|

|

市場調査レポート

商品コード

1304606

羊膜製品の世界市場:種類別 (凍結保存羊膜、脱水羊膜)・用途別 (創傷ケア、眼科、整形外科)・エンドユーザー別 (病院・外来手術センター) の将来予測 (2028年まで)Amniotic Products Market by Type (Cryopreserved Amniotic Membranes, Dehydrated Amniotic Membranes), Application (Wound Care, Ophthalmology, Orthopedics), End User (Hospital & Ambulatory Surgical Centers) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 羊膜製品の世界市場:種類別 (凍結保存羊膜、脱水羊膜)・用途別 (創傷ケア、眼科、整形外科)・エンドユーザー別 (病院・外来手術センター) の将来予測 (2028年まで) |

|

出版日: 2023年07月06日

発行: MarketsandMarkets

ページ情報: 英文 175 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の羊膜製品の市場規模は、予測期間中に7.4%のCAGRで成長し、2023年の9億米ドルから、2028年には12億8,900万米ドルに達すると予測されます。

同市場の成長は、眼科・美容整形外科・整形外科手術の増加、戦略的提携やパートナーシップなどが主な要因となっています。しかし、コストと手頃な価格に関する課題は、この市場の成長を脅かす可能性があります。

"種類別では、脱水羊膜が予測期間中に2番目に高い成長を遂げます"

羊膜製品市場を種類別に見ると、脱水羊膜が予測期間中に2番目に高いCAGRで成長すると予測されています。例えば、凍結保存羊膜は特殊な保管・輸送方法を必要とするため、脱水羊膜は凍結保存羊膜よりも物流面で有利となっています。また、脱水羊膜は使用前に再水和でき、より柔軟な応用が可能です。

"アジア太平洋が予測期間中に、3番目に高いCAGRで成長する"

羊膜製品市場を地域別に見ると、アジア太平洋地域の市場が、予測期間中に3番目に高い成長率を記録すると予測されています。この市場の成長の主な原動力は、高度な創傷ケア製品の利点に関する意識の高まり、高齢者人口の増加、慢性創傷の有病率の増加、褥瘡・眼科手術・整形外科手術に苦しむ人々の増加などです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 機会

- 課題

- 動向

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

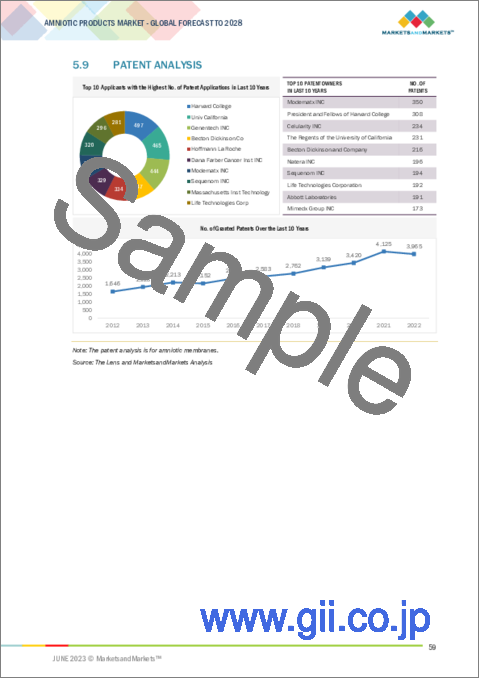

- 特許分析

- 貿易分析

- 規制状況

- ポーターのファイブフォース分析

第6章 羊膜製品市場:種類別

- イントロダクション

- 羊膜

- 凍結保存羊膜

- 脱水羊膜

第7章 羊膜製品市場:用途別

- イントロダクション

- 主な注記

- 創傷ケア

- 整形外科

- 眼科

- その他の用途

第8章 羊膜製品市場:エンドユーザー別

- イントロダクション

- 病院・外来手術センター

- その他のエンドユーザー

第9章 羊膜製品市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析 (2022年)

- 収益シェア分析 (2022年)

- 企業評価クアドラント

- 中小企業/スタートアップの評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

- 企業フットプリント分析

第11章 企業プロファイル

- 主要企業

- MIMEDX GROUP, INC.

- SMITH+NEPHEW

- ORGANOGENESIS INC.

- INTEGRA LIFESCIENCES

- STRYKER

- APPLIED BIOLOGICS

- CELULARITY INC.

- CORZA OPHTHALMOLOGY

- LUCINA BIOSCIENCES

- NEXT BIOSCIENCES

- SKYE BIOLOGICS HOLDINGS, LLC

- SURGENEX

- その他の企業

- BIOTISSUE

- VENTRIS MEDICAL, LLC

- STIMLABS LLC

- VIVEX BIOLOGICS, INC.

- LIFECELL

- NUVISION BIOTHERAPIES LTD

- GENESIS BIOLOGICS, INC.

- SURGILOGIX

- TIDES MEDICAL

- ORTHOFIX US LLC

- ALLOSOURCE

- MERAKRIS THERAPEUTICS, INC.

- MTF BIOLOGICS

第12章 付録

The global Amniotic Products Market is projected to reach USD 1,289 Million by 2028 from USD 900 Million in 2023, at a CAGR of 7.4% during the forecast period. The growth of this market is majorly driven by Increasing number of ophthalmology, cosmetic, and orthopedic surgeries and Strategic Collaborations and Partnerships. However, Challenges associated with cost and affordability may threat the growth of this market.

"Dehydrated Amniotic Membrane in the type of segment to witness the second highest growth during the forecast period."

Based on the Type, the Amniotic products market is segmented into Cryopreserved Amniotic Membrane, and Dehydrated Amniotic Membrane. The Dehydrated Amniotic Membrane is projected to grow at the second highest CAGR during the forecast period. The significant factors contributing to the growth of this market is its application reliability for instance, Dehydrated amniotic membranes have logistical advantages over cryopreserved amniotic membranes as cryopreserved membranes require specialized storage and transport methods, Dehydrated amniotic membranes can be rehydrated before use, allowing for greater flexibility in their application, Reduced Risk of Disease Transmission as during the dehydration processes, such as freeze-drying, can help inactivate or eliminate potential pathogens present in the amniotic membrane.

"Asia Pacific is estimated to register the third highest CAGR during the forecast period."

In this report, the amniotic products market is segmented into four major regional segments: North America, Europe, Asia Pacific, Latin America, Middle East & Africa. The market in Asia Pacific is projected to register the third highest growth rate during the forecast period. The growth in this market is primarily driven by the The growing awareness about the benefits of advanced wound care products, the rising geriatric population, increasing prevalence of chronic wounds, and growth in the number of people suffering from pressure ulcers, ophthalmic and orthopedic surgeries.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- By Company Type: Tier 1 (48%), Tier 2 (34%), and Tier 3 (18%)

- By Designation: C-level (33%), Director-level (40%), and Others (27%)

- By Region: North America (36%), Europe (28%), AsiaPacific (19%), Latin America (10%), Middle East & Africa (7%),

List of Companies Profiled in the Report

- mimedx (US)

- Smith+Nephew (UK)

- Organogenesis Inc. (US)

- Integra LifeSciences (US)

- Stryker (US)

- APPLIED BIOLOGICS. (US)

- Celularity Inc. (US)

- Corza Ophthalmology (US)

- Lucina BioSciences (US)

- Next Biosciences. (South Africa)

- Skye Biologics Holdings, LLC (US)

- BioTissue. (US)

- Ventris Medical, LLC (US)

- Stimlabs LLC (US)

- VIVEX Biologics, Inc. (US)

- LifeCell (India)

- NuVision Biotherapies Ltd (UK)

- Genesis Biologics, Inc. (US)

- SURGILOGIX (US)

- Tides Medical (US)

- Orthofix US LLC. (US)

- AlloSource (US)

- Merakris Therapeutics, Inc. (US)

- MTF Biologics (US)

- Surgenex (US)

- SURGITECH INNOVATION (India)

Research Coverage:

This report studies the amniotic products market based on product and region. The report also analyzes factors (such as drivers, opportunities, and challenges) affecting the market growth. It evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micromarkets with respect to their growth trends, prospects, and contributions to the total Amniotic Products market. The report forecasts the revenue of the market segments with respect to five major regions.

Reasons to Buy the Report:

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on Amniotic Products products offered by the top 26 players in the amniotic products market. The report analyzes the amniotic products market by Type, and region.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various securement devices across key geographic regions.

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the amniotic products market.

- Competitive Assessment: In-depth assessment of market shares and strategies of the leading players in the amniotic products market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 AMNIOTIC PRODUCTS MARKET SEGMENTATION

- 1.3.1 REGIONS CONSIDERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

- 1.7 RECESSION IMPACT

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AMNIOTIC PRODUCTS MARKET: RESEARCH DESIGN

- 2.2 SECONDARY DATA

- 2.2.1 SECONDARY SOURCES

- 2.3 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.3.1 KEY DATA FROM PRIMARY SOURCES

- 2.3.2 KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.4.1 GROWTH FORECAST

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.6 MARKET SHARE ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

- 2.10 GROWTH RATE ASSUMPTIONS

- 2.11 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 AMNIOTIC PRODUCTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AMNIOTIC PRODUCTS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 AMNIOTIC PRODUCTS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AMNIOTIC PRODUCTS MARKET

- FIGURE 13 GROWING TARGET PATIENT POPULATION TO DRIVE MARKET

- 4.2 AMNIOTIC PRODUCTS MARKET, BY TYPE

- FIGURE 14 CRYOPRESERVED AMNIOTIC MEMBRANES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY TYPE AND COUNTRY

- FIGURE 15 US ACCOUNTED FOR LARGEST MARKET SHARE IN NORTH AMERICA IN 2022

- 4.4 AMNIOTIC PRODUCTS MARKET, BY COUNTRY

- FIGURE 16 US AND UK TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 17 AMNIOTIC PRODUCTS MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in target patient population

- TABLE 1 GLOBAL PREVALENCE OF DIABETES

- 5.2.1.2 Rising incidence of burn injuries and increasing number of traumatic wounds

- 5.2.1.3 Wound care awareness programs and increasing funding for wound care treatment and management

- TABLE 2 WOUND CARE AWARENESS INITIATIVES

- TABLE 3 FUNDING FOR REGENERATIVE MEDICINE RESEARCH BY NIH UNDER 21ST CENTURY CURES ACT

- TABLE 4 FUNDING INITIATIVES FROM CORPORATE PARTNERSHIPS IN 2022 (USD MILLION)

- TABLE 5 FUNDING FROM CORPORATE PARTNERSHIPS IN 2021 (USD MILLION)

- FIGURE 18 ARTICLES RELATED TO AMNIOTIC PRODUCTS PUBLISHED DURING 2010-2021

- 5.2.1.4 Increasing number of amniotic membrane transplantations

- TABLE 6 NUMBER OF AMNIOTIC MEMBRANE TRANSPLANTATIONS PERFORMED IN UNIVERSITY EYE HOSPITAL TUBINGEN, GERMANY

- 5.2.1.5 Increasing number of ophthalmology, cosmetic, and orthopedic surgeries

- 5.2.1.6 Strategic collaborations and partnerships

- 5.2.1.7 Favorable reimbursement policies

- TABLE 7 MEDICARE ALLOWABLE AMOUNTS (USD)

- 5.2.2 OPPORTUNITIES

- 5.2.2.1 Untapped opportunities in emerging economies

- TABLE 8 STRATEGIC DEVELOPMENTS IN ASIA PACIFIC

- 5.2.2.2 Implementation of 21st Century Cures Act (US)

- 5.2.2.3 Increasing demand for stem cell research and regenerative medicine

- FIGURE 19 STEM CELL RESEARCH FUNDING FROM 2011 TO 2020

- TABLE 9 NIH FUNDING FOR CELL-BASED RESEARCH, 2016-2021 (USD MILLION)

- 5.2.3 CHALLENGES

- 5.2.3.1 Complications and limitations associated with use of amniotic membranes

- 5.2.3.2 Ethical and legal concerns of using amniotic membranes

- 5.2.3.3 High cost of amniotic membrane products

- 5.2.3.4 Competition from alternative therapies

- 5.2.4 TRENDS

- 5.2.4.1 Increasing clinical trials for stem cell and chimeric antigen receptor-T cell therapies

- 5.2.4.2 Expanding applications and rising focus on standardization and regulation of amniotic products

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND REVENUE POCKETS FOR AMNIOTIC PRODUCT MANUFACTURERS

- 5.3.2 REVENUE SHIFT IN AMNIOTIC PRODUCTS MARKET

- 5.4 PRICING ANALYSIS

- TABLE 10 PRICES OF AMNIOTIC PRODUCTS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 20 DIRECT DISTRIBUTION: STRATEGY PREFERRED BY PROMINENT COMPANIES

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE-ADDED DURING DEVELOPMENT PHASE

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 ROLE IN ECOSYSTEM

- TABLE 11 ROLE OF KEY PLAYERS IN ECOSYSTEM

- FIGURE 22 KEY PLAYERS IN AMNIOTIC PRODUCTS ECOSYSTEM

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- TABLE 12 IMPORT DATA FOR EXTRACTS OF GLANDS OR OTHER ORGANS OR OF THEIR SECRETIONS FOR ORGANO-THERAPEUTIC USE, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR EXTRACTS OF GLANDS OR OTHER ORGANS OR OF THEIR SECRETIONS FOR ORGANO-THERAPEUTIC USE, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 NORTH AMERICA

- 5.11.2 EUROPE

- 5.11.3 EMERGING ECONOMIES

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 AMNIOTIC PRODUCTS MARKET: IMPACT OF PORTER'S FIVE FORCES

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 THREAT OF NEW ENTRANTS

6 AMNIOTIC PRODUCTS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 AMNIOTIC MEMBRANES

- TABLE 15 AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.1 CRYOPRESERVED AMNIOTIC MEMBRANES

- 6.2.1.1 Cryopreserved amniotic membranes to dominate amniotic membranes market during forecast period

- TABLE 16 CRYOPRESERVED AMNIOTIC MEMBRANES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 DEHYDRATED AMNIOTIC MEMBRANES

- 6.2.2.1 Logistical advantages of dehydrated amniotic membranes over cryopreserved amniotic membranes to drive demand

- TABLE 17 DEHYDRATED AMNIOTIC MEMBRANES MARKET, BY REGION, 2021-2028 (USD MILLION)

7 AMNIOTIC PRODUCTS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PRIMARY NOTES

- TABLE 18 AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.3 WOUND CARE

- 7.3.1 RISING INCIDENCE OF ULCERS, TRAUMATIC AND SURGICAL WOUNDS, AND BURNS TO DRIVE MARKET

- TABLE 19 AMNIOTIC PRODUCTS MARKET FOR WOUND CARE, BY REGION, 2021-2028 (USD MILLION)

- 7.4 ORTHOPEDICS

- 7.4.1 BENEFITS OFFERED BY AMNIOTIC PRODUCTS FOR ORTHOPEDIC APPLICATIONS TO DRIVE MARKET

- TABLE 20 AMNIOTIC PRODUCTS MARKET FOR ORTHOPEDICS, BY REGION, 2021-2028 (USD MILLION)

- 7.5 OPHTHALMOLOGY

- 7.5.1 LIGHTWEIGHT, THIN, AND ELASTIC NATURE OF AMNIOTIC MEMBRANES TO DRIVE DEMAND IN OPHTHALMOLOGY

- TABLE 21 AMNIOTIC PRODUCTS MARKET FOR OPHTHALMOLOGY, BY REGION, 2021-2028 (USD MILLION)

- 7.6 OTHER APPLICATIONS

- TABLE 22 ESTIMATED NUMBER OF COLORECTAL CANCER CASES AND DEATHS IN US IN 2020, BY AGE

- TABLE 23 AMNIOTIC PRODUCTS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

8 AMNIOTIC PRODUCTS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 24 AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 HOSPITALS & AMBULATORY SURGERY CENTERS

- 8.2.1 INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

- TABLE 25 AMNIOTIC PRODUCTS MARKET FOR HOSPITALS & ASCS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 OTHER END USERS

- TABLE 26 AMNIOTIC PRODUCTS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

9 AMNIOTIC PRODUCTS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 27 AMNIOTIC PRODUCTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 23 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET SNAPSHOT

- TABLE 28 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Growing geriatric population and high prevalence of chronic wounds and diabetes to drive market

- TABLE 32 US: KEY MACRO INDICATORS

- TABLE 33 US: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 34 US: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 35 US: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Rising prevalence of target diseases to drive market

- TABLE 36 INCIDENCE OF DIABETES IN CANADA, 2019 VS. 2029

- TABLE 37 CANADA: KEY MACRO INDICATORS

- TABLE 38 CANADA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 39 CANADA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 40 CANADA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 RECESSION IMPACT ON NORTH AMERICA

- 9.3 EUROPE

- TABLE 41 EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY (% OF GDP)

- TABLE 42 PREVALENCE OF DIABETES IN EUROPE, 2019 VS. 2045

- TABLE 43 EUROPE: AMNIOTIC PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 45 EUROPE: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 46 EUROPE: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Increasing incidence of diabetes to drive market

- TABLE 47 GERMANY: KEY MACRO INDICATORS

- TABLE 48 GERMANY: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 49 GERMANY: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 50 GERMANY: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 High prevalence of diabetes activities to drive market

- TABLE 51 UK: KEY MACRO INDICATORS

- TABLE 52 UK: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 53 UK: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 54 UK: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Government support to drive demand for amniotic products

- TABLE 55 FRANCE: KEY MACRO INDICATORS

- TABLE 56 FRANCE: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 57 FRANCE: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 58 FRANCE: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 REST OF EUROPE

- TABLE 59 REST OF EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2021 (% OF GDP)

- TABLE 60 REST OF EUROPE: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 61 REST OF EUROPE: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 62 REST OF EUROPE: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 RECESSION IMPACT ON EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET SNAPSHOT

- TABLE 63 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Increasing incidence of diabetes and growth in geriatric population to drive market

- TABLE 67 CHINA: KEY MACRO INDICATORS

- TABLE 68 CHINA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 CHINA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 70 CHINA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Growing geriatric population to drive market

- TABLE 71 JAPAN: KEY MACRO INDICATORS

- TABLE 72 JAPAN: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 JAPAN: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 74 JAPAN: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 REST OF ASIA PACIFIC

- TABLE 75 REST OF ASIA PACIFIC: DIABETES PREVALENCE (% OF POPULATION AGED 20-79), BY COUNTRY, 2021

- TABLE 76 REST OF ASIA PACIFIC: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 RECESSION IMPACT ON ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 INCREASING PREVALENCE OF DIABETES TO DRIVE MARKET

- TABLE 79 LATIN AMERICA: DIABETES PREVALENCE (% OF POPULATION AGED 20-79), BY COUNTRY, 2021

- TABLE 80 LATIN AMERICA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 LATIN AMERICA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 82 LATIN AMERICA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWTH IN HEALTHCARE INFRASTRUCTURE AND GOVERNMENT INITIATIVES TO DRIVE MARKET

- TABLE 83 MIDDLE EAST & AFRICA: DIABETES PREVALENCE (% OF POPULATION AGED 20-79), BY COUNTRY, 2021

- TABLE 84 MIDDLE EAST & AFRICA: AMNIOTIC MEMBRANES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: AMNIOTIC PRODUCTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: AMNIOTIC PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 87 OVERVIEW OF STRATEGIES ADOPTED BY KEY AMNIOTIC PRODUCT MARKET PLAYERS

- 10.3 MARKET SHARE ANALYSIS, 2022

- TABLE 88 AMNIOTIC PRODUCTS MARKET: DEGREE OF COMPETITION (2022)

- 10.4 REVENUE SHARE ANALYSIS, 2022

- FIGURE 25 AMNIOTIC PRODUCTS MARKET: REVENUE ANALYSIS OF TOP FOUR MARKET PLAYERS, 2020-2022

- 10.5 COMPANY EVALUATION QUADRANT

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 26 AMNIOTIC PRODUCTS MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6 SMALL AND MEDIUM-SIZED ENTERPRISE/STARTUP EVALUATION QUADRANT

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 STARTING BLOCKS

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 27 AMNIOTIC PRODUCTS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISE/ STARTUP EVALUATION MATRIX, 2022

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 89 AMNIOTIC PRODUCTS MARKET: DETAILED LIST OF KEY SMALL AND MEDIUM-SIZED ENTERPRISES/STARTUPS

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 90 PRODUCT LAUNCHES

- 10.8.2 DEALS

- TABLE 91 DEALS

- 10.8.3 OTHERS

- TABLE 92 OTHERS

- 10.9 COMPANY FOOTPRINT ANALYSIS

- TABLE 93 COMPANY FOOTPRINT ANALYSIS

- TABLE 94 COMPANY PRODUCT FOOTPRINT

- TABLE 95 COMPANY REGIONAL FOOTPRINT

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 KEY PLAYERS

- 11.1.1 MIMEDX GROUP, INC.

- TABLE 96 MIMEDX GROUP, INC.: COMPANY OVERVIEW

- FIGURE 28 MIMEDX GROUP, INC.: COMPANY SNAPSHOT (2022)

- 11.1.2 SMITH+NEPHEW

- TABLE 97 SMITH+NEPHEW: COMPANY OVERVIEW

- FIGURE 29 SMITH+NEPHEW: COMPANY SNAPSHOT (2022)

- 11.1.3 ORGANOGENESIS INC.

- TABLE 98 ORGANOGENESIS INC.: COMPANY OVERVIEW

- FIGURE 30 ORGANOGENESIS INC.: COMPANY SNAPSHOT (2022)

- 11.1.4 INTEGRA LIFESCIENCES

- TABLE 99 INTEGRA LIFESCIENCES: COMPANY OVERVIEW

- FIGURE 31 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2022)

- 11.1.5 STRYKER

- TABLE 100 STRYKER: COMPANY OVERVIEW

- FIGURE 32 STRYKER: COMPANY SNAPSHOT (2022)

- 11.1.6 APPLIED BIOLOGICS

- TABLE 101 APPLIED BIOLOGICS: COMPANY OVERVIEW

- 11.1.7 CELULARITY INC.

- TABLE 102 CELULARITY INC.: COMPANY OVERVIEW

- 11.1.8 CORZA OPHTHALMOLOGY

- TABLE 103 CORZA OPHTHALMOLOGY: COMPANY OVERVIEW

- 11.1.9 LUCINA BIOSCIENCES

- TABLE 104 LUCINA BIOSCIENCES: COMPANY OVERVIEW

- 11.1.10 NEXT BIOSCIENCES

- TABLE 105 NEXT BIOSCIENCES: COMPANY OVERVIEW

- 11.1.11 SKYE BIOLOGICS HOLDINGS, LLC

- TABLE 106 SKYE BIOLOGICS HOLDINGS, LLC: COMPANY OVERVIEW

- 11.1.12 SURGENEX

- TABLE 107 SURGENEX: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 BIOTISSUE

- 11.2.2 VENTRIS MEDICAL, LLC

- 11.2.3 STIMLABS LLC

- 11.2.4 VIVEX BIOLOGICS, INC.

- 11.2.5 LIFECELL

- 11.2.6 NUVISION BIOTHERAPIES LTD

- 11.2.7 GENESIS BIOLOGICS, INC.

- 11.2.8 SURGILOGIX

- 11.2.9 TIDES MEDICAL

- 11.2.10 ORTHOFIX US LLC

- 11.2.11 ALLOSOURCE

- 11.2.12 MERAKRIS THERAPEUTICS, INC.

- 11.2.13 MTF BIOLOGICS

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS