|

|

市場調査レポート

商品コード

1718905

表面消毒剤の世界市場:組成別、タイプ別、用途別、エンドユーザー別、地域別 - 予測(~2030年)Surface Disinfectant Market by Composition (Alcohols, Chlorine, Quaternary Ammonium, H2O2), Type (Liquid, Wipes, Sprays), Application (Surface Disinfection), End User (Hospitals, Clinics, Diagnostic Laboratories), & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 表面消毒剤の世界市場:組成別、タイプ別、用途別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年04月30日

発行: MarketsandMarkets

ページ情報: 英文 306 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の表面殺菌剤の市場規模は、2025年の30億4,000万米ドルから2030年までに43億8,000万米ドルに達すると予測され、予測期間にCAGRで7.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 組成、タイプ、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

この背景には、除菌への先進の表面消毒剤の採用の増加、外科手術の増加、院内感染を軽減するための感染対策への注目の高まり、医療環境における衛生に対する消費者の意識の高まりなどがあります。しかし、化学消毒剤の使用による潜在的な影響や、代替の表面消毒法の採用の増加などが市場の主な抑制要因となっています。さらに、厳しい規制情勢が市場成長の大きな課題となっています。

表面消毒セグメントが2024年に最大の市場シェアを占めました。

用途別では、表面消毒剤市場は表面消毒、器具消毒、その他の用途に区分されます。表面消毒セグメントが2024年にもっとも大きい市場シェアを占めました。この用途セグメントのシェアが大きいのは、世界中での院内感染の多発と、これらの表面を洗浄するために必要な消毒剤の数量が多いことに起因しています。病棟、手術室、受付、診療所などのエリアにはさまざまな細菌やバクテリアが生息しているため、浴室、壁、家具の消毒が必要となります。これらのエリアは表面積が大きいため、清掃に大量の消毒剤が必要となります。

2022年、WHOは、高所得国の急性期医療患者100人につき、高所得国の患者7人、中低所得国の患者15人が入院中に少なくとも1回はHAIを発症すると報告しました。汚染された表面が病原体の拡散に大きく寄与していることを考慮すると、HAIの増加は、感染の伝播を予防し患者の安全を促進するために、医療において効果的な表面消毒技術を求める声が高まっていることを示しています。

病院・診療所・ASCセグメントが2024年に表面消毒剤市場で最大の市場シェアを占めました。

エンドユーザー別では、表面消毒剤市場は病院・診療所・ASC、診断研究所、製薬・バイオテクノロジー企業、研究所に区分されます。2024年、病院・診療所・ASCが表面消毒剤市場で最大の市場シェアを占めました。このセグメントの大きなシェアは、病院やASCにおけるHAIの高い有病率、消毒に関する厳しい規制、医療費の増加によるものと考えられます。

NIH 2023の論文によると、HAIは米国では全入院患者の3.2%、欧州連合/欧州経済領域では6.5%に影響を及ぼしており、中低所得国では有病率は5.7%~19.2%です。米国疾病予防管理センター(CDC、2022)の推計によると、米国の病院では毎年、HAIが推定170万件の感染と9万件の関連死を引き起こしています。HAIの高い罹患率と、それに伴うすべてのステークホルダーへのコスト負担が、消毒・滅菌サービスなどの感染防止対策を医療機器に採用することを促進しています。

地域別では、欧州が2024年に表面消毒剤の第2位の市場シェアを占めました。

世界の表面消毒剤市場は、北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカの5つの主要地域に区分されます。2024年の欧州の表面消毒剤市場は、2番目に大きい地域市場です。HAIの有病率の上昇、老年人口の増加、滅菌・消毒に対する政府の取り組みの増加、同地域における複数の消毒・滅菌市場企業のプレゼンスの増加が、欧州の表面消毒剤市場の主な促進要因です。欧州の表面消毒剤市場で最大のシェアを占めるのはドイツです。

当レポートでは、世界の表面消毒剤市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 表面消毒剤市場の概要

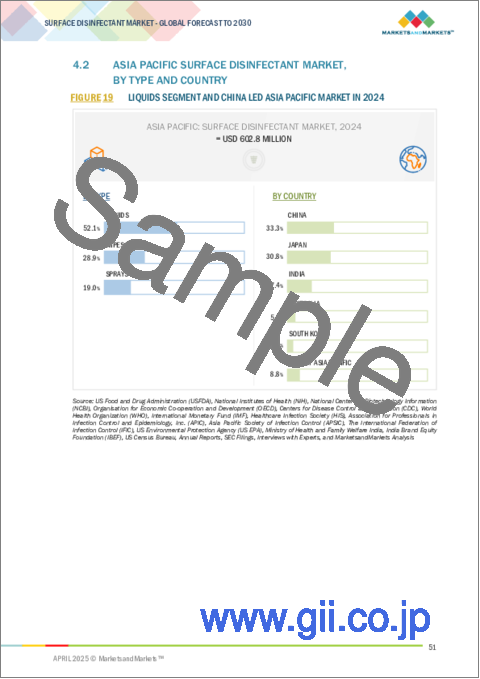

- アジア太平洋の表面消毒剤市場:タイプ別、国別

- 表面消毒剤市場:国別

- 表面消毒剤市場:地域別(2025年・2030年)

- 表面消毒剤市場:新興経済国市場 vs. 先進国市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格の動向:主要企業別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 特許分析

- 貿易分析

- HSコード380894の輸入データ

- HSコード380894の輸出データ

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制管轄権

- 規制分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 表面消毒剤市場に対するAI/生成AIの影響

- イントロダクション

- 表面消毒剤市場におけるAIの市場可能性

- AIユースケース

- 表面消毒剤エコシステムにおける生成AIの未来

第6章 表面消毒剤市場:組成別

- イントロダクション

- アルコール

- 塩素化合物

- 第四級アンモニウム化合物

- 過酸化水素

- 過酢酸

- フェノール化合物

- その他の組成

第7章 表面消毒剤市場:タイプ別

- イントロダクション

- 液体

- ワイプ

- スプレー

第8章 表面消毒剤市場:用途別

- イントロダクション

- 表面消毒

- 器具消毒

- その他の用途

第9章 表面消毒剤市場:エンドユーザー別

- イントロダクション

- 病院・診療所・ASCS

- 診断研究所

- 製薬・バイオテクノロジー企業

- 研究所

第10章 表面消毒剤市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2019年~2023年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- RECKITT BENCKISER

- PROCTER & GAMBLE

- 3M

- THE CLOROX COMPANY

- ECOLAB

- STERIS

- PAUL HARTMANN AG

- SC JOHNSON PROFESSIONAL USA, INC.

- CARROLLCLEAN

- MEDALKAN

- GOJO INDUSTRIES, INC.

- WHITELEY

- SANOSIL AG

- BETCO

- METREX RESEARCH, LLC

- その他の企業

- ACURO ORGANICS LIMITED

- PHARMAX LIMITED

- PDI, INC.

- RUHOF

- CARENOW

- CETYLITE, INC.

- MICRO-SCIENTIFIC, LLC

- PAL INTERNATIONAL

- BRULIN

- KCWW

- AMITY INTERNATIONAL

- WEXFORD LABS, INC.

- DETROX

第13章 付録

List of Tables

- TABLE 1 SURFACE DISINFECTANT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 SURFACE DISINFECTANT MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 3 SURFACE DISINFECTANT MARKET: PARAMETRIC ASSUMPTIONS

- TABLE 4 SURFACE DISINFECTANT MARKET: RISK ASSESSMENT

- TABLE 5 AVERAGE SELLING PRICE TREND OF SURFACE DISINFECTANTS (LIQUIDS), BY KEY PLAYER, 2022-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF SURFACE DISINFECTANTS, BY REGION, 2022-2024 (USD)

- TABLE 7 SURFACE DISINFECTANT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 SURFACE DISINFECTANT MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023-2024

- TABLE 9 IMPORT DATA FOR HS CODE 380894, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 380894, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 SURFACE DISINFECTANT MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 FDA- AND EPA-REGISTERED PRODUCT CATEGORIES

- TABLE 18 SURFACE DISINFECTANT MARKET: PORTER'S FIVE FORCES

- TABLE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 20 KEY BUYING CRITERIA FOR MAJOR END USERS

- TABLE 21 SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 22 ALCOHOL-BASED DISINFECTANTS OFFERED BY MARKET PLAYERS

- TABLE 23 SURFACE DISINFECTANT MARKET FOR ALCOHOLS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR ALCOHOLS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 25 EUROPE: SURFACE DISINFECTANT MARKET FOR ALCOHOLS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 26 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR ALCOHOLS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 27 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR ALCOHOLS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 28 SURFACE DISINFECTANT MARKET FOR CHLORINE COMPOUNDS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR CHLORINE COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 30 EUROPE: SURFACE DISINFECTANT MARKET FOR CHLORINE COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR CHLORINE COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 32 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR CHLORINE COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 33 QUATERNARY AMMONIUM COMPOUNDS OFFERED BY MARKET PLAYERS

- TABLE 34 SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUNDS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 36 EUROPE: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 38 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 39 SURFACE DISINFECTANT MARKET FOR HYDROGEN PEROXIDE, BY REGION, 2022-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR HYDROGEN PEROXIDE, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 41 EUROPE: SURFACE DISINFECTANT MARKET FOR HYDROGEN PEROXIDE, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR HYDROGEN PEROXIDE, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 43 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR HYDROGEN PEROXIDE, BY COUNTRY, 2022-2030 (USD MILLION)

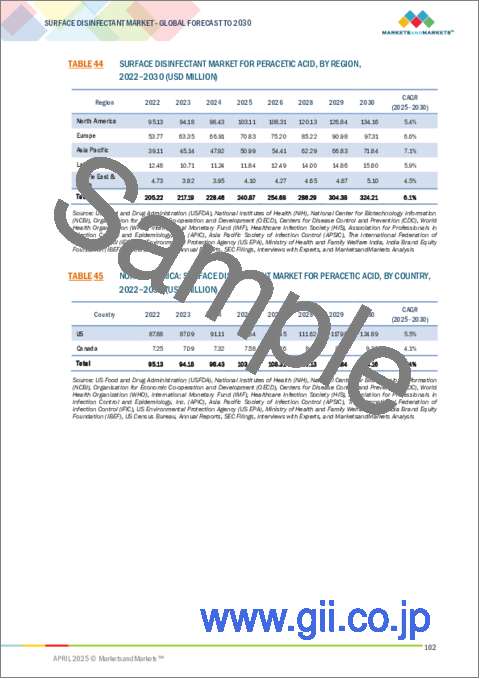

- TABLE 44 SURFACE DISINFECTANT MARKET FOR PERACETIC ACID, BY REGION, 2022-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR PERACETIC ACID, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 46 EUROPE: SURFACE DISINFECTANT MARKET FOR PERACETIC ACID, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR PERACETIC ACID, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 48 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR PERACETIC ACID, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 49 SURFACE DISINFECTANT MARKET FOR PHENOLIC COMPOUNDS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR PHENOLIC COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 51 EUROPE: SURFACE DISINFECTANT MARKET FOR PHENOLIC COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR PHENOLIC COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR PHENOLIC COMPOUNDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 54 SURFACE DISINFECTANT MARKET FOR OTHER COMPOSITIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR OTHER COMPOSITIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 56 EUROPE: SURFACE DISINFECTANT MARKET FOR OTHER COMPOSITIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR OTHER COMPOSITIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 58 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR OTHER COMPOSITIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 59 SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 60 DISINFECTANT LIQUIDS OFFERED BY MARKET PLAYERS

- TABLE 61 SURFACE DISINFECTANT MARKET FOR LIQUIDS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR LIQUIDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 63 EUROPE: SURFACE DISINFECTANT MARKET FOR LIQUIDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR LIQUIDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 65 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR LIQUIDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 66 DISINFECTANT WIPES OFFERED BY MARKET PLAYERS

- TABLE 67 PRODUCTION OF DISINFECTING WIPES/DAY, 2022-2030 (MILLION UNITS)

- TABLE 68 SURFACE DISINFECTANT MARKET FOR WIPES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 70 EUROPE: SURFACE DISINFECTANT MARKET FOR WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 72 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 73 SURFACE DISINFECTANT MARKET FOR WIPES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 74 SURFACE DISINFECTANT MARKET FOR ALCOHOL-BASED WIPES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR ALCOHOL-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 76 EUROPE: SURFACE DISINFECTANT MARKET FOR ALCOHOL-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR ALCOHOL-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 78 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR ALCOHOL-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 79 SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUND-BASED WIPES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUND-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 81 EUROPE: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUND-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUND-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 83 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR QUATERNARY AMMONIUM COMPOUND-BASED WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 84 GERMICIDAL WIPES OFFERED BY MARKET PLAYERS

- TABLE 85 SURFACE DISINFECTANT MARKET FOR OTHER WIPES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR OTHER WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 87 EUROPE: SURFACE DISINFECTANT MARKET FOR OTHER WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR OTHER WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 89 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR OTHER WIPES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 90 DISINFECTANT SPRAYS OFFERED BY MARKET PLAYERS

- TABLE 91 SURFACE DISINFECTANT MARKET FOR SPRAYS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR SPRAYS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 93 EUROPE: SURFACE DISINFECTANT MARKET FOR SPRAYS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR SPRAYS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 95 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR SPRAYS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 96 SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 97 SURFACE DISINFECTANTS OFFERED BY KEY MARKET PLAYERS

- TABLE 98 SURFACE DISINFECTION MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: SURFACE DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 100 EUROPE: SURFACE DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SURFACE DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: SURFACE DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 103 INSTRUMENT DISINFECTANTS OFFERED BY KEY MARKET PLAYERS

- TABLE 104 INSTRUMENT DISINFECTION MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: INSTRUMENT DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 106 EUROPE: INSTRUMENT DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: INSTRUMENT DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: INSTRUMENT DISINFECTION MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 109 SURFACE DISINFECTANT MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 111 EUROPE: SURFACE DISINFECTANT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 113 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 114 SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 115 SURFACE DISINFECTANT MARKET FOR HOSPITALS, CLINICS, AND ASCS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR HOSPITALS, CLINICS, AND ASCS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 117 EUROPE: SURFACE DISINFECTANT MARKET FOR HOSPITALS, CLINICS, AND ASCS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR HOSPITALS, CLINICS, AND ASCS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 119 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR HOSPITALS, CLINICS, AND ASCS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 120 SURFACE DISINFECTANT MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 122 EUROPE: SURFACE DISINFECTANT MARKET FOR DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 124 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 125 SURFACE DISINFECTANT MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 127 EUROPE: SURFACE DISINFECTANT MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 129 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 130 SURFACE DISINFECTANT MARKET FOR RESEARCH LABORATORIES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: SURFACE DISINFECTANT MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 132 EUROPE: SURFACE DISINFECTANT MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SURFACE DISINFECTANT MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: SURFACE DISINFECTANT MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 135 SURFACE DISINFECTANT MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 137 NORTH AMERICA: SURFACE DISINFECTANT MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 143 US: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 144 US: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 145 US: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 146 US: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 147 US: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 148 CANADA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 149 CANADA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 150 CANADA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 151 CANADA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 152 CANADA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 153 EUROPEAN: KEY MACROECONOMIC INDICATORS

- TABLE 154 EUROPE: SURFACE DISINFECTANT MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 155 EUROPE: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 156 EUROPE: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 157 EUROPE: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 158 EUROPE: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 159 EUROPE: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 160 GERMANY: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 161 GERMANY: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 162 GERMANY: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 163 GERMANY: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 164 GERMANY: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 165 FRANCE: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 166 FRANCE: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 167 FRANCE: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 168 FRANCE: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 169 FRANCE: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 170 UK: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 171 UK: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 172 UK: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 173 UK: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 174 UK: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 175 ITALY: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 176 ITALY: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 177 ITALY: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 178 ITALY: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 179 ITALY: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 180 SPAIN: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 181 SPAIN: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 182 SPAIN: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 183 SPAIN: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 184 SPAIN: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 186 REST OF EUROPE: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 187 REST OF EUROPE: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 188 REST OF EUROPE: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 189 REST OF EUROPE: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 191 ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 197 CHINA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 198 CHINA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 199 CHINA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 200 CHINA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 201 CHINA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 202 JAPAN: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 203 JAPAN: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 204 JAPAN: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 205 JAPAN: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 206 JAPAN: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 207 INDIA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 208 INDIA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 209 INDIA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 210 INDIA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 211 INDIA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 212 AUSTRALIA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 213 AUSTRALIA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 214 AUSTRALIA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 215 AUSTRALIA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 216 AUSTRALIA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 217 SOUTH KOREA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 218 SOUTH KOREA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 219 SOUTH KOREA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 220 SOUTH KOREA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 221 SOUTH KOREA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 227 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 228 LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 234 BRAZIL: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 235 BRAZIL: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 236 BRAZIL: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 237 BRAZIL: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 238 BRAZIL: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 239 MEXICO: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 240 MEXICO: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 241 MEXICO: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 242 MEXICO: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 243 MEXICO: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 245 REST OF LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 247 REST OF LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 248 REST OF LATIN AMERICA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 250 MIDDLE EAST & AFRICA: SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2022-2030 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: SURFACE DISINFECTANT MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: SURFACE DISINFECTANT MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: SURFACE DISINFECTANT MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 255 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURFACE DISINFECTANT MARKET

- TABLE 256 SURFACE DISINFECTANT MARKET: DEGREE OF COMPETITION

- TABLE 257 SURFACE DISINFECTANT MARKET: REGION FOOTPRINT

- TABLE 258 SURFACE DISINFECTANT MARKET: TYPE FOOTPRINT

- TABLE 259 SURFACE DISINFECTANT MARKET: APPLICATION FOOTPRINT

- TABLE 260 SURFACE DISINFECTANT MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 261 SURFACE DISINFECTANT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 262 SURFACE DISINFECTANT MARKET: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 263 SURFACE DISINFECTANT MARKET: DEALS, JANUARY 2022-FEBRUARY 2025

- TABLE 264 SURFACE DISINFECTANT MARKET: EXPANSIONS, JANUARY 2022-FEBRUARY 2025

- TABLE 265 SURFACE DISINFECTANT MARKET: OTHER DEVELOPMENTS, JANUARY 2022-FEBRUARY 2025

- TABLE 266 RECKITT BENCKISER: COMPANY OVERVIEW

- TABLE 267 EXCHANGE RATES USED FOR CONVERSION OF EUROS TO USD, DECEMBER 2022-DECEMBER 2024

- TABLE 268 RECKITT BENCKISER: PRODUCTS OFFERED

- TABLE 269 RECKITT BENCKISER: DEALS, JANUARY 2022-FEBRUARY 2025

- TABLE 270 RECKITT BENCKISER: EXPANSIONS, JANUARY 2022-FEBRUARY 2025

- TABLE 271 PROCTER & GAMBLE: COMPANY OVERVIEW

- TABLE 272 PROCTER & GAMBLE: PRODUCTS OFFERED

- TABLE 273 3M: COMPANY OVERVIEW

- TABLE 274 3M: PRODUCTS OFFERED

- TABLE 275 THE CLOROX COMPANY: COMPANY OVERVIEW

- TABLE 276 THE CLOROX COMPANY: PRODUCTS OFFERED

- TABLE 277 THE CLOROX COMPANY: DEALS, JANUARY 2022-FEBRUARY 2025

- TABLE 278 ECOLAB: COMPANY OVERVIEW

- TABLE 279 ECOLAB: PRODUCTS OFFERED

- TABLE 280 STERIS: COMPANY OVERVIEW

- TABLE 281 STERIS: PRODUCTS OFFERED

- TABLE 282 PAUL HARTMANN AG: COMPANY OVERVIEW

- TABLE 283 PAUL HARTMANN AG: PRODUCTS OFFERED

- TABLE 284 PAUL HARTMANN AG: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 285 SC JOHNSON PROFESSIONAL USA, INC.: COMPANY OVERVIEW

- TABLE 286 SC JOHNSON PROFESSIONAL USA, INC.: PRODUCTS OFFERED

- TABLE 287 SC JOHNSON PROFESSIONAL USA, INC.: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 288 CARROLLCLEAN: COMPANY OVERVIEW

- TABLE 289 CARROLLCLEAN: PRODUCTS OFFERED

- TABLE 290 MEDALKAN: COMPANY OVERVIEW

- TABLE 291 MEDALKAN: PRODUCTS OFFERED

- TABLE 292 MEDALKAN: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 293 GOJO INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 294 GOJO INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 295 GOJO INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2022-FEBRUARY 2025

- TABLE 296 WHITELEY: COMPANY OVERVIEW

- TABLE 297 WHITELEY: PRODUCTS OFFERED

- TABLE 298 WHITELEY: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2024

- TABLE 299 SANOSIL AG: COMPANY OVERVIEW

- TABLE 300 SANOSIL AG: PRODUCTS OFFERED

- TABLE 301 BETCO: COMPANY OVERVIEW

- TABLE 302 BETCO: PRODUCTS OFFERED

- TABLE 303 METREX RESEARCH, LLC: COMPANY OVERVIEW

- TABLE 304 METREX RESEARCH, LLC: PRODUCTS OFFERED

- TABLE 305 ACURO ORGANICS LIMITED: COMPANY OVERVIEW

- TABLE 306 PHARMAX LIMITED: COMPANY OVERVIEW

- TABLE 307 PDI, INC.: COMPANY OVERVIEW

- TABLE 308 RUHOF: COMPANY OVERVIEW

- TABLE 309 CARENOW: COMPANY OVERVIEW

- TABLE 310 CETYLITE, INC.: COMPANY OVERVIEW

- TABLE 311 MICRO-SCIENTIFIC, LLC: COMPANY OVERVIEW

- TABLE 312 PAL INTERNATIONAL: COMPANY OVERVIEW

- TABLE 313 BRULIN: COMPANY OVERVIEW

- TABLE 314 KCWW: COMPANY OVERVIEW

- TABLE 315 AMITY INTERNATIONAL: COMPANY OVERVIEW

- TABLE 316 WEXFORD LABS, INC.: COMPANY OVERVIEW

- TABLE 317 DETROX: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SURFACE DISINFECTANT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SURFACE DISINFECTANT MARKET: RESEARCH DESIGN

- FIGURE 3 SURFACE DISINFECTANT MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 SURFACE DISINFECTANT MARKET: KEY PRIMARY SOURCES

- FIGURE 5 SURFACE DISINFECTANT MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 SURFACE DISINFECTANT MARKET: REVENUE SHARE ANALYSIS

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 SURFACE DISINFECTANT MARKET: TOP-DOWN APPROACH

- FIGURE 11 SURFACE DISINFECTANT MARKET: DATA TRIANGULATION

- FIGURE 12 SURFACE DISINFECTANT MARKET, BY COMPOSITION, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 SURFACE DISINFECTANT MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 SURFACE DISINFECTANT MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 SURFACE DISINFECTANT MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF SURFACE DISINFECTANT MARKET

- FIGURE 18 RISING PREVALENCE OF HEALTHCARE-ASSOCIATED INFECTIONS TO DRIVE MARKET

- FIGURE 19 LIQUIDS SEGMENT AND CHINA LED ASIA PACIFIC MARKET IN 2024

- FIGURE 20 CHINA TO RECORD HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 21 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 23 SURFACE DISINFECTANT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 SURFACE DISINFECTANT MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF SURFACE DISINFECTANTS (LIQUIDS), BY KEY PLAYER, 2022-2024 (USD)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SURFACE DISINFECTANTS (LIQUIDS), BY REGION, 2022-2024 (USD)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SURFACE DISINFECTANTS (WIPES), BY REGION, 2022-2024 (USD)

- FIGURE 28 SURFACE DISINFECTANT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 SURFACE DISINFECTANT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 SURFACE DISINFECTANT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 32 SURFACE DISINFECTANT MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 33 SURFACE DISINFECTANT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 35 KEY BUYING CRITERIA FOR MAJOR END USERS

- FIGURE 36 AI USE CASES

- FIGURE 37 NORTH AMERICA: SURFACE DISINFECTANT MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: SURFACE DISINFECTANT MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN SURFACE DISINFECTANT MARKET, 2019-2023

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SURFACE DISINFECTANT MARKET, 2024

- FIGURE 41 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 42 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 43 SURFACE DISINFECTANT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 SURFACE DISINFECTANT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 SURFACE DISINFECTANT MARKET: COMPANY FOOTPRINT

- FIGURE 46 SURFACE DISINFECTANT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 RECKITT BENCKISER: COMPANY SNAPSHOT (2024)

- FIGURE 48 PROCTER & GAMBLE: COMPANY SNAPSHOT (2024)

- FIGURE 49 3M: COMPANY SNAPSHOT (2024)

- FIGURE 50 THE CLOROX COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 51 ECOLAB: COMPANY SNAPSHOT (2024)

- FIGURE 52 STERIS: COMPANY SNAPSHOT (2024)

- FIGURE 53 PAUL HARTMANN AG: COMPANY SNAPSHOT (2024)

The global surface disinfectant market is projected to reach USD 4.38 billion by 2030 from USD 3.04 billion in 2025, at a CAGR of 7.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Composition, Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

This is due to the rising adoption of advanced surface disinfectants for sanitization, increasing surgical procedures, growing focus on infection control measures to mitigate hospital-acquired infections, and increasing consumer awareness of hygiene in healthcare settings. However, the potential consequences of chemical disinfectant use and the increasing adoption of alternative surface disinfection methods are the major restraints to the market. Additionally, the strict regulatory requirement landscape is a major challenge for market growth.

The surface disinfection segment accounted for the largest market share in 2024.

Based on application, the surface disinfectant market is segmented into surface disinfection, instrument disinfection, and other applications. The surface disinfection segment accounted for the larges market share in 2024. The large share of this application segment can be attributed to the high prevalence of hospital-acquired infections across the globe and the higher volume of disinfectants required to clean these surfaces. Areas such as hospital wards, operation theaters, reception areas, and clinics are home to a wide range of germs and bacteria, necessitating disinfecting bathrooms, walls, and furniture. These areas possess large surface areas and, therefore, need a highly large quantity of disinfectants for their cleaning.

In 2022, the WHO reported that for every 100 acute care patients in high-income countries, seven high-income-country patients and 15 low- and middle-income-country patients will develop at least one HAI while in hospital. Considering the key contribution of contaminated surfaces to pathogen spread, increasing HAIs represent a growing call for effective surface disinfection techniques within healthcare to prevent infection transmission and promote patient safety.

The hospitals, clinics, and ASCs segment accounted for the largest market share in 2024 in the surface disinfectant market.

Based on end user, the surface disinfectant market is segmented into hospitals, clinics, and ASCs, diagnostic laboratories, pharmaceutical & biotechnology companies, and research laboratories. In 2024, the hospitals, clinics, and ASCs accounted for the largest market share in the surface disinfectant market. The large share of this segment can be attributed to the high prevalence of HAIs in hospitals and ASCs, stringent regulations for disinfection, and rising healthcare expenditure.

According to an article in NIH 2023, HAIs affect 3.2% of all hospitalized patients in the US and 6.5% in the European Union/European Economic Area, while in low- and middle-income countries, the prevalence rate ranges between 5.7% and 19.2%. The Centers for Disease Control and Prevention (CDC, 2022) estimated that in American hospitals, HAIs account for an estimated 1.7 million infections and 90,000 associated deaths each year. The high incidence of HAIs and the resulting cost burden on all the stakeholders have driven the adoption of infection prevention measures, such as disinfection and sterilization services, for their use in medical devices.

Europe accounted for the second-largest share of the surface disinfectant market by region in 2024.

The global surface disinfectant market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The surface disinfectant market in Europe in 2024 is the second-largest regional market. The rising prevalence of HAIs, the growing geriatric population, the increasing number of government initiatives for sterilization and disinfection, and the increasing presence of several disinfection and sterilization market players in the region are the major factors driving the surface disinfectant market in Europe. Germany accounted for the largest share of the surface disinfectant market in Europe.

The rapidly growing aging population, the increasing demand for healthcare services, the rising number of advancements in medical sciences, and rising life expectancies are also expected to result in an increasing number of surgical procedures performed yearly. According to the UN Population Division, Germany's population aged 65 and above is expected to rise by 41% to around 24 million by 2050, accounting for around 30% of the total population. This, in turn, will increase the number of spinal, orthopedic, and cardiovascular procedures performed, thereby driving the growth of HAIs and increasing the demand for surface disinfectants in Germany.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 40%, Tier 2- 30%, and Tier 3- 30%

- By Designation: C Level- 27%, Director Level- 18% and Others- 55%

- By Region: North America- 35%, Europe- 30%, Asia Pacific- 22%, Latin America- 10%, and Middle East & Africa- 3%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the surface disinfectant market are Reckitt Benckiser (UK), Procter & Gamble (US), 3M (US), Ecolab (US), The Clorox Company (US), STERIS (US), SC Johnson Professional USA, Inc. (US), CarrollCLEAN (US), Paul Hartmann AG (Germany), Medalkan (Greece), GOJO Industries, Inc. (US), Whiteley (Australia), Sanosil AG (Switzerland), Betco (US), Metrex Research, LLC. (US), KCWW (US), Acuro Organics Limited (India), Pharmax Limited (Canada), PDI, Inc. (US), CARENOW (India), Cetylite, Inc. (US), Micro-Scientific, LLC (US), Pal International (UK), Brulin (US), Amity International (UK), Wexford Labs, Inc. (US), Detrox (Turkiye), and Ruhof (US).

Research Coverage

This report studies the surface disinfectant market based on composition, type, application, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of Key drivers (Growing focus on mitigating hospital-acquired infections, rising adoption of advanced surface disinfectants for sanitization, growing consumer awareness of hygiene in healthcare settings, and increasing surgical procedures), restraints (Potential consequences of chemical disinfectant use, increasing adoption of alternative surface disinfection methods), challenge (Strict regulatory requirements), opportunity (Rising healthcare expenditures in emerging economies, shift toward eco-friendly & non-toxic disinfectants, increasing presence of medical device and pharmaceutical companies in developing countries)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the surface disinfectant market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the surface disinfectant market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the surface disinfectant market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources for secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.1.1 Presentations of companies and primary interviews

- 2.2.1.1.2 Primary interviews

- 2.2.1.1 Company revenue estimation approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURFACE DISINFECTANT MARKET OVERVIEW

- 4.2 ASIA PACIFIC SURFACE DISINFECTANT MARKET, BY TYPE AND COUNTRY

- 4.3 SURFACE DISINFECTANT MARKET, BY COUNTRY

- 4.4 SURFACE DISINFECTANT MARKET, REGIONAL MIX, 2025 VS. 2030

- 4.5 SURFACE DISINFECTANT MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus on mitigating hospital-acquired infections

- 5.2.1.2 Rising adoption of advanced surface disinfectants for sanitization

- 5.2.1.3 Growing consumer awareness of hygiene in healthcare settings

- 5.2.1.4 Increasing surgical procedures worldwide

- 5.2.2 RESTRAINTS

- 5.2.2.1 Potential consequences of chemical disinfectant use

- 5.2.2.2 Increasing adoption of alternative surface disinfection methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising healthcare expenditure in emerging economies

- 5.2.3.2 Shift toward eco-friendly and non-toxic disinfectants

- 5.2.3.3 Increasing presence of medical device and pharmaceutical companies in developing countries

- 5.2.4 CHALLENGES

- 5.2.4.1 Strict regulatory requirements

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Surface disinfection

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 UV disinfection

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 380894

- 5.11.2 EXPORT DATA FOR HS CODE 380894

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY JURISDICTION

- 5.13.3 REGULATORY ANALYSIS

- 5.13.3.1 North America

- 5.13.3.1.1 US

- 5.13.3.1.2 Canada

- 5.13.3.2 Europe

- 5.13.3.3 Asia Pacific

- 5.13.3.3.1 Japan

- 5.13.3.3.2 India

- 5.13.3.3.3 China

- 5.13.3.4 Latin America

- 5.13.3.4.1 Brazil

- 5.13.3.4.2 Mexico

- 5.13.3.5 Middle East

- 5.13.3.6 Africa

- 5.13.3.1 North America

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF BUYERS

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON SURFACE DISINFECTANT MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI IN SURFACE DISINFECTANT MARKET

- 5.16.3 AI USE CASES

- 5.16.4 FUTURE OF GENERATIVE AI IN SURFACE DISINFECTANT ECOSYSTEM

6 SURFACE DISINFECTANT MARKET, BY COMPOSITION

- 6.1 INTRODUCTION

- 6.2 ALCOHOLS

- 6.2.1 INCREASING DEMAND FOR DOMESTIC AND HOSPITAL-GRADE DISINFECTANTS TO SUSTAIN GROWTH

- 6.3 CHLORINE COMPOUNDS

- 6.3.1 MINIMAL ENVIRONMENTAL HAZARDS TO AMPLIFY GROWTH

- 6.4 QUATERNARY AMMONIUM COMPOUNDS

- 6.4.1 ENHANCED RESIDUAL ACTIVITY AND BROAD-SPECTRUM EFFICACY TO STIMULATE GROWTH

- 6.5 HYDROGEN PEROXIDE

- 6.5.1 LOW TOXICITY AND STRONG OXIDIZING PROPERTIES TO SUPPORT GROWTH

- 6.6 PERACETIC ACID

- 6.6.1 WIDE USE AS DISINFECTANT, SANITIZER, BLEACH, STERILANT, INDUSTRIAL REAGENT, OXIDIZER, AND POLYMERIZATION CATALYST TO DRIVE MARKET

- 6.7 PHENOLIC COMPOUNDS

- 6.7.1 RISING FOCUS ON LONG-LASTING INFECTION CONTROL TO FACILITATE GROWTH

- 6.8 OTHER COMPOSITIONS

7 SURFACE DISINFECTANT MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 LIQUIDS

- 7.2.1 COST-EFFECTIVENESS AND HIGH EFFICACY TO ENCOURAGE GROWTH

- 7.3 WIPES

- 7.3.1 ALCOHOL-BASED WIPES

- 7.3.1.1 Stringent infection prevention protocols to contribute to growth

- 7.3.2 QUATERNARY AMMONIUM COMPOUND-BASED WIPES

- 7.3.2.1 Need for efficient, ready-to-use disinfection solutions in medical environment to expedite growth

- 7.3.3 OTHER WIPES

- 7.3.1 ALCOHOL-BASED WIPES

- 7.4 SPRAYS

- 7.4.1 GROWING USE OF SPRAYS IN FOGGING TECHNIQUES TO FUEL MARKET

8 SURFACE DISINFECTANT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 SURFACE DISINFECTION

- 8.2.1 INCREASING PREVALENCE OF HEALTHCARE-ASSOCIATED INFECTIONS TO AUGMENT GROWTH

- 8.3 INSTRUMENT DISINFECTION

- 8.3.1 GROWING USE OF MEDICAL DEVICES IN HOSPITALS AND LABORATORIES TO DRIVE MARKET

- 8.4 OTHER APPLICATIONS

9 SURFACE DISINFECTANT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS, CLINICS, AND ASCS

- 9.2.1 GROWING FOCUS ON HOSPITAL HYGIENE TO BOOST MARKET

- 9.3 DIAGNOSTIC LABORATORIES

- 9.3.1 NEED TO ENSURE COMPLIANCE WITH SAFETY AND REGULATORY STANDARDS TO AID GROWTH

- 9.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.4.1 INCREASING FUNDING AND INVESTMENT ACTIVITIES IN PHARMA AND BIOTECH SECTOR TO PROMOTE GROWTH

- 9.5 RESEARCH LABORATORIES

- 9.5.1 GROWING EMPHASIS ON STERILE AND CONTROLLED RESEARCH LABORATORY ENVIRONMENTS TO FUEL MARKET

10 SURFACE DISINFECTANT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rapid growth in geriatric population to encourage growth

- 10.2.3 CANADA

- 10.2.3.1 High prevalence of healthcare-associated infections to aid growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 High prevalence of HAIs in hospitals and ICUs to support market growth

- 10.3.3 FRANCE

- 10.3.3.1 Favorable insurance and infection control policies to accelerate growth

- 10.3.4 UK

- 10.3.4.1 Increasing funding for clinical trials to amplify growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing geriatric population to favor growth

- 10.3.6 SPAIN

- 10.3.6.1 Growing prevalence of diabetes to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Changing lifestyles and prevalence of obesity to bolster growth

- 10.4.3 JAPAN

- 10.4.3.1 Universal healthcare coverage to contribute to growth

- 10.4.4 INDIA

- 10.4.4.1 Expanding acute care settings to fuel market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Growing rate of chronic diseases to boost market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing focus on improving healthcare infrastructure to expedite growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Increased surgical procedures to support growth

- 10.5.3 MEXICO

- 10.5.3.1 Favorable government initiatives to augment growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RISING HEALTHCARE EXPENDITURE AND ROBUST INFRASTRUCTURE DEVELOPMENT TO EXPEDITE GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURFACE DISINFECTANT MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startup/SME players

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 RECKITT BENCKISER

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 PROCTER & GAMBLE

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 3M

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 THE CLOROX COMPANY

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.5 ECOLAB

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.6 STERIS

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 PAUL HARTMANN AG

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.8 SC JOHNSON PROFESSIONAL USA, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.9 CARROLLCLEAN

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 MEDALKAN

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.11 GOJO INDUSTRIES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 WHITELEY

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Other developments

- 12.1.13 SANOSIL AG

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 BETCO

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 METREX RESEARCH, LLC

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 RECKITT BENCKISER

- 12.2 OTHER PLAYERS

- 12.2.1 ACURO ORGANICS LIMITED

- 12.2.2 PHARMAX LIMITED

- 12.2.3 PDI, INC.

- 12.2.4 RUHOF

- 12.2.5 CARENOW

- 12.2.6 CETYLITE, INC.

- 12.2.7 MICRO-SCIENTIFIC, LLC

- 12.2.8 PAL INTERNATIONAL

- 12.2.9 BRULIN

- 12.2.10 KCWW

- 12.2.11 AMITY INTERNATIONAL

- 12.2.12 WEXFORD LABS, INC.

- 12.2.13 DETROX

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS