|

|

市場調査レポート

商品コード

1080148

局所ドラッグデリバリーの世界市場:種類別 (半固形 (クリーム、ゲル、ローション)、固形 (座薬)、液体 (溶液)、経皮吸収剤)・投与経路別 (経皮、眼科)・使用施設別 (在宅医療、病院、火傷治療センター) の将来予測 (2027年まで)Topical Drug Delivery Market by Type (Semi-solids (Creams, Gels, Lotions), Solids(Suppositories), Liquids(Solutions), Transdermal products), Route(Dermal, Ophthalmic), Facility of Use (Homecare setting, Hospitals, Burn Centres) - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 局所ドラッグデリバリーの世界市場:種類別 (半固形 (クリーム、ゲル、ローション)、固形 (座薬)、液体 (溶液)、経皮吸収剤)・投与経路別 (経皮、眼科)・使用施設別 (在宅医療、病院、火傷治療センター) の将来予測 (2027年まで) |

|

出版日: 2022年05月26日

発行: MarketsandMarkets

ページ情報: 英文 297 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の局所ドラッグデリバリーの市場規模は、2022年の2,074億米ドルから、2027年には3,178億米ドルへと、8.9%のCAGRで成長すると予測されています。

市場の主な促進要因として、ドライアイ疾患に対する局所処方療法の高い普及率や、スマートな経皮ドラッグデリバリーシステムの研究開発に対する製薬企業の関心増大、中枢神経疾患の有病率の増加、非侵襲ドラッグデリバリー方法の人気拡大などが挙げられます。

種類別では半固形製剤が、投与経路別では皮膚ドラッグデリバリーが、使用施設別では在宅医療が最大のシェアを占めています。地域別に見ると、アジア太平洋が最も高いCAGRで成長する見通しです。

当レポートでは、世界の局所ドラッグデリバリーの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、製品別・投与経路別・使用施設別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

- 産業動向

- 主要な会議とイベント (2022年~2023年)

- COVID-19の影響

- 規制分析

- バリューチェーン分析

- 生態系マッピング

- 技術分析

- 価格分析

- ポーターのファイブフォース分析

- 特許分析

第6章 局所ドラッグデリバリー市場:製品別

- イントロダクション

- 半固形製剤

- 軟膏

- クリーム

- ローション

- ゲル

- ペースト

- 液体製剤

- 懸濁液

- 溶液

- 固形製剤

- パウダー

- 坐剤

- 経皮吸収剤

- 経皮パッチ

- 経皮セミソリッド

第7章 局所ドラッグデリバリー市場:投与経路別

- イントロダクション

- 経皮ドラッグデリバリー

- 眼科用ドラッグデリバリー

- 経膣ドラッグデリバリー

- 直腸ドラッグデリバリー

- 経鼻ドラッグデリバリー

第8章 局所ドラッグデリバリー市場:使用施設別

- イントロダクション

- 在宅医療

- 病院・クリニック

- 火傷治療センター

- その他の施設

第9章 局所ドラッグデリバリー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- スイス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業の戦略/市場獲得戦略

- 主要企業の収益シェア分析

- 市場シェア分析

- 競合リーダーシップ・マッピング

- その他の企業:競合リーダーシップマッピング

- 企業のフットプリント

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の開発

第11章 企業プロファイル

- 主要企業

- GLENMARK PHARMACEUTICALS LTD.

- GALDERMA

- JOHNSON & JOHNSON PRIVATE LIMITED

- GLAXOSMITHKLINE PLC.

- BAUSCH HEALTH COMPANIES INC.

- HISAMITSU PHARMACEUTICAL CO., INC.

- CIPLA

- BAYER AG

- VIATRIS INC. (MYLAN N.V.)

- 3M

- MERCK & CO., INC.

- CRESCITA THERAPEUTICS INC.

- NOVARTIS INTERNATIONAL AG

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- PFIZER INC.

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- BRISTOL MYERS SQUIBB

- LEAD CHEMICAL CO., LTD.

- PURDUE PHARMA L.P.

- LAVIPHARM

- ABBVIE INC.

- その他の企業

- CMP PHARMA, INC.

- ENCORE DERMATOLOGY, INC.

- PROSOLUS INC.

- RUSAN PHARMA LTD.

第12章 付録

The global topical drug delivery market is projected to reach USD 317.8 billion by 2027 from USD 207.4 billion in 2022, at a CAGR of 8.9%. The growth of this market can largely be attributed to the high prevalence of topical prescription therapy for dry eye diseases, growing focus of pharmaceutical companies on the R&D of smart transdermal drug delivery systems, increase in prevalence of central nervous disorders, rising preference for non-invasive drug delivery methods.

"The semi-solid formulation segment accounted for the largest share of the topical drug delivery market, based on product in 2021."

Based on products, the topical drug delivery the market is segmented into semi-solid formulations, liquid formulations, solid formulations, and transdermal products. The large share of semi-solid formulations segment is attributed to better patient adherence with limited side effects, more absorption, provide efficiency in drug release, and does not harm the gastrointestinal tract.

"Dermal drug delivery accounted for the largest share of the market."

Based on the route of administration, the market is segmented into dermal, ophthalmic, rectal, vaginal, and nasal drug delivery. The large share of the dermal drug delivery market segment can largely be attributed to accessible product launches and adoption as they have fewer regulatory requirements, enhancement of penetrations and permeation of drugs as they are delivered through skin, and less irritation in patients as compared to nasal or ophthalmic drug delivery.

"Home care settings hold the largest share in the market, by facility of use"

Based on the facility of use, the market is segmented into home care settings, hospitals & clinics, burn centers, and other facilities. The large share of home care settings segment can be attributed to better patient comfort, growing awareness regarding home care settings is improving patient acceptability, decline in hospital visits due to COVID-19 pandemic, and shift in trend from treatments carried out in hospitals and nursing homes to treatments at home due to cost-effectiveness of home care settings.

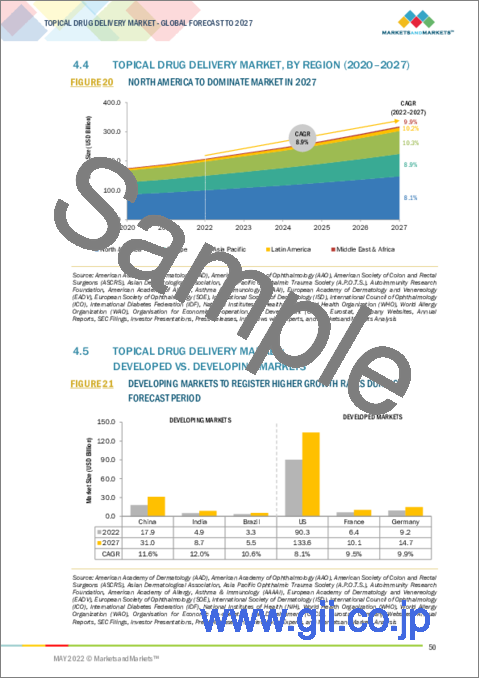

"The APAC to witness the highest growth during the forecast period."

Asia Pacific is expected to grow at the highest CAGR during the forecast period of 2022-2027. The high incidence of skin diseases (such as skin cancer), the rising prevalence of chronic diseases (such as diabetes), increasing use of contraceptives, the increasing geriatric population, and the growing focus of pharmaceutical companies on the R&D of smart transdermal drug delivery systems are some of the major factors that are expected to drive the growth of the topical drug delivery market in the Asia Pacific region.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Europe-30%, Asia Pacific-20%, Latin America- 3%, Middle East and Africa-2%

Key players in the Topical Drug Delivery Market

The prominent players in the topical drug delivery market are Glenmark Pharmaceuticals Ltd. (India), Galderma (Switzerland), Johnson & Johnson Private Limited (US), GlaxoSmithKline Plc. (UK), Bausch Health Companies Inc. (Canada), Hisamitsu Pharmaceuticals Inc. (Japan), Cipla (India), Bayer AG (Germany), Viatris Inc. (Mylan N.V.) (US), 3M (US), Merck & Co.Inc.. (Germany), Crescita Therpeautics Inc. (Canada), Novartis International AG (Switzerland), Boehringer Ingelheim International GmBH (Germany), Pfizer Inc. (US), Teva Pharmaceuticals Industries Ltd. (Israel), Bristol Myers Squibb (US), Lead Chemical Co., Ltd. (Japan), Purdue Pharma L.P. (US), Lavipharm (Greece), AbbVie Inc. (US), CMP Pharma, Inc. (Germany), Encore Dermatology, Inc. (US), Prosolus Inc. (US), and Rusan Pharma Ltd. (India).

Research Coverage:

The report analyzes the topical drug delivery market and aims at estimating the market size and future growth potential of this market based on various segments such as product, route of administration, facility of use, and region. The report also includes a product portfolio matrix of various topical drug delivery products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the topical drug delivery market. The report analyzes this market by product, by route of administration, and by facility of use.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global topical drug delivery market

- Market Development: Comprehensive information on the lucrative emerging markets by product, route of administration, and facility of use

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global topical drug delivery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global topical drug delivery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.2.2 MARKETS COVERED

- FIGURE 1 TOPICAL DRUG DELIVERY MARKET SEGMENTATION

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE PARTICIPANTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 7 TOPICAL DRUG DELIVERY MARKET - REVENUE SHARE ANALYSIS ILLUSTRATION: JOHNSON & JOHNSON

- FIGURE 8 PHARMACEUTICAL SALES APPROACH

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 CAGR PROJECTIONS

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TOPICAL DRUG DELIVERY MARKET (2022-2027): IMPACT ON MARKET GROWTH & CAGR

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: TOPICAL DRUG DELIVERY MARKET

3 EXECUTIVE SUMMARY

- FIGURE 13 TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

- FIGURE 14 TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2022 VS. 2027 (USD BILLION)

- FIGURE 15 TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2022 VS. 2027 (USD BILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF TOPICAL DRUG DELIVERY MARKET

4 PREMIUM INSIGHTS

- 4.1 TOPICAL DRUG DELIVERY MARKET OVERVIEW

- FIGURE 17 HIGH PREVALENCE OF SKIN DISEASES AND HIGH INCIDENCE OF BURN INJURIES TO DRIVE MARKET GROWTH

- 4.2 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT AND COUNTRY (2021)

- FIGURE 18 SEMI-SOLID FORMULATIONS TO DOMINATE LATIN AMERICA MARKET IN 2021

- 4.3 TOPICAL DRUG DELIVERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 19 INDIA TO REGISTER HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

- 4.4 TOPICAL DRUG DELIVERY MARKET, BY REGION (2020-2027)

- FIGURE 20 NORTH AMERICA TO DOMINATE MARKET IN 2027

- 4.5 TOPICAL DRUG DELIVERY MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- TABLE 3 TOPICAL DRUG DELIVERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 High prevalence of skin diseases

- 5.2.1.2 Increase in self-medication as a popular practice in dermatology

- 5.2.1.3 High prevalence of topical prescription therapy for dry eye diseases

- 5.2.1.4 Switching from conventional needle injections to transdermal patches

- 5.2.1.5 High incidence of burn injuries

- 5.2.1.6 Growing prevalence of diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Continuous irritation of skin and allergies caused by topical drugs

- 5.2.2.2 Preference for alternative modes of drug delivery

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for self-administration and home care

- 5.2.3.2 Delivery of biologics through transdermal route

- 5.2.3.3 Topical vehicles used in cosmetic industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Topical formulations for drugs with limited plasma concentration

- 5.2.4.2 Increasing number of drug failures and product recalls

- 5.3 INDUSTRY TRENDS

- 5.3.1 NEW ADVANCEMENT IN TRANSDERMAL DRUG DELIVERY SYSTEM

- 5.3.2 ADOPTION OF TELEDERMATOLOGY

- 5.4 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 4 TOPICAL DRUG DELIVERY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.5 IMPACT OF COVID-19

- 5.6 REGULATORY ANALYSIS

- TABLE 5 REGULATORY SCENARIO, BY COUNTRY

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 22 TOPICAL DRUG DELIVERY MARKET: VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM MAPPING

- FIGURE 23 PHARMACEUTICAL DRUG DELIVERY MARKET ECOSYSTEM

- 5.9 TECHNOLOGY ANALYSIS

- 5.10 PRICING ANALYSIS

- TABLE 6 REGIONAL PRICING ANALYSIS OF TOPICAL DRUGS, 2021 (USD)

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 TOPICAL DRUG DELIVERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 PATENT ANALYSIS

- 5.12.1 PATENT PUBLICATION TRENDS FOR TOPICAL DRUG DELIVERY

- FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2011- APRIL 2022)

- 5.12.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 25 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR TOPICAL DRUG DELIVERY PATENTS (JANUARY 2011-APRIL 2022)

- FIGURE 26 TOP APPLICANT COUNTRIES/REGIONS FOR TOPICAL DRUG DELIVERY (JANUARY 2011-APRIL 2022)

- TABLE 8 LIST OF PATENTS/PATENT APPLICATIONS IN TOPICAL DRUG DELIVERY MARKET, 2021-2022

6 TOPICAL DRUG DELIVERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 9 TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- 6.2 SEMI-SOLID FORMULATIONS

- TABLE 10 KEY TOPICAL DRUG DELIVERY SEMI-SOLID FORMULATIONS AVAILABLE

- TABLE 11 TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 12 TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.2.1 OINTMENTS

- 6.2.1.1 Ointments to be widely used in analgesic indications

- TABLE 13 TOPICAL DRUG DELIVERY MARKET FOR OINTMENTS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.2.2 CREAMS

- 6.2.2.1 Creams to be most widely used formulation due to better absorption

- TABLE 14 TOPICAL DRUG DELIVERY MARKET FOR CREAMS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.2.3 LOTIONS

- 6.2.3.1 Easy administration of lotions to drive demand

- TABLE 15 TOPICAL DRUG DELIVERY MARKET FOR LOTIONS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.2.4 GELS

- 6.2.4.1 Faster drug release and greater patient acceptability to drive gels market

- TABLE 16 TOPICAL DRUG DELIVERY MARKET FOR GELS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.2.5 PASTES

- 6.2.5.1 Topical pastes to treat and prevent skin irritation

- TABLE 17 TOPICAL DRUG DELIVERY MARKET FOR PASTES, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.3 LIQUID FORMULATIONS

- TABLE 18 TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 19 TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 20 KEY LIQUID FORMULATIONS AVAILABLE

- 6.3.1 SUSPENSIONS

- 6.3.1.1 Higher rate of bioavailability and controlled onset of action to support market growth

- TABLE 21 TOPICAL DRUG DELIVERY MARKET FOR SUSPENSIONS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.3.2 SOLUTIONS

- 6.3.2.1 Topical solutions with soluble chemicals to dissolve in various solvents

- TABLE 22 TOPICAL DRUG DELIVERY MARKET FOR SOLUTIONS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.4 SOLID FORMULATIONS

- TABLE 23 TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 24 TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 25 KEY SOLID FORMULATIONS AVAILABLE

- 6.4.1 POWDERS

- 6.4.1.1 Inexpensive manufacturing and effectiveness against antifungal infections to propel powders market

- TABLE 26 TOPICAL DRUG DELIVERY MARKET FOR POWDERS, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.4.2 SUPPOSITORIES

- 6.4.2.1 Suppositories require suitable base to ensure drug compatibility and stability

- TABLE 27 TOPICAL DRUG DELIVERY MARKET FOR SUPPOSITORIES , BY COUNTRY, 2020-2027 (USD BILLION)

- 6.5 TRANSDERMAL PRODUCTS

- TABLE 28 TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 29 TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 30 KEY TRANSDERMAL PRODUCTS AVAILABLE

- 6.5.1 TRANSDERMAL PATCHES

- 6.5.1.1 Transdermal patches to offer increased drug permeability across skin

- TABLE 31 TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PATCHES, BY COUNTRY, 2020-2027 (USD BILLION)

- 6.5.2 TRANSDERMAL SEMI-SOLIDS

- 6.5.2.1 Transdermal semi-solids to offer fast drying on application site

- TABLE 32 TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL SEMI-SOLIDS, BY COUNTRY, 2020-2027 (USD BILLION)

7 TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION

- 7.1 INTRODUCTION

- TABLE 33 TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

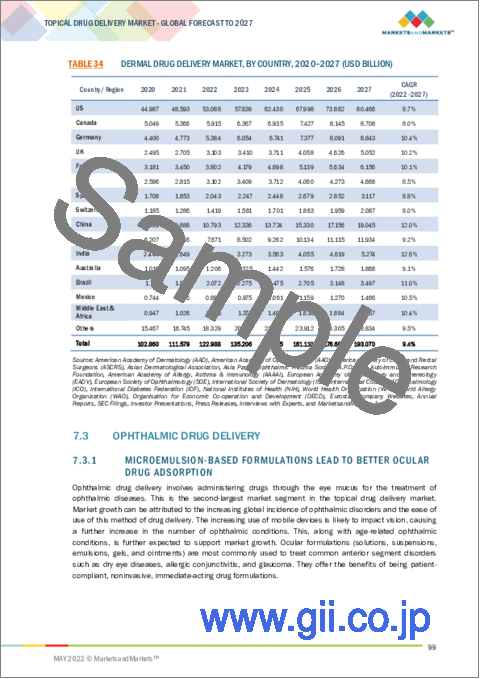

- 7.2 DERMAL DRUG DELIVERY

- 7.2.1 NANO-SIZED DRUG CARRIER SYSTEMS TO BE STUDIED TO OVERCOME DRUG PENETRATION LIMITATION

- TABLE 34 DERMAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- 7.3 OPHTHALMIC DRUG DELIVERY

- 7.3.1 MICROEMULSION-BASED FORMULATIONS LEAD TO BETTER OCULAR DRUG ADSORPTION

- TABLE 35 OPHTHALMIC DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- 7.4 VAGINAL DRUG DELIVERY

- 7.4.1 RICH AND COMPLEX NETWORK OF CAPILLARIES OF UPPER VAGINA TO CREATE SYSTEMIC DRUG DELIVERY SYSTEM

- TABLE 36 VAGINAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- 7.5 RECTAL DRUG DELIVERY

- 7.5.1 RECTAL ADMINISTRATION TO ENABLE BOTH LOCAL AND SYSTEMIC THERAPY OF DRUGS

- TABLE 37 RECTAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- 7.6 NASAL DRUG DELIVERY

- 7.6.1 NASAL DELIVERY ROUTE OFFERS QUICK ONSET OF DRUG ACTION AND CONVENIENCE AS COMPARED TO PARENTERAL ROUTE

- TABLE 38 NASAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

8 TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE

- 8.1 INTRODUCTION

- TABLE 39 TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 8.2 HOMECARE SETTINGS

- 8.2.1 HOMECARE TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 40 TOPICAL DRUG DELIVERY MARKET FOR HOMECARE SETTINGS, BY COUNTRY, 2020-2027 (USD BILLION)

- 8.3 HOSPITALS & CLINICS

- 8.3.1 TOPICAL ANAESTHETICS TO BE ADOPTED FOR VARIOUS MEDICAL AND SURGICAL SUB-SPECIALTIES

- TABLE 41 TOPICAL DRUG DELIVERY MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2020-2027 (USD BILLION)

- 8.4 BURN CENTERS

- 8.4.1 TOPICAL ANTIMICROBIAL FORMULATIONS FOR BURN-RELATED INJURIES TO DRIVE MARKET GROWTH

- TABLE 42 TOPICAL DRUG DELIVERY MARKET FOR BURN CENTERS, BY COUNTRY, 2020-2027 (USD BILLION)

- 8.5 OTHER FACILITIES

- TABLE 43 TOPICAL DRUG DELIVERY MARKET FOR OTHER FACILITIES, BY COUNTRY, 2020-2027 (USD BILLION)

9 TOPICAL DRUG DELIVERY MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 27 TOPICAL DRUG DELIVERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 44 TOPICAL DRUG DELIVERY MARKET, BY REGION, 2020-2027 (USD BILLION)

- 9.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET SNAPSHOT

- TABLE 45 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 46 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 47 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 48 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 49 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 50 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 51 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 52 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.2.1 US

- 9.2.1.1 Rising prevalence of skin diseases alongside approval and launch of innovative topical formulations to propel market growth

- TABLE 53 US: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 54 US: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 55 US: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 56 US: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 57 US: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 58 US: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 59 US: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.2.2 CANADA

- 9.2.2.1 Rising prevalence of hypertension and funding for topical drugs research to drive market growth

- TABLE 60 CANADA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 61 CANADA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 62 CANADA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 63 CANADA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 64 CANADA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 65 CANADA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 66 CANADA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3 EUROPE

- TABLE 67 RECENT DEVELOPMENTS IN EUROPEAN TOPICAL DRUG DELIVERY MARKET, 2019-2022

- TABLE 68 EUROPE: TOPICAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 69 EUROPE: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 70 EUROPE: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 71 EUROPE: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 72 EUROPE: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 73 EUROPE: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 74 EUROPE: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 75 EUROPE: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Growing focus of pharmaceutical companies on topical products development and increasing target diseases to drive market growth

- TABLE 76 DEVELOPMENTS AND PRODUCT LAUNCHES IN TOPICAL DRUG DELIVERY IN GERMANY, 2019-2022

- TABLE 77 GERMANY: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 78 GERMANY: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 79 GERMANY: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 80 GERMANY: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 81 GERMANY: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 82 GERMANY: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 83 GERMANY: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.2 UK

- 9.3.2.1 Increasing developments by top players and demand for pain-free treatment to drive market growth

- TABLE 84 UK: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 85 UK: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 86 UK: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 87 UK: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 88 UK: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 UK: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 90 UK: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Rising prevalence of diabetes and increasing geriatric population to support market growth

- TABLE 91 FRANCE: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 92 FRANCE: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 93 FRANCE: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 94 FRANCE: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 95 FRANCE: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 96 FRANCE: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 97 FRANCE: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.4 ITALY

- 9.3.4.1 Rising number of smokers to propel transdermal patches demand

- TABLE 98 ITALY: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 99 ITALY: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 100 ITALY: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 101 ITALY: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 102 ITALY: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 103 ITALY: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 104 ITALY: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Growing diabetic patients to drive market growth

- TABLE 105 SPAIN: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 106 SPAIN: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 107 SPAIN: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 108 SPAIN: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 109 SPAIN: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 110 SPAIN: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 111 SPAIN: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.6 SWITZERLAND

- 9.3.6.1 Rising geriatric population and emerging players focusing on topical drugs development to drive market growth

- TABLE 112 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 113 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 114 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 115 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 116 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 117 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 118 SWITZERLAND: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.3.7 REST OF EUROPE

- TABLE 119 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 120 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 121 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 122 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 123 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 124 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 125 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.4 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET SNAPSHOT

- TABLE 126 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 127 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 128 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 129 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 130 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 131 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 132 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 133 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.4.1 CHINA

- 9.4.1.1 Prevalence of diabetes and increase in pharmaceutical R&D investments to drive market growth

- TABLE 134 CHINA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 135 CHINA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 136 CHINA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 137 CHINA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 138 CHINA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 139 CHINA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 140 CHINA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Increasing number of product approvals and growing focus of local players on topical formulations R&D to support market growth

- TABLE 141 JAPAN: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 142 JAPAN: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 143 JAPAN: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 144 JAPAN: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 145 JAPAN: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 146 JAPAN: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 147 JAPAN: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising awareness among healthcare providers and patients alongside increasing focus on noninvasive methods of drug delivery to drive market growth

- TABLE 148 INDIA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 149 INDIA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 150 INDIA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 151 INDIA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 152 INDIA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 153 INDIA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 154 INDIA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Increasing number of smokers to drive market growth

- TABLE 155 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 156 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 157 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 158 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 159 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 160 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 161 AUSTRALIA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 162 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 163 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 164 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 165 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 166 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 167 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 168 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.5 LATIN AMERICA

- TABLE 169 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY COUNTRY, 2020-2027 (USD BILLION)

- TABLE 170 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 171 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 172 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 173 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 174 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 175 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 176 LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 High prevalence of diabetes to propel market growth

- TABLE 177 BRAZIL: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 178 BRAZIL: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 179 BRAZIL: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 180 BRAZIL: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 181 BRAZIL: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 182 BRAZIL: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 183 BRAZIL: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Increasing prevalence of glaucoma to drive market growth

- TABLE 184 MEXICO: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 185 MEXICO: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 186 MEXICO: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 187 MEXICO: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 188 MEXICO: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 189 MEXICO: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 190 MEXICO: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 191 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 192 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 193 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 194 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 195 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 196 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 197 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING PREVALENCE OF BURN INJURIES AND INCREASING EXPENDITURE ON HEALTHCARE TO DRIVE MARKET GROWTH

- TABLE 198 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020-2027 (USD BILLION)

- TABLE 199 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 200 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 201 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020-2027 (USD BILLION)

- TABLE 202 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD BILLION)

- TABLE 204 MIDDLE EAST & AFRICA: TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE, 2020-2027 (USD BILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 30 REVENUE ANALYSIS OF TOP PLAYERS IN TOPICAL DRUG DELIVERY MARKET

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 31 TOPICAL DRUG DELIVERY MARKET SHARE, BY KEY PLAYER, 2021

- TABLE 205 TOPICAL DRUG DELIVERY MARKET: DEGREE OF COMPETITION

- 10.5 COMPETITIVE LEADERSHIP MAPPING

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 32 TOPICAL DRUG DELIVERY MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 10.6 COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 STARTING BLOCKS

- 10.6.4 RESPONSIVE COMPANIES

- FIGURE 33 TOPICAL DRUG DELIVERY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS (2021)

- 10.7 COMPANY FOOTPRINT

- TABLE 206 COMPANY FOOTPRINT: TOPICAL DRUG DELIVERY MARKET

- 10.7.1 PRODUCT FOOTPRINT OF MAJOR PLAYERS

- TABLE 207 PRODUCT FOOTPRINT: TOPICAL DRUG DELIVERY MARKET (2021)

- 10.7.2 ROUTE OF ADMINISTRATION FOOTPRINT OF TOPICAL DRUG DELIVERY MARKET

- TABLE 208 ROUTE OF ADMINISTRATION FOOTPRINT: TOPICAL DRUG DELIVERY MARKET (2021)

- 10.7.3 FACILITY OF USE IN TOPICAL DRUG DELIVERY MARKET

- TABLE 209 FACILITY OF USE FOOTPRINT: TOPICAL DRUG DELIVERY MARKET (2021)

- 10.7.4 GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN TOPICAL DRUG DELIVERY MARKET

- TABLE 210 GEOGRAPHIC FOOTPRINT: TOPICAL DRUG DELIVERY MARKET (2021)

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 211 PRODUCT LAUNCHES, JANUARY 2019-APRIL 2022

- 10.8.2 DEALS

- TABLE 212 DEALS, JANUARY 2019-APRIL 2022

- 10.8.3 OTHER DEVELOPMENTS

- TABLE 213 OTHER DEVELOPMENTS, JANUARY 2019-APRIL 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 GLENMARK PHARMACEUTICALS LTD.

- TABLE 214 GLENMARK PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

- FIGURE 34 GLENMARK PHARMACEUTICALS LTD.: COMPANY SNAPSHOT (2021)

- 11.1.2 GALDERMA

- TABLE 215 GALDERMA: BUSINESS OVERVIEW

- 11.1.3 JOHNSON & JOHNSON PRIVATE LIMITED

- TABLE 216 JOHNSON & JOHNSON PRIVATE LIMITED: BUSINESS OVERVIEW

- FIGURE 35 JOHNSON & JOHNSON PRIVATE LIMITED: COMPANY SNAPSHOT (2021)

- 11.1.4 GLAXOSMITHKLINE PLC.

- TABLE 217 GLAXOSMITHKLINE PLC: BUSINESS OVERVIEW

- FIGURE 36 GLAXOSMITHKLINE, PLC.: COMPANY SNAPSHOT (2021)

- 11.1.5 BAUSCH HEALTH COMPANIES INC.

- TABLE 218 BAUSCH HEALTH COMPANIES INC.: BUSINESS OVERVIEW

- FIGURE 37 BAUSCH HEALTH COMPANIES INC.: COMPANY SNAPSHOT (2021)

- 11.1.6 HISAMITSU PHARMACEUTICAL CO., INC.

- TABLE 219 HISAMITSU PHARMACEUTICAL CO., INC.: BUSINESS OVERVIEW

- FIGURE 38 HISAMITSU PHARMACEUTICAL CO., INC.: COMPANY SNAPSHOT (2021)

- 11.1.7 CIPLA

- TABLE 220 CIPLA: BUSINESS OVERVIEW

- FIGURE 39 CIPLA: COMPANY SNAPSHOT (2021)

- 11.1.8 BAYER AG

- TABLE 221 BAYER AG: BUSINESS OVERVIEW

- FIGURE 40 BAYER AG: COMPANY SNAPSHOT (2021)

- 11.1.9 VIATRIS INC. (MYLAN N.V.)

- TABLE 222 VIATRIS INC.: BUSINESS OVERVIEW

- FIGURE 41 VIATRIS INC.: COMPANY SNAPSHOT (2021)

- 11.1.10 3M

- TABLE 223 3M: BUSINESS OVERVIEW

- FIGURE 42 3M: COMPANY SNAPSHOT (2021)

- 11.1.11 MERCK & CO., INC.

- TABLE 224 MERCK & CO., INC.: BUSINESS OVERVIEW

- FIGURE 43 MERCK & CO., INC.: COMPANY SNAPSHOT (2021)

- 11.1.12 CRESCITA THERAPEUTICS INC.

- TABLE 225 CRESCITA THERAPEUTICS INC.: BUSINESS OVERVIEW

- FIGURE 44 CRESCITA THERAPEUTICS INC.: COMPANY SNAPSHOT (2021)

- 11.1.13 NOVARTIS INTERNATIONAL AG

- TABLE 226 NOVARTIS INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 45 NOVARTIS INTERNATIONAL AG: COMPANY SNAPSHOT (2021)

- 11.1.14 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- TABLE 227 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: BUSINESS OVERVIEW

- FIGURE 46 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT (2021)

- 11.1.15 PFIZER INC.

- TABLE 228 PFIZER INC.: BUSINESS OVERVIEW

- FIGURE 47 PFIZER INC.: COMPANY SNAPSHOT (2021)

- 11.1.16 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- TABLE 229 TEVA PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 48 TEVA PHARMACEUTICALS: COMPANY SNAPSHOT (2021)

- 11.1.17 BRISTOL MYERS SQUIBB

- TABLE 230 BRISTOL MYERS SQUIBB: BUSINESS OVERVIEW

- FIGURE 49 BRISTOL MYERS SQUIBB: COMPANY SNAPSHOT (2021)

- 11.1.18 LEAD CHEMICAL CO., LTD.

- TABLE 231 LEAD CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- 11.1.19 PURDUE PHARMA L.P.

- TABLE 232 PURDUE PHARMA L.P.: BUSINESS OVERVIEW

- 11.1.20 LAVIPHARM

- TABLE 233 LAVIPHARM: BUSINESS OVERVIEW

- 11.1.21 ABBVIE INC.

- TABLE 234 ABBVIE INC.: BUSINESS OVERVIEW

- FIGURE 50 ABBVIE INC.: COMPANY SNAPSHOT (2021)

- 11.2 OTHER PLAYERS

- 11.2.1 CMP PHARMA, INC.

- 11.2.2 ENCORE DERMATOLOGY, INC.

- 11.2.3 PROSOLUS INC.

- 11.2.4 RUSAN PHARMA LTD.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 AVAILABLE CUSTOMIZATIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS