|

|

市場調査レポート

商品コード

1504296

リングメインユニットの世界市場:ポジション別、絶縁タイプ別、設置別、定格電圧別、構造別、エンドユーザー別、地域別 - 2029年までの予測Ring Main Unit Market by Insulation Type (Gas-insulated, Air-insulated, Oil-insulated, Solid Dielectric), Voltage Rating (Up to 15 kV, 16-25 kV, Above 25 kV), Installation (Indoor, Outdoor), Structure, Application, Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| リングメインユニットの世界市場:ポジション別、絶縁タイプ別、設置別、定格電圧別、構造別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年06月19日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のリングメインユニットの市場規模は大幅な成長を遂げ、2029年には34億米ドルに達すると予測されています。

これは、2024年の25億米ドルからの顕著な増加であり、2024年から2029年までの期間における5.7%の安定した年間平均成長率(CAGR)を反映しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | ポジション別、絶縁タイプ別、設置別、定格電圧別、構造別、エンドユーザー別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

リングメインユニット(RMU)市場は、いくつかの主要な要因によって牽引されています。都市化と工業化の進展により、信頼性が高く中断のない電力供給に対する需要が高まっていることが主な要因です。さらに、人口増加による世界の電力消費の増大は、配電インフラの拡張と近代化を必要とします。太陽光発電や風力発電のような再生可能エネルギー源の既存送電網への統合も、効率的で柔軟な送電網管理を促進するため、RMUの需要を押し上げています。老朽化した送電網を改良するための大規模な投資は、アジア太平洋などの新興国市場に注目しながら、市場をさらに促進しています。スマートグリッド技術の進歩とインテリジェント電子機器の普及は、RMUの機能性と魅力を高め、様々な分野での需要拡大に貢献しています。

配電ユーティリティ分野は、いくつかの説得力のある要因により、2024年から2029年にかけてリングメインユニット(RMU)の市場で最も急成長すると予測されています。主に、急速な都市化と産業拡大による世界の電力需要の高まりにより、堅牢で信頼性の高い配電システムが必要とされています。配電事業者は、この需要増に対応するため、インフラをアップグレード・拡張する最前線に立ち、エンドユーザーへの中断のない効率的な電力供給を確保しています。さらに、特に発展途上地域では、老朽化した送電網を近代化するための多額の投資が、この成長をさらに後押ししています。効果的な管理と安定性のために高度なRMUを必要とする再生可能エネルギー源のグリッドへの統合も、重要な役割を果たしています。さらに、スマートグリッド技術とデジタル化に対する公益事業セクターの注目度が高まっていることも、RMUの採用を後押ししています。RMUはグリッドの回復力、柔軟性、効率の向上に不可欠だからです。このような要因が重なり、配電ユーティリティ部門は予測期間中のRMU市場拡大の主要な促進要因となっています。

屋外設置部門は、いくつかの重要な要因により、リングメインユニット(RMU)市場で最も急成長する部門になると予想されます。まず、都市部と農村部の両方で配電網の拡張と改良の必要性が、屋外設置可能なRMUの需要を促進しています。これらのユニットは、多様な環境条件下での電力供給の信頼性と効率を高めるために極めて重要であり、屋外環境に最適です。さらに、屋外用RMUは過酷な気象条件に耐え、最小限のメンテナンスで堅牢な性能を発揮するように設計されており、遠隔地やアクセスが困難な場所では不可欠です。風力発電所や太陽光発電所などの再生可能エネルギープロジェクトが急成長していることも、屋外用RMUの需要をさらに押し上げています。こうした設備では、再生可能エネルギー源を効率的にグリッドに統合するために、信頼性が高く耐候性に優れたユニットが必要とされることが多いからです。さらに、特に発展途上地域におけるインフラ整備への投資の増加、スマートグリッドの導入と農村電化プロジェクトへの注力は、屋外設置セグメントの拡大に大きく寄与しています。これらの要因が総合的に、世界市場における屋外RMU設置の成長加速を裏付けています。

当レポートでは、世界のリングメインユニット市場について調査し、ポジション別、絶縁タイプ別、設置別、定格電圧別、構造別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- 価格分析

- サプライチェーン分析

- 技術分析

- 投資と資金調達のシナリオ

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

第6章 リングメインユニット市場(ポジション別)

- イントロダクション

- 3ポジション

- 6ポジション

- その他

第7章 リングメインユニット市場(絶縁タイプ別)

- イントロダクション

- ガス絶縁

- 空気断熱

- オイル絶縁

- 固体誘電体

第8章 リングメインユニット市場(設置別)

- イントロダクション

- 屋内

- 屋外

第9章 リングメインユニット市場(定格電圧別)

- イントロダクション

- 15KV以下

- 16~25KV

- 25KV以上

第10章 リングメインユニット市場(構造別)

- イントロダクション

- 拡張不可

- 拡張可能

第11章 リングメインユニット市場(エンドユーザー別)

- イントロダクション

- 配電設備

- 工業用

- 交通インフラ

- 商業ビル

第12章 リングメインユニット市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2023年

- 収益分析、2019-2023

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- ABB

- SIEMENS

- EATON

- SCHNEIDER ELECTRIC

- LS ELECTRIC CO., LTD.

- LUCY GROUP LTD.

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- TIEPCO

- ENTEC ELECTRIC & ELECTRONIC

- ORECCO

- LARSEN & TOUBRO LIMITED

- NATUS GMBH & CO. KG

- ALFANAR GROUP

- ROCKWILL

- KONCAR D.D.

- MEGAWIN

- BONOMI EUGENIO SPA

- CHINT GROUP

- KDM STEEL

- C-SEC TECHNOLOGIES PRIVATE LIMITED

- その他の企業

- YUEQING LIYOND ELECTRIC CO., LTD

- CHINA TRANSPOWERS ELECTRIC CO., LIMITED

- INDKOM ENGINEERING SDN. BHD.

- SKYY CREATECH SERVICES PVT. LTD.

- BVM TECHNOLOGIES PRIVATE LIMITED

第15章 付録

The global market for Ring main unit is poised for substantial growth, with a projected trajectory reaching USD 3.4 billion by the year 2029. This represents a noteworthy increase from the estimated value of USD 2.5 billion in 2024, reflecting a steady Compound Annual Growth Rate (CAGR) of 5.7% over the period spanning from 2024 to 2029.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Insulation Type, Installation, Voltage Rating, Structure, Application |

| Regions covered | Asia Pacific, North America, Europe, Middle East and Africa, and South America |

The ring main unit (RMU) market is driven by several key factors. The rising demand for reliable and uninterrupted power supply, fueled by increasing urbanization and industrialization, is a primary driver. Additionally, the growing global electricity consumption due to population growth necessitates the expansion and modernization of power distribution infrastructure. The integration of renewable energy sources like solar and wind power into existing grids also boosts the demand for RMUs, as they facilitate efficient and flexible grid management. Significant investments in upgrading aging power grids further propel the market, with a notable focus on developing regions such as Asia-Pacific. Advancements in smart grid technologies and the widespread adoption of intelligent electronic devices enhance the functionality and appeal of RMUs, contributing to their increased demand across various sectors.

"The distribution utilities segment, by application, to be fastest growing market from 2024 to 2029."

The distribution utilities segment is projected to be the fastest-growing market for ring main units (RMUs) from 2024 to 2029 due to several compelling factors. Primarily, the escalating global demand for electricity, driven by rapid urbanization and industrial expansion, necessitates robust and reliable power distribution systems. Distribution utilities are at the forefront of upgrading and expanding their infrastructure to meet this rising demand, ensuring uninterrupted and efficient power delivery to end-users. Additionally, significant investments in modernizing aging power grids, particularly in developing regions, further fuel this growth. The integration of renewable energy sources into the grid, which requires advanced RMUs for effective management and stability, also plays a crucial role. Furthermore, the increasing focus on smart grid technologies and digitalization within the utilities sector enhances the adoption of RMUs, as these units are essential for improving grid resilience, flexibility, and efficiency. This convergence of factors positions the distribution utilities segment as a key driver of the RMU market's expansion during the forecast period.

"Outdoor installation: The fastest-growing segment of the ring main unit market based on installation."

The outdoor installation segment is expected to be the fastest-growing sector of the ring main unit (RMU) market due to several key factors. Firstly, the need for expanding and upgrading power distribution networks in both urban and rural areas is driving the demand for RMUs that can be installed outdoors. These units are crucial for enhancing the reliability and efficiency of power supply in diverse environmental conditions, making them ideal for outdoor settings. Additionally, outdoor RMUs are designed to withstand harsh weather conditions and provide robust performance with minimal maintenance, which is essential for remote and hard-to-access locations. The rapid growth of renewable energy projects, such as wind and solar farms, further boosts the demand for outdoor RMUs, as these installations often require reliable and weather-resistant units to integrate renewable energy sources into the grid effectively. Furthermore, increasing investments in infrastructure development, particularly in developing regions, and the focus on smart grid implementation and rural electrification projects contribute significantly to the expansion of the outdoor installation segment. These factors collectively underscore the accelerated growth of outdoor RMU installations in the global market.

"Asia Pacific to be largest and fastest growing region in ring main unit market."

Asia Pacific is poised to emerge as both the largest and fastest-growing region in the ring main unit (RMU) market, driven by several compelling factors. Firstly, the region is witnessing rapid industrialization and urbanization, leading to a surge in electricity demand for residential, commercial, and industrial purposes. This escalating demand necessitates the expansion and modernization of power distribution networks, wherein RMUs play a pivotal role in ensuring efficient and reliable electricity supply. Moreover, Asia Pacific governments are increasingly investing in infrastructure development, including the enhancement of electrical grids, to support economic growth and meet the needs of growing populations. Additionally, the region's commitment to renewable energy adoption, driven by environmental concerns and energy security, fuels the demand for RMUs for integrating renewable energy sources into the grid. Furthermore, initiatives aimed at rural electrification and improving energy access contribute to the growing deployment of RMUs across diverse geographical and socioeconomic landscapes in the region. The convergence of these factors positions Asia Pacific as a key market for RMUs, with substantial growth opportunities both in terms of market size and expansion rate in the coming years.

Breakdown of Primaries:

Significant qualitative and quantitative data, as well as future market prospects, were confirmed through in-depth interviews with subject-matter experts, C-level executives of major market players, industry consultants, and other specialists. The following is how the main interviews were dispersed:

By Company Type: Tier 1: 65%, Tier 2: 24%, and Tier 3: 11%

By Designation: C-level: 30%, Directors: 25%, and Others: 45%

By Region: North America: 33%, Europe: 27%, Asia Pacific: 20%, South America: 12%, the Middle East & Africa: 8%.

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2022: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

There are a few major players in the ring main unit market that are well-established throughout the region. ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Schneider Electric (France), Lucy Electric (UK), CG Power and Industrial Solutions (India), and a few other companies are the market leaders for ring main units.

Research Coverage:

The global ring main unit market is defined, explained, and forecasted in this report based on insulation type, installation, voltage rating, structure, and application. The study offers a thorough analysis of the main market factors, opportunities, obstacles, and restraints. It also discusses a number of significant market facets. These comprise an examination of the market's competitive environment, market dynamics, value-based market estimates, and potential future developments in the ring main unit market.

Key Benefits of Buying the Report

The Ring main unit market report has been carefully crafted to cater to the requirements of both seasoned industry veterans and recent entrants. It is an indispensable tool for stakeholders seeking to gain a comprehensive understanding of the competitive landscape because it offers accurate revenue projections for the market as a whole as well as its numerous sub-segments. Stakeholders can use this information to create market strategies that work for their companies. Furthermore, by providing essential insights into the drivers, constraints, challenges, and growth opportunities, the report is a crucial tool for stakeholders to understand the state of the market today. Stakeholders can stay informed and adapt to the dynamically changing Ring main unit industry with the help of these insights.

- Analysis of key drivers (Increased Demand for Reliable Power, Integration of Renewable Energy, Focus on Infrastructure Development), restraints (High Initial Investment, Regulations restricting SF6 gas emissions), opportunities (Smart Grid Integration, Digitalization, Growing Demand for Automation), and challenges (High competition from unorganized sector) influencing the growth of the ring main unit market.

- Product Development/ Innovation: Product development and innovation play pivotal roles in shaping the ring main unit (RMU) market landscape. Manufacturers are continually investing in research and development initiatives to introduce advanced RMU solutions that meet evolving customer needs and regulatory requirements. Key areas of innovation include the development of compact and eco-friendly RMUs, integration with smart grid technologies for enhanced monitoring and control capabilities, and the use of alternative insulation materials to address environmental concerns. Moreover, advancements in digitalization, such as the incorporation of Internet of Things (IoT) capabilities and predictive maintenance features, are transforming RMUs into intelligent and efficient components of modern power distribution networks. These innovations not only improve the performance and reliability of RMUs but also offer opportunities for differentiation and competitive advantage in the market. As utilities and industries seek more reliable and sustainable power distribution solutions, product development and innovation will continue to drive growth and expansion in the RMU market.

- Market Development: Market development in the ring main unit (RMU) market involves expanding into new geographic regions or segments to drive growth. This strategy entails identifying untapped opportunities in emerging markets, such as Asia-Pacific and Latin America, where increasing urbanization, industrialization, and infrastructure development create demand for reliable power distribution solutions. Additionally, market development efforts may target niche segments within existing markets, such as renewable energy integration or rural electrification projects, leveraging technological advancements and tailored solutions to address specific customer needs. By focusing on market development initiatives, RMU manufacturers can diversify their customer base, mitigate risks associated with mature markets, and capitalize on emerging opportunities for sustained growth and market expansion.

- Market Diversification: Market diversification in the ring main unit (RMU) market involves expanding product offerings and exploring new market segments to reduce reliance on traditional markets and mitigate risks. This strategy entails developing RMUs with varying specifications, such as voltage ratings, insulation types, and applications, to cater to diverse customer needs. Additionally, targeting emerging markets in regions like Asia Pacific and Latin America, where rapid industrialization and urbanization drive electricity demand, presents opportunities for growth. Furthermore, exploring niche markets, such as renewable energy integration and smart grid applications, can diversify revenue streams and enhance market resilience. By embracing market diversification strategies, RMU manufacturers can strengthen their competitive position, mitigate market volatility, and capitalize on new growth avenues in the evolving electrical distribution landscape.

- Competitive Assessment: In the competitive landscape of the ring main unit (RMU) market, several key players vie for market share through strategies such as product innovation, partnerships, and geographic expansion. Established industry giants like ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Schneider Electric (France), Lucy Electric (UK), CG Power and Industrial Solutions (India) dominate the market with their extensive product portfolios, global presence, and strong brand reputation. These companies continually invest in research and development to enhance their RMU offerings, focusing on features like compact design, eco-friendliness, and advanced smart grid integration capabilities. Additionally, partnerships with utility providers and strategic acquisitions allow them to expand their market reach and penetrate emerging markets effectively. Alongside these industry leaders, smaller regional players and new entrants also play a significant role, offering niche solutions and catering to specific customer segments. Intense competition among these players fosters innovation and drives continuous improvements in RMU technology, ultimately benefiting consumers by offering a wide range of options to meet their diverse requirements.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 RING MAIN UNIT MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INSULATION TYPE: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INSTALLATION: INCLUSIONS AND EXCLUSIONS

- TABLE 3 STRUCTURE: INCLUSIONS AND EXCLUSIONS

- TABLE 4 POSITION: INCLUSIONS AND EXCLUSIONS

- TABLE 5 END USER: INCLUSIONS AND EXCLUSIONS

- TABLE 6 VOLTAGE RATING: INCLUSIONS AND EXCLUSIONS

- TABLE 7 REGION: INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RING MAIN UNIT MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- 2.2.1 SECONDARY AND PRIMARY RESEARCH

- 2.2.2 SECONDARY DATA

- 2.2.2.1 List of key secondary sources

- 2.2.2.2 Key data from secondary sources

- 2.2.3 PRIMARY DATA

- 2.2.3.1 Breakdown of primaries

- 2.2.3.2 Key data from primary sources

- 2.2.3.3 Key industry insights

- 2.2.3.4 List of major primary interview participants

- 2.2.3.5 Intended participants and key opinion leaders in primary interviews

- 2.3 RESEARCH SCOPE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- FIGURE 5 PARAMETERS CONSIDERED TO ASSESS DEMAND FOR RING MAIN UNITS

- 2.4.3.1 Approach to estimate market size using demand-size analysis

- 2.4.3.2 Demand-side assumptions

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF RING MAIN UNITS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS: ILLUSTRATION OF REVENUE ESTIMATIONS FOR TOP PLAYER IN RING MAIN UNIT MARKET

- 2.4.4.1 Approach to estimate market size using supply-side analysis

- 2.4.4.2 Supply-side assumptions

- 2.5 FORECAST

- 2.5.1 IMPACT OF RECESSION

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 RESEARCH LIMITATIONS

- 2.6.2 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 8 RING MAIN UNIT MARKET SNAPSHOT

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN RING MAIN UNIT MARKET DURING FORECAST PERIOD

- FIGURE 9 GAS-INSULATED SEGMENT TO LEAD MARKET IN 2029

- FIGURE 10 OUTDOOR SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 UP TO 15 KV SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 NON-EXTENSIBLE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 13 DISTRIBUTION UTILITIES SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 14 3-POSITION SEGMENT TO LEAD MARKET IN 2029

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RING MAIN UNIT MARKET

- FIGURE 15 GROWING SHIFT TOWARD RENEWABLE ENERGY SOURCES TO DRIVE MARKET

- 4.2 RING MAIN UNIT MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 RING MAIN UNIT MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- FIGURE 17 DISTRIBUTION UTILITIES AND CHINA DOMINATED MARKET IN ASIA PACIFIC IN 2023

- 4.4 RING MAIN UNIT MARKET, BY INSULATION TYPE

- FIGURE 18 GAS-INSULATED SEGMENT TO DOMINATE MARKET IN 2029

- 4.5 RING MAIN UNIT MARKET, BY INSTALLATION

- FIGURE 19 OUTDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- 4.6 RING MAIN UNIT MARKET, BY VOLTAGE RATING

- FIGURE 20 UP TO 15 KV SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2029

- 4.7 RING MAIN UNIT MARKET, BY STRUCTURE

- FIGURE 21 NON-EXTENSIBLE SEGMENT TO DOMINATE MARKET IN 2029

- 4.8 RING MAIN UNIT MARKET, BY END USER

- FIGURE 22 DISTRIBUTION UTILITIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- 4.9 RING MAIN UNIT MARKET, BY POSITION

- FIGURE 23 3-POSITION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 RING MAIN UNIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for reliable and resilient power grids

- FIGURE 25 REGIONAL/COUNTRY-WISE DATA ON INVESTMENTS IN POWER GRIDS, 2015-2022

- 5.2.1.2 Integration of renewable energy into existing grid infrastructure

- FIGURE 26 GLOBAL DATA ON INVESTMENTS IN CLEAN ENERGY AND FOSSIL FUELS, 2015-2023

- FIGURE 27 DATA ON RENEWABLE ELECTRICITY CAPACITY, 2016-2022

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental concerns associated with RMUs

- TABLE 9 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME HORIZON)

- 5.2.2.2 Volatile raw material prices

- 5.2.2.3 Limited land availability

- 5.2.2.4 High expenses associated with retrofitting existing RMUs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Benefits of integrating RMUs with distribution management system

- 5.2.3.2 Government-led initiatives to boost adoption of smart RMUs

- 5.2.3.3 Growing use of smart technologies to transform power distribution

- 5.2.3.4 Ongoing digitalization of electricity sector

- FIGURE 28 GLOBAL DATA ON INVESTMENTS IN ENERGY, 2015-2023

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial investment in smart RMUs

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 30 ECOSYSTEM ANALYSIS: RING MAIN UNIT MARKET

- TABLE 10 ROLES OF COMPANIES IN RING MAIN UNIT ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING TREND, BY VOLTAGE RATING

- TABLE 11 INDICATIVE PRICING TREND, BY VOLTAGE RATING (USD)

- 5.5.2 AVERAGE SELLING PRICE TREND OF RING MAIN UNIT, BY REGION

- TABLE 12 AVERAGE SELLING PRICE TREND OF RING MAIN UNIT, BY REGION, 2020-2024 (USD)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF RING MAIN UNIT, BY REGION, 2020-2024 (USD)

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 32 RING MAIN UNIT MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Vacuum technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Smart RMUs

- 5.7.1 KEY TECHNOLOGIES

- 5.8 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 13 RING MAIN UNIT MARKET: LIST OF CONFERENCES AND EVENTS

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFF ANALYSIS

- TABLE 14 IMPORT TARIFF FOR HS CODE 853690-COMPLIANT PRODUCTS, 2023

- TABLE 15 IMPORT DATA FOR HS 853590 CODE-COMPLIANT PRODUCTS, 2023

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 CODES AND REGULATIONS

- TABLE 20 GLOBAL REGULATIONS AND STANDARDS RELATED TO RING MAIN UNIT TECHNOLOGY

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 853590)

- TABLE 21 IMPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- FIGURE 34 IMPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- 5.11.2 EXPORT DATA (HS CODE 853590)

- TABLE 22 EXPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- FIGURE 35 EXPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- 5.11.3 IMPORT DATA (HS CODE 853690)

- TABLE 23 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- FIGURE 36 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- 5.11.4 EXPORT DATA (HS CODE 853690)

- TABLE 24 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- FIGURE 37 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

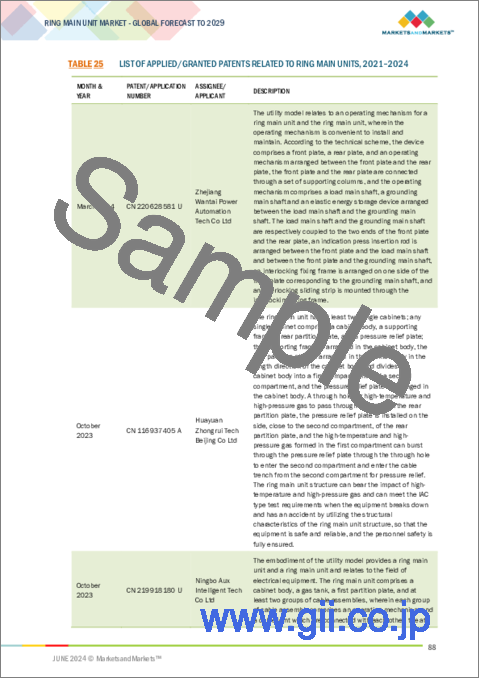

- 5.12 PATENT ANALYSIS

- FIGURE 38 NUMBER OF PATENTS APPLIED AND GRANTED FOR RING MAIN UNITS, 2014-2023

- TABLE 25 LIST OF APPLIED/GRANTED PATENTS RELATED TO RING MAIN UNITS, 2021-2024

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 RING MAIN UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 26 RING MAIN UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 41 KEY BUYING CRITERIA, BY END USER

- TABLE 28 KEY BUYING CRITERIA, BY END USER

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 LS ELECTRIC OFFERED RENEWABLE PROJECTS AEGIS 36-RING MAIN UNIT TO ENSURE RELIABILITY AND COST-EFFICIENCY

- 5.15.2 SUC COBURG PROVIDED ABB WITH SAFERING AIRPLUS RMUS TO BOOST POWER RELIABILITY

- 5.15.3 SCHNEIDER ELECTRIC PROVIDED UTILITY COMPANY WITH RM6 SERIES GAS-INSULATED RMUS TO IMPROVE NETWORK MANAGEMENT

6 RING MAIN UNIT MARKET, BY POSITION

- 6.1 INTRODUCTION

- FIGURE 42 3-POSITION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- TABLE 29 RING MAIN UNIT MARKET, BY POSITION, 2020-2023 (USD MILLION)

- TABLE 30 RING MAIN UNIT MARKET, BY POSITION, 2024-2029 (USD MILLION)

- 6.2 3-POSITION

- 6.2.1 BUILT-IN DIAGNOSTICS FEATURE FOR PROACTIVE PERFORMANCE MONITORING TO FUEL MARKET GROWTH

- 6.3 6-POSITION

- 6.3.1 ABILITY TO CONTROL ELECTRICAL POWER DISTRIBUTION IN MEDIUM TO HIGH-VOLTAGE ENVIRONMENTS TO DRIVE DEMAND

- 6.4 OTHERS

7 RING MAIN UNIT MARKET, BY INSULATION TYPE

- 7.1 INTRODUCTION

- FIGURE 43 GAS-INSULATED SEGMENT DOMINATED MARKET IN 2023

- TABLE 31 RING MAIN UNIT MARKET, BY INSULATION TYPE, 2020-2023 (USD MILLION)

- TABLE 32 RING MAIN UNIT MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- 7.2 GAS-INSULATED

- 7.2.1 GROWING DEMAND FOR HIGH DIELECTRIC STRENGTH IN MEDIUM-AND HIGH-VOLTAGE APPLICATIONS TO FUEL SEGMENTAL GROWTH

- TABLE 33 GAS-INSULATED: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 GAS-INSULATED: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 AIR-INSULATED

- 7.3.1 RISING NEED TO REDUCE CARBON FOOTPRINTS TO DRIVE MARKET

- TABLE 35 AIR-INSULATED: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 AIR-INSULATED: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4 OIL-INSULATED

- 7.4.1 ABILITY TO WITHSTAND HEAVY LOADS IN INDUSTRIAL SETTINGS TO STIMULATE MARKET GROWTH

- TABLE 37 OIL-INSULATED: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 OIL-INSULATED: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.5 SOLID DIELECTRIC

- 7.5.1 INCREASING DEMAND FOR LOW-MAINTENANCE AND ECO-FRIENDLY SOLUTIONS TO FOSTER MARKET GROWTH

- TABLE 39 SOLID DIELECTRIC: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 SOLID DIELECTRIC: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

8 RING MAIN UNIT MARKET, BY INSTALLATION

- 8.1 INTRODUCTION

- FIGURE 44 INDOOR SEGMENT CLAIMED LARGER MARKET SHARE IN 2023

- TABLE 41 RING MAIN UNIT MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 42 RING MAIN UNIT MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- 8.2 INDOOR

- 8.2.1 RISING DEMAND FOR INTERLOCKS AND ARC-PROOF ENCLOSURES TO FUEL SEGMENTAL GROWTH

- TABLE 43 INDOOR: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 INDOOR: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 OUTDOOR

- 8.3.1 ABILITY TO WITHSTAND EXTREME TEMPERATURES, RAIN, AND HUMIDITY TO DRIVE MARKET

- TABLE 45 OUTDOOR: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 OUTDOOR: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

9 RING MAIN UNIT MARKET, BY VOLTAGE RATING

- 9.1 INTRODUCTION

- FIGURE 45 UP TO 15 KV SEGMENT DOMINATED MARKET IN 2023

- TABLE 47 RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2020-2023 (USD MILLION)

- TABLE 48 RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- 9.2 UP TO 15 KV

- 9.2.1 GOVERNMENT-LED INITIATIVES TO ELECTRIFY RURAL AREAS TO DRIVE MARKET

- TABLE 49 UP TO 15 KV: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 UP TO 15 KV: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 16-25 KV

- 9.3.1 ONGOING DEVELOPMENTS IN WIND ENERGY AND INDUSTRIAL AUTOMATION TO FUEL MARKET GROWTH

- TABLE 51 16-25 KV: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 16-25 KV: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 ABOVE 25 KV

- 9.4.1 GROWING IMPLEMENTATION IN LARGE-SCALE COMMERCIAL BUILDINGS TO BOOST DEMAND

- TABLE 53 ABOVE 25 KV: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 ABOVE 25 KV: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

10 RING MAIN UNIT MARKET, BY STRUCTURE

- 10.1 INTRODUCTION

- FIGURE 46 NON-EXTENSIBLE SEGMENT SECURED LARGER MARKET SHARE IN 2023

- TABLE 55 RING MAIN UNIT MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 56 RING MAIN UNIT MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- 10.2 NON-EXTENSIBLE

- 10.2.1 GROWING NUMBER OF INFRASTRUCTURE PROJECTS IN URBAN REDEVELOPMENT AND SMART CITY INITIATIVES TO DRIVE MARKET

- TABLE 57 NON-EXTENSIBLE: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 NON-EXTENSIBLE: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 EXTENSIBLE

- 10.3.1 RISING EMPHASIS ON URBANIZATION AND INDUSTRIALIZATION TO BOOST DEMAND

- TABLE 59 EXTENSIBLE: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 EXTENSIBLE: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

11 RING MAIN UNIT MARKET, BY END USER

- 11.1 INTRODUCTION

- FIGURE 47 DISTRIBUTION UTILITIES SEGMENT LED MARKET IN 2023

- TABLE 61 RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 62 RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.2 DISTRIBUTION UTILITIES

- 11.2.1 GOVERNMENT-LED INITIATIVES AND INVESTMENTS TO DEVELOP SMART GRID TECHNOLOGIES TO BOOST DEMAND

- TABLE 63 DISTRIBUTION UTILITIES: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 DISTRIBUTION UTILITIES: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.3 INDUSTRIAL

- 11.3.1 RISING FOCUS OF REFINERIES AND PROCESSING FACILITIES ON SAFETY TO BOOST DEMAND

- TABLE 65 INDUSTRIAL PLANTS: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 INDUSTRIAL PLANTS: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.4 TRANSPORTATION INFRASTRUCTURE

- 11.4.1 GROWING REQUIREMENT FOR UNINTERRUPTED POWER SUPPLY TO ACCELERATE DEMAND

- TABLE 67 TRANSPORTATION INFRASTRUCTURE: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 TRANSPORTATION INFRASTRUCTURE: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.5 COMMERCIAL BUILDINGS

- 11.5.1 INCREASING DEPLOYMENT IN ESCALATORS, ELEVATORS, SECURITY SYSTEMS, AND HVAC UNITS TO DRIVE MARKET

- TABLE 69 COMMERCIAL BUILDINGS: RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 COMMERCIAL BUILDINGS: RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

12 RING MAIN UNIT MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 48 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 RING MAIN UNIT MARKET SHARE, BY REGION, 2023

- TABLE 71 RING MAIN UNIT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 RING MAIN UNIT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 RING MAIN UNIT MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 74 RING MAIN UNIT MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- 12.2 ASIA PACIFIC

- 12.2.1 RECESSION IMPACT ON RING MAIN UNIT MARKET IN ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: RING MAIN UNIT MARKET SNAPSHOT

- TABLE 75 ASIA PACIFIC: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2020-2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 77 ASIA PACIFIC: RING MAIN UNIT MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 78 ASIA PACIFIC: RING MAIN UNIT MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 79 ASIA PACIFIC: RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2020-2023 (USD MILLION)

- TABLE 80 ASIA PACIFIC: RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 81 ASIA PACIFIC: RING MAIN UNIT MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 82 ASIA PACIFIC: RING MAIN UNIT MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 83 ASIA PACIFIC: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 84 ASIA PACIFIC: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 85 ASIA PACIFIC: RING MAIN UNIT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 ASIA PACIFIC: RING MAIN UNIT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.2.2 CHINA

- 12.2.2.1 Government-led initiatives to upgrade and expand existing grid infrastructure to boost demand

- TABLE 87 CHINA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 88 CHINA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.2.3 INDIA

- 12.2.3.1 Increasing demand for reliable power distribution infrastructure to drive market

- TABLE 89 INDIA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 90 INDIA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.2.4 JAPAN

- 12.2.4.1 Rising focus on modernizing existing electricity grid to fuel market growth

- TABLE 91 JAPAN: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 92 JAPAN: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.2.5 MALAYSIA

- 12.2.5.1 Growing emphasis on reducing greenhouse gas emissions to boost demand

- TABLE 93 MALAYSIA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 94 MALAYSIA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.2.6 SOUTH KOREA

- 12.2.6.1 Increasing deployment of smart grid technologies in urban areas to drive market

- TABLE 95 SOUTH KOREA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 96 SOUTH KOREA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.2.7 REST OF ASIA PACIFIC

- TABLE 97 REST OF ASIA PACIFIC: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT ON RING MAIN UNIT MARKET IN EUROPE

- FIGURE 51 EUROPE: RING MAIN UNIT MARKET SNAPSHOT

- TABLE 99 EUROPE: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2020-2023 (USD MILLION)

- TABLE 100 EUROPE: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 101 EUROPE: RING MAIN UNIT MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 102 EUROPE: RING MAIN UNIT MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 103 EUROPE: RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2020-2023 (USD MILLION)

- TABLE 104 EUROPE: RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 105 EUROPE: RING MAIN UNIT MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 106 EUROPE: RING MAIN UNIT MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 107 EUROPE: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 108 EUROPE: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 109 EUROPE: RING MAIN UNIT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 EUROPE: RING MAIN UNIT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Growing emphasis on national grid expansion and modification to drive market

- TABLE 111 GERMANY: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 112 GERMANY: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Shifting focus to cut nuclear power reliance in electricity generation to boost market

- TABLE 113 FRANCE: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 114 FRANCE: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.3.4 UK

- 12.3.4.1 Government-led initiatives to regulate greenhouse gas emissions to fuel market growth

- TABLE 115 UK: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 116 UK: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.3.5 REST OF EUROPE

- TABLE 117 REST OF EUROPE: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 118 REST OF EUROPE: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.4 NORTH AMERICA

- 12.4.1 RECESSION IMPACT ON RING MAIN UNIT MARKET IN NORTH AMERICA

- TABLE 119 NORTH AMERICA: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2020-2023 (USD MILLION)

- TABLE 120 NORTH AMERICA: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 121 NORTH AMERICA: RING MAIN UNIT MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: RING MAIN UNIT MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 123 NORTH AMERICA: RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2020-2023 (USD MILLION)

- TABLE 124 NORTH AMERICA: RING MAIN UNIT MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 125 NORTH AMERICA: RING MAIN UNIT MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 126 NORTH AMERICA: RING MAIN UNIT MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 127 NORTH AMERICA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 128 NORTH AMERICA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 129 NORTH AMERICA: RING MAIN UNIT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 130 NORTH AMERICA: RING MAIN UNIT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.4.2 US

- 12.4.2.1 Increasing adoption of renewable energy sources to drive market

- TABLE 131 US: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 132 US: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.4.3 CANADA

- 12.4.3.1 Growing emphasis on developing alternative insulation materials to SF6 to boost demand

- TABLE 133 CANADA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 134 CANADA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.4.4 MEXICO

- 12.4.4.1 Pressing need to reduce dependence on coal for power generation to boost demand

- TABLE 135 MEXICO: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 136 MEXICO: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 RECESSION IMPACT ON RING MAIN UNIT MARKET IN MIDDLE EAST & AFRICA

- TABLE 137 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2020-2023 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 147 GCC: RING MAIN UNIT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 148 GCC: RING MAIN UNIT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.5.2 GCC

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Rapid urbanization and industrialization to boost demand

- 12.5.2.1 Saudi Arabia

- TABLE 149 SAUDI ARABIA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 150 SAUDI ARABIA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.5.2.2 UAE

- 12.5.2.2.1 Rising need for grid modernization to meet high energy demands to create opportunities

- 12.5.2.2 UAE

- TABLE 151 UAE: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 152 UAE: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.5.2.3 Rest of GCC

- TABLE 153 REST OF GCC: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 154 REST OF GCC: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.5.3 EGYPT

- 12.5.3.1 Increasing urbanization and industrialization to drive market

- TABLE 155 EGYPT: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 156 EGYPT: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Integration of advanced monitoring and control systems to drive market

- TABLE 157 SOUTH AFRICA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 158 SOUTH AFRICA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 159 REST OF MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.6 SOUTH AMERICA

- 12.6.1 RECESSION IMPACT ON RING MAIN UNIT MARKET IN SOUTH AMERICA

- TABLE 161 SOUTH AMERICA: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2020-2023 (USD MILLION)

- TABLE 162 SOUTH AMERICA: RING MAIN UNIT MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 163 SOUTH AMERICA: RING MAIN UNIT MARKET, BY INSTALLATION, 2020-2023 (USD MILLION)

- TABLE 164 SOUTH AMERICA: RING MAIN UNIT MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 165 SOUTH AMERICA: RING MAIN UNIT MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 166 SOUTH AMERICA: RING MAIN UNIT MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 167 SOUTH AMERICA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 168 SOUTH AMERICA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 169 SOUTH AMERICA: RING MAIN UNIT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 SOUTH AMERICA: RING MAIN UNIT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.6.2 BRAZIL

- 12.6.2.1 Increasing demand for efficient electricity distribution to drive demand

- TABLE 171 BRAZIL: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 172 BRAZIL: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.6.3 ARGENTINA

- 12.6.3.1 Rising use of automated and digital monitoring systems to drive market

- TABLE 173 ARGENTINA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 174 ARGENTINA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

- 12.6.4 REST OF SOUTH AMERICA

- TABLE 175 REST OF SOUTH AMERICA: RING MAIN UNIT MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: RING MAIN UNIT MARKET, BY END USER, 2024-2029 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 177 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2023

- TABLE 178 RING MAIN UNIT MARKET: DEGREE OF COMPETITION, 2023

- FIGURE 52 RING MAIN UNIT MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2019-2023

- FIGURE 53 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 54 RING MAIN UNIT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- FIGURE 55 RING MAIN UNIT MARKET: COMPANY FOOTPRINT

- 13.5.5.2 End user footprint

- TABLE 179 RING MAIN UNIT MARKET: END USER FOOTPRINT

- 13.5.5.3 Installation footprint

- TABLE 180 RING MAIN UNIT MARKET: INSTALLATION FOOTPRINT

- 13.5.5.4 Voltage rating footprint

- TABLE 181 RING MAIN UNIT MARKET: VOLTAGE RATING FOOTPRINT

- 13.5.5.5 Insulation type footprint

- TABLE 182 RING MAIN UNIT MARKET: INSULATION TYPE FOOTPRINT

- 13.5.5.6 Position footprint

- TABLE 183 RING MAIN UNIT MARKET: POSITION FOOTPRINT

- 13.5.5.7 Structure footprint

- TABLE 184 RING MAIN UNIT MARKET: STRUCTURE FOOTPRINT

- 13.5.5.8 Region footprint

- TABLE 185 RING MAIN UNIT MARKET: REGION FOOTPRINT

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 56 RING MAIN UNIT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.6.5.1 Detailed list of key startups/SMEs

- TABLE 186 RING MAIN UNIT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 187 RING MAIN UNIT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 58 COMPANY VALUATION, 2024

- 13.8 BRAND/PRODUCT COMPARISON

- FIGURE 59 PRODUCT/BRAND COMPARISON

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- TABLE 188 RING MAIN UNIT MARKET: PRODUCT LAUNCHES, APRIL 2020-FEBRUARY 2024

- 13.9.2 DEALS

- TABLE 189 RING MAIN UNIT MARKET: DEALS, APRIL 2020-FEBRUARY 2024

- 13.9.3 OTHERS

- TABLE 190 RING MAIN UNIT MARKET: OTHERS, APRIL 2020-FEBRUARY 2024

14 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 14.1 KEY PLAYERS

- 14.1.1 ABB

- TABLE 191 ABB: COMPANY OVERVIEW

- FIGURE 60 ABB: COMPANY SNAPSHOT

- TABLE 192 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 ABB: OTHERS

- 14.1.2 SIEMENS

- TABLE 194 SIEMENS: COMPANY OVERVIEW

- FIGURE 61 SIEMENS: COMPANY SNAPSHOT

- TABLE 195 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 SIEMENS: PRODUCT LAUNCHES

- TABLE 197 SIEMENS: DEALS

- TABLE 198 SIEMENS: OTHERS

- 14.1.3 EATON

- TABLE 199 EATON: COMPANY OVERVIEW

- FIGURE 62 EATON: COMPANY SNAPSHOT

- TABLE 200 EATON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 EATON: DEALS

- 14.1.4 SCHNEIDER ELECTRIC

- TABLE 202 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 203 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 205 SCHNEIDER ELECTRIC: DEALS

- TABLE 206 SCHNEIDER ELECTRIC: OTHERS

- 14.1.5 LS ELECTRIC CO., LTD.

- TABLE 207 LS ELECTRIC CO., LTD.: COMPANY OVERVIEW

- FIGURE 64 LS ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 208 LS ELECTRIC CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 209 LS ELECTRIC CO., LTD.: PRODUCT LAUNCHES

- TABLE 210 LS ELECTRIC CO., LTD.: DEALS

- 14.1.6 LUCY GROUP LTD.

- TABLE 211 LUCY GROUP LTD.: COMPANY OVERVIEW

- TABLE 212 LUCY GROUP LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 LUCY GROUP LTD.: DEALS

- 14.1.7 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- TABLE 214 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY OVERVIEW

- FIGURE 65 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

- TABLE 215 CG POWER & INDUSTRIAL SOLUTIONS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.8 TIEPCO

- TABLE 216 TIEPCO: COMPANY OVERVIEW

- TABLE 217 TIEPCO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.9 ENTEC ELECTRIC & ELECTRONIC

- TABLE 218 ENTEC ELECTRIC & ELECTRONIC: COMPANY OVERVIEW

- TABLE 219 ENTEC ELECTRIC & ELECTRONIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.10 ORECCO

- TABLE 220 ORECCO: COMPANY OVERVIEW

- TABLE 221 ORECCO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.11 LARSEN & TOUBRO LIMITED

- TABLE 222 LARSEN & TOUBRO LIMITED: COMPANY OVERVIEW

- FIGURE 66 LARSEN & TOUBRO LIMITED: COMPANY SNAPSHOT

- TABLE 223 LARSEN & TOUBRO LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 LARSEN & TOUBRO LIMITED: OTHERS

- 14.1.12 NATUS GMBH & CO. KG

- TABLE 225 NATUS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 226 NATUS GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.13 ALFANAR GROUP

- TABLE 227 ALFANAR GROUP: COMPANY OVERVIEW

- TABLE 228 ALFANAR GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.14 ROCKWILL

- TABLE 229 ROCKWILL: COMPANY OVERVIEW

- TABLE 230 ROCKWILL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.15 KONCAR D.D.

- TABLE 231 KONCAR D.D.: COMPANY OVERVIEW

- FIGURE 67 KONCAR D.D.: COMPANY SNAPSHOT

- TABLE 232 KONCAR D.D.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.16 MEGAWIN

- TABLE 233 MEGAWIN: COMPANY OVERVIEW

- TABLE 234 MEGAWIN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.17 BONOMI EUGENIO SPA

- TABLE 235 BONOMI EUGENIO SPA: COMPANY OVERVIEW

- TABLE 236 BONOMI EUGENIO SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.18 CHINT GROUP

- TABLE 237 CHINT GROUP: COMPANY OVERVIEW

- TABLE 238 CHINT GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 CHINT GROUP: DEALS

- 14.1.19 KDM STEEL

- TABLE 240 KDM STEEL: COMPANY OVERVIEW

- TABLE 241 KDM STEEL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.20 C-SEC TECHNOLOGIES PRIVATE LIMITED

- TABLE 242 C-SEC TECHNOLOGIES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 243 C-SEC TECHNOLOGIES PRIVATE LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 YUEQING LIYOND ELECTRIC CO., LTD

- 14.2.2 CHINA TRANSPOWERS ELECTRIC CO., LIMITED

- 14.2.3 INDKOM ENGINEERING SDN. BHD.

- 14.2.4 SKYY CREATECH SERVICES PVT. LTD.

- 14.2.5 BVM TECHNOLOGIES PRIVATE LIMITED

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS