER SEATS MARKET, BY REGION, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 59 GENUINE LEATHER SEATS MARKET, BY REGION, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 60 GENUINE LEATHER SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 GENUINE LEATHER SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.4 FABRIC

- 7.4.1 LOW COST AND EASE OF MAINTENANCE TO DRIVE GROWTH

- TABLE 62 MODELS WITH FABRIC SEATS, 2022

- TABLE 63 FABRIC SEATS MARKET, BY REGION, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 64 FABRIC SEATS MARKET, BY REGION, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 65 FABRIC SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 FABRIC SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.4.2 POLYESTER WOVEN FABRIC

- TABLE 67 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 68 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 69 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 POLYESTER WOVEN FABRIC SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.4.3 WOVEN VELOUR FABRIC

- TABLE 71 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 72 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 73 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.4.4 PVC AND OTHERS

- TABLE 75 PVC AND OTHER SEATS MARKET, BY REGION, 2018-2022 (THOUSAND SQUARE METERS)

- TABLE 76 PVC AND OTHER SEATS MARKET, BY REGION, 2023-2030 (THOUSAND SQUARE METERS)

- TABLE 77 PVC AND OTHER SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 PVC AND OTHER SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.5 POLYURETHANE FOAM

- TABLE 79 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2018-2022 (THOUSAND KILOGRAMS)

- TABLE 80 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2023-2030 (THOUSAND KILOGRAMS)

- TABLE 81 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

8 AUTOMOTIVE SEATS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.1.1 INDUSTRY INSIGHTS

- FIGURE 35 AUTOMOTIVE SEATS MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- TABLE 83 AUTOMOTIVE SEATS MARKET, BY COMPONENT, 2018-2022 (MILLION UNITS)

- TABLE 84 AUTOMOTIVE SEATS MARKET, BY COMPONENT, 2023-2030 (MILLION UNITS)

- TABLE 85 AUTOMOTIVE SEATS MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 86 AUTOMOTIVE SEATS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- 8.2 ARMRESTS

- TABLE 87 MODELS WITH ARMRESTS, 2022

- TABLE 88 ARMRESTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 89 ARMRESTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 90 ARMRESTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 91 ARMRESTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.3 PNEUMATIC SYSTEMS

- TABLE 92 PNEUMATIC SYSTEMS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 93 PNEUMATIC SYSTEMS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 94 PNEUMATIC SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 95 PNEUMATIC SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.4 SEAT BELTS

- TABLE 96 SEAT BELT LAWS, BY COUNTRY

- TABLE 97 SEAT BELTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 98 SEAT BELTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 99 SEAT BELTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 100 SEAT BELTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.5 SEAT FRAMES AND STRUCTURES

- TABLE 101 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 102 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 103 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 104 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.6 SEAT HEADRESTS

- TABLE 105 SEAT HEADRESTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 106 SEAT HEADRESTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 107 SEAT HEADRESTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 108 SEAT HEADRESTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.7 SEAT HEIGHT ADJUSTERS

- TABLE 109 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 110 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 111 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 112 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.8 SEAT RECLINERS

- TABLE 113 SEAT RECLINERS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 114 SEAT RECLINERS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 115 SEAT RECLINERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 116 SEAT RECLINERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.9 SEAT TRACKS

- TABLE 117 SEAT TRACKS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 118 SEAT TRACKS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 119 SEAT TRACKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 120 SEAT TRACKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.10 SIDE CURTAIN AIRBAGS

- TABLE 121 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 122 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 123 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 124 SIDE CURTAIN AIRBAGS MARKET, BY REGION, 2023-2030 (USD MILLION)

9 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- FIGURE 36 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- TABLE 125 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 126 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- TABLE 127 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 128 AUTOMOTIVE SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (USD MILLION)

- 9.2 PASSENGER CARS

- 9.2.1 EVOLVING CONSUMER EXPECTATIONS TO DRIVE GROWTH

- TABLE 129 PASSENGER CAR SEATS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 130 PASSENGER CAR SEATS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 131 PASSENGER CAR SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 132 PASSENGER CAR SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.3 LIGHT COMMERCIAL VEHICLES

- 9.3.1 GROWING PREVALENCE OF LAST-MILE DELIVERY SERVICES TO DRIVE GROWTH

- TABLE 133 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 134 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 135 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 136 LIGHT COMMERCIAL VEHICLE SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.4 HEAVY TRUCKS

- 9.4.1 BOOMING E-COMMERCE SECTOR TO DRIVE GROWTH

- TABLE 137 HEAVY TRUCK SEATS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 138 HEAVY TRUCK SEATS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 139 HEAVY TRUCK SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 140 HEAVY TRUCK SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.5 BUSES

- 9.5.1 SOARING TOURISM AND SHUTTLE SERVICES TO DRIVE GROWTH

- TABLE 141 BUS SEATS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 142 BUS SEATS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 143 BUS SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 144 BUS SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

10 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE

- 10.1 INTRODUCTION

- 10.1.1 INDUSTRY INSIGHTS

- FIGURE 37 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE, 2023 VS. 2030 (THOUSAND UNITS)

- TABLE 145 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 146 ELECTRIC VEHICLE SEATS MARKET, BY PROPULSION TYPE, 2023-2030 (THOUSAND UNITS)

- 10.2 BATTERY ELECTRIC VEHICLES

- 10.2.1 INCREASED INVESTMENTS IN BATTERY TECHNOLOGY TO DRIVE GROWTH

- TABLE 147 BEV SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 148 BEV SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 10.3 PLUG-IN HYBRID ELECTRIC VEHICLES

- 10.3.1 STRINGENT EMISSION REGULATIONS TO DRIVE GROWTH

- TABLE 149 PHEV SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 150 PHEV SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 10.4 FUEL CELL ELECTRIC VEHICLES

- 10.4.1 IMPROVEMENTS IN FUEL CELL TECHNOLOGY TO DRIVE GROWTH

- TABLE 151 FCEV SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 152 FCEV SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

11 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE

- 11.1 INTRODUCTION

- 11.1.1 INDUSTRY INSIGHTS

- FIGURE 38 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE, 2023 VS. 2030 (USD BILLION)

- TABLE 153 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE, 2018-2022 (MILLION UNITS)

- TABLE 154 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE, 2023-2030 (MILLION UNITS)

- TABLE 155 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE, 2018-2022 (USD BILLION)

- TABLE 156 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE, 2023-2030 (USD BILLION)

- 11.2 BUCKET

- 11.2.1 INCREASING ADOPTION IN HIGH-PERFORMANCE CARS TO DRIVE GROWTH

- TABLE 157 SAFETY REGULATION FOR BUCKET SEATS

- TABLE 158 MODELS WITH BUCKET SEATS, 2022

- TABLE 159 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 160 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- TABLE 161 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (USD BILLION)

- TABLE 162 BUCKET SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (USD BILLION)

- 11.3 SPLIT BENCH

- 11.3.1 GROWING DEMAND FOR SUVS TO DRIVE GROWTH

- TABLE 163 SAFETY REGULATIONS FOR SPLIT BENCH SEATS

- TABLE 164 MODELS WITH SPLIT BENCH SEATS, 2022

- TABLE 165 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 166 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- TABLE 167 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (USD BILLION)

- TABLE 168 SPLIT BENCH SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (USD BILLION)

12 AUTOMOTIVE SEATS MARKET, BY MATERIAL

- 12.1 INTRODUCTION

- 12.1.1 INDUSTRY INSIGHTS

- FIGURE 39 AUTOMOTIVE SEATS MARKET, BY MATERIAL, 2023 VS. 2030 (USD THOUSAND)

- TABLE 169 AUTOMOTIVE SEATS MARKET, BY MATERIAL, 2018-2022 (METRIC TONS)

- TABLE 170 AUTOMOTIVE SEATS MARKET, BY MATERIAL, 2023-2030 (METRIC TONS)

- TABLE 171 AUTOMOTIVE SEATS MARKET, BY MATERIAL, 2018-2022 (USD THOUSAND)

- TABLE 172 AUTOMOTIVE SEATS MARKET, BY MATERIAL, 2023-2030 (USD THOUSAND)

- 12.2 STEEL

- 12.2.1 RISING FOCUS ON SAFETY TO DRIVE GROWTH

- TABLE 173 STRENGTH VS. DENSITY CHART

- TABLE 174 STEEL: AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (METRIC TONS)

- TABLE 175 STEEL: AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (METRIC TONS)

- TABLE 176 STEEL: AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 177 STEEL: AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3 ALUMINUM

- 12.3.1 INCREASING PREFERENCE FOR LIGHTWEIGHT MATERIALS TO DRIVE GROWTH

- TABLE 178 ALUMINUM: AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (METRIC TONS)

- TABLE 179 ALUMINUM: AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (METRIC TONS)

- TABLE 180 ALUMINUM: AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 181 ALUMINUM: AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.4 CARBON-AMIDE-METAL

- 12.4.1 LOW COST AND LIGHTWEIGHT PROPERTIES TO DRIVE GROWTH

- TABLE 182 CARBON-AMIDE-METAL: AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (METRIC TONS)

- TABLE 183 CARBON-AMIDE-METAL: AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (METRIC TONS)

- TABLE 184 CARBON-AMIDE-METAL: AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 185 CARBON-AMIDE-METAL: AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

13 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE

- 13.1 INTRODUCTION

- 13.1.1 INDUSTRY INSIGHTS

- FIGURE 40 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (THOUSAND UNITS)

- TABLE 186 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 187 OFF-HIGHWAY VEHICLE SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (THOUSAND UNITS)

- 13.2 CONSTRUCTION AND MINING EQUIPMENT

- TABLE 188 CONSTRUCTION AND MINING EQUIPMENT WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 189 CONSTRUCTION AND MINING EQUIPMENT SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 190 CONSTRUCTION AND MINING EQUIPMENT SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 13.3 AGRICULTURAL TRACTORS

- TABLE 191 AGRICULTURAL TRACTOR SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 192 AGRICULTURAL TRACTOR SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

14 LSV SEATS MARKET, BY VEHICLE TYPE

- 14.1 INTRODUCTION

- 14.1.1 INDUSTRY INSIGHTS

- FIGURE 41 LSV SEATS MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- TABLE 193 LSV SEATS MARKET, BY VEHICLE TYPE, 2018-2022 (UNITS)

- TABLE 194 LSV SEATS MARKET, BY VEHICLE TYPE, 2023-2030 (UNITS)

- 14.2 GOLF CARTS

- 14.2.1 IMPROVEMENTS IN CHARGING INFRASTRUCTURE TO DRIVE GROWTH

- TABLE 195 GOLF CARTS: FOUR-SEATER MODELS, 2022-2023

- TABLE 196 GOLF CART SEATS MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 197 GOLF CART SEATS MARKET, BY REGION, 2023-2030 (UNITS)

- 14.3 COMMERCIAL TURF UTILITY VEHICLES

- 14.3.1 HIGH DEMAND FROM HOTELS AND RESORTS TO DRIVE GROWTH

- TABLE 198 COMMERCIAL TURF UTILITY VEHICLES: TWO-SEATER MODELS, 2022-2023

- TABLE 199 COMMERCIAL TURF UTILITY VEHICLE SEATS MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 200 COMMERCIAL TURF UTILITY VEHICLE SEATS MARKET, BY REGION, 2023-2030 (UNITS)

- 14.4 INDUSTRIAL UTILITY VEHICLES

- 14.4.1 WIDESPREAD USE IN CONSTRUCTION INDUSTRY TO DRIVE GROWTH

- TABLE 201 INDUSTRIAL UTILITY VEHICLES: TWO-SEATER MODELS, 2022-2023

- TABLE 202 INDUSTRIAL UTILITY VEHICLE SEATS MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 203 INDUSTRIAL UTILITY VEHICLE SEATS MARKET, BY REGION, 2023-2030 (UNITS)

- 14.5 PERSONAL MOBILITY VEHICLES

- 14.5.1 GOVERNMENT SUBSIDIES AND INCENTIVES TO DRIVE GROWTH

- TABLE 204 PERSONAL MOBILITY VEHICLES: TWO-SEATER MODELS, 2022-2023

- TABLE 205 PERSONAL MOBILITY VEHICLE SEATS MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 206 PERSONAL MOBILITY VEHICLE SEATS MARKET, BY REGION, 2023-2030 (UNITS)

15 ATV SEATS MARKET, BY SEATING CAPACITY

- 15.1 INTRODUCTION

- 15.1.1 INDUSTRY INSIGHTS

- FIGURE 42 ATV SEATS MARKET, BY SEATING CAPACITY, 2023 VS. 2030 (USD MILLION)

- TABLE 207 ATV SEATS MARKET, BY SEATING CAPACITY, 2018-2022 (THOUSAND UNITS)

- TABLE 208 ATV SEATS MARKET, BY SEATING CAPACITY, 2023-2030 (THOUSAND UNITS)

- TABLE 209 ATV SEATS MARKET, BY SEATING CAPACITY, 2018-2022 (USD MILLION)

- TABLE 210 ATV SEATS MARKET, BY SEATING CAPACITY, 2023-2030 (USD MILLION)

- 15.2 ONE-SEATER

- TABLE 211 ONE-SEATER ATV SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 212 ONE-SEATER ATV SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 213 ONE-SEATER ATV SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 214 ONE-SEATER ATV SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 15.3 TWO-SEATER

- TABLE 215 TWO-SEATER ATV SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 216 TWO-SEATER ATV SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 217 TWO-SEATER ATV SEATS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 218 TWO-SEATER ATV SEATS MARKET, BY REGION, 2023-2030 (USD MILLION)

16 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL

- 16.1 INTRODUCTION

- 16.1.1 INDUSTRY INSIGHTS

- FIGURE 43 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL, 2023 VS. 2030 (USD MILLION)

- TABLE 219 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL, 2018-2022 (USD MILLION)

- TABLE 220 AUTOMOTIVE SEATS TRIM MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- 16.2 OEM

- TABLE 221 AUTOMOTIVE SEATS TRIM OE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 222 AUTOMOTIVE SEATS TRIM OE MARKET, BY REGION, 2023-2030 (USD MILLION)

- 16.3 AFTERMARKET

- TABLE 223 AUTOMOTIVE SEATS TRIM AFTERMARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 224 AUTOMOTIVE SEATS TRIM AFTERMARKET, BY REGION, 2023-2030 (USD MILLION)

17 AUTOMOTIVE SEATS MARKET, BY REGION

- 17.1 INTRODUCTION

- 17.1.1 INDUSTRY INSIGHTS

- FIGURE 44 AUTOMOTIVE SEATS MARKET, BY REGION, 2023 VS. 2030 (THOUSAND UNITS)

- TABLE 225 AUTOMOTIVE SEATS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 226 AUTOMOTIVE SEATS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 17.2 AMERICAS

- FIGURE 45 AMERICAS: AUTOMOTIVE SEATS MARKET SNAPSHOT

- TABLE 227 AMERICAS: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 228 AMERICAS: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- 17.2.1 AMERICAS: RECESSION IMPACT

- 17.2.2 US

- 17.2.2.1 Increased investments in advanced seating technologies to drive growth

- TABLE 229 US: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 230 US: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 231 US: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.2.3 MEXICO

- 17.2.3.1 Free trade agreements to drive growth

- TABLE 232 MEXICO: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 233 MEXICO: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 234 MEXICO: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.2.4 CANADA

- 17.2.4.1 Government incentives on electric vehicles to drive growth

- TABLE 235 CANADA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 236 CANADA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 237 CANADA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.2.5 BRAZIL

- 17.2.5.1 Availability of alternate fuel sources to drive growth

- TABLE 238 BRAZIL: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 239 BRAZIL: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 240 BRAZIL: AUTOMOTIVE MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.2.6 ARGENTINA

- 17.2.6.1 Scrappage programs for old vehicles to drive growth

- TABLE 241 ARGENTINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 242 ARGENTINA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 243 ARGENTINA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.2.7 OTHER COUNTRIES

- TABLE 244 OTHER COUNTRIES: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 245 OTHER COUNTRIES: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3 ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: AUTOMOTIVE SEATS MARKET SNAPSHOT

- TABLE 246 ASIA PACIFIC: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 247 ASIA PACIFIC: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- 17.3.1 ASIA PACIFIC: RECESSION IMPACT

- 17.3.2 CHINA

- 17.3.2.1 Emission control mandates to drive growth

- TABLE 248 CHINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 249 CHINA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 250 CHINA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3.3 INDIA

- 17.3.3.1 High import duty tax on vehicles to drive growth

- TABLE 251 INDIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 252 INDIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 253 INDIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3.4 INDONESIA

- 17.3.4.1 Limited domestic public transportation to drive growth

- TABLE 254 INDONESIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 255 INDONESIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3.5 JAPAN

- 17.3.5.1 Growing trend of carpooling and ridesharing to drive growth

- TABLE 256 JAPAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 257 JAPAN: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 258 JAPAN: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3.6 SOUTH KOREA

- 17.3.6.1 Tax incentives on eco-friendly vehicles to drive growth

- TABLE 259 SOUTH KOREA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 260 SOUTH KOREA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 261 SOUTH KOREA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3.7 THAILAND

- 17.3.7.1 Booming tourism industry to drive growth

- TABLE 262 THAILAND: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 263 THAILAND: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.3.8 REST OF ASIA PACIFIC

- TABLE 264 REST OF ASIA PACIFIC: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 265 REST OF ASIA PACIFIC: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4 EUROPE

- TABLE 266 EUROPE: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 267 EUROPE: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- 17.4.1 EUROPE: RECESSION IMPACT

- 17.4.2 FRANCE

- 17.4.2.1 Presence of renowned automakers to drive growth

- TABLE 268 FRANCE: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 269 FRANCE: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 270 FRANCE: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.3 GERMANY

- 17.4.3.1 Increasing charging infrastructure to drive growth

- TABLE 271 GERMANY: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 272 GERMANY: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 273 GERMANY: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.4 ITALY

- 17.4.4.1 Large-scale production of SUVs to drive growth

- TABLE 274 ITALY: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 275 ITALY: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 276 ITALY: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.5 RUSSIA

- 17.4.5.1 Exemption in import duties to drive growth

- TABLE 277 RUSSIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 278 RUSSIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 279 RUSSIA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.6 SPAIN

- 17.4.6.1 New safety regulations to drive growth

- TABLE 280 SPAIN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 281 SPAIN: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 282 SPAIN: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.7 TURKEY

- 17.4.7.1 Low operating cost of vehicles to drive growth

- TABLE 283 TURKEY: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 284 TURKEY: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.8 UK

- 17.4.8.1 Stringent emission regulations to drive growth

- TABLE 285 UK: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 286 UK: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 287 UK: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.4.9 REST OF EUROPE

- TABLE 288 REST OF EUROPE: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 289 REST OF EUROPE: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.5 MIDDLE EAST & AFRICA

- TABLE 290 MIDDLE EAST & AFRICA: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 291 MIDDLE EAST & AFRICA: AUTOMOTIVE SEATS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNITS)

- 17.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 17.5.2 IRAN

- 17.5.2.1 Government subsidies to reduce car shortage to drive growth

- TABLE 292 IRAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 293 IRAN: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 294 IRAN: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.5.3 SOUTH AFRICA

- 17.5.3.1 Vast production of passenger cars to drive growth

- TABLE 295 SOUTH AFRICA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 296 SOUTH AFRICA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 297 SOUTH AFRICA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

- 17.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 298 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2018-2022 (THOUSAND UNITS)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND UNITS)

18 COMPETITIVE LANDSCAPE

- 18.1 OVERVIEW

- FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 18.2 REVENUE ANALYSIS OF KEY PLAYERS, 2020 VS. 2022

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022

- 18.3 COMPANY EVALUATION MATRIX

- 18.3.1 STARS

- 18.3.2 EMERGING LEADERS

- 18.3.3 PERVASIVE PLAYERS

- 18.3.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- 18.4 COMPANY EVALUATION MATRIX: AUTOMOTIVE SEAT COMPONENT MANUFACTURERS

- 18.4.1 STARS

- 18.4.2 EMERGING LEADERS

- 18.4.3 PERVASIVE PLAYERS

- 18.4.4 PARTICIPANTS

- FIGURE 50 COMPANY EVALUATION MATRIX: AUTOMOTIVE SEAT COMPONENT MANUFACTURERS, 2022

- TABLE 300 KEY GROWTH STRATEGIES, 2022-2023

- 18.5 COMPETITIVE SCENARIO

- 18.5.1 PRODUCT DEVELOPMENTS

- TABLE 301 PRODUCT DEVELOPMENTS, 2022-2023

- 18.5.2 DEALS

- TABLE 302 DEALS, 2022-2023

- 18.5.3 OTHERS

- TABLE 303 OTHERS, 2022-2023

- 18.6 STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2023

- TABLE 304 STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2023

- 18.7 COMPETITIVE BENCHMARKING

- TABLE 305 AUTOMOTIVE SEAT MANUFACTURERS: KEY START-UPS/SMES

19 COMPANY PROFILES

- 19.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 19.1.1 ADIENT PLC

- TABLE 306 ADIENT PLC: COMPANY OVERVIEW

- FIGURE 51 ADIENT PLC: COMPANY SNAPSHOT

- TABLE 307 ADIENT PLC: PRODUCTS OFFERED

- TABLE 308 ADIENT PLC: PRODUCT DEVELOPMENTS

- TABLE 309 ADIENT PLC: DEALS

- TABLE 310 ADIENT PLC: OTHERS

- 19.1.2 FAURECIA

- TABLE 311 FAURECIA: COMPANY OVERVIEW

- FIGURE 52 FAURECIA: COMPANY SNAPSHOT

- TABLE 312 FAURECIA: PRODUCTS OFFERED

- TABLE 313 FAURECIA: PRODUCT DEVELOPMENTS

- TABLE 314 FAURECIA: DEALS

- TABLE 315 FAURECIA: OTHERS

- 19.1.3 LEAR CORPORATION

- TABLE 316 LEAR CORPORATION: COMPANY OVERVIEW

- FIGURE 53 LEAR CORPORATION: COMPANY SNAPSHOT

- TABLE 317 LEAR CORPORATION: PRODUCTS OFFERED

- TABLE 318 LEAR CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 319 LEAR CORPORATION: DEALS

- TABLE 320 LEAR CORPORATION: OTHERS

- 19.1.4 TOYOTA BOSHOKU CORPORATION

- TABLE 321 TOYOTA BOSHOKU CORPORATION: COMPANY OVERVIEW

- FIGURE 54 TOYOTA BOSHOKU CORPORATION: COMPANY SNAPSHOT

- TABLE 322 TOYOTA BOSHOKU CORPORATION: PRODUCTS OFFERED

- TABLE 323 TOYOTA BOSHOKU CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 324 TOYOTA BOSHOKU CORPORATION: DEALS

- TABLE 325 TOYOTA BOSHOKU CORPORATION: OTHERS

- 19.1.5 MAGNA INTERNATIONAL

- TABLE 326 MAGNA INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 55 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 327 MAGNA INTERNATIONAL: PRODUCTS OFFERED

- TABLE 328 MAGNA INTERNATIONAL: PRODUCT DEVELOPMENTS

- TABLE 329 MAGNA INTERNATIONAL: DEALS

- TABLE 330 MAGNA INTERNATIONAL: OTHERS

- 19.1.6 TS TECH CO., LTD.

- TABLE 331 TS TECH CO., LTD.: COMPANY OVERVIEW

- FIGURE 56 TS TECH CO., LTD.: COMPANY SNAPSHOT

- TABLE 332 TS TECH CO., LTD.: PRODUCTS OFFERED

- 19.1.6.3 Recent developments

- TABLE 333 TS TECH CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 334 TS TECH CO., LTD.: OTHERS

- 19.1.7 AISIN CORPORATION

- TABLE 335 AISIN CORPORATION: COMPANY OVERVIEW

- FIGURE 57 AISIN CORPORATION: COMPANY SNAPSHOT

- TABLE 336 AISIN CORPORATION: PRODUCTS OFFERED

- 19.1.8 NHK SPRING CO., LTD.

- TABLE 337 NHK SPRING CO., LTD.: COMPANY OVERVIEW

- FIGURE 58 NHK SPRING CO., LTD.: COMPANY SNAPSHOT

- TABLE 338 NHK SPRING CO., LTD.: PRODUCTS OFFERED

- TABLE 339 NHK SPRING CO., LTD.: OTHERS

- 19.1.9 TACHI-S CO., LTD.

- TABLE 340 TACHI-S CO., LTD.: COMPANY OVERVIEW

- FIGURE 59 TACHI-S CO., LTD.: COMPANY SNAPSHOT

- TABLE 341 TACHI-S CO., LTD.: PRODUCTS OFFERED

- TABLE 342 TACHI-S CO., LTD.: DEALS

- TABLE 343 TACHI-S CO., LTD.: OTHERS

- 19.1.10 GENTHERM

- TABLE 344 GENTHERM: COMPANY OVERVIEW

- FIGURE 60 GENTHERM: COMPANY SNAPSHOT

- TABLE 345 GENTHERM: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 19.2 OTHER PLAYERS

- 19.2.1 BROSE FAHRZEUGTEILE SE & CO. KG

- TABLE 346 BROSE FAHRZEUGTEILE SE & CO. KG: COMPANY OVERVIEW

- 19.2.2 GRAMMER AG

- TABLE 347 GRAMMER AG: COMPANY OVERVIEW

- 19.2.3 C.I.E.B. KAHOVEC

- TABLE 348 C.I.E.B. KAHOVEC: COMPANY OVERVIEW

- 19.2.4 PHOENIX SEATING LIMITED

- TABLE 349 PHOENIX SEATING LIMITED: COMPANY OVERVIEW

- 19.2.5 IG BAUERHIN GMBH

- TABLE 350 IG BAUERHIN GMBH: COMPANY OVERVIEW

- 19.2.6 SABELT

- TABLE 351 SABELT: COMPANY OVERVIEW

- 19.2.7 GUELPH MANUFACTURING

- TABLE 352 GUELPH MANUFACTURING: COMPANY OVERVIEW

- 19.2.8 CAMACO-AMVIAN

- TABLE 353 CAMACO-AMVIAN: COMPANY OVERVIEW

- 19.2.9 FREEDMAN SEATING COMPANY

- TABLE 354 FREEDMAN SEATING COMPANY: COMPANY OVERVIEW

- 19.2.10 DAE WON KANG UP

- TABLE 355 DAE WON KANG UP: COMPANY OVERVIEW

- 19.2.11 TATA AUTOCOMP SYSTEMS

- TABLE 356 TATA AUTOCOMP SYSTEMS: COMPANY OVERVIEW

- 19.2.12 SUMMIT AUTO SEATS

- TABLE 357 SUMMIT AUTO SEATS: COMPANY OVERVIEW

- 19.2.13 HARITA SEATING SYSTEMS LTD.

- TABLE 358 HARITA SEATING SYSTEMS LTD: COMPANY OVERVIEW

- 19.2.14 DELTA KOGYO CO. LTD.

- TABLE 359 DELTA KOGYO CO., LTD.: COMPANY OVERVIEW

- 19.2.15 BHARAT SEATS LIMITED (BSL)

- TABLE 360 BHARAT SEATS LIMITED (BSL): COMPANY OVERVIEW

20 RECOMMENDATIONS BY MARKETSANDMARKETS

- 20.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE SEATS

- 20.2 RISING INTEGRATION OF POWERED SEATS IN SUVS TO DRIVE GROWTH

- 20.3 CONCLUSION

21 APPENDIX

- 21.1 KEY INDUSTRY INSIGHTS

- 21.2 DISCUSSION GUIDE

- 21.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 21.4 CUSTOMIZATION OPTIONS

- 21.4.1 AUTOMOTIVE SEAT SEATS MARKET, BY VEHICLE BODY TYPE

- 21.4.1.1 Sedans

- 21.4.1.2 SUVs

- 21.4.1.3 Hatchbacks

- 21.4.2 AUTOMOTIVE SEATS MARKET, BY INTEGRATED INFOTAINMENT SYSTEM

- 21.4.2.1 Built-in screen

- 21.4.2.2 Speakers

- 21.4.2.3 Headphone jacks

- 21.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS

- 21.4.1 AUTOMOTIVE SEAT SEATS MARKET, BY VEHICLE BODY TYPE

- 21.5 RELATED REPORTS

- 21.6 AUTHOR DETAILS