|

|

市場調査レポート

商品コード

1764343

エッジAIハードウェアの世界市場:デバイス別、消費電力別、プロセッサ別、機能別、業界別、地域別 - 2030年までの予測Edge AI Hardware Market by Device, Processor (CPU, GPU, and ASIC), Function, Power Consumption (Less than 1 W, 1-3 W, >3-5 W, >5-10 W, and More than 10 W), Vertical and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エッジAIハードウェアの世界市場:デバイス別、消費電力別、プロセッサ別、機能別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月04日

発行: MarketsandMarkets

ページ情報: 英文 304 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

エッジAIハードウェアの市場規模は、17.6%のCAGRで拡大し、2025年の261億4,000万米ドルから2030年には589億米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | デバイス別、消費電力別、プロセッサ別、機能別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

エッジAIハードウェア市場は、リアルタイムデータ処理、待ち時間の短縮、プライバシーの強化、帯域幅効率の向上に対する需要により成長しています。半導体技術、IoT、自律走行車、スマートデバイスの進歩もこの成長を後押ししています。しかし、複雑なAIモデルを実行するためにエッジデバイスで利用可能な処理能力、メモリ、エネルギーの不足など、採用には限界があります。このため、精度に悪影響を及ぼす可能性のある徹底的な最適化が必要となります。また、エッジAIハードウェアの採用には、セキュリティの脆弱性、導入コスト、スケーリング、分散型エッジシステムのメンテナンスなど、その周辺にも限界があります。

エッジAIのトレーニング機能は、AIモデルを分散エッジデバイスで直接トレーニングできる連携学習が定着し続けるにつれて、推論機能よりも高いCAGRを記録すると思われます。同時に、データのプライバシーや規制にも対応できます。様々な種類の膨大なデータセットをエッジで生成する産業界では、リアルタイムの学習とローカルな状況への適応に対応するため、常時稼働するデバイスベースのモデル更新の必要性が高まっています。さらに、コンピューティングの進歩の可能性は、災害対応、ヘルスケア、金融、自律システムなどの代表例として、必要な分散型トレーニング戦略の展開をこれまで以上に容易にしています。

スマートフォンは、その膨大な世界ユーザーベースとAI対応機能の普及により、エッジAIハードウェアの市場を独占しています。これらのデバイスは手軽でどこにでもあるものとなり、リアルタイム言語翻訳、顔認識、高度な写真撮影などの機能を提供しています。モバイル5Gテクノロジーはスマートフォンの普及をさらに加速させ、クラウド接続に依存しないシームレスなユーザー体験を提供しながら、より洗練された強力なAIアプリケーションを実行できるようにしました。その結果、デバイス・メーカーはスマートフォンの高度なプロセッシング・ユニットの開発を優先し、世界で最も人気のあるエッジAIデバイスとしての地位を固めています。

アジア太平洋は、予測期間を通じて最大の市場シェアを占めると予想されます。市場の成長は、中国政府からの支援と、新世代人工知能開発計画やメイド・イン・チャイナ2025などの様々な開発計画によって促進されます。ファーウェイやバイドゥといった信頼できる企業も、研究とイノベーションに投資しています。中国における膨大なユーザー基盤は、家電製品の消費と革新における著しい進歩とともに、この成長にも寄与しています。さらに、中国の人口が生成する大量のデータは、エッジAIモデルの訓練と展開に最適な環境を作り出しています。スマート製造、スマートシティ、自律走行車など、さまざまな産業にAIを統合する中国の戦略的アプローチは、この地域におけるエッジAI市場の拡大をさらに支え、加速させると思われます。

当レポートでは、世界のエッジAIハードウェア市場について調査し、デバイス別、消費電力別、プロセッサ別、機能別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 技術分析

- 貿易分析

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- 価格分析

- AIが市場に与える影響

- 2025年の米国関税が市場に与える影響

第6章 エッジAIハードウェア市場(デバイス別)

- イントロダクション

- スマートフォン

- 監視カメラ

- ロボット

- ウェアラブル

- エッジサーバー

- スマートスピーカー

- 自動車システム

- その他

第7章 エッジAIハードウェア市場(消費電力別)

- イントロダクション

- 1W未満

- 1~3 W

- 3~5W

- 5~10W

- 10W以上

第8章 エッジAIハードウェア市場(プロセッサ別)

- イントロダクション

- CPU

- グラフィックプロセッサ

- ASIC

- その他

第9章 エッジAIハードウェア市場(機能別)

- イントロダクション

- トレーニング

- 推論

第10章 エッジAIハードウェア市場(業界別)

- イントロダクション

- 家電

- スマートホーム

- 自動車・輸送

- 政府

- ヘルスケア

- 工業

- 航空宇宙・防衛

- 建設

- その他

第11章 エッジAIハードウェア市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年1月~2025年5月

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- QUALCOMM TECHNOLOGIES, INC.

- HUAWEI TECHNOLOGIES CO., LTD.

- SAMSUNG

- APPLE INC.

- MEDIATEK INC.

- INTEL CORPORATION

- NVIDIA CORPORATION

- IBM

- MICRON TECHNOLOGY, INC.

- ADVANCED MICRO DEVICES, INC.

- META

- TESLA

- MICROSOFT

- その他の企業

- AXELERA AI

- IMAGINATION TECHNOLOGIES

- CAMBRICON

- TENSTORRENT

- BLAIZE

- GENERAL VISION INC.

- MYTHIC

- ZERO ASIC CORPORATION

- APPLIED BRAIN RESEARCH(ABR)

- HORIZON ROBOTICS

- CEVA, INC.

- GRAPHCORE

- SAMBANOVA SYSTEMS, INC.

- HAILO

第14章 付録

List of Tables

- TABLE 1 PARAMETERS INCLUDED AND EXCLUDED

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 LIST OF INDUSTRY EXPERTS

- TABLE 4 ASSUMPTIONS CONSIDERED DURING RESEARCH

- TABLE 5 RISK ASSESSMENT ANALYSIS

- TABLE 6 ROLES OF COMPANIES IN EDGE AI HARDWARE ECOSYSTEM

- TABLE 7 EDGE AI HARDWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL (%)

- TABLE 9 KEY BUYING CRITERIA, BY VERTICAL

- TABLE 10 IMAGIMOB ENHANCED FITNESS TRACKERS WITH MOTION INTELLIGENCE FOR DEEPER ACTIVITY INSIGHTS

- TABLE 11 ANAGOG JEDAI 4.0 ENABLED BANKS TO MONITOR AND PREDICT CUSTOMER LIFESTYLE SHIFTS

- TABLE 12 BYTELAKE DEVELOPED STARTER KIT TO ACCELERATE COMPUTER VISION DEPLOYMENT IN RETAIL

- TABLE 13 BYTELAKE INTEGRATED INTEL'S VPU TO REDUCE LATENCY IN TRAFFIC MONITORING SYSTEMS

- TABLE 14 IMPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 LIST OF MAJOR PATENTS APPLIED/GRANTED, 2020-2024

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EDGE AI HARDWARE MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 PRICING RANGE OF PROCESSORS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 23 PRICING RANGE OF PROCESSORS, 2024 (USD)

- TABLE 24 AVERAGE SELLING PRICE TREND OF GPU, BY REGION, 2021-2024 (USD)

- TABLE 25 AVERAGE SELLING PRICE TREND OF CPU, BY REGION, 2021-2024 (USD)

- TABLE 26 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024 (USD)

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 29 EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 30 EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (USD MILLION)

- TABLE 31 EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (USD MILLION)

- TABLE 32 SMARTPHONES: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 33 SMARTPHONES: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 34 SURVEILLANCE CAMERAS: EDGE AI HARDWARE MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 35 SURVEILLANCE CAMERAS: EDGE AI HARDWARE MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 36 SURVEILLANCE CAMERAS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 37 SURVEILLANCE CAMERAS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

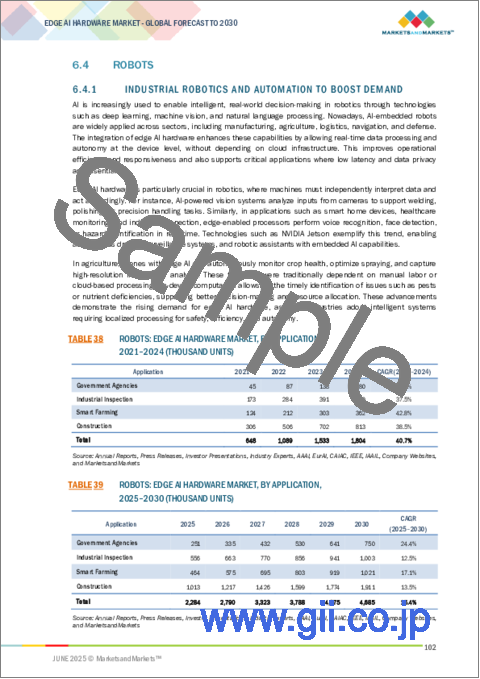

- TABLE 38 ROBOTS: EDGE AI HARDWARE MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 39 ROBOTS: EDGE AI HARDWARE MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 40 ROBOTS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 41 ROBOTS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 42 WEARABLES: EDGE AI HARDWARE MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 43 WEARABLES: EDGE AI HARDWARE MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 44 WEARABLES: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 45 WEARABLES: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 46 EDGE SERVERS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 47 EDGE SERVERS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 48 SMART SPEAKERS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 49 SMART SPEAKERS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 50 AUTOMOTIVE SYSTEMS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 AUTOMOTIVE SYSTEMS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 52 OTHER DEVICES: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 53 OTHER DEVICES: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 54 EDGE AI HARDWARE MARKET, BY POWER CONSUMPTION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 EDGE AI HARDWARE MARKET, BY POWER CONSUMPTION, 2025-2030 (THOUSAND UNITS)

- TABLE 56 EDGE AI HARDWARE MARKET, BY PROCESSOR, 2021-2024 (THOUSAND UNITS)

- TABLE 57 EDGE AI HARDWARE MARKET, BY PROCESSOR, 2025-2030 (THOUSAND UNITS)

- TABLE 58 EDGE AI HARDWARE MARKET, BY FUNCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 59 EDGE AI HARDWARE MARKET, BY FUNCTION, 2025-2030 (THOUSAND UNITS)

- TABLE 60 EDGE AI HARDWARE MARKET, BY VERTICAL, 2021-2024 (THOUSAND UNITS)

- TABLE 61 EDGE AI HARDWARE MARKET, BY VERTICAL, 2025-2030 (THOUSAND UNITS)

- TABLE 62 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 63 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 64 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 65 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 66 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 67 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 68 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 69 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 70 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 71 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 72 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 73 CONSUMER ELECTRONICS: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 74 SMART HOME: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 75 SMART HOMES: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 76 SMART HOME: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 77 SMART HOME: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 78 SMART HOME: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 79 SMART HOME: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 80 SMART HOME: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 81 SMART HOME: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 82 SMART HOME: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 83 SMART HOME: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 84 SMART HOME: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 85 SMART HOME: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 86 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 87 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 88 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 89 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 90 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 91 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 92 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 93 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 94 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 95 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 96 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 97 AUTOMOTIVE & TRANSPORTATION: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 98 GOVERNMENT: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 99 GOVERNMENT: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 100 GOVERNMENT: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 101 GOVERNMENT: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 102 GOVERNMENT: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 103 GOVERNMENT: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 104 GOVERNMENT: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 105 GOVERNMENT: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 106 GOVERNMENT: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 107 GOVERNMENT: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 108 GOVERNMENT: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 109 GOVERNMENT: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 110 HEALTHCARE: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 111 HEALTHCARE: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 112 HEALTHCARE: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 113 HEALTHCARE: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 114 HEALTHCARE: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 115 HEALTHCARE: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 116 HEALTHCARE: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 117 HEALTHCARE: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 118 HEALTHCARE: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 119 HEALTHCARE: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 120 HEALTHCARE: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 121 HEALTHCARE: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 122 INDUSTRIAL: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 123 INDUSTRIAL: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 124 INDUSTRIAL: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 125 INDUSTRIAL: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 126 INDUSTRIAL: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 127 INDUSTRIAL: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 128 INDUSTRIAL: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 129 INDUSTRIAL: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 130 INDUSTRIAL: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 131 INDUSTRIAL: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 132 INDUSTRIAL: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 133 INDUSTRIAL: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 134 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 135 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 136 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 137 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 138 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 139 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 140 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 141 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 142 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 143 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 144 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 145 AEROSPACE & DEFENSE: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 146 CONSTRUCTION: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 147 CONSTRUCTION: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 148 CONSTRUCTION: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 149 CONSTRUCTION: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 150 CONSTRUCTION: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 151 CONSTRUCTION: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 152 CONSTRUCTION: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 153 CONSTRUCTION: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 154 CONSTRUCTION: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 155 CONSTRUCTION: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 156 CONSTRUCTION: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 157 CONSTRUCTION: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 158 OTHER VERTICALS: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 159 OTHER VERTICALS: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 160 OTHER VERTICALS: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 161 OTHER VERTICALS: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 162 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 163 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 164 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 165 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 166 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 167 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 168 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 169 OTHER VERTICALS: EDGE AI HARDWARE MARKET IN ROW, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 170 EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 171 EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 172 NORTH AMERICA: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 173 NORTH AMERICA: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 174 NORTH AMERICA: EDGE AI HARDWARE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 175 NORTH AMERICA: EDGE AI HARDWARE MARKET, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 176 EUROPE: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 177 EUROPE: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 178 EUROPE: EDGE AI HARDWARE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 179 EUROPE: EDGE AI HARDWARE MARKET, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 180 ASIA PACIFIC: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 181 ASIA PACIFIC: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 182 ASIA PACIFIC: EDGE AI HARDWARE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 183 ASIA PACIFIC: EDGE AI HARDWARE MARKET, BY COUNTRY, 2025-2030(THOUSAND UNITS)

- TABLE 184 ROW: EDGE AI HARDWARE MARKET, BY DEVICE, 2021-2024 (THOUSAND UNITS)

- TABLE 185 ROW: EDGE AI HARDWARE MARKET, BY DEVICE, 2025-2030 (THOUSAND UNITS)

- TABLE 186 ROW: EDGE AI HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 187 ROW: EDGE AI HARDWARE MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 188 MIDDLE EAST: EDGE AI HARDWARE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 189 MIDDLE EAST: EDGE AI HARDWARE MARKET, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 190 AFRICA: EDGE AI HARDWARE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 191 AFRICA: EDGE AI HARDWARE MARKET, BY COUNTRY, 2025-2030 (THOUSAND UNITS)

- TABLE 192 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 193 EDGE AI HARDWARE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 194 EDGE AI HARDWARE MARKET: REGION FOOTPRINT

- TABLE 195 EDGE AI HARDWARE MARKET: DEVICE FOOTPRINT

- TABLE 196 EDGE AI HARDWARE MARKET: POWER CONSUMPTION FOOTPRINT

- TABLE 197 EDGE AI HARDWARE MARKET: PROCESSOR FOOTPRINT

- TABLE 198 EDGE AI HARDWARE MARKET: FUNCTION FOOTPRINT

- TABLE 199 EDGE AI HARDWARE MARKET: VERTICAL FOOTPRINT

- TABLE 200 EDGE AI HARDWARE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 201 EDGE AI HARDWARE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 202 EDGE AI HARDWARE MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, JANUARY 2020-MAY 2025

- TABLE 203 EDGE AI HARDWARE MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 204 EDGE AI HARDWARE MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2025

- TABLE 205 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 206 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 208 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 209 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 210 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 212 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 213 HUAWEI TECHNOLOGIES CO., LTD.: OTHER DEVELOPMENTS

- TABLE 214 SAMSUNG: COMPANY OVERVIEW

- TABLE 215 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 217 SAMSUNG ELECTRONICS CO., LTD.: DEALS

- TABLE 218 APPLE INC.: COMPANY OVERVIEW

- TABLE 219 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 APPLE INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 221 APPLE INC.: DEALS

- TABLE 222 MEDIATEK INC.: COMPANY OVERVIEW

- TABLE 223 MEDIATEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 MEDIATEK INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 225 MEDIATEK INC.: DEALS

- TABLE 226 MEDIATEK INC.: OTHER DEVELOPMENTS

- TABLE 227 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 228 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 INTEL CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 230 INTEL CORPORATION: DEALS

- TABLE 231 INTEL CORPORATION: OTHER DEVELOPMENTS

- TABLE 232 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 233 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 NVIDIA CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 235 NVIDIA CORPORATION: DEALS

- TABLE 236 NVIDIA CORPORATION: OTHER DEVELOPMENTS

- TABLE 237 IBM: COMPANY OVERVIEW

- TABLE 238 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 IBM: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 240 IBM: DEALS

- TABLE 241 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 242 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 244 MICRON TECHNOLOGY, INC.: DEALS

- TABLE 245 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 246 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 248 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 249 META: COMPANY OVERVIEW

- TABLE 250 META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 META: DEALS

- TABLE 252 TESLA: COMPANY OVERVIEW

- TABLE 253 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 GOOGLE: COMPANY OVERVIEW

- TABLE 255 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 GOOGLE: PRODUCT LAUNCHES

- TABLE 257 GOOGLE: DEALS

- TABLE 258 MICROSOFT: COMPANY OVERVIEW

- TABLE 259 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 MICROSOFT: DEALS

List of Figures

- FIGURE 1 EDGE AI HARDWARE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EDGE AI HARDWARE MARKET: RESEARCH DESIGN

- FIGURE 3 DATA CAPTURED THROUGH SECONDARY SOURCES

- FIGURE 4 KEY DATA RECEIVED FROM PRIMARY SOURCES

- FIGURE 5 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 PRIMARY BREAKDOWN: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 PRIMARY AND SECONDARY RESEARCH APPROACH

- FIGURE 8 EDGE AI HARDWARE MARKET: BOTTOM-UP APPROACH

- FIGURE 9 EDGE AI HARDWARE MARKET: TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 SMARTPHONES SEGMENT TO DOMINATE EDGE AI HARDWARE MARKET, IN TERMS OF VOLUME, FROM 2025 TO 2030

- FIGURE 12 TRAINING SEGMENT TO RECORD HIGHER CAGR IN EDGE AI HARDWARE MARKET, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- FIGURE 13 CONSUMER ELECTRONICS SEGMENT LED MARKET, IN TERMS OF VOLUME, IN 2024

- FIGURE 14 ASIA PACIFIC CAPTURED PROMINENT MARKET SHARE, IN TERMS OF VOLUME, IN 2024

- FIGURE 15 EMERGENCE OF 5G NETWORKS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 16 SMARTPHONES TO ACCOUNT FOR MAJORITY OF MARKET SHARE, IN TERMS OF VOLUME, IN 2030

- FIGURE 17 CONSUMER ELECTRONICS VERTICAL TO GAIN PROMINENT MARKET SHARE, IN TERMS OF VOLUME, IN 2030

- FIGURE 18 EDGE AI HARDWARE WITH 1-3 WATT POWER CONSUMPTION TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 19 SMARTPHONES SEGMENT AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC MARKET, IN TERMS OF VOLUME, IN 2024

- FIGURE 20 CHINA TO EXHIBIT SECOND-HIGHEST CAGR IN GLOBAL EDGE AI HARDWARE MARKET, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- FIGURE 21 EDGE AI HARDWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 EDGE AI HARDWARE MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 EDGE AI HARDWARE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 EDGE AI HARDWARE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 EDGE AI HARDWARE MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 EDGE AI HARDWARE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 EDGE AI HARDWARE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- FIGURE 31 KEY BUYING CRITERIA, BY VERTICAL

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO FOR STARTUP COMPANIES

- FIGURE 33 IMPORT SCENARIO FOR HS CODE 854231-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 34 EXPORT SCENARIO FOR HS CODE 854231-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 35 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 36 AVERAGE SELLING PRICE TREND OF GPU, BY REGION, 2021-2024

- FIGURE 37 AVERAGE SELLING PRICE TREND OF CPU, BY REGION, 2021-2024

- FIGURE 38 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024

- FIGURE 39 EDGE AI HARDWARE MARKET: IMPACT OF AI

- FIGURE 40 SMARTPHONES TO ACCOUNT FOR LARGEST SHARE OF EDGE AI HARDWARE MARKET, IN TERMS OF VOLUME, IN 2025

- FIGURE 41 MORE THAN 10 W SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 CPU SEGMENT TO HOLD LARGEST SHARE OF EDGE AI HARDWARE MARKET IN 2030

- FIGURE 43 INFERENCE FUNCTION TO HOLD PROMINENT MARKET SHARE IN 2025

- FIGURE 44 CONSUMER ELECTRONICS TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 45 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: EDGE AI HARDWARE MARKET SNAPSHOT

- FIGURE 47 EUROPE: EDGE AI HARDWARE MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: EDGE AI HARDWARE MARKET SNAPSHOT

- FIGURE 49 EDGE AI HARDWARE MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2024

- FIGURE 50 EDGE AI HARDWARE MARKET SHARE ANALYSIS, 2024

- FIGURE 51 VALUATION OF KEY PLAYERS IN EDGE AI HARDWARE MARKET

- FIGURE 52 EV/EBITDA OF KEY PLAYERS

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 EDGE AI HARDWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 EDGE AI HARDWARE MARKET: COMPANY FOOTPRINT

- FIGURE 56 EDGE AI HARDWARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 58 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 60 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 61 MEDIATEK INC.: COMPANY SNAPSHOT

- FIGURE 62 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 IBM: COMPANY SNAPSHOT

- FIGURE 65 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 66 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 67 META: COMPANY SNAPSHOT

- FIGURE 68 TESLA: COMPANY SNAPSHOT

- FIGURE 69 ALPHABET, INC.: COMPANY SNAPSHOT

- FIGURE 70 MICROSOFT: COMPANY SNAPSHOT

The edge AI hardware market is projected to reach USD 58.90 billion by 2030, up from USD 26.14 billion in 2025, at a CAGR of 17.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By device, power consumption, processor, function, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

The edge AI hardware market is growing due to the demand for real-time data processing, reduced latency, enhanced privacy, and better bandwidth efficiency. Advancements in semiconductor technology, IoT, autonomous vehicles, and smart devices also drive this growth. However, the adoption has limitations, including the lack of processing power, memory, and energy available on edge devices to run complex AI models. This requires intense optimization that may negatively impact accuracy. Other limitations to adopting edge AI hardware in the vicinity included security vulnerabilities, deployment costs, scaling, and maintenance in distributed edge systems.

"Training function to record higher CAGR during forecast period"

The training functionality in edge AI will register a higher CAGR than the inference function as federated learning continues to take hold, wherein AI models can be trained on distributed edge devices directly. At the same time, data privacy and regulations can be complied with. With industries producing massive datasets of various types at the edge, there is a growing need for always-on, device-based model updates to accommodate real-time learning and adaptation to local conditions. Furthermore, the potential of computing advances makes deploying necessary, decentralized training strategies ever easier, with disaster response, healthcare, finance, and autonomous systems prime examples.

"Smartphone devices to capture largest market share during forecast period"

Smartphones dominate the market for edge AI hardware due to their vast global user base and the widespread availability of AI-enabled features. These devices have become handy and ubiquitous, offering capabilities such as real-time language translation, facial recognition, and advanced photography-all of which require on-device processing to minimize latency and enhance user privacy. Mobile 5G technology has further accelerated smartphone adoption, enabling devices to run more sophisticated and powerful AI applications while providing a seamless user experience without relying on cloud connectivity. Consequently, device manufacturers prioritize the development of advanced processing units in smartphones, solidifying their status as the most popular edge AI devices in the world.

"China to account for largest market share in Asia Pacific during forecast period"

Asia Pacific is expected to account for the largest market share throughout the forecast period. The market's growth will be fueled by support from the Chinese government and various development plans, such as the New Generation Artificial Intelligence Development Plan and Made in China 2025. Credible companies such as Huawei and Baidu also invest in research and innovation. The vast user base in China, along with significant advancements in the consumption and innovation of consumer electronics, also contributes to this growth. Moreover, the large volumes of data generated by the Chinese population create an excellent environment for training and deploying edge AI models. China's strategic approach to integrating AI into various industries-including smart manufacturing, smart cities, and autonomous vehicles-will further support and accelerate the expansion of the edge AI market in the region.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 18%, Tier 2 - 22%, and Tier 3 - 60%

- By Designation: C-level Executives - 21%, Directors -35%, and Others - 44%

- By Region: North America -45%, Europe - 20%, Asia Pacific- 30%, and RoW - 5%

The report profiles key edge AI hardware market players with their respective market ranking analysis. Prominent players profiled in this report include Qualcomm Technologies, Inc. (US), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), Apple Inc. (US), MediaTek Inc. (Taiwan), Intel Corporation (US), NVIDIA Corporation (US), IBM (US), Micron Technology, Inc. (US), and Advanced Micro Devices, Inc. (US). Meta (US), Tesla (US), Google (US), Microsoft (US), Imagination Technologies (UK), Cambricon (China), Tenstorrent (Canada), Blaize (US), General Vision, Inc (US), Mythic (US), Zero ASIC Corporation (US), Applied Brain Research, Inc. (Canada), Horizon Robotics (China), CEVA Inc. (US), Graphcore (UK), SambaNova Systems, Inc. (US), HAILO (Israel), and Axelera AI (Netherlands) are among a few other key companies in the edge AI hardware market.

Research Coverage:

The report defines, describes, and forecasts the edge AI hardware market based on device, power consumption, processor, function, vertical, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. It also analyzes competitive developments such as product launches, acquisitions, expansions, and actions carried out by the key players to grow in the market.

Reason to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall edge AI hardware market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Need for real-time data processing and reduced cloud dependency), restraints (Complexities associated with network implementation), opportunities (Advancements in edge AI hardware through generative AI workload optimization), and challenges (Shortage of skilled workforce) of the edge AI hardware market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the edge AI hardware market

- Market Development: Comprehensive information about lucrative markets by analyzing the edge AI hardware market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the edge AI hardware market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players in the edge AI hardware market, such as Qualcomm Technologies, Inc. (US), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), Apple Inc. (US), and MediaTek Inc. (Taiwan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.4 BOTTOM-UP APPROACH

- 2.1.4.1 Approach to derive market size using bottom-up approach (Demand-side)

- 2.1.5 TOP-DOWN APPROACH

- 2.1.5.1 Approach to derive market size using top-down analysis (Supply-side)

- 2.1.1 SECONDARY DATA

- 2.2 DATA TRIANGULATION

- 2.3 RESEARCH ASSUMPTIONS

- 2.4 REPORT LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN EDGE AI HARDWARE MARKET

- 4.2 EDGE AI HARDWARE MARKET, BY DEVICE

- 4.3 EDGE AI HARDWARE MARKET, BY VERTICAL

- 4.4 EDGE AI HARDWARE MARKET, BY POWER CONSUMPTION

- 4.5 EDGE AI HARDWARE MARKET IN ASIA PACIFIC, BY DEVICE AND COUNTRY

- 4.6 EDGE AI HARDWARE MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for real-time data processing and reduced cloud dependency

- 5.2.1.2 Development of dedicated AI processing units for edge device applications

- 5.2.1.3 Necessity to optimize data management and reduce cloud infrastructure load

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexities associated with network implementation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in edge AI hardware through generative AI workload optimization

- 5.2.3.2 Development of on-device visual processors for next-generation mobile AI applications

- 5.2.3.3 Growing integration of edge computing across robotics, automotive, and industrial sectors

- 5.2.3.4 Opportunities in ultra-low latency AI applications with 5G-powered edge infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing performance and power consumption in edge AI systems

- 5.2.4.2 Developing cohesive edge AI standards across diverse industry requirements

- 5.2.4.3 Shortage of skilled workforce

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDY ANALYSIS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 IoT

- 5.10.1.2 5G

- 5.10.1.3 Fog computing

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Generative AI

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Blockchain

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854231)

- 5.11.2 EXPORT SCENARIO (HS CODE 854231)

- 5.12 PATENT ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PRICING ANALYSIS

- 5.15.1 PRICING RANGE OF PROCESSORS, BY KEY PLAYER, 2024

- 5.15.2 AVERAGE SELLING PRICE TREND OF PROCESSORS, BY REGION, 2021-2024

- 5.16 AI IMPACT ON MARKET

- 5.17 2025 US TARIFF IMPACT ON MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 MOST-IMPACTED REGIONS/COUNTRIES

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 VERTICAL-LEVEL IMPACT

6 EDGE AI HARDWARE MARKET, BY DEVICE

- 6.1 INTRODUCTION

- 6.2 SMARTPHONES

- 6.2.1 SHIFT TOWARD EDGE COMPUTING IN MOBILE DEVICES TO DRIVE MARKET

- 6.3 SURVEILLANCE CAMERAS

- 6.3.1 ABILITY TO RUN DEEP NEURAL NETWORKS AT HIGH SPEED AND LOW POWER TO FUEL MARKET GROWTH

- 6.4 ROBOTS

- 6.4.1 INDUSTRIAL ROBOTICS AND AUTOMATION TO BOOST DEMAND

- 6.5 WEARABLES

- 6.5.1 RISING FOCUS ON HEALTH MONITORING AND PERSONALIZED WELLNESS TO FOSTER MARKET GROWTH

- 6.6 EDGE SERVERS

- 6.6.1 EXCELLENCE IN ENABLING FASTER DECISION-MAKING AND AUTOMATED ACTIONS TO ACCELERATE ADOPTION

- 6.7 SMART SPEAKERS

- 6.7.1 POTENTIAL TO OPTIMIZE VOICE ASSISTANT PERFORMANCE TO PROPEL MARKET

- 6.8 AUTOMOTIVE SYSTEMS

- 6.8.1 EMPHASIS OF AUTOMAKERS ON ENHANCING IN-VEHICLE INTELLIGENCE TO DRIVE MARKET

- 6.9 OTHER DEVICES

7 EDGE AI HARDWARE MARKET, BY POWER CONSUMPTION

- 7.1 INTRODUCTION

- 7.2 LESS THAN 1 W

- 7.2.1 RISING USE OF WEARABLES CONSUMING LESS THAN 1 W OF ELECTRICITY TO BOOST SEGMENTAL GROWTH

- 7.3 1-3 W

- 7.3.1 INCREASING SMARTPHONE SUBSCRIBERS TO FOSTER SEGMENTAL GROWTH

- 7.4 >3-5 W

- 7.4.1 ABILITY TO DELIVER OPTIMIZED POWER MANAGEMENT FOR SMART SPEAKERS TO BOOST DEMAND

- 7.5 >5-10 W

- 7.5.1 GROWING DEPLOYMENT OF SURVEILLANCE CAMERAS WITH FACE RECOGNITION AND VEHICLE RECOGNITION ABILITY TO DRIVE MARKET

- 7.6 MORE THAN 10 W

- 7.6.1 RISING DEMAND FOR SMART MIRRORS TO FUEL MARKET GROWTH

8 EDGE AI HARDWARE MARKET, BY PROCESSOR

- 8.1 INTRODUCTION

- 8.2 CPU

- 8.2.1 INCREASING DEPLOYMENT IN SMARTPHONES AND SMART SPEAKERS TO FUEL SEGMENTAL GROWTH

- 8.3 GPU

- 8.3.1 POTENTIAL TO ENABLE HIGH-SPEED PARALLEL PROCESSING FOR MODERN APPLICATIONS TO FOSTER SEGMENTAL GROWTH

- 8.4 ASIC

- 8.4.1 ELEVATING USE OF HIGH-SPEED FIXED-FUNCTION ASICS IN VISION PROCESSING TO PROPEL MARKET

- 8.5 OTHER PROCESSORS

9 EDGE AI HARDWARE MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- 9.2 TRAINING

- 9.2.1 MAXIMIZING DATA SECURITY THROUGH ON-DEVICE TRAINING TO DRIVE MARKET

- 9.3 INFERENCE

- 9.3.1 RISING FOCUS ON DEVELOPING LOW-POWER AND HIGH-PERFORMANCE PROCESSORS TO ACCELERATE DEMAND

10 EDGE AI HARDWARE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 EXPANDING USE OF ON-DEVICE AI IN CONSUMER ELECTRONICS TO FUEL MARKET GROWTH

- 10.2.2 SMARTPHONES

- 10.2.2.1 Escalating demand for dedicated AI chipset-enabled smartphones to accelerate market growth

- 10.2.3 WEARABLES

- 10.2.3.1 Rising use of AR/VR technology in gaming applications to support market growth

- 10.2.4 ENTERTAINMENT ROBOTS

- 10.2.4.1 Growing adoption of robotic pets as companions to create opportunities

- 10.3 SMART HOMES

- 10.3.1 ELEVATING DEMAND FOR SMART SPEAKERS TO DRIVE MARKET

- 10.3.2 SMART SPEAKERS

- 10.3.2.1 Ease of use and convenience to increase adoption by elderly and busy people

- 10.3.3 SMART CAMERAS

- 10.3.3.1 Round-the-clock security requirement to surge adoption

- 10.3.4 DOMESTIC ROBOTS

- 10.3.4.1 Ability to manage lawn mowing and floor, pool, and window cleaning activities to spike demand

- 10.4 AUTOMOTIVE & TRANSPORTATION

- 10.4.1 EMERGENCE OF AUTONOMOUS VEHICLES TO FUEL MARKET GROWTH

- 10.4.2 AUTOMOTIVE SYSTEMS

- 10.4.2.1 Strong focus on enhancing safety and automation in modern vehicles to drive market

- 10.4.3 SURVEILLANCE CAMERAS

- 10.4.3.1 Need for advanced vehicle recognition and counting technology to boost deployment

- 10.4.4 LOGISTICS ROBOTS

- 10.4.4.1 Elevating use in courier and cargo handling applications to drive market

- 10.4.5 OTHER AUTOMOTIVE & TRANSPORTATION DEVICES

- 10.5 GOVERNMENT

- 10.5.1 RISING ADOPTION OF ADVANCED TECHNOLOGIES TO ENSURE CITIZEN SECURITY AND SAFETY TO CREATE OPPORTUNITIES

- 10.5.2 SURVEILLANCE CAMERAS

- 10.5.2.1 Increasing use by police and first responders to augment market growth

- 10.5.3 DRONES

- 10.5.3.1 Adoption of AI-powered drones in tracking suspects and investigating accidents to propel market

- 10.6 HEALTHCARE

- 10.6.1 EMERGENCE OF AI-POWERED MEDICAL ROBOTS AND WEARABLES TO OFFER LUCRATIVE OPPORTUNITIES

- 10.6.2 MEDICAL ROBOTS

- 10.6.2.1 Emphasis on minimizing infection risks to patients to boost adoption

- 10.6.3 WEARABLES

- 10.6.3.1 Growing trend of remote patient monitoring to encourage adoption

- 10.6.4 OTHER HEALTHCARE DEVICES

- 10.7 INDUSTRIAL

- 10.7.1 GROWING USE IN QUALITY CONTROL AND MACHINE INSPECTION APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

- 10.7.2 INDUSTRIAL ROBOTS

- 10.7.2.1 Increasing adoption to speed up production, improve productivity, and reduce product cost to drive market

- 10.7.3 DRONES

- 10.7.3.1 Rising use to automate inspection processes, save time, and provide accurate results to support market growth

- 10.7.4 MV CAMERAS

- 10.7.4.1 Potential to minimize production downtime by detecting machinery defects at faster rate to elevate adoption

- 10.8 AEROSPACE & DEFENSE

- 10.8.1 EMERGING DEFENSE TECHNOLOGIES TO ENABLE AUTONOMOUS COMBAT TO BOOST ADOPTION

- 10.8.2 SERVICE ROBOTS

- 10.8.2.1 Rising use in confined space operations to stimulate market growth

- 10.8.3 OTHER AEROSPACE & DEFENSE DEVICES

- 10.9 CONSTRUCTION

- 10.9.1 INCREASING EXECUTION OF DEMOLITION PROJECTS TO SPUR DEMAND

- 10.9.2 SERVICE ROBOTS

- 10.9.2.1 Elevating use across transportation, water, and urban infrastructure development projects to fuel market growth

- 10.9.3 DRONES

- 10.9.3.1 Increasing use in earthwork management, project planning, and surveying applications to support market growth

- 10.10 OTHER VERTICALS

- 10.10.1 SURVEILLANCE CAMERAS

- 10.10.1.1 Growing incidents of robbery and terror threats to create requirement for surveillance cameras

- 10.10.2 PROFESSIONAL SERVICE ROBOTS

- 10.10.2.1 Retail stores, restaurants, amusement parks, and airports to be major end users of professional robots

- 10.10.3 WEARABLES

- 10.10.3.1 Rising use of wearables by enterprises for on-the-job training to propel market growth

- 10.10.4 OTHER DEVICES

- 10.10.4.1 Emergence of virtual dressing rooms in apparel industry to support market growth

- 10.10.5 EDGE SERVERS

- 10.10.5.1 Need to improve efficiency of agricultural operations to generate requirement for edge AI

- 10.10.6 DRONES

- 10.10.6.1 Surging adoption of drones to monitor crops to push market growth

- 10.10.1 SURVEILLANCE CAMERAS

11 EDGE AI HARDWARE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Government-led investments in machine learning solutions to drive market

- 11.2.3 CANADA

- 11.2.3.1 Rising focus of startups on developing AI ecosystem to accelerate demand

- 11.2.4 MEXICO

- 11.2.4.1 Increasing penetration of AL and robotics in manufacturing sector to fuel market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growing adoption of digital solutions in manufacturing plants to fuel market growth

- 11.3.3 UK

- 11.3.3.1 Rising demand for AI-based robots in industrial applications to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Government-led funding in AI-based startups to expedite market growth

- 11.3.5 SPAIN

- 11.3.5.1 Rapid adoption of cloud computing to accelerate demand

- 11.3.6 ITALY

- 11.3.6.1 Growing inclination toward AI adoption and digital transformation to offer lucrative growth opportunities

- 11.3.7 POLAND

- 11.3.7.1 Increasing foreign and domestic investments in cloud and AI infrastructure development to spur demand

- 11.3.8 NORDICS

- 11.3.8.1 Government support to enhance AI capabilities to create lucrative opportunities

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Booming automotive & transportation sector to contribute to market growth

- 11.4.3 JAPAN

- 11.4.3.1 Strong emphasis on manufacturing industrial robots to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Growing emphasis on developing AI infrastructure to drive market

- 11.4.5 INDIA

- 11.4.5.1 Government-led initiatives to boost AI infrastructure to create market growth potential

- 11.4.6 AUSTRALIA

- 11.4.6.1 Government initiatives encouraging AI adoption to support market growth

- 11.4.7 INDONESIA

- 11.4.7.1 Rapid digital transformation and data center expansion to increase demand

- 11.4.8 MALAYSIA

- 11.4.8.1 Government support to strengthen data center capacity to offer lucrative opportunities

- 11.4.9 THAILAND

- 11.4.9.1 Significant focus on AI innovation and setting digital economy to facilitate demand

- 11.4.10 VIETNAM

- 11.4.10.1 Investments in establishing green AI-ready data centers to spike demand

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 High investments in IT security and services to accelerate market growth

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Rapid industrialization and smart city products to drive demand

- 11.5.3.2 Bahrain

- 11.5.3.2.1 Foreign investments in AI innovation to propel market

- 11.5.3.3 Kuwait

- 11.5.3.3.1 Growing demand for AI workloads and cloud services to drive market

- 11.5.3.4 Oman

- 11.5.3.4.1 Significant focus on developing local expertise in chip design and manufacturing to create opportunities

- 11.5.3.5 Qatar

- 11.5.3.5.1 Advancements in AI and graphics processing technologies to propel market

- 11.5.3.6 Saudi Arabia

- 11.5.3.6.1 Growing emphasis on digital transformation and technological innovation to drive market

- 11.5.3.7 UAE

- 11.5.3.7.1 Goal to become a global AI and digital innovation hub to contribute to market growth

- 11.5.3.8 Rest of Middle East

- 11.5.4 AFRICA

- 11.5.4.1 Increasing demand for cloud and AI-driven solutions to drive market

- 11.5.4.2 South Africa

- 11.5.4.2.1 Rapid digital transformation to support market expansion

- 11.5.4.3 Other African countries

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-MAY 2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Device footprint

- 12.7.5.4 Power consumption footprint

- 12.7.5.5 Processor footprint

- 12.7.5.6 Function footprint

- 12.7.5.7 Vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMES

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY COMPANIES

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches/Enhancements

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 HUAWEI TECHNOLOGIES CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches/Enhancements

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 SAMSUNG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches/Enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 APPLE INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches/Enhancements

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 MEDIATEK INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches/Enhancements

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 INTEL CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches/Enhancements

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Other developments

- 13.1.7 NVIDIA CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches/Enhancements

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Other developments

- 13.1.8 IBM

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches/Enhancements

- 13.1.8.3.2 Deals

- 13.1.9 MICRON TECHNOLOGY, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches/Enhancements

- 13.1.9.3.2 Deals

- 13.1.10 ADVANCED MICRO DEVICES, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches/Enhancements

- 13.1.10.3.2 Deals

- 13.1.11 META

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 TESLA

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 GOOGLE

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches/Enhancements

- 13.1.13.3.2 Deals

- 13.1.14 MICROSOFT

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 AXELERA AI

- 13.2.2 IMAGINATION TECHNOLOGIES

- 13.2.3 CAMBRICON

- 13.2.4 TENSTORRENT

- 13.2.5 BLAIZE

- 13.2.6 GENERAL VISION INC.

- 13.2.7 MYTHIC

- 13.2.8 ZERO ASIC CORPORATION

- 13.2.9 APPLIED BRAIN RESEARCH (ABR)

- 13.2.10 HORIZON ROBOTICS

- 13.2.11 CEVA, INC.

- 13.2.12 GRAPHCORE

- 13.2.13 SAMBANOVA SYSTEMS, INC.

- 13.2.14 HAILO

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS