|

|

市場調査レポート

商品コード

1126036

防弾の世界市場:材料別(金属・合金、セラミック、複合材料、防弾ガラス、ファブリック)、製品別、技術別、脅威レベル別(レベルII・IIA、レベルIII・IIIA、レベルIV、レベルIV以上)、プラットフォーム別、用途別、地域別 - 2027年までの予測Ballistic Protection Market by Material (Metals & Alloys, Ceramics, Composites, Bulletproof Glass, Fabric), Product, Technology, Threat Level (Level II & IIA, Level III & IIIA, Level IV & Above), Platform, Application & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 防弾の世界市場:材料別(金属・合金、セラミック、複合材料、防弾ガラス、ファブリック)、製品別、技術別、脅威レベル別(レベルII・IIA、レベルIII・IIIA、レベルIV、レベルIV以上)、プラットフォーム別、用途別、地域別 - 2027年までの予測 |

|

出版日: 2022年09月08日

発行: MarketsandMarkets

ページ情報: 英文 224 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の防弾の市場規模は、2022年の134億米ドルから2027年までに169億米ドルに達し、2022年から2027年までのCAGRで4.7%の成長が予測されています。

装甲車の調達が増加していることも、米国の防弾市場の成長を後押ししています。米国の主要メーカーは、新しい高度な装甲車の開発のために、研究開発活動への投資を増やしています。2022年3月には、国防費を7.1%増額して2,290億米ドルに達したと発表し、インド太平洋地域における米軍の優位性に挑戦する、ますます強力な軍への堅調な支出を長年続けています。中国の防弾市場の成長は、ケブラーガラスやファイバーなどの車両装甲保護システムの調達に起因していると考えられます。インドは、中国に次いで急成長している防弾市場です。この国の市場の成長は、国防予算の増加や、警察、第一応答者、VIP警備員などの国土安全保障部隊の全体的な発展に起因しています。また、パキスタンや中国との国境紛争が増加していることから、軍事力の強化や安全保障にも力を入れています。

防弾市場力学:

促進要因:新興国における政情不安の高まり

抑制要因:完全な防護を提供できない

機会:多目的装備に対する需要の高まり

課題:装甲材料の高い生産コスト

防弾市場エコシステム:

防弾市場は、海上セグメントが金額ベースで最大の市場シェアを占めている

防弾市場は、プラットフォーム別に、陸上、空中、海上に区分されています。海上は防弾市場全体の49.2%を占めています。防衛艦艇は、沿岸警備隊や海軍によって特別に設計され、使用されています。用途、設計、建造方法、適用される技術などの点で民間船舶とは異なります。船体は、弾道材料が使用される主要な部分です。船体以外では、窓、武器マウント、オプトロニクスなどに防弾システムが搭載されています。

国土安全保障は、予測期間中に最も高いCAGRで成長すると予想される

用途別では、国土安全保障セグメントが予測期間中に7.4%という最高のCAGRで成長すると予測されています。耐弾性ボディアーマーは、特定の弾道脅威から身を守るために、国土安全保障省の職員が現場で着用するものです。国土安全保障省の職員は、任務中の安全を確保するために、防弾チョッキ、防弾ヘルメット、手袋などの個人用保護具を使用します。防弾ヘルメットは、小火器や破片の脅威から着用者を保護するためのものです。国土安全保障省の職員が使用する戦闘システムは、セラミックや熱可塑性樹脂で強化されているため、耐弾性があります。

金額ベースでは、北米が防弾市場をリード

市場分析では、米国とカナダを北米とみなしています。北米地域の市場成長は、高度な装甲車の調達増加や、軍事力による個人防護具の需要に起因していると考えられます。テロの脅威の増加が、陸上、空中、海上プラットフォーム用の防弾システムの調達の主な理由となっています。世界の防衛産業の研究開発への投資は、高度な戦闘服、ブーツ、ハードアーマー、アイウェア、ヘルメットなど、生存能力と持続能力を強化する新しい兵士の近代化技術の開発につながりました。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 防弾市場のエコシステム

- 技術分析

- ユースケース分析

- 防弾市場のバリューチェーン分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 関税と規制状況

- 防弾市場:貿易データ

- 主な会議とイベント

第6章 業界動向

- イントロダクション

- 防弾向け先端材料

- 技術動向

- 防弾市場:サプライチェーン分析

- 防弾市場:特許分析

第7章 防弾市場:プラットフォーム別

- イントロダクション

- 陸上

- 空中

- 海上

第8章 防弾市場:用途別

- イントロダクション

- 軍事

- 国土安全保障

第9章 防弾市場:技術別

- イントロダクション

- ハードアーマー

- ソフトアーマー

第10章 防弾市場:材料別

- イントロダクション

- 金属・合金

- セラミック

- 複合材料

- 防弾ガラス

- ファブリック

第11章 防弾市場:製品別

- イントロダクション

- 個人用防護具(PPE)

- 防弾コンテナ・ポータブルシェルター

- 防弾ブロック

- 防弾バリアシステム

- ハル・ボディ

- 武器ステーション・オプトロニクス

- 落下燃料タンク・弾薬庫

- 防弾コックピット

- パイロットシート防護

- 防弾床

- 防弾窓

- 防弾ドア

- エンジン防護

第12章 防弾市場:脅威レベル別

- イントロダクション

- レベルII・IIA

- レベルIII・IIIA

- レベルIV以上

第13章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ロシア

- イタリア

- その他

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他

- 中東

- アラブ首長国連邦

- サウジアラビア

- イスラエル

- アフリカ

- ラテンアメリカ

第14章 競合情勢

- イントロダクション

- 競合リーダーシップマッピング(市場全体)

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- BAE SYSTEMS

- AVON PROTECTION

- RHEINMETALL AG

- TENCATE ADVANCED ARMOR

- FMS ENTERPRISES MIGUN LTD.

- POINT BLANK ENTERPRISES

- SEYNTEX

- ADA(AUSTRALIAN DEFENCE APPAREL)

- SURVITEC GROUP LIMITED

- ARMORWORKS

- REVISION MILITARY

- ARMORSOURCE LLC.

- SOUTHERN STATES LLC.

- CRAIG INTERNATIONAL BALLISTICS PTY LTD.

- PAUL BOYE TECHNOLOGIES

- ROKETSAN

- SAAB AB

- MKU LIMITED

- PACIFIC SAFETY PRODUCTS

- ELMON

- NP AEROSPACE

- PLASAN

- ARMOR EXPRESS

第16章 付録

The ballistic protection market is projected to grow from USD 13.4 billion in 2022 to USD 16.9 billion by 2027, at a CAGR of 4.7% from 2022 to 2027.

Increasing procurement of armored vehicles are also aiding the growth of the ballistic protection market in the US. Key manufacturers in the US are increasingly investing in R&D activities for the development of new and advanced armored vehicles. . In March 2022, it announced that it had increased its defense spending by 7.1% to reach USD 229 billion, continuing years of robust spending on its increasingly powerful military that is challenging the dominance of US armed forces in the Indo-Pacific region. The growth of the ballistic protection market in China can be attributed to the procurement of vehicle armor protection systems such as Kevlar glass and fibers. India is the second-fastest-growing market for ballistic protection after China. The growth of the market in this country can be attributed to the increase in the defense budget and the overall development of the homeland security forces, such as the police, the first responders, and the VIP security personnel. With the rise in inter-border conflicts with Pakistan and China, the country also focuses on strengthening its military capabilities as well as safeguarding them.

Various players such as BAE Systems (UK), Avon Protection (US), Rheinmetall AG (US), Tencate Advanced Armor (Netherlands), Point Blank Enterprises (US), SAAB AB (Sweden) among others, are prominent players operating in the ballistic protection market.

Ballistic Protection Market Dynamics:

Driver: Rising political unrest in emerging economies

An increase in political instability and unrest, as well as increasing terrorist activities, have prompted law enforcement agencies and the material science community to develop and provide effective solutions that can help the safe movement of troops and vehicles. In the present scenario, the political conflicts in Syria, Libya, Iraq, and Afghanistan, along with Russia & Ukraine, India & Pakistan, India & China, and Russia & Turkey are increasing the need for combat armor. Domestic conflicts in many countries are also boosting the need for ammunition. This drives the demand for protective equipment.

Developing countries, such as Brazil, India, and Russia, are spending heavily on defense owing to internal conflicts and tensions with their neighboring countries. The Middle East & Africa region suffers from severe political unrest, boosting the need for advanced armor materials.

Unstable political conditions and terrorism across the world are adversely affecting the economies of many countries. Therefore, these countries are channeling their resources to invest in defense systems to counter these issues, which is a long-term driver for the global ballistic protection market

Restraint: Failure to provide complete protection

Regardless of technological advances, present ballistic composite technologies and products are unable to provide complete protection, especially on the battlefield. Fiber vests and composite helmets are good against shrapnel from artillery or grenades, which accounts for 70% to 85% of battlefield casualties. However, ballistic composites fail to provide 100% protection against other casualties, such as those caused by high-powered rifle fire. Therefore, companies in the industry are looking for better hard-facing inserts to counter existing threats

Opportunity: Rising demand for multipurpose equipment

The current market for personal protective equipment (PPE) is focused on high-performance and reasonably priced products. Many customers prefer protective equipment that serves more than one function. In general, PPE is designed for protection against a hazard—for instance, fire-resistant (FR) clothing is resistant to fire damage but may not provide adequate protection against mechanical hazards. However, workers in industries such as oil & gas and chemical may be exposed to multiple hazards at once. In such situations, workers need multifunctional protective clothing for protection against multiple hazards.

Challenges: High production cost of armor materials

The production process of armor materials varies based on their application. The technology used in manufacturing these materials is one of the most vital parts of the value chain. Production is governed by various agencies as well as by military forces, as it is a sensitive market. Various initiatives have been undertaken by these agencies and forces to ensure the secrecy and security of the technology used in the production of armor materials. The production process also needs to undergo several control methodologies to ensure intellectual property theft is minimized. These factors increase the production cost of armor materials. Manufacturers also invest heavily in R&D to enhance the efficiency of armor, thus increasing the overall cost of the material

Ballistic Protection Market Ecosystem:

The key stakeholders in the ballistic protection market ecosystem include companies which provide platforms and ballistic protection products. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licencing agencies.

Marine segment held largest market share in terms of value in ballistic protection market

On the basis of platform, the ballistic protection market has been segmented into land, airborne and marine. Mairne accounted for 49.2% of the overall ballistic protection market. Defense naval vessels are specifically designed and used by coastguards and naval forces. They differ from commercial ships in terms of their applications, design, construction methods, and technologies applied. The hull of a ship is the major area in which ballistic materials are used. Apart from the hull, ballistic protection systems are installed on windows, weapon mounts, and optronics, among others.

The marine segment includes destroyers, frigates, corvettes, aircraft carriers, offshore support vehicles, and unmanned surface vehicles. The increase in demand for maritime security has resulted in the growth of the unmanned surface vehicles market.

Homeland Security is anticipated to grow at highest CAGR during forecast period

The homeland security application segment is expected to grow at the highest CAGR of 7.4% during the forecast period. Ballistic-resistant body armor is worn by homeland security officers while in the field to protect against specific ballistic threats. Homeland security officers use personal protective equipment, including body vests, ballistic helmets, and gloves to ensure safety during missions. Ballistic helmets are intended to protect the wearer against small arms fire and fragmentation threats. The combat systems used by homeland security officers are ballistic-resistant as they are reinforced with ceramics and thermoplastics.

In terms of value, North America led the ballistic protection market

The US and Canada are considered under North America for market analysis. Market growth in the North American region can be attributed to the increased procurement of highly advanced armored vehicles and the demand for personal protective equipment by military forces of the region. The increase in terror threats is the main reason for the procurement of ballistic protection systems for land, airborne, and marine platforms. The global defense industry investment in R&D has led to the development of new soldier modernization technologies that enhance survivability and sustainability capabilities, including advanced combat clothing, boots, hard armors, eyewear, and helmets.

Key Market Players

Some of the key players profiled in the ballistic protection market report include BAE Systems (UK), Avon Protection (US), Rheinmetall AG (US), Tencate Advanced Armor (Netherlands), Point Blank Enterprises (US), SAAB AB (Sweden) among others, are prominent players operating in the ballistic protection market.

Recent Developments

- In May 2022, TenCate Advanced Armor received a contract from the Naval Surface Warfare Center to provide maritime buoyant plates to support the Antiterrorism Afloat Equipage Program

- In March 2022, BAE Systems received a contract from the US Marine Corps to provide an Amphibious Combat Vehicle Recovery variant. The new variant provides direct field support and maintenance to the ACV family of vehicles.

- In March 2022, BAE Systems received a contract from the US Contracting Command for providing M109A7 and M992A3 combat vehicles.

- In March 2022, BAE Systems received a contract from the US Marine Corps to provide amphibious combat vehicles.

- In February 2022, Tencate Advanced Armor received a contract for providing a force protection system for Mack Granite-based M917A3 Heavy Dump Truck (HDT) and other Mack Defense vehicle platforms.

- In February 2022, Avon Protection received a contract to provide the second generation advanced combat helmet (ACH).

- In February 2022, Avon Protection received a contract from the United States Department of Defense for providing second-generation advanced combat helmets.

- In February 2022, Point Blank Enterprises received a contract from the US Marine Corps CH-53K for providing ballistic armor systems.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 BALLISTIC PROTECTION MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES

- 1.5 LIMITATIONS

- 1.6 INCLUSIONS & EXCLUSIONS

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN: BALLISTIC PROTECTION MARKET

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Ballistic protection market

- 2.2.1.2 Ballistic protection market, by application

- 2.2.1.3 Ballistic protection market, by technology

- 2.2.1.4 Ballistic protection market, by product

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Ballistic protection market, by system and by threat level

- 2.2.2.2 Ballistic protection market, by system and by material

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION & VALIDATION

- 2.3.1 TRIANGULATION THROUGH SECONDARY

- 2.3.2 TRIANGULATION THROUGH PRIMARIES

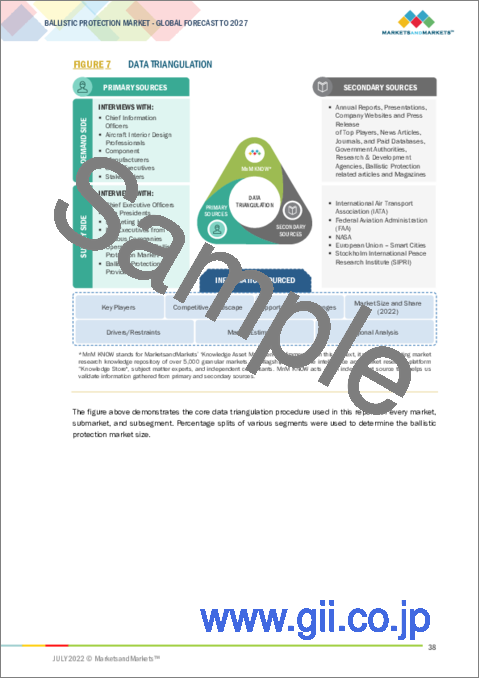

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH LIMITATIONS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 LAND SEGMENT TO LEAD BALLISTIC PROTECTION MARKET DURING FORECAST PERIOD

- FIGURE 9 HARD ARMOR SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 10 MILITARY TO BE LEADING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF BALLISTIC PROTECTION MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN BALLISTIC PROTECTION MARKET

- FIGURE 12 INCREASING GEOPOLITICAL TENSIONS IN EMERGING ECONOMIES TO DRIVE BALLISTIC PROTECTION MARKET

- 4.2 BALLISTIC PROTECTION MARKET, BY MATERIAL

- FIGURE 13 COMPOSITES SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2022 TO 2027

- 4.3 BALLISTIC PROTECTION MARKET, BY PLATFORM

- FIGURE 14 LAND TO BE LARGEST PLATFORM SEGMENT DURING FORECAST PERIOD

- 4.4 BALLISTIC PROTECTION MARKET, BY KEY REGION

- FIGURE 15 EUROPE TO HOLD DOMINANT POSITION IN 2022

- 4.5 BALLISTIC PROTECTION MARKET, BY APPLICATION

- FIGURE 16 MILITARY APPLICATION TO DOMINATE DURING FORECAST PERIOD

- 4.6 BALLISTIC PROTECTION MARKET, BY THREAT LEVEL

- FIGURE 17 THREAT LEVEL IV & ABOVE TO HOLD LARGEST MARKET SHARE

- 4.7 BALLISTIC PROTECTION MARKET, BY COUNTRY

- FIGURE 18 SOUTH KOREA TO REGISTER HIGHEST CAGR IN BALLISTIC PROTECTION MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 BALLISTIC PROTECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising political unrest in emerging economies

- 5.2.1.2 Need for upgrades in battlefield scenarios

- 5.2.1.3 Development of lightweight, comfortable, and high-strength materials

- 5.2.1.4 Demand for protection by VVIPs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inability to provide complete protection

- 5.2.2.2 Stringent standards for ballistic composite products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for multipurpose equipment

- 5.2.3.2 Increasing demand from Asia Pacific

- 5.2.3.3 Advancements in armor composite materials

- 5.2.4 CHALLENGES

- 5.2.4.1 High production cost of armor materials

- 5.2.4.2 Demand for increased comfort and functionality

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR BALLISTIC PROTECTION MARKET

- FIGURE 20 REVENUE SHIFT IN BUSINESS BALLISTIC PROTECTION MARKET

- 5.4 BALLISTIC PROTECTION MARKET ECOSYSTEM

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 START-UPS AND SMALL ENTERPRISES

- 5.4.3 END USERS

- FIGURE 21 BALLISTIC PROTECTION MARKET ECOSYSTEM MAP

- TABLE 2 BALLISTIC PROTECTION MARKET ECOSYSTEM

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 COMPOSITE TEXTILES IN HIGH-PERFORMANCE APPAREL

- 5.6 USE CASE ANALYSIS

- 5.6.1 USE CASE: ENHANCED COMFORT DURING COMBAT

- TABLE 3 PROBLEMS ASSOCIATED WITH ACTIONS DURING COMBAT

- 5.7 VALUE CHAIN ANALYSIS OF BALLISTIC PROTECTION MARKET

- FIGURE 22 VALUE CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 BALLISTIC PROTECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 BALLISTIC PROTECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 BALLISTIC PROTECTION MARKET: TRADE DATA

- TABLE 12 COUNTRY-WISE IMPORTS, 2020-2021 (USD THOUSAND)

- TABLE 13 COUNTRY-WISE EXPORTS, 2020-2021 (USD THOUSAND)

- 5.12 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 14 BALLISTIC PROTECTION MARKET: CONFERENCES & EVENTS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 ADVANCED MATERIALS FOR BALLISTIC PROTECTION

- 6.2.1 ELECTRONIC TEXTILES

- 6.2.2 ELECTRIC ARMOR

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 DOUBLE-SIDED COMBAT UNIFORM FABRIC

- 6.3.2 DEFCON ARMOR TECHNOLOGY

- 6.3.3 MODULAR BALLISTIC PROTECTION SYSTEMS

- 6.3.4 ADVANCED CERAMIC BALLISTIC ARMOR

- 6.3.5 DYNEEMA FORCE MULTIPLIER TECHNOLOGY

- 6.3.6 IMPROVED OUTER TACTICAL VESTS

- 6.3.7 LIQUID ARMOR

- 6.3.8 SMART FLUID

- 6.3.9 REACTIVE ARMOR TECHNOLOGY

- 6.3.10 SENSOR TECHNOLOGY

- 6.3.11 NEXT-GEN SUITS

- 6.4 BALLISTIC PROTECTION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- 6.5 BALLISTIC PROTECTION MARKET: PATENT ANALYSIS

- TABLE 15 PATENT ANALYSIS (2019-2022)

7 BALLISTIC PROTECTION MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 27 BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022 & 2027

- TABLE 16 BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 17 BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 7.2 LAND

- 7.2.1 COMBAT ARMORED VEHICLES

- 7.2.1.1 Main battle tanks

- 7.2.1.1.1 Increasing offensive cross-country operations

- 7.2.1.2 Infantry fighting vehicles

- 7.2.1.2.1 Procurement by emerging economies

- 7.2.1.3 Armored personnel carriers

- 7.2.1.3.1 Increasing demand to counter terrorist attacks and asymmetric warfare

- 7.2.1.4 Armored amphibious vehicles

- 7.2.1.4.1 Used by military forces for amphibious operations

- 7.2.1.5 Mine-resistant ambush protected

- 7.2.1.5.1 Increasing use for protection from IEDs and mines

- 7.2.1.6 Light armored vehicles

- 7.2.1.6.1 Uses for border patrol and ISR

- 7.2.1.7 Self-propelled howitzers

- 7.2.1.7.1 Easy maneuverability boosts demand

- 7.2.1.8 Air defense vehicles

- 7.2.1.8.1 Adoption of vehicle-mounted anti-aircraft guns

- 7.2.1.9 Armored mortar carriers

- 7.2.1.9.1 High demand for integrated armored vehicles with dedicated mortar storage compartment

- 7.2.1.1 Main battle tanks

- 7.2.2 COMBAT SUPPORT VEHICLES

- 7.2.2.1 Armored supply trucks

- 7.2.2.1.1 Increasing use for fuel and ammunition supply to troops

- 7.2.2.2 Armored fuel trucks

- 7.2.2.2.1 Used to transport fuel to forward arming and refueling points

- 7.2.2.3 Armored ammunition replenishment vehicles

- 7.2.2.3.1 Used at forward bases during warfare operations

- 7.2.2.4 Armored ambulances

- 7.2.2.4.1 Vital to transport injured personnel to medical facilities

- 7.2.2.5 Armored command and control vehicles

- 7.2.2.5.1 Increasing adoption for mobile armored operations

- 7.2.2.6 Repair and recovery vehicles

- 7.2.2.6.1 High demand for towing or repair of combat vehicles

- 7.2.2.1 Armored supply trucks

- 7.2.3 UNMANNED ARMORED GROUND VEHICLES

- 7.2.3.1 Increasing research & development on UGVs for warfare

- 7.2.4 SOLDIERS & SECURITY PERSONNEL

- 7.2.4.1 Wide-scale use of personal protective equipment

- 7.2.5 BASE STATIONS

- 7.2.5.1 Stations used for shelter and storage by military

- 7.2.1 COMBAT ARMORED VEHICLES

- 7.3 AIRBORNE

- 7.3.1 FIXED-WING AIRCRAFT

- 7.3.1.1 Upcoming defense programs to drive segment

- 7.3.1.2 Fighter aircraft

- 7.3.1.3 Transport aircraft

- 7.3.1.4 Reconnaissance & surveillance aircraft

- 7.3.2 HELICOPTERS

- 7.3.2.1 Provide accessibility for special missions

- 7.3.2.2 Attack & reconnaissance helicopters

- 7.3.2.3 Special mission helicopters

- 7.3.2.4 Maritime helicopters

- 7.3.2.5 Transport helicopters

- 7.3.3 UNMANNED AERIAL VEHICLES (UAV)

- 7.3.3.1 High number of ISR missions drives demand

- 7.3.1 FIXED-WING AIRCRAFT

- 7.4 MARINE

- 7.4.1 DESTROYERS

- 7.4.1.1 Fast, long-lasting, maneuverable ships

- 7.4.2 FRIGATES

- 7.4.2.1 Used to protect other warships and merchant ships

- 7.4.3 CORVETTES

- 7.4.3.1 Smallest vessel class among warships

- 7.4.4 OFFSHORE SUPPORT VESSELS (OSVS)

- 7.4.4.1 Small patrol vessels used for coastal defense

- 7.4.5 AIRCRAFT CARRIERS

- 7.4.5.1 Possibility of using hybrid propulsion for aircraft carriers

- 7.4.6 SUBMARINES

- 7.4.6.1 US, France, and India - currently using or developing electric propulsion systems

- 7.4.7 UNMANNED SURFACE VEHICLES

- 7.4.7.1 Used in military applications for seaborne targets

- 7.4.1 DESTROYERS

8 BALLISTIC PROTECTION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 28 BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022 & 2027 (USD MILLION)

- TABLE 18 BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 19 BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2 MILITARY

- 8.2.1 HIGH LEVEL OF THREAT DEMANDS HIGHER PROTECTION

- 8.3 HOMELAND SECURITY

- 8.3.1 PARAMILITARY FORCES

- 8.3.1.1 Semi-militarized forces for domestic tactical missions

- 8.3.2 POLICE FORCES

- 8.3.2.1 Wide-scale use of body vests and helmets

- 8.3.3 SPECIAL FORCES

- 8.3.3.1 Security units for special operations

- 8.3.1 PARAMILITARY FORCES

9 BALLISTIC PROTECTION MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 29 BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022 & 2027

- TABLE 20 BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 21 BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.2 HARD ARMOR

- 9.2.1 USED IN HIGH-RISK-OF-ATTACK SCENARIOS

- 9.2.2 LAND

- 9.2.3 AIRBORNE

- 9.2.4 MARINE

- 9.3 SOFT ARMOR

- 9.3.1 DEMAND DRIVEN BY NEED FOR LIGHTWEIGHT BODY ARMOR

- 9.3.2 LAND

- 9.3.3 AIRBORNE

- 9.3.4 MARINE

10 BALLISTIC PROTECTION MARKET, BY MATERIAL

- 10.1 INTRODUCTION

- FIGURE 30 BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022 & 2027

- TABLE 22 BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 23 BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- 10.2 METALS & ALLOYS

- 10.2.1 HIGH-DENSITY STEEL

- 10.2.1.1 Protects armored vehicles from different ballistic threats

- 10.2.2 ALUMINUM

- 10.2.2.1 Lightweight property makes it ideal for military applications

- 10.2.3 TITANIUM

- 10.2.3.1 Superior material for combat systems

- 10.2.1 HIGH-DENSITY STEEL

- 10.3 CERAMICS

- 10.3.1 ALUMINUM OXIDE

- 10.3.1.1 Contributes to enhancement of body armor

- 10.3.2 SILICON CARBIDE

- 10.3.2.1 Effective material against bullets

- 10.3.1 ALUMINUM OXIDE

- 10.4 COMPOSITES

- 10.4.1 ARAMID COMPOSITES

- 10.4.1.1 Used in aerospace and military applications

- 10.4.1.2 Para-aramid

- 10.4.1.3 Meta-aramid

- 10.4.2 CARBON COMPOSITES

- 10.4.2.1 Suitable for aerospace structure applications

- 10.4.3 HYBRID COMPOSITES

- 10.4.3.1 Incorporate natural and synthetic fibers

- 10.4.4 3D COMPOSITES

- 10.4.4.1 Used to manufacture wing-to-spar joints in aircraft

- 10.4.1 ARAMID COMPOSITES

- 10.5 BULLETPROOF GLASS

- 10.5.1 ACRYLIC

- 10.5.1.1 Used in bullet-resistant systems for ballistic panels

- 10.5.2 POLYCARBONATE

- 10.5.2.1 Provides protection against multiple-shot penetration

- 10.5.1 ACRYLIC

- 10.6 FABRIC

- 10.6.1 OFFERS PROTECTION AGAINST PROJECTILE IMPACT

- 10.6.2 ORGANIC COTTON

- 10.6.2.1 Can be used to make protective apparel

- 10.6.3 SYNTHETIC NYLON & POLYESTER

- 10.6.3.1 Used in multilayered armor systems

11 BALLISTIC PROTECTION MARKET, BY PRODUCT

- 11.1 INTRODUCTION

- FIGURE 31 BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022 & 2027

- TABLE 24 BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 25 BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 11.2 PERSONAL PROTECTIVE EQUIPMENT

- 11.2.1 BODY ARMOR CLOTHING

- 11.2.1.1 NBC SUITS & THERMAL CAMOUFLAGE SUITS

- 11.2.1.1.1 Designed to protect against chemical, biological, or radioactive contamination

- 11.2.1.2 IMMERSION SUITS

- 11.2.1.2.1 Used to remain afloat and for protection against hazards in water

- 11.2.1.3 ADVANCED BALLISTIC SUITS

- 11.2.1.3.1 Increasing demand for cooling system ballistic suits

- 11.2.1.1 NBC SUITS & THERMAL CAMOUFLAGE SUITS

- 11.2.2 BALLISTIC HELMETS

- 11.2.2.1 Advanced ballistic helmets

- 11.2.2.2 HUD/HMD helmets

- 11.2.3 VESTS

- 11.2.3.1 Interceptor Body Armor (IBA)

- 11.2.3.2 Interim Small Arms Protective Overvest (ISAPO)

- 11.2.3.3 Personnel Armor Systems for Ground Troops (PASGT)

- 11.2.3.4 Ranger Body Armor (RBA)

- 11.2.3.5 Survival Vests

- 11.2.4 BALLISTIC BOOTS

- 11.2.4.1 Provide stability to feet in rugged terrain

- 11.2.5 BALLISTIC GLOVES

- 11.2.5.1 Effectively disguise wearer across conditions

- 11.2.1 BODY ARMOR CLOTHING

- 11.3 BALLISTIC CONTAINERS & PORTABLE SHELTERS

- 11.3.1 KEY DEMAND DRIVERS - LOW WEIGHT, FLEXIBILITY, AND STATIC STRENGTH

- 11.4 BALLISTIC BLOCKS

- 11.4.1 CAN BE INSTALLED INDOORS AND OUTDOORS

- 11.5 BALLISTIC BARRIER SYSTEMS

- 11.5.1 CAN WITHSTAND IMPACT OF .50 CALIBER BMG APIT AMMUNITION

- 11.6 HULL & BODY

- 11.6.1 PROVIDE PROTECTION ON MARINE PLATFORMS

- 11.7 WEAPON STATIONS & OPTRONICS

- 11.7.1 USED TO PROTECT OPTRONIC DEVICES AGAINST LEVEL III AND IV BALLISTIC THREATS

- 11.8 FUEL DROP TANKS & AMMUNITION STORAGE

- 11.8.1 HIGH LEVEL OF BALLISTIC PROTECTION REQUIRED

- 11.9 COCKPIT BALLISTIC PROTECTION

- 11.9.1 PROVIDES PROTECTION FROM SMALL ARMS FIRE

- 11.10 PILOT SEAT PROTECTION

- 11.10.1 PROTECT AGAINST BALLISTIC FRAGMENTS AND EXPLOSIVE ELEMENTS

- 11.11 BALLISTIC FLOORS

- 11.11.1 PROVIDE ACOUSTIC INSULATION AND SUPERIOR DURABILITY

- 11.12 BALLISTIC WINDOWS

- 11.12.1 ACCOMMODATE A RANGE OF PROTECTION LEVELS

- 11.13 BALLISTIC DOORS

- 11.13.1 MADE OF BULLET-RESISTANT STEEL AND HEAVY-DUTY HARDWARE

- 11.14 ENGINE PROTECTION

- 11.14.1 CONSISTS OF BALLISTIC-RESISTANT LIGHTWEIGHT MATERIALS

12 BALLISTIC PROTECTION MARKET, BY THREAT LEVEL

- 12.1 INTRODUCTION

- FIGURE 32 BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022 & 2027

- TABLE 26 BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 27 BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- 12.2 LEVEL II & LEVEL IIA

- 12.2.1 COVERT-STYLE BODY ARMOR

- 12.3 LEVEL III & LEVEL IIIA

- 12.3.1 LEVEL IIIA - HIGHEST THREAT LEVEL IN SOFT ARMOR

- 12.4 LEVEL IV & ABOVE

- 12.4.1 CAN STOP BULLETS FROM RIFLES AND SUBMACHINE GUNS

13 REGIONAL ANALYSIS

- 13.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC DOMINATES BALLISTIC PROTECTION MARKET IN 2022

- TABLE 28 BALLISTIC PROTECTION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 BALLISTIC PROTECTION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- FIGURE 34 NORTH AMERICA: BALLISTIC PROTECTION MARKET SNAPSHOT

- TABLE 30 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 31 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 33 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 35 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 37 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 39 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 41 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 43 NORTH AMERICA: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.2.1 US

- 13.2.1.1 Increased procurement of armored vehicles

- TABLE 44 US: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 45 US: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 46 US: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 47 US: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 48 US: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 49 US: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.2.2 CANADA

- 13.2.2.1 Commercialization of advanced materials

- TABLE 50 CANADA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 51 CANADA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 52 CANADA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 53 CANADA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 54 CANADA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 55 CANADA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3 EUROPE

- FIGURE 35 EUROPE: BALLISTIC PROTECTION MARKET SNAPSHOT

- TABLE 56 EUROPE: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 57 EUROPE: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 58 EUROPE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 59 EUROPE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 60 EUROPE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 61 EUROPE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 62 EUROPE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 63 EUROPE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 64 EUROPE: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 65 EUROPE: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 66 EUROPE: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 67 EUROPE: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- TABLE 68 EUROPE: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 69 EUROPE: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 13.3.1 UK

- 13.3.1.1 Rising investments in ballistic protection systems

- TABLE 70 UK: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 71 UK: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 72 UK: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 73 UK: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 74 UK: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 75 UK: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.2 FRANCE

- 13.3.2.1 Military modernization programs

- TABLE 76 FRANCE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 77 FRANCE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 78 FRANCE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 79 FRANCE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 80 FRANCE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 81 FRANCE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.3 RUSSIA

- 13.3.3.1 Developing mock-ups of new helmets and complete body armor

- TABLE 82 RUSSIA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 83 RUSSIA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 84 RUSSIA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 85 RUSSIA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 86 RUSSIA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 87 RUSSIA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.4 ITALY

- 13.3.4.1 Second-largest consumer of ballistic protection systems in Europe

- TABLE 88 ITALY: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 89 ITALY: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 90 ITALY: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 91 ITALY: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 92 ITALY: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 93 ITALY: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.5 REST OF EUROPE

- 13.3.5.1 Increase in demand for armored combat equipment

- TABLE 94 REST OF EUROPE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 95 REST OF EUROPE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 96 REST OF EUROPE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 REST OF EUROPE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 REST OF EUROPE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 99 REST OF EUROPE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: BALLISTIC PROTECTION MARKET SNAPSHOT

- TABLE 100 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 101 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 102 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 105 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 109 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 110 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 111 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 113 ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 13.4.1 CHINA

- 13.4.1.1 Increased defense spending

- TABLE 114 CHINA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 115 CHINA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 116 CHINA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 117 CHINA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 118 CHINA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 119 CHINA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.2 INDIA

- 13.4.2.1 Conflicts with Pakistan and China drive demand

- TABLE 120 INDIA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 121 INDIA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 122 INDIA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 123 INDIA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 124 INDIA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 125 INDIA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.3 JAPAN

- 13.4.3.1 Need for increased security in East Asia

- TABLE 126 JAPAN: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 127 JAPAN: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 128 JAPAN: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 129 JAPAN: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 130 JAPAN: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 131 JAPAN: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Modernization programs by defense forces

- TABLE 132 SOUTH KOREA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 133 SOUTH KOREA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 134 SOUTH KOREA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 135 SOUTH KOREA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 136 SOUTH KOREA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 137 SOUTH KOREA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.5.1 Demand driven by increasing use of IEDs and other explosives

- TABLE 138 REST OF ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.5 MIDDLE EAST

- FIGURE 37 MIDDLE EAST: BALLISTIC PROTECTION MARKET SNAPSHOT

- TABLE 144 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 145 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 146 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 147 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 148 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 149 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 150 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 151 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 152 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 153 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 154 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 155 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- TABLE 156 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 157 MIDDLE EAST: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 13.5.1 UAE

- 13.5.1.1 Increasing collaborations for armored vehicles

- TABLE 158 UAE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 159 UAE: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 160 UAE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 161 UAE: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 162 UAE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 163 UAE: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Rising procurement of armored vehicles

- TABLE 164 SAUDI ARABIA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 165 SAUDI ARABIA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 166 SAUDI ARABIA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 167 SAUDI ARABIA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 168 SAUDI ARABIA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 169 SAUDI ARABIA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.5.3 ISRAEL

- 13.5.3.1 Increasing investment in ballistic technology

- TABLE 170 ISRAEL: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 171 ISRAEL: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 172 ISRAEL: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 173 ISRAEL: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 174 ISRAEL: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 175 ISRAEL: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.6 AFRICA

- FIGURE 38 AFRICA: BALLISTIC PROTECTION MARKET SNAPSHOT

- TABLE 176 AFRICA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 177 AFRICA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 178 AFRICA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 179 AFRICA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 180 AFRICA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 181 AFRICA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 182 AFRICA: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 183 AFRICA: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 184 AFRICA: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 185 AFRICA: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 186 AFRICA: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 187 AFRICA: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- 13.7 LATIN AMERICA

- FIGURE 39 LATIN AMERICA: BALLISTIC PROTECTION MARKET SNAPSHOT

- TABLE 188 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 189 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 190 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 191 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 192 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2018-2021 (USD MILLION)

- TABLE 193 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY MATERIAL, 2022-2027 (USD MILLION)

- TABLE 194 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 195 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 196 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2018-2021 (USD MILLION)

- TABLE 197 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY THREAT LEVEL, 2022-2027 (USD MILLION)

- TABLE 198 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 199 LATIN AMERICA: BALLISTIC PROTECTION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- FIGURE 40 CONTRACTS WAS KEY GROWTH STRATEGY BETWEEN 2017 AND JUNE 2022

- 14.1.1 MARKET EVALUATION FRAMEWORK

- FIGURE 41 MARKET EVALUATION FRAMEWORK: CONTRACTS TO BE LEADING STRATEGY FOR TOP PLAYERS IN 2022

- 14.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

- 14.2.1 VISIONARY LEADERS

- 14.2.2 INNOVATORS

- 14.2.3 DYNAMIC DIFFERENTIATORS

- 14.2.4 EMERGING COMPANIES

- 14.3 COMPETITIVE SCENARIO

- 14.3.1 CONTRACTS AND AGREEMENTS

- TABLE 200 CONTRACTS, 2017-JUNE 2022

15 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 BAE SYSTEMS

- TABLE 201 BAE SYSTEMS: BUSINESS OVERVIEW

- FIGURE 42 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 202 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 BAE SYSTEMS: DEALS

- 15.2.2 AVON PROTECTION

- TABLE 204 AVON PROTECTION: BUSINESS OVERVIEW

- FIGURE 43 AVON PROTECTION: COMPANY SNAPSHOT

- TABLE 205 AVON PROTECTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 AVON PROTECTION: DEALS

- 15.2.3 RHEINMETALL AG

- TABLE 207 RHEINMETALL AG: BUSINESS OVERVIEW

- FIGURE 44 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 208 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 RHEINMETALL AG: DEALS

- 15.2.4 TENCATE ADVANCED ARMOR

- TABLE 210 TENCATE ADVANCED ARMOR: BUSINESS OVERVIEW

- TABLE 211 TENCATE ADVANCED ARMOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 TENCATE ADVANCED ARMOR: DEALS

- 15.2.5 FMS ENTERPRISES MIGUN LTD.

- TABLE 213 FMS ENTERPRISES MIGUN LTD.: BUSINESS OVERVIEW

- TABLE 214 FMS ENTERPRISES MIGUN LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.6 POINT BLANK ENTERPRISES

- TABLE 215 POINT BLANK ENTERPRISES: BUSINESS OVERVIEW

- TABLE 216 POINT BLANK ENTERPRISES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 POINT BLANK ENTERPRISES: DEALS

- 15.2.7 SEYNTEX

- TABLE 218 SEYNTEX: BUSINESS OVERVIEW

- TABLE 219 SEYNTEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 SEYNTEX: DEALS

- 15.2.8 ADA (AUSTRALIAN DEFENCE APPAREL)

- TABLE 221 ADA (AUSTRALIAN DEFENCE APPAREL): BUSINESS OVERVIEW

- TABLE 222 ADA (AUSTRALIAN DEFENCE APPAREL): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ADA (AUSTRALIAN DEFENCE APPAREL): DEALS

- 15.2.9 SURVITEC GROUP LIMITED

- TABLE 224 SURVITEC GROUP LIMITED: BUSINESS OVERVIEW

- TABLE 225 SURVITEC GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.10 ARMORWORKS

- TABLE 226 ARMORWORKS: BUSINESS OVERVIEW

- TABLE 227 ARMORWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.11 REVISION MILITARY

- TABLE 228 REVISION MILITARY: BUSINESS OVERVIEW

- TABLE 229 REVISION MILITARY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 REVISION MILITARY: DEALS

- 15.2.12 ARMORSOURCE LLC.

- TABLE 231 ARMORSOURCE LLC.: BUSINESS OVERVIEW

- TABLE 232 ARMORSOURCE LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 ARMORSOURCE LLC.: DEALS

- 15.2.13 SOUTHERN STATES LLC.

- TABLE 234 SOUTHERN STATES LLC.: BUSINESS OVERVIEW

- TABLE 235 SOUTHERN STATES LLC. : PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.14 CRAIG INTERNATIONAL BALLISTICS PTY LTD.

- TABLE 236 CRAIG INTERNATIONAL BALLISTICS PTY LTD.: BUSINESS OVERVIEW

- TABLE 237 CRAIG INTERNATIONAL BALLISTICS PTY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 CRAIG INTERNATIONAL BALLISTICS PTY LTD.: DEALS

- 15.2.15 PAUL BOYE TECHNOLOGIES

- TABLE 239 PAUL BOYE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 240 PAUL BOYE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.16 ROKETSAN

- TABLE 241 ROKETSAN: BUSINESS OVERVIEW

- TABLE 242 ROKETSAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.17 SAAB AB

- TABLE 243 SAAB AB: BUSINESS OVERVIEW

- FIGURE 45 SAAB AB: COMPANY SNAPSHOT

- TABLE 244 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.18 MKU LIMITED

- TABLE 245 MKU LIMITED: BUSINESS OVERVIEW

- TABLE 246 MKU LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.19 PACIFIC SAFETY PRODUCTS

- TABLE 247 PACIFIC SAFETY PRODUCTS: BUSINESS OVERVIEW

- TABLE 248 PACIFIC SAFETY PRODUCTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.20 ELMON

- TABLE 249 ELMON: BUSINESS OVERVIEW

- TABLE 250 ELMON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.2.21 NP AEROSPACE

- TABLE 251 NP AEROSPACE: BUSINESS OVERVIEW

- 15.2.22 PLASAN

- TABLE 252 PLASAN: BUSINESS OVERVIEW

- 15.2.23 ARMOR EXPRESS

- TABLE 253 ARMOR EXPRESS: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS