|

|

市場調査レポート

商品コード

1881234

眼科機器の世界市場 (~2030年):技術・製品タイプ (外科用機器・診断&モニタリング機器)・エンドユーザー別Ophthalmic Equipment Market by Technology, Product Type (Surgical Devices, Diagnostic & Monitoring Devices ), End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 眼科機器の世界市場 (~2030年):技術・製品タイプ (外科用機器・診断&モニタリング機器)・エンドユーザー別 |

|

出版日: 2025年11月05日

発行: MarketsandMarkets

ページ情報: 英文 474 Pages

納期: 即納可能

|

概要

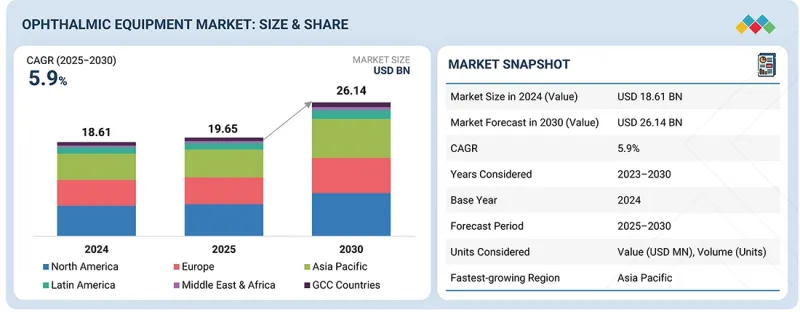

眼科機器の市場規模は、予測期間中にCAGR 5.9%で成長し、2025年の196億5,000万米ドルから、2030年には261億4,000万米ドルに達すると見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2024年~2033年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 技術、製品タイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

眼科機器市場は、主に白内障、緑内障、糖尿病性網膜症などの眼疾患の有病率の増加や、世界的な高齢化によって牽引されています。OCTや眼底カメラなどの高度な診断ツールの使用の増加、医療費の増加、発展途上国における眼科医療サービスへのアクセス拡大も市場成長を促進しています。

さらに、低侵襲およびAIベースの眼科医療ソリューションを支える技術革新もその普及を促進しています。しかしながら、機器の高コストと熟練した専門家の不足が市場の拡大を制限しています。

製品タイプ別では、白内障手術、屈折矯正手術、緑内障手術の世界的な実施件数が多いことから、外科用機器が市場を独占しています。顕微手術技術、フェムト秒レーザー、超音波乳化吸引システムの進歩により精度と治療成績が向上し、採用が増加しています。さらに、高齢人口の増加と先進的な外科センターの拡大も眼科外科用機器の需要をさらに押し上げています。

エンドユーザー別では、病院が最大のシェアを占めています。病院は包括的な眼科医療を提供する主要な拠点として、診断サービスと外科手術サービスの両方を提供しています。高度なインフラと熟練した眼科医を擁し、診療所よりも多くの患者を集めています。さらに、複雑な処置のための高機能眼科機器への投資能力が、市場全体における病院の優位性を強化しています。

北米は、先進的な医療インフラ、革新的診断・手術技術の普及率の高さ、主要メーカーの強力な存在感により、最大のシェアを占めています。同地域は、多額の医療支出、支援的な償還政策、多数の訓練を受けた眼科医の存在から恩恵を受けています。さらに、緑内障や加齢黄斑変性症などの加齢性眼疾患の有病率増加が機器需要をさらに押し上げており、継続的な技術革新と早期導入が市場の優位性維持に寄与しています。

当レポートでは、世界の眼科機器の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 業界動向

- 特許分析

- 貿易分析

- 2025-2026年の主な会議とイベント

- ケーススタディ分析

- 規制分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- アンメットニーズ/エンドユーザーの期待

- 2025年の米国関税が眼科機器市場に与える影響

- AIが眼科機器市場に与える影響

- 隣接市場分析

第6章 眼科機器市場:技術別

- AI非対応機器

- AI対応機器

第7章 眼科機器市場:製品別

- 外科用機器

- 白内障手術機器

- 硝子体網膜手術機器

- 屈折矯正手術機器

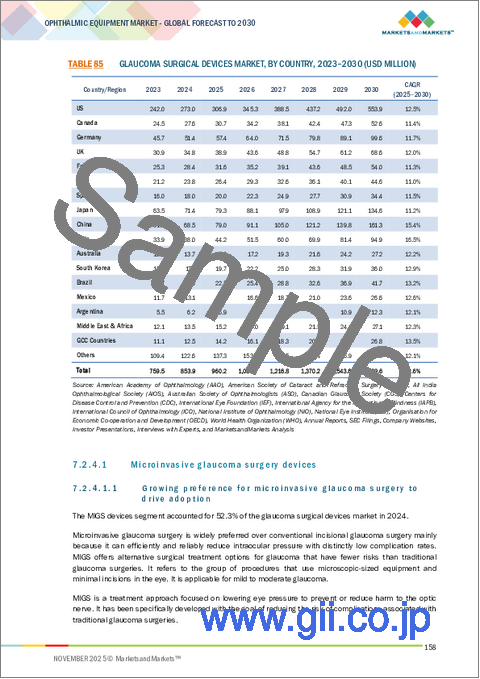

- 緑内障手術機器

- 眼科顕微鏡

- 眼科手術用アクセサリー

- 診断およびモニタリング機器

- 光干渉断層撮影機器

- 眼底カメラ

- 視野計/視野分析機器

- オートレフラクターとケラトメーター

- 眼科用超音波画像システム

- その他の眼科用超音波画像システム

- 眼圧計

- スリットランプ

- フォロプター

- 波面収差計

- 光学生体認証システム

- 眼底鏡

- レンズメーター

- 角膜トポグラフィーシステム

- チャートプロジェクター

- スペキュラー顕微鏡

- 網膜鏡

- その他の診断・モニタリング機器

第8章 眼科機器市場:エンドユーザー別

- 病院

- 専門クリニックと外来手術センター

- その他

第9章 眼科機器市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

- 中東・アフリカ

- マクロ経済見通し

- GCC諸国

- マクロ経済見通し

第10章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- ALCON

- JOHNSON & JOHNSON

- CARL ZEISS MEDITEC AG

- BAUSCH HEALTH COMPANIES INC.

- HOYA CORPORATION

- ESSILORLUXOTTICA

- CANON

- GLAUKOS CORPORATION

- TOPCON CORPORATION

- NIDEK CO., LTD.

- STAAR SURGICAL

- HALMA PLC

- HAAG-STREIT

- SHANGHAI MEDIWORKS PRECISION INSTRUMENTS CO., LTD.

- VISIONIX

- その他の企業

- VISUNEX MEDICAL SYSTEMS

- COSTRUZIONE STRUMENTI OFTALMICI

- HAI LABORATORIES, INC.

- FORUS HEALTH

- ZIEMER OPHTHALMIC SYSTEMS AG

- CRYSTALVUE MEDICAL CORPORATION

- REMIDIO INNOVATIVE SOLUTIONS PVT. LTD.

- SUZHOU KANGJIE MEDICAL INC.

- LUMENIS

- OPHTEC BV