|

|

市場調査レポート

商品コード

1151823

環境試験の世界市場:サンプル別 (廃水/排水、土壌、水質、大気)・技術別 (迅速、従来型)・試験対象別 (微生物汚染、有機化合物、重金属、残留物、固体)・エンドユーザー別・地域別の将来予測 (2027年まで)Environmental Testing Market by Sample (Wastewater/Effluent, Soil, Water, Air), Technology (Rapid, conventional), Target Tested (Microbial Contamination, Organic Compounds, Heavy Metals, Residues, Solids), End Users and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 環境試験の世界市場:サンプル別 (廃水/排水、土壌、水質、大気)・技術別 (迅速、従来型)・試験対象別 (微生物汚染、有機化合物、重金属、残留物、固体)・エンドユーザー別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月08日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

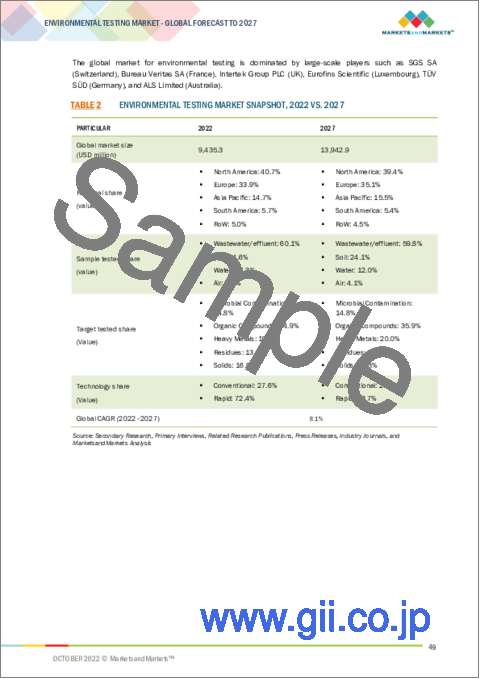

世界の環境試験の市場規模は、2022年に94億米ドルに達した後、8.1%のCAGRで成長し、2027年には139億米ドルに達すると予測されています。

サンプル別では、水質のセグメントが最も高いCAGRで、最も早く成長しています。水源を検査することは、水が安全に飲めることを確認したい人々と、環境や健康への脅威から守るために水域の規制を目指す政府機関の双方にとって重要です。また、技術進歩に伴い、水質検査の報告も迅速に行われるようになりました。

技術別では、迅速検査のセグメントが市場シェアを独占しています。迅速検査は従来の方法よりも洗練されており、一部の産業分野では、検査結果がより速く、信頼性が高く、正確であることを期待しています。

地域別に見ると、アジア太平洋が予測期間中に最も高いCAGRで急速に成長しています。環境汚染と持続可能性に対する意識の高まりが、アジア太平洋地域の環境試験市場を後押ししています。

当レポートでは、世界の環境試験の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、試験対象別・サンプル別・技術別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 工業化と都市化の進展により、環境試験の需要が高まる

- 世界的に増加する汚染

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 動向

- イントロダクション

- サプライチェーン分析

- 技術分析

- 環境試験市場における将来の技術

- 土壌・水質検査用の高度装置

- 特許分析

- 市場マップ

- ポーターのファイブフォース分析

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

- 主な利害関係者と購入基準

- ケーススタディ分析

第7章 環境試験市場:試験対象別

- イントロダクション

- 微生物汚染

- 有機化合物

- 重金属

- 残留物

- 固形物

第8章 環境試験市場:サンプル別

- イントロダクション

- 廃水/排水

- 土壌

- 水質

- 空気

第9章 環境試験市場:技術別

- イントロダクション

- 従来型

- 培養皿法:微生物の存在の検出

- 水質分析における溶存酸素 (DO) の測定

- 生物学的・化学的酸素要求量

- 迅速検査

- 分光測定

- クロマトグラフィー

- PCR

- イムノアッセイ

- 近赤外線 (NIR) 技術

第10章 環境試験市場:エンドユーザー別

- イントロダクション

- 農業・灌漑部門

- 政府機関・研究開発 (R&D) 研究所

- 工業製品メーカー

- 林業・地質

第11章 環境試験市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 韓国

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- 南アフリカ

- 中東

- 他のアフリカ諸国

第12章 競合情勢

- 概要

- 市場シェア分析 (2021年)

- 主要企業の戦略

- 主要企業の収益分析:セグメント別

- 企業評価クアドラント (主要企業)

- サービスのフットプリント

- 環境試験市場:スタートアップ/中小企業の評価クアドラント (2021年)

- 競合シナリオと動向

- サービス開始

- 資本取引

- その他

第13章 企業プロファイル

- 主要企業

- SGS SA

- EUROFINS SCIENTIFIC

- INTERTEK GROUP PLC

- BUREAU VERITAS

- ALS

- TUV SUD

- ASUREQUALITY

- MERIEUX NUTRISCIENCES CORPORATION

- MICROBAC LABORATORIES, INC.

- ENVIROLAB SERVICES PTY LTD

- R J HILL LABORATORIES LIMITED

- SYMBIO LABORATORIES

- ALEX STEWART INTERNATIONAL

- EMSL ANALYTICAL, INC.

- F.B.A. LABORATORIES LTD.

- その他の企業 (中小企業/スタートアップ)

- ENVIRONMENTAL TESTING, INC.

- ALPHA ANALYTICAL, INC.

- ADVANCED ANALYTICAL TESTING LABORATORY

- AMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.

- PACE ANALYTICAL

- その他の主要企業

- ANALAB CORPORATION

- SUBURBAN TESTING LABS

- ELEMENT MATERIALS TECHNOLOGY

- TRADEBE

- CITY ANALYSTS

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- 食品安全検査市場

- 農業試験市場

第15章 付録

The market for Environmental testing is estimated at USD 9.4 billion in 2022; it is projected to grow at a CAGR of 8.1% to reach USD 13.9 billion by 2027. Environment testing usually refers to testing of Water, Soil and Air. There is a several environmental protests & activists movements happening to conserve the environment and scarce resources. Which have constantly, pressurized government bodies to implement more environmental standards and regulations. Environmental testing service covers the analysis and detection of chemicals and contaminants in water, soil, and air in both micro and macro environments. Water testing is a common environmental analysis performed to check that the quality of water is suitable for the intended purpose and safe for usage. Soil testing is frequently done for agricultural and geotechnical purposes. Outdoor and indoor ambient air quality is a growing problem and detecting air contaminants is critical to assessing risk and for implementing new air quality regulations and standards. Regulations for wastewater/ effluent treatment testing are becoming stricter as industrialization expands and becomes a major source of pollution for water bodies.

The water sample is the fastest-growing segment, and it is accounted with the highest CAGR in the environmental testing market.

Testing water sources is important for both people who want to make sure their water is safe to drink and government entities aiming to regulate waters to protect against environmental and health threats. And the water testing reports have become rapid as technology has advanced. Such factors have fueled the growth of water testing for environmental testing market.

The rapid testing technology segment dominates the market share for environmental testing market.

Rapid tests are more sophisticated than the traditional method. Several industrial clients are expecting the testing results to be faster, reliable and accurate. Hence, the market for rapid technology segment is dominating the environmental testing market.

Asia Pacific region is growing faster with highest CAGR growth rate for the environmental testing market during forecast period.

The Asia Pacific region primarily driven by infrastructure, developments, population growth, energy-related projects and more, which have been raising concerns about environmental pollution. The rising awareness of environmental pollution and sustainability has been boosting the environmental testing market in the Asia Pacific region.

Break-up of Primaries

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, Tier 3 - 40%

- By Designation: CXO's: 25%, Managers:45%, Director: 30%

- By Region: North America: 17%, Europe: 28%, Asia Pacific: 33%, RoW: 22%

Leading players profiled in this report

1. SGS SA (Switzerland)

2. Eurofins Scientific (Luxembourg)

3. Intertek Group plc (UK)

4. Bureau Veritas (France)

5. ALS (Australia)

6. TUV SUD (Germany)

7. AsureQuality (New Zealand)

8. Merieux NutriSciences (France)

9. Microbac Laboratories, Inc. (US)

10. Envirolab Services Pty Ltd (Australia)

11. R J Hill Laboratories Limited (New Zealand)

12. Symbio Laboratories (Australia)

13. Alex Stewart International (UK)

14. EMSL Analytical, Inc. (US)

15. F.B.A. Laboratories Ltd (Ireland).

Research Coverage

This report segments the Environmental testing market on the basis of sample, target tested, technology and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the Environmental testing market, the high-growth regions, countries, government initiatives, market disruption, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the Environmental testing market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions, in which the Environmental testing market is flourishing.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION: ENVIRONMENTAL TESTING MARKET

- FIGURE 2 GEOGRAPHIC SCOPE

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 ENVIRONMENTAL TESTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 SUPPLY SIDE

- FIGURE 4 DATA TRIANGULATION: SUPPLY SIDE

- 2.2.4 DEMAND SIDE

- FIGURE 5 DATA TRIANGULATION: DEMAND SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 ENVIRONMENTAL TESTING MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 7 ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 ENVIRONMENTAL TESTING MARKET, BY TARGETS TESTED, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 ENVIRONMENTAL TESTING MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENVIRONMENTAL TESTING MARKET

- FIGURE 11 GROWING ENVIRONMENTAL NORMS EXPECTED TO DRIVE GROWTH OF ENVIRONMENTAL TESTING MARKET

- 4.2 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY KEY SAMPLE AND COUNTRY

- FIGURE 12 JAPAN ACCOUNTED FOR LARGEST SHARE AND WASTEWATER/EFFLUENT DOMINATED IN TERMS OF SAMPLES, IN 2021

- 4.3 ENVIRONMENTAL TESTING MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 13 INDIA IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 ENVIRONMENTAL TESTING MARKET, BY SAMPLE AND REGION

- FIGURE 14 ASIA PACIFIC TO DOMINATE MARKET ACROSS SAMPLE SEGMENT

- 4.5 ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY

- FIGURE 15 RAPID ENVIRONMENTAL TESTING PROJECTED TO GROW AT HIGHER CAGR

- 4.6 ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY

- FIGURE 16 IMMUNOASSAY TECHNOLOGY PROJECTED TO GROW AT HIGHER CAGR

- 4.7 ENVIRONMENTAL TESTING MARKET, BY TARGETS TESTED

- FIGURE 17 ORGANIC COMPOUNDS PROJECTED TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWING INDUSTRIALIZATION AND URBANIZATION TO FUEL DEMAND FOR ENVIRONMENTAL TESTING

- FIGURE 18 POPULATION LIVING IN URBAN AREAS (%), 2015, 2020, 2050

- FIGURE 19 GLOBAL ANNUAL GROWTH RATE OF INDUSTRIES, 2017-2021

- 5.2.2 INCREASING POLLUTION GLOBALLY

- FIGURE 20 NUMBER OF DEATHS BY RISK FACTOR GLOBALLY, 2019

- 5.3 MARKET DYNAMICS

- FIGURE 21 ENVIRONMENTAL TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Growing need for cost-saving and time-effective customized testing services

- 5.3.1.2 Active participation of government and regulatory bodies to monitor environmental conditions

- TABLE 3 REGULATORY BODIES FOR ENVIRONMENTAL PROTECTION AND MONITORING

- 5.3.1.3 Privatization of environmental testing services

- 5.3.1.4 Rising awareness about environmental pollution

- 5.3.2 RESTRAINTS

- 5.3.2.1 High capital investment for accurate and sensitive analytical testing

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increase in industrial activities in emerging markets

- 5.3.3.2 Introduction of innovative technologies

- 5.3.3.3 Integration of technologies through mergers, acquisitions, and partnerships

- FIGURE 22 MERGERS & ACQUISITIONS, BY INDUSTRIAL SECTOR, 2017

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of basic supporting infrastructure

- 5.3.4.2 Shortage of skilled workforce

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 UPCOMING TECHNOLOGIES IN ENVIRONMENTAL TESTING MARKET

- 6.3.1.1 Microarray

- 6.3.1.2 Biochip

- 6.3.1.3 Biosensors

- 6.3.1.4 Flow cytometry

- 6.3.1.5 NMR

- 6.3.1.6 NIRs

- 6.3.1.7 ICP

- 6.3.2 ADVANCED INSTRUMENTS FOR SOIL AND WATER TESTING

- 6.3.2.1 Soil testing

- 6.3.2.1.1 Gas chromatography with mass spectrometry (GC-MS)

- 6.3.2.1.2 Portable X-ray fluorescence (PXRF)

- 6.3.2.1.3 Bottle top dispenser (BTD)

- 6.3.2.1.4 Micropipettes

- 6.3.2.1.5 Electronic burette

- 6.3.2.2 Water Testing

- 6.3.2.2.1 Turbidimeter

- 6.3.2.2.2 Colorimeter

- 6.3.2.2.3 Electronic Burette

- 6.3.2.1 Soil testing

- 6.3.1 UPCOMING TECHNOLOGIES IN ENVIRONMENTAL TESTING MARKET

- 6.4 PATENT ANALYSIS

- FIGURE 24 PATENTS GRANTED FOR ENVIRONMENTAL TESTING MARKET, 2011-2021

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR ENVIRONMENTAL TESTING MARKET, 2011-2021

- TABLE 4 KEY PATENTS FOR ENVIRONMENTAL TESTING MARKET, 2020-2022

- 6.5 MARKET MAP

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 26 ENVIRONMENTAL TESTING MARKET: MARKET MAP

- TABLE 5 ENVIRONMENTAL TESTING MARKET: ECOSYSTEM

- 6.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 ENVIRONMENTAL TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.6.2 BARGAINING POWER OF BUYERS

- 6.6.3 BARGAINING POWER OF SUPPLIERS

- 6.6.4 THREAT OF SUBSTITUTES

- 6.6.5 THREAT OF NEW ENTRANTS

- 6.7 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 7 ENVIRONMENTAL TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- 6.8 TARIFF AND REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 27 REVENUE SHIFT FOR ENVIRONMENTAL TESTING SERVICES

- 6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TWO TYPES

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOURCES (%)

- 6.9.2 BUYING CRITERIA

- TABLE 13 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 29 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 ANALYSIS OF GOVERNMENT PROJECT

- 6.10.2 SOIL ANALYSIS BY MVA SCIENTIFIC CONSULTANTS

7 ENVIRONMENTAL TESTING MARKET, BY TARGETS TESTED

- 7.1 INTRODUCTION

- FIGURE 30 ENVIRONMENTAL TESTING MARKET, BY TARGETS TESTED, 2022 VS. 2027 (USD MILLION)

- TABLE 14 ENVIRONMENTAL TESTING MARKET, BY TARGETS TESTED, 2018-2021 (USD MILLION)

- TABLE 15 ENVIRONMENTAL TESTING MARKET, BY TARGETS TESTED, 2022-2027 (USD MILLION)

- 7.2 MICROBIAL CONTAMINATION

- 7.2.1 MICROBIAL CONTAMINATION OF WATER BODIES: KEY CONCERN DRIVING MARKET GROWTH

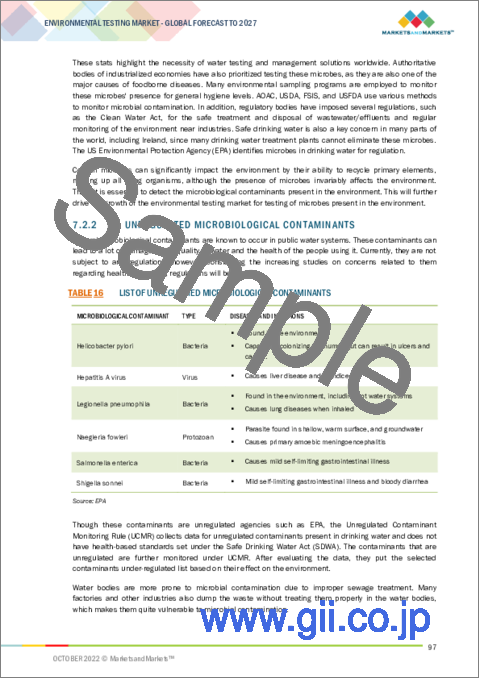

- 7.2.2 UNREGULATED MICROBIOLOGICAL CONTAMINANTS

- TABLE 16 LIST OF UNREGULATED MICROBIOLOGICAL CONTAMINANTS

- TABLE 17 ENVIRONMENTAL TESTING MARKET FOR MICROBIAL CONTAMINATION, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 18 ENVIRONMENTAL TESTING MARKET FOR MICROBIAL CONTAMINATION, BY SAMPLE, 2022-2027 (USD MILLION)

- 7.3 ORGANIC COMPOUNDS

- 7.3.1 HOUSEHOLDS AT HIGH RISK OF EXPOSURE TO ORGANIC COMPOUNDS

- TABLE 19 ENVIRONMENTAL TESTING MARKET FOR ORGANIC COMPOUNDS, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 20 ENVIRONMENTAL TESTING MARKET FOR ORGANIC COMPOUNDS, BY SAMPLE, 2022-2027 (USD MILLION)

- 7.4 HEAVY METALS

- 7.4.1 RELEASE OF TOXIC HEAVY METALS FROM INDUSTRIAL ACTIVITIES

- TABLE 21 ENVIRONMENTAL TESTING MARKET FOR HEAVY METALS, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 22 ENVIRONMENTAL TESTING MARKET FOR HEAVY METALS, BY SAMPLE, 2022-2027 (USD MILLION)

- 7.5 RESIDUES

- 7.5.1 RELEASE OF RESIDUES DUE TO AGRICULTURAL ACTIVITIES

- TABLE 23 ENVIRONMENTAL TESTING MARKET FOR RESIDUES, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 24 ENVIRONMENTAL TESTING MARKET FOR RESIDUES, BY SAMPLE, 2022-2027 (USD MILLION)

- 7.6 SOLIDS

- 7.6.1 SOLIDS TO CAUSE LESS PERMANENT ENVIRONMENTAL DAMAGE

- TABLE 25 ENVIRONMENTAL TESTING MARKET FOR SOLIDS, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 26 ENVIRONMENTAL TESTING MARKET FOR SOLIDS, BY SAMPLE, 2022-2027 (USD MILLION)

8 ENVIRONMENTAL TESTING MARKET, BY SAMPLE

- 8.1 INTRODUCTION

- FIGURE 31 ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022 VS. 2027 (USD MILLION)

- TABLE 27 ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 28 ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- 8.2 WASTEWATER/EFFLUENT

- 8.2.1 WASTEWATER/EFFLUENT TO DOMINATE ENVIRONMENTAL TESTING MARKET

- TABLE 29 ENVIRONMENTAL TESTING MARKET, FOR WASTEWATER/EFFLUENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 ENVIRONMENTAL TESTING MARKET, FOR WASTEWATER/EFFLUENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 31 ENVIRONMENTAL TESTING MARKET, FOR WASTEWATER/EFFLUENT, BY TARGETS TESTED, 2018-2021 (USD MILLION)

- TABLE 32 ENVIRONMENTAL TESTING MARKET, FOR WASTEWATER/EFFLUENT, BY TARGETS TESTED, 2022-2027 (USD MILLION)

- 8.3 SOIL

- 8.3.1 SOIL TESTING TO INCREASE CROP PRODUCTION

- TABLE 33 ENVIRONMENTAL TESTING MARKET, FOR SOIL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 ENVIRONMENTAL TESTING MARKET, FOR SOIL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 35 ENVIRONMENTAL TESTING MARKET FOR SOIL, BY TARGETS TESTED, 2018-2021 (USD MILLION)

- TABLE 36 ENVIRONMENTAL TESTING MARKET FOR SOIL, BY TARGETS TESTED, 2022-2027 (USD MILLION)

- 8.4 WATER

- 8.4.1 NECESSITY OF QUALITY CHECK OF WATER

- TABLE 37 ENVIRONMENTAL TESTING MARKET, FOR WATER, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 ENVIRONMENTAL TESTING MARKET, FOR WATER, BY REGION, 2022-2027 (USD MILLION)

- TABLE 39 ENVIRONMENTAL TESTING MARKET FOR WATER, BY TARGETS TESTED, 2018-2021 (USD MILLION)

- TABLE 40 ENVIRONMENTAL TESTING MARKET FOR WATER, BY TARGETS TESTED, 2022-2027 (USD MILLION)

- 8.5 AIR

- 8.5.1 RISE IN AIRBORNE DISEASES TO INCREASE TESTING OF AIR SAMPLES

- TABLE 41 ENVIRONMENTAL TESTING MARKET, FOR AIR, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 ENVIRONMENTAL TESTING MARKET, FOR AIR, BY REGION, 2022-2027 (USD MILLION)

- TABLE 43 ENVIRONMENTAL TESTING MARKET FOR AIR, BY TARGETS TESTED, 2018-2021 (USD MILLION)

- TABLE 44 ENVIRONMENTAL TESTING MARKET FOR AIR, BY TARGETS TESTED, 2022-2027 (USD MILLION)

9 ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 32 ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- TABLE 45 ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 46 ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.2 CONVENTIONAL

- 9.2.1 CONVENTIONAL METHODS DEPICT SAMPLE SOURCE

- TABLE 47 ENVIRONMENTAL TESTING MARKET FOR CONVENTIONAL TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 ENVIRONMENTAL TESTING MARKET FOR CONVENTIONAL TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 9.2.2 CULTURE PLATE METHOD TO DETECT PRESENCE OF MICROBES

- 9.2.3 DISSOLVED OXYGEN (DO) DETERMINATION IN WATER ANALYSIS

- 9.2.4 BIOLOGICAL & CHEMICAL OXYGEN DEMAND

- 9.3 RAPID METHOD

- 9.3.1 RAPID TESTING TO DOMINATE MARKET

- TABLE 49 ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 50 ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 51 ENVIRONMENTAL TESTING MARKET FOR RAPID TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 ENVIRONMENTAL TESTING MARKET FOR RAPID TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 9.3.2 SPECTROMETRY

- TABLE 53 CHEMICAL CONTAMINANTS AND SPECTROSCOPY TECHNOLOGIES

- TABLE 54 ENVIRONMENTAL TESTING MARKET FOR SPECTROMETRY TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 ENVIRONMENTAL TESTING MARKET FOR SPECTROMETRY TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 9.3.3 CHROMATOGRAPHY

- TABLE 56 CHEMICAL CONTAMINANTS AND CHROMATOGRAPHY TECHNOLOGIES

- TABLE 57 ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 9.3.4 PCR

- TABLE 59 LABORATORY WORKFLOW FOR PCR METHOD

- TABLE 60 ENVIRONMENTAL TESTING MARKET FOR PCR TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 61 ENVIRONMENTAL TESTING MARKET FOR PCR TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 9.3.5 IMMUNOASSAY

- TABLE 62 ENVIRONMENTAL TESTING MARKET FOR IMMUNOASSAY TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 ENVIRONMENTAL TESTING MARKET FOR IMMUNOASSAY TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

- 9.3.6 NEAR-INFRARED (NIR) TECHNOLOGY

- TABLE 64 ENVIRONMENTAL TESTING MARKET FOR NEAR-INFRARED (NIR) TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 ENVIRONMENTAL TESTING MARKET FOR NEAR-INFRARED (NIR) TECHNOLOGY, BY REGION, 2022-2027 (USD MILLION)

10 ENVIRONMENTAL TESTING MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 AGRICULTURE & IRRIGATION SECTOR

- 10.2.1 AGRICULTURE & IRRIGATION SECTOR TO DOMINATE END-USER SEGMENT

- 10.3 GOVERNMENT INSTITUTES AND R&D LABORATORIES

- 10.3.1 NEED FOR ENVIRONMENTAL TESTING

- FIGURE 33 CONSUMPTION EXPENDITURE OF INDIA, 2012 TO 2022

- 10.4 INDUSTRIAL PRODUCT MANUFACTURERS

- 10.4.1 STRINGENT GOVERNMENT NORMS TO DRIVE MARKET

- FIGURE 34 EXPORT AND IMPORT VALUE OF MERCHANDISING TRADE, 2016 TO 2021

- 10.5 FORESTRY & GEOLOGY

- 10.5.1 NEED FOR SUSTAINABLE GROWTH TO BOOST DEMAND FOR ENVIRONMENTAL TESTING SERVICES

- FIGURE 35 MOBILIZATION FUND FOR CLIMATE ACTION, 2016 TO 2019

11 ENVIRONMENTAL TESTING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 36 REGIONAL SNAPSHOT: US HELD LARGEST SHARE IN ENVIRONMENTAL TESTING MARKET IN 2021

- TABLE 66 ENVIRONMENTAL TESTING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 ENVIRONMENTAL TESTING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 69 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 71 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 73 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 75 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Stringent environment protection laws to uplift market growth

- TABLE 76 US: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 77 US: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 78 US: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 79 US: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Rise in demand for green technology

- TABLE 80 CANADA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 81 CANADA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 82 CANADA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 83 CANADA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Need for infrastructure of wastewater treatment

- TABLE 84 MEXICO: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 85 MEXICO: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 86 MEXICO: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 87 MEXICO: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- TABLE 88 EUROPE: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2018-2021 (USD MILLION)

- TABLE 89 EUROPE: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2022-2027 (USD MILLION)

- TABLE 90 EUROPE: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 91 EUROPE: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 92 EUROPE: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 93 EUROPE: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 94 EUROPE: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 95 EUROPE: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- 11.3.1 UK

- 11.3.1.1 Role of institutions in monitoring environmental conditions

- TABLE 96 UK: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 97 UK: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 98 UK: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 99 UK: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Concern for soil and water quality

- TABLE 100 GERMANY: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 101 GERMANY: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 102 GERMANY: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 103 GERMANY: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Frequent law changes

- TABLE 104 FRANCE: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 105 FRANCE: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 106 FRANCE: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 107 FRANCE: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Exploitation of water resources

- TABLE 108 ITALY: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 109 ITALY: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 110 ITALY: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 111 ITALY: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Stringent regulatory frameworks by ministry of environment

- TABLE 112 SPAIN: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 113 SPAIN: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 114 SPAIN: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 115 SPAIN: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3.6 POLAND

- 11.3.6.1 Robust transport infrastructure to drive market growth

- TABLE 116 POLAND: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 117 POLAND: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 118 POLAND: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 119 POLAND: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.3.7 REST OF EUROPE

- 11.3.7.1 Economic development to drive market growth

- TABLE 120 REST OF EUROPE: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 121 REST OF EUROPE: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 123 REST OF EUROPE: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 124 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2018-2021 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2022-2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 127 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 128 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 129 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Investment in pollution control to drive market growth

- TABLE 132 CHINA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 133 CHINA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 134 CHINA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 135 CHINA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.4.2 INDIA

- 11.4.2.1 Indian environmental industry to provide growth opportunities

- TABLE 136 INDIAN IMPORTS OF ENVIRONMENTAL TECHNOLOGY EQUIPMENT (USD MILLION)

- TABLE 137 INDIA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 138 INDIA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 139 INDIA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 140 INDIA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Government initiatives to drive market growth

- TABLE 141 JAPAN: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 142 JAPAN: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 143 JAPAN: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 144 JAPAN: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Presence of regulatory bodies to ensure environment safety

- TABLE 145 AUSTRALIA & NEW ZEALAND: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 146 AUSTRALIA & NEW ZEALAND: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 147 AUSTRALIA & NEW ZEALAND: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 148 AUSTRALIA & NEW ZEALAND: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Growth of industrial sector to drive market growth

- TABLE 149 SOUTH KOREA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 150 SOUTH KOREA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 151 SOUTH KOREA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 152 SOUTH KOREA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.6.1 Improving economies to drive market growth

- TABLE 153 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.5 SOUTH AMERICA

- TABLE 157 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2018-2021 (USD MILLION)

- TABLE 158 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2022-2027 (USD MILLION)

- TABLE 159 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 162 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 163 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 164 SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Various government strategies to drive market growth

- TABLE 165 BRAZIL: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 166 BRAZIL: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 167 BRAZIL: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 168 BRAZIL: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Agricultural & irrigation sector to drive demand for environmental testing services

- TABLE 169 ARGENTINA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 170 ARGENTINA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 171 ARGENTINA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 172 ARGENTINA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.3.1 Demand for wastewater infrastructure to drive market

- TABLE 173 REST OF SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 175 REST OF SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.6 REST OF THE WORLD

- TABLE 177 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2018-2021 (USD MILLION)

- TABLE 178 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY COUNTRY/REGION, 2022-2027 (USD MILLION)

- TABLE 179 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 180 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 181 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 182 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY RAPID TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 183 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 184 REST OF THE WORLD: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- 11.6.1 SOUTH AFRICA

- 11.6.1.1 Lack of water infrastructure to drive demand for microbial testing of samples

- TABLE 185 SOUTH AFRICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 186 SOUTH AFRICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 187 SOUTH AFRICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 188 SOUTH AFRICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Increasing air pollution to increase demand for environmental testing services

- TABLE 189 MIDDLE EAST: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 190 MIDDLE EAST: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 191 MIDDLE EAST: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 192 MIDDLE EAST: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.6.3 REST OF AFRICA

- 11.6.3.1 Mining activities to drive market growth

- TABLE 193 REST OF AFRICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2018-2021 (USD MILLION)

- TABLE 194 REST OF AFRICA: ENVIRONMENTAL TESTING MARKET, BY SAMPLE, 2022-2027 (USD MILLION)

- TABLE 195 REST OF AFRICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 196 REST OF AFRICA: ENVIRONMENTAL TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- TABLE 197 ENVIRONMENTAL TESTING MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 12.3 KEY PLAYER STRATEGIES

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 39 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017-2021 (USD MILLION)

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 40 ENVIRONMENTAL TESTING MARKET: COMPANY EVALUATION QUADRANT OF KEY PLAYERS, 2021

- 12.6 SERVICE FOOTPRINT

- TABLE 198 COMPANY, BY SAMPLE TESTED FOOTPRINT

- TABLE 199 COMPANY, BY END-USERS FOOTPRINT

- TABLE 200 COMPANY, BY REGION FOOTPRINT

- TABLE 201 OVERALL COMPANY FOOTPRINT

- 12.7 ENVIRONMENTAL TESTING MARKET, EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 41 ENVIRONMENTAL TESTING MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UP/SME)

- 12.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 202 ENVIRONMENTAL TESTING MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 203 ENVIRONMENTAL TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 12.8 COMPETITIVE SCENARIO AND TRENDS

- 12.8.1 SERVICES LAUNCHED

- TABLE 204 ENVIRONMENTAL TESTING MARKET: SERVICE LAUNCHES, 2018-2022

- 12.8.2 DEALS

- TABLE 205 ENVIRONMENTAL TESTING MARKET: DEALS, 2018-2022

- 12.8.3 OTHERS

- TABLE 206 ENVIRONMENTAL TESTING MARKET: OTHERS, 2018-2022

13 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 SGS SA

- TABLE 207 SGS SA: BUSINESS OVERVIEW

- FIGURE 42 SGS SA: COMPANY SNAPSHOT

- TABLE 208 SGS SA: SERVICES OFFERED

- TABLE 209 SGS SA: DEALS

- 13.1.2 EUROFINS SCIENTIFIC

- TABLE 210 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 43 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- TABLE 211 EUROFINS SCIENTIFIC: SERVICES OFFERED

- TABLE 212 EUROFINS SCIENTIFIC: SERVICES LAUNCHED

- TABLE 213 EUROFINS SCIENTIFIC: DEALS

- 13.1.3 INTERTEK GROUP PLC

- TABLE 214 INTERTEK GROUP PLC: BUSINESS OVERVIEW

- FIGURE 44 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- TABLE 215 INTERTEK GROUP PLC: SERVICES OFFERED

- TABLE 216 INTERTEK GROUP PLC: OTHERS

- 13.1.4 BUREAU VERITAS

- TABLE 217 BUREAU VERITAS: BUSINESS OVERVIEW

- FIGURE 45 BUREAU VERITAS: COMPANY SNAPSHOT

- TABLE 218 BUREAU VERITAS: SERVICES OFFERED

- TABLE 219 BUREAU VERITAS: OTHERS

- 13.1.5 ALS

- TABLE 220 ALS: BUSINESS OVERVIEW

- FIGURE 46 ALS: COMPANY SNAPSHOT

- TABLE 221 ALS: SERVICES OFFERED

- TABLE 222 ALS: DEALS

- 13.1.6 TUV SUD

- TABLE 223 TUV SUD: BUSINESS OVERVIEW

- FIGURE 47 TUV SUD: COMPANY SNAPSHOT

- TABLE 224 TUV SUD: SERVICES OFFERED

- TABLE 225 TUV SUD: OTHERS

- 13.1.7 ASUREQUALITY

- TABLE 226 ASUREQUALITY: BUSINESS OVERVIEW

- FIGURE 48 ASUREQUALITY: COMPANY SNAPSHOT

- TABLE 227 ASUREQUALITY: SERVICES OFFERED

- 13.1.8 MERIEUX NUTRISCIENCES CORPORATION

- TABLE 228 MERIEUX NUTRISCIENCES CORPORATION: BUSINESS OVERVIEW

- TABLE 229 MERIEUX NUTRISCIENCES CORPORATION: SERVICES OFFERED

- TABLE 230 MERIEUX NUTRISCIENCES CORPORATION: DEALS

- 13.1.9 MICROBAC LABORATORIES, INC.

- TABLE 231 MICROBAC LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 232 MICROBAC LABORATORIES, INC.: SERVICES OFFERED

- 13.1.10 ENVIROLAB SERVICES PTY LTD

- TABLE 233 ENVIROLAB SERVICES PTY LTD: BUSINESS OVERVIEW

- TABLE 234 ENVIROLAB SERVICES PTY LTD: SERVICES OFFERED

- 13.1.11 R J HILL LABORATORIES LIMITED

- TABLE 235 R J HILL LABORATORIES LIMITED: BUSINESS OVERVIEW

- TABLE 236 R J HILL LABORATORIES LIMITED: SERVICES OFFERED

- TABLE 237 R J HILL LABORATORIES LIMITED: OTHERS

- 13.1.12 SYMBIO LABORATORIES

- TABLE 238 SYMBIO LABORATORIES: BUSINESS OVERVIEW

- TABLE 239 SYMBIO LABORATORIES: SERVICES OFFERED

- TABLE 240 SYMBIO LABORATORIES: OTHERS

- 13.1.13 ALEX STEWART INTERNATIONAL

- TABLE 241 ALEX STEWART INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 242 ALEX STEWART INTERNATIONAL: SERVICES OFFERED

- 13.1.14 EMSL ANALYTICAL, INC.

- TABLE 243 EMSL ANALYTICAL, INC.: BUSINESS OVERVIEW

- TABLE 244 EMSL ANALYTICAL, INC.: SERVICES OFFERED

- 13.1.15 F.B.A. LABORATORIES LTD.

- TABLE 245 F.B.A. LABORATORIES LTD.: BUSINESS OVERVIEW

- TABLE 246 F.B.A. LABORATORIES LTD.: SERVICES OFFERED

- 13.2 OTHER PLAYERS (SMES/START-UPS)

- 13.2.1 ENVIRONMENTAL TESTING, INC.

- TABLE 247 ENVIRONMENTAL TESTING, INC.-BUSINESS OVERVIEW

- TABLE 248 ENVIRONMENTAL TESTING, INC.: SERVICES OFFERED

- 13.2.2 ALPHA ANALYTICAL, INC.

- TABLE 249 ALPHA ANALYTICAL, INC.: BUSINESS OVERVIEW

- TABLE 250 ALPHA ANALYTICAL, INC.: SERVICES OFFERED

- TABLE 251 ALPHA ANALYTICAL, INC.: OTHERS

- 13.2.3 ADVANCED ANALYTICAL TESTING LABORATORY

- TABLE 252 ADVANCED ANALYTICAL TESTING LABORATORY: BUSINESS OVERVIEW

- TABLE 253 ADVANCED ANALYTICAL TESTING LABORATORY: SERVICES OFFERED

- 13.2.4 AMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.

- TABLE 254 AMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.: BUSINESS OVERVIEW

- TABLE 255 AMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.: SERVICES OFFERED

- 13.2.5 PACE ANALYTICAL

- TABLE 256 PACE ANALYTICAL: BUSINESS OVERVIEW

- TABLE 257 PACE ANALYTICAL: SERVICES OFFERED

- TABLE 258 PACE ANALYTICAL: DEALS

- 13.3 OTHER KEY PLAYERS

- 13.3.1 ANALAB CORPORATION

- 13.3.2 SUBURBAN TESTING LABS

- 13.3.3 ELEMENT MATERIALS TECHNOLOGY

- 13.3.4 TRADEBE

- 13.3.5 CITY ANALYSTS

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 FOOD SAFETY TESTING MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 FOOD SAFETY TESTING MARKET, BY TARGET TESTED

- 14.3.3.1 Introduction

- TABLE 259 FOOD SAFETY TESTING MARKET, BY TARGETS TESTED, 2017-2021 (USD MILLION)

- TABLE 260 FOOD SAFETY TESTING MARKET, BY TARGETS TESTED, 2022-2027 (USD MILLION)

- 14.3.4 FOOD SAFETY TESTING MARKET, BY REGION

- 14.3.4.1 Introduction

- TABLE 261 FOOD SAFETY TESTING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 262 FOOD SAFETY TESTING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.4 AGRICULTURAL TESTING MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 AGRICULTURAL TESTING MARKET, BY SAMPLE

- 14.4.3.1 Introduction

- TABLE 263 AGRICULTURAL TESTING MARKET, BY SAMPLE, 2015-2022(USD MILLION)

- 14.4.4 AGRICULTURAL TESTING MARKET, BY REGION

- 14.4.4.1 Introduction

- TABLE 264 AGRICULTURAL TESTING MARKET, BY REGION, 2015-2022 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS