|

|

市場調査レポート

商品コード

1927591

量子暗号の世界市場 (~2031年):ソリューション (量子鍵配送 (QKD)・量子乱数生成器 (QRNG)・耐量子暗号)・サービス (導入&統合・暗号コンサルティング) 別Quantum Cryptography Market by Solution (Quantum Key Distribution (QKD), Quantum Random Number Generators (QRNG), Quantum-safe Cryptography), Service (Deployment & Integration, Crypto Consulting) - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| 量子暗号の世界市場 (~2031年):ソリューション (量子鍵配送 (QKD)・量子乱数生成器 (QRNG)・耐量子暗号)・サービス (導入&統合・暗号コンサルティング) 別 |

|

出版日: 2025年12月03日

発行: MarketsandMarkets

ページ情報: 英文 472 Pages

納期: 即納可能

|

概要

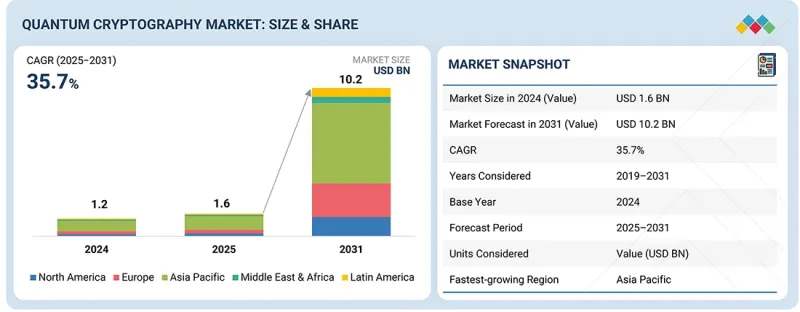

世界の量子暗号の市場規模は、予測期間中にCAGR 35.7%で成長し、2025年の16億米ドルから、2031年には102億米ドルに達すると見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2019年~2031年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2031年 |

| 単位 | 金額 (米ドル) |

| セグメント | ソリューション別、サービス別、伝送媒体別、導入形態別、組織規模別、産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、ラテンアメリカ |

ソフトウェア定義型量子セキュリティへの移行は、企業や通信事業者が量子セキュア鍵管理、QKDルーティング、PQC制御をSDNおよび自動化されたネットワークオーケストレーションプラットフォームに統合するにつれて、強力な市場勢いを生み出しています。これにより、プログラム可能な量子セキュリティ層、動的な鍵更新、自動化ポリシー適用、マルチクラウド、メトロ、バックボーンネットワーク全体での量子安全通信のシームレスな統合が可能となります。ネットワークの仮想化と分散化が進むにつれ、ソフトウェア主導の量子安全制御プレーンに対する需要は加速し続けています。

組織規模別では、大企業セグメントが最大の市場シェアを占めています。

大企業は、広範な通信ネットワークを管理し、機密性の高い多地域にわたる業務を扱い、分散型インフラ全体で長期的なデータを保護する必要があるため、量子暗号分野で最大の市場シェアを占めています。世界の銀行、クラウドサービスプロバイダー、公益事業、航空宇宙産業などの業界は、サイト間トラフィックや高価値な知的財産を保護するために量子安全チャネルに依存しています。2024年には、欧州の大手通信事業者が2つのコアネットワークサイト間の通信を保護するQKD (量子鍵配送) を用いたパイロット試験を完了し、大企業が既存の光インフラに量子安全リンクを統合する方法を実証しました。大企業はまた、厳格な内部セキュリティフレームワーク、専任のサイバーセキュリティチーム、将来の量子復号化脅威からミッションクリティカルなシステムを保護する必要性から導入を主導しており、実世界の展開における主要な推進力となっています。

提供区分別では、サービス部門が予測期間中に最も高い成長率を示すと予想されます。

クラウド展開は最も急速な成長率を示しており、企業がワークロードをマルチクラウドやハイブリッド環境に移行する中で、転送中のデータ、API、分散型アプリケーションに対する量子耐性保護が求められています。クラウドサービスプロバイダーは、PQC対応鍵管理、量子耐性TLS、QRNG (量子乱数生成器) ベースのエントロピーサービスをセキュリティスタックに直接統合しており、組織は専用ハードウェアを導入せずに量子保護を導入できるようになっています。2024年には、複数の世界のクラウドベンダーが規制産業を支援するため、PQC対応VPNゲートウェイおよび量子安全な地域間リンクの試験を開始しました。この動きは、拡張性の容易さ、迅速な導入、地理的に分散した環境全体での量子安全通信の拡張可能性によって推進されており、クラウドベースの量子セキュリティは、企業がインフラを近代化する上で好ましい選択肢となっています。

アジア太平洋地域の量子暗号市場は、政府の強力な投資、国家量子通信プログラム、早期の商用展開により急速に拡大しています。中国は、近年開始された複数都市を結ぶ量子バックボーンや衛星ベースの量子リンクを含む、大規模QKDネットワークの構築を継続しています。日本は2023年以降、通信事業者との連携で都市圏レベルのQKD試験環境を開発しており、安全な金融取引やデータセンター間接続に重点を置いています。韓国では2024年、QKDを国家通信インフラの一部へ統合し、5Gバックホールセキュリティのパイロットプロジェクトを拡大しました。インドも2023年4月に発表した「国家量子ミッション」を通じ、QKD研究・安全通信試験・量子ネットワーク開発の加速に約7億2,600万米ドルを配分し、市場強化を図っています。この地域全体において、強力な公的資金、技術提携、通信事業者主導の導入が、量子セキュア通信の実用化を加速させています。

当レポートでは、世界の量子暗号の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズとホワイトスペース

- 関連市場・異業種との分野横断的機会

- ティア1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済指標

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 顧客の事業に影響を与える動向とディスラプション

- 主な会議とイベント

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響- 量子暗号市場

第6章 技術の進歩、AI別影響、特許、イノベーション、将来の応用

- 主要な新興技術

- 量子鍵配送 (QKD)

- 量子乱数生成器 (QRNG)

- 量子エンタングルメント(量子もつれ)

- 量子デジタル署名 (QDS)

- 補完的技術

- ブロックチェーン技術

- 公開鍵インフラ(PKI)

- トランスポート層セキュリティ (TLS)

- 技術/製品ロードマップ

- 特許分析

- 将来の応用

- 量子耐性ネットワークセキュリティ (エンタングルメントベースQKD)

- 衛星QKD通信 (グローバル量子セキュリティ)

- ハイブリッドQKD+耐量子暗号 (PQC) セキュリティ

- 量子セキュアクラウド接続

- AIを活用した量子鍵オーケストレーション

- AI/生成AIが量子暗号市場に与える影響

- 量子暗号市場におけるAI導入事例

- 相互接続された隣接エコシステムと市場企業への影響

- 量子暗号市場における生成AI導入に対する顧客の準備状況

第7章 関税分析と規制状況

- 地域の規制とコンプライアンス

- 関税

第8章 消費者動向と購買行動

- 意思決定プロセス

- 購買プロセスに関与する主要なステークホルダーとその評価基準

- 採用の障壁と内部課題

- さまざまなエンドユーザー産業からの満たされていないニーズ

- 市場収益性

第9章 量子暗号市場:ソリューション別

- 量子鍵配送 (QKD)

- 離散変数QKD (DV-QKD)

- 連続変数QKD (CV-QKD)

- 量子乱数生成器 (QRNG)

- QRNGチップ

- QRNG USBデバイス

- PCIEカード

- ハードウェアセキュリティモジュール (HSMS)

- 耐量子暗号

- 量子鍵管理

第10章 量子暗号市場:サービス別

- 導入・統合

- 暗号コンサルティング

- サポート・メンテナンス

- PQC統合・移行

- トレーニング・認定

- 量子サービス

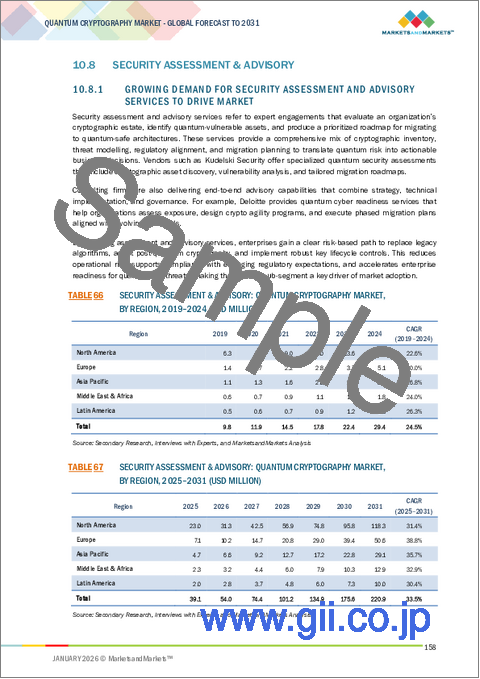

- セキュリティ評価・アドバイス

第11章 量子鍵配送市場:伝送媒体別

- 光ファイバーケーブル伝送

- 衛星通信

第12章 量子暗号市場:導入形態別

- オンプレミス

- クラウド

- サービスベース/キャリア管理

第13章 量子暗号市場:組織規模別

- 中小企業

- 大企業

第14章 量子暗号市場:産業別

- 銀行、金融サービス、保険 (BFSI)

- 政府

- 防衛・情報

- 健康管理

- 電気通信

- データセンター

- 航空宇宙・輸送

- 研究・学術

- エネルギー・公益事業

- その他の業種

第15章 量子暗号市場:地域別

- 北米

- 市場促進要因

- 米国

- カナダ

- 欧州

- 市場促進要因

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 市場促進要因

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- 市場促進要因

- GCC諸国

- 南アフリカ

- その他

- ラテンアメリカ

- 市場促進要因

- ブラジル

- メキシコ

- その他

第16章 競合情勢

- 主要企業の競合戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- TOSHIBA

- NXP SEMICONDUCTORS

- THALES

- IDEMIA

- DIGICERT

- QUINTESSENCELABS

- QUANTUMCTEK

- ISARA

- IBM

- ID QUANTIQUE

- MAGIQ TECHNOLOGIES

- CRYPTA LABS

- QASKY

- QUBITEKK

- NUCRYPT

- QUANTUM XCHANGE

- EVIDEN

- RAMBUS

- INFINEON

- その他の企業

- QUTOOLS

- QNU LABS

- POST QUANTUM

- HPE

- CRYPTO QUANTIQUE

- QRYPT

- KETS QUANTUM SECURITY

- PQSHIELD

- QUBALT

- VERIQLOUD

- SSH COMMUNICATIONS SECURITY

- HEQA SECURITY (FORMERLY QUANTLR)

- QUSECURE

- ORIGIN QUANTUM

- QUANTINUUM

- KUDELSKI SECURITY

- FORTANIX

- Q**BIRD

- QUSIDE