|

|

市場調査レポート

商品コード

1324793

CNG・RNG・水素タンクの世界市場:ガスタイプ別、材料タイプ別、タンクタイプ別、用途別、地域別 - 予測(~2030年)CNG, RNG, and Hydrogen Tanks Market by Gas Type (CNG, RNG, Hydrogen), Material Type (Metal, Carbon Fiber, Glass Fiber), Tank Type (Type 1, Type 2, Type 3, Type 4), Application (Fuel, Transportation), and Region - Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| CNG・RNG・水素タンクの世界市場:ガスタイプ別、材料タイプ別、タンクタイプ別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2023年08月01日

発行: MarketsandMarkets

ページ情報: 英文 245 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のCNG・RNG・水素タンクの市場規模は大きな発展が見込まれており、2022年の25億米ドルから2030年までに56億米ドルに拡大し、2023年~2030年にCAGRで10.7%の成長が予測されています。

"水素ガスタイプセグメントが金額と数量の両面で急成長しています。"

水素ガスは、2023年~2030年に金額ベースでもっとも高いCAGRが見込まれています。

"金属が数量において最大の材料タイプセグメントとなっています。"

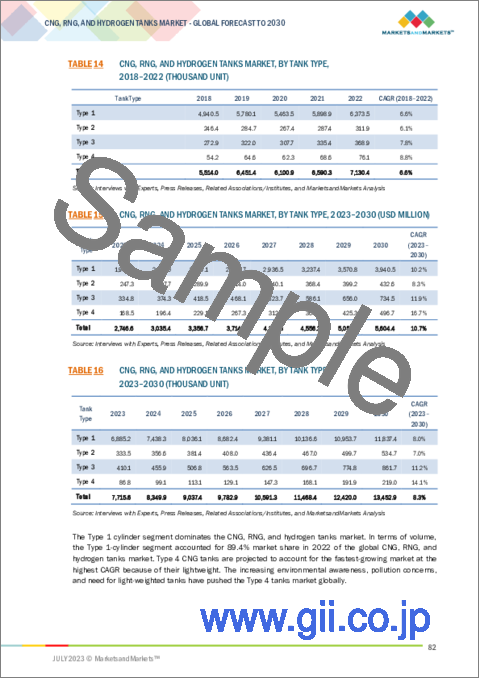

"タイプ4タンクが最大のCAGRとなる見込みです。"

2023年~2030年にすべてのタンクタイプのうちもっとも高いCAGRが予測されるのは、タイプ4のCNG・RNG・水素タンクです。タイプ4タンクの採用は、より環境に優しく、より持続可能な輸送手段への要望の高まりによって促進されており、このこともCAGRの予測が最大となった要因です。

"燃料タンク用途は、市場を金額と数量の両面で独占しました。"

燃料タンク用途では、CNG、RNG、水素が、従来ガソリンやディーゼルで走る自動車の代替燃料として広く使用されています。自動車業界のこれらのガソリンタンクに対する需要の向上は、その優れた耐久性、費用対効果、CO2排出の少なさなどの多数の要因に起因する可能性があります。小型車、中型車、大型車など、さまざまなタイプの車両がこのガソリンタンクを使用しています。

"アジア太平洋はCNG・RNG・水素タンクの主要市場です。"

金額と数量の両面で、アジア太平洋はCNG・RNG・水素タンクの主要市場です。特に輸送や燃料タンクなど、さまざまな用途でこれらのタンクの使用が増加していることが、アジア太平洋における市場拡大の主な要因となっています。この需要は、中国、インド、パキスタン、タイといった国々の目覚ましい産業発展によって大きく後押しされています。中国は、自動車産業におけるCNG・RNG・水素タンクの主要消費国として浮上しており、今後もその地位を固めていく見込みです。中国とインドの両政府は、大気汚染の軽減を最優先課題としており、これが天然ガス車両の使用を促し、各国における市場成長を後押ししています。アジア太平洋市場の拡大をさらに後押ししているのは、アジア太平洋政府による都市部での代替燃料の使用と低排出ガスを推進する積極的な活動です。

当レポートでは、世界のCNG・RNG・水素タンク市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- CNG・RNG・水素タンク市場の企業にとっての魅力的な機会

- CNG・RNG・水素タンク市場:タンクタイプ別、地域別(2022年)

- CNG・RNG・水素タンク市場:材料別(2022年)

- CNG・RNG・水素タンク市場:用途別(2022年)

- CNG・RNG・水素タンク市場:ガスタイプ別

- CNG・RNG・水素タンク市場の成長:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 平均販売価格の動向

- 主なステークホルダーと購入基準

- 技術分析

- エコシステムマッピング

- バリューチェーン分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 輸出入の主要市場

- 中国

- イタリア

- 米国

- ウクライナ

- アルメニア

- 規制情勢

- 特許分析

- 主な会議とイベント(2023年~2024年)

第6章 CNG・RNG・水素タンク市場:タンクタイプ別

- イントロダクション

- タイプ1

- タイプ2

- タイプ3

- タイプ4

第7章 CNG・RNG・水素タンク市場:ガスタイプ別

- イントロダクション

- CNG

- 水素

- RNG

第8章 CNG・RNG・水素タンク市場:用途別

- イントロダクション

- 燃料タンク

- 輸送タンク

第9章 CNG・RNG・水素タンク市場:材料別

- イントロダクション

- 金属

- ガラス繊維

- 炭素繊維

第10章 CNG・RNG・水素タンク市場:地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 市場ランキング

- 主要企業の収益の分析

- 企業の評価マトリクス

- 市場の評価の枠組み

- 競合ベンチマーキング

- スタートアップ/中小企業(SME)の評価マトリクス

第12章 企業プロファイル

- 主要企業

- WORTHINGTON INDUSTRIES, INC.

- LUXFER GROUP

- HEXAGON COMPOSITES ASA

- QUANTUM FUEL SYSTEMS LLC.

- EVEREST KANTO CYLINDER LTD.

- PRAXAIR TECHNOLOGIES INC.

- AVANCO GROUP

- BEIJING TIANHAI INDUSTRY CO. LTD.

- LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP CO. LTD.

- FABER INDUSTRIE SPA

- COMPOSITES ADVANCED TECHNOLOGIES, LLC. (CATEC GASES)

- CIMC ENRIC

- LUXI NEW ENERGY EQUIPMENT GROUP CO., LTD.

- SINOCLEANSKY

- その他の企業

- LINDE PLC

- ULLIT SA

- AGILITY FUEL SOLUTIONS

- RAMA CYLINDERS PRIVATE LIMITED

- JPM GROUP

- SAHUWALA CYLINDERS PVT. LTD.

- EURO INDIA CYLINDERS LTD.

- CEVOTEC GMBH

- NPROXX

- STEELHEAD COMPOSITES, INC.

- JIANGSU QIULIN SPECIAL ENERGY EQUIPMENT JOINT STOCK LIMITED COMPANY

第13章 付録

The size of the global market for CNG, RNG, and hydrogen tanks is anticipated to develop significantly, rising from USD 2.5 billion in 2022 to USD 5.6 billion by 2030, with a predicted CAGR of 10.7% from 2023 to 2030. Tanks made of CNG, RNG, and hydrogen provide a number of benefits, such as longevity, affordability, and environmental friendliness. These tanks are used as transportation tanks and fuel tanks. Based on the material used to make tanks, the market is divided into metal, carbon fiber and glass fiber segments.

"Hydrogen gas type is the fastest-growing segment in terms of both value and volume."

Hydrogen gas is anticipated to experience the highest compound annual growth rate (CAGR) in terms of value between 2023 and 2030. Compared to other flammable fuels, particularly natural gas, hydrogen has the highest density per kilogram since it is the lightest and most prevalent element in the universe. However, storing and moving hydrogen present difficulties because of its high mass-energy density and light weight. Both chemical and physical approaches of hydrogen storage are possible. The key responses said that Type 3 and Type 4 tanks are the best options for fuel and transportation tank applications since Type 1 or Type 2 tanks run the risk of impregnating with metal particulates. The gaseous hydrogen is stored in high-pressure tanks of 350 bars to 700 bars which is the most preferred and widely commercialized method for its storage.

"Metal is the largest material type segment in terms volume."

The manufacturing of CNG, RNG, and hydrogen tanks involves the use of different metals such as steel, aluminum, and metal alloys. Steel is commonly employed in Type 1, Type 2, and Type 3 cylinders. While the use of metal in these tanks increases their weight, it also offers sufficient protection to the cylinders. The durability of metal and metal-lined cylinders depends on the rate of fatigue crack growth throughout their lifecycle.

"Type 4 tanks are expected to project the maximum CAGR."

The highest compound annual growth rate (CAGR) among all tank types is anticipated for Type 4 CNG, RNG and hydrogen tanks between 2023 and 2030. Type 4 tanks have increased storage capacities, improved safety measures, and less weight thanks to the use of innovative composite materials in their construction. The adoption of Type 4 tanks is being fueled by the rising desire for greener, more sustainable transportation options, which is also a factor in the market's maximum CAGR prediction for these tanks.

"Fuel tank application dominated the CNG, RNG, and hydrogen tanks market in terms of value and volume both."

For fuel tank applications, CNG, RNG, and hydrogen are widely used as substitute fuels for cars that traditionally run on gasoline and diesel. The automotive industry's rising demand for these gasoline tanks can be ascribed to a number of factors, including their remarkable durability, cost effectiveness, and low CO2 emissions. automobiles fueled by natural gas tanks are less expensive than diesel-powered automobiles. Many different types of vehicles, including light-duty, medium-duty, and heavy-duty vehicles, use these gasoline tanks.

"Asia Pacific is the leading market for CNG, RNG, and hydrogen tanks."

In terms of both value and volume, Asia Pacific is the leading market for CNG, RNG, and hydrogen tanks. The rising use of these tanks in different applications, particularly in transportation and fuel tanks, is the main driver of market expansion in the Asia Pacific region. This demand is significantly fueled by the impressive industrial development of nations like China, India, Pakistan, and Thailand. China has emerged as the top consumer of CNG, RNG, and hydrogen tanks in the automotive industry, and it is anticipated that it will continue to solidify its position. The governments of China and India both have a high priority on lowering air pollution, which has prompted them to encourage the use of natural gas vehicles and boosted the market growth for these tanks in those nations. Further boosting the expansion of the CNG, RNG, and hydrogen tanks market in the region is the active efforts being made by Asia Pacific governments to promote the use of alternative fuels and lower emissions in urban areas.

Breakdown of Profiles of Primary Interviews:

- By Company Type- Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation- C Level- 50%, Director Level- 30%, and Others- 20%

- By Region- North America- 15%, Europe- 50%, Asia Pacific (APAC) - 20%, Latin America-10%, Middle East & Africa (MEA)-5%,

The report provides a comprehensive analysis of company profiles listed below:

- Worthington Industries, Inc. (US),

- Luxfer Group (UK),

- Hexagon Composites ASA (Norway),

- Quantum Fuel Systems LLC. (US),

- Everest Kanto Cylinders Ltd. (India),

- Praxair Technologies Inc. (US),

- Avanco Group (Germany),

- Xinyi Beijing Tianhai Industry Co. Ltd. (China),

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. (China),

- Faber Industrie SpA (Italy)

Research Coverage

This report covers the global CNG, RNG, and hydrogen tanks market and forecasts the market size until 2030. It includes the following market segmentation - gas type(CNG, RNG, hydrogen), material (metal, carbon fiber, glass fiber), tank type (type 1, type 2, type 3, type 4), application (fuel tank, transportation tank) and Region (Europe, North America, APAC, Latin America, and MEA). Porter's Five Forces Analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global CNG, RNG, and hydrogen tanks market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall CNG, RNG, and hydrogen tanks market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing use of natural gas in automotive industry), restraints (Limited availability of hydrogen and CNG refueling infrastructure in developed economies), opportunities (Emergence of lightweight composite material based CNG cylinders), and challenges (Impact of fluctuating oil prices on the CNG, RNG, and hydrogen tanks market) influencing the growth of the CNG, RNG, and hydrogen tanks market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the CNG, RNG, and hydrogen tanks market

- Market Development: Comprehensive information about lucrative markets - the report analyses the CNG, RNG, and hydrogen tanks market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the CNG, RNG, and hydrogen tanks market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like include Worthington Industries, Inc. (US), Luxfer Group (UK), Hexagon Composites ASA (Norway), Quantum Fuel Systems LLC. (US), Everest Kanto Cylinders Ltd. (India), Praxair Technologies Inc. (US), Avanco Group (Germany), among others in the CNG, RNG, and hydrogen tanks market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 CNG, RNG, AND HYDROGEN TANKS MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 CNG, RNG, AND HYDROGEN TANKS MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.2.2.1 Approach 1: Through application

- 2.2.2.2 Approach 2: Through gas type

- 2.3 IMPACT OF RECESSION

- 2.4 FORECAST NUMBER CALCULATION

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH DATA

- 2.5.1 SECONDARY DATA

- 2.5.1.1 Key data from secondary sources

- 2.5.2 PRIMARY DATA

- 2.5.2.1 Key primary participants

- 2.5.2.2 Breakdown of primary interviews

- 2.5.2.3 Key industry insights

- 2.5.1 SECONDARY DATA

- 2.6 MARKET SIZE ESTIMATION

- 2.6.1 BOTTOM-UP APPROACH

- FIGURE 3 CNG, RNG, AND HYDROGEN TANKS MARKET: BOTTOM-UP APPROACH

- 2.6.2 TOP-DOWN APPROACH

- FIGURE 4 CNG, RNG, AND HYDROGEN TANKS MARKET: TOP-DOWN APPROACH

- 2.7 DATA TRIANGULATION

- FIGURE 5 CNG, RNG, AND HYDROGEN TANKS MARKET: DATA TRIANGULATION

- 2.8 FACTOR ANALYSIS

- 2.9 ASSUMPTIONS

- 2.10 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

- FIGURE 6 CNG TANKS WAS LARGEST SEGMENT OF CNG, RNG, AND HYDROGEN TANKS MARKET IN 2022

- FIGURE 7 CARBON FIBER-BASED CNG, RNG, AND HYDROGEN TANKS REGISTER HIGHEST CAGR

- FIGURE 8 FUEL TANK APPLICATION DOMINATED THE MARKET IN 2022

- FIGURE 9 TYPE 1 SEGMENT DOMINATED THE MARKET IN 2022

- FIGURE 10 ASIA PACIFIC LED CNG, RNG, AND HYDROGEN TANKS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CNG, RNG, AND HYDROGEN TANKS MARKETS

- FIGURE 11 SIGNIFICANT GROWTH PROJECTED IN GLOBAL MARKET BETWEEN 2023 AND 2030

- 4.2 CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE AND REGION, 2022

- FIGURE 12 TYPE 1 SEGMENT AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.3 CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2022

- FIGURE 13 METAL SEGMENT DOMINATED MARKET

- 4.4 CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2022

- FIGURE 14 FUEL TANK APPLICATION DOMINATED MARKET

- 4.5 CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE

- FIGURE 15 CNG DOMINATED MARKET

- 4.6 CNG, RNG, AND HYDROGEN TANKS MARKET GROWTH, BY KEY COUNTRY

- FIGURE 16 INDIA TO BE FASTEST-GROWING CNG TANKS MARKET, (2023-2030)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of natural gas in automotive industry

- 5.2.1.2 Increasing tax incentives for CNG vehicles and infrastructure

- 5.2.1.3 Increased demand for natural gas vehicles

- 5.2.1.4 Rising environmental awareness of benefits of natural gas

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of hydrogen and CNG refueling infrastructure in emerging economies

- 5.2.2.2 High cost of composite material tanks and regulatory approvals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of lightweight composite material based CNG cylinders

- 5.2.3.2 Development of lightweight transportation tanks

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of fluctuating oil prices on the CNG, RNG, and hydrogen tanks market

- 5.2.4.2 Development of electric cars

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 CNG, RNG, AND HYDROGEN TANKS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF BUYERS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 CNG, RNG, AND HYDROGEN TANKS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- TABLE 2 CNG, RNG, AND HYDROGEN TANKS MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- FIGURE 19 AVERAGE SELLING PRICE FOR CNG, RNG, AND HYDROGEN TANKS (THOUSAND USD/UNIT)

- 5.5.2 AVERAGE SELLING PRICE, BY GAS TYPE (KEY PLAYERS)

- FIGURE 20 AVERAGE SELLING PRICE FOR GAS TYPE (THOUSAND/UNIT)

- 5.5.3 AVERAGE SELLING PRICE, BY TANK TYPE (KEY PLAYERS)

- FIGURE 21 AVERAGE SELLING PRICE FOR TANK TYPE (THOUSAND/UNIT)

- 5.5.4 AVERAGE SELLING PRICE, BY MATERIAL TYPE (KEY PLAYERS)

- FIGURE 22 AVERAGE SELLING PRICE BASED ON MATERIAL TYPE (THOUSAND/UNIT)

- 5.5.5 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- FIGURE 23 AVERAGE SELLING PRICE BASED ON APPLICATION (THOUSAND/UNIT)

- 5.6 AVERAGE SELLING PRICE TREND

- TABLE 3 CNG, RNG, AND HYDROGEN: AVERAGE SELLING PRICE IN CNG, LNG, AND HYDROGEN TANKS MARKET, BY REGION

- 5.7 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 APPLICATIONS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- 5.7.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP 2 APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP 2 APPLICATIONS

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 ECOSYSTEM MAPPING

- 5.10 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS: CNG, RNG, AND HYDROGEN TANKS MARKET

- 5.10.1 RAW MATERIALS

- 5.10.2 MANUFACTURING

- 5.10.3 APPLICATIONS AND END-USE INDUSTRIES

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY MARKETS FOR IMPORT/EXPORT

- 5.13.1 CHINA

- 5.13.2 ITALY

- 5.13.3 US

- 5.13.4 UKRAINE

- 5.13.5 ARMENIA

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS FOR CNG, RNG, AND HYDROGEN TANKS MARKET

- TABLE 10 CURRENT STANDARD CODES FOR CNG, RNG, AND HYDROGEN TANKS MARKET

- 5.15 PATENT ANALYSIS

- 5.15.1 INTRODUCTION

- 5.15.2 METHODOLOGY

- 5.15.3 DOCUMENT TYPE

- TABLE 11 HYDROGEN TANKS MARKET: GLOBAL PATENTS

- FIGURE 27 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 28 GLOBAL PATENT PUBLICATION TREND: 2012-2022

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS OF PATENTS

- FIGURE 29 HYDROGEN TANKS MARKET: LEGAL STATUS OF PATENTS

- 5.15.6 JURISDICTION ANALYSIS

- FIGURE 30 GLOBAL JURISDICTION ANALYSIS

- 5.15.7 ANALYSIS OF TOP APPLICATNS

- FIGURE 31 CHINA PETROLEUM & CHEM CORP. REGISTERED HIGHEST NUMBER OF PATENTS

- 5.15.8 PATENTS BY CHINA PETROLEUM & CHEM CORP.

- 5.15.9 PATENTS BY SINOPEC ENGINEERING GROUP CO.

- 5.15.10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.16 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 12 CONFERENCES & EVENTS

6 CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE

- 6.1 INTRODUCTION

- FIGURE 32 TYPE 1 CYLINDER SEGMENT TO DOMINATE CNG, RNG, AND HYDROGEN TANKS MARKET

- TABLE 13 CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (USD MILLION)

- TABLE 14 CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 15 CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (USD MILLION)

- TABLE 16 CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (THOUSAND UNIT)

- 6.2 TYPE 1

- 6.2.1 AFFORDABLE AND COST-EFFECTIVE FUEL TANK APPLICATION TO DRIVE MARKET

- FIGURE 33 DEMAND FOR TYPE 1 CYLINDER TANKS TO BE HIGHEST IN ASIA PACIFIC

- TABLE 17 TYPE 1: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 TYPE 1: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 19 TYPE 1: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 20 TYPE 1: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- 6.3 TYPE 2

- 6.3.1 INCREASING DEMAND FROM TYPE 2 APPLICATIONS TO DRIVE MARKET

- TABLE 21 TYPE 2: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 TYPE 2: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 23 TYPE 2: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 TYPE 2: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- 6.4 TYPE 3

- 6.4.1 HIGH STRENGTH AND EXTRA IMPACT RESISTANCE QUALITIES OF TYPE 3 TO DRIVE MARKET

- TABLE 25 TYPE 3: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 TYPE 3: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 27 TYPE 3: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 TYPE 3: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- 6.5 TYPE 4

- 6.5.1 INCREASING DEMAND FOR LIGHT CYLINDERS TO DRIVE MARKET

- TABLE 29 TYPE 4: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 TYPE 4: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 31 TYPE 4: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 TYPE 4: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

7 CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE

- 7.1 INTRODUCTION

- FIGURE 34 CNG GAS SEGMENT TO LEAD CNG, RNG, AND HYDROGEN TANKS MARKET

- TABLE 33 CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 34 CNG, RNG, AND HYDROGEN TANKS MARKET, GAS TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 35 CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 36 CNG, RNG, AND HYDROGEN TANKS MARKET, GAS TYPE, 2023-2030 (THOUSAND UNIT)

- 7.2 CNG

- 7.2.1 INCREASING DEMAND FROM AUTOMOTIVE SECTOR TO DRIVE MARKET

- FIGURE 35 DEMAND FOR CNG TO BE HIGHEST IN ASIA PACIFIC

- TABLE 37 CNG TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 CNG TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 39 CNG TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 CNG TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- TABLE 41 CNG TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 42 CNG TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 43 CNG TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 44 CNG TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- 7.3 HYDROGEN

- 7.3.1 HIGH MASS-ENERGY DENSITY QUALITY COMPARED TO OTHER COMBUSTIBLE FUELS TO DRIVE MARKET

- TABLE 45 HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 47 HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- TABLE 49 HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 50 HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 51 HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 52 HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- 7.4 RNG

- 7.4.1 INCREASING DEMAND FOR RENEWABLE FUEL TO DRIVE MARKET

- TABLE 53 RNG TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 RNG TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 55 RNG TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 RNG TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- TABLE 57 RNG TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 58 RNG TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 59 RNG TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 60 RNG TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

8 CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 36 FUEL TANK APPLICATION TO DOMINATE CNG, RNG, AND HYDROGEN TANKS MARKET

- TABLE 61 CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 62 CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNITS)

- TABLE 63 CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNITS)

- 8.2 FUEL TANK

- 8.2.1 DURABLE, CHEAPER, AND LOWER CO2 EMISSION TO DRIVE MARKET

- 8.2.2 LIGHT-DUTY VEHICLES

- 8.2.3 MEDIUM-DUTY VEHICLES

- 8.2.4 HEAVY-DUTY VEHICLES

- FIGURE 37 DEMAND FOR FUEL TANKS TO BE HIGHEST IN ASIA PACIFIC

- TABLE 65 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 67 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 69 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 70 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 71 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 72 FUEL TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNITS)

- 8.3 TRANSPORTATION TANK

- 8.3.1 WEIGHT REDUCTION QUALITIES OF TANKS TO DRIVE MARKET

- TABLE 73 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 75 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 77 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 78 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 79 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 80 TRANSPORTATION TANK: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNITS)

9 CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- FIGURE 38 METAL SEGMENT TO LEAD CNG, RNG, AND HYDROGEN TANKS MARKET

- TABLE 81 CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 82 CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (THOUSAND UNIT)

- TABLE 83 CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

- TABLE 84 CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (THOUSAND UNIT)

- 9.2 METAL

- 9.2.1 INCREASING DEMAND FOR CHEAP RAW MATERIAL TO DRIVE MARKET

- FIGURE 39 DEMAND FOR METAL TO BE HIGHEST IN ASIA PACIFIC

- TABLE 85 METAL TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 METAL TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 87 METAL TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 METAL TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- 9.3 GLASS FIBER

- 9.3.1 INCREASING DEMAND FOR LIGHTER TRADITIONAL STEEL TO DRIVE MARKET

- TABLE 89 GLASS FIBER TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 90 GLASS FIBER TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 91 GLASS FIBER TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 92 GLASS FIBER TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- 9.4 CARBON FIBER

- 9.4.1 INCREASED USE OF HIGH-VALUE APPLICATIONS TO DRIVE MARKET

- TABLE 93 CARBON FIBER TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 CARBON FIBER TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 95 CARBON FIBER TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 96 CARBON FIBER TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

10 CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 40 INDIA TO BE THE FASTEST-GROWING CNG TANKS MARKET

- TABLE 97 CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 98 CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2018-2022 (THOUSAND UNIT)

- TABLE 99 CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 CNG, RNG, AND HYDROGEN TANKS MARKET, BY REGION, 2023-2030 (THOUSAND UNIT)

- 10.2 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET SNAPSHOT

- 10.3 RECESSION IMPACT

- TABLE 101 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 103 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- TABLE 105 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 107 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 109 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 111 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 113 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (THOUSAND UNIT)

- TABLE 115 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (THOUSAND UNIT)

- TABLE 117 NORTH AMERICA: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 119 NORTH AMERICA: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 121 NORTH AMERICA: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 123 NORTH AMERICA: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 125 NORTH AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 126 NORTH AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 127 NORTH AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- 10.3.1 US

- 10.3.1.1 Presence of major CNG, RNG, and hydrogen tank manufacturers to drive market

- 10.3.2 CANADA

- 10.3.2.1 Increasing tax incentives for NGVs to drive market

- 10.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET SNAPSHOT

- 10.4.1 RECESSION IMPACT

- TABLE 129 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 131 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- TABLE 133 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 135 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 137 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 139 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 141 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (THOUSAND UNIT)

- TABLE 143 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (THOUSAND UNIT)

- TABLE 145 ASIA PACIFIC: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 147 ASIA PACIFIC: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 149 ASIA PACIFIC: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 151 ASIA PACIFIC: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 153 ASIA PACIFIC: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 155 ASIA PACIFIC: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- 10.4.1.1 China

- 10.4.1.1.1 Growing automotive industry to drive market

- 10.4.1.2 Pakistan

- 10.4.1.2.1 Government initiatives to drive market for natural gas

- 10.4.1.3 India

- 10.4.1.3.1 Low running cost and eco-friendliness of CNG to drive market

- 10.4.1.4 Thailand

- 10.4.1.4.1 Infrastructure constraints to drive market

- 10.4.1.5 Rest of Asia Pacific

- 10.4.1.1 China

- 10.5 EUROPE

- FIGURE 43 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET SNAPSHOT

- 10.5.1 RECESSION IMPACT

- TABLE 157 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 158 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 159 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 160 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- TABLE 161 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (USD MILLION)

- TABLE 162 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 163 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (USD MILLION)

- TABLE 164 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 165 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 166 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 167 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 168 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 169 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 170 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (THOUSAND UNIT)

- TABLE 171 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

- TABLE 172 EUROPE: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (THOUSAND UNIT)

- TABLE 173 EUROPE: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 174 EUROPE: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 175 EUROPE: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 176 EUROPE: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 177 EUROPE: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 178 EUROPE: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 179 EUROPE: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 180 EUROPE: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 181 EUROPE: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 182 EUROPE: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 183 EUROPE: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 184 EUROPE: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- 10.5.1.1 Germany

- 10.5.1.1.1 Low tax rates to drive market

- 10.5.1.2 France

- 10.5.1.2.1 Increased use of natural gas-driven fuel tanks to drive market

- 10.5.1.3 UK

- 10.5.1.3.1 Significant investments by UK government to increase hydrogen production to drive market

- 10.5.1.4 Spain

- 10.5.1.4.1 Increasing demand from NGVs to drive market

- 10.5.1.5 Italy

- 10.5.1.5.1 Reduced taxes on natural gas to drive market

- 10.5.1.6 Russia

- 10.5.1.6.1 Developed natural gas infrastructure to drive market

- 10.5.1.7 Sweden

- 10.5.1.7.1 Government initiatives to promote use of NGVs to drive market

- 10.5.1.8 Ukraine

- 10.5.1.8.1 High demand for CNG vehicles to drive market

- 10.5.1.9 Armenia

- 10.5.1.9.1 Increasing demand for affordable fuel to drive market

- 10.5.1.10 Bulgaria

- 10.5.1.10.1 Increasing demand for CNG-driven vehicles to drive market growth

- 10.5.1.11 Switzerland

- 10.5.1.11.1 Bi-fuel vehicles to generate demand for CNG and RNG tanks

- 10.5.1.12 Austria

- 10.5.1.12.1 Initiatives taken to promote CNG to commute to drive market

- 10.5.1.13 Netherlands

- 10.5.1.13.1 Increasing demand for clean fuel to drive market

- 10.5.1.14 Rest of Europe

- 10.5.1.1 Germany

- 10.6 MIDDLE EAST & AFRICA

- FIGURE 44 IRAN IS THE LARGEST MARKET FOR CNG TANKS

- 10.6.1 RECESSION IMPACT

- TABLE 185 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 187 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- TABLE 189 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 191 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 193 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 195 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 197 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (THOUSAND UNIT)

- TABLE 199 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (THOUSAND UNIT)

- TABLE 201 MIDDLE EAST & AFRICA: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 203 MIDDLE EAST & AFRICA: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 205 MIDDLE EAST & AFRICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 207 MIDDLE EAST & AFRICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- 10.6.1.1 Iran

- 10.6.1.1.1 Five-year investment plan to promote use of NGVs to drive market

- 10.6.1.2 Uzbekistan

- 10.6.1.2.1 Adoption of natural gas to drive market

- 10.6.1.3 Rest of Middle East & Africa

- 10.6.1.1 Iran

- 10.7 LATIN AMERICA

- FIGURE 45 HIGH CAGR IS DUE TO GROWING AUTOMOTIVE INDUSTRY IN BRAZIL

- 10.7.1 RECESSION IMPACT

- TABLE 209 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 210 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNIT)

- TABLE 211 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 212 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY APPLICATION, 2023-2030 (THOUSAND UNIT)

- TABLE 213 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (USD MILLION)

- TABLE 214 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 215 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (USD MILLION)

- TABLE 216 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY TANK TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 217 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (USD MILLION)

- TABLE 218 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2018-2022 (THOUSAND UNIT)

- TABLE 219 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (USD MILLION)

- TABLE 220 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY GAS TYPE, 2023-2030 (THOUSAND UNIT)

- TABLE 221 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (USD MILLION)

- TABLE 222 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2018-2022 (THOUSAND UNIT)

- TABLE 223 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (USD MILLION)

- TABLE 224 LATIN AMERICA: CNG, RNG, AND HYDROGEN TANKS MARKET, BY MATERIAL, 2023-2030 (THOUSAND UNIT)

- TABLE 225 LATIN AMERICA: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 226 LATIN AMERICA: CNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 227 LATIN AMERICA: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 228 LATIN AMERICA: CNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 229 LATIN AMERICA: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 230 LATIN AMERICA: RNG TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 231 LATIN AMERICA: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: RNG TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- TABLE 233 LATIN AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNIT)

- TABLE 235 LATIN AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 236 LATIN AMERICA: HYDROGEN TANKS MARKET, BY COUNTRY, 2023-2030 (THOUSAND UNIT)

- 10.7.1.1 Brazil

- 10.7.1.1.1 Promotion of CNG-converted vehicles to drive market

- 10.7.1.2 Argentina

- 10.7.1.2.1 Strengthening of refueling network to drive market

- 10.7.1.3 Rest of Latin America

- 10.7.1.1 Brazil

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- FIGURE 46 MARKET SHARE OF TOP COMPANIES IN THE CNG, RNG, AND HYDROGEN TANKS MARKET, 2022

- TABLE 237 DEGREE OF COMPETITION: CNG, RNG, AND HYDROGEN TANKS MARKET

- 11.3 MARKET RANKING

- FIGURE 47 RANKING OF TOP FIVE PLAYERS IN THE CNG, RNG, AND HYDROGEN TANKS MARKET

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 48 REVENUE ANALYSIS OF TOP PLAYERS IN CNG, RNG, AND HYDROGEN TANKS MARKET

- 11.5 COMPANY EVALUATION MATRIX

- TABLE 238 COMPANY PRODUCT FOOTPRINT

- TABLE 239 COMPANY END-USE APPLICATION FOOTPRINT

- TABLE 240 COMPANY REGION FOOTPRINT

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 49 COMPETITIVE LEADERSHIP MAPPING, 2022

- 11.6 MARKET EVALUATION FRAMEWORK

- TABLE 241 PRODUCT DEVELOPMENTS, 2018-2023

- TABLE 242 DEALS, 2016-2023

- TABLE 243 CNG, RNG, AND HYDROGEN TANKS MARKET: OTHERS, 2016-2023

- 11.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 244 CNG, RNG, AND HYDROGEN TANKS MARKET: KEY STARTUPS/SMES

- TABLE 245 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 50 CNG, RNG, AND HYDROGEN TANKS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

12 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 WORTHINGTON INDUSTRIES, INC.

- TABLE 246 WORTHINGTON INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 51 WORTHINGTON INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 247 WORTHINGTON INDUSTRIES, INC.: NEW PRODUCT DEVELOPMENT

- TABLE 248 WORTHINGTON INDUSTRIES, INC.: DEALS

- 12.1.2 LUXFER GROUP

- TABLE 249 LUXFER GROUP: COMPANY OVERVIEW

- FIGURE 52 LUXFER GROUP: COMPANY SNAPSHOT

- TABLE 250 LUXFER GROUP: NEW PRODUCT DEVELOPMENT

- TABLE 251 LUXFER GROUP: DEALS

- 12.1.3 HEXAGON COMPOSITES ASA

- TABLE 252 HEXAGON COMPOSITES ASA: COMPANY OVERVIEW

- FIGURE 53 HEXAGON COMPOSITES ASA: COMPANY SNAPSHOT

- TABLE 253 HEXAGON COMPOSITES ASA: DEALS

- TABLE 254 HEXAGON COMPOSITES ASA: OTHER DEALS

- 12.1.4 QUANTUM FUEL SYSTEMS LLC.

- TABLE 255 QUANTUM FUEL SYSTEMS LLC.: COMPANY OVERVIEW

- TABLE 256 QUANTUM FUEL SYSTEMS LLC.: DEALS

- 12.1.5 EVEREST KANTO CYLINDER LTD.

- TABLE 257 EVEREST KANTO CYLINDER LTD.: COMPANY OVERVIEW

- FIGURE 54 EVEREST KANTO CYLINDER LTD.: COMPANY SNAPSHOT

- 12.1.6 PRAXAIR TECHNOLOGIES INC.

- TABLE 258 PRAXAIR TECHNOLOGIES INC.: COMPANY OVERVIEW

- 12.1.7 AVANCO GROUP

- TABLE 259 AVANCO GROUP: COMPANY OVERVIEW

- TABLE 260 AVANCO GROUP: DEALS

- 12.1.8 BEIJING TIANHAI INDUSTRY CO. LTD.

- TABLE 261 BEIJING TIANHAI INDUSTRY CO. LTD.: COMPANY OVERVIEW

- 12.1.9 LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP CO. LTD.

- TABLE 262 LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP CO. LTD.: COMPANY OVERVIEW

- 12.1.10 FABER INDUSTRIE SPA

- TABLE 263 FABER INDUSTRIE SPA: COMPANY OVERVIEW

- TABLE 264 FABER INDUSTRIE SPA: NEW PRODUCT DEVELOPMENT

- 12.1.11 COMPOSITES ADVANCED TECHNOLOGIES, LLC. (CATEC GASES)

- TABLE 265 COMPOSITES ADVANCED TECHNOLOGIES, LLC.: COMPANY OVERVIEW

- 12.1.12 CIMC ENRIC

- TABLE 266 CIMC ENRIC: COMPANY OVERVIEW

- FIGURE 55 CIMC ENRIC: COMPANY SNAPSHOT

- TABLE 267 CIMC ENRIC: DEALS

- 12.1.13 LUXI NEW ENERGY EQUIPMENT GROUP CO., LTD.

- TABLE 268 LUXI NEW ENERGY EQUIPMENT GROUP CO., LTD.: COMPANY OVERVIEW

- 12.1.14 SINOCLEANSKY

- TABLE 269 SINOCLEANSKY: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 LINDE PLC

- TABLE 270 LINDE PLC: COMPANY OVERVIEW

- 12.2.2 ULLIT SA

- TABLE 271 ULLIT SA: COMPANY OVERVIEW

- 12.2.3 AGILITY FUEL SOLUTIONS

- TABLE 272 AGILITY FUEL SOLUTIONS: COMPANY OVERVIEW

- 12.2.4 RAMA CYLINDERS PRIVATE LIMITED

- TABLE 273 RAMA CYLINDERS PRIVATE LIMITED: COMPANY OVERVIEW

- 12.2.5 JPM GROUP

- TABLE 274 JPM GROUP: COMPANY OVERVIEW

- 12.2.6 SAHUWALA CYLINDERS PVT. LTD.

- TABLE 275 SAHUWALA CYLINDERS LTD.: COMPANY OVERVIEW

- 12.2.7 EURO INDIA CYLINDERS LTD.

- TABLE 276 EURO INDIA CYLINDERS LTD.: COMPANY OVERVIEW

- 12.2.8 CEVOTEC GMBH

- TABLE 277 CEVOTEC GMBH: COMPANY OVERVIEW

- 12.2.9 NPROXX

- TABLE 278 NPROXX: COMPANY OVERVIEW

- 12.2.10 STEELHEAD COMPOSITES, INC.

- TABLE 279 STEELHEAD COMPOSITES, INC.: COMPANY OVERVIEW

- 12.2.11 JIANGSU QIULIN SPECIAL ENERGY EQUIPMENT JOINT STOCK LIMITED COMPANY

- TABLE 280 JIANGSU QIULIN SPECIAL ENERGY EQUIPMENT JOINT STOCK LIMITED COMPANY: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS