|

|

市場調査レポート

商品コード

1614462

産業用攪拌機の世界市場:コンポーネント別、モデルタイプ別、形態別、取り付け方式別、最終用途産業別、地域別 - 2029年までの予測Industrial Agitators Market by Type (Portable, Large Tank, Drum), Component (Head, Impeller, Propeller, Shaft), Mixture (liquid-liquid, solid-liquid, liquid-gas), Mounting (Top-entry, Side-entry, Bottom-entry ) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 産業用攪拌機の世界市場:コンポーネント別、モデルタイプ別、形態別、取り付け方式別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月11日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の産業用撹拌機の市場規模は、2024年に31億米ドル、2029年には39億9,000万米ドルに達すると予測され、予測期間中のCAGRは5.2%になるとみられています。

都市化の進展、規制要件、技術的進歩により、さまざまな粘度や密度に対応できるよう設計された高効率の撹拌機が開発され、混合プロセスにおける撹拌機の採用がさらに進んでいます。また、エネルギー効率とプロセスの最適化に対する注目の高まりも需要を押し上げており、最新の撹拌機は優れた性能を維持しながら消費電力を削減するように設計されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、モデルタイプ別、形態別、取り付け方式別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

大型タンク撹拌機は、一貫した効率的な混合が要求される大規模な工業プロセスで使用されます。そのため、大型タンク撹拌機が大きなシェアを占めると予想されます。大型タンク攪拌機は、化学、石油・ガス、食品・飲料、廃水治療で使用されており、これらの分野では、大量のマテリアルハンドリングを行い、大型貯蔵容器や反応器内の均一性を確保するために大型タンク攪拌機に依存しています。これらの攪拌機は、液体の均質化、添加物の混合、固形物の懸濁といった、より一般的なバルク処理用途で特に必要とされます。大型タンク攪拌機は、他のタイプの攪拌機では十分な性能を発揮できないような、高粘度流体、かなりの量の薬液、長時間の発酵工程を伴う作業で特に非常に効果的です。その強力で信頼性の高い混合能力は、最適な化学反応を保証し、熱伝達を促進し、貯蔵タンク内の沈殿を確実に防止し、そのすべてが作業効率と製品の品質につながります。技術革新がエネルギー効率の高い自動化システムの設計を後押しする一方で、食品・飲料製造、化学処理、エネルギー生産産業などにおける大規模生産の需要が高まっていることを示すように、大型タンク用撹拌機セグメントはさらに牽引されます。

2023年には、トップマウント型セグメントがより大きな市場シェアを占め、予測期間中も同様の動向が観察されそうです。工業用撹拌機システムの使用は、化粧品、医薬品などの新しく出現した用途で増加傾向にあるためです。トップマウント型攪拌機もまた、化学、医薬品、食品・飲料、水処理など様々な産業において効率的で高性能な混合を必要とする用途に使用されているため、産業用攪拌機市場に大きく貢献すると予想されます。これらのアジテーターが持つ利点には、幅広い流体粘度と密度に対応する能力があり、これによりライトデューティーとヘビーデューティーの両方の用途を達成することができます。また、トップマウント型であるため、設置やメンテナンスが容易であり、大規模な生産現場でも安定した混合が可能です。

産業界、特に医薬品や食品加工において、厳しい品質基準を満たすという重要なニーズは、良好な化学反応、効率的な熱伝達、製品の均一性によって達成されます。そのため、エネルギー効率が高く、カスタマイズ可能で耐久性のある混合ソリューションに対する需要が増加し、トップマウント型攪拌機の採用率が高くなり、世界の産業用攪拌機市場でかなりのシェアを維持するとみられています。

当レポートでは、世界の産業用攪拌機市場について調査し、コンポーネント別、モデルタイプ別、形態別、取り付け方式別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- 産業用撹拌機市場におけるAIの影響

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 関税と規制状況

- 特許分析

- 2024年~2025年の主な会議とイベント

第6章 産業用撹拌機の流通チャネル

- イントロダクション

- 直接チャネル

- 間接チャネル

第7章 産業用撹拌機の定格出力

- イントロダクション

- 50馬力未満

- 50~100馬力

- 100馬力以上

第8章 産業用撹拌機の用途

- イントロダクション

- 均質化

- 浮遊

- 乳化

- 分散

- 中和

- 結晶

- 発酵

- 排ガス脱硫(FGD)

第9章 産業用撹拌機市場(コンポーネント別)

- イントロダクション

- ヘッド

- シーリングシステム

- インペラー

- その他

第10章 産業用撹拌機市場(モデルタイプ別)

- イントロダクション

- 大型タンク撹拌機

- ポータブル撹拌機

- ドラム型アジテーター

- その他

第11章 産業用撹拌機市場(形態別)

- イントロダクション

- 固体と固体の混合

- 固体と液体の混合

- 液体とガスの混合

- 液体と液体の混合

第12章 産業用撹拌機市場(取り付け方式別)

- イントロダクション

- トップマウント型撹拌機

- サイドマウント型撹拌機

- 底部取り付け型撹拌機

第13章 産業用撹拌機市場(最終用途産業別)

- イントロダクション

- 化学薬品

- 鉱業

- 食品・飲料

- 医薬品

- 化粧品

- 塗料・コーティング剤

- その他の最終用途産業

第14章 産業用撹拌機市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- 中東

- アフリカ

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- SPX FLOW

- XYLEM

- EKATO GROUP

- NOV

- SULZER

- INGERSOLL RAND

- DYNAMIX AGITATORS INC.

- MIXER DIRECT

- SILVERSON

- STATIFLO GROUP

- TACMINA CORPORATION

- その他の企業

- ALFA LAVAL

- DE DIETRICH PROCESS SYSTEMS

- EUROMIXERS

- FAWCETT

- MIXEL AGITATORS

- PRG AGITATORS

- PROQUIP

- SAVINO BARBERA

- SHARPE MIXERS

- SHUANGLONG GROUP

- SUMA RUHRTECHNIK

- TERALBA INDUSTRIES

- TIMSA

- WOODMAN AGITATORS

- ZHEJIANG GREATWALL MIXERS

第17章 付録

List of Tables

- TABLE 1 INDUSTRIAL AGITATORS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE OF INDUSTRIAL AGITATORS OFFERED BY KEY PLAYERS, BY MODEL TYPE (USD)

- TABLE 3 AVERAGE SELLING PRICE OF INDUSTRIAL AGITATORS OFFERED BY KEY PLAYERS, BY MOUNTING (USD)

- TABLE 4 INDICATIVE PRICING OF INDUSTRIAL AGITATORS, BY REGION

- TABLE 5 INDUSTRIAL AGITATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 IMPORT DATA FOR HS CODE 847982-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 847982-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 MFN TARIFF FOR HS CODE 847982-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 11 MFN TARIFF FOR HS CODE 847982-COMPLIANT EXPORTED BY CHINA, 2023

- TABLE 12 MFN TARIFF FOR HS CODE 847982-COMPLIANT EXPORTED BY UK, 2023

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 LIST OF MAJOR PATENTS, 2020-2024

- TABLE 18 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 19 INDUSTRIAL AGITATORS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 20 INDUSTRIAL AGITATORS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 21 INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 22 INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 23 LARGE TANK AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 24 LARGE TANK AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 25 PORTABLE AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 26 PORTABLE AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 27 DRUM AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 28 DRUM AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 29 OTHER MODEL TYPES: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 30 OTHER MODEL TYPES: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 31 INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 32 INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 33 SOLID-SOLID MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 34 SOLID-SOLID MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 35 SOLID-LIQUID MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 36 SOLID-LIQUID MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 37 LIQUID-GAS MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 38 LIQUID-GAS MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 39 LIQUID-LIQUID MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 40 LIQUID-LIQUID MIXTURE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 41 INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 42 INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 43 INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (MILLION UNITS)

- TABLE 44 INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (MILLION UNITS)

- TABLE 45 TOP-MOUNTED AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 46 TOP-MOUNTED AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 47 SIDE-MOUNTED AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 48 SIDE-MOUNTED AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 49 BOTTOM-MOUNTED AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 50 BOTTOM-MOUNTED AGITATORS: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 51 INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 52 INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 53 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 54 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 55 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 56 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 57 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 58 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 59 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 CHEMICAL: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 62 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 63 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 64 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 65 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 66 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 67 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 CHEMICAL: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 MINING: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 70 MINING: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 71 MINING: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 72 MINING: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 73 MINING: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 74 MINING: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 75 MINING: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 MINING: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 MINING: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 MINING: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 MINING: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 80 MINING: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 81 MINING: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 82 MINING: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 83 MINING: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 MINING: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 86 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 87 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 88 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 89 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 90 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 91 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 93 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 95 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 96 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 97 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 FOOD & BEVERAGE: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 101 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 102 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 103 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 104 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 105 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 106 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 107 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 108 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 109 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 112 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 113 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 114 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 115 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 116 PHARMACEUTICAL: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 117 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 118 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 119 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 120 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 121 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 122 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 123 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 124 COSMETICS: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 125 COSMETICS: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 COSMETICS: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 COSMETICS: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 COSMETICS: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 COSMETICS: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 130 COSMETICS: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 131 COSMETICS: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 132 COSMETICS: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 133 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 134 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 135 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 136 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 137 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 138 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 139 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 140 PAINT & COATING: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 141 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 142 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 143 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 144 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 145 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 146 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 147 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 148 PAINT & COATING: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 149 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2020-2023 (USD MILLION)

- TABLE 150 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE, 2024-2029 (USD MILLION)

- TABLE 151 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2020-2023 (USD MILLION)

- TABLE 152 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY MOUNTING, 2024-2029 (USD MILLION)

- TABLE 153 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 154 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 155 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 156 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 157 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 158 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 159 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 160 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 161 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 162 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 163 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 164 OTHER END-USE INDUSTRIES: INDUSTRIAL AGITATORS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 165 INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 166 INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 167 NORTH AMERICA: INDUSTRIAL AGITATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 168 NORTH AMERICA: INDUSTRIAL AGITATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 169 NORTH AMERICA: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 170 NORTH AMERICA: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 171 EUROPE: INDUSTRIAL AGITATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 172 EUROPE: INDUSTRIAL AGITATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 173 EUROPE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 174 EUROPE: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: INDUSTRIAL AGITATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: INDUSTRIAL AGITATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 177 ASIA PACIFIC: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 178 ASIA PACIFIC: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 179 ROW: INDUSTRIAL AGITATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 180 ROW: INDUSTRIAL AGITATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 181 ROW: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 182 ROW: INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 183 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 184 INDUSTRIAL AGITATORS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 185 INDUSTRIAL AGITATORS MARKET: REGION FOOTPRINT

- TABLE 186 INDUSTRIAL AGITATORS MARKET: MODEL TYPE FOOTPRINT

- TABLE 187 INDUSTRIAL AGITATORS MARKET: MOUNTING FOOTPRINT

- TABLE 188 INDUSTRIAL AGITATORS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 189 INDUSTRIAL AGITATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 190 INDUSTRIAL AGITATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 191 INDUSTRIAL AGITATORS MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2024

- TABLE 192 INDUSTRIAL AGITATORS MARKET: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 193 INDUSTRIAL AGITATORS MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 194 INDUSTRIAL AGITATORS MARKET: OTHERS, JANUARY 2020-OCTOBER 2024

- TABLE 195 SPX FLOW: COMPANY OVERVIEW

- TABLE 196 SPX FLOW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 197 SPX FLOW: PRODUCT LAUNCHES

- TABLE 198 SPX FLOW: DEALS

- TABLE 199 SPX FLOW: EXPANSIONS

- TABLE 200 SPX FLOW: OTHERS

- TABLE 201 XYLEM: COMPANY OVERVIEW

- TABLE 202 XYLEM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 203 XYLEM: DEALS

- TABLE 204 EKATO GROUP: COMPANY OVERVIEW

- TABLE 205 EKATO GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 EKATO GROUP: OTHERS

- TABLE 207 NOV: COMPANY OVERVIEW

- TABLE 208 NOV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 209 NOV: PRODUCT LAUNCHES

- TABLE 210 NOV: DEALS

- TABLE 211 SULZER: COMPANY OVERVIEW

- TABLE 212 SULZER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 SULZER: PRODUCT LAUNCHES

- TABLE 214 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 215 INGERSOLL RAND: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 INGERSOLL RAND: PRODUCT LAUNCHES

- TABLE 217 INGERSOLL RAND: DEALS

- TABLE 218 DYNAMIX AGITATORS INC.: COMPANY OVERVIEW

- TABLE 219 DYNAMIX AGITATORS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 220 MIXER DIRECT: COMPANY OVERVIEW

- TABLE 221 MIXER DIRECT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 222 SILVERSON: COMPANY OVERVIEW

- TABLE 223 SILVERSON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 STATIFLO GROUP: COMPANY OVERVIEW

- TABLE 225 STATIFLO GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 226 STATIFLO GROUP: DEALS

- TABLE 227 STATIFLO GROUP: EXPANSIONS

- TABLE 228 TACMINA CORPORATION: COMPANY OVERVIEW

- TABLE 229 TACMINA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 231 DE DIETRICH PROCESS SYSTEMS: COMPANY OVERVIEW

- TABLE 232 EUROMIXERS: COMPANY OVERVIEW

- TABLE 233 FAWCETT: COMPANY OVERVIEW

- TABLE 234 MIXEL AGITATORS: COMPANY OVERVIEW

- TABLE 235 PRG AGITATORS: COMPANY OVERVIEW

- TABLE 236 PROQUIP: COMPANY OVERVIEW

- TABLE 237 SAVINO BARBERA: COMPANY OVERVIEW

- TABLE 238 SHARPE MIXERS: COMPANY OVERVIEW

- TABLE 239 SHUANGLONG GROUP: COMPANY OVERVIEW

- TABLE 240 SUMA RUHRTECHNIK: COMPANY OVERVIEW

- TABLE 241 TERALBA INDUSTRIES: COMPANY OVERVIEW

- TABLE 242 TIMSA: COMPANY OVERVIEW

- TABLE 243 WOODMAN AGITATORS: COMPANY OVERVIEW

- TABLE 244 ZHEJIANG GREATWALL MIXERS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INDUSTRIAL AGITATORS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL AGITATORS MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 INDUSTRIAL AGITATORS MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM INDUSTRIAL AGITATORS MARKET

- FIGURE 7 DATA TRIANGULATION: INDUSTRIAL AGITATORS MARKET

- FIGURE 8 TOP-MOUNTED AGITATORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 9 PORTABLE SEGMENT TO DOMINATE OVERALL INDUSTRIAL AGITATORS MARKET IN 2029

- FIGURE 10 PHARMACEUTICAL TO BE LARGEST END USER OF INDUSTRIAL AGITATORS DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR IN INDUSTRIAL AGITATORS MARKET DURING FORECAST PERIOD

- FIGURE 12 RISING NEED FOR ENERGY-EFFICIENT AND CUSTOMIZED MIXING EQUIPMENT DRIVING MARKET GROWTH

- FIGURE 13 PORTABLE AGITATORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 14 TOP-MOUNTED AGITATORS SEGMENT DOMINATES MARKET IN 2024

- FIGURE 15 LIQUID-LIQUID MIXTURE TO LEAD INDUSTRIAL AGITATORS MARKET IN 2029

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN INDUSTRIAL AGITATORS MARKET DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL AGITATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 INDUSTRIAL AGITATORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 INDUSTRIAL AGITATORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE OF INDUSTRIAL AGITATORS OFFERED BY KEY PLAYERS, BY MODEL TYPE

- FIGURE 27 INDICATIVE PRICING OF INDUSTRIAL AGITATORS, BY REGION, 2020-2023

- FIGURE 28 INDUSTRIAL AGITATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 31 IMPORT DATA FOR HS CODE 847982-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 32 EXPORT DATA FOR HS CODE 847982-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 34 DISTRIBUTION CHANNELS FOR INDUSTRIAL AGITATORS

- FIGURE 35 DISTRIBUTION CHANNEL ENTITIES IN INDUSTRIAL AGITATORS MARKET

- FIGURE 36 POWER RATINGS FOR INDUSTRIAL AGITATORS

- FIGURE 37 APPLICATION AREAS OF INDUSTRIAL AGITATORS

- FIGURE 38 INDUSTRIAL AGITATORS MARKET, BY COMPONENT

- FIGURE 39 IMPELLERS TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL AGITATORS MARKET

- FIGURE 40 INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE

- FIGURE 41 PORTABLE AGITATORS TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL AGITATORS MARKET

- FIGURE 42 INDUSTRIAL AGITATORS MARKET, BY FORM

- FIGURE 43 LIQUID-LIQUID MIXTURE FORM TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL AGITATORS MARKET

- FIGURE 44 INDUSTRIAL AGITATORS MARKET, BY MOUNTING

- FIGURE 45 TOP-MOUNTED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL AGITATORS MARKET

- FIGURE 46 PHARMACEUTICAL INDUSTRY TO DOMINATE TOP-MOUNTED AGITATORS MARKET DURING FORECAST PERIOD

- FIGURE 47 INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY

- FIGURE 48 PHARMACEUTICAL INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL AGITATORS MARKET DURING FORECAST PERIOD

- FIGURE 49 PORTABLE AGITATORS TO REGISTER HIGHEST CAGR IN FOOD & BEVERAGE INDUSTRY DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO BE LARGEST MARKET FOR INDUSTRIAL AGITATORS IN PHARMACEUTICAL SEGMENT

- FIGURE 51 INDUSTRIAL AGITATORS MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 52 NORTH AMERICA: INDUSTRIAL AGITATORS MARKET SNAPSHOT

- FIGURE 53 EUROPE: INDUSTRIAL AGITATORS MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: INDUSTRIAL AGITATORS MARKET SNAPSHOT

- FIGURE 55 INDUSTRIAL AGITATORS MARKET: REVENUE ANALYSIS, 2019-2023

- FIGURE 56 INDUSTRIAL AGITATORS MARKET SHARE ANALYSIS, 2023

- FIGURE 57 COMPANY VALUATION, 2024

- FIGURE 58 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 59 BRAND/PRODUCT COMPARISON

- FIGURE 60 INDUSTRIAL AGITATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 61 INDUSTRIAL AGITATORS MARKET: COMPANY FOOTPRINT

- FIGURE 62 INDUSTRIAL AGITATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 63 SPX FLOW: COMPANY SNAPSHOT

- FIGURE 64 XYLEM: COMPANY SNAPSHOT

- FIGURE 65 NOV: COMPANY SNAPSHOT

- FIGURE 66 SULZER: COMPANY SNAPSHOT

- FIGURE 67 INGERSOLL RAND: COMPANY SNAPSHOT

The global industrial agitators market was valued at USD 3.10 billion in 2024 and is estimated to reach USD 3.99 billion by 2029, registering a CAGR of 5.2% during the forecast period. Rising urbanization, regulatory requirements, technological advancements have led to the development of highly efficient agitators designed to handle varying viscosities and densities, further driving their adoption of agitators in mixing processes. The rising focus on energy efficiency and process optimization has also boosted demand, as modern agitators are engineered to reduce power consumption while maintaining superior performance.t.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Model Type, Mounting, Form, Component, Industry, Region |

| Regions covered | North America, Europe, APAC, RoW |

"Large Tank agitators to contribute significant share in industrial agitators market."

Large tank agitators are used in large-scale industrial processes which demand consistent and efficient mixing. Therefore, significant share is expected to be contributed by large tank agitators. The large tank agitators are used in chemicals, oil and gas, food and beverages, and wastewater treatment, all of which rely on large tank agitators for handling high volumes of materials and ensuring uniformity in large storage vessels or reactors. These agitators are particularly needed for those more ordinary bulk processing applications like liquid homogenizing, additive mixing and suspension of solids.Large tank agitators are particularly very effective in operations involving high-viscosity fluids, considerable volumes of chemical solution, and long fermentation processes where other types of agitators may not adequately perform. Their capability to provide strong, reliable mixing ensures optimum chemical reactions, enhances heat transfer, and ensures prevention from sedimentation in the storage tank, all leading to operational efficiency and quality of product. Indicative of the growing demand for large-scale production in the food and beverage manufacturing, chemical processing, and energy production industries, among other sectors, while technological innovations prop up the design of energy-efficient and automated systems, the large tank agitators segment is driven further.

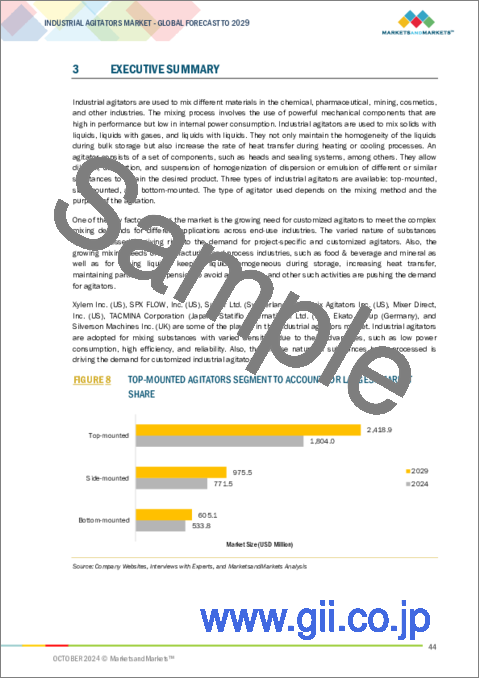

"Top-mounted to grow significantly in the industrial agitators market."

In 2023, the top-mounted segment accounted for a larger market share, and a similar trend is likely to be observed during the forecast period, as the use of industrial agitators systems is on the rise in newly emerging applications such as cosmetics, pharmaceuticals and so on. Top-mounted agitators are also expected to contribute well to the industrial agitators market because of their applications that require efficient, high-performance mixing in various industries such as chemicals, pharmaceuticals, food and beverages, and water treatment, among others. The advantages these agitators possess include their ability to handle a broad range of fluid viscosities and densities, thereby achieving both light and heavy-duty applications. Their top-mounted design also affords easy installation and service while ensuring consistent mixing in large-scale production operations.

The critical need in industry, particularly in pharmaceuticals and food processing, to meet the strict quality standards can be achieved through good chemical reactions, efficient heat transfer, and product uniformity. Thus, there would be a growth in demand for energy-efficient, customizable, and durable mixing solutions that will lend to the high adoption rate of top-mounted agitators, keeping them at a considerable share in the global industrial agitators market.

"Asia Pacific will contribute significantly to the growth rate in industrial agitators market."

Asia Pacific is poised to contribute a significant share to the industrial agitators market for several compelling reasons, by increasing adoption of energy-efficient technologie in Asia Pacific countries due to environmental regulations and more awareness towards sustainable practices. The Asia Pacific region is estimated to be the largest market for industrial agitators. The region has a good contribution because of the synergy of rapid industrialization, urbanization, as well as the growing demand for pharmaceuticals and chemical industry. It is also projected to be the fastest-growing market during the forecast period. Asia-Pacific has a strong industrial base in chemicals, food and beverage, and pharmaceuticals, which fuels demand for agitators. This raises a need for advanced mixing equipment for blending and suspension processes generates growth in the demand for such equipment.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the industrial agitators market place.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region: North America- 35%, Europe - 18%, Asia Pacific- 40% and RoW- 7%

The study includes an in-depth competitive analysis of these key players in the industrial agitators market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the industrial agitators market by type, form, mounting, component, industry and region (North America, Europe, Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the industrial agitators market. A detailed analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, Contracts, partnerships, and agreements. New product and service launches, acquisitions, and recent developments associated with the industrial agitators market. This report covers competitive analysis of upcoming startups in the industrial agitators market ecosystem.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the industrial agitators market, and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for agitators for efficiently implementing wastewater treatment practices, Rising demand for energy efficient, flow maximization, rapid mixing, and waste reduction, Robust growth of process and manufacturing industries, Increasing demand for customized industrial agitators, Advancements in automation and smart technologies in agitators

Expansion of food & beverage industry and demand for hygiene compliance), restraints (High cost of maintenance and repair in agitators, Lengthy lead times for custom equipment), opportunities (Growing use of mixing technologies in multiple applicationsIntegration of IoT and data analytics for predictive maintenance), and challenges (Stringent government safety norms and product compliance standards, Emerging trend of agitators/mixer equipment leasing due to high cost or limited usage, Increasing competition from low-cost manufacturers) influencing the growth of the industrial agitators market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the industrial agitators market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial agitators market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the industrial agitators market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as SPX Flow, Inc. (US), Xylem Inc. (US), Ekato Group (Germany), Sulzer Ltd. (Switzerland) and NOV Inc (US) among others in the industrial agitators market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants in primary interviews

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.2.5 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Bottom-up approach for estimating market size

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Top-down approach for estimating market size

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL AGITATORS MARKET

- 4.2 INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE

- 4.3 INDUSTRIAL AGITATORS MARKET, BY MOUNTING

- 4.4 INDUSTRIAL AGITATORS MARKET, BY FORM

- 4.5 INDUSTRIAL AGITATORS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 increasing need for efficient implementation of wastewater treatment practices

- 5.2.1.2 Rising demand for energy efficiency, flow maximization, rapid mixing, and waste reduction

- 5.2.1.3 Strong growth of process and manufacturing industries

- 5.2.1.4 Increasing demand for customized industrial agitators

- 5.2.1.5 Advancements in automation and smart technologies

- 5.2.1.6 Expansion of food & beverage industry and need for hygiene compliance

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of maintenance and repair

- 5.2.2.2 Lengthy lead times for custom equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of mixing technologies in multiple applications

- 5.2.3.2 Integration of IoT and data analytics for predictive maintenance

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent government safety norms and product compliance standards

- 5.2.4.2 Emerging trend of agitators/mixer equipment leasing due to high cost or limited usage

- 5.2.4.3 Increasing competition from low-cost manufacturers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF INDUSTRIAL AGITATORS, BY KEY PLAYERS

- 5.7.2 INDICATIVE PRICING OF INDUSTRIAL AGITATORS, BY KEY PLAYERS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Mixing blades and impellers

- 5.8.1.2 Variable speed drives (VSD)

- 5.8.1.3 Control systems (PLC and HMI)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Sensors (temperature, pressure, viscosity)

- 5.8.2.2 Heat exchangers

- 5.8.2.3 Material handling systems

- 5.8.2.4 Cleaning-in-place (CIP) systems

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Automation and robotics

- 5.8.3.2 Industrial Internet of Things (IIoT)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 IMPACT OF AI ON INDUSTRIAL AGITATORS MARKET

- 5.9.1 INTRODUCTION

- 5.9.2 CASE STUDIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 THREAT OF SUBSTITUTES

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 TACMINA CORPORATION'S CONTINUOUS MIXING SYSTEM ENHANCES PRODUCTION AND COATING ACCURACY

- 5.12.2 SPX FLOW'S MMR PROGRAM OFFERS TIME REDUCTION AND IMPROVEMENT IN EFFICIENCY

- 5.12.3 XYLEM OFFERED MIXER AND PUMP TO MINING COMPANY FOR ENHANCED PRODUCTION AND SIMPLIFIED WASTE DISPOSAL

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 847982)

- 5.13.2 EXPORT SCENARIO (HS CODE 847982)

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 STANDARDS

- 5.15 PATENT ANALYSIS

- 5.16 KEY CONFERENCES AND EVENTS, 2024-2025

6 DISTRIBUTION CHANNELS FOR INDUSTRIAL AGITATORS

- 6.1 INTRODUCTION

- 6.2 DIRECT CHANNELS

- 6.2.1 DIRECT DISTRIBUTION CHANNELS ADOPTED BY MAJOR COMPANIES FOR HIGHER PROFITS

- 6.3 INDIRECT CHANNELS

- 6.3.1 RISING GLOBAL DEMAND TO INCREASE SALES THROUGH DISTRIBUTORS AND INTERMEDIARIES

7 POWER RATINGS OF INDUSTRIAL AGITATORS

- 7.1 INTRODUCTION

- 7.2 LESS THAN 50 HP

- 7.2.1 USED PRIMARILY IN MEDIUM-SCALE OPERATIONS WITH SMALL/MEDIUM TANK SIZES

- 7.3 50 TO 100 HP

- 7.3.1 DEMAND IN LARGE-SCALE AND DEMANDING INDUSTRIAL PROCESSES TO DRIVE MARKET

- 7.4 MORE THAN 100 HP

- 7.4.1 MOSTLY USED IN CHEMICALS AND PHARMACEUTICAL INDUSTRIES

8 APPLICATIONS OF INDUSTRIAL AGITATORS

- 8.1 INTRODUCTION

- 8.2 HOMOGENIZATION

- 8.3 SUSPENSION

- 8.4 EMULSIFICATION

- 8.5 DISPERSION

- 8.6 NEUTRALIZATION

- 8.7 CRYSTALLIZATION

- 8.8 FERMENTATION

- 8.9 FLUE GAS DESULFURIZATION (FGD)

9 INDUSTRIAL AGITATORS MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 HEADS

- 9.2.1 RISING DEMAND FOR AGITATORS IN CHEMICAL AND PHARMACEUTICAL INDUSTRIES TO DRIVE MARKET

- 9.3 SEALING SYSTEMS

- 9.3.1 ENHANCES SMOOTH MOVEMENT WITH MINIMUM CONTAMINATION DURING AGITATION

- 9.4 IMPELLERS

- 9.4.1 SELECTION OF APPROPRIATE IMPELLER CRITICAL FOR ACHIEVING EFFICIENCY

- 9.5 OTHER COMPONENTS

10 INDUSTRIAL AGITATORS MARKET, BY MODEL TYPE

- 10.1 INTRODUCTION

- 10.2 LARGE TANK AGITATORS

- 10.2.1 RISING NEED TO ENSURE EFFICIENT HEAVY MIXING WITH CONTINUOUS OPERATION TO DRIVE MARKET

- 10.3 PORTABLE AGITATORS

- 10.3.1 HIGH DEMAND FOR MIXING AND BLENDING APPLICATIONS IN FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

- 10.4 DRUM AGITATORS

- 10.4.1 NEED TO ENHANCE PRODUCT UNIFORMITY AND ENABLE WASTE MINIMIZATION TO FUEL MARKET GROWTH

- 10.5 OTHER MODEL TYPES

11 INDUSTRIAL AGITATORS MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 SOLID-SOLID MIXTURE

- 11.2.1 REQUIREMENT FOR BULK MIXING IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- 11.3 SOLID-LIQUID MIXTURE

- 11.3.1 GROWING DEMAND FOR TROUBLE-FREE WETTING AND DISPERSION IN SOLID-LIQUID MIXTURE TO DRIVE MARKET

- 11.4 LIQUID-GAS MIXTURE

- 11.4.1 GROWING DEMAND IN CHEMICAL AND BIOLOGICAL PROCESS TECHNOLOGIES TO DRIVE MARKET

- 11.5 LIQUID-LIQUID MIXTURE

- 11.5.1 INCREASING USAGE IN CHEMICAL, FOOD & BEVERAGE, AND PHARMACEUTICAL INDUSTRIES TO DRIVE MARKET

12 INDUSTRIAL AGITATORS MARKET, BY MOUNTING

- 12.1 INTRODUCTION

- 12.2 TOP-MOUNTED AGITATORS

- 12.2.1 INCREASING DEMAND FOR MIXING OF HIGH-VISCOSITY FLUIDS IN VARIOUS INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 12.3 SIDE-MOUNTED AGITATORS

- 12.3.1 EASY INTEGRATION INTO EXISTING SYSTEMS FOR ENHANCEMENT OF PRODUCTION AND PRODUCT QUALITY TO DRIVE DEMAND

- 12.4 BOTTOM-MOUNTED AGITATORS

- 12.4.1 NEED FOR MIXING AND BLENDING IN CHEMICAL AND BIOTECHNOLOGY INDUSTRIES TO FUEL MARKET GROWTH

13 INDUSTRIAL AGITATORS MARKET, BY END-USE INDUSTRY

- 13.1 INTRODUCTION

- 13.2 CHEMICAL

- 13.2.1 OIL & PETROLEUM

- 13.2.1.1 Agitators utilized in mud mixing, extracting, and refining crude oil in oil & petroleum industry

- 13.2.1.2 Emulsification

- 13.2.1.3 Crude oil processing

- 13.2.1.4 Liquid & gas blending

- 13.2.1.5 Gas dispersion & absorption

- 13.2.2 WATER & WASTEWATER TREATMENT

- 13.2.2.1 Increasing need for wastewater treatment and improvements in water purification processes to drive demand

- 13.2.2.2 Gas dispersion & absorption

- 13.2.2.3 Washing & leaching

- 13.2.1 OIL & PETROLEUM

- 13.3 MINING

- 13.3.1 AGITATORS INCREASINGLY USED FOR HYDROMETALLURGICAL PROCESSES AND ATMOSPHERIC LEACH APPLICATIONS

- 13.3.2 LEACHING

- 13.3.3 SLURRY MIXING

- 13.3.4 ORE BENEFICIATION

- 13.3.5 FLOTATION PROCESSES

- 13.3.6 CYANIDATION

- 13.3.7 PRECIPITATION REACTIONS

- 13.3.8 CARBON-IN-PULP (CIP) & CARBON-IN-LEACH (CIL)

- 13.4 FOOD & BEVERAGE

- 13.4.1 RISING DEMAND FOR EFFICIENT FOOD & BEVERAGE PROCESSING TO DRIVE DEMAND

- 13.4.2 MIXING & BLENDING

- 13.4.3 FERMENTATION

- 13.4.4 HOMOGENIZATION

- 13.4.5 DISSOLVING SUGAR & SALTS

- 13.4.6 AERATION

- 13.4.7 FLAVORING AND ADDITIVE MIXING

- 13.5 PHARMACEUTICAL

- 13.5.1 AGITATORS WIDELY USED IN TABLET GRANULATIONS AND MIXING SYRUPS

- 13.5.2 ACTIVE PHARMACEUTICAL INGREDIENTS (APIS)

- 13.5.3 LIQUID DOSAGE FORM PREPARATION

- 13.5.4 VACCINE PRODUCTION

- 13.5.5 ANTIBIOTIC PRODUCTION

- 13.5.6 CONTROLLED RELEASE FORMULATION

- 13.5.7 STERILE MIXING

- 13.6 COSMETICS

- 13.6.1 AGITATORS USED IN COSMETICS INDUSTRY FOR EMULSIFICATION, POWDER WET-OUT, AND PARTICLE SIZE REDUCTION

- 13.6.2 GEL MIXING

- 13.6.3 COLORANT DISPERSION

- 13.6.4 AEROSOL PROPELLANT MIXING

- 13.6.5 VISCOSITY CONTROL

- 13.6.6 SUSPENSION OF SOLID INGREDIENTS

- 13.6.7 COSMETIC INGREDIENT ACTIVATION

- 13.6.8 TOPICAL FORMULATION MIXING

- 13.6.9 FILLING AND PACKAGING ASSISTANCE

- 13.7 PAINT & COATING

- 13.7.1 HELPS MINIMIZE COMPLEXITIES IN PAINT FORMULATIONS AND ENSURE QUALITY COATING

- 13.7.2 PIGMENT DISPERSION

- 13.7.3 EMULSION FORMATION

- 13.7.4 VISCOSITY CONTROL

- 13.7.5 POLYMERIZATION

- 13.7.6 SOLVENT MIXING

- 13.7.7 FILLER INCORPORATION

- 13.7.8 POWDER COATING MIXING

- 13.7.9 SPRAY COATING PREPARATION

- 13.7.10 PAINT RECYCLING

- 13.7.11 CHEMICAL REACTION MANAGEMENT

- 13.7.12 BATCH MIXING

- 13.7.13 ADDITIVE MIXING

- 13.8 OTHER END-USE INDUSTRIES

14 INDUSTRIAL AGITATORS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Growth in chemical and food & beverage industries to drive growth

- 14.2.3 CANADA

- 14.2.3.1 Government's focus on chemical industry to fuel demand for agitators

- 14.2.4 MEXICO

- 14.2.4.1 Structural reforms to boost growth of various sectors

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 UK

- 14.3.2.1 Surging R&D activities in pharmaceutical and chemical industries to fuel demand

- 14.3.3 GERMANY

- 14.3.3.1 Demand from chemical, pharmaceutical, and paint & coating industries to drive market

- 14.3.4 FRANCE

- 14.3.4.1 Surging chemical industry to support market growth

- 14.3.5 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 Domestic chemical manufacturing to provide opportunities for market players

- 14.4.3 JAPAN

- 14.4.3.1 Paradigm shift toward specialty chemicals to push demand for industrial agitators

- 14.4.4 INDIA

- 14.4.4.1 Government's plans to achieve self-sufficiency and expansion in various sectors to increase demand

- 14.4.5 REST OF ASIA PACIFIC

- 14.5 REST OF THE WORLD

- 14.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 14.5.2 SOUTH AMERICA

- 14.5.2.1 Food & beverage industry to propel demand for industrial agitators

- 14.5.3 MIDDLE EAST

- 14.5.3.1 Surging demand for oil to support market growth

- 14.5.4 AFRICA

- 14.5.4.1 Mining industry to be significant end user of industrial agitators

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 15.3 REVENUE ANALYSIS, 2019-2023

- 15.4 MARKET SHARE ANALYSIS, 2023

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Model type footprint

- 15.7.5.4 Mounting footprint

- 15.7.5.5 End-use industry footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHERS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 SPX FLOW

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Services/Solutions offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Others

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 XYLEM

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Services/Solutions offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deal

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 EKATO GROUP

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Services/Solutions offered

- 16.1.3.3 Recent developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 NOV

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Services/Solutions offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 SULZER

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Services/Solutions offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 INGERSOLL RAND

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Services/Solutions offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.7 DYNAMIX AGITATORS INC.

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Services/Solutions offered

- 16.1.8 MIXER DIRECT

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Services/Solutions offered

- 16.1.9 SILVERSON

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Services/Solutions offered

- 16.1.10 STATIFLO GROUP

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Services/Solutions offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deal

- 16.1.10.3.2 Expansions

- 16.1.11 TACMINA CORPORATION

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Services/Solutions offered

- 16.1.1 SPX FLOW

- 16.2 OTHER PLAYERS

- 16.2.1 ALFA LAVAL

- 16.2.2 DE DIETRICH PROCESS SYSTEMS

- 16.2.3 EUROMIXERS

- 16.2.4 FAWCETT

- 16.2.5 MIXEL AGITATORS

- 16.2.6 PRG AGITATORS

- 16.2.7 PROQUIP

- 16.2.8 SAVINO BARBERA

- 16.2.9 SHARPE MIXERS

- 16.2.10 SHUANGLONG GROUP

- 16.2.11 SUMA RUHRTECHNIK

- 16.2.12 TERALBA INDUSTRIES

- 16.2.13 TIMSA

- 16.2.14 WOODMAN AGITATORS

- 16.2.15 ZHEJIANG GREATWALL MIXERS

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS