|

|

市場調査レポート

商品コード

1455831

電気式ヒートトレースの世界市場:タイプ別・コンポーネント別・産業別 - 予測(~2029年)Electric Heat Tracing Market by Type (Self-regulating, Constant Wattage, Mineral-insulated), Component (Heat Tracing Cables, Control & Monitoring Systems, Thermal Insulation Materials, Power Connection Kits), Vertical - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 電気式ヒートトレースの世界市場:タイプ別・コンポーネント別・産業別 - 予測(~2029年) |

|

出版日: 2024年03月25日

発行: MarketsandMarkets

ページ情報: 英文 242 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

電気式ヒートトレースの市場規模は、予測期間中に7.9%のCAGRで推移し、2024年の29億6,000万米ドルから、2029年には43億4,000万米ドルの規模に成長すると予測されています。

世界のヒートトレース市場は、石油・ガス、化学、製造などの産業の精密な温度制御に対する需要の拡大、ヒートトレース技術の進歩、インフラプロジェクトの増加などから、力強い成長を遂げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | タイプ・コンポーネント・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

タイプ別では、自己制御型の部門が予測期間中にもっとも高いCAGRで成長する見込みです。自己制御型ヒーティングケーブルは、高い効率と信頼性で温度制御を最適化する特徴的な設計です。これらのケーブルには、正確な電流を流すための専用バスワイヤーが組み込まれており、エネルギーの無駄なく均一な熱分布が確保されます。特殊な導電性ポリマーマトリックスに埋め込まれたこれらのケーブルは、周囲の温度変化に対して自律的に抵抗を調整し、熱出力を効果的に調節します。この革新的な技術により、過熱のリスクが軽減され、ケーブルの柔軟性により配管エルボやバルブなどの複雑な構造物への設置が合理化されます。さらに、自己制御型ヒーティングケーブルは、メンテナンスが最小限で済み、寿命が延びるため、ビジネス環境における多様な用途のための費用対効果が高く、信頼できるソリューションとして確立されています。

用途別では、凍結防止・プロセス温度維持の部門が予測期間中にもっとも高いCAGRで成長します。凍結による損害や経済的混乱のリスクを軽減するため、企業はパイプトレースケーブルシステムを採用しています。これらのシステムは、断熱されたパイプや機器からの熱損失を防ぐように設計されており、パイプの凍結や流体性能の潜在的な低下から保護します。自己制御型ヒーティングケーブル、サーモスタット、コントローラー、センサー、制御パネルで構成されるこれらの包括的なソリューションは、凍結防止という課題に対処します。

地域別では、米国が予測期間中に大きな成長機会を示す見通しです。米国は北米の電気式ヒートトレース市場を独占しており、いくつかの要因に後押しされています。同市場は、冬が厳しい地域で信頼性の高い凍結防止ソリューションの需要があるため、大幅な成長を遂げています。また、石油・ガスパイプラインを含む重要インフラの近代化と拡張が進行していることも、大きな成長見通しを生み出しています。さらに、市場の拡大は石油・ガス部門に限定されるものではなく、化学、商業、住宅部門など多様な業界で電気式ヒートトレースシステムの需要が顕著に急増しています。サーモスタット、コントローラー、センサー、制御パネルと自己制御型ヒーティングケーブルを統合したこれらの包括的ソリューションは、正確な温度制御を保証し、コストのかかるダウンタイムを効果的に軽減します。

当レポートでは、世界の電気式ヒートトレースの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 電気式ヒートトレースのさまざまなモード

- パイプ

- 船舶・タンク

- 鉄道線路・道路

- 屋根

- その他

第7章 電気式ヒートトレース市場:コンポーネント別

- 電気式ヒートトレースケーブル

- 電源接続キット

- 制御・監視システム

- 断熱材

- その他

第8章 電気式ヒートトレース市場:タイプ別

- 自己制御型

- 定電力型

- 鉱物絶縁型

- スキンエフェクト

第9章 電気式ヒートトレース市場:用途別

- 凍結防止・プロセス温度維持

- 屋根・雨樋の除氷

- 床暖房

- その他

第10章 電気式ヒートトレース市場:産業別

- 商用

- 石油・ガス

- 化学薬品

- 住宅

- 電力・エネルギー

- 食品・飲料

- 医薬品

- 水・廃水処理

- その他

第11章 電気式ヒートトレース市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第12章 競合情勢

- 主要企業の戦略/有力企業

- 主要企業の収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合ベンチマーキング:主要スタートアップ企業/中小企業

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- DANFOSS

- EMERSON ELECTRIC CO.

- BARTEC TOP HOLDING GMBH

- NIBE INDUSTRIER AB

- THERMON GROUP HOLDINGS, INC.

- DREXAN ENERGY SYSTEMS, INC.

- ELTHERM GMBH

- WATLOW ELECTRIC MANUFACTURING COMPANY

- SPIRAX-SARCO ENGINEERING PLC

- NVENT ELECTRIC PLC

- その他の企業

- DREXMA INDUSTRIES INC.

- EBECO

- HEAT TRACE PRODUCTS, LLC.

- KING ELECTRIC

- NEXANS

- SST GROUP INC.

- TRASOR CORP.

- GF PIPING SYSTEMS

- WARMUP PLC

- HEAT-LINE

- VULCANIC

- TEMPCO ELECTRIC HEATER CORPORATION

- VALIN CORPORATION

- KLOPPER-THERM GMBH & CO. KG

- GENERI S.R.O.

第14章 付録

The electric heat tracing market is projected to grow from USD 2.96 billion in 2024 to USD 4.34 billion in 2029; it is expected to grow at a CAGR of 7.9% during the forecasted period. The global heat tracing market is experiencing robust growth, driven by increasing demand for precise temperature control across industries such as oil and gas, chemicals, and manufacturing, coupled with advancements in heat tracing technologies and expanding infrastructure projects.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Component, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Self regulating is expected to grow at highest CAGR during the forecasted period."

Self-regulating heating cables boast a distinctive design that optimizes temperature control with efficiency and reliability. These cables incorporate dedicated bus wires for precise current flow, ensuring uniform heat distribution without energy wastage. Embedded in a specialized conductive polymer matrix, these cables autonomously adapt their resistance to changes in surrounding temperature, effectively regulating heat output. This innovative technology mitigates the risk of overheating and streamlines installation on intricate structures like pipe elbows and valves, owing to the cable's flexibility. Moreover, self-regulating heating cables demand minimal maintenance and provide an extended lifespan, establishing them as a cost-effective and dependable solution for diverse applications in the business landscape.

"Market for freeze protection & process temperature maintenance application is to grow at highest CAGR during forecast period. "

To mitigate the risk of damage and financial disruptions caused by freezing temperatures, businesses employ pipe tracing cable systems. These systems are designed to prevent heat loss from insulated pipes and equipment, safeguarding against frozen pipes and potential compromises in fluid performance. Comprising self-regulating heating cables, thermostats, controllers, sensors, and control panels, these comprehensive solutions address the challenge of freeze protection. Particularly critical for water-based products susceptible to freezing at 0°C (32°F), these solutions ensure optimal temperature control and minimize costly downtime. Renowned for their versatility across industries, heat trace systems provide reliable freeze protection for liquids in pipes across various industrial applications, even in hazardous environments.

"US to offer significant growth opportunities for Electric heat tracing market between 2024 and 2029."

The United States commands the electric heat tracing market in North America, propelled by several factors. The market experiences substantial growth due to the demand for dependable freeze protection solutions in regions with harsh winters. Additionally, the ongoing modernization and expansion of critical infrastructure, including oil and gas pipelines, create significant growth prospects. This involves the replacement of outdated systems and accommodation for heightened exploration and production activities. The market's expansion is not limited to the oil and gas sector; there is a notable surge in demand for electric heat tracing systems across diverse industries such as chemicals, commercial, and residential sectors. These comprehensive solutions, integrating self-regulating heating cables with thermostats, controllers, sensors, and control panels, ensure precise temperature control and effectively mitigate costly downtime.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 -45%, Tier 2 -30%, and Tier 3 - 25%

- By Designation: C-level Executives - 40%, Directors - 35%, and Others -25%

- By Region: North America - 45%, Europe -30%, Asia Pacific - 15%, ROW - 10%

The key players operating in the electric heat tracing market are nVent Electric PLC (UK), Thermon Group Holdings (US), Spirax-Sarco Engineering Plc (UK), Nibe Industrier AB (Sweden), Bartec Top Holdings Gmbh(Germany).

Research Coverage:

This market research report delivers a thorough analysis of the electric heat tracing market, categorized by type, component, application, vertical industry, and geographic region. Key insights encompass identifying primary drivers and challenges influencing market growth, providing a reliable market forecast until 2029, and presenting a detailed competitive landscape analysis with key players strategically positioned in the electric heat tracing ecosystem. The report emphasizes factors such as the demand for dependable freeze protection solutions in regions with severe winters, the growth opportunities propelled by the modernization and expansion of infrastructure like oil and gas pipelines, and the escalating adoption of electric heat tracing systems across various sectors beyond oil and gas, including chemicals, commercial, and residential industries. This meticulous examination aims to furnish valuable insights for stakeholders to leverage opportunities and navigate potential challenges in the electric heat tracing market.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing adoption of electric heat tracing systems over conventional steam tracing systems in hardware technologies, Rising demand for energy-efficient electric heat tracing systems, Low maintenance cost associated with electric heat tracing systems), restraints (Adverse effects of overlapping heating cables), opportunities (Growing demand for heat tracing systems in various verticals, Rising adoption of heat tracing systems in power plants), and challenges (Installation of heat tracing systems on tanks and large vessels) influencing the growth of the electric heat tracing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the electric heat tracing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the electric heat tracing market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the electric heat tracing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like nVent Electric PLC (UK), Thermon Group Holdings (US), Spirax-Sarco Engineering Plc (UK), Nibe Industrier AB (Sweden), Bartec Top Holdings Gmbh(Germany). among others in the Electric heat tracing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ELECTRIC HEAT TRACING MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ELECTRIC HEAT TRACING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 ELECTRIC HEAT TRACING MARKET: RESEARCH FLOW

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF ELECTRIC HEAT TRACING PRODUCTS

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

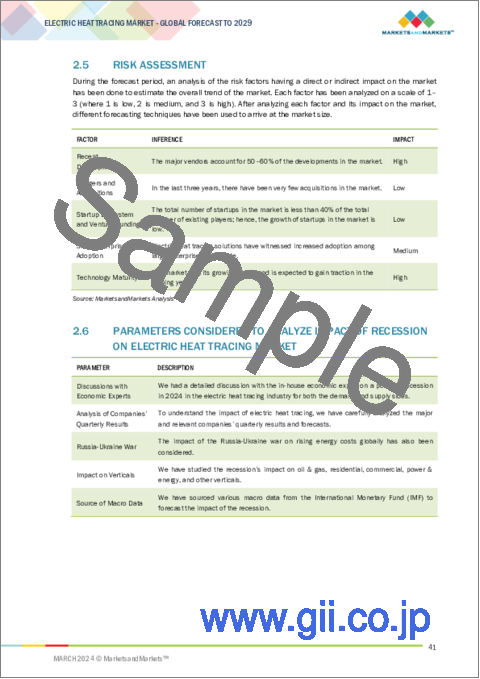

- 2.5 RISK ASSESSMENT

- 2.6 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON ELECTRIC HEAT TRACING MARKET

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 ELECTRIC HEAT TRACING CABLES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF ELECTRIC HEAT TRACING MARKET IN 2029

- FIGURE 9 SELF-REGULATING SEGMENT TO DOMINATE ELECTRIC HEAT TRACING MARKET IN 2029

- FIGURE 10 FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE SEGMENT TO EXHIBIT HIGHEST CAGR IN ELECTRIC HEAT TRACING MARKET DURING FORECAST PERIOD

- FIGURE 11 OIL & GAS SEGMENT TO LEAD ELECTRIC HEAT TRACING MARKET IN 2029

- FIGURE 12 ELECTRIC HEAT TRACING MARKET IN NORTH AMERICA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN ELECTRIC HEAT TRACING MARKET

- FIGURE 13 RISING NUMBER OF OIL & GAS CONSTRUCTION PROJECTS TO DRIVE MARKET

- 4.2 ELECTRIC HEAT TRACING MARKET IN NORTH AMERICA, BY COUNTRY AND VERTICAL

- FIGURE 14 US AND OIL & GAS VERTICAL HELD LARGEST SHARES OF ELECTRIC HEAT TRACING MARKET IN NORTH AMERICA IN 2023

- 4.3 ELECTRIC HEAT TRACING MARKET, BY COUNTRY

- FIGURE 15 US TO RECORD HIGHEST CAGR IN ELECTRIC HEAT TRACING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 ELECTRIC HEAT TRACING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing preference for electric heat tracing systems over steam tracing systems

- 5.2.1.2 Rising demand for energy-efficient electric heat tracing systems

- 5.2.1.3 Low maintenance costs associated with electric heat tracing systems

- FIGURE 17 ELECTRIC HEAT TRACING MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adverse effects of overlapping heating cables

- FIGURE 18 ELECTRIC HEAT TRACING MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for heat tracing systems in oil & gas industry

- 5.2.3.2 Rising adoption of heat tracing systems in power plants

- FIGURE 19 ELECTRIC HEAT TRACING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties in installing heat tracing systems on tanks and large vessels

- FIGURE 20 ELECTRIC HEAT TRACING MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 ELECTRIC HEAT TRACING MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF ELECTRIC HEAT TRACING CABLES, BY VERTICAL

- FIGURE 22 AVERAGE SELLING PRICE TREND OF ELECTRIC HEAT TRACING CABLES, BY VERTICAL (USD/METER)

- TABLE 1 AVERAGE SELLING PRICE TREND OF ELECTRIC HEAT TRACING CABLES, BY VERTICAL (USD/METER)

- 5.4.2 AVERAGE SELLING PRICE TREND OF ELECTRIC HEAT TRACING CABLES, BY REGION

- FIGURE 23 AVERAGE SELLING PRICE TREND OF ELECTRIC HEAT TRACING CABLES, BY REGION, 2019-2023 (USD/METER)

- FIGURE 24 AVERAGE SELLING PRICE OF ELECTRIC HEAT TRACING CABLES, 2020-2029 (USD/METER)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 25 ELECTRIC HEAT TRACING MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 26 ELECTRIC HEAT TRACING MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 ROLE OF PLAYERS IN ELECTRIC HEAT TRACING ECOSYSTEM

- 5.7 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 NUMBER OF DEALS IN ELECTRIC HEAT TRACING MARKET

- FIGURE 28 FUNDING IN ELECTRIC HEAT TRACING MARKET

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Self-regulating cables

- 5.8.1.2 Digital control systems

- 5.8.1.3 High-temperature insulation materials

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Thermal imaging

- 5.8.2.2 Advanced heat transfer fluids

- 5.8.2.3 Wireless sensor networks

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Renewable energy integration

- 5.8.3.2 Predictive maintenance solutions

- 5.8.3.3 Remote access management platforms

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 29 NUMBER OF PATENTS GRANTED IN ELECTRIC HEAT TRACING MARKET, 2014-2023

- TABLE 3 LIST OF PATENTS GRANTED IN ELECTRIC HEAT TRACING MARKET, 2023

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 30 IMPORT DATA FOR HS CODE 851680-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.10.2 EXPORT SCENARIO

- FIGURE 31 EXPORT DATA FOR HS CODE 851680-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 4 ELECTRIC HEAT TRACING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 PROJECT ENGINEERING FIRM DEPLOYED CHROMALOX'S HEAT TRACE CABLE FOR RAPID-RESPONSE TEMPERATURE CONTROL SYSTEM

- 5.12.2 HYDROELECTRIC DAM IMPLEMENTED NEW CUSTOMIZED CHROMALOX OPEN COIL ELEMENT HEATERS FOR EFFICIENT ELECTRIC HEAT TRACING

- 5.12.3 COMPANY UTILIZED NVENT ELECTRIC PLC'S TRACE HEATING SUPPLIES TO PROVIDE INDUSTRIAL FROST PROTECTION SERVICE

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- TABLE 5 MFN TARIFFS FOR HS CODE 851680-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 6 MFN TARIFFS FOR HS CODE 851680-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 7 MFN TARIFFS FOR HS CODE 851680-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AMERICAS: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS AND REGULATIONS

- 5.13.3.1 IEC 62395-1 - Electrical Resistance Trace Heating Systems - Industrial and Commercial Applications

- 5.13.3.2 IEC 62395-2 - Electrical Resistance Trace Heating Systems - Application Guide for System Design, Installation, and Maintenance

- 5.13.3.3 UL 1673 - Electric Space Heating Cables

- 5.13.3.4 UL 1588 - Roof and Gutter De-Icing Cable Units

- 5.13.3.5 UL 515 - Commercial and Industrial Ordinary Locations

- 5.13.3.6 IEEE Std.515.1 - Standards for Testing, Design, and Installation of Electrical Resistance Heat Cables

- 5.13.3.7 IEC 60079-30-1 - General and Testing Requirements

- 5.13.3.8 IEC 60079-30-2 - Applications for Design, Installation, and Maintenance

- 5.13.3.9 UL 515- Hazardous Location Requirements

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 ELECTRIC HEAT TRACING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 ELECTRIC HEAT TRACING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 DIFFERENT MODES OF ELECTRIC HEAT TRACING

- 6.1 INTRODUCTION

- 6.2 PIPES

- 6.3 VESSELS AND TANKS

- 6.4 RAIL TRACKS AND ROADS

- 6.5 ROOFS

- 6.6 OTHER MODES

7 ELECTRIC HEAT TRACING MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 35 ELECTRIC HEAT TRACING CABLES TO ACCOUNT FOR LARGEST SHARE OF ELECTRIC HEAT TRACING MARKET IN 2029

- TABLE 14 ELECTRIC HEAT TRACING MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 15 ELECTRIC HEAT TRACING MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 7.2 ELECTRIC HEAT TRACING CABLES

- 7.2.1 STRINGENT REGULATORY STANDARDS TO BOOST ADOPTION

- TABLE 16 ELECTRIC HEAT TRACING CABLES: ELECTRIC HEAT TRACING MARKET, 2020-2023 (MILLION METERS)

- TABLE 17 ELECTRIC HEAT TRACING CABLES: ELECTRIC HEAT TRACING MARKET, 2024-2029 (MILLION METERS)

- 7.2.2 BY MAINTENANCE TEMPERATURE

- 7.2.2.1 Up to 100°C

- 7.2.2.2 101°C to 250°C

- 7.2.2.3 Above 250°C

- 7.3 POWER CONNECTION KITS

- 7.3.1 CONVENIENCE, EFFICIENCY, AND SAFETY FEATURES OF POWER CONNECTION KITS TO DRIVE MARKET

- 7.4 CONTROL AND MONITORING SYSTEMS

- 7.4.1 NECESSITY TO MONITOR AND CONTROL HEATING SYSTEMS FOR OPTIMUM FUNCTIONING TO ACCELERATE DEMAND

- 7.5 THERMAL INSULATION MATERIALS

- 7.5.1 NEED TO MITIGATE HEAT LOSS IN HEATING SYSTEMS TO FOSTER MARKET GROWTH

- 7.6 OTHER COMPONENTS

8 ELECTRIC HEAT TRACING MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 36 SELF-REGULATING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF ELECTRIC HEAT TRACING MARKET IN 2029

- TABLE 18 ELECTRIC HEAT TRACING MARKET, BY TYPE 2020-2023 (USD MILLION)

- TABLE 19 ELECTRIC HEAT TRACING MARKET, BY TYPE 2024-2029 (USD MILLION)

- 8.2 SELF REGULATING

- 8.2.1 ABILITY TO ADJUST HEAT OUTPUT BASED ON ENVIRONMENTAL CONDITIONS TO BOOST ADOPTION

- TABLE 20 SELF REGULATING: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 21 SELF REGULATING: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 8.3 CONSTANT WATTAGE

- 8.3.1 SIGNIFICANT FOCUS ON PREVENTING DISRUPTIONS IN INDUSTRIAL PROCESSES TO BOOST DEMAND

- TABLE 22 CONSTANT WATTAGE: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 23 CONSTANT WATTAGE: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 8.4 MINERAL INSULATED

- 8.4.1 GROWING DEPLOYMENT DUE TO FIRE-RESISTANT AND SUPER AMPACITY PROPERTIES TO FUEL MARKET GROWTH

- TABLE 24 MINERAL INSULATED: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 25 MINERAL INSULATED: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 8.5 SKIN EFFECT

- 8.5.1 RISING USE TO TRACE LONG PIPELINES COST-EFFECTIVELY TO FOSTER MARKET GROWTH

- TABLE 26 SKIN EFFECT: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 27 SKIN EFFECT: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

9 ELECTRIC HEAT TRACING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF ELECTRIC HEAT TRACING MARKET IN 2029

- TABLE 28 ELECTRIC HEAT TRACING MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 29 ELECTRIC HEAT TRACING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 9.2 FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE

- 9.2.1 INCREASING NEED FOR FLUID TEMPERATURE CONTROL IN OIL & GAS INDUSTRY TO CONTRIBUTE TO MARKET GROWTH

- 9.3 ROOF AND GUTTER DE-ICING

- 9.3.1 GROWING INCLINATION TOWARD MAINTAINING STRUCTURAL INTEGRITY OF BUILDINGS AND INFRASTRUCTURE TO PROPEL MARKET

- 9.4 FLOOR HEATING

- 9.4.1 RISING USE TO PREVENT SOLIDIFICATION OF FLUIDS IN CHEMICAL INDUSTRIES TO FOSTER MARKET GROWTH

- 9.5 OTHER APPLICATIONS

10 ELECTRIC HEAT TRACING MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 38 OIL & GAS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF ELECTRIC HEAT TRACING MARKET IN 2029

- TABLE 30 ELECTRIC HEAT TRACING MARKET, BY VERTICAL 2020-2023 (USD MILLION)

- TABLE 31 ELECTRIC HEAT TRACING MARKET, BY VERTICAL 2024-2029 (USD MILLION)

- 10.2 COMMERCIAL

- 10.2.1 INCREASING UTILIZATION BY EDUCATIONAL INSTITUTIONS AND HEALTHCARE AND HOSPITALITY FACILITIES TO DRIVE MARKET

- TABLE 32 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 33 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 34 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 37 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 38 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 39 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 40 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 41 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 42 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 43 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.3 OIL & GAS

- 10.3.1 GROWING DEMAND IN UPSTREAM AND DOWNSTREAM APPLICATIONS TO PROPEL MARKET

- TABLE 44 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 45 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 46 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 49 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 50 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 51 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 52 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 53 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 54 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 55 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.4 CHEMICALS

- 10.4.1 RISING DEMAND FOR MAINTAINING PROCESS TEMPERATURES AND PREVENTING PIPELINE FREEZING IN CHEMICAL TRANSPORTATION TO FOSTER MARKET GROWTH

- TABLE 56 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 57 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 58 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 61 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 62 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 63 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 64 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 65 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 66 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 67 CHEMICALS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.5 RESIDENTIAL

- 10.5.1 SURGING USE IN ROOF DE-ICING AND FLOOR HEATING APPLICATIONS TO SUPPORT MARKET GROWTH

- TABLE 68 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 69 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 70 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 73 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 74 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 75 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 76 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 77 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 78 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 79 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.6 POWER & ENERGY

- 10.6.1 INCREASING ADOPTION IN COAL-FIRED, NUCLEAR, AND SOLAR POWER PLANTS TO FOSTER MARKET GROWTH

- TABLE 80 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 81 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 82 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 83 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 85 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 86 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 87 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 88 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 89 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 90 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 91 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.7 FOOD & BEVERAGES

- 10.7.1 PRESSING NEED TO MAINTAIN DESIRED TEMPERATURE OF FOOD ADDITIVES TO ACCELERATE DEMAND

- TABLE 92 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 93 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 94 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 95 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 96 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 97 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 98 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 99 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 100 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 101 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 102 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 103 FOOD & BEVERAGES: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.8 PHARMACEUTICALS

- 10.8.1 GROWING FOCUS OF HEALTHCARE PROFESSIONALS ON AVOIDING MEDICINE DEGRADATION TO STIMULATE DEMAND

- TABLE 104 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 105 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 106 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 107 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 108 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 109 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 110 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 111 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 112 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 113 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 114 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 115 PHARMACEUTICALS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

- 10.9 WATER & WASTEWATER TREATMENT

- 10.9.1 RISING DEMAND TO SAFEGUARD VALVES, PIPES, TANKS, AND INSTRUMENTATION LINES FROM FREEZING TO PROPEL MARKET

- TABLE 116 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 117 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 118 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 119 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 120 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 121 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 122 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 123 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 124 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 125 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 126 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD THOUSAND)

- TABLE 127 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD THOUSAND)

- 10.10 OTHER VERTICALS

- TABLE 128 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 129 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 130 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 131 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 132 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2020-2023 (USD MILLION)

- TABLE 133 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY NORTH AMERICA, 2024-2029 (USD MILLION)

- TABLE 134 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2020-2023 (USD MILLION)

- TABLE 135 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY EUROPE, 2024-2029 (USD MILLION)

- TABLE 136 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2020-2023 (USD MILLION)

- TABLE 137 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY ASIA PACIFIC, 2024-2029 (USD MILLION)

- TABLE 138 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2020-2023 (USD MILLION)

- TABLE 139 OTHER VERTICALS: ELECTRIC HEAT TRACING MARKET, BY ROW, 2024-2029 (USD MILLION)

11 ELECTRIC HEAT TRACING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF ELECTRIC HEAT TRACING MARKET IN 2029

- TABLE 140 ELECTRIC HEAT TRACING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 141 ELECTRIC HEAT TRACING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 IMPACT OF RECESSION ON ELECTRIC HEAT TRACING MARKET IN NORTH AMERICA

- FIGURE 40 NORTH AMERICA: ELECTRIC HEAT TRACING MARKET SNAPSHOT

- TABLE 142 NORTH AMERICA: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 143 NORTH AMERICA: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 144 NORTH AMERICA: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 145 NORTH AMERICA: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Rapid expansion and extensive network of oil and gas pipelines to drive market

- 11.2.3 CANADA

- 11.2.3.1 Growing demand from petroleum companies to fuel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Strong focus of country on energy export to create growth opportunities

- 11.3 EUROPE

- 11.3.1 IMPACT OF RECESSION ON ELECTRIC HEAT TRACING MARKET IN EUROPE

- FIGURE 41 EUROPE: ELECTRIC HEAT TRACING MARKET SNAPSHOT

- TABLE 146 EUROPE: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 147 EUROPE: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 148 EUROPE: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 149 EUROPE: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Escalating demand from commercial and residential customers to drive market

- 11.3.3 GERMANY

- 11.3.3.1 Rising deployment of heat tracing systems in chemical sector to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Significant need for heat tracing systems across commercial and residential verticals to fuel market growth

- 11.3.5 RUSSIA

- 11.3.5.1 Extensive network of oil and gas pipelines to contribute to market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 IMPACT OF RECESSION ON ELECTRIC HEAT TRACING MARKET IN ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: ELECTRIC HEAT TRACING MARKET SNAPSHOT

- TABLE 150 ASIA PACIFIC: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing adoption in oil & gas industry to regulate fluid temperature in pipelines to support market growth

- 11.4.3 JAPAN

- 11.4.3.1 Minimal average low temperatures across Japan to propel demand

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Growing requirement from oil refineries to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 IMPACT OF RECESSION ON ELECTRIC HEAT TRACING MARKET IN ROW

- TABLE 154 ROW: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 155 ROW: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 ROW: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 157 ROW: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Increasing utilization in temperature maintenance and freeze protection applications to fuel market growth

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Significant expansion of oil & gas vertical to drive demand

- 11.5.4 AFRICA

- 11.5.4.1 Need to maintain operational integrity and efficiency across industrial processes to complement market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JULY 2019-JANUARY 2024

- TABLE 158 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES IN ELECTRIC HEAT TRACING MARKET

- 12.3 REVENUE ANALYSIS OF KEY PLAYERS IN ELECTRIC HEAT TRACING MARKET, 2018-2022

- FIGURE 43 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN ELECTRIC HEAT TRACING MARKET

- 12.4 MARKET SHARE ANALYSIS, 2023

- FIGURE 44 MARKET SHARE ANALYSIS OF MAJOR PLAYERS, 2023

- TABLE 159 DEGREE OF COMPETITION

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 45 COMPANY VALUATION (USD MILLION), 2023

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA), 2023

- 12.6 BRAND COMPARISON

- FIGURE 47 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 48 ELECTRIC HEAT TRACING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- FIGURE 49 OVERALL COMPANY FOOTPRINT

- 12.7.5.2 Component footprint

- TABLE 160 COMPANY COMPONENT FOOTPRINT

- 12.7.5.3 Type footprint

- TABLE 161 COMPANY TYPE FOOTPRINT

- 12.7.5.4 Application footprint

- TABLE 162 COMPANY APPLICATION FOOTPRINT

- 12.7.5.5 Vertical footprint

- TABLE 163 COMPANY VERTICAL FOOTPRINT

- 12.7.5.6 Region footprint

- TABLE 164 COMPANY REGION FOOTPRINT

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 50 ELECTRIC HEAT TRACING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2023

- 12.8.5.1 List of key startups/SMEs

- TABLE 165 ELECTRIC HEAT TRACING MARKET: LIST OF KEY STARTUPS/SMES

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 166 OVERALL STARTUPS/SMES FOOTPRINT

- TABLE 167 STARTUPS/SMES COMPONENT FOOTPRINT

- TABLE 168 STARTUPS/SMES TYPE FOOTPRINT

- TABLE 169 STARTUPS/SMES APPLICATION FOOTPRINT

- TABLE 170 STARTUPS/SMES VERTICAL FOOTPRINT

- TABLE 171 STARTUPS/SMES REGION FOOTPRINT

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 172 ELECTRIC HEAT TRACING MARKET: PRODUCT LAUNCHES, JULY 2019-JANUARY 2024

- 12.9.2 DEALS

- TABLE 173 ELECTRIC HEAT TRACING MARKET: DEALS, JULY 2019-JANUARY 2024

- 12.9.3 OTHER DEALS

- TABLE 174 ELECTRIC HEAT TRACING MARKET: OTHER DEALS, JULY 2019-JANUARY 2024

13 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1 KEY PLAYERS

- 13.1.1 DANFOSS

- TABLE 175 DANFOSS: COMPANY OVERVIEW

- FIGURE 51 DANFOSS: COMPANY SNAPSHOT

- TABLE 176 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 DANFOSS: PRODUCT/SERVICE LAUNCHES

- TABLE 178 DANFOSS: DEALS

- 13.1.2 EMERSON ELECTRIC CO.

- TABLE 179 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 52 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 180 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 EMERSON ELECTRIC CO.: PRODUCT/SERVICE LAUNCHES

- TABLE 182 EMERSON ELECTRIC CO.: DEALS

- TABLE 183 EMERSON ELECTRIC CO.: OTHER DEALS

- 13.1.3 BARTEC TOP HOLDING GMBH

- TABLE 184 BARTEC TOP HOLDING GMBH: COMPANY OVERVIEW

- TABLE 185 BARTEC TOP HOLDING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 BARTEC TOP HOLDING GMBH: PRODUCT/SERVICE LAUNCHES

- TABLE 187 BARTEC TOP HOLDING GMBH: DEALS

- 13.1.4 NIBE INDUSTRIER AB

- TABLE 188 NIBE INDUSTRIER AB: COMPANY OVERVIEW

- FIGURE 53 NIBE INDUSTRIER AB: COMPANY SNAPSHOT

- TABLE 189 NIBE INDUSTRIER AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 NIBE INDUSTRIER AB: DEALS

- 13.1.5 THERMON GROUP HOLDINGS, INC.

- TABLE 191 THERMON GROUP HOLDINGS, INC.: COMPANY OVERVIEW

- FIGURE 54 THERMON GROUP HOLDINGS, INC.: COMPANY SNAPSHOT

- TABLE 192 THERMON GROUP HOLDINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 THERMON GROUP HOLDINGS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 194 THERMON GROUP HOLDINGS, INC.: DEALS

- 13.1.6 DREXAN ENERGY SYSTEMS, INC.

- TABLE 195 DREXAN ENERGY SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 196 DREXAN ENERGY SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 DREXAN ENERGY SYSTEMS, INC.: PRODUCT/SERVICE LAUNCHES

- 13.1.7 ELTHERM GMBH

- TABLE 198 ELTHERM GMBH: COMPANY OVERVIEW

- TABLE 199 ELTHERM GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 ELTHERM GMBH: PRODUCT/SERVICE LAUNCHES

- 13.1.8 WATLOW ELECTRIC MANUFACTURING COMPANY

- TABLE 201 WATLOW ELECTRIC MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 202 WATLOW ELECTRIC MANUFACTURING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 WATLOW ELECTRIC MANUFACTURING COMPANY: PRODUCT/SERVICE LAUNCHES

- 13.1.9 SPIRAX-SARCO ENGINEERING PLC

- TABLE 204 SPIRAX-SARCO ENGINEERING PLC: COMPANY OVERVIEW

- FIGURE 55 SPIRAX-SARCO ENGINEERING PLC: COMPANY SNAPSHOT

- TABLE 205 SPIRAX-SARCO ENGINEERING PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 SPIRAX-SARCO ENGINEERING PLC: PRODUCT/SERVICE LAUNCHES

- TABLE 207 SPIRAX-SARCO ENGINEERING PLC: DEALS

- TABLE 208 SPIRAX-SARCO ENGINEERING PLC: OTHER DEALS

- 13.1.10 NVENT ELECTRIC PLC

- TABLE 209 NVENT ELECTRIC PLC: COMPANY OVERVIEW

- FIGURE 56 NVENT ELECTRIC PLC: COMPANY SNAPSHOT

- TABLE 210 NVENT ELECTRIC PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 NVENT ELECTRIC PLC: PRODUCT/SERVICE LAUNCHES

- TABLE 212 NVENT ELECTRIC PLC: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 DREXMA INDUSTRIES INC.

- 13.2.2 EBECO

- 13.2.3 HEAT TRACE PRODUCTS, LLC.

- 13.2.4 KING ELECTRIC

- 13.2.5 NEXANS

- 13.2.6 SST GROUP INC.

- 13.2.7 TRASOR CORP.

- 13.2.8 GF PIPING SYSTEMS

- 13.2.9 WARMUP PLC

- 13.2.10 HEAT-LINE

- 13.2.11 VULCANIC

- 13.2.12 TEMPCO ELECTRIC HEATER CORPORATION

- 13.2.13 VALIN CORPORATION

- 13.2.14 KLOPPER-THERM GMBH & CO. KG

- 13.2.15 GENERI S.R.O.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS