|

|

市場調査レポート

商品コード

1840080

電気自動車の世界市場 (~2035年):車両タイプ・推進区分・車両コネクティビティ・コンポーネント・エンドユーザー・PEV市場・HEV市場・地域別Electric Vehicle Market by Vehicle Type, Propulsion, Vehicle Connectivity, Component, End Use, P-EV market, H-EV market and Region - Global Forecast 2035 |

||||||

カスタマイズ可能

|

|||||||

| 電気自動車の世界市場 (~2035年):車両タイプ・推進区分・車両コネクティビティ・コンポーネント・エンドユーザー・PEV市場・HEV市場・地域別 |

|

出版日: 2025年10月10日

発行: MarketsandMarkets

ページ情報: 英文 486 Pages

納期: 即納可能

|

概要

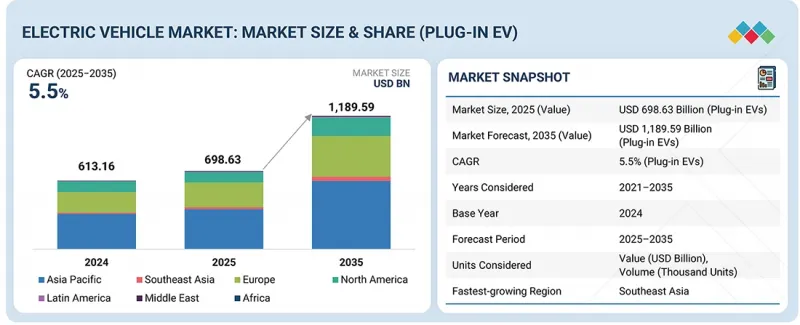

世界のプラグイン電気自動車 (PEV) の市場規模は、2025年の6,986億3,000万米ドルから、予測期間中は5.5%のCAGRで推移し、2035年には1兆1,895億9,000万米ドルへと成長すると予測されています。

また、ハイブリッド電気自動車市場 (HEV+MHEV) の市場規模は、2025年の4,468億7,000万米ドルから、4.1%のCAGRで推移し、2035年には6,677億5,000万米ドルへと成長すると予測されています。全体として、電気自動車 (EV) 市場は、乗用車および商用車の両セグメントにおけるバッテリー駆動型モビリティへの需要拡大を背景に、着実な成長軌道を描いています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2035年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2035年 |

| 単位 | 数量 (台) ・金額 (米ドル) |

| セグメント | 車両タイプ、推進区分、EVアーキテクチャ、車両最高速度、車両駆動タイプ、車体タイプ、構成タイプ、トポロジー、車両コネクティビティ、推進区分&コンポーネント、エンドユーザー、地域 |

| 対象地域 | アジア太平洋、東南アジア、欧州、北米、ラテンアメリカ、中東・アフリカ |

主要な成長要因には、バッテリーのエネルギー密度の向上、急速充電機能の進化、車両の安全性と性能の改善が挙げられます。欧州の2035年ゼロエミッション目標や、ドイツ、ノルウェーなどでの支援的な規制政策が導入を加速させる一方で、中国や米国では補助金が段階的に縮小している状況です。充電インフラの拡充やパワートレイン効率への投資が航続距離の延伸と保有コストの削減を実現しています。また、消費者のEVへの関心の高まりにより、OEMは、改良された熱管理システムやソフトウェア主導のエネルギー最適化技術といった先進技術の統合に注力しています。これにより、車両はより安全で、効率的で、ユーザーフレンドリーなものとなっています。さらに、車両設計・ソフトウェア統合・エネルギー管理における継続的なイノベーションが、予測期間を通じてEV市場の持続的成長を支えています。

"前輪駆動タイプが予測期間中に最大の成長を示す見通し"

前輪駆動 (FWD) セグメントは、コスト効率、実用性、都市部や交通量の多い環境での適性の高さから、EV市場で最も高い成長が見込まれています。FWDシステムは後輪駆動 (RWD) や全輪駆動 (AWD) よりも構造が単純で製造コストが低く、価格を抑えたEVモデルの提供を可能にします。また、ドライブトレインの軽量化によるエネルギー効率の向上と航続距離の延長や、前輪軸への重量配分による雨天・降雪時の優れたトラクションが、多様な気候条件下での魅力を高めています。さらに多くのメーカーが、既存のCEプラットフォームをFWD構造でEV化することで、初期導入を加速させています。RWDやAWDは依然として高性能・高級モデルに需要がありますが、価格競争力・効率性・日常の都市モビリティへの適合性の観点から、FWDが市場をリードすると予測されています。

"欧州が予測期間中に著しい成長を示す見通し"

欧州では、政策的義務化、OEMの積極的な投資、消費者による導入拡大が市場成長を牽引しています。EUの2035年ゼロエミッション目標 (新車およびバン対象) や、2030年のCO2削減基準の強化が、完全電動車およびプラグインハイブリッド車への移行を加速させています。Volkswagen、BMW、Mercedes-Benz、Volvo、Stellantisなどの主要メーカーは、EV生産・ソフトウェア統合・専用充電ネットワーク整備に多額の投資を行っており、VW ID.4、BMW iX、Mercedes EQCなどの新モデルを投入して需要に応えています。また、プラグインハイブリッド (PHEV) の普及がデュアルパワートレインの需要を支える一方で、バッテリーEV (BEV) の拡大が高容量バッテリー、熱管理システム、インバーター冷却ソリューションの進化を後押ししています。

2025年上半期、欧州のBEV登録台数は前年同期比34%増加し、市場シェアは15.6%に達しました。PHEVは8.4%を占め、ドイツ、ベルギー、オランダがこの成長を主導しました。また、ミュンヘンで開催されたIAA Mobilityモーターショーでは、中国の高級自動車メーカーであるHongqiが550kmの航続距離と急速充電機能 (20分で10%から80%) を備えたコンパクト電気SUV、を発表し、都市・郊外ドライバーをターゲットにしています。欧州は、強固な自動車製造基盤に加え、部品の現地生産や充電ネットワーク拡大への投資によって、サプライチェーンの強靭性と競争力を確保しています。規制強化、OEMの電動化ロードマップ、ハイブリッド需要、消費者の関心の高まりにより、欧州は電気自動車市場の持続的成長に向けた最有力地域となっています。

当レポートでは、世界の電気自動車の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- 規制状況

- 持続可能性への取り組み

- 認証、ラベル、環境基準

- 技術分析

- 技術/製品ロードマップ

- 特許分析

- 将来の応用

- AI/生成AIが電気自動車市場に与える影響

- 成功事例と実世界への応用

- EV市場への投資意思決定プロセス

- 購入基準における主要なステークホルダー

- 採用障壁と内部課題

- エコシステム分析

- サプライチェーン分析

- 価格分析

- 顧客の事業に影響を与える動向と混乱

- 投資と資金調達のシナリオ

- 使用事例別の資金調達

- 主な会議とイベント

- 貿易分析

- ケーススタディ分析

- 既存および今後の電気自動車モデル

- 総所有コスト

- 部品表分析

- OEM電気自動車の進歩

第7章 電気自動車市場:推進区分別

- 2024年の電気自動車のベストセラーモデル

- バッテリー電気自動車 (BEV)

- 燃料電池電気自動車 (FCEV)

- プラグインハイブリッド電気自動車 (PHEV)

- ハイブリッド電気自動車 (HEV)

- マイルドハイブリッド電気自動車 (MHEV)

- 主要な洞察

第8章 電気自動車市場:車両タイプ別

- 乗用車

- 商用車

- 主要な洞察

第9章 電気自動車市場:コンポーネント別

- バッテリーセルとパック

- オンボード充電器

- モーター

- 電力制御ユニット

- バッテリー管理システム

- 燃料電池スタック

- 燃料処理装置

- パワーコンディショナー

- エアコンプレッサー

- 加湿器

第10章 電気自動車市場:エンドユーザー別

- 運用データ

- 個人

- 商用フリート

第11章 電気自動車市場:車両コネクティビティ別

- 車両・建物 (V2B) /車両・インフラ (V2I)

- 車両・電力網 (V2G)

- 車両車通信 (V2V)

第12章 ハイブリッド電気自動車市場:構成タイプ別

- シリーズ方式

- パラレル方式

- シリーズ・パラレル方式

- 主要な洞察

第13章 マイルドハイブリッド電気自動車市場:トポロジー別

- P0-ベルト統合

- P1-エンジン・トランスミッション間

- P2-トランスミッション側統合 (ベルト接続)

- P3-トランスミッション側統合 (シャフト接続)

- P4-後輪軸統合

第14章 プラグイン電気自動車市場:電気アーキテクチャ別

- 車両モデル:電気アーキテクチャ別

- 400V

- 800V

- 主要な洞察

第15章 プラグイン電気自動車市場:車体タイプ別

- SUV/MPV

- セダン

- ハッチバック

- 主要な洞察

第16章 プラグイン電気自動車市場:駆動区分別

- 人気の電気自動車モデル (駆動区分別)

- 前輪駆動 (FWD)

- 後輪駆動 (RWD)

- 全輪駆動 (AWD)

- 主要な洞察

第17章 プラグイン電気自動車市場:最高速度別

- 時速110マイル未満

- 時速110マイル以上

- 主要な洞察

第18章 電気自動車市場:地域別

- アジア太平洋

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- 東南アジア

- マクロ経済見通し

- タイ

- インドネシア

- マレーシア

- ベトナム

- シンガポール

- フィリピン

- オーストラリア

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- ドイツ

- フランス

- オランダ

- ノルウェー

- スウェーデン

- 英国

- デンマーク

- オーストリア

- スイス

- スペイン

- ロシア

- イタリア

- 中東

- マクロ経済見通し

- アラブ首長国連邦

- サウジアラビア

- イスラエル

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- コロンビア

- チリ

- ウルグアイ

- コスタリカ

- アフリカ

- マクロ経済見通し

- モロッコ

- エジプト

- 南アフリカ

第19章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第20章 企業プロファイル

- 主要企業

- BYD COMPANY LTD.

- TESLA

- ZHEJIANG GEELY HOLDING GROUP

- VOLKSWAGEN GROUP

- GENERAL MOTORS

- CHANGAN

- BMW GROUP

- LI AUTO INC.

- HYUNDAI MOTOR GROUP

- GAC GROUP

- STELLANTIS NV

- GREAT WALL MOTOR

- その他の企業

- TOYOTA MOTOR CORPORATION

- RENAULT-NISSAN-MITSUBISHI

- HONDA MOTOR CO., LTD.

- MERCEDES-BENZ GROUP AG

- FORD MOTOR COMPANY

- CHERY

- LEAPMOTOR INTERNATIONAL B.V.

- SAIC MOTOR CORPORATION LIMITED

- NIO

- XIAOMI

- RIVIAN

- LUCID

- DONGFENG MOTOR CORPORATION

- FAW TRUCKS CO., LTD.

- XPENG INC.

- KG MOBILITY CORP.

- NETA

- MAZDA MOTOR CORPORATION

- SUBARU CORPORATION

- BAIC GROUP CO., LTD.

- TATA MOTORS LIMITED

- XIAOMI AUTO

第21章 MARKETSANDMARKETSによる提言

- 東南アジアが有利な機会を提供

- BEVが市場シェアの大半を占有

- 800V電気アーキテクチャの導入が採用を加速

- 新興ビジネスモデル:Battery-as-a-ServiceとCharging-as-a-Service

- 結論