|

|

市場調査レポート

商品コード

1423876

インバーターの世界市場:タイプ別、定格出力電力別、エンドユーザー別、接続別、電圧別、販売チャネル別、地域別 - 予測(~2028年)Inverter Market by Type (Solar Inverters, Vehicle Inverter), Output Power Rating (Upto 10 kW, 10-50 kW, 51-100 kW, above 100 kW), End User (PV Plants, Residential, Automotive), Connection, Voltage, Sales Channel & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| インバーターの世界市場:タイプ別、定格出力電力別、エンドユーザー別、接続別、電圧別、販売チャネル別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月07日

発行: MarketsandMarkets

ページ情報: 英文 283 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のインバーターの市場規模は、2023年の推定189億米ドルから2028年までに396億米ドルに達し、予測期間にCAGRで16.0%の成長が見込まれます。

技術革新と太陽光発電システム設置の増加が、インバーター業界拡大の2大促進要因です。近年では、インバーターはその手頃な価格、信頼性、適応性から、家庭市場でますます一般的になっています。技術の進歩による、信頼できるエネルギーソリューションと電気料金の削減に向けてインバーターを使用する家庭の結果として、インバーター市場は成長すると予測されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2028年 |

| 標準年 | 2023年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 10億米ドル |

| セグメント | 定格出力、エンドユーザー、タイプ、出力電圧、接続タイプ、販売チャネル、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「エンドユーザー別では、住宅セグメントがインバーター市場で最大のセグメントです。」

世界中での住宅用太陽光発電設備の増加と持続可能なエネルギー源への移行が、インバーター市場の住宅セグメントの成長を促進しています。住宅所有者は、政府の優遇措置や環境問題に対する社会の意識の高まりにより、ソーラーシステムへの投資を奨励されています。このような住宅設備には、太陽光発電で生成された直流を交流に変換し、家庭で使用できるようにするインバーターが必要です。

「接続タイプ別では、グリッドタイセグメントがもっとも急成長する見込みです。」

インバーター市場のグリッドタイセグメントがもっとも速いペースで拡大しているのは、エネルギー情勢の変化に対応しているためです。グリッドタイインバーターは、太陽エネルギーのような再生可能エネルギーを現在のグリッドにスムーズに組み込むことを容易にします。顧客が余剰エネルギーをグリッドに戻すことを可能にすることで、この接続タイプは持続可能性を促進し、電気料金を節約できる可能性があります。世界がよりクリーンなエネルギー利用やグリッドの近代化に向かうにつれ、グリッドタイインバーターの需要はますます高まっています。これは住宅、商業、工業の各用途が、効率的で接続性が高く、環境にやさしいエネルギーソリューションを求めているためです。

「アジア太平洋がインバーター市場で最大の地域となる見込みです。」

アジア太平洋では、急速な経済拡大、工業化の進行、再生可能エネルギーの利用の重視のために、インバーター市場が拡大しています。積極的なクリーンエネルギー目標を掲げる中国、インド、日本などの国々が市場を牽引し、太陽光発電や風力発電プロジェクト向けのインバーター需要を生み出しています。この地域の優位性は、急速な都市化、電化率の上昇、持続可能な技術を奨励する政府の施策の結果です。家庭用太陽光発電設備の需要も、アジア太平洋の中間層の拡大が後押ししています。この地域は、グリーンエネルギーソリューションへの積極的な取り組みにより、世界のインバーター市場における主要地域として位置づけられています。

「販売チャネル別では、間接販売が最速のセグメントとなる見込みです。」

インバーター技術の複雑性と専門性により、インバーター市場では間接販売チャネルが最大のセグメントとなっています。メーカーは多様なエンドユーザーを獲得するために、販売業者、小売業者、サードパーティーベンダーのネットワークに頼ることが多いです。この間接的なアプローチにより、より広い市場の範囲、効率的な流通、的を絞ったカスタマーサポートが可能になります。インバーターには複雑な技術的要件があるため、知識豊富な仲介業者が必要となり、間接販売チャネルは幅広い顧客層にリーチし、特定の業界ニーズに対応するのに適した方法となっています。

当レポートでは、世界のインバーター市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- インバーター市場の企業にとって魅力的な機会

- アジア太平洋のインバーター市場:エンドユーザー別、国別

- インバーター市場:定格出力電力別

- インバーター市場:出力電圧別

- インバーター市場:エンドユーザー別

- インバーター市場:インバータータイプ別

- インバーター市場:接続タイプ別

- インバーター市場:販売チャネル別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- エコシステムマッピング

- バリューチェーン分析

- 原材料プロバイダー/コンポーネントメーカー/サプライヤー

- インバーターメーカー/組立業者

- 販売業者/再販業者

- エンドユーザー

- メンテナンス/サービスプロバイダー

- 技術分析

- Zソースインバーター

- ソーラーマイクロインバーター

- スマートインバーター

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 価格分析

- 関税、標準、規制情勢

- 規制機関、政府機関、その他の組織

- 規格

- 関税

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主なステークホルダーと購入標準

- 購入プロセスにおける主なステークホルダー

- 購入標準

- 主な会議とイベント(2024年)

第6章 インバーター市場:定格出力電力別

- イントロダクション

- 10KW未満

- 10~50KW

- 51~100KW

- 100KW超

第7章 インバーター市場:エンドユーザー別

- イントロダクション

- 住宅

- 自動車

- 太陽光発電(PV)プラント

- その他

第8章 インバーター市場:タイプ別

- イントロダクション

- ソーラーインバーター

- セントラルインバーター

- ストリングインバーター

- マイクロインバーター

- ハイブリッドインバーター

- 車両用インバーター

- バッテリー電気自動車(BEV)

- ハイブリッド電気自動車(HEV)

- プラグインハイブリッド電気自動車(PHEV)

- その他

第9章 インバーター市場:出力電圧別

- イントロダクション

- 100~300V

- 301~500V

- 500V超

第10章 インバーター市場:接続タイプ別

- イントロダクション

- スタンドアロン

- グリッドタイ

- 従来型インバーター

- スマートインバーター

第11章 インバーター市場:販売チャネル別

- イントロダクション

- 直接

- 間接

第12章 インバーター市場:地域別

- イントロダクション

- 北米

- 中東・アフリカ

- 南米

- アジア太平洋

- 欧州

第13章 競合情勢

- 概要

- 主要企業が採用した戦略(2018年~2023年)

- 市場シェア分析(2022年)

- 主要企業の収益の分析(2018年~2022年)

- 企業の評価マトリクス(2022年)

- スタートアップ/中小企業(SME)の評価マトリクス(2022年)

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- HUAWEI TECHNOLOGIES CO., LTD.

- SUNGROW

- SMA SOLAR TECHNOLOGY AG

- POWER ELECTRONICS S.L.

- FIMER GROUP

- SOLAREDGE

- FRONIUS INTERNATIONAL GMBH

- ALTENERGY POWER SYSTEM INC.

- ENPHASE ENERGY

- DARFON

- SCHNEIDER ELECTRIC

- GENERAL ELECTRIC

- DELTA ELECTRONICS, INC.

- EXIDE INDUSTRIES LTD.

- その他の企業

- CONTINENTAL ENGINEERING SERVICES

- DELPHI TECHNOLOGIES

- SENSATA TECHNOLOGIES

- SAMLEX EUROPE BV

- BESTEK

- GOODWE

- TMEIC (TOSHIBA MITSUBISHI-ELECTRIC INDUSTRIAL SYSTEMS CORPORATION)

- YASKAWA-SOLECTRIA SOLAR

- KACO NEW ENERGY

- GROWATT NEW ENERGY

- TBEA

第15章 付録

The Inverter market is estimated to grow from USD 39.6 billion by 2028 from an estimated USD 18.9 billion in 2023, at a CAGR of 16.0% during the forecast period. Innovation in technology and a rise in solar PV system installations are two main drivers of the inverter industry's expansion. These days, inverters are more and more common in the home market because of their affordability, dependability, and adaptability. The inverter market is expected to grow as a result of homes using inverters for dependable energy solutions and lower electricity bills due to advancements in technology.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2023 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | Output Power Rating, End User, Type, Output Voltage, Connection Type, Sales Channel, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

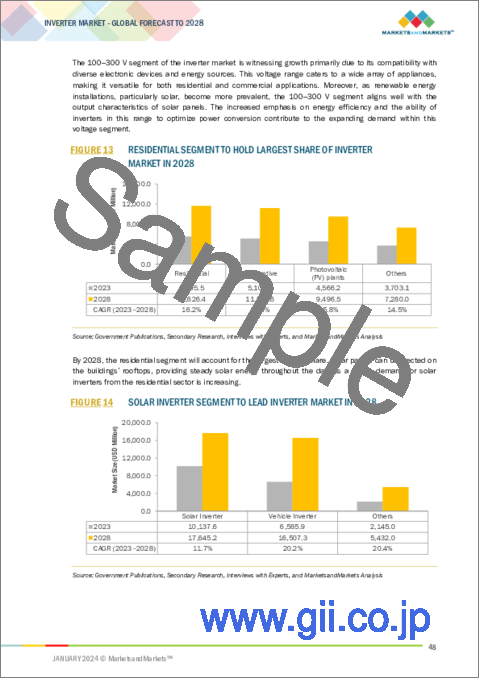

"Residential segment is the largest segment of the Inverter market, by end user"

Based on end user, the Inverter market has been split into four types: residential, automotive, photovoltaic (PV) plants, and others. The increase in residential solar installations and the world's transition to sustainable energy sources are driving growth in the inverter market's residential segment. Homeowners are encouraged to invest in solar systems by government incentives and growing public awareness of environmental issues. These residential installations require inverters, which transform solar-generated DC into AC that may be used for domestic purposes.

"Grid-tied segment is expected to emerge as the fastest-growing segment based on connection type"

Based on connection type, the Inverter market has been segmented into standalone and grid-tied . The inverter market's grid-tied segment is expanding at the fastest pace because it is in line with the changing energy landscape. Grid-tied inverters make it easier to smoothly incorporate renewable energy sources-like solar energy-into the current electrical grids. By enabling customers to send excess energy back into the grid, this connection type promotes sustainability and may save electricity prices. Grid-tied inverters are becoming more and more in demand as the world moves towards cleaner energy practices and grid modernization. This is because residential, commercial, and industrial applications are looking for energy solutions that are efficient, connected, and environmentally friendly.

"Asia Pacific is expected to emerge as the largest region based on Inverter market"

By region, the Inverter market has been segmented into Asia Pacific, North America, South America, Europe, and Middle East & Africa. In the region, the Inverter market is expanding in Asia Pacific because of the region's rapid economic expansion, growing industrialization, and strong emphasis on the use of renewable energy. With their aggressive clean energy goals, nations like China, India, and Japan are driving the market and creating demand for inverters for solar and wind power projects. The region's supremacy is a result of rapid urbanisation, rising electrification, and government measures encouraging sustainable technologies. Demand for home solar installations is also fueled by Asia Pacific's expanding middle class. The region is positioned as a key player in the global inverter market thanks to its aggressive dedication to green energy solutions.

"Indirect is expected to be the fastest segment based on sales channel"

The indirect sales channel is the largest segment in the inverter market due to the complexity and specialized nature of inverter technologies. Manufacturers often rely on a network of distributors, retailers, and third-party vendors to reach diverse end-users. This indirect approach allows for wider market coverage, efficient distribution, and targeted customer support. The intricate technical requirements of inverters necessitate knowledgeable intermediaries, making the indirect sales channel the preferred method for reaching a broad customer base and catering to specific industry needs.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, the Middle East & Africa- 12%, and South America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Inverter market is dominated by a few major players that have a wide regional presence. The leading players in the Inverter market are Huawei Technologies Co., Ltd. (China), SUNGROW (China), SMA Solar Technology AG (Germany), Power Electronics S.L. (Spain), and Fimer Group (Italy).

Research Coverage:

The report defines, describes, and forecasts the Inverter market, by output power rating, end user, output voltage, type, connection type, sales channel and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the Inverter market.

Key Benefits of Buying the Report

- Increasing investments in renewable energy sector and rising number of solar installations attributed to government-led incentives and schemes. Growing demand for residential solar rooftop installations and distributed energy resources (DERs).

- Product Development/ Innovation: The trends such as Z-source inverter, solar micro-inverter and smart inverters.

- Market Development: The global scenario of Inverter has developed due to a global shift towards sustainable energy solutions, increased adoption of renewable sources like solar and wind power, technological advancements enhancing efficiency, and the growing demand for electric vehicles. These factors collectively propel innovation, creating a dynamic landscape for inverter technologies to meet evolving energy demands.

- Market Diversification: Market diversification in the inverter market is a response to varied energy needs across industries and regions. As renewable energy adoption expands, diverse applications emerge, from residential solar installations to utility-scale projects. Inverter manufacturers diversify their product offerings to cater to the specific requirements of different sectors, fostering market growth and resilience.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Huawei Technologies Co., Ltd. (China), SUNGROW (China), SMA Solar Technology AG (Germany), Power Electronics S.L. (Spain), and Fimer Group (Italy) among others in the Inverter market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INVERTER MARKET, BY OUTPUT POWER RATING: INCLUSIONS AND EXCLUSIONS

- 1.2.2 INVERTER MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.2.3 INVERTER MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- 1.2.4 INVERTER MARKET, BY OUTPUT VOLTAGE: INCLUSIONS AND EXCLUSIONS

- 1.2.5 INVERTER MARKET, BY CONNECTION TYPE: INCLUSIONS AND EXCLUSIONS

- 1.2.6 INVERTER MARKET, BY SALES CHANNEL: INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INVERTER MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INVERTER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Primary interviews with experts

- 2.1.2.3 Breakdown of primaries

- 2.2 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 RESEARCH SCOPE

- FIGURE 4 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR INVERTERS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF INVERTERS

- FIGURE 8 INVERTER MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Assumptions for supply-side analysis

- 2.4.4.2 Calculations for supply-side analysis

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2023

- 2.4.5 GROWTH FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION ON INVERTER MARKET

3 EXECUTIVE SUMMARY

- TABLE 1 INVERTER MARKET SNAPSHOT

- FIGURE 10 INVERTER MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 BELOW 10 KW SEGMENT TO LEAD INVERTER MARKET IN 2028

- FIGURE 12 100-300 V SEGMENT TO DOMINATE INVERTER MARKET IN 2028

- FIGURE 13 RESIDENTIAL SEGMENT TO HOLD LARGEST SHARE OF INVERTER MARKET IN 2028

- FIGURE 14 SOLAR INVERTER SEGMENT TO LEAD INVERTER MARKET IN 2028

- FIGURE 15 STANDALONE SEGMENT TO DOMINATE INVERTER MARKET IN 2028

- FIGURE 16 INDIRECT SEGMENT TO HOLD LARGER SHARE OF INVERTER MARKET IN 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INVERTER MARKET

- FIGURE 17 INCREASING ADOPTION OF RENEWABLE ENERGY SOURCES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS DURING FORECAST PERIOD

- 4.2 INVERTER MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- FIGURE 18 RESIDENTIAL SEGMENT AND CHINA TO HOLD LARGEST SHARES OF INVERTER MARKET IN ASIA PACIFIC IN 2023

- 4.3 INVERTER MARKET, BY OUTPUT POWER RATING

- FIGURE 19 BELOW 10 KW SEGMENT TO DOMINATE INVERTER MARKET IN 2028

- 4.4 INVERTER MARKET, BY OUTPUT VOLTAGE

- FIGURE 20 100-300 V SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INVERTER MARKET IN 2028

- 4.5 INVERTER MARKET, BY END USER

- FIGURE 21 RESIDENTIAL SEGMENT TO HOLD LARGEST SHARE OF INVERTER MARKET IN 2028

- 4.6 INVERTER MARKET, BY INVERTER TYPE

- FIGURE 22 SOLAR INVERTER SEGMENT TO DOMINATE INVERTER MARKET IN 2028

- 4.7 INVERTER MARKET, BY CONNECTION TYPE

- FIGURE 23 STANDALONE SEGMENT TO ACCOUNT FOR LARGER SHARE OF INVERTER MARKET IN 2028

- 4.8 INVERTER MARKET, BY SALES CHANNEL

- FIGURE 24 INDIRECT SEGMENT TO HOLD LARGER SHARE OF INVERTER MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 INVERTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in renewable energy sector

- FIGURE 26 NET SOLAR PV ELECTRICITY CAPACITY ADDITIONS, BY REGION, 2022-2024

- FIGURE 27 GLOBAL INVESTMENTS IN CLEAN ENERGY GENERATION, 2015-2023 (USD BILLION)

- 5.2.1.2 Rising number of solar installations attributed to government-led initiatives and schemes

- 5.2.1.3 Increasing residential solar rooftop installations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety risks associated with high DC voltages

- 5.2.2.2 Strain on batteries due to prolonged use of inverters

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for electric vehicles

- 5.2.3.2 Increasing investments in development of smart grids

- 5.2.3.3 Demand for high-power density inverters

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of cost-effective products in gray market leading to pricing pressure on manufacturers

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 ECOSYSTEM MAPPING

- TABLE 2 ROLE OF PLAYERS IN INVERTER ECOSYSTEM

- FIGURE 31 ECOSYSTEM MAPPING

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 32 INVERTER MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/COMPONENT MANUFACTURERS/SUPPLIERS

- 5.5.2 INVERTER MANUFACTURERS/ASSEMBLERS

- 5.5.3 DISTRIBUTORS/RESELLERS

- 5.5.4 END USERS

- 5.5.5 MAINTENANCE/SERVICE PROVIDERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 Z-SOURCE INVERTERS

- 5.6.2 SOLAR MICRO INVERTERS

- 5.6.3 SMART INVERTERS

- 5.7 PATENT ANALYSIS

- FIGURE 33 INVERTER MARKET: PATENT REGISTRATIONS, 2012-2022

- TABLE 3 INVERTER MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2019-2023

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- FIGURE 34 IMPORT DATA FOR HS CODE 850440-COMPLIANT PRODUCTS, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- TABLE 4 IMPORT DATA FOR HS CODE 850440-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.8.2 EXPORT SCENARIO

- FIGURE 35 EXPORT DATA FOR HS CODE 850440-COMPLIANT PRODUCTS, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- TABLE 5 EXPORT DATA FOR HS CODE 850440-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.9 PRICING ANALYSIS

- FIGURE 36 AVERAGE SELLING PRICE (ASP) TREND OF INVERTERS, BY TYPE, 2021-2023 (USD/UNIT)

- TABLE 6 AVERAGE SELLING PRICE (ASP) TREND OF INVERTERS, BY TYPE, 2021-2023 (USD/UNIT)

- FIGURE 37 AVERAGE SELLING PRICE (ASP) TREND OF INVERTERS, BY REGION, 2021-2023 (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE (ASP) TREND OF INVERTERS, BY REGION, 2021-2023 (USD/UNIT)

- 5.10 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 STANDARDS

- TABLE 13 GLOBAL: STANDARDS

- 5.10.3 TARIFFS

- TABLE 14 IMPORT TARIFF FOR HS CODE 850440-COMPLIANT PRODUCTS, 2022

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INVERTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 INVERTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF SUBSTITUTES

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF NEW ENTRANTS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 SOLAR POWER PLANT IN BARGAS, SPAIN, TO DEPLOY TURNKEY SOLUTION BY SUNGROW

- 5.12.2 MAN TRUCKS & BUSES, SOUTH AFRICA, TO GO GREEN WITH GOODWE INVERTERS

- 5.12.3 FIVE MID-LARGE SCALE SOLAR FARM PROJECTS IN REGIONAL SOUTH AUSTRALIA TO USE INVERTER BY FIMER

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 16 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.13.2 BUYING CRITERIA

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.14 KEY CONFERENCES AND EVENTS, 2024

- TABLE 18 INVERTER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024

6 INVERTER MARKET, BY OUTPUT POWER RATING

- 6.1 INTRODUCTION

- FIGURE 41 INVERTER MARKET, BY OUTPUT POWER RATING, 2023

- TABLE 19 INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 20 INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- 6.2 BELOW 10 KW

- 6.2.1 RISING DEMAND FROM RESIDENTIAL SECTOR TO CONTRIBUTE TO MARKET GROWTH

- TABLE 21 BELOW 10 KW: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 22 BELOW 10 KW: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 10-50 KW

- 6.3.1 INCREASING DEPLOYMENT IN EXPANDING COMMERCIAL SECTOR TO FUEL DEMAND

- TABLE 23 10-50 KW: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 24 10-50 KW: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 51-100 KW

- 6.4.1 GROWING DEMAND FROM PV PLANTS AND VARIOUS INDUSTRIES TO BOOST MARKET GROWTH

- TABLE 25 51-100 KW: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 26 51-100 KW: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

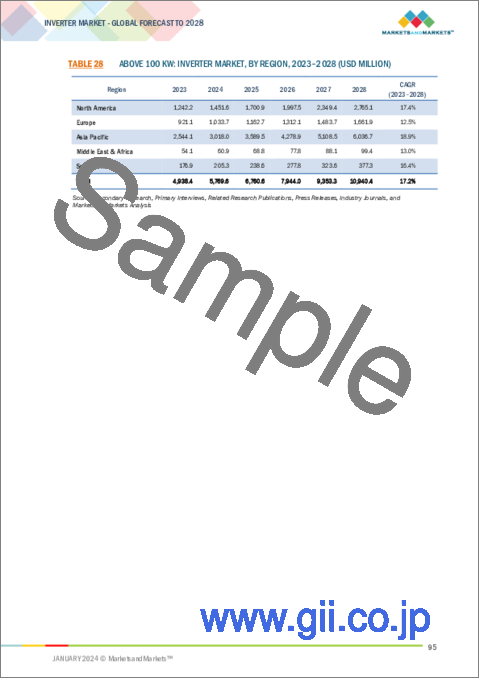

- 6.5 ABOVE 100 KW

- 6.5.1 RISING NUMBER OF PV PLANTS AND EXPANDING AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- TABLE 27 ABOVE 100 KW: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 28 ABOVE 100 KW: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

7 INVERTER MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 42 INVERTER MARKET, BY END USER, 2023 (USD MILLION)

- TABLE 29 INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 30 INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 7.2 RESIDENTIAL

- 7.2.1 RISING GOVERNMENT INITIATIVES TO INCREASE RENEWABLE ENERGY ACCESS FOR HOUSEHOLDS TO DRIVE MARKET

- TABLE 31 RESIDENTIAL: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 32 RESIDENTIAL: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 AUTOMOTIVE

- 7.3.1 GROWING ADOPTION OF ELECTRIC VEHICLES TO FUEL DEMAND

- TABLE 33 AUTOMOTIVE: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 34 AUTOMOTIVE: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 PHOTOVOLTAIC (PV) PLANTS

- 7.4.1 INCREASING IMPLEMENTATION OF RENEWABLE ENERGY POLICIES IN SEVERAL COUNTRIES TO FOSTER MARKET GROWTH

- TABLE 35 PHOTOVOLTAIC (PV) PLANTS: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 36 PHOTOVOLTAIC (PV) PLANTS: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 OTHERS

- TABLE 37 OTHERS: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 38 OTHERS: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

8 INVERTER MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 43 INVERTER MARKET, BY TYPE, 2023 (USD MILLION)

- TABLE 39 INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 40 INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 41 INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 42 INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- 8.2 SOLAR INVERTER

- TABLE 43 SOLAR INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 44 SOLAR INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 SOLAR INVERTER: INVERTER MARKET, BY SUB-TYPE, 2020-2022 (USD MILLION)

- TABLE 46 SOLAR INVERTER: INVERTER MARKET, BY SUB-TYPE, 2023-2028 (USD MILLION)

- 8.2.1 CENTRAL INVERTER

- 8.2.1.1 Rising demand from PV plants to drive market

- TABLE 47 CENTRAL INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 48 CENTRAL INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 STRING INVERTER

- 8.2.2.1 Rising installation of solar panels in residential and commercial sectors to boost market growth

- TABLE 49 STRING INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 50 STRING INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3 MICRO INVERTER

- 8.2.3.1 Increasing demand for micro inverters in residential sector to fuel market growth

- TABLE 51 MICRO INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 52 MICRO INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.4 HYBRID INVERTER

- 8.2.4.1 Multiple benefits of hybrid inverters to drive market

- TABLE 53 HYBRID INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 54 HYBRID INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 VEHICLE INVERTER

- TABLE 55 VEHICLE INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 56 VEHICLE INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 VEHICLE INVERTER: INVERTER MARKET, BY SUB-TYPE, 2020-2022 (USD MILLION)

- TABLE 58 VEHICLE INVERTER: INVERTER MARKET, BY SUB-TYPE, 2023-2028 (USD MILLION)

- 8.3.1 BATTERY ELECTRIC VEHICLE (BEV)

- 8.3.1.1 Favorable government initiatives related to EVs to propel market

- TABLE 59 BATTERY ELECTRIC VEHICLE (BEV): INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 60 BATTERY ELECTRIC VEHICLE (BEV): INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2 HYBRID ELECTRIC VEHICLE (HEV)

- 8.3.2.1 Increased demand for fuel-efficient vehicles and implementation of stringent emission norms to fuel market growth

- TABLE 61 HYBRID ELECTRIC VEHICLE (HEV): INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 62 HYBRID ELECTRIC VEHICLE (BEV): INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 8.3.3.1 Rising demand for EVs to boost market growth

- TABLE 63 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV): INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 64 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV): INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 OTHERS

- TABLE 65 OTHERS: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 66 OTHERS: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

9 INVERTER MARKET, BY OUTPUT VOLTAGE

- 9.1 INTRODUCTION

- FIGURE 44 INVERTER MARKET, BY OUTPUT VOLTAGE, 2023 (USD MILLION)

- TABLE 67 INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 68 INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- 9.2 100-300 V

- 9.2.1 RISING ELECTRICITY DEMAND DUE TO URBANIZATION TO DRIVE MARKET

- TABLE 69 100-300 V: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 70 100-300 V: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 301-500 V

- 9.3.1 GROWING REQUIREMENT FOR UNINTERRUPTED POWER SUPPLY FROM COMMERCIAL AND INDUSTRIAL SECTORS TO FUEL MARKET GROWTH

- TABLE 71 301-500 V: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 72 301-500 V: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 ABOVE 500 V

- 9.4.1 INCREASING INVESTMENTS IN POWER INFRASTRUCTURE DEVELOPMENT TO CONTRIBUTE TO MARKET GROWTH

- TABLE 73 500 V: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 74 500 V: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

10 INVERTER MARKET, BY CONNECTION TYPE

- 10.1 INTRODUCTION

- FIGURE 45 INVERTER MARKET, CONNECTION TYPE, 2023 (USD MILLION)

- TABLE 75 INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 76 INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- 10.2 STANDALONE

- 10.2.1 RISING ELECTRICITY CONSUMPTION AND DEPENDENCE ON ELECTRONIC DEVICES TO BOOST MARKET

- TABLE 77 STANDALONE: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 78 STANDALONE: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 GRID-TIED

- TABLE 79 GRID-TIED: INVERTER MARKET, BY SUB-TYPE, 2020-2022 (USD MILLION)

- TABLE 80 GRID-TIED: INVERTER MARKET, BY SUB-TYPE, 2023-2028 (USD MILLION)

- 10.3.1 CONVENTIONAL INVERTER

- 10.3.1.1 Increasing installation of solar PV systems in residential and commercial sectors to propel market

- TABLE 81 CONVENTIONAL INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 82 CONVENTIONAL INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.2 SMART INVERTER

- 10.3.2.1 Technological advancements in grid-tied inverters to drive market

- TABLE 83 SMART INVERTER: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 84 SMART INVERTER: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

11 INVERTER MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- FIGURE 46 INVERTER MARKET, BY SALES CHANNEL, 2023 (USD MILLION)

- TABLE 85 INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 86 INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- 11.2 DIRECT

- 11.2.1 RISING PREFERENCE FOR DIRECT PROCUREMENT OF VEHICLE INVERTERS AMONG AUTOMOBILE MANUFACTURERS TO DRIVE MARKET

- TABLE 87 DIRECT: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 88 DIRECT: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 INDIRECT

- 11.3.1 INCREASING ADOPTION OF INVERTERS IN RESIDENTIAL SECTOR AND PV PLANTS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 89 INDIRECT: INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 90 INDIRECT: INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

12 INVERTER MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 47 INVERTER MARKET, BY REGION, 2023

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN INVERTER MARKET DURING FORECAST PERIOD

- TABLE 91 INVERTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 92 INVERTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 93 INVERTER MARKET, BY REGION, 2020-2022 (THOUSAND UNITS)

- TABLE 94 INVERTER MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 95 INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 96 INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- TABLE 97 INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 98 INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 99 INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 100 INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 101 INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 102 INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 103 INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 104 INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 105 INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 106 INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- TABLE 107 INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 108 INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 49 NORTH AMERICA: INVERTER MARKET SNAPSHOT

- 12.2.1 IMPACT OF RECESSION ON INVERTER MARKET IN NORTH AMERICA

- TABLE 109 NORTH AMERICA: INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 118 NORTH AMERICA: INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 119 NORTH AMERICA: INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 123 NORTH AMERICA: INVERTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: INVERTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.1.1 US

- 12.2.1.1.1 Favorable government policies for renewable energy generation to drive market

- 12.2.1.1 US

- TABLE 125 US: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 126 US: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.2.1.2 Canada

- 12.2.1.2.1 Rise in residential PV installations to fuel market growth

- 12.2.1.2 Canada

- TABLE 127 CANADA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 128 CANADA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.2.1.3 Mexico

- 12.2.1.3.1 Increased deployment of clean energy sources in various applications to contribute to market growth

- 12.2.1.3 Mexico

- TABLE 129 MEXICO: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 130 MEXICO: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3 MIDDLE EAST & AFRICA

- 12.3.1 IMPACT OF RECESSION ON INVERTER MARKET IN MIDDLE EAST & AFRICA

- TABLE 131 MIDDLE EAST & AFRICA: INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 140 MIDDLE EAST & AFRICA: INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 141 MIDDLE EAST & AFRICA: INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: INVERTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: INVERTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.2 GCC COUNTRIES

- 12.3.2.1 Saudi Arabia

- 12.3.2.1.1 Increasing power generation from solar resources to fuel demand

- 12.3.2.1 Saudi Arabia

- TABLE 147 SAUDI ARABIA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 148 SAUDI ARABIA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.2.2 UAE

- 12.3.2.2.1 Expansion of EV charging infrastructure to create demand

- 12.3.2.2 UAE

- TABLE 149 UAE: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 150 UAE: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.3 SOUTH AFRICA

- 12.3.3.1 Expanding automotive industry and establishment of PV plants to contribute to market growth

- TABLE 151 SOUTH AFRICA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 152 SOUTH AFRICA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.4 REST OF MIDDLE EAST & AFRICA

- TABLE 153 REST OF MIDDLE EAST & AFRICA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST & AFRICA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4 SOUTH AMERICA

- 12.4.1 IMPACT OF RECESSION ON INVERTER MARKET IN SOUTH AMERICA

- TABLE 155 SOUTH AMERICA: INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 156 SOUTH AMERICA: INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 158 SOUTH AMERICA: INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 159 SOUTH AMERICA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 162 SOUTH AMERICA: INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 163 SOUTH AMERICA: INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 164 SOUTH AMERICA: INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 165 SOUTH AMERICA: INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 166 SOUTH AMERICA: INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- TABLE 167 SOUTH AMERICA: INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 168 SOUTH AMERICA: INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 169 SOUTH AMERICA: INVERTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 170 SOUTH AMERICA: INVERTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1.1 Brazil

- 12.4.1.1.1 Increasing investments in solar technology to propel demand

- 12.4.1.1 Brazil

- TABLE 171 BRAZIL: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 172 BRAZIL: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.1.2 Argentina

- 12.4.1.2.1 Government incentives to promote solar energy generation to boost market growth

- 12.4.1.2 Argentina

- TABLE 173 ARGENTINA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 174 ARGENTINA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.1.3 Rest of South America

- TABLE 175 REST OF SOUTH AMERICA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5 ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: INVERTER MARKET SNAPSHOT

- 12.5.1 IMPACT OF RECESSION ON INVERTER MARKET IN ASIA PACIFIC

- TABLE 177 ASIA PACIFIC: INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 186 ASIA PACIFIC: INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 187 ASIA PACIFIC: INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 190 ASIA PACIFIC: INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: INVERTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 192 ASIA PACIFIC: INVERTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.5.1.1 China

- 12.5.1.1.1 Rising electricity demand due to automation of various sectors to fuel market growth

- 12.5.1.1 China

- TABLE 193 CHINA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 194 CHINA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.1.2 India

- 12.5.1.2.1 Increase in number of solar rooftop installations to contribute to demand

- 12.5.1.2 India

- TABLE 195 INDIA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 196 INDIA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.1.3 Australia

- 12.5.1.3.1 Favorable government policies to achieve net-zero target to boost market growth

- 12.5.1.3 Australia

- TABLE 197 AUSTRALIA: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 198 AUSTRALIA: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.1.4 Japan

- 12.5.1.4.1 Rising investments in renewable energy technologies to reduce GHG emissions to drive market

- 12.5.1.4 Japan

- TABLE 199 JAPAN: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 200 JAPAN: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.1.5 Rest of Asia Pacific

- TABLE 201 REST OF ASIA PACIFIC: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6 EUROPE

- 12.6.1 IMPACT OF RECESSION ON INVERTER MARKET IN EUROPE

- TABLE 203 EUROPE: INVERTER MARKET, BY OUTPUT POWER RATING, 2020-2022 (USD MILLION)

- TABLE 204 EUROPE: INVERTER MARKET, BY OUTPUT POWER RATING, 2023-2028 (USD MILLION)

- TABLE 205 EUROPE: INVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2022 (USD MILLION)

- TABLE 206 EUROPE: INVERTER MARKET, BY OUTPUT VOLTAGE, 2023-2028 (USD MILLION)

- TABLE 207 EUROPE: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 208 EUROPE: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 209 EUROPE: INVERTER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 210 EUROPE: INVERTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 211 EUROPE: INVERTER MARKET, BY TYPE, 2020-2022 (THOUSAND UNITS)

- TABLE 212 EUROPE: INVERTER MARKET, BY TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 213 EUROPE: INVERTER MARKET, BY CONNECTION TYPE, 2020-2022 (USD MILLION)

- TABLE 214 EUROPE: INVERTER MARKET, BY CONNECTION TYPE, 2023-2028 (USD MILLION)

- TABLE 215 EUROPE: INVERTER MARKET, BY SALES CHANNEL, 2020-2022 (USD MILLION)

- TABLE 216 EUROPE: INVERTER MARKET, BY SALES CHANNEL, 2023-2028 (USD MILLION)

- TABLE 217 EUROPE: INVERTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 218 EUROPE: INVERTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.6.1.1 Germany

- 12.6.1.1.1 Growing automotive sector and rising adoption of renewable energy to drive market

- 12.6.1.1 Germany

- TABLE 219 GERMANY: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 220 GERMANY: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.1.2 UK

- 12.6.1.2.1 Increasing investments in battery production and solar power generation to propel market

- 12.6.1.2 UK

- TABLE 221 UK: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 222 UK: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.1.3 ITALY

- 12.6.1.3.1 Rising establishment of large-scale PV plants to fuel market growth

- 12.6.1.3 ITALY

- TABLE 223 ITALY: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 224 ITALY: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.1.4 France

- 12.6.1.4.1 Increase in solar PV installation capacity to propel market

- 12.6.1.4 France

- TABLE 225 FRANCE: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 226 FRANCE: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.1.5 Spain

- 12.6.1.5.1 Expanding automotive industry to drive market

- 12.6.1.5 Spain

- TABLE 227 SPAIN: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 228 SPAIN: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.1.6 Rest of Europe

- TABLE 229 REST OF EUROPE: INVERTER MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 230 REST OF EUROPE: INVERTER MARKET, BY END USER, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2018-2023

- 13.3 MARKET SHARE ANALYSIS, 2022

- FIGURE 51 INVERTER MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- 13.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022

- FIGURE 52 INVERTER MARKET: REVENUE ANALYSIS, 2018-2022

- 13.5 COMPANY EVALUATION MATRIX, 2022

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 53 INVERTER MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.5.5 COMPANY FOOTPRINT

- TABLE 232 COMPANY TYPE FOOTPRINT

- TABLE 233 COMPANY OUTPUT POWER RATING FOOTPRINT

- TABLE 234 COMPANY END USER FOOTPRINT

- TABLE 235 COMPANY REGION FOOTPRINT

- TABLE 236 COMPANY OVERALL FOOTPRINT

- 13.6 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION MATRIX, 2022

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 54 INVERTER MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 237 INVERTER MARKET: LIST OF START-UPS/SMES

- TABLE 238 COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY END USER

- TABLE 239 COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY TYPE

- TABLE 240 COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY POWER RATING

- TABLE 241 COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY REGION

- 13.7 COMPETITIVE SCENARIOS AND TRENDS

- 13.7.1 DEALS

- TABLE 242 INVERTER MARKET: DEALS, NOVEMBER 2019-JULY 2023

- 13.7.2 OTHERS

- TABLE 243 INVERTER MARKET: OTHERS, NOVEMBER 2020-NOVEMBER 2023

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1.1 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 244 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 55 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- TABLE 245 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 247 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 248 HUAWEI TECHNOLOGIES CO., LTD.: OTHERS

- 14.1.2 SUNGROW

- TABLE 249 SUNGROW: COMPANY OVERVIEW

- FIGURE 56 SUNGROW: COMPANY SNAPSHOT

- TABLE 250 SUNGROW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 SUNGROW: PRODUCT LAUNCHES

- TABLE 252 SUNGROW: DEALS

- TABLE 253 SUNGROW: OTHERS

- 14.1.3 SMA SOLAR TECHNOLOGY AG

- TABLE 254 SMA SOLAR TECHNOLOGY AG: COMPANY OVERVIEW

- FIGURE 57 SMA SOLAR TECHNOLOGY AG: COMPANY SNAPSHOT

- TABLE 255 SMA SOLAR TECHNOLOGY AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 SMA SOLAR TECHNOLOGY AG: PRODUCT LAUNCHES

- TABLE 257 SMA SOLAR TECHNOLOGY AG: DEALS

- TABLE 258 SMA SOLAR TECHNOLOGY AG: OTHERS

- 14.1.4 POWER ELECTRONICS S.L.

- TABLE 259 POWER ELECTRONICS S.L.: COMPANY OVERVIEW

- TABLE 260 POWER ELECTRONICS S.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 POWER ELECTRONICS S.L.: PRODUCT LAUNCHES

- 14.1.5 FIMER GROUP

- TABLE 262 FIMER GROUP: COMPANY OVERVIEW

- TABLE 263 FIMER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 FIMER GROUP: PRODUCT LAUNCHES

- TABLE 265 FIMER GROUP: DEALS

- TABLE 266 FIMER GROUP: OTHERS

- 14.1.6 SOLAREDGE

- TABLE 267 SOLAREDGE: COMPANY OVERVIEW

- FIGURE 58 SOLAREDGE: COMPANY SNAPSHOT

- TABLE 268 SOLAREDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 SOLAREDGE TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 270 SOLAREDGE: DEALS

- 14.1.7 FRONIUS INTERNATIONAL GMBH

- TABLE 271 FRONIUS INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 272 FRONIUS INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 FRONIUS INTERNATIONAL GMBH: PRODUCT LAUNCHES

- TABLE 274 FRONIUS INTERNATIONAL GMBH: DEALS

- 14.1.8 ALTENERGY POWER SYSTEM INC.

- TABLE 275 ALTENERGY POWER SYSTEM INC.: COMPANY OVERVIEW

- TABLE 276 ALTENERGY POWER SYSTEM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ALTENERGY POWER SYSTEM INC.: PRODUCT LAUNCHES

- TABLE 278 ALTENERGY POWER SYSTEMS INC.: DEALS

- 14.1.9 ENPHASE ENERGY

- TABLE 279 ENPHASE ENERGY: COMPANY OVERVIEW

- FIGURE 59 ENPHASE ENERGY: COMPANY SNAPSHOT

- TABLE 280 ENPHASE ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 ENPHASE ENERGY: PRODUCT LAUNCHES

- TABLE 282 ENPHASE ENERGY: DEALS

- TABLE 283 ENPHASE ENERGY: OTHERS

- 14.1.10 DARFON

- TABLE 284 DARFON: COMPANY OVERVIEW

- FIGURE 60 DAFRON: COMPANY SNAPSHOT

- TABLE 285 DARFON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 DARFON: PRODUCT LAUNCHES

- 14.1.11 SCHNEIDER ELECTRIC

- TABLE 287 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 61 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 288 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SCHNEIDER ELECTRIC: DEALS

- TABLE 290 SCHNEIDER ELECTRIC: OTHERS

- 14.1.12 GENERAL ELECTRIC

- TABLE 291 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 62 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 292 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 294 GENERAL ELECTRIC: OTHERS

- 14.1.13 DELTA ELECTRONICS, INC.

- TABLE 295 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- FIGURE 63 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- TABLE 296 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 DELTA ELECTRONICS, INC.: PRODUCT LAUNCHES

- TABLE 298 DELTA ELECTRONICS, INC.: DEALS

- TABLE 299 DELTA ELECTRONICS, INC.: OTHERS

- 14.1.14 EXIDE INDUSTRIES LTD.

- TABLE 300 EXIDE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 64 EXIDE ELECTRONICS LTD.: COMPANY SNAPSHOT

- TABLE 301 EXIDE ELECTRONICS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 EXIDE ELECTRONICS LTD.: PRODUCT LAUNCHES

- 14.2 OTHER PLAYERS

- 14.2.1 CONTINENTAL ENGINEERING SERVICES

- 14.2.2 DELPHI TECHNOLOGIES

- 14.2.3 SENSATA TECHNOLOGIES

- 14.2.4 SAMLEX EUROPE BV

- 14.2.5 BESTEK

- 14.2.6 GOODWE

- 14.2.7 TMEIC (TOSHIBA MITSUBISHI-ELECTRIC INDUSTRIAL SYSTEMS CORPORATION)

- 14.2.8 YASKAWA-SOLECTRIA SOLAR

- 14.2.9 KACO NEW ENERGY

- 14.2.10 GROWATT NEW ENERGY

- 14.2.11 TBEA

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS