|

|

市場調査レポート

商品コード

1633513

圧電デバイスの世界市場:製品別、材料別、要素別、用途別、地域別 - 2030年までの予測Piezoelectric Devices Market by Product (Sensors, Actuators, Motors, Generators, Transducers, Transformers, and Resonator), Material (Polymer, Crystal, Ceramic, and Composites), Element (Discs, Rings and Plates) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 圧電デバイスの世界市場:製品別、材料別、要素別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年01月07日

発行: MarketsandMarkets

ページ情報: 英文 284 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

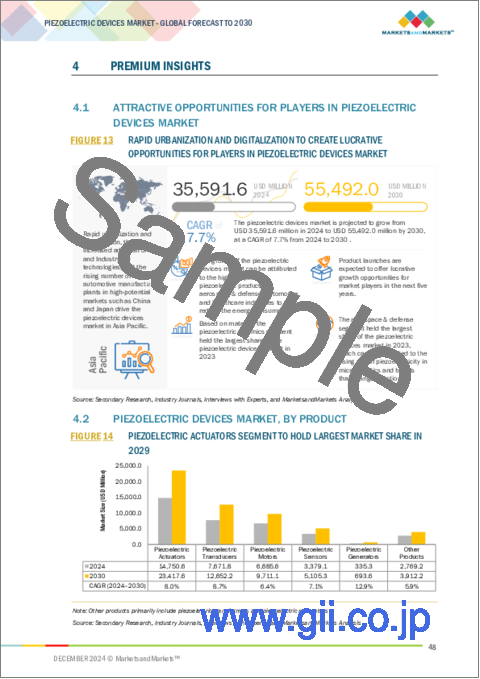

圧電デバイスの市場規模は、2024年の355億9,000万米ドルから成長し、2030年には554億9,000万米ドルに達すると予測されています。

高度な運転補助装置やセンシング技術の採用が増加しているため、2024年から2030年までのCAGRは7.7%で成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 製品別、材料別、要素別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

圧電ナノ材料は、そのユニークな特性により、電子デバイスの性能を向上させ、この市場の最前線にいます。圧電材料は、機械的ストレスによって活性化され、電気エネルギーを生成するもので、ナノエレクトロニクス、スマートセンサー、さらにはエネルギーハーベスターとして有用であることが証明されています。比誘電率が300~20,000のチタン酸ジルコン酸鉛(PZT)ナノ粒子やナノパウダーは、検出器に利用すると素早い応答時間を示します。これらの材料は、低電圧および高電圧で動作する回路に適用でき、優れた機械的および音響的結合を示します。PZTナノ粒子およびナノ粉末は、圧電特性を有する無機強誘電体として、一般に圧電共振器、超音波トランスデューサ、赤外(IR)分光器などに利用されています。PZTナノ粒子は、化学的に不活性で物理的強度が高いため、最も一般的な圧電材料の一つとなっています。PZTナノ粒子は、赤外光電界効果トランジスタ、ラム波デバイス、変調器などの用途に様々な用途があります。PZTナノ粒子は、赤外分光の広い範囲を考慮すると、感知、検出、送信用や焦電型赤外検出器にも使用されます。その卓越した圧電特性、機械特性、調整可能な電気特性により、圧電材料はナノジェネレータ、センサ、アクチュエータ、電子デバイスの用途で採用が増加しています。

自動車、航空宇宙、ヘルスケア、産業オートメーションなどの分野にわたる幅広い用途が圧電トランスデューサの成長に寄与しています。圧電トランスデューサーは、機械エネルギーを電気信号に変換したり、逆に電気信号を電気信号に変換したりする基本的なものであるため、その使用は、超音波イメージング、ソナーシステム、圧力センサー、振動モニタリングなどの分野で非常に重要です。ヘルスケア分野では、圧電トランスデューサーは超音波デバイスに使用され、医療診断や治療分野で広く使用されています。同様に、自動車の圧電トランスデューサーは、パーキングセンサー、エンジンのノックセンス検出、アダプティブクルーズコントロールシステムなどの用途に必要です。航空宇宙分野では、航空機の構造ヘルスモニタリングや振動制御に圧電トランスデューサーが役立っています。さらに、材料技術と小型化の進歩は、圧電トランスデューサの性能と効率をさらに増幅させ、より高い使用を可能にしました。産業やIoT対応システムにおける自動化傾向の高まりは、最も正確で信頼性の高いトランスデューサへの需要をさらに煽る。したがって、圧電デバイスの主要コンポーネントの1つとして、その見通しは依然として強いままです。

"圧電複合材市場は予測期間中、圧電デバイス市場で大きなCAGRを記録する見込み"

当レポートでは、世界の圧電デバイス市場について調査し、製品別、材料別、要素別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 技術分析

- 貿易分析

- 特許分析

- 関税と規制状況

- 2025年の主な会議とイベント

- 価格分析

- 生成AI/AIが圧電デバイス市場に与える影響

第6章 圧電デバイスの動作モード

第7章 圧電デバイス市場(製品別)

- イントロダクション

- 圧電センサー

- 圧電アクチュエータ

- 圧電モーター

- 圧電発電機

- 圧電トランスデューサー

- その他

第8章 圧電デバイス市場(材料別)

- イントロダクション

- 圧電結晶

- 圧電セラミックス

- 圧電ポリマー

- 圧電複合材料

第9章 圧電デバイス市場(要素別)

- イントロダクション

- 圧電ディスク

- 圧電リング

- 圧電プレート

第10章 圧電デバイス市場(用途別)

- イントロダクション

- 航空宇宙・防衛

- 工業・製造

- 自動車

- ヘルスケア

- 情報・通信

- 家電

- その他

第11章 圧電デバイス市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- ブランド比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- CERAMTEC GMBH

- CTS CORPORATION

- KISTLER GROUP

- PHYSIK INSTRUMENTE(PI)SE & CO. KG.

- AEROTECH

- PIEZOSYSTEM JENA

- KEMET CORPORATION

- PIEZO TECHNOLOGIES

- APC INTERNATIONAL, LTD.

- MAD CITY LABS, INC

- その他の企業

- TE CONNECTIVITY

- MIDE TECHNOLOGY CORP.

- OMEGA PIEZO TECHNOLOGIES

- PCB PIEZOTRONICS, INC.

- PIEZOMOTOR

- PIEZOMECHANIK DR. LUTZ PICKELMANN GMBH

- DYTRAN INSTRUMENTS, INC.

- PIEZO SOLUTIONS

- ELPA RESEARCH INSTITUTE

- HOERBIGER MOTION CONTROL GMBH

- CENTRAL ELECTRONICS LIMITED

- HONG KONG PIEZO CO LTD.

- TRS TECHNOLOGIES, INC.

- SPARKLER CERAMICS PVT. LTD.

- PIEZOTECH ARKEMA

- SOLVAY

第14章 付録

List of Tables

- TABLE 1 PIEZOELECTRIC DEVICES MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN PIEZOELECTRIC DEVICES ECOSYSTEM

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 IMPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 LIST OF MAJOR PATENTS, 2021-2023

- TABLE 9 MFN TARIFF FOR HS CODE 854160-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 10 MFN TARIFF FOR HS CODE 854160-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 16 PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 17 PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

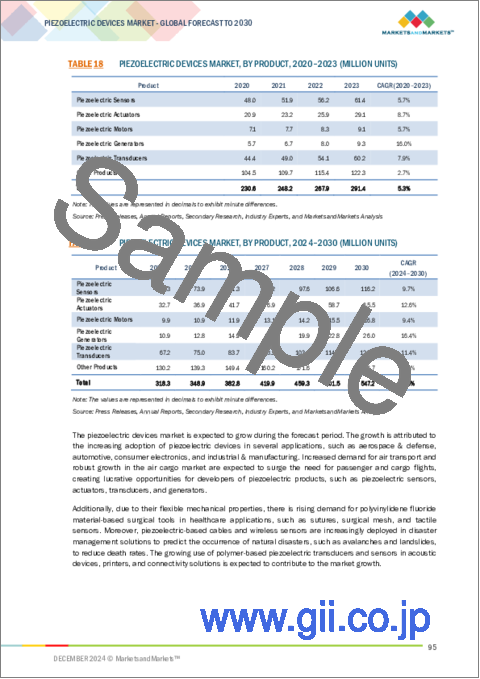

- TABLE 18 PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (MILLION UNITS)

- TABLE 19 PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (MILLION UNITS)

- TABLE 20 PIEZOELECTRIC SENSORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 21 PIEZOELECTRIC SENSORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 22 PIEZOELECTRIC SENSORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 23 PIEZOELECTRIC SENSORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 24 PIEZOELECTRIC SENSORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 25 PIEZOELECTRIC SENSORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 26 PIEZOELECTRIC ACTUATORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 27 PIEZOELECTRIC ACTUATORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 28 PIEZOELECTRIC ACTUATORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 29 PIEZOELECTRIC ACTUATORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 30 PIEZOELECTRIC ACTUATORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 PIEZOELECTRIC ACTUATORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 32 PIEZOELECTRIC MOTORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 33 PIEZOELECTRIC MOTORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 34 PIEZOELECTRIC MOTORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 35 PIEZOELECTRIC MOTORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 36 PIEZOELECTRIC MOTORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 PIEZOELECTRIC MOTORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 38 PIEZOELECTRIC GENERATORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 39 PIEZOELECTRIC GENERATORS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 40 PIEZOELECTRIC GENERATORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 41 PIEZOELECTRIC GENERATORS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 42 PIEZOELECTRIC GENERATORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 PIEZOELECTRIC GENERATORS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 PIEZOELECTRIC TRANSDUCERS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 45 PIEZOELECTRIC TRANSDUCERS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 46 PIEZOELECTRIC TRANSDUCERS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 47 PIEZOELECTRIC TRANSDUCERS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 48 PIEZOELECTRIC TRANSDUCERS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 PIEZOELECTRIC TRANSDUCERS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 50 OTHER PRODUCTS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 51 OTHER PRODUCTS: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 52 OTHER PRODUCTS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 OTHER PRODUCTS: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 54 OTHER PRODUCTS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 OTHER PRODUCTS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 56 PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 57 PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 58 PIEZOELECTRIC CRYSTALS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 59 PIEZOELECTRIC CRYSTALS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 60 PIEZOELECTRIC CRYSTALS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 PIEZOELECTRIC CRYSTALS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 62 PIEZOELECTRIC CERAMICS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 63 PIEZOELECTRIC CERAMICS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 64 PIEZOELECTRIC CERAMICS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 PIEZOELECTRIC CERAMICS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 66 PIEZOELECTRIC POLYMERS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 67 PIEZOELECTRIC POLYMERS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 68 PIEZOELECTRIC POLYMERS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 PIEZOELECTRIC POLYMERS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 70 PIEZOELECTRIC COMPOSITES: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 71 PIEZOELECTRIC COMPOSITES: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 72 PIEZOELECTRIC COMPOSITES: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 PIEZOELECTRIC COMPOSITES: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 74 PIEZOELECTRIC DEVICES MARKET, BY ELEMENT, 2020-2023 (USD MILLION)

- TABLE 75 PIEZOELECTRIC DEVICES MARKET, BY ELEMENT, 2024-2030 (USD MILLION)

- TABLE 76 PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 77 PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 78 AEROSPACE & DEFENSE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 79 AEROSPACE & DEFENSE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 80 AEROSPACE & DEFENSE: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 AEROSPACE & DEFENSE: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 82 INDUSTRIAL & MANUFACTURING: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 83 INDUSTRIAL & MANUFACTURING: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 84 INDUSTRIAL & MANUFACTURING: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 INDUSTRIAL & MANUFACTURING: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 86 AUTOMOTIVE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 87 AUTOMOTIVE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 88 AUTOMOTIVE: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 89 AUTOMOTIVE: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 90 HEALTHCARE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 91 HEALTHCARE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 92 HEALTHCARE: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 HEALTHCARE: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 94 INFORMATION & COMMUNICATION: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 95 INFORMATION & COMMUNICATION: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 96 INFORMATION & COMMUNICATION: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 97 INFORMATION & COMMUNICATION: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 98 CONSUMER ELECTRONICS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 99 CONSUMER ELECTRONICS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 100 CONSUMER ELECTRONICS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 101 CONSUMER ELECTRONICS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 102 OTHER APPLICATIONS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 104 OTHER APPLICATIONS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 105 OTHER APPLICATIONS: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 106 PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 107 PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 116 US: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 117 US: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 118 CANADA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 119 CANADA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 120 MEXICO: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 121 MEXICO: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 122 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 123 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 124 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 125 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 126 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 127 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 128 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 129 EUROPE: PIEZOELECTRIC DEVICES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 130 GERMANY: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 131 GERMANY: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 132 FRANCE: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 133 FRANCE: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 134 UK: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 135 UK: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 136 ITALY: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 137 ITALY: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 139 REST OF EUROPE: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 141 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 145 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 148 JAPAN: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 149 JAPAN: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 150 CHINA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 151 CHINA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 152 INDIA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 153 INDIA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 155 SOUTH KOREA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 158 ROW: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 159 ROW: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 160 ROW: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 161 ROW: PIEZOELECTRIC DEVICES MARKET, BY PRODUCT, 2024-2030 (USD MILLION)

- TABLE 162 ROW: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 163 ROW: PIEZOELECTRIC DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 164 ROW: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 165 ROW: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: PIEZOELECTRIC DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 170 SOUTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 171 SOUTH AMERICA: PIEZOELECTRIC DEVICES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 172 PIEZOELECTRIC DEVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-NOVEMBER 2024

- TABLE 173 PIEZOELECTRIC DEVICES MARKET: DEGREE OF COMPETITION, 2023

- TABLE 174 PIEZOELECTRIC DEVICES MARKET: REGION FOOTPRINT

- TABLE 175 PIEZOELECTRIC DEVICES MARKET: PRODUCT FOOTPRINT

- TABLE 176 PIEZOELECTRIC DEVICES MARKET: MATERIAL FOOTPRINT

- TABLE 177 PIEZOELECTRIC DEVICES MARKET: APPLICATION FOOTPRINT

- TABLE 178 PIEZOELECTRIC DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 PIEZOELECTRIC DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 PIEZOELECTRIC DEVICES MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 181 PIEZOELECTRIC DEVICES MARKET: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 182 CERAMTEC GMBH: COMPANY OVERVIEW

- TABLE 183 CERAMTEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 CERAMTEC GMBH: PRODUCT LAUNCHES

- TABLE 185 CERAMTEC GMBH: DEALS

- TABLE 186 CERAMTEC GMBH: EXPANSIONS

- TABLE 187 CTS CORPORATION: COMPANY OVERVIEW

- TABLE 188 CTS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 CTS CORPORATION: DEALS

- TABLE 190 CTS CORPORATION: OTHER DEVELOPMENTS

- TABLE 191 KISTLER GROUP: COMPANY OVERVIEW

- TABLE 192 KISTLER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 KISTLER GROUP: PRODUCT LAUNCHES

- TABLE 194 KISTLER GROUP: OTHER DEVELOPMENTS

- TABLE 195 PHYSIK INSTRUMENTE (PI) SE & CO. KG.: COMPANY OVERVIEW

- TABLE 196 PHYSIK INSTRUMENTE (PI) SE & CO. KG.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 PHYSIK INSTRUMENTE (PI) SE & CO. KG.: PRODUCT LAUNCHES

- TABLE 198 PHYSIK INSTRUMENTE (PI) SE & CO. KG.: DEALS

- TABLE 199 PHYSIK INSTRUMENTE (PI) SE & CO. KG: EXPANSIONS

- TABLE 200 PHYSIK INSTRUMENTE (PI) SE & CO. KG: OTHER DEVELOPMENTS

- TABLE 201 AEROTECH: COMPANY OVERVIEW

- TABLE 202 AEROTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AEROTECH: PRODUCT LAUNCHES

- TABLE 204 AEROTECH: DEALS

- TABLE 205 PIEZOSYSTEM JENA: COMPANY OVERVIEW

- TABLE 206 PIEZOSYSTEM JENA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 PIEZOSYSTEM JENA: PRODUCT LAUNCHES

- TABLE 208 KEMET CORPORATION: COMPANY OVERVIEW

- TABLE 209 KEMET CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 KEMET CORPORATION: PRODUCT LAUNCHES

- TABLE 211 PIEZO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 212 PIEZO TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 APC INTERNATIONAL, LTD.: COMPANY OVERVIEW

- TABLE 214 APC INTERNATIONAL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 MAD CITY LABS, INC: COMPANY OVERVIEW

- TABLE 216 MAD CITY LABS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 PIEZOELECTRIC DEVICES MARKET SEGMENTATION

- FIGURE 2 PIEZOELECTRIC DEVICES MARKET: RESEARCH DESIGN

- FIGURE 3 PIEZOELECTRIC DEVICES MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 PIEZOELECTRIC DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 5 PIEZOELECTRIC DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 6 PIEZOELECTRIC DEVICES MARKET: DATA TRIANGULATION

- FIGURE 7 PIEZOELECTRIC DEVICES MARKET: RESEARCH ASSUMPTIONS

- FIGURE 8 PIEZOELECTRIC DEVICES MARKET: RESEARCH LIMITATIONS

- FIGURE 9 PIEZOELECTRIC GENERATORS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 PIEZOELECTRIC CERAMICS SEGMENT TO DOMINATE MARKET BETWEEN 2024 AND 2030

- FIGURE 11 HEALTHCARE SEGMENT TO RECORD HIGHEST CAGR FROM 2024 TO 2030

- FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PIEZOELECTRIC DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 13 RAPID URBANIZATION AND DIGITALIZATION TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN PIEZOELECTRIC DEVICES MARKET

- FIGURE 14 PIEZOELECTRIC ACTUATORS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 15 AEROSPACE & DEFENSE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 PIEZOELECTRIC POLYMERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 AEROSPACE & DEFENCE SEGMENT AND CHINA TO HOLD LARGEST SHARES OF PIEZOELECTRIC DEVICES MARKET IN ASIA PACIFIC IN 2024

- FIGURE 18 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL PIEZOELECTRIC DEVICES MARKET FROM 2024 TO 2030

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 PIEZOELECTRIC DEVICES ECOSYSTEM

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 31 IMPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 32 EXPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 34 AVERAGE SELLING PRICE TREND OF PIEZOELECTRIC DEVICES, BY PRODUCT, 2020-2023

- FIGURE 35 AVERAGE SELLING PRICE TREND OF PIEZOELECTRIC DEVICES, BY REGION, 2020-2023

- FIGURE 36 IMPACT OF GEN AI/AI ON PIEZOELECTRIC DEVICES MARKET

- FIGURE 37 DIRECT PIEZOELECTRIC EFFECT

- FIGURE 38 CONVERSE PIEZOELECTRIC EFFECT

- FIGURE 39 PIEZOELECTRIC ACTUATORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 40 PIEZOELECTRIC CERAMICS SEGMENT TO DOMINATE MARKET FOR PIEZOELECTRIC ACTUATORS DURING FORECAST PERIOD

- FIGURE 41 HEALTHCARE SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET FOR PIEZOELECTRIC TRANSDUCERS FROM 2024 TO 2030

- FIGURE 42 PIEZOELECTRIC POLYMERS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2030

- FIGURE 43 PIEZOELECTRIC ACTUATORS SEGMENT TO DOMINATE MARKET FOR PIEZOELECTRIC CERAMICS DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET FOR PIEZOELECTRIC COMPOSITES FROM 2024 TO 2030

- FIGURE 45 PIEZO DISCS SEGMENT TO DOMINATE PIEZOELECTRIC DEVICES MARKET BETWEEN 2024 AND 2030

- FIGURE 46 HEALTHCARE SEGMENT TO RECORD HIGHEST CAGR IN PIEZOELECTRIC DEVICES MARKET BETWEEN 2024 AND 2030

- FIGURE 47 PIEZOELECTRIC ACTUATORS SEGMENT TO CAPTURE LARGEST SHARE OF MARKET FOR AUTOMOTIVE IN 2030

- FIGURE 48 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET FOR CONSUMER ELECTRONICS IN 2030

- FIGURE 49 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA: PIEZOELECTRIC DEVICES MARKET SNAPSHOT

- FIGURE 51 EUROPE: PIEZOELECTRIC DEVICES MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: PIEZOELECTRIC DEVICES MARKET SNAPSHOT

- FIGURE 53 PIEZOELECTRIC DEVICES MARKET: REVENUE ANALYSIS OF TWO KEY PLAYERS, 2021-2023

- FIGURE 54 MARKET SHARE ANALYSIS OF COMPANIES OFFERING PIEZOELECTRIC DEVICES, 2023

- FIGURE 55 COMPANY VALUATION, 2024

- FIGURE 56 FINANCIAL METRICS, 2024

- FIGURE 57 BRAND COMPARISON

- FIGURE 58 PIEZOELECTRIC DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 59 PIEZOELECTRIC DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 60 PIEZOELECTRIC DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 61 CERAMTEC GMBH: COMPANY SNAPSHOT

- FIGURE 62 CTS CORPORATION: COMPANY SNAPSHOT

The Piezoelectric Devices market is projected to grow from USD 35.59 billion in 2024 and is projected to reach USD 55.49 billion by 2030; it is expected to grow at a CAGR of 7.7% from 2024 to 2030 due to rising adoption of advanced driving aids and sensing technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Material, Element, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Growing use of piezoelectric nanomaterials in electronic devices is driving the demand for piezoelectric devices market"

Piezoelectric nanomaterials due their unique properties are at the forefront of this market by enhancing the performance in electronic devices. Piezoelectric materials, that are activated by mechanical stress to produce electrical energy, prove useful in nanoelectronics, smart sensors, and even as energy harvesters. Lead zirconate titanate (PZT) nanoparticles and nanopowder, which have a relative permittivity ranging from 300 to 20,000, exhibit a quick response time when utilized in detectors. These materials can be applied in circuits operating at low and high voltages, and they demonstrate excellent mechanical and acoustic coupling. PZT nanoparticles and nanopowder are generally utilized in piezoelectric resonators, ultrasonic transducers, and infrared (IR) spectroscopy as inorganic ferroelectric agents with piezoelectric properties. Because of their chemical inertness and high physical strength, PZT nanoparticles and nanopowder have become one of the most common piezoelectric materials.PZT Nanoparticles have various uses in applications such as Infrared optical field-effect transistor, Lamb wave devices and modulators. Given the wide range of IR spectroscopy, PZT nanoparticles are also used in sensing, detecting, and transmitting applications and in pyroelectric IR detectors. Due to their exceptional piezoelectric, mechanical, and tunable electric properties, piezoelectric materials adoptions in increasing in applications for nanogenerators, sensors, actuators, and electronic devices.

"Market for piezoelectric transducers product segment is projected to account for second-largest share during the forecast timeline."

Wide applications across sectors such as the automotive, aerospace, healthcare, and industrial automation are contributing to the growth of piezoelectric transducers. Piezoelectric transducers are fundamental in converting mechanical energy into electrical signals and vice versa, so their usage is very crucial in application-based fields such as ultrasonic imaging, sonar systems, pressure sensors, and vibration monitoring. In healthcare sector piezoelectric transducers, are used in ultrasonic devices and are widely used in medical diagnostic and therapeutic areas. Similarly, in the automobile piezoelectric transducers, are necessary for applications like parking sensors, knock sense detection in engines, and adaptive cruise control systems. The aerospace sector benefits from piezoelectric transducers for structural health monitoring and vibration control in aircraft. Additionally, advancements in material technology and miniaturization further amplified the performance and efficiency of piezoelectric transducers, thus allowing higher usage. The increasing trend for automation in industries and IoT-enabled systems further fuels the demand for the most accurate and reliable transducer. Thus, its prospects remain strong as one of the key components of piezoelectric devices.

"Market for piezoelectric composites is expected to register significant CAGR in the piezoelectric device market during the forecast period."

Piezoelectric composites are used in various sectors such as medicine, military, and renewable resources, in the medical field, this composite are majorly used in ultrasound imaging and therapeutic devices due to its acoustic impedance matching and higher sensitivity traditional piezoelectric materials. The defense industry relies on piezoelectric composites for sonar systems and vibration sensing applications, while the renewable energy sector benefits from their use in energy harvesting technologies. Also, the latest trends in piezoelectric composites is the preparation of these materials with two disparate fillers: ceramic and conducting fillers, ceramic and ferromagnetic fillers, and all possible combinations of the former, such as core-shell fillers, for improving performance in fields that include dielectric-based capacitors, batteries, electric devices, and microwave absorbers is set to favor the growth of the market.

"China is expected to account for largest market share in Asia Pacific during the forecast period."

China's industrial growth continues to boom, especially in manufacturing and technological sectors, thereby increasing the demand for piezoelectric devices. It is also one of the world's leading producer of piezoelectric crystals and components, which are necessary for use in sensors and actuators. China's strong presence in industries such as consumer electronics, automotive, healthcare, and industrial automation makes it a significant contributor to the global piezoelectric devices market. China uses large numbers of piezoelectric components such as sensors, actuators, and transducers for smartphone, wearable device, and IoT-enabled system applications. The production of electric vehicles and ADAS adoption in the automotive industry further increases the demand of piezoelectric technology. Meanwhile, China also invest heavily in renewable sources of energy such as wind power and solar energy. This triggers the widespread installation of piezoelectric devices for energy-harvesting and monitoring systems.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the piezoelectric devices marketplace. The break-up of the profile of primary participants in the piezoelectric devices market:

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C Level - 40%, Director Level - 40%, Others-20%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, ROW- 10%

CeramTec GmbH (Germany), CTS Corporation (US), Kistler Group (Switzerland), Physik Instrumente (PI) SE & Co. KG. (US), Aerotech (US), Piezosystem jena (Germany), KEMET Corporation (US), Piezo Technologies (US), APC International, Ltd. (US), Mad City Labs, Inc (US), TE Connectivity (Switzerland), Mide Technology Corp (US), Omega Piezo Technologies (US) , PCB Piezotronics, Inc. (US), and PiezoMotor (Sweden), are some of the key players in the piezoelectric devices market.

The study includes an in-depth competitive analysis of these key players in the piezoelectric devices market, with their company profiles, recent developments, and key market strategies. Research Coverage: This research report categorizes the piezoelectric devices market by product (Sensors, Actuators, Motors, Transducers, Generators, Other products), by material (Crystals, Ceramics, Polymers, Composites), by element (Discs, Rings, Plates), by application (Aerospace & Defense, Industrial & Manufacturing, Automotive, Healthcare, Information & Communication, Consumer Electronics, Other Applications), and by region (North America, Europe, Asia Pacific, and RoW).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the piezoelectric devices market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the piezoelectric devices market have been covered in the report. This report covers a competitive analysis of upcoming startups in the piezoelectric devices market ecosystem.

Reasons to buy this report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall piezoelectric devices market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key benefits of buying the report:

- Analysis of key drivers (Rising adoption of piezoelectric materials to enhance efficiency of aircraft structures, Increasing investment in renewable energy, Escalating adoption of advanced driving aids and sensing technologies, rising adoption in aerospace industry as the aerospace industry, piezoelectric polymers are favored for their high mechanical strength, lightweight nature, easy and fast processing, thermal and chemical stability, and excellent wear resistance.), restraints (High costs of templated grain growth (TGG) ceramics, Limited applications of piezoelectric ceramics, and Stringent government policies restricting use of lead-based piezoelectric materials), opportunities (Growing use of piezoelectric nanomaterials in electronic devices, Rising adoption of piezoelectric polymers in biomedical and surgical applications, Surging deployment of piezoelectric sensors and polymers in healthcare devices, 3D printing of piezoelectric materials) and challenges (Developing alternative materials to PZT ceramic materials with similar properties) influencing the growth of the piezoelectric devices market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the piezoelectric devices market.

- Market Development: Comprehensive information about lucrative markets - the report analysis the piezoelectric devices market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the piezoelectric devices market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading CeramTec GmbH (Germany), CTS Corporation (US), Kistler Group (Switzerland), Physik Instrumente (PI) SE & Co. KG. (US), Aerotech (US), Piezosystem jena (Germany), KEMET Corporation (US), Piezo Technologies (US), APC International, Ltd. (US), Mad City Labs, Inc (US), TE Connectivity (Switzerland), Mide Technology Corp (US), Omega Piezo Technologies (US) , PCB Piezotronics, Inc. (US), and PiezoMotor (Sweden) market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PIEZOELECTRIC DEVICES MARKET

- 4.2 PIEZOELECTRIC DEVICES MARKET, BY PRODUCT

- 4.3 PIEZOELECTRIC DEVICES MARKET, BY APPLICATION

- 4.4 PIEZOELECTRIC DEVICES MARKET, BY MATERIAL

- 4.5 PIEZOELECTRIC DEVICES MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.6 PIEZOELECTRIC DEVICES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of piezoelectric materials to enhance efficiency of aircraft structures

- 5.2.1.2 Increasing investment in renewable energy

- 5.2.1.3 Escalating adoption of advanced driving aids and sensing technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs of templated grain growth (TGG) ceramics

- 5.2.2.2 Limited applications of piezoelectric ceramics

- 5.2.2.3 Stringent government policies restricting use of lead-based piezoelectric materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of piezoelectric nanomaterials in electronic devices

- 5.2.3.2 Rising adoption of piezoelectric polymers in biomedical and surgical applications

- 5.2.3.3 Burgeoning demand for polymer-based piezoelectric sensors and films in aerospace and other industries

- 5.2.3.4 Surging deployment of piezoelectric sensors and polymers in healthcare devices

- 5.2.3.5 Emergence of 3D printing technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Developing alternative materials with properties similar to PZT ceramic materials

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 GERMAN AEROSPACE CENTER ADOPTS KISTLER GROUP'S ADVANCED PIEZOELECTRIC SENSORS TO PERFORM VIBRATION TESTS

- 5.8.2 PI CERAMIC'S PIEZO DISCS, PLATES, AND FOCUS BOWLS IMPROVE SUCCESS IN MINIMALLY INVASIVE AND TREATMENT METHODS

- 5.8.3 ONERA LEVERAGES PIEZOTRONIC ACCELEROMETERS FROM PCB PIEZOTRONICS FOR VIBRATION MEASUREMENTS

- 5.8.4 PIEZO STRAIN SENSORS HELP IMPROVE NOISE IMMUNITY IN GROUND VIBRATION TESTING OF AIRCRAFT

- 5.8.5 SPANISH CLINIC LEVERAGES KISTLER GROUP'S PIEZOELECTRIC FORCE PLATES FOR DIAGNOSTICS AND TREATMENT DEVELOPMENT

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Micro-electro-mechanical systems

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Energy harvesting technologies

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Pyroelectric technologies

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854160)

- 5.11.2 EXPORT SCENARIO (HS CODE 854160)

- 5.12 PATENT ANALYSIS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATIONS

- 5.13.4 STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND OF PIEZOELECTRIC DEVICES, BY PRODUCT, 2020-2023

- 5.15.2 AVERAGE SELLING PRICE TREND OF PIEZOELECTRIC DEVICES, BY REGION, 2020-2023

- 5.16 IMPACT OF GEN AI/AI ON PIEZOELECTRIC DEVICES MARKET

6 MODE OF OPERATION OF PIEZOELECTRIC DEVICES

- 6.1 INTRODUCTION

- 6.2 DIRECT PIEZOELECTRIC EFFECT

- 6.3 CONVERSE PIEZOELECTRIC EFFECT

7 PIEZOELECTRIC DEVICES MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 PIEZOELECTRIC SENSORS

- 7.2.1 INCREASING USE IN PORTABLE CONSUMER DEVICES AND WEARABLES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.3 PIEZOELECTRIC ACTUATORS

- 7.3.1 RISING APPLICATION IN MODERN HIGH-TECH FIELDS TO BOLSTER SEGMENTAL GROWTH

- 7.3.2 STACK ACTUATORS

- 7.3.3 STRIPE ACTUATORS

- 7.3.4 SHEAR ACTUATORS

- 7.3.5 TUBE ACTUATORS

- 7.4 PIEZOELECTRIC MOTORS

- 7.4.1 HIGH EFFICIENCY AND COST-EFFECTIVENESS OVER CONVENTIONAL DC MOTORS TO BOOST SEGMENTAL GROWTH

- 7.5 PIEZOELECTRIC GENERATORS

- 7.5.1 INCREASING USE AS POWER GENERATION SOURCE FOR PORTABLE AND LOW-POWER-CONSUMING DEVICES TO DRIVE MARKET

- 7.5.2 SINGLE-LAYER

- 7.5.3 MULTI-LAYER

- 7.6 PIEZOELECTRIC TRANSDUCERS

- 7.6.1 ROBUST DESIGN AND LOW ENERGY CONSUMPTION ATTRIBUTES TO FOSTER SEGMENTAL GROWTH

- 7.7 OTHER PRODUCTS

8 PIEZOELECTRIC DEVICES MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 PIEZOELECTRIC CRYSTALS

- 8.2.1 USE AS TINY BATTERIES AND TO DETECT HIGH-FREQUENCY ULTRASOUND WAVES TO BOOST SEGMENTAL GROWTH

- 8.3 PIEZOELECTRIC CERAMICS

- 8.3.1 ADOPTION TO CONVERT MECHANICAL COMPRESSION OR TENSION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.3.2 SOFT CERAMICS

- 8.3.3 HARD CERAMICS

- 8.4 PIEZOELECTRIC POLYMERS

- 8.4.1 APPLICATION SCOPE IN MEDICAL SECTOR DUE TO BIOCOMPATIBILITY TO BOOST SEGMENTAL GROWTH

- 8.5 PIEZOELECTRIC COMPOSITES

- 8.5.1 EXTENSIVE USAGE AS FILLERS TO ACCELERATE SEGMENTAL GROWTH

9 PIEZOELECTRIC DEVICES MARKET, BY ELEMENT

- 9.1 INTRODUCTION

- 9.2 PIEZOELECTRIC DISCS

- 9.2.1 HIGH EFFICIENCY AND LOW POWER CONSUMPTION ATTRIBUTES TO ACCELERATE SEGMENTAL GROWTH

- 9.3 PIEZOELECTRIC RINGS

- 9.3.1 ESCALATING ADOPTION IN HEALTHCARE AND ULTRASONIC APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 9.4 PIEZOELECTRIC PLATES

- 9.4.1 INCREASING USE TO MEASURE ACCELERATION, FORCE, PRESSURE, AND STRAIN TO AUGMENT SEGMENTAL GROWTH

10 PIEZOELECTRIC DEVICES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 AEROSPACE & DEFENSE

- 10.2.1 ADOPTION OF PIEZOELECTRIC MATERIALS DUE TO ABILITY TO WITHSTAND VIBRATIONS AND SHOCKS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.3 INDUSTRIAL & MANUFACTURING

- 10.3.1 REQUIREMENT FOR PIEZOELECTRIC SENSORS FOR MATERIAL HANDLING AND SORTING TO BOOST SEGMENTAL GROWTH

- 10.4 AUTOMOTIVE

- 10.4.1 USE OF SENSORS TO DEVELOP SMART AND SAFE VEHICLES TO FUEL SEGMENTAL GROWTH

- 10.5 HEALTHCARE

- 10.5.1 RELIANCE ON ADVANCED TECHNOLOGIES TO DELIVER OPTIMAL CARE TO AUGMENT SEGMENTAL GROWTH

- 10.5.2 IMAGING DEVICES

- 10.5.3 DIAGNOSTIC EQUIPMENT

- 10.5.4 SURGICAL TOOLS

- 10.6 INFORMATION & COMMUNICATION

- 10.6.1 ADOPTION OF PIEZOELECTRIC COMPONENTS IN SONAR APPLICATIONS TO DRIVE MARKET

- 10.7 CONSUMER ELECTRONICS

- 10.7.1 TREND TOWARD MINIATURE DEVICES WITH IMPROVED FUNCTIONALITIES TO BOLSTER SEGMENTAL GROWTH

- 10.7.2 WEARABLE DEVICES

- 10.7.3 ELECTRONIC DEVICES

- 10.8 OTHER APPLICATIONS

11 PIEZOELECTRIC DEVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Thriving consumer electronics and military industries to contribute to market growth

- 11.2.3 CANADA

- 11.2.3.1 Rising initiatives to boost production of lithium battery cells and electric vehicles to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Rapid advances in industrial manufacturing to stimulate market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Rapid technological advances in automotive sector to foster market growth

- 11.3.3 FRANCE

- 11.3.3.1 Increasing motor vehicle production to contribute to market growth

- 11.3.4 UK

- 11.3.4.1 Thriving aerospace & defense industry to boost demand for piezoelectric devices

- 11.3.5 ITALY

- 11.3.5.1 Rising government initiatives to promote energy efficiency to spur market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Rising emphasis on research and development of piezoelectric materials to accelerate market growth

- 11.4.3 CHINA

- 11.4.3.1 Rapid expansion of manufacturing sector to contribute to market growth

- 11.4.4 INDIA

- 11.4.4.1 Increasing funding for industrial manufacturing facilities to augment market growth

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Strong presence of consumer electronics and automobile manufacturers to spur market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Thriving automotive industry to contribute to market growth

- 11.5.2.2 GCC countries

- 11.5.2.3 Africa & Rest of Middle East

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Increasing investment in manufacturing sector to bolster market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Material footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CERAMTEC GMBH

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 CTS CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 KISTLER GROUP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 PHYSIK INSTRUMENTE (PI) SE & CO. KG.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 AEROTECH

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 PIEZOSYSTEM JENA

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.7 KEMET CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 PIEZO TECHNOLOGIES

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 APC INTERNATIONAL, LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 MAD CITY LABS, INC

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.1 CERAMTEC GMBH

- 13.2 OTHER PLAYERS

- 13.2.1 TE CONNECTIVITY

- 13.2.2 MIDE TECHNOLOGY CORP.

- 13.2.3 OMEGA PIEZO TECHNOLOGIES

- 13.2.4 PCB PIEZOTRONICS, INC.

- 13.2.5 PIEZOMOTOR

- 13.2.6 PIEZOMECHANIK DR. LUTZ PICKELMANN GMBH

- 13.2.7 DYTRAN INSTRUMENTS, INC.

- 13.2.8 PIEZO SOLUTIONS

- 13.2.9 ELPA RESEARCH INSTITUTE

- 13.2.10 HOERBIGER MOTION CONTROL GMBH

- 13.2.11 CENTRAL ELECTRONICS LIMITED

- 13.2.12 HONG KONG PIEZO CO LTD.

- 13.2.13 TRS TECHNOLOGIES, INC.

- 13.2.14 SPARKLER CERAMICS PVT. LTD.

- 13.2.15 PIEZOTECH ARKEMA

- 13.2.16 SOLVAY

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS