|

|

市場調査レポート

商品コード

1364762

定量ポンプの世界市場:タイプ別、最終用途産業別、ポンプ駆動別、地域別 - 予測(~2028年)Metering Pumps Market by Type (Diaphragm pump, Pistons/Plungers), End-Use Industry (Water Treatment, Petrochemicals and Oil & Gas, Chemical Processing, Pharmaceuticals), Pump drive (Motor, Solenoid, Pneumatic) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 定量ポンプの世界市場:タイプ別、最終用途産業別、ポンプ駆動別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月09日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の定量ポンプの市場規模は、2023年に69億米ドル、2028年までに85億米ドルに達し、CAGRで4.3%の成長が予測されています。

水処理、医薬品、石油・ガス、自動車、食品・飲料などの最終用途部門の継続的な拡大が、予測期間における定量ポンプの需要を促進しています。

タイプ別では、ダイヤフラムポンプが予測期間中にもっとも高いCAGRを記録します。

ダイヤフラムポンプは、その強化された動作効率、優れた安全機能、精度により、大幅に成長する見込みです。研究開発活動への注目の高まりと、製薬産業や化学産業からの需要の向上により、今後しばらくダイヤフラムポンプの需要が高まると予測されます。

最終用途産業別では、製薬産業が予測期間中にもっとも高いCAGRとなる見込みです。

製薬産業が予測期間中に定量ポンプの急成長市場として台頭すると予測されています。この成長は、疾病の蔓延、健康意識の向上、技術の進歩、医療支出の増大などの要因によるものです。製薬産業では医薬品の生産が増加しており、定量ポンプはこの産業における精密なポンピング/ディスペンシングソリューションの提供に不可欠な存在であるため、需要が高まっています。

モーター駆動ポンプが予測期間中にもっとも急速に成長する市場となる見込みです。

この急成長は、さまざまな最終用途産業、特に医薬品や水処理におけるモーター駆動定量ポンプの需要の増加に起因しています。これらのポンプは、これらの部門の重要な用途における効率性と信頼性により注目されています。

アジア太平洋が最大の定量ポンプ市場として台頭します。

アジア太平洋が予測期間中にもっとも高い市場シェアを達成する見込みです。この力強い成長は、石油とガスの精製、化学生産、海水淡水化プラントなどの最終用途産業が大きく成長している、インド、中国、日本における需要の増加によって促進されています。さらに、アジア太平洋における製薬や食品・飲料部門への多額の投資が、市場の拡大をさらに後押しすると予測されます。

当レポートでは、世界の定量ポンプ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 定量ポンプ市場の企業にとって魅力的な機会

- アジア太平洋の定量ポンプ市場:タイプ別、国別(2022年)

- 定量ポンプ市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業の動向

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- 平均販売価格:地域別

- 平均販売価格:タイプ別

- サプライチェーン分析

- エコシステムマッピング

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント(2023年~2024年)

- 規制情勢

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- シナリオ

- ケーススタディ分析

- マクロ経済指標

第7章 定量ポンプ市場:タイプ別

- イントロダクション

- ダイヤフラムポンプ

- ピストン/プランジャーポンプ

- その他のポンプ

第8章 定量ポンプ市場:ポンプ駆動別

- イントロダクション

- モーター駆動

- ソレノイド駆動

- 空気圧駆動

- その他のポンプ駆動

第9章 定量ポンプ市場:最終用途産業別

- イントロダクション

- 水処理

- 石油化学、石油・ガス

- 化学処理

- 医薬品

- 食品・飲料

- パルプ・紙

- テキスタイル

- 自動車

- その他の最終用途産業

第10章 定量ポンプ市場:地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響の分析

- 中国

- インド

- 日本

- 韓国

- バングラデシュ

- ASEAN諸国

- その他のアジア太平洋

- 北米

- 景気後退の影響の分析

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響の分析

- ドイツ

- フランス

- 英国

- ロシア

- スペイン

- イタリア

- その他の欧州

- 中東・アフリカ

- 景気後退の影響の分析

- サウジアラビア

- アラブ首長国連邦

- トルコ

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 景気後退の影響の分析

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- 概要

- 主要企業の戦略

- 市場シェア分析

- 上位5社の収益分析

- 企業の評価マトリクス(2022年)

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- INGERSOLL RAND, INC.

- PROMINENT GMBH

- IDEX CORPORATION

- GRACO, INC.

- DOVER CORPORATION

- SEKO S.P.A.

- GRUNDFOS HOLDING A/S

- LEWA GMBH

- SPIRAX-SARCO ENGINEERING PLC

- AVANTOR, INC.

- その他の企業

- IWAKI CO., LTD.

- SPX FLOW, INC.

- VERDER GROUP

- ZHEJIANG AILIPU TECHNOLOGY CO., LTD.

- ENELSA ENDUSTRIYEL ELEKTRONIK

- WANNER ENGINEERING INC.

- NANFANG PUMP INDUSTRY CO., LTD (CNP)

- BLUE-WHITE INDUSTRIES LTD.

- SWELORE ENGINEERING PVT. LTD.

- SHREE RAJESHWARI ENGINEERING WORKS PVT. LTD.

- TAPFLO GROUP

- AALBORG INSTRUMENTS & CONTROLS, INC.

- INTEGRA

- INITIATIVE ENGINEERING

- ETATRON D.S.

- MINIMAX PUMPS PVT. LTD.

第13章 隣接市場と関連市場

- イントロダクション

- 制限事項

- ペリスタルティックポンプ市場

- 市場の定義

- 市場の概要

- ペリスタルティックポンプ市場:タイプ別

- ペリスタルティックポンプ市場:吐出量別

- ペリスタルティックポンプ市場:最終用途産業別

- ペリスタルティックポンプ市場:地域別

第14章 付録

The market size for metering pumps is estimated to be USD 6.9 billion in 2023, with a projected growth to USD 8.5 billion by 2028, at a compound annual growth rate (CAGR) of 4.3%. These pumps, classified as positive displacement pumps, excel at moving specific volumes of fluids within a particular pressure range. The continuous expansion of end-use sectors like water treatment, pharmaceuticals, oil and gas, automotive, and food & beverages is propelling the demand for metering pumps in the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD billion) and Volume (Units) |

| Segments | Type, End use industry, Pump Drive, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

By Type, Diaphragm pumps to register the highest CAGR during the forecast period

Within the metering pumps market, the diaphragm pumps segment stands out as the fastest-growing market during the forecast period. diaphragm pumps are poised for substantial growth due to their enhanced operational efficiency, superior safety features, and precision. The increasing focus on Research and Development (R&D) activities, coupled with a rising demand from the pharmaceutical and chemical industries is expected to drive the heightened demand for diaphragm pumps in the foreseeable future.

By End Use Industry, Pharmaceutical Industry to account for the highest CAGR during the forecast period

The pharmaceutical industry is anticipated to emerge as the fastest-growing market for metering pumps during the forecast period. This growth is attributed to several factors, including the increasing prevalence of diseases, rising health awareness, technological advancements, and augmented healthcare expenditure. The pharmaceutical sector is witnessing increased drug production, which, in turn, is driving the demand for metering pumps due to their essential role in delivering precision pumping and dispensing solutions within this industry.

Motor Driven Pumps to be the fastest growing market in the forecast Period

Motor-driven pumps are experiencing the most rapid growth among pump drive segments. This surge is attributed to the growing demand for motor-driven metering pumps across various end-use industries, notably pharmaceuticals and water treatment. These pumps are gaining prominence due to their efficiency and reliability in critical applications within these sectors.

APAC Emerges as the Biggest Metering Pumps Market

The Asia-Pacific (APAC) region is poised to achieve the highest market share in the metering pumps market during the forecast period. This robust growth is primarily driven by increased demand in India, China, and Japan, where end-use industries like oil and gas refineries, chemical production, and desalination plants are experiencing substantial growth. Furthermore, significant investments in the pharmaceutical and food and beverage sectors in APAC are expected to further boost the market's expansion.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered: IDEX Corporation (US), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), Grundfos Holding A/S (Denmark), SEKO S.P.A. (Italy), and others are covered in the metering pumps market.

Research Coverage

The market study covers the metering pumps market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type, End-use industry, pump drive and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the metering pumps market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall metering pumps market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (stringent regulations for wastewater treatment, rise in population & rapid urbanization), restraints (raw material price fluctuations), opportunities (joint venture activities and expansions by end users in high-growth markets) and challenges (growing customization demands from the end-use industries) influencing the growth of the metering pumps market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the metering pumps market

- Market Development: Comprehensive information about lucrative markets - the report analyses the metering pumps market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the metering pumps market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like IDEX Corporation (US), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), Grundfos Holding A/S (Denmark), SEKO S.P.A. (Italy), and among others in the metering pumps market. The report also helps stakeholders understand the pulse of the metering pumps market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- FIGURE 1 METERING PUMPS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 METERING PUMPS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 METERING PUMPS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 METERING PUMPS MARKET: DATA TRIANGULATION

- 2.4 RECESSION IMPACT

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

- FIGURE 6 DIAPHRAGM PUMPS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 7 WATER TREATMENT APPLICATION TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 8 MOTOR-DRIVEN SEGMENT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC REGISTERED HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METERING PUMPS MARKET

- FIGURE 10 INCREASING DEMAND IN WATER TREATMENT APPLICATIONS TO DRIVE MARKET

- 4.2 ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE AND COUNTRY, 2022

- FIGURE 11 CHINA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC METERING PUMPS MARKET

- 4.3 METERING PUMPS MARKET, BY COUNTRY

- FIGURE 12 ASEAN COUNTRIES TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METERING PUMPS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent regulations for wastewater treatment and increasing capacity additions

- TABLE 2 INDUSTRIAL DEMAND FOR WATER, BY REGION

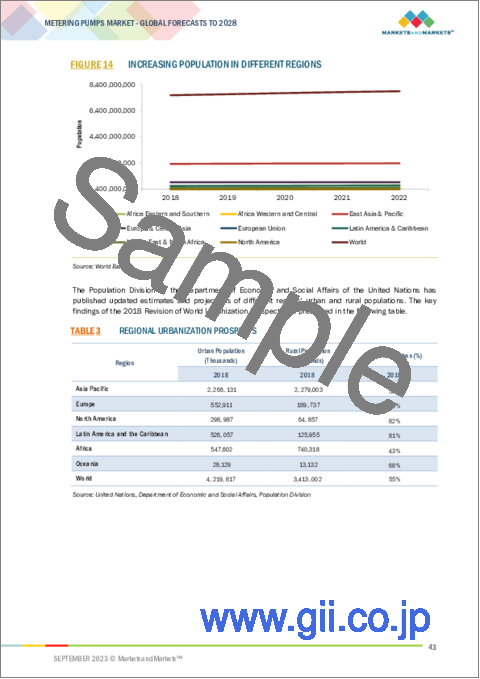

- 5.2.1.2 Rise in population & rapid urbanization

- FIGURE 14 INCREASING POPULATION IN DIFFERENT REGIONS

- TABLE 3 REGIONAL URBANIZATION PROSPECTS

- FIGURE 15 ESTIMATED URBAN POPULATION IN DIFFERENT REGIONS, 2021 VS. 2050

- 5.2.1.3 Increasing pharmaceutical production capacity in different regions

- 5.2.1.4 Suitability, high efficiency, and high performance of diaphragm pumps

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement of frequent maintenance

- 5.2.2.2 Raw material price fluctuations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Joint venture activities and expansions

- 5.2.3.2 Growing preference for digital pumping solutions and advanced pumps

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing demand for customization from end-use industries

- 5.2.4.2 Low scope of product differentiation

6 INDUSTRY TRENDS

- 6.1 TRENDS & DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 16 ADOPTION OF INDUSTRY 4.0 AND DIGITIZATION TO BRING CHANGE IN FUTURE REVENUE MIX

- TABLE 4 SHIFTS IMPACTING YC AND YCC

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 17 AVERAGE SELLING PRICE, BY REGION (USD/UNIT)

- 6.2.2 AVERAGE SELLING PRICE, BY TYPE

- TABLE 5 AVERAGE SELLING PRICE, BY TYPE (USD/UNIT)

- 6.3 SUPPLY CHAIN ANALYSIS

- TABLE 6 PROCUREMENT CHANNEL ANALYSIS, BY END USER VS. SUPPLY CHAIN PHASE

- 6.4 ECOSYSTEM MAPPING

- FIGURE 18 METERING PUMPS MARKET ECOSYSTEM

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 SELECTION OF PROPER SIZE OF METERING PUMPS

- 6.5.2 PERISTALTIC PUMPS

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- FIGURE 19 GRANTED PATENTS ACCOUNTED FOR 3% OF ALL PATENTS IN LAST TEN YEARS

- FIGURE 20 PUBLICATION TRENDS - LAST FIVE YEARS

- FIGURE 21 JURISDICTION ANALYSIS

- FIGURE 22 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 7 PATENT DETAILS OF KEY PLAYERS

- 6.7 TRADE ANALYSIS

- TABLE 8 INTENSITY OF TRADE, BY KEY COUNTRY

- 6.8 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 9 METERING PUMPS MARKET: CONFERENCES & EVENTS

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 HYDRAULIC INSTITUTE (HI) STANDARDS

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 METERING PUMPS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 METERING PUMPS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 THREAT OF NEW ENTRANTS

- 6.10.2 THREAT OF SUBSTITUTES

- 6.10.3 BARGAINING POWER OF SUPPLIERS

- 6.10.4 BARGAINING POWER OF BUYERS

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP THREE APPLICATIONS

- 6.11.1 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR METERING PUMPS

- TABLE 13 KEY BUYING CRITERIA FOR METERING PUMPS

- 6.12 SCENARIOS

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 A SPECIAL DIAPHRAGM METERING PUMP, PROVIDING A SOLUTION

- 6.13.2 A COMPANY PROVIDED SOLUTION TO INCREASE PERFORMANCE

- 6.13.3 A MEASURING PUMP TO INCREASE ACCURACY, SAVE DOWNTIME, AND ADDRESS HOSE BLOWOUT ISSUES

- 6.14 MACROECONOMIC INDICATORS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECAST

- TABLE 14 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

7 METERING PUMPS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 26 METERING PUMPS MARKET, BY TYPE, 2023-2028

- TABLE 15 METERING PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 16 METERING PUMPS MARKET, BY TYPE, 2017-2020 (UNITS)

- TABLE 17 METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 18 METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- 7.2 DIAPHRAGM PUMPS

- 7.2.1 LOW OPERATING COSTS TO DRIVE DEMAND

- 7.3 PISTON/PLUNGER PUMPS

- 7.3.1 IMPLEMENTATION OF NEW ENERGY-SAVING REGULATIONS TO SUPPORT MARKET GROWTH

- 7.4 OTHER PUMPS

8 METERING PUMPS MARKET, BY PUMP DRIVE

- 8.1 INTRODUCTION

- FIGURE 27 METERING PUMPS MARKET, BY PUMP DRIVE (2023-2028)

- TABLE 19 METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (USD MILLION)

- TABLE 20 METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (UNITS)

- TABLE 21 METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (USD MILLION)

- TABLE 22 METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (UNITS)

- 8.2 MOTOR-DRIVEN

- 8.2.1 RISING DEMAND FROM CHEMICAL AND WATER TREATMENT INDUSTRIES TO FUEL DEMAND

- 8.3 SOLENOID-DRIVEN

- 8.3.1 LOW MAINTENANCE AND REPAIR COSTS TO DRIVE MARKET

- 8.4 PNEUMATIC-DRIVEN

- 8.4.1 COMPACT SIZE AND EASE OF MOBILITY TO SUPPORT MARKET GROWTH

- 8.5 OTHER PUMP DRIVES

9 METERING PUMPS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 28 METERING PUMPS MARKET, BY END-USE INDUSTRY (2023-2028)

- TABLE 23 METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 24 METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (UNITS)

- TABLE 25 METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 26 METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 9.2 WATER TREATMENT

- 9.2.1 RISING INVESTMENTS IN WATER TREATMENT PLANTS TO FUEL DEMAND

- 9.3 PETROCHEMICALS AND OIL & GAS

- 9.3.1 EXTENSIVE USE IN UPSTREAM, MIDSTREAM, AND DOWNSTREAM OPERATIONS TO DRIVE GROWTH

- 9.4 CHEMICAL PROCESSING

- 9.4.1 LARGE-SCALE INDUSTRIAL PRODUCTION TO DRIVE MARKET

- 9.5 PHARMACEUTICALS

- 9.5.1 EXTENSIVE USE BY PHARMA COMPANIES TO DRIVE DEMAND

- 9.6 FOOD & BEVERAGES

- 9.6.1 STRINGENT REGULATIONS FOR FOOD PROCESSING TO SUPPORT MARKET

- 9.7 PULP & PAPER

- 9.7.1 BOOST IN PAPER PACKAGING & PRINTING APPLICATIONS TO ENHANCE MARKET GROWTH

- 9.8 TEXTILES

- 9.8.1 RISING DISPOSABLE INCOME IN DEVELOPING ECONOMIES TO FUEL DEMAND

- 9.9 AUTOMOTIVE

- 9.9.1 INCREASING AUTOMOBILE PRODUCTION TO SUPPORT MARKET

- 9.10 OTHER END-USE INDUSTRIES

10 METERING PUMPS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 29 METERING PUMPS MARKET, BY REGION (2023-2028)

- FIGURE 30 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 27 METERING PUMPS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 28 METERING PUMPS MARKET, BY REGION, 2021-2028 (UNITS)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 31 ASIA PACIFIC: METERING PUMPS MARKET SNAPSHOT

- TABLE 29 ASIA PACIFIC: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (UNITS)

- TABLE 31 ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 32 ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE, 2017-2020 (UNITS)

- TABLE 33 ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 35 ASIA PACIFIC: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 36 ASIA PACIFIC: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (UNITS)

- TABLE 37 ASIA PACIFIC: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- TABLE 39 ASIA PACIFIC: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (USD MILLION)

- TABLE 40 ASIA PACIFIC: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (UNITS)

- TABLE 41 ASIA PACIFIC: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (UNITS)

- 10.2.2 CHINA

- 10.2.2.1 Booming manufacturing and oil & gas sectors to drive market

- TABLE 43 CHINA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 44 CHINA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 45 CHINA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 46 CHINA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.2.3 INDIA

- 10.2.3.1 Domestic economic development to fuel demand

- TABLE 47 INDIA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 48 INDIA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 49 INDIA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 50 INDIA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.2.4 JAPAN

- 10.2.4.1 Robust water treatment infrastructure to support market growth

- TABLE 51 JAPAN: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 52 JAPAN: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 53 JAPAN: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 54 JAPAN: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Increasing focus on water & wastewater treatment to boost market

- TABLE 55 SOUTH KOREA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 56 SOUTH KOREA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 57 SOUTH KOREA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 58 SOUTH KOREA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.2.6 BANGLADESH

- 10.2.6.1 Expanding manufacturing capabilities to fuel market

- TABLE 59 BANGLADESH: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 BANGLADESH: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 61 BANGLADESH: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 62 BANGLADESH: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.2.7 ASEAN COUNTRIES

- TABLE 63 ASEAN COUNTRIES: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 ASEAN COUNTRIES: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 65 ASEAN COUNTRIES: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 66 ASEAN COUNTRIES: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.2.8 REST OF ASIA PACIFIC

- TABLE 67 REST OF ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 69 REST OF ASIA PACIFIC: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 32 NORTH AMERICA: METERING PUMPS MARKET SNAPSHOT

- TABLE 71 NORTH AMERICA: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (UNITS)

- TABLE 73 NORTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 74 NORTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2017-2020 (UNITS)

- TABLE 75 NORTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 77 NORTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 78 NORTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (UNITS)

- TABLE 79 NORTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- TABLE 81 NORTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (USD MILLION)

- TABLE 82 NORTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (UNITS)

- TABLE 83 NORTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (UNITS)

- 10.3.2 US

- 10.3.2.1 Increasing efforts toward wastewater management to fuel market

- TABLE 85 US: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 US: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 87 US: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 88 US: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.3.3 CANADA

- 10.3.3.1 Increasing government investments in water & wastewater industry to drive market

- TABLE 89 CANADA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 CANADA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 91 CANADA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 92 CANADA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.3.4 MEXICO

- 10.3.4.1 Expanding food & beverage industry to increase demand

- TABLE 93 MEXICO: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 MEXICO: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 95 MEXICO: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 96 MEXICO: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT ANALYSIS

- TABLE 97 EUROPE: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (UNITS)

- TABLE 99 EUROPE: METERING PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 100 EUROPE: METERING PUMPS MARKET, BY TYPE, 2017-2020 (UNITS)

- TABLE 101 EUROPE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 EUROPE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 103 EUROPE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 104 EUROPE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (UNITS)

- TABLE 105 EUROPE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- TABLE 107 EUROPE: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (USD MILLION)

- TABLE 108 EUROPE: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (UNITS)

- TABLE 109 EUROPE: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (USD MILLION)

- TABLE 110 EUROPE: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (UNITS)

- 10.4.2 GERMANY

- 10.4.2.1 Robust automotive and water treatment industries to drive growth

- TABLE 111 GERMANY: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 GERMANY: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 113 GERMANY: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 114 GERMANY: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4.3 FRANCE

- 10.4.3.1 Investments in domestic food and pharmaceutical industries to be major driver

- TABLE 115 FRANCE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 FRANCE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 117 FRANCE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 118 FRANCE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4.4 UK

- 10.4.4.1 Rising demand from food & beverage and chemical processing industries to drive growth

- TABLE 119 UK: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 UK: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 121 UK: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 122 UK: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4.5 RUSSIA

- 10.4.5.1 War with Ukraine to restrain growth of market

- TABLE 123 RUSSIA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 RUSSIA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 125 RUSSIA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 126 RUSSIA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4.6 SPAIN

- 10.4.6.1 Strong presence of automobile companies to drive growth

- TABLE 127 SPAIN: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 SPAIN: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 129 SPAIN: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 130 SPAIN: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4.7 ITALY

- 10.4.7.1 Rapid adoption in retail, food, medical, and healthcare sectors to support market

- TABLE 131 ITALY: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 ITALY: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 133 ITALY: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 134 ITALY: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.4.8 REST OF EUROPE

- TABLE 135 REST OF EUROPE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 REST OF EUROPE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 137 REST OF EUROPE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT ANALYSIS

- TABLE 139 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (UNITS)

- TABLE 141 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY TYPE, 2017-2020 (UNITS)

- TABLE 143 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 145 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (UNITS)

- TABLE 147 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- TABLE 149 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (UNITS)

- TABLE 151 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (UNITS)

- 10.5.2 SAUDI ARABIA

- 10.5.2.1 Presence of strong oil & gas industry to drive growth

- TABLE 153 SAUDI ARABIA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 SAUDI ARABIA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 155 SAUDI ARABIA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 156 SAUDI ARABIA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.5.3 UAE

- 10.5.3.1 Reliance on desalination process to drive growth

- TABLE 157 UAE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 UAE: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 159 UAE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 160 UAE: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.5.4 TURKEY

- 10.5.4.1 Large-scale food and beverage industry to fuel demand

- TABLE 161 TURKEY: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 TURKEY: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 163 TURKEY: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 164 TURKEY: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Rapid industrialization and urbanization to drive market

- TABLE 165 SOUTH AFRICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 SOUTH AFRICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 167 SOUTH AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 168 SOUTH AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 169 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT ANALYSIS

- TABLE 173 SOUTH AMERICA: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 174 SOUTH AMERICA: METERING PUMPS MARKET, BY COUNTRY, 2021-2028 (UNITS)

- TABLE 175 SOUTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 176 SOUTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2017-2020 (UNITS)

- TABLE 177 SOUTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 SOUTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 179 SOUTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 180 SOUTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (UNITS)

- TABLE 181 SOUTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 182 SOUTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- TABLE 183 SOUTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (USD MILLION)

- TABLE 184 SOUTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2017-2020 (UNITS)

- TABLE 185 SOUTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (USD MILLION)

- TABLE 186 SOUTH AMERICA: METERING PUMPS MARKET, BY PUMP DRIVE, 2021-2028 (UNITS)

- 10.6.2 BRAZIL

- 10.6.2.1 Expanding chemical industry to increase demand for metering pumps

- TABLE 187 BRAZIL: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 BRAZIL: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 189 BRAZIL: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 190 BRAZIL: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.6.3 ARGENTINA

- 10.6.3.1 Increase in vehicle production to support market growth

- TABLE 191 ARGENTINA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 ARGENTINA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 193 ARGENTINA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 194 ARGENTINA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 195 REST OF SOUTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 REST OF SOUTH AMERICA: METERING PUMPS MARKET, BY TYPE, 2021-2028 (UNITS)

- TABLE 197 REST OF SOUTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: METERING PUMPS MARKET, BY END-USE INDUSTRY, 2021-2028 (UNITS)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES

- FIGURE 33 OVERVIEW OF STRATEGIES ADOPTED BY METERING PUMP MANUFACTURERS

- 11.3 MARKET SHARE ANALYSIS

- TABLE 199 METERING PUMP MARKET: MARKET SHARE OF KEY PLAYERS

- FIGURE 34 METERING PUMP MARKET: MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS OF TOP 5 COMPANIES

- 11.5 COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 35 METERING PUMP MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT

- TABLE 200 METERING PUMPS MARKET: COMPANY FOOTPRINT

- 11.6 START-UP/SMES EVALUATION MATRIX, 2022

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 36 METERING PUMPS MARKET: STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 201 METERING PUMP MARKET: KEY PLAYERS

- 11.7 COMPETITIVE SCENARIO AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 202 METERING PUMPS MARKET: PRODUCT LAUNCHES

- 11.7.2 DEALS

- TABLE 203 METERING PUMP MARKET: DEALS

- 11.7.3 OTHERS

- TABLE 204 METERING PUMPS MARKET: OTHERS

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 INGERSOLL RAND, INC.

- TABLE 205 INGERSOLL RAND, INC.: COMPANY OVERVIEW

- FIGURE 37 INGERSOLL RAND, INC.: COMPANY SNAPSHOT

- TABLE 206 INGERSOLL RAND, INC.: DEALS

- 12.1.2 PROMINENT GMBH

- TABLE 207 PROMINENT GMBH: COMPANY OVERVIEW

- TABLE 208 PROMINENT GMBH: PRODUCT LAUNCHES

- TABLE 209 PROMINENT GMBH: OTHERS

- 12.1.3 IDEX CORPORATION

- TABLE 210 IDEX CORPORATION: COMPANY OVERVIEW

- FIGURE 38 IDEX CORPORATION: COMPANY SNAPSHOT

- TABLE 211 IDEX CORPORATION: PRODUCT LAUNCHES

- TABLE 212 IDEX CORPORATION: DEALS

- TABLE 213 IDEX CORPORATION.: OTHERS

- 12.1.4 GRACO, INC.

- TABLE 214 GRACO, INC.: COMPANY OVERVIEW

- FIGURE 39 GRACO, INC.: COMPANY SNAPSHOT

- TABLE 215 GRACO INC.: PRODUCT LAUNCHES

- TABLE 216 GRACO INC.: OTHERS

- 12.1.5 DOVER CORPORATION

- TABLE 217 DOVER CORPORATION: COMPANY OVERVIEW

- FIGURE 40 DOVER CORPORATION: COMPANY SNAPSHOT

- TABLE 218 DOVER CORPORATION: DEALS

- TABLE 219 DOVER CORPORATION: PRODUCT LAUNCHES

- TABLE 220 DOVER CORPORATION: OTHERS

- 12.1.6 SEKO S.P.A.

- TABLE 221 SEKO S.P.A: COMPANY OVERVIEW

- TABLE 222 SEKO S.P.A.: DEALS

- TABLE 223 SEKO S.P.A.: PRODUCT LAUNCHES

- TABLE 224 SEKO S.P.A: OTHERS

- 12.1.7 GRUNDFOS HOLDING A/S

- TABLE 225 GRUNDFOS HOLDING A/S: COMPANY OVERVIEW

- FIGURE 41 GRUNDFOS HOLDING A/S: COMPANY SNAPSHOT

- TABLE 226 GRUNDFOS HOLDING A/S: DEALS

- TABLE 227 GRUNDFOS HOLDING A/S: PRODUCT LAUNCHES

- TABLE 228 GRUNDFOS HOLDING A/S: OTHERS

- 12.1.8 LEWA GMBH

- TABLE 229 LEWA GMBH: COMPANY OVERVIEW

- TABLE 230 LEWA GMBH: PRODUCT LAUNCHES

- 12.1.9 SPIRAX-SARCO ENGINEERING PLC

- TABLE 231 SPIRAX-SARCO ENGINEERING PLC: COMPANY OVERVIEW

- FIGURE 42 SPIRAX-SARCO ENGINEERING PLC: COMPANY SNAPSHOT

- TABLE 232 SPIRAX-SARCO ENGINEERING PLC: PRODUCT LAUNCHES

- TABLE 233 SPIRAX-SARCO ENGINEERING PLC: OTHERS

- 12.1.10 AVANTOR, INC.

- TABLE 234 AVANTOR, INC.: COMPANY OVERVIEW

- FIGURE 43 AVANTOR, INC.: COMPANY SNAPSHOT

- TABLE 235 AVANTOR, INC.: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 IWAKI CO., LTD.

- TABLE 236 IWAKI CO., LTD.: COMPANY OVERVIEW

- 12.2.2 SPX FLOW, INC.

- TABLE 237 SPX FLOW, INC.: COMPANY OVERVIEW

- 12.2.3 VERDER GROUP

- TABLE 238 VERDER GROUP: COMPANY OVERVIEW

- 12.2.4 ZHEJIANG AILIPU TECHNOLOGY CO., LTD.

- TABLE 239 ZHEJIANG AILIPU TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 12.2.5 ENELSA ENDUSTRIYEL ELEKTRONIK

- TABLE 240 ENELSA ENDUSTRIYEL ELEKTRONIK: COMPANY OVERVIEW

- 12.2.6 WANNER ENGINEERING INC.

- TABLE 241 WANNER ENGINEERING INC.: COMPANY OVERVIEW

- 12.2.7 NANFANG PUMP INDUSTRY CO., LTD (CNP)

- TABLE 242 NANFANG PUMP INDUSTRY CO., LTD (CNP): COMPANY OVERVIEW

- 12.2.8 BLUE-WHITE INDUSTRIES LTD.

- TABLE 243 BLUE-WHITE INDUSTRIES LTD.: COMPANY OVERVIEW

- 12.2.9 SWELORE ENGINEERING PVT. LTD.

- TABLE 244 SWELORE ENGINEERING PVT. LTD.: COMPANY OVERVIEW

- 12.2.10 SHREE RAJESHWARI ENGINEERING WORKS PVT. LTD.

- TABLE 245 SHREE RAJESHWARI ENGINEERING WORKS PVT. LTD.: COMPANY OVERVIEW

- 12.2.11 TAPFLO GROUP

- TABLE 246 TAPFLO GROUP: COMPANY OVERVIEW

- 12.2.12 AALBORG INSTRUMENTS & CONTROLS, INC.,

- TABLE 247 AALBORG INSTRUMENTS & CONTROLS, INC.: COMPANY OVERVIEW

- 12.2.13 INTEGRA

- TABLE 248 INTEGRA: COMPANY OVERVIEW

- 12.2.14 INITIATIVE ENGINEERING

- TABLE 249 INITIATIVE ENGINEERING: COMPANY OVERVIEW

- 12.2.15 ETATRON D.S.

- TABLE 250 ETATRON D.S.: COMPANY OVERVIEW

- 12.2.16 MINIMAX PUMPS PVT. LTD.

- TABLE 251 MINIMAX PUMPS PVT. LTD.: COMPANY OVERVIEW

13 ADJACENT & RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 PERISTALTIC PUMPS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 PERISTALTIC PUMPS MARKET, BY TYPE

- TABLE 252 PERISTALTIC PUMPS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 253 PERISTALTIC PUMPS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 254 PERISTALTIC PUMPS MARKET, BY TYPE, 2017-2020 ('00 UNIT)

- TABLE 255 PERISTALTIC PUMPS MARKET, BY TYPE, 2021-2027 ('00 UNIT)

- 13.5 PERISTALTIC PUMPS MARKET, BY DISCHARGE CAPACITY

- TABLE 256 PERISTALTIC PUMPS MARKET, BY TDISCHARGE CAPACITY, 2017-2020 (USD MILLION)

- TABLE 257 PERISTALTIC PUMPS MARKET, BY DISCHARGE CAPACITY, 2021-2027 (USD MILLION)

- TABLE 258 PERISTALTIC PUMPS MARKET, BY DISCHARGE CAPACITY, 2017-2020 ('00 UNIT)

- TABLE 259 PERISTALTIC PUMPS MARKET, BY DISCHARGE CAPACITY, 2021-2027 ('00 UNIT)

- 13.6 PERISTALTIC PUMPS MARKET, BY END-USE INDUSTRY

- TABLE 260 PERISTALTIC PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 261 PERISTALTIC PUMPS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 262 PERISTALTIC PUMPS MARKET, BY END-USE INDUSTRY, 2017-2020 ('00 UNIT)

- TABLE 263 PERISTALTIC PUMPS MARKET, BY END-USE INDUSTRY, 2021-2027 ('00 UNIT)

- 13.7 PERISTALTIC PUMPS MARKET, BY REGION

- TABLE 264 PERISTALTIC PUMPS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 265 PERISTALTIC PUMPS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 266 PERISTALTIC PUMPS MARKET, BY REGION, 2017-2020 ('00 UNIT)

- TABLE 267 PERISTALTIC PUMPS MARKET, BY REGION, 2021-2027 ('00 UNIT)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS