|

|

市場調査レポート

商品コード

1459089

無線テストの世界市場:製品別、技術別、用途別、地域別 - 予測(~2029年)Wireless Testing Market by Offering (Equipment, Services), Technology (5G, Bluetooth, Wi-Fi, 2G/3G, 4G/LTE, GPS/GNSS), Application (Consumer Electronics, IT & telecommunication, Medical Devices, Aerospace & Defense) & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 無線テストの世界市場:製品別、技術別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年03月28日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の無線テストの市場規模は、2024年の226億米ドルから2029年までに341億米ドルに達し、予測期間にCAGRで8.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 提供別、技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

無線テスト市場の主な成長促進要因は、スマートフォンやスマートガジェットの世界的な普及、クラウドコンピューティングやIoT技術の採用の拡大などです。しかし、接続プロトコルの標準化の欠如は、今後の市場の課題として作用します。市場企業の主な成長機会は、自動運転の採用や、無線機能を強化したWi-Fi 6(802.11ax)およびWi-Fi 6Eの採用です。

「予測期間にコンシューマーエレクトロニクス向け市場がもっとも高いCAGRを有する見込みです。」

無線テスト市場のコンシューマーエレクトロニクスセグメントは、予測期間にもっとも高いCAGRが見込まれます。ガジェットの小型化、スマート化が重視される中、無線テストはコンシューマーエレクトロニクスセグメントにとって極めて重要です。また、すべてのコンシューマーエレクトロニクスは、販売前に機能性、安全性、有効性のテストを受けなければなりません。そのため、これらの製品は、最終ラインでの製造テスト、統合テスト、コンポーネントテストにかけられます。タブレットやスマートフォンを含むコンシューマーエレクトロニクスは主に、LTE、UMTS、GSM技術を利用しています。NFC、Bluetooth、セルラー、Wi-Fiなどのコンシューマーガジェットに組み込まれている無線技術はすべて、テストサービスプロバイダーによってテストされます。

「予測期間に研究開発セグメントがもっとも高いCAGRを記録する見込みです。」

研究開発セグメントは、予測期間にもっとも高いCAGRを占めると予測されます。無線テストは、無線技術セグメントにおける研究開発(R&D)プロセスの重大な要素です。研究開発段階では、新しい無線技術、機器、機能の性能、信頼性、セキュリティを検証、最適化、保証するためにテストが採用されます。プライベート5Gのようなプライベート領域での5Gネットワーク構築に向けた研究や実証の取り組みとともに、自動車分野での5Gの利用に向けた研究開発も始まっています。5G無線モジュールやWi-Fi 6Eを生み出す必要性が生じ、無線テストの需要が高まっています。さらに、次世代の通信規格である6Gの開発も始まっています。

「北米が2023年に地域別で第2位の市場シェアを占めました。」

2023年、北米が無線テスト市場で第2位のシェアを占めました。無線テスト市場の主要企業の多くはこの地域に拠点を置いています。IoTの研究開発(R&D)への支出の増加が無線テスト市場の成長を促進しています。学術レベルや産業レベルでの研究開発の活発化は、特に北米において、コンシューマーエレクトロニクス、自動車、医療機器などのさまざまな最終用途産業におけるIoT/無線テストの応用分野を広げています。

4Gネットワークから5Gネットワークへの移行は、この地域の無線ネットワークテスト装置プロバイダーにとって有利な成長機会を生み出しています。北米は技術革新の主要拠点です。また、新しい先進の技術をいち早く採用する地域でもあります。同地域のKeysightやVIAVI Solutionsなどの主要企業は、新技術への需要を支持し、これらの技術に関する認知の向上に寄与しています。

当レポートでは、世界の無線テスト市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 無線テスト市場の企業にとって魅力的な機会

- 無線テスト市場:機器タイプ別

- アジア太平洋の無線テスト市場:用途別、国別

- 無線テスト市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 無線ネットワークテスト装置の平均販売価格(ASP)

- 無線機器テスト装置の平均販売価格(ASP)

- 無線ネットワークテスト装置の過去の平均販売価格(ASP)の動向

- 無線機器テスト装置の過去の平均販売価格(ASP)の動向

- オシロスコープ、スペクトラムアナライザーの参考販売価格:主要メーカー別

- OTAテスターの販売価格の動向:地域別

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ(2020年~2024年)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 規制情勢と基準

- 無線テスト接続に関連する規制機関、政府機関、その他の組織

- 規制

- 標準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 無線テスト市場:提供別

- イントロダクション

- 装置

- 無線機器テスト

- 無線ネットワークテスト

- 無線モジュールテスト

- 無線ICテスト

- サービス

- 社内

- 外注

第7章 無線テスト市場:接続技術別

- イントロダクション

- 5G

- Wi-Fi

- Bluetooth

- GPS/GNSSモジュール

- 2G/3G

- 4G/LTE

- その他の接続技術

第8章 無線テスト市場:用途別

- イントロダクション

- コンシューマーエレクトロニクス

- 自動車

- IT・通信

- エネルギー・電力

- 医療機器

- 航空宇宙・防衛

- 工業

- その他の用途

第9章 無線テスト市場:ユースケース別

- イントロダクション

- 研究開発(R&D)

- 生産

- 返品保証(RMA)

- その他のユースケース

第10章 無線テスト市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 北米の無線テスト市場に対する不況の影響

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- スイス

- その他の欧州

- 欧州の無線テスト市場に対する不況の影響

- アジア太平洋

- 日本

- 中国

- インド

- 韓国

- 台湾

- オーストラリア

- シンガポール

- その他のアジア太平洋

- アジア太平洋の無線テスト市場に対する不況の影響

- その他の地域

- 南米

- GCC

- その他の中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した主要戦略

- 市場シェア分析(2023年)

- 収益分析(2018年~2022年)

- 企業の評価と財務指標(2022年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- SGS S.A.

- BUREAU VERITAS

- INTERTEK

- DEKRA SE

- ANRITSU

- ALIFECOM TECHNOLOGY

- KEYSIGHT TECHNOLOGIES

- ROHDE & SCHWARZ

- VIAVI SOLUTIONS INC.

- TUV NORD GROUP

- その他の企業

- EXFO INC.

- TUV RHEINLAND

- TUV SUD

- SPIRENT COMMUNICATIONS

- EUROFINS SCIENTIFIC

- APPLUS+

- VERKOTAN

- TESTILABS OY

- ELEMENT MATERIALS TECHNOLOGY

- EVTL INDIA

- QUADSAT

- IOTAS LTD

- ELECTRO MAGNETIC TEST, INC

- TESSOLVE

- TIMCO ENGINEERING, INC.

第13章 付録

The wireless testing market is projected to grow from USD 22.6 billion in 2024 to USD 34.1 billion by 2029, registering a CAGR of 8.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Technology, Application and Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

Some of the major factors driving the growth of the wireless testing market include rising global adoption of smartphones and smart gadgets and growing adoption of cloud computing and IoT technologies. However, Lack of standardization in connectivity protocols act as a challenge for the market in the future. The major growth opportunities for the market players are the adoption of autonomous driving and adoption of Wi-Fi 6 (802.11ax) and Wi-Fi 6E with enhanced wireless capabilities.

"Market for consumer electronics expected to have the highest CAGR during the forecast period."

The consumer electronics segment of the wireless testing market is expected to witness the highest CAGR during the forecast period. With an emphasis on making gadgets compact and smart, wireless testing is crucial to the consumer electronics sector. In addition, before to being on sale, all consumer electronics must undergo testing for functionality, safety, and effectiveness. These goods are therefore put through end-of-line production testing, integration testing, and component testing. Consumer electronics, including tablets and smartphones, primarily make use of LTE, UMTS, and GSM technologies. Near-field communication (NFC), Bluetooth, cellphone, Wi-Fi, and other wireless technologies that are integrated into consumer gadgets are all tested by the testing service providers.

" Research & Development segment expected to register the highest CAGR during the forecast period."

The research & development segment is expected to account for the highest CAGR in the forecast period. Wireless testing is a crucial component of the research and development (R&D) process in the field of wireless technologies. In the R&D phase, testing is employed to validate, optimize, and ensure the performance, reliability, and security of new wireless technologies, devices, or features. Along with research and demonstration efforts for constructing 5G networks in private domains, such as private 5G, research and development for 5G use in the automotive area has started. The need to create 5G wireless modules and Wi-Fi 6E has arisen, which is fueling the demand for wireless testing. In addition, development has started on the 6G standard, the next generation of communication.

"North America to account for the second highest market share among other regions in 2023."

In 2023, North America accounted for the second largest share of the wireless testing market. Most of the leading players in the wireless testing market are based in this region. The increased spending on the research and development (R&D) of the Internet of Things (IoT) is driving the growth of the wireless testing market. The growing R&D at academic and industry levels are broadening IoT/wireless testing application areas in different end-user industries, such as consumer electronics, automotive, and medical devices, especially in North America.

The transition from 4G to 5G networks has generated lucrative growth opportunities for wireless network test equipment providers in the region. North America is a major hub for technological innovations. It is also an early adopter of new and advanced technologies. Major players, such as Keysight and VIAVI Solutions, among others in the region, support the demand for new technologies and help increase awareness regarding these technologies.

In determining and verifying the market size for several segments and subsegments gathered through extensive secondary research, primary interviews have been conducted with key industry experts in the wireless testing market.

The break-up of primary participants for the report has been shown below:

- By company type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By designation: C-Level Executives - 40%, Managers - 30%, and Others - 30%

- By region: North America - 35%, Europe - 20%, Asia Pacific - 35%, and RoW - 10%

The report profiles key players in the wireless testing market with their respective market ranking analyses. Prominent players profiled in this report include SGS Group (Switzerland), Bureau Veritas (France), Intertek (UK), DEKRA SE (Germany), Anritsu (Japan), ALifecom Technology (Taiwan), Keysight Technologies (US), Rohde & Schwarz (Germany), VIAVI Solutions (US), TUV NORD Group (Germany), and among others.

Research Coverage

This research report categorizes the wireless testing market based on technology, end-user industry, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the wireless testing market and forecasts the same till 2029. The report also consists of leadership mapping and analysis of companies in the wireless testing ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall wireless testing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (advancements in wireless technology, increasing focus on deployment of 5G network, rising global adoption of smartphones and smart gadgets, and growing adoption of cloud computing and IoT technologies), restraints (high investments involved in establishing electromagnetic compatibility (EMC) testing facilities, high equipment cost and lack of skilled workforce, and lack of standardization in connectivity protocols), opportunities (growing popularity of automated cars and rising adoption of Wi-Fi 6 and Wi-Fi 6E), and challenges (long lead time required for overseas qualification tests and requirement for constant upgrading of equipment and services with technological advancements) influencing the growth of the wireless testing market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the wireless testing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the wireless testing market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the wireless testing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/service offerings of leading players like SGS Group (Switzerland), Bureau Veritas (France), Intertek (UK), DEKRA SE (Germany), Anritsu (Japan), ALifecom Technology (Taiwan), Keysight Technologies (US), Rohde & Schwarz (Germany), VIAVI Solutions (US), TUV NORD Group (Germany), and among others in the wireless testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 WIRELESS TESTING MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON WIRELESS TESTING MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 6 SERVICES SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 7 PRODUCTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 8 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

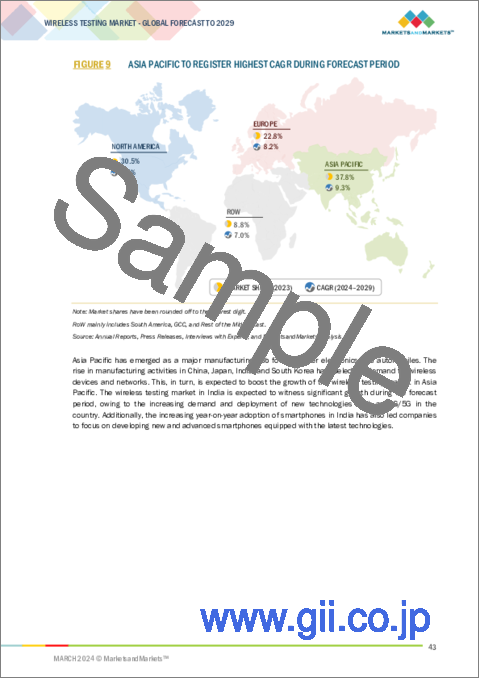

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIRELESS TESTING MARKET

- FIGURE 10 INCREASING DEMAND FOR WIRELESS TESTING IN IT & TELECOMMUNICATION APPLICATION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 WIRELESS TESTING MARKET, BY EQUIPMENT TYPE

- FIGURE 11 WIRELESS NETWORK TESTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC WIRELESS TESTING MARKET, BY APPLICATION AND COUNTRY

- FIGURE 12 IT & TELECOMMUNICATION SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC WIRELESS TESTING MARKET IN 2023

- 4.4 WIRELESS TESTING MARKET, BY COUNTRY

- FIGURE 13 INDIA TO DOMINATE WIRELESS TESTING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 WIRELESS TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 15 WIRELESS TESTING MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.1.1 Advancements in wireless technology

- 5.2.1.2 Increasing focus on 5G network deployment

- 5.2.1.3 Rising global adoption of smartphones and smart gadgets

- 5.2.1.4 Growing adoption of cloud computing and IoT technologies

- 5.2.2 RESTRAINTS

- FIGURE 16 WIRELESS TESTING MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.2.1 High investments involved in establishing electromagnetic compatibility (EMC) testing facilities

- 5.2.2.2 Lack of standardization in connectivity protocols

- 5.2.2.3 High equipment cost and lack of skilled workforce

- 5.2.3 OPPORTUNITIES

- FIGURE 17 WIRELESS TESTING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.3.1 Growing popularity of automated cars

- 5.2.3.2 Rising adoption of Wi-Fi 6 and Wi-Fi 6E

- 5.2.4 CHALLENGES

- FIGURE 18 WIRELESS TESTING MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.2.4.1 Long lead time required for overseas qualification tests

- 5.2.4.2 Requirement for constant upgrades of equipment and services with technological advancements

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE (ASP) OF WIRELESS NETWORK TESTING EQUIPMENT

- TABLE 1 AVERAGE SELLING PRICE (ASP) OF WIRELESS NETWORK TESTING EQUIPMENT, 2023 (USD)

- FIGURE 20 AVERAGE SELLING PRICE (ASP) OF WIRELESS NETWORK TESTING EQUIPMENT, 2023 (USD)

- 5.4.2 AVERAGE SELLING PRICE (ASP) OF WIRELESS DEVICE TESTING EQUIPMENT

- TABLE 2 AVERAGE SELLING PRICE (ASP) OF WIRELESS DEVICE TESTING EQUIPMENT, 2023 (USD)

- FIGURE 21 AVERAGE SELLING PRICE (ASP) OF WIRELESS DEVICE TESTING EQUIPMENT, 2023 (USD)

- 5.4.3 HISTORICAL AVERAGE SELLING PRICE (ASP) TREND OF WIRELESS NETWORK TESTING EQUIPMENT

- FIGURE 22 HISTORICAL AVERAGE SELLING PRICE (ASP) TREND OF WIRELESS NETWORK TESTING EQUIPMENT, 2020-2023 (USD)

- 5.4.4 HISTORICAL AVERAGE SELLING PRICE (ASP) TREND OF WIRELESS DEVICE TESTING EQUIPMENT

- FIGURE 23 HISTORICAL AVERAGE SELLING PRICE (ASP) TREND OF WIRELESS DEVICE TESTING EQUIPMENT, 2020-2023 (USD)

- 5.4.5 INDICATIVE SELLING PRICE OF OSCILLOSCOPES AND SPECTRUM ANALYZERS, BY KEY PLAYER

- FIGURE 24 INDICATIVE SELLING PRICE OF OSCILLOSCOPES AND SPECTRUM ANALYZERS OFFERED BY TWO KEY PLAYERS (USD)

- TABLE 3 INDICATIVE SELLING PRICE OF OSCILLOSCOPES AND SPECTRUM ANALYZERS OFFERED BY TWO KEY PLAYERS (USD)

- 5.4.6 INDICATIVE SELLING PRICE TREND OF OTA TESTERS, BY REGION

- FIGURE 25 INDICATIVE SELLING PRICE TREND OF OTA TESTERS, BY REGION, 2020-2029 (USD THOUSAND)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 WIRELESS TESTING MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 27 WIRELESS TESTING MARKET: ECOSYSTEM ANALYSIS

- TABLE 4 ROLES OF COMPANIES IN WIRELESS TESTING ECOSYSTEM

- 5.7 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 28 FUNDS AUTHORIZED BY SEVERAL KEY PLAYERS IN WIRELESS TESTING MARKET, 2020-2024 (USD MILLION)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI-powered testing

- 5.8.1.2 Over-the-Air (OTA) testing

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Network security testing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 5G testing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 5 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- 5.9.1 LIST OF MAJOR PATENTS

- TABLE 6 LIST OF MAJOR PATENTS RELATED TO WIRELESS TESTING CONNECTIONS, 2022-2024

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 30 IMPORT DATA FOR HS CODE 851712-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.10.2 EXPORT SCENARIO

- FIGURE 31 EXPORT DATA FOR HS CODE 851712-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 7 WIRELESS TESTING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 EXCIS REBUILT END-TO-END WIRELESS INFRASTRUCTURE AND SECURITY FOR MANUFACTURING PLANT IN FULDA, GERMANY

- 5.12.2 KEYSIGHT OFFERED IOT0047A SOFTWARE TO ETSI TO PERFORM COMPLEX AND TIME-CONSUMING ADAPTIVITY TESTS

- 5.12.3 CAPGEMINI CONDUCTED PUBLIC TRIALS OF 41 NEW 5G SERVICES TO ENHANCE TRAFFIC MANAGEMENT, HEALTHCARE, TOURISM, AND EMERGENCY SERVICES IN MILAN

- 5.13 REGULATORY LANDSCAPE AND STANDARDS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO WIRELESS TESTING CONNECTIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATIONS

- 5.13.2.1 General Data Protection Regulation (GDPR)

- 5.13.3 STANDARDS

- TABLE 12 SECURITY AND PRIVACY STANDARDS IMPLEMENTED BY EUROPEAN TELECOMMUNICATION STANDARDS INSTITUTE (ETSI)

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 WIRELESS TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 WIRELESS TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 WIRELESS TESTING MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 14 WIRELESS TESTING MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 34 WIRELESS TESTING MARKET: KEY BUYING CRITERIA FOR THREE KEY APPLICATIONS

- TABLE 15 WIRELESS TESTING MARKET: KEY BUYING CRITERIA FOR THREE KEY APPLICATIONS

6 WIRELESS TESTING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 35 WIRELESS TESTING MARKET, BY OFFERING

- FIGURE 36 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 16 WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 17 WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 18 WIRELESS TESTING MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 19 WIRELESS TESTING MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- 6.2 EQUIPMENT

- TABLE 20 EQUIPMENT: WIRELESS TESTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 EQUIPMENT: WIRELESS TESTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 22 EQUIPMENT: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

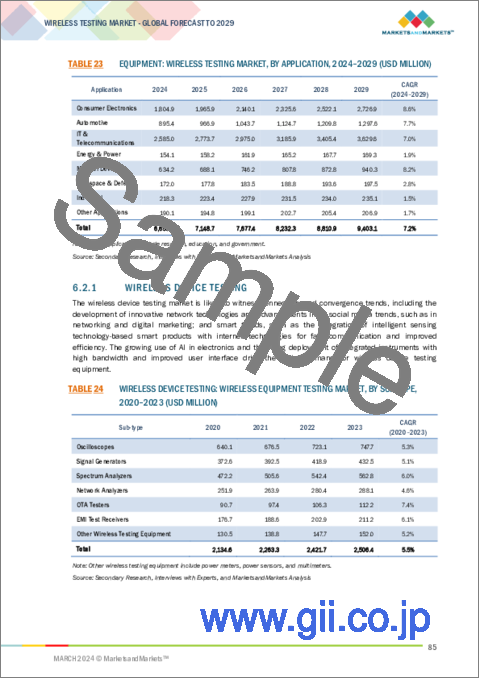

- TABLE 23 EQUIPMENT: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 6.2.1 WIRELESS DEVICE TESTING

- TABLE 24 WIRELESS DEVICE TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 25 WIRELESS DEVICE TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 26 WIRELESS DEVICE TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 27 WIRELESS DEVICE TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2024-2029 (THOUSAND UNITS)

- 6.2.1.1 Oscilloscopes

- 6.2.1.1.1 Growing use of digital oscilloscopes to drive market

- 6.2.1.2 Signal generators

- 6.2.1.2.1 Rising adoption of signal generators across various sectors for testing applications to drive market

- 6.2.1.3 Spectrum analyzers

- 6.2.1.3.1 Ability of spectrum analyzers to connect to wireless devices and analyze electromagnetic signals to drive demand

- 6.2.1.4 Network analyzers

- 6.2.1.4.1 Growing use of network analyzers in RF design laboratories to measure network parameters to drive market

- 6.2.1.5 Over-the-Air (OTA) testers

- 6.2.1.5.1 Rising use of OTA testers to test IoT devices to drive market

- 6.2.1.6 Electromagnetic interference (EMI) testers

- 6.2.1.6.1 Proliferation of electronic devices across various sectors to drive market

- 6.2.1.7 Other wireless testing equipment

- 6.2.1.1 Oscilloscopes

- 6.2.2 WIRELESS NETWORK TESTING

- TABLE 28 WIRELESS NETWORK TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 29 WIRELESS NETWORK TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 30 WIRELESS NETWORK TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 31 WIRELESS NETWORK TESTING: WIRELESS EQUIPMENT TESTING MARKET, BY SUB-TYPE, 2024-2029 (THOUSAND UNITS)

- 6.2.2.1 Network testers

- 6.2.2.1.1 Use of network testers for solving issues of interference and congestion to drive market

- 6.2.2.2 Network scanners

- 6.2.2.2.1 Increased adoption of network scanners by network administrators to verify IP address documentation to drive market

- 6.2.2.3 Other wireless network testing equipment

- 6.2.2.1 Network testers

- 6.2.3 WIRELESS MODULE TESTING

- 6.2.3.1 Presence of several companies offering wireless module testing to drive market

- 6.2.4 WIRELESS IC TESTING

- 6.2.4.1 Emergence of 5G, Wi-Fi 6E, and other high-speed wireless technologies to drive market

- 6.3 SERVICES

- TABLE 32 SERVICES: WIRELESS TESTING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 33 SERVICES: WIRELESS TESTING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 34 SERVICES: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 35 SERVICES: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 6.3.1 IN-HOUSE

- 6.3.1.1 Increasing preference for in-house wireless testing services to drive market

- 6.3.2 OUTSOURCED

- 6.3.2.1 Small- and medium-sized players to dominate market

7 WIRELESS TESTING MARKET, BY CONNECTIVITY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 37 WIRELESS TESTING MARKET, BY CONNECTIVITY TECHNOLOGY

- TABLE 36 WIRELESS DEVICE TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 37 WIRELESS DEVICE TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 38 WIRELESS NETWORK TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 39 WIRELESS NETWORK TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 40 WIRELESS IC TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 41 WIRELESS IC TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 42 WIRELESS MODULE TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 43 WIRELESS MODULE TESTING MARKET, BY CONNECTIVITY TECHNOLOGY, 2024-2029 (USD MILLION)

- 7.2 5G

- 7.2.1 CAPABILITY OF 5G TECHNOLOGY TO DELIVER ENHANCED BROADBAND EXPERIENCE AND PROVIDE PLATFORM FOR CLOUD- AND AI-BASED SERVICES TO DRIVE MARKET

- 7.3 WI-FI

- 7.3.1 DIGITAL TRANSFORMATION INITIATIVES IN BUSINESSES TO DRIVE DEMAND

- 7.4 BLUETOOTH

- 7.4.1 RELIABILITY OF BLUETOOTH CONNECTIVITY IN MULTIPLE APPLICATIONS TO DRIVE DEMAND

- 7.5 GLOBAL POSITIONING SYSTEM (GPS)/GLOBAL NAVIGATION SATELLITE SYSTEM (GNSS) MODULE

- 7.5.1 RISING USE OF GPS IN MILITARY, CIVIL, AND COMMERCIAL APPLICATIONS TO DRIVE MARKET

- 7.6 2G/3G

- 7.6.1 SHIFTING OF CUSTOMER BASE TO 4G AND 5G TECHNOLOGIES TO HAMPER DEMAND

- 7.7 4G/LTE

- 7.7.1 DEMAND FOR HIGH-SPEED CONNECTIVITY SERVICES TO FUEL MARKET GROWTH

- 7.8 OTHER CONNECTIVITY TECHNOLOGIES

8 WIRELESS TESTING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 38 WIRELESS TESTING MARKET, BY APPLICATION

- FIGURE 39 IT & TELECOMMUNICATION SEGMENT TO HOLD LARGEST SHARE OF WIRELESS TESTING MARKET IN 2029

- TABLE 44 WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 45 WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 8.2 CONSUMER ELECTRONICS

- 8.2.1 RISE IN DEMAND FOR WEARABLE DEVICES TO FUEL MARKET GROWTH

- TABLE 46 CONSUMER ELECTRONICS: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 47 CONSUMER ELECTRONICS: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 48 CONSUMER ELECTRONICS: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 CONSUMER ELECTRONICS: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.2 TABLETS

- 8.2.3 LAPTOPS

- 8.2.4 SMARTPHONES

- 8.2.5 WEARABLES

- 8.2.6 OTHERS

- 8.3 AUTOMOTIVE

- 8.3.1 INCREASING DEMAND FOR AUTONOMOUS AND CONNECTED VEHICLES TO DRIVE MARKET

- TABLE 50 AUTOMOTIVE: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 51 AUTOMOTIVE: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 52 AUTOMOTIVE: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 AUTOMOTIVE: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3.2 VEHICLE ELECTRONICS

- 8.3.3 INFOTAINMENT SYSTEMS

- 8.3.4 BATTERY SYSTEMS

- 8.4 IT & TELECOMMUNICATION

- 8.4.1 RISE IN NUMBER OF MOBILE USERS AND INSTALLATION OF ANTENNAS AND TOWERS TO FUEL DEMAND

- TABLE 54 IT & TELECOMMUNICATION: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 55 IT & TELECOMMUNICATION: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 56 IT & TELECOMMUNICATION: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 IT & TELECOMMUNICATION: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4.2 ROUTERS, HOTSPOTS, ACCESS POINTS, GATEWAYS, AND MOBILE WI-FI (MIFI)

- 8.4.3 ANTENNAS AND TOWERS

- 8.5 ENERGY & POWER

- 8.5.1 TRANSMISSION OF POWER WITHOUT CABLES USING WIRELESS TECHNOLOGY DURING POWER GENERATION TO DRIVE MARKET

- TABLE 58 ENERGY & POWER: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 59 ENERGY & POWER: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 60 ENERGY & POWER: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 ENERGY & POWER: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.5.2 POWER GENERATION

- 8.5.3 POWER DISTRIBUTION

- 8.5.4 OTHERS

- 8.6 MEDICAL DEVICES

- 8.6.1 HIGH NEED TO TEST AND CERTIFY WIRELESS MEDICAL DEVICES BY CONCERNED GOVERNMENT AGENCIES BEFORE COMMERCIAL USE TO DRIVE MARKET

- TABLE 62 MEDICAL DEVICES: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 63 MEDICAL DEVICES: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 64 MEDICAL DEVICES: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 MEDICAL DEVICES: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.6.2 MEDICAL EQUIPMENT

- 8.6.3 LABORATORY DEVICES

- 8.7 AEROSPACE & DEFENSE

- 8.7.1 RISE IN USE OF WIRELESS TESTING TO CHECK DIFFERENT EQUIPMENT AND SYSTEMS USED IN AEROSPACE & DEFENSE INDUSTRY TO DRIVE MARKET

- TABLE 66 AEROSPACE & DEFENSE: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 67 AEROSPACE & DEFENSE: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 68 AEROSPACE & DEFENSE: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 AEROSPACE & DEFENSE: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.8 INDUSTRIAL

- 8.8.1 GROWING ADOPTION OF WIRELESS SENSOR NETWORKS IN INDUSTRIAL SECTOR TO FUEL MARKET GROWTH

- TABLE 70 INDUSTRIAL: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 71 INDUSTRIAL: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 72 INDUSTRIAL: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 INDUSTRIAL: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.9 OTHER APPLICATIONS

- TABLE 74 OTHER APPLICATIONS: WIRELESS TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 75 OTHER APPLICATIONS: WIRELESS TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS: WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 77 OTHER APPLICATIONS: WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

9 WIRELESS TESTING MARKET, BY USE CASE

- 9.1 INTRODUCTION

- FIGURE 40 WIRELESS TESTING MARKET, BY USE CASE

- FIGURE 41 RESEARCH AND DEVELOPMENT (R&D) SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 78 WIRELESS TESTING MARKET, BY USE CASE, 2020-2023 (USD MILLION)

- TABLE 79 WIRELESS TESTING MARKET, BY USE CASE, 2024-2029 (USD MILLION)

- 9.2 RESEARCH AND DEVELOPMENT (R&D)

- 9.2.1 GROWING NEED FOR DEVELOPING 5G WIRELESS MODULES AND WI-FI 6E TO DRIVE MARKET

- 9.3 PRODUCTION

- 9.3.1 PRESENCE OF VARIOUS COMPANIES OFFERING TEST SETUP SOLUTIONS TO DRIVE MARKET

- 9.4 RETURN MERCHANDISE AUTHORIZATION (RMA)

- 9.4.1 RISING E-COMMERCE TRENDS, CUSTOMER EXPECTATIONS, AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- 9.5 OTHER USE CASES

10 WIRELESS TESTING MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL WIRELESS TESTING MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 80 WIRELESS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 WIRELESS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: WIRELESS TESTING MARKET SNAPSHOT

- TABLE 82 NORTH AMERICA: WIRELESS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: WIRELESS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Increased demand for automobile electronics to drive market

- TABLE 86 US: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 87 US: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Rise in adoption of wireless services and products to fuel market growth

- TABLE 88 CANADA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 89 CANADA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 Increasing smart building and smart home initiatives to drive market

- TABLE 90 MEXICO: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 91 MEXICO: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2.4 IMPACT OF RECESSION ON WIRELESS TESTING MARKET IN NORTH AMERICA

- 10.3 EUROPE

- FIGURE 45 EUROPE: WIRELESS TESTING MARKET SNAPSHOT

- TABLE 92 EUROPE: WIRELESS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 93 EUROPE: WIRELESS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 94 EUROPE: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 95 EUROPE: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Development of smart cities to drive demand

- TABLE 96 UK: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 97 UK: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Smart utility and smart city projects to increase demand

- TABLE 98 GERMANY: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 99 GERMANY: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.3 SPAIN

- 10.3.3.1 Adoption of EU directives to develop certification and testing standards to drive market

- TABLE 100 SPAIN: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 101 SPAIN: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Presence of renowned car manufacturers to drive demand

- TABLE 102 FRANCE: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 103 FRANCE: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Development of new wireless network for IoT to fuel demand

- TABLE 104 ITALY: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 105 ITALY: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.6 SWITZERLAND

- 10.3.6.1 Large presence of companies providing testing, inspecting, and certifying services to drive market

- TABLE 106 SWITZERLAND: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 107 SWITZERLAND: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 108 REST OF EUROPE: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 109 REST OF EUROPE: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.8 IMPACT OF RECESSION ON WIRELESS TESTING MARKET IN EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: WIRELESS TESTING MARKET SNAPSHOT

- TABLE 110 ASIA PACIFIC: WIRELESS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 111 ASIA PACIFIC: WIRELESS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 112 ASIA PACIFIC: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.1 JAPAN

- 10.4.1.1 Significant deployment of advanced wireless infrastructures to drive market

- TABLE 114 JAPAN: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 115 JAPAN: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Deployment of 5G services to fuel market

- TABLE 116 CHINA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 117 CHINA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Launch of 4G and 5G networks to fuel market growth

- TABLE 118 INDIA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 119 INDIA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing R&D and field trials for 5G technology to fuel market growth

- TABLE 120 SOUTH KOREA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 121 SOUTH KOREA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.5 TAIWAN

- 10.4.5.1 Growing adoption of IoT, smart machinery, and biochemical and medical care technologies to drive market

- TABLE 122 TAIWAN: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 123 TAIWAN: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.6 AUSTRALIA

- 10.4.6.1 Development of mature regulatory framework for ICT products to fuel demand

- TABLE 124 AUSTRALIA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 125 AUSTRALIA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.7 SINGAPORE

- 10.4.7.1 Government-led frequency band fee waivers for 5G trials to drive demand

- TABLE 126 SINGAPORE: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 127 SINGAPORE: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.8 REST OF ASIA PACIFIC

- TABLE 128 REST OF ASIA PACIFIC: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.9 IMPACT OF RECESSION ON WIRELESS TESTING MARKET IN ASIA PACIFIC

- 10.5 ROW

- TABLE 130 ROW: WIRELESS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 131 ROW: WIRELESS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 132 ROW: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 133 ROW: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Increased demand for improved data transfer speed to drive market

- TABLE 134 SOUTH AMERICA: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 135 SOUTH AMERICA: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.5.2 GCC

- 10.5.2.1 Increasing implementation of smart grids and smart city projects to drive market

- TABLE 136 GCC: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 137 GCC: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 138 REST OF MIDDLE EAST: WIRELESS TESTING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST: WIRELESS TESTING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 140 WIRELESS TESTING MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS, 2020-2024

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2023

- FIGURE 47 WIRELESS TESTING SERVICE MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2023

- TABLE 141 WIRELESS TESTING SERVICE MARKET SHARE ANALYSIS, 2023

- FIGURE 48 WIRELESS TESTING EQUIPMENT MARKET: REVENUE ANALYSIS OF TOP THREE PLAYERS, 2023

- TABLE 142 WIRELESS TESTING EQUIPMENT MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 49 WIRELESS TESTING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2022

- FIGURE 50 COMPANY VALUATION, 2022 (USD BILLION)

- FIGURE 51 FINANCIAL METRICS (EV/EBITDA), 2022

- 11.6 BRAND/PRODUCT COMPARISON

- FIGURE 52 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 53 WIRELESS TESTING MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Overall footprint

- FIGURE 54 COMPANY OVERALL FOOTPRINT

- 11.7.5.2 Application footprint

- TABLE 143 COMPANY APPLICATION FOOTPRINT

- 11.7.5.3 Offering footprint

- TABLE 144 COMPANY OFFERING FOOTPRINT

- 11.7.5.4 Connectivity technology footprint

- TABLE 145 COMPANY CONNECTIVITY TECHNOLOGY FOOTPRINT

- 11.7.5.5 Region footprint

- TABLE 146 COMPANY REGION FOOTPRINT

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 55 WIRELESS TESTING MARKET: COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 11.8.5.1 Competitive benchmarking of key start-ups/SMEs

- TABLE 147 WIRELESS TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.8.5.2 List of key start-ups/SMEs

- TABLE 148 WIRELESS TESTING MARKET: LIST OF KEY START-UPS/SMES

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 149 WIRELESS TESTING MARKET: PRODUCT LAUNCHES, NOVEMBER 2021-JANUARY 2024

- 11.9.2 DEALS

- TABLE 150 WIRELESS TESTING MARKET: DEALS, JANUARY 2022-JANUARY 2024

- 11.9.3 EXPANSIONS

- TABLE 151 WIRELESS TESTING MARKET: EXPANSIONS, MAY 2022-APRIL 2023

12 COMPANY PROFILES

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 SGS S.A.

- TABLE 152 SGS S.A.: COMPANY OVERVIEW

- FIGURE 56 SGS S.A.: COMPANY SNAPSHOT

- TABLE 153 SGS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 SGS S.A.: DEALS

- 12.1.2 BUREAU VERITAS

- TABLE 155 BUREAU VERITAS: COMPANY OVERVIEW

- FIGURE 57 BUREAU VERITAS: COMPANY SNAPSHOT

- TABLE 156 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 BUREAU VERITAS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 158 BUREAU VERITAS: DEALS

- TABLE 159 BUREAU VERITAS: EXPANSIONS

- 12.1.3 INTERTEK

- TABLE 160 INTERTEK: COMPANY OVERVIEW

- FIGURE 58 INTERTEK: COMPANY SNAPSHOT

- TABLE 161 INTERTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 INTERTEK: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 163 INTERTEK: DEALS

- TABLE 164 INTERTEK: EXPANSIONS

- 12.1.4 DEKRA SE

- TABLE 165 DEKRA SE: COMPANY OVERVIEW

- TABLE 166 DEKRA SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 DEKRA SE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 168 DEKRA SE: DEALS

- 12.1.5 ANRITSU

- TABLE 169 ANRITSU: COMPANY OVERVIEW

- FIGURE 59 ANRITSU: COMPANY SNAPSHOT

- TABLE 170 ANRITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 ANRITSU: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 172 ANRITSU: DEALS

- 12.1.6 ALIFECOM TECHNOLOGY

- TABLE 173 ALIFECOM TECHNOLOGY: COMPANY OVERVIEW

- TABLE 174 ALIFECOM TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ALIFECOM TECHNOLOGY: PRODUCT LAUNCHES/DEVELOPMENTS

- 12.1.7 KEYSIGHT TECHNOLOGIES

- TABLE 176 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 60 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 177 NXP SEMICONDUCTORS NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 179 KEYSIGHT TECHNOLOGIES: DEALS

- 12.1.8 ROHDE & SCHWARZ

- TABLE 180 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 181 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ROHDE & SCHWARZ: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 183 ROHDE & SCHWARZ: DEALS

- 12.1.9 VIAVI SOLUTIONS INC.

- TABLE 184 VIAVI SOLUTIONS INC.: COMPANY OVERVIEW

- FIGURE 61 VIAVI SOLUTIONS INC.: COMPANY SNAPSHOT

- TABLE 185 VIAVI SOLUTIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 VIAVI SOLUTIONS INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 187 VIAVI SOLUTIONS INC.: DEALS

- 12.1.10 TUV NORD GROUP

- TABLE 188 TUV NORD GROUP: COMPANY OVERVIEW

- FIGURE 62 TUV NORD GROUP: COMPANY SNAPSHOT

- TABLE 189 TUV NORD GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 EXFO INC.

- 12.2.2 TUV RHEINLAND

- 12.2.3 TUV SUD

- 12.2.4 SPIRENT COMMUNICATIONS

- 12.2.5 EUROFINS SCIENTIFIC

- 12.2.6 APPLUS+

- 12.2.7 VERKOTAN

- 12.2.8 TESTILABS OY

- 12.2.9 ELEMENT MATERIALS TECHNOLOGY

- 12.2.10 EVTL INDIA

- 12.2.11 QUADSAT

- 12.2.12 IOTAS LTD

- 12.2.13 ELECTRO MAGNETIC TEST, INC

- 12.2.14 TESSOLVE

- 12.2.15 TIMCO ENGINEERING, INC.

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS