|

|

市場調査レポート

商品コード

1418783

モーションコントロールの世界市場:オファリング別、システム別、エンドユーザー業界別、地域別 - 2029年までの予測Motion Control Market by Offering (Actuators & Mechanical Systems, Drives, Motors, Motion Controllers, Sensors & Feedback Services, Software & Services), System (Open-loop, Closed-loop), End-user Industry and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| モーションコントロールの世界市場:オファリング別、システム別、エンドユーザー業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年01月22日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、システム別、エンドユーザー業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

モーションコントロールの市場規模は、2024年には165億米ドル規模になると予測されています。

同市場は、予測期間中に5.5%のCAGRで拡大し、2029年には216億米ドルに達すると予測されています。世界のモーションコントロール市場は、企業が効率と生産性の向上に努めるにつれて大幅な成長を遂げており、モーションコントロールシステムの統合は、機械や自動化されたプロセスを正確に制御するために不可欠となっています。さらに、モーションコントロールが機械の制御された安全な動きを保証する上で極めて重要な役割を果たす、職場の安全促進を目的とした政府の取り組みも大きな原動力となっています。自動化に関連する利点の認識の高まりと、より安全な作業環境の構築への関心の高まりが、モーションコントロール市場の世界の拡大に寄与しています。この動向は、産業オートメーションを推進し、世界規模の安全目標を達成する上で、この技術が重要な役割を担っていることを示しています。

モーターはモーションコントロールシステムの中核部品であり、モーターは機械や自動化システムの動きを制御する原動力として機能します。モーター技術の継続的な進歩と相まって、産業界全体で自動化の需要が急増していることが、市場におけるモーターの支配的な地位の一因となっています。モーターは、製造業、ロボット工学、自動車、航空宇宙などの多様な分野で、正確な位置決め、速度制御、全体的な運用効率の達成に重要な役割を果たしています。モーションコントロールシステムと共にモーターの採用が増加していることは、オートメーションのシームレスな統合を促進するモーターの重要性を強調しており、それによってモーションコントロール市場の全体的な成長とリーダーシップの主要な貢献者としての地位を確固たるものにしています。

当レポートでは、世界のモーションコントロール市場について調査し、オファリング別、システム別、エンドユーザー業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- サプライチェーン分析

- 生態系マッピング

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主要な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 モーションコントロール技術に関連する動向と新たな用途

- イントロダクション

- モーションコントロール技術に関する動向

- モーションコントロールテクノロジーに関連した新たな用途

第7章 モーションコントロールシステムの新たな実装分野

- イントロダクション

- 金属の切断

- 金属成形

- マテリアルハンドリング

- 包装とラベル貼り

- ロボット工学

- その他の実装分野

第8章 モーションコントロール市場、オファリング別

- イントロダクション

- アクチュエータ・メカニカルシステム

- ドライブ

- モーター

- モーションコントローラ

- センサー・フィードバックデバイス

- ソフトウェア・サービス

第9章 モーションコントロール市場、システム別

- イントロダクション

- オープンループシステム

- クローズドループシステム

第10章 モーションコントロール市場、エンドユーザー業界別

- イントロダクション

- 航空宇宙

- 自動車

- 半導体・エレクトロニクス

- 金属・機械

- 食品・飲料

- 医療機器

- 印刷・紙

- 医薬品・化粧品

- その他

第11章 モーションコントロール市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業が採用した戦略、2020年~2023年

- 収益分析、2018~2022年

- 市場シェア分析、2023年

- 企業評価マトリックス、2023年

- スタートアップ/中小企業評価マトリックス、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ABB

- FANUC CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- SIEMENS

- YASKAWA ELECTRIC CORPORATION

- REGAL REXNORD CORPORATION

- ROBERT BOSCH GMBH

- PARKER HANNIFIN CORP

- ROCKWELL AUTOMATION

- NOVANTA INC.

- その他の企業

- DOVER MOTION

- OMRON CORPORATION

- ALLIED MOTION, INC.

- AMETEK, INC.

- ADTECH(SHENZHEN)TECHNOLOGY CO., LTD.

- POWERTEC

- DELTA ELECTRONICS, INC.

- BAUMULLER

- MOONS'

- ELMO MOTION CONTROL LTD.

- ABSOLUTE MACHINE TOOLS

- IQ MOTION CONTROL

- APPTRONIK

- GALIL

- ANALOG DEVICES, INC.

第14章 隣接市場

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, System, End-user Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

The motion control market is estimated to be worth USD 16.5 billion in 2024 and is projected to reach USD 21.6 billion by 2029 at a CAGR of 5.5% during the forecast period. The global Motion Control Market is experiencing substantial growth as businesses strive to enhance efficiency and productivity, the integration of motion control systems becomes crucial for precise control over machinery and automated processes. Additionally, a significant impetus comes from government initiatives aimed at promoting workplace safety, where motion control plays a pivotal role in ensuring controlled and secure movement of machinery. The growing recognition of the benefits associated with automation, coupled with a heightened focus on creating safer work environments, contributes to the global expansion of the Motion Control Market. This trend is indicative of the technology's key role in advancing industrial automation and aligning with safety objectives on a global scale.

"Motors to hold the largest share of motion control market in 2023."

Motors are the core components of motion control systems; motors serve as the driving force behind the controlled motion of machinery and automated systems. The surge in demand for automation across industries, coupled with the continuous advancements in motor technology, contributes to their dominant position in the market. Motors play a crucial role in achieving accurate positioning, speed control, and overall operational efficiency in diverse sectors such as manufacturing, robotics, automotive, and aerospace. The increasing adoption of motors in conjunction with motion control systems underscores their significance in facilitating the seamless integration of automation, thereby solidifying their position as the key contributors to the overall growth and leadership of the Motion Control Market.

"Semiconductor & Electronics industry to hold the second largest share of motion control market in 2023."

Motion control systems play a critical role in semiconductor and electronics manufacturing processes by providing precise control over machinery and robotic systems. As the demand for electronic components and devices continues to rise, the industry is increasingly adopting motion control solutions to optimize production efficiency, enhance accuracy, and ensure the seamless operation of complex machinery. The intricate and high-precision requirements of semiconductor manufacturing make motion control systems integral to achieving the exacting standards necessary for quality production. The Semiconductor and Electronics industry's heavy share in the Motion Control Market is indicative of the technology's fundamental contribution to the evolution and efficiency of manufacturing processes within this dynamic and rapidly advancing sector.

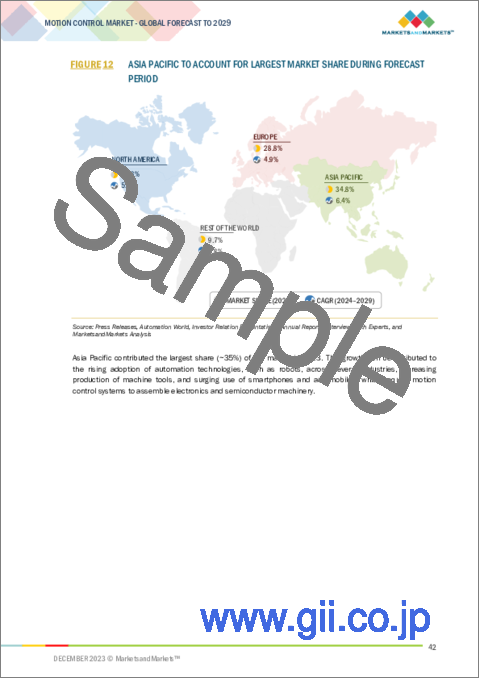

"Europe to hold the second largest market share of motion control market in 2023."

Europe is poised to command a significant share of the Motion Control Market, reflecting the region's robust industrial landscape and a commitment to technological innovation. The adoption of motion control systems in Europe is driven by the imperative for increased automation, precision, and efficiency across diverse industries. The region's strong presence in manufacturing, automotive, aerospace, and other key sectors underscores the pivotal role of motion control technologies. Furthermore, government initiatives promoting Industry 4.0, smart manufacturing practices, and stringent quality standards contribute to the heightened demand for advanced motion control solutions. As European industries continue to embrace cutting-edge automation technologies, the Motion Control Market in the region is set to play a crucial role in shaping and enhancing industrial processes, thereby securing a significant share in the global landscape.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation - C-level Executives - 57%, Directors - 27%, and Others - 16%

- By Region - North America - 24%, Europe - 24%, Asia Pacific - 46%, and Rest of the World - 6%

Major players in the motion control market are ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan).

Research Coverage

The report segments the motion control market by offering, system, industry, and region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall motion control market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising need for high-end automation across industries, government initiatives to promote workplace safety, rising adoption and usage of industrial robots by manufacturers, and adoption of AI and IoT with motion control systems is driving the market), restraints (Heavy maintenance and replacement cost associated with motion control systems and susceptibility of motion control systems to cyberattacks are hindering the growth of the market), opportunities (Adoption of industry 4.0 principles for manufacturing, integration of emerging technologies such as programmable logic controllers (PLCs) and human-machine interface (HMI) with motion control systems and implementation of integrated communication system across various sectors), and challenges (Designing flexible, scalable, and low-cost motion control systems and shortage of skilled and experienced workforce) influencing the growth of the motion control market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the motion control market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the motion control market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the motion control market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MOTION CONTROL MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MOTION CONTROL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Primary interviews with experts

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN MOTION CONTROL MARKET

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

- FIGURE 4 MOTION CONTROL MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

- FIGURE 5 MOTION CONTROL MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON MOTION CONTROL MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- FIGURE 7 RISK ASSESSMENT OF RESEARCH STUDY

3 EXECUTIVE SUMMARY

- FIGURE 8 MOTION CONTROL MARKET, 2020-2029 (USD MILLION)

- FIGURE 9 MOTORS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 CLOSED-LOOP SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 PHARMACEUTICALS & COSMETICS TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MOTION CONTROL MARKET

- FIGURE 13 GROWING ADOPTION OF AUTOMATION ACROSS VARIOUS MANUFACTURING PROCESSES TO DRIVE MARKET

- 4.2 MOTION CONTROL MARKET, BY OFFERING

- FIGURE 14 DRIVES SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2024 AND 2029

- 4.3 MOTION CONTROL MARKET, BY SYSTEM

- FIGURE 15 CLOSED-LOOP SYSTEMS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 MOTION CONTROL MARKET, BY INDUSTRY

- FIGURE 16 AUTOMOTIVE SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 MOTION CONTROL MARKET, BY COUNTRY

- FIGURE 17 MOTION CONTROL MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 MOTION CONTROL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for high-end automation across industries

- 5.2.1.2 Government initiatives to promote workplace safety

- 5.2.1.3 Growing use of industrial robots by manufacturers

- 5.2.1.4 Increasing integration of AI and IoT with motion control systems

- FIGURE 19 MOTION CONTROL MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Heavy maintenance and replacement costs associated with motion control systems

- 5.2.2.2 Susceptibility of motion control systems to cyberattacks

- FIGURE 20 MOTION CONTROL MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of Industry 4.0 principles for manufacturing

- 5.2.3.2 Integration of emerging technologies with motion control systems

- 5.2.3.3 Implementation of integrated communication systems across various sectors

- FIGURE 21 MOTION CONTROL MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Designing flexible, scalable, and low-cost motion control systems

- 5.2.4.2 Shortage of skilled and experienced workforce

- FIGURE 22 MOTION CONTROL MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 MOTION CONTROL MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- TABLE 1 AVERAGE SELLING PRICE OF MOTION CONTROL DEVICES, BY TYPE

- FIGURE 24 AVERAGE SELLING PRICE TREND OF SERVO MOTORS, 2020-2029 (USD)

- 5.4.1 AVERAGE SELLING PRICE TREND OF SERVO MOTORS FOR KEY PLAYERS, BY POWER RATING

- FIGURE 25 AVERAGE SELLING PRICE OF SERVO MOTORS, BY POWER RATING FOR KEY PLAYERS (USD)

- TABLE 2 AVERAGE SELLING PRICE OF SERVO MOTORS, BY POWER RATING FOR KEY PLAYERS (USD)

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 3 AVERAGE SELLING PRICE TREND OF SERVO MOTORS, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 26 MOTION CONTROL MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAPPING

- FIGURE 27 MOTION CONTROL MARKET: ECOSYSTEM MAP

- TABLE 4 COMPANIES AND THEIR ROLE IN MOTION CONTROL ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE

- 5.7.2 SIMULATION & DIGITAL TWINNING

- 5.7.3 FRAMELESS MOTORS

- 5.7.4 PREDICTIVE MAINTENANCE

- 5.7.5 IIOT SENSORS

- 5.7.6 MOTION OUT-OF-THE-BOX

- 5.8 PATENT ANALYSIS

- FIGURE 28 MOTION CONTROL MARKET: TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2014-2023

- FIGURE 29 MOTION CONTROL MARKET: NUMBER OF GRANTED PATENTS RELATED TO MOTION CONTROL SYSTEMS, 2014-2023

- TABLE 5 MOTION CONTROL MARKET: TOP 20 PATENT OWNERS, 2014-2023

- TABLE 6 LIST OF PATENTS RELATED TO MOTION CONTROL SYSTEMS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- FIGURE 30 MOTION CONTROL MARKET: IMPORT DATA FOR HS CODE 8501, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.9.2 EXPORT SCENARIO

- FIGURE 31 MOTION CONTROL MARKET: EXPORT DATA FOR HS CODE 8501, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 7 MOTION CONTROL MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- 5.11 CASE STUDY ANALYSIS

- TABLE 8 NIDEC MOTOR PROVIDES IMPROVED TEMPERATURE CONTROL, WITH SAVINGS OF NEARLY 7,500 KWH

- TABLE 9 MITSUBISHI ELECTRIC OFFERS IMPROVED RELIABILITY, EXPANDED CUSTOMER FEATURES, AND OVERWRAPPING ACCURACY WITHOUT LABEL DISTORTION

- TABLE 10 MOTION CONTROL MOTORS AND DRIVES DESIGNED WITH CUTTING-EDGE TECHNOLOGY ACCELERATE BOTTLE LABELING

- TABLE 11 TROUBLESHOOTING MOTION CONTROL SYSTEMS USING MOOG ANIMATICS SMARTMOTOR DATA

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY STANDARDS

- 5.12.3 IEC 61508

- 5.12.4 IEC 61511

- 5.12.5 IEC 62061

- 5.12.6 IEC 62443

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 MOTION CONTROL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 MOTION CONTROL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 34 MOTION CONTROL MARKET: KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 18 MOTION CONTROL MARKET: KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

6 TRENDS AND EMERGING APPLICATIONS RELATED TO MOTION CONTROL TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 TRENDS RELATED TO MOTION CONTROL TECHNOLOGY

- 6.2.1 ADVANCED ROBOTICS AND COBOTS

- 6.2.2 HUMAN-MACHINE INTERFACE (HMI)

- 6.2.3 AUTONOMOUS VEHICLES AND DRONES

- 6.2.4 3D PRINTING AND ADDITIVE MANUFACTURING

- 6.3 EMERGING APPLICATIONS RELATED TO MOTION CONTROL TECHNOLOGY

- 6.3.1 REHABILITATION ROBOTICS

- 6.3.2 DIGITAL TWIN TECHNOLOGY

- 6.3.3 AUTONOMOUS UNDERWATER VEHICLES (AUVS)

- 6.3.4 ADVANCED PACKAGING AND MATERIAL HANDLING

7 EMERGING IMPLEMENTATION AREAS OF MOTION CONTROL SYSTEMS

- 7.1 INTRODUCTION

- 7.2 METAL CUTTING

- 7.3 METAL FORMING

- 7.4 MATERIAL HANDLING

- 7.5 PACKAGING & LABELLING

- 7.6 ROBOTICS

- 7.7 OTHER IMPLEMENTATION AREAS

8 MOTION CONTROL MARKET, BY OFFERING

- 8.1 INTRODUCTION

- FIGURE 35 MOTION CONTROL MARKET SEGMENTATION, BY OFFERING

- FIGURE 36 MOTORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 19 MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 20 MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 8.2 ACTUATORS AND MECHANICAL SYSTEMS

- 8.2.1 INCREASING USE DUE TO GREATER EFFICIENCY TO DRIVE MARKET

- 8.2.2 ELECTRIC

- 8.2.3 HYDRAULIC

- 8.2.4 PNEUMATIC

- 8.2.5 OTHERS

- TABLE 21 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 22 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 23 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 DRIVES

- 8.3.1 AUTOMATION IN MANUFACTURING INDUSTRY TO DRIVE MARKET

- TABLE 25 DRIVES: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 26 DRIVES: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- FIGURE 37 ASIA PACIFIC TO LEAD MARKET FOR DRIVES DURING FORECAST PERIOD

- TABLE 27 DRIVES: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 DRIVES: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4 MOTORS

- TABLE 29 MOTORS: MOTION CONTROL MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 30 MOTORS: MOTION CONTROL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 31 MOTORS: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 32 MOTORS: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 33 MOTORS: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 MOTORS: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4.1 SERVO MOTORS

- 8.4.1.1 High torque and acceleration to drive market

- TABLE 35 SERVO MOTORS: MOTION CONTROL MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 36 SERVO MOTORS: MOTION CONTROL MARKET, 2024-2029 (THOUSAND UNITS)

- 8.4.2 STEPPER MOTORS

- 8.4.2.1 Compact design to drive market

- TABLE 37 STEPPER MOTORS: MOTION CONTROL MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 38 STEPPER MOTORS: MOTION CONTROL MARKET, 2024-2029 (THOUSAND UNITS)

- 8.5 MOTION CONTROLLERS

- 8.5.1 RAPID REAL-TIME RESPONSE AND MINIMIZED ERRORS TO DRIVE MARKET

- TABLE 39 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 40 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE OF MOTION CONTROLLERS DURING FORECAST PERIOD

- TABLE 41 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.6 SENSORS AND FEEDBACK DEVICES

- 8.6.1 CONTACTLESS SWITCHING, POSITION DETECTION, AND PRESSURE DETECTION APPLICATIONS TO DRIVE MARKET

- TABLE 43 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 44 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 45 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.7 SOFTWARE AND SERVICES

- 8.7.1 UTILIZATION IN NETWORKING MANAGEMENT SOFTWARE TO DRIVE MARKET

- TABLE 47 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 48 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 49 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

9 MOTION CONTROL MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- FIGURE 39 CLOSED-LOOP SYSTEMS TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 51 MOTION CONTROL MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 52 MOTION CONTROL MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- 9.2 OPEN-LOOP SYSTEMS

- 9.2.1 LOW MAINTENANCE COST TO DRIVE MARKET

- 9.3 CLOSED-LOOP SYSTEMS

- 9.3.1 CAPABILITIES TO REDUCE SENSITIVITY AND IMPROVE STABILITY OF SYSTEMS TO DRIVE MARKET

10 MOTION CONTROL MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 40 MOTION CONTROL MARKET, BY INDUSTRY

- FIGURE 41 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF MOTION CONTROL MARKET DURING FORECAST PERIOD

- TABLE 53 MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 54 MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 10.2 AEROSPACE

- 10.2.1 NEED FOR PRECISE AIRCRAFT COMPONENT MANUFACTURING TO DRIVE MARKET

- TABLE 55 AEROSPACE: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 56 AEROSPACE: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 57 AEROSPACE: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 AEROSPACE: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 AUTOMOTIVE

- 10.3.1 ADVANCED DRIVER ASSISTANCE SYSTEMS TO DRIVE MARKET

- FIGURE 42 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE OF AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

- TABLE 59 AUTOMOTIVE: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 60 AUTOMOTIVE: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 61 AUTOMOTIVE: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 AUTOMOTIVE: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 SEMICONDUCTOR & ELECTRONICS

- 10.4.1 INSPECTION, WAFER TEST, AND DICING APPLICATIONS TO DRIVE MARKET

- TABLE 63 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 64 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 65 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 METALS & MACHINERY

- 10.5.1 NEED FOR EFFICIENT ASSEMBLY LINES AND AUTOMATION IN MANUFACTURING HUBS TO DRIVE MARKET

- TABLE 67 METALS & MACHINERY: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 68 METALS & MACHINERY: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 69 METALS & MACHINERY: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 METALS & MACHINERY: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 FOOD & BEVERAGES

- 10.6.1 FILLING, CAPPING, LABELING, PACKING, AND PALLETIZING ACTIVITIES TO DRIVE MARKET

- FIGURE 43 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE OF FOOD & BEVERAGES INDUSTRY DURING FORECAST PERIOD

- TABLE 71 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 72 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 73 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 MEDICAL DEVICES

- 10.7.1 DIAGNOSTIC IMAGING AND SURGICAL ROBOTICS TO DRIVE MARKET

- TABLE 75 MEDICAL DEVICES: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 76 MEDICAL DEVICES: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 77 MEDICAL DEVICES: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 MEDICAL DEVICES: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 PRINTING & PAPER

- 10.8.1 3D PRINTING TECHNOLOGY TO DRIVE MARKET

- TABLE 79 PRINTING & PAPER: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 80 PRINTING & PAPER: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 81 PRINTING & PAPER: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 PRINTING & PAPER: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.9 PHARMACEUTICALS & COSMETICS

- 10.9.1 RETRIEVAL, PLACEMENT, AND FILLING OF CONTAINERS TO DRIVE MARKET

- TABLE 83 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 84 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 85 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 86 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.10 OTHER INDUSTRIES

- TABLE 87 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 88 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 89 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 90 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

11 MOTION CONTROL MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 44 MOTION CONTROL MARKET IN INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 91 MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 NORTH AMERICA: MOTION CONTROL MARKET SNAPSHOT

- TABLE 93 NORTH AMERICA: MOTION CONTROL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: MOTION CONTROL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Smart manufacturing and Industry 4.0 initiatives to drive market

- 11.2.3 CANADA

- 11.2.3.1 Integration of robotics with collaborative technologies and other smart safety products and appliances to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Association for Advancing Automation to drive market

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 46 EUROPE: MOTION CONTROL MARKET SNAPSHOT

- TABLE 97 EUROPE: MOTION CONTROL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 EUROPE: MOTION CONTROL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 EUROPE: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 100 EUROPE: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Made Smarter initiative and government funding to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Industrie du Futur initiative and Industrial Plants of the Future plan to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Growing use of industrial robots in assembling, machine tending, painting, and welding to drive market

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 47 ASIA PACIFIC: MOTION CONTROL MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: MOTION CONTROL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MOTION CONTROL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Made in China 2025 initiative to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Shift toward EV and adoption of motion control solutions in assembly lines to drive market

- 11.4.4 INDIA

- 11.4.4.1 SAMARTH Udyog Bharat 4.0 initiative and improved infrastructure to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increased adoption of hybrid electric vehicles to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD

- 11.5.1 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- TABLE 105 REST OF THE WORLD: MOTION CONTROL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 REST OF THE WORLD: MOTION CONTROL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 107 REST OF THE WORLD: MOTION CONTROL MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 108 REST OF THE WORLD: MOTION CONTROL MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Growing mining sector and rising demand for AI and IIoT-based solutions and software to drive market

- 11.5.3 GCC

- 11.5.3.1 Expansion of oil & gas and automotive sectors to drive market

- 11.5.4 AFRICA & REST OF MIDDLE EAST

- 11.5.4.1 Assistance from International Monetary Fund to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 109 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 12.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022

- 12.4 MARKET SHARE ANALYSIS, 2023

- TABLE 110 MOTION CONTROL MARKET: DEGREE OF COMPETITION

- FIGURE 49 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY EVALUATION MATRIX, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 50 COMPANY EVALUATION MATRIX, 2023

- 12.5.5 COMPANY FOOTPRINT

- TABLE 111 KEY COMPANIES: COMPANY FOOTPRINT

- TABLE 112 KEY COMPANIES: OFFERING FOOTPRINT

- TABLE 113 KEY COMPANIES: INDUSTRY FOOTPRINT

- TABLE 114 KEY COMPANIES: REGION FOOTPRINT

- 12.6 START-UP/SME EVALUATION MATRIX, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 51 START-UP/SME EVALUATION MATRIX, 2023

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 115 KEY START-UPS/SMES

- TABLE 116 START-UPS/SMES: OFFERING FOOTPRINT

- TABLE 117 START-UPS/SMES: INDUSTRY FOOTPRINT

- TABLE 118 START-UPS/SMES: REGION FOOTPRINT

- 12.7 COMPETITIVE SCENARIO

- TABLE 119 PRODUCT LAUNCHES, 2020-2023

- TABLE 120 DEALS, 2020-2023

- TABLE 121 OTHERS, 2020-2023

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))** **Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

- 13.1 KEY PLAYERS

- 13.1.1 ABB

- TABLE 122 ABB: COMPANY OVERVIEW

- FIGURE 52 ABB: COMPANY SNAPSHOT

- TABLE 123 ABB: PRODUCTS OFFERED

- TABLE 124 ABB: PRODUCT LAUNCHES

- TABLE 125 ABB: OTHERS

- 13.1.2 FANUC CORPORATION

- TABLE 126 FANUC CORPORATION: COMPANY OVERVIEW

- FIGURE 53 FANUC CORPORATION: COMPANY SNAPSHOT

- TABLE 127 FANUC CORPORATION: PRODUCTS OFFERED

- 13.1.3 MITSUBISHI ELECTRIC CORPORATION

- TABLE 128 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 54 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 129 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 130 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 131 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 132 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- 13.1.4 SIEMENS

- TABLE 133 SIEMENS: COMPANY OVERVIEW

- FIGURE 55 SIEMENS: COMPANY SNAPSHOT

- TABLE 134 SIEMENS: PRODUCTS OFFERED

- TABLE 135 SIEMENS: PRODUCT LAUNCHES

- TABLE 136 SIEMENS: DEALS

- 13.1.5 YASKAWA ELECTRIC CORPORATION

- TABLE 137 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 56 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 138 YASKAWA ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 139 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 140 YASKAWA ELECTRIC CORPORATION: OTHERS

- 13.1.6 REGAL REXNORD CORPORATION

- TABLE 141 REGAL REXNORD CORPORATION: COMPANY OVERVIEW

- FIGURE 57 REGAL REXNORD CORPORATION: COMPANY SNAPSHOT

- TABLE 142 REGAL REXNORD CORPORATION: PRODUCTS OFFERED

- TABLE 143 REGAL REXNORD: PRODUCT LAUNCHES

- TABLE 144 REGAL REXNORD: DEALS

- 13.1.7 ROBERT BOSCH GMBH

- TABLE 145 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 146 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- 13.1.8 PARKER HANNIFIN CORP

- TABLE 147 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- FIGURE 59 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- TABLE 148 PARKER HANNIFIN CORP: PRODUCTS OFFERED

- TABLE 149 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- 13.1.9 ROCKWELL AUTOMATION

- TABLE 150 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 60 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 151 ROCKWELL AUTOMATION: PRODUCTS OFFERED

- TABLE 152 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 153 ROCKWELL AUTOMATION: DEALS

- 13.1.10 NOVANTA INC.

- TABLE 154 NOVANTA INC.: COMPANY OVERVIEW

- FIGURE 61 NOVANTA INC.: COMPANY SNAPSHOT

- TABLE 155 NOVANTA INC.: PRODUCTS OFFERED

- TABLE 156 NOVANTA INC.: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 DOVER MOTION

- 13.2.2 OMRON CORPORATION

- 13.2.3 ALLIED MOTION, INC.

- 13.2.4 AMETEK, INC.

- 13.2.5 ADTECH (SHENZHEN) TECHNOLOGY CO., LTD.

- 13.2.6 POWERTEC

- 13.2.7 DELTA ELECTRONICS, INC.

- 13.2.8 BAUMULLER

- 13.2.9 MOONS'

- 13.2.10 ELMO MOTION CONTROL LTD.

- 13.2.11 ABSOLUTE MACHINE TOOLS

- 13.2.12 IQ MOTION CONTROL

- 13.2.13 APPTRONIK

- 13.2.14 GALIL

- 13.2.15 ANALOG DEVICES, INC.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT MARKET

- 14.1 ENCODER MARKET

- 14.2 INTRODUCTION

- FIGURE 62 ENCODER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 157 ENCODER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 158 ENCODER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 14.3 INDUSTRIAL

- 14.3.1 INCREASING USE OF ENCODERS IN ROBOTICS AND FACTORY AUTOMATION TO DRIVE MARKET

- TABLE 159 INDUSTRIAL: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 160 INDUSTRIAL: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 161 INDUSTRIAL: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 162 INDUSTRIAL: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.4 HEALTHCARE

- 14.4.1 ADOPTION OF SURGICAL ROBOTS IN MEDICAL APPLICATIONS TO DRIVE MARKET

- TABLE 163 HEALTHCARE: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 164 HEALTHCARE: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 165 HEALTHCARE: ENCODER MARKET, BY REGION, 2019-2022(USD MILLION)

- TABLE 166 HEALTHCARE: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.5 CONSUMER ELECTRONICS

- 14.5.1 PROLIFERATION OF LINEAR MOTOR ENCODERS IN ELECTRICAL APPLIANCES TO DRIVE MARKET

- TABLE 167 CONSUMER ELECTRONICS: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 168 CONSUMER ELECTRONICS: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 169 CONSUMER ELECTRONICS: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 170 CONSUMER ELECTRONICS: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.6 AUTOMOTIVE

- 14.6.1 TREND OF AUTOMATION IN AUTOMOBILES TO DRIVE MARKET

- TABLE 171 AUTOMOTIVE: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 172 AUTOMOTIVE: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 173 AUTOMOTIVE: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 174 AUTOMOTIVE: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.7 POWER

- 14.7.1 COMPLEXITIES IN SOLAR AND WIND ENERGY APPLICATIONS TO DRIVE MARKET

- TABLE 175 POWER: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 176 POWER: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 177 POWER: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 178 POWER: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.8 FOOD & BEVERAGE

- 14.8.1 INTEGRATION OF IO-LINK TECHNOLOGY INTO ENCODERS TO DRIVE MARKET

- TABLE 179 FOOD & BEVERAGE: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 180 FOOD & BEVERAGE: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 181 FOOD & BEVERAGE: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 182 FOOD & BEVERAGE: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.9 AEROSPACE

- 14.9.1 NEED FOR PRECISION CONTROL TECHNOLOGY IN AIRBORNE SYSTEMS TO DRIVE MARKET

- TABLE 183 AEROSPACE: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 184 AEROSPACE: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 185 AEROSPACE: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 186 AEROSPACE: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.10 PRINTING

- 14.10.1 HIGH DEMAND FOR ROTARY ENCODERS IN PRINTING APPLICATIONS AND OFFICE EQUIPMENT TO DRIVE MARKET

- TABLE 187 PRINTING: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 188 PRINTING: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 189 PRINTING: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 190 PRINTING: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.11 TEXTILE

- 14.11.1 INTEGRATION OF ENCODERS IN WEAVING & KNITTING PROCESSES TO DRIVE MARKET

- TABLE 191 TEXTILE: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 192 TEXTILE: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 193 TEXTILE: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 194 TEXTILE: ENCODER MARKET, BY REGION, 2023-2028(USD MILLION)

- 14.12 OTHER APPLICATIONS

- TABLE 195 OTHER APPLICATIONS: ENCODER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 196 OTHER APPLICATIONS: ENCODER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 197 OTHER APPLICATIONS: ENCODER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 198 OTHER APPLICATIONS: ENCODER MARKET, BY REGION, 2023-2028 (USD MILLION)

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS