|

|

市場調査レポート

商品コード

1812631

炭酸エチレンの世界市場:用途別、最終用途産業別、地域別 - 予測(~2032年)Ethylene Carbonate Market by Application (Lithium Battery Electrolytes, Lubricants, Surface Coatings, Plasticizers), End-use Industry (Automotive, Industrial, Oil & Gas, Medical, Personal Care & Hygiene), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 炭酸エチレンの世界市場:用途別、最終用途産業別、地域別 - 予測(~2032年) |

|

出版日: 2025年09月12日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

概要

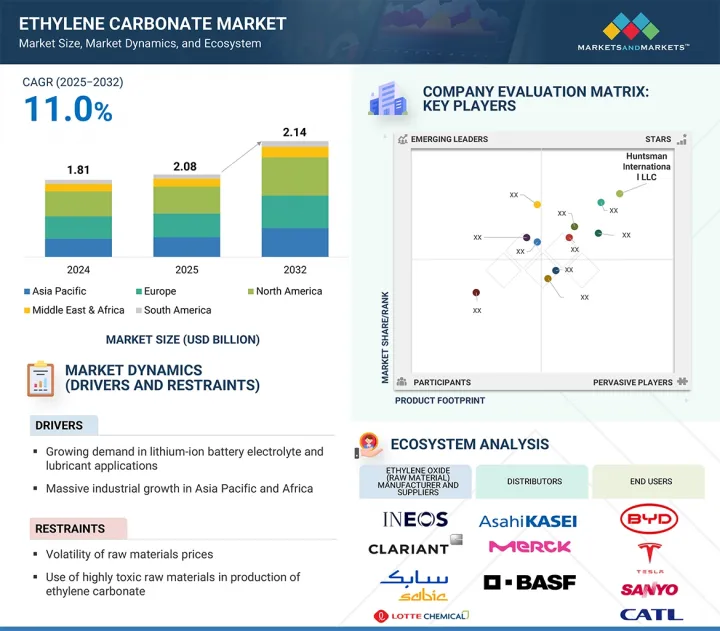

世界の炭酸エチレンの市場規模は、2025年の10億3,000万米ドルから2032年までに21億4,000万米ドルに達すると予測され、予測期間にCAGRで11.0%の成長が見込まれます。

この成長の主因は、電気自動車(EV)、コンシューマーエレクトロニクス、再生可能エネルギー貯蔵システムにおけるリチウムイオン電池の需要の増加であり、この化合物は重要な電解質の溶媒として機能し、イオン伝導性、安定性、電池寿命を向上させます。厳しい排ガス規制とEV採用に対する政府のインセンティブに支えられたクリーンエネルギーと輸送へのシフトが、消費を大幅に押し上げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 100万米ドル/10億米ドル、個数 |

| セグメント | 形状、最終用途産業、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

また、潤滑油、コーティング、プラスチックの利用の拡大が産業成長に拍車をかけ、市場の拡大に寄与しています。アジアではコスト効率の高い生産が可能であり、電池技術の進歩が続いていることから、炭酸エチレンの世界的な需要はさらに拡大しています。

「形状別では、固形セグメントが予測期間に第2位のシェアを占める見込みです。」

固形セグメントが予測期間に第2位の市場シェアを占める見込みです。固体炭酸エチレンは、その安定性、扱いやすさ、高純度が高く評価されており、さまざまな産業用途に適しています。潤滑剤、可塑剤、表面コーティング、特殊化学製剤の中間体として広く使用されています。リチウムイオン電池産業では、純度と組成の精密な管理が必要な高性能電解質の調製に固形炭酸エチレンが好んで使用されることが多いです。さらに、ポリマー加工、接着剤、シーラントにおける溶剤と架橋剤としての役割も、製造部門からの安定した需要を支えています。このセグメントの成長は、EV用電池用途では液体が優勢であるため液体に比べて鈍化する可能性がありますが、固体の汎用性、貯蔵安定性、ニッチ用途への適合性により、予測期間を通じて大きな市場シェアを維持します。

「用途別では、主にリチウムイオン電池の需要の拡大により、リチウム電池用電解質が大きな市場シェアを占めます。」

リチウム電池用電解質が炭酸エチレン市場を独占しており、さまざまな産業でリチウムイオン電池の需要が高まっていることがその主因となっています。炭酸エチレンは、これらの電池に不可欠な高誘電率溶媒であり、効率的なイオン移動を可能にし、安定した固体電解質界面相(SEI)を形成することで、電池の性能、安全性、寿命を向上させます。もっとも急成長しているセグメントは、脱炭素化への取り組み、厳しい排出基準、政府の奨励策に支えられた電気自動車(EV)の普及に後押しされています。さらに、スマートフォン、ラップトップ、タブレット、ウェアラブルなどのコンシューマーエレクトロニクス部門が活況を呈しており、信頼性の高い高エネルギー密度電池へのニーズが高まり続けています。さらに、送電網における再生可能エネルギー貯蔵システムの利用の拡大により、固定条件下でのリチウムイオン電池の利用が広がっています。電池製造への世界的な投資、特にアジア太平洋での投資が増加し続ける中、リチウム電池用電解質における炭酸エチレンの需要は、予測期間を通じて優位性を保つ見込みです。

当レポートでは、世界の炭酸エチレン市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 炭酸エチレン市場における魅力的な機会

- アジア太平洋の炭酸エチレン市場:用途別、国別

- 炭酸エチレン市場:主要国

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- エコシステム分析

- 価格設定の分析

- 特許分析

- 調査手法

- 特許公報の動向

- 考察

- 管轄分析

- ケーススタディ分析

- リチウム、カルシウム、アルミニウムアノード界面における炭酸エチレン系電解質の分解の比較研究

- 炭酸エチレンの温度分解結晶構造

- 電池動作条件下での水と水酸化物による炭酸エチレンの加水分解

- 投資と資金調達のシナリオ

- 貿易分析

- 輸入シナリオ(HSコード290121)

- 輸出シナリオ(HSコード290121)

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- イントロダクション

- 規制機関、政府機関、その他の組織

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- ビジネスに影響を与える動向/混乱

- マクロ経済の見通し

- 炭酸エチレン市場に対するAIの影響

- 2025年の米国関税の影響 - 炭酸エチレン市場

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 炭酸エチレン市場:形状別

- イントロダクション

- 固体

- 液体

第7章 炭酸エチレン市場:グレード別

- イントロダクション

- 電池グレード

- 電子グレード

- 工業グレード

第8章 炭酸エチレン市場:用途別

- イントロダクション

- リチウム電池用電解質

- 潤滑剤

- 表面コーティング

- 可塑剤

- その他の用途

第9章 炭酸エチレン市場:最終用途産業別

- イントロダクション

- 自動車

- 工業

- 石油・ガス

- 医療

- パーソナルケア・衛生

- その他の最終用途産業

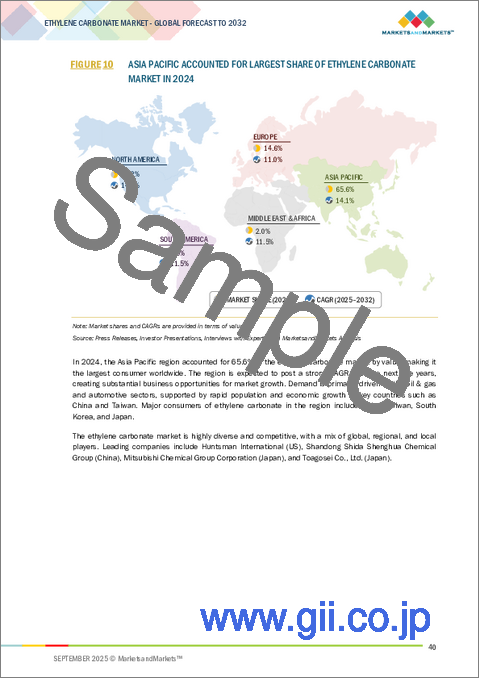

第10章 炭酸エチレン市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- 台湾

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- トルコ

- ロシア

- その他の欧州

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

- 企業の評価と財務指標

第12章 企業プロファイル

- 主要企業

- ORIENTAL UNION CHEMICAL CORPORATION

- MITSUBISHI CHEMICAL GROUP CORPORATION

- HUNTSMAN INTERNATIONAL LLC

- TOAGOSEI CO., LTD.

- SHINGHWA ADVANCED MATERIAL GROUP CO., LTD.

- DUBI CHEM

- ZIBO DONGHAI INDUSTRIES CO., LTD.

- MERCK KGAA

- INDORAMA VENTURES PUBLIC COMPANY LIMITED

- LOTTE CHEMICAL CORPORATION

- ASAHI KASEI CORPORATION

- EMPOWER MATERIALS

- VIZAG CHEMICAL

- JUNSEI CHEMICAL CO., LTD.

- SHANDONG LIXING ADVANCED MATERIAL CO., LTD.

- ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO., LTD.

- YINGKOU HENGYANG NEW ENERGY CHEMICAL CO., LTD.

- その他の企業

- OCEANCHEM GROUP LIMITED

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- RX MARINE INTERNATIONAL

- DONGYING HI-TECH SPRING CHEMICAL INDUSTRY CO., LTD.

- HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

第13章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 相互接続された市場