|

|

市場調査レポート

商品コード

1443450

V2Xサイバーセキュリティの世界市場:形態、通信タイプ、セキュリティフレームワーク、セキュリティタイプ、コネクティビティタイプ、推進区分、車両タイプ、地域別 - 予測(~2030年)V2X Cybersecurity Market by Form, Communication Type, Security Framework, Security type, Connectivity Type, Propulsion, Vehicle Type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| V2Xサイバーセキュリティの世界市場:形態、通信タイプ、セキュリティフレームワーク、セキュリティタイプ、コネクティビティタイプ、推進区分、車両タイプ、地域別 - 予測(~2030年) |

|

出版日: 2024年02月29日

発行: MarketsandMarkets

ページ情報: 英文 269 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のV2Xサイバーセキュリティの市場規模は、2023年の4,200万米ドルから、予測期間中に51.3%のCAGRで推移し、2030年には7,780億米ドルの規模に成長すると予測されています。

同市場の成長は、コネクテッドカーに対する需要の増加と自動車V2X市場の大幅な拡大が原動力となっています。さらに、V2X技術を推進する政府のイニシアティブに支えられた電気自動車の販売急増もV2Xサイバーセキュリティ市場に新たな機会をもたらすと期待されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 形態・通信タイプ・セキュリティフレームワーク・セキュリティタイプ・コネクティビティタイプ・推進区分・車両タイプ・地域別 |

| 対象地域 | アジア太平洋・欧州・北米・その他の地域 |

通信別では、V2Vの部門が予測期間中に最大の規模を示す見通しです。V2V通信は、車両が位置、方向、速度に関する情報を共有することを可能にする無線インタラクションです。この通信は全方位のメッセージ交換を容易にし、車両に近隣車両の360度の認識を提供します。V2V通信は現在、DSRCを利用しており、5.9GHz帯で動作し、通信距離は300メートルを超えます。米国運輸省によると、V2V技術は年間約615,000件の自動車事故を防ぐ可能性があるといいます。V2Vは、前方衝突警報 (FCW)、死角警告 (BSW)、車線変更警告 (LCW)、追い越し禁止警告 (DNPW) などの安全警告機能を強化します。交差点移動アシスト (IMA)、左折アシスト (LTA)、緊急電子ブレーキライトなどの安全用途もV2Vによって実現されます。V2V通信の主な利点には、交通渋滞の緩和、交通安全の強化、車両の流れの合理化などがあります。

地域別では、欧州が予測期間中に大きな成長を示すと予測されています。欧州は、厳格な安全規制とV2X技術を搭載したコネクテッドカーに対する需要の高まりにより、大きく成長すると予測されています。また、自動車業界のコネクテッドカーへの移行と金融危機からの回復も同市場の大幅な成長に寄与する見通しです。ドイツは、強固なインフラとOEMのコミットメントの恩恵を受け、コネクテッドカーとサイバーセキュリティソリューションの市場としてもっとも急成長すると予測されています。

当レポートでは、世界のV2Xサイバーセキュリティの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場力学の影響

- サプライチェーン分析

- 主なステークホルダーと購入基準

- V2Xサイバーセキュリティの脅威とソリューション

- 技術分析

- エコシステムマッピング

- 投資シナリオ

- 自動車V2X市場の発展:OEM別

- V2X攻撃の主な特徴

- V2X通信のセキュリティ評価および仮想化プラットフォーム

- 顧客のビジネスに影響を与える動向とディスラプション

- 特許分析

- ケーススタディ

- 規制状況

- 主な会議とイベント

第6章 自動車V2X市場:コネクティビティ別

- DSRC

- C-V2X

- 主要洞察

第7章 V2Xサイバーセキュリティ市場:通信別

- V2V

- V2I

- V2P

- V2G

- 主要洞察

第8章 V2Xサイバーセキュリティ市場:車両タイプ別

- 乗用車

- 商用車

- 主要洞察

第9章 V2Xサイバーセキュリティ市場:セキュリティフレームワーク別

- 公開鍵インフラストラクチャ (PKI)

- 埋め込み

- 主要洞察

第10章 V2Xサイバーセキュリティ市場:形態別

- 車載

- 外部クラウドサービス

- 主要洞察

第11章 V2Xサイバーセキュリティ市場:推進区分別

- 内燃機関 (ICE)

- 電気

- 主要洞察

第12章 V2Xサイバーセキュリティ市場:セキュリティタイプ別

- エンドポイントセキュリティ

- ソフトウェアセキュリティ

- クラウドセキュリティ

- 主要洞察

第13章 V2Xサイバーセキュリティ市場:地域別

- アジア太平洋

- 欧州

- 北米

- その他の地域

第14章 競合情勢

- 概要

- 主要企業の採用戦略

- ランキング分析

- 収益分析

- 企業評価と財務指標

- ブランド/製品の比較

- 企業評価マトリックス

- 新興企業/中小企業評価マトリックス

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- ESCRYPT GMBH

- QUALCOMM INCORPORATEDS

- AUTOTALKS

- AUTOCRYPT CO., LTD.

- CONTINENTAL AG

- GREEN HILLS SOFTWARE

- KARAMBA SECURITY

- ID QUANTIQUE

- NXP SEMICONDUCTORS N.V.

- INFINEON TECHNOLOGIES AG

- HARMAN INTERNATIONAL

- APTIV PLC

- その他の主要企業

- ATOS SE

- SECUNET SECURITY NETWORKS AG

- CAPGEMINI ENGINEERING

- VECTOR INFORMATIK GMBH

- STMICROELECTRONICS

- LEAR CORPORATION

- CERTICOM CORP

- DENSO CORPORATION

- SAFERIDE TECHNOLOGIES LTD.

第16章 MARKETSANDMARKETSによる推奨事項

- アジア太平洋がV2Xサイバーセキュリティの最大市場に

- インテリジェント交通の未来を推進するC-V2X技術

- V2G通信が有望な技術として登場

- 総論

第17章 付録

The global V2X cybersecurity market is projected to grow from USD 42 million in 2023 to USD 778 billion by 2030, at a CAGR of 51.3%. The growth of the V2X cybersecurity market is driven by the increasing demand for connected vehicles and the significant expansion of the automotive V2X market. Additionally, the surging sales of electric vehicles, supported by governmental initiatives promoting V2X technology, are expected to open up new opportunities for the V2X cybersecurity market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD Million) |

| Segments | Form, Communication Type, Security Framework, Security type, Connectivity Type, Propulsion, Vehicle Type and Region |

| Regions covered | Asia Pacific, Europe, North America, and RoW |

"V2V segment is expected to be the largest market during the forecast period, by communication."

Vehicle-to-Vehicle (V2V) communication is a wireless interaction enabling vehicles to share information regarding their location, direction, and speed. This communication facilitates the exchange of omnidirectional messages, providing vehicles with a 360-degree awareness of nearby vehicles. V2V communication, currently utilizing Dedicated Short Range Communication (DSRC), operates within the 5.9 GHz spectrum with a range exceeding 300 meters. According to the US Department of Transportation, V2V technology has the potential to prevent around 615,000 motor vehicle crashes annually. V2V enhances safety warning capabilities, including forward collision warning (FCW), blind spot warning (BSW), lane changing warning (LCW), and do-not-pass warning (DNPW). Safety applications such as Intersection Movement Assist (IMA), Left Turn Assist (LTA), and Emergency Electronic Brake Light are achieved through V2V. The primary advantages of V2V communication include reduced traffic congestion, enhanced road safety, and streamlined vehicle flow. However, securing these communications poses challenges for cybersecurity solution providers. While V2V is instrumental in traffic optimization, unauthorized access or remote tampering by hackers can disrupt traffic conditions. Tampered information received by vehicles may compromise their safety features, particularly in vehicles with automatic driver assist features. To avert such scenarios, cybersecurity solution providers must prioritize the security of V2V communications.

"Europe is expected to have significant growth during the forecast period."

Europe emerges as a significant growth prospect for the V2X cybersecurity market, driven by stringent safety regulations and a rising demand for connected cars featuring V2X technologies. The market is anticipated to experience substantial growth in this region, supported by the automotive industry's inclination towards connected vehicles and recovery from the financial crisis. Germany is projected to be the fastest-growing market for connected cars and cybersecurity solutions, benefiting from the robust infrastructure and commitment of Original Equipment Manufacturers (OEMs) in the region. To bolster the competitiveness of the EU automotive sector and uphold global technological leadership, the European Commission promotes technological harmonization and allocates funds for Research and Development (R&D). The German automotive industry, renowned as a global innovation hub, contributes significantly to premium car production worldwide, with German OEMs manufacturing around 70% of premium cars globally. The region's extensive R&D landscape, technological prowess, and a wealth of automotive electronics-related study programs reinforce its dominance in connectivity, vehicle electronics, self-driving cars, and cybersecurity. The development of intelligent transportation systems further propels the V2X cybersecurity market in Europe. Prominent European vehicle manufacturers like Daimler AG and Volkswagen AG have integrated V2X technology into their vehicles. The European market benefits from the presence of key players in the V2X cybersecurity sector, including ESCRYPT GmbH, ID Quantique, and Altran, contributing to its growth throughout the forecast period.

"Passenger car expected to be the largest segment in V2X cybersecurity market during the forecast period"

Passenger cars, encompassing sedans, hatchbacks, station wagons, sports utility vehicles, multi-utility vehicles, and vans, constitute the largest vehicle segment in the global automotive industry and represent a highly promising market for automotive V2X. With a maximum authorized mass below 3.5 tons, this segment has witnessed rapid growth, particularly in developing countries like China and India. Leading automotive manufacturers are increasing their investments in these countries, leveraging available resources, cost-effective skilled labor, existing auto-ancillary businesses, and favorable government policies for production and trade. The susceptibility of V2X technologies in passenger cars to cyberattacks is notable, especially compared to commercial vehicles, owing to the prevalence of connected technology in passenger cars. In-vehicle communication systems, along with a broad array of external networks such as Wi-Fi and cellular connectivity, expose passenger cars to increased vulnerability to cyber threats. Connected passenger cars generate substantial data from diverse sources, engaging in interactions with other vehicles, exchanging data, and providing drivers with real-time updates. Additionally, these cars can communicate with road sensors, charging stations, and embedded road infrastructure (RSUs) for traffic updates and rerouting alerts. V2X-enabled passenger cars extend their communication to residences, offices, and smart devices, collecting a vast array of information. Consequently, the imperative for cybersecurity in passenger cars becomes paramount, particularly given the extensive transfer of V2V and V2I data. The escalating concerns over road accidents and traffic safety are anticipated to drive the adoption of advanced technologies such as Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), and Vehicle-to-Pedestrian (V2P). However, these communications remain vulnerable to cyberattacks as they involve the exchange of information with vehicles, pedestrians, and infrastructures, propelling the growth of the V2X cybersecurity market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 21%, Tier I - 31%, and Tier II - 48%

- By Designation: CXOs - 40%, Directors - 35%, and Others - 25%

- By Region: North America - 30%, Europe - 50%, Asia Pacific - 15%, and RoW - 5%

The V2X cybersecurity market is dominated by major players including ESCRYPT GmbH (Germany), Qualcomm Incorporated (US), Autotalks (Israel), AUTOCRYPT Co., Ltd. (Korea), and Continental AG (Germany). These companies have strong product portfolio as well as strong distribution networks at the global level.

Research Coverage:

The report covers the V2X cybersecurity market, in terms of Connectivity (DSRC, and Cellular), Communication (V2V, V2I, V2P, and V2G), Vehicle Type (Passenger Cars, and Commercial Vehicles), Security Framework (PKI, and Embedded), Form (In-Vehicle, and External Cloud Services), Propulsion (Internal Combustion Engines, and Electric Vehicles), Security Type (Endpoint Security, Software Security, and Cloud Security), and Region (Asia Pacific, Europe, North America, and Row). It covers the competitive landscape and company profiles of the major players in the V2X cybersecurity market ecosystem.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall V2X cybersecurity market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of different V2X cybersecurity systems based on their capacity.

The report provides insight on the following pointers:

- Analysis of key drivers (Large amount of data generated by vehicles and increasing cyberattacks, Significantly growing global automotive V2X market, Increasing demand for fully autonomous driving and safe vehicles, Reinforcement of mandates by regulatory bodies for vehicle data protection), restraints (Complex ecosystem with multiple stakeholders, Lack of infrastructure for proper functioning of V2X, Underdeveloped regulatory frameworks in V2X cybersecurity), challenges (Need for keeping up with continuous evolutions in V2X ecosystem, Legacy systems and cybersecurity mismatch), and opportunities (Increasing trend of connected and autonomous vehicle technologies prone to cyberattacks, Rising demand for electric vehicles, Specialized coverage for v2x cybersecurity challenges).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive V2X market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the V2X cybersecurity market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the V2X cybersecurity market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like ESCRYPT GmbH (Germany), Qualcomm Incorporated (US), Autotalks (Israel), AUTOCRYPT Co., Ltd. (Korea), and Continental AG (Germany) among others in V2X cybersecurity market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 MARKET DEFINITION, BY COMMUNICATION

- TABLE 2 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 MARKET DEFINITION, BY CONNECTIVITY

- TABLE 4 MARKET DEFINITION, BY PROPULSION

- TABLE 5 MARKET DEFINITION, BY SECURITY FRAMEWORK

- TABLE 6 MARKET DEFINITION, BY SECURITY FORM

- TABLE 7 MARKET DEFINITION, BY SECURITY TYPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 8 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 V2X CYBERSECURITY MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 9 CURRENCY EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews from demand and supply sides

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION NOTES

- 2.2.3 RECESSION IMPACT ANALYSIS

- FIGURE 8 RESEARCH DESIGN AND METHODOLOGY (DEMAND-SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

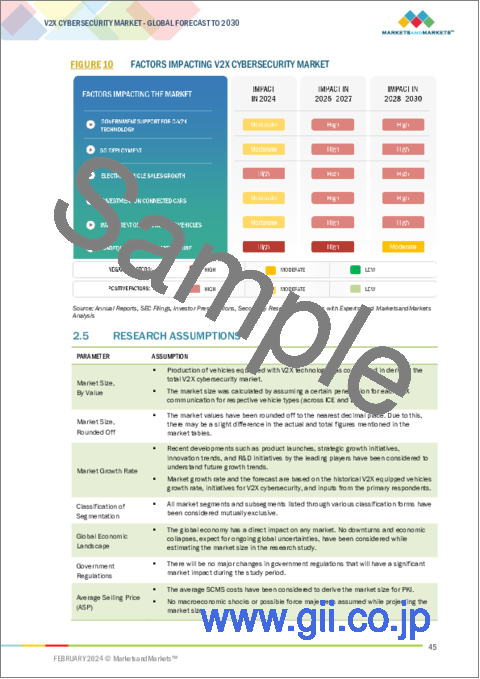

- FIGURE 10 FACTORS IMPACTING V2X CYBERSECURITY MARKET

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 10 C-V2X-EQUIPPED VEHICLES

- FIGURE 11 V2X CYBERSECURITY MARKET OVERVIEW

- FIGURE 12 V2X CYBERSECURITY MARKET, BY REGION, 2023-2030

- FIGURE 13 KEY PLAYERS IN V2X CYBERSECURITY MARKET

- FIGURE 14 V2X CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2030

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN V2X CYBERSECURITY MARKET

- FIGURE 15 INCREASING INCLINATION TOWARD AUTONOMOUS MOBILITY AND CONNECTED CAR TECHNOLOGY

- 4.2 V2X CYBERSECURITY MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO BE LARGEST MARKET FOR V2X CYBERSECURITY DURING FORECAST PERIOD

- 4.3 V2X CYBERSECURITY MARKET, BY COMMUNICATION

- FIGURE 17 V2V SEGMENT TO HOLD MAXIMUM MARKET SHARE IN 2030

- 4.4 V2X CYBERSECURITY MARKET, BY CONNECTIVITY

- FIGURE 18 C-V2X TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.5 V2X CYBERSECURITY MARKET, BY PROPULSION

- FIGURE 19 ELECTRIC TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.6 V2X CYBERSECURITY MARKET, BY SECURITY FRAMEWORK

- FIGURE 20 EMBEDDED SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- 4.7 V2X CYBERSECURITY MARKET, BY SECURITY TYPE

- FIGURE 21 SOFTWARE SECURITY TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.8 V2X CYBERSECURITY MARKET, BY VEHICLE TYPE

- FIGURE 22 PASSENGER CARS TO ACQUIRE LARGEST MARKET SHARE IN 2030

- 4.9 V2X CYBERSECURITY MARKET, BY FORM

- FIGURE 23 IN-VEHICLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 24 PRIVACY CONCERNS IN V2X COMMUNICATION

- FIGURE 25 ATTACK VECTORS AGAINST V2X ENVIRONMENT

- 5.2 MARKET DYNAMICS

- FIGURE 26 V2X CYBERSECURITY MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising cyberattacks in automotive sector

- FIGURE 27 DATA FROM AUTONOMOUS VEHICLES

- 5.2.1.2 Booming global automotive V2X market

- FIGURE 28 KEY ELEMENTS OF V2X

- FIGURE 29 CLASSIFICATION OF V2X CYBERSECURITY THREATS

- 5.2.1.3 Advancements in autonomous vehicle technologies

- FIGURE 30 VEHICULAR NETWORK ARCHITECTURE

- TABLE 11 SAFETY FACTS CONCERNING V2X COMMUNICATION

- FIGURE 31 ROAD TRAFFIC INJURIES

- 5.2.1.4 Reinforcement of mandates by regulatory bodies for vehicle data protection

- FIGURE 32 CYBER VULNERABILITIES IN VEHICULAR ECOSYSTEM

- TABLE 12 BASE STANDARDS FOR SECURITY AND PRIVACY IN ETSI'S INTELLIGENT TRANSPORT SYSTEMS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complex integration of V2X system components

- FIGURE 33 IMPACT OF CYBERATTACKS ON VARIOUS STAKEHOLDERS

- 5.2.2.2 Lack of dedicated infrastructure for V2X communication in emerging economies

- FIGURE 34 POPULATION COVERAGE, BY MOBILE NETWORK AND AREA, 2023

- 5.2.2.3 Underdeveloped regulatory frameworks for V2X cybersecurity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing trend of connected and autonomous vehicle technologies

- FIGURE 35 EVOLUTION OF V2X USE CASES TOWARD CONNECTED COOPERATIVE DRIVING

- FIGURE 36 CYBERATTACK VECTORS COMMUNICATION FRAMEWORK

- 5.2.3.2 Rapid adoption of electric vehicles

- TABLE 13 PROJECTS UNDERTAKEN BY VARIOUS COMPANIES FOR V2G AND VPP

- 5.2.3.3 Availability of specialized cyber insurance policies

- 5.2.4 CHALLENGES

- 5.2.4.1 Rapidly evolving V2X ecosystem

- TABLE 14 VEHICULAR COMMUNICATION TECHNOLOGIES

- 5.2.4.2 Prevalence of legacy systems in existing vehicles

- FIGURE 37 STRUCTURE OF V2X AS CYBER-PHYSICAL-SOCIAL SYSTEM

- 5.2.5 IMPACT OF MARKET DYNAMICS

- TABLE 15 IMPACT OF MARKET DYNAMICS

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 38 SUPPLY CHAIN ANALYSIS

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF V2X CYBERSECURITY

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF V2X CYBERSECURITY (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 40 KEY BUYING CRITERIA FOR V2X CYBERSECURITY

- TABLE 17 KEY BUYING CRITERIA FOR V2X CYBERSECURITY

- 5.5 V2X CYBERSECURITY THREATS AND SOLUTIONS

- TABLE 18 AUTOMOTIVE CYBERSECURITY THREATS AND SOLUTIONS

- 5.5.1 STANDARDS

- TABLE 19 C-ITS STANDARDS

- 5.5.2 SERVICES

- TABLE 20 C-ITS SERVICES

- 5.5.3 RECENT DEVELOPMENTS

- TABLE 21 RECENT DEVELOPMENTS, 2017-2023

- 5.5.4 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE (ETSI)

- TABLE 22 ETSI STANDARDS

- FIGURE 41 SUB-BANDS OF ORIGINAL EUROPEAN VARIANT ITS-G5

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 INTELLIGENT TRANSPORT SYSTEM

- TABLE 23 TRAFFIC SIMULATORS FOR V2X COMMUNICATION

- 5.6.3 COOPERATIVE INTELLIGENT TRANSPORT SYSTEM

- FIGURE 42 KEY ELEMENTS OF C-ITS

- 5.6.4 CELLULAR VEHICLE-TO-EVERYTHING

- FIGURE 43 C-V2X NETWORK ARCHITECTURE

- FIGURE 44 C-V2X TIMELINE WITH FEATURES

- TABLE 24 CUMULATIVE GAIN WHILE USING 5G NR (NEW RADIO) C-V2X

- 5.6.5 LTE-V2X

- TABLE 25 COMPARISON OF IEEE802.11P AND LTE-V2X

- FIGURE 45 VEHICLE COMMUNICATION MODES

- 5.6.6 5G-V2X

- FIGURE 46 EVOLUTION OF C-V2X TOWARD 5G NR V2X

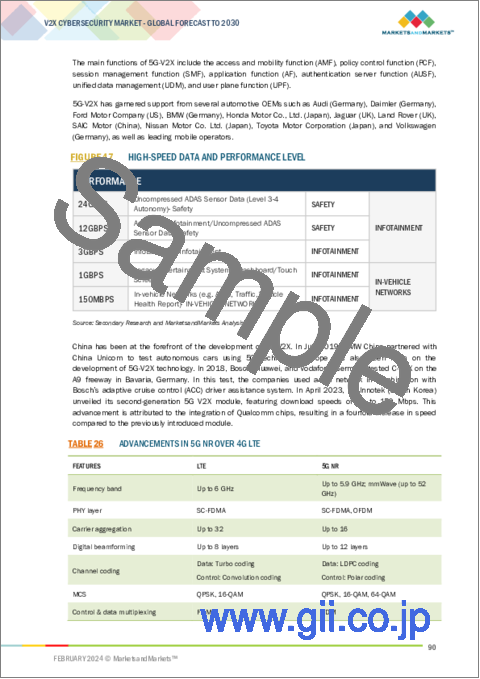

- FIGURE 47 HIGH-SPEED DATA AND PERFORMANCE LEVEL

- TABLE 26 ADVANCEMENTS IN 5G NR OVER 4G LTE

- TABLE 27 5G-V2X USE CASE PERFORMANCES

- 5.6.7 BLOCKCHAIN TECHNOLOGY

- FIGURE 48 IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY INTO NETWORKING STACK

- FIGURE 49 SERVICES PROVIDED BY BLOCKCHAIN TO V2X APPLICATIONS

- 5.6.8 EDGE COMPUTING

- FIGURE 50 IMPLEMENTATION OF EDGE COMPUTING INTO V2V COMMUNICATION

- 5.6.9 6G-V2X

- FIGURE 51 CRITICAL ASPECTS OF 6G-V2X

- FIGURE 52 BENEFITS AND THREATS INTRODUCED BY AI/ML IN V2X SECURITY

- TABLE 28 COMPARISON BETWEEN 6G AND OTHER CELLULAR TECHNOLOGIES

- 5.6.10 VEHICLE SECURITY OPERATION CENTER

- FIGURE 53 VSOC SERVICE

- 5.7 ECOSYSTEM MAPPING

- FIGURE 54 ECOSYSTEM MAPPING

- 5.7.1 OEMS

- 5.7.2 TIER 1 INTEGRATORS

- 5.7.3 TECHNOLOGY PROVIDERS

- 5.7.4 SOFTWARE PROVIDERS

- 5.7.5 SECURITY SOLUTION PROVIDERS

- TABLE 29 ROLE OF COMPANIES IN ECOSYSTEM

- 5.8 INVESTMENT SCENARIO

- FIGURE 55 INVESTMENT SCENARIO, 2020-2023

- 5.9 DEVELOPMENTS IN AUTOMOTIVE V2X MARKET, BY OEM

- 5.9.1 MERCEDES-BENZ

- 5.9.2 BMW

- 5.9.3 FORD MOTOR COMPANY

- 5.9.4 BYD

- 5.9.5 GENERAL MOTORS

- 5.9.6 HONDA MOTOR COMPANY

- 5.9.7 GEELY

- 5.9.8 HYUNDAI

- 5.9.9 MITSUBISHI MOTORS CORPORATION

- 5.9.10 NIO

- 5.9.11 NISSAN MOTOR CO. LTD.

- 5.9.12 SAIC MOTOR

- 5.9.13 VOLVO CARS

- 5.9.14 TOYOTA MOTOR CORPORATION

- 5.10 KEY CHARACTERISTICS OF V2X ATTACKS

- 5.11 SECURITY ASSESSMENT AND VIRTUALIZATION PLATFORMS FOR V2X COMMUNICATION

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 56 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 PATENT ANALYSIS

- 5.13.1 INTRODUCTION

- FIGURE 57 PUBLICATION TRENDS, 2014-2023

- 5.13.2 TOP PATENT APPLICANTS, 2014-2023

- FIGURE 58 TOP PATENT APPLICANTS, 2014-2023

- TABLE 30 PATENT ANALYSIS

- 5.14 CASE STUDIES

- 5.14.1 V2X CYBERSECURITY IN CHINA'S C-ITS INITIATIVE

- 5.14.2 SAVARI'S SUCCESS WITH INFINEON'S ESE INTEGRATION

- 5.14.3 V2X COMMUNICATION IN THAILAND'S SMART TRANSPORT

- 5.14.4 PILOT PROJECT ON SAN DIEGO ROADWAYS

- 5.14.5 MARVELL'S 802.11AX SOLUTION FOR SECURITY OF CONNECTED VEHICLES

- 5.14.6 RECTIFICATION OF SOFTWARE BUGS IN FIAT CHRYSLER'S VEHICLE RECALL

- 5.14.7 DEMONSTRATION ON POTENTIAL CYBER THREATS BY GUARDKNOX

- 5.14.8 DETECTION OF CYBER THREATS WITH ARCRAN'S ISECV SOLUTION

- 5.15 REGULATORY LANDSCAPE

- TABLE 31 V2X COMMUNICATION REGULATIONS

- TABLE 32 US AND EU SPECIFICATION STANDARDS

- TABLE 33 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 35 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCE AND EVENTS, 2024-2025

- TABLE 36 KEY CONFERENCES AND EVENTS, 2024-2025

6 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY

- 6.1 INTRODUCTION

- TABLE 37 DSRC VS. C-V2X

- TABLE 38 DIFFERENCE BETWEEN DSRC AND C-V2X

- FIGURE 59 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2023 VS. 2030 (THOUSAND UNITS)

- TABLE 39 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2019-2022 (THOUSAND UNITS)

- TABLE 40 AUTOMOTIVE V2X MARKET, BY CONNECTIVITY, 2023-2030 (THOUSAND UNITS)

- 6.1.1 OPERATIONAL DATA

- TABLE 41 COMPANIES OFFERING V2X SOLUTIONS, BY CONNECTIVITY

- TABLE 42 USE CASES AND QUALITY OF SERVICE REQUIREMENTS OF V2X APPLICATIONS

- 6.2 DEDICATED SHORT-RANGE COMMUNICATION (DSRC)

- 6.2.1 VULNERABILITY TO CYBERATTACKS TO DRIVE MARKET

- TABLE 43 DSRC V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 44 DSRC V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.3 CELLULAR VEHICLE-TO-EVERYTHING (C-V2X)

- 6.3.1 SUPERIOR EFFICIENCY AND SAFETY TO DRIVE MARKET

- FIGURE 60 C-V2X ARCHITECTURE

- FIGURE 61 C-V2X MARKET SEGMENTATION

- FIGURE 62 C-V2X SOLUTIONS FOR CHALLENGES ASSOCIATED WITH CONNECTED VEHICLES

- TABLE 45 PERFORMANCE OF DSRC VS. C-V2X

- TABLE 46 V2X STANDARDS FOR VARIOUS COMMUNICATION RANGES

- TABLE 47 C-V2X MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 48 C-V2X MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 6.4 KEY PRIMARY INSIGHTS

7 V2X CYBERSECURITY MARKET, BY COMMUNICATION

- 7.1 INTRODUCTION

- FIGURE 63 V2V CYBERSECURITY MARKET, BY COMMUNICATION, 2023 VS. 2030 (USD MILLION)

- TABLE 49 V2X CYBERSECURITY MARKET, BY COMMUNICATION, 2019-2022 (USD MILLION)

- TABLE 50 V2X CYBERSECURITY MARKET, BY COMMUNICATION, 2023-2030 (USD MILLION)

- 7.1.1 OPERATIONAL DATA

- TABLE 51 V2X OFFERINGS, BY COMMUNICATION

- TABLE 52 V2X TECHNOLOGIES, BY COMMUNICATION

- 7.2 VEHICLE-TO-VEHICLE (V2V)

- 7.2.1 IMPROVEMENTS IN SAFETY WARNING CAPABILITIES TO DRIVE MARKET

- TABLE 53 V2V CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 V2V CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.3 VEHICLE-TO-INFRASTRUCTURE (V2I)

- 7.3.1 FOCUS ON SMART INFRASTRUCTURE TO DRIVE MARKET

- TABLE 55 V2I CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 V2I CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.4 VEHICLE-TO-PEDESTRIAN (V2P)

- 7.4.1 RISE IN PEDESTRIAN SAFETY CONCERNS TO DRIVE MARKET

- TABLE 57 V2P CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 V2P CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.5 VEHICLE-TO-GRID (V2G)

- 7.5.1 OPERATIONAL BENEFITS OF TWO-WAY ENERGY EXCHANGE TO DRIVE MARKET

- TABLE 59 V2G CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 V2G CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.6 KEY PRIMARY INSIGHTS

8 V2X CYBERSECURITY MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- FIGURE 64 SECURITY CHALLENGES IN ROAD TRANSPORTATION NETWORKS

- FIGURE 65 V2X CYBERSECURITY MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- TABLE 61 V2X CYBERSECURITY MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 62 V2X CYBERSECURITY MARKET, BY VEHICLE TYPE, 2023-2030 (USD MILLION)

- 8.1.1 OPERATIONAL DATA

- TABLE 63 V2X-EQUIPPED PASSENGER CAR OFFERINGS

- 8.2 PASSENGER CARS

- 8.2.1 GROWING CUSTOMER DEMAND FOR CONNECTED CARS TO DRIVE MARKET

- TABLE 64 PASSENGER CARS: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 PASSENGER CARS: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.3 COMMERCIAL VEHICLES

- 8.3.1 V2X DEPLOYMENT IN COMMERCIAL FLEET VEHICLES TO DRIVE MARKET

- FIGURE 66 VEHICLE PLATOONING ATTACKS

- TABLE 66 COMMERCIAL VEHICLES: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 COMMERCIAL VEHICLES: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.4 KEY PRIMARY INSIGHTS

9 V2X CYBERSECURITY MARKET, BY SECURITY FRAMEWORK

- 9.1 INTRODUCTION

- FIGURE 67 V2X CYBERSECURITY MARKET, BY SECURITY FRAMEWORK, 2023 VS. 2030 (USD MILLION)

- TABLE 68 V2X CYBERSECURITY MARKET, BY SECURITY FRAMEWORK, 2019-2022 (USD MILLION)

- TABLE 69 V2X CYBERSECURITY MARKET, BY SECURITY FRAMEWORK, 2023-2030 (USD MILLION)

- 9.1.1 OPERATIONAL DATA

- TABLE 70 V2X OFFERINGS FOR EMBEDDED SECURITY

- 9.2 PUBLIC KEY INFRASTRUCTURE (PKI)

- 9.2.1 EMPHASIS ON CONNECTED VEHICLE TECHNOLOGY TO DRIVE MARKET

- FIGURE 68 PKI FRAMEWORK FOR V2X

- FIGURE 69 PKI-BASED V2X SECURITY SOLUTIONS

- TABLE 71 PKI: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 PKI: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.3 EMBEDDED

- 9.3.1 SAFETY ASSURANCE IN CONNECTED ENVIRONMENTS TO DRIVE MARKET

- TABLE 73 EMBEDDED: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 EMBEDDED: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.4 KEY PRIMARY INSIGHTS

10 V2X CYBERSECURITY MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 70 V2X CYBERSECURITY MARKET, BY FORM, 2023 VS. 2030 (USD MILLION)

- TABLE 75 V2X CYBERSECURITY MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 76 V2X CYBERSECURITY MARKET, BY FORM, 2023-2030 (USD MILLION)

- 10.1.1 OPERATIONAL DATA

- TABLE 77 COMPANIES OFFERING V2X SOLUTIONS, BY FORM

- 10.2 IN-VEHICLE

- 10.2.1 RAPID DEVELOPMENT OF V2X-ENABLED VEHICLES TO DRIVE MARKET

- TABLE 78 IN-VEHICLE: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 IN-VEHICLE: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.3 EXTERNAL CLOUD SERVICE

- 10.3.1 INTEGRATION OF 5G NETWORK IN CONNECTED VEHICLES TO DRIVE MARKET

- FIGURE 71 CLOUD-BASED SOLUTIONS

- TABLE 80 EXTERNAL CLOUD SERVICE: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 EXTERNAL CLOUD SERVICE: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.4 KEY PRIMARY INSIGHTS

11 V2X CYBERSECURITY MARKET, BY PROPULSION

- 11.1 INTRODUCTION

- FIGURE 72 V2X CYBERSECURITY MARKET, BY PROPULSION, 2023 VS. 2030 (USD MILLION)

- TABLE 82 V2X CYBERSECURITY MARKET, BY PROPULSION, 2019-2022 (USD MILLION)

- TABLE 83 V2X CYBERSECURITY MARKET, BY PROPULSION, 2023-2030 (USD MILLION)

- 11.1.1 OPERATIONAL DATA

- TABLE 84 V2X OFFERINGS, BY PROPULSION

- 11.2 INTERNAL COMBUSTION ENGINE (ICE)

- 11.2.1 NEED FOR CYBERSECURITY IN ADVANCED AUTOMOTIVE TECHNOLOGIES TO DRIVE MARKET

- TABLE 85 ICE: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 ICE: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.3 ELECTRIC

- 11.3.1 EASE OF V2X ADOPTION IN EV ARCHITECTURE TO DRIVE MARKET

- TABLE 87 ELECTRIC: V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 ELECTRIC: V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.4 KEY PRIMARY INSIGHTS

12 V2X CYBERSECURITY MARKET, BY SECURITY TYPE

- 12.1 INTRODUCTION

- FIGURE 73 V2X CYBERSECURITY MARKET, BY SECURITY TYPE, 2023 VS. 2030 (USD MILLION)

- TABLE 89 V2X CYBERSECURITY MARKET, BY SECURITY TYPE, 2019-2022 (USD MILLION)

- TABLE 90 V2X CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2030 (USD MILLION)

- 12.1.1 OPERATIONAL DATA

- TABLE 91 ATTACK VECTORS AND SECURITY TYPE REQUIREMENT

- 12.2 ENDPOINT SECURITY

- 12.2.1 GROWING V2V DEPLOYMENT BY OEMS FOR ENHANCED SAFETY TO DRIVE MARKET

- TABLE 92 ENDPOINT SECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 ENDPOINT SECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3 SOFTWARE SECURITY

- 12.3.1 RISING PENETRATION OF V2V AND V2I TECHNOLOGIES TO DRIVE MARKET

- TABLE 94 SOFTWARE SECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 95 SOFTWARE SECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.4 CLOUD SECURITY

- 12.4.1 OVER-RELIANCE ON CLOUD-BASED SERVICES TO DRIVE MARKET

- TABLE 96 ATTACK FEASIBILITY RATING BASED ON INTERFACE

- TABLE 97 CLOUD SECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 98 CLOUD SECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.5 KEY INDUSTRY INSIGHTS

13 V2X CYBERSECURITY MARKET, BY REGION

- 13.1 INTRODUCTION

- TABLE 99 V2X SHORT-RANGE ENVIRONMENT

- FIGURE 74 V2X CYBERSECURITY MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- TABLE 100 V2X CYBERSECURITY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 101 V2X CYBERSECURITY MARKET, BY REGION, 2023-2030 (USD MILLION)

- 13.2 ASIA PACIFIC

- FIGURE 75 ASIA PACIFIC: V2X CYBERSECURITY MARKET SNAPSHOT

- TABLE 102 ASIA PACIFIC: V2X CYBERSECURITY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: V2X CYBERSECURITY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 13.2.1 RECESSION IMPACT ANALYSIS

- 13.2.2 CHINA

- 13.2.2.1 Government support and OEMs shifting to C-V2X to drive market

- FIGURE 76 CHINA: C-V2X TIMELINES AND MILESTONES, 2019-2025

- 13.2.3 JAPAN

- 13.2.3.1 Rising adoption of V2X technologies to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Technological advancements to drive market

- 13.2.5 INDIA

- 13.2.5.1 Plans to equip V2X technology in new-generation vehicles to drive market

- 13.3 EUROPE

- FIGURE 77 EUROPE: V2X CYBERSECURITY MARKET, 2023 VS. 2030 (USD MILLION)

- TABLE 104 EUROPE: V2X CYBERSECURITY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 105 EUROPE: V2X CYBERSECURITY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 13.3.1 RECESSION IMPACT ANALYSIS

- 13.3.2 GERMANY

- 13.3.2.1 Increase in C-V2X trials and tests to drive market

- 13.3.3 FRANCE

- 13.3.3.1 Government-funded projects for V2X development to drive market

- 13.3.4 UK

- 13.3.4.1 Government initiatives for implementing V2X to drive market

- 13.3.5 ITALY

- 13.3.5.1 Testing of V2X technology for platooning to drive market

- 13.3.6 SPAIN

- 13.3.6.1 Focus on 5G infrastructure development to drive market

- 13.4 NORTH AMERICA

- FIGURE 78 NORTH AMERICA: V2X CYBERSECURITY MARKET SNAPSHOT

- TABLE 106 NORTH AMERICA: V2X CYBERSECURITY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: V2X CYBERSECURITY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 13.4.1 RECESSION IMPACT ANALYSIS

- 13.4.2 US

- 13.4.2.1 Increasing V2X adoption by leading OEMs to drive market

- 13.4.3 CANADA

- 13.4.3.1 Presence of innovative V2X start-ups to drive market

- 13.4.4 MEXICO

- 13.4.4.1 Flourishing automotive sector to drive market

- 13.5 REST OF THE WORLD

- FIGURE 79 REST OF THE WORLD: V2X CYBERSECURITY MARKET, 2023 VS. 2030 (USD MILLION)

- TABLE 108 REST OF THE WORLD: V2X CYBERSECURITY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 109 REST OF THE WORLD: V2X CYBERSECURITY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 13.5.1 RECESSION IMPACT ANALYSIS

- 13.5.2 BRAZIL

- 13.5.2.1 Government initiatives for vehicle safety to drive market

- 13.5.3 ARGENTINA

- 13.5.3.1 Presence of start-ups offering V2X technology to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 110 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 14.3 RANKING ANALYSIS, 2023

- FIGURE 80 MARKET RANKING OF KEY PLAYERS, 2023

- 14.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 81 REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 82 COMPANY VALUATION OF TOP FIVE PLAYERS

- FIGURE 83 FINANCIAL METRICS OF TOP FIVE PLAYERS

- 14.6 BRAND/PRODUCT COMPARISON

- TABLE 111 BRAND COMPARISON FOR V2X CYBERSECURITY

- 14.7 COMPANY EVALUATION MATRIX, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- FIGURE 84 COMPANY EVALUATION MATRIX, 2023

- 14.7.5 COMPANY FOOTPRINT

- TABLE 112 COMPANY FOOTPRINT, 2023

- TABLE 113 SECURITY FRAMEWORK FOOTPRINT, 2023

- TABLE 114 REGION FOOTPRINT, 2023

- 14.8 START-UP/SME EVALUATION MATRIX, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- FIGURE 85 START-UP/SME EVALUATION MATRIX, 2023

- 14.8.5 COMPETITIVE BENCHMARKING

- TABLE 115 KEY START-UPS/SMES

- TABLE 116 COMPETITIVE BENCHMARKING OF KEY START-UP/SMES

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 117 V2X CYBERSECURITY MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2023

- 14.9.2 DEALS

- TABLE 118 V2X CYBERSECURITY MARKET: DEALS, 2020-2023

- 14.9.3 EXPANSIONS

- TABLE 119 V2X CYBERSECURITY MARKET: EXPANSIONS, 2020-2023

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 15.1.1 ESCRYPT GMBH

- TABLE 120 ESCRYPT GMBH: COMPANY OVERVIEW

- FIGURE 86 ESCRYPT GMBH: CREDENTIAL MANAGEMENT SYSTEM

- FIGURE 87 ESCRYPT GMBH: HARMONIZED V2X PKI

- FIGURE 88 ESCRYPT GMBH: MISBEHAVIOR DETECTION

- TABLE 121 ESCRYPT GMBH: PRODUCTS OFFERED

- TABLE 122 ESCRYPT GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 123 ESCRYPT GMBH: DEALS

- 15.1.2 QUALCOMM INCORPORATEDS

- TABLE 124 QUALCOMM INCORPORATED: COMPANY OVERVIEW

- FIGURE 89 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

- TABLE 125 QUALCOMM INCORPORATED: PRODUCTS OFFERED

- TABLE 126 QUALCOMM INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 127 QUALCOMM INCORPORATED: DEALS

- 15.1.3 AUTOTALKS

- TABLE 128 AUTOTALKS: COMPANY OVERVIEW

- FIGURE 90 AUTOTALKS: V2X COMMUNICATION SECURITY

- TABLE 129 AUTOTALKS: PRODUCTS OFFERED

- TABLE 130 AUTOTALKS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 131 AUTOTALKS: DEALS

- 15.1.4 AUTOCRYPT CO., LTD.

- TABLE 132 AUTOCRYPT CO., LTD.: COMPANY OVERVIEW

- FIGURE 91 AUTOCRYPT CO., LTD.: V2X VERIFICATION PROCESS

- FIGURE 92 AUTOCRYPT CO., LTD.: V2X SECURITY

- FIGURE 93 AUTOCRYPT CO., LTD.: MISBEHAVIOR DETECTION AND REPORTING

- FIGURE 94 AUTOCRYPT CO., LTD.: SECURE PLUG AND CHARGE

- TABLE 133 AUTOCRYPT CO., LTD.: PRODUCTS OFFERED

- TABLE 134 AUTOCRYPT CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 135 AUTOCRYPT CO., LTD.: DEALS

- TABLE 136 AUTOCRYPT CO., LTD.: EXPANSIONS

- 15.1.5 CONTINENTAL AG

- TABLE 137 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 95 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 138 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 139 CONTINENTAL AG: KEY CUSTOMERS

- TABLE 140 CONTINENTAL AG: DEALS

- 15.1.6 GREEN HILLS SOFTWARE

- TABLE 141 GREEN HILLS SOFTWARE: COMPANY OVERVIEW

- TABLE 142 GREEN HILLS SOFTWARE: PRODUCTS OFFERED

- TABLE 143 GREEN HILLS SOFTWARE: THIRD-PARTY PARTNERS

- TABLE 144 GREEN HILLS SOFTWARE: DEALS

- 15.1.7 KARAMBA SECURITY

- TABLE 145 KARAMBA SECURITY: COMPANY OVERVIEW

- TABLE 146 KARAMBA SECURITY: PRODUCTS OFFERED

- TABLE 147 KARAMBA SECURITY: DEALS

- 15.1.8 ID QUANTIQUE

- TABLE 148 ID QUANTIQUE: COMPANY OVERVIEW

- FIGURE 96 ID QUANTIQUE: QUANTUM HARDWARE SECURITY MODULE

- TABLE 149 ID QUANTIQUE: PRODUCTS OFFERED

- TABLE 150 ID QUANTIQUE: DEALS

- TABLE 151 ID QUANTIQUE: EXPANSIONS

- 15.1.9 NXP SEMICONDUCTORS N.V.

- TABLE 152 NXP SEMICONDUCTORS N.V.: COMPANY OVERVIEW

- FIGURE 97 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

- TABLE 153 NXP SEMICONDUCTORS N.V.: PRODUCTS OFFERED

- TABLE 154 NXP SEMICONDUCTORS N.V.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 155 NXP SEMICONDUCTORS N.V.: DEALS

- 15.1.10 INFINEON TECHNOLOGIES AG

- TABLE 156 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 98 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 99 INFINEON TECHNOLOGIES AG: CUSTOMERS IN CONNECTED SECURE SYSTEMS

- FIGURE 100 INFINEON TECHNOLOGIES AG: V2X DEVICE INTERACTIONS

- TABLE 157 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 158 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 159 INFINEON TECHNOLOGIES AG: DEALS

- 15.1.11 HARMAN INTERNATIONAL

- TABLE 160 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 101 HARMAN INTERNATIONAL: V2X EDGE COMPUTE SOFTWARE PLATFORM

- TABLE 161 HARMAN INTERNATIONAL: PRODUCTS OFFERED

- TABLE 162 HARMAN INTERNATIONAL: EXPANSIONS

- 15.1.12 APTIV PLC

- TABLE 163 APTIV PLC: COMPANY OVERVIEW

- FIGURE 102 APTIV PLC: COMPANY SNAPSHOT

- TABLE 164 APTIV PLC: PRODUCTS OFFERED

- TABLE 165 APTIV PLC: KEY CUSTOMERS

- TABLE 166 APTIV PLC: EXPANSIONS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 15.2 OTHER KEY PLAYERS

- 15.2.1 ATOS SE

- TABLE 167 ATOS SE: COMPANY OVERVIEW

- 15.2.2 SECUNET SECURITY NETWORKS AG

- TABLE 168 SECUNET SECURITY NETWORKS AG: COMPANY OVERVIEW

- 15.2.3 CAPGEMINI ENGINEERING

- TABLE 169 CAPGEMINI ENGINEERING: COMPANY OVERVIEW

- 15.2.4 VECTOR INFORMATIK GMBH

- TABLE 170 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- 15.2.5 STMICROELECTRONICS

- TABLE 171 STMICROELECTRONICS: COMPANY OVERVIEW

- 15.2.6 LEAR CORPORATION

- TABLE 172 LEAR CORPORATION: COMPANY OVERVIEW

- 15.2.7 CERTICOM CORP

- TABLE 173 CERTICOM CORP: COMPANY OVERVIEW

- 15.2.8 DENSO CORPORATION

- TABLE 174 DENSO CORPORATION: COMPANY OVERVIEW

- 15.2.9 SAFERIDE TECHNOLOGIES LTD.

- TABLE 175 SAFERIDE TECHNOLOGIES LTD.: COMPANY OVERVIEW

16 RECOMMENDATIONS BY MARKETSANDMARKETS

- 16.1 ASIA PACIFIC TO BE LARGEST MARKET FOR V2X CYBERSECURITY

- 16.2 C-V2X TECHNOLOGY TO DRIVE FUTURE OF INTELLIGENT TRANSPORTATION

- 16.3 V2G COMMUNICATION TO EMERGE AS PROMISING TECHNOLOGY

- 16.4 CONCLUSION

17 APPENDIX

- 17.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.4.1 V2X CYBERSECURITY MARKET, BY CONNECTIVITY TYPE, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 17.4.2 COMPANY INFORMATION

- 17.4.2.1 Profiling of additional market players (Up to Five)

- 17.4.2.2 Additional countries for region (Up to Three)

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS