|

|

市場調査レポート

商品コード

1399270

ボールバルブの世界市場:材質別、タイプ別、サイズ別、産業別、地域別-2028年までの予測Ball Valves Market by Material, Type, Size, Industry & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ボールバルブの世界市場:材質別、タイプ別、サイズ別、産業別、地域別-2028年までの予測 |

|

出版日: 2023年12月15日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 素材別、タイプ別、サイズ別、産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界のボールバルブの市場規模は、2023年の136億米ドルから2028年には170億米ドルに成長し、CAGR 4.6%になると予測されています。

ボールバルブ分野は、産業活動の増加、石油・ガス産業からの要求の高まり、水処理、大規模な世界的インフラプロジェクトにより、顕著な拡大を経験しています。技術の進歩に加え、流体制御システムの効率性と信頼性の向上が重視されていることが、市場の成長を後押しする重要な要因となっています。

ステンレス鋼セグメントは市場で力強い成長を遂げています。ステンレス製ボールバルブは、その耐久性、耐食性、多様な産業用途により、世界市場で力強い成長を遂げています。石油・ガス、化学、水処理など様々な分野での信頼性が、世界の需要の増加を後押ししています。

ボールバルブ分野は、産業活動の増加、石油・ガス産業、水処理、大規模な世界インフラプロジェクトからの要求の高まりにより、顕著な拡大を経験しています。技術の進歩は、流体制御システムの効率と信頼性の向上に重点を置いており、市場の成長を促進する重要な要因となっています。

1~5インチのボールバルブ市場は、複数の産業で適応的に使用されるため、大きな拡大を経験しています。これらのバルブは、その巧みな流量制御、信頼性の高いシール、および長持ちする構築のために支持され、石油・ガス、水処理、化学処理の分野で広範なアプリケーションを見つける。そのコンパクトさ、高圧への対応力、メンテナンスの容易さは、様々な産業分野での需要拡大に貢献しています。

ボールバルブは、その堅牢性、厳しい環境下での信頼性、材料の技術的進歩、安全基準の遵守により、石油・ガス分野で優れています。メンテナンスの必要性を減少させ、安全性を確保し、厳しい環境では極めて重要です。エネルギー部門が成長するにつれて、インフラ拡張を支えるその役割は引き続き不可欠であり、業界の課題に取り組み、操業効率を維持するための継続的な技術革新が求められています。

当レポートでは、世界のボールバルブ市場について調査し、材質別、タイプ別、サイズ別、産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2023年~2024年の主要な会議とイベント

- 関税、規制、基準

- 規格

第6章 ボールバルブ市場、材質別

- イントロダクション

- ステンレス鋼

- 鋳鉄

- 合金ベース

- その他

第7章 ボールバルブ市場、タイプ別

- イントロダクション

- トラニオンマウント

- フローティング

- ライジングステム

第8章 ボールバルブ市場、サイズ別

- イントロダクション

- 1インチ未満

- 1~5インチ

- 6~24インチ

- 25~50インチ

- 50インチ超

第9章 ボールバルブ市場、産業別

- イントロダクション

- 石油ガス

- エネルギー・電力

- 水・廃水処理

- 化学薬品

- 建築・建設

- 医薬品

- 農業

- 金属・鉱業

- 紙パルプ

- 食品・飲料

- その他

第10章 ボールバルブ市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 主要参入企業の戦略

- 上位5社の収益分析

- 上位5社の市場シェア分析、2022年

- 企業評価マトリックス、2022年

- 中小企業(SMES)評価マトリックス、2022年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- EMERSON ELECTRIC CO.

- FLOWSERVE CORPORATION

- SLB

- IMI CRITICAL ENGINEERING

- VALMET

- CRANE COMPANY

- KITZ CORPORATION

- NEWAY VALVE

- SPIRAX SARCO LIMITED

- TRILLIUM FLOW TECHNOLOGIES

- その他の企業

- ALFA LAVAL

- PARKER HANNIFIN CORP

- BRAY INTERNATIONAL

- XYLEM

- HAM-LET GROUP

- スタートアップ/中小企業

- APOLLO INDIA VALVES

- AVCON CONTROLS PVT. LTD.

- AVK HOLDING A/S

- DWYER INSTRUMENTS LTD.

- FORBES MARSHALL

- KLINGER HOLDING

- POWELL VALVES

- SAMSON AKTIENGESELLSCHAFT

- SWAGELOK COMPANY

- XHVAL VALVE CO., LTD.

第13章 隣接市場および関連市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Material, Type, Size, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

The global Ball valves market is expected to grow from USD 13.6 billion in 2023 to USD 17.0 billion by 2028, registering a CAGR of 4.6%. The ball valves sector has experienced notable expansion due to the rise in industrial activities, heightened requirements from oil and gas industries, water treatment, and extensive global infrastructure projects. Advancements in technology, alongside a strong emphasis on enhancing efficiency and dependability in fluid control systems, have been pivotal factors propelling the market's growth.

"Stainless Steel segment to grow at highest CAGR in Liquid analyzer market."

The Stainless Steel segment is experiencing robust growth in the market. Stainless steel ball valves have experienced robust growth in the global market due to their durability, corrosion resistance, and diverse industrial applications. Their reliability in various sectors, including oil & gas, chemical, and water treatment, has propelled their increasing demand worldwide..

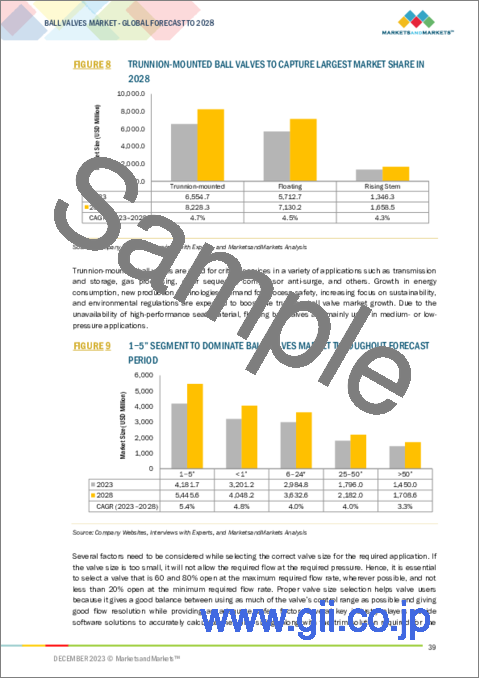

"Trunnion-mounted segment accounted for the largest share of the Ball valves market in 2022."

The ball valves sector has experienced notable expansion due to the rise in industrial activities, heightened requirements from oil and gas industries, water treatment, and extensive global infrastructure projects. Advancements in technology, alongside a strong emphasis on enhancing efficiency and dependability in fluid control systems, have been pivotal factors propelling the market's growth.

"PC-based Ball valves System segment accounted for the largest share of the Ball valves market in 2022."

The market for ball valves ranging from 1"-5" has experienced significant expansion due to their adaptable use across multiple industries. These valves are favored for their adept flow control, dependable seals, and long-lasting build, finding extensive application in oil, gas, water treatment, and chemical processing sectors. Their compactness, capability to handle high pressures, and ease of upkeep contribute to their escalating demand in various industrial contexts.

"Oil & Gas to hold largest market share in year 2022"

Ball valves excel in the oil and gas sector due to their robustness, reliability in tough settings, technological advancements in materials, and adherence to safety standards. They diminish maintenance needs and ensure safety, crucial in demanding environments. As the energy sector grows, their role in supporting infrastructure expansion remains vital, prompting continuous innovation to tackle industry challenges and sustain operational efficiency..

"Asia Pacific to account for the largest market size in 2022"

Rapid expansion across various industries in the Asia Pacific region has propelled a surge in the utilization of ball valves. This surge stems from the valves' efficacy in control, reliability, and endurance, making them pivotal in sectors like oil & gas, water treatment, and manufacturing. The region's infrastructural growth and increasing urbanization have amplified the demand, fostering significant market expansion and driving innovative technological developments in this sphere.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 35%, Tier 2 - 30%, and Tier 3 - 35%

- By Designation - C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region - North America - 35%, Europe - 25%, Asia Pacific - 30%, RoW- 10%

The major players in the market are Emerson Electric Co. (US), Flowserve Corporation (US), SLB (US), IMI (UK), and KITZ Corporation (Japan)

Research Coverage:

The Ball valves market has been segmented into material, type, size Industry, and region. The Ball valves market was studied in North America, Europe, Asia Pacific, and the Rest of the World (RoW). The report describes the major drivers, restraints, challenges, and opportunities of the Ball valves market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the Ball valves ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the Ball valves market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- Analysis of Key Drivers (Growing need for replacement of outdated ball valves and adoption of smart valves, Rising focus on industrialization, urbanization, and smart city development, and Increasing new nuclear power plant projects and upgrades of existing ones), restraints (Lack of standardized norms and government policies and High Costs of Raw Materials), Opportunities (Utilization of IIoT and digital transformation in industrial plants, Application of 3D printing technology in valve manufacturing, Focus of industry players on offering improved customer services), Challenges (Intense pricing pressure due to availability of low-priced valves and Rise in collaboration activities among industry players).

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the Ball valves market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Ball valves market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Ball valves market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Emerson Electric Co. (US), Flowserve Corporation (US), SLB (US), IMI (UK), Valmet (Finland), Crane Company (US), KITZ Corporation (Japan), Neway Valves Co. Ltd. (China), Spirax Sarco Limited (UK), Trillium Flow Technologies (US) among others in the Ball valves market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 BALL VALVES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.3 PRIMARY AND SECONDARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED THROUGH SALES OF DIFFERENT TYPES OF BALL VALVES

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 APPROACH TO ESTIMATE RECESSION IMPACT

- 2.6 RISK ASSESSMENT

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 STAINLESS STEEL BALL VALVES TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 8 TRUNNION-MOUNTED BALL VALVES TO CAPTURE LARGEST MARKET SHARE IN 2028

- FIGURE 9 1-5" SEGMENT TO DOMINATE BALL VALVES MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 10 OIL & GAS INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 NORTH AMERICA TO EXHIBIT HIGHEST CAGR IN BALL VALVES MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BALL VALVES MARKET

- FIGURE 12 INCREASING OIL AND GAS EXPLORATION ACTIVITIES IN ASIA PACIFIC TO PROVIDE LUCRATIVE OPPORTUNITIES

- 4.2 BALL VALVES MARKET, BY MATERIAL

- FIGURE 13 STAINLESS STEEL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 BALL VALVES MARKET, BY TYPE

- FIGURE 14 TRUNNION-MOUNTED SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.4 BALL VALVES MARKET, BY SIZE

- FIGURE 15 1-5" SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.5 BALL VALVES MARKET, BY INDUSTRY

- FIGURE 16 PULP & PAPER INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.6 BALL VALVES MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF BALL VALVES MARKET IN 2023

- 4.7 BALL VALVES MARKET, BY COUNTRY

- FIGURE 18 US AND INDIA TO BE LUCRATIVE MARKETS FOR BALL VALVES FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 BALL VALVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing need for replacement of outdated ball valves and adoption of smart valves

- 5.2.1.2 Rising focus on industrialization, urbanization, and smart city development

- 5.2.1.3 Pressing need to upgrade existing valves with increasing number of nuclear power plant projects

- FIGURE 20 BALL VALVES MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardized norms and regulatory policies

- 5.2.2.2 High cost of raw materials

- FIGURE 21 BALL VALVES MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Utilization of IIoT and digital technologies in industrial plants

- 5.2.3.2 Adoption of 3D printing in valve manufacturing

- 5.2.3.3 Focus of industry players on offering improved customer services

- FIGURE 22 BALL VALVES MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense pricing pressure due to availability of local, low-priced valves

- 5.2.4.2 Rise in collaboration activities among industry players

- FIGURE 23 BALL VALVES MARKET CHALLENGES: IMPACT ANALYSIS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: BALL VALVES MARKET

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 25 BALL VALVES ECOSYSTEM

- TABLE 2 BALL VALVES MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE OF BALL VALVES, 2022-2028

- 5.5.1 AVERAGE SELLING PRICE TREND OF BALL VALVES PROVIDED BY KEY PLAYERS, BY TYPE

- FIGURE 27 AVERAGE SELLING PRICE TREND OF BALL VALVE COMPONENTS OFFERED BY KEY PLAYERS

- TABLE 3 AVERAGE SELLING PRICE OF BALL VALVE COMPONENTS OFFERED BY KEY PLAYERS (USD)

- TABLE 4 AVERAGE SELLING PRICE OF OPTICS, BY REGION (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE

- 5.7.2 INDUSTRIAL INTERNET OF THINGS (IIOT)

- 5.7.3 VALVE CONDITION MONITORING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS AND THEIR IMPACT (2022)

- FIGURE 29 BALL VALVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS TOP THREE INDUSTRIES

- 5.9.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 USE CASE 01: LADISH VALVES SECURED OFFERED SEVERE SERVICE BALL VALVES TO DEPLOY IN HIGH-TEMPERATURE AND -PRESSURE APPLICATIONS

- 5.10.2 USE CASE 02: ROSELAND PUMPING STATION DEPLOYED VAL-MATIC VALVE & MFG. CORPORATION'S BALL VALVES TO ADDRESS WATER SYSTEM PROBLEMS

- 5.10.3 USE CASE 03: HABONIM PROVIDED BIDIRECTIONAL CRYOGENIC FLOATING BALL VALVES FOR FIRST INLAND BUNKER PONTOON IN EUROPE

- 5.11 TRADE ANALYSIS

- FIGURE 32 IMPORT DATA FOR HS CODE 848110-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR HS CODE 848110-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 35 NO. OF PATENTS GRANTED IN LAST 10 YEARS, 2013 TO 2022

- TABLE 8 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- 5.12.1 LIST OF MAJOR PATENTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 9 BALL VALVES MARKET: LIST OF CONFERENCES AND EVENTS

- 5.14 TARIFFS, REGULATIONS, AND STANDARDS

- 5.14.1 TARIFF FOR HS CODE 848110-COMPLIANT PRESSURE-REDUCING VALVES

- TABLE 10 TARRIFF, BY COUNTRY

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 STANDARDS

- TABLE 15 STANDARDS FOLLOWED BY MANUFACTURERS OF BALL VALVES

6 BALL VALVES MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- FIGURE 36 BALL VALVES MARKET, BY MATERIAL

- FIGURE 37 STAINLESS STEEL BALL VALVES TO HOLD LARGEST MARKET SIZE IN 2023

- TABLE 16 BALL VALVES MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 17 BALL VALVES MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 6.2 STAINLESS STEEL

- 6.2.1 EXCEPTIONAL CORROSION RESISTANCE AND DURABILITY TO DRIVE MARKET

- 6.3 CAST IRON

- 6.3.1 RISING ADOPTION IN WATER & WASTEWATER TREATMENT AND OIL & GAS INDUSTRIES TO FUEL MARKET GROWTH

- 6.4 ALLOY-BASED

- 6.4.1 WIDE ADOPTION IN CHEMICAL, PHARMACEUTICAL, AND PULP & PAPER INDUSTRIES TO FOSTER MARKET GROWTH

- 6.5 OTHERS

- 6.5.1 BRASS

- 6.5.2 BRONZE

- 6.5.3 PLASTIC

7 BALL VALVES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 38 BALL VALVES MARKET, BY TYPE

- FIGURE 39 TRUNNION-MOUNTED BALL VALVES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- TABLE 18 BALL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 19 BALL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 TRUNNION-MOUNTED

- 7.2.1 INCREASING USE IN HIGH-PRESSURE LOW-TORQUE OPERATIONS TO DRIVE MARKET

- 7.3 FLOATING

- 7.3.1 RISING IMPLEMENTATION IN MEDIUM- /LOW-PRESSURE APPLICATIONS TO FUEL MARKET GROWTH

- 7.4 RISING STEM

- 7.4.1 SURGING DEMAND FROM CHEMICAL INDUSTRY TO DRIVE MARKET

8 BALL VALVES MARKET, BY SIZE

- 8.1 INTRODUCTION

- FIGURE 40 BALL VALVES MARKET, BY SIZE

- FIGURE 41 1-5" VALVES TO CAPTURE LARGEST MARKET SHARE IN 2023

- TABLE 20 BALL VALVES MARKET, BY SIZE, 2019-2022 (USD MILLION)

- TABLE 21 BALL VALVES MARKET, BY SIZE, 2023-2028 (USD MILLION)

- TABLE 22 BALL VALVES MARKET, 2022-2028 (THOUSAND UNITS)

- 8.2 <1"

- 8.2.1 GROWING DEPLOYMENT IN SMALL MANUFACTURING PLANTS TO DRIVE MARKET

- 8.3 1-5"

- 8.3.1 INCREASING USE IN BUILDING & CONSTRUCTION AND OIL & GAS APPLICATIONS TO ACCELERATE MARKET GROWTH

- 8.4 6-24"

- 8.4.1 RAPID ADOPTION IN HIGH-PRESSURE APPLICATIONS IN WATER & WASTEWATER INDUSTRY TO DRIVE MARKET

- 8.5 25-50"

- 8.5.1 RISING IMPLEMENTATION IN HIGH-TEMPERATURE AND PRESSURE-HANDLING APPLICATIONS TO FUEL MARKET GROWTH

- 8.6 >50"

- 8.6.1 GROWING UTILIZATION IN THERMAL POWER PLANTS TO STIMULATE MARKET GROWTH

9 BALL VALVES MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 42 BALL VALVES MARKET, BY INDUSTRY

- FIGURE 43 OIL & GAS INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2023

- TABLE 23 BALL VALVES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 24 BALL VALVES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 OIL & GAS

- 9.2.1 INCREASING FOCUS OF OIL & GAS COMPANIES ON CAPACITY EXPANSION PROJECTS AND MRO CONTRACTS TO DRIVE MARKET

- TABLE 25 OIL & GAS: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 OIL & GAS: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 OIL & GAS: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 28 OIL & GAS: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 29 OIL & GAS: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 30 OIL & GAS: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 31 OIL & GAS: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 32 OIL & GAS: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 33 OIL & GAS: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 OIL & GAS: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.3 ENERGY & POWER

- 9.3.1 RISING CONSTRUCTION OF NEW COAL-FIRED POWER PLANTS, GAS TURBINES, AND NUCLEAR POWER PLANTS TO DRIVE MARKET

- TABLE 35 ENERGY & POWER: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 ENERGY & POWER: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 ENERGY & POWER: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 38 ENERGY & POWER: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 39 ENERGY & POWER: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 40 ENERGY & POWER: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 41 ENERGY & POWER: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 42 ENERGY & POWER: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 43 ENERGY & POWER: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 ENERGY & POWER: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.4 WATER & WASTEWATER TREATMENT

- 9.4.1 URGENT NEED TO MODIFY OLDER WATER INFRASTRUCTURE TO AUGMENT DEMAND FOR BALL VALVES

- TABLE 45 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 48 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 49 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 50 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 51 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 52 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 53 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 WATER & WASTEWATER TREATMENT: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.5 CHEMICAL

- 9.5.1 SIGNIFICANT INCREASE IN CHEMICAL PRODUCTION TO FOSTER DEMAND

- TABLE 55 CHEMICAL: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 CHEMICAL: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 CHEMICAL: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 58 CHEMICAL: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 59 CHEMICAL: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 60 CHEMICAL: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 61 CHEMICAL: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 62 CHEMICAL: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 CHEMICAL: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 CHEMICAL: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.6 BUILDING & CONSTRUCTION

- 9.6.1 GROWING DEPLOYMENT OF HOT WATER AND SAFETY SYSTEMS IN NEW BUILDINGS TO BOOST DEMAND

- TABLE 65 BUILDING & CONSTRUCTION: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 BUILDING & CONSTRUCTION: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 68 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 69 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 70 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 71 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 72 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN ASIA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 73 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 BUILDING & CONSTRUCTION: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.7 PHARMACEUTICAL

- 9.7.1 BOOMING MARKET FOR PHARMACEUTICAL IN ASIA PACIFIC TO BOOST DEMAND

- TABLE 75 PHARMACEUTICAL: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 PHARMACEUTICAL: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 PHARMACEUTICAL: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 78 PHARMACEUTICAL: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 79 PHARMACEUTICAL: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 PHARMACEUTICAL: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 81 PHARMACEUTICAL: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 82 PHARMACEUTICAL: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 83 PHARMACEUTICAL: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 PHARMACEUTICAL: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.8 AGRICULTURE

- 9.8.1 EMPHASIS ON IMPROVING EFFICIENCY IN AGRICULTURE SECTOR TO ACCELERATE DEMAND

- TABLE 85 AGRICULTURE: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 AGRICULTURE: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 87 AGRICULTURE: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 AGRICULTURE: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 AGRICULTURE: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 90 AGRICULTURE: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 91 AGRICULTURE: ASIA PACIFIC BALL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 92 AGRICULTURE: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 93 AGRICULTURE: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 AGRICULTURE: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.9 METAL & MINING

- 9.9.1 GROWING DEMAND FOR PREDICTIVE MAINTENANCE TO ENCOURAGE USE OF BALL VALVES

- TABLE 95 METAL & MINING: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 METAL & MINING: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 METAL & MINING: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 98 METAL & MINING: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 99 METAL & MINING: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 100 METAL & MINING: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 101 METAL & MINING: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 METAL & MINING: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 103 METAL & MINING: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 METAL & MINING: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.10 PULP & PAPER

- 9.10.1 HIGH DEMAND FOR PACKAGING PAPER PRODUCTS TO DRIVE MARKET

- TABLE 105 PULP & PAPER: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 106 PULP & PAPER: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 107 PULP & PAPER: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 PULP & PAPER: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 109 PULP & PAPER: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 110 PULP & PAPER: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 PULP & PAPER: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 112 PULP & PAPER: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 PULP & PAPER: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 114 PULP & PAPER: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.11 FOOD & BEVERAGE

- 9.11.1 SANITATION, CONTAMINATION, AND PROCESS CONTROL CHALLENGES WITNESSED BY FOOD AND BEVERAGE COMPANIES TO BOOST DEMAND

- TABLE 115 FOOD & BEVERAGE: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 116 FOOD & BEVERAGE: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 117 FOOD & BEVERAGE: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 FOOD & BEVERAGE: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 119 FOOD & BEVERAGE: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 120 FOOD & BEVERAGE: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 121 FOOD & BEVERAGE: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 122 FOOD & BEVERAGE: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 123 FOOD & BEVERAGE: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 124 FOOD & BEVERAGE: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.12 OTHERS

- TABLE 125 OTHERS: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 126 OTHERS: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 127 OTHERS: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 128 OTHERS: BALL VALVES MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 129 OTHERS: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 130 OTHERS: BALL VALVES MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 131 OTHERS: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 132 OTHERS: BALL VALVES MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 OTHERS: BALL VALVES MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 134 OTHERS: BALL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

10 BALL VALVES MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 135 BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 136 BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 44 ASIA PACIFIC TO CAPTURE LARGEST MARKET SHARE IN 2023

- 10.2 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: BALL VALVES MARKET SNAPSHOT

- TABLE 137 NORTH AMERICA: BALL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: BALL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: BALL VALVES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 140 NORTH AMERICA: BALL VALVES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.1 IMPACT OF RECESSION ON MARKET IN NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Massive investments in oil & gas industry to drive market

- 10.2.3 CANADA

- 10.2.3.1 Rising energy demand to augment market growth

- 10.2.4 MEXICO

- 10.2.4.1 Growing focus on expansion of industrial plants to boost demand

- 10.3 EUROPE

- FIGURE 46 EUROPE: BALL VALVES MARKET SNAPSHOT

- TABLE 141 EUROPE: BALL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 142 EUROPE: BALL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 143 EUROPE: BALL VALVES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 144 EUROPE: BALL VALVES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.1 IMPACT OF RECESSION ON MARKET IN EUROPE

- 10.3.2 UK

- 10.3.2.1 Water & wastewater treatment industry to contribute to market growth

- 10.3.3 GERMANY

- 10.3.3.1 Significant demand from chemical and energy & power industries to support market growth

- 10.3.4 FRANCE

- 10.3.4.1 Investments in power generation technologies to fuel market growth

- 10.3.5 ITALY

- 10.3.5.1 Growing use of ball valves in desalination and wastewater treatment to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 47 ASIA PACIFIC: BALL VALVES MARKET SNAPSHOT

- TABLE 145 ASIA PACIFIC: BALL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: BALL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: BALL VALVES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: BALL VALVES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.1 IMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Significant presence of leading and mid-sized valve manufacturing firms to contribute to market growth

- 10.4.3 JAPAN

- 10.4.3.1 Strong focus on personnel safety to boost demand

- 10.4.4 INDIA

- 10.4.4.1 Thriving power industry to support market growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Flourishing semiconductor and chemical industry to support market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 ROW

- TABLE 149 ROW: BALL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 150 ROW: BALL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 151 GCC COUNTRIES: BALL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 152 GCC COUNTRIES: BALL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 153 ROW: BALL VALVES MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 154 ROW: BALL VALVES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.1 IMPACT OF RECESSION ON MARKET IN ROW

- 10.5.2 GCC COUNTRIES

- 10.5.2.1 Heightened demand in water management applications to drive market

- 10.5.3 AFRICA & REST OF MIDDLE EAST

- 10.5.3.1 Government investments and water management initiatives to drive market

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Emergence of region as manufacturing hub to facilitate demand

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 155 KEY DEVELOPMENTS IN BALL VALVES MARKET, 2021-2023

- 11.2 REVENUE ANALYSIS OF TOP FIVE COMPANIES

- FIGURE 48 BALL VALVES MARKET: REVENUE ANALYSIS, 2022

- 11.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

- TABLE 156 BALL VALVES MARKET: DEGREE OF COMPETITION

- FIGURE 49 BALL VALVES MARKET: MARKET SHARE ANALYSIS, 2022

- 11.4 COMPANY EVALUATION MATRIX, 2022

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 50 BALL VALVES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 11.4.5 COMPANY FOOTPRINT

- TABLE 157 COMPANY TYPE FOOTPRINT

- TABLE 158 COMPANY INDUSTRY FOOTPRINT

- TABLE 159 COMPANY REGION FOOTPRINT

- TABLE 160 COMPANY FOOTPRINT

- 11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 51 BALL VALVES MARKET (GLOBAL): SME EVALUATION MATRIX, 2022

- 11.5.5 COMPETITIVE BENCHMARKING

- TABLE 161 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 162 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.6 COMPETITIVE SCENARIO AND TRENDS

- 11.6.1 PRODUCT LAUNCHES

- TABLE 163 BALL VALVES MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.6.2 DEALS

- TABLE 164 BALL VALVES MARKET: DEALS

- 11.6.3 OTHER DEVELOPMENTS

- TABLE 165 BALL VALVES MARKET: OTHER DEVELOPMENTS

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 EMERSON ELECTRIC CO.

- TABLE 166 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 52 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 167 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

- TABLE 168 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 169 EMERSON ELECTRIC CO.: DEALS

- 12.1.2 FLOWSERVE CORPORATION

- TABLE 170 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- FIGURE 53 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- TABLE 171 FLOWSERVE CORPORATION: PRODUCTS OFFERED

- TABLE 172 FLOWSERVE CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 173 FLOWSERVE CORPORATION: DEALS

- 12.1.3 SLB

- TABLE 174 SLB: COMPANY OVERVIEW

- FIGURE 54 SLB: COMPANY SNAPSHOT

- TABLE 175 SLB: PRODUCTS OFFERED

- TABLE 176 SLB: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.4 IMI CRITICAL ENGINEERING

- TABLE 177 IMI CRITICAL ENGINEERING: COMPANY OVERVIEW

- FIGURE 55 IMI CRITICAL ENGINEERING: COMPANY SNAPSHOT

- TABLE 178 IMI CRITICAL ENGINEERING: PRODUCTS OFFERED

- TABLE 179 IMI CRITICAL ENGINEERING: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 180 IMI CRITICAL ENGINEERING: OTHERS

- 12.1.5 VALMET

- TABLE 181 VALMET: COMPANY OVERVIEW

- FIGURE 56 VALMET: COMPANY SNAPSHOT

- TABLE 182 VALMET: PRODUCTS OFFERED

- TABLE 183 VALMET: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 184 VALMET: DEALS

- 12.1.6 CRANE COMPANY

- TABLE 185 CRANE COMPANY: COMPANY OVERVIEW

- FIGURE 57 CRANE COMPANY: COMPANY SNAPSHOT

- TABLE 186 CRANE COMPANY: PRODUCTS OFFERED

- TABLE 187 CRANE COMPANY: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 188 CRANE COMPANY: OTHERS

- 12.1.7 KITZ CORPORATION

- TABLE 189 KITZ CORPORATION: COMPANY OVERVIEW

- FIGURE 58 KITZ CORPORATION: COMPANY SNAPSHOT

- TABLE 190 KITZ CORPORATION: PRODUCTS OFFERED

- TABLE 191 KITZ CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 192 KITZ CORPORATION: OTHERS

- 12.1.8 NEWAY VALVE

- TABLE 193 NEWAY VALVE: COMPANY OVERVIEW

- TABLE 194 NEWAY VALVE: PRODUCTS OFFERED

- TABLE 195 NEWAY VALVE: OTHERS

- 12.1.9 SPIRAX SARCO LIMITED

- TABLE 196 SPIRAX SARCO LIMITED: COMPANY OVERVIEW

- FIGURE 59 SPIRAX SARCO LIMITED: COMPANY SNAPSHOT

- TABLE 197 SPIRAX SARCO LIMITED: PRODUCTS OFFERED

- 12.1.10 TRILLIUM FLOW TECHNOLOGIES

- TABLE 198 TRILLIUM FLOW TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 199 TRILLIUM FLOW TECHNOLOGIES: PRODUCTS OFFERED

- 12.2 OTHER KEY PLAYERS

- 12.2.1 ALFA LAVAL

- TABLE 200 ALFA LAVAL: COMPANY OVERVIEW

- 12.2.2 PARKER HANNIFIN CORP

- TABLE 201 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- 12.2.3 BRAY INTERNATIONAL

- TABLE 202 BRAY INTERNATIONAL: COMPANY OVERVIEW

- 12.2.4 XYLEM

- TABLE 203 XYLEM: COMPANY OVERVIEW

- 12.2.5 HAM-LET GROUP

- TABLE 204 HAM-LET GROUP: COMPANY OVERVIEW

- 12.3 STARTUPS AND SMES

- 12.3.1 APOLLO INDIA VALVES

- TABLE 205 APOLLO INDIA VALVES: COMPANY OVERVIEW

- 12.3.2 AVCON CONTROLS PVT. LTD.

- TABLE 206 AVCON CONTROLS PVT. LTD.: COMPANY OVERVIEW

- 12.3.3 AVK HOLDING A/S

- TABLE 207 AVK HOLDING A/S: COMPANY OVERVIEW

- 12.3.4 DWYER INSTRUMENTS LTD.

- TABLE 208 DWYER INSTRUMENTS LTD.: COMPANY OVERVIEW

- 12.3.5 FORBES MARSHALL

- TABLE 209 FORBES MARSHALL: COMPANY OVERVIEW

- 12.3.6 KLINGER HOLDING

- TABLE 210 KLINGER HOLDING: COMPANY OVERVIEW

- 12.3.7 POWELL VALVES

- TABLE 211 POWELL VALVES: COMPANY OVERVIEW

- 12.3.8 SAMSON AKTIENGESELLSCHAFT

- TABLE 212 SAMSON AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- 12.3.9 SWAGELOK COMPANY

- TABLE 213 SWAGELOK COMPANY: COMPANY OVERVIEW

- 12.3.10 XHVAL VALVE CO., LTD.

- TABLE 214 XHVAL VALVE CO., LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INDUSTRIAL VALVES MARKET, BY COMPONENT

- 13.3.1 INTRODUCTION

- TABLE 215 INDUSTRIAL VALVES MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 216 INDUSTRIAL VALVES MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 13.4 ACTUATORS

- 13.4.1 PNEUMATIC ACTUATORS

- 13.4.1.1 Diaphragm actuators

- 13.4.1.1.1 Growing use in control valves to boost segmental growth

- 13.4.1.2 Piston actuators

- 13.4.1.2.1 Increasing demand for butterfly valves from food, chemical, and pharmaceutical companies to drive market

- 13.4.1.1 Diaphragm actuators

- 13.4.2 ELECTRIC ACTUATORS

- 13.4.2.1 Wide use in water & wastewater treatment and chemical plants to boost segmental growth

- 13.4.3 HYDRAULIC ACTUATORS

- 13.4.3.1 Rising deployment of HVAC, fire protection, and irrigation systems to boost demand

- TABLE 217 ACTUATORS: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 218 ACTUATORS: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 13.4.1 PNEUMATIC ACTUATORS

- 13.5 VALVE BODY

- 13.5.1 RISING DEMAND FOR VALVE BODIES FEATURING HIGH CORROSION RESISTANCE AND BETTER CHEMICAL COMPATIBILITY TO SUPPORT SEGMENTAL GROWTH

- 13.6 OTHER COMPONENTS

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS