|

|

市場調査レポート

商品コード

1483021

電気外科の世界市場:製品・手術・エンドユーザー別 の予測 (~2029年)Electrosurgery Market by Product, Surgery, End User - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 電気外科の世界市場:製品・手術・エンドユーザー別 の予測 (~2029年) |

|

出版日: 2024年05月20日

発行: MarketsandMarkets

ページ情報: 英文 374 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の電気外科の市場規模は、2024年の69億米ドルから、予測期間中は6.4%のCAGRで推移し、2029年には94億米ドルの規模に成長すると予測されています。

費用対効果と利便性から、外来手術や外来診療の人気が高まっており、こうした環境に適した電気外科用機器の需要が高まっています。これらの機器は、携帯可能で使いやすく、低侵襲手術に対応するように設計されているため、従来の病院環境以外でも安全で効率的な手術が可能になります。医療において患者中心のケアと効率性が重視されるようになる中で、医療提供の分散化という動向に合わせて、外来患者環境に合わせた電気外科用機器の需要が急増することも予想されています。遠隔地や十分な医療を受けていない地域では、高度な電気外科処置や機器へのアクセスが限られており、医療提供の格差があることから、市場成長につながる見通しです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 製品タイプ・手術タイプ・エンドユーザー・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

電気外科器具の部門が2023年に最大シェアを示す:

感染対策、利便性、費用対効果への懸念から、医療従事者の間で使い捨て電気外科器具への嗜好が高まっており、同部門の成長に拍車をかけています。使い捨て器具は滅菌の必要性をなくし、ヘルスケア関連感染のリスクを低減し、ワークフローを合理化します。さらに、高価な滅菌装置が不要になり、人件費が削減されるため、コスト削減も実現します。医療従事者が感染対策と効率化を優先させる中、使い捨て電気外科器具の需要は今後も高まり続けると予想されています。

手術タイプ別では、一般外科の部門が予測期間中に急成長の見通し:

電気外科手術は、メスを使った従来の技術よりも優れているため、一般外科手術でますます採用されるようになっています。より良い止血を行い、出血を減らし、視認性を向上させることで、手術の精度を高め、患者の回復を早めます。さらに、電気手術では組織の剥離が改善されるため、外科医は組織層をより効率的に、周囲への外傷を最小限に抑えながら切り開くことができます。これらの利点が電気手術の普及を促進し、電気手術市場の成長に寄与しています。

予測期間中はアジア太平洋地域が最大のCAGRを示すと予測されています。一方で、北米が2023年に最大のシェアを示しています。北米地域では、電気外科機器を使用する医療処置に対する償還政策が強力であるため、ヘルスケアプロバイダーが電気外科を採用する動機付けとなり、市場成長を促進しています。このような政策により、電気外科機器を使用した処置に対する十分な報酬が保証されるため、医療提供者にとって経済的に実行可能であり、患者にとっても利用しやすいものとなっています。好条件の償還は、電気外科技術の利用を促進し、技術革新を刺激し、先進治療への幅広い患者アクセスをサポートし、市場拡大に大きく貢献しています。

当レポートでは、世界の電気外科の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制・償還環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- バリューチェーン分析

- 技術分析

- ポーターのファイブフォース分析

- 規制状況

- 特許分析

- HSコード:電気外科機器/製品

- 価格分析

- 償還分析

- 主な会議とイベント

- 主なステークホルダーと購入基準

- 電気外科市場におけるアンメットニーズとエンドユーザーの期待

- 電気外科市場におけるAIの統合

- エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 隣接市場の分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 電気外科市場:投資と資金調達のシナリオ

第6章 電気外科市場:製品別

- 電気外科器具

- バイポーラ電気外科器具

- モノポーラ電気外科器具

- 電気外科用発電機

- 電気外科用付属品

- 患者リターン電極

- コード、ケーブル、アダプタ

- その他

- 煙排出システム

第7章 電気外科市場:手術タイプ別

- 一般外科

- 産婦人外科

- 整形外科

- 心臓血管外科

- 腫瘍外科

- 美容整形外科

- 泌尿器外科

- 脳神経外科

- その他

第8章 電気外科市場:エンドユーザー別

- 病院、クリニック、アブレーションセンター

- 外来手術センター

- 研究機関・学術機関

第9章 電気外科市場:地域別

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分配分析

- 市場シェア分析

- 電気外科ベンダーの評価と財務指標

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合状況と動向

- ブランド/製品比較分析

- 電気外科市場:R&D費

第11章 企業プロファイル

- 主要企業

- MEDTRONIC PLC

- JOHNSON & JOHNSON(ETHICON)

- OLYMPUS CORPORATION

- B. BRAUN

- CONMED CORPORATION

- BOSTON SCIENTIFIC CORPORATION

- SMITH+NEPHEW

- ERBE ELEKTROMEDIZIN GMBH

- STRYKER CORPORATION

- BOWA-ELECTRONIC GMBH & CO. KG

- THE COOPER COMPANIES, INC.

- KIRWAN SURGICAL PRODUCTS LLC

- ZIMMER BIOMET

- UTAH MEDICAL PRODUCTS, INC.

- INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- ENCISION, INC.

- KLS MARTIN GROUP

- SURGICAL HOLDINGS

- I. C. MEDICAL, INC.

- MEYER-HAAKE GMBH MEDICAL INNOVATIONS

- その他の企業

- ASPEN SURGICAL

- APPLIED MEDICAL RESOURCES CORPORATION

- APYX MEDICAL

- EPMD GROUP

- DIRECTA DENTAL GROUP

第12章 付録

The electrosurgery market is projected to reach USD 9.4 Billion by 2029 from USD 6.9 Billion in 2024 at a CAGR of 6.4% during the forecast period. The rising popularity of outpatient surgeries and ambulatory care, driven by cost-effectiveness and convenience, is set to increase demand for electrosurgical devices suitable for these settings. These devices are designed to be portable, user-friendly, and compatible with minimally invasive procedures, facilitating safe and efficient surgeries outside traditional hospital environments. As healthcare focuses on patient-centered care and efficiency, the demand for electrosurgical devices tailored to outpatient settings is expected to surge, aligning with the trend towards decentralized healthcare delivery. In remote or underserved areas, access to advanced electrosurgical procedures and equipment may be limited, leading to disparities in healthcare delivery and market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) Billion |

| Segments | By Product, Surgery Type, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

"Electrosurgical instruments segment commands the largest share of the electrosurgery market in 2023."

The electrosurgery market by product is segmented into electrosurgical generators, electrosurgical instruments, electrosurgical accessories, and smoke evacuation systems on the basis of product type. The rising preference among healthcare providers for disposable electrosurgical instruments, driven by concerns over infection control, convenience, and cost-effectiveness, is fueling market growth in this segment. Disposable instruments eliminate the need for sterilization, reducing the risk of healthcare-associated infections and streamlining workflow. Additionally, they offer cost savings by eliminating the need for expensive sterilization equipment and reducing labor costs. As healthcare providers prioritize infection control and efficiency, the demand for disposable electrosurgical instruments is expected to continue rising, contributing to the expansion of this market segment.

"General surgery sub-segment of surgery type segment projected the rapid growth during the forecast period."

The electrosurgery market by surgery type is segmented into as general surgery, obstetric/gynecological surgery, urological surgery, orthopedic surgery, cardiovascular surgery, cosmetic surgery, neurosurgery, oncological surgery, and other surgical procedures. Electrosurgery is increasingly adopted in general surgery due to its advantages over conventional techniques like scalpel-based surgery. It provides better hemostasis, reduces blood loss, and improves visibility, leading to enhanced surgical precision and faster patient recovery. Additionally, electrosurgery offers improved tissue dissection, allowing surgeons to cut through tissue layers more efficiently and with minimal trauma to surrounding structures. These benefits are driving its adoption and contributing to the growth of the electrosurgery market.

"Hospitals, clinics, and ablation centres segment accounted for the largest share of the electrosurgery market in 2023"

The electrosurgery market by end user is divided into hospitals, clinics, and ablation centers; ambulatory surgical centers; and research laboratories and academic institutes. Ablation techniques like radiofrequency, microwave, and cryoablation are increasingly used across various medical specialties, driving demand for electrosurgical devices in specialized ablation centers. These techniques offer minimally invasive alternatives for treating conditions such as tumors, cardiac arrhythmias, and chronic pain, with advantages including effectiveness, reduced risk, and faster recovery. As demand for ablation therapies grows, the need for advanced electrosurgical devices tailored to ablation procedures rises, propelling market expansion in specialized ablation centers.

"North America to witness the substantial growth rate during the forecast period".

The electrosurgery market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa based on the region type. In 2023, the Asia Pacific region is anticipated to exhibit the highest compound annual growth rate (CAGR) during the forecast period. However, North America holds the largest share of the electrosurgery market in 2023. The region's strong reimbursement policies for medical procedures, including those using electrosurgical devices, incentivize healthcare providers to adopt electrosurgery, thus driving market growth. These policies ensure adequate compensation for procedures involving electrosurgical devices, making them financially viable for providers and accessible for patients. Favorable reimbursement fosters increased utilization of electrosurgical techniques, stimulates innovation, and supports broader patient access to advanced treatments, contributing significantly to market expansion.

A breakdown of the primary participants (supply-side) for the electrosurgery market referred to for this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-34%, and Tier 3-21%

- By Designation: C-level-26%, Director Level-30%, and Others-44%

- By Region: North America-35%, Europe-32%, Asia Pacific-25%, Latin America- 6%, and Middle East and Africa- 2%

Prominent players in electrosurgery market include Medtronic plc (Ireland), Johnson & Johnson (Ethicon) (US), Olympus Corporation (Japan), B. Braun Melsungen (Germany), CONMED Corporation (US), Boston Scientific Corporation (US), Smith and Nephew Plc (UK), Erbe Elektromedizin GmbH (Germany), KLS Martin Group (Germany), BOWA-electronic GmbH & Co. KG (Germany), The Cooper Companies, Inc. (US), Kirwan Surgical Products LLC (US), Zimmer Biomet (US), Utah Medical Products Inc. (US), Encision Inc. (US), Stryker Corporation (US), Meyer-Haake GmbH Medical Innovations (Germany), Surgical Holdings (UK), I. C. Medical, Inc. (US), Aspen Surgical (US), Applied Medical Resources Corporation (US), Apyx Medical (US), EPMD Group (india) and Directa Dental Group (US).

Research Coverage:

The market study covers the electrosurgery market across various segments. It aims at estimating the market size and the growth potential of this market across different segments by product, surgery type, end user, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Research Coverage:

The report analyzes the Analytical Testing Services Market and aims to estimate the market size and future growth potential of various market segments, based on type, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of Market Dynamics: Drivers (growing prevalence of chronic diseases, increasing demand for minimally invasive surgeries, innovation and technological advancements in electrosurgical instruments, increasing number of hospitals coupled with growing number of surgical procedures, and shifting preference toward outpatient surgeries in developed regions), restraints (risks associated with electrosurgical procedures, stringent regulatory framework, and shortage of surgeons) opportunities (emerging markets, rising government funding to develop advanced medical treatments, and expected increase in number of cosmetic and bariatric procedures due to growing obesity prevalence), and challenges (concerns regarding toxic fumes produced during surgical procedures and concerns about electromagnetic interference)

- Services/Innovations: Detailed insights on upcoming technologies, research & development activities, and new service launches in the electrosurgery market.

- Market Development: Comprehensive information on the lucrative emerging markets, components, demographics, end-user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the electrosurgery market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the electrosurgery market like Medtronic plc (Ireland), Johnson & Johnson (Ethicon) (US), Olympus Corporation (Japan), B. Braun Melsungen (Germany), CONMED Corporation (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ELECTROSURGERY MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT: ELECTROSURGERY MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 RESEARCH METHODOLOGY DESIGN

- FIGURE 2 ELECTROSURGERY MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Insights from primary experts

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 ELECTROSURGERY MARKET: REVENUE SHARE ANALYSIS ILLUSTRATION OF MEDTRONIC

- FIGURE 8 BOTTOM-UP APPROACH

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 ELECTROSURGERY MARKET: SURGERY-TYPE-BASED ESTIMATION (2023)

- FIGURE 11 DEMAND-SIDE MARKET ESTIMATION: BIPOLAR & MONOPOLAR ELECTROSURGICAL INSTRUMENTS

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.4 MARKET SHARE ESTIMATION

- 2.5 DATA TRIANGULATION

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- 2.6 STUDY ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 LIMITATIONS & ASSOCIATED RISKS

- 2.8 RESEARCH LIMITATIONS

- 2.8.1 METHODOLOGY-RELATED LIMITATIONS

- 2.9 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 15 ELECTROSURGERY MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 17 BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 19 ELECTROSURGERY MARKET, BY SURGERY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 ELECTROSURGERY MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 21 REGIONAL SNAPSHOT: ELECTROSURGERY MARKET

4 PREMIUM INSIGHTS

- 4.1 ELECTROSURGERY MARKET OVERVIEW

- FIGURE 22 GROWING NUMBER OF SURGERIES PERFORMED WORLDWIDE TO DRIVE MARKET GROWTH

- 4.2 ELECTROSURGERY MARKET: REGIONAL MIX

- FIGURE 23 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ELECTROSURGERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 24 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 ELECTROSURGERY MARKET: DEVELOPED VS. EMERGING MARKETS

- FIGURE 25 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 26 ELECTROSURGERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing prevalence of chronic diseases

- 5.2.1.2 Increasing demand for minimally invasive surgeries

- TABLE 3 MINIMALLY INVASIVE SURGICAL PROCEDURES DATA, BY COUNTRY (2022)

- 5.2.1.3 Innovation and technological advancements in electrosurgical instruments

- 5.2.1.4 Increasing count of hospitals coupled with rising surgical procedures

- TABLE 4 NUMBER OF SURGICAL PROCEDURES, BY COUNTRY (2022)

- FIGURE 27 NUMBER OF HOSPITALS, BY COUNTRY (2022)

- 5.2.1.5 Shifting preference toward outpatient surgeries in developed regions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risks associated with electrosurgical procedures

- 5.2.2.2 Stringent regulatory framework

- 5.2.2.3 Shortage of surgeons

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets

- TABLE 5 AVERAGE SURGICAL PROCEDURE COSTS (2022)

- 5.2.3.2 Rising government funding to develop advanced medical treatments

- 5.2.3.3 Expected increase in cosmetic and bariatric procedures due to growing obesity prevalence

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns regarding toxic fumes produced during surgical procedures

- 5.2.4.2 Concerns regarding electromagnetic-interference-related risks

- 5.3 INDUSTRY TRENDS

- FIGURE 28 INVENTION OF SMOKE EVACUATION PENCILS AND CONSOLIDATION IN ELECTROSURGERY MARKET-LEADING INDUSTRY TRENDS

- 5.3.1 INVENTION OF SMOKE EVACUATION PENCILS

- 5.3.2 ROBOTIC SURGERIES

- 5.3.3 GROWING ELECTROSURGERY BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 29 ELECTROSURGERY MARKET: VALUE CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Radiofrequency electrosurgery

- 5.5.1.2 Ultrasonic electrosurgery

- 5.5.1.3 Argon plasma electrosurgery (APC)

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Advanced imaging technologies

- 5.5.2.2 Energy delivery systems

- 5.5.2.3 Advanced robotics

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Laser surgery

- 5.5.3.2 Advanced hemostatic agents

- 5.5.3.3 Single-incision laparoscopic surgery

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 ELECTROSURGERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY ANALYSIS

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 Japan

- 5.7.1.3.2 India

- 5.7.1.4 Latin America

- 5.7.1.4.1 Brazil

- 5.7.1.4.2 Mexico

- 5.7.1.5 Middle East

- 5.7.1.1 North America

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 REGULATORY ANALYSIS

- 5.8 PATENT ANALYSIS

- 5.8.1 PATENT PUBLICATION TRENDS FOR ELECTROSURGERY MARKET

- FIGURE 30 PATENT PUBLICATION TRENDS (2014-2024)

- 5.8.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 31 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR ELECTROSURGERY PATENTS (JANUARY 2014-APRIL 2024)

- FIGURE 32 TOP APPLICANT COUNTRIES/REGIONS FOR ELECTROSURGERY (JANUARY 2014-APRIL 2024)

- TABLE 12 LIST OF PATENTS IN ELECTROSURGERY MARKET, 2022-2024

- 5.9 HS CODES: ELECTROSURGERY EQUIPMENT/PRODUCTS

- 5.9.1 TRADE ANALYSIS FOR ELECTROSURGERY

- TABLE 13 TRADE ANALYSIS OF ELECTROSURGERY PRODUCTS

- 5.9.2 TRADE ANALYSIS FOR ELECTROSURGERY EQUIPMENT (2022)

- TABLE 14 IMPORT DATA FOR INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL OR VETERINARY SCIENCES, N.E.S. (HS CODE 901890), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL OR VETERINARY SCIENCES, N.E.S. (HS CODE 901890), BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.10 PRICING ANALYSIS

- 5.10.1 PRICING ANALYSIS, BY PRODUCT

- TABLE 16 PRICING ANALYSIS OF ELECTROSURGERY PRODUCTS, 2021-2023 (USD)

- 5.10.2 PRICING ANALYSIS, BY KEY PLAYER

- TABLE 17 PRICING ANALYSIS OF ELECTROSURGICAL DEVICES OFFERED BY LEADING PLAYERS, 2023 (USD)

- 5.11 REIMBURSEMENT ANALYSIS

- TABLE 18 MAJOR CPT CODES FOR SURGERIES

- 5.12 KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 19 LIST OF MAJOR CONFERENCES AND EVENTS IN ELECTROSURGERY MARKET, 2024-2025

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ELECTROSURGERY PRODUCTS

- TABLE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ELECTROSURGERY PRODUCTS

- 5.13.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR ELECTROSURGERY PRODUCTS

- TABLE 21 KEY BUYING CRITERIA FOR ELECTROSURGERY PRODUCTS

- 5.14 UNMET NEEDS AND END-USER EXPECTATION IN ELECTROSURGERY MARKET

- TABLE 22 UNMET NEEDS: ELECTROSURGERY MARKET

- TABLE 23 END-USER EXPECTATIONS: ELECTROSURGERY MARKET

- 5.15 AI INTEGRATION IN ELECTROSURGERY MARKET

- TABLE 24 AI INTEGRATION: ELECTROSURGERY MARKET

- 5.16 ECOSYSTEM ANALYSIS

- FIGURE 35 ELECTROSURGERY MARKET: ECOSYSTEM

- TABLE 25 ELECTROSURGERY MARKET: ECOSYSTEM ANALYSIS

- 5.17 CASE STUDY ANALYSIS

- TABLE 26 CASE STUDY 1: OPTIMIZING HOSPITAL BUDGETS: ANALYZING ECONOMIC IMPACT OF ELECTROSURGERY TECHNOLOGIES ACROSS PROCEDURE TYPES IN US

- TABLE 27 CASE STUDY 2: ERGONOMIC DESIGN OF ELECTROSURGICAL SMOKE EVACUATOR

- TABLE 28 CASE STUDY 3: ASSESSING SURGEONS' COMPETENCY IN ELECTROSURGERY: STUDY IN KSA

- TABLE 29 CASE STUDY 4: ENHANCING ELECTROSURGICAL EDUCATION FOR SAFER PRACTICE

- 5.18 SUPPLY CHAIN ANALYSIS

- FIGURE 36 SUPPLY CHAIN ANALYSIS

- 5.19 ADJACENT MARKET ANALYSIS

- 5.19.1 MINIMALLY INVASIVE SURGERY MARKET

- FIGURE 37 MINIMALLY INVASIVE SURGERY (MIS) MARKET OVERVIEW

- 5.19.2 ENDOSCOPY EQUIPMENT MARKET

- FIGURE 38 ENDOSCOPY EQUIPMENT MARKET OVERVIEW

- 5.20 TRENDS/DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- FIGURE 39 ELECTROSURGERY MARKET: TRENDS/DISRUPTIONS AFFECTING CUSTOMERS' BUSINESSES

- 5.21 ELECTROSURGERY MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 40 NUMBER OF INVESTOR DEALS, BY KEY PLAYER (2018-2022)

- FIGURE 41 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2018-2022 (USD MILLION)

6 ELECTROSURGERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 30 ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 31 ELECTROSURGERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.2 ELECTROSURGICAL INSTRUMENTS

- TABLE 32 KEY PLAYERS PROVIDING ELECTROSURGICAL INSTRUMENTS

- TABLE 33 ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 34 ELECTROSURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 35 ELECTROSURGICAL INSTRUMENTS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.1 BIPOLAR ELECTROSURGICAL INSTRUMENTS

- TABLE 36 KEY PLAYERS PROVIDING BIPOLAR ELECTROSURGICAL INSTRUMENTS

- TABLE 37 BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 38 BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 39 BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.1.1 Advanced vessel-sealing instruments

- 6.2.1.1.1 Technological developments and rising demand for minimally invasive surgical procedures to drive market

- 6.2.1.1 Advanced vessel-sealing instruments

- TABLE 40 KEY PLAYERS PROVIDING ADVANCED VESSEL-SEALING INSTRUMENTS

- TABLE 41 ADVANCED VESSEL-SEALING INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 ADVANCED VESSEL-SEALING INSTRUMENTS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.1.2 Bipolar forceps

- 6.2.1.2.1 Rising number of cosmetic procedures to boost growth

- 6.2.1.2 Bipolar forceps

- TABLE 43 KEY PLAYERS PROVIDING BIPOLAR FORCEPS

- TABLE 44 BIPOLAR FORCEPS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 45 BIPOLAR FORCEPS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.2 MONOPOLAR ELECTROSURGICAL INSTRUMENTS

- TABLE 46 KEY PLAYERS PROVIDING MONOPOLAR ELECTROSURGICAL INSTRUMENTS

- TABLE 47 MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 48 MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 49 MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.2.1 Electrosurgical pencils

- 6.2.2.1.1 Improved compatibility with electrosurgery generators to accelerate market growth

- 6.2.2.1 Electrosurgical pencils

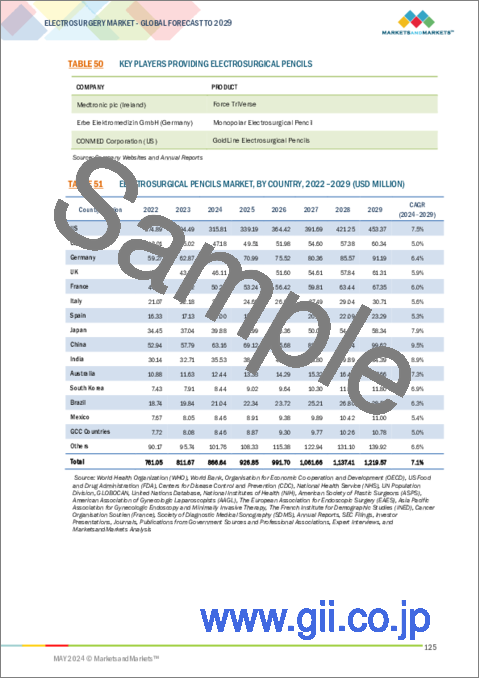

- TABLE 50 KEY PLAYERS PROVIDING ELECTROSURGICAL PENCILS

- TABLE 51 ELECTROSURGICAL PENCILS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 52 ELECTROSURGICAL PENCILS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.2.2 Electrosurgical electrodes

- 6.2.2.2.1 Increasing demand for minimally invasive surgical procedures to drive segment growth

- 6.2.2.2 Electrosurgical electrodes

- TABLE 53 KEY PLAYERS PROVIDING ELECTROSURGICAL ELECTRODES

- TABLE 54 ELECTROSURGICAL ELECTRODES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 55 ELECTROSURGICAL ELECTRODES MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.2.3 Suction coagulators

- 6.2.2.3.1 Increasing geriatric population to fuel market growth

- 6.2.2.3 Suction coagulators

- TABLE 56 KEY PLAYERS PROVIDING SUCTION COAGULATORS

- TABLE 57 SUCTION COAGULATORS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 58 SUCTION COAGULATORS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.2.2.4 Monopolar forceps

- 6.2.2.4.1 Cost-effectiveness and increasing acceptance of advanced electrosurgical instruments to drive market

- 6.2.2.4 Monopolar forceps

- TABLE 59 KEY PLAYERS PROVIDING MONOPOLAR FORCEPS

- TABLE 60 MONOPOLAR FORCEPS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 61 MONOPOLAR FORCEPS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.3 ELECTROSURGICAL GENERATORS

- 6.3.1 TECHNOLOGICAL ADVANCEMENTS TO INCREASE DEMAND FOR ELECTROSURGICAL GENERATORS

- TABLE 62 KEY PLAYERS PROVIDING ELECTROSURGICAL GENERATORS

- TABLE 63 ELECTROSURGICAL GENERATORS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 64 ELECTROSURGICAL GENERATORS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 6.4 ELECTROSURGICAL ACCESSORIES

- TABLE 65 KEY PLAYERS PROVIDING ELECTROSURGICAL ACCESSORIES

- TABLE 66 ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 67 ELECTROSURGICAL ACCESSORIES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.4.1 PATIENT RETURN ELECTRODES

- 6.4.1.1 Government initiatives to spread awareness of surgical safety among surgeons to aid market growth

- TABLE 68 KEY PLAYERS PROVIDING PATIENT RETURNS ELECTRODES

- TABLE 69 PATIENT RETURN ELECTRODES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.4.2 CORDS, CABLES, AND ADAPTERS

- 6.4.2.1 Increasing adoption of electrosurgical instruments to drive demand for electrosurgical accessories

- TABLE 70 KEY PLAYERS PROVIDING CORDS, CABLES, AND ADAPTERS

- TABLE 71 CORDS, CABLES, AND ADAPTERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.4.3 OTHER ELECTROSURGICAL ACCESSORIES

- TABLE 72 KEY PLAYERS PROVIDING OTHER ELECTROSURGICAL ACCESSORIES

- TABLE 73 OTHER ELECTROSURGICAL ACCESSORIES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.5 SMOKE EVACUATION SYSTEMS

- 6.5.1 HIGH RISK OF FIRE AND EXPLOSION, CONTAMINATION, AND ELECTRIC MALFUNCTION TO HINDER MARKET GROWTH

- TABLE 74 KEY PLAYERS PROVIDING SMOKE EVACUATION SYSTEMS

- TABLE 75 SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 76 SMOKE EVACUATION SYSTEMS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

7 ELECTROSURGERY MARKET, BY SURGERY TYPE

- 7.1 INTRODUCTION

- TABLE 77 ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 7.2 GENERAL SURGERY

- 7.2.1 INCREASING NUMBER OF BARIATRIC SURGERIES TO STIMULATE MARKET GROWTH

- TABLE 78 ELECTROSURGERY MARKET FOR GENERAL SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.3 OBSTETRICS/GYNECOLOGICAL SURGERY

- 7.3.1 LACK OF SUFFICIENT KNOWLEDGE ABOUT TECHNICAL ASPECTS OF ELECTROSURGERY AMONG OBSTETRICIANS AND GYNECOLOGISTS TO RESTRAIN MARKET GROWTH

- TABLE 79 ELECTROSURGERY MARKET FOR OBSTETRICS/GYNECOLOGICAL SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.4 ORTHOPEDIC SURGERY

- 7.4.1 INCREASING PREVALENCE OF BONE DISEASES TO DRIVE MARKET

- TABLE 80 ELECTROSURGERY MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.5 CARDIOVASCULAR SURGERY

- 7.5.1 ABILITY TO MAKE PRECISE CUTS WITH LIMITED BLOOD LOSS TO PROPEL MARKET GROWTH

- TABLE 81 ELECTROSURGERY MARKET FOR CARDIOVASCULAR SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.6 ONCOLOGICAL SURGERY

- 7.6.1 DEPENDENCY ON RADIOTHERAPY AND CHEMOTHERAPY OVER ELECTROSURGERY FOR CANCER TREATMENT TO HINDER GROWTH

- TABLE 82 ELECTROSURGERY MARKET FOR ONCOLOGICAL SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.7 COSMETIC SURGERY

- 7.7.1 RISK OF ELECTROSURGICAL BURNS TO HINDER SEGMENT GROWTH

- TABLE 83 ELECTROSURGERY MARKET FOR COSMETIC SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.8 UROLOGICAL SURGERY

- 7.8.1 RISING INCIDENCE OF KIDNEY AND UROLOGICAL DISEASES TO DRIVE MARKET GROWTH

- TABLE 84 ELECTROSURGERY MARKET FOR UROLOGICAL SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.9 NEUROSURGERY

- 7.9.1 AVAILABILITY OF APPLICATION-SPECIFIC SPECIALIZED ELECTROSURGERY INSTRUMENTS TO BOOST MARKET

- TABLE 85 ELECTROSURGERY MARKET FOR NEUROSURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.10 OTHER SURGERIES

- TABLE 86 ELECTROSURGERY MARKET FOR OTHER SURGERIES, BY COUNTRY, 2022-2029 (USD MILLION)

8 ELECTROSURGERY MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 87 ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 8.2 HOSPITALS, CLINICS, AND ABLATION CENTERS

- 8.2.1 INCREASING ADOPTION OF ROBOTIC PROCEDURES IN HOSPITALS TO BOLSTER MARKET GROWTH

- TABLE 88 ELECTROSURGERY MARKET FOR HOSPITALS, CLINICS, AND ABLATION CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.3 AMBULATORY SURGICAL CENTERS

- 8.3.1 SHORTER WAIT TIMES AND REDUCED COSTS AS COMPARED TO TRADITIONAL HOSPITAL SETTINGS TO SUPPORT MARKET GROWTH

- TABLE 89 ELECTROSURGERY MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTES

- 8.4.1 BUDGETARY RESTRICTIONS TO LIMIT ADOPTION OF HIGH-END ELECTROSURGERY PRODUCTS AMONG RESEARCHERS

- TABLE 90 ELECTROSURGERY MARKET FOR RESEARCH LABORATORIES AND ACADEMIC INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

9 ELECTROSURGERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 42 NORTH AMERICA: ELECTROSURGERY MARKET SNAPSHOT

- TABLE 91 NORTH AMERICA: ELECTROSURGERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Rising adoption of electrosurgery products in minimally invasive and laparoscopic surgeries to drive market growth

- TABLE 99 US: KEY MACRO INDICATORS

- TABLE 100 US: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 101 US: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 102 US: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 103 US: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 104 US: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 105 US: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 106 US: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Rising geriatric population and subsequent increase in prevalence of chronic diseases to fuel market growth

- TABLE 107 CANADA: KEY MACRO INDICATORS

- TABLE 108 CANADA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 109 CANADA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 110 CANADA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 111 CANADA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 112 CANADA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 113 CANADA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 114 CANADA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- TABLE 115 EUROPE: ELECTROSURGERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 116 EUROPE: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 117 EUROPE: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 118 EUROPE: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 119 EUROPE: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 120 EUROPE: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 121 EUROPE: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 122 EUROPE: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Continuous technological advancements and increase in prevalence of chronic diseases to accelerate market growth

- TABLE 123 GERMANY: KEY MACRO INDICATORS

- TABLE 124 GERMANY: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 125 GERMANY: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 126 GERMANY: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 127 GERMANY: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 128 GERMANY: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 129 GERMANY: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 130 GERMANY: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Increasing surgical volumes and growing disease incidence to drive market

- TABLE 131 UK: KEY MACRO INDICATORS

- TABLE 132 UK: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 133 UK: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 134 UK: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 135 UK: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 136 UK: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 137 UK: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 138 UK: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Awareness initiatives and relatively low healthcare costs to support market growth

- TABLE 139 FRANCE: KEY MACRO INDICATORS

- TABLE 140 FRANCE: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 141 FRANCE: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 142 FRANCE: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 143 FRANCE: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 144 FRANCE: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 145 FRANCE: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 146 FRANCE: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Escalating incidence of spinal injuries and heightened demand for electrosurgery to bolster market growth

- TABLE 147 ITALY: KEY MACRO INDICATORS

- TABLE 148 ITALY: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 149 ITALY: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 150 ITALY: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 151 ITALY: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 152 ITALY: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 153 ITALY: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 154 ITALY: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Increasing acceptance of single-port video-assisted thoracic surgery to accelerate market growth

- TABLE 155 SPAIN: KEY MACRO INDICATORS

- TABLE 156 SPAIN: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 157 SPAIN: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 158 SPAIN: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 159 SPAIN: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 160 SPAIN: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 161 SPAIN: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 162 SPAIN: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 163 REST OF EUROPE: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 164 REST OF EUROPE: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 165 REST OF EUROPE: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 166 REST OF EUROPE: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 167 REST OF EUROPE: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 168 REST OF EUROPE: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 169 REST OF EUROPE: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 43 ASIA PACIFIC: ELECTROSURGERY MARKET SNAPSHOT

- TABLE 170 ASIA PACIFIC: ELECTROSURGERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 172 ASIA PACIFIC: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 173 ASIA PACIFIC: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 176 ASIA PACIFIC: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 177 ASIA PACIFIC: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Expanding geriatric population and growing popularity of cosmetic surgeries to drive market

- TABLE 178 CHINA: KEY MACRO INDICATORS

- TABLE 179 CHINA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 180 CHINA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 181 CHINA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 182 CHINA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 183 CHINA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 184 CHINA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 185 CHINA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Growing prevalence of chronic diseases to drive market

- TABLE 186 JAPAN: KEY MACRO INDICATORS

- TABLE 187 JAPAN: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 188 JAPAN: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 189 JAPAN: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 190 JAPAN: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 191 JAPAN: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 192 JAPAN: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 193 JAPAN: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Rapidly improving healthcare infrastructure and surging demand for advanced medical treatments to support market growth

- TABLE 194 INDIA: KEY MACRO INDICATORS

- TABLE 195 INDIA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 196 INDIA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 197 INDIA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 198 INDIA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 199 INDIA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 200 INDIA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 201 INDIA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.5 AUSTRALIA

- 9.4.5.1 Improvements in healthcare infrastructure and increasing government funding to fuel market growth

- TABLE 202 AUSTRALIA: KEY MACRO INDICATORS

- TABLE 203 AUSTRALIA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 204 AUSTRALIA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 205 AUSTRALIA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 206 AUSTRALIA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 207 AUSTRALIA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 208 AUSTRALIA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 209 AUSTRALIA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.6 SOUTH KOREA

- 9.4.6.1 High cosmetic surgery volumes to drive demand for electrosurgical instruments

- TABLE 210 SOUTH KOREA: KEY MACRO INDICATORS

- TABLE 211 SOUTH KOREA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 212 SOUTH KOREA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 213 SOUTH KOREA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 214 SOUTH KOREA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 215 SOUTH KOREA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 216 SOUTH KOREA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 217 SOUTH KOREA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.4.7 REST OF ASIA PACIFIC

- TABLE 218 REST OF ASIA PACIFIC: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 225 LATIN AMERICA: ELECTROSURGERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 226 LATIN AMERICA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 227 LATIN AMERICA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 228 LATIN AMERICA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 229 LATIN AMERICA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 230 LATIN AMERICA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 231 LATIN AMERICA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 232 LATIN AMERICA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.5.2 BRAZIL

- 9.5.2.1 Government initiatives aimed at improving healthcare infrastructure and services to boost market

- TABLE 233 BRAZIL: KEY MACRO INDICATORS

- TABLE 234 BRAZIL: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 235 BRAZIL: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 236 BRAZIL: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 237 BRAZIL: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 238 BRAZIL: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 239 BRAZIL: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 240 BRAZIL: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 Spike in demand for surgical procedures to fuel market growth

- TABLE 241 MEXICO: KEY MACRO INDICATORS

- TABLE 242 MEXICO: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 243 MEXICO: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 244 MEXICO: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 245 MEXICO: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 246 MEXICO: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 247 MEXICO: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 248 MEXICO: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 249 REST OF LATIN AMERICA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 250 REST OF LATIN AMERICA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 251 REST OF LATIN AMERICA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 252 REST OF LATIN AMERICA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 253 REST OF LATIN AMERICA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 254 REST OF LATIN AMERICA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 255 REST OF LATIN AMERICA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 256 MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.6.2 GCC COUNTRIES:

- 9.6.2.1 Increasing investment in healthcare infrastructure and growing medical tourism to support market growth

- TABLE 264 GCC COUNTRIES: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 265 GCC COUNTRIES: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 266 GCC COUNTRIES: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 267 GCC COUNTRIES: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 268 GCC COUNTRIES: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 269 GCC COUNTRIES: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 270 GCC COUNTRIES: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 271 REST OF MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 272 REST OF MIDDLE EAST & AFRICA: ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 273 REST OF MIDDLE EAST & AFRICA: BIPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 274 REST OF MIDDLE EAST & AFRICA: MONOPOLAR ELECTROSURGICAL INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 275 REST OF MIDDLE EAST & AFRICA: ELECTROSURGICAL ACCESSORIES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 276 REST OF MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 277 REST OF MIDDLE EAST & AFRICA: ELECTROSURGERY MARKET, BY END USER, 2022-2029 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ELECTROSURGERY MARKET

- FIGURE 44 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 45 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN ELECTROSURGERY MARKET (2019-2023)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS (2023)

- TABLE 278 ELECTROSURGERY MARKET: DEGREE OF COMPETITION

- 10.5 VALUATION AND FINANCIAL METRICS OF ELECTROSURGERY VENDORS

- FIGURE 47 EV/EBITDA OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 49 ELECTROSURGERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS

- FIGURE 50 COMPANY FOOTPRINT

- TABLE 279 KEY PLAYERS: PRODUCT FOOTPRINT

- TABLE 280 KEY PLAYERS: SURGERY FOOTPRINT

- TABLE 281 KEY PLAYERS: END-USER FOOTPRINT

- TABLE 282 KEY PLAYERS: REGIONAL FOOTPRINT

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 51 ELECTROSURGERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- TABLE 283 ELECTROSURGERY MARKET: LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 284 STARTUPS/SMES: PRODUCT FOOTPRINT

- TABLE 285 STARTUPS/SMES: SURGERY FOOTPRINT

- TABLE 286 STARTUPS/SMES: END-USER FOOTPRINT

- TABLE 287 STARTUPS/SMES: REGIONAL FOOTPRINT

- 10.8 COMPETITIVE SITUATION AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 288 ELECTROSURGERY MARKET: PRODUCT LAUNCHES (JANUARY 2020-APRIL 2024)

- 10.8.2 DEALS

- TABLE 289 ELECTROSURGERY MARKET: DEALS (JANUARY 2020-APRIL 2024)

- 10.8.3 EXPANSIONS

- TABLE 290 ELECTROSURGERY MARKET: EXPANSIONS (JANUARY 2020-APRIL 2024)

- 10.9 BRAND/PRODUCT COMPARATIVE ANALYSIS

- TABLE 291 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY MODEL

- 10.10 ELECTROSURGERY MARKET: R&D EXPENDITURE

- FIGURE 52 R&D EXPENDITURE OF KEY PLAYERS (2022 VS. 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 MEDTRONIC PLC

- TABLE 292 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 53 MEDTRONIC PLC: COMPANY SNAPSHOT (2023)

- TABLE 293 MEDTRONIC PLC: PRODUCTS OFFERED

- TABLE 294 MEDTRONIC PLC: PRODUCT LAUNCHES (JANUARY 2020-APRIL 2024)

- TABLE 295 MEDTRONIC PLC: DEALS (JANUARY 2020-APRIL 2024)

- TABLE 296 MEDTRONIC PLC: EXPANSIONS (JANUARY 2020 - APRIL 2024)

- 11.1.2 JOHNSON & JOHNSON (ETHICON)

- TABLE 297 JOHNSON & JOHNSON: BUSINESS OVERVIEW

- FIGURE 54 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2023)

- TABLE 298 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 299 JOHNSON & JOHNSON: PRODUCT LAUNCHES (JANUARY 2020-APRIL 2024)

- TABLE 300 JOHNSON & JOHNSON: DEALS (JANUARY 2020-APRIL 2024)

- TABLE 301 JOHNSON & JOHNSON: EXPANSIONS (JANUARY 2020-APRIL 2024)

- 11.1.3 OLYMPUS CORPORATION

- TABLE 302 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- FIGURE 55 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 303 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 304 OLYMPUS CORPORATION: PRODUCT LAUNCHES (JANUARY 2020-APRIL 2024)

- TABLE 305 OLYMPUS CORPORATION: EXPANSIONS (JANUARY 2020-APRIL 2024)

- 11.1.4 B. BRAUN

- TABLE 306 B. BRAUN: BUSINESS OVERVIEW

- FIGURE 56 B. BRAUN: COMPANY SNAPSHOT (2023)

- TABLE 307 B. BRAUN: PRODUCTS OFFERED

- TABLE 308 B. BRAUN: DEALS (JANUARY 2020-APRIL 2024)

- TABLE 309 B. BRAUN: EXPANSIONS (JANUARY 2020-APRIL 2024)

- TABLE 310 B. BRAUN: OTHER DEVELOPMENTS (JANUARY 2020-APRIL 2024)

- 11.1.5 CONMED CORPORATION

- TABLE 311 CONMED CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 CONMED CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 312 CONMED CORPORATION: PRODUCTS OFFERED

- 11.1.6 BOSTON SCIENTIFIC CORPORATION

- TABLE 313 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 58 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 314 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 315 BOSTON SCIENTIFIC CORPORATION: PRODUCT LAUNCHES (JANUARY 2020-APRIL 2024)

- TABLE 316 BOSTON SCIENTIFIC CORPORATION: DEALS (JANUARY 2020-APRIL 2024)

- 11.1.7 SMITH+NEPHEW

- TABLE 317 SMITH+NEPHEW: BUSINESS OVERVIEW

- FIGURE 59 SMITH+NEPHEW: COMPANY SNAPSHOT (2023)

- TABLE 318 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 319 SMITH+NEPHEW: PRODUCT LAUNCHES (JANUARY 2020 - APRIL 2024)

- TABLE 320 SMITH+NEPHEW: DEALS (JANUARY 2020-APRIL 2024)

- TABLE 321 SMITH+NEPHEW: EXPANSIONS (JANUARY 2020 - APRIL 2024)

- 11.1.8 ERBE ELEKTROMEDIZIN GMBH

- TABLE 322 ERBE ELEKTROMEDIZIN GMBH: BUSINESS OVERVIEW

- TABLE 323 ERBE ELEKTROMEDIZIN GMBH: PRODUCTS OFFERED

- TABLE 324 ERBE ELEKTROMEDIZIN GMBH: PRODUCT LAUNCHES (JANUARY 2020-APRIL 2024)

- TABLE 325 ERBE ELEKTROMEDIZIN GMBH: DEALS (JANUARY 2020-APRIL 2024)

- 11.1.9 STRYKER CORPORATION

- TABLE 326 STRYKER CORPORATION: BUSINESS OVERVIEW

- FIGURE 60 STRYKER CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 327 STRYER CORPORATION: PRODUCTS OFFERED

- 11.1.10 BOWA-ELECTRONIC GMBH & CO. KG

- TABLE 328 BOWA-ELECTRONIC GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 329 BOWA-ELECTRONIC GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 330 BOWA-ELECTRONIC GMBH & CO. KG: DEALS (JANUARY 2020 - APRIL 2024)

- TABLE 331 BOWA-ELECTRONIC GMBH & CO. KG: EXPANSIONS (JANUARY 2020 - APRIL 2024)

- 11.1.11 THE COOPER COMPANIES, INC.

- TABLE 332 THE COOPER COMPANIES, INC.: BUSINESS OVERVIEW

- FIGURE 61 THE COOPER COMPANIES, INC.: COMPANY SNAPSHOT (2023)

- TABLE 333 THE COOPER COMPANIES, INC.: PRODUCTS OFFERED

- TABLE 334 THE COOPER COMPANIES, INC.: DEALS (JANUARY 2020 - APRIL 2024)

- 11.1.12 KIRWAN SURGICAL PRODUCTS LLC

- TABLE 335 KIRWAN SURGICAL PRODUCTS LLC: BUSINESS OVERVIEW

- TABLE 336 KIRWAN SURGICAL PRODUCTS LLC: PRODUCTS OFFERED

- 11.1.13 ZIMMER BIOMET

- TABLE 337 ZIMMER BIOMET: BUSINESS OVERVIEW

- FIGURE 62 ZIMMER BIOMET: COMPANY SNAPSHOT (2023)

- TABLE 338 ZIMMER BIOMET: PRODUCTS OFFERED

- TABLE 339 ZIMMER BIOMET: DEALS (JANUARY 2020 - APRIL 2024)

- 11.1.14 UTAH MEDICAL PRODUCTS, INC.

- TABLE 340 UTAH MEDICAL PRODUCTS, INC.: BUSINESS OVERVIEW

- FIGURE 63 UTAH MEDICAL PRODUCTS, INC.: COMPANY SNAPSHOT (2023)

- TABLE 341 UTAH MEDICAL PRODUCTS, INC.: PRODUCTS OFFERED

- 11.1.15 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- TABLE 342 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 64 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 343 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 344 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: DEALS (JANUARY 2020-APRIL 2024)

- 11.1.16 ENCISION, INC.

- TABLE 345 ENCISION, INC.: BUSINESS OVERVIEW

- FIGURE 65 ENCISION, INC.: COMPANY SNAPSHOT (2023)

- TABLE 346 ENCISION, INC.: PRODUCTS OFFERED

- TABLE 347 ENCISION, INC.: DEALS (JANUARY 2020 - APRIL 2024)

- 11.1.17 KLS MARTIN GROUP

- TABLE 348 KLS MARTIN GROUP: BUSINESS OVERVIEW

- TABLE 349 KLS MARTIN GROUP: PRODUCTS OFFERED

- 11.1.18 SURGICAL HOLDINGS

- TABLE 350 SURGICAL HOLDINGS: BUSINESS OVERVIEW

- TABLE 351 SURGICAL HOLDINGS: PRODUCTS OFFERED

- 11.1.19 I. C. MEDICAL, INC.

- TABLE 352 I. C. MEDICAL, INC.: BUSINESS OVERVIEW

- TABLE 353 I. C. MEDICAL, INC.: PRODUCTS OFFERED

- 11.1.20 MEYER-HAAKE GMBH MEDICAL INNOVATIONS

- TABLE 354 MEYER-HAAKE GMBH MEDICAL INNOVATIONS: BUSINESS OVERVIEW

- TABLE 355 MEYER-HAAKE GMBH MEDICAL INNOVATIONS: PRODUCTS OFFERED

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 ASPEN SURGICAL

- 11.2.2 APPLIED MEDICAL RESOURCES CORPORATION

- 11.2.3 APYX MEDICAL

- 11.2.4 EPMD GROUP

- 11.2.5 DIRECTA DENTAL GROUP

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS