|

|

市場調査レポート

商品コード

1463252

電動工具の世界市場:工具タイプ別、動作モード別、用途別、地域別 - 2029年までの予測Power Tools Market by Tool Type (Drilling and Fastening Tools, Demolition Tools, Sawing and Cutting Tools, Material Removal Tools, Routing Tools), Mode of Operation (Electric, Pneumatic, Hydraulic), Application and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 電動工具の世界市場:工具タイプ別、動作モード別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年04月12日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

電動工具の市場規模は、2024年の395億米ドルから2029年には455億米ドルに成長すると予測され、予測期間中のCAGRは2.9%になるとみられています。

電動工具市場は、様々な産業における電動締め付け工具の需要増加、世界のバッテリー式電動工具の採用増加、スマート&コネクテッド電動工具の開拓、家庭用電動工具の需要増加などの要因によって牽引され、今後5年間で市場参入企業に大きな成長機会をもたらします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 工具タイプ別、動作モード別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

ドリルおよび締結工具分野は、予測期間中に最高のCAGRで成長する見込みです。ドリルおよび締結工具は、汎用性が高く実用的であるため、様々な産業で広く使用されています。専門家は、さまざまな修理やメンテナンス作業にこれらの工具を利用しています。さらに、インパクト工具、スクリュー 促進要因、インパクトレンチ、ナットランナは、産業と住宅の両方の環境での取り付けと締結に一般的に使用されています。特に自動車産業は、これらの工具を業務に多用することで市場の成長を牽引しています。これらの要因が総合的に、電動工具市場におけるドリルおよび締結工具分野の急成長が予想される要因となっています。

電動操作モードは、予測期間中に最も高いCAGRで成長する見込みです。電動工具は柔軟性があり、作業要件に応じてバッテリーまたはコード付き電源のいずれかで動作します。コードレス電動工具への動向の高まりは、その使いやすさと携帯性の向上によるものです。さらに、バッテリー技術の進歩は、これらのコードレスオプションの性能と耐久性を大幅に向上させ、専門家とDIY愛好家の両方にアピールしています。

当レポートでは、世界の電動工具市場について調査し、工具タイプ別、動作モード別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 規制と基準

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第6章 さまざまな材料への電動工具の応用

- イントロダクション

- レンガ/ブロック

- コンクリート

- 眼鏡

- 木材/金属

- その他の材料

第7章 電動工具の流通経路

- イントロダクション

- オンライン

- オフライン

第8章 電動工具市場、工具タイプ別

- イントロダクション

- ドリルおよび締結工具

- 解体工具

- 鋸および切断工具

- 材料除去工具

- ルーティング工具

- その他

第9章 電動工具市場、動作モード別

- イントロダクション

- 電動式

- 空気圧式

- 油圧式

第10章 電動工具市場、用途別

- イントロダクション

- 産業/プロ用

- 住宅/DIY

第11章 電動工具市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 2023年3月~2024年2月に主要企業が採用する戦略

- 2019年~2023年の主要企業5社の収益分析

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- ブランド/製品比較

- 競争評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競争シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- STANLEY BLACK & DECKER, INC.

- ROBERT BOSCH GMBH

- TECHTRONIC INDUSTRIES CO. LTD.

- MAKITA CORPORATION

- HILTI CORPORATION

- ANDREAS STIHL AG & CO. KG

- APEX TOOL GROUP, LLC

- ATLAS COPCO AB

- INGERSOLL RAND

- SNAP-ON INCORPORATED

- その他の企業

- KOKI HOLDINGS CO., LTD.

- YAMABIKO CORPORATION

- PANASONIC INDUSTRY EUROPE GMBH

- KEN HOLDING CO., LTD

- DYNABRADE INC.

- AMICO

- C. & E. FEIN GMBH

- CHERVON(CHINA)TRADING CO., LTD.

- CS UNITEC, INC.

- FERM INTERNATIONAL B.V.

- INTERSKOL

- POSITEC TOOL CORPORATION

- RIDGID

- GREENWORKSTOOLS

- URYU SEISAKU, LTD.

第14章 隣接市場と関連市場

第15章 付録

The power tools market size is expected to grow from USD 39.5 billion in 2024 to USD 45.5 billion by 2029, at a CAGR of 2.9% during the forecast period. The power tools market is driven by factors such as rising demand for electric fastening tools in various industries and increased adoption of battery-powered power tools globally, Development of smart and connected power tools and growing demand for household application power tools to create a significant growth opportunity for the market players in the next 5 years

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Tool Type, Mode of Operation, Application and Region |

| Regions covered | North America, Europe, Asia Pacific, and RoW. |

"Drilling and fastening tools segment is expected to grow at the highest CAGR during the forecast period"

Drilling and fastening tools segment is expected to grow at the highest CAGR during the forecast period. Drilling and fastening tools are widely used in various industries because they are versatile and practical. Professionals rely on these tools for many different repair and maintenance tasks. Additionally, impact tools, screwdrivers, impact wrenches, and nut runners are commonly used for fitting and fastening in both industrial and residential settings. The automotive industry especially drives market growth by heavily using these tools in its operations. These factors collectively contribute to the anticipated rapid growth of the drilling and fastening tools segment in the power tools market.

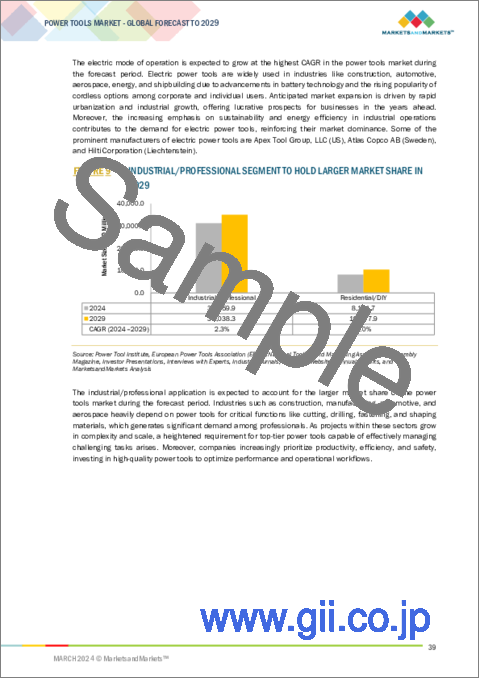

"Electric mode of operation is expected to grow at the highest CAGR during the forecast period"

The electric mode of operation is expected to grow at the highest CAGR during the forecast period. Electric power tools offer flexibility, running on either a battery or corded power, based on the task requirements. The increasing trend towards cordless electric tools is driven by their enhanced ease of use and portability. Furthermore, advancements in battery technology have significantly boosted the performance and durability of these cordless options, appealing to both professionals and DIY enthusiasts.

"Residential/DIY Application is expected to grow at the highest CAGR during the forecast period"

Residential/DIY Application is expected to grow at the highest CAGR during the forecast period. Corded electric tools provide convenient plug-and-play functionality, while cordless counterparts are valued for their ease of use, efficiency, and portability. The ergonomic advantages of cordless equipment have led to a preference among users over traditional gas-powered options. Recent innovations in cordless technology have not only increased power but have also introduced features for precise operation, even in challenging environments. The growing demand for portable tools and their uptake among homeowners, due to reduced operating costs resulting from advancements in battery technology and overall performance, are driving the expansion of the electric segment.

"Asia Pacific is expected to grow at the highest CAGR during the forecast period"

Asia Pacific is expected to grow at a higher CAGR during the forecast period. The rapid urbanization and industrialization witnessed in countries such as China, India, and Southeast Asian nations are driving notable investments in infrastructure, construction, and manufacturing. This surge in construction and industrial activities is resulting in a heightened demand for power tools across various sectors. Furthermore, the increasing disposable income and expanding middle-class population in the region are fueling the desire for power tools for residential and DIY applications. Additionally, advancements in technology and the availability of customized power tool solutions for the Asian market are contributing significantly to market expansion.

Breakdown of primaries

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the power tools market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 = 55%, Tier 2 = 30%, and Tier 3 = 15%

- By Designation: C-Level Executives = 48%, Directors = 32%, and Others= 20%

- By Region: North America = 30%, Europe = 20%, Asia Pacific = 45%, and RoW = 5%

Major companies operating in the power tools market include Stanley Black & Decker, Inc. (US), Robert Bosch GmbH (Germany), Techtronic Industries Co. Ltd. (Hong Kong), Makita Corporation (Japan), Hilti Corporation, (Liechtenstein), Andreas Stihl AG & Co. KG (STIHL) (Germany), Atlas Copco AB (Sweden), Apex Tool Group, LLC (US), Ingersoll Rand (US), Snap-on Incorporated (US), among others.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the power tools market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased adoption of battery-powered power tools globally, surging demand for power tools in the automotive industry, growing construction industry in emerging economies, and rising demand for electric fastening tools in various industries ), restraints (High maintenance costs and variations in raw material prices), opportunities (Development of smart and connected power tools, rising demand for fastening tools in the wind energy industry, and growing demand for household application power tools), and challenges (Stringent trade policies and safety standards, and difficulties in designing ergonomic and lightweight power tools).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the power tools market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the power tools market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the power tools market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Stanley Black & Decker, Inc. (US), Robert Bosch GmbH (Germany), Techtronic Industries Co. Ltd. (Hong Kong), Makita Corporation (Japan), Hilti Corporation, (Liechtenstein), and other players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- FIGURE 1 POWER TOOLS MARKET SEGMENTATION

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 POWER TOOLS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of key interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF COMPONENTS AND POWER TOOLS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON POWER TOOLS MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 DRILLING AND FASTENING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 8 ELECTRIC SEGMENT TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 9 INDUSTRIAL/PROFESSIONAL SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN POWER TOOLS MARKET

- FIGURE 11 EXPANDING CONSTRUCTION INDUSTRY IN EMERGING ECONOMIES TO FUEL MARKET GROWTH

- 4.2 POWER TOOLS MARKET, BY TOOL TYPE

- FIGURE 12 DRILLING AND FASTENING TOOLS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- 4.3 POWER TOOLS MARKET, BY MODE OF OPERATION

- FIGURE 13 ELECTRIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 POWER TOOLS MARKET, BY APPLICATION

- FIGURE 14 INDUSTRIAL/PROFESSIONAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 POWER TOOLS MARKET, BY COUNTRY

- FIGURE 15 INDIA TO RECORD HIGHEST CAGR IN GLOBAL POWER TOOLS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 POWER TOOLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing construction activities worldwide

- 5.2.1.2 Thriving automotive sector

- 5.2.1.3 Rising preference for battery-powered tools owing to advances in battery technology

- 5.2.1.4 Surging use of electric fastening tools in various industries

- FIGURE 17 POWER TOOLS MARKET: IMPACT OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance costs

- 5.2.2.2 Fluctuating raw material prices

- FIGURE 18 POWER TOOLS MARKET: IMPACT OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of wind energy

- FIGURE 19 GLOBAL TREND OF WIND POWER CAPACITY (GW), 2016-2022

- 5.2.3.2 Development of smart and connected power tools

- 5.2.3.3 Growing demand for power tools by residential consumers

- FIGURE 20 POWER TOOLS MARKET: IMPACT OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties in designing ergonomic and lightweight power tools

- 5.2.4.2 Stringent trade policies and safety standards

- FIGURE 21 POWER TOOLS MARKET: IMPACT OF CHALLENGES

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING TREND OF POWER TOOLS PROVIDED BY MARKET PLAYERS, BY TOOL TYPE, 2023 (USD)

- FIGURE 23 INDICATIVE PRICING TREND OF POWER TOOLS OFFERED BY KEY PLAYERS, BY TOOL TYPE, 2023 (USD)

- TABLE 1 INDICATIVE PRICING TREND OF POWER TOOLS PROVIDED BY KEY PLAYERS, BY TOOL TYPE, 2023 (USD)

- FIGURE 24 AVERAGE SELLING PRICING TREND OF POWER TOOLS, BY TOOL TYPE, 2019-2023 (USD)

- 5.4.2 AVERAGE SELLING PRICE TREND OF POWER TOOLS, BY REGION, 2019-2023 (USD)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF POWER TOOLS, BY REGION, 2019-2023 (USD)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 26 GLOBAL POWER TOOLS MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 27 KEY PLAYERS IN ECOSYSTEM

- TABLE 2 ROLE OF PLAYERS IN POWER TOOLS ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Smart and connected assembly power tools

- 5.7.1.2 Brushless DC motors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 40V MAX and 80V MAX lithium-ion batteries

- 5.7.2.2 Wireless charging

- 5.7.3 ADJACENT TECHNOLOGY

- 5.7.3.1 Easy start system

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- FIGURE 28 TOP 10 COMPANIES WITH SIGNIFICANT NUMBER OF PATENT APPLICATIONS FROM 2014 TO 2023

- TABLE 3 MAJOR PATENT OWNERS IN POWER TOOLS MARKET

- 5.8.1 LIST OF MAJOR PATENTS, 2022-2023

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA

- FIGURE 29 IMPORT DATA FOR HS CODE 8467-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.9.2 EXPORT DATA

- FIGURE 30 EXPORT DATA FOR HS CODE 8467-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 4 POWER TOOLS MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 DI ENVIRONMENT IMPLEMENTED TRELAWNY'S VL303 VIBRO-LO NEEDLE SCALERS TO REDUCE OPERATOR FATIGUE AND DOWNTIME

- 5.11.2 BIG IMPLEMENTATION ADOPTED CS UNITEC'S MAB 485 PORTABLE MAGNETIC DRILL FOR DRILLING BOEING 747

- 5.11.3 RICHMOND PRIMOID DEPLOYED HILTI CORPORATION'S HIGH-QUALITY TOOLS TO ENHANCE JOB EFFICIENCY AND STREAMLINE OPERATIONS

- 5.12 REGULATIONS AND STANDARDS

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 STANDARDS

- TABLE 9 POWER TOOLS MARKET: STANDARDS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 POWER TOOLS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 POWER TOOLS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING CRITERIA

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS

6 APPLICATIONS OF POWER TOOLS ON DIFFERENT MATERIALS

- 6.1 INTRODUCTION

- FIGURE 34 APPLICATIONS OF POWER TOOLS ON DIFFERENT MATERIALS

- 6.2 BRICKS/BLOCKS

- 6.3 CONCRETES

- 6.4 GLASSES

- 6.5 WOODS/METALS

- 6.6 OTHER MATERIALS

7 DISTRIBUTION CHANNELS OF POWER TOOLS

- 7.1 INTRODUCTION

- FIGURE 35 DISTRIBUTION CHANNELS OF POWER TOOLS

- 7.2 ONLINE

- 7.3 OFFLINE

8 POWER TOOLS MARKET, BY TOOL TYPE

- 8.1 INTRODUCTION

- FIGURE 36 POWER TOOLS MARKET, BY TOOL TYPE

- FIGURE 37 DRILLING AND FASTENING TOOLS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 13 POWER TOOLS MARKET, BY TOOL TYPE, 2020-2023 (USD MILLION)

- TABLE 14 POWER TOOLS MARKET, BY TOOL TYPE, 2024-2029 (USD MILLION)

- TABLE 15 POWER TOOLS MARKET, BY TOOL TYPE, 2020-2023 (MILLION UNITS)

- TABLE 16 POWER TOOLS MARKET, BY TOOL TYPE, 2024-2029 (MILLION UNITS)

- 8.2 DRILLING AND FASTENING TOOLS

- 8.2.1 DRILLS

- 8.2.1.1 Portability and light weight of corded power drills to boost demand

- 8.2.2 IMPACT DRIVERS

- 8.2.2.1 Ability to provide high torque to drive market

- 8.2.3 IMPACT WRENCHES

- 8.2.3.1 Increasing demand from solar industry to offer lucrative growth opportunities

- 8.2.4 SCREWDRIVERS AND NUTRUNNERS

- 8.2.4.1 Rising use in aerospace and automotive assembly operations to drive market

- 8.2.1 DRILLS

- 8.3 DEMOLITION TOOLS

- 8.3.1 ROTARY HAMMERS/HAMMER DRILLS/DEMOLITION HAMMERS

- 8.3.1.1 Rapid demolition of brittle materials with fast drilling and minimum efforts to boost demand

- 8.3.1 ROTARY HAMMERS/HAMMER DRILLS/DEMOLITION HAMMERS

- 8.4 SAWING AND CUTTING TOOLS

- 8.4.1 JIGSAWS

- 8.4.1.1 Rising demand for lightweight and high-speed equipment to foster segmental growth

- 8.4.2 RECIPROCATING SAWS

- 8.4.2.1 Growing application in construction and demolition to fuel market growth

- 8.4.3 CIRCULAR SAWS

- 8.4.3.1 Expansion of construction industry to propel market

- 8.4.4 BAND SAWS

- 8.4.4.1 Increasing use for cutting irregular or curved jigsaws to drive market

- 8.4.5 SHEARS & NIBBLERS

- 8.4.5.1 Ability to cut nonferrous metals and plastics from thin plates and strips to boost demand

- 8.4.1 JIGSAWS

- 8.5 MATERIAL REMOVAL TOOLS

- 8.5.1 SANDERS/POLISHERS/BUFFERS

- 8.5.1.1 Growing application in industrial and residential sectors to drive market

- 8.5.2 AIR SCALERS

- 8.5.2.1 Efficiency in cleaning and removing old paint from metal surfaces to fuel market growth

- 8.5.3 GRINDERS

- 8.5.3.1 Growing utilization in abrasive cutting, grinding, and polishing to foster segmental growth

- 8.5.3.2 Angle grinders

- 8.5.3.2.1 Growing demand at construction sites for metal fabrications to fuel market growth

- 8.5.3.3 Die and straight grinders

- 8.5.3.3.1 Suitability for metal grinding and shipyard maintenance to accelerate demand

- 8.5.1 SANDERS/POLISHERS/BUFFERS

- 8.6 ROUTING TOOLS

- 8.6.1 QUICK-ACTING SAFETY BRAKE SYSTEM AND SPINDLE-STOP CUTTER-CHANGING FEATURES TO STIMULATE DEMAND

- 8.6.2 ROUTERS/PLANERS/JOINERS

- 8.6.2.1 Palm routers and laminate trimmers

- 8.6.2.1.1 Excellence in creating decorative or corrective edges and crafting crown moldings to drive market

- 8.6.2.1 Palm routers and laminate trimmers

- 8.7 OTHER TOOLS

9 POWER TOOLS MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- FIGURE 38 POWER TOOLS MARKET, BY MODE OF OPERATION

- FIGURE 39 ELECTRIC SEGMENT TO DOMINATE MARKET IN 2029

- TABLE 17 POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 18 POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- 9.2 ELECTRIC

- TABLE 19 ELECTRIC: POWER TOOLS MARKET, BY TOOL TYPE, 2020-2023 (USD MILLION)

- TABLE 20 ELECTRIC: POWER TOOLS MARKET, BY TOOL TYPE, 2024-2029 (USD MILLION)

- TABLE 21 ELECTRIC: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 22 ELECTRIC: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 23 ELECTRIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 24 ELECTRIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 25 ELECTRIC: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 ELECTRIC: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 ELECTRIC: POWER TOOLS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 28 ELECTRIC: POWER TOOLS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.2.1 CORDED TOOLS

- 9.2.1.1 Growing applications for drilling and mining operations to drive market

- 9.2.2 CORDLESS TOOLS

- 9.2.2.1 Independence from secondary power sources to fuel market growth

- 9.3 PNEUMATIC

- 9.3.1 GROWING DEMAND FROM AUTOMOTIVE INDUSTRY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- TABLE 29 PNEUMATIC: POWER TOOLS MARKET, BY TOOL TYPE, 2020-2023 (USD MILLION)

- TABLE 30 PNEUMATIC: POWER TOOLS MARKET, BY TOOL TYPE, 2024-2029 (USD MILLION)

- TABLE 31 PNEUMATIC: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 PNEUMATIC: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 PNEUMATIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 34 PNEUMATIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 35 PNEUMATIC: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 PNEUMATIC: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 HYDRAULIC

- 9.4.1 INCREASING USES IN ROAD CONSTRUCTIONS AND TRENCH EXCAVATIONS TO BOOST DEMAND

- TABLE 37 HYDRAULIC: POWER TOOLS MARKET, BY TOOL TYPE, 2020-2023 (USD MILLION)

- TABLE 38 HYDRAULIC: POWER TOOLS MARKET, BY TOOL TYPE, 2024-2029 (USD MILLION)

- TABLE 39 HYDRAULIC: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 40 HYDRAULIC: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 HYDRAULIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 42 HYDRAULIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 43 HYDRAULIC: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 HYDRAULIC: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

10 POWER TOOLS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 40 POWER TOOLS MARKET, BY APPLICATION

- FIGURE 41 RESIDENTIAL/DIY SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 45 POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 46 POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2 INDUSTRIAL/PROFESSIONAL

- FIGURE 42 CONSTRUCTION SEGMENT TO DOMINATE POWER TOOLS MARKET FOR INDUSTRIAL/PROFESSIONAL APPLICATIONS IN 2029

- TABLE 47 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 49 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.1 CONSTRUCTION

- 10.2.1.1 Growing demand for impact drills and rotary hammers in construction projects to boost demand

- TABLE 51 CONSTRUCTION: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 52 CONSTRUCTION: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 53 CONSTRUCTION: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 CONSTRUCTION: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.2 AUTOMOTIVE

- 10.2.2.1 Ease of maintenance by speeding up repetitive processes to drive demand

- TABLE 55 AUTOMOTIVE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 56 AUTOMOTIVE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 57 AUTOMOTIVE: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 AUTOMOTIVE: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.3 AEROSPACE

- 10.2.3.1 Rising demand for fuel-efficient and quiet aircraft components to accelerate demand

- TABLE 59 AEROSPACE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 60 AEROSPACE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 61 AEROSPACE: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 AEROSPACE: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.4 ENERGY

- 10.2.4.1 Increasing number of wind projects in developing countries to drive market

- TABLE 63 ENERGY: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 64 ENERGY: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 65 ENERGY: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 ENERGY: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.5 SHIPBUILDING

- 10.2.5.1 Growing demand for screwdrivers, electric nutrunners, and impact wrenches to boost demand

- TABLE 67 SHIPBUILDING: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 68 SHIPBUILDING: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 69 SHIPBUILDING: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 SHIPBUILDING: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.6 OTHER INDUSTRIES

- TABLE 71 OTHER INDUSTRIES: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 72 OTHER INDUSTRIES: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 73 OTHER INDUSTRIES: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 OTHER INDUSTRIES: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 RESIDENTIAL/DIY

- 10.3.1 GROWING PREFERENCE FOR REMODELING AND REFURBISHING EXISTING HOMES TO BOOST DEMAND

- TABLE 75 RESIDENTIAL/DIY: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 RESIDENTIAL/DIY: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

11 POWER TOOLS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 43 POWER TOOLS MARKET, BY REGION

- FIGURE 44 INDIA TO RECORD HIGHEST GROWTH RATE IN GLOBAL POWER TOOLS MARKET DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA TO DOMINATE GLOBAL POWER TOOLS MARKET FROM 2024 TO 2029

- TABLE 77 POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 IMPACT OF RECESSION ON POWER TOOLS MARKET IN NORTH AMERICA

- FIGURE 46 NORTH AMERICA: POWER TOOLS MARKET SNAPSHOT

- TABLE 79 NORTH AMERICA: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2020-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: POWER TOOLS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: POWER TOOLS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Thriving automotive and construction industries to boost demand

- 11.2.3 CANADA

- 11.2.3.1 Rising demand in residential construction projects to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Implementation of free-trade agreements to drive market

- 11.3 EUROPE

- 11.3.1 IMPACT OF RECESSION ON POWER TOOLS MARKET IN EUROPE

- FIGURE 47 EUROPE: POWER TOOLS MARKET SNAPSHOT

- TABLE 87 EUROPE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 91 EUROPE: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2024-2029 (USD MILLION)

- TABLE 93 EUROPE: POWER TOOLS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: POWER TOOLS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Rising focus to upgrade assembly lines for smart manufacturing to boost demand

- 11.3.3 FRANCE

- 11.3.3.1 Presence of aircraft manufacturing companies to fuel market growth

- 11.3.4 UK

- 11.3.4.1 Increasing construction activities in residential and nonresidential sectors to boost demand

- 11.3.5 ITALY

- 11.3.5.1 Wind energy sector to offer lucrative growth opportunities for market players

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 IMPACT OF RECESSION ON POWER TOOLS MARKET IN ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: POWER TOOLS MARKET SNAPSHOT

- TABLE 95 ASIA PACIFIC: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: POWER TOOLS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: POWER TOOLS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Low labor and material costs to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Established global exporter of large construction vehicles to accelerate demand

- 11.4.4 INDIA

- 11.4.4.1 Government-led initiatives to boost construction industry to drive demand

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Growing adoption in shipbuilding industry to accelerate demand

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 IMPACT OF RECESSION ON POWER TOOLS MARKET IN ROW

- TABLE 103 ROW: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 104 ROW: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- TABLE 105 ROW: POWER TOOLS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 106 ROW: POWER TOOLS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 107 ROW: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 ROW: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 ROW: POWER TOOLS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 110 ROW: POWER TOOLS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Government-led initiatives to develop infrastructure to drive market

- 11.5.3 GCC COUNTRIES

- 11.5.3.1 Growing initiatives of smart city projects to drive market

- 11.5.4 AFRICA & REST OF MIDDLE EAST

- 11.5.4.1 Expanding commercial and residential real estate sectors to fuel market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, MARCH 2023-FEBRUARY 2024

- TABLE 111 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN POWER TOOLS MARKET, MARCH 2023-FEBRUARY 2024

- 12.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- FIGURE 49 FIVE-YEAR REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- TABLE 112 POWER TOOLS MARKET: DEGREE OF COMPETITION, 2023

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- FIGURE 51 VALUATION OF KEY PLAYERS IN POWER TOOLS MARKET, 2024

- FIGURE 52 EV/EBITDA OF KEY PLAYERS, 2023

- 12.6 BRANDS/PRODUCTS COMPARISON

- FIGURE 53 BRANDS/PRODUCTS COMPARISON

- 12.7 COMPETITIVE EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 54 POWER TOOLS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.7.5.1 Company overall footprint

- FIGURE 55 COMPANY OVERALL FOOTPRINT

- 12.7.5.2 Tool type footprint

- TABLE 113 POWER TOOLS MARKET: TOOL TYPE FOOTPRINT

- 12.7.5.3 Mode of operation footprint

- TABLE 114 POWER TOOLS MARKET: MODE OF OPERATION FOOTPRINT

- 12.7.5.4 Application footprint

- TABLE 115 POWER TOOLS MARKET: APPLICATION FOOTPRINT

- 12.7.5.5 Region footprint

- TABLE 116 POWER TOOLS MARKET: REGION FOOTPRINT

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 56 POWER TOOLS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of startups/SMEs

- TABLE 117 POWER TOOLS MARKET: LIST OF KEY STARTUPS/SMES

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 118 POWER TOOLS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 119 POWER TOOLS MARKET: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2024

- 12.9.2 DEALS

- TABLE 120 POWER TOOLS MARKET: DEALS, JANUARY 2022-FEBRUARY 2024

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 STANLEY BLACK & DECKER, INC.

- TABLE 121 STANLEY BLACK & DECKER, INC.: COMPANY OVERVIEW

- FIGURE 57 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT

- TABLE 122 STANLEY BLACK & DECKER, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 123 STANLEY BLACK & DECKER, INC.: PRODUCT LAUNCHES

- TABLE 124 STANLEY BLACK & DECKER, INC.: OTHERS

- 13.1.2 ROBERT BOSCH GMBH

- TABLE 125 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 126 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 127 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- 13.1.3 TECHTRONIC INDUSTRIES CO. LTD.

- TABLE 128 TECHTRONIC INDUSTRIES CO. LTD.: COMPANY OVERVIEW

- FIGURE 59 TECHTRONIC INDUSTRIES CO. LTD.: COMPANY SNAPSHOT

- TABLE 129 TECHTRONIC INDUSTRIES CO. LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 130 TECHTRONIC INDUSTRIES CO. LTD.: PRODUCT LAUNCHES

- 13.1.4 MAKITA CORPORATION

- TABLE 131 MAKITA CORPORATION: COMPANY OVERVIEW

- FIGURE 60 MAKITA CORPORATION: COMPANY SNAPSHOT

- TABLE 132 MAKITA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 133 MAKITA CORPORATION: PRODUCT LAUNCHES

- 13.1.5 HILTI CORPORATION

- TABLE 134 HILTI CORPORATION: COMPANY OVERVIEW

- FIGURE 61 HILTI CORPORATION: COMPANY SNAPSHOT

- TABLE 135 HILTI CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 HILTI CORPORATION: DEALS

- 13.1.6 ANDREAS STIHL AG & CO. KG

- TABLE 137 ANDREAS STIHL AG & CO. KG: COMPANY OVERVIEW

- TABLE 138 ANDREAS STIHL AG & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 APEX TOOL GROUP, LLC

- TABLE 139 APEX TOOL GROUP, LLC: COMPANY OVERVIEW

- TABLE 140 APEX TOOL GROUP, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 ATLAS COPCO AB

- TABLE 141 ATLAS COPCO AB: COMPANY OVERVIEW

- FIGURE 62 ATLAS COPCO AB: COMPANY SNAPSHOT

- TABLE 142 ATLAS COPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 ATLAS COPCO AB: PRODUCT LAUNCHES

- 13.1.9 INGERSOLL RAND

- TABLE 144 INGERSOLL RAND: COMPANY OVERVIEW

- FIGURE 63 INGERSOLL RAND: COMPANY SNAPSHOT

- TABLE 145 INGERSOLL RAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 INGERSOLL RAND: DEALS

- 13.1.10 SNAP-ON INCORPORATED

- TABLE 147 SNAP-ON INCORPORATED: COMPANY OVERVIEW

- FIGURE 64 SNAP-ON INCORPORATED: COMPANY SNAPSHOT

- TABLE 148 SNAP-ON INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 SNAP-ON INCORPORATED: PRODUCT LAUNCHES

- TABLE 150 SNAP-ON INCORPORATED: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 KOKI HOLDINGS CO., LTD.

- TABLE 151 KOKI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- 13.2.2 YAMABIKO CORPORATION

- TABLE 152 YAMABIKO CORPORATION: COMPANY OVERVIEW

- 13.2.3 PANASONIC INDUSTRY EUROPE GMBH

- TABLE 153 PANASONIC INDUSTRY EUROPE GMBH: COMPANY OVERVIEW

- 13.2.4 KEN HOLDING CO., LTD

- TABLE 154 KEN HOLDING CO., LTD: COMPANY OVERVIEW

- 13.2.5 DYNABRADE INC.

- TABLE 155 DYNABRADE INC.: COMPANY OVERVIEW

- 13.2.6 AMICO

- TABLE 156 AMICO: COMPANY OVERVIEW

- 13.2.7 C. & E. FEIN GMBH

- TABLE 157 C. & E. FEIN GMBH: COMPANY OVERVIEW

- 13.2.8 CHERVON (CHINA) TRADING CO., LTD.

- TABLE 158 CHERVON (CHINA) TRADING CO., LTD.: COMPANY OVERVIEW

- 13.2.9 CS UNITEC, INC.

- TABLE 159 CS UNITEC, INC.: COMPANY OVERVIEW

- 13.2.10 FERM INTERNATIONAL B.V.

- TABLE 160 FERM INTERNATIONAL B.V.: COMPANY OVERVIEW

- 13.2.11 INTERSKOL

- TABLE 161 INTERSKOL: COMPANY OVERVIEW

- 13.2.12 POSITEC TOOL CORPORATION

- TABLE 162 POSITEC TOOL CORPORATION: COMPANY OVERVIEW

- 13.2.13 RIDGID

- TABLE 163 RIDGID: COMPANY OVERVIEW

- 13.2.14 GREENWORKSTOOLS

- TABLE 164 GREENWORKSTOOLS: COMPANY OVERVIEW

- 13.2.15 URYU SEISAKU, LTD.

- TABLE 165 URYU SEISAKU, LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION

- TABLE 166 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 167 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 14.3 COMMERCIAL

- 14.3.1 INCREASING CONSTRUCTION ACTIVITIES TO PROPEL MARKET GROWTH

- TABLE 168 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 169 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 170 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 171 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 14.4 RESIDENTIAL/DIY

- 14.4.1 GROWING POPULARITY OF DIY GARDENING CULTURE TO DRIVE MARKET

- TABLE 172 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 173 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 174 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 175 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

15 APPENDIX

- 15.1 INSIGHTS OF INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS