|

|

市場調査レポート

商品コード

1800733

E-バイク市場:使用法別、クラス別、コンポーネント別、駆動システム別、モード別、オーナーシップ別、速度別、バッテリー容量別、バッテリー統合タイプ別、バッテリータイプ別、バッテリー電圧別、モーター出力別、モーター重量別、モータータイプ別、地域別 - 2032年までの予測E-bike Market by Class, Battery, Motor, Mode, Usage, Speed, Battery Capacity, Component, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| E-バイク市場:使用法別、クラス別、コンポーネント別、駆動システム別、モード別、オーナーシップ別、速度別、バッテリー容量別、バッテリー統合タイプ別、バッテリータイプ別、バッテリー電圧別、モーター出力別、モーター重量別、モータータイプ別、地域別 - 2032年までの予測 |

|

出版日: 2025年08月18日

発行: MarketsandMarkets

ページ情報: 英文 536 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

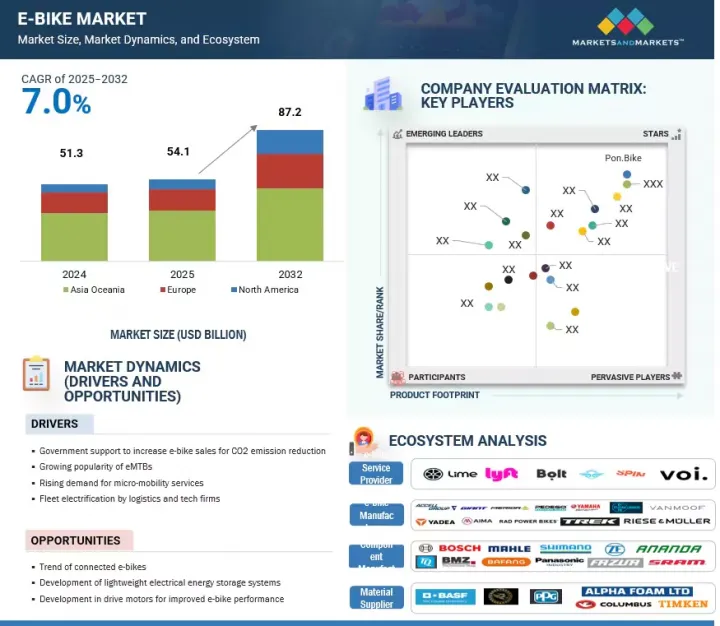

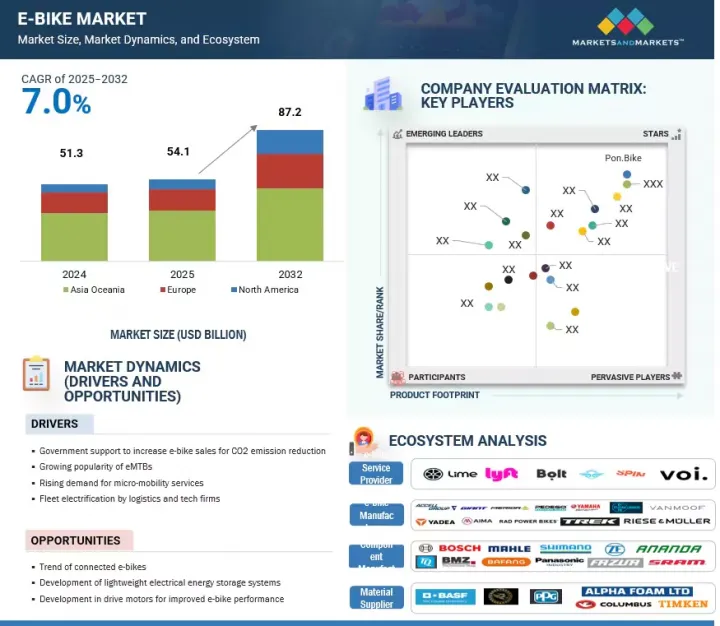

E-バイクの市場規模は、7.0%のCAGRで拡大し、2025年の541億米ドルから2032年には872億米ドルに成長すると予測されています。

市場は、環境意識の高まりとパンデミック時の代替モビリティ需要により、2019年から2021年にかけて力強い成長を示しました。しかし、2023年には、景気減速と在庫調整により、欧州を中心に一部の地域で売上が減少しました。2024年にはアジア・オセアニアと北米を中心に回復が始まり、規制の後押しとインフラの整備が普及を後押ししました。クラスIのE-バイクが引き続き優勢であったが、特に北米では、より高速走行が可能なクラスIIIのモデルが人気を集めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | クラス別、コンポーネント別、駆動システム別、モード別、オーナーシップ別、速度別、バッテリー容量別、バッテリー統合タイプ別、バッテリータイプ別、バッテリー電圧別、モーター出力別、モーター重量別、モータータイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア・オセアニア |

e-MTBとカーゴE-バイクの需要は、オフロード用途と都市部のラストワンマイルデリバリーニーズによって急速に高まっています。強化されたバッテリー技術、ライダー・アシスト機能、通勤者の嗜好の変化が長期的な市場拡大を後押しすると予想されます。

高モータートルクは、特にオフロード、マウンテンバイク、カーゴ用途において、進化するE-バイクを特徴づけるものです。70NMを超えるトルクを持つE-bikeは、過酷な地形や高負荷作業に対して堅牢な性能を提供し、ギアアシストシステムは極端なオフロード条件下で800~1,000N*mのトルク出力に達します。このパワーは、都市物流において最大200kgの荷物を扱う貨物用E-バイクに不可欠であり、安定性と効率性がラストワンマイルの配送に不可欠です。欧州は依然として高トルクE-バイクの最大市場であり、都市物流の成長とプレミアムレクリエーション用途に支えられています。BoschのPerformance Line CXのようなミッドドライブ・モーターの進歩は、ギア増幅で最大85N*mを提供し、ハンドリングとバッテリー性能を維持しながら効率的な電力供給を可能にしています。さらに、Ariel RiderやJuiced Bikesなどのブランドは、85~110N*mのモデルでトルクの閾値をさらに押し上げており、パワー中心のソリューションへと業界がシフトしていることを示しています。しかし、この動向は主に北米と欧州に集中しており、そこではインフラと消費者支出が3,000米ドル以上の価格帯を支えることができます。多くの地域で時速25~32kmの速度制限があるなど、規制上の制約が主流への導入を制限し続けているため、高トルクのE-バイクは世界市場において特殊ではあるが成長しているセグメントとなっています。

シティ/アーバンE-バイクは、使いやすさ、快適さ、日々の都市生活における実用性から、急速に注目と人気を集めています。都市化が進むにつれ、E-バイクやその他の環境に優しい交通手段に対する需要も拡大すると予想されます。シティ/アーバンE-バイクの成長を促す主な要因は、電力消費量が少なく、メンテナンスが簡単で経済的であることです。市街地・都市型E-バイクの価格は1,000米ドルから3,000米ドルで、都市部の住宅所有者が短距離の通勤をするのに適しています。ほとんどの都市型E-バイクは、250W~500Wのハブまたはミッドドライブ・モーターを搭載しており、都市部の平坦な地形で効率的な性能を発揮します。バッテリー容量は一般的に360Whから500Whの間で、1回の充電で40~80kmの実用的な走行距離を実現し、毎日の通勤には十分です。

アジア・オセアニアアジア・オセアニアは、2025年の都市・都市向けE-バイク販売額が最も大きい地域です。交通渋滞のある都市では、超小型モビリティ・サービスにシフトしており、Hellobike(中国)、Anywheel(シンガポール)、Coo Rides(インド)のように、ほとんどのシティ/アーバンバイクが超小型モビリティに利用されています。市街地・都市型E-バイクを製造する著名な参入企業は、Giant Manufacturing Ltd. (台湾), Yadea Group Holdings Ltd.(中国)、 Emotorad(インド)、Trek Bicycle Corporation(米国)などです。市街地用E-バイクの例としては、Rad Power Bikes RadCity 5 Plus、Tenways CGO600 Pro、Giant Escape+E+3、Trek Verve+、Specialized Turbo Vado 4.0などがあります。

ロシア・ウクライナ戦争、世界の景気減速、インフレ、高水準の在庫、個人消費の減少など、いくつかのマクロ経済的・地政学的要因により、2023年と2024年の欧州のEバイク販売は減少しました。この地域最大の市場であるドイツでは、購入者が新しいバイクを購入するよりも既存のバイクを維持することを選んだため、2023年の210万台から2024年には205万台へと約2.4%減少しました。しかし、欧州各地の政府は、補助金、インフラのアップグレード、グリーンモビリティプログラムを通じて、E-バイクの導入を積極的に推進しています。例えば、購入者はE-バイクの購入価格の最大25%、上限1,100米ドルをリベートとして請求できます。さらに、Eurobike 2022で展示された専用レーン、充電ステーション、小型標準充電コネクタなどのインフラ開拓は、市場回復の基盤を強化しています。

2024年には、ドイツ、オーストリア、ベルギーなどの国々におけるE-バイクの販売台数が従来の自転車を上回り、ドイツのE-バイクは自転車販売台数全体の~53%を占める。特に英国では、ラストワンマイル配達用のe-カーゴバイクの台頭も、商業用途の拡大を反映しており、市場の長期的成長を支えています。

当レポートでは、世界のE-バイク市場について調査し、使用法別、クラス別、コンポーネント別、駆動システム別、モード別、オーナーシップ別、速度別、バッテリー容量別、バッテリー統合タイプ別、バッテリータイプ別、バッテリー電圧別、モーター出力別、モーター重量別、モータータイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学、動向、OEM分析、コストの内訳などを含むE-バイク市場の市場概要

- イントロダクション

- 市場力学

- 主要な利害関係者と購入基準

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- 価格分析

- 世界有数のEバイクOEM-生産拠点、生産能力、製品重点

- 貿易分析

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 国別E-バイク販売上位モデルと価格帯

- OEM別E-バイクブランド一覧

- OEM分析:E-バイク部品サプライヤー×モーターパワー

- OEM分析:OEM X提供される製品の息吹

- OEM分析:OEM×モータータイプ

- OEM分析:OEM×バッテリー電圧

- 用途別の走行距離

- 投資と資金調達のシナリオ

- 部品表

- 総所有コスト

- AI/生成AIがE-バイク市場に与える影響

- E-バイクバッテリーのリサイクルプロセス、ポリシー、基準

第6章 E-バイク市場(使用法別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- 山/トレッキング

- シティ/アーバン

- 貨物

- その他

- 主要な洞察

第7章 E-バイク市場(クラス別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- クラスI

- クラスII

- クラスIII

- 主要な洞察

第8章 E-バイク市場(コンポーネント別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- バッテリー

- 電動モーター

- フォーク付きフレーム

- 車輪

- クランクギア

- ブレーキシステム

- モーターコントローラー

- 主要な洞察

第9章 E-バイク市場(駆動システム別)

- 2032年までの市場規模の潜在性と機会評価- 数量(1,000台)

- イントロダクション

- E-バイクのモデルとその駆動システム

- チェーンドライブ

- ベルトドライブ

第10章 E-バイク市場(モード別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- ペダルアシスト

- スロットル

- 主要な洞察

第11章 E-バイク市場(オーナーシップ別)

- 2032年までの市場規模の潜在性と機会評価- 数量(1,000台)

- イントロダクション

- 共有

- 個人

- 主要な洞察

第12章 E-バイク市場(速度別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- 最高時速25キロメートル

- 時速25~45キロ

- 主要な洞察

第13章 E-バイク市場(バッテリー容量別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- 250W未満

- 250W~450W

- 450W~<650W

- 650W以上

第14章 E-バイク市場(バッテリー統合タイプ別)

- 2032年までの市場規模の潜在性と機会評価- 数量(1,000台)

- イントロダクション

- E-バイクのモデルとバッテリー統合の種類

- 統合型

- 外部型

第15章 E-バイク市場(バッテリータイプ別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- リチウムイオン

- リチウムイオンポリマー

- 鉛蓄電池

- その他

- 主要な洞察

第16章 E-バイク市場(バッテリー電圧別)

- 2032年までの市場規模の潜在性と機会評価- 数量(1,000台)

- イントロダクション

- E-バイクのモデルとバッテリー電圧

- 39V未満

- 39V~45V

- 45V~51V

第17章 E-バイク市場(モーター出力(NM)別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- E-バイクモデルとモーター出力(NM)

- 40NM未満

- 40~70NM

- 70NM超

第18章 E-バイク市場(モーター重量別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- 運用データ

- 2kg未満

- 2kg~2.4kg

- 2.4kg超

第19章 E-バイク市場(モーター出力(ワット)別)

- 2032年までの市場規模の潜在性と機会評価- 数量(1,000台)

- イントロダクション

- E-バイクのモデルとそのモーターパワー

- 250W未満

- 251~350W

- 351~500W

- 501~600W

- 600W以上

第20章 E-バイク市場(モータータイプ別)

- 2032年までの市場規模の潜在性と機会評価- 価値と数量(1,000台)

- イントロダクション

- ハブモーター

- ミッドドライブモーター

- 主要な洞察

第21章 E-バイク市場(地域別)

- 国レベルの分析、2032年までの市場規模の潜在性と機会評価、用途別およびクラス別- 金額および数量(千単位)

- イントロダクション

- E-バイク市場:用途別

- E-バイク市場:クラス別

- アジア・オセアニア

- マクロ経済見通し

- アジア・オセアニア:国レベルのE-バイクOEM製造工場

- アジア・オセアニアのE-バイク市場(用途別)

- アジア・オセアニアのE-バイク市場(クラス別)

- 中国

- 日本

- インド

- 韓国

- 台湾

- オーストラリア

- 北米

- マクロ経済見通し

- 北米:国レベルのE-バイクOEM製造工場

- 北米:E-バイク市場(用途別)

- 北米:E-バイク市場(クラス別)

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- 欧州:国レベルのE-バイクOEM製造工場

- 欧州:E-バイク市場(用途別)

- 欧州:E-バイク市場(クラス別)

- ドイツ

- オランダ

- フランス

- 英国

- オーストリア

- イタリア

- ベルギー

- スペイン

- スイス

第22章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2023年5月~2025年3月

- E-バイク市場シェア分析(2024年)

- サプライヤー分析

- 上位上場企業/公開企業の収益分析

- 企業評価マトリックス:E-バイクメーカー、2024年

- 企業評価マトリックス:E-バイク部品サプライヤー、2024年

- スタートアップ/中小企業評価マトリックス:E-バイクメーカー、2024年

- 競合シナリオ

- ブランド比較

- 2025年の企業評価

- 2025年の企業財務指標

第23章 企業プロファイル

- 主要参入企業(E-バイクメーカー)

- GIANT BICYCLES

- ACCELL GROUP N.V.

- YADEA TECHNOLOGY GROUP CO., LTD.

- YAMAHA MOTOR CO., LTD.

- PEDEGO

- PON.BIKE

- AIMA TECHNOLOGY GROUP CO., LTD.

- MERIDA INDUSTRY CO. LTD.

- TREK BICYCLE CORPORATION

- SPECIALIZED BICYCLE COMPONENTS, INC.

- E-バイクコンポーネントサプライヤー

- ROBERT BOSCH GMBH

- SAMSUNG SDI CO. LTD.

- PANASONIC HOLDINGS CORPORATION

- BAFANG ELECTRIC(SUZHOU)CO., LTD.

- BROSE FAHRZEUGTEILE

- SHIMANO INC.

- JOHNSON MATTHEY

- PROMOVEC A/S

- BMZ GROUP

- WUXI TRUCKRUN MOTOR CO., LTD

- ANANDA DRIVE TECHNIQUES(SHANGHAI)CO., LTD.

- MAHLE GMBH

- ZF FRIEDRICHSHAFEN AG

- SRAM LLC

- TQ GROUP

- その他の企業

- HERO LECTRO E-CYCLES

- CUBE

- FUJI-TA BICYCLE CO., LTD.

- ELECTRIC BIKE COMPANY

- RAD POWER BIKES LLC

- VANMOOF

- BH BIKES

- BROMPTON BICYCLE LIMITED

- RIESE & MULLER GMBH

- MYSTROMER AG

- COWBOY

第24章 提言

第25章 付録

List of Tables

- TABLE 1 EBIKE NOMENCLATURE, BY REGION/COUNTRY

- TABLE 2 CURRENCY EXCHANGE RATES, 2021-2024

- TABLE 3 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- TABLE 4 EUROPE: COUNTRY-WISE INCENTIVES/REBATE PROGRAMS TO BOOST EBIKE SALES

- TABLE 5 NORTH AMERICA: COUNTRY-WISE INCENTIVES/REBATE PROGRAMS TO BOOST EBIKE SALES

- TABLE 6 ASIA OCEANIA: COUNTRY-WISE INCENTIVES/REBATE PROGRAMS TO BOOST EBIKE SALES

- TABLE 7 ELECTRIC MOUNTAIN AND CARGO BIKE MODELS AND THEIR TECHNICAL SPECIFICATIONS

- TABLE 8 EBIKE CLASSIFICATION AND REGULATIONS

- TABLE 9 KEY BUYING CRITERIA FOR TOP 3 EBIKE USAGES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 EBIKE USAGES

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE OF EBIKES, BY USAGE AND KEY PLAYERS, 2025

- TABLE 13 AVERAGE SELLING PRICE OF EBIKES, BY REGION, 2021-2025

- TABLE 14 AVERAGE SELLING PRICE OF EBIKES, BY KEY COUNTRY, 2025

- TABLE 15 LEADING GLOBAL E-BIKE OEMS - PRODUCTION FOOTPRINT, CAPACITY, AND PRODUCT FOCUS

- TABLE 16 CHINA: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 17 GERMANY: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 18 NETHERLANDS: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 19 TAIPEI, CHINESE: EXPORT DATA FOR HS CODE 871160: EBIKE EXPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 20 GERMANY: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 21 US: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 22 NETHERLANDS: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 23 FRANCE: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 24 BELGIUM: IMPORT DATA FOR HS CODE 871160: EBIKE IMPORT SHARE, BY COUNTRY, 2020-2024

- TABLE 25 EBIKE MARKET: KEY PATENTS, FEBRUARY 2021-MAY 2025

- TABLE 26 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPEAN UNION: EBIKE REGULATIONS

- TABLE 30 CHINA: EBIKE REGULATIONS

- TABLE 31 INDIA: EBIKE REGULATIONS

- TABLE 32 JAPAN: EBIKE REGULATIONS

- TABLE 33 US: EBIKE REGULATIONS

- TABLE 34 CALIFORNIA: EBIKE REGULATIONS

- TABLE 35 EBIKE MARKET: KEY CONFERENCES AND EVENTS IN 2025-2026

- TABLE 36 US: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 37 CANADA: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 38 GERMANY: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 39 NETHERLANDS: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 40 UK: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 41 JAPAN: TOP EBIKE SUPPLIERS AND THEIR TOP SELLING MODELS VS. PRICE RANGE

- TABLE 42 CHINA: TOP EBIKE SUPPLIERS AND THEIR TOP-SELLING MODELS VS. PRICE RANGE

- TABLE 43 LIST OF EBIKE BRANDS PER OEM

- TABLE 44 FACTORS AFFECTING RANGE OF EBIKES

- TABLE 45 EBIKE: BATTERY VOLTAGE VS. MILES

- TABLE 46 LIST OF FUNDING IN 2022-2024

- TABLE 47 TOTAL COST OF OWNERSHIP OF EBIKES

- TABLE 48 5-YEAR TOTAL COST OF OWNERSHIP OF EBIKES IN INDIA

- TABLE 49 RECENT DEVELOPMENTS

- TABLE 50 POLICIES AND STANDARDS, BY REGION

- TABLE 51 RECENT DEVELOPMENTS (2024-2025)

- TABLE 52 KEY PLAYERS IN EBIKE BATTERY RECYCLING

- TABLE 53 EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 54 EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 55 EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 56 EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 57 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 58 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 59 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 MOUNTAIN/TREKKING EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 CITY/URBAN EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 62 CITY/URBAN EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 63 CITY/URBAN EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CITY/URBAN EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 CARGO EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 66 CARGO EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 67 CARGO EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 CARGO EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 OTHER USAGES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 70 OTHER USAGES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 71 OTHER USAGES: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OTHER USAGES: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 74 EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 75 EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 76 EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 77 CLASS I E-BIKE OEM - PRODUCT LINE, MANUFACTURING FACILITIES & TECHNICAL DETAILS

- TABLE 78 CLASS I EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 79 CLASS I EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 80 CLASS I EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 CLASS I EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 82 CLASS II EBIKE OEM - PRODUCT LINE, MANUFACTURING FACILITIES & TECHNICAL DETAILS

- TABLE 83 CLASS II EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 84 CLASS II EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 85 CLASS II EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 CLASS II EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 CLASS III EBIKE OEM - PRODUCT LINE, MANUFACTURING FACILITIES, AND TECHNICAL DETAILS

- TABLE 88 CLASS III EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 89 CLASS III EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 90 CLASS III EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 CLASS III EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 EBIKE MARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 93 EBIKE MARKET, BY COMPONENT, 2025-2032 (THOUSAND UNITS)

- TABLE 94 EBIKE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 95 EBIKE MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 96 EBIKE BATTERY MANUFACTURERS - PRODUCT OFFERINGS & TECHNICAL SPECIFICATIONS

- TABLE 97 BATTERY: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 98 BATTERY: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 99 BATTERY: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 BATTERY: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 101 EBIKE ELECTRIC MOTOR MANUFACTURERS - PRODUCT OFFERINGS & TECHNICAL SPECIFICATIONS

- TABLE 102 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 103 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 104 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 ELECTRIC MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 EBIKE FRAME WITH FORK MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 107 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 108 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 109 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 FRAME WITH FORK: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 EBIKE WHEEL MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 112 WHEEL: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 113 WHEEL: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 114 WHEEL: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 WHEEL: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 116 EBIKE CRANK GEAR MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 117 CRANK GEAR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 118 CRANK GEAR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 119 CRANK GEAR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 CRANK GEAR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 121 EBIKE BRAKE SYSTEM MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 122 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 123 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 124 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 BRAKE SYSTEM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 126 EBIKE MOTOR CONTROLLER MANUFACTURERS - PRODUCT OFFERINGS & HIGHLIGHTS

- TABLE 127 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 128 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 129 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 MOTOR CONTROLLER: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 131 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND DRIVE SYSTEM

- TABLE 132 EBIKE MARKET, BY DRIVE SYSTEM, 2021-2024 (THOUSAND UNITS)

- TABLE 133 EBIKE MARKET, BY DRIVE SYSTEM, 2025-2032 (THOUSAND UNITS)

- TABLE 134 CHAIN DRIVE: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 135 CHAIN DRIVE: EBIKE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 136 BELT DRIVE: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 137 BELT DRIVE: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 138 EBIKE MARKET, BY MODE, 2021-2024 (THOUSAND UNITS)

- TABLE 139 EBIKE MARKET, BY MODE, 2025-2032 (THOUSAND UNITS)

- TABLE 140 EBIKE MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 141 EBIKE MARKET, BY MODE, 2025-2032 (USD MILLION)

- TABLE 142 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 PEDAL-ASSIST EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 THROTTLE-MODE EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 147 THROTTLE-MODE EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 148 THROTTLE-MODE EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 THROTTLE-MODE EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 150 EBIKE MARKET, BY OWNERSHIP, 2021-2024 (THOUSAND UNITS)

- TABLE 151 EBIKE MARKET, BY OWNERSHIP, 2025-2032 (THOUSAND UNITS)

- TABLE 152 SHARED EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 153 SHARED EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 154 PERSONAL EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 155 PERSONAL EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 156 EBIKE MARKET, BY SPEED, 2021-2024 (THOUSAND UNITS)

- TABLE 157 EBIKE MARKET, BY SPEED, 2025-2032 (THOUSAND UNITS)

- TABLE 158 EBIKE MARKET, BY SPEED, 2021-2024 (USD MILLION)

- TABLE 159 EBIKE MARKET, BY SPEED, 2025-2032 (USD MILLION)

- TABLE 160 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 161 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 162 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 163 UP TO 25 KM/H EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 164 25-45 KM/H EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 165 25-45 KM/H EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 166 25-45 KM/H EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 167 25-45 KM/H EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 168 EBIKE MARKET, BY BATTERY CAPACITY, 2021-2024 (THOUSAND UNITS)

- TABLE 169 EBIKE MARKET, BY BATTERY CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 170 EBIKE MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 171 EBIKE MARKET, BY BATTERY CAPACITY, 2025-2032 (USD MILLION)

- TABLE 172 <250W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 173 <250W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 174 <250W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 175 <250W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 176 >250W-<450W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 177 >250W-<450W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 178 >250W-<450W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 179 >250W-<450W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 180 >450W-<650W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 181 >450W-<650W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 182 >450W-<650W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 183 >450W-<650W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 184 >650W EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 185 >650W EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 186 >650W EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 187 >650W EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 188 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND BATTERY INTEGRATION

- TABLE 189 EBIKE MARKET, BY TYPE OF BATTERY INTEGRATION, 2021-2024 (THOUSAND UNITS)

- TABLE 190 EBIKE MARKET, BY TYPE OF BATTERY INTEGRATION, 2024-2030 (THOUSAND UNITS)

- TABLE 191 INTEGRATED BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 192 INTEGRATED BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 193 EXTERNAL BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 194 EXTERNAL BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 195 EBIKE MARKET, BY BATTERY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 196 EBIKE MARKET, BY BATTERY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 197 EBIKE MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 198 EBIKE MARKET, BY BATTERY TYPE, 2025-2032 (USD MILLION)

- TABLE 199 LITHIUM-ION: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 200 LITHIUM-ION: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 201 LITHIUM-ION: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 LITHIUM-ION: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 204 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 205 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 LITHIUM-ION POLYMER: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 LEAD-ACID: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 208 LEAD-ACID: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 209 LEAD-ACID: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 210 LEAD-ACID: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 212 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 213 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 214 OTHER BATTERY TYPES: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND BATTERY VOLTAGE

- TABLE 216 EBIKE MARKET, BY BATTERY VOLTAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 217 EBIKE MARKET, BY BATTERY VOLTAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 218 LESS THAN 39V BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 219 LESS THAN 39V BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 220 39V TO 45V BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 221 39V TO 45V BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 222 45V TO 51V BATTERIES: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 223 45V TO 51V BATTERIES: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 224 EBIKE MARKET: SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND POWER (NM)

- TABLE 225 TORQUE LEVELS BY EBIKE TYPE & OEM MOTOR OFFERINGS

- TABLE 226 EBIKE MARKET, BY MOTOR POWER, 2021-2024 (THOUSAND UNITS)

- TABLE 227 EBIKE MARKET, BY MOTOR POWER, 2025-2032 (THOUSAND UNITS)

- TABLE 228 EBIKE MARKET, BY MOTOR POWER, 2021-2024 (USD MILLION)

- TABLE 229 EBIKE MARKET, BY MOTOR POWER, 2025-2032 (USD MILLION)

- TABLE 230 <40 NM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 231 <40 NM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 232 <40 NM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 233 <40 NM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 234 >40-<70 NM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 235 >40-<70 NM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 236 >40-<70 NM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 237 >40-<70 NM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 238 >70 NM: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 239 >70 NM: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 240 >70 NM: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 241 >70 NM: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 242 E-BIKE MOTORS, BY COMPANY NAME AND MOTOR WEIGHT (KG)

- TABLE 243 EBIKE MARKET, BY MOTOR WEIGHT, 2021-2024 (THOUSAND UNITS)

- TABLE 244 EBIKE MARKET, BY MOTOR WEIGHT, 2025-2032 (THOUSAND UNITS)

- TABLE 245 EBIKE MARKET, BY MOTOR WEIGHT, 2021-2024 (USD MILLION)

- TABLE 246 EBIKE MARKET, BY MOTOR WEIGHT, 2025-2032 (USD MILLION)

- TABLE 247 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 248 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 249 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 250 < 2 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 251 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 252 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 253 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 254 > 2 KG-< 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 255 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 256 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 257 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 258 > 2.4 KG MOTOR EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 259 EBIKE MARKET SUPPLIER ANALYSIS, BY COMPANY NAME, MODEL, AND MOTOR POWER

- TABLE 260 EBIKE MARKET, BY MOTOR POWER (WATT), 2021-2024 (THOUSAND UNITS)

- TABLE 261 EBIKE MARKET, BY MOTOR POWER (WATT), 2025-2032 (THOUSAND UNITS)

- TABLE 262 <250W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 263 <250W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 264 251-350W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 265 251-350W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 266 351-500W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 267 351-500W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 268 501-600W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 269 501-600W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 270 >600W MOTOR POWER: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 271 >600W MOTOR POWER: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 272 EBIKE MARKET, BY MOTOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 273 EBIKE MARKET, BY MOTOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 274 EBIKE MARKET, BY MOTOR TYPE, 2021-2024 (USD MILLION)

- TABLE 275 EBIKE MARKET, BY MOTOR TYPE, 2025-2032 (USD MILLION)

- TABLE 276 HUB MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 277 HUB MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 278 HUB MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 279 HUB MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 280 MID MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 281 MID MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 282 MID MOTOR: EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 283 MID MOTOR: EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 284 EBIKE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 285 EBIKE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 286 EBIKE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 287 EBIKE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 288 EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 289 EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 290 EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 291 EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 292 EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 293 EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 294 EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 295 EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 296 ASIA OCEANIA: COUNTRY LEVEL EBIKE OEM MANUFACTURING PLANT

- TABLE 297 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 298 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 299 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 300 ASIA OCEANIA: EBIKE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 301 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 302 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 303 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 304 ASIA OCEANIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 305 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 306 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 307 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 308 ASIA OCEANIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 309 CHINA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 310 CHINA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 311 CHINA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 312 CHINA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 313 CHINA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 314 CHINA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 315 CHINA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 316 CHINA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 317 JAPAN: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 318 JAPAN: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 319 JAPAN: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 320 JAPAN: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 321 JAPAN: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 322 JAPAN: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 323 JAPAN: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 324 JAPAN: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 325 INDIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 326 INDIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 327 INDIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 328 INDIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 329 INDIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 330 INDIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 331 INDIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 332 INDIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 333 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 334 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 335 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 336 SOUTH KOREA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 337 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 338 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 339 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 340 SOUTH KOREA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 341 TAIWAN: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 342 TAIWAN: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 343 TAIWAN: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 344 TAIWAN: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 345 TAIWAN: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 346 TAIWAN: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 347 TAIWAN: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 348 TAIWAN: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 349 AUSTRALIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 350 AUSTRALIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 351 AUSTRALIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 352 AUSTRALIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 353 AUSTRALIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 354 AUSTRALIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 355 AUSTRALIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 356 AUSTRALIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 357 NORTH AMERICA: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- TABLE 358 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 359 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 360 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 361 NORTH AMERICA: EBIKE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 362 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 363 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 364 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 365 NORTH AMERICA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 366 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 367 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 368 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 369 NORTH AMERICA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 370 US: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 371 US: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 372 US: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 373 US: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 374 US: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 375 US: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 376 US: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 377 US: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 378 CANADA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 379 CANADA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 380 CANADA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 381 CANADA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 382 CANADA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 383 CANADA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 384 CANADA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 385 CANADA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 386 EUROPE: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- TABLE 387 EUROPE: EBIKE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 388 EUROPE: EBIKE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 389 EUROPE: EBIKE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 390 EUROPE: EBIKE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 391 EUROPE: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 392 EUROPE: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 393 EUROPE: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 394 EUROPE: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 395 EUROPE: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 396 EUROPE: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 397 EUROPE: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 398 EUROPE: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 399 GERMANY: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 400 GERMANY: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 401 GERMANY: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 402 GERMANY: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 403 GERMANY: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 404 GERMANY: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 405 GERMANY: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 406 GERMANY: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 407 NETHERLANDS: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 408 NETHERLANDS: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 409 NETHERLANDS: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 410 NETHERLANDS: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 411 NETHERLANDS: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 412 NETHERLANDS: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 413 NETHERLANDS: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 414 NETHERLANDS: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 415 FRANCE: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 416 FRANCE: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 417 FRANCE: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 418 FRANCE: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 419 FRANCE: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 420 FRANCE: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 421 FRANCE: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 422 FRANCE: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 423 UK: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 424 UK: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 425 UK: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 426 UK: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 427 UK: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 428 UK: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 429 UK: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 430 UK: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 431 AUSTRIA: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 432 AUSTRIA: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 433 AUSTRIA: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 434 AUSTRIA: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 435 AUSTRIA: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 436 AUSTRIA: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 437 AUSTRIA: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 438 AUSTRIA: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 439 ITALY: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 440 ITALY: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 441 ITALY: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 442 ITALY: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 443 ITALY: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 444 ITALY: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 445 ITALY: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 446 ITALY: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 447 BELGIUM: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 448 BELGIUM: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 449 BELGIUM: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 450 BELGIUM: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 451 BELGIUM EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 452 BELGIUM: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 453 BELGIUM: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 454 BELGIUM: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 455 SPAIN: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 456 SPAIN: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 457 SPAIN: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 458 SPAIN: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 459 SPAIN: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 460 SPAIN: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 461 SPAIN: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 462 SPAIN: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 463 SWITZERLAND: EBIKE MARKET, BY USAGE, 2021-2024 (THOUSAND UNITS)

- TABLE 464 SWITZERLAND: EBIKE MARKET, BY USAGE, 2025-2032 (THOUSAND UNITS)

- TABLE 465 SWITZERLAND: EBIKE MARKET, BY USAGE, 2021-2024 (USD MILLION)

- TABLE 466 SWITZERLAND: EBIKE MARKET, BY USAGE, 2025-2032 (USD MILLION)

- TABLE 467 SWITZERLAND: EBIKE MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 468 SWITZERLAND: EBIKE MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 469 SWITZERLAND: EBIKE MARKET, BY CLASS, 2021-2024 (USD MILLION)

- TABLE 470 SWITZERLAND: EBIKE MARKET, BY CLASS, 2025-2032 (USD MILLION)

- TABLE 471 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 472 OEM-LEVEL EBIKE MARKET SHARE ANALYSIS, 2023-2024

- TABLE 473 LIST OF PLAYERS WITH GRAVEL EBIKE PRODUCT OFFERINGS

- TABLE 474 LIST OF PLAYERS WITH KIDS' EBIKE PRODUCT OFFERINGS

- TABLE 475 MOTOR SUPPLIERS TO KEY OEMS

- TABLE 476 INVERTER SUPPLIERS TO KEY OEMS

- TABLE 477 BATTERY AND BATTERY MANAGEMENT SYSTEM SUPPLIERS TO KEY OEMS

- TABLE 478 COMPONENT AS A PACKAGE TO OEMS

- TABLE 479 EBIKE MARKET: SPEED FOOTPRINT, 2024

- TABLE 480 EBIKE MARKET: USAGE FOOTPRINT, 2024

- TABLE 481 EBIKE MARKET: REGION FOOTPRINT, 2024

- TABLE 482 EBIKE COMPONENT SUPPLIERS: MOTOR TYPE FOOTPRINT, 2024

- TABLE 483 EBIKE COMPONENT SUPPLIERS: PRODUCT FOOTPRINT, 2024

- TABLE 484 EBIKE COMPONENT SUPPLIERS: REGION FOOTPRINT, 2024

- TABLE 485 EBIKE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 486 EBIKE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 487 EBIKE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, APRIL 2022-JUNE 2025

- TABLE 488 EBIKE MARKET: DEALS, APRIL 2022-JUNE 2025

- TABLE 489 EBIKE MARKET: EXPANSIONS, APRIL 2022-JULY 2025

- TABLE 490 EBIKE MARKET: OTHER DEVELOPMENTS, AUGUST 2023-MARCH 2025

- TABLE 491 GIANT BICYCLES: PRODUCTS OFFERED

- TABLE 492 GIANT BICYCLES: PRODUCT LAUNCHES

- TABLE 493 GIANT BICYCLES: DEALS

- TABLE 494 GIANT BICYCLES: EXPANSIONS

- TABLE 495 GIANT BICYCLES: OTHER DEVELOPMENTS

- TABLE 496 ACCELL GROUP N.V.: COMPANY OVERVIEW

- TABLE 497 ACCELL GROUP N.V.: PRODUCTS OFFERED

- TABLE 498 ACCELL GROUP N.V.: PRODUCT LAUNCHES

- TABLE 499 ACCELL GROUP N.V.: DEALS

- TABLE 500 ACCELL GROUP N.V.: EXPANSIONS

- TABLE 501 ACCELL GROUP N.V.: OTHER DEVELOPMENTS

- TABLE 502 YADEA TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 503 YADEA TECHNOLOGY GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 504 YADEA TECHNOLOGY GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 505 YADEA TECHNOLOGY GROUP CO., LTD.: EXPANSIONS

- TABLE 506 YAMAHA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 507 YAMAHA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 508 YAMAHA MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 509 YAMAHA MOTOR CO., LTD.: DEALS

- TABLE 510 YAMAHA MOTOR CO., LTD.: EXPANSIONS

- TABLE 511 PEDEGO: COMPANY OVERVIEW

- TABLE 512 PEDEGO: PRODUCTS OFFERED

- TABLE 513 PEDEGO: PRODUCT LAUNCHES

- TABLE 514 PEDEGO: DEALS

- TABLE 515 PEDEGO: EXPANSIONS

- TABLE 516 PON.BIKE: COMPANY OVERVIEW

- TABLE 517 PON.BIKE: PRODUCTS OFFERED

- TABLE 518 PON.BIKE: DEALS

- TABLE 519 PON.BIKE: OTHER DEVELOPMENTS

- TABLE 520 AIMA TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 521 AIMA TECHNOLOGY GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 522 AIMA TECHNOLOGY GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 523 AIMA TECHNOLOGY GROUP CO., LTD.: DEALS

- TABLE 524 MERIDA INDUSTRY CO. LTD.: COMPANY OVERVIEW

- TABLE 525 MERIDA INDUSTRY CO. LTD.: PRODUCTS OFFERED

- TABLE 526 MERIDA INDUSTRY CO. LTD.: PRODUCT LAUNCHES

- TABLE 527 MERIDA INDUSTRY CO. LTD.: DEALS

- TABLE 528 TREK BICYCLE CORPORATION: COMPANY OVERVIEW

- TABLE 529 TREK BICYCLE CORPORATION: PRODUCTS OFFERED

- TABLE 530 TREK BICYCLE CORPORATION: PRODUCT LAUNCHES

- TABLE 531 TREK BICYCLE CORPORATION: DEALS

- TABLE 532 SPECIALIZED BICYCLE COMPONENTS, INC.: COMPANY OVERVIEW

- TABLE 533 SPECIALIZED BICYCLE COMPONENTS, INC.: PRODUCTS OFFERED

- TABLE 534 SPECIALIZED BICYCLE COMPONENTS, INC.: DEALS

- TABLE 535 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 536 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 537 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS/ENHANCEMENTS

- TABLE 538 ROBERT BOSCH GMBH: DEALS

- TABLE 539 SAMSUNG SDI CO. LTD.: COMPANY OVERVIEW

- TABLE 540 SAMSUNG SDI CO. LTD.: PRODUCTS OFFERED

- TABLE 541 SAMSUNG SDI CO. LTD.: PRODUCT LAUNCHES

- TABLE 542 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 543 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 544 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 545 BAFANG ELECTRIC (SUZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 546 BAFANG ELECTRIC (SUZHOU) CO., LTD.: PRODUCTS OFFERED

- TABLE 547 BAFANG ELECTRIC (SUZHOU) CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 548 BAFANG ELECTRIC (SUZHOU) CO., LTD.: DEALS

- TABLE 549 BAFANG ELECTRIC (SUZHOU) CO., LTD.: EXPANSIONS

- TABLE 550 BROSE FAHRZEUGTEILE: COMPANY OVERVIEW

- TABLE 551 BROSE FAHRZEUGTEILE: PRODUCTS OFFERED

- TABLE 552 BROSE FAHRZEUGTEILE: PRODUCT ENHANCEMENTS

- TABLE 553 BROSE FAHRZEUGTEILE: DEALS

- TABLE 554 BROSE FAHRZEUGTEILE: OTHER DEVELOPMENTS

- TABLE 555 SHIMANO INC.: COMPANY OVERVIEW

- TABLE 556 SHIMANO INC.: PRODUCTS OFFERED

- TABLE 557 SHIMANO INC.: PRODUCT LAUNCHES

- TABLE 558 JOHNSON MATTHEY: COMPANY OVERVIEW

- TABLE 559 JOHNSON MATTHEY: PRODUCTS OFFERED

- TABLE 560 JOHNSON MATTHEY: DEALS

- TABLE 561 PROMOVEC A/S: COMPANY OVERVIEW

- TABLE 562 PROMOVEC A/S: PRODUCTS OFFERED

- TABLE 563 PROMOVEC A/S : DEALS

- TABLE 564 BMZ GROUP: COMPANY OVERVIEW

- TABLE 565 BMZ GROUP: PRODUCTS OFFERED

- TABLE 566 BMZ GROUP: DEALS

- TABLE 567 BMZ GROUP: EXPANSIONS

- TABLE 568 WUXI TRUCKRUN MOTOR CO., LTD: COMPANY OVERVIEW

- TABLE 569 WUXI TRUCKRUN MOTOR CO., LTD: PRODUCTS OFFERED

- TABLE 570 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.: COMPANY OVERVIEW

- TABLE 571 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.: PRODUCTS OFFERED

- TABLE 572 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.: PRODUCT LAUNCHES

- TABLE 573 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.: DEALS

- TABLE 574 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.: EXPANSIONS

- TABLE 575 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.: OTHER DEVELOPMENTS

- TABLE 576 MAHLE GMBH: COMPANY OVERVIEW

- TABLE 577 MAHLE GMBH: PRODUCTS OFFERED

- TABLE 578 MAHLE GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 579 MAHLE GMBH: DEALS

- TABLE 580 MAHLE GMBH: OTHER DEVELOPMENTS

- TABLE 581 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 582 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 583 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 584 SRAM LLC: COMPANY OVERVIEW

- TABLE 585 SRAM LLC: PRODUCTS OFFERED

- TABLE 586 SRAM LLC: DEALS

- TABLE 587 TQ GROUP: COMPANY OVERVIEW

- TABLE 588 TQ GROUP: PRODUCTS OFFERED

- TABLE 589 TQ GROUP: PRODUCT LAUNCHES

- TABLE 590 HERO LECTRO E-CYCLES: COMPANY OVERVIEW

- TABLE 591 CUBE: COMPANY OVERVIEW

- TABLE 592 FUJI-TA BICYCLE CO., LTD.: COMPANY OVERVIEW

- TABLE 593 ELECTRIC BIKE COMPANY: COMPANY OVERVIEW

- TABLE 594 RAD POWER BIKES LLC: COMPANY OVERVIEW

- TABLE 595 VANMOOF: COMPANY OVERVIEW

- TABLE 596 BH BIKES: COMPANY OVERVIEW

- TABLE 597 BROMPTON BICYCLE LIMITED: COMPANY OVERVIEW

- TABLE 598 RIESE & MULLER GMBH: COMPANY OVERVIEW

- TABLE 599 MYSTROMER AG: COMPANY OVERVIEW

- TABLE 600 COWBOY: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EBIKE MARKET SEGMENTATION

- FIGURE 2 EBIKE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 EBIKE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY REGION AND CLASS

- FIGURE 7 EBIKE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY REGION AND USAGE

- FIGURE 8 EBIKE MARKET SIZE ESTIMATION: TOP-DOWN APPROACH, BY BATTERY TYPE

- FIGURE 9 EBIKE MARKET SIZE ESTIMATION: TOP-DOWN APPROACH, BY MOTOR TYPE

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 EBIKE MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 12 EBIKE MARKET, BY USAGE, 2025 VS. 2032 (USD MILLION)

- FIGURE 13 INCREASING ADOPTION OF EBIKES FOR DAILY COMMUTE, RECREATION, AND FITNESS ACTIVITIES TO DRIVE MARKET

- FIGURE 14 PEDAL ASSIST MODE TO ACCOUNT FOR DOMINANT MARKET SHARE IN 2025

- FIGURE 15 MID MOTOR SEGMENT TO GROW AT HIGHER CAGR THAN HUB MOTOR SEGMENT DURING FORECAST PERIOD

- FIGURE 16 CLASS I SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 17 CITY/URBAN TO BE LARGEST USAGE SEGMENT BY 2032

- FIGURE 18 LITHIUM-ION SEGMENT TO LEAD EBIKE MARKET DURING FORECAST PERIOD

- FIGURE 19 UP TO 25 KM/H SEGMENT TO DOMINATE EBIKE MARKET IN 2025

- FIGURE 20 PERSONAL SEGMENT TO DOMINATE EBIKE MARKET IN 2025

- FIGURE 21 BATTERY SEGMENT TO LEAD EBIKE MARKET DURING FORECAST PERIOD

- FIGURE 22 >2.4 KG SEGMENT TO DOMINATE EBIKE MARKET IN 2025

- FIGURE 23 > 250W-< 450W SEGMENT TO LEAD EBIKE MARKET DURING FORECAST PERIOD

- FIGURE 24 >40-<70 NM MOTOR POWER SEGMENT TO LEAD EBIKE MARKET DURING FORECAST PERIOD

- FIGURE 25 <250W TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 26 >45 TO <51V BATTERY VOLTAGE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 27 INTEGRATED TO BE DOMINANT BATTERY INTEGRATION SEGMENT DURING FORECAST PERIOD

- FIGURE 28 CHAIN DRIVE TO BE DOMINANT DRIVE SYSTEM DURING FORECAST PERIOD

- FIGURE 29 ASIA OCEANIA TO ACCOUNT FOR LARGEST SHARE OF EBIKE MARKET IN 2025

- FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN EBIKE MARKET

- FIGURE 31 EBIKE CO2 EMISSIONS COMPARED TO OTHER TRANSPORTATION MODES (G/KM), 2025

- FIGURE 32 BATTERY TECHNOLOGY DEVELOPMENT AND ITS IMPACT ON ENVIRONMENT

- FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 EBIKE TYPES

- FIGURE 34 SUPPLY CHAIN ANALYSIS OF EBIKE MARKET

- FIGURE 35 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN EBIKE MARKET

- FIGURE 36 EBIKE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 37 KEY PLAYERS IN ECOSYSTEM

- FIGURE 38 NUMBER OF PATENTS GRANTED FOR EBIKES, JANUARY 2014-JULY 2025

- FIGURE 39 OEM ANALYSIS: EBIKE COMPONENT SUPPLIERS X MOTOR POWER

- FIGURE 40 OEM X BREATH OF THE PRODUCT OFFERED

- FIGURE 41 OEM ANALYSIS: EBIKE OEM X MOTOR TYPE

- FIGURE 42 OEM ANALYSIS: EBIKE OEM X BATTERY VOLTAGE

- FIGURE 43 EMTB: DISTANCE VS. RIDING TIME

- FIGURE 44 EBIKE: DISTANCE VS. SYSTEM WEIGHT

- FIGURE 45 INVESTMENT SCENARIO, 2022-2025

- FIGURE 46 EBIKE MARKET: BILL OF MATERIALS

- FIGURE 47 EBIKE MARKET: COST BREAKDOWN

- FIGURE 48 EBIKE MARKET, BY USAGE, 2025 VS. 2032 (USD MILLION)

- FIGURE 49 MOUNTAIN/TREKKING EBIKE MARKET INSIGHTS

- FIGURE 50 CITY/URBAN EBIKE MARKET INSIGHTS

- FIGURE 51 CARGO EBIKE MARKET INSIGHTS

- FIGURE 52 OTHER EBIKE USAGES MARKET INSIGHTS

- FIGURE 53 EBIKE MARKET, BY CLASS, 2025 VS. 2032 (USD MILLION)

- FIGURE 54 EBIKE MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION)

- FIGURE 55 EBIKE MARKET, BY DRIVE SYSTEM, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 56 PRIMARY INSIGHTS

- FIGURE 57 EBIKE MARKET, BY MODE, 2025 VS. 2032 (USD MILLION)

- FIGURE 58 EBIKE MARKET, BY OWNERSHIP, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 59 EBIKE MARKET, BY SPEED, 2025 VS. 2032 (USD MILLION)

- FIGURE 60 EBIKE MARKET, BY BATTERY CAPACITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 61 <250W EBIKE MARKET INSIGHTS

- FIGURE 62 >250W-<450W EBIKE MARKET INSIGHTS

- FIGURE 63 >450W-<650W EBIKE MARKET INSIGHTS

- FIGURE 64 >650W EBIKE MARKET INSIGHTS

- FIGURE 65 EBIKE MARKET, BY BATTERY INTEGRATION, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 66 PRIMARY INSIGHTS

- FIGURE 67 EBIKE MARKET, BY BATTERY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 68 EBIKE MARKET, BY BATTERY VOLTAGE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 69 LESS THAN 39V BATTERIES: EBIKE MARKET INSIGHTS

- FIGURE 70 39V TO 45V BATTERIES: EBIKE MARKET INSIGHTS

- FIGURE 71 45V TO 51V BATTERIES: EBIKE MARKET INSIGHTS

- FIGURE 72 PRIMARY INSIGHTS

- FIGURE 73 EBIKE MARKET, BY MOTOR POWER, 2025 VS. 2032 (USD MILLION)

- FIGURE 74 PRIMARY INSIGHTS

- FIGURE 75 EBIKE MARKET, BY MOTOR WEIGHT, 2025 VS. 2032 (USD MILLION)

- FIGURE 76 PRIMARY INSIGHTS

- FIGURE 77 EBIKE MARKET, BY MOTOR POWER (WATT), 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 78 <250W MOTOR POWER: EBIKE MARKET INSIGHTS

- FIGURE 79 251-350W MOTOR POWER: EBIKE MARKET INSIGHTS

- FIGURE 80 351-500W MOTOR POWER: EBIKE MARKET INSIGHTS

- FIGURE 81 501-600W MOTOR POWER: EBIKE MARKET INSIGHTS

- FIGURE 82 >600W MOTOR POWER: EBIKE MARKET INSIGHTS

- FIGURE 83 PRIMARY INSIGHTS

- FIGURE 84 EBIKE MARKET, BY MOTOR TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 85 EBIKE MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 86 ASIA OCEANIA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 87 ASIA OCEANIA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 88 ASIA OCEANIA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 89 ASIA OCEANIA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 90 ASIA OCEANIA: EBIKE MARKET SNAPSHOT

- FIGURE 91 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 92 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 93 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 94 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 95 NORTH AMERICA: EBIKE MARKET SNAPSHOT

- FIGURE 96 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 97 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 98 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 99 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 100 EUROPE: EBIKE MARKET SNAPSHOT

- FIGURE 101 EBIKE MARKET SHARE ANALYSIS, 2024

- FIGURE 102 NORTH AMERICA: EBIKE MARKET SHARE ANALYSIS, 2024

- FIGURE 103 EUROPE: EBIKE MARKET SHARE ANALYSIS, 2024

- FIGURE 104 ASIA OCEANIA: EBIKE MARKET SHARE ANALYSIS, 2024

- FIGURE 105 EBIKE DISPLAY MARKET SHARE ANALYSIS, 2024

- FIGURE 106 EBIKE BATTERY MARKET SHARE ANALYSIS, 2024

- FIGURE 107 EBIKE DRIVE UNIT MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2023-2024

- FIGURE 108 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2024

- FIGURE 109 COMPANY EVALUATION MATRIX (EBIKE MANUFACTURERS), 2024

- FIGURE 110 EBIKE MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 111 COMPANY EVALUATION MATRIX (EBIKE COMPONENT SUPPLIERS), 2024

- FIGURE 112 EBIKE MARKET: COMPANY FOOTPRINT (EBIKE COMPONENT SUPPLIERS), 2024

- FIGURE 113 EBIKE MARKET: STARTUP/SME EVALUATION MATRIX, 2024

- FIGURE 114 BRAND COMPARISON

- FIGURE 115 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 116 COMPANY FINANCIAL METRICS, 2025 (USD BILLION)

- FIGURE 117 GIANT BICYCLES: COMPANY SNAPSHOT

- FIGURE 118 ACCELL GROUP N.V.: COMPANY SNAPSHOT

- FIGURE 119 YADEA TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 120 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 121 AIMA TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 122 MERIDA INDUSTRY CO. LTD.: COMPANY SNAPSHOT

- FIGURE 123 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 124 SAMSUNG SDI CO. LTD.: COMPANY SNAPSHOT

- FIGURE 125 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 126 SHIMANO INC.: COMPANY SNAPSHOT

- FIGURE 127 JOHNSON MATTHEY: COMPANY SNAPSHOT

- FIGURE 128 MAHLE GMBH: COMPANY SNAPSHOT

- FIGURE 129 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

The e-bike market is projected to grow from USD 54.1 billion in 2025 to USD 87.2 billion by 2032 at a CAGR of 7.0%. The market witnessed strong growth between 2019 and 2021 due to increased environmental awareness and demand for alternative mobility during the pandemic. However, 2023 saw a decline in sales across some regions, particularly Europe, due to economic slowdowns and inventory corrections. Recovery began in 2024, led by Asia Oceania and North America, where supportive regulations and improved infrastructure fueled adoption. Class-I e-bikes continued to dominate, but Class-III models were gaining traction, especially in North America, due to their higher speed capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | Class, Battery, Motor, Mode, Usage, Speed, Battery Capacity, Component, and Region |

| Regions covered | North America, Europe, Asia Oceania |

The demand for e-MTBs and cargo e-bikes is rising rapidly, driven by off-road applications and urban last-mile delivery needs. Enhanced battery technology, rider assist features, and shifting commuter preferences are expected to support long-term market expansion.

">70 NM motor-powered e-bikes are projected to be the fastest-growing segment over the forecast period."

High motor torque is a defining feature in the evolving e-bike landscape, particularly for off-road, mountain biking, and cargo applications. E-bikes with >70 NM torque offer robust performance for demanding terrains and heavy-duty tasks, with gear-assisted systems reaching torque outputs of 800-1,000 N*m in extreme off-road conditions. This power is essential in urban logistics for cargo e-bikes handling loads of up to 200 kg, where stability and efficiency are critical for last-mile delivery. Europe remains the largest market for high-torque e-bikes, supported by urban logistics growth and premium recreational use. Advancements in mid-drive motors, like Bosch's Performance Line CX offering up to 85 N*m with gear amplification, have enabled efficient power delivery while maintaining handling and battery performance. Additionally, brands such as Ariel Rider and Juiced Bikes are pushing torque thresholds further with 85-110 N*m models, signaling an industry shift toward power-centric solutions. However, this trend is mainly concentrated in North America and Europe, where infrastructure and consumer spending can support the USD 3,000+ price range. Regulatory constraints, such as 25-32 km/h speed limits in many regions, continue to restrict mainstream adoption, making high-torque e-bikes a specialized but growing segment in the global market.

"City/urban bikes are projected to be the largest segment during the forecast period."

City or urban e-bikes have quickly gained attention and popularity due to their ease of use, comfort, and practicality for daily city life. As urbanization increases, the demand for e-bikes and other eco-friendly forms of transport is also expected to grow. The main factor driving the growth of city/urban e-bikes is their low electricity consumption, and they are easy to maintain, making them economical. City/urban e-bikes are priced between USD 1,000 and USD 3,000, and they are more suitable for city homeowners for short-distance commutes. Most urban e-bikes are equipped with 250W to 500W hub or mid-drive motors, providing efficient performance across flat urban terrain. Battery capacities generally range between 360Wh and 500Wh, delivering practical ranges of 40-80 km per charge, sufficient for daily commutes.

Asia Oceania is the region with the most significant city/urban e-bike sales in terms of value in 2025. Cities with traffic congestion are shifting towards micro-mobility services, and most city/urban bikes are used for micro-mobility, like Hellobike (China), Anywheel (Singapore), and Coo Rides (India). Prominent players who manufacture city/urban e-bikes are Giant Manufacturing Ltd. (Taiwan), Yadea Group Holdings Ltd. (China), Emotorad (India), and Trek Bicycle Corporation (US). Examples of city/urban e-bikes include Rad Power Bikes RadCity 5 Plus, Tenways CGO600 Pro, Giant Escape+ E+ 3, Trek Verve+, and Specialized Turbo Vado 4.0.

"Europe is estimated to be the second-largest e-bike market in 2025 due to the rising demand for e-bikes."

E-bike sales in Europe declined in 2023 and 2024 due to several macroeconomic and geopolitical factors, including the Russia-Ukraine war, global economic slowdown, inflation, high inventory levels, and reduced consumer spending. Germany, the region's largest market, saw a decline from 2.1 million units in 2023 to 2.05 million in 2024, a ~2.4% drop, as buyers opted to maintain existing bikes rather than purchase new ones. However, governments across Europe are actively promoting e-bike adoption through subsidies, infrastructure upgrades, and green mobility programs. For example, buyers can claim up to 25% of an e-bike's purchase price, with a rebate cap of USD 1,100. Additionally, infrastructure development such as dedicated lanes, charging stations, and compact standardized charging connectors showcased at Eurobike 2022 is reinforcing the market foundation for a rebound.

In 2024, e-bike sales in countries like Germany, Austria, and Belgium surpassed traditional bicycles, with Germany's e-bikes accounting for ~53% of total bike sales. The rise of e-cargo bikes for last-mile delivery, particularly in the UK, also reflects a growing commercial application, supporting the market's long-term growth.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

Here's the breakdown of the interviews conducted:

- By Company Type: OEM - 80%, Tier I - 20%

- By Designation: D Level - 30%, C Level - 60%, and Others - 10%

- By Region: North America - 10%, Europe - 60%, Asia Oceania - 30%,

The key players in the e-bike market are Giant Manufacturing Co., Ltd. (Taiwan), Yamaha Motor Company (Japan), Accell Group NV (Netherlands), Yadea Group Holdings, Ltd. (China), and Pedego (US). Major companies' key strategies to maintain their position in the global e-bike market are strong global networking, mergers and acquisitions, partnerships, and technological advancements.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the e-bike market and the sub-segments. The report discusses ups and downs in e-bike sales, allowing component suppliers to plan their strategies. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities. It will help in understanding the drive unit supplier market share, e-bike display system market share by key suppliers, and OEM analysis.

The report further provides insights into the following points:

- Market Dynamics: Analysis of key drivers (government support to increase e-bike sales to reduce CO2 emissions, growing popularity of e-MTBs, rising demand for micro-mobility services), restraints (high stagnant inventory of e-bikes, government regulations, and lack of infrastructure, e-bike conversion kits), opportunities (trend toward connected e-bikes, development of lightweight electrical energy storage systems, development in drive motors for increased e-bike performance), and challenges (challenges in importing to EU and US from China, high cost of e-bikes) influencing the growth of the e-Bike market

- Product Development/Innovation: Detailed insights on upcoming technologies and product & service launches in the e-bike market

- Market Development: Comprehensive market information (the report analyses the authentication and brand protection market across varied regions)

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the e-bike market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Pon. Bike (Netherlands), Accell Group N.V. (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings, Ltd. (China), and Merida Bicycle (Taiwan) in the e-bike market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for eBike sales/market sizing

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH: BY REGION, CLASS, AND USAGE

- 2.2.2 TOP-DOWN APPROACH: BY BATTERY TYPE AND MOTOR TYPE

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EBIKE MARKET

- 4.2 EBIKE MARKET, BY MODE

- 4.3 EBIKE MARKET, BY MOTOR TYPE

- 4.4 EBIKE MARKET, BY CLASS

- 4.5 EBIKE MARKET, BY USAGE

- 4.6 EBIKE MARKET, BY BATTERY TYPE

- 4.7 EBIKE MARKET, BY SPEED

- 4.8 EBIKE MARKET, BY OWNERSHIP

- 4.9 EBIKE MARKET, BY COMPONENT

- 4.10 EBIKE MARKET, BY MOTOR WEIGHT

- 4.11 EBIKE MARKET, BY BATTERY CAPACITY

- 4.12 EBIKE MARKET, BY MOTOR POWER

- 4.13 EBIKE MARKET, BY MOTOR POWER (WATT)

- 4.14 EBIKE MARKET, BY BATTERY VOLTAGE

- 4.15 EBIKE MARKET, BY BATTERY INTEGRATION

- 4.16 EBIKE MARKET, BY DRIVE SYSTEM

- 4.17 EBIKE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 Market overview of eBike market with market dynamics, trends, OEM Analysis, Cost Breakdown, and others

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government support to increase eBike sales for CO2 emission reduction

- 5.2.1.1.1 Europe

- 5.2.1.1.2 North America

- 5.2.1.1.3 Asia Oceania

- 5.2.1.2 Growing popularity of electric mountain and cargo bikes

- 5.2.1.2.1 Electric mountain and cargo bike models and their technical specifications

- 5.2.1.3 Growth of micro mobility services and Mobility-as-a-Service (MaaS)

- 5.2.1.1 Government support to increase eBike sales for CO2 emission reduction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited charging infrastructure for eBikes

- 5.2.2.2 Varied government regulations and lack of proper infrastructure

- 5.2.2.3 eBike conversion kits

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Trend of connected eBikes

- 5.2.3.2 Development of lightweight electrical energy storage systems

- 5.2.3.3 Developments in drive motors for improved performance of eBikes

- 5.2.4 CHALLENGES

- 5.2.4.1 High price of eBikes

- 5.2.4.2 Challenges in importing to European Union and US from China

- 5.2.4.2.1 China to European Union: Import requirements

- 5.2.4.2.2 China to US: Import requirements

- 5.2.1 DRIVERS

- 5.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.1 FOOD DELIVERY

- 5.3.2 POSTAL SERVICES

- 5.3.3 MUNICIPAL SERVICES

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 All-wheel drive

- 5.7.1.2 Motor drive

- 5.7.1.3 Battery technology

- 5.7.1.4 Electric mountain bikes

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Swappable batteries

- 5.7.2.2 Integration of intelligent features

- 5.7.2.3 Folding eBikes for urban mobility

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Aftermarket eBike kit

- 5.7.3.2 Subscription and sharing services

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 BY OEM AND TYPE, 2025

- 5.8.2 BY REGION

- 5.8.3 BY KEY COUNTRY

- 5.9 LEADING GLOBAL E-BIKE OEMS - PRODUCTION FOOTPRINT, CAPACITY, AND PRODUCT FOCUS

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORTS

- 5.10.1.1 China

- 5.10.1.2 Germany

- 5.10.1.3 Netherlands

- 5.10.1.4 Taipei, Chinese

- 5.10.2 IMPORTS

- 5.10.2.1 Germany

- 5.10.2.2 US

- 5.10.2.3 Netherlands

- 5.10.2.4 France

- 5.10.2.5 Belgium

- 5.10.1 EXPORTS

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY ANALYSIS OF EBIKE MARKET, BY REGION/COUNTRY

- 5.12.2.1 European Union

- 5.12.2.2 China

- 5.12.2.3 India

- 5.12.2.4 Japan

- 5.12.2.5 US

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 COMODULE CONNECTIVITY: THEFT-PROOF URBAN ARROW CARGO EBIKES

- 5.14.2 NYE SOLUTION: REQUIREMENT OF LUBRICANTS FOR ROTARY MOTOR GEAR OF EBIKES

- 5.14.3 COMODULE: LAUNCH OF IOT INTEGRATIONS FOR SHIMANO DRIVETRAINS

- 5.14.4 BINOVA DRIVE UNIT: CONTACTLESS TORQUE SENSORS

- 5.14.5 MAHLE GROUP: NEW GENERATION OF DRIVE SYSTEM FOR EBIKES

- 5.14.6 REVONTE ONE DRIVE SYSTEM: DEVELOPMENT OF NEW DRIVE SYSTEM FOR EBIKES WITH AUTOMATIC TRANSMISSION

- 5.15 TOP-SELLING EBIKE MODELS VS. PRICE RANGE BY COUNTRY

- 5.15.1 US

- 5.15.2 CANADA

- 5.15.3 GERMANY

- 5.15.4 NETHERLANDS

- 5.15.5 UK

- 5.15.6 JAPAN

- 5.15.7 CHINA

- 5.16 LIST OF EBIKE BRANDS PER OEM

- 5.17 OEM ANALYSIS: EBIKE COMPONENT SUPPLIERS X MOTOR POWER

- 5.17.1 EBIKE MOTOR SUPPLIERS VS MOTOR POWER

- 5.18 OEM ANALYSIS: OEM X BREATH OF THE PRODUCT OFFERED

- 5.18.1 OEM X BREATH OF THE PRODUCT OFFERED

- 5.19 OEM ANALYSIS: OEM X MOTOR TYPE

- 5.19.1 EBIKE OEM VS MOTOR TYPE

- 5.20 OEM ANALYSIS: OEM X BATTERY VOLTAGE

- 5.20.1 EBIKE OEM VS BATTERY VOLTAGE

- 5.21 DISTANCE DRIVEN PER APPLICATION

- 5.21.1 EMTB: DISTANCE VS. RIDING TIME

- 5.21.2 EBIKE: DISTANCE VS. SYSTEM WEIGHT

- 5.21.3 EBIKE: BATTERY VOLTAGE VS. MILES

- 5.22 INVESTMENT AND FUNDING SCENARIO

- 5.23 BILL OF MATERIALS

- 5.24 TOTAL COST OF OWNERSHIP

- 5.24.1 TOTAL COST OF OWNERSHIP (GLOBAL)

- 5.24.2 TOTAL COST OF OWNERSHIP FOR EBIKES IN INDIA, EBIKE VS. E2W VS. ICE 2W

- 5.24.2.1 Total cost of ownership (India)

- 5.24.3 COST BREAKDOWN

- 5.25 IMPACT OF AI/GEN AI ON EBIKE MARKET

- 5.25.1 IMPACT AND RECOMMENDATIONS

- 5.26 EBIKE BATTERY RECYCLING PROCESS, POLICIES, AND STANDARDS

- 5.26.1 RECYCLING PROCESS OVERVIEW

- 5.26.2 POLICIES AND STANDARDS, BY REGION

- 5.26.3 RECENT DEVELOPMENTS (2024-2025)

- 5.26.4 KEY PLAYERS IN EBIKE BATTERY RECYCLING

6 EBIKE MARKET, BY USAGE

- 6.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 6.1 INTRODUCTION

- 6.2 MOUNTAIN/TREKKING

- 6.2.1 AGILE FRAME STRUCTURE FOR EASY OFF-ROAD CYCLING TO DRIVE GROWTH

- 6.2.1.1 Mountain eBike, model-wise motor power and battery weight

- 6.2.1 AGILE FRAME STRUCTURE FOR EASY OFF-ROAD CYCLING TO DRIVE GROWTH

- 6.3 CITY/URBAN

- 6.3.1 DESIGNED FOR FREQUENT, SHORT, AND MODERATE-PACE RIDES

- 6.3.1.1 City/Urban eBike, model-wise motor power and battery weight

- 6.3.1 DESIGNED FOR FREQUENT, SHORT, AND MODERATE-PACE RIDES

- 6.4 CARGO

- 6.4.1 RISE IN E-COMMERCE INDUSTRY TO DRIVE MARKET

- 6.4.1.1 Cargo eBike, model-wise motor power and battery weight

- 6.4.1 RISE IN E-COMMERCE INDUSTRY TO DRIVE MARKET

- 6.5 OTHER USAGES

- 6.5.1 OTHER EBIKE USAGES, MODEL-WISE MOTOR POWER AND BATTERY WEIGHT

- 6.6 PRIMARY INSIGHTS

7 EBIKE MARKET, BY CLASS

- 7.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 7.1 INTRODUCTION

- 7.2 CLASS I

- 7.2.1 RAPIDLY GROWING SEGMENT OF EBIKE MARKET

- 7.2.1.1 Production and model insights for Class I eBike OEMs

- 7.2.1 RAPIDLY GROWING SEGMENT OF EBIKE MARKET

- 7.3 CLASS II

- 7.3.1 REGULATORY SUPPORT IN NORTH AMERICA TO DRIVE MARKET

- 7.3.1.1 Production and model insights for Class II eBike OEMs

- 7.3.1 REGULATORY SUPPORT IN NORTH AMERICA TO DRIVE MARKET

- 7.4 CLASS III

- 7.4.1 MOST REGULATED CLASS OF EBIKES

- 7.4.1.1 Production and model insights for Class III eBike OEMs

- 7.4.1 MOST REGULATED CLASS OF EBIKES

- 7.5 PRIMARY INSIGHTS

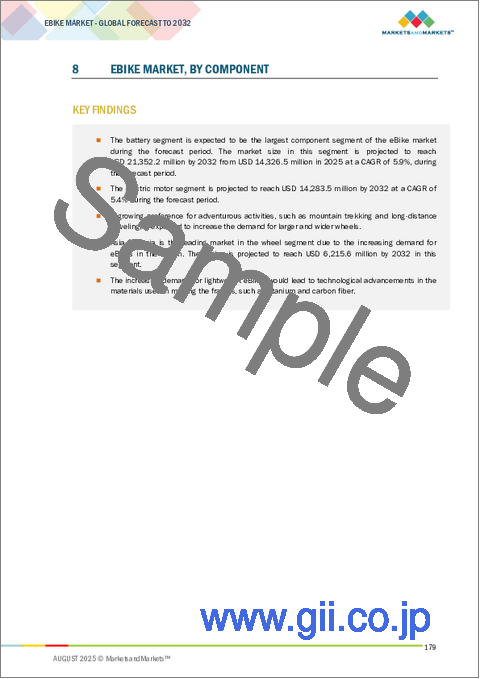

8 EBIKE MARKET, BY COMPONENT

- 8.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 8.1 INTRODUCTION

- 8.2 BATTERY

- 8.2.1 ADVANCEMENT IN BATTERY TECHNOLOGIES FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.2.1.1 Comprehensive overview of leading eBike battery manufacturers

- 8.2.1 ADVANCEMENT IN BATTERY TECHNOLOGIES FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.3 ELECTRIC MOTOR

- 8.3.1 CONSTANT DEVELOPMENTS IN EBIKE MOTORS AND GROWING DEMAND FOR HIGH PERFORMANCE TO DRIVE MARKET

- 8.3.1.1 Comprehensive overview of leading eBike motor manufacturers

- 8.3.1 CONSTANT DEVELOPMENTS IN EBIKE MOTORS AND GROWING DEMAND FOR HIGH PERFORMANCE TO DRIVE MARKET

- 8.4 FRAME WITH FORK