|

|

市場調査レポート

商品コード

1394076

5Gサービスの世界市場:通信タイプ別、エンドユーザー別、用途別、企業別、地域別-2028年までの予測5G Services Market by Communication Type (eMBB, URLLC, mMTC), End User (Consumers and Enterprises), Application (Industry 4.0, Smart Cities, Smart Buildings), Enterprises (Manufacturing, Telecom, Retail & eCommerce) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 5Gサービスの世界市場:通信タイプ別、エンドユーザー別、用途別、企業別、地域別-2028年までの予測 |

|

出版日: 2023年12月04日

発行: MarketsandMarkets

ページ情報: 英文 307 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2018年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象ユニット | 金額(10億米ドル) |

| セグメント | 用途別、通信タイプ別、エンドユーザー別、企業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

5Gサービスの市場規模は、2023年に1,218億米ドル、2028年には1兆23億米ドルに達すると推定され、年間平均成長率(CAGR)は52.4%になるとみられています。

5G対応スマートフォンの普及は、消費者セグメントにおいて極めて重要な推進力として浮上し、5G技術の普及に拍車をかけています。通信会社が先進的なネットワークを展開するにつれ、消費者は接続性の向上とモバイル体験の改善が期待できる5Gにますます引き付けられるようになっています。より高速なデータ転送速度と低遅延を誇る5G対応スマートフォンが利用可能になることで、ユーザーはデバイスをアップグレードする動機付けとなります。シームレスなストリーミング、拡張現実アプリケーション、より速いダウンロード速度など、5Gの可能性をフルに活用したいという願望が、消費者が最新のスマートフォン技術に投資する動機となっています。優れたネットワーク機能の魅力に後押しされた5G対応機器への需要の急増は、コンシューマー市場における5G導入の全体的な勢いに大きく寄与し、個人のモバイル接続への関わり方とその恩恵を享受しています。

ヘルスケア・ライフサイエンス分野は、予測期間中に最も速い成長率を記録する見込みです。5G技術の登場は、ヘルスケアドローンの能力を大幅に強化することで、ヘルスケア・ライフサイエンスに革命をもたらしています。高速接続性を持つ5Gは、様々なヘルスケア用途にドローンを配備するのに不可欠なシームレスでリアルタイムの通信インフラを容易にします。医療物資へのアクセスが困難な遠隔地では、5Gはドローンに救命薬や物資を効率的に届ける力を与え、それによってヘルスケアへのアクセスにおける重要なギャップを埋めることになります。

賑やかな都心部の接続需要に応えるBeyond 5Gは、アジア太平洋全域の遠隔地やサービスが行き届いていない地域が直面する持続的な接続性の課題を克服するための極めて重要なソリューションとして浮上しています。従来のインフラが限られているこれらの地域では、5G技術がブロードバンドアクセスの強化を促進し、変革的な役割を果たします。これは、アクセスが容易でない地域に蔓延するデジタルデバイドに対処するだけでなく、包括性の育成にも積極的に貢献します。高速で信頼性の高い接続性を遠隔地のコミュニティに提供することで、5Gは彼らがデジタル経済に参加し、教育リソースにアクセスし、遠隔医療などの必要不可欠なサービスの恩恵を受けることを可能にします。このような十分なサービスが提供されていない地域への5Gネットワークの展開は、アジア太平洋の多様な景観全体を通じて、技術格差を縮小し、新たな機会を引き出し、より公平でつながりのある社会を育成するというコミットメントを反映しています。

当レポートでは、世界の5Gサービス市場について調査し、通信タイプ別、エンドユーザー別、用途別、企業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 5Gテクノロジーの略歴

- 生態系/市場マップ

- ケーススタディ分析

- バリューチェーン分析

- 規制状況

- 特許分析

- 技術分析

- 価格分析

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向と混乱

- 主要な利害関係者と購入基準

- 主要な会議とイベント

- 5Gサービス市場のベストプラクティス

- 現在および新たなビジネスモデル

- 5Gサービスのツール、フレームワーク、および技術

- 5Gサービス市場の将来情勢

第6章 5Gサービス市場、用途別

- イントロダクション

- スマートシティ

- スマートビルディング

- 自動運転車

- スマートヘルスケア

- インダストリー4.0

- スマートユーティリティ

- 没入型メディアとゲーム

- その他

第7章 5Gサービス市場、エンドユーザー別

- イントロダクション

- 消費者

- 企業

第8章 5Gサービス市場、通信タイプ別

- イントロダクション

- 拡張モバイルブロードバンド(EMBB)

- 大規模マシンタイプ通信(MMTC)

- 超信頼性の高い低遅延通信

第9章 5Gサービス市場、企業別

- イントロダクション

- 製造業

- ITとITES

- 通信

- ヘルスケア・ライフサイエンス

- 小売・電子商取引

- 輸送・物流

- 教育

- エネルギー・公共事業

- メディア・エンターテイメント

- BFSI

- 政府・公共部門

- 建設・不動産

- その他の企業

第10章 5Gサービス市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

- 5Gサービス製品のベンチマーク

- 主要な5Gサービスプロバイダーの評価と財務指標

第12章 企業プロファイル

- 主要参入企業

- AT&T

- CHINA MOBILE

- VERIZON COMMUNICATIONS

- DEUTSCHE TELEKOM AG

- VODAFONE GROUP

- SK TELECOM

- BT GROUP

- CHINA TELECOM CORPORATION LIMITED

- ORANGE S.A.

- KT CORPORATION

- CHINA UNICOM NETWORK COMMUNICATIONS

- TELSTRA GROUP LIMITED

- ROGERS COMMUNICATION INC.

- BELL CANADA

- ETISALAT GROUP

- SAUDI TELECOM COMPANY

- KDDI CORPORATION

- TELUS CORPORATION

- LG UPLUS CORP.

- SWISSCOM

- RELIANCE JIO

- BHARTI AIRTEL LIMITED

- TELENOR ASA

- MTN GROUP

- RAKUTEN GROUP

- NTT DOCOMO

- DISH NETWORK CORPORATION

- TELEFONICA S.A.

- スタートアップ/中小企業

- JMA WIRELESS

- VERANA NETWORKS

- CELONA

- MANGATA NETWORKS

- AIRSPAN NETWORKS

- EDGEQ

- OMNIFLOW

- AARNA NETWORKS

第13章 隣接/関連市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2018 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Application, Communication type, End user, Enterprise, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The 5G Services market is estimated at USD 121.8 billion in 2023 to USD 1002.3 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 52.4%. The proliferation of 5G-compatible smartphones has emerged as a pivotal driver within the consumer segment, fueling the widespread adoption of 5G technology. As telecommunications companies deploy advanced networks, consumers are increasingly drawn to the promise of enhanced connectivity and improved mobile experiences. The availability of 5G-enabled smartphones, boasting faster data transfer speeds and lower latency, incentivizes users to upgrade their devices. The desire to leverage the full potential of 5G, including seamless streaming, augmented reality applications, and quicker download speeds, motivates consumers to invest in the latest smartphone technology. This surge in demand for 5G-compatible devices, driven by the allure of superior network capabilities, contributes significantly to the overall momentum of 5G adoption in the consumer market, shaping the way individuals engage with and benefit from mobile connectivity.

"The healthcare & life sciences segment is expected to register the fastest growth rate during the forecast period." The advent of 5G technology is revolutionizing healthcare & life sciences by significantly enhancing the capabilities of healthcare drones. With its high-speed connectivity, 5G facilitates a seamless and real-time communication infrastructure crucial for deploying drones in various healthcare applications. In remote areas, where access to medical supplies is challenging, 5G empowers drones to efficiently deliver life-saving medications and supplies, thereby bridging critical gaps in healthcare accessibility. Moreover, the rapid transmission speeds and low latency of 5G enable the swift transportation of lab samples, facilitating timely diagnostic processes. Beyond logistics, 5G-enabled drones can also provide aerial telemedicine support, connecting healthcare professionals with patients in remote locations. This transformative synergy between 5G and healthcare drones not only expands the reach of healthcare services but also establishes an agile and responsive healthcare ecosystem capable of addressing challenges in both routine and emergency medical situations.

"The Industry 4.0 segment to hold the largest market size during the forecast period." The advent of 5G technology is reshaping manufacturing processes within the framework of Industry 4.0 through the deployment of sophisticated quality control measures and predictive maintenance systems. In this new paradigm, the strategic placement of sensors and Internet of Things (IoT) devices across the manufacturing environment facilitates continuous monitoring of equipment conditions. These sensors gather real-time data on crucial factors such as temperature, vibration, and wear, providing a comprehensive insight into machinery health. Harnessing the high-speed, low-latency capabilities of 5G, this wealth of data is rapidly transmitted and processed, enabling swift detection of anomalies or deviations from optimal operating conditions. Within the context of Industry 4.0, this real-time connectivity powered by 5G becomes a driving force for transformative change. The seamless transmission and processing of data allow manufacturers to adopt a proactive approach to maintenance. By incorporating advanced analytics and machine learning algorithms, manufacturers can predict potential equipment failures before they manifest. This predictive maintenance strategy minimizes unplanned downtime, as maintenance activities can be precisely scheduled when needed, optimizing the overall effectiveness of equipment. In essence, the integration of 5G-enabled predictive maintenance becomes a cornerstone of Industry 4.0, enhancing operational efficiency, extending equipment lifespan, and contributing significantly to cost savings for manufacturers.

"Asia Pacific's highest growth rate during the forecast period."

Beyond catering to the connectivity demands of bustling urban centers, 5G emerges as a pivotal solution for overcoming the persistent connectivity challenges faced by remote and underserved areas across the Asia Pacific. In these regions, where traditional infrastructure may be limited, 5G technology plays a transformative role by facilitating enhanced broadband access. This not only addresses the digital divide prevalent in less accessible areas but also actively contributes to fostering inclusivity. By extending high-speed, reliable connectivity to remote communities, 5G enables them to partake in the digital economy, access educational resources, and benefit from essential services such as telemedicine. The deployment of 5G networks in these underserved regions reflects a commitment to narrowing the technological gap, unlocking new opportunities, and fostering a more equitable and connected society throughout the diverse landscapes of the Asia Pacific.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Middle East & Africa - 10%, and Latin America- 5%.

The major players in the 5G Services market AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), China Telecom (China), Orange (France), Vodafone (UK), China Unicom (China), Telstra (Australia), Telefonica S.A (Spain), KT Corporation (South Korea), Roger Communications (Canada), Bell Canada (Canada), Etisalat (UAE), Saudi Telecom Company (Saudi Arabia), LG Uplus (South Korea), NTT Docomo (Japan), KDDI (Japan), Telus (Canada), Swisscom (Switzerland), Dish Network (US), Reliance Jio Infocomm (India), Rakuten Group (Japan), MTN Group (South Africa), Bharti Airtel Limited (India), Telenor Group (Norway), JMA Wireless (US), Verana Networks (US), Celona (US), Mangata Networks (US), Airspan Networks (US), Edge Q (US), Omniflow (US), Aarna Networks (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their 5G Services market footprint.

Research Coverage

The market study covers the 5G Services market size across different segments. It aims at estimating the market size and the growth potential across different segments, including applications (smart cities, smart buildings, Industry 4.0, autonomous vehicles, smart healthcare, smart utilities, immersive media & gaming, other applications, end users ( consumers, enterprises), communication type (enhanced mobile broadband, massive machine type communication, ultra-reliable low-latency communications), vertical (IT & ITeS, telecom, BFSI, retail & eCommerce, healthcare & life sciences, media & entertainment, construction & real estate, manufacturing, transportation, & logistics, education, government & public safety, energy & utilities and other verticals (agriculture, travel & hospitality, mining, oil & gas, and sports), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global 5G Services market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (Increase in mobile network data traffic, development of smart infrastructure, and timely availability of 5G compatible devices from several vendors, accelerated digital transformation across verticals, and need to transform mobile broadband experience), restraints (High costs for deployment of 5G network), opportunities (Fixed Wireless Access gaining momentum and increasing demand for high reliability and low latency networks), and challenges (Security concerns regarding 5G and delay in spectrum harmonization across geographies) influencing the growth of the 5G Services market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 5G Services market.

3. Market Development: Comprehensive information about lucrative markets - the report analyses the 5G Services market across various regions.

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the 5G Services market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), China Telecom (China), Orange (France), Vodafone (UK), China Unicom (China), Telstra (Australia), Telefonica S.A. (Spain), KT Corporation (South Korea), Roger Communications (Canada), Bell Canada (Canada), Etisalat (UAE), Saudi Telecom Company (Saudi Arabia), LG Uplus (South Korea), NTT Docomo (Japan), KDDI (Japan), Telus (Canada), Swisscom (Switzerland), Dish Network (US), Reliance Jio Infocomm (India), Rakuten Group (Japan), MTN Group (South Africa), Bharti Airtel Limited (India), Telenor Group (Norway), JMA Wireless (US), Verana Networks (US), Celona (US), Mangata Networks (US), Airspan Networks (US), Edge Q (US), Omniflow (US), Aarna Networks (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 IMPACT OF RECESSION

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 5G SERVICES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews with experts

- 2.1.2.3 Breakdown of primary profiles

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 5G SERVICES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 4 APPROACH 1 (SUPPLY-SIDE): REVENUE OF VENDORS IN 5G SERVICES MARKET

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 5 APPROACH 2 (DEMAND-SIDE): REVENUE IN 5G SERVICES MARKET

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 8 5G SERVICES MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 9 5G SERVICES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR 5G SERVICES MARKET PLAYERS

- FIGURE 10 INCREASE IN DEMAND FOR MACHINE-TO-MACHINE (M2M) COMMUNICATION AND SMART INFRASTRUCTURE TO DRIVE MARKET

- 4.2 5G SERVICES MARKET: TOP SEGMENTS

- FIGURE 11 LARGEST SEGMENTS IN MARKET IN 2023

- 4.3 5G SERVICES MARKET, BY APPLICATION

- FIGURE 12 INDUSTRY 4.0 SEGMENT TO BE LEADING APPLICATION MARKET IN 2023

- 4.4 5G SERVICES MARKET, BY COMMUNICATION TYPE

- FIGURE 13 ULTRA-RELIABLE LOW-LATENCY COMMUNICATION SEGMENT TO HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.5 5G SERVICES MARKET, BY END USER

- FIGURE 14 ENTERPRISE END USERS TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

- 4.6 5G SERVICES MARKET, BY ENTERPRISE

- FIGURE 15 MANUFACTURING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

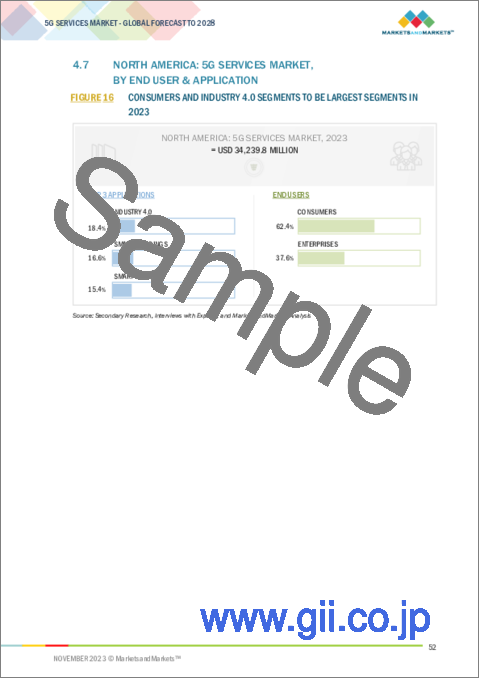

- 4.7 NORTH AMERICA: 5G SERVICES MARKET, BY END USER & APPLICATION

- FIGURE 16 CONSUMERS AND INDUSTRY 4.0 SEGMENTS TO BE LARGEST SEGMENTS IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G SERVICES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in mobile network data traffic

- FIGURE 18 GLOBAL MOBILE DATA TRAFFIC, 2022-2028

- 5.2.1.2 Need to transform mobile broadband experience

- 5.2.1.3 Accelerated digital transformation across verticals

- TABLE 4 EMERGING USE CASES SUPPORTED BY 5G NETWORK

- 5.2.1.4 Development of smart infrastructure

- 5.2.1.5 Timely availability of 5G-compatible devices from several vendors

- 5.2.2 RESTRAINTS

- 5.2.2.1 High deployment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Global proliferation of Fixed Wireless Access (FWA)

- FIGURE 19 REGIONAL FIXED WIRELESS ACCESS SERVICE PROVIDER ADOPTION IN 2023

- 5.2.3.2 Increase in demand for high reliability and low latency networks

- FIGURE 20 TIME-CRITICAL USE CASES ACROSS SECTORS

- 5.2.3.3 Introduction of massive IoT ecosystem and critical communications services

- 5.2.4 CHALLENGES

- 5.2.4.1 Delay in spectrum harmonization across geographies

- 5.2.4.2 Security concerns regarding 5G networks

- 5.3 BRIEF HISTORY OF 5G TECHNOLOGY

- FIGURE 21 BRIEF HISTORY OF 5G TECHNOLOGY

- 5.3.1 1980-1990

- 5.3.2 1990-2000

- 5.3.3 2000-2009

- 5.3.4 2009-2020

- 5.3.5 2020-PRESENT

- 5.4 ECOSYSTEM/MARKET MAP

- FIGURE 22 KEY PLAYERS IN 5G SERVICES MARKET ECOSYSTEM

- TABLE 5 5G SERVICES MARKET: ECOSYSTEM

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 TDC NET DEPLOYED ERICSSON'S E2E SLA FOR NETWORK SLICING

- 5.5.2 IMR PARTNERED WITH VODAFONE BUSINESS TO HELP LOCAL MANUFACTURERS ADOPT INDUSTRY 4.0

- 5.5.3 VODAFONE BUSINESS HELPED H-FARM CREATE FUTURE-FIT INNOVATION HUB

- 5.5.4 SUNRISE HELPED BOOST LAAX'S BUSINESSES BY LEVERAGING 5G

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 23 5G SERVICES MARKET: VALUE CHAIN ANALYSIS

- 5.6.1 5G INFRASTRUCTURE VENDORS

- 5.6.2 5G MOBILE CHIPSET AND TECHNOLOGY PROVIDERS

- 5.6.3 MOBILE CARRIERS

- 5.6.4 MOBILE DEVICE MAKERS

- 5.6.5 END USERS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.2.1 UK

- 5.7.1.2.2 Germany

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 China

- 5.7.1.3.2 India

- 5.7.1.3.3 Australia

- 5.7.1.3.4 Japan

- 5.7.1.4 Middle East & Africa

- 5.7.1.4.1 UAE

- 5.7.1.4.2 KSA

- 5.7.1.5 Latin America

- 5.7.1.5.1 Brazil

- 5.7.1.5.2 Mexico

- 5.7.1.1 North America

- 5.8 PATENT ANALYSIS

- FIGURE 24 LIST OF MAJOR PATENTS FOR 5G SERVICES

- 5.8.1 LIST OF MAJOR PATENTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 5G Massive MIMO

- 5.9.1.2 Millimeter-Wave

- 5.9.1.3 Small Cell Networks

- 5.9.1.4 Network Slicing

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Wi-Fi

- 5.9.2.2 WiMAX

- 5.9.2.3 LTE

- 5.9.2.4 OnGo Alliance

- FIGURE 25 THREE-TIER MODEL FOR CITIZENS BROADBAND RADIO SERVICE SPECTRUM ACCESS

- 5.9.2.5 MulteFire

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 IoT

- 5.9.3.2 AI

- 5.9.3.3 Edge Computing

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END USER

- FIGURE 26 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY END USER

- TABLE 10 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY END USER (USD)

- 5.10.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION

- TABLE 11 INDICATIVE PRICING LEVELS OF 5G SERVICES

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 PORTER'S FIVE FORCES IMPACT ON 5G SERVICES MARKET

- FIGURE 27 PORTER'S FIVE FORCE ANALYSIS: 5G SERVICES MARKET

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISES

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISES

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISES

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.14 KEY CONFERENCES & EVENTS

- TABLE 15 5G SERVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.15 BEST PRACTICES IN 5G SERVICES MARKET

- 5.15.1 NETWORK RELIABILITY AND COVERAGE

- 5.15.2 SECURITY AND PRIVACY

- 5.15.3 SPECTRUM MANAGEMENT

- 5.15.4 NETWORK SLICING FOR CUSTOMIZATION

- 5.15.5 COLLABORATION WITH ECOSYSTEM PARTNERS

- 5.15.6 CUSTOMER ENGAGEMENT AND SUPPORT

- 5.16 CURRENT AND EMERGING BUSINESS MODELS

- 5.16.1 SUBSCRIPTION MODEL

- 5.16.2 FREEMIUM

- 5.16.3 B2B AND ENTERPRISE MODELS

- 5.16.4 CONTENT AND APPLICATION PARTNERSHIP

- 5.16.5 CONTENT MARKETPLACE

- 5.16.6 5G ENABLEMENT PLATFORMS

- 5.17 5G SERVICES TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.17.1 5G SERVICES TOOLS

- 5.17.1.1 Network performance monitoring tools

- 5.17.1.2 Network slicing orchestrators

- 5.17.1.3 Security and threat detection software

- 5.17.1.4 Network optimization software

- 5.17.2 5G SERVICE FRAMEWORKS

- 5.17.2.1 Open radio access network (RAN)

- 5.17.2.2 Open network automation platform (ONAP)

- 5.17.2.3 Multi-access edge computing (MEC)

- 5.17.3 5G TECHNIQUES

- 5.17.3.1 Beamforming

- 5.17.3.2 Non-standalone (NSA) and standalone (SA) mode

- 5.17.3.3 Dynamic spectrum sharing

- 5.17.1 5G SERVICES TOOLS

- 5.18 FUTURE LANDSCAPE OF 5G SERVICE MARKET

- 5.18.1 SHORT-TERM ROADMAP (2023-2025)

- 5.18.2 MID-TERM ROADMAP (2026-2028)

- 5.18.3 LONG-TERM ROADMAP (2029-2030)

6 5G SERVICES MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 31 INDUSTRY 4.0 SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- 6.1.1 APPLICATION: 5G SERVICES MARKET DRIVERS

- TABLE 16 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 17 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 6.2 SMART CITIES

- 6.2.1 BENEFITS OF LOW-LATENCY, SMART, AND SECURE 5G-BASED INFRASTRUCTURE ECOSYSTEMS

- TABLE 18 5G SERVICES MARKET IN SMART CITIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 19 5G SERVICES MARKET IN SMART CITIES, BY REGION, 2023-2028 (USD MILLION)

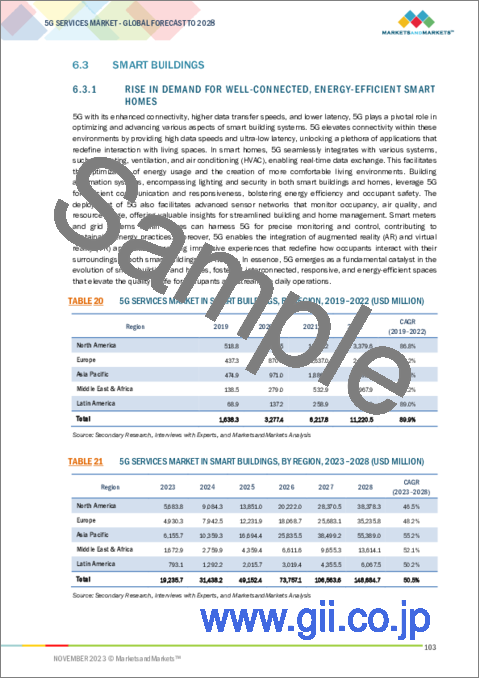

- 6.3 SMART BUILDINGS

- 6.3.1 RISE IN DEMAND FOR WELL-CONNECTED, ENERGY-EFFICIENT SMART HOMES

- TABLE 20 5G SERVICES MARKET IN SMART BUILDINGS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 21 5G SERVICES MARKET IN SMART BUILDINGS, BY REGION, 2023-2028 (USD MILLION)

- 6.4 AUTONOMOUS VEHICLES

- 6.4.1 VEHICLE-TO-VEHICLE COMMUNICATION AND SMART TRAFFIC SYSTEMS TO CREATE SEAMLESS ENVIRONMENT FOR AUTONOMOUS VEHICLES

- TABLE 22 5G SERVICES MARKET IN AUTONOMOUS VEHICLES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 5G SERVICES MARKET IN AUTONOMOUS VEHICLES, BY REGION, 2023-2028 (USD MILLION)

- 6.5 SMART HEALTHCARE

- 6.5.1 INTERNET OF MEDICAL THINGS TO BE ESSENTIAL IN REMOTE MONITORING, SURGERIES, TREATMENT PLANS, AND PREDICTIVE ANALYTICS

- TABLE 24 5G SERVICES MARKET IN SMART HEALTHCARE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 5G SERVICES MARKET IN SMART HEALTHCARE, BY REGION, 2023-2028 (USD MILLION)

- 6.6 INDUSTRY 4.0

- 6.6.1 INTEGRATION OF CYBER-PHYSICAL PRODUCTION SYSTEMS WITH 5G TO RESTRUCTURE VALUE CREATION AND SUPPLY CHAINS

- TABLE 26 5G SERVICES MARKET IN INDUSTRY 4.0, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 5G SERVICES MARKET IN INDUSTRY 4.0, BY REGION, 2023-2028 (USD MILLION)

- 6.7 SMART UTILITIES

- 6.7.1 DEMAND FOR ACCURATE AND EFFICIENT RESOURCE MANAGEMENT

- TABLE 28 5G SERVICES MARKET IN SMART UTILITIES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 5G SERVICES MARKET IN SMART UTILITIES, BY REGION, 2023-2028 (USD MILLION)

- 6.8 IMMERSIVE MEDIA & GAMING

- 6.8.1 IMPROVEMENTS IN CONNECTIVITY DURING GAMING AND IMMERSIVE CONTENT CONSUMPTION

- TABLE 30 5G SERVICES MARKET IN IMMERSIVE MEDIA & GAMING, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 5G SERVICES MARKET IN IMMERSIVE MEDIA & GAMING, BY REGION, 2023-2028 (USD MILLION)

- 6.9 OTHER APPLICATIONS

- TABLE 32 5G SERVICES MARKET IN OTHER APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 5G SERVICES MARKET IN OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

7 5G SERVICES MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 32 ADOPTION OF 5G AMONG ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 END USER: 5G SERVICES MARKET DRIVERS

- TABLE 34 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 35 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 7.2 CONSUMER

- 7.2.1 LOW LATENCY OFFERED IN SMART HOME DEVICES, WITH 5G-INTEGRATED EMERGING TECHNOLOGIES

- TABLE 36 5G SERVICES MARKET AMONG CONSUMERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 5G SERVICES MARKET AMONG CONSUMERS, BY REGION, 2023-2028 (USD MILLION)

- 7.3 ENTERPRISES

- 7.3.1 INCREASE IN DEMAND FOR SECURE NETWORKS AND REMOTE WORK SOLUTIONS

- TABLE 38 5G SERVICES MARKET AMONG ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 5G SERVICES MARKET AMONG ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

8 5G SERVICES MARKET, BY COMMUNICATION TYPE

- 8.1 INTRODUCTION

- FIGURE 33 URLLC TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 8.1.1 COMMUNICATION TYPE: 5G SERVICES MARKET DRIVERS

- TABLE 40 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 41 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- 8.2 ENHANCED MOBILE BROADBAND (EMBB)

- 8.2.1 DEMAND FOR SEAMLESS STREAMING OF HIGHER VIDEO RESOLUTIONS

- TABLE 42 ENHANCED MOBILE BROADBAND SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 ENHANCED MOBILE BROADBAND SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 MASSIVE MACHINE TYPE COMMUNICATION (MMTC)

- 8.3.1 BENEFITS OF IMPROVISING FUNCTIONING OF IOT DEVICES ACROSS VARIOUS ENTERPRISES

- TABLE 44 MASSIVE MACHINE TYPE COMMUNICATION SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 MASSIVE MACHINE TYPE COMMUNICATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 ULTRA-RELIABLE LOW LATENCY COMMUNICATION

- 8.4.1 RELIABILITY OF 5G ACROSS MISSION CRITICAL APPLICATIONS

- TABLE 46 ULTRA-RELIABLE LOW LATENCY COMMUNICATION SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 ULTRA-RELIABLE LOW LATENCY COMMUNICATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

9 5G SERVICES MARKET, BY ENTERPRISE

- 9.1 INTRODUCTION

- FIGURE 34 HEALTHCARE & LIFE SCIENCES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 9.1.1 ENTERPRISE: 5G SERVICES MARKET DRIVERS

- TABLE 48 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 49 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 9.2 MANUFACTURING

- 9.2.1 RAPID DEVELOPMENT OF SMART FACTORIES WITH HIGH BANDWIDTH, NETWORK SLICING, AND EDGE COMPUTING CAPABILITIES

- 9.2.2 USE CASES

- 9.2.2.1 Industrial IoT (IIoT) Connectivity

- 9.2.2.2 Precision Robotics and Automation

- TABLE 50 5G SERVICES MARKET AMONG MANUFACTURING ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 5G SERVICES MARKET AMONG MANUFACTURING ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.3 IT & ITES

- 9.3.1 NEED TO ENHANCE AND MAINTAIN CONFIDENTIALITY AND INTEGRITY OF SENSITIVE DATA TRANSMITTED ACROSS NETWORKS

- 9.3.2 USE CASES

- 9.3.2.1 Enhanced Cloud Computing

- 9.3.2.2 Real-time Data Analytics

- TABLE 52 5G SERVICES MARKET AMONG IT & ITES ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 5G SERVICES MARKET AMONG IT & ITES ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.4 TELECOM

- 9.4.1 FLEXIBILITY, SCALABILITY, AND OPERATIONAL EFFICIENCY TO ACCELERATE SERVICE DEPLOYMENT AND REDUCE COSTS FOR TELECOM OPERATORS

- 9.4.2 USE CASES

- 9.4.2.1 Cloud-native Networks

- 9.4.2.2 Voice over 5G

- TABLE 54 5G SERVICES MARKET AMONG TELECOM ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 5G SERVICES MARKET AMONG TELECOM ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.5 HEALTHCARE & LIFESCIENCES

- 9.5.1 REAL-TIME PATIENT MONITORING AND WEARABLE HEALTH DEVICES TO BENEFIT FROM 5G CONNECTIVITY

- 9.5.2 USE CASES

- 9.5.2.1 IoT-enabled Healthcare Devices

- 9.5.2.2 Connected Ambulance

- TABLE 56 5G SERVICES MARKET AMONG HEALTHCARE & LIFE SCIENCES ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 5G SERVICES MARKET AMONG HEALTHCARE & LIFE SCIENCES ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.6 RETAIL & ECOMMERCE

- 9.6.1 STEEP RISE IN ONLINE SHOPPING AND USE OF CONTACTLESS PAYMENT METHODS SUCH AS MOBILE WALLETS, CONTACTLESS CARDS, AND WEARABLE DEVICES

- 9.6.2 USE CASES

- 9.6.2.1 Contactless Payments and Digital Wallets

- 9.6.2.2 Personalized Marketing through Location-based Services

- TABLE 58 5G SERVICES MARKET AMONG RETAIL & ECOMMERCE ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 5G SERVICES MARKET AMONG RETAIL & ECOMMERCE ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.7 TRANSPORTATION & LOGISTICS

- 9.7.1 ROUTE OPTIMIZATION, BETTER CONNECTIVITY, AND VEHICLE MONITORING TO ENHANCE TRAFFIC MANAGEMENT AND SAFETY, ESPECIALLY IN SMART PORTS

- 9.7.2 USE CASES

- 9.7.2.1 Last-Mile Delivery Optimization

- 9.7.2.2 Smart Ports and Maritime Operations

- TABLE 60 5G SERVICES MARKET AMONG TRANSPORTATION & LOGISTICS ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 5G SERVICES MARKET AMONG TRANSPORTATION & LOGISTICS ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.8 EDUCATION

- 9.8.1 SMART CAMPUSES AND ELEARNING WITH SMOOTH ACCESS TO ONLINE RESOURCES, COLLABORATIVE PLATFORMS, AND INTERACTIVE CONTENT

- 9.8.2 USE CASES

- 9.8.2.1 Online Learning Platforms and Remote Education

- 9.8.2.2 Smart Classrooms and Interactive Displays

- TABLE 62 5G SERVICES MARKET AMONG EDUCATION ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 5G SERVICES MARKET AMONG EDUCATION ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.9 ENERGY & UTILITIES

- 9.9.1 EFFICIENT MANAGEMENT & CONSUMPTION OF ENERGY BY LEVERAGING 5G

- 9.9.2 USE CASES

- 9.9.2.1 Smart Metering and Home Automation

- 9.9.2.2 Efficient Water Management

- TABLE 64 5G SERVICES MARKET AMONG ENERGY & UTILITIES ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 5G SERVICES MARKET AMONG ENERGY & UTILITIES ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.10 MEDIA & ENTERTAINMENT

- 9.10.1 DEMAND FOR BETTER OTT STREAMING AND CLOUD GAMING EXPERIENCES

- 9.10.2 USE CASES

- 9.10.2.1 Live Streaming in High Resolutions

- 9.10.2.2 OTT Platforms with Enhanced Streaming

- TABLE 66 5G SERVICES MARKET AMONG MEDIA & ENTERTAINMENT ENTERPRISE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 5G SERVICES MARKET AMONG MEDIA & ENTERTAINMENT ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.11 BFSI

- 9.11.1 FINANCIAL INSTITUTIONS TO LEVERAGE 5G FOR SECURE TRANSACTIONS AND DATA PROTECTION

- 9.11.2 USE CASES

- 9.11.2.1 Biometric Authentication

- 9.11.2.2 Smart ATMs

- TABLE 68 5G SERVICES MARKET AMONG BFSI ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 5G SERVICES MARKET AMONG BFSI ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.12 GOVERNMENT & PUBLIC SECTOR

- 9.12.1 LEVERAGING 5G FOR AUTOMATED ADMINISTRATIVE TASKS AND EGOVERNMENT INITIATIVES

- 9.12.2 USE CASES

- 9.12.2.1 Online Portals and Service

- 9.12.2.2 Automated Administrative Processes

- TABLE 70 5G SERVICES MARKET AMONG GOVERNMENT & PUBLIC SECTOR ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 5G SERVICES MARKET AMONG GOVERNMENT & PUBLIC SECTOR ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.13 CONSTRUCTION & REAL ESTATE

- 9.13.1 BENEFITS OF SMART BUILDINGS AND VIRTUAL PROPERTY TOURS USING AR AND VR FOR REAL ESTATE

- 9.13.2 USE CASES

- 9.13.2.1 Connected Construction Equipment

- 9.13.2.2 Efficient Construction Machinery Control

- TABLE 72 5G SERVICES MARKET AMONG CONSTRUCTION & REAL ESTATE ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 5G SERVICES MARKET AMONG CONSTRUCTION & REAL ESTATE ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.14 OTHER ENTERPRISES

- 9.14.1 USE CASES

- 9.14.1.1 Player Performance Analytics

- 9.14.1.2 Smart Irrigation System

- 9.14.1.3 Smart Hotel Rooms

- TABLE 74 5G SERVICES MARKET AMONG OTHER ENTERPRISES, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 5G SERVICES MARKET AMONG OTHER ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 9.14.1 USE CASES

10 5G SERVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 76 5G SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 5G SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: 5G SERVICES MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 35 NORTH AMERICA: 5G SERVICES MARKET SNAPSHOT

- TABLE 78 NORTH AMERICA: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: 5G SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: 5G SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Robust ecosystem and presence of prominent 5G players

- TABLE 88 US: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 89 US: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 90 US: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 91 US: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 92 US: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 93 US: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 94 US: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 95 US: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Extensive research and government initiatives

- TABLE 96 CANADA: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 97 CANADA: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 98 CANADA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 99 CANADA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 100 CANADA: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 101 CANADA: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 102 CANADA: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 103 CANADA: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: 5G SERVICES MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 104 EUROPE: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 EUROPE: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 107 EUROPE: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 108 EUROPE: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 109 EUROPE: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 111 EUROPE: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: 5G SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 113 EUROPE: 5G SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Funding initiatives, grants, and tax incentives for tech companies

- TABLE 114 UK: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 UK: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 UK: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 117 UK: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 118 UK: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 119 UK: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 120 UK: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 121 UK: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Government strategies with dedication to advancing its 5G infrastructure

- TABLE 122 GERMANY: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 GERMANY: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 124 GERMANY: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 125 GERMANY: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 126 GERMANY: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 127 GERMANY: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 128 GERMANY: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 129 GERMANY: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Ample funding and extensive research into potential of 5G

- TABLE 130 ITALY: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 131 ITALY: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 132 ITALY: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 133 ITALY: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 134 ITALY: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 135 ITALY: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 136 ITALY: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 137 ITALY: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Strategic investments and collaborations with Germany aimed at 5G and 6G advancements

- 10.3.7 SPAIN

- 10.3.7.1 Spain's proactive stance in incorporating 5G across various industries

- 10.3.8 NORDICS

- 10.3.8.1 Strategic focus on continuous digitalization and cross-border collaboration

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: 5G SERVICES MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC: 5G SERVICES MARKET SNAPSHOT

- TABLE 138 ASIA PACIFIC: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: 5G SERVICES MARKET, BY END USER 2023-2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: 5G SERVICES MARKET, BY COUNTRY/REGION, 2019-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: 5G SERVICES MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Robust 5G ecosystem & infrastructure with presence of significant 5G players

- TABLE 148 CHINA: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 149 CHINA: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 150 CHINA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 151 CHINA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 152 CHINA: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 153 CHINA: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 154 CHINA: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 155 CHINA: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Substantial Investments and proliferation of 5G smartphones to catalyze digital transformation

- 10.4.5 JAPAN

- 10.4.5.1 Strategic focus on 5G infrastructure development with key target set for 2030

- 10.4.6 AUSTRALIA & NEW ZEALAND

- 10.4.6.1 Substantial investments and active fostering of 5G R&D

- 10.4.7 SOUTH KOREA

- 10.4.7.1 Development of autonomous vehicles and substantial investments in 5G technology

- 10.4.8 SOUTHEAST ASIA

- 10.4.8.1 Significant initiatives, partnerships, and investments by key players

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: 5G SERVICES MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 156 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: 5G SERVICES MARKET, BY COUNTRY/REGION, 2019-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA 5G SERVICES MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 166 GCC: 5G SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 167 GCC: 5G SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 GCC COUNTRIES

- TABLE 168 GCC: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 169 GCC: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 170 GCC: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 171 GCC: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 172 GCC: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 173 GCC: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 174 GCC: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 175 GCC: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.5.3.1 UAE

- 10.5.3.1.1 Expansion of 5G networks by major telecom operators

- 10.5.3.2 Kingdom of Saudi Arabia

- 10.5.3.2.1 Increase in adoption of 5G technologies for IoT deployments

- 10.5.3.3 Rest of GCC countries

- 10.5.3.1 UAE

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Surge in demand for digitalization

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: 5G SERVICES MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 176 LATIN AMERICA: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: 5G SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: 5G SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Rolling out of 5G standalone services using 2.3 GHz and 3.5 GHz spectrum

- TABLE 186 BRAZIL: 5G SERVICES MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 187 BRAZIL: 5G SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 188 BRAZIL: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2019-2022 (USD MILLION)

- TABLE 189 BRAZIL: 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 190 BRAZIL: 5G SERVICES MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 191 BRAZIL: 5G SERVICES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 192 BRAZIL: 5G SERVICES MARKET, BY ENTERPRISE, 2019-2022 (USD MILLION)

- TABLE 193 BRAZIL: 5G SERVICES MARKET, BY ENTERPRISE, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Improved collaboration between government and telecom companies for expedited 5G rollout

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY 5G SERVICE PROVIDERS

- 11.3 REVENUE ANALYSIS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD BILLION)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 38 5G SERVICES MARKET SHARE ANALYSIS, 2022

- TABLE 194 5G SERVICES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 39 COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT

- TABLE 195 COMPANY APPLICATION FOOTPRINT

- TABLE 196 COMPANY ENTERPRISE FOOTPRINT

- TABLE 197 COMPANY REGIONAL FOOTPRINT

- TABLE 198 OVERALL COMPANY FOOTPRINT

- 11.6 STARTUP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 40 STARTUP/SME EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 199 DETAILED LIST OF START-UPS/SMES

- TABLE 200 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 201 5G SERVICES MARKET: SERVICE LAUNCHES, DECEMBER 2021-SEPTEMBER 2023

- 11.7.2 DEALS

- TABLE 202 5G SERVICES MARKET: DEALS, JANUARY 2021-OCTOBER 2023

- 11.8 5G SERVICES PRODUCT BENCHMARKING

- 11.8.1 PROMINENT 5G SERVICES

- TABLE 203 COMPARATIVE ANALYSIS OF PROMINENT 5G SERVICES

- 11.8.1.1 AT&T 5G Unlimited

- 11.8.1.2 Verizon 5G Services

- 11.8.1.3 Vodafone 5G Home broadband

- 11.8.1.4 China Mobile 5G Services

- 11.8.1.5 Deutsche Telekom 5G Services

- 11.9 VALUATION AND FINANCIAL METRICS OF KEY 5G SERVICE PROVIDERS

- FIGURE 41 VALUATION AND FINANCIAL METRICS OF KEY 5G SERVICE VENDORS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.1.1 AT&T

- TABLE 204 AT&T: COMPANY OVERVIEW

- FIGURE 42 AT&T: COMPANY SNAPSHOT

- TABLE 205 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 AT&T: SERVICE LAUNCHES

- TABLE 207 AT&T: DEALS

- 12.1.2 CHINA MOBILE

- TABLE 208 CHINA MOBILE: COMPANY OVERVIEW

- FIGURE 43 CHINA MOBILE: COMPANY SNAPSHOT

- TABLE 209 CHINA MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 CHINA MOBILE: SERVICE LAUNCHES

- TABLE 211 CHINA MOBILE: DEALS

- TABLE 212 CHINA MOBILE: OTHERS

- 12.1.3 VERIZON COMMUNICATIONS

- TABLE 213 VERIZON COMMUNICATIONS: COMPANY OVERVIEW

- FIGURE 44 VERIZON COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 214 VERIZON COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 VERIZON COMMUNICATIONS: SERVICE LAUNCHES

- TABLE 216 VERIZON COMMUNICATIONS: DEALS

- 12.1.4 DEUTSCHE TELEKOM AG

- TABLE 217 DEUTSCHE TELEKOM AG: COMPANY OVERVIEW

- FIGURE 45 DEUTSCHE TELEKOM AG: COMPANY SNAPSHOT

- TABLE 218 DEUTSCHE TELEKOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 DEUTSCHE TELEKOM AG: SERVICE LAUNCHES

- TABLE 220 DEUTSCHE TELEKOM AG: DEALS

- 12.1.5 VODAFONE GROUP

- TABLE 221 VODAFONE GROUP: COMPANY OVERVIEW

- FIGURE 46 VODAFONE GROUP: COMPANY SNAPSHOT

- TABLE 222 VODAFONE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 VODAFONE GROUP: SERVICE LAUNCHES

- TABLE 224 VODAFONE GROUP: DEALS

- 12.1.6 SK TELECOM

- TABLE 225 SK TELECOM: COMPANY OVERVIEW

- FIGURE 47 SK TELECOM: COMPANY SNAPSHOT

- TABLE 226 SK TELECOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 SK TELECOM: DEALS

- 12.1.7 BT GROUP

- TABLE 228 BT GROUP: COMPANY OVERVIEW

- FIGURE 48 BT GROUP: COMPANY SNAPSHOT

- TABLE 229 BT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 BT GROUP: DEALS

- 12.1.8 CHINA TELECOM CORPORATION LIMITED

- TABLE 231 CHINA TELECOM CORPORATION LIMITED: COMPANY OVERVIEW

- FIGURE 49 CHINA TELECOM CORPORATION LIMITED: COMPANY SNAPSHOT

- TABLE 232 CHINA TELECOM CORPORATION LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 CHINA TELECOM CORPORATION LIMITED: SERVICE LAUNCHES

- TABLE 234 CHINA TELECOM CORPORATION LIMITED: DEALS

- 12.1.9 ORANGE S.A.

- TABLE 235 ORANGE S.A.: COMPANY OVERVIEW

- FIGURE 50 ORANGE S.A.: COMPANY SNAPSHOT

- TABLE 236 ORANGE S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 ORANGE S.A.: SERVICE LAUNCHES

- TABLE 238 ORANGE S.A.: DEALS

- TABLE 239 ORANGE S.A.: OTHERS

- 12.1.10 KT CORPORATION

- TABLE 240 KT CORPORATION: COMPANY OVERVIEW

- FIGURE 51 KT CORPORATION: COMPANY SNAPSHOT

- TABLE 241 KT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 KT CORPORATION: DEALS

- 12.1.11 CHINA UNICOM NETWORK COMMUNICATIONS

- 12.1.12 TELSTRA GROUP LIMITED

- 12.1.13 ROGERS COMMUNICATION INC.

- 12.1.14 BELL CANADA

- 12.1.15 ETISALAT GROUP

- 12.1.16 SAUDI TELECOM COMPANY

- 12.1.17 KDDI CORPORATION

- 12.1.18 TELUS CORPORATION

- 12.1.19 LG UPLUS CORP.

- 12.1.20 SWISSCOM

- 12.1.21 RELIANCE JIO

- 12.1.22 BHARTI AIRTEL LIMITED

- 12.1.23 TELENOR ASA

- 12.1.24 MTN GROUP

- 12.1.25 RAKUTEN GROUP

- 12.1.26 NTT DOCOMO

- 12.1.27 DISH NETWORK CORPORATION

- 12.1.28 TELEFONICA S.A.

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.2 STARTUPS/SMES

- 12.2.1 JMA WIRELESS

- 12.2.2 VERANA NETWORKS

- 12.2.3 CELONA

- 12.2.4 MANGATA NETWORKS

- 12.2.5 AIRSPAN NETWORKS

- 12.2.6 EDGEQ

- 12.2.7 OMNIFLOW

- 12.2.8 AARNA NETWORKS

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 SMALL CELL 5G NETWORK MARKET

- 13.2.1 MARKET OVERVIEW

- 13.2.2 SMALL CELL 5G NETWORK MARKET, BY COMPONENT

- TABLE 243 SMALL CELL 5G NETWORK MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- 13.2.2.1 Solutions

- TABLE 244 SOLUTIONS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- 13.2.2.2 Services

- TABLE 245 SERVICES: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 246 SERVICES: SMALL CELL 5G NETWORK MARKET, BY TYPE, 2019-2025 (USD MILLION)

- TABLE 247 CONSULTING MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 248 INTEGRATION AND DEPLOYMENT MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 249 TRAINING AND SUPPORT MARKET, BY REGION, 2019-2025 (USD MILLION)

- 13.2.3 SMALL CELL 5G NETWORK MARKET, BY CELL TYPE

- TABLE 250 SMALL CELL 5G NETWORK MARKET, BY CELL TYPE, 2019-2025 (USD MILLION)

- TABLE 251 PICOCELLS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 252 FEMTOCELLS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 253 MICROCELLS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- 13.2.4 SMALL CELL 5G NETWORK MARKET, BY DEPLOYMENT MODE

- TABLE 254 SMALL CELL 5G NETWORK MARKET, BY DEPLOYMENT MODE, 2019-2025 (USD MILLION)

- 13.2.5 SMALL CELL 5G NETWORK MARKET, BY RADIO TECHNOLOGY

- TABLE 255 SMALL CELL 5G NETWORK MARKET, BY RADIO TECHNOLOGY, 2019-2025 (USD MILLION)

- 13.2.6 SMALL CELL 5G NETWORK MARKET, BY END USER

- TABLE 256 SMALL CELL 5G NETWORK MARKET, BY END USER, 2019-2025 (USD MILLION)

- 13.2.7 SMALL CELL 5G NETWORK MARKET, BY REGION

- TABLE 257 SMALL CELL 5G NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- 13.3 5G IOT MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 5G IOT MARKET, BY COMPONENT

- TABLE 258 5G IOT MARKET, BY COMPONENT, 2020-2028 (USD MILLION)

- TABLE 259 HARDWARE: 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 260 PLATFORM: 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 261 CONNECTIVITY: 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 262 5G IOT MARKET, BY SERVICE, 2020-2028 (USD MILLION)

- TABLE 263 5G IOT MARKET, BY PROFESSIONAL SERVICE, 2020-2028 (USD MILLION)

- 13.3.4 5G IOT MARKET, BY NETWORK TYPE

- TABLE 264 5G IOT MARKET, BY NETWORK TYPE, 2020-2028 (USD MILLION)

- TABLE 265 5G STANDALONE: 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 266 5G NON-STANDALONE: 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

- 13.3.5 5G IOT MARKET, BY END USER

- TABLE 267 5G IOT MARKET, BY END USER, 2020-2028 (USD MILLION)

- 13.3.6 5G IOT MARKET, BY REGION

- TABLE 268 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS