|

|

市場調査レポート

商品コード

1614457

電子棚札の世界市場:コンポーネント別、製品タイプ別、オファリング別、通信技術別、画面サイズ別、エンドユーザー別、地域別 - 2029年までの予測Electronic Shelf Labels Market by Full Graphic E-paper, LCDs, Segmented E-paper, Retail, Industrial, Label Management, Inventory & Stock Management, Transceivers, Infrared, Radio Frequency, Near-field Communication and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 電子棚札の世界市場:コンポーネント別、製品タイプ別、オファリング別、通信技術別、画面サイズ別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月05日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

電子棚札(ESL)の市場規模は、2024年に23億4,000万米ドルになるとみられ、2029年には41億8,000万米ドルに達すると予測されており、予測期間中に12.3%のCAGRで拡大すると予想されています。

ESLが統合されたことで、価格のダイナミックな変更が容易になり、手作業による価格更新の必要性がなくなったことが成長の原動力となっています。一方、ワイヤレス技術に適したインフラがなく、設置やサポートにかかるインフラ費用が高いことが、電子棚札市場の成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、製品タイプ別、オファリング別、通信技術別、画面サイズ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

LCDセグメントは予測期間中、2番目に高いCAGRで成長すると予測されています。この成長の背景には、消費者の注目を集め、遠くからでも読みやすい情報を提供するために、高品質で鮮明なディスプレイ機能が重要な小売環境において、LCDベースのESLソリューションの普及が進んでいることがあります。

NFCベースのESLは、特にNFC技術を搭載したスマートフォンやその他のデバイスとのインターフェース機能という点でユニークな特徴を持っています。その結果、NFCベースのラベルは在庫確認、価格変更、製品確認など様々な用途に適しており、これら全てがこのプログラムの汎用性を証明しています。NFCは高速かつ正確で非接触型であり、時間が最も重要な小売環境に最適です。NFCに対応したESLは、小売業者がNFCラベル上のデバイスにタッチすることで、外出先から価格や商品、販促情報などを変更することを可能にします。

欧州の市場は予測期間中、最大のシェアで成長すると予想されています。この優位性を支えているのは、確立された小売市場、小売店舗の運営における先進技術の継続的な統合、顧客体験の向上への強い注力など、いくつかの理由があります。ESLは欧州の小売業者に絶大な人気を博しており、彼らは店内/店舗での効率性を高め、コストを最小限に抑え、消費者に商品価格に関する正確な情報をタイムリーに提供することに関心を寄せています。欧州の著名な市場参入企業とその継続的な技術革新と拡大計画が市場の成長に貢献しています。この地域のビジネス環境は、効率的なエネルギー技術や持続可能性の利用を促進しており、電子棚札の利用を促進するもう一つの要因となっています。

当レポートでは、世界の電子棚札市場について調査し、コンポーネント別、製品タイプ別、オファリング別、通信技術別、画面サイズ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- AI/生成AIが電子棚札市場に与える影響

第6章 電子棚札市場、コンポーネント別

- イントロダクション

- ディスプレイ

- バッテリー

- トランシーバー

- マイクロプロセッサ

- その他

第7章 電子棚札市場、製品タイプ別

- イントロダクション

- 液晶

- セグメント化された電子ペーパーディスプレイ

- フルグラフィック電子ペーパーディスプレイ

第8章 電子棚札市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェアとサービス

第9章 電子棚札市場、通信技術別

- イントロダクション

- 無線周波数

- 赤外線

- 近距離無線通信

- その他

第10章 電子棚札市場、画面サイズ別

- イントロダクション

- 3インチ未満

- 3~7インチ

- 7~10インチ

- 10インチ以上

第11章 電子棚札市場、エンドユーザー別

- イントロダクション

- 小売

- 工業

第12章 電子棚札市場、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- フランス

- 英国

- ドイツ

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- 台湾

- その他

- 行

- ROWのマクロ経済見通し

- 南米

- 中東・アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2023年

- 収益分析、2020年~2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- VUSIONGROUP

- PRICER

- SOLUM

- DISPLAYDATA LTD.

- TERAOKA SEIKO CO., LTD.

- M2COMM

- OPTICON

- PARTRON ESL

- SHANGHAI SUNMI TECHNOLOGY CO., LTD.

- HANSHOW TECHNOLOGY

- その他の企業

- DALIAN SERTAG TECHNOLOGY CO., LTD.

- MINEWTAG

- LABELNEST

- DIGETY

- ZKONG NETWORKS

- TRONITAG GMBH

- YALATECH

- SSSIND

- ALLSEE TECHNOLOGIES LIMITED

- MOKOSMART

- FUTURE SHELF

- HENDERSON TECHNOLOGY

- ZHSUNYCO

- NZ ELECTRONIC SHELF LABELLING

- LANCOM SYSTEMS GMBH

第15章 付録

List of Tables

- TABLE 1 ELECTRONIC SHELF LABELS MARKET: GROWTH FORECAST ASSUMPTIONS

- TABLE 2 ELECTRONIC SHELF LABELS MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 ELECTRONIC SHELF LABELS MARKET: RISK ASSESSMENT

- TABLE 4 AVERAGE SELLING PRICE TREND, BY DISPLAY SIZE, 2019-2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF ELECTRONIC SHELF LABELS, BY REGION, 2020-2023 (USD)

- TABLE 6 ELECTRONIC SHELF LABELS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 ELECTRONIC SHELF LABELS MARKET: KEY PATENTS, 2022-2023

- TABLE 8 IMPORT SCENARIO FOR HS CODE 853120-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT SCENARIO FOR HS CODE 853120-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 11 MFN TARIFF FOR HS CODE 853120-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 PORTER'S FIVE FORCES: IMPACT ON ELECTRONIC SHELF LABELS MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 18 KEY BUYING CRITERIA, BY END USER

- TABLE 19 ELECTRONIC SHELF LABELS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 20 ELECTRONIC SHELF LABELS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 21 DISPLAYS: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY TYPE, 2020-2023 (USD MILLION)

- TABLE 22 DISPLAYS: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY TYPE, 2024-2029 (USD MILLION)

- TABLE 23 ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 24 ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 25 LCD: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 26 LCD: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 27 LCD: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 28 LCD: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 29 LCD: ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 30 LCD: ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 31 LCD: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 32 LCD: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 33 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 34 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 35 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 36 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 37 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 38 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 39 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 40 SEGMENTED E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 41 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 42 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 43 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 44 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 45 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 46 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 47 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 48 FULLY GRAPHIC E-PAPER DISPLAY: ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 49 ELECTRONIC SHELF LABELS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 50 ELECTRONIC SHELF LABELS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 51 ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 52 ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 53 RADIO FREQUENCY: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 54 RADIO FREQUENCY: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 55 INFRARED: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 56 INFRARED: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 57 NEAR-FIELD COMMUNICATION: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 58 NEAR-FIELD COMMUNICATION: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 59 OTHER COMMUNICATION TECHNOLOGIES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 60 OTHER COMMUNICATION TECHNOLOGIES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 61 ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 62 ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 63 ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2020-2023 (MILLION UNITS)

- TABLE 64 ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE, 2024-2029 (MILLION UNITS)

- TABLE 65 LESS THAN 3 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 66 LESS THAN 3 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 67 3 TO 7 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 68 3 TO 7 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 69 7 TO 10 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 70 7 TO 10 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 71 MORE THAN 10 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 72 MORE THAN 10 INCHES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 73 ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 74 ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 75 RETAIL: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 76 RETAIL: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 77 RETAIL: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 78 RETAIL: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 79 RETAIL: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 RETAIL: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 82 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 83 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 HYPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ROW, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 93 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 94 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 95 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 100 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 101 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 102 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 103 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 SUPERMARKETS: ELECTRONIC SHELF LABELS MARKET IN ROW, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 105 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 106 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 107 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 108 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 109 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 112 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 113 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 114 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 115 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 116 NON-FOOD RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ROW, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 118 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 119 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 120 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 121 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 122 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 123 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 124 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 125 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 128 SPECIALTY STORES: ELECTRONIC SHELF LABELS MARKET IN ROW, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 130 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 131 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 132 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 133 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 134 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 135 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 136 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 137 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 138 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 139 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 140 OTHER RETAIL STORES: ELECTRONIC SHELF LABELS MARKET IN ROW, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 141 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 142 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 143 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 144 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 145 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 146 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 147 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 148 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 149 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 150 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 151 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 152 INDUSTRIAL: ELECTRONIC SHELF LABELS MARKET IN ROW, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 154 ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 155 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 156 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 157 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 158 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 159 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 160 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 161 EUROPE: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 162 EUROPE: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 163 EUROPE: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 164 EUROPE: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 165 EUROPE: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 166 EUROPE: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 172 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 173 ROW: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 174 ROW: ELECTRONIC SHELF LABELS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 175 ROW: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2020-2023 (USD MILLION)

- TABLE 176 ROW: ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE, 2024-2029 (USD MILLION)

- TABLE 177 ROW: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 178 ROW: ELECTRONIC SHELF LABELS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ELECTRONIC SHELF LABELS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 181 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 182 ELECTRONIC SHELF LABELS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 183 ELECTRONIC SHELF LABELS MARKET: REGION FOOTPRINT

- TABLE 184 ELECTRONIC SHELF LABELS MARKET: DISPLAY SIZE FOOTPRINT

- TABLE 185 ELECTRONIC SHELF LABELS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 186 ELECTRONIC SHELF LABELS MARKET: END USER FOOTPRINT

- TABLE 187 ELECTRONIC SHELF LABELS MARKET: STARTUPS/SMES

- TABLE 188 ELECTRONIC SHELF LABELS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 ELECTRONIC SHELF LABELS MARKET: PRODUCT LAUNCHES, APRIL 2020-OCTOBER 2024

- TABLE 190 ELECTRONIC SHELF LABELS MARKET: DEALS, APRIL 2020-OCTOBER 2024

- TABLE 191 VUSIONGROUP: COMPANY OVERVIEW

- TABLE 192 VUSIONGROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 VUSIONGROUP: PRODUCT LAUNCHES

- TABLE 194 VUSIONGROUP: DEALS

- TABLE 195 PRICER: COMPANY OVERVIEW

- TABLE 196 PRICER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 PRICER: DEALS

- TABLE 198 PRICER: EXPANSIONS

- TABLE 199 SOLUM: COMPANY OVERVIEW

- TABLE 200 SOLUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SOLUM: PRODUCT LAUNCHES

- TABLE 202 SOLUM: DEALS

- TABLE 203 DISPLAYDATA LTD.: COMPANY OVERVIEW

- TABLE 204 DISPLAYDATA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 DISPLAYDATA LTD.: PRODUCT LAUNCHES

- TABLE 206 DISPLAYDATA LTD.: DEALS

- TABLE 207 TERAOKA SEIKO CO., LTD.: COMPANY OVERVIEW

- TABLE 208 TERAOKA SEIKO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 TERAOKA SEIKO CO., LTD.: EXPANSIONS

- TABLE 210 M2COMM: COMPANY OVERVIEW

- TABLE 211 M2COMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 OPTICON: COMPANY OVERVIEW

- TABLE 213 OPTICON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 OPTICON: DEALS

- TABLE 215 PARTRON ESL: COMPANY OVERVIEW

- TABLE 216 PARTRON ESL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 PARTRON ESL: PRODUCT LAUNCHES

- TABLE 218 PARTRON ESL: DEALS

- TABLE 219 SHANGHAI SUNMI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 220 SHANGHAI SUNMI TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 HANSHOW TECHNOLOGY: COMPANY OVERVIEW

- TABLE 222 HANSHOW TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 HANSHOW TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 224 HANSHOW TECHNOLOGY: DEALS

- TABLE 225 HANSHOW TECHNOLOGY: EXPANSIONS

List of Figures

- FIGURE 1 ELECTRONIC SHELF LABELS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ELECTRONIC SHELF LABELS MARKET: RESEARCH DESIGN

- FIGURE 3 ELECTRONIC SHELF LABELS MARKET: RESEARCH APPROACH

- FIGURE 4 ELECTRONIC SHELF LABELS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 REVENUE GENERATED FROM SALES OF ELECTRONIC SHELF LABELS

- FIGURE 6 ELECTRONIC SHELF LABELS MARKET: BOTTOM-UP APPROACH

- FIGURE 7 ELECTRONIC SHELF LABELS MARKET: TOP-DOWN APPROACH

- FIGURE 8 ELECTRONIC SHELF LABELS MARKET: DATA TRIANGULATION

- FIGURE 9 ELECTRONIC SHELF LABELS MARKET, 2020-2029

- FIGURE 10 NON-FOOD RETAIL STORES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 7 TO 10 INCHES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 DISPLAYS TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 GROWING DEMAND FOR OMNICHANNEL RETAIL TO DRIVE MARKET

- FIGURE 14 FULLY GRAPHIC E-PAPER DISPLAY SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 RADIO FREQUENCY TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 NON-FOOD RETAIL STORES TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 EUROPE TO BE LARGEST MARKET FOR ELECTRONIC SHELF LABELS IN 2029

- FIGURE 19 TAIWAN TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 ELECTRONIC SHELF LABELS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 HOURLY LABOR COSTS, 2023

- FIGURE 22 IMPACT OF DRIVERS ON ELECTRONIC SHELF LABELS MARKET

- FIGURE 23 IMPACT OF RESTRAINTS ON ELECTRONIC SHELF LABELS MARKET

- FIGURE 24 IMPACT OF OPPORTUNITIES ON ELECTRONIC SHELF LABELS MARKET

- FIGURE 25 IMPACT OF CHALLENGES ON ELECTRONIC SHELF LABELS MARKET

- FIGURE 26 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE OF KEY PLAYERS, BY DISPLAY SIZE, 2023

- FIGURE 28 AVERAGE SELLING PRICE, BY REGION, 2020-2023 (USD)

- FIGURE 29 ELECTRONIC SHELF LABELS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 ELECTRONIC SHELF LABELS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 STARTUP FUNDING FOR ELECTRONIC SHELF LABELS

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 33 IMPORT DATA FOR HS CODE 853120-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR HS CODE 853120-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS: ELECTRONIC SHELF LABELS MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 37 KEY BUYING CRITERIA, BY END USER

- FIGURE 38 MPACT OF AI/GEN AI ON ELECTRONIC SHELF LABELS MARKET

- FIGURE 39 DISPLAYS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 FULLY GRAPHIC E-PAPER DISPLAY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 RETAIL SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 HYPERMARKETS TO ACCOUNT FOR LARGEST SHARE OF SEGMENTED E-PAPER DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 43 RADIO FREQUENCY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BETWEEN 2024 AND 2029

- FIGURE 44 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 INVENTORY & STOCK MANAGEMENT SOFTWARE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 46 RADIO FREQUENCY SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 47 LESS THAN 3 INCHES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 48 RETAIL SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 49 HYPERMARKETS TO ACCOUNT FOR LARGEST SHARE OF RETAIL ELECTRONIC SHELF LABELS MARKET DURING FORECAST PERIOD

- FIGURE 50 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 51 EUROPE TO BE LARGEST CONSUMER OF ELECTRONIC SHELF LABELS IN INDUSTRIAL SECTOR

- FIGURE 52 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: ELECTRONIC SHELF LABELS MARKET SNAPSHOT

- FIGURE 54 RETAIL SEGMENT TO DOMINATE ELECTRONIC SHELF LABELS MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 55 EUROPE: ELECTRONIC SHELF LABELS MARKET SNAPSHOT

- FIGURE 56 HYPERMARKETS TO BE LARGEST END USER OF ELECTRONIC SHELF LABELS IN EUROPE

- FIGURE 57 ASIA PACIFIC: ELECTRONIC SHELF LABELS MARKET SNAPSHOT

- FIGURE 58 INDUSTRIAL SEGMENT TO REGISTER HIGHER GROWTH RATE IN ASIA PACIFIC ELECTRONIC SHELF LABELS MARKET

- FIGURE 59 OTHER RETAIL STORES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 60 ELECTRONIC SHELF LABELS MARKET SHARE ANALYSIS, 2023

- FIGURE 61 ELECTRONIC SHELF LABELS MARKET: REVENUE ANALYSIS OF TOP PLAYERS, 2020-2023

- FIGURE 62 COMPANY VALUATION, 2024

- FIGURE 63 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 64 BRAND/PRODUCT COMPARISON

- FIGURE 65 ELECTRONIC SHELF LABELS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 66 ELECTRONIC SHELF LABELS MARKET: COMPANY FOOTPRINT

- FIGURE 67 ELECTRONIC SHELF LABELS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 68 VUSIONGROUP: COMPANY SNAPSHOT

- FIGURE 69 PRICER: COMPANY SNAPSHOT

The electronic shelf labels market was valued at 2.34 billion in 2024 and is projected to reach USD 4.18 billion by 2029; it is expected to register a CAGR of 12.3% during the forecast period. The integration of ESL facilitates dynamic price changes, eliminating the need for manual price updat is driving the growth. Whereas lack of suitable infrastructures for wireless technologies and high installation and supporting infrastructure expenses is restraining the growth of the electronic shelf labels market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By component, product type, communication technology, display size, end-user, region |

| Regions covered | North America, Europe, APAC, RoW |

"The LCD segment is expected to grow at the second highest CAGR during the forecast period."

The LCD segment is projected to grow at the second highest CAGR during the forecast period. This growth can be attributed to the increasing penetration of LCD-based ESL solutions in retail environments where high quality clear display capabilities are important in capturing consumer attention, and to offer information which can easily be read from a distance.

The Near-field Communication type is likely to grow at the second highest CAGR during the forecast period

The Near-field Communication is expected to grow at second highest CAGR during the forecast period.

The NFC-based ESLs have unique characteristics especially in terms of their capability to interface with smart phones and other devices equipped with NFC technology. As a result, NFC-based labels are quite appropriate for various uses such as stock checking, changes in prices, as well as product verification; all of which prove the versatility of the programmes. NFC is fast, accurate and contactless - perfect for a retail environment where time is of the essence. ESLs that are NFC compatible enable retailers to make changes such as prices, product and promotional information on the go by touching the device on the NFC label.

"Europe is likely to grow at the largest share during the forecast period."

The market in Europe is expected to grow at the largest share during the forecast period. There are several reasons that support this dominance, such as established retail market, continuous integration of the advanced technologies in the operation of retail outlets, and a strong focus on enhancing customer experience. ESL is becoming incredibly popular with the European retailers as they are interested in enhancing their in-/store efficiency, minimizing costs, and giving the consumers accurate timely information on the product prices. Some of the prominent market players in Europe and their ongoing innovation and expansion schemes contribute to the growth of the market. The region's business environment, which promotes the use of efficient energy technology ad sustainability, also provides another consideration for the use of electronic shelf labels.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, Tier 3 - 20%

- By Designation- C-level Executives - 50%, Directors - 30%, Others - 20%

- By Region-North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW - 5%

The electronic shelf labels market is dominated by a few globally established players such as VusionGroup (France), SOLUM (South Korea), Pricer (Sweden), Displaydata Ltd. (UK), Teraoka Seiko Co., Ltd. (Japan). The study includes an in-depth competitive analysis of these key players in the electronic shelf labels market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the Home automation system market and forecasts its size by component, product type, communications technology, display size, end-user, region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main region-North America, Asia Pacific, Europe, RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the electronic shelf labels ecosystem.

Key Benefits to Buy the Report:

- Analysis of key Drivers (Growing trend of retail automation, Benefits offered by ESLs, High demand for price optimization from retailers, Electronic shelf labels facilitate reduced labor efforts, Advent of 5G), Restraints (High installation and supporting infrastructure expenses, Lack of suitable infrastructures for wireless technologies), Opportunities (Constantly growing retail sector, Growth in Omni-Channel Retail, Digital disruptions facilitating adoption of advanced retail solutions), Challenges (Low labor costs in developing countries, Growing trend of e-commerce, Low retail margins hindering adoption of advanced retail solutions)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the electronic shelf labels market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Home automation system market across varied countries.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the electronic shelf labels market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and system types of leading players like VusionGroup (France), SOLUM (South Korea), Pricer (Sweden), Displaydata Ltd. (UK), Teraoka Seiko Co., Ltd. (Japan), M2COMM (Taiwan), Opticon (Netherlands), PARTRON ESL (South Korea), Shanghai SUNMI Technology Co., Ltd. (China), Hanshow (China), Dalian Sertag Technology Co., Ltd. (China), among others in the electronic shelf labels market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 List of key primary interview participants

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Keys industry insights

- 2.2 FACTOR ANALYSIS

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.2.3 GROWTH FORECAST ASSUMPTIONS

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR KEY PLAYERS IN ELECTRONIC SHELF LABELS MARKET

- 4.2 ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE

- 4.3 ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY

- 4.4 ELECTRONIC SHELF LABELS MARKET, BY RETAIL STORE TYPE

- 4.5 ELECTRONIC SHELF LABELS MARKET IN EUROPE, BY END USER

- 4.6 ELECTRONIC SHELF LABELS MARKET, BY REGION

- 4.7 ELECTRONIC SHELF LABELS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing trend of retail automation

- 5.2.1.2 Increasing need for dynamic pricing in retail sector

- 5.2.1.3 Need to reduce labor and human errors

- 5.2.1.4 Advent of 5G technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of installation and supporting infrastructure

- 5.2.2.2 Lack of suitable infrastructures for wireless technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of omnichannel sales by retailers

- 5.2.3.2 Expansion of retail sector

- 5.2.3.3 Implementation of advanced retail solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Low labor costs in developing countries

- 5.2.4.2 Growth of e-commerce sector

- 5.2.4.3 Low profit margins hindering adoption of automation technology

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY DISPLAY SIZE, 2023

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION (2020-2023)

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI-powered dynamic pricing solutions

- 5.8.1.2 E-paper displays

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Shelf monitoring software

- 5.8.2.2 Self-scanning solutions

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Endcap shelf edge displays

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA (HS CODE 853120)

- 5.10.2 EXPORT DATA (HS CODE 853120)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 PENGUIN RANDOM HOUSE ADOPTED ELECTRONIC SHELF LABELS TO OPTIMIZE BOOK FAIR LOGISTICS

- 5.12.2 LOSURDOS IMPLEMENTED COMPREHENSIVE DIGITAL TRANSFORMATION SOLUTION TO ENHANCE EFFICIENCY AND CUSTOMER SATISFACTION

- 5.12.3 LOBESHOP.DK ADOPTS DISPLAYDATA LIMITED'S ESL SOLUTION TO ALIGN ONLINE AND OFFLINE PRODUCT PRICES

- 5.12.4 SHOPRITE ADOPTED SOLUM'S ESL TO ENHANCE RETAIL DIGITIZATION

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF DATA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

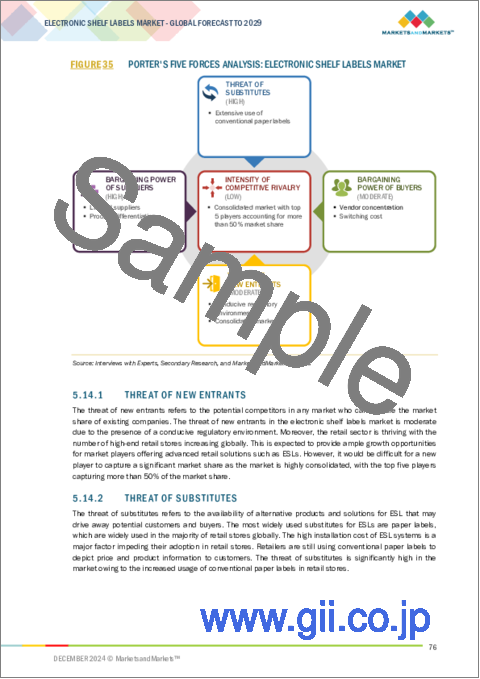

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON ELECTRONIC SHELF LABELS MARKET

6 ELECTRONIC SHELF LABELS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 DISPLAYS

- 6.2.1 GROWING USE OF ELECTRONIC SHELF LABELS IN RETAIL SECTOR TO DRIVE DEMAND FOR DISPLAYS

- 6.3 BATTERIES

- 6.3.1 EASY DEPLOYMENT OF BATTERY-POWERED ELECTRONIC SHELF LABELS TO DRIVE DEMAND

- 6.4 TRANSCEIVERS

- 6.4.1 ABILITY TO ENABLE COMMUNICATION BETWEEN ELECTRONIC SHELF LABELS AND CENTRAL HUB COMPUTERS TO DRIVE MARKET

- 6.5 MICROPROCESSORS

- 6.5.1 NEED TO PROCESS DATA RECEIVED BY TRANSCEIVERS FROM CENTRAL HUBS TO FUEL SEGMENTAL GROWTH

- 6.6 OTHER COMPONENTS

7 ELECTRONIC SHELF LABELS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 LCD

- 7.2.1 MAINTENANCE-FREE AND LOW POWER CONSUMPTION BENEFITS TO DRIVE DEMAND

- 7.3 SEGMENTED E-PAPER DISPLAY

- 7.3.1 NEED FOR EFFORTLESS UPDATES TO BOOST DEMAND

- 7.4 FULLY GRAPHIC E-PAPER DISPLAY

- 7.4.1 GROWING NEED TO DISPLAY GRAPHIC-BASED CONTENT IN TIER I AND TIER II RETAIL STORES TO DRIVE MARKET

8 ELECTRONIC SHELF LABELS MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 NEED FOR AUTOMATED RETAIL PRICING TO DRIVE MARKET GROWTH

- 8.3 SOFTWARE & SERVICES

- 8.3.1 LABEL MANAGEMENT SOFTWARE

- 8.3.1.1 Necessity to streamline pricing updates to boost demand

- 8.3.2 INVENTORY & STOCK MANAGEMENT SOFTWARE

- 8.3.2.1 Demand for optimizing retail operations with ESL fueling growth

- 8.3.1 LABEL MANAGEMENT SOFTWARE

9 ELECTRONIC SHELF LABELS MARKET, BY COMMUNICATION TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 RADIO FREQUENCY

- 9.2.1 HIGH STABILITY AND FULLY AUTOMATED DATA TRANSFER BENEFITS DRIVING DEMAND FOR RF-BASED ESLS

- 9.3 INFRARED

- 9.3.1 ELIMINATES NEED FOR TRANSMITTERS AND RECEIVERS TO BE IN EACH OTHER'S LINE OF SIGHT

- 9.4 NEAR-FIELD COMMUNICATION

- 9.4.1 ABILITY TO CONNECT WITH NFC-BASED END DEVICES TO DRIVE MARKET

- 9.5 OTHER COMMUNICATION TECHNOLOGIES

10 ELECTRONIC SHELF LABELS MARKET, BY DISPLAY SIZE

- 10.1 INTRODUCTION

- 10.2 LESS THAN 3 INCHES

- 10.2.1 INCREASING NEED TO MANAGE SKUS EFFECTIVELY TO DRIVE MARKET

- 10.3 3 TO 7 INCHES

- 10.3.1 STRONG FOCUS OF RETAILERS ON ENHANCING SHOPPING EXPERIENCE TO FOSTER MARKET GROWTH

- 10.4 7 TO 10 INCHES

- 10.4.1 USE OF NFC TECHNOLOGY TO FACILITATE INTEGRATION WITH SMART DEVICES TO DRIVE DEMAND

- 10.5 MORE THAN 10 INCHES

- 10.5.1 GROWING USE IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

11 ELECTRONIC SHELF LABELS MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 RETAIL

- 11.2.1 HYPERMARKETS

- 11.2.1.1 Need for reduced operational costs in hypermarkets to drive demand

- 11.2.2 SUPERMARKETS

- 11.2.2.1 Need for dynamic pricing capabilities to fuel demand

- 11.2.3 NON-FOOD RETAIL STORES

- 11.2.3.1 Ability to offer enhanced management capabilities to propel segmental growth

- 11.2.4 SPECIALTY STORES

- 11.2.4.1 Emphasis on attracting customers to foster increased adoption

- 11.2.5 OTHER RETAIL STORES

- 11.2.1 HYPERMARKETS

- 11.3 INDUSTRIAL

- 11.3.1 OFFERS HIGH EFFICIENCY AND VALUE ADDITION IN CRITICAL INDUSTRIAL PROCESSES

12 ELECTRONIC SHELF LABELS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Consolidation of retail stores to drive demand

- 12.2.3 CANADA

- 12.2.3.1 Growing trend of retail automation to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Increasing number of retail stores to fuel adoption

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 FRANCE

- 12.3.2.1 Presence of leading manufacturers and hypermarkets to propel market

- 12.3.3 UK

- 12.3.3.1 Growing need to reduce labor costs to facilitate increased adoption

- 12.3.4 GERMANY

- 12.3.4.1 Thriving retail and industrial sectors to provide growth opportunities for market players

- 12.3.5 ITALY

- 12.3.5.1 Need for regular price updates and enhanced product promotion to drive market

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Adoption of automated retail solutions by retailers to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Expansion of global retail brands to create growth opportunities for market players

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Favorable regulatory environment to drive market

- 12.4.5 TAIWAN

- 12.4.5.1 Presence of leading market players to fuel market growth

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Rapid urbanization and growth of retail sector to increase adoption

- 12.5.3 MIDDLE EAST & AFRICA

- 12.5.3.1 Expanding retail sector to drive market

- 12.5.3.2 GCC countries

- 12.5.3.3 Rest of Middle East & Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2020-2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Display size footprint

- 13.7.5.4 Product type footprint

- 13.7.5.5 End user footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 VUSIONGROUP

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 PRICER

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SOLUM

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 DISPLAYDATA LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 TERAOKA SEIKO CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 M2COMM

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 OPTICON

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 PARTRON ESL

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 SHANGHAI SUNMI TECHNOLOGY CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 HANSHOW TECHNOLOGY

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.1 VUSIONGROUP

- 14.2 OTHER PLAYERS

- 14.2.1 DALIAN SERTAG TECHNOLOGY CO., LTD.

- 14.2.2 MINEWTAG

- 14.2.3 LABELNEST

- 14.2.4 DIGETY

- 14.2.5 ZKONG NETWORKS

- 14.2.6 TRONITAG GMBH

- 14.2.7 YALATECH

- 14.2.8 SSSIND

- 14.2.9 ALLSEE TECHNOLOGIES LIMITED

- 14.2.10 MOKOSMART

- 14.2.11 FUTURE SHELF

- 14.2.12 HENDERSON TECHNOLOGY

- 14.2.13 ZHSUNYCO

- 14.2.14 NZ ELECTRONIC SHELF LABELLING

- 14.2.15 LANCOM SYSTEMS GMBH

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS