|

|

市場調査レポート

商品コード

1358281

プッシュトゥトーク(PTT)の世界市場:製品別、ネットワークタイプ別、産業別、地域別 - 予測(~2028年)Push-to-talk Market by Offering (Hardware, Solutions, and Services), Network Type (LMR and Cellular), Vertical (Government & Public Safety, Aerospace & Defense, and Transportation & Logistics) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| プッシュトゥトーク(PTT)の世界市場:製品別、ネットワークタイプ別、産業別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月02日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のプッシュトゥトーク(PTT)の市場規模は、2023年に353億米ドル、2028年までに574億米ドルに達し、CAGRで10.2%の成長が予測されています。

迅速で便利でインフォーマルなコミュニケーション体験に対する需要が、スマートフォンやコンシューマーデバイス向けPTTアプリの開発と普及を促進しています。

| レポート範囲 | |

|---|---|

| 対象年 | 2017-2028年 |

| 基準年 | 2022年 |

| 対象期間 | 2023-2028年 |

| 単位 | 米ドル |

| セグメント | 提供, ネットワークタイプ, 産業, 地域 |

| 対象地域 | 北米・欧州・アジア太平洋・南米・中東&アフリカ |

ネットワークタイプ別では、陸上移動無線セグメントが予測期間中に最大の市場規模を持ちます。

産業別では、旅行・ホスピタリティセグメントが予測期間中にもっとも高い成長率を記録する見込みです。

予測期間中、アジア太平洋がもっとも高い成長率です。

PTTは、人口密度の高い都市部と広大な田園風景が共存する日本、韓国、中国のような国々で、調整と応答時間の強化に不可欠なものとなっています。さらに、スマートフォンの手頃な価格と入手性により、PTTアプリは企業や個人が広く利用できるようになり、その普及がさらに促進されています。アジア太平洋が経済成長と近代化を続ける中、PTT技術の採用は今後も続き、地域の多様な産業と人口の進化する通信ニーズに対応するために進化していく可能性が高いです。

当レポートでは、世界のプッシュトゥトーク(PTT)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 世界のプッシュトゥトーク(PTT)市場における魅力的な機会

- プッシュトゥトーク(PTT)市場:提供別(2023年)

- プッシュトゥトーク(PTT)市場:ネットワークタイプ別(2023年)

- プッシュトゥトーク(PTT)市場:ソリューション別(2023年)

- プッシュトゥトーク(PTT)市場:産業別(2023年・2028年)

- 北米のプッシュトゥトーク(PTT)市場:ソリューションと3大産業

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- プッシュトゥトーク(PTT)技術の略歴

- エコシステム分析

- ケーススタディ分析

- バリューチェーン分析

- 関税と規制情勢

- ポーターのファイブフォース分析

- 特許分析

- HSコード:電話機(8517)

- 購買者/クライアントのビジネスに影響を与える動向と混乱

- 主な会議とイベント(2023年~2024年)

- 価格分析

- 主なステークホルダーと購入基準

- プッシュトゥトーク(PTT)市場のベストプラクティス

- 現行と新規のビジネスモデル

- プッシュトゥトーク(PTT)のフレームワークと技術

- 技術分析

- プッシュトゥトーク(PTT)市場の将来の情勢

- プッシュトゥトーク(PTT)デバイスの主な機能

第6章 プッシュトゥトーク(PTT)市場:提供別

- イントロダクション

- ハードウェア

- ソリューション

- サービス

第7章 プッシュトゥトーク(PTT)市場:ネットワークタイプ別

- イントロダクション

- 陸上移動無線

- セルラー

第8章 プッシュトゥトーク(PTT)市場:産業別

- イントロダクション

- 政府・公共安全

- 航空宇宙・防衛

- 輸送・ロジスティクス

- 製造

- 建設・鉱業

- エネルギー・公共事業

- 旅行・ホスピタリティ

- 医療

- その他の産業

第9章 プッシュトゥトーク(PTT)市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 北米のプッシュトゥトーク(PTT)市場の促進要因

- 米国

- カナダ

- 欧州

- 欧州の不況の影響

- 欧州のプッシュトゥトーク(PTT)市場の促進要因

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- アジア太平洋のプッシュトゥトーク(PTT)市場の促進要因

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの不況の影響

- 中東・アフリカのプッシュトゥトーク(PTT)市場の促進要因

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカの不況の影響

- ラテンアメリカのプッシュトゥトーク(PTT)市場の促進要因

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 収益実績の分析

- 主要企業の市場シェアの分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオ

- PTT製品のベンチマーク

- 主なPTTベンダーの評価と財務指標

第11章 企業プロファイル

- 主要企業

- AT&T

- VERIZON

- MOTOROLA SOLUTIONS

- T-MOBILE

- QUALCOMM

- ERICSSON

- AIRBUS

- BELL CANADA

- ZEBRA TECHNOLOGIES

- TELSTRA

- HYTERA

- IRIDIUM COMMUNICATIONS

- TAIT COMMUNICATIONS

- SERVICEMAX

- L3HARRIS TECHNOLOGIES

- スタートアップ/中小企業

- GROUPTALK

- ORION

- ZELLO

- VOXER

- IPTT

- ESCHAT

- AINA WIRELESS

- AZETTI NETWORKS

- TEAMCONNECT

- VOICELAYER

- SIMOCO WIRELESS SOLUTIONS

- PEAKPTT

- RUGGEAR

- PROMOBI TECHNOLOGIES

第12章 隣接/関連市場

- イントロダクション

- エンタープライズモビリティマネジメント市場

- 市場の定義

- 市場の概要

- エンタープライズモビリティマネジメント市場:コンポーネント別

- エンタープライズモビリティマネジメント市場:組織規模別

- エンタープライズモビリティマネジメント市場:展開方式別

- エンタープライズモビリティマネジメント市場:産業別

- モバイルデバイスマネジメント市場

- 市場の定義

- 市場の概要

- モバイルデバイスマネジメント市場:コンポーネント別

- モバイルデバイスマネジメント市場:オペレーティングシステム別

- モバイルデバイスマネジメント市場:産業別

第13章 付録

The push-to-talk (PTT) market is estimated at USD 35.3 billion in 2023 to USD 57.4 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 10.2%. The demand for quick, convenient, and informal communication experiences has fueled the development and adoption of PTT applications for smartphones and consumer devices. These apps cater to the need for instant gratification, simplicity, and efficiency, making them a popular choice for both social and recreational communication. Additionally, features like group communication, cost savings, and integration with other functionalities contribute to their widespread use in personal contexts.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Offering(Hardware, Solutions & Services), Network Type, Vertical, Region |

| Regions covered | North America, Europe, APAC, South America, MEA |

"By network type, land mobile radio segment to hold the largest market size during the forecast period."

Land Mobile Radio (LMR) segment is a critical communication tool primarily used in industries where reliable, instant, and group-based voice communication is essential. LMR systems, often called two-way radios, have long been the backbone of communication for first responders, public safety agencies, transportation, and utilities. PTT functionality lets users quickly establish a voice connection by pressing a button, ensuring immediate and efficient communication during emergencies or day-to-day operations.

Based on vertical, the travel & hospitality segment is expected to register the fastest growth rate during the forecast period.

The PTT technology has revolutionized the travel and hospitality segment by enhancing communication efficiency and guest satisfaction. In this sector, where seamless communication is pivotal, PTT enables instant voice communication between staff members, improving coordination and response times. Hotel and resort employees can quickly address guest requests, such as room service or housekeeping, resulting in a more personalized and efficient guest experience. Overall, PTT technology has become an indispensable tool in the travel and hospitality industry, enhancing both operational efficiency and guest satisfaction.

"Asia Pacific highest growth rate during the forecast period."

PTT has become vital for enhancing coordination and response times in countries like Japan, South Korea, and China, where densely populated urban areas coexist with vast rural landscapes. Additionally, the affordability and accessibility of smartphones have made PTT applications widely available to businesses and individuals, further driving its adoption. As the Asia Pacific region continues to experience economic growth and modernization, adopting PTT technology will likely persist and evolve to meet the evolving communication needs of the region's diverse industries and populations.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: C-level -45%, D-level - 35%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW- 5%.

The major players in the PTT market include AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the PTT market.

Research Coverage

The market study covers the PTT market size across different segments. It aims to estimate the market size and the growth potential across different segments, including offerings (hardware, solutions, and services), network type, vertical, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global PTT market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (growing demand for PoC, proliferation of rugged and ultra-rugged smartphones, growing need for driver safety, and transition of LMR systems from analog to digital), restraints (dependence on a stable network connection) opportunities (high-speed 5G network for enhancing PTT-related operations, and standardization of infrastructure platforms ), and challenges (LMR and PTT interoperability issues, and high existing investments by public sector to deploy LMR systems) influencing the growth of the PTT market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the PTT market. Market Development: Comprehensive information about lucrative markets - the report analyses the PTT market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the PTT market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 PUSH-TO-TALK MARKET: MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 IMPACT OF RECESSION

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PUSH-TO-TALK MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Primary sources

- 2.1.2.4 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF OFFERINGS IN PUSH-TO-TALK MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): PUSH-TO-TALK MARKET

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 9 MARKET BREAKUP AND DATA TRIANGULATION

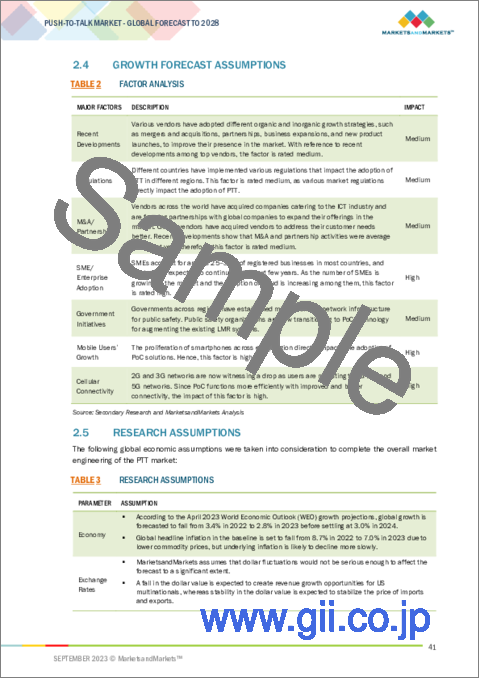

- 2.4 GROWTH FORECAST ASSUMPTIONS

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 4 RISK ASSESSMENT: PUSH-TO-TALK MARKET

- 2.7 LIMITATIONS

- 2.8 IMPLICATION OF RECESSION ON PUSH-TO-TALK MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 PUSH-TO-TALK MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 11 PUSH-TO-TALK MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL PUSH-TO-TALK MARKET

- FIGURE 12 PROLIFERATION OF PUSH-TO-TALK TECHNOLOGY OVER CELLULAR NETWORKS TO DRIVE GLOBAL MARKET

- 4.2 PUSH-TO-TALK MARKET, BY OFFERING, 2023

- FIGURE 13 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN PUSH-TO-TALK MARKET IN 2023

- 4.3 PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023

- FIGURE 14 CELLULAR SEGMENT TO WITNESS HIGHER GROWTH RATE IN FORECAST PERIOD

- 4.4 PUSH-TO-TALK MARKET, BY SOLUTION, 2023

- FIGURE 15 MISSION-CRITICAL PUSH-TO-TALK SOLUTION SEGMENT TO LEAD MARKET IN 2023

- 4.5 PUSH-TO-TALK MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 16 GOVERNMENT & PUBLIC SAFETY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 PUSH-TO-TALK MARKET IN NORTH AMERICA: SOLUTION AND TOP THREE VERTICALS

- FIGURE 17 MISSION-CRITICAL PUSH-TO-TALK SOLUTIONS AND GOVERNMENT & PUBLIC SAFETY TO HOLD LARGEST MARKET SHARES IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PUSH-TO-TALK MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for PoC

- 5.2.1.2 Proliferation of rugged and ultra-rugged smartphones

- 5.2.1.3 Growing need for driver safety

- 5.2.1.4 Transition of LMR systems from analog to digital

- 5.2.2 RESTRAINTS

- 5.2.2.1 Dependence on stable network connection

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High-speed 5G network to enhance push-to-talk-related operations

- 5.2.3.2 Standardization of infrastructure platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 LMR and PTT interoperability issues

- 5.2.4.2 High existing investments by public sector to deploy LMR systems

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF PUSH-TO-TALK TECHNOLOGY

- FIGURE 19 BRIEF HISTORY OF PUSH-TO-TALK TECHNOLOGY

- 5.3.1.1 1990s

- 5.3.1.2 2000s

- 5.3.1.3 2010s

- 5.3.1.4 2020s

- 5.3.2 ECOSYSTEM ANALYSIS

- FIGURE 20 PUSH-TO-TALK MARKET: ECOSYSTEM

- TABLE 5 PUSH-TO-TALK MARKET: ECOSYSTEM

- 5.3.2.1 Solution providers

- 5.3.2.2 Service providers

- 5.3.2.3 Hardware providers

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 Case study 1: Windsor Regional Hospital used Bell Push-to-Talk solution to help its nonclinical teams provide outstanding patient care

- 5.3.3.2 Case study 2: Hydro-Quebec worked with Network Innovations and Tel-Loc to leverage Iridium Push-To-Talk (PTT) solutions for keeping field workers, medical and safety personnel, and operations centers connected throughout development of new utility line

- 5.3.3.3 Case study 3: Orion Labs increased Summit Hospitality Group's operational efficiency across properties with its PTT Voice Services

- 5.3.3.4 Case study 4: Zello's ZelloWork helped YRC Worldwide improve communications for dispatchers

- 5.3.3.5 Case study 5: Connexus Energy selected Motorola's WAVE to improve workforce communications

- 5.3.4 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: PUSH-TO-TALK MARKET

- 5.3.5 TARIFF AND REGULATORY LANDSCAPE

- 5.3.5.1 Tariff related to Push-to-Talk devices

- TABLE 6 TARIFF RELATED TO TELEPHONE SETS WITH CORDLESS HANDSETS

- 5.3.5.2 Regulatory bodies, government agencies, and other organizations

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.5.3 North America

- 5.3.5.3.1 US

- 5.3.5.3.2 Canada

- 5.3.5.4 Europe

- 5.3.5.5 Asia Pacific

- 5.3.5.5.1 China

- 5.3.5.5.2 India

- 5.3.5.6 Middle East & Africa

- 5.3.5.6.1 UAE

- 5.3.5.7 Latin America

- 5.3.5.7.1 Brazil

- 5.3.5.7.2 Mexico

- 5.3.5.3 North America

- 5.3.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 PUSH-TO-TALK MARKET: PORTER'S FIVE FORCES MODEL ANALYSIS

- FIGURE 22 PUSH-TO-TALK MARKET: PORTER'S FIVE FORCES MODEL

- 5.3.6.1 Threat of new entrants

- 5.3.6.2 Threat of substitutes

- 5.3.6.3 Bargaining power of buyers

- 5.3.6.4 Bargaining power of suppliers

- 5.3.6.5 Intensity of competitive rivalry

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 Methodology

- 5.3.7.2 Document types

- TABLE 12 PATENTS FILED, JANUARY 2021-AUGUST 2023

- 5.3.7.3 Innovation and patent applications

- FIGURE 23 NUMBER OF PATENTS GRANTED ANNUALLY, 2021-2023

- 5.3.7.3.1 Top applicants

- FIGURE 24 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021-2023

- TABLE 13 LIST OF PATENTS IN PUSH-TO-TALK MARKET, 2021-2023

- 5.3.8 HS CODE: TELEPHONE SETS (8517)

- 5.3.8.1 Export scenario for HS Code: 8517

- FIGURE 25 PUSH-TO-TALK TELEPHONE SETS EXPORT, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.3.8.2 Import scenario for HS Code: 8517

- FIGURE 26 PUSH-TO-TALK TELEPHONE SETS IMPORT, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.3.9 TRENDS AND DISRUPTIONS IMPACTING BUYERS'/CLIENTS' BUSINESSES

- 5.3.10 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 14 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.3.11 PRICING ANALYSIS

- 5.3.11.1 Average selling price trend of key players, by solution and service

- TABLE 15 AVERAGE SELLING PRICES OF KEY PLAYERS, BY SOLUTION AND SERVICE

- 5.3.11.2 Indicative pricing analysis, by hardware

- TABLE 16 INDICATIVE PRICING ANALYSIS, BY HARDWARE

- 5.3.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.3.12.1 Key stakeholders in buying criteria

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.3.12.2 Buying criteria

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.3.13 BEST PRACTICES IN PUSH-TO-TALK MARKET

- 5.3.13.1 Choose appropriate equipment

- 5.3.13.2 Set up group and private channels

- 5.3.13.3 Practice emergency protocols

- 5.3.14 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.14.1 Subscription-services model

- 5.3.14.2 Integration-with-other-application model

- 5.3.14.3 Paid add-ons model

- 5.3.15 PUSH-TO-TALK FRAMEWORKS AND TECHNIQUES

- 5.3.15.1 Push-to-talk techniques

- 5.3.15.1.1 Single-channel PTT

- 5.3.15.1.2 Multi-channel PTT

- 5.3.15.1.3 Encrypted PTT

- 5.3.15.2 Push-to-talk framework

- 5.3.15.1 Push-to-talk techniques

- FIGURE 29 ONE-TO-MANY PUSH-TO-TALK OVER CELLULAR GROUP SESSION (VOICE TRANSMISSION) PTT FRAMEWORK

- 5.3.16 TECHNOLOGY ANALYSIS

- 5.3.16.1 Key technologies

- 5.3.16.1.1 VoIP

- 5.3.16.1.2 Encryption

- 5.3.16.2 Complementary technologies

- 5.3.16.2.1 Location tracking

- 5.3.16.2.2 Cellular technologies

- 5.3.16.3 Adjacent technologies

- 5.3.16.3.1 Cloud computing

- 5.3.16.3.2 Artificial intelligence and machine learning

- 5.3.16.3.3 Mesh networks

- 5.3.16.3.4 IoT

- 5.3.16.1 Key technologies

- 5.3.17 FUTURE LANDSCAPE OF PUSH-TO-TALK MARKET

- 5.3.17.1 Push-to-talk technology roadmap to 2030

- 5.3.17.1.1 Short-term roadmap (2023-2025)

- 5.3.17.1.2 Mid-term roadmap (2026-2028)

- 5.3.17.1.3 Long-term roadmap (2029-2030)

- 5.3.17.1 Push-to-talk technology roadmap to 2030

- 5.3.18 KEY FEATURES OF PUSH-TO-TALK DEVICES

- 5.3.18.1 Multimedia sharing

- 5.3.18.2 Real-time location tracking

- 5.3.18.3 Communication

- 5.3.18.4 Integration

- 5.3.18.5 Alerting & broadcasting

- 5.3.18.6 LMR interoperability

- 5.3.18.7 End-to-end encryption

- 5.3.18.8 Web dispatch

6 PUSH-TO-TALK MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 30 SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERING: PUSH-TO-TALK MARKET DRIVERS

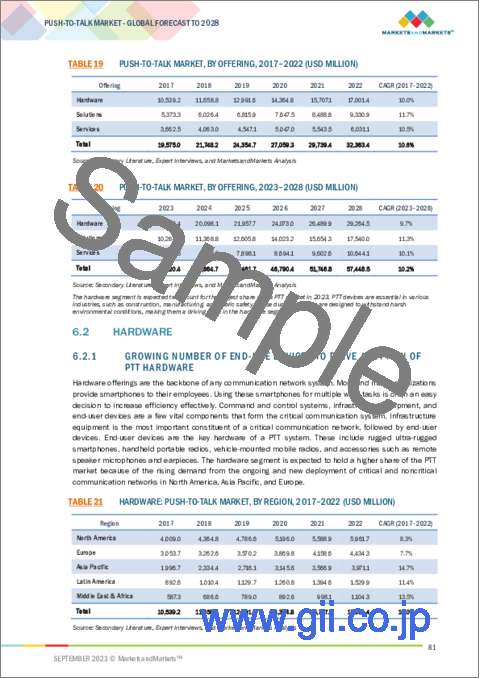

- TABLE 19 PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 20 PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 GROWING NUMBER OF END-USE DEVICES TO DRIVE ADOPTION OF PTT HARDWARE

- TABLE 21 HARDWARE: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 22 HARDWARE: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SOLUTIONS

- 6.3.1 PUSH-TO-TALK SOLUTIONS TO ENABLE RELIABLE COMMUNICATION FOR MISSION-CRITICAL PURPOSES

- FIGURE 31 OVER-THE-TOP PTT SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 23 PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 24 PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 25 SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 CARRIER-INTEGRATED PTT SOLUTION

- TABLE 27 CARRIER-INTEGRATED PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 CARRIER-INTEGRATED PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 OVER-THE-TOP PTT SOLUTION

- TABLE 29 OVER-THE-TOP PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 OVER-THE-TOP PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4 MISSION-CRITICAL PTT SOLUTION

- TABLE 31 MISSION-CRITICAL PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 MISSION-CRITICAL PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SERVICES

- FIGURE 32 SUPPORT & MAINTENANCE SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 34 PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 35 SERVICES: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 SERVICES: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1 CONSULTING

- 6.4.1.1 Need for technical expertise in setting up robust PTT system to drive demand for consulting services

- TABLE 37 CONSULTING: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 CONSULTING: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 IMPLEMENTATION

- 6.4.2.1 Implementation services to help critical communications organizations operate at their highest capacity

- TABLE 39 IMPLEMENTATION: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 IMPLEMENTATION: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.3 SUPPORT & MAINTENANCE

- 6.4.3.1 Need for 24/7 real-time support to fuel demand for support and maintenance services

- TABLE 41 SUPPORT & MAINTENANCE: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 SUPPORT & MAINTENANCE: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

7 PUSH-TO-TALK MARKET, BY NETWORK TYPE

- 7.1 INTRODUCTION

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 NETWORK TYPE: PUSH-TO-TALK MARKET DRIVERS

- TABLE 43 PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 44 PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- 7.2 LAND MOBILE RADIO

- 7.2.1 GROWING ADOPTION IN PUBLIC SAFETY VERTICAL TO DRIVE MARKET FOR LAND MOBILE RADIO SYSTEMS

- TABLE 45 LAND MOBILE RADIO: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 LAND MOBILE RADIO: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 CELLULAR

- 7.3.1 HIGH SPEED AND LOW LATENCY COMMUNICATIONS TO DRIVE MARKET

- TABLE 47 CELLULAR: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 CELLULAR: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

8 PUSH-TO-TALK MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 34 TRAVEL & HOSPITALITY SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 8.1.1 VERTICAL: PUSH-TO-TALK MARKET DRIVERS

- TABLE 49 PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 50 PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 GOVERNMENT & PUBLIC SAFETY

- 8.2.1 NEED FOR RELIABLE, STABLE, AND FLEXIBLE GROUP COMMUNICATION SYSTEM WITH PTT FUNCTIONALITY TO BOOST MARKET

- 8.2.2 GOVERNMENT & PUBLIC SAFETY: PUSH-TO-TALK USE CASES

- 8.2.2.1 Emergency command centers

- 8.2.2.2 Search and rescue operations

- 8.2.2.3 Fire departments

- TABLE 51 GOVERNMENT & PUBLIC SAFETY: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 GOVERNMENT & PUBLIC SAFETY: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 AEROSPACE & DEFENSE

- 8.3.1 REAL-TIME COORDINATION DURING MILITARY OPERATIONS AND REMOTE CONTROL OF UNMANNED VEHICLES TO DRIVE MARKET

- 8.3.2 AEROSPACE & DEFENSE: PUSH-TO-TALK USE CASES

- 8.3.2.1 Air traffic control

- 8.3.2.2 Tactical communication

- TABLE 53 AEROSPACE & DEFENSE: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 AEROSPACE & DEFENSE: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 TRANSPORTATION & LOGISTICS

- 8.4.1 RELIABLE DELIVERY OF SHIPMENTS AND REAL-TIME TRACKING OF FLEETS TO BOOST MARKET

- 8.4.2 TRANSPORTATION & LOGISTICS: PUSH-TO-TALK USE CASES

- 8.4.2.1 Fleet management and dispatch

- 8.4.2.2 Warehouse operations

- TABLE 55 TRANSPORTATION & LOGISTICS: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 TRANSPORTATION & LOGISTICS: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 MANUFACTURING

- 8.5.1 PUSH-TO-TALK SOLUTIONS TO HELP MANUFACTURERS IMPROVE WORKER SAFETY AND PRODUCTIVITY

- 8.5.2 MANUFACTURING: PUSH-TO-TALK USE CASES

- 8.5.2.1 Maximize worker safety

- 8.5.2.2 Streamline communications

- TABLE 57 MANUFACTURING: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 MANUFACTURING: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 CONSTRUCTION & MINING

- 8.6.1 PUSH-TO-TALK SOLUTIONS TO OFFER EFFECTIVE COMMUNICATION OPTIONS AT CONSTRUCTION SITES

- 8.6.2 CONSTRUCTION & MINING: PUSH-TO-TALK USE CASES

- 8.6.2.1 Site coordination

- 8.6.2.2 Remote monitoring

- TABLE 59 CONSTRUCTION & MINING: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 CONSTRUCTION & MINING: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 ENERGY & UTILITIES

- 8.7.1 PUSH-TO-TALK DEVICES TO ENABLE REAL-TIME COMMUNICATION AND ENSURE SAFETY OF LARGE WORKFORCES IN ENERGY & UTILITIES VERTICAL

- 8.7.2 ENERGY & UTILITIES: PUSH-TO-TALK USE CASES

- 8.7.2.1 Smart grid management

- 8.7.2.2 Disaster response and recovery

- TABLE 61 ENERGY & UTILITIES: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 ENERGY & UTILITIES: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 TRAVEL & HOSPITALITY

- 8.8.1 INTEGRATED VOICE AND BUSINESS APPLICATIONS TO IMPROVE OVERALL GUEST AND TRAVELER EXPERIENCE

- 8.8.2 TRAVEL & HOSPITALITY: PUSH-TO-TALK USE CASES

- 8.8.2.1 Event management

- 8.8.2.2 Maintenance and housekeeping

- TABLE 63 TRAVEL & HOSPITALITY: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 TRAVEL & HOSPITALITY: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9 HEALTHCARE

- 8.9.1 FASTER RESPONSE TIMES AND IMPROVED COLLABORATION TO PROPEL MARKET GROWTH

- 8.9.2 HEALTHCARE: PUSH-TO-TALK USE CASES

- 8.9.2.1 Speedy response time

- 8.9.2.2 Security and safety

- TABLE 65 HEALTHCARE: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 HEALTHCARE: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.10 OTHER VERTICALS

- 8.10.1 OTHER VERTICALS: PUSH-TO-TALK USE CASES

- 8.10.1.1 Network maintenance

- 8.10.1.2 Administrative communication

- 8.10.1.3 Store management

- TABLE 67 OTHER VERTICALS: PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 OTHER VERTICALS: PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.10.1 OTHER VERTICALS: PUSH-TO-TALK USE CASES

9 PUSH-TO-TALK MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 69 PUSH-TO-TALK MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 PUSH-TO-TALK MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 NORTH AMERICA: PUSH-TO-TALK MARKET DRIVERS

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 71 NORTH AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Highly developed telecom infrastructure and presence of several PTT vendors to drive market

- TABLE 83 US: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 84 US: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 85 US: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 86 US: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 87 US: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 88 US: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 89 US: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 90 US: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 91 US: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 92 US: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Adoption of critical communication solutions to fuel market growth

- TABLE 93 CANADA: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 94 CANADA: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 95 CANADA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 96 CANADA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 97 CANADA: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 98 CANADA: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 99 CANADA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 100 CANADA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 101 CANADA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 102 CANADA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- 9.3.2 EUROPE: PUSH-TO-TALK MARKET DRIVERS

- TABLE 103 EUROPE: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 104 EUROPE: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 105 EUROPE: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 106 EUROPE: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 108 EUROPE: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 109 EUROPE: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 110 EUROPE: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 111 EUROPE: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 112 EUROPE: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 113 EUROPE: PUSH-TO-TALK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 114 EUROPE: PUSH-TO-TALK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 GERMANY

- 9.3.3.1 Increase in developments in PoC services to boost market

- TABLE 115 GERMANY: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 116 GERMANY: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 117 GERMANY: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 118 GERMANY: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 119 GERMANY: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 120 GERMANY: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 121 GERMANY: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 122 GERMANY: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 123 GERMANY: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 124 GERMANY: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.4 UNITED KINGDOM

- 9.3.4.1 Increasing demand for digital transformation to drive market

- 9.3.5 FRANCE

- 9.3.5.1 Advanced economy and flourishing IoT, AI, and ML technologies to drive market

- 9.3.6 ITALY

- 9.3.6.1 Increasing adoption of cloud-based PTT devices to fuel market growth

- 9.3.7 SPAIN

- 9.3.7.1 Increasing popularity of smartphones and other mobile devices to drive market

- 9.3.8 NORDICS

- 9.3.8.1 High level of mobile adoption and growing demand for real-time communication to increase adoption of push-to-talk technology

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- 9.4.2 ASIA PACIFIC: PUSH-TO-TALK MARKET DRIVERS

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 125 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Continuous demand for integrated voice and data on mobile devices to drive market

- TABLE 137 CHINA: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 138 CHINA: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 139 CHINA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 140 CHINA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 141 CHINA: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 142 CHINA: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 143 CHINA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 144 CHINA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 145 CHINA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 146 CHINA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Rise in adoption of PTT solutions in defense services to drive market

- 9.4.5 JAPAN

- 9.4.5.1 Surge in demand for cost-effective communication solutions to fuel market growth

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Need for more secure and reliable communication solutions to boost market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.5.2 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET DRIVERS

- TABLE 147 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3 MIDDLE EAST

- TABLE 159 MIDDLE EAST: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 160 MIDDLE EAST: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 162 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 164 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 166 MIDDLE EAST: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 167 MIDDLE EAST: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 168 MIDDLE EAST: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 169 MIDDLE EAST: PUSH-TO-TALK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 170 MIDDLE EAST: PUSH-TO-TALK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3.1 KSA

- 9.5.3.1.1 Focus on safe communications in hazardous areas to drive market

- 9.5.3.1 KSA

- TABLE 171 KSA: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 172 KSA: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 173 KSA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 174 KSA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 175 KSA: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 176 KSA: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 177 KSA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 178 KSA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 179 KSA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 180 KSA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.5.3.2 UAE

- 9.5.3.2.1 Adoption of mission-critical and smart city services by UAE government to propel market growth

- 9.5.3.3 Rest of Middle East

- 9.5.3.2 UAE

- 9.5.4 AFRICA

- 9.5.4.1 Transition from analog to digital systems to accelerate market growth

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: RECESSION IMPACT

- 9.6.2 LATIN AMERICA: PUSH-TO-TALK MARKET DRIVERS

- TABLE 181 LATIN AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Spike in demand for remote solutions in organizations to boost market

- TABLE 193 BRAZIL: PUSH-TO-TALK MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 194 BRAZIL: PUSH-TO-TALK MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 195 BRAZIL: PUSH-TO-TALK MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 196 BRAZIL: PUSH-TO-TALK MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 197 BRAZIL: PUSH-TO-TALK MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 198 BRAZIL: PUSH-TO-TALK MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 199 BRAZIL: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017-2022 (USD MILLION)

- TABLE 200 BRAZIL: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023-2028 (USD MILLION)

- TABLE 201 BRAZIL: PUSH-TO-TALK MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 202 BRAZIL: PUSH-TO-TALK MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.6.4 MEXICO

- 9.6.4.1 Telecom reforms and government initiatives to boost adoption of PTT technology

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 203 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- TABLE 204 PUSH-TO-TALK MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 38 GLOBAL PTT MARKET COMPANY EVALUATION MATRIX, 2023

- 10.5.5 COMPANY FOOTPRINT

- TABLE 205 OFFERING FOOTPRINT

- TABLE 206 VERTICAL FOOTPRINT

- TABLE 207 REGIONAL FOOTPRINT

- TABLE 208 COMPANY FOOTPRINT

- 10.6 STARTUP/SME EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 39 GLOBAL PTT MARKET STARTUP/SME EVALUATION MATRIX, 2023

- 10.6.5 COMPETITIVE BENCHMARKING

- TABLE 209 PTT MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 210 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 211 PTT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- TABLE 212 PRODUCT LAUNCHES, 2020-2023

- 10.7.2 DEALS

- TABLE 213 DEALS, 2020-2023

- 10.8 PTT PRODUCT BENCHMARKING

- 10.8.1 PROMINENT PTT SOLUTION PROVIDERS

- TABLE 214 COMPARATIVE ANALYSIS OF PROMINENT PTT SOLUTION PROVIDERS

- 10.8.1.1 AT&T Enhanced Push-to-Talk platform

- 10.8.1.2 Verizon Push to Talk Plus

- 10.8.1.3 T-Mobile Push-to-Talk (PTT)

- 10.8.1.4 QChat Push-to-Chat solution

- 10.8.1.5 Airbus Agnet

- 10.8.2 PROMINENT PTT SERVICE PROVIDERS

- TABLE 215 COMPARATIVE ANALYSIS OF PROMINENT PTT SERVICE PROVIDERS

- 10.8.2.1 WAVE PTX

- 10.8.2.2 Bell Canada Push-to-Talk Service

- 10.8.2.3 Ericsson Mission-Critical Services

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY PTT VENDORS

- FIGURE 40 VALUATION AND FINANCIAL METRICS OF KEY PTT VENDORS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 11.1.1 AT&T

- TABLE 216 AT&T: COMPANY OVERVIEW

- FIGURE 41 AT&T: COMPANY SNAPSHOT

- TABLE 217 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 219 AT&T: DEALS

- 11.1.2 VERIZON

- TABLE 220 VERIZON: COMPANY OVERVIEW

- FIGURE 42 VERIZON: COMPANY SNAPSHOT

- TABLE 221 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 VERIZON: PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.1.3 MOTOROLA SOLUTIONS

- TABLE 223 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

- FIGURE 43 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

- TABLE 224 MOTOROLA SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 MOTOROLA SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 226 MOTOROLA SOLUTIONS: DEALS

- 11.1.4 T-MOBILE

- TABLE 227 T-MOBILE: COMPANY OVERVIEW

- FIGURE 44 T-MOBILE: COMPANY SNAPSHOT

- TABLE 228 T-MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 T-MOBILE: DEALS

- 11.1.5 QUALCOMM

- TABLE 230 QUALCOMM: COMPANY OVERVIEW

- FIGURE 45 QUALCOMM: COMPANY SNAPSHOT

- TABLE 231 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 QUALCOMM: DEALS

- 11.1.6 ERICSSON

- TABLE 233 ERICSSON: COMPANY OVERVIEW

- FIGURE 46 ERICSSON: COMPANY SNAPSHOT

- TABLE 234 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ERICSSON: DEALS

- 11.1.7 AIRBUS

- TABLE 236 AIRBUS: COMPANY OVERVIEW

- FIGURE 47 AIRBUS: COMPANY SNAPSHOT

- TABLE 237 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 AIRBUS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 AIRBUS: DEALS

- 11.1.8 BELL CANADA

- TABLE 240 BELL CANADA: BUSINESS OVERVIEW

- FIGURE 48 BELL CANADA: COMPANY SNAPSHOT

- TABLE 241 BELL CANADA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 BELL CANADA: DEALS

- 11.1.9 ZEBRA TECHNOLOGIES

- TABLE 243 ZEBRA TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 49 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 244 ZEBRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ZEBRA TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 ZEBRA TECHNOLOGIES: DEALS

- 11.1.10 TELSTRA

- TABLE 247 TELSTRA: COMPANY OVERVIEW

- FIGURE 50 TELSTRA: COMPANY SNAPSHOT

- TABLE 248 TELSTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 TELSTRA: DEALS

- 11.1.11 HYTERA

- TABLE 250 HYTERA: COMPANY OVERVIEW

- TABLE 251 HYTERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 HYTERA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 HYTERA: DEALS

- 11.1.12 IRIDIUM COMMUNICATIONS

- 11.1.13 TAIT COMMUNICATIONS

- 11.1.14 SERVICEMAX

- 11.1.15 L3HARRIS TECHNOLOGIES

- 11.2 STARTUPS/SMES

- 11.2.1 GROUPTALK

- 11.2.2 ORION

- 11.2.3 ZELLO

- 11.2.4 VOXER

- 11.2.5 IPTT

- 11.2.6 ESCHAT

- 11.2.7 AINA WIRELESS

- 11.2.8 AZETTI NETWORKS

- 11.2.9 TEAMCONNECT

- 11.2.10 VOICELAYER

- 11.2.11 SIMOCO WIRELESS SOLUTIONS

- 11.2.12 PEAKPTT

- 11.2.13 RUGGEAR

- 11.2.14 PROMOBI TECHNOLOGIES

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 ENTERPRISE MOBILITY MANAGEMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY COMPONENT

- TABLE 254 EMM MARKET, BY COMPONENT, 2020-2026 (USD MILLION)

- 12.2.4 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE

- TABLE 255 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2026 (USD MILLION)

- 12.2.5 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE

- TABLE 256 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2026 (USD MILLION)

- 12.2.6 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY VERTICAL

- TABLE 257 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY VERTICAL, 2020-2026 (USD MILLION)

- 12.3 MOBILE DEVICE MANAGEMENT MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT

- TABLE 258 MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 259 MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 12.3.4 MOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEM

- TABLE 260 MOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEM, 2016-2021 (USD MILLION)

- TABLE 261 MOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEM, 2022-2027 (USD MILLION)

- 12.3.5 MOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL

- TABLE 262 MOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 263 MOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS