|

|

市場調査レポート

商品コード

1074019

リモートタワーの世界市場:オペレーションタイプ(シングル、マルチ、コンティンジェンシー)、システムタイプ、用途(通信、情報&管理、監視)、地域別 - 2027年までの予測Remote Towers Market by Operation Type (Single, Multiple, Contingency), System Type (Airport Equipment, Remote Tower Modules, Solutions & Software), Application (Communication, Information & Control, Surveillance) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| リモートタワーの世界市場:オペレーションタイプ(シングル、マルチ、コンティンジェンシー)、システムタイプ、用途(通信、情報&管理、監視)、地域別 - 2027年までの予測 |

|

出版日: 2022年05月05日

発行: MarketsandMarkets

ページ情報: 英文 249 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のリモートタワーの市場規模は、2022年から2027年までの間に19.6%のCAGRで推移し、2022年の3億米ドルから、2027年までに6億米ドルに達すると予測されています。

リモートタワーは、新しく高度で高速なカメラ、リモートモジュール、通信システムの開発により、技術面で急速に進化しており、コスト削減、効率性、安全性の向上などが、リモートタワーの需要を後押ししています。

2022年のリモートタワー市場は欧州がリードし、英国、スウェーデンが地域市場の大きなシェアを占める見通しです。高解像度カメラやパノラマディスプレイ、通信システムなど、リモートタワーのコンポーネントの先進技術開発に加え、欧州地域でのリモートタワーに対する需要の高まりが、同地域市場を牽引する主な要因です。

当レポートでは、世界のリモートタワー市場について調査しており、市場力学、エコシステム、メガトレンドの影響、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- COVID-19リモートタワー市場への影響

- リモートタワー市場のサプライチェーン分析

- 市場のエコシステム

- 顧客のビジネスに影響を与える動向/ディスラプション

- リモートタワーおよび関連製品の平均販売価格(2021-2022)

- ポーターのファイブフォース分析

- 関税と規制状況

- イベントと会議(2022-2023)

第6章 動向

- テクノロジーの動向

- テクノロジー分析

- ユースケース

- メガトレンドの影響

- イノベーションと特許登録

第7章 オペレーションタイプ別:リモートタワー市場

- シングル

- マルチ

- コンティンジェンシー

- 補助リモートタワー

第8章 システムタイプ別:リモートタワー市場

- 空港設備

- カメラ(180/360/PAN)

- ディスプレイ

- VHF/UHFラジオ

- NAVAIDS

- METセンサー

- リモートタワーモジュール

- ヘッドアップディスプレイ(HUD)

- ヘッドダウンディスプレイ(HDD)

- ソリューションとソフトウェア

- ワイドエリアネットワーク(WAN)

- 高速IPネットワーク

- データ収集・アラートシステム

- インターフェース・統合

- プラットフォーム・スーツ

第9章 用途別:リモートタワー市場

- 通信

- 情報・管理

- フライトデータの取り扱い

- 監視

- 視覚化

第10章 エンドユーザー別:リモートタワー市場

- 軍用飛行場

- 商業空港

- クラスA(2,000万超)

- クラスB(1,000万~2,000万)

- クラスC(100万~1,000万)

- クラスD(100万未満)

第11章 投資別:リモートタワー市場

- 新規設置

- 拡張と近代化

第12章 地域分析

- 北米

- PESTLE分析:北米

- 米国

- カナダ

- 欧州

- PESTLE分析:欧州

- 英国

- フランス

- ノルウェー

- ドイツ

- スウェーデン

- その他

- アジア太平洋

- PESTLE分析:アジア太平洋

- 中国

- インド

- オーストラリア

- その他

- その他の地域

- PESTLE分析:その他の地域

- 中東

- ラテンアメリカ

- アフリカ

第13章 競合情勢

- 市場の主要企業

- 市場における主要企業のランキング(2021)

- 市場シェア分析:リモートタワー市場(2021)

- 市場における主要企業の成功機会

- 競合リーダーシップマッピング

- 市場の競合リーダーシップマッピング(スタートアップ)

- 競合ベンチマーキング

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- SAAB AB

- FREQUENTIS GROUP

- THALES GROUP

- INDRA SISTEMAS

- RAYTHEON TECHNOLOGIES CORPORATION

- L3HARRIS TECHNOLOGIES

- NORTHROP GRUMMAN CORPORATION(PARK AIR SYSTEMS LIMITED)

- SEARIDGE TECHNOLOGIES

- LEONARDO S.P.A

- KONGSBERG GRUPPEN

- LEIDOS

- RETIA A.S

- ROHDE & SCHWARZ GMBH & CO.

- DFS DEUTSCHE FLUGSICHERUNG GMBH

- BLACK BOX

- BECKER AVIONICS GMBH

- CS GROUP

- ADACEL

- EIZO CORP.

- ERA

- INSERO AIR TRAFFIC SOLUTIONS

- MOBILE ATC SYSTEMS LTD

- SKYSOFT-ATM

- IBROSS

- ADB SAFEGATE

- その他の企業(サービスプロバイダーと中小企業)

- AVINOR AS

- NATS HOLDING LIMITED

- NUCLEO-AMPER GROUP

- SYSTEMS INTERFACE

- ACAMS AIRPORT TOWER SOLUTIONS

- GUNTERMANN & DRUNCK

- ALTYS TECHNOLOGIES

- SAIPHER ATC

- NAV CANADA

- AQUILA AIR TRAFFIC MANAGEMENT SERVICES

第15章 付録

The global remote towers market is projected to grow from USD 0.3 Billion in 2022 to USD 0.6 Billion by 2027, at a CAGR of 19.6% from 2022 to 2027. Remote towers refer to air traffic control towers that are remotely located, either near or far from airports. They provide Air Traffic Services (ATS) remotely through a real-time visual reproduction of the airport via high-definition cameras. These towers replace an air traffic control operator's direct out-of-the-window view with a live video feed. Remote towers consist of workstations known as Controller Working Positions (CWPs) that can control multiple airports simultaneously or on in a sequence as per a pre-determined schedule. This report also discusses the benefits of digital towers. A digital tower is a larger airport with numerous digital data sources such as surveillance and ATM data, where the opportunity to integrate fruitful data can prove beneficial.

This market report covers various applications and systems related to remote towers that are used in commercial and military airports. Remote towers are evolving rapidly in terms of technology, with the development of new, advanced, and high-speed cameras, remote modules, and communication systems. Increased cost saving, efficiency, and safety fuel the demand for remote towers.

The operational and financial effect of COVID-19 on the aviation industry is unparalleled. Air travel worldwide almost entirely ceased in April 2020, and this negatively impacted the remote towers market as well. Domestic air travel has improved to around 65% of pre-crisis levels, while international air travel is still down roughly 70% due to travel restrictions. Additionally, profiles for traffic recovery vary dramatically by region and country. However, with the revival of COVID-19 variants in some regions, there remains ambiguity over how soon international traffic will recover regardless of the roll out of vaccinations. Business development opportunity of multiple remote tower firms has been severely impacted due to the overall shortage in demand of remote tower systems due to COVID-19 pandemic.

By operation type, the multiple segment is projected to grow at the highest CAGR during the forecast period.

In the simultaneous or a multiple configuration, the module and CWP enable Air traffic Service (ATS) to operate for two or more airports at the same time. In order to operate airport safely and to save build cost, equipment and manpower, major airport operators and Air Navigation Service together are working towards connecting various small airport with low traffic and making centralized to manage.

Based on investment, the expansion & modernization segment is projected to lead the remote towers market during the forecast period. Various European and American airports, including London City Airport (UK), Heathrow Airport (UK), Saarbrucken (Germany), Erfurt (Germany), and Dresden (Germany) are operating through expansion and modernization programs. The key priority of airport operators and air navigation service providers is to centralize 2-3 airports with low and medium air traffic with remote towers infrastructure.

Communication segment would lead based on application, because it is a crucial component for air traffic management. Communication between air traffic controllers and aircraft is in the form of voice and text. Remote towers are equipped with specific systems that process and display communication data. These systems collect and relay communications between control working positions (CWPs) and the aircraft.

Europe to lead the remote tower market in 2022, with the UK, and Sweden accounting for the significant share of the regional market. The growing demand for remote towers in the European region with the development of new and technologically advanced remote towers component such as high resolution cameras and panoramic display and communication systems are the key factors driving the market in Europe.

The break-up of profile of primary participants in the remote towers market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 55%, Europe - 27%, Asia Pacific - 9%, RoW - 9%

Saab (Sweden), Thales Group (France), Frequentis Group (Austria), Indra Sistemas (Spain), and L3Harris Technologies (US) are some of the leading players operating in the remote towers market. These key players offer remote towers technology across the North America, European, Asia Pacific, Middle East & Africa and South America.

Research Coverage:

This report categories remote towers based on end users (military airport and commercial airport), based on application (communication, information & control, flight data handling, surveillance and visualization), based on operation type (single/sequential, multiple/ simultaneous, contingency, supplementary remote tower), based on system type (airport equipment, remote towers module and solutions & software) and based on investment (new installations and modernization & expansion). Also, this report discusses major regions of the world where leading service providers, suppliers and manufacturers of remote towers are located, namely Europe, North America, Europe, Asia Pacific and Rest of the World, along with their key countries. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the remote towers market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; agreements, collaborations, new product launches, contracts, expansion, acquisitions, and partnerships associated with the remote towers market.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall remote towers market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on remote towers offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the remote towers market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the remote towers market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the remote towers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the remote towers market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 REMOTE TOWERS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED FOR THE STUDY

- 1.4 CURRENCY & PRICING

- 1.5 USD EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 LIMITATIONS

- 1.8 MARKET STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.4 DEMAND-SIDE INDICATORS

- 2.1.5 SUPPLY-SIDE ANALYSIS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET DEFINITION & SCOPE

- 2.2.2 EXCLUSIONS

- 2.2.3 SEGMENTS AND SUBSEGMENTS

- 2.2.4 BOTTOM-UP APPROACH

- 2.2.4.1 Regional remote towers market

- 2.2.4.2 Remote towers market, by operation type

- 2.2.5 TOP-DOWN APPROACH

- 2.2.5.1 Remote towers market, by application

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.3.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.4 GROWTH RATE ASSUMPTIONS

- 2.5 ASSUMPTIONS FOR THE RESEARCH STUDY

- 2.6 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 4 BY OPERATION TYPE, MULTIPLE SEGMENT IN EUROPE PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 5 BY INVESTMENT, EXPANSION & MODERNIZATION SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 6 BY APPLICATION, COMMUNICATION SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 EUROPE ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN REMOTE TOWERS MARKET

- FIGURE 8 INCREASED COST-SAVING AND EFFICIENCY & SAFETY DRIVE MARKET GROWTH

- 4.2 REMOTE TOWERS MARKET, BY APPLICATION

- FIGURE 9 BY APPLICATION, COMMUNICATION SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

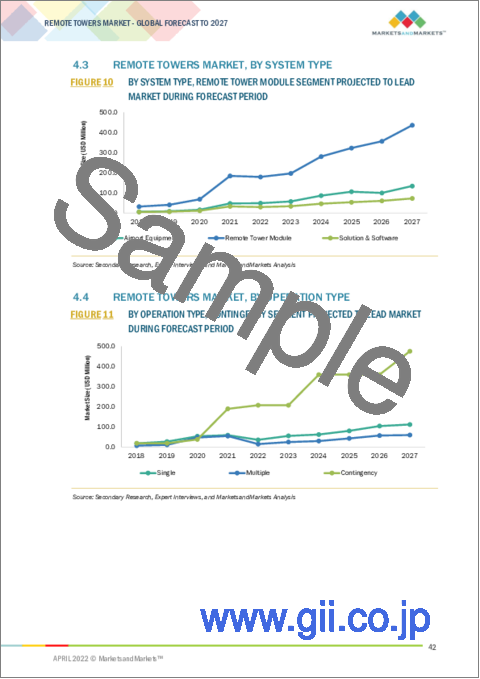

- 4.3 REMOTE TOWERS MARKET, BY SYSTEM TYPE

- FIGURE 10 BY SYSTEM TYPE, REMOTE TOWER MODULE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 REMOTE TOWERS MARKET, BY OPERATION TYPE

- FIGURE 11 BY OPERATION TYPE, CONTINGENCY SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 REMOTE TOWERS MARKET, BY END USER

- FIGURE 12 MILITARY AIRPORT SEGMENT PROJECTED TO WITNESS UPWARD TREND DURING FORECAST PERIOD

- 4.6 REMOTE TOWERS MARKET, BY COUNTRY

- FIGURE 13 CHINA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 MARKET DYNAMICS IN REMOTE TOWERS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increased cost savings

- 5.2.1.2 Enhanced efficiency and safety

- 5.2.1.3 Growth in air passenger traffic fueling demand for new airlines

- FIGURE 15 NEW AIRPORT INVESTMENT, BY REGION, AS OF OCTOBER 2021

- 5.2.1.4 Growing investments across aviation industry

- TABLE 1 ANSP INVESTMENTS FOR REMOTE TOWER PROJECTS WORLDWIDE, 2010-2020

- 5.2.1.5 Improved situational awareness with digital towers for military sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited network infrastructure

- 5.2.2.2 Capacity issues of big airports

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Modernization of current air traffic management infrastructure

- 5.2.3.2 Growth of overall air traffic management industry

- 5.2.3.3 Digitalization in air traffic management

- 5.2.4 CHALLENGES

- 5.2.4.1 Rise in cyber threats to air traffic management

- 5.2.4.2 Risks associated with automation and need for extensive training & familiarity with new remote towers

- 5.3 COVID-19 IMPACT ON REMOTE TOWERS MARKET

- FIGURE 16 COVID-19 IMPACT ON REMOTE TOWERS MARKET

- FIGURE 17 COVID-19 IMPACT ON SUPPLY AND DEMAND SIDES OF REMOTE TOWERS MARKET

- 5.3.1 RANGES AND SCENARIOS

- FIGURE 18 DEPENDING ON HOW UNCERTAINTIES UNFOLD, SPECTRUM OF SCENARIOS FOR REMOTE TOWERS MARKET

- 5.4 SUPPLY CHAIN ANALYSIS OF REMOTE TOWERS MARKET

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- 5.5 REMOTE TOWERS MARKET ECOSYSTEM

- FIGURE 20 MARKET ECOSYSTEM MAP: REMOTE TOWERS MARKET

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR REMOTE TOWERS MARKET PLAYERS

- 5.7 AVERAGE SELLING PRICES OF REMOTE TOWERS AND RELATED PRODUCTS, 2021-2022

- TABLE 2 REMOTE TOWERS MARKET: AVERAGE SELLING PRICES, 2021-2022

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 REMOTE TOWERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 DEGREE OF COMPETITION

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 AIR TRAFFIC CONTROL (ATC) CHARGES

- 5.9.1.1 Safety, Efficiency, & Transparency

- 5.9.1.2 International Campaigns

- 5.9.1.3 Exception Still Exists:

- 5.9.2 REGULATORY LANDSCAPE FOR DEPLOYMENT OF REMOTE AND DIGITAL TOWER TECHNOLOGY

- FIGURE 21 REGULATORY ENVIRONMENT FOR REMOTE VIRTUAL TOWER

- 5.9.1 AIR TRAFFIC CONTROL (ATC) CHARGES

- 5.10 EVENTS AND CONFERENCES IN 2022-2023

- TABLE 4 LIST OF UPCOMING REMOTE TOWER OR AIR TRAFFIC MANAGEMENT EVENTS AND CONFERENCES, 2022-2023

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 5G NETWORK

- 6.2.2 DIGITALIZATION

- 6.2.3 ARTIFICIAL INTELLIGENCE, MACHINE LEARNING, AND QUANTUM COMPUTING

- 6.2.4 STANDARD TERMINAL AUTOMATION REPLACEMENT SYSTEM (STARS)

- 6.2.5 AIRPORT SAFETY NETS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 ADS-B STREAMLINING SURVEILLANCE TECHNOLOGIES

- 6.3.2 AI INNOVATIONS PROVIDE CUTTING-EDGE SOLUTIONS IN AIR TRAFFIC CONTROL

- 6.3.3 AUTOMATION IN ATC

- 6.4 USE CASES

- 6.4.1 AIR TRAFFIC CONTROL THE NETHERLANDS (LVNL)'S AIR TRAFFIC CONTROL INITIATIVE FOR REGIONAL AIRPORTS

- 6.4.2 JERSEY AIRPORT'S DIGITAL AIR TRAFFIC CONTROL TOWER

- 6.4.3 SEARIDGE TECHNOLOGIES' ENHANCED AIRPORT VISION DISPLAY (EAVD)

- 6.4.4 ISAVIA AND FREQUENTIS GROUP PARTNERSHIP

- 6.4.5 CRANFIELD UNIVERSITY AND SAAB PARTNERSHIP

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 INTERNET OF THINGS (IOT)

- TABLE 5 IOT INFRASTRUCTURE FOR REMOTE TOWERS & ATM

- 6.5.2 ENHANCED SITUATIONAL AWARENESS

- 6.6 INNOVATIONS & PATENT REGISTRATIONS

- TABLE 6 INNOVATIONS & PATENT REGISTRATIONS, 2012-2020

7 REMOTE TOWERS MARKET, BY OPERATION TYPE

- 7.1 INTRODUCTION

- FIGURE 22 REMOTE TOWERS MARKET SIZE, BY OPERATION TYPE, 2022-2027 (USD MILLION)

- TABLE 7 REMOTE TOWERS MARKET SIZE, BY OPERATION TYPE, 2018-2021 (USD MILLION)

- TABLE 8 REMOTE TOWERS MARKET SIZE, BY OPERATION TYPE, 2022-2027 (USD MILLION)

- 7.2 SINGLE

- 7.2.1 MEDIUM-SIZE AIRPORTS REQUIRE DEDICATED SINGLE REMOTE TOWERS

- 7.3 MULTIPLE

- 7.3.1 LARGE AND MEDIUM-SIZED AIRPORTS REQUIRE SIMULTANEOUSLY OR SEQUENTIALLY CONTROLLING REMOTE TOWERS

- 7.4 CONTINGENCY

- 7.4.1 EMERGENCY AND BACKUP REMOTE TOWERS

- 7.5 SUPPLEMENTARY REMOTE TOWER

- 7.5.1 PROVIDES EXTRA VIEW FOR NEW RUNWAYS

8 REMOTE TOWERS MARKET, BY SYSTEM TYPE

- 8.1 INTRODUCTION

- FIGURE 23 REMOTE TOWERS MARKET SIZE, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 9 REMOTE TOWERS MARKET SIZE, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 10 REMOTE TOWERS MARKET SIZE, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 8.2 AIRPORT EQUIPMENT

- 8.2.1 HELPS GAIN REAL-TIME AIRPORT VIEW AT REMOTE LOCATION

- 8.2.2 CAMERAS (180/360/PAN)

- 8.2.3 DISPLAY

- 8.2.4 VHF/UHF RADIOS

- 8.2.5 NAVAIDS

- 8.2.6 MET SENSORS

- 8.3 REMOTE TOWER MODULE

- 8.3.1 INCLUDES CONTROL WORKING POSITION AND VISUAL SYSTEMS

- 8.3.2 HEADS-UP DISPLAY (HUD)

- 8.3.3 HEADS-DOWN-DISPLAY (HDD)

- 8.4 SOLUTION & SOFTWARE

- 8.4.1 WIDE AREA NETWORK TO CONNECT REMOTE TOWER MODULES WITH AIRPORT EQUIPMENT

- 8.4.2 WIDE AREA NETWORK (WAN)

- 8.4.2.1 WAN provides a connection between the airport and remote virtual tower to share communication

- 8.4.3 HIGH-SPEED IP NETWORK

- 8.4.3.1 High-speed IP network could be utilized in several fruitful live trials, delivering essential voice

- 8.4.4 DATA GATHERING AND ALERT SYSTEMS

- 8.4.4.1 Capturing & sensing surroundings, collecting data, and alerting control towers

- 8.4.5 INTERFACING AND INTEGRATION

- 8.4.5.1 Integration of individual systems with each other

- 8.4.6 PLATFORM AND SUITS

- 8.4.6.1 Present operational overview interactively

9 REMOTE TOWERS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 24 REMOTE TOWERS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 11 REMOTE TOWERS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 12 REMOTE TOWERS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 COMMUNICATION

- 9.2.1 CONNECTS AIR TRAFFIC AND GROUND-BASED SYSTEMS

- 9.3 INFORMATION & CONTROL

- 9.3.1 DATA PROCESSING AND PROVIDING OUTPUT FOR DECISION MAKING

- 9.4 FLIGHT DATA HANDLING

- 9.4.1 FLIGHT DATA INPUT TO CONTROLLERS AT CWPA

- 9.5 SURVEILLANCE

- 9.5.1 RADARS AND TRANSPONDERS AID WITH DATA FOR SURVEILLANCE

- 9.6 VISUALIZATION

- 9.6.1 DISPLAY SYSTEMS ARE INTEGRAL PART OF REMOTE TOWER SETUP

10 REMOTE TOWERS MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 25 REMOTE TOWERS MARKET SIZE, BY END USER, 2022-2027 (USD MILLION)

- TABLE 13 REMOTE TOWERS MARKET SIZE, BY END USER, 2018-2021 (USD MILLION)

- TABLE 14 REMOTE TOWERS MARKET SIZE, BY END USER, 2022-2027 (USD MILLION)

- 10.2 MILITARY AIRPORT

- 10.3 COMMERCIAL AIRPORT

- 10.3.1 CLASS A (>20 MILLION)

- 10.3.2 CLASS B (10-20 MILLION)

- 10.3.3 CLASS C (1-10 MILLION)

- 10.3.4 CLASS D (<1 MILLION)

11 REMOTE TOWERS MARKET, BY INVESTMENT

- 11.1 INTRODUCTION

- FIGURE 26 REMOTE TOWERS MARKET SIZE, BY INVESTMENT, 2022-2027 (USD MILLION)

- TABLE 15 REMOTE TOWERS MARKET SIZE, BY INVESTMENT, 2018-2021 (USD MILLION)

- TABLE 16 REMOTE TOWERS MARKET SIZE, BY INVESTMENT, 2022-2027 (USD MILLION)

- 11.2 NEW INSTALLATION

- 11.2.1 GROWTH OF PASSENGER AND CARGO TRAFFIC DRIVES NEW INSTALLATION PROJECTS

- 11.3 EXPANSION & MODERNIZATION

- 11.3.1 ARRAY OF ECONOMIC, SOCIAL, AND ENVIRONMENTAL PROFITS ASSOCIATED WITH EXPANSION & MODERNIZATION REDEVELOPMENT PROJECTS TO BOOST MARKET

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- FIGURE 27 REMOTE TOWERS MARKET: REGIONAL SNAPSHOT, 2021

- TABLE 17 GLOBAL REMOTE TOWERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 18 GLOBAL REMOTE TOWERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: REMOTE TOWERS MARKET SNAPSHOT

- 12.2.1 PESTLE ANALYSIS: NORTH AMERICA

- TABLE 19 NORTH AMERICA: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2018-2021 (USD MILLION)

- TABLE 20 NORTH AMERICA: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2022-2027 (USD MILLION)

- TABLE 21 NORTH AMERICA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 22 NORTH AMERICA: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 23 NORTH AMERICA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 24 NORTH AMERICA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 25 NORTH AMERICA: REMOTE TOWERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 26 NORTH AMERICA: REMOTE TOWERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 NextGen program for modernization of existing atm systems drives market

- TABLE 27 US: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 28 US: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 29 US: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 30 US: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 New airport projects drive demand for remote towers

- TABLE 31 CANADA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 32 CANADA: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 33 CANADA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 34 CANADA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 29 EUROPE: REMOTE TOWERS MARKET SNAPSHOT, 2022

- TABLE 35 EUROPE: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2018-2021 (USD MILLION)

- TABLE 36 EUROPE: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2022-2027 (USD MILLION)

- TABLE 37 EUROPE: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 38 EUROPE :REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 39 EUROPE: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 40 EUROPE: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 41 EUROPE: REMOTE TOWERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 42 EUROPE: REMOTE TOWERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Airport modernization efforts boost market for digital towers

- TABLE 43 UK: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 44 UK: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 45 UK: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 46 UK: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Presence of key remote tower system suppliers boosts market

- TABLE 47 FRANCE: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 48 FRANCE :REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 FRANCE: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 50 FRANCE: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3.4 NORWAY

- 12.3.4.1 Demand driven by high demand for regional connectivity

- TABLE 51 NORWAY: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 NORWAY :REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 NORWAY: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 54 NORWAY: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3.5 GERMANY

- 12.3.5.1 Extensive R&D work under SESAR 2020 project to boost market

- TABLE 55 GERMANY: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 56 GERMANY: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 57 GERMANY: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 58 GERMANY: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3.6 SWEDEN

- 12.3.6.1 Continuous efforts of LFV to provide sound ATC drives market

- TABLE 59 SWEDEN: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 60 SWEDEN: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 61 SWEDEN: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 62 SWEDEN: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.3.7 REST OF EUROPE

- 12.3.7.1 Market driven by new remote tower projects

- TABLE 63 REST OF EUROPE: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 64 REST OF EUROPE: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 REST OF EUROPE: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 66 REST OF EUROPE: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: REMOTE TOWERS MARKET SNAPSHOT

- 12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 67 ASIA PACIFIC: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2018-2021 (USD MILLION)

- TABLE 68 ASIA PACIFIC: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2022-2027 (USD MILLION)

- TABLE 69 ASIA PACIFIC: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 70 ASIA PACIFIC :REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 71 ASIA PACIFIC: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 72 ASIA PACIFIC: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.4.2 BY COUNTRY

- TABLE 73 ASIA PACIFIC: REMOTE TOWERS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 74 ASIA PACIFIC: REMOTE TOWERS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Upcoming greenfield airport projects expected to propel market growth

- TABLE 75 CHINA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 76 CHINA: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 77 CHINA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 78 CHINA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Market driver - Government focus on increasing regional connectivity

- TABLE 79 INDIA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 80 INDIA :REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 81 INDIA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 82 INDIA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.4.5 AUSTRALIA

- 12.4.5.1 Airport modernization projects drive market

- TABLE 83 AUSTRALIA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 84 AUSTRALIA: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 85 AUSTRALIA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 86 AUSTRALIA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.6.1 Loss-making regional airports to replace conventional ATC with RT

- TABLE 87 REST OF ASIA PACIFIC: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 91 REST OF THE WORLD: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2018-2021 (USD MILLION)

- TABLE 92 REST OF THE WORLD: REMOTE TOWERS MARKET, BY OPERATION TYPE, 2022-2027 (USD MILLION)

- TABLE 93 REST OF THE WORLD: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 94 REST OF THE WORLD: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 95 REST OF THE WORLD: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 96 REST OF THE WORLD: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- TABLE 97 REST OF THE WORLD: REMOTE TOWERS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 REST OF THE WORLD: REMOTE TOWERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Increasing tourism drives demand to manage increased air traffic and airport modernization

- TABLE 99 MIDDLE EAST: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 100 MIDDLE EAST :REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 101 MIDDLE EAST: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 102 MIDDLE EAST: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.5.3 LATIN AMERICA

- 12.5.3.1 Modernization of airports and tourism traffic boost market

- TABLE 103 LATIN AMERICA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 104 LATIN AMERICA: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 105 LATIN AMERICA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 106 LATIN AMERICA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

- 12.5.4 AFRICA

- 12.5.4.1 Investments in new airport projects drive market

- TABLE 107 AFRICA: REMOTE TOWERS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 108 AFRICA: REMOTE TOWERS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 109 AFRICA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 110 AFRICA: REMOTE TOWERS MARKET, BY SYSTEM TYPE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS IN REMOTE TOWERS MARKET

- FIGURE 31 RANKING OF KEY PLAYERS IN REMOTE TOWERS MARKET, 2021

- 13.3 RANKING OF LEADING PLAYERS IN REMOTE TOWERS MARKET, 2021

- FIGURE 32 REVENUE ANALYSIS OF KEY COMPANIES REMOTE TOWERS MARKET IN LAST 3 YEARS

- 13.4 MARKET SHARE ANALYSIS: REMOTE TOWERS MARKET, 2021

- TABLE 111 REMOTE TOWERS MARKET: DEGREE OF COMPETITION

- 13.5 WINNING IMPERATIVES OF KEY PLAYERS IN REMOTE TOWERS MARKET

- 13.6 COMPETITIVE LEADERSHIP MAPPING

- 13.6.1 STAR

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE

- 13.6.4 PARTICIPANT COMPANIES

- FIGURE 33 REMOTE TOWERS MARKET, COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.7 REMOTE TOWERS MARKET, COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

- FIGURE 34 REMOTE TOWERS MARKET (STARTUPS), COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 112 COMPANY PRODUCT FOOTPRINT

- TABLE 113 COMPANY REGIONAL FOOTPRINT

- TABLE 114 COMPANY PRODUCTS, SERVICES, CONTRACTS FOOTPRINT

- TABLE 115 COMPANY APPLICATION FOOTPRINT

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2022

- TABLE 116 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2022

- 13.9.2 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, 2018-2022

- TABLE 117 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, 2018-2022

- 13.9.3 COLLABORATIONS AND EXPANSIONS, 2018-2022

- TABLE 118 COLLABORATIONS AND EXPANSIONS, 2018-2022

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 SAAB AB

- TABLE 119 SAAB: BUSINESS OVERVIEW

- TABLE 120 SAAB: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 121 SAAB: DEALS

- 14.2.2 FREQUENTIS GROUP

- TABLE 122 FREQUENTIS GROUP: BUSINESS OVERVIEW

- FIGURE 36 FREQUENTIS GROUP: COMPANY SNAPSHOT

- TABLE 123 FREQUENTIS GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 124 FREQUENTIS GROUP: DEALS

- 14.2.3 THALES GROUP

- TABLE 125 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 37 THALES GROUP: COMPANY SNAPSHOT

- TABLE 126 THALES GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 127 THALES GROUP: DEALS

- 14.2.4 INDRA SISTEMAS

- TABLE 128 INDRA SISTEMAS: BUSINESS OVERVIEW

- FIGURE 38 INDRA SISTEMAS: COMPANY SNAPSHOT

- TABLE 129 INDRA SISTEMAS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 130 INDRA SISTEMAS: DEALS

- 14.2.5 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 131 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 132 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 133 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 14.2.6 L3HARRIS TECHNOLOGIES

- TABLE 134 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 40 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 135 L3HARRIS TECHNOLOGIES: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 136 L3HARRIS TECHNOLOGIES: DEALS

- 14.2.7 NORTHROP GRUMMAN CORPORATION (PARK AIR SYSTEMS LIMITED)

- TABLE 137 NORTHROP GRUMMAN CORPORATION (PARK AIR SYSTEMS LIMITED): BUSINESS OVERVIEW

- TABLE 138 NORTHROP GRUMMAN CORPORATION (PARK AIR SYSTEMS LIMITED): PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 139 NORTHROP GRUMMAN CORPORATION (PARK AIR SYSTEMS LIMITED): DEALS

- 14.2.8 SEARIDGE TECHNOLOGIES

- TABLE 140 SEARIDGE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 141 SEARIDGE TECHNOLOGIES: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 142 SEARIDGE TECHNOLOGIES: DEALS

- 14.2.9 LEONARDO S.P.A

- TABLE 143 LEONARDO S.P.A: BUSINESS OVERVIEW

- FIGURE 41 LEONARDO S.P.A: COMPANY SNAPSHOT

- TABLE 144 LEONARDO S.P.A: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 145 LEONARDO S.P.A: PRODUCT LAUNCH

- TABLE 146 LEONARDO S.P.A: DEALS

- 14.2.10 KONGSBERG GRUPPEN

- TABLE 147 KONGSBERG GRUPPEN: BUSINESS OVERVIEW

- FIGURE 42 KONGSBERG GRUPPEN: COMPANY SNAPSHOT

- TABLE 148 KONGSBERG GRUPPEN: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 149 KONGSBERG GRUPPEN: DEALS

- 14.2.11 LEIDOS

- TABLE 150 LEIDOS: BUSINESS OVERVIEW

- FIGURE 43 LEIDOS: COMPANY SNAPSHOT

- TABLE 151 LEIDOS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 152 LEIDOS: PRODUCT LAUNCH

- TABLE 153 LEIDOS: DEALS

- 14.2.12 RETIA A.S

- TABLE 154 RETIA A.S: BUSINESS OVERVIEW

- TABLE 155 RETIA A.S: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 156 RETIA A.S: DEALS

- 14.2.13 ROHDE & SCHWARZ GMBH & CO.

- TABLE 157 ROHDE & SCHWARZ GMBH & CO.: BUSINESS OVERVIEW

- TABLE 158 ROHDE & SCHWARZ GMBH & CO.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 159 ROHDE & SCHWARZ GMBH & CO.: PRODUCT LAUNCH

- TABLE 160 ROHDE & SCHWARZ GMBH & CO.: DEALS

- TABLE 161 ROHDE & SCHWARZ GMBH & CO.: OTHERS

- 14.2.14 DFS DEUTSCHE FLUGSICHERUNG GMBH

- TABLE 162 DFS DEUTSCHE FLUGSICHERUNG GMBH: BUSINESS OVERVIEW

- TABLE 163 DFS DEUTSCHE FLUGSICHERUNG GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 164 DFS DEUTSCHE FLUGSICHERUNG GMBH: DEALS

- TABLE 165 DFS DEUTSCHE FLUGSICHERUNG GMBH: OTHERS

- 14.2.15 BLACK BOX

- TABLE 166 BLACK BOX: BUSINESS OVERVIEW

- TABLE 167 BLACK BOX: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 14.2.16 BECKER AVIONICS GMBH

- TABLE 168 BECKER AVIONICS GMBH: BUSINESS OVERVIEW

- TABLE 169 BECKER AVIONICS GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 170 BECKER AVIONICS GMBH: DEALS

- 14.2.17 CS GROUP

- TABLE 171 CS GROUP: BUSINESS OVERVIEW

- TABLE 172 CS GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 14.2.18 ADACEL

- TABLE 173 ADACEL.: BUSINESS OVERVIEW

- FIGURE 44 ADACEL: COMPANY SNAPSHOT

- TABLE 174 ADACEL: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ADACEL: DEALS

- 14.2.19 EIZO CORP.

- TABLE 176 EIZO CORP.: BUSINESS OVERVIEW

- FIGURE 45 EIZO CORP. COMPANY SNAPSHOT

- TABLE 177 EIZO CORP.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 178 EIZO CORP.: PRODUCT LAUNCH

- TABLE 179 EIZO: OTHERS

- 14.2.20 ERA

- TABLE 180 ERA.: BUSINESS OVERVIEW

- TABLE 181 ERA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ERA.: PRODUCT LAUNCH

- TABLE 183 ERA: DEALS

- 14.2.21 INSERO AIR TRAFFIC SOLUTIONS

- TABLE 184 INSERO AIR TRAFFIC SOLUTIONS: BUSINESS OVERVIEW

- FIGURE 46 INSERO AIR TRAFFIC SOLUTIONS: COMPANY SNAPSHOT

- TABLE 185 INSERO AIR TRAFFIC SOLUTIONS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 186 INSERO AIR TRAFFIC SOLUTIONS: PRODUCT LAUNCH

- TABLE 187 INSERO AIR TRAFFIC SOLUTIONS: DEALS

- 14.2.22 MOBILE ATC SYSTEMS LTD

- TABLE 188 MOBILE ATC SYSTEMS LTD: BUSINESS OVERVIEW

- TABLE 189 MOBILE ATC SYSTEMS LTD: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 14.2.23 SKYSOFT-ATM

- TABLE 190 SKYSOFT-ATM: BUSINESS OVERVIEW

- TABLE 191 SKYSOFT-ATM: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SKYSOFT-ATM: DEALS

- 14.2.24 IBROSS

- TABLE 193 IBROSS: BUSINESS OVERVIEW

- TABLE 194 IBROSS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 14.2.25 ADB SAFEGATE

- TABLE 195 ADB SAFEGATE: BUSINESS OVERVIEW

- TABLE 196 ADB SAFEGATE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- 14.3 OTHER PLAYERS (SERVICES PROVIDERS AND SMES)

- 14.3.1 AVINOR AS

- TABLE 197 AVINOR AS: COMPANY OVERVIEW

- 14.3.2 NATS HOLDING LIMITED

- TABLE 198 NATS HOLDING LIMITED: COMPANY OVERVIEW

- 14.3.3 NUCLEO-AMPER GROUP

- TABLE 199 NUCLEO-AMPER GROUP: COMPANY OVERVIEW

- 14.3.4 SYSTEMS INTERFACE

- TABLE 200 SYSTEMS INTERFACE: COMPANY OVERVIEW

- 14.3.5 ACAMS AIRPORT TOWER SOLUTIONS

- TABLE 201 ACAMS AIRPORT TOWER SOLUTIONS: COMPANY OVERVIEW

- 14.3.6 GUNTERMANN & DRUNCK

- TABLE 202 GUNTERMANN & DRUNCK: COMPANY OVERVIEW

- 14.3.7 ALTYS TECHNOLOGIES

- TABLE 203 ALTYS TECHNOLOGIES: COMPANY OVERVIEWS

- 14.3.8 SAIPHER ATC

- TABLE 204 SAIPHER ATC: COMPANY OVERVIEWS

- 14.3.9 NAV CANADA

- TABLE 205 NAV CANADA: COMPANY OVERVIEWS

- 14.3.10 AQUILA AIR TRAFFIC MANAGEMENT SERVICES

- TABLE 206 AQUILA AIR TRAFFIC MANAGEMENT SERVICES: COMPANY OVERVIEWS

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.1.1 REMOTE TOWERS MARKET (2022-2027)

- 15.1.2 MARKET SEGMENTATION

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS