|

|

市場調査レポート

商品コード

1826562

量子コンピューティングの世界市場 (~2030年):提供区分・展開・用途・技術・エンドユーザー産業・地域別Quantum Computing Market by Offering, Deployment, Application, Technology, End User Industry and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 量子コンピューティングの世界市場 (~2030年):提供区分・展開・用途・技術・エンドユーザー産業・地域別 |

|

出版日: 2025年09月11日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

概要

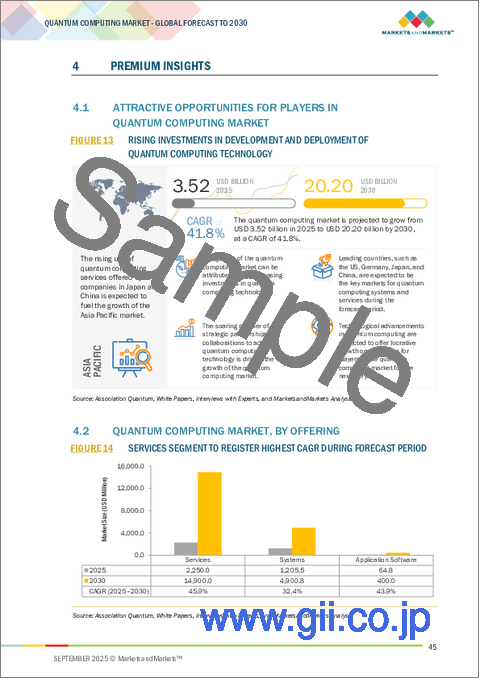

量子コンピューティングの市場規模は、予測期間中にCAGR 41.8%で推移し、2025年の35億2,000万米ドルから、2030年には202億米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分・手k内・技術・用途・エンドユーザー産業・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

量子コンピューティング市場の主要な推進要因は、創薬、金融モデリング、物流最適化といった、従来のシステムでは限界がある複雑な問題を解決するための高性能コンピューティングへの需要の高まりです。強力な政府資金援助と企業による研究開発投資が進歩をさらに加速させています。しかし、主要な制約要因は高いエラーレートと量子ビットの不安定性であり、信頼できる大規模計算を妨げています。さらに、高額なインフラコストと量子分野に熟練した専門人材の不足も、広範な普及に対する課題となっています。

"展開別では、クラウドが予測期間中に最も高いCAGRで成長する見込み"

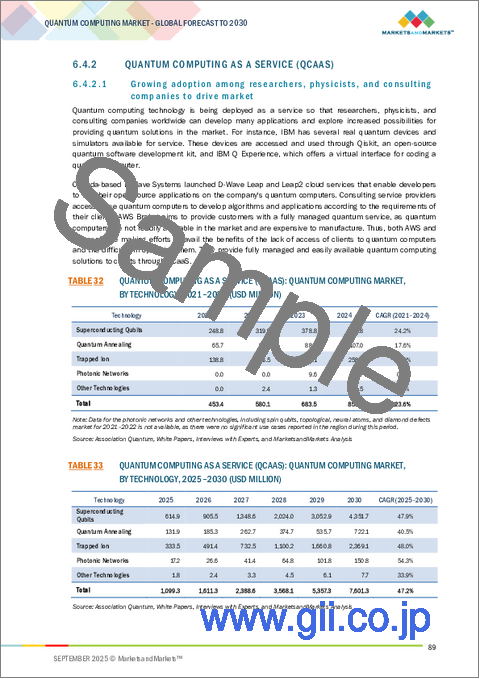

クラウドベースの導入は、重いインフラ投資を必要とせずに量子システムへのコスト効率的なアクセスを提供するため、最高のCAGRで成長すると見込まれています。これにより、あらゆる規模の企業が柔軟な従量課金モデルを通じてアプリケーションを試行し、拡張することが可能となります。AWS、Microsoft Azure、IBM といった主要プロバイダーが QCaaS(Quantum Computing as a Service)の提供を拡大しており、採用拡大を牽引しています。既存のクラウドエコシステムとの統合やリモートアクセス需要の高まりも、この導入モデルをさらに押し上げています。

"予測期間中、北米市場では最適化アプリケーションが最大の市場シェアを確保する見込み"

北米では、産業界が量子コンピューティングを活用して複雑な物流・運用課題を解決していることから、最適化アプリケーションが強い成長を示しています。金融、サプライチェーン、エネルギーといった分野が、効率性向上とコスト削減のために量子アルゴリズムを採用しています。同地域の強力な技術企業とスタートアップのエコシステムが、量子最適化ソリューションの開発を加速させています。さらに、政府と企業の協力関係が北米のこのアプリケーション分野におけるリーダーシップを一層強化しています。

"予測期間中、北米地域は量子コンピューティング市場で第2位のシェアを占める"

北米は、強力な政府のイニシアチブや資金援助プログラムに支えられ、量子コンピューティング市場で力強い成長を遂げています。この地域には IBM、Google、Microsoft、AWSといった主要企業が存在し、ハードウェア、ソフトウェア、サービスの進展を推進しています。学術界、研究機関、企業の協力がイノベーションと商業化を加速させています。金融、防衛、医療、航空宇宙といった産業が早期導入者となり、需要を押し上げています。総じて、北米は世界の量子コンピューティング成長とリーダーシップの主要拠点であり続けています。

当レポートでは、世界の量子コンピューティングの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客に影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025-2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- AI/生成AIが量子コンピューティング市場に与える影響

- 2025年の米国関税が量子コンピューティング市場に与える影響

第6章 量子コンピューティング市場:提供区分別

- システム

- アプリケーションソフトウェア

- サービス

- QCaaS(Quantum Computing as a Service)

- コンサルティングサービス

第7章 量子コンピューティング市場:展開別

- オンプレミス

- クラウドベース

第8章 量子コンピューティング市場:用途別

- 最適化

- 機械学習

- シミュレーション

- その他

第9章 量子コンピューティング市場:技術別

- 超伝導量子ビット

- イオントラップ

- 量子アニーリング

- フォトニックネットワーク

- その他

第10章 量子コンピューティング市場:エンドユーザー産業別

- 宇宙・防衛

- 銀行・金融

- ヘルスケア・医薬品

- エネルギー・電力

- 化学品

- 運輸・物流

- 政府

- 学術研究

第11章 量子コンピューティング市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ・メキシコ

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- オランダ

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- マクロ経済見通し

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス、主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競争シナリオ

第13章 企業プロファイル

- 主要企業

- IBM

- D-WAVE QUANTUM INC.

- MICROSOFT

- AMAZON WEB SERVICES, INC.

- RIGETTI COMPUTING

- INTEL

- TOSHIBA

- QUANTINUUM

- QC WARE

- IONQ

- その他の企業

- 1QB INFORMATION TECHNOLOGIES

- ROBERT BOSCH GMBH

- NEC CORPORATION

- AQT

- NTT DATA GROUP

- HITACHI, LTD.

- NORTHROP GRUMMAN

- ACCENTURE

- FUJITSU

- XANADU

- RIVERLANE

- QUANTUM COMPUTING INC.

- EVOLUTIONQ

- ANYON SYSTEMS, INC.

- PSIQUANTUM

- ALGORITHMIQ

- PHASECRAFT

- HQS QUANTUM SIMULATIONS

- STRANGEWORKS INC.

- ATOM COMPUTING, INC.

- ALICE & BOB.

- DIRAQ