|

|

市場調査レポート

商品コード

1877350

動物用創傷ケアの世界市場:製品別、動物タイプ別、流通チャネル別、エンドユーザー別、地域別 - 2030年までの予測Animal Wound Care Market by Product (Surgical, Advanced, Traditional ), Animal Type, Distribution Channel, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 動物用創傷ケアの世界市場:製品別、動物タイプ別、流通チャネル別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年11月17日

発行: MarketsandMarkets

ページ情報: 英文 414 Pages

納期: 即納可能

|

概要

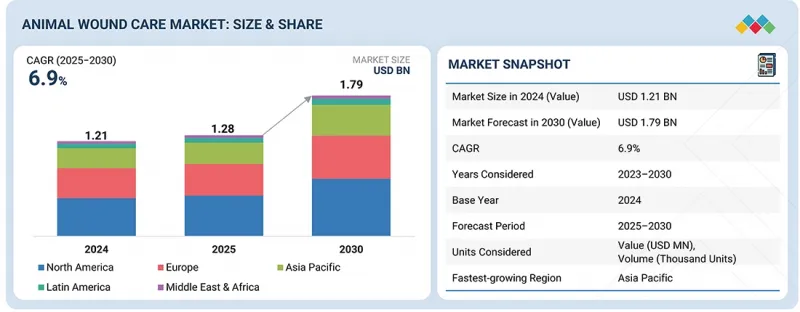

動物用創傷ケアの市場規模は、2025年の12億8,000万米ドルから2030年までに17億9,000万米ドルに達すると予測されており、2025年から2030年までのCAGRは6.9%と見込まれています。

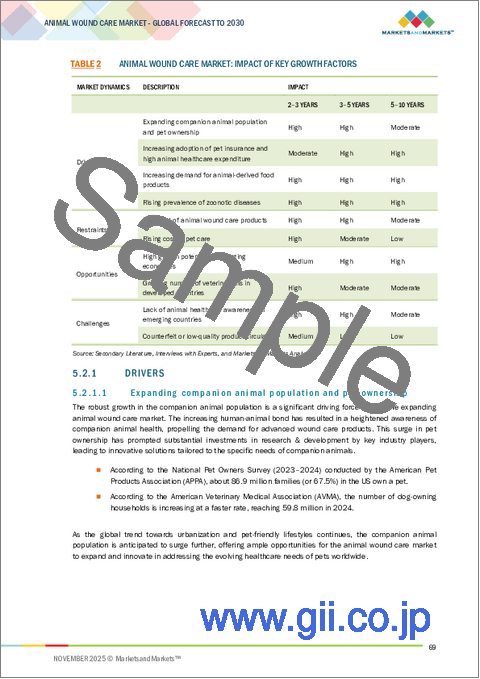

動物用創傷ケア市場の主な動向としては、世界的なペット飼育数の増加と動物の健康に対する関心の高まりが挙げられます。ペットオーナーは、自身の動物の健康と福祉に対する意識を高め、より深く関わるようになってきています。この意識の高まりが、ペットのための先進的な創傷ケア治療やソリューションを求める動機となっています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(100万米ドル) |

| セグメント | 製品別、動物タイプ別、流通チャネル別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

犬や猫などのコンパニオンアニマルの増加に伴い、専門的な創傷ケア製品およびサービスへの需要が高まっています。さらに、ペットオーナー様は、動物のための高度な獣医療や個別化された医療ケアに投資する意欲をお持ちであり、これが動物用創傷ケア市場の拡大を促進しています。

動物用創傷ケア市場は、大きく4つのセグメントに分類されます(外科用創傷ケア製品、先進的創傷ケア製品、従来型創傷ケア製品、治療機器)。このうち外科用創傷ケア製品セグメントは、予測期間中に最も高いCAGRを記録すると見込まれています。動物における慢性疾患治療のための外科手術や様々な医療介入の増加は、専門的な外科用創傷ケア製品への需要拡大に寄与しています。縫合糸、ステープラー、組織接着剤、シーラント、グルーなどを含むこれらの製品は、動物の術後ケアと回復において重要な役割を果たします。

さらに、動物用創傷ケア分野における継続的な技術革新により、画期的な外科用創傷ケア製品の開発が進んでいます。これらの革新は、有効性の向上、使用の簡便化、および全体的な治療成果の改善に焦点を当てており、獣医療現場における当該製品の採用をさらに促進しています。

さらに、動物用創傷ケア市場における外科的創傷ケア製品への需要の高まりは、獣医手術の増加とペットの健康に対する意識の向上によって促進されています。これらの動向が相まって、外科的創傷ケア製品は動物用創傷ケア市場の主要な推進力として位置づけられています。

動物用創傷ケア市場は、コンパニオンアニマルと家畜の2セグメントに区分されます。2024年にはコンパニオンアニマルセグメントが世界市場を牽引すると予測されます。この成長は主に、ペットの飼育率増加、ペットケア支出の拡大、ペット保険の顕著な普及に起因しています。

コンパニオンアニマルの増加とペットの慢性疾患の蔓延が相まって、創傷ケアや一般的な健康管理を目的とした動物病院の受診が大幅に増加しています。ペットオーナーは動物の健康への投資意欲を高めており、創傷ケア製品や治療を含む獣医療サービスへの支出が増加しています。これらの要因が相まって、コンパニオンアニマルの健康への投資全体が増加し、動物用創傷ケア製品の需要を押し上げています。

アジア太平洋は動物用創傷ケア市場において最も高い成長率を記録し、インドと中国が特に大きな成長可能性を秘めた国として浮上しています。これらの地域におけるペット動物の増加が、市場拡大の主要な促進要因となっています。加えて、ペットの飼育率の上昇、動物の健康と福祉に対する意識の高まり、特にインドと中国における動物医療費の増加が、動物用創傷ケア製品の需要を後押ししています。その結果、この地域では動物用創傷ケア市場が著しい成長を遂げています。

当レポートでは、世界の動物用創傷ケア市場について調査し、製品別、動物タイプ別、流通チャネル別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 規制分析

- 特許分析

- 価格分析

- 貿易分析

- エコシステム分析

- バリューチェーン分析

- サプライチェーン分析

- 払い戻しシナリオ

- 2025-2026年の主な会議とイベント

- AI/生成AIが動物用創傷ケア市場に与える影響

- アンメットニーズとエンドユーザーの期待

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 投資と資金調達のシナリオ

- 2025年の米国関税が動物用創傷ケア市場に与える影響

第6章 動物用創傷ケア市場(製品別)

- イントロダクション

- 外科用創傷ケア製品

- 高度な創傷ケア製品

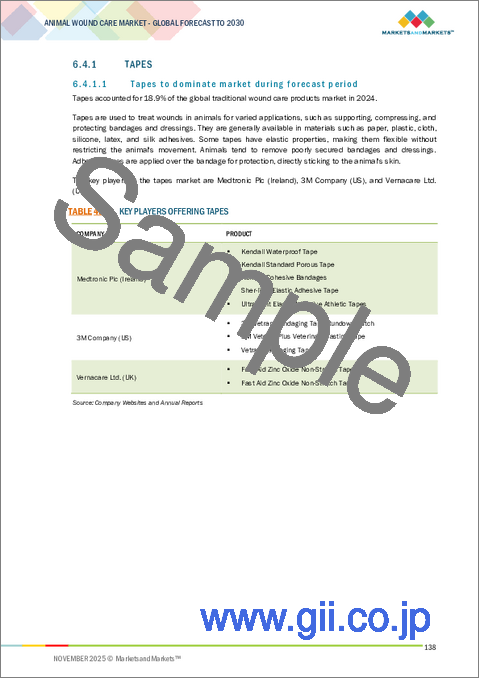

- 従来型創傷ケア製品

- 治療機器

第7章 動物用創傷ケア市場(動物タイプ別)

- イントロダクション

- コンパニオンアニマル

- 家畜

第8章 動物用創傷ケア市場(流通チャネル別)

- イントロダクション

- 小売チャネル

- 電子商取引プラットフォーム

- 獣医クリニックおよび病院(院内調剤)

- 直接販売チャネル

第9章 動物用創傷ケア市場(エンドユーザー別)

- イントロダクション

- 動物病院・クリニック

- 在宅ケア

- 畜産農場

- 救助センターとNGO

- その他

第10章 動物用創傷ケア市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 北米:外科用創傷ケア製品の数量分析(タイプ別)、2023年~2030年(1,000個)

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- 欧州:外科用創傷ケア製品の数量分析(タイプ別)、2023年~2030年(1,000個)

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- オランダ

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- アジア太平洋:外科用創傷ケア製品の数量分析(タイプ別)、2023年~2030年(1,000個)

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- タイ

- インドネシア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ラテンアメリカ:外科用創傷ケア製品の数量分析(タイプ別)、2023年~2030年(1,000個)

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- 中東・アフリカ:外科用創傷ケア製品の数量分析(タイプ別)、2023年~2030年(1,000個)

- GCC諸国

- その他中東とアフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 主要企業の研究開発費

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- B. BRAUN SE

- MEDTRONIC PLC

- 3M COMPANY

- VIRBAC

- DECHRA PHARMACEUTICALS PLC

- NEOGEN CORPORATION

- JORGEN KRUUSE A/S

- SONOMA PHARMACEUTICALS, INC.

- ETHICON, INC.

- ZOETIS INC.

- JAZZ MEDICAL, LLC

- KERICURE INC.

- ADVANCIS MEDICAL

- VERNACARE LTD.

- CREATIVE SCIENCE

- THE WOUND VAC COMPANY, LLC

- DOMES PHARMA, INC.

- その他の企業

- PRIMAVET INC.

- INNOVACYN, INC.

- SILVERGLIDE

- VETOQUINOL

- MILLPLEDGE LTD.

- OVIK HEALTH

- HYDROFERA

- RIVERPOINT MEDICAL

- INTERNACIONAL FARMACEUTICA S.A. DE C.V.

- ORION SUTURES INDIA PVT. LTD.