|

|

市場調査レポート

商品コード

1373319

ドローンサービスの世界市場:タイプ別(プラットフォームサービス、MRO、トレーニング・シミュレーション)、用途別、業界別、ソリューション別(エンドツーエンド、ポイント)、地域別-2028年までの予測Drone Services Market by Type (Platform Service, MRO, and Training and Simulation), Application, Industry, Solution (End-To-End, Point), and Region( North America, Europe, Asia Pacific, Middle East and Row) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ドローンサービスの世界市場:タイプ別(プラットフォームサービス、MRO、トレーニング・シミュレーション)、用途別、業界別、ソリューション別(エンドツーエンド、ポイント)、地域別-2028年までの予測 |

|

出版日: 2023年10月26日

発行: MarketsandMarkets

ページ情報: 英文 282 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | (10億米ドル) |

| セグメント | タイプ別、用途別、業界別、ソリューション別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、その他の地域 |

ドローンサービスの市場規模は、2023年の170億米ドルから2028年には578億米ドルに成長し、2023年から2028年までのCAGRは27.7%になると予測されています。

2023年には北米がドローンサービス市場で最大のシェアを占めると予測されます。

ドローンサービスは、航空調査、映画撮影、捜索救助など、商業分野における従来の用途を急速に置き換えています。ドローンは、人間のオペレーターによる遠隔操作でも、搭載されたコンピューターによる自律操作でも、長時間の運用が可能です。様々な民間および商業用途でドローンサービスの採用が増加しているのは、その卓越した耐久性と費用対効果による。さらに、人工知能、IoT、クラウドコンピューティングなどの新技術がドローンサービスに統合されることで、さまざまな分野での需要がさらに高まると予想されています。

タイプ別では、プラットフォームは、予測期間中に最も高い年間平均成長率(CAGR)を示すと見られています。これは、優れたデータ収集効率、費用対効果、世界中でドローンサービスが広く利用されていることに起因しています。

産業別では、特に、ヘルスケア・社会支援分野が最も大きな成長を遂げると予測されています。この成長は、COVID-19パンデミック時にこの分野への投資が増加したこと、特にテストサンプルやワクチンの配送のために増加したことに起因しています。

ソリューション別では、エンドツーエンドソリューション分野は、操縦・操作からデータ分析・データ処理までを包括する包括的なパッケージソリューションに対する需要が高まっていることから、予測期間中に最も高い成長が見込まれます。

用途別では、輸送・配送分野は、予測期間中に最も高い年間平均成長率(CAGR)となり、市場成長の主要な促進要因になると予測されています。この動向は、迅速な荷物配送サービス、特にパンデミックの発生により需要が高まったヘルスケア分野での需要の増加に起因しています。

北米は、2023年も優勢な市場シェアを維持すると予測されています。この顕著な地域成長は、eコマースプラットフォームを介したオンライン小売の急増動向と、米国連邦航空局(FAA)によって確立された有利な規制枠組みに起因しています。さらに、新興の宅配便サービス・プラットフォームを強化するための著名な利害関係者からの投資の増加は、予測期間を通じてこの地域市場の拡大の重要な促進要因になると予想されます。

当レポートでは、世界のドローンサービス市場について調査し、タイプ別、用途別、業界別、ソリューション別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 生態系マッピング

- 平均販売価格分析

- ポーターのファイブフォース分析

- 平均サービス料金分析

- 貿易データ分析

- 関税と規制状況

第6章 業界の動向

- イントロダクション

- 技術動向

- 技術分析

- ケーススタディ分析

- メガトレンドの影響

- イノベーションと特許登録

第7章 ドローンサービス市場、タイプ別

- イントロダクション

- プラットフォームサービス

- メンテナンス、修理、オーバーホール(MRO)

- シミュレーションとトレーニング

第8章 ドローンサービス市場、用途別

- イントロダクション

- 検査と監視

- 地図作成と測量

- 噴霧と播種

- 撮影と写真撮影

- 輸送と配達

- 安全、捜索、救助

第9章 ドローンサービス市場、業界別

- イントロダクション

- 建設とインフラ

- 農業

- ユーティリティ

- 石油ガス

- 採掘

- 防衛と法執行

- メディアとエンターテイメント

- 保険

- 航空

- 船舶

- ヘルスケアと社会援助

- 輸送、物流、倉庫保管

第10章 ドローンサービス市場、ソリューション別

- イントロダクション

- エンドツーエンド

- ポイント

第11章 地域分析

- イントロダクション

- 景気後退の影響分析

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第12章 競合情勢

- イントロダクション

- 会社概要

- ランキング分析、2023年

- ドローンサービス市場の主要企業

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- EDALL SYSTEMS

- PRECISIONHAWK

- CYBERHAWK

- VERMEER

- AGEAGLE AERIAL SYSTEMS

- ICR INTEGRITY

- SHARPER SHAPE INC.

- DRONEDEPLOY INC.

- IDENTIFIED TECHNOLOGIES

- TERRA DRONE CORPORATION

- THE SKY GUYS

- DEVERON UAS CORP.

- ZIPLINE

- MATTERNET, INC.

- AERODYNE GROUP

- SKYDROP

- ZEITVIEW

- DRONEGENUITY

- MISTRAS GROUP, INC.

- AEROVIRONMENT, INC.

- HEMAV

- SKYCATCH

- AUSTRALIAN UAV PTY LTD.

- SKYSPECS

- ARCH AERIAL LLC

- その他の企業

- UNMANNED EXPERTS INC.(UMEX)

- VIPER DRONES

- RAPTOR MAPS

- GARUDA UAV

- MAVERICK INSPECTION SERVICES

- CANADIAN UAV SOLUTIONS

- DJM AERIAL SOLUTIONS

- RELIABILITY MAINTENANCE SOLUTIONS LTD.

- DRONEFLIGHT

- FLYTREX

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Application, Industry, Solution and Region |

| Regions covered | North America, Europe, APAC, MEA, RoW |

The drone services market is estimated to grow from USD 17.0 Billion in 2023 to USD 57.8 Billion by 2028, at a CAGR of 27.7% from 2023 to 2028. North America is estimated to account for the largest share of the drone services market in 2023.

Drone services are rapidly displacing conventional applications in the commercial sector, such as aerial surveys, cinematography, and search & rescue. Drones can be operated for extended periods either remotely by human operators or autonomously by onboard computers. The increased adoption of drone services in various civil and commercial applications is driven by their exceptional endurance and cost-effectiveness. Furthermore, the integration of emerging technologies like artificial intelligence, IoT, and cloud computing into drone services is anticipated to further boost their demand across various sectors.

In terms of categorization, the drone services market is divided into platform, MRO (Maintenance, Repair, and Operations); and simulation & training. Platform which encompasses flight piloting & operation, data analysis, and data processing. The platform segment is poised to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This can be attributed to its superior data collection efficiency, cost-effectiveness, and the widespread accessibility of drone services worldwide.

Based on industry, includes segments such as construction & infrastructure, agriculture, utility, oil & gas, mining, defense & law enforcement, media & entertainment, scientific research, insurance, aviation, marine, healthcare & social assistance, and transportation, logistics, & warehousing. Notably, the healthcare & social assistance segment is forecasted to experience the most substantial growth. This growth is attributed to the increased investments in this sector during the COVID-19 pandemic, particularly for the delivery of test samples and vaccines.

Based on solutions, the drone services market is segmented into end-to-end and point solutions. The end-to-end solution segment is expected to witness the highest growth during the forecast period due to the rising demand for comprehensive package solutions that encompass everything from piloting & operation to data analysis and data processing.

Based on application, the drone services market has been categorized into several segments, including inspection and monitoring, mapping and surveying, spraying and seeding, filming and photography, transport and delivery, and security, search, and rescue. Among these application areas, the transport and delivery segment is projected to be the predominant driver of market growth, characterized by the highest Compound Annual Growth Rate (CAGR) during the forecast period. This trend can be attributed to the increasing demand for expeditious package delivery services, particularly in the healthcare sector, which has seen heightened demand due to the outbreak of the pandemic.

" North America is expected to hold the highest market share in 2023."

North America is projected to maintain the predominant market share in 2023. This notable regional growth can be attributed to the burgeoning trend of online retail via e-commerce platforms and the favorable regulatory framework established by the Federal Aviation Administration (FAA) in the United States. Moreover, the increase in investments from prominent industry stakeholders to bolster emerging parcel service platforms is anticipated to be a significant driver of the regional market's expansion throughout the forecasted period.

The break-up of profile of primary participants in the drone services market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 55%, Europe - 27%, Asia Pacific - 9%, RoW - 9%

Winners of drone services market are Cyberhawk (UK), Sky-Futures Ltd. (UK), DroneDeploy Inc. (US), Terra Drone Corporation (Japan), PrecisionHawk (US), and Aerodyne Group (Malaysia). These key players offer drones applicable for various sector and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, Middle East and Rest of the World (RoW).

Research Coverage:

The drone services market has been categorized based on the type of services offered into three primary segments, namely, platform, maintenance, repair, and operations (MRO), and simulation and training. The platform segment further encompasses flight piloting and operation, data analysis, and data processing.

In terms of applications, the drone services market is divided into inspection and monitoring, mapping and surveying, spraying and seeding, filming and photography, transport and delivery, as well as security, search, and rescue.

The industry-based segmentation includes construction and infrastructure, agriculture, utility, oil and gas, mining, defense and law enforcement, media and entertainment, scientific research, insurance, aviation, marine, healthcare and social assistance, and transportation, logistics, and warehousing. These industries utilize a wide range of drone services, including inspection and monitoring, mapping and surveying, and filming and photography.

The drone services market, with regard to solutions, is categorized into end-to-end and point solutions. The end-to-end solution encompasses all platform services, such as piloting and operations, data analytics, and data processing. In contrast, point solutions are specific to piloting or data processing for applications such as surveying, inspection, and monitoring.

This report segments the drone services market across five key regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (ROW), along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the drone services market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the drone services market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the drone services market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulate effective go-to-market strategies for drone services. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver, restraint and there are several factors that could contribute to an increase in the drone services market

- Market Penetration: Comprehensive information on drone services system offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the drone services market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the drone services market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the drone services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the drone services market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key insights from primary experts

- 2.1.2.2 Key data from primary sources

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Platform services market approach

- 2.3.1.2 MRO market approach

- 2.3.1.3 Simulation and training market approach

- 2.3.1.4 Regional split of drone services market

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 PLATFORM SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 8 INSPECTION AND MONITORING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 POINT SOLUTION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DRONE SERVICES MARKET

- FIGURE 11 GROWING NEED FOR DATA WITH HIGH ACCURACY TO DRIVE MARKET

- 4.2 DRONE SERVICES MARKET, BY TYPE

- FIGURE 12 PLATFORM SERVICES SEGMENT TO LEAD MARKET SHARE DURING FORECAST PERIOD

- 4.3 DRONE SERVICES MARKET, BY APPLICATION

- FIGURE 13 INSPECTION AND MONITORING SEGMENT TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 DRONE SERVICES MARKET, BY INDUSTRY

- FIGURE 14 AGRICULTURE SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 DRONE SERVICES MARKET, BY REGION

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF DRONE SERVICES MARKET IN 2023

- 4.6 DRONE SERVICES MARKET, BY SOLUTION

- FIGURE 16 END-TO-END SOLUTION TO DOMINATE DRONE SERVICES MARKET DURING FORECAST PERIOD

- 4.7 NORTH AMERICA: DRONE SERVICES MARKET, BY COUNTRY

- FIGURE 17 US TO HOLD LARGEST SHARE OF NORTH AMERICAN DRONE SERVICES MARKET IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

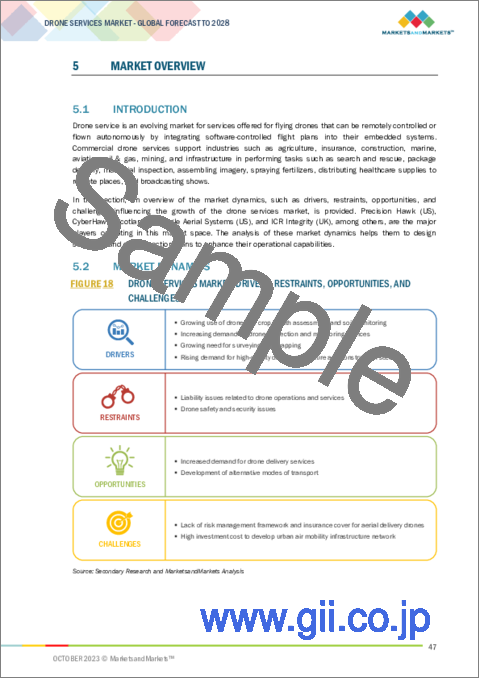

- FIGURE 18 DRONE SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of drones for crop health assessment and soil monitoring

- 5.2.1.2 Increasing demand for drone inspection and monitoring services

- 5.2.1.3 Growing need for surveying and mapping

- 5.2.1.4 Rising demand for high-quality data in agriculture and construction sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Liability issues related to drone operations and services

- 5.2.2.2 Drone safety and security issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased demand for drone delivery services

- 5.2.3.2 Development of alternative modes of transport

- TABLE 2 UAM-RELATED PROJECTS

- TABLE 3 UAM-BASED SERVICES

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of risk management framework and insurance cover for aerial delivery drones

- 5.2.4.2 High investment cost to develop urban air mobility infrastructure network

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN DRONE SERVICES MARKET

- 5.5 ECOSYSTEM MAPPING

- FIGURE 21 ECOSYSTEM ANALYSIS

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF DRONE SERVICES IN US FOR VARIOUS APPLICATIONS, 2020-2021

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWERS OF SUPPLIERS

- 5.7.4 BARGAINING POWERS OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 AVERAGE SERVICE CHARGE ANALYSIS

- TABLE 6 AVERAGE SERVICE CHARGE, BY OPERATIONS AND INDUSTRY

- 5.9 TRADE DATA ANALYSIS

- TABLE 7 LIST OF IMPORTERS FOR PRODUCTS: 880211 - HELICOPTERS OF UNLADEN WEIGHT, 2,000 KG

- TABLE 8 LIST OF EXPORTERS FOR PRODUCTS: 880211 HELICOPTERS OF UNLADEN WEIGHT <= 2,000 KG

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- TABLE 9 HSN CODE AND GST RATE FOR AIRCRAFT AND UAV DRONES

- TABLE 10 NORTH AMERICA: DUTY RATES FOR DRONES AND THEIR ACCESSORIES, 2019

- TABLE 11 DRONE REGULATIONS AND APPROVALS FOR COMMERCIAL SECTOR, BY COUNTRY

- 5.10.1 FEDERAL AVIATION ADMINISTRATION GUIDELINES FOR DRONE OPERATIONS

- TABLE 12 US: FAA RULES AND GUIDELINES FOR DRONE OPERATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 DRONE DATA PHOTOGRAMMETRY

- 6.2.2 ARTIFICIAL INTELLIGENCE DRONES

- 6.2.3 LIDAR AND HYPERSPECTRAL IMAGING

- 6.2.4 BLOCKCHAIN

- 6.2.5 3D-PRINTED DRONES

- 6.2.6 DRONE PAYLOADS

- 6.2.7 SWARM DRONES

- 6.2.8 WIRELESS CHARGING

- 6.2.9 AUTOMATED DRONES

- 6.2.10 DRONE INSURANCE

- TABLE 13 DRONE INSURANCE COVERAGE

- TABLE 14 COMPANIES PROVIDING DRONE INSURANCE

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 UTILIZATION OF HYDROGEN FUEL CELLS

- 6.3.2 DRONE TRACKING AND NAVIGATION UPGRADES

- 6.3.3 IMPROVED COMPUTER VISION AND MOTION PLANNING

- 6.3.4 NOISE REDUCTION IN DRONES

- 6.4 CASE STUDY ANALYSIS

- 6.4.1 DRONE SURVEYING FOR INFRASTRUCTURE DEVELOPMENT

- 6.4.2 USE OF DRONE TECHNOLOGY FOR TOPOGRAPHIC SURVEYS

- 6.4.3 ENHANCED GENERAL VISUAL INSPECTION USING DRONES

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 GREEN INITIATIVE

- 6.5.2 INTERNET OF THINGS (IOT)

- 6.5.3 RAPID URBANIZATION

- FIGURE 23 NON-DESTRUCTIVE TESTING APPLICATIONS IN BRIDGE CONDITION MONITORING

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS, 2015-2021

7 DRONE SERVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 16 DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 17 DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- FIGURE 24 PLATFORM SERVICES TO LEAD MARKET DURING FORECAST PERIOD

- 7.2 PLATFORM SERVICES

- TABLE 18 DRONE SERVICES MARKET, BY PLATFORM SERVICES, 2020-2022 (USD MILLION)

- TABLE 19 DRONE SERVICES MARKET, BY PLATFORM SERVICES, 2023-2028 (USD MILLION)

- 7.2.1 PILOTING AND OPERATIONS

- 7.2.1.1 Crucial role in determining flight plan to drive market

- 7.2.2 DATA ANALYSIS

- 7.2.2.1 Higher accuracy in data collection to drive market

- 7.2.3 DATA PROCESSING

- 7.2.3.1 Need to analyze and extract valuable insights from drones to drive market

- 7.3 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

- 7.3.1 NEED FOR REGULAR SERVICING AND MAINTENANCE OF DRONES TO DRIVE MARKET

- 7.4 SIMULATION AND TRAINING

- 7.4.1 FAVORABLE RULES AND REGULATIONS FOR DRONE OPERATORS AND REMOTE PILOTS TO DRIVE MARKET

8 DRONE SERVICES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 25 TRANSPORT AND DELIVERY SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 21 DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 INSPECTION AND MONITORING

- 8.2.1 FOCUS ON ENVIRONMENTAL MONITORING AND INSPECTION TO DRIVE MARKET

- 8.3 MAPPING AND SURVEYING

- 8.3.1 HUMAN SAFETY AND COST BENEFITS TO DRIVE MARKET

- 8.4 SPRAYING AND SEEDING

- 8.4.1 RISING FOCUS ON COST-EFFECTIVE AGRICULTURAL MANAGEMENT TO DRIVE MARKET

- 8.5 FILMING AND PHOTOGRAPHY

- 8.5.1 4K SHOOTING AND USE OF FULL HD IMAGES TO DRIVE MARKET

- 8.6 TRANSPORT AND DELIVERY

- 8.6.1 GROWING DEMAND FOR FAST DELIVERY OF PRODUCTS AND NEED FOR HASSLE-FREE TRAVEL TO DRIVE MARKET

- 8.7 SECURITY, SEARCH, AND RESCUE

- 8.7.1 HIGHER EFFICIENCY OF DRONES NAVIGATING THROUGH INACCESSIBLE AREAS TO DRIVE MARKET

9 DRONE SERVICES MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 26 CONSTRUCTION AND INFRASTRUCTURE SEGMENT TO HAVE HIGHEST MARKET SHARE IN 2023

- TABLE 22 DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 23 DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 CONSTRUCTION AND INFRASTRUCTURE

- 9.2.1 GROWING DEMAND FOR DRONES IN ASSESSMENT OF BRIDGES AND RAILWAYS TO DRIVE MARKET

- 9.3 AGRICULTURE

- 9.3.1 INCREASING DEMAND FOR HIGHER CROP YIELD TO DRIVE MARKET

- 9.4 UTILITIES

- 9.4.1 INCREASING DEPLOYMENT OF DRONES FOR AERIAL INSPECTION TO DRIVE MARKET

- 9.5 OIL & GAS

- 9.5.1 USE OF DRONES IN MONITORING REFINERIES AND PIPELINES TO DRIVE MARKET

- 9.6 MINING

- 9.6.1 MAPPING OF DEEP MINES AND MEASURING STOCKPILES TO DRIVE MARKET

- 9.7 DEFENSE AND LAW ENFORCEMENT

- 9.7.1 GROWING USE OF DRONES IN SEARCH AND RESCUE OPERATIONS TO DRIVE MARKET

- 9.8 MEDIA AND ENTERTAINMENT

- 9.8.1 SURGE IN DRONE USE BY MEDIA AND PRODUCTION HOUSES FOR MAINSTREAM FILMMAKING TO DRIVE MARKET

- 9.9 INSURANCE

- 9.9.1 DEMAND FOR LOWER OPERATION COSTS TO DRIVE MARKET

- 9.10 AVIATION

- 9.10.1 GROWING USE OF DRONES FOR AIRCRAFT INSPECTION TO DRIVE MARKET

- 9.11 MARINE

- 9.11.1 NEED TO INSPECT REMOTE ACCESS AREAS IN SHORTER TIME TO DRIVE MARKET

- 9.12 HEALTHCARE AND SOCIAL ASSISTANCE

- 9.12.1 INCREASING DEMAND FOR FASTER DELIVERIES OF MEDICAL SUPPLIES TO DRIVE MARKET

- 9.13 TRANSPORT, LOGISTICS, AND WAREHOUSING

- 9.13.1 USE OF DRONES IN CARGO AND INVENTORY INSPECTION AND MONITORING TO DRIVE MARKET

10 DRONE SERVICES MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- FIGURE 27 POINT SOLUTION TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- TABLE 24 DRONE SERVICES MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 25 DRONE SERVICES MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 10.2 END-TO-END

- 10.2.1 ABILITY TO ENSURE COMPLIANCE AND STREAMLINE DATA COLLECTION TO DRIVE MARKET

- 10.3 POINT

- 10.3.1 GROWING APPLICATIONS IN SURVEYING, MAPPING, AND DELIVERY SERVICES TO DRIVE MARKET

11 REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- 11.2 RECESSION IMPACT ANALYSIS

- TABLE 26 DRONE SERVICES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 27 DRONE SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 NORTH AMERICA

- 11.3.1 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 28 NORTH AMERICA: DRONE SERVICES MARKET SNAPSHOT

- TABLE 28 NORTH AMERICA: DRONE SERVICES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: DRONE SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.2 US

- 11.3.2.1 Growing demand for packaged delivery to drive market

- TABLE 36 US: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 37 US: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 38 US: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 39 US: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 40 US: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 41 US: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.3 CANADA

- 11.3.3.1 Growing demand for inspection and monitoring services to drive market

- TABLE 42 CANADA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 43 CANADA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 44 CANADA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 45 CANADA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 46 CANADA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 47 CANADA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 EUROPE: PESTLE ANALYSIS

- FIGURE 29 EUROPE: DRONE SERVICES MARKET SNAPSHOT

- TABLE 48 EUROPE: DRONE SERVICES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 49 EUROPE: DRONE SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 50 EUROPE: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 51 EUROPE: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 52 EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 53 EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 54 EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 55 EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.2 UK

- 11.4.2.1 Cost saving and productivity benefits of drone services to drive market

- TABLE 56 UK: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 57 UK: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 58 UK: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 59 UK: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 60 UK: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 61 UK: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.3 FRANCE

- 11.4.3.1 Favorable government policies and increasing trials of drone delivery to drive market

- TABLE 62 FRANCE: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 63 FRANCE: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 FRANCE: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 65 FRANCE: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 66 FRANCE: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 67 FRANCE: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.4 GERMANY

- 11.4.4.1 High-budget government contracts to develop military drone services to drive market

- TABLE 68 GERMANY: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 69 GERMANY: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 70 GERMANY: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 71 GERMANY: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 72 GERMANY: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 73 GERMANY: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.5 RUSSIA

- 11.4.5.1 Increasing use of drones for autonomous inspection in oil & gas industry to drive market

- TABLE 74 RUSSIA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 75 RUSSIA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 76 RUSSIA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 77 RUSSIA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 78 RUSSIA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 79 RUSSIA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.6 ITALY

- 11.4.6.1 Manufacturing and testing efforts by domestic companies to drive market

- TABLE 80 ITALY: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 81 ITALY: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 ITALY: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 83 ITALY: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 84 ITALY: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 85 ITALY: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.7 SWEDEN

- 11.4.7.1 Permission for legal use of drones to drive market

- TABLE 86 SWEDEN: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 87 SWEDEN: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 88 SWEDEN: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 89 SWEDEN: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 90 SWEDEN: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 91 SWEDEN: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.8 REST OF EUROPE

- TABLE 92 REST OF EUROPE: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 93 REST OF EUROPE: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 REST OF EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 95 REST OF EUROPE: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 97 REST OF EUROPE: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5 ASIA PACIFIC

- 11.5.1 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 30 ASIA PACIFIC: DRONE SERVICES MARKET SNAPSHOT

- TABLE 98 ASIA PACIFIC: DRONE SERVICES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: DRONE SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.2 CHINA

- 11.5.2.1 Increasing demand for commercial and consumer drones to drive market

- TABLE 106 CHINA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 107 CHINA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 108 CHINA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 109 CHINA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 110 CHINA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 111 CHINA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.3 INDIA

- 11.5.3.1 Emergence of startups to drive market

- TABLE 112 INDIA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 113 INDIA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 114 INDIA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 115 INDIA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 INDIA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 117 INDIA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.4 JAPAN

- 11.5.4.1 Growing preference for drone services in precision agriculture and recreational activities to drive market

- TABLE 118 JAPAN: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 119 JAPAN: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 120 JAPAN: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 121 JAPAN: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 122 JAPAN: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 123 JAPAN: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.5 AUSTRALIA

- 11.5.5.1 Easing of rules for commercial drones by Civil Aviation Safety Authority to drive market

- TABLE 124 AUSTRALIA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 125 AUSTRALIA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 126 AUSTRALIA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 127 AUSTRALIA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 AUSTRALIA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 129 AUSTRALIA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.6 SOUTH KOREA

- 11.5.6.1 Rising demand for remote location delivery services to drive market

- TABLE 130 SOUTH KOREA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 131 SOUTH KOREA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 132 SOUTH KOREA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 133 SOUTH KOREA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 134 SOUTH KOREA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 135 SOUTH KOREA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.7 REST OF ASIA PACIFIC

- TABLE 136 REST OF ASIA PACIFIC: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.6 MIDDLE EAST

- FIGURE 31 MIDDLE EAST: DRONE SERVICES MARKET SNAPSHOT

- 11.6.1 MIDDLE EAST: PESTLE ANALYSIS

- TABLE 142 MIDDLE EAST: DRONE SERVICES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 143 MIDDLE EAST: DRONE SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 145 MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 146 MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 147 MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 149 MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.2 TURKEY

- 11.6.2.1 Growing demand for drone services in telecommunication and transportation sectors to drive market

- TABLE 150 TURKEY: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 151 TURKEY: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 152 TURKEY: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 153 TURKEY: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 154 TURKEY: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 155 TURKEY: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.3 UAE

- 11.6.3.1 Development and implementation of drone programs to drive market

- TABLE 156 UAE: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 157 UAE: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 UAE: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 159 UAE: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 160 UAE: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 161 UAE: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.4 ISRAEL

- 11.6.4.1 Ongoing drone innovations to drive market

- TABLE 162 ISRAEL: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 163 ISRAEL: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 164 ISRAEL: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 165 ISRAEL: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 166 ISRAEL: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 167 ISRAEL: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.5 REST OF MIDDLE EAST

- TABLE 168 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.7 REST OF THE WORLD

- 11.7.1 REST OF THE WORLD: PESTLE ANALYSIS

- TABLE 174 REST OF THE WORLD: DRONE SERVICES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 175 REST OF THE WORLD: DRONE SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 176 REST OF THE WORLD: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 177 REST OF THE WORLD: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 178 REST OF THE WORLD: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 179 REST OF THE WORLD: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 180 REST OF THE WORLD: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 181 REST OF THE WORLD: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.7.2 AFRICA

- 11.7.2.1 Increased investments and adoption of drones in various sectors to drive market

- TABLE 182 AFRICA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 183 AFRICA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 184 AFRICA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 185 AFRICA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 186 AFRICA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 187 AFRICA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.7.3 LATIN AMERICA

- 11.7.3.1 Increasing use of drones by authorities to drive market

- TABLE 188 LATIN AMERICA: DRONE SERVICES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: DRONE SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: DRONE SERVICES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: DRONE SERVICES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 COMPANY OVERVIEW

- TABLE 194 KEY DEVELOPMENTS OF LEADING PLAYERS IN DRONE SERVICES MARKET, 2020-2022

- 12.3 RANKING ANALYSIS, 2023

- 12.4 KEY PLAYERS IN DRONE SERVICES MARKET

- FIGURE 32 RANKING OF KEY PLAYERS, 2023

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 33 COMPANY EVALUATION MATRIX, 2022

- 12.5.5 COMPANY FOOTPRINT

- TABLE 195 COMPANY FOOTPRINT

- TABLE 196 COMPANY FOOTPRINT, BY SERVICE

- TABLE 197 COMPANY FOOTPRINT, BY INDUSTRY

- TABLE 198 COMPANY FOOTPRINT, BY REGION

- 12.6 STARTUP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 34 STARTUP/SME EVALUATION MATRIX, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 199 DETAILED LIST OF KEY STARTUPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 200 PRODUCT LAUNCHES, FEBRUARY 2018-OCTOBER 2020

- 12.7.2 DEALS

- TABLE 201 DEALS, JANUARY 2018-AUGUST 2023

- 12.7.3 OTHERS

- TABLE 202 OTHERS, JANUARY 2018- AUGUST 2023

13 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 EDALL SYSTEMS

- TABLE 203 EDALL SYSTEMS: COMPANY OVERVIEW

- TABLE 204 EDALL SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 EDALL SYSTEMS: PRODUCT LAUNCHES

- 13.2.2 PRECISIONHAWK

- TABLE 206 PRECISIONHAWK: COMPANY OVERVIEW

- TABLE 207 PRECISIONHAWK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 PRECISIONHAWK: DEALS

- TABLE 209 PRECISIONHAWK: OTHERS

- 13.2.3 CYBERHAWK

- TABLE 210 CYBERHAWK: COMPANY OVERVIEW

- TABLE 211 CYBERHAWK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 CYBERHAWK: DEALS

- 13.2.4 VERMEER

- TABLE 213 VERMEER: COMPANY OVERVIEW

- TABLE 214 VERMEER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 VERMEER: PRODUCT LAUNCHES

- TABLE 216 VERMEER: DEALS

- 13.2.5 AGEAGLE AERIAL SYSTEMS

- TABLE 217 AGEAGLE AERIAL SYSTEMS: COMPANY OVERVIEW

- FIGURE 35 AGEAGLE AERIAL SYSTEMS: COMPANY SNAPSHOT

- TABLE 218 AGEAGLE AERIAL SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 AGEAGLE AERIAL SYSTEMS: PRODUCT LAUNCHES

- TABLE 220 AGEAGLE AERIAL SYSTEMS: DEALS

- TABLE 221 AGEAGLE AERIAL SYSTEMS: OTHERS

- 13.2.6 ICR INTEGRITY

- TABLE 222 ICR INTEGRITY: COMPANY OVERVIEW

- TABLE 223 ICR INTEGRITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 ICR INTEGRITY: OTHERS

- 13.2.7 SHARPER SHAPE INC.

- TABLE 225 SHARPER SHAPE INC.: COMPANY OVERVIEW

- TABLE 226 SHARPER SHAPE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 SHARPER SHAPE INC.: DEALS

- 13.2.8 DRONEDEPLOY INC.

- TABLE 228 DRONEDEPLOY INC.: COMPANY OVERVIEW

- TABLE 229 DRONEDEPLOY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 DRONEDEPLOY INC.: DEALS

- 13.2.9 IDENTIFIED TECHNOLOGIES

- TABLE 231 IDENTIFIED TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 232 IDENTIFIED TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 IDENTIFIED TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 234 IDENTIFIED TECHNOLOGIES: DEALS

- 13.2.10 TERRA DRONE CORPORATION

- TABLE 235 TERRA DRONE CORPORATION: COMPANY OVERVIEW

- TABLE 236 TERRA DRONE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 TERRA DRONE CORPORATION: DEALS

- TABLE 238 TERRA DRONE CORPORATION: OTHERS

- 13.2.11 THE SKY GUYS

- TABLE 239 THE SKY GUYS: COMPANY OVERVIEW

- TABLE 240 THE SKY GUYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 THE SKY GUYS: DEALS

- 13.2.12 DEVERON UAS CORP.

- TABLE 242 DEVERON UAS CORP.: COMPANY OVERVIEW

- FIGURE 36 DEVERON UAS CORP.: COMPANY SNAPSHOT

- TABLE 243 DEVERON UAS CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 DEVERON UAS CORP.: DEALS

- 13.2.13 ZIPLINE

- TABLE 245 ZIPLINE: COMPANY OVERVIEW

- TABLE 246 ZIPLINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 ZIPLINE: DEALS

- TABLE 248 ZIPLINE: OTHERS

- 13.2.14 MATTERNET, INC.

- TABLE 249 MATTERNET, INC.: COMPANY OVERVIEW

- TABLE 250 MATTERNET, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 MATTERNET, INC.: PRODUCT LAUNCHES

- TABLE 252 MATTERNET, INC.: DEALS

- TABLE 253 MATTERNET, INC.: OTHERS

- 13.2.15 AERODYNE GROUP

- TABLE 254 AERODYNE GROUP: COMPANY OVERVIEW

- TABLE 255 AERODYNE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 AERODYNE GROUP: DEALS

- TABLE 257 AERODYNE GROUP: OTHERS

- 13.2.16 SKYDROP

- TABLE 258 SKYDROP: COMPANY OVERVIEW

- TABLE 259 SKYDROP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 SKYDROP: PRODUCT LAUNCHES

- TABLE 261 SKYDROP: DEALS

- TABLE 262 SKYDROP: OTHERS

- 13.2.17 ZEITVIEW

- TABLE 263 ZEITVIEW: COMPANY OVERVIEW

- TABLE 264 ZEITVIEW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ZEITVIEW: DEALS

- TABLE 266 ZEITVIEW: OTHERS

- 13.2.18 DRONEGENUITY

- TABLE 267 DRONEGENUITY: COMPANY OVERVIEW

- TABLE 268 DRONEGENUITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 DRONEGENUITY: OTHERS

- 13.2.19 MISTRAS GROUP, INC.

- TABLE 270 MISTRAS GROUP, INC.: COMPANY OVERVIEW

- FIGURE 37 MISTRAS GROUP, INC.: COMPANY SNAPSHOT

- TABLE 271 MISTRAS GROUP, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.20 AEROVIRONMENT, INC.

- TABLE 272 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- FIGURE 38 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- TABLE 273 AEROVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.21 HEMAV

- TABLE 274 HEMAV: COMPANY OVERVIEW

- TABLE 275 HEMAV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.22 SKYCATCH

- TABLE 276 SKYCATCH: COMPANY OVERVIEW

- TABLE 277 SKYCATCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 SKYCATCH: DEALS

- 13.2.23 AUSTRALIAN UAV PTY LTD.

- TABLE 279 AUSTRALIAN UAV PTY LTD.: COMPANY OVERVIEW

- TABLE 280 AUSTRALIAN UAV PTY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 AUSTRALIAN UAV PTY LTD.: OTHERS

- 13.2.24 SKYSPECS

- TABLE 282 SKYSPECS: COMPANY OVERVIEW

- TABLE 283 SKYSPECS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 SKYSPECS: OTHERS

- 13.2.25 ARCH AERIAL LLC

- TABLE 285 ARCH AERIAL LLC: COMPANY OVERVIEW

- TABLE 286 ARCH AERIAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 ARCH AERIAL LLC: DEALS

- TABLE 288 ARCH AERIAL LLC: OTHERS

- 13.3 OTHER PLAYERS

- 13.3.1 UNMANNED EXPERTS INC. (UMEX)

- TABLE 289 UNMANNED EXPERTS INC. (UMEX): COMPANY OVERVIEW

- 13.3.2 VIPER DRONES

- TABLE 290 VIPER DRONES: COMPANY OVERVIEW

- 13.3.3 RAPTOR MAPS

- TABLE 291 RAPTOR MAPS: COMPANY OVERVIEW

- 13.3.4 GARUDA UAV

- TABLE 292 GARUDA UAV: COMPANY OVERVIEW

- 13.3.5 MAVERICK INSPECTION SERVICES

- TABLE 293 MAVERICK INSPECTION SERVICES: COMPANY OVERVIEW

- 13.3.6 CANADIAN UAV SOLUTIONS

- TABLE 294 CANADIAN UAV SOLUTIONS: COMPANY OVERVIEW

- 13.3.7 DJM AERIAL SOLUTIONS

- TABLE 295 DJM AERIAL SOLUTIONS: COMPANY OVERVIEW

- 13.3.8 RELIABILITY MAINTENANCE SOLUTIONS LTD.

- TABLE 296 RELIABILITY MAINTENANCE SOLUTIONS LTD.: COMPANY OVERVIEW

- 13.3.9 DRONEFLIGHT

- TABLE 297 DRONEFLIGHT: COMPANY OVERVIEW

- 13.3.10 FLYTREX

- TABLE 298 FLYTREX: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS