|

|

市場調査レポート

商品コード

1103430

粒子計数器の世界市場:種類別 (空中、液体)・用途別 (クリーンルーム監視、液体汚染監視、エアロゾル監視)・エンドユーザー別 (ライフサイエンス・医療機器、半導体)・地域別の将来予測 (2027年)Particle Counters Market by Type (Airborne, Liquid Particle Counters), Application (Cleanroom Monitoring, Contamination Monitoring of Liquid, Aerosol Monitoring), End User (Life Sciences & Medical Devices, Semiconductor), Region -Global Forecasts -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 粒子計数器の世界市場:種類別 (空中、液体)・用途別 (クリーンルーム監視、液体汚染監視、エアロゾル監視)・エンドユーザー別 (ライフサイエンス・医療機器、半導体)・地域別の将来予測 (2027年) |

|

出版日: 2022年07月13日

発行: MarketsandMarkets

ページ情報: 英文 192 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

粒子計数器 (パーティクルカウンター) の世界市場は、2022年の5億1,100万米ドルから2027年には8億2,500万米ドルに達すると推定され、2022年から2027年までのCAGRは10.0%となります。

大気・水質汚染の効果的な監視・制御に対する政府の支持的規制、クリーンルームや製造業に対する支持的規制と基準、食品の品質に対する関心の高まり、技術進歩および新製品の発売が世界的に市場の成長を促進しています。しかし、粒子計数器の高コストと技術的な限界が、この市場の成長に悪影響を及ぼしています。

"種類別では、液体粒子計数器部門が2022~2027年の予測期間中に大きな成長を記録する"

これらの計数器は、水、医薬品、オイル、作動油など、さまざまな液体のモニタリングに使用されています。液体粒子計数器は、製薬業界や半導体業界で広く利用されています。製薬業界では、医薬品の製造に使用される水の連続モニタリングや、医薬品の注射剤の汚染モニタリングに使用されています。製薬業界と半導体業界の成長が、このセグメントの成長を牽引するものと思われます。液体粒子計数器は、さらにオンライン/インライン粒子計数器とオフライン粒子計数器に区分されます。

"2021年の空中粒子計数器市場において、種類別ではポータブル粒子計数器セグメントがより大きなシェアを占めている"

種類別に見ると、市場は空中粒子計数器と液体粒子計数器に区分されます。空中粒子計数器セグメントは、さらにポータブル粒子計数器、ハンドヘルド粒子計数器、リモート粒子計数器、結露粒子計数器に分けられます。ポータブル粒子計数器セグメントは、2021年に空中粒子計数器市場で最大のシェアを占めると推定されます。ポータブル粒子計数器は高感度であり、その高流量により、クリーンルームでの分類と検証に必要な時間を短縮します。これらのカウンターは、マイクロプロセッサー、半導体、航空宇宙、製薬、医療機器など、高感度のクリーンルーム領域を必要とするアプリケーションを見つけます。様々な産業で携帯型エア粒子計数器が広く採用されており、市場の牽引役となることが期待されています。

"エンドユーザー別では、2021年に半導体産業セグメントが2番目に大きな市場シェアを占めた"

エンドユーザー別では、ライフサイエンス・医療機器産業、半導体産業、自動車産業、航空宇宙産業、飲食品産業、その他のエンドユーザーに区分されます。2021年の粒子計数器市場では、半導体産業分野が2番目に大きなシェアを占めています。新技術や新素材 (3D半導体など) の開発、ハイテク製品の継続的な小型化により、部品のクリーン化のニーズが高まっています。粒子計数器は、クリーンルーム内での汚染物質の分類、監視、診断に重要な役割を果たします。継続的な粒子モニタリングは、性能の低下、生産歩留まりの低下、運用コストの削減を回避するために非常に重要です。このように、半導体技術の進歩は、市場成長にプラスの影響を与えると予想される重要な要因です。

"アジア太平洋市場は、予測期間中に最も高い成長を示すことが期待される"

アジア太平洋の粒子計数器市場は、予測期間中に最高のCAGRを示すと予想されています。製薬、食品・飲料検査、医療機器産業の著しい成長、研究開発資金の増加、CROの増加、製薬・バイオ医薬品産業を促進する政府の有利なイニシアティブ、環境モニタリングと食品の安全性に対する関心の高まりが、アジア太平洋の粒子計数器市場を牽引する主要因となっています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- エコシステムの範囲

- バリューチェーン分析

- サプライチェーン分析

- 特許分析

- ポーターのファイブフォース分析

- COVID-19が粒子計数器市場に与える影響

第6章 粒子計数器市場:種類別

- イントロダクション

- 空中粒子計数器

- ポータブル粒子計数器

- リモート粒子計数器

- ハンドヘルド粒子計数器

- 凝縮粒子カウンター

- 液体粒子計数器

- オンライン粒子計数器

- オフライン粒子計数器

第7章 粒子計数器市場:用途別

- イントロダクション

- クリーンルーム監視

- 液体汚染監視

- 室内空気質監視

- エアロゾル監視・研究

- 化学的汚染監視

- 飲用水汚染監視

- その他の用途

第8章 粒子計数器市場:エンドユーザー別

- イントロダクション

- ライフサイエンス・医療機器産業

- 半導体産業

- 自動車産業

- 航空宇宙産業

- 食品・飲料産業

- その他のエンドユーザー

第9章 粒子計数器市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価マトリックス (主要企業)

- 競合リーダーシップマッピング (スタートアップ・中小企業)

- 企業のフットプリント

- 競合シナリオと動向

- 製品の発売と承認

- 取引

第11章 企業プロファイル

- 主要企業

- PARTICLE MEASURING SYSTEMS, INC. (SPECTRIS PLC)

- BECKMAN COULTER (DANAHER CORPORATION)

- RION CO., LTD.

- LIGHTHOUSE WORLDWIDE SOLUTIONS

- TSI INCORPORATED

- CLIMET INSTRUMENTS COMPANY (VENTUREDYNE LTD.)

- KANOMAX USA, INC.

- MET ONE INSTRUMENTS, INC.

- PARTICLE PLUS, INC.

- SETRA SYSTEMS

- PAMAS PARTIKELMESS

- CHEMTRAC, INC.

- HAL TECHNOLOGY

- VELTEK ASSOCIATES, INC.

- PCE INSTRUMENTS UK LTD.

- その他の企業

- GRAYWOLF SENSING SOLUTIONS

- EXTECH INSTRUMENTS

- PALAS GMBH

- HYDAC INTERNATIONAL

- FLUKE CORPORATION

第12章 付録

The global particle counters market is estimated to reach USD 825 million by 2027 from USD 511 million in 2022, at a CAGR of 10.0% from 2022 to 2027. Supportive government regulations for effective air and water pollution monitoring and control, supportive regulations and standards for cleanrooms and manufacturing, growing focus on the quality of food products, and technological advancement & new product launch to drive the growth of the market globally. However, the high cost and technical limitations of particle counters are adversely impacting the growth of this market.

"By type, the liquid particle counters segment to register significant growth over the forecast period of 2022-27"

These counters are used for monitoring a variety of liquids, such as water, pharmaceuticals, oils, and hydraulic fluids. The liquid particle counters are widely utilized in the pharmaceutical and semiconductor industries. In the pharmaceutical industry, these particle counters are used for the continuous monitoring of water used to produce pharmaceutical products and the contamination monitoring of pharmaceutical injectables. Growth in the pharmaceutical & semiconductor industries is likely to drive the segment growth. Liquid particle counters are further segmented into online/inline particle counters and offline particle counters.

"The portable particle counters segment accounted for the larger share of the airborne particle counters market, by type, in 2021"

On the basis of type, the market is segmented into airborne and liquid particle counters. The airborne particle counters segment is further divided into portable particle counters, handheld particle counters, remote particle counters, and condensation particle counters. The portable particle counters segment is estimated to command the largest share of the airborne particle counters market in 2021. Portable particle counters are highly sensitive, and their high flow rate shortens the time required for cleanroom classification and verification. These counters find applications in microprocessors, semiconductors, aerospace, pharmaceutical, and medical devices, all of which require highly sensitive cleanroom areas. Widespread adoption of portable air particle counters in various industries is expected to drive the market.

"By end user, the semiconductor industry segment accounted for the second largest market share in 2021"

On the basis of end user, the market is segmented into the life sciences & medical device industry, semiconductor industry, automotive industry, aerospace industry, food & beverage industry, and other end users. In 2021, the semiconductors industry segment accounted for the second largest share of the particle counters market. The development of new technologies and materials (such as 3D semiconductors) and the continuous miniaturization of high technology products have resulted in an increased need for cleaner parts. Particle counters play a crucial role in classifying, monitoring, and diagnosing the source of contaminants in cleanroom operations. Continuous particle monitoring is crucial in avoiding performance degradation and reductions in production yield and operational costs. Thus, semiconductor technological advancements are a key factor expected to positively impact market growth

"The market in the APAC region is expected to witness the highest growth during the forecast period."

The particle counters market in the APAC is expected to witness the highest CAGR during the forecast period. Significant growth in the pharmaceutical, food & beverage testing, and medical device industries; increasing R&D funding; the growing number of CROs; favorable government initiatives to promote pharmaceutical and biopharmaceutical industries; and growing concern about environmental monitoring and food safety are major factors driving the particle counters market in the Asia Pacific.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 21%, Tier 2: 26%, and Tier 3: 53%

- By Designation: C-level: 32%, Director-level: 26%, and Others: 42%

- By Region: North America: 35%, Europe: 30%, Asia Pacific: 15%, Latin America: 10%, and the Middle East & Africa: 10%

The prominent players in the particle counters market are Particle Measuring Systems (US), Beckman Coulter (US), RION Co., Ltd. (Japan), Lighthouse Worldwide Solutions (US), TSI (US), Climet Instruments Company (US), Met One Instruments, Inc. (US), Particle Plus (US), Setra Systems (US), PAMAS (Germany), Chemtrac (US), Hal Technology (US), Konamax (US), Veltek Associates (US), PCE Instruments (UK), GrayWolf Sensing Solutions (US), Extech Instruments (US), Palas GmbH (Germany), HYDAC International (Australia), and Fluke Corporation (US).

Research Coverage:

The report analyzes the particle counters market and aims at estimating the market size and future growth potential of the market and the different application segments, such as cleanroom monitoring, indoor air quality monitoring, contamination monitoring of liquids, drinking water contamination monitoring, aerosol monitoring & research, chemical contamination monitoring, and other applications. The report also includes an in-depth competitive analysis of the key players in this market, along with their company profiles, product offerings, and recent developments.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a greater share. Firms purchasing the report could use one, or a combination of the below mentioned five strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the particle counters market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the particle counter market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the global particle counters market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, revenue analysis, and products of the leading players in the particle counters market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET COVERED

- 1.3.1 MARKET SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 PARTICLE COUNTERS MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 PARTICLE COUNTERS MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

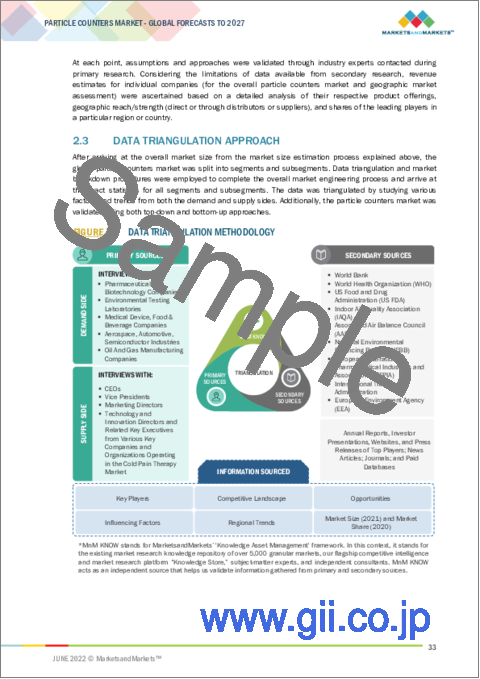

- 2.3 DATA TRIANGULATION APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.7.1 RISK ASSESSMENT: PARTICLE COUNTERS MARKET

- 2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 PARTICLE COUNTERS MARKET, BY TYPE, 2022 VS. 2027

- FIGURE 9 AIRBORNE PARTICLE COUNTERS MARKET SHARE, BY TYPE, 2022 VS 2027

- FIGURE 10 LIQUID PARTICLE COUNTERS MARKET SHARE, BY TYPE, 2022 VS 2027

- FIGURE 11 PARTICLE COUNTERS MARKET SHARE, BY APPLICATION, 2022 VS 2027

- FIGURE 12 PARTICLE COUNTERS MARKET SHARE, BY END USER, 2022 VS 2027

- FIGURE 13 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 PARTICLE COUNTERS MARKET OVERVIEW

- FIGURE 14 GROWTH OF END-USE INDUSTRIES TO DRIVE THE MARKET FOR PARTICLE COUNTERS

- 4.2 APAC: PARTICLE COUNTERS MARKET, BY APPLICATION, 2021

- FIGURE 15 CLEANROOM MONITORING SEGMENT HELD THE LARGEST SHARE OF THE APAC MARKET IN 2021

- 4.3 GEOGRAPHICAL SNAPSHOT OF THE PARTICLE COUNTERS MARKET

- FIGURE 16 CHINA TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 PARTICLE COUNTERS MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

- 5.2.1 DRIVERS

- 5.2.1.1 Robust growth in applied markets

- 5.2.1.1.1 Pharmaceutical & biotechnology industries

- 5.2.1.1.2 Semiconductor & automotive industries

- 5.2.1.1.3 Medical device industry

- 5.2.1.2 Favorable regulatory scenario

- 5.2.1.2.1 Supportive government regulations for effective air and water pollution monitoring and control

- 5.2.1.1 Robust growth in applied markets

- TABLE 1 MAJOR POLLUTION CONTROL LAWS IN THE US

- 5.2.1.2.2 Regulations and standards for cleanrooms and manufacturing

- TABLE 2 PHARMACEUTICAL PRODUCT RECALLS (2020 - 2022)

- 5.2.1.3 Growing focus on the quality of food products

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of particle counters

- 5.2.2.2 Technical limitations of particle counters

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets

- 5.3 ECOSYSTEM COVERAGE

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS OF THE PARTICLE COUNTERS MARKET

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 19 PARTICLE COUNTERS MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 PARTICLE COUNTERS MARKET: ROLE IN ECOSYSTEM

- 5.6 PATENT ANALYSIS

- FIGURE 20 PATENT ANALYSIS FOR PARTICLE COUNTERS

- 5.6.1 TRADE ANALYSIS FOR PARTICLE COUNTERS

- TABLE 3 IMPORT DATA FOR PARTICLE COUNTERS (HS CODE 9027), BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 4 EXPORT DATA FOR PARTICLE COUNTERS (HS CODE 9027), BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 5 IMPORT DATA FOR PARTICLE COUNTERS (HS CODE 9031), BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 6 EXPORT DATA FOR PARTICLE COUNTERS (HS CODE 9031), BY COUNTRY, 2017-2021 (USD MILLION)

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 PARTICLE COUNTERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 DEGREE OF COMPETITION

- 5.8 IMPACT OF COVID-19 ON PARTICLE COUNTERS MARKET

6 PARTICLE COUNTERS MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 8 PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 AIRBORNE PARTICLE COUNTERS

- TABLE 9 AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 10 AIRBORNE PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.1 AIRBORNE PARTICLE COUNTERS MARKET, BY APPLICATION

- TABLE 11 AIRBORNE PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.2 AIRBORNE PARTICLE COUNTERS MARKET, BY END USER

- TABLE 12 AIRBORNE PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 6.2.3 PORTABLE PARTICLE COUNTERS

- 6.2.3.1 Widespread adoption of portable air particle counters is expected to drive the market

- TABLE 13 PORTABLE PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.3.2 Portable particle counters market, by application

- TABLE 14 PORTABLE PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.3.3 Portable particle counters market, by end user

- TABLE 15 PORTABLE PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

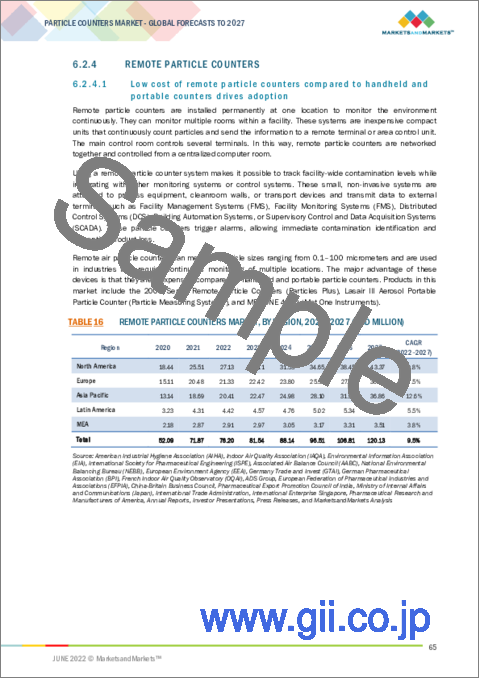

- 6.2.4 REMOTE PARTICLE COUNTERS

- 6.2.4.1 Low cost of remote particle counters compared to handheld and portable counters drives adoption

- TABLE 16 REMOTE PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.4.2 Remote particle counters market, by application

- TABLE 17 REMOTE PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.4.3 Remote particle counters market, by end user

- TABLE 18 REMOTE PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 6.2.5 HANDHELD PARTICLE COUNTERS

- 6.2.5.1 Rising awareness of indoor air quality monitoring to drive market growth

- TABLE 19 HANDHELD PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.5.2 Handheld particle counters market, by application

- TABLE 20 HANDHELD PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.5.3 Handheld particle counters market, by end user

- TABLE 21 HANDHELD PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 6.2.6 CONDENSATION PARTICLE COUNTERS

- 6.2.6.1 High costs limit the adoption of condensation/ ultrafine particle counters

- TABLE 22 CONDENSATION PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.6.2 Condensation particle counters market, by application

- TABLE 23 CONDENSATION PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.6.3 Condensation particle counters market, by end user

- TABLE 24 CONDENSATION PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 6.3 LIQUID PARTICLE COUNTERS

- TABLE 25 LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 26 LIQUID PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1 LIQUID PARTICLE COUNTERS MARKET, BY APPLICATION

- TABLE 27 LIQUID PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3.2 LIQUID PARTICLE COUNTERS MARKET, BY END USER

- TABLE 28 LIQUID PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 6.3.3 ONLINE PARTICLE COUNTERS

- 6.3.3.1 Growth in the pharmaceutical & semiconductor industries is likely to drive the market

- TABLE 29 ONLINE PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3.2 Online particle counters market, by application

- TABLE 30 ONLINE PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3.3.3 Online particle counters market, by end user

- TABLE 31 ONLINE PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 6.3.4 OFFLINE PARTICLE COUNTERS

- 6.3.4.1 Disadvantages of offline particle counters to restrain market growth

- TABLE 32 OFFLINE PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4.2 Offline particle counters market, by application

- TABLE 33 OFFLINE PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3.4.3 Offline particle counters market, by end user

- TABLE 34 OFFLINE PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

7 PARTICLE COUNTERS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 35 PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 CLEANROOM MONITORING

- 7.2.1 CLEANROOM MONITORING DOMINATES THE APPLICATIONS MARKET

- TABLE 36 PARTICLE COUNTERS MARKET FOR CLEANROOM MONITORING, BY REGION, 2020-2027 (USD MILLION)

- 7.3 CONTAMINATION MONITORING OF LIQUIDS

- 7.3.1 RISING ACTIVITY IN END-USE INDUSTRIES WILL ENSURE THE GROWTH OF THIS APPLICATION SEGMENT

- TABLE 37 PARTICLE COUNTERS MARKET FOR CONTAMINATION MONITORING OF LIQUIDS, BY REGION, 2020-2027 (USD MILLION)

- 7.4 INDOOR AIR QUALITY MONITORING

- 7.4.1 INCREASING MEASURES TO REDUCE INDOOR AIR POLLUTION ARE LIKELY TO DRIVE MARKET GROWTH

- TABLE 38 PARTICLE COUNTERS MARKET FOR INDOOR AIR QUALITY MONITORING, BY REGION, 2020-2027 (USD MILLION)

- 7.5 AEROSOL MONITORING AND RESEARCH

- 7.5.1 INCREASING RESEARCH ON AEROSOLS AND GROWING POLLUTION LEVELS HAVE SUPPORTED THE ADOPTION OF PARTICLE COUNTERS IN THIS SEGMENT

- TABLE 39 PARTICLE COUNTERS MARKET FOR AEROSOL MONITORING AND RESEARCH, BY REGION, 2020-2027 (USD MILLION)

- 7.6 CHEMICAL CONTAMINATION MONITORING

- 7.6.1 NEED FOR HIGH-PURITY CHEMICALS IN SEMICONDUCTOR AND ELECTRONIC MANUFACTURING IS DRIVING MARKET GROWTH

- TABLE 40 PARTICLE COUNTERS MARKET FOR CHEMICAL CONTAMINATION MONITORING, BY REGION, 2020-2027 (USD MILLION)

- 7.7 DRINKING WATER CONTAMINATION MONITORING

- 7.7.1 FAVORABLE INITIATIVES AND THE GROWING NEED FOR CHECKING WATER CONTAMINATION ARE LIKELY TO SUPPORT MARKET GROWTH

- TABLE 41 PARTICLE COUNTERS MARKET FOR DRINKING WATER CONTAMINATION MONITORING, BY REGION, 2020-2027 (USD MILLION)

- 7.8 OTHER APPLICATIONS

- TABLE 42 PARTICLE COUNTERS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

8 PARTICLE COUNTERS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 43 PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 LIFE SCIENCE & MEDICAL DEVICE INDUSTRY

- 8.2.1 NEED TO MAINTAIN REGULATORY COMPLIANCE AND ENSURE PRODUCT QUALITY DRIVES RELIANCE ON PARTICLE COUNTERS

- TABLE 44 PARTICLE COUNTERS MARKET FOR THE LIFE SCIENCE & MEDICAL DEVICE INDUSTRY, BY REGION, 2020-2027 (USD MILLION)

- 8.3 SEMICONDUCTOR INDUSTRY

- 8.3.1 TECHNOLOGICAL ADVANCEMENTS IN SEMICONDUCTORS WILL DRIVE MARKET GROWTH

- TABLE 45 PARTICLE COUNTERS MARKET FOR THE SEMICONDUCTOR INDUSTRY, BY REGION, 2020-2027 (USD MILLION)

- 8.4 AUTOMOTIVE INDUSTRY

- 8.4.1 ENFORCEMENT OF STRINGENT CLEANLINESS REGULATIONS FOR AUTOMOTIVE MANUFACTURING IS FUELING THE DEMAND FOR PARTICLE COUNTERS

- TABLE 46 PARTICLE COUNTERS MARKET FOR THE AUTOMOTIVE INDUSTRY, BY REGION, 2020-2027 (USD MILLION)

- 8.5 AEROSPACE INDUSTRY

- 8.5.1 GROWTH IN THE AEROSPACE INDUSTRY TO SUPPORT MARKET GROWTH

- TABLE 47 PARTICLE COUNTERS MARKET FOR THE AEROSPACE INDUSTRY, BY REGION, 2020-2027 (USD MILLION)

- 8.6 FOOD & BEVERAGE INDUSTRY

- 8.6.1 GROWING FOOD SAFETY CONCERNS WILL SUPPORT MARKET GROWTH

- TABLE 48 PARTICLE COUNTERS MARKET FOR THE FOOD & BEVERAGE INDUSTRY, BY REGION, 2020-2027 (USD MILLION)

- 8.7 OTHER END USERS

- TABLE 49 PARTICLE COUNTERS MARKET FOR OTHER END USERS, BY REGION, 2020-2027 (USD MILLION)

9 PARTICLE COUNTERS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 50 PARTICLE COUNTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 21 NORTH AMERICA: PARTICLE COUNTERS MARKET SNAPSHOT

- TABLE 51 NORTH AMERICA: PARTICLE COUNTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 The US dominates the North American particle counters market

- TABLE 57 US: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 US: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 59 US: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Stringent guidelines for pharmaceuticals and food products to drive the demand for particle counters in Canada

- TABLE 60 CANADA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 CANADA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 CANADA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 63 EUROPE: PARTICLE COUNTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 64 EUROPE: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 EUROPE: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 66 EUROPE: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 EUROPE: PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 68 EUROPE: PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Germany is the largest market for particle counters in Europe

- TABLE 69 GERMANY: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 70 GERMANY: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 GERMANY: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Amendments of policies and regulations for contamination control to support market growth in the UK

- TABLE 72 UK: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 73 UK: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 74 UK: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growth in applied markets to drive the use of particle counters in France

- TABLE 75 FRANCE: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 FRANCE: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 77 FRANCE: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 High volume of exports and stringent regulations to drive the adoption of particle counters in Italy

- TABLE 78 ITALY: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 79 ITALY: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 ITALY: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Spain is one of the major producers of pharmaceutical and biological products in Europe

- TABLE 81 SPAIN: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 SPAIN: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 83 SPAIN: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 84 REST OF EUROPE: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 REST OF EUROPE: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 86 REST OF EUROPE: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 22 ASIA PACIFIC: PARTICLE COUNTERS MARKET SNAPSHOT

- TABLE 87 ASIA PACIFIC: PARTICLE COUNTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 90 ASIA PACIFIC: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Stringent regulations on high-pollution sectors-a key factor driving market growth

- TABLE 93 CHINA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 94 CHINA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 95 CHINA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Growing food safety concerns drive the adoption of particle counters in Japan

- TABLE 96 JAPAN: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 JAPAN: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 98 JAPAN: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Growth in the manufacturing and pharmaceutical industries supports market growth in India

- TABLE 99 INDIA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 INDIA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 INDIA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Growing semiconductor industry and public focus on water quality monitoring augment the market demand in South Korea

- TABLE 102 SOUTH KOREA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 SOUTH KOREA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 104 SOUTH KOREA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing healthcare, medical devices, and pharma industry to increase the demand for particle counters

- TABLE 105 AUSTRALIA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 AUSTRALIA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 107 AUSTRALIA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 108 REST OF ASIA PACIFIC: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 111 LATIN AMERICA: PARTICLE COUNTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 112 LATIN AMERICA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 LATIN AMERICA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 LATIN AMERICA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 116 LATIN AMERICA: PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Growing biotechnology and pharmaceutical industries to support market growth in Brazil

- TABLE 117 BRAZIL: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 BRAZIL: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 119 BRAZIL: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Government efforts for pollutant monitoring drive the market growth in Mexico

- TABLE 120 MEXICO: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 MEXICO: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 MEXICO: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 123 REST OF LATIN AMERICA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 REST OF LATIN AMERICA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 REST OF LATIN AMERICA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWTH OF OIL AND GAS INDUSTRIES COUPLED WITH INCREASING R&D IN THE PHARMACEUTICAL SECTOR TO FUEL THE MARKET

- TABLE 126 MEA: PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 127 MEA: AIRBORNE PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 128 MEA: LIQUID PARTICLE COUNTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 129 MEA: PARTICLE COUNTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 130 MEA: PARTICLE COUNTERS MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 131 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 10.3 REVENUE ANALYSIS

- FIGURE 23 REVENUE ANALYSIS OF KEY PLAYERS IN THE PARTICLE COUNTERS MARKET

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 24 PARTICLE COUNTERS MARKET SHARE ANALYSIS, 2021

- TABLE 132 PARTICLE COUNTERS MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION MATRIX (KEY PLAYERS)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PARTICIPANTS

- 10.5.4 PERVASIVE PLAYERS

- FIGURE 25 PARTICLE COUNTERS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 10.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS AND SMES)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 PARTICIPANT COMPANIES

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 26 PARTICLE COUNTERS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SME/START-UPS, 2021

- 10.7 COMPANY FOOTPRINT

- TABLE 133 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 134 GEOGRAPHICAL FOOTPRINT OF COMPANIES

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 135 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019-MAY 2022

- 10.8.2 DEALS

- TABLE 136 DEALS, JANUARY 2019-MAY 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 PARTICLE MEASURING SYSTEMS, INC. (SPECTRIS PLC)

- TABLE 137 SPECTRIS PLC: BUSINESS OVERVIEW

- FIGURE 27 SPECTRIS PLC: COMPANY SNAPSHOT (2021)

- 11.1.2 BECKMAN COULTER (DANAHER CORPORATION)

- TABLE 138 DANAHER CORPORATION: BUSINESS OVERVIEW

- FIGURE 28 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.3 RION CO., LTD.

- TABLE 139 RION CO., LTD.: BUSINESS OVERVIEW

- FIGURE 29 RION CO., LTD.: COMPANY SNAPSHOT (2021)

- 11.1.4 LIGHTHOUSE WORLDWIDE SOLUTIONS

- TABLE 140 LIGHTHOUSE WORLDWIDE SOLUTIONS: BUSINESS OVERVIEW

- 11.1.5 TSI INCORPORATED

- TABLE 141 TSI: BUSINESS OVERVIEW

- 11.1.6 CLIMET INSTRUMENTS COMPANY (VENTUREDYNE LTD.)

- TABLE 142 CLIMET INSTRUMENTS COMPANY: BUSINESS OVERVIEW

- 11.1.7 KANOMAX USA, INC.

- TABLE 143 KANOMAX USA, INC: BUSINESS OVERVIEW

- 11.1.8 MET ONE INSTRUMENTS, INC.

- TABLE 144 MET ONE INSTRUMENTS, INC.: BUSINESS OVERVIEW

- 11.1.9 PARTICLE PLUS, INC.

- TABLE 145 PARTICLE PLUS, INC.: BUSINESS OVERVIEW

- 11.1.10 SETRA SYSTEMS

- TABLE 146 SETRA SYSTEMS: BUSINESS OVERVIEW

- 11.1.11 PAMAS PARTIKELMESS

- TABLE 147 PAMAS PARTIKELMESS: BUSINESS OVERVIEW

- 11.1.12 CHEMTRAC, INC.

- TABLE 148 CHEMTRAC, INC: BUSINESS OVERVIEW

- 11.1.13 HAL TECHNOLOGY

- TABLE 149 HAL TECHNOLOGY: BUSINESS OVERVIEW

- 11.1.14 VELTEK ASSOCIATES, INC.

- TABLE 150 VELTEK ASSOCIATES, INC.: BUSINESS OVERVIEW

- 11.1.15 PCE INSTRUMENTS UK LTD.

- TABLE 151 PCE INSTRUMENTS UK LTD.: BUSINESS OVERVIEW

- 11.2 OTHER COMPANIES

- 11.2.1 GRAYWOLF SENSING SOLUTIONS

- 11.2.2 EXTECH INSTRUMENTS

- 11.2.3 PALAS GMBH

- 11.2.4 HYDAC INTERNATIONAL

- 11.2.5 FLUKE CORPORATION

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS