|

|

市場調査レポート

商品コード

1267422

食品・飲料加工装置の世界市場:種類別 (加工、前処理)・用途別 (ベーカリー・菓子類、食肉・鶏肉、乳製品、アルコール飲料、非アルコール飲料)・操作方法別・最終製品の形状別・地域別の将来予測 (2028年まで)Food & Beverage Processing Equipment Market by Type (Processing, Pre-Processing), Application (Bakery & Confectionery, Meat & Poultry, Dairy, Alcoholic & Non Alcoholic Beverages), Mode of Operation, End Product Form and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 食品・飲料加工装置の世界市場:種類別 (加工、前処理)・用途別 (ベーカリー・菓子類、食肉・鶏肉、乳製品、アルコール飲料、非アルコール飲料)・操作方法別・最終製品の形状別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月24日

発行: MarketsandMarkets

ページ情報: 英文 338 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の食品・飲料加工装置の市場規模は、2023年に646億米ドル、2028年には849億米ドルに達すると予測され、予測期間中のCAGRは5.6%となる見通しです。

IMFによると、世界の人口は2050年までに97億人以上増加すると予想されており、食品・飲料の需要増につながっています。人口増加に伴い食品・飲料の需要も増加するため、食品の製造・加工・包装を行う加工装置の需要も増加すると考えられます。食品・飲料業界は、消費者の需要に応えるため、常に最新技術に投資してきました。最新技術を提供するために、食品・飲料加工装置メーカーは常に革新的な新技術を導入し、加工食品の生産効率と費用対効果を高めています。

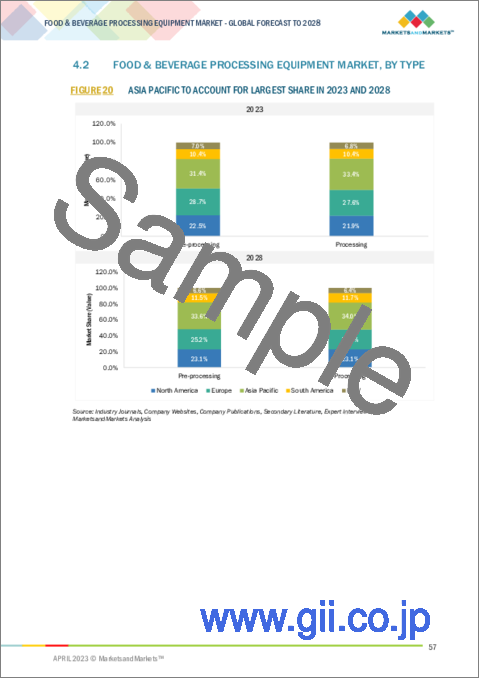

アジア太平洋は予測期間中に、6.2%のCAGRで成長する

世界の食品・飲料加工装置の市場規模のうち、アジア太平洋は2022年に200億6,000万米ドルを占めています。アジア太平洋の食品・飲料加工装置市場は、予測期間中に6.2%という最高のCAGRで成長すると予測されています。アジア太平洋の食品・飲料産業は多様で、米やお茶などの伝統的な製品から、加工スナック食品、乳製品、飲料などの近代的な製品まで、その範囲は幅広くなっています。このため、食品・飲料加工装置メーカーは、さまざまな食品・飲料業界の固有のニーズに対応することを目指し、大きな市場を形成しています。FAO (国連食糧農業機関) によると、インドの牛乳生産量は世界第1位で、世界の牛乳生産量の24%を占めています。また、FAOの統計によると、中国・インドは穀物・豆類の生産量が世界一となっています。このため、アジア太平洋の食品・飲料加工装置メーカー向けに、これらの食品を加工するためのビジネスチャンスが生じています。

ベーカリー・菓子類が、世界の食品・飲料加工装置市場で急速に人気を集めている

ベーカリー・菓子類は、世界的に見て主要な消費者向け食品産業の一つです。ベーカリー・菓子類は、今や大多数の人々の必須食品となっています。都市化により、リーズナブルな価格ですぐに食べられる製品への需要が高まっています。パンとビスケットはベーカリー産業の主要な部分であり、USDAによると、ベーカリー製品の総輸出額は2022年に41億1,000万米ドルと推定され、1.5%のCAGRで成長しています (2013年~2022年)。ベーカリー・菓子類産業の成長とその製品に対する需要から、食品・飲料加工装置市場では、同業界向け専用装置が高い比率を占めています。

加工セグメントが食品・飲料加工装置市場を独占し、2022年には408億米ドルと最大規模となる

加工装置には、成形、押出、コーティング、乾燥・冷却・凍結、熱処理、均質化、濾過、圧搾などの作業を行う機械が含まれます。加工装置は、食品製造において重要な役割を担っており、原材料の配合や調理に関わる作業の大半を行い、目的の製品を作り上げることができます。熱処理や冷却作業は、食品を加工し安全に保存するために、食品産業で最もよく使われる方法です。その重要性と食品加工への影響力から、これらの種類の装置には非常に大きな需要があります。その影響力の大きさから、食品・飲料加工装置メーカーは、加工食品の製造における工程効率と費用対効果を高めるために、常に革新的な新技術を導入しています。

半自動セグメントは、2023年から2028年にかけて6.0%と高いCAGRで成長する

半自動機械は、手作業と完全自動化システムの間のバランスを提供し、より高い効率を実現しながらも、ある程度の人間の制御と調整を可能にします。さらに、半自動機械は完全自動システムよりも費用対効果が高い傾向にあり、大規模な自動化に投資する資源がない中小企業にとって、より利用しやすいものとなっています。そのため、半自動加工装置に対する需要が生まれています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 規制の枠組み

- 特許分析

- バリューチェーン分析

- 食品・飲料加工装置のバイヤーに影響を与える動向/混乱

- 市場のエコシステム

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 購入基準

第7章 食品・飲料加工装置市場:操作方法別

- イントロダクション

- 半自動

- 自動

第8章 食品・飲料加工装置市場:最終製品の形状別

- イントロダクション

- 固体

- 液体

- 半固体

第9章 食品・飲料加工装置市場:用途別

- イントロダクション

- ベーカリー・菓子類製品

- 食肉・鶏肉

- 乳製品

- 魚介類

- アルコール飲料

- 非アルコール飲料

- その他の用途

第10章 食品・飲料加工装置市場:種類別

- イントロダクション

- 前処理

- 並べ替え・等級付け

- 切断・皮むき・粉砕・スライス・洗浄

- 混合・ブレンド

- 加工

- 成形

- 押出

- コーティング

- 乾燥・冷却・凍結

- 熱処理

- 均質化

- 濾過

- 圧搾

第11章 食品・飲料加工装置市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- その他アジア太平洋

- 欧州

- 英国

- ドイツ

- イタリア

- スペイン

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- その他の地域 (ROW)

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要企業のセグメントによる収益分析

- 市場シェア分析

- 主要企業の戦略

- 企業評価クアドラント (主要企業)

- 企業評価クアドラント (スタートアップ/中小企業)

- 主要なスタートアップ/中小企業の競合ベンチマーキング

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- TETRA LAVAL

- MAREL

- GEA GROUP AKTIENGESELLSCHAFT

- JBT

- BUHLER

- ALFA LAVAL

- BUCHER INDUSTRIES AG

- SPX FLOW, INC.

- THE MIDDLEBY CORPORATION

- KRONES AG

- BIGTEM MAKINE A.S.

- EQUIPAMIENTOS CARNICOS, S.L.

- TNA AUSTRALIA PTY LIMITED

- FENCO FOOD MACHINERY S.R.L.

- KHS GROUP

- その他の企業

- CLEXTRAL

- GOMA

- NEOLOGIC ENGINEERS PVT. LTD

- FINIS FOOD PROCESSING EQUIPMENT B.V.

- ANDERSON DAHLEN

- HEAT AND CONTROL, INC.

- ANKO FOOD MACHINE CO., LTD

- BAADER

- DOVER CORPORATION

- BETTCHER INDUSTRIES, INC

第14章 隣接・関連市場

- イントロダクション

- 飲料加工装置市場

- ベーカリー加工装置市場

- 乳製品加工装置市場

第15章 付録

The global market for food and beverage processing equipment was valued at USD 64.6 Billion in 2023 and is projected to reach USD 84.9 Billion by 2028, at a CAGR of 5.6% during the forecast period. The world's population is expected to grow by more than 9.7 billion by 2050 according to IMF, leading to increased demand for food and beverages. As the population grows, the demand for food and beverages will also increase, which will lead to an increased demand for processing equipment to produce, process and pack food products. Food and beverage industries have been constantly investing on latest technologies, to meet the consumer demands. To provide latest technologies, food and beverage processing equipment companies are constantly innovating and introducing new technologies, leading to increased efficiency and cost-effectiveness in the production of processed foods.

Asia Pacific is projected to witness the growth of 6.2% CAGR during the forecast period.

The Asia Pacific region accounts USD 20.06 Billion of the market size in global market for food and beverage processing equipment in 2022. The food and beverage processing equipment market in the Asia Pacific region is projected to grow at the highest CAGR of 6.2% during forecasted period. The Asia Pacific region has a diverse range of food and beverage industries, from traditional products such as rice and tea to more modern products such as packaged snacks, dairy and beverages. This has created a large market for food and beverage processing equipment companies, as manufacturers seek to cater to the unique needs of different food and beverage industries. According to FAO (Food and Agriculture Organization of the United Nations), India ranks first in milk production in the world contributing 24% of global milk production. More stats from FAO also mentioned that China and India leading in grains, cereals and pulses production. Thus, creating business opportunities for food and beverage processing equipment companies in Asia Pacific region, to process these food commodities.

Bakery & confectionery is gaining rapid popularity in the food and beverage processing equipment market across the globe.

Bakery & confectionery industry includes one of the leading consumer food industries, globally. The bakery & confectionery products have now become essential food items of the vast majority of population. Urbanization has resulted in increased demand for ready to eat products at reasonable costs etc. Bread and biscuits are the major part of the bakery industry, according to USDA the total export value of Baked goods was estimated at USD 4.11 Billion in 2022, with a compound average growth of 1.5% (2013-2022). The bakery & confectionery industry's growth and demand for its products have led to the dominance of its specialized equipment in the food and beverage processing equipment market.

The processing segment dominated the market for food & beverage processing equipment and was valued the largest at USD 40.8 billion in 2022.

The processing segment equipment's includes machines that performs operations such as Forming, Extruding , Coating, Drying, Cooling, Freezing, Thermal Process, Homogenization, Filtration and Pressing. Processing equipment plays a critical role in food production, as it performs the majority of operations involved in formulating and cooking ingredients to create the desired products. Thermal processing and cooling operations are the most commonly used methods in the food industry for processing and safely storing food. Due to their significance and influence on food processing, these types of equipment are in great demand. Due to their influence, the food and beverage processing equipment companies is constantly innovating and introducing new technologies, to increase the process efficiency and cost-effectiveness in the production of processed foods.

The semi-automatic segment of the global food & beverage processing equipment market is projected to grow at a higher CAGR of 6.0% from 2023 to 2028.

Semi-automatic machines offer a balance between manual labor and fully automated systems, providing greater efficiency while still allowing for some level of human control and customization. Furthermore, semi-automatic machines tend to be more cost-effective than fully automated systems, making them more accessible to small and medium-sized businesses that may not have the resources to invest in large-scale automation. Thus, creating demand for Semi-automatic processing machines.

The break-up of the profile of primary participants in the food and beverage processing equipment market:

- By Value Chain: Supply Side - 41.0%, Demand Side - 59.0%

- By Designation: Managers - 24.0%, CXOs - 31.0%, and Executives- 45.0%

- By Region: North America - 15%, Europe - 15%, Asia Pacific -40%, RoW - 30%

Prominent companies include Tetra Laval (Switzerland), GEA Group Aktiengesellschaft (Germany), JBT (US) and among others.

Research Coverage:

This research report categorizes the food and beverage processing equipment market by Type (processing , pre-processing ), by Application (Bakery & confectionery products, Meat & poultry ,Dairy products, Fish & seafood, Alcoholic beverages, Non-alcoholic beverages, Other applications), by End Product form (Solid, Liquid, Semi-solid), by Mode of Operation (Semi-automatic, Automatic), and region (North America, Europe, Asia pacific, the middle east & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the food and beverage processing equipment market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; contracts, partnerships, agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the food and beverage processing equipment market. Competitive analysis of upcoming startups in the food and beverage processing equipment market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall food and beverage processing equipment market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growth in demand for convenience foods), restraints (Several rules and regulations implemented by governments globally), opportunities (New technological trends in food processing), and challenges (Infrastructural challenges in emerging economies) influencing the growth of the food and beverage processing equipment market.

- Product Development/Innovation: Detailed insights on research & development activities, and new product & service launches in the food and beverage processing equipment market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the food and beverage processing equipment market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the food and beverage processing equipment market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Tetra Laval (Switzerland), Marel (Iceland), GEA Group Aktiengesellschaft (Germany), JBT (US) and Buhler (Switzerland), among others in the food and beverage processing equipment market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 FOOD & BEVERAGE EQUIPMENT PROCESSING MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.2.4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- 2.3 GROWTH RATE FORECAST ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

- 2.7.1 MACROECONOMIC INDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE, 2011-2021

- FIGURE 11 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET

- FIGURE 13 GLOBAL FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

3 EXECUTIVE SUMMARY

- 3.1 INTRODUCTION

- TABLE 4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GLOBAL SHARE OF FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET PLAYERS

- FIGURE 19 RISE IN FOOD DEMAND TO DRIVE MARKET GROWTH

- 4.2 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE

- FIGURE 20 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN 2023 AND 2028

- 4.3 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION AND COUNTRY

- FIGURE 21 AUTOMATIC SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT RESPECTIVE SHARES IN 2023

- 4.4 GLOBAL MARKET FOR FOOD & BEVERAGE PROCESSING MARKET

- FIGURE 22 INDIA ACCOUNTED FOR LARGEST SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN DEMAND FOR MEAT, POULTRY, AND BAKERY PRODUCTS

- FIGURE 23 MEAT PRODUCTION, BY REGION, 2019-2021 (MILLION TONNES)

- FIGURE 24 POULTRY PRODUCTION, BY REGION, 2021 (MILLION TONNES)

- 5.2.2 INCREASE IN CONSUMPTION OF SAFE AND HYGIENIC PROCESSED FOODS

- 5.3 MARKET DYNAMICS

- FIGURE 25 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growth in demand for convenience foods

- 5.3.1.2 Restaurants generate profits through automation in food & beverage industry

- 5.3.2 RESTRAINTS

- 5.3.2.1 Several rules and regulations implemented by governments globally

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Government initiatives toward meat & processed food industry

- 5.3.3.2 New technological trends in food processing

- 5.3.4 CHALLENGES

- 5.3.4.1 Infrastructural challenges in emerging economies

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.2 REGULATORY FRAMEWORK

- 6.2.3 COUNTRY-WISE REGULATORY AUTHORITIES FOR FOOD & BEVERAGE PROCESSING EQUIPMENT

- 6.2.3.1 North America

- 6.2.3.1.1 US

- 6.2.3.1.2 Canada

- 6.2.3.2 Europe

- 6.2.3.3 Asia Pacific

- 6.2.3.3.1 China

- 6.2.3.3.2 Japan

- 6.2.3.3.3 Australia & New Zealand

- 6.2.3.1 North America

- 6.3 PATENT ANALYSIS

- FIGURE 26 NUMBER OF PATENTS APPROVED FOR FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, 2012-2022

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO FOOD & BEVERAGE PROCESSING EQUIPMENT, 2012-2022

- FIGURE 27 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR FOOD & BEVERAGE PROCESSING EQUIPMENT, 2012-2022

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.4.2 INPUTS

- 6.4.3 FOOD & BEVERAGE PROCESSING EQUIPMENT MANUFACTURING

- 6.4.4 DISTRIBUTION & SALES MANAGEMENT

- 6.4.5 END-USER INDUSTRY

- 6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS OF FOOD & BEVERAGE PROCESSING EQUIPMENT

- 6.5.1 PELLET FRYING LINE

- 6.5.2 ROBOT GRIPPERS

- 6.6 MARKET ECOSYSTEM

- 6.6.1 UPSTREAM

- 6.6.1.1 Equipment manufacturers

- 6.6.1.2 Technology providers

- 6.6.1.3 End users

- 6.6.2 DOWNSTREAM

- 6.6.2.1 Startups/Emerging companies

- TABLE 9 FOOD & BEVERAGE PROCESSING EQUIPMENT: ECOSYSTEM VIEW

- 6.6.1 UPSTREAM

- 6.7 TRADE ANALYSIS

- TABLE 10 IMPORT VALUE OF INDUSTRIAL FOOD PREPARATION MACHINERY FOR KEY COUNTRIES, 2021 (USD MILLION)

- TABLE 11 EXPORT VALUE OF INDUSTRIAL FOOD PREPARATION MACHINERY FOR KEY COUNTRIES, 2021 (USD MILLION)

- 6.8 KEY CONFERENCES & EVENTS

- TABLE 12 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: CONFERENCES & EVENTS, 2023-2024

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 INSTALLATION OF FASTER PACKAGING LINE AT MEAT PRODUCTION FACILITIES

- 6.9.2 PRODUCTION LINE AUTOMATION NEEDED AT FROZEN FOOD AND MEAT PRODUCT FACILITIES IN CHINA

- 6.9.3 BISCUIT MANUFACTURING WITH EFFICIENT, COMPACT PACKAGING EQUIPMENT

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 ISOCHORIC FREEZING

- 6.10.2 HIGH-VOLTAGE ATMOSPHERIC COLD PLASMA

- 6.10.3 ELECTROHYDRODYNAMIC DRYING

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT FROM NEW ENTRANTS

- 6.11.2 THREAT FROM SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF OPERATION

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF OPERATION

- 6.13 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR MODE OF OPERATION OF FOOD & BEVERAGE PROCESSING EQUIPMENT

- TABLE 15 KEY BUYING CRITERIA FOR MODE OF OPERATION

7 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION

- 7.1 INTRODUCTION

- FIGURE 33 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023 VS. 2028 (USD BILLION)

- TABLE 16 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018-2022 (USD MILLION)

- TABLE 17 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- 7.2 SEMI-AUTOMATIC

- 7.2.1 LOWER INSTALLATION AND MAINTENANCE COSTS FUEL MARKET IN EMERGING ECONOMIES

- TABLE 18 SEMI-AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 SEMI-AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 AUTOMATIC

- 7.3.1 ACCURACY, TIME-SAVING, AND EFFICIENCY OFFERED BY AUTOMATION

- TABLE 20 AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION 2023-2028 (USD MILLION)

8 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM

- 8.1 INTRODUCTION

- FIGURE 34 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023 VS. 2028 (USD BILLION)

- TABLE 22 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018-2022 (USD MILLION)

- TABLE 23 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023-2028 (USD MILLION)

- 8.2 SOLID

- 8.2.1 INCREASING CONSUMPTION OF ULTRA-PROCESSED SOLID FOOD PRODUCTS

- TABLE 24 SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION 2023-2028 (USD MILLION)

- 8.3 LIQUID

- 8.3.1 GROWTH IN HEALTH AWARENESS AND DEMAND FOR FRUIT & VEGETABLE JUICES

- TABLE 26 LIQUID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 LIQUID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION 2023-2028 (USD MILLION)

- 8.4 SEMI-SOLID

- 8.4.1 WIDE RANGE OF APPLICATIONS IN DIPS, SAUCES, SPREADS, AND DRESSINGS

- TABLE 28 SEMI-SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 SEMI-SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

9 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 35 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- TABLE 30 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 31 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 BAKERY & CONFECTIONERY PRODUCTS

- 9.2.1 HIGH DEMAND FOR PROCESSED AND PREMIUM BAKERY PRODUCTS IN DEVELOPED COUNTRIES

- TABLE 32 BAKERY & CONFECTIONERY PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 BAKERY & CONFECTIONERY PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MEAT & POULTRY

- 9.3.1 INCREASED CONSUMPTION OF PROCESSED AND FROZEN MEAL PRODUCTS

- TABLE 34 MEAT & POULTRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 MEAT & POULTRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 DAIRY PRODUCTS

- 9.4.1 AUTOMATED PROCESSING LINES CURATED BY MANY DAIRY PRODUCT MANUFACTURERS TO INCREASE PRODUCTION

- TABLE 36 DAIRY PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 DAIRY PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 FISH & SEAFOOD

- 9.5.1 USAGE OF AUTOMATION PROCESSING EQUIPMENT FOR FISH & SEAFOOD TO INCREASE SHELF LIFE

- TABLE 38 FISH & SEAFOOD PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 FISH & SEAFOOD PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 ALCOHOLIC BEVERAGES

- 9.6.1 INCREASE IN NUMBER OF BREWERIES

- TABLE 40 ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 NON-ALCOHOLIC BEVERAGES

- 9.7.1 RISE IN AWARENESS TOWARD HEALTHY AND FUNCTIONAL DRINKS

- TABLE 42 NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER APPLICATIONS

- TABLE 44 OTHER FOOD & BEVERAGE PROCESSING EQUIPMENT APPLICATIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 OTHER FOOD & BEVERAGE PROCESSING EQUIPMENT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 36 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- TABLE 46 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 47 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2 PRE-PROCESSING

- TABLE 48 PRE-PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 PRE-PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 51 PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.1 SORTING & GRADING

- 10.2.1.1 Reduced wastage, food safety assurance, and improved quality of sorted food products

- TABLE 52 SORTING & GRADING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 SORTING & GRADING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.2 CUTTING, PEELING, GRINDING, SLICING, AND WASHING

- 10.2.2.1 Improved hygiene and consistency of cut fruits and vegetables

- TABLE 54 CUTTING, PEELING, GRINDING, SLICING, AND WASHING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 CUTTING, PEELING, GRINDING, SLICING, AND WASHING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.3 MIXING & BLENDING

- 10.2.3.1 Easy and consistent mixing of ingredients in bakery & confectionery, beverage, and dairy industries

- TABLE 56 MIXING & BLENDING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 MIXING & BLENDING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 PROCESSING

- TABLE 58 PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 61 PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.1 FORMING

- 10.3.1.1 Consistent quality, quick processing, and errors associated with manual operations avoided by forming equipment

- TABLE 62 FORMING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 FORMING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.2 EXTRUDING

- 10.3.2.1 High efficiency of extrusion in production of breakfast cereals

- TABLE 64 EXTRUDING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 EXTRUDING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.3 COATING

- 10.3.3.1 Increase in demand for healthier snack products and premium coated confectionery products

- TABLE 66 COATING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 COATING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.4 DRYING, COOLING, AND FREEZING

- 10.3.4.1 Freeze and spray drying find major applications in processing seasonal and perishable food products

- TABLE 68 DRYING, COOLING, AND FREEZING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 DRYING, COOLING, AND FREEZING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.5 THERMAL

- 10.3.5.1 Prevention of food spoilage due to heat treatment

- TABLE 70 THERMAL EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 THERMAL EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.6 HOMOGENIZATION

- 10.3.6.1 High-volume processing, along with low energy costs of dairy products

- TABLE 72 HOMOGENIZATION EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 HOMOGENIZATION EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.7 FILTRATION

- 10.3.7.1 Demand for high quality and extended shelf life of filtered alcoholic and non-alcoholic beverages

- TABLE 74 FILTRATION EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 FILTRATION EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.8 PRESSING

- 10.3.8.1 High efficiency and ease of sap extraction in wine and fruit juice industries

- TABLE 76 PRESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 77 PRESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

11 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 37 GEOGRAPHICAL SNAPSHOT (2023-2028): ASIA PACIFIC EMERGING AS NEW HOTSPOT FOR FOOD & BEVERAGE PROCESSING EQUIPMENT

- TABLE 78 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 39 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- TABLE 80 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Strong presence of key market players and increasing use of automation in US

- TABLE 94 US: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 95 US: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Increase in processed food & beverage consumption in Canada

- TABLE 96 CANADA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 97 CANADA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Presence of established processed food manufacturers in Mexico

- TABLE 98 MEXICO: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 99 MEXICO: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 ASIA PACIFIC

- 11.3.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 41 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 100 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023-2028 (USD MILLION)

- 11.3.2 CHINA

- 11.3.2.1 High preference for fortified food & beverage products in China

- TABLE 114 CHINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 115 CHINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.3 JAPAN

- 11.3.3.1 Westernized food consumption patterns, along with inclination toward balanced and healthy diets in Japan

- TABLE 116 JAPAN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 117 JAPAN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 INDIA

- 11.3.4.1 Supportive government policies and growing consumer awareness regarding healthy diet in India

- TABLE 118 INDIA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 119 INDIA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 AUSTRALIA & NEW ZEALAND

- 11.3.5.1 Consumer preference to spend on nutritional food products in Australia & New Zealand

- TABLE 120 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 121 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.6 REST OF ASIA PACIFIC

- TABLE 122 REST OF ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 43 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 44 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- TABLE 124 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 125 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 127 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 129 EUROPE: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 131 EUROPE: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 133 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018-2022 (USD MILLION)

- TABLE 135 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- TABLE 136 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018-2022 (USD MILLION)

- TABLE 137 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023-2028 (USD MILLION)

- 11.4.2 UK

- 11.4.2.1 Increased preference for frozen convenience food & beverages in UK

- TABLE 138 UK: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 139 UK: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.3 GERMANY

- 11.4.3.1 Small and medium-scale companies dominate food processing industry in Germany

- TABLE 140 GERMANY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 141 GERMANY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 ITALY

- 11.4.4.1 Focus on food processing and export of food machinery in Italy

- TABLE 142 ITALY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 143 ITALY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 SPAIN

- 11.4.5.1 Significantly large meat and seafood industry in Spain

- TABLE 144 SPAIN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 145 SPAIN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 FRANCE

- 11.4.6.1 Investment by French companies in Asia Pacific to produce dairy, bakery & confectionery products, and beverages

- TABLE 146 FRANCE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 147 FRANCE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.7 REST OF EUROPE

- TABLE 148 REST OF EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 46 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 47 SOUTH AMERICA: MARKET SNAPSHOT

- TABLE 150 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 151 SOUTH AMERICA: FOOD & BEVERAGE PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION 2023-2028 (USD MILLION)

- TABLE 152 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 155 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 SOUTH AMERICA: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 159 SOUTH AMERICA: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 160 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018-2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- TABLE 162 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018-2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Rise in demand for bakery & confectionery and investments in processed food & beverages in Brazil

- TABLE 164 BRAZIL: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 165 BRAZIL: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Increase in meat consumption to drive processing in Argentina

- TABLE 166 ARGENTINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 167 ARGENTINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 168 REST OF SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6 REST OF THE WORLD (ROW)

- 11.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 48 ROW: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 49 ROW: RECESSION IMPACT ANALYSIS, 2022-2023

- TABLE 170 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 171 ROW: FOOD & BEVERAGE PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION 2023-2028 (USD MILLION)

- TABLE 172 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 173 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 174 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 175 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 176 ROW: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 177 ROW: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 178 ROW: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 179 ROW: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 180 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018-2022 (USD MILLION)

- TABLE 181 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023-2028 (USD MILLION)

- TABLE 182 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018-2022 (USD MILLION)

- TABLE 183 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Rise in demand for dairy products and increase in investments in Middle Eastern processed food & beverage industry

- TABLE 184 MIDDLE EAST: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.3 AFRICA

- 11.6.3.1 Consumer preference to drive African bakery & confectionery industry

- TABLE 186 AFRICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 187 AFRICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 50 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018-2022 (USD BILLION)

- 12.3 MARKET SHARE ANALYSIS

- TABLE 188 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 12.4 KEY PLAYER STRATEGIES

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 51 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 12.5.5 PRODUCT FOOTPRINT

- TABLE 189 COMPANY FOOTPRINT, BY PRODUCT TYPE

- TABLE 190 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 191 COMPANY FOOTPRINT, BY REGION

- TABLE 192 OVERALL COMPANY FOOTPRINT

- 12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 52 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

- 12.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 193 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 194 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 195 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: PRODUCT LAUNCHES, JUNE 2021-FEBRUARY 2023

- 12.7.2 DEALS

- TABLE 196 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: DEALS, DECEMBER 2020-APRIL 2023

- 12.7.3 OTHERS

- TABLE 197 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: OTHERS, MAY 2020-JULY 2022

13 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 TETRA LAVAL

- TABLE 198 TETRA LAVAL: BUSINESS OVERVIEW

- FIGURE 53 TETRA LAVAL: COMPANY SNAPSHOT

- TABLE 199 TETRA LAVAL: PRODUCT OFFERINGS

- TABLE 200 TETRA LAVAL: OTHERS

- 13.1.2 MAREL

- TABLE 201 MAREL: BUSINESS OVERVIEW

- FIGURE 54 MAREL: COMPANY SNAPSHOT

- TABLE 202 MAREL: PRODUCT OFFERINGS

- TABLE 203 MAREL: PRODUCT LAUNCHES

- TABLE 204 MAREL: DEALS

- TABLE 205 MAREL: OTHERS

- 13.1.3 GEA GROUP AKTIENGESELLSCHAFT

- TABLE 206 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 55 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 207 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT OFFERINGS

- TABLE 208 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 209 GEA GROUP AKTIENGESELLSCHAFT: OTHERS

- 13.1.4 JBT

- TABLE 210 JBT: BUSINESS OVERVIEW

- FIGURE 56 JBT: COMPANY SNAPSHOT

- TABLE 211 JBT: PRODUCT OFFERINGS

- TABLE 212 JBT: PRODUCT LAUNCHES

- TABLE 213 JBT: OTHERS

- 13.1.5 BUHLER

- TABLE 214 BUHLER: BUSINESS OVERVIEW

- FIGURE 57 BUHLER: COMPANY SNAPSHOT

- TABLE 215 BUHLER: PRODUCT OFFERINGS

- TABLE 216 BUHLER: PRODUCT LAUNCHES

- TABLE 217 BUHLER: DEALS

- TABLE 218 BUHLER: OTHERS

- 13.1.6 ALFA LAVAL

- TABLE 219 ALFA LAVAL: BUSINESS OVERVIEW

- FIGURE 58 ALFA LAVAL: COMPANY SNAPSHOT

- TABLE 220 ALFA LAVAL: PRODUCT OFFERINGS

- TABLE 221 ALFA LAVAL: OTHERS

- 13.1.7 BUCHER INDUSTRIES AG

- TABLE 222 BUCHER INDUSTRIES AG: BUSINESS OVERVIEW

- FIGURE 59 BUCHER INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 223 BUCHER INDUSTRIES AG: PRODUCT OFFERINGS

- 13.1.8 SPX FLOW, INC.

- TABLE 224 SPX FLOW INC.: BUSINESS OVERVIEW

- FIGURE 60 SPX FLOW INC.: COMPANY SNAPSHOT

- TABLE 225 SPX FLOW INC.: PRODUCT OFFERINGS

- TABLE 226 SPX FLOW INC.: PRODUCT LAUNCHES

- TABLE 227 SPX FLOW INC.: DEALS

- TABLE 228 SPX FLOW INC.: OTHERS

- 13.1.9 THE MIDDLEBY CORPORATION

- TABLE 229 THE MIDDLEBY CORPORATION: BUSINESS OVERVIEW

- FIGURE 61 THE MIDDLEBY CORPORATION: COMPANY SNAPSHOT

- TABLE 230 THE MIDDLEBY CORPORATION: PRODUCT OFFERINGS

- TABLE 231 THE MIDDLEBY CORPORATION: DEALS

- TABLE 232 THE MIDDLEBY CORPORATION: OTHERS

- 13.1.10 KRONES AG

- TABLE 233 KRONES AG: BUSINESS OVERVIEW

- FIGURE 62 KRONES AG: COMPANY SNAPSHOT

- TABLE 234 KRONES AG: PRODUCT OFFERINGS

- TABLE 235 KRONES AG: OTHERS

- 13.1.11 BIGTEM MAKINE A.S.

- TABLE 236 BIGTEM MAKINE A.S.: BUSINESS OVERVIEW

- TABLE 237 BIGTEM MAKINE A.S.: PRODUCT OFFERINGS

- 13.1.12 EQUIPAMIENTOS CARNICOS, S.L.

- TABLE 238 EQUIPAMIENTOS CARNICOS, S.L.: BUSINESS OVERVIEW

- TABLE 239 EQUIPAMIENTOS CARNICOS, S.L.: PRODUCT OFFERINGS

- 13.1.13 TNA AUSTRALIA PTY LIMITED

- TABLE 240 TNA AUSTRALIA PTY LIMITED: BUSINESS OVERVIEW

- TABLE 241 TNA AUSTRALIA PTY LIMITED: PRODUCT OFFERINGS

- 13.1.14 FENCO FOOD MACHINERY S.R.L.

- TABLE 242 FENCO FOOD MACHINERY S.R.L.: BUSINESS OVERVIEW

- TABLE 243 FENCO FOOD MACHINERY S.R.L.: PRODUCT OFFERINGS

- 13.1.15 KHS GROUP

- TABLE 244 KHS GROUP: BUSINESS OVERVIEW

- TABLE 245 KHS GROUP: PRODUCT OFFERINGS

- TABLE 246 KHS GROUP: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 CLEXTRAL

- TABLE 247 CLEXTRAL: BUSINESS OVERVIEW

- TABLE 248 CLEXTRAL: PRODUCT OFFERINGS

- 13.2.2 GOMA

- TABLE 249 GOMA: BUSINESS OVERVIEW

- TABLE 250 GOMA: PRODUCT OFFERINGS

- 13.2.3 NEOLOGIC ENGINEERS PVT. LTD

- TABLE 251 NEOLOGIC ENGINEERS PVT. LTD: BUSINESS OVERVIEW

- TABLE 252 NEOLOGIC ENGINEERS PVT. LTD: PRODUCT OFFERINGS

- 13.2.4 FINIS FOOD PROCESSING EQUIPMENT B.V.

- TABLE 253 FINIS FOOD PROCESSING EQUIPMENT B.V.: BUSINESS OVERVIEW

- TABLE 254 FINIS FOOD PROCESSING EQUIPMENT B.V.: PRODUCT OFFERINGS

- 13.2.5 ANDERSON DAHLEN

- TABLE 255 ANDERSON DAHLEN: BUSINESS OVERVIEW

- TABLE 256 ANDERSON DAHLEN: PRODUCT OFFERINGS

- 13.2.6 HEAT AND CONTROL, INC.

- 13.2.7 ANKO FOOD MACHINE CO., LTD

- 13.2.8 BAADER

- 13.2.9 DOVER CORPORATION

- 13.2.10 BETTCHER INDUSTRIES, INC

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 BEVERAGE PROCESSING EQUIPMENT MARKET

- 14.2.1 LIMITATIONS

- 14.2.2 MARKET DEFINITION

- 14.2.3 MARKET OVERVIEW

- 14.2.4 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE

- TABLE 257 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2017-2020 (USD MILLION)

- TABLE 258 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2021-2026 (USD MILLION)

- 14.2.5 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

- TABLE 259 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 260 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- 14.3 BAKERY PROCESSING EQUIPMENT MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE

- TABLE 261 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

- 14.3.4 BAKERY PROCESSING EQUIPMENT MARKET, BY REGION

- TABLE 262 BAKERY PROCESSING EQUIPMENT MARKET, BY REGION, 2020-2025 (USD MILLION)

- 14.4 DAIRY PROCESSING EQUIPMENT MARKET

- 14.4.1 LIMITATIONS

- 14.4.2 MARKET DEFINITION

- 14.4.3 MARKET OVERVIEW

- TABLE 263 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 264 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS