|

|

市場調査レポート

商品コード

1300112

コラーゲンペプチドの世界市場:原料別 (ウシ、ブタ、海産物、家禽)・用途別 (食品・飲料、栄養製品、化粧品・パーソナルケア製品、医薬品)・形状別 (乾燥、液体)・地域別の将来予測 (2028年まで)Collagen Peptides Market by Source (Bovine, Porcine, Marine & Poultry), Application (Food & Beverages, Nutritional Products, Cosmetics & Personal Care Products, Pharmaceuticals), Form (Dry, Liquid) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| コラーゲンペプチドの世界市場:原料別 (ウシ、ブタ、海産物、家禽)・用途別 (食品・飲料、栄養製品、化粧品・パーソナルケア製品、医薬品)・形状別 (乾燥、液体)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月22日

発行: MarketsandMarkets

ページ情報: 英文 224 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のコラーゲンペプチドの市場規模は、2023年の6億9,900万米ドルから、2028年までに9億2,200万米ドルに達し、予測期間中に5.7%のCAGR (金額ベース) で成長すると予測されています。

コラーゲンペプチド市場には、乾燥・液体の二つの形状があります。乾燥の方が市場シェアは大きいですが、液体コラーゲンペプチドは、様々な濃度・粘度で利用可能なことなどの要因によって牽引されています。乾燥状態のコラーゲンペプチドの需要は主に、費用対効果、優れた混合特性、より長い保存期間、便利な包装形態などの要因によるものです。主な制約と課題は、動物由来のコラーゲン製品に対する菜食主義への消費者のシフトなど、持続可能で倫理的な問題です。さらに、中東、イスラエル、インドなどの地域における文化的制限が、コラーゲンペプチド市場の成長を妨げています。

"用途別では、海産物・家禽が予測期間中に高い需要が見込まれる"

ウシやブタから抽出されるコラーゲンペプチドは、豚インフルエンザなどの健康上の問題からいくつかの制限があるため、研究者により他の抽出源が発見されました。マリンコラーゲンは、魚類やクラゲや海綿動物などの無脊椎動物から抽出されます。魚から抽出されたコラーゲンペプチドは、ペプチド組成の種類が比較的小さいです。これらは消化性が高く、体内で吸収・分布されやすいです。魚から抽出されたコラーゲンは溶解性が高く、使用中に溶けやすい性質があります。さらに、魚コラーゲンペプチドは、生物医学、食品科学、化粧品などの用途に使用できます。これらの要因から、このセグメントは最も高いCAGRで成長すると予測されています。

"形状別では、乾燥形状がコラーゲンペプチド市場を独占する"

乾燥形状のコラーゲンペプチドは、凝集体または微粉末として入手可能です。粉末形態は、その迅速な溶解挙動により、様々な産業で主に使用されています。粉末コラーゲンペプチドは優れた混合特性を示し、そのため様々な食品用途 (コーヒー、スムージー、乳製品、スナック、スープ、ソース、菓子類など) でますます使用されるようになっています。凝集粉末は塊にならない特性や、取扱過程で粉塵を出さない、滑らかな流動性、一貫性、目詰まりがない、優れた保存性など、他にもいくつかの利点を有しています。これらすべての特性が、食品加工における乾燥・粉末コラーゲンペプチドの使用を後押ししています。

"アジア太平洋は予測期間中、市場成長に大きく貢献する"

アジア太平洋 (中国、インド、日本、オーストラリア、ニュージーランド、その他) のコラーゲンペプチド市場は、主に人口の増加、アジア太平洋地域の急速な都市化、可処分所得の増加、栄養製品に対する需要の増加などの要因によって成長しています。

オーストラリア・ニュージーランド、インド、中国、日本では、人口の購買力の上昇と健康食品・飲食品、医薬品、化粧品に対する需要の高まりにより、大幅な成長が見られます。

この地域は異質であり、所得水準、技術、バリューチェーンにおけるエンドユーザー・メーカーにより良い品質のコラーゲンペプチドを提供するための最終消費者の要求が多様です。アジア太平洋市場は、製造業者にとっての投資機会と経済の繁栄により、コラーゲンペプチドにとって計り知れない機会を提供しています。これらの要因は、コラーゲンペプチド市場の需要を促進すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン

- サプライチェーン

- 技術分析:コラーゲンペプチド市場

- 機能性:コラーゲンペプチド市場

- 価格分析:コラーゲンペプチド市場

- 市場マップとエコシステム:コラーゲンペプチド市場

- 購入者に影響を与える動向/混乱

- 特許分析

- 主要な会議とイベント

- 資本取引データ:コラーゲンペプチド市場

- ポーターのファイブフォース分析

- 規制の枠組み

- ケーススタディ

第7章 コラーゲンペプチド市場:用途別

- イントロダクション

- 食品・飲料

- 飲料

- 乳製品

- スナック・スープ・ソース

- 肉製品

- 菓子類製品

- その他の食品用途

- 栄養製品

- 栄養補助食品

- スポーツ栄養

- 化粧品・パーソナルケア製品

- 医薬品

第8章 コラーゲンペプチド市場:原料別

- イントロダクション

- ウシ

- ブタ

- 海産物・家禽

第9章 コラーゲンペプチド市場:形状別

- イントロダクション

- 乾燥

- 液体

第10章 コラーゲンペプチド市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- オーストラリアとニュージーランド

- インド

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- アフリカ

- 中東

第11章 競合情勢

- 概要

- 市場シェア分析 (2022年)

- 主要企業の収益分析:セグメント別

- 主要企業が採用した戦略

- 企業評価クアドラント:主要企業

- コラーゲンペプチド市場:製品フットプリント (主要企業)

- コラーゲンペプチド市場:スタートアップ/中小企業向け企業評価クアドラント (2022年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- TESSENDERLO GROUP

- GELITA AG

- HOLISTA COLLTECH

- DARLING INGREDIENTS

- NITTA GELATIN, INC

- GELNEX

- LAPI GELATINE S.P.A.

- WEISHARDT

- CRESCENT BIOTECH

- FOODMATE CO., LTD.

- VISCOFAN DE GMBH

- BIOCELL TECHNOLOGY

- AMICOGEN, INC

- KAYOS

- NIPPI. INC

- その他の企業

- ASPEN NATURALS

- VITAL PROTEINS LLC

- CHAITANYA AGRO BIOTECH PVT. LTD

- EWALD GELATINE GMBH

- PEPTECH COLAGENO DO BRASIL LTDA

- BSA PHARMA INC.

- NEW ALLIANCE FINE CHEM PRIVATE LIMITED

- JELLICE GELATIN & COLLAGEN

- RUDRA BIOVENTURES PRIVATE LIMITED

- ALPSPURE LIFESCIENCES PRIVATE LIMITED

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- コラーゲン市場

- マリンコラーゲン市場

第14章 付録

According to MarketsandMarkets, the collagen peptides market is projected to reach USD 922 million by 2028 from USD 699 million by 2023, at a CAGR of 5.7% during the forecast period in terms of value. The collagen peptides market comprises both dry and liquid forms; although dry forms hold a larger market share, liquid collagen peptides are being driven by factors such as their use as variable agents across varying viscosity in different protein concentrations. The demand for dry forms of collagen peptides is mainly due to factors such as cost-effectiveness, excellent blending properties, longer shelf lives, and convenient packaging. The major constraints and challenges are sustainable and ethical issues such as consumer shift towards veganism for animal-based collagen products. Moreover, cultural restrictions in areas such as Middle East, Israel, and India hinders the growth of the collagen peptides market.

"By application, marine & poultry is projected in high demand during the forecast period."

As collagen peptides extracted from bovine and porcine have some limitations due to health problems such as swine flu, other sources of extraction were discovered by researchers. Marine collagens are extracted from different sources, which include fishes and invertebrate marine animals such as jellyfish and sponges. Collagen peptides extracted from fish are relatively smaller in terms of the type of peptide composition. These increase digestibility and are absorbed and distributed easily in the body. The collagen sourced from fish has increased solubility, which makes it dissolve easily during its usage. Furthermore, fish collagen peptides can be used in applications, such as biomedicine, food science, and cosmetics. Owing to these factors, the segment is projected to grow at the highest CAGR.

"By form, the dry format is expected to dominate the market for collagen peptides"

The dry form of collagen peptides is available as agglomerated or fine powder. The powder form is majorly used in various industries, owing to its quick solubility behavior. Powdered collagen peptides showcase excellent blending properties, which is why it is increasingly used in various food applications. These can be added to most food applications, including coffee, smoothies, dairy products, snacks, soups, & sauces, and confectionery products. The agglomerated powder possesses several other advantages, such as no lump formation, dust-free handling, smooth flowability, consistency, no clogging, and excellent storage ability. All these properties drive the use of the dry or powdered form of collagen peptides in food processing.

Asia Pacific will significantly contribute towards market growth during the forecast period

Geographically, the region is segmented as China, India, Japan, Australia, and New Zealand along with the Rest of Asia-Pacific. The collagen peptides market in Asia-Pacific is growing primarily due to factors such as growth in population, rapid urbanization in the Asia Pacific region, rise in disposable incomes, and an increase in demand for nutritional products.

Substantial growth is witnessed in Australia & New Zealand, India, China, and Japan owing to the rise in the purchasing power of the population and demand for healthy food & beverages, pharma, and cosmetics products.

The region is heterogeneous, with diversity in income levels, technology, and demands of the end consumers to provide better-quality collagen peptides to end-user manufacturers in value chain. The Asia Pacific market presents immense opportunities for collagen peptides owing to investment opportunities for manufacturers and thriving economies. These factors are expected to drive demand for collagen peptides market.

The break-up of Primaries:

By Company Type: Tier1-30%, Tier 2-25%, Tier 3- 45%

By Designation: CXOs-40%, Managers - 25%, and Executives- 35%

By Region: Asia Pacific - 40%, Europe - 30%, North America - 16%, RoW - 14%,

Leading players profiled in this report:

- Tessenderlo Group (Belgium)

- Gelita AG (Germany)

- Holista Colltech (Australia)

- Darling Ingredients (US)

- Nitta Gelatin, Inc. (Japan)

- Gelnex (Brazil)

- Lapi Gelatin S.p.a (Italy)

- Weishardt (France)

- Crescent Biotech (India)

- Foodmate Co., Ltd. (China)

- Viscofan DE GmbH (Germany)

- Biocell Technology (US)

- Amicogen, Inc (South Korea)

- Nippi, Inc (Japan)

- Vital Proteins LLC (US)

- Chaitanya Agro Biotech Pvt. Ltd. (India)

- Ewald Gelatin (Germany)

- Peptech Colageno do Brasil Ltda (Brazil)

- BSA Pharma Inc (India)

- NEW ALLIANCE FINE CHEM PVT. LTD (India)

- JELLICE GELATIN & COLLAGEN (Netherlands)

- Rudra Bioventures Pvt. Ltd. (India)

- Alpsure Lifesciences Private Limited (India)

The study includes an in-depth competitive analysis of these key players in the collagen peptides market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the collagen peptides market on the basis of Source, Application, Form, and Region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global collagen peptides market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall collagen peptides market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased demand for collagen peptides in food & beverage industry), restraints (consumer shift towards vegan diets), opportunity (Promotion of healthy diets by governments), and challenges (Ethical and sustainability concerns) influencing the growth of the collagen peptides market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the collagen peptides market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the collagen peptides market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the collagen peptides market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Tessenderlo Group (Belgium), Gelita AG (Germany), Holista Colltech (Australia), Darling Ingredients (US), and Nitta Gelatin Inc. (Japan). The report also helps stakeholders understand the collagen peptides and related market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.6.1 CURRENCY

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.6.2 VOLUME

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 COLLAGEN PEPTIDES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE - BOTTOM-UP (BASED ON COLLAGEN PEPTIDE TYPE, BY REGION)

- 2.2.2 APPROACH TWO - TOP-DOWN (BASED ON THE GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 RECESSION IMPACT ON MARKET

- 2.4.1 MACRO INDICATORS OF RECESSION

- FIGURE 4 INDICATORS OF RECESSION

- FIGURE 5 WORLD INFLATION RATE: 2011-2021

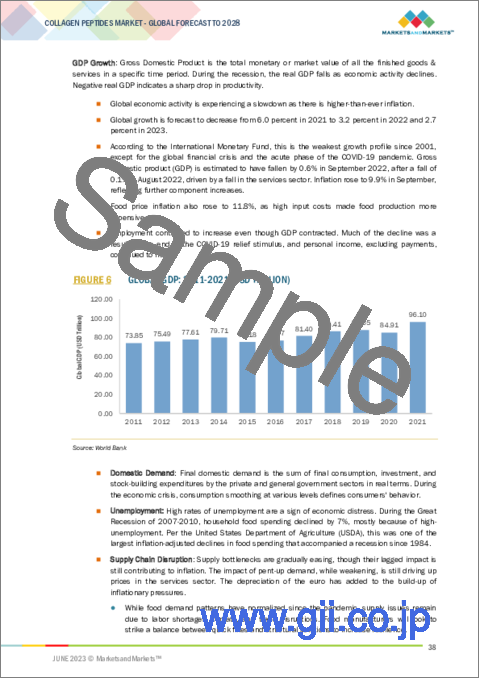

- FIGURE 6 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 7 RECESSION INDICATORS AND THEIR IMPACT ON MARKET

- FIGURE 8 COLLAGEN PEPTIDES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT OF STUDY

3 EXECUTIVE SUMMARY

- TABLE 2 COLLAGEN PEPTIDES MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 9 COLLAGEN PEPTIDES MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 COLLAGEN PEPTIDES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 COLLAGEN PEPTIDES MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 COLLAGEN PEPTIDES MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN COLLAGEN PEPTIDES MARKET

- FIGURE 13 INCREASING DEMAND FOR NUTRITIONAL PRODUCTS TO PROPEL MARKET

- 4.2 EUROPE: COLLAGEN PEPTIDES MARKET, BY SOURCE AND COUNTRY

- FIGURE 14 BOVINE SEGMENT AND GERMANY TO ACCOUNT FOR LARGEST SHARES IN MARKET

- 4.3 COLLAGEN PEPTIDES MARKET, BY APPLICATION

- FIGURE 15 NUTRITIONAL PRODUCTS SEGMENT TO DOMINATE MARKET

- 4.4 COLLAGEN PEPTIDES MARKET, BY SOURCE

- FIGURE 16 BOVINE TO DOMINATE MARKET

- 4.5 COLLAGEN PEPTIDES MARKET, BY FORM

- FIGURE 17 DRY SEGMENT TO DOMINATE MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 COLLAGEN PEPTIDES MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for collagen peptides in medical applications

- 5.2.1.2 Increasing use of collagen peptides in food & beverages

- TABLE 3 USAGE LEVEL OF COLLAGEN PEPTIDES IN FOOD & BEVERAGE APPLICATIONS

- 5.2.1.3 Increasing use of cosmetic and personal care products in collagen peptides

- 5.2.1.4 Technological advancements in collagen extraction and production

- 5.2.2 RESTRAINTS

- 5.2.2.1 Consumer shift toward vegan diets

- 5.2.2.2 Cultural restriction on consumption of animal-sourced proteins

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Promotion of healthy diets by governments

- 5.2.3.2 Immense opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Insufficient processing technologies

- 5.2.4.2 Ethical and sustainability concerns

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- FIGURE 19 COLLAGEN PEPTIDES MARKET: VALUE CHAIN

- 6.3 SUPPLY CHAIN

- FIGURE 20 COLLAGEN PEPTIDES MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS: COLLAGEN PEPTIDES MARKET

- 6.5 FUNCTIONALITIES: COLLAGEN PEPTIDES MARKET

- 6.5.1 BINDING AGENT

- 6.5.1.1 Water-binding properties help in production of low-fat meat products

- 6.5.2 TEXTURING AGENT

- 6.5.2.1 Collagen peptides provide unique mouthfeel and boost food nutritional profile

- 6.5.3 ANTIOXIDANT

- 6.5.3.1 Collagen peptides increasingly used in food & beverages as antioxidants

- 6.5.1 BINDING AGENT

- 6.6 PRICING ANALYSIS: COLLAGEN PEPTIDES MARKET

- 6.6.1 AVERAGE SELLING PRICE, BY SOURCE

- FIGURE 21 GLOBAL: AVERAGE SELLING PRICE, BY SOURCE (USD/TON)

- TABLE 4 COLLAGEN PEPTIDES MARKET: AVERAGE SELLING PRICE, BY SOURCE, 2020-2022 (USD/TON)

- TABLE 5 COLLAGEN PEPTIDES MARKET: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- 6.7 MARKET MAP AND ECOSYSTEM: COLLAGEN PEPTIDES MARKET

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.7.3 ECOSYSTEM VIEW

- FIGURE 22 MARKET MAP

- TABLE 6 COLLAGEN PEPTIDES MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.8 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING BUYERS: COLLAGEN PEPTIDES MARKET

- 6.9 PATENT ANALYSIS

- FIGURE 24 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 25 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 26 TOP 10 APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 7 PATENTS PERTAINING TO COLLAGEN PEPTIDES, 2021-2023

- 6.10 KEY CONFERENCES AND EVENTS

- TABLE 8 KEY CONFERENCES AND EVENTS IN COLLAGEN PEPTIDES MARKET, 2023-2024

- 6.11 TRADE DATA: COLLAGEN PEPTIDES MARKET

- 6.11.1 FOR PEPTONES AND THEIR DERIVATIVES (2020)

- TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2020 (KG)

- 6.11.2 FOR PEPTONES AND THEIR DERIVATIVES (2021)

- TABLE 10 TOP 10 IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2021 (USD THOUSAND)

- 6.11.3 FOR PEPTONES AND THEIR DERIVATIVES (2022)

- TABLE 11 TOP 10 IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2022 (USD THOUSAND)

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 COLLAGEN PEPTIDES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 REGULATORY FRAMEWORK

- 6.13.1 NORTH AMERICA

- 6.13.1.1 US

- 6.13.2 EUROPEAN FOOD SAFETY AUTHORITY (EFSA)

- 6.13.3 ASIA PACIFIC

- 6.13.3.1 China

- 6.13.3.2 Japan

- 6.13.3.3 India

- 6.13.4 SOUTH AMERICA

- 6.13.4.1 Brazil

- 6.13.5 MIDDLE EAST

- 6.13.5.1 UAE

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13.1 NORTH AMERICA

- 6.14 CASE STUDIES

- 6.14.1 GROWING DEMAND FOR COLLAGEN PEPTIDE-BASED SKINCARE PRODUCTS

- 6.14.2 RISING CONCERNS REGARDING HUMAN HEALTH AND WELLNESS

7 COLLAGEN PEPTIDES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 27 COLLAGEN PEPTIDES MARKET SIZE (VALUE), BY APPLICATION, 2023 VS. 2028

- TABLE 16 COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 17 COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 FOOD & BEVERAGES

- TABLE 18 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 20 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2018-2022 (USD MILLION)

- TABLE 21 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2023-2028 (USD MILLION)

- 7.2.1 BEVERAGES

- 7.2.1.1 Use of collagen peptides to add functional benefits

- 7.2.2 DAIRY PRODUCTS

- 7.2.2.1 Easy digestibility and cold solubility to fuel demand for collagen peptides in dairy products

- 7.2.3 SNACKS, SOUPS, AND SAUCES

- 7.2.3.1 Use of collagen peptides to provide health benefits

- 7.2.4 MEAT PRODUCTS

- 7.2.4.1 Collagen peptides to increase protein content in meat products

- 7.2.5 CONFECTIONERY PRODUCTS

- 7.2.5.1 Collagen peptides to replace unhealthy ingredients

- 7.2.6 OTHER FOOD APPLICATIONS

- 7.3 NUTRITIONAL PRODUCTS

- TABLE 22 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2018-2022 (USD MILLION)

- TABLE 25 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2023-2028 (USD MILLION)

- 7.3.1 DIETARY SUPPLEMENTS

- 7.3.1.1 Amino acids in collagen peptides to promote their use

- 7.3.2 SPORTS NUTRITION

- 7.3.2.1 Collagen peptides to witness increased demand by athletes

- 7.4 COSMETICS AND PERSONAL CARE PRODUCTS

- 7.4.1 COLLAGEN PROTEIN TO BE RESPONSIBLE FOR SKIN STRENGTH AND ELASTICITY

- TABLE 26 COSMETICS & PERSONAL CARE PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 COSMETICS & PERSONAL CARE PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- 7.5 PHARMACEUTICALS

- 7.5.1 BIOTECHNOLOGICAL ADVANCEMENTS TO INCREASE USE OF COLLAGEN PEPTIDES

- TABLE 28 PHARMACEUTICALS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 PHARMACEUTICALS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

8 COLLAGEN PEPTIDES MARKET, BY SOURCE

- 8.1 INTRODUCTION

- FIGURE 28 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- TABLE 30 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 31 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 32 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (KT)

- TABLE 33 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (KT)

- 8.2 BOVINE

- 8.2.1 EASE OF AVAILABILITY AND BIO-COMPATIBILITY TO MAKE BOVINE MAJOR COLLAGEN SOURCE

- TABLE 34 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (KT)

- TABLE 37 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (KT)

- 8.3 PORCINE

- 8.3.1 NON-ALLERGENIC ATTRIBUTES OF PORCINE TO FUEL DEMAND FOR COLLAGEN PEPTIDES

- TABLE 38 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (KT)

- TABLE 41 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (KT)

- 8.4 MARINE & POULTRY

- 8.4.1 INCREASED ABSORPTION AND EASY DIGESTIBILITY TO DRIVE DEMAND FOR COLLAGEN PEPTIDES SOURCED FROM MARINE & POULTRY

- TABLE 42 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (KT)

- TABLE 45 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (KT)

9 COLLAGEN PEPTIDES MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 29 COLLAGEN PEPTIDES MARKET SIZE (VALUE), BY FORM, 2023 VS. 2028

- TABLE 46 COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018-2022 (USD MILLION)

- TABLE 47 COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023-2028 (USD MILLION)

- 9.2 DRY

- 9.2.1 VERSATILITY OF POWDERED FORM OF COLLAGEN PEPTIDES TO MAKE IT POPULAR AMONG CONSUMERS

- TABLE 48 DRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 DRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- 9.3 LIQUID

- 9.3.1 VARYING VISCOSITY TO ENABLE MANUFACTURERS TO USE THEM AS VARIABLE AGENTS

- TABLE 50 LIQUID: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 LIQUID: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

10 COLLAGEN PEPTIDES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 AUSTRALIA & NEW ZEALAND TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 52 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 54 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (KT)

- TABLE 55 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (KT)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 31 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 32 NORTH AMERICAN COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- TABLE 56 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (KT)

- TABLE 61 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (KT)

- TABLE 62 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018-2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Increase in chronic diseases and technological advancements to drive market

- TABLE 66 US: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 67 US: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 68 US: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 69 US: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Growth in processed meat sector to drive demand for collagen peptides

- TABLE 70 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 71 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 72 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 73 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 Growth of beef and pork to drive market

- TABLE 74 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 75 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 76 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 77 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 33 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 34 EUROPEAN COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE: COLLAGEN PEPTIDES MARKET SNAPSHOT

- TABLE 78 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 79 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 80 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 81 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 82 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (KT)

- TABLE 83 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (KT)

- TABLE 84 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 85 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018-2022 (USD MILLION)

- TABLE 87 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rise in health awareness to contribute to market growth

- TABLE 88 UK: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 89 UK: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 90 UK: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 91 UK: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 Meat being staple in Germany to drive demand for collagen peptides

- TABLE 92 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 93 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 94 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 95 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.4 SPAIN

- 10.3.4.1 Growing food & beverage industry to facilitate use of collagen peptides

- TABLE 96 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 97 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 98 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 99 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 R&D activities to find new applications of collagen peptides

- TABLE 100 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 101 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 102 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 103 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Growing cosmetics industry to drive market

- TABLE 104 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 105 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 106 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 107 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 108 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 36 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 37 ASIA PACIFIC COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SNAPSHOT

- TABLE 112 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (KT)

- TABLE 117 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (KT)

- TABLE 118 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Wide coastal line to contribute to growth of marine-sourced collagen peptides

- TABLE 122 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 123 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 124 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 125 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Increase in consumption of processed food to drive market

- TABLE 126 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 127 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 128 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 129 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.4 AUSTRALIA & NEW ZEALAND

- 10.4.4.1 Rising demand for anti-aging skin care products to drive market growth

- TABLE 130 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 131 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 132 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Demand for healthier alternatives to ready-to-eat products to drive market growth

- TABLE 134 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 135 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 136 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 137 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 138 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 40 SOUTH AMERICAN COLLAGEN PEPTIDE MARKET: RECESSION IMPACT ANALYSIS

- TABLE 142 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 144 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (KT)

- TABLE 147 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (KT)

- TABLE 148 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018-2022 (USD MILLION)

- TABLE 151 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Brazil to be leading producer of grass-fed cattle

- TABLE 152 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 153 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 154 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 155 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.3 ARGENTINA

- 10.5.3.1 Abundance of grassland and breeding of cows without chemicals to drive demand for bovine-sourced collagen peptides

- TABLE 156 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 157 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 158 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 159 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.4 REST OF SOUTH AMERICA

- TABLE 160 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 161 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6 REST OF THE WORLD

- 10.6.1 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 41 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 42 REST OF THE WORLD COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- TABLE 164 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 168 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (KT)

- TABLE 169 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (KT)

- TABLE 170 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018-2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023-2028 (USD MILLION)

- 10.6.2 AFRICA

- 10.6.2.1 Usage of collagen peptides in medicines to address chronic diseases

- TABLE 174 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 175 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 176 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 177 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.3 MIDDLE EAST

- 10.6.3.1 Liberalization of trade to provide better-quality food products for citizens, driving collagen peptides market growth

- TABLE 178 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 179 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 180 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 181 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- TABLE 182 GLOBAL COLLAGEN PEPTIDE MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD BILLION)

- 11.4 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 183 COLLAGEN PEPTIDES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 44 GLOBAL COLLAGEN PEPTIDES MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 11.6 COLLAGEN PEPTIDES MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 184 COMPANY SOURCE FOOTPRINT

- TABLE 185 COMPANY APPLICATION FOOTPRINT

- TABLE 186 COMPANY REGIONAL FOOTPRINT

- TABLE 187 OVERALL COMPANY FOOTPRINT

- 11.7 COLLAGEN PEPTIDES MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 STARTING BLOCKS

- 11.7.3 RESPONSIVE COMPANIES

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 45 GLOBAL COLLAGEN PEPTIDES MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UPS/SMES)

- 11.7.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 188 GLOBAL COLLAGEN PEPTIDES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 189 GLOBAL COLLAGEN PEPTIDES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- TABLE 190 COLLAGEN PEPTIDES MARKET: PRODUCT LAUNCHES, 2019-2022

- 11.8.2 DEALS

- TABLE 191 COLLAGEN PEPTIDES MARKET: DEALS, 2019-2022

- 11.8.3 OTHERS

- TABLE 192 COLLAGEN PEPTIDES MARKET: OTHERS, 2019-2022

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

(Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)**

- 12.1.1 TESSENDERLO GROUP

- TABLE 193 TESSENDERLO GROUP: BUSINESS OVERVIEW

- FIGURE 46 TESSENDERLO GROUP: COMPANY SNAPSHOT

- TABLE 194 TESSENDERLO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TESSENDERLO GROUP: PRODUCT LAUNCHES

- TABLE 196 TESSENDERLO GROUP: DEALS

- TABLE 197 TESSENDERLO GROUP: OTHERS

- 12.1.2 GELITA AG

- TABLE 198 GELITA AG: BUSINESS OVERVIEW

- FIGURE 47 GELITA AG: COMPANY SNAPSHOT

- TABLE 199 GELITA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 GELITA AG: DEALS

- 12.1.3 HOLISTA COLLTECH

- TABLE 201 HOLISTA COLLTECH: BUSINESS OVERVIEW

- FIGURE 48 HOLISTA COLLTECH: COMPANY SNAPSHOT

- TABLE 202 HOLISTA COLLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HOLISTA COLLTECH: OTHERS

- 12.1.4 DARLING INGREDIENTS

- TABLE 204 DARLING INGREDIENTS: BUSINESS OVERVIEW

- FIGURE 49 DARLING INGREDIENTS: COMPANY SNAPSHOT

- TABLE 205 DARLING INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 DARLING INGREDIENTS: DEALS

- TABLE 207 DARLING INGREDIENTS: OTHERS

- 12.1.5 NITTA GELATIN, INC

- TABLE 208 NITTA GELATIN, INC: BUSINESS OVERVIEW

- FIGURE 50 NITTA GELATIN, INC: COMPANY SNAPSHOT

- TABLE 209 NITTA GELATIN, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NITTA GELATIN, INC: DEALS

- 12.1.6 GELNEX

- TABLE 211 GELNEX: BUSINESS OVERVIEW

- TABLE 212 GELNEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 GELNEX: OTHERS

- 12.1.7 LAPI GELATINE S.P.A.

- TABLE 214 LAPI GELATINE S.P.A.: BUSINESS OVERVIEW

- TABLE 215 LAPI GELATINE S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 WEISHARDT

- TABLE 216 WEISHARDT: BUSINESS OVERVIEW

- TABLE 217 WEISHARDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 CRESCENT BIOTECH

- TABLE 218 CRESCENT BIOTECH: BUSINESS OVERVIEW

- TABLE 219 CRESCENT BIOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.10 FOODMATE CO., LTD.

- TABLE 220 FOODMATE CO., LTD.: BUSINESS OVERVIEW

- TABLE 221 FOODMATE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.11 VISCOFAN DE GMBH

- TABLE 222 VISCOFAN DE GMBH: BUSINESS OVERVIEW

- TABLE 223 VISCOFAN DE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 BIOCELL TECHNOLOGY

- TABLE 224 BIOCELL TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 225 BIOCELL TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 AMICOGEN, INC

- TABLE 226 AMICOGEN, INC: BUSINESS OVERVIEW

- FIGURE 51 AMICOGEN, INC: COMPANY SNAPSHOT

- TABLE 227 AMICOGEN, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 KAYOS

- TABLE 228 KAYOS: BUSINESS OVERVIEW

- TABLE 229 KAYOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 NIPPI. INC

- TABLE 230 NIPPI, INC: BUSINESS OVERVIEW

- TABLE 231 NIPPI. INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 ASPEN NATURALS

- TABLE 232 ASPEN NATURALS: BUSINESS OVERVIEW

- TABLE 233 ASPEN NATURALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.2 VITAL PROTEINS LLC

- TABLE 234 VITAL PROTEINS LLC: BUSINESS OVERVIEW

- TABLE 235 VITAL PROTEINS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 VITAL PROTEINS LLC: NEW PRODUCT LAUNCHES

- 12.2.3 CHAITANYA AGRO BIOTECH PVT. LTD

- TABLE 237 CHAITANYA AGRO BIOTECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 238 CHAITANYA AGRO BIOTECH PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.4 EWALD GELATINE GMBH

- TABLE 239 EWALD GELATINE GMBH: BUSINESS OVERVIEW

- TABLE 240 EWALD GELATINE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.5 PEPTECH COLAGENO DO BRASIL LTDA

- TABLE 241 PEPTECH COLAGENO DO BRASIL LTDA: BUSINESS OVERVIEW

- TABLE 242 PEPTECH COLAGENO DO BRASIL LTDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

- 12.2.6 BSA PHARMA INC.

- TABLE 243 BSA PHARMA INC.: COMPANY OVERVIEW

- 12.2.7 NEW ALLIANCE FINE CHEM PRIVATE LIMITED

- TABLE 244 NEW ALLIANCE FINE CHEM PRIVATE LIMITED: COMPANY OVERVIEW

- 12.2.8 JELLICE GELATIN & COLLAGEN

- TABLE 245 JELLICE GELATIN & COLLAGEN: COMPANY OVERVIEW

- 12.2.9 RUDRA BIOVENTURES PRIVATE LIMITED

- TABLE 246 RUDRA BIOVENTURES PRIVATE LIMITED: COMPANY OVERVIEW

- 12.2.10 ALPSPURE LIFESCIENCES PRIVATE LIMITED

- TABLE 247 ALPSPURE LIFESCIENCES PRIVATE LIMITED: COMPANY OVERVIEW

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 248 ADJACENT MARKETS TO COLLAGEN PEPTIDES

- 13.2 LIMITATIONS

- 13.3 COLLAGEN MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 249 COLLAGEN MARKET, BY SOURCE, 2020-2030 (USD MILLION)

- 13.4 MARINE COLLAGEN MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 250 MARINE COLLAGEN MARKET, BY SOURCE, 2018-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.1 AUTHOR DETAILS