|

|

市場調査レポート

商品コード

1446309

複合材料の世界市場:繊維タイプ別、樹脂タイプ別、製造プロセス別、最終用途産業別、地域別 - 予測(~2028年)Composites Market by Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites), Resin Type (Thermoset Composites, Thermoplastic Composites), Manufacturing Process, End-use Industry, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 複合材料の世界市場:繊維タイプ別、樹脂タイプ別、製造プロセス別、最終用途産業別、地域別 - 予測(~2028年) |

|

出版日: 2024年03月01日

発行: MarketsandMarkets

ページ情報: 英文 482 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の複合材料の市場規模は、2023年の1,088億米ドルから、予測期間中は10.8%のCAGRで推移し、2028年には1,817億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル)・数量 (キロトン) |

| セグメント | 繊維タイプ・樹脂タイプ・製造プロセ・最終用途産業・地域 |

| 対象地域 | 北米・アジア太平洋・中東&アフリカ・ラテンアメリカ |

炭素繊維複合材料が金額ベースでもっとも急成長している繊維タイプです。炭素繊維複合材料は、2023年から2028年にかけて金額ベースでもっとも高いCAGRを記録すると予測されています。炭素繊維は、その卓越した強度と軽量特性で知られています。炭素繊維は、製品の性能と効率を高める能力があるため、航空宇宙、自動車、スポーツ用品、建設などの産業で広範な用途を見出しています。航空宇宙産業では、炭素繊維複合材料の使用は大幅な軽量化に貢献し、燃費の向上と排出ガスの削減につながっています。

熱可塑性複合材料は、金額ベースでもっとも急成長している樹脂タイプです。最近では、繊維強化複合材料の領域で熱可塑性樹脂の利用が顕著に急増しています。このタイプの樹脂を連続繊維と組み合わせると、構造用複合材料製品ができます。マトリックス物質として熱可塑性樹脂を使用する主な利点は、熱硬化性樹脂とは異なり、再成形・再利用が可能なことです。その結果、熱可塑性樹脂から作られた複合材料はリサイクルしやすく、過去10年間にその採用が大幅に増加しました。

樹脂トランスファー成形 (RTM) 製造プロセスは、複合材料の製造プロセスの中で、金額ベースで2番目に急成長しています。RTMは、真空アシスト樹脂転写工程で表面圧縮を強化するために、硬質でありながら柔軟性のあるカウンターモールドを利用します。この方法は、優れた強度対重量比、ラミネートの圧縮率の向上、ガラス対樹脂比の上昇をもたらします。主に、大型で複雑な形状の部品を高品質に仕上げるために使用されます。このような部品は通常、自動車、建設、インフラ、航空宇宙分野で見られます。RTM技術は、特に新興市場における自動車や建設分野での使用拡大により、今後5年間で大きな成長が見込まれています。

アジア太平洋地域は、今後5年間、金額ベースのCAGRがもっとも高くなると予測されています。この地域は、電気・電子産業において大きな成長の可能性を秘めています。技術的に高度な電子機器の継続的な拡大により、軽量で強度の高い電子製品へのニーズが高まっています。多様な用途における最先端の電子製品に対する需要の高まりが、アジア太平洋地域における複合材料産業の革新と進歩に拍車をかけています。

当レポートでは、世界の複合材料の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- エコシステムマップ

- 価格分析

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 特許分析

- 関税と規制

- 主な会議とイベント

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向とディスラプション

- 複合材料の投資情勢

- 複合材料の応用

第6章 複合材料市場:製造プロセス別

- レイアッププロセス

- フィラメントワインディングプロセス

- 射出成形プロセス

- 引抜成形プロセス

- 圧縮成形プロセス

- 樹脂トランスファー成形 (RTM) プロセス

- その他

第7章 複合材料市場:繊維タイプ別

- ガラス繊維複合材料

- 炭素繊維複合材料

- 天然繊維複合材料

- その他の繊維タイプ

- 玄武岩繊維複合材料

- アラミド繊維複合材料

- ボロン繊維複合材料

- ハイブリッド繊維複合材料

- 超高分子量ポリエチレン (UHMWPE) 繊維複合材料

第8章 複合材料市場:樹脂タイプ別

- 熱硬化性複合材料

- エポキシ樹脂

- ポリエステル樹脂

- ビニルエステル樹脂

- ポリウレタン樹脂

- その他

- 熱可塑性複合材料

- ポリカーボネート

- ポリプロピレン

- ポリフェニレンスルフィド

- ポリエーテルイミド

- ポリエーテルエーテルケトン

- ポリアミド

- その他

第9章 複合材料市場:最終用途産業別

- 航空宇宙・防衛

- 民間

- 防衛

- 風力エネルギー

- 自動車・輸送

- 自動車

- RV車

- バス、トラック、その他の大型車両

- 地下鉄・モノレール

- 旅客用レール

- 高速鉄道・新幹線

- 建設・インフラ

- パイプ

- 船舶

- パワーボート

- ヨット

- クルーズ船

- その他

- タンク・圧力容器

- 電気・電子

- その他

- 工業

- ヘルスケア

- スポーツ用品

第10章 複合材料市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 大手企業が採用した主な戦略

- 市場シェア分析

- ブランド/製品の比較分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 複合材料ベンダーの評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- OWENS CORNING

- TORAY INDUSTRIES, INC.

- MITSUBISHI CHEMICAL HOLDINGS CORPORATION

- SOLVAY S.A.

- TEIJIN LIMITED

- SGL CARBON SE

- HEXCEL CORPORATION

- NIPPON ELECTRIC GLASS CO., LTD.

- HUNTSMAN INTERNATIONAL LLC

- GURIT HOLDING AG

- WEYERHAEUSER COMPANY

- CHINA JUSHI CO., LTD.

- AGY

- TAISHAN FIBERGLASS INC. (CTG GROUP)

- CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)

- SAINT-GOBAIN

- INEOS CAPITAL LIMITED

- HEXION

- ASAHI FIBER GLASS CO., LTD.

- HYOSUNG ADVANCED MATERIALS

- ZHONGFU SHENYING CARBON FIBER CO., LTD.

- KUREHA CORPORATION

- DOWAKSA

- JILIN CHEMICAL FIBER GROUP CO., LTD.

- JIANGSU HENGSHEN CO., LTD.

- ZHEJIANG SHIJIN BASALT FIBER CO., LTD. (GBF)

- MAFIC

- KAMENNY VEK

- TECHNOBASALT INVEST

- ISOMATEX

- POLYVLIES FRANZ BEYER GMBH & CO. KG

- TECNARO GMBH

- PROCOTEX SA CORPORATION NV

- FLEXFORM TECHNOLOGIES

- JELU-WERK JOSEF EHRLER GMBH & CO. KG

- MAGNA INTERNATIONAL INC.

- STRONGWELL CORPORATION (COMPOSITE PART MANUFACTURERS)

- SPIRIT AEROSYSTEMS (COMPOSITE PART MANUFACTURERS)

- EXEL COMPOSITES

- その他の企業

- BPREG COMPOSITES

- BCOMP LTD.

- INFINITUM COMPOSITES SIA

- FIBRAWORKS GMBH

- ATOMIC-6

- AEON-T

- NOVA CARBON

- ANTEFIL COMPOSITE TECH AG

- MIDWEST COMPOSITES

- RRTC, INC.

第13章 付録

The global composites market size is projected to grow from 108.8 USD billion in 2023 and is estimated to reach 181.7 USD billion by 2028., at a CAGR of 10.8% between 2023 and 2028. Composite materials are transforming numerous industries by integrating different materials to form an enhanced composite. These materials provide exceptional versatility, allowing customization of characteristics such as durability, rigidity, electrical conductivity, and heat tolerance through careful selection and combination of components. Often presenting a substantial reduction in weight compared to traditional metals or materials, composites are perfectly suited for use in sectors like aerospace, transportation, and sports equipment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD), Volume (Kiloton) |

| Segments | Fiber Type, Resin Type, Manufacturing Process, End-use Industry and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and Latin America |

"Carbon fiber composites are the fastest-growing fiber type of composites market in terms of value."

Carbon fiber composites are projected to register the highest CAGR in terms of value between 2023 and 2028.Carbon fiber is renowned for its exceptional strength and lightweight properties, making it a superior. carbon fiber finds extensive application in industries such as aerospace, automotive, sports equipment, and construction due to its ability to enhance the performance and efficiency of products. In the aerospace industry, for instance, the use of carbon fiber composites contributes to significant weight savings, leading to improved fuel efficiency and reduced emissions.

"Thermoplastic composites is the fastest-growing resin type of composites, in terms of value."

Thermoplastic composites have emerged as the most rapidly expanding category of resin types. In recent times, there has been a notable surge in the utilization of thermoplastic resins within the realm of fiber-reinforced composites. This type of resin, when combined with continuous fiber, yields structural composite products. A key benefit of employing thermoplastic resin as a matrix substance is its ability to be remolded and reused, distinguishing it from thermoset resin. As a result, composites made from thermoplastic resin are easily recyclable, leading to a significant rise in their adoption over the past decade.

"Resin Transfer Molding (RTM) manufacturing process is the second fastest-growing manufacturing process of composites, in terms of value."

RTM utilizes a rigid, yet flexible, counter mold to enhance surface compression during the vacuum-assisted resin transfer process. This method leads to superior strength-to-weight ratios, increased laminate compaction, and elevated glass-to-resin ratios. It is primarily used for molding large, complexly shaped parts with a high-quality finish. Such components are typically found in automotive, construction, infrastructure, and aerospace sectors. The RTM technique is anticipated to see significant growth over the next five years, particularly due to its expanding use in the automotive and construction sectors within emerging markets.

"Wind energy is the second fastest-growing end-use industry of composites, in terms of value."

The wind energy sector is forecasted to experience the second-highest compound annual growth rate (CAGR) over the next five years. Composite materials, known for their remarkable tensile strength, play a crucial role in constructing wind turbines, facilitating the production of large blades and increased energy output. Approximately 70-75% of the weight of wind blades consists of fiber reinforcement, typically combined with epoxy or unsaturated polymer resins. Fiberglass, renowned for its robust tensile strength, aids manufacturers in achieving larger blades and maximizing energy production. Moreover, fiberglass enhances the wind energy industry's resilience by enabling turbines to operate effectively in harsh environments, thanks to its corrosion-resistant properties.

"Asia Pacific is the fastest-growing composites market."

The Asia Pacific region is forecasted to experience the highest compound annual growth rate (CAGR) in the composites sector in terms of value over the upcoming five years. This region holds significant potential for growth in the electrical and electronics industry. The continuous expansion of technologically advanced electronic devices has generated a substantial need for lightweight and strong electronic products. This escalating demand for cutting-edge electronic products across diverse applications has spurred innovations and advancements in the composites industry within Asia Pacific.

This study has been validated through primary interviews conducted with various industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation - C Level- 50%, Director Level- 30%, and Executives- 20%

- By Region - North America- 15%, Europe- 50%, Asia Pacific- 20%, Middle East & Africa (MEA)-10%, Latin America-10%

The report provides a comprehensive analysis of company profiles listed below:

- Owens Corning (US)

- Toray Industries, Inc. (Japan)

- Teijin Limited (Japan)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Hexcel Corporation (US)

- SGL Group (Germany)

- Nippon Electric Glass Co. Ltd. (Japan)

- Huntsman International LLC. (US)

- Solvay S.A. (Belgium)

Research Coverage

This report covers the global composites market and forecasts the market size until 2028. The report includes the market segmentation - Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, and Other), Resin Type (Thermoset Composites and Thermoplastic Composites), Manufacturing process (Lay-up, filament winding, injection molding, pultrusion, compression molding, RTM, and others), End-use Industry (Aerospace & Defense, Wind Energy, Automotive & Transportation, Construction & Infrastructure, Marine, Pipes, Tanks & Pressure vessels, Electrical & Electronics, and Others) and Region (Europe, North America, Asia Pacific, South America, and Middle East & Africa). Porter's Five Forces analysis, along with the drivers, restraints, opportunities, and challenges, are discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global composites market.

Key benefits of buying the report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall composites market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers ( Increasing demand from aerospace applications

- Extensive use of composites in construction & infrastructure industry, Growing demand from satellite parts manufacturing, Stringent eco-friendly regulations to drive adoption of composites in automotive applications, Increasing use of ATF and AFP technologies for manufacturing aircraft primary structures, Increasing focus on lightweight and high-performance materials), restraints (High processing and manufacturing costs, Lack of standardization in manufacturing technologies

- Limitations in use of carbon fiber composites in high-temperature aerospace applications), opportunities ( High demand for environmentally friendly electric vehicles, Growing adoption of natural fiber composites, Growing penetration of natural fiber composites and carbon fiber composites in emerging applications, Reduction of carbon fiber composite costs, Increasing use of carbon fiber composites in 3D printing, Increasing number of wind energy capacity installations

- Development of advanced software tools for prepreg product development, High demand for carbon fiber composite in CNG and hydrogen storage.,) and challenges (Developing low-cost technologies,Issues related to recycling) influencing the growth of the composite market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the composite market

- Market Development: Comprehensive information about lucrative markets - the report analyses the composite market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the composite market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Owens Corning (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Holdings Corporation (Japan), Hexcel Corporation (US), SGL Group (Germany), Nippon Electric Glass Co. Ltd. (Japan), Huntsman International LLC. (US), Solvay S.A. (Belgium) among others in the composite market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 COMPOSITES MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 COMPOSITES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.2.3 Key industry insights

- 2.2 IMPACT OF RECESSION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 COMPOSITES MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 COMPOSITES MARKET: TOP-DOWN APPROACH

- 2.4 BASE NUMBER CALCULATION

- 2.4.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.4.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.5 MARKET FORECAST APPROACH

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 DATA TRIANGULATION

- FIGURE 5 COMPOSITES MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 6 GLASS FIBER COMPOSITES DOMINATED MARKET IN 2022

- FIGURE 7 THERMOSET COMPOSITES DOMINATED MARKET IN 2022

- FIGURE 8 LAY-UP MANUFACTURING PROCESS ACCOUNTED FOR LARGEST SHARE OF COMPOSITES MARKET IN 2022

- FIGURE 9 AUTOMOTIVE AND TRANSPORTATION LED MARKET IN 2022

- FIGURE 10 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMPOSITES MARKET

- FIGURE 11 SIGNIFICANT GROWTH EXPECTED IN COMPOSITES MARKET BETWEEN 2023 AND 2028

- 4.2 COMPOSITES MARKET, BY FIBER TYPE

- FIGURE 12 GLASS FIBER COMPOSITES DOMINATED MARKET IN 2022

- 4.3 COMPOSITES MARKET, BY RESIN TYPE

- FIGURE 13 THERMOSET COMPOSITES ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.4 COMPOSITES MARKET, BY MANUFACTURING PROCESS

- FIGURE 14 LAY-UP WAS LARGEST MANUFACTURING PROCESS IN 2022

- 4.5 COMPOSITES MARKET, BY END-USE INDUSTRY

- FIGURE 15 AUTOMOTIVE & TRANSPORTATION INDUSTRY DOMINATED MARKET IN 2022

- 4.6 COMPOSITES MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC DOMINATED MARKET IN 2022

- 4.7 COMPOSITES MARKET, BY KEY COUNTRY

- FIGURE 17 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COMPOSITES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for composites in aerospace industry

- TABLE 1 ORDERS OF DIFFERENT BOEING PLANES

- 5.2.1.2 Extensive use of fiberglass composites in construction & infrastructure industry

- 5.2.1.3 Wide deployment of carbon fiber in satellite components

- 5.2.1.4 Rising demand for fiberglass in automotive applications

- 5.2.1.5 Increasing use of ATF and AFP technologies in primary aircraft structures

- 5.2.1.6 Rising focus on lightweight and high-performance materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 High processing and manufacturing costs

- 5.2.2.2 Lack of standardization in manufacturing technologies

- 5.2.2.3 Limited application of carbon fiber composites in high-temperature aerospace applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High demand for electric vehicles

- 5.2.3.2 Rising adoption of natural composites

- 5.2.3.3 Pressing need for natural and carbon fiber composites in emerging applications

- 5.2.3.4 Reduction in cost of carbon fiber composites

- 5.2.3.5 Increasing use of carbon fiber composites in 3D printing

- 5.2.3.6 Increasing number of wind energy capacity installations

- TABLE 2 ESTIMATED GLOBAL WIND ENERGY INSTALLATIONS, 2021-2030

- 5.2.3.7 Development of advanced software tools for prepreg product development

- 5.2.3.8 High demand for carbon fiber composites in CNG and hydrogen storage

- 5.2.4 CHALLENGES

- 5.2.4.1 Developing low-cost technologies

- 5.2.4.2 Obstacles in recycling composites

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 ECOSYSTEM MAP

- FIGURE 20 KEY PLAYERS IN COMPOSITE MARKET ECOSYSTEM

- FIGURE 21 ECOSYSTEM ANALYSIS: COMPOSITES MARKET

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY END-USE INDUSTRY (KEY PLAYERS)

- FIGURE 22 AVERAGE SELLING PRICE OF COMPOSITES OFFERED BY KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES (USD/KG)

- 5.5.2 AVERAGE SELLING PRICE, BY FIBER TYPE

- FIGURE 23 AVERAGE SELLING PRICE BASED ON FIBER TYPE (USD/KG)

- 5.5.3 AVERAGE SELLING PRICE, BY RESIN TYPE

- FIGURE 24 AVERAGE SELLING PRICE BASED ON RESIN TYPE (USD/KG)

- 5.5.4 AVERAGE SELLING PRICE, BY REGION

- TABLE 4 AVERAGE SELLING PRICE OF COMPOSITES, BY REGION

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 25 COMPOSITES MARKET: VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIALS

- FIGURE 26 LEADING COMPOSITE RAW MATERIAL MANUFACTURERS AND SUPPLIERS

- 5.7.2 INTERMEDIATES

- FIGURE 27 LEADING COMPOSITE INTERMEDIATE MANUFACTURERS

- 5.7.3 MOLDERS

- FIGURE 28 LEADING MOLDERS IN COMPOSITES MARKET

- 5.7.4 OEM/ASSEMBLY

- FIGURE 29 MAJOR END USERS OF COMPOSITE PRODUCTS

- 5.7.5 DISTRIBUTION CHANNEL

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO FOR HS CODE 7019

- FIGURE 30 EXPORT OF GLASS FIBERS, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 5 TOP 10 EXPORTING COUNTRIES IN 2022

- 5.8.2 IMPORT SCENARIO FOR HS CODE 7019

- FIGURE 31 IMPORT OF GLASS FIBERS, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 6 TOP 10 IMPORTING COUNTRIES IN 2022

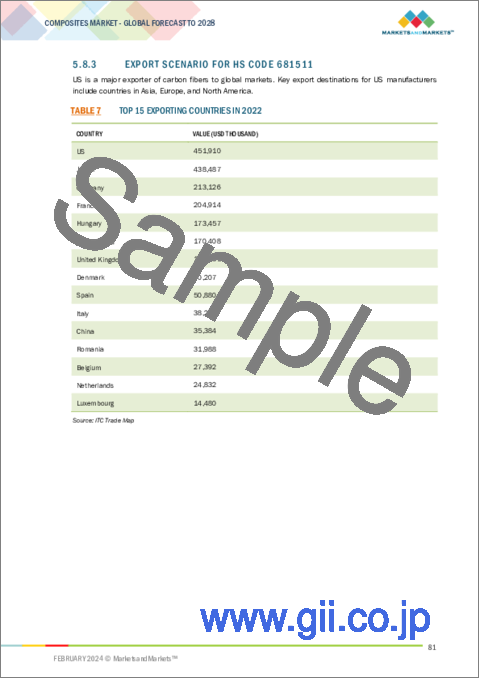

- 5.8.3 EXPORT SCENARIO FOR HS CODE 681511

- TABLE 7 TOP 15 EXPORTING COUNTRIES IN 2022

- 5.8.4 IMPORT SCENARIO FOR HS CODE 681511

- TABLE 8 TOP 15 IMPORTING COUNTRIES IN 2022

- 5.9 TECHNOLOGY ANALYSIS

- TABLE 9 COMPARATIVE STUDY OF MAJOR COMPOSITE MANUFACTURING PROCESSES

- 5.9.1 KEY TECHNOLOGY ANALYSIS FOR GLASS FIBER COMPOSITES

- 5.9.2 KEY TECHNOLOGY ANALYSIS FOR CARBON FIBER COMPOSITES

- 5.9.3 COMPLEMENTARY TECHNOLOGY FOR LATEST MANUFACTURING PROCESS OF CARBON FIBERS

- 5.9.4 KEY TECHNOLOGY ANALYSIS FOR NATURAL FIBER COMPOSITES

- TABLE 10 COMPARATIVE STUDY OF MAJOR NATURAL FIBER COMPOSITE MANUFACTURING PROCESSES

- 5.9.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.5.1 Key stakeholders in buying process

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- 5.9.6 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.10.2 METHODOLOGY

- 5.10.3 DOCUMENT TYPES

- TABLE 13 COMPOSITES MARKET: GLOBAL PATENTS

- FIGURE 34 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 35 GLOBAL PATENT PUBLICATION TREND ANALYSIS, LAST 5 YEARS

- 5.10.4 INSIGHTS

- 5.10.5 LEGAL STATUS OF PATENTS

- FIGURE 36 COMPOSITES MARKET: LEGAL STATUS OF PATENTS

- 5.10.6 JURISDICTION ANALYSIS

- FIGURE 37 GLOBAL JURISDICTION ANALYSIS

- 5.10.7 TOP APPLICANT ANALYSIS

- FIGURE 38 UNIVERSITY OF TIAJIN ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

- 5.10.8 PATENTS BY BOEING

- 5.10.9 PATENTS BY UNIVERSITY OF TIAJIN

- 5.10.10 PATENTS BY STATE GRID CORP CHINA

- 5.10.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.11 TARIFFS AND REGULATIONS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 STANDARDS IN COMPOSITES MARKET

- TABLE 18 CURRENT STANDARD CODES FOR AUTOMOTIVE COMPOSITES

- TABLE 19 CURRENT STANDARD CODES FOR CONSTRUCTION COMPOSITES

- 5.12 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 20 COMPOSITES MARKET: KEY CONFERENCES & EVENTS, 2023-2024

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 39 REVENUE SHIFT AND NEW REVENUE POCKETS IN COMPOSITES MARKET

- 5.15 COMPOSITES INVESTMENT LANDSCAPE

- FIGURE 40 INVESTOR DEALS AND FUNDING IN COMPOSITES MARKET SOARED IN 2023

- 5.16 APPLICATION OF COMPOSITES

- 5.16.1 COMPOSITES IN ELECTRIC-POWERED AIRCRAFT

- 5.16.2 EMERGING NEED FOR COMPOSITES IN URBAN TAXIS

- 5.16.3 APPLICATION OF COMPOSITES IN SENSOR POSITION OPTIMIZATION

- 5.16.4 COMPOSITES FOR HYPERSONIC AIRCRAFT

6 COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 6.1 INTRODUCTION

- FIGURE 41 LAY-UP MANUFACTURING PROCESS TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 21 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 22 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 23 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 24 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- 6.2 LAY-UP PROCESS

- 6.2.1 DEMAND FROM AEROSPACE & DEFENSE SECTOR TO DRIVE MARKET

- FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 6.2.2 LAY-UP PROCESS: COMPOSITES MARKET, BY REGION

- TABLE 25 LAY-UP PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 26 LAY-UP PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 27 LAY-UP PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 28 LAY-UP PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.3 FILAMENT WINDING PROCESS

- 6.3.1 HIGH DEPLOYMENT IN MARINE AND CONSTRUCTION END-USE INDUSTRIES TO DRIVE MARKET

- FIGURE 43 ASIA PACIFIC TO LEAD FILAMENT WINDING PROCESS SEGMENT DURING FORECAST PERIOD

- 6.3.2 FILAMENT WINDING PROCESS: COMPOSITES MARKET, BY REGION

- TABLE 29 FILAMENT WINDING PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 30 FILAMENT WINDING PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 31 FILAMENT WINDING PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 FILAMENT WINDING PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.4 INJECTION MOLDING PROCESS

- 6.4.1 LARGE PRODUCTION VOLUME AND LOW COSTS TO DRIVE MARKET

- FIGURE 44 NORTH AMERICA TO BE LARGEST MARKET FOR INJECTION MOLDING PROCESS DURING FORECAST PERIOD

- 6.4.2 INJECTION MOLDING PROCESS: COMPOSITES MARKET, BY REGION

- TABLE 33 INJECTION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 34 INJECTION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 35 INJECTION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 INJECTION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.5 PULTRUSION PROCESS

- 6.5.1 LOW-COST PRODUCTION METHOD TO BOOST MARKET

- FIGURE 45 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 6.5.2 PULTRUSION PROCESS: COMPOSITES MARKET, BY REGION

- TABLE 37 PULTRUSION PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 38 PULTRUSION PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 39 PULTRUSION PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 PULTRUSION PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.6 COMPRESSION MOLDING PROCESS

- 6.6.1 LOW INVESTMENT AND MINIMAL MAINTENANCE TO DRIVE MARKET

- FIGURE 46 ASIA PACIFIC TO BE LARGEST MARKET FOR COMPRESSION MOLDING PROCESS

- 6.6.2 COMPRESSION MOLDING PROCESS: COMPOSITES MARKET, BY REGION

- TABLE 41 COMPRESSION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 42 COMPRESSION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 43 COMPRESSION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 COMPRESSION MOLDING PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.7 RESIN TRANSFER MOLDING (RTM) PROCESS

- 6.7.1 DEMAND FOR COMPLEX STRUCTURES FROM AUTOMOTIVE AND AEROSPACE INDUSTRY TO DRIVE MARKET

- FIGURE 47 ASIA PACIFIC TO BE LARGEST MARKET FOR RESIN TRANSFER MOLDING PROCESS

- 6.7.2 RTM PROCESS: COMPOSITES MARKET, BY REGION

- TABLE 45 RTM PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 46 RTM PROCESS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 47 RTM PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 RTM PROCESS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.8 OTHER MANUFACTURING PROCESSES

- FIGURE 48 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- 6.8.1 OTHER MANUFACTURING PROCESSES: COMPOSITES MARKET, BY REGION

- TABLE 49 OTHER MANUFACTURING PROCESSES: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 50 OTHER MANUFACTURING PROCESSES: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 51 OTHER MANUFACTURING PROCESSES: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 OTHER MANUFACTURING PROCESSES: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

7 COMPOSITES MARKET, BY FIBER TYPE

- 7.1 INTRODUCTION

- FIGURE 49 GLASS FIBER COMPOSITES TO DOMINATE MARKET

- TABLE 53 COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 54 COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 55 COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 56 COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 7.2 GLASS FIBER COMPOSITES

- FIGURE 50 ASIA PACIFIC TO BE LARGEST GLASS FIBER COMPOSITES MARKET DURING FORECAST PERIOD

- 7.2.1 GLASS FIBER: COMPOSITES MARKET, BY REGION

- TABLE 57 GLASS FIBER: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 58 GLASS FIBER: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 59 GLASS FIBER: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 GLASS FIBER: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.3 CARBON FIBER COMPOSITES

- FIGURE 51 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- 7.3.1 CARBON FIBER: COMPOSITES MARKET, BY REGION

- TABLE 61 CARBON FIBER: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 62 CARBON FIBER: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 63 CARBON FIBER COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 CARBON FIBER: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.4 NATURAL FIBER COMPOSITES

- TABLE 65 NATURAL FIBER COMPOSITES IN AUTOMOTIVE SECTOR, BY DIFFERENT MANUFACTURERS

- 7.4.1 NATURAL FIBER COMPOSITES MARKET, BY REGION

- TABLE 66 NATURAL FIBER: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 67 NATURAL FIBER: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 68 NATURAL FIBER: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 69 NATURAL FIBER: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.5 OTHER FIBER TYPES

- 7.5.1 BASALT FIBER COMPOSITES

- 7.5.2 ARAMID FIBER COMPOSITES

- 7.5.3 BORON FIBER COMPOSITES

- 7.5.4 HYBRID FIBER COMPOSITES

- 7.5.5 ULTRA-HIGH-MOLECULAR-WEIGHT POLYETHYLENE (UHMWPE) FIBER COMPOSITES

- 7.5.6 OTHER FIBER TYPES: COMPOSITES MARKET, BY REGION

- TABLE 70 OTHER FIBER TYPES: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 71 OTHER FIBER TYPES: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 72 OTHER FIBER TYPES: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 OTHER FIBER TYPES: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

8 COMPOSITES MARKET, BY RESIN TYPE

- 8.1 INTRODUCTION

- FIGURE 52 THERMOSET COMPOSITES TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 74 COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 75 COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 76 COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 77 COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 8.2 THERMOSET COMPOSITES

- 8.2.1 INCREASING DEMAND FROM END-USE INDUSTRIES IN ASIA PACIFIC TO DRIVE MARKET

- 8.2.2 EPOXY RESIN

- 8.2.3 POLYESTER RESIN

- 8.2.4 VINYL ESTER RESIN

- 8.2.5 POLYURETHANE RESIN

- 8.2.6 OTHER THERMOSET COMPOSITES

- FIGURE 53 ASIA PACIFIC TO BE LARGEST THERMOSET COMPOSITES MARKET

- 8.2.7 THERMOSET COMPOSITES MARKET, BY REGION

- TABLE 78 THERMOSET COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 79 THERMOSET COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 80 THERMOSET COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 81 THERMOSET COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.3 THERMOPLASTIC COMPOSITES

- 8.3.1 INCREASING DEMAND FROM AEROSPACE & TRANSPORTATION INDUSTRIES TO DRIVE MARKET

- 8.3.2 POLYCARBONATES

- 8.3.3 POLYPROPYLENE

- 8.3.4 POLYPHENYLENE SULFIDE

- 8.3.5 POLYETHERIMIDE

- 8.3.6 POLYETHERETHERKETONE

- 8.3.7 POLYAMIDE

- 8.3.8 OTHER THERMOPLASTIC COMPOSITES

- FIGURE 54 ASIA PACIFIC TO BE LARGEST THERMOPLASTIC COMPOSITES MARKET

- 8.3.9 THERMOPLASTIC COMPOSITES MARKET, BY REGION

- TABLE 82 THERMOPLASTIC COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 83 THERMOPLASTIC COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 84 THERMOPLASTIC COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 85 THERMOPLASTIC COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

9 COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 55 TRANSPORTATION INDUSTRY TO DOMINATE COMPOSITES MARKET DURING FORECAST PERIOD

- TABLE 86 COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 87 COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 88 COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 89 COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2 AEROSPACE & DEFENSE

- 9.2.1 INCREASING DEMAND FOR CARBON COMPOSITES IN AIRFRAME STRUCTURES TO DRIVE MARKET

- 9.2.2 CIVIL

- 9.2.3 DEFENSE

- TABLE 90 NUMBER OF NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION (2023-2042)

- FIGURE 56 EUROPE TO WITNESS HIGHEST DEMAND FOR COMPOSITES FROM AEROSPACE & DEFENSE END-USE INDUSTRY

- 9.2.4 AEROSPACE & DEFENSE: COMPOSITES MARKET, BY REGION

- TABLE 91 AEROSPACE & DEFENSE: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 92 AEROSPACE & DEFENSE: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 93 AEROSPACE & DEFENSE: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 AEROSPACE & DEFENSE: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.3 WIND ENERGY

- 9.3.1 PRESSING NEED FOR FIBER GLASS IN WIND TURBINES TO DRIVE MARKET

- FIGURE 57 ASIA PACIFIC TO WITNESS HIGHEST DEMAND FROM WIND ENERGY INDUSTRY

- 9.3.2 WIND ENERGY: COMPOSITES MARKET, BY REGION

- TABLE 95 WIND ENERGY: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 96 WIND ENERGY: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 97 WIND ENERGY: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 98 WIND ENERGY: COMPOSITES MARKET, 2023-2028 (KILOTON)

- 9.4 AUTOMOTIVE & TRANSPORTATION

- 9.4.1 INCREASING DEMAND FROM AUTOMOTIVE SECTOR TO BOOST MARKET

- TABLE 99 COST BENEFITS OF COMPOSITE PARTS VS. STEEL PARTS

- 9.4.2 AUTOMOTIVE

- 9.4.3 RECREATIONAL VEHICLES

- 9.4.4 BUS, TRUCKS, AND OTHER HEAVY VEHICLES

- 9.4.5 METROS AND MONORAILS

- 9.4.6 PASSENGER RAILS

- 9.4.7 HIGH-SPEED AND BULLET TRAINS

- FIGURE 58 ASIA PACIFIC TO LEAD MARKET IN AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 9.4.8 AUTOMOTIVE & TRANSPORTATION: COMPOSITES MARKET, BY REGION

- TABLE 100 AUTOMOTIVE & TRANSPORTATION: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 101 AUTOMOTIVE & TRANSPORTATION: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 102 AUTOMOTIVE & TRANSPORTATION: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 103 AUTOMOTIVE & TRANSPORTATION: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.5 CONSTRUCTION & INFRASTRUCTURE

- 9.5.1 WIDE USE OF COMPOSITES IN CONCRETE STRUCTURES TO BOOST MARKET

- FIGURE 59 ASIA PACIFIC TO BE LARGEST MARKET FOR COMPOSITES IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY

- 9.5.2 CONSTRUCTION & INFRASTRUCTURE: COMPOSITES MARKET, BY REGION

- TABLE 104 CONSTRUCTION & INFRASTRUCTURE: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 105 CONSTRUCTION & INFRASTRUCTURE: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 106 CONSTRUCTION & INFRASTRUCTURE: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 107 CONSTRUCTION & INFRASTRUCTURE: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

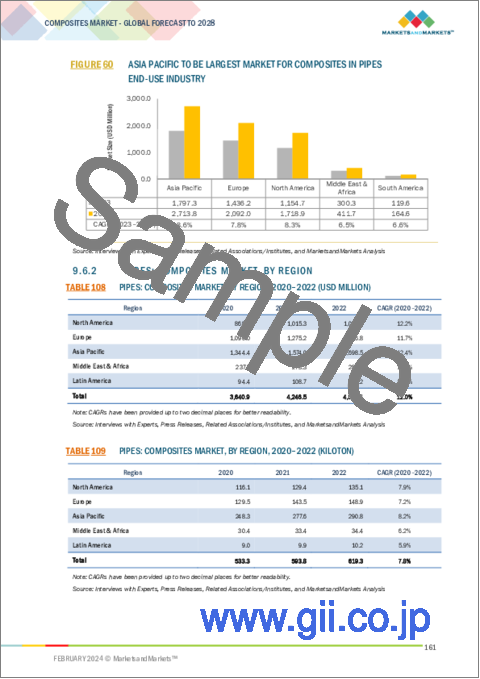

- 9.6 PIPES

- 9.6.1 INCREASING DEMAND FROM OIL & GAS INDUSTRY TO BOOST MARKET

- FIGURE 60 ASIA PACIFIC TO BE LARGEST MARKET FOR COMPOSITES IN PIPES END-USE INDUSTRY

- 9.6.2 PIPES: COMPOSITES MARKET, BY REGION

- TABLE 108 PIPES: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 109 PIPES: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 110 PIPES: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 111 PIPES: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.7 MARINE

- 9.7.1 INCREASING USE OF COMPOSITES IN YACHTS AND CATAMARANS TO BOOST MARKET

- 9.7.2 POWERBOAT

- 9.7.3 SAILBOAT

- 9.7.4 CRUISE SHIP

- 9.7.5 OTHERS

- FIGURE 61 NORTH AMERICA TO BE LARGEST MARKET COMPOSITES IN MARINE END-USE INDUSTRY

- 9.7.6 MARINE: COMPOSITES MARKET, BY REGION

- TABLE 112 MARINE: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 113 MARINE: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 114 MARINE: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 115 COMPOSITES MARKET IN MARINE END-USE INDUSTRY, BY REGION, 2023-2028 (KILOTON)

- 9.8 TANKS & PRESSURE VESSELS

- 9.8.1 WIDE DEPLOYMENT OF COMPOSITE VESSELS IN WATER DISTRIBUTION NETWORKS TO DRIVE MARKET

- FIGURE 62 ASIA PACIFIC TO BE LARGEST MARKET FOR COMPOSITES IN TANKS & PRESSURE VESSEL END-USE INDUSTRY

- 9.8.2 TANKS & PRESSURE VESSELS: COMPOSITES MARKET, BY REGION

- TABLE 116 TANKS & PRESSURE VESSELS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 117 TANKS & PRESSURE VESSELS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 118 TANKS & PRESSURE VESSELS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 119 TANKS & PRESSURE VESSELS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.9 ELECTRICAL & ELECTRONICS

- 9.9.1 APPLICATION OF COMPOSITES IN PRINTED CIRCUIT BOARDS AND COMPUTER TERMINAL HOUSINGS TO DRIVE MARKET

- FIGURE 63 ASIA PACIFIC TO BE LARGEST MARKET FOR COMPOSITES IN ELECTRICAL & ELECTRONICS END-USE INDUSTRY

- 9.9.2 ELECTRICAL & ELECTRONICS: COMPOSITES MARKET, BY REGION

- TABLE 120 ELECTRICAL & ELECTRONICS: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 121 ELECTRICAL & ELECTRONICS: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 122 ELECTRICAL & ELECTRONICS: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 123 ELECTRICAL & ELECTRONICS: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.10 OTHER END-USE INDUSTRIES

- 9.10.1 INDUSTRIAL

- 9.10.2 HEALTHCARE

- 9.10.3 SPORTING GOODS

- FIGURE 64 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 9.10.4 OTHER END-USE INDUSTRIES: COMPOSITES MARKET, BY REGION

- TABLE 124 OTHER END-USE INDUSTRIES: COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 125 OTHER END-USE INDUSTRIES: COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 126 OTHER END-USE INDUSTRIES: COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 127 OTHER END-USE INDUSTRIES: COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

10 COMPOSITES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 65 CHINA TO BE FASTEST-GROWING COMPOSITES MARKET DURING FORECAST PERIOD

- TABLE 128 COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 129 COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 130 COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 131 COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT

- FIGURE 66 NORTH AMERICA: COMPOSITES MARKET SNAPSHOT

- 10.2.2 NORTH AMERICA: COMPOSITES MARKET, BY FIBER TYPE

- TABLE 132 NORTH AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 134 NORTH AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.2.3 NORTH AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS

- TABLE 136 NORTH AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 138 NORTH AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- 10.2.4 NORTH AMERICA: COMPOSITES MARKET, BY RESIN TYPE

- TABLE 140 NORTH AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 142 NORTH AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 10.2.5 NORTH AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 144 NORTH AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 146 NORTH AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.2.6 NORTH AMERICA: COMPOSITES MARKET, BY COUNTRY

- TABLE 148 NORTH AMERICA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 150 NORTH AMERICA: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.2.6.1 US

- 10.2.6.1.1 Rising demand for commercial & next-generation aircraft to boost market

- 10.2.6.1 US

- TABLE 152 US: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 153 US: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 154 US: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 155 US: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 156 US: NEW WIND ENERGY INSTALLATIONS, 2010-2022 (MW)

- 10.2.6.2 Canada

- 10.2.6.2.1 Demand from aerospace industry to drive market

- 10.2.6.2 Canada

- TABLE 157 CANADA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 158 CANADA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 159 CANADA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 160 CANADA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT

- FIGURE 67 EUROPE: COMPOSITES MARKET SNAPSHOT

- 10.3.2 EUROPE: COMPOSITES MARKET, BY FIBER TYPE

- TABLE 161 EUROPE: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 162 EUROPE: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 163 EUROPE: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 164 EUROPE: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.3.3 EUROPE: COMPOSITES MARKET, BY MANUFACTURING PROCESS

- TABLE 165 EUROPE: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 166 EUROPE: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 167 EUROPE: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 168 EUROPE: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- 10.3.4 EUROPE: COMPOSITES MARKET, BY RESIN TYPE

- TABLE 169 EUROPE: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 170 EUROPE: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 171 EUROPE: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 172 EUROPE: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 10.3.5 EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 173 EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 174 EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 175 EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 176 EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6 EUROPE: COMPOSITES MARKET, BY COUNTRY

- TABLE 177 EUROPE: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 178 EUROPE: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 179 EUROPE: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 180 EUROPE: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.3.6.1 Germany

- 10.3.6.1.1 Increasing demand for pressure vessels to drive market

- 10.3.6.1 Germany

- TABLE 181 GERMANY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 182 GERMANY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 183 GERMANY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 184 GERMANY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6.2 France

- 10.3.6.2.1 Growth of transportation industry to fuel market

- 10.3.6.2 France

- TABLE 185 FRANCE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 186 FRANCE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 187 FRANCE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 188 FRANCE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6.3 UK

- 10.3.6.3.1 Demand from automotive industry to drive market

- 10.3.6.3 UK

- TABLE 189 UK: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 190 UK: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 191 UK: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 192 UK: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6.4 Italy

- 10.3.6.4.1 Rising demand of composites in aircraft designs to drive market

- 10.3.6.4 Italy

- TABLE 193 ITALY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 194 ITALY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 195 ITALY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 196 ITALY: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6.5 Spain

- 10.3.6.5.1 Growth of automotive industry to drive market

- 10.3.6.5 Spain

- TABLE 197 SPAIN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 198 SPAIN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 199 SPAIN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 200 SPAIN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6.6 Russia

- 10.3.6.6.1 Increase in nuclear power plants to drive market

- 10.3.6.6 Russia

- TABLE 201 RUSSIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 202 RUSSIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 203 RUSSIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 204 RUSSIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.3.6.7 Rest of Europe

- TABLE 205 REST OF EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 206 REST OF EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 207 REST OF EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 208 REST OF EUROPE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT

- FIGURE 68 ASIA PACIFIC: COMPOSITES MARKET SNAPSHOT

- 10.4.2 ASIA PACIFIC: COMPOSITES MARKET, BY FIBER TYPE

- TABLE 209 ASIA PACIFIC: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 210 ASIA PACIFIC: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 211 ASIA PACIFIC: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.4.3 ASIA PACIFIC: COMPOSITES MARKET, BY MANUFACTURING PROCESS

- TABLE 213 ASIA PACIFIC: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 214 ASIA PACIFIC: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 215 ASIA PACIFIC: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- 10.4.4 ASIA PACIFIC: COMPOSITES MARKET, BY RESIN TYPE

- TABLE 217 ASIA PACIFIC: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 218 ASIA PACIFIC: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 219 ASIA PACIFIC: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 10.4.5 ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 221 ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 223 ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 224 ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.4.6 ASIA PACIFIC: COMPOSITES MARKET, BY COUNTRY

- TABLE 225 ASIA PACIFIC: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 227 ASIA PACIFIC: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.4.6.1 China

- 10.4.6.1.1 Presence of large-scale manufacturing facilities to increase demand for composites

- 10.4.6.1 China

- TABLE 229 CHINA: NEW WIND ENERGY INSTALLATIONS, 2010-2022 (MW)

- TABLE 230 CHINA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 231 CHINA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 232 CHINA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 233 CHINA: COMPOSITES MARKET, BY END USE INDUSTRY, 2023-2028 (KILOTON)

- 10.4.6.2 Japan

- 10.4.6.2.1 Increasing demand from automotive and transportation industry to drive market

- 10.4.6.2 Japan

- TABLE 234 JAPAN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 235 JAPAN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 236 JAPAN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 237 JAPAN: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.4.6.3 India

- 10.4.6.3.1 Inexpensive labor and availability of raw materials to drive market

- 10.4.6.3 India

- TABLE 238 INDIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 239 INDIA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 240 INDIA: COMPOSITES MARKET, BY END USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 241 INDIA: COMPOSITES MARKET, BY END USE INDUSTRY, 2023-2028 (KILOTON)

- 10.4.6.4 South Korea

- 10.4.6.4.1 Rising demand for composites in wind energy and automotive industry to drive market

- 10.4.6.4 South Korea

- TABLE 242 SOUTH KOREA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 243 SOUTH KOREA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 244 SOUTH KOREA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 245 SOUTH KOREA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.4.6.5 Rest of Asia Pacific

- TABLE 246 REST OF ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 248 REST OF ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.5 LATIN AMERICA

- 10.5.1 RECESSION IMPACT

- FIGURE 69 LATIN AMERICA: COMPOSITES MARKET SNAPSHOT

- 10.5.2 LATIN AMERICA: COMPOSITES MARKET, BY FIBER TYPE

- TABLE 250 LATIN AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 251 LATIN AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 252 LATIN AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 253 LATIN AMERICA: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.5.3 LATIN AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS

- TABLE 254 LATIN AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 255 LATIN AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 256 LATIN AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- 10.5.4 LATIN AMERICA: COMPOSITES MARKET, BY RESIN TYPE

- TABLE 258 LATIN AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 259 LATIN AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 260 LATIN AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 261 LATIN AMERICA: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 10.5.5 LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 262 LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 263 LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 264 LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.5.6 LATIN AMERICA: COMPOSITES MARKET, BY COUNTRY

- TABLE 266 LATIN AMERICA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 267 LATIN AMERICA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 268 LATIN AMERICA: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.5.6.1 Brazil

- 10.5.6.1.1 Growing electricity demand to drive market

- 10.5.6.1 Brazil

- TABLE 270 BRAZIL: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 271 BRAZIL: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 272 BRAZIL: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 273 BRAZIL: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.5.6.2 Mexico

- 10.5.6.2.1 Growing demand for pressure vessels to boost market

- 10.5.6.2 Mexico

- TABLE 274 MEXICO: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 275 MEXICO: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 276 MEXICO: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 277 MEXICO: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.5.6.3 Rest of Latin America

- TABLE 278 REST OF LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 280 REST OF LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT

- FIGURE 70 MIDDLE EAST & AFRICA: COMPOSITES MARKET SNAPSHOT

- 10.6.2 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY FIBER TYPE

- TABLE 282 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 284 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.6.3 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS

- TABLE 286 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 288 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- 10.6.4 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY RESIN TYPE

- TABLE 290 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 292 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 10.6.5 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 294 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 296 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.6.6 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY COUNTRY

- TABLE 298 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 300 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.6.6.1 GCC Countries

- 10.6.6.2 Saudi Arabia

- 10.6.6.2.1 Increasing demand from tanks & pressure vessels industry to drive market

- TABLE 302 SAUDI ARABIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 303 SAUDI ARABIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 304 SAUDI ARABIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 305 SAUDI ARABIA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.6.6.3 UAE

- 10.6.6.3.1 Rise in infrastructure and building projects to drive market

- 10.6.6.3 UAE

- TABLE 306 UAE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 307 UAE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 308 UAE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 309 UAE: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.6.6.4 Rest of GCC countries

- TABLE 310 REST OF GCC COUNTRIES: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 311 REST OF GCC COUNTRIES: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 312 REST OF GCC COUNTRIES: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 313 REST OF GCC COUNTRIES: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.6.6.5 South Africa

- 10.6.6.5.1 Growth of construction industry to drive market

- 10.6.6.5 South Africa

- TABLE 314 SOUTH AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 315 SOUTH AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 316 SOUTH AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 317 SOUTH AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 10.6.6.6 Rest of Middle East & Africa

- TABLE 318 REST OF MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 320 REST OF MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 321 REST OF MIDDLE EAST & AFRICA: COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 322 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPOSITE MARKET VENDORS

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 MARKET SHARE ANALYSIS FOR MAJOR CARBON FIBER COMPOSITE MANUFACTURERS

- FIGURE 71 MARKET SHARE OF TOP COMPANIES IN CARBON FIBER COMPOSITES MARKET

- TABLE 323 CARBON FIBER COMPOSITES MARKET: DEGREE OF COMPETITION

- 11.3.2 MARKET SHARE ANALYSIS FOR MAJOR GLASS FIBER COMPOSITE MANUFACTURERS

- FIGURE 72 MARKET SHARE OF TOP COMPANIES IN GLASS FIBER COMPOSITES MARKET

- TABLE 324 GLASS FIBER COMPOSITES MARKET: DEGREE OF COMPETITION

- 11.4 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 73 COMPOSITES MARKET: TOP TRENDING BRAND/PRODUCTS

- 11.4.1 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY COMPOSITE PRODUCTS

- FIGURE 74 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY COMPOSITE PRODUCTS

- 11.4.1.1 ShieldStrand S

- 11.4.1.2 Toray Cetex

- 11.4.1.3 CYFORM

- 11.4.1.4 Sereebo

- 11.4.1.5 SPRINT CBS 96

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 75 COMPOSITES MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT

- FIGURE 76 COMPANY PRODUCT FOOTPRINT (10 COMPANIES)

- TABLE 325 COMPANY END-USE INDUSTRY FOOTPRINT (10 COMPANIES)

- TABLE 326 COMPANY FIBER TYPE FOOTPRINT (10 COMPANIES)

- TABLE 327 COMPANY RESIN TYPE FOOTPRINT (10 COMPANIES)

- TABLE 328 COMPANY REGION FOOTPRINT (18 COMPANIES)

- 11.6 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 77 COMPOSITES MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 329 COMPOSITE MARKET: KEY STARTUPS/SMES (10 COMPANIES)

- 11.8 VALUATION AND FINANCIAL METRICS OF COMPOSITES VENDORS

- FIGURE 78 EV/EBITDA OF KEY VENDORS

- FIGURE 79 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- 11.9 COMPETITIVE SCENARIO

- TABLE 330 COMPOSITES MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2022

- TABLE 331 COMPOSITES MARKET: DEALS, 2018-2023

- TABLE 332 COMPOSITES MARKET: EXPANSION, 2018-2022

- TABLE 333 COMPOSITES MARKET: OTHER DEVELOPMENTS, 2018-2022

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 KEY COMPANIES

- 12.1.1 OWENS CORNING

- TABLE 334 OWENS CORNING: COMPANY OVERVIEW

- FIGURE 80 OWENS CORNING: COMPANY SNAPSHOT

- TABLE 335 OWENS CORNING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 OWENS CORNING: DEALS

- TABLE 337 OWENS CORNING: OTHER DEVELOPMENTS

- 12.1.2 TORAY INDUSTRIES, INC.

- TABLE 338 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 81 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 339 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 TORAY INDUSTRIES, INC.: DEALS

- TABLE 341 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 342 TORAY INDUSTRIES, INC.: PRODUCTS LAUNCHES

- 12.1.3 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

- TABLE 343 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 82 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 344 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: RODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 345 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: DEALS

- TABLE 346 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 347 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: PRODUCT LAUNCHES

- 12.1.4 SOLVAY S.A.

- TABLE 348 SOLVAY S.A.: COMPANY OVERVIEW

- FIGURE 83 SOLVAY S.A.: COMPANY SNAPSHOT

- TABLE 349 SOLVAY S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 SOLVAY S.A.: DEALS

- TABLE 351 SOLVAY S.A.: OTHER DEVELOPMENTS

- TABLE 352 SOLVAY S.A: PRODUCT DEVELOPMENT

- 12.1.5 TEIJIN LIMITED

- TABLE 353 TEIJIN LIMITED: COMPANY OVERVIEW

- FIGURE 84 TEIJIN LIMITED: COMPANY SNAPSHOT

- TABLE 354 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 TEIJIN LIMITED: DEALS

- TABLE 356 TEIJIN LIMITED: OTHER DEVELOPMENTS

- TABLE 357 TEIJIN LIMITED: PRODUCT LAUNCHES

- 12.1.6 SGL CARBON SE

- TABLE 358 SGL CARBON SE: COMPANY OVERVIEW

- FIGURE 85 SGL CARBON SE: COMPANY SNAPSHOT

- TABLE 359 SGL CARBON SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 SGL CARBON SE: DEALS

- TABLE 361 SGL CARBON SE: OTHER DEVELOPMENTS

- TABLE 362 SGL CARBON SE: PRODUCT LAUNCHES

- 12.1.7 HEXCEL CORPORATION

- TABLE 363 HEXCEL CORPORATION: COMPANY OVERVIEW

- FIGURE 86 HEXCEL CORPORATION: COMPANY SNAPSHOT

- TABLE 364 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 HEXCEL CORPORATION: DEALS

- TABLE 366 HEXCEL CORPORATION: OTHER DEVELOPMENTS

- TABLE 367 HEXCEL CORPORATION: PRODUCT LAUNCHES

- 12.1.8 NIPPON ELECTRIC GLASS CO., LTD.

- TABLE 368 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- FIGURE 87 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

- TABLE 369 NIPPON ELECTRIC GLASS CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 NIPPON ELECTRIC GLASS CO., LTD: DEALS

- TABLE 371 NIPPON ELECTRIC GLASS CO., LTD.: PRODUCT LAUNCHES

- TABLE 372 NIPPON ELECTRIC GLASS CO., LTD.: OTHER DEVELOPMENTS

- 12.1.9 HUNTSMAN INTERNATIONAL LLC

- TABLE 373 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- FIGURE 88 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- TABLE 374 HUNTSMAN INTERNATIONAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 HUNTSMAN INTERNATIONAL LLC: DEALS

- TABLE 376 HUNTSMAN INTERNATIONAL LLC: PRODUCT LAUNCHES

- 12.1.10 GURIT HOLDING AG

- TABLE 377 GURIT HOLDING AG: COMPANY OVERVIEW

- FIGURE 89 GURIT HOLDING AG: COMPANY SNAPSHOT

- TABLE 378 GURIT HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 GURIT HOLDING AG: DEALS

- 12.1.11 WEYERHAEUSER COMPANY

- TABLE 380 WEYERHAEUSER COMPANY: COMPANY OVERVIEW

- FIGURE 90 WEYERHAEUSER COMPANY: COMPANY SNAPSHOT

- TABLE 381 WEYERHAEUSER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 WEYERHAEUSER COMPANY: PRODUCT LAUNCHES

- 12.1.12 CHINA JUSHI CO., LTD.

- TABLE 383 CHINA JUSHI CO., LTD.: COMPANY OVERVIEW

- FIGURE 91 CHINA JUSHI CO., LTD.: COMPANY SNAPSHOT

- TABLE 384 CHINA JUSHI CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 CHINA JUSHI CO., LTD.: PRODUCT LAUNCHES

- TABLE 386 CHINA JUSHI CO., LTD.: DEALS

- TABLE 387 CHINA JUSHI CO., LTD.: OTHER DEVELOPMENTS

- 12.1.13 AGY

- TABLE 388 AGY: COMPANY OVERVIEW

- TABLE 389 AGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 390 AGY: OTHER DEVELOPMENTS

- 12.1.14 TAISHAN FIBERGLASS INC. (CTG GROUP)

- TABLE 391 TAISHAN FIBERGLASS INC. (CTG GROUP): COMPANY OVERVIEW

- TABLE 392 TAISHAN FIBERGLASS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 TAISHAN FIBERGLASS INC. (CTG GROUP): PRODUCT LAUNCHES

- TABLE 394 TAISHAN FIBERGLASS INC. (CTG): DEALS

- TABLE 395 TAISHAN FIBERGLASS INC. (CTG GROUP): OTHER DEVELOPMENTS

- 12.1.15 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)

- TABLE 396 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): COMPANY OVERVIEW

- TABLE 397 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): PRODUCT LAUNCHES

- TABLE 399 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): DEALS

- 12.1.16 SAINT-GOBAIN

- TABLE 400 SAINT-GOBAIN: COMPANY OVERVIEW

- FIGURE 92 SAINT-GOBAIN: COMPANY SNAPSHOT

- TABLE 401 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 402 SAINT-GOBAIN: PRODUCT LAUNCHES

- TABLE 403 SAINT-GOBAIN: DEALS

- TABLE 404 SAINT-GOBAIN: OTHER DEVELOPMENTS

- 12.1.17 INEOS CAPITAL LIMITED

- TABLE 405 INEOS CAPITAL LIMITED.: COMPANY OVERVIEW

- FIGURE 93 INEOS CAPITAL LIMITED: COMPANY SNAPSHOT

- TABLE 406 INEOS CAPITAL LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 407 INEOS CAPITAL LIMITED: PRODUCT LAUNCHES

- TABLE 408 INEOS CAPITAL LIMITED: OTHER DEVELOPMENTS

- 12.1.18 HEXION

- TABLE 409 HEXION: COMPANY OVERVIEW

- TABLE 410 HEXION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 411 HEXION INC.: DEALS

- TABLE 412 HEXION INC.: PRODUCT LAUNCHES

- TABLE 413 HEXION INC.: OTHER DEVELOPMENTS

- 12.1.19 ASAHI FIBER GLASS CO., LTD.

- TABLE 414 ASAHI FIBER GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 415 ASAHI FIBER GLASS CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 416 ASAHI FIBER GLASS CO., LTD.: OTHER DEVELOPMENTS

- 12.1.20 HYOSUNG ADVANCED MATERIALS

- TABLE 417 HYOSUNG ADVANCED MATERIALS: COMPANY OVERVIEW

- FIGURE 94 HYOSUNG ADVANCED MATERIALS: COMPANY SNAPSHOT

- TABLE 418 HYOSUNG ADVANCED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 419 HYOSUNG ADVANCED MATERIALS: PRODUCT LAUNCHES

- TABLE 420 HYOSUNG ADVANCED MATERIALS: DEALS

- TABLE 421 HYOSUNG ADVANCED MATERIALS: OTHER DEVELOPMENTS

- 12.1.21 ZHONGFU SHENYING CARBON FIBER CO., LTD.

- TABLE 422 ZHONGFU SHENYING CARBON FIBER CO., LTD.: COMPANY OVERVIEW

- FIGURE 95 ZHONGFU SHENYING CARBON FIBER CO., LTD.: COMPANY SNAPSHOT

- TABLE 423 ZHONGFU SHENYING CARBON FIBER CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 424 ZHONGFU SHENYING CARBON FIBER CO., LTD.: OTHER DEVELOPMENTS

- 12.1.22 KUREHA CORPORATION

- TABLE 425 KUREHA CORPORATION: COMPANY OVERVIEW

- FIGURE 96 KUREHA CORPORATION: COMPANY SNAPSHOT

- TABLE 426 KUREHA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.23 DOWAKSA

- TABLE 427 DOWAKSA: COMPANY OVERVIEW

- TABLE 428 DOWAKSA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 429 DOWAKSA: OTHER DEVELOPMENTS

- 12.1.24 JILIN CHEMICAL FIBER GROUP CO., LTD.

- TABLE 430 JILIN CHEMICAL FIBER GROUP CO., LTD.: COMPANY OVERVIEW

- FIGURE 97 JILIN CHEMICAL FIBER GROUP CO., LTD.: COMPANY SNAPSHOT

- TABLE 431 JILIN CHEMICAL FIBER GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.25 JIANGSU HENGSHEN CO., LTD.

- TABLE 432 JIANGSU HENGSHEN CO., LTD.: COMPANY OVERVIEW

- TABLE 433 JIANGSU HENGSHEN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 434 JIANGSU HENGSHEN CO., LTD.: PRODUCT LAUNCHES

- TABLE 435 JIANGSU HENGSHEN CO., LTD.: DEALS

- TABLE 436 JIANGSU HENGSHEN CO., LTD.: OTHER DEVELOPMENTS

- 12.1.26 ZHEJIANG SHIJIN BASALT FIBER CO., LTD. (GBF)

- TABLE 437 ZHEJIANG SHIJIN BASALT FIBER CO., LTD. (GBF): COMPANY OVERVIEW

- TABLE 438 ZHEJIANG SHIJIN BASALT FIBER CO., LTD. (GBF): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 439 ZHEJIANG SHIJIN BASALT FIBER CO., LTD. (GBF): PRODUCT LAUNCHES

- TABLE 440 ZHEJIANG SHIJIN BASALT FIBER CO., LTD. (GBF): DEALS

- 12.1.27 MAFIC

- TABLE 441 MAFIC: COMPANY OVERVIEW

- TABLE 442 MAFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.28 KAMENNY VEK

- TABLE 443 KAMENNY VEK: COMPANY OVERVIEW

- TABLE 444 KAMENNY VEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 445 KAMENNY VEK: PRODUCT LAUNCHES

- 12.1.29 TECHNOBASALT INVEST

- TABLE 446 TECHNOBASALT INVEST: COMPANY OVERVIEW

- TABLE 447 TECHNOBASALT INVEST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.30 ISOMATEX

- TABLE 448 ISOMATEX: COMPANY OVERVIEW

- TABLE 449 ISOMATEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.31 POLYVLIES FRANZ BEYER GMBH & CO. KG

- TABLE 450 POLYVLIES FRANZ BEYER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 451 POLYVLIES FRANZ BEYER GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.32 TECNARO GMBH

- TABLE 452 TECNARO GMBH: COMPANY OVERVIEW

- TABLE 453 TECNARO GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 454 TECNARO GMBH: DEALS

- 12.1.33 PROCOTEX SA CORPORATION NV

- TABLE 455 PROCOTEX SA CORPORATION NV: COMPANY OVERVIEW

- TABLE 456 PROCOTEX SA CORPORATION NV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.34 FLEXFORM TECHNOLOGIES

- TABLE 457 FLEXFORM TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 458 FLEXFORM TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.35 JELU-WERK JOSEF EHRLER GMBH & CO. KG

- TABLE 459 JELU-WERK JOSEF EHRLER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 460 JELU-WERK JOSEF EHRLER GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.36 MAGNA INTERNATIONAL INC.

- TABLE 461 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 462 MAGNA INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 463 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 464 MAGNA INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 465 MAGNA INTERNATIONAL INC.: OTHER DEVELOPMENTS

- 12.1.37 STRONGWELL CORPORATION (COMPOSITE PART MANUFACTURERS)

- TABLE 466 STRONGWELL CORPORATION: COMPANY OVERVIEW

- TABLE 467 STRONGWELL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 468 STRONGWELL CORPORATION: DEALS

- TABLE 469 STRONGWELL CORPORATION: OTHER DEVELOPMENTS

- 12.1.38 SPIRIT AEROSYSTEMS (COMPOSITE PART MANUFACTURERS)

- TABLE 470 SPIRIT AEROSYSTEMS: COMPANY OVERVIEW

- TABLE 471 SPIRIT AEROSYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 472 SPIRIT AEROSYSTEMS: DEALS

- TABLE 473 SPIRIT AEROSYSTEMS: PRODUCT LAUNCHES

- TABLE 474 SPIRIT AEROSYSTEMS: OTHER DEVELOPMENTS

- 12.1.39 EXEL COMPOSITES

- TABLE 475 EXEL COMPOSITES: COMPANY OVERVIEW

- TABLE 476 EXEL COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 477 EXEL COMPOSITES: DEALS

- 12.2 OTHER KEY PLAYERS

- 12.2.1 BPREG COMPOSITES

- TABLE 478 BPREG COMPOSITES: COMPANY OVERVIEW

- 12.2.2 BCOMP LTD.

- TABLE 479 BCOMP LTD.: COMPANY OVERVIEW

- 12.2.3 INFINITUM COMPOSITES SIA

- TABLE 480 INFINITUM COMPOSITES SIA: COMPANY OVERVIEW

- 12.2.4 FIBRAWORKS GMBH

- TABLE 481 FIBRAWORKS GMBH: COMPANY OVERVIEW

- 12.2.5 ATOMIC-6

- TABLE 482 ATOMIC-6: COMPANY OVERVIEW

- 12.2.6 AEON-T

- TABLE 483 AEON-T: COMPANY OVERVIEW

- 12.2.7 NOVA CARBON

- TABLE 484 NOVA CARBON: COMPANY OVERVIEW

- 12.2.8 ANTEFIL COMPOSITE TECH AG

- TABLE 485 ANTEFIL COMPOSITE TECH AG: COMPANY OVERVIEW

- 12.2.9 MIDWEST COMPOSITES

- TABLE 486 MIDWEST COMPOSITES: COMPANY OVERVIEW

- 12.2.10 RRTC, INC.

- TABLE 487 RRTC, INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS