|

|

市場調査レポート

商品コード

1546635

動物用消毒剤の世界市場:形態別、タイプ別、用途別、動物タイプ別、エンドユーザー別、地域別 - 2029年までの予測Animal Disinfectants Market by Type (Iodine, Lactic Acid, Hydrogen Peroxide), Application (Dairy Cleaning, Swine, Poultry, Equine, Ruminants, Pets, And Aquaculture), Animal Type, End-User, Form, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 動物用消毒剤の世界市場:形態別、タイプ別、用途別、動物タイプ別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月23日

発行: MarketsandMarkets

ページ情報: 英文 349 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の動物用消毒剤の市場規模は2024年に39億米ドルと推定され、2029年には57億米ドルに達すると予測されており、予測期間中のCAGRは7.9%になると見込まれています。

世界の酪農産業はここ数十年で大きく発展してきました。新興諸国では、牛乳生産が家計の生計、食糧安全保障、良質な栄養の有力な要素として台頭してきました。FAOによると、過去30年間に世界の生乳生産量は77%以上増加し、1992年の5億2,400万トンから2022年には9億3,000万トンになっています。酪農生産の増大は、結果として生産動物の数を増加させ、アニマルケア製品に対する需要の増大をもたらしましたが、その中でも消毒剤は牛群の健康維持のために重要な位置を占めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | 形態別、タイプ別、用途別、動物タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

乳房炎は最も一般的な乳牛の病気であり、牛群の成績と農場の収益性を脅かす最も深刻な脅威のひとつです。企業が絶え間ない技術革新に取り組み、より強力な新しい消毒剤を発売することで、乳房炎を引き起こす病原菌の発生率は減少すると予想されます。デラバル(スウェーデン)の2023年9月付け記事によると、デラバルのOceanBluスプレー、OceanBluプロ、OceanBluバリアなど、高度な皮膚コンディショニングと効果的な消毒を提供する先進的な製品の発売は、酪農用消毒剤セグメントの成長を高めると予想されています。

過酸化水素は、バクテリアからウイルス、真菌まであらゆる種類の微生物を殺す能力があるため、動物のハウスキーピングにおいて最も使用されている消毒剤の1つです。また、過酸化水素の分解生成物は水と酸素であるため、残留物が少なく環境に優しい薬剤です。過酸化水素の用途は、動物病院、農場、動物保護施設など、バイオセキュリティが重視される場面で勢いを増しています。動物用消毒剤としての過酸化水素の用途が拡大しているのは、無毒で適用が容易であることに加え、動物の疾病予防に見られる厳格な衛生習慣に対する意識の高まりによるものと考えられます。抗生物質耐性や化学消毒剤の安全性に対する懸念が高まる中、過酸化水素は、様々な動物飼育分野において、動物と人間にとって安全で健康的な環境を確立し維持するために、ますます選択される消毒剤となっています。

当レポートでは、世界の動物用消毒剤市場について調査し、形態別、タイプ別、用途別、動物タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済見通し

- 市場力学

- 生成AIが動物の栄養に与える影響

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム/市場マップ

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- 規制枠組み

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 動物用消毒剤市場(形態別)

- イントロダクション

- 液体

- 粉末

第8章 動物用消毒剤市場(タイプ別)

- イントロダクション

- ヨウ素

- 乳酸

- 過酸化水素

- フェノール酸

- 過酢酸

- 第四級化合物

- 塩素

- 二酸化塩素

- クロロヘキシジン

- グルトクワットミックス

- グリコール酸

- その他

第9章 動物用消毒剤市場(用途別)

- イントロダクション

- 乳製品の洗浄

- 豚

- 家禽

- 馬

- 反芻動物

- 養殖業

- ペット

第10章 動物用消毒剤市場(動物タイプ別)

- イントロダクション

- 家畜

- ペット

第11章 動物用消毒剤市場(エンドユーザー別)

- イントロダクション

- 獣医クリニック

- 畜産農場

- 研究機関およびその他

第12章 動物用消毒剤市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- LANXESS

- ZOETIS

- NEOGEN CORPORATION

- ECOLAB

- GEA GROUP AKTIENGESELLSCHAFT

- SOLVAY

- VIRBAC

- STOCKMEIER GROUP

- KERSIA GROUP

- EVANS VANODINE INTERNATIONAL PLC

- KEMIN INDUSTRIES, INC.

- DELAVAL

- DIVERSEY HOLDINGS LTD.

- FINK TEC GMBH

- SANOSIL LTD

- その他の企業/スタートアップ/中小企業

- PCC GROUP

- VEESURE

- VIROX ANIMAL HEALTH

- ALBERT KERBL GMBH

- INTERNATIONAL HEALTH CARE

- SUNWAYS BIOSCIENCE LLP

- ZELENCE INDUSTRIES PRIVATE LIMITED

- CREST AQUA TECH

- ADVACARE PHARMA

- ACURO ORGANICS LTD.

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 ANIMAL DISINFECTANTS MARKET SHARE SNAPSHOT, 2024 VS. 2029 (USD MILLION)

- TABLE 3 CHICKEN MEAT PRODUCTION FOR KEY COUNTRIES (MILLION METRIC TONS), 2019-2023

- TABLE 4 MAJOR LIVESTOCK DISEASES CONSIDERED FOR ANIMAL DISINFECTANTS STUDY

- TABLE 5 IMPORT SCENARIO FOR HS CODE: 280120, BY COUNTRY, 2019-2023 (USD)

- TABLE 6 EXPORT SCENARIO FOR HS CODE: 280120, BY COUNTRY, 2019-2023 (USD)

- TABLE 7 IMPORT SCENARIO FOR HS CODE: 280110, BY COUNTRY, 2019-2023 (USD)

- TABLE 8 EXPORT SCENARIO FOR HS CODE: 280110, BY COUNTRY, 2019-2023 (USD)

- TABLE 9 IMPORT SCENARIO FOR HS CODE: 284700, BY COUNTRY, 2019-2023 (USD)

- TABLE 10 EXPORT SCENARIO FOR HS CODE: 284700, BY COUNTRY, 2019-2023 (USD)

- TABLE 11 AVERAGE SELLING PRICE TREND OF ANIMAL DISINFECTANTS AMONG KEY PLAYERS, BY TYPE, 2023 (USD/LITER)

- TABLE 12 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/TON)

- TABLE 13 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2023 (USD/TON)

- TABLE 14 ANIMAL DISINFECTANTS MARKET: ECOSYSTEM

- TABLE 15 LIST OF MAJOR PATENTS PERTAINING TO ANIMAL DISINFECTANTS MARKET, 2014-2024

- TABLE 16 ANIMAL DISINFECTANTS MARKET: LIST OF KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 PORTER'S FIVE FORCES: IMPACT ON ANIMAL DISINFECTANTS MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 24 NEOGEN CORPORATION - TRANSFORMING ANIMAL DISINFECTANTS FOR ENHANCED BIOSECURITY

- TABLE 25 EVONIK'S DEDICATION TO ADVANCING ANIMAL DISINFECTANTS RESULTED IN IMPROVED BIOSECURITY

- TABLE 26 ANIMAL DISINFECTANTS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 27 ANIMAL DISINFECTANTS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 28 LIQUID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 LIQUID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 POWDER: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 POWDER: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 COMMON DISINFECTANTS AND THEIR APPLICATIONS

- TABLE 33 ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 34 ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 35 ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 36 ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (KT)

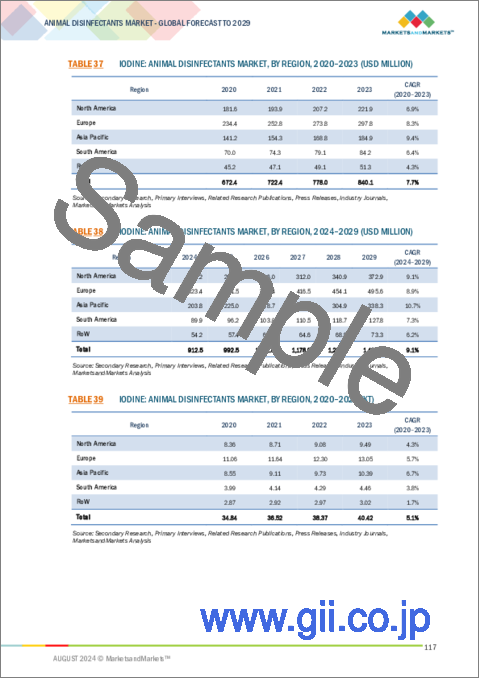

- TABLE 37 IODINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 IODINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 IODINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 40 IODINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 41 TOP 5 EXPORTERS OF LACTIC ACID WORLDWIDE IN 2023

- TABLE 42 LACTIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 LACTIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 LACTIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 45 LACTIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 46 HYDROGEN PEROXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 HYDROGEN PEROXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 HYDROGEN PEROXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 49 HYDROGEN PEROXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 50 PHENOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 PHENOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 PHENOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 53 PHENOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 54 PERACETIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 PERACETIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 PERACETIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 57 PERACETIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 58 QUATERNARY COMPOUNDS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 QUATERNARY COMPOUNDS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 QUATERNARY COMPOUNDS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 61 QUATERNARY COMPOUNDS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 62 CHLORINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 CHLORINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 CHLORINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 65 CHLORINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 66 CHLORINE DIOXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 CHLORINE DIOXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 CHLORINE DIOXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 69 CHLORINE DIOXIDE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 70 CHLOROHEXIDINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 CHLOROHEXIDINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 CHLOROHEXIDINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 73 CHLOROHEXIDINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 74 GLUT-QUAT MIXES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 75 GLUT-QUAT MIXES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 GLUT-QUAT MIXES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 77 GLUT-QUAT MIXES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 78 GLYCOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 GLYCOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 GLYCOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 81 GLYCOLIC ACID: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 82 OTHER TYPES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 83 OTHER TYPES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 OTHER TYPES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 85 OTHER TYPES: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 86 ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 87 ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 88 MAJOR PATHOGENIC MICROORGANISMS ASSOCIATED WITH MILK AND DAIRY PRODUCTS

- TABLE 89 DAIRY CLEANING: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 90 DAIRY CLEANING: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 DAIRY CLEANING: ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 92 DAIRY CLEANING: ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 93 SWINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 94 SWINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 95 SWINE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 96 SWINE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 97 SWINE: TERMINAL BIOSECURITY, BY SUBTYPE, 2020-2023 (USD MILLION)

- TABLE 98 SWINE: TERMINAL BIOSECURITY, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 99 SWINE: CONTINUOUS BIOSECURITY, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 100 SWINE: CONTINUOUS BIOSECURITY, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 101 POULTRY: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 POULTRY: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 103 POULTRY: ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 104 POULTRY: GLOBAL ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 105 POULTRY: TERMINAL BIOSECURITY, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 106 POULTRY: TERMINAL BIOSECURITY, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 107 POULTRY: CONTINUOUS BIOSECURITY, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 108 POULTRY: CONTINUOUS BIOSECURITY, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 109 EQUINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 110 EQUINE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 111 EQUINE: ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 112 EQUINE: ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 113 EQUINE: TERMINAL BIOSECURITY, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 114 EQUINE: TERMINAL BIOSECURITY, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 115 EQUINE: CONTINUOUS BIOSECURITY, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 116 EQUINE: CONTINUOUS BIOSECURITY, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 117 RUMINANTS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 118 RUMINANTS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 119 RUMINANTS: GLOBAL ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 120 RUMINANTS: GLOBAL ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 121 AQUACULTURE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 122 AQUACULTURE: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 123 AQUACULTURE: GLOBAL ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2020-2023 (USD MILLION)

- TABLE 124 AQUACULTURE: GLOBAL ANIMAL DISINFECTANTS MARKET, BY SUB-TYPE, 2024-2029 (USD MILLION)

- TABLE 125 PETS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 126 PETS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 127 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2020-2023 (USD MILLION)

- TABLE 128 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024-2029 (USD MILLION)

- TABLE 129 LIVESTOCK: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 130 LIVESTOCK: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 131 COMPANION ANIMALS: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 132 COMPANION ANIMALS: ANIMAL DISINFECTANTS MARKET, 2024-2029 (USD MILLION)

- TABLE 133 EFFICACIES OF COMMON DISINFECTANT CLASSES

- TABLE 134 ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 135 ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 136 ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (KT)

- TABLE 137 ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (KT)

- TABLE 138 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 139 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 140 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 142 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 143 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 144 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 145 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 146 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 147 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 148 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2020-2023 (USD MILLION)

- TABLE 149 NORTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024-2029 (USD MILLION)

- TABLE 150 US: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 151 US: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 152 CANADA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 153 CANADA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 154 MEXICO: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 155 MEXICO: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 EUROPE: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 157 EUROPE: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 158 EUROPE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 159 EUROPE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 160 EUROPE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 161 EUROPE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 162 EUROPE: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 163 EUROPE: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 164 EUROPE: ANIMAL DISINFECTANTS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 165 EUROPE: ANIMAL DISINFECTANTS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 166 EUROPE: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2020-2023 (USD MILLION)

- TABLE 167 EUROPE: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024-2029 (USD MILLION)

- TABLE 168 FRANCE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 169 FRANCE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 170 GERMANY: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 171 GERMANY: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 172 UK: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 173 UK: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 174 SPAIN: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 175 SPAIN: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 176 ITALY: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 177 ITALY: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 178 RUSSIA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 179 RUSSIA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 180 TURKEY: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 181 TURKEY: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 182 POLAND: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 183 POLAND: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 184 GREECE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 185 GREECE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 186 NETHERLANDS: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 187 NETHERLANDS: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 188 DENMARK: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 189 DENMARK: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 REST OF EUROPE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 191 REST OF EUROPE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 192 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 193 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 194 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 195 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 196 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 197 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 198 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 199 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 200 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 201 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 202 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2020-2023 (USD MILLION)

- TABLE 203 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024-2029 (USD MILLION)

- TABLE 204 CHINA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 205 CHINA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 206 INDIA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 207 INDIA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 208 JAPAN: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 209 JAPAN: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 210 AUSTRALIA & NEW ZEALAND: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 211 AUSTRALIA & NEW ZEALAND: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 212 VIETNAM: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 213 VIETNAM: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 214 SOUTH KOREA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 215 SOUTH KOREA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 216 PHILIPPINES: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 217 PHILIPPINES: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 220 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 221 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 222 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 223 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 224 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 225 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 226 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 227 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 228 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 229 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 230 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2020-2023 (USD MILLION)

- TABLE 231 SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024-2029 (USD MILLION)

- TABLE 232 BRAZIL: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 233 BRAZIL: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 234 ARGENTINA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 235 ARGENTINA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 236 PERU: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 237 PERU: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 238 CHILE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 239 CHILE: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 240 ECUADOR: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 241 ECUADOR: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 242 REST OF SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 243 REST OF SOUTH AMERICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 244 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 245 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 246 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 247 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 248 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (KT)

- TABLE 249 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 250 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 251 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 252 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 253 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 254 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2020-2023 (USD MILLION)

- TABLE 255 REST OF THE WORLD: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024-2029 (USD MILLION)

- TABLE 256 MIDDLE EAST: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 257 MIDDLE EAST: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 258 AFRICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 259 AFRICA: ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 260 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ANIMAL DISINFECTANT MARKET PLAYERS

- TABLE 261 ANIMAL DISINFECTANTS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 262 ANIMAL DISINFECTANTS MARKET: APPLICATION FOOTPRINT

- TABLE 263 ANIMAL DISINFECTANTS MARKET: TYPE FOOTPRINT

- TABLE 264 ANIMAL DISINFECTANTS MARKET: FORM FOOTPRINT

- TABLE 265 ANIMAL DISINFECTANTS MARKET: REGION FOOTPRINT

- TABLE 266 ANIMAL DISINFECTANTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 267 ANIMAL DISINFECTANTS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 268 ANIMAL DISINFECTANTS MARKET: PRODUCT LAUNCHES, FEBRUARY 2019-JULY 2024

- TABLE 269 ANIMAL DISINFECTANTS MARKET: DEALS, APRIL 2019-JULY 2024

- TABLE 270 ANIMAL DISINFECTANTS MARKET: EXPANSIONS, JUNE 2019-JULY 2024

- TABLE 271 LANXESS: COMPANY OVERVIEW

- TABLE 272 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 LANXESS: DEALS

- TABLE 274 LANXESS: EXPANSIONS

- TABLE 275 ZOETIS: COMPANY OVERVIEW

- TABLE 276 ZOETIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ZOETIS: DEALS

- TABLE 278 NEOGEN CORPORATION: COMPANY OVERVIEW

- TABLE 279 NEOGEN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 NEOGEN CORPORATION: PRODUCT LAUNCHES

- TABLE 281 NEOGEN CORPORATION: DEALS

- TABLE 282 ECOLAB: COMPANY OVERVIEW

- TABLE 283 ECOLAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 ECOLAB: DEALS

- TABLE 285 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 286 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 288 SOLVAY: COMPANY OVERVIEW

- TABLE 289 SOLVAY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 SOLVAY GROUP: EXPANSIONS

- TABLE 291 VIRBAC: COMPANY OVERVIEW

- TABLE 292 VIRBAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 STOCKMEIER GROUP: COMPANY OVERVIEW

- TABLE 294 STOCKMEIER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 STOCKMEIER GROUP: DEALS

- TABLE 296 KERSIA GROUP: COMPANY OVERVIEW

- TABLE 297 KERSIA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 KERSIA GROUP: PRODUCT LAUNCHES

- TABLE 299 KERSIA GROUP: DEALS

- TABLE 300 EVANS VANODINE INTERNATIONAL PLC: COMPANY OVERVIEW

- TABLE 301 EVANS VANODINE INTERNATIONAL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 KEMIN INDUSTRIES, INC: COMPANY OVERVIEW

- TABLE 303 KEMIN INDUSTRIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 KEMIN INDUSTRIES, INC: PRODUCT LAUNCHES

- TABLE 305 DELAVAL: COMPANY OVERVIEW

- TABLE 306 DELAVAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 DIVERSEY HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 308 DIVERSEY HOLDINGS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 DIVERSEY HOLDINGS LTD.: DEALS

- TABLE 310 FINK TEC GMBH: COMPANY OVERVIEW

- TABLE 311 FINK TEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 SANOSIL LTD: COMPANY OVERVIEW

- TABLE 313 SANOSIL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 PCC GROUP: COMPANY OVERVIEW

- TABLE 315 PCC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 PCC GROUPS: DEALS

- TABLE 317 VEESURE: COMPANY OVERVIEW

- TABLE 318 VEESURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 VIROX ANIMAL HEALTH: COMPANY OVERVIEW

- TABLE 320 VIROX ANIMAL HEALTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 ALBERT KERBL GMBH: COMPANY OVERVIEW

- TABLE 322 ALBERT KERBL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 INTERNATIONAL HEALTH CARE: COMPANY OVERVIEW

- TABLE 324 INTERNATIONAL HEALTH CARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 ADJACENT MARKETS

- TABLE 326 FOOD DISINFECTANTS MARKET, BY APPLICATION AREA, 2018-2025 (USD MILLION)

- TABLE 327 AGRICULTURAL DISINFECTANTS MARKET, BY END USE, 2014-2021 (USD MILLION)

List of Figures

- FIGURE 1 ANIMAL DISINFECTANTS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 ANIMAL DISINFECTANTS MARKET SIZE CALCULATION: SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 8 ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 9 ANIMAL DISINFECTANTS MARKET, BY FORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 ANIMAL DISINFECTANTS MARKET SHARE AND GROWTH RATE, BY REGION, 2024

- FIGURE 12 RISING INCIDENCES OF DISEASES IN LIVESTOCK TO PROPEL MARKET

- FIGURE 13 CHINA AND LIVESTOCK SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2024

- FIGURE 14 LIQUID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 IODINE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 DAIRY CLEANING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 LIVESTOCK SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 LIVESTOCK SEGMENT TO LEAD ACROSS ALL REGIONS DURING FORECAST PERIOD

- FIGURE 19 US TO DOMINATE ANIMAL DISINFECTANTS MARKET IN 2024

- FIGURE 20 WORLD POPULATION GROWTH, 1950-2050

- FIGURE 21 CHICKEN MEAT PRODUCTION FOR KEY COUNTRIES, 2019-2023 (MILLION METRIC TONS)

- FIGURE 22 ANIMAL DISINFECTANTS MARKET DYNAMICS

- FIGURE 23 ADOPTION OF GEN AI IN ANIMAL NUTRITION INDUSTRY

- FIGURE 24 ANIMAL DISINFECTANTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 ANIMAL DISINFECTANTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 IMPORT OF IODINE, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 27 EXPORT OF IODINE, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 28 IMPORT OF CHLORINE, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 29 EXPORT OF CHLORINE, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 30 IMPORT OF HYDROGEN PEROXIDE, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 31 EXPORT OF HYDROGEN PEROXIDE, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF ANIMAL DISINFECTANTS AMONG KEY PLAYERS, BY TYPE (USD/LITER)

- FIGURE 33 ANIMAL DISINFECTANTS MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/TON)

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2023 (USD/TON)

- FIGURE 35 MARKET MAP: ANIMAL DISINFECTANTS MARKET

- FIGURE 36 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 37 NUMBER OF PATENTS GRANTED FOR ANIMAL DISINFECTANTS MARKET, 2014-2024

- FIGURE 38 REGIONAL ANALYSIS OF PATENTS GRANTED FOR ANIMAL DISINFECTANTS MARKET, 2023

- FIGURE 39 ANIMAL DISINFECTANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 41 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 42 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 43 ANIMAL DISINFECTANTS MARKET, BY FORM, 2024 VS. 2029 (USD MILLION)

- FIGURE 44 ANIMAL DISINFECTANTS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 45 TOP GLOBAL IMPORTERS OF QUATERNARY AMMONIUM COMPOUNDS, 2023

- FIGURE 46 EXPORT OF CHLORINE FROM KEY COUNTRIES, 2023 (USD THOUSAND)

- FIGURE 47 ANIMAL DISINFECTANTS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 48 TRADE OF LIVE POULTRY, 2019-2023 (USD MILLION)

- FIGURE 49 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 50 FRANCE TO BE FASTEST-GROWING COUNTRY, 2024-2029

- FIGURE 51 EUROPE: ANIMAL DISINFECTANTS MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET SNAPSHOT

- FIGURE 53 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST 5 YEARS, 2019-2023 (USD BILLION)

- FIGURE 54 SHARE OF LEADING PLAYERS IN ANIMAL DISINFECTANTS MARKET, 2023

- FIGURE 55 RANKING OF TOP FIVE PLAYERS IN ANIMAL DISINFECTANTS MARKET

- FIGURE 56 ANIMAL DISINFECTANTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 57 ANIMAL DISINFECTANTS MARKET: COMPANY FOOTPRINT

- FIGURE 58 ANIMAL DISINFECTANTS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 59 COMPANY VALUATION FOR SIX MAJOR PLAYERS IN ANIMAL DISINFECTANTS MARKET

- FIGURE 60 EV/EBITDA OF MAJOR PLAYERS

- FIGURE 61 ANIMAL DISINFECTANTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 62 LANXESS: COMPANY SNAPSHOT

- FIGURE 63 ZOETIS: COMPANY SNAPSHOT

- FIGURE 64 NEOGEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ECOLAB: COMPANY SNAPSHOT

- FIGURE 66 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 67 SOLVAY: COMPANY SNAPSHOT

- FIGURE 68 VIRBAC: COMPANY SNAPSHOT

- FIGURE 69 DELAVAL: COMPANY SNAPSHOT

The global market for animal disinfectants is estimated to be valued at USD 3.9 billion in 2024 and is projected to reach USD 5.7 billion by 2029, at a CAGR of 7.9% during the forecast period. The global dairy industry has been developing significantly over the last few decades. In developing countries, milk production emerged as a powerful component of household livelihoods, food security, and good nutrition. According to FAO, during the past three decades, world milk production increased by more than 77 percent, from 524 million tons in 1992 to 930 million tons in 2022. Growing dairy production, consequently boosting the number of producing animals, has resulted in an increased demand for animal care products, of which disinfectants occupy an important position for health maintenance within herds.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Application, Form, Type and Region |

| Regions covered | North America, Europe, Asia Pacific, South America and RoW |

Mastitis is the most common dairy cattle disease-one of the most serious threats to herd performance and farm profitability. With firms working relentlessly on innovation and launching new and more potent disinfectant products, the incidence of mastitis-pathogen-causing is expected to be reduced. According to DeLaval, Sweden, in an article dated September 2023, the launch of advanced products such as DeLaval's OceanBlu spray, OceanBlu pro, and OceanBlu barrier, which offers advanced skin conditioning and effective disinfection, is expected to enhance the growth of the dairy disinfectant segment.

Furthermore, the market is likely to grow at a substantial compound annual growth rate in the forecasted period, owing to a rise in the number of dairy farmers who focus on herd health and productivity by using advanced udder care solutions.

"The hydrogen peroxide segment is projected to hold a significant market share in the type of segment during the forecast period."

Hydrogen peroxide has been one of the most used disinfectants in animal housekeeping due to its ability to kill all types of microorganisms, from bacteria to viruses and fungi. In addition, it is an environment-friendly agent with low residues since its decomposition products are water and oxygen. Its uses have been gaining momentum in situations where biosecurity is of high concern, such as veterinary clinics, farms, and animal shelters. The growing application of hydrogen peroxide as a disinfectant for animals could be due to it being non-toxic and easy to apply, coupled with increasing awareness of stringent hygiene practices that have been observed in preventing diseases among animals. With growing concerns about antibiotic resistance and the safety of chemical disinfectants, hydrogen peroxide is increasingly the disinfectant of choice to establish and maintain a safe and healthy environment for animals and humans in various animal care segments.

Recent research from the University of Georgia in January 2022 suggests that Dry Hydrogen Peroxide (DHP) could be a more efficient and effective alternative to formaldehyde fogging for disinfecting poultry hatcheries. Unlike liquid hydrogen peroxide, DHP is a gas created by breaking down and reassembling water and oxygen molecules. This method has proven to be effective against microbes on both surfaces and in the air, including bacteria, fungi, and viruses. The results of this study proved that using DHP in hatcheries not only lowered microbial contamination but also improved the hatchability and survival rates of chicks. With formaldehyde fogging being phased out due to its toxicity, DHP is a safer and promising solution to hatchery hygiene. This development underlines clearly the rising importance of hydrogen peroxide in animal care and disinfection practices.

"The liquid form is estimated to dominate the market during the forecast period."

The liquid form of animal disinfectant products is gaining more popularity since it is ready for use and has an extremely convenient mode of application. In contrast to powdered or granular forms, liquid disinfectants do not require any preparation and, therefore, prove very well-suited for quick and efficient application in livestock and poultry farms. This trend is further fueled by firms that bring out new liquid products to meet the ever-increasing demand. Companies are increasingly launching liquid fluid products designed for ease of handling and ready-to-use applications, addressing the demands of challenging environments. For instance, Neogen Corporation (US) recently introduced Neogen Farm Fluid MAX in April 2024, a dual-action disinfectant tailored for the livestock industry. Such products are designed to be applied directly with minimal preparation, enhancing convenience for users while maintaining high efficacy in various conditions, including indoor and outdoor environments.

"Europe has consistently held a substantial market share within the animal disinfectant sector during the study period."

The fast-growing dairy and poultry industries in Europe are likely to result in major driving effects on the animal disinfectants market. According to the article published by Dairy Global in April 2023, in 2022, the population in the EU's dairy sector was strong at 20.1 million dairy cows, out of which Germany had the largest with 3.8 million cows, followed by France with 3.2 million, and Poland maintaining a large herd of more than 2 million cows. The significant population of dairy cattle are expected to boosts the usage of animal disinfectants.

Furthermore, according to the article published by EFSA in December 2022, in collaboration with the European Centre for Disease Prevention and Control (ECDC) and the EU Reference Laboratory (EURL), there is a rise in highly pathogenic avian influenza (HPAI) cases in Europe among poultry and water birds in 2022. In response to this growing threat in February 2024, companies such as Axcentive (France) have introduced innovative solutions such as Halamid, a powerful disinfectant proven to be highly effective against AI viruses. The rising dairy and poultry sectors, coupled with the strong presence of highly active key players, position Europe as a dominant market in the animal disinfectants industry.

The break-up of the profile of primary participants in the animal disinfectants market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXO's - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 30%, South America - 15% and Rest of the World -10%

Prominent companies in the market include Neogen Corporation (US), GEA Group (Germany), Lanxess (Germany), Zoetis (US), Solvay (Belgium), Stockmeier Group (Germany), Kersia Group (France), Ecolab (US), Albert Kerbl GmbH (Germany), PCC Group (Germany), DeLaval Inc. (Sweden), Diversey Holdings Ltd. (US), Virbac (France), Kemin Industries Inc. (US) and Fink Tec GmbH (Germany).

Other players include Evans Vanodien International PLC (UK), Sanosil LTD (Switzerland), Virox Animal Health (Canada), Veesure (India), Ashish Life Science (India), Sunways Bioscience LLP (Cyprus), Zelence Industries Private Limited (India), Cresta Aqua Tech (India), Advacare Pharma (US), Acuro Organics Ltd (India).

Research Coverage:

This research report categorizes the Animal Disinfectants Market By Type (Iodine, Lactic Acid, Hydrogen Peroxide, Phenolic Acid, Peracetic Acid, Quaternary Compounds, Chlorine, Chlorine Dioxide, Chlorohexidine, Glut-Quat Mixes, Glycolic Acid, Other Types), By Applications (Dairy Cleaning, Swine, Poultry, Equine, Dairy & Ruminant, Aquaculture), By Form (Powder and Liquid) and By Region (North America, Europe, Asia Pacific, South America, RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of animal disinfectants. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the animal disinfectants market. Competitive analysis of upcoming startups in the animal disinfectants market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall animal disinfectants and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising incidences of diseases in livestock), restraints (high entry barriers for players), opportunities (Increase in consumer preference for biological disinfectants), and challenges (Low usage due to lack of awareness about standard operating procedures) influencing the growth of the animal disinfectants market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the animal disinfectants market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the animal disinfectant across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the animal disinfectants market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product food prints of leading players such as Neogen Corporation (US), GEA Group Aktiengesellschaft (Germany), LANXESS (Germany), Zoetis Services LLC (US), Solvay (Belgium), STOCKMEIER Group (Germany) and others in the animal disinfectants market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.4.2 VOLUME UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ANIMAL DISINFECTANTS MARKET

- 4.2 ASIA PACIFIC: ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE AND COUNTRY

- 4.3 ANIMAL DISINFECTANTS MARKET, BY FORM

- 4.4 ANIMAL DISINFECTANTS MARKET, BY TYPE

- 4.5 ANIMAL DISINFECTANTS MARKET, BY APPLICATION

- 4.6 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE

- 4.7 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE AND REGION

- 4.8 ANIMAL DISINFECTANTS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

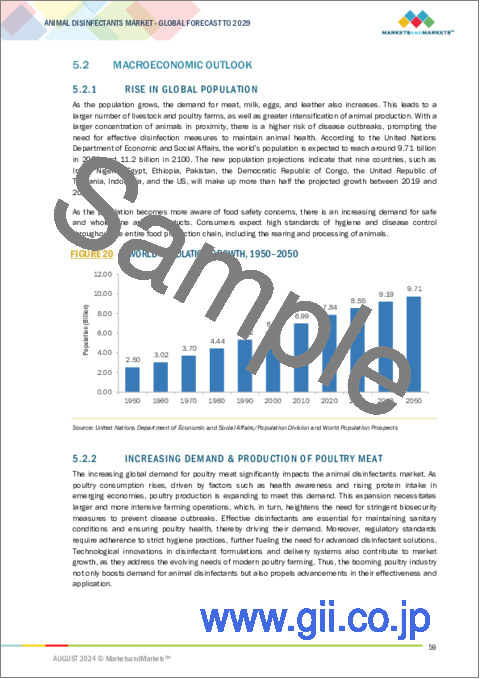

- 5.2.1 RISE IN GLOBAL POPULATION

- 5.2.2 INCREASING DEMAND & PRODUCTION OF POULTRY MEAT

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising incidences of diseases in livestock

- 5.3.1.2 Growth in livestock production to drive animal hygiene products usage

- 5.3.1.3 Increase in regulations concerning terminal disinfection to curb potential outbreaks

- 5.3.2 RESTRAINTS

- 5.3.2.1 High costs and long duration associated with disinfectant compounds

- 5.3.2.2 Overuse of similar disinfectants leads to antimicrobial resistance

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increase in consumer preference for biological disinfectants

- 5.3.3.2 Strategic partnerships and collaborations among key players

- 5.3.4 CHALLENGES

- 5.3.4.1 Low usage due to lack of awareness about standard operating procedures

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON ANIMAL NUTRITION

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN ANIMAL NUTRITION

- 5.4.3 IMPACT OF AI ON ANIMAL DISINFECTANTS MARKET

- 5.4.4 IMPACT OF GEN AI ON ADJACENT ECOSYSTEM

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 PROCUREMENT

- 6.3.3 PRODUCTION & PROCESSING

- 6.3.4 DISTRIBUTION

- 6.3.5 MARKETING AND SALES

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO OF IODINE, 2019-2023 (USD)

- 6.4.2 EXPORT SCENARIO OF IODINE, 2019-2023 (USD)

- 6.4.3 IMPORT SCENARIO OF CHLORINE, 2019-2023 (USD)

- 6.4.4 EXPORT SCENARIO OF CHLORINE, 2019-2023 (USD)

- 6.4.5 IMPORT SCENARIO OF HYDROGEN PEROXIDE, 2019-2023 (USD)

- 6.4.6 EXPORT SCENARIO OF HYDROGEN PEROXIDE, 2019-2023 (USD)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGY

- 6.5.1.1 Accelerated Hydrogen Peroxide (AHP) technology

- 6.5.2 COMPLEMENTARY TECHNOLOGY

- 6.5.2.1 Nanotechnology-based disinfectants

- 6.5.3 ADJACENT TECHNOLOGY

- 6.5.3.1 Citr-IQ

- 6.5.1 KEY TECHNOLOGY

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF ANIMAL DISINFECTANTS AMONG KEY PLAYERS, BY TYPE

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023

- 6.6.3 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2023

- 6.7 ECOSYSTEM/MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS DURING 2024-2025

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 INTRODUCTION

- 6.12.2 NORTH AMERICA

- 6.12.2.1 US

- 6.12.2.2 Canada

- 6.12.3 EUROPE

- 6.12.4 ASIA PACIFIC

- 6.12.4.1 China

- 6.12.4.2 India

- 6.12.4.3 Japan

- 6.12.4.4 Australia

- 6.12.5 SOUTH AMERICA

- 6.12.5.1 Brazil

- 6.12.5.2 Argentina

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 NEOGEN CORPORATION'S INNOVATIONS REVOLUTIONIZED BIOSECURITY PRACTICES, LEADING TO IMPROVED ANIMAL HEALTH

- 6.15.2 EVONIK - ADVANCING ANIMAL DISINFECTANTS FOR IMPROVED BIOSECURITY

- 6.16 INVESTMENT AND FUNDING SCENARIO

7 ANIMAL DISINFECTANTS MARKET, BY FORM

- 7.1 INTRODUCTION

- 7.2 LIQUID

- 7.2.1 EASY AVAILABILITY, LOW COST, AND WATER-SOLUBLE NATURE TO DRIVE DEMAND

- 7.3 POWDER

- 7.3.1 EASE OF STORAGE & HANDLING TO DRIVE MARKET

8 ANIMAL DISINFECTANTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 IODINE

- 8.2.1 EFFECTIVE ANTIMICROBIAL PROPERTIES OF IODINE TO INFLUENCE GROWTH OF IODINE-BASED ANIMAL DISINFECTANTS

- 8.3 LACTIC ACID

- 8.3.1 EFFECTIVE ACTION AGAINST BACTERIA TO MAKE LACTIC ACID DISINFECTANTS SUITABLE FOR SURFACE CLEANING

- 8.4 HYDROGEN PEROXIDE

- 8.4.1 RAPID BACTERIAL ACTIVITY TO MAKE HYDROGEN PEROXIDE EFFECTIVE DISINFECTANT

- 8.5 PHENOLIC ACID

- 8.5.1 STRONG DISINFECTANT EFFICACY OF PHENOL & DERIVATIVES TO BE USEFUL IN DISINFECTION OF EQUIPMENT

- 8.6 PERACETIC ACID

- 8.6.1 ENVIRONMENTALLY FRIENDLY PROPERTIES OF PERACETIC ACID TO DRIVE GROWTH

- 8.7 QUATERNARY COMPOUNDS

- 8.7.1 DEMAND FOR QUATERNARY COMPOUNDS TO REMAIN HIGH DUE TO NON-TOXIC AND BIODEGRADABLE NATURE

- 8.8 CHLORINE

- 8.8.1 BLEACHING AND GERMICIDAL PROPERTIES TO MAKE IT PREFERRED DISINFECTANT

- 8.9 CHLORINE DIOXIDE

- 8.9.1 FAST DISINFECTION AND REDUCTION OF IMPURITIES IN WATER TO DRIVE MARKET

- 8.10 CHLOROHEXIDINE

- 8.10.1 LOW TOXICITY OF CHLOROHEXIDINE TO BENEFIT MARKET

- 8.11 GLUT-QUAT MIXES

- 8.11.1 STRONG DISINFECTION EFFICACY PROVIDED BY GLUTARALDEHYDE TO STRENGTHEN MARKET GROWTH

- 8.12 GLYCOLIC ACID

- 8.12.1 APPLICATION IN DISINFECTING EQUIPMENT TO DRIVE MARKET

- 8.13 OTHER TYPES

9 ANIMAL DISINFECTANTS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DAIRY CLEANING

- 9.2.1 CIP

- 9.2.1.1 Increase in hygiene concerns and need for effective cleaning to drive demand

- 9.2.2 PIPELINES

- 9.2.2.1 Demand for alkaline and non-foaming detergents to drive market

- 9.2.3 BULK TANKS

- 9.2.3.1 Removal of milk fats and storage cleaning to drive market

- 9.2.4 MILKING SYSTEMS

- 9.2.4.1 Increase in cattle heads to bolster demand

- 9.2.1 CIP

- 9.3 SWINE

- 9.3.1 TERMINAL BIOSECURITY

- 9.3.1.1 Losses due to African Swine Fever (ASF) to drive demand

- 9.3.1.1.1 Surface disinfection housing

- 9.3.1.1.2 Equipment

- 9.3.1.1.3 Water lines

- 9.3.1.1.4 Aerial disinfection

- 9.3.1.1 Losses due to African Swine Fever (ASF) to drive demand

- 9.3.2 CONTINUOUS BIOSECURITY

- 9.3.2.1 Rise in swine products across developed economies to drive demand

- 9.3.2.1.1 Hand sanitation

- 9.3.2.1.2 Footbaths

- 9.3.2.1.3 Drinking water

- 9.3.2.1.4 Vehicle

- 9.3.2.1 Rise in swine products across developed economies to drive demand

- 9.3.1 TERMINAL BIOSECURITY

- 9.4 POULTRY

- 9.4.1 TERMINAL BIOSECURITY

- 9.4.1.1 Intensive poultry farming to drive demand

- 9.4.1.1.1 Surface disinfection housing

- 9.4.1.1.2 Equipment

- 9.4.1.1.3 Water lines

- 9.4.1.1.4 Aerial disinfection

- 9.4.1.1 Intensive poultry farming to drive demand

- 9.4.2 CONTINUOUS BIOSECURITY

- 9.4.2.1 Rise in incidences of avian influenza and coccidiosis to fuel growth

- 9.4.2.1.1 Hand sanitation

- 9.4.2.1.2 Footbaths

- 9.4.2.1.3 Drinking water

- 9.4.2.1.4 Vehicle

- 9.4.2.1 Rise in incidences of avian influenza and coccidiosis to fuel growth

- 9.4.1 TERMINAL BIOSECURITY

- 9.5 EQUINE

- 9.5.1 TERMINAL BIOSECURITY

- 9.5.1.1 Stable maintenance and equine disinfection procedures to drive demand

- 9.5.1.1.1 Surface disinfection housing

- 9.5.1.1.2 Equipment

- 9.5.1.1.3 Water lines

- 9.5.1.1.4 Aerial disinfection

- 9.5.1.1 Stable maintenance and equine disinfection procedures to drive demand

- 9.5.2 CONTINUOUS BIOSECURITY

- 9.5.2.1 Disease prevention programs and high livestock value to drive demand

- 9.5.2.1.1 Hand sanitation

- 9.5.2.1.2 Footbaths

- 9.5.2.1.3 Drinking water

- 9.5.2.1.4 Vehicle

- 9.5.2.1 Disease prevention programs and high livestock value to drive demand

- 9.5.1 TERMINAL BIOSECURITY

- 9.6 RUMINANTS

- 9.6.1 TEAT DIPS

- 9.6.1.1 Concerns over dairy cattle health and mastitis threat to drive demand

- 9.6.2 HOOF CARE

- 9.6.2.1 Expansion of dairy operations and focus on health of dairy herds to drive demand

- 9.6.1 TEAT DIPS

- 9.7 AQUACULTURE

- 9.7.1 SURFACE DISINFECTION

- 9.7.1.1 Increase in commercial aquaculture activities to drive demand

- 9.7.2 CONTINUOUS DISINFECTION

- 9.7.2.1 Increased awareness regarding disease prevention and control to augment demand

- 9.7.1 SURFACE DISINFECTION

- 9.8 PETS

- 9.8.1 RISING NUMBER OF PETS & AWARENESS ABOUT THEIR HEALTH TO DRIVE MARKET

10 ANIMAL DISINFECTANTS MARKET, BY ANIMAL TYPE

- 10.1 INTRODUCTION

- 10.2 LIVESTOCK

- 10.2.1 RISING MEAT & POULTRY INDUSTRY TO DRIVE MARKET

- 10.3 COMPANION ANIMALS

- 10.3.1 RISING HEALTH AWARENESS AMONG PET PARENTS TO DRIVE GROWTH

11 ANIMAL DISINFECTANTS MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 VETERINARY CLINICS

- 11.3 LIVESTOCK FARMS

- 11.4 RESEARCH LABORATORIES & OTHER END-USERS

12 ANIMAL DISINFECTANTS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Rising poultry industry to drive market

- 12.2.2 CANADA

- 12.2.2.1 High export demand and industry standards to encourage disinfectants' use

- 12.2.3 MEXICO

- 12.2.3.1 Government regulations and export requirements to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 FRANCE

- 12.3.1.1 Largest beef producer to drive market

- 12.3.2 GERMANY

- 12.3.2.1 Outbreak of avian influenza to drive demand

- 12.3.3 UK

- 12.3.3.1 Intensive livestock farming and prevalence of Lyme and Hepatitis E to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Growth in meat industry to increase market demand

- 12.3.5 ITALY

- 12.3.5.1 Export of beef to other countries to influence demand

- 12.3.6 RUSSIA

- 12.3.6.1 Development in dairy segment to drive demand

- 12.3.7 TURKEY

- 12.3.7.1 Growth in livestock production and intensive farming to increase demand

- 12.3.8 POLAND

- 12.3.8.1 Dairy & pork production growth to increase demand

- 12.3.9 GREECE

- 12.3.9.1 Intensification of animal production to drive market

- 12.3.10 NETHERLANDS

- 12.3.10.1 Export of dairy and rearing of livestock to drive market

- 12.3.11 DENMARK

- 12.3.11.1 Growing livestock and dairy sectors to drive demand

- 12.3.12 REST OF EUROPE

- 12.3.1 FRANCE

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Increase in meat supply to drive demand

- 12.4.2 INDIA

- 12.4.2.1 Increased consumption of milk & meat to boost market

- 12.4.3 JAPAN

- 12.4.3.1 Regulatory imposition on biosecurity measures to drive adoption of animal disinfectants

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Maintaining animal hygiene to increase export to drive demand

- 12.4.5 VIETNAM

- 12.4.5.1 Emergence of zoonotic disease to drive market

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Increasing meat consumption to drive animal disinfectants market

- 12.4.7 PHILIPPINES

- 12.4.7.1 Increasing poultry production to drive demand

- 12.4.8 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Increased exports of meat products to support disinfectant use

- 12.5.2 ARGENTINA

- 12.5.2.1 Increased demand for beef/cattle to drive market

- 12.5.3 PERU

- 12.5.3.1 Government regulations on animal products import to influence market demand

- 12.5.4 CHILE

- 12.5.4.1 Prevalence of Fascioliasis in livestock to drive market demand

- 12.5.5 ECUADOR

- 12.5.5.1 Prevalence of foot & mouth disease and bovine brucellosis to drive demand

- 12.5.6 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Rising meat production to boost demand

- 12.6.1.2 Saudi Arabia

- 12.6.1.2.1 Regulations and initiatives by government for animal health to drive demand

- 12.6.1.3 Egypt

- 12.6.1.3.1 Increasing consumption of meat products to boost sales

- 12.6.1.4 Rest of Middle East

- 12.6.1.4.1 Rising livestock production to bolster demand

- 12.6.2 AFRICA

- 12.6.2.1 Increasing livestock production to drive demand

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 MARKET RANKING ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Application footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Form footprint

- 13.5.5.5 Region footprint

- 13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING, START-UPS/SMES, 2023

- 13.6.5.1 Detailed list of key start-ups/SMEs

- 13.6.5.2 Competitive benchmarking of start-ups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 LANXESS

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 ZOETIS

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 NEOGEN CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ECOLAB

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 GEA GROUP AKTIENGESELLSCHAFT

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SOLVAY

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Expansions

- 14.1.6.4 MnM view

- 14.1.7 VIRBAC

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.4 MnM view

- 14.1.8 STOCKMEIER GROUP

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.4 MnM view

- 14.1.9 KERSIA GROUP

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.4 MnM view

- 14.1.10 EVANS VANODINE INTERNATIONAL PLC

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.4 MnM view

- 14.1.11 KEMIN INDUSTRIES, INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.4 MnM view

- 14.1.12 DELAVAL

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.4 MnM view

- 14.1.13 DIVERSEY HOLDINGS LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.4 MnM view

- 14.1.14 FINK TEC GMBH

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.4 MnM view

- 14.1.15 SANOSIL LTD

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.4 MnM view

- 14.1.1 LANXESS

- 14.2 OTHER PLAYERS/STARTUPS/SMES

- 14.2.1 PCC GROUP

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Deals

- 14.2.1.4 MnM view

- 14.2.2 VEESURE

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.4 MnM view

- 14.2.3 VIROX ANIMAL HEALTH

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.4 MnM view

- 14.2.4 ALBERT KERBL GMBH

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.4 MnM view

- 14.2.5 INTERNATIONAL HEALTH CARE

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.4 MnM view

- 14.2.6 SUNWAYS BIOSCIENCE LLP

- 14.2.7 ZELENCE INDUSTRIES PRIVATE LIMITED

- 14.2.8 CREST AQUA TECH

- 14.2.9 ADVACARE PHARMA

- 14.2.10 ACURO ORGANICS LTD.

- 14.2.1 PCC GROUP

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 STUDY LIMITATIONS

- 15.3 FOOD DISINFECTANTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 AGRICULTURAL DISINFECTANTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS