|

|

市場調査レポート

商品コード

1754852

粘着テープの世界市場:樹脂タイプ別、技術別、裏地材別、カテゴリー別、最終用途産業別、接着剤タイプ別、接着タイプ別、厚さ別、地域別 - 2030年までの予測Adhesive Tapes Market by Resin Type, Technology, Backing Material, End-use Industry Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 粘着テープの世界市場:樹脂タイプ別、技術別、裏地材別、カテゴリー別、最終用途産業別、接着剤タイプ別、接着タイプ別、厚さ別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月17日

発行: MarketsandMarkets

ページ情報: 英文 360 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

粘着テープの市場規模は、2025年の884億6,000万米ドルから4.70%のCAGRで拡大し、2030年には1,113億1,000万米ドルに達すると予測されています。

2025年の粘着テープ市場は、アジア太平洋地域が金額ベースで最大のシェアを占めると予測されます。粘着テープは、柔軟性、粘着性、耐久性、環境要因への耐性といった独自の特性により、さまざまな用途に汎用性の高いソリューションを提供します。自動車分野では、強力な接着特性と高い耐熱性を持つ粘着テープが、組み立てや表面保護作業に不可欠です。同様に、包装業界では、優れた粘着性と引張強度を持つテープが、商品の安全かつ効率的な包装に不可欠です。工業化と都市化が自動車、包装、エレクトロニクス、建設、ヘルスケアなどの分野全体の需要を牽引する中、粘着テープの市場もそれに応じて拡大しています。さらに、特にアジア太平洋地域で進行中のインフラ開発プロジェクトが、接着、シーリング、絶縁などの建設用途における粘着テープの需要を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(100万平方メートル) |

| セグメント | 樹脂タイプ別、技術別、裏地材別、カテゴリー別、最終用途産業別、接着剤タイプ別、接着タイプ別、厚さ別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

Make in India"などの政府の取り組みにより製造業が拡大するインドでは、自動車、包装、エレクトロニクス、建設、ヘルスケアなど様々な産業で粘着テープの需要が増加しています。自動車産業は生産と消費の増加により著しい成長を遂げており、接着、表面保護、絶縁などの用途で粘着テープの必要性を高めています。インドではeコマースの台頭により、商品の出荷や取り扱い時の安全な梱包のために粘着テープの需要が急増しています。オンラインショッピングを利用する消費者が増えるにつれ、信頼性が高く効率的な包装ソリューションへのニーズが高まり、粘着テープ市場をさらに牽引しています。

北米は、自動車、包装、エレクトロニクス、建設、ヘルスケアなどの分野で産業基盤が確立されており、粘着テープの安定した需要を牽引しています。自動車産業では、粘着テープは接着、表面保護、騒音低減に使用され、市場の成長に貢献しています。北米の包装業界では、カートンのシール、結束、ラベリングなど様々な用途で粘着テープが多用されています。eコマースの普及が進み、効率的なパッケージング・ソリューションへの需要が高まる中、粘着テープ市場は成長を続けています。粘着テープ技術の進歩と、厳しい業界基準や規制を満たすように調整された配合が、北米の市場成長をさらに後押ししています。同地域の技術革新と持続可能性への注力も、環境に優しい粘着テープソリューションの採用を後押ししています。

世界の工場とも呼ばれる中国の堅調な製造業は、自動車、包装、エレクトロニクス、建設、ヘルスケアなど、さまざまな産業で粘着テープの大きな需要を生み出しています。例えば、中国の自動車産業は、接着、表面保護、消音などの用途で粘着テープに大きく依存しています。中国ではeコマースセクターが急成長しており、商品の出荷や取り扱いの際に安全で効率的な梱包を行うために、粘着テープの需要が大幅に増加しています。オンライン・ショッピングの台頭と物流・配送サービスの拡大により、粘着テープは梱包された商品の完全性を確保する上で重要な役割を果たしています。中国は、粘着テープの配合とコーティングにおける技術の進歩と技術革新に重点を置いており、市場の成長にさらに貢献しています。人口が多く、可処分所得が増加していることも、特に粘着テープが広く使用されているエレクトロニクスやヘルスケアなどの分野での消費を促進しています。

当レポートでは、世界の粘着テープ市場について調査し、樹脂タイプ別、技術別、裏地材別、カテゴリー別、最終用途産業別、接着剤タイプ別、接着タイプ別、厚さ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 貿易分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが粘着テープ市場に与える影響

- 2025年の米国関税の影響- 粘着テープ市場

第7章 粘着テープ市場(樹脂タイプ別)

- イントロダクション

- アクリル

- ゴム

- シリコーン

- その他

第8章 粘着テープ市場(技術別)

- イントロダクション

- 溶剤ベース

- ホットメルトベース

- 水性

第9章 粘着テープ市場(裏地材別)

- イントロダクション

- ポリプロピレン(PP)

- 紙

- ポリ塩化ビニル(PVC)

- その他

第10章 粘着テープ市場(カテゴリー別)

- イントロダクション

- 商品

- 専門

第11章 粘着テープ市場(最終用途産業別)

- イントロダクション

- 汎用粘着テープ

- 特殊粘着テープ

第12章 接着テープ市場(接着剤タイプ別)

- イントロダクション

- 一時的

- 永続的

第13章 接着テープ市場(接着タイプ別)

- イントロダクション

- 片面テープ

- 両面テープ

第14章 粘着テープ市場(厚さ別)

- イントロダクション

- 20ミクロン未満

- 20~30ミクロン

- 30~40ミクロン

- 40ミクロン以上

第15章 粘着テープ市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 台湾

- インドネシア

- ベトナム

- 欧州

- ドイツ

- イタリア

- トルコ

- フランス

- オランダ

- 英国

- スペイン

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

- コロンビア

第16章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 評価と財務指標

- 競合シナリオ

第17章 企業プロファイル

- 主要参入企業

- 3M

- TESA SE

- NITTO DENKO CORPORATION

- LINTEC CORPORATION

- IPG

- AVERY DENNISON CORPORATION

- LOHMANN

- NICHIBAN CO., LTD.

- SCAPA GROUP PLC(MATIV HOLDINGS)

- SAINT-GOBAIN S.A.

- その他の企業

- ADHESIVES RESEARCH

- SHURTAPE TECHNOLOGIES, LLC

- ATP ADHESIVE SYSTEMS AG

- GERGONNE-THE ADHESIVE SOLUTION

- ORAFOL EUROPE GMBH

- PPI ADHESIVE PRODUCTS

- WUHAN HUAXIA NANFANG ADHESIVE TAPES CO., LTD.

- AMERICAN BILTRITE INC.

- TERAOKA SEISAKUSHO CO., LTD.

- ADVANCE TAPES INTERNATIONAL

- YEM CHIO CO. LTD.

- DERMAMED COATINGS COMPANY, LLC

- CCT(COATINGS & CONVERTING TECHNOLOGIES, LLC)

- ECHOTAPE

- AJIT INDUSTRIES

- FABO S.P.A.

- ADK TAPES

第18章 隣接市場/関連市場

第19章 付録

List of Tables

- TABLE 1 ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY RESIN TYPE

- TABLE 2 ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- TABLE 3 ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY BACKING MATERIAL

- TABLE 4 ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY CATEGORY

- TABLE 5 ADHESIVE TAPES MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 6 ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 9 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2029 (USD BILLION)

- TABLE 10 AVERAGE SELLING PRICE OF ADHESIVE TAPES OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/SQ. METER)

- TABLE 11 AVERAGE SELLING PRICE OF ADHESIVE TAPES, BY REGION, 2024 (USD/SQ. METER)

- TABLE 12 ADHESIVE TAPES MARKET: ROLE IN ECOSYSTEM

- TABLE 13 EXPORT OF ADHESIVE TAPES, BY REGION, 2020-2024 (USD BILLION)

- TABLE 14 IMPORT OF ADHESIVE TAPES, BY REGION, 2020-2024 (USD BILLION)

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ADHESIVE TAPES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 21 PATENT STATUS: PATENT APPLICATIONS AND GRANTED PATENTS

- TABLE 22 MAJOR PATENTS FOR ADHESIVE TAPES

- TABLE 23 PATENTS BY BASF SE

- TABLE 24 PATENTS BY SAMSUNG ELECTRONICS CO., LTD.

- TABLE 25 TOP 10 PATENT OWNERS IN US, 2014-2024

- TABLE 26 TARIFF RATES

- TABLE 27 ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 28 ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 29 ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (USD MILLION)

- TABLE 30 ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 31 ACRYLIC: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 32 ACRYLIC: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 33 ACRYLIC: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 ACRYLIC: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 RUBBER: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 36 RUBBER: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 37 RUBBER: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 RUBBER: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 SILICONE: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 40 SILICONE: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 41 SILICONE: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 SILICONE: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OTHER RESIN TYPES: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 44 OTHER RESIN TYPES: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 45 OTHER RESIN TYPES: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 OTHER RESIN TYPES: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 48 ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 49 ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 50 ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

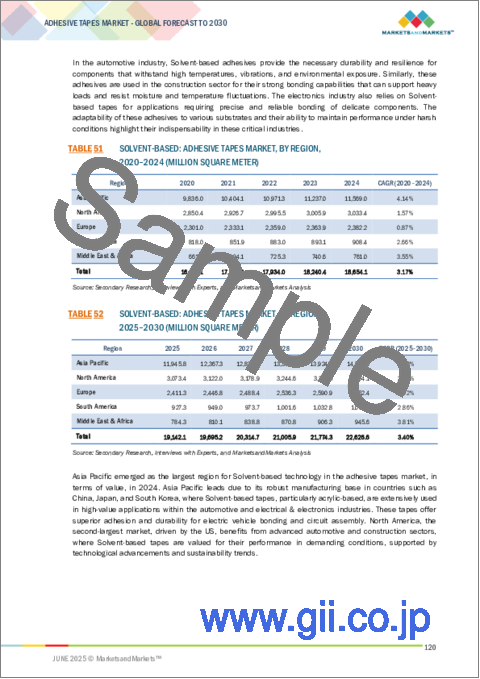

- TABLE 51 SOLVENT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 52 SOLVENT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 53 SOLVENT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 SOLVENT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 HOT-MELT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 56 HOT-MELT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 57 HOT-MELT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 HOT-MELT-BASED: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 WATER-BASED: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 60 WATER-BASED: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 61 WATER-BASED: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 WATER-BASED: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 64 ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 65 ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 66 ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 67 POLYPROPYLENE (PP): ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 68 POLYPROPYLENE (PP): ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 69 POLYPROPYLENE (PP): ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 POLYPROPYLENE (PP): ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 PAPER: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 72 PAPER: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 73 PAPER: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 PAPER: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 POLYVINYL CHLORIDE (PVC): ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 76 POLYVINYL CHLORIDE (PVC): ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 77 POLYVINYL CHLORIDE (PVC): ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 POLYVINYL CHLORIDE (PVC): ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 OTHER BACKING MATERIALS: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 80 OTHER BACKING MATERIALS: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 81 OTHER BACKING MATERIALS: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 OTHER BACKING MATERIALS: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 84 ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 85 ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 86 ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 87 COMMODITY: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 88 COMMODITY: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 89 COMMODITY: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 COMMODITY: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 SPECIALTY: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 92 SPECIALTY: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 93 SPECIALTY: ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 SPECIALTY: ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 96 COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 97 COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 98 COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 PACKAGING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 100 PACKAGING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 101 PACKAGING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 PACKAGING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 MASKING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 104 MASKING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 105 MASKING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 MASKING: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 CONSUMER & OFFICE: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 108 CONSUMER & OFFICE: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 109 CONSUMER & OFFICE: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 CONSUMER & OFFICE: COMMODITY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 112 SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 113 SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 114 SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 ELECTRICAL & ELECTRONICS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 116 ELECTRICAL & ELECTRONICS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 117 ELECTRICAL & ELECTRONICS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 118 ELECTRICAL & ELECTRONICS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 HEALTHCARE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 120 HEALTHCARE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 121 HEALTHCARE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 122 HEALTHCARE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 AUTOMOTIVE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 124 AUTOMOTIVE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 125 AUTOMOTIVE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 AUTOMOTIVE: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 WHITE GOODS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 128 WHITE GOODS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 129 WHITE GOODS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 130 WHITE GOODS: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 PAPER & PRINTING: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 132 PAPER & PRINTING: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 133 PAPER & PRINTING: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 134 PAPER & PRINTING: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 BUILDING & CONSTRUCTION: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 136 BUILDING & CONSTRUCTION: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 137 BUILDING & CONSTRUCTION: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 138 BUILDING & CONSTRUCTION: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 RETAIL: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 140 RETAIL: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 141 RETAIL: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 142 RETAIL: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 OTHER END-USE INDUSTRIES: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 144 OTHER END-USE INDUSTRIES: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 145 OTHER END-USE INDUSTRIES: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 146 OTHER END-USE INDUSTRIES: SPECIALTY ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (MILLION SQUARE METER)

- TABLE 148 ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 149 ADHESIVE TAPES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 150 ADHESIVE TAPES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 152 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 153 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 156 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 157 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 160 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 161 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 164 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 165 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 166 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 168 ASIA PACIFIC: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 169 ASIA PACIFIC: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 172 ASIA PACIFIC: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 173 ASIA PACIFIC: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 176 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 177 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 CHINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 180 CHINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 181 CHINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 182 CHINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 183 INDIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 184 INDIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 185 INDIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 186 INDIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 187 JAPAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 188 JAPAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 189 JAPAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 190 JAPAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH KOREA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 192 SOUTH KOREA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 193 SOUTH KOREA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 194 SOUTH KOREA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 195 TAIWAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 196 TAIWAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 197 TAIWAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 198 TAIWAN: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 199 INDONESIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 200 INDONESIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 201 INDONESIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 202 INDONESIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 203 VIETNAM: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 204 VIETNAM: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 205 VIETNAM: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 206 VIETNAM: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 207 EUROPE: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 208 EUROPE: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 209 EUROPE: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (USD MILLION)

- TABLE 210 EUROPE: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 211 EUROPE: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 212 EUROPE: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 213 EUROPE: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 214 EUROPE: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 215 EUROPE: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 216 EUROPE: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 217 EUROPE: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 218 EUROPE: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 219 EUROPE: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 220 EUROPE: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 221 EUROPE: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 222 EUROPE: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 223 EUROPE: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 224 EUROPE: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 225 EUROPE: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 226 EUROPE: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 227 EUROPE: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 228 EUROPE: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 229 EUROPE: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 230 EUROPE: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 231 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 232 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 233 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 234 EUROPE: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 235 GERMANY: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 236 GERMANY: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 237 GERMANY: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 238 GERMANY: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 239 ITALY: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 240 ITALY: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 241 ITALY: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 242 ITALY: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 243 TURKEY: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 244 TURKEY: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 245 TURKEY: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 246 TURKEY: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 247 FRANCE: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 248 FRANCE: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 249 FRANCE: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 250 FRANCE: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 251 NETHERLANDS: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 252 NETHERLANDS: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 253 NETHERLANDS: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 254 NETHERLANDS: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 255 UK: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 256 UK: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 257 UK: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 258 UK: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 259 SPAIN: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 260 SPAIN: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 261 SPAIN: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 262 SPAIN: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 263 NORTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 264 NORTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 265 NORTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (USD MILLION)

- TABLE 266 NORTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 267 NORTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 268 NORTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 269 NORTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 270 NORTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 271 NORTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 272 NORTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 273 NORTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 274 NORTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 275 NORTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 276 NORTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 277 NORTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 278 NORTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 279 NORTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 280 NORTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 281 NORTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 282 NORTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 283 NORTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 284 NORTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 285 NORTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 286 NORTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 287 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 288 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 289 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 290 NORTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 291 US: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 292 US: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 293 US: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 294 US: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 295 CANADA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 296 CANADA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 297 CANADA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 298 CANADA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 299 MEXICO: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 300 MEXICO: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 301 MEXICO: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 302 MEXICO: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 304 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 305 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 308 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 309 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 312 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 313 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 316 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 317 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 320 MIDDLE EAST & AFRICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 321 MIDDLE EAST & AFRICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 323 MIDDLE EAST & AFRICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 324 MIDDLE EAST & AFRICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 325 MIDDLE EAST & AFRICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 326 MIDDLE EAST & AFRICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 327 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 328 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 329 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 330 MIDDLE EAST & AFRICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 331 UAE: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 332 UAE: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 333 UAE: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 334 UAE: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 335 SAUDI ARABIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 336 SAUDI ARABIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 337 SAUDI ARABIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 338 SAUDI ARABIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 339 SOUTH AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 340 SOUTH AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 341 SOUTH AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 342 SOUTH AFRICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 343 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (MILLION SQUARE METER)

- TABLE 344 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 345 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2024 (USD MILLION)

- TABLE 346 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 347 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (MILLION SQUARE METER)

- TABLE 348 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (MILLION SQUARE METER)

- TABLE 349 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 350 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 351 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (MILLION SQUARE METER)

- TABLE 352 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (MILLION SQUARE METER)

- TABLE 353 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2024 (USD MILLION)

- TABLE 354 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2025-2030 (USD MILLION)

- TABLE 355 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 356 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 357 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 358 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 359 SOUTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 360 SOUTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 361 SOUTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 362 SOUTH AMERICA: COMMODITY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 363 SOUTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 364 SOUTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 365 SOUTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 366 SOUTH AMERICA: SPECIALTY ADHESIVE TAPES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 367 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (MILLION SQUARE METER)

- TABLE 368 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 369 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 370 SOUTH AMERICA: ADHESIVE TAPES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 371 BRAZIL: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 372 BRAZIL: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 373 BRAZIL: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 374 BRAZIL: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 375 ARGENTINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 376 ARGENTINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 377 ARGENTINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 378 ARGENTINA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 379 COLOMBIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (MILLION SQUARE METER)

- TABLE 380 COLOMBIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (MILLION SQUARE METER)

- TABLE 381 COLOMBIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2020-2024 (USD MILLION)

- TABLE 382 COLOMBIA: ADHESIVE TAPES MARKET, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 383 ADHESIVE TAPES MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2019-MAY 2025

- TABLE 384 ADHESIVE TAPES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 385 ADHESIVE TAPES MARKET: REGION FOOTPRINT

- TABLE 386 ADHESIVE TAPES MARKET: RESIN TYPE FOOTPRINT

- TABLE 387 ADHESIVE TAPES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 388 ADHESIVE TAPES MARKET: BACKING MATERIAL FOOTPRINT

- TABLE 389 ADHESIVE TAPES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 390 ADHESIVE TAPES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 391 ADHESIVE TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 392 ADHESIVE TAPES MARKET: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 393 ADHESIVE TAPES MARKET: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 394 ADHESIVE TAPES MARKET: DEALS, JANUARY 2019-MAY 2025

- TABLE 395 3M: COMPANY OVERVIEW

- TABLE 396 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 3M: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 398 TESA SE: COMPANY OVERVIEW

- TABLE 399 TESA SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 TESA SE: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 401 TESA SE: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 402 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- TABLE 403 NITTO DENKO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 404 NITTO DENKO CORPORATION: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 405 NITTO DENKO CORPORATION: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 406 LINTEC CORPORATION: COMPANY OVERVIEW

- TABLE 407 LINTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 IPG: COMPANY OVERVIEW

- TABLE 409 IPG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 410 IPG: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 411 IPG: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 412 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 413 AVERY DENNISON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 414 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 415 AVERY DENNISON CORPORATION: DEALS, JANUARY 2019-MAY 2025

- TABLE 416 LOHMANN: COMPANY OVERVIEW

- TABLE 417 LOHMANN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 418 LOHMANN: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 419 LOHMANN: EXPANSIONS, JANUARY 2019-MAY 2025

- TABLE 420 NICHIBAN CO., LTD.: COMPANY OVERVIEW

- TABLE 421 NICHIBAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 422 SCAPA GROUP PLC (MATIV HOLDINGS): COMPANY OVERVIEW

- TABLE 423 SCAPA GROUP PLC (MATIV HOLDINGS): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 424 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- TABLE 425 SAINT-GOBAIN S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 426 SAINT-GOBAIN S.A.: PRODUCT LAUNCHES, JANUARY 2019-MAY 2025

- TABLE 427 ADHESIVES RESEARCH: COMPANY OVERVIEW

- TABLE 428 SHURTAPE TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 429 ATP ADHESIVE SYSTEMS AG: COMPANY OVERVIEW

- TABLE 430 GERGONNE - THE ADHESIVE SOLUTION: COMPANY OVERVIEW

- TABLE 431 ORAFOL EUROPE GMBH: COMPANY OVERVIEW

- TABLE 432 PPI ADHESIVE PRODUCTS: COMPANY OVERVIEW

- TABLE 433 WUHAN HUAXIA NANFANG ADHESIVE TAPES CO., LTD.: COMPANY OVERVIEW

- TABLE 434 AMERICAN BILTRITE INC.: COMPANY OVERVIEW

- TABLE 435 TERAOKA SEISAKUSHO CO., LTD.: COMPANY OVERVIEW

- TABLE 436 ADVANCE TAPES INTERNATIONAL: COMPANY OVERVIEW

- TABLE 437 YEM CHIO CO. LTD.: COMPANY OVERVIEW

- TABLE 438 DERMAMED COATINGS COMPANY, LLC: COMPANY OVERVIEW

- TABLE 439 CCT (COATINGS & CONVERTING TECHNOLOGIES, LLC): COMPANY OVERVIEW

- TABLE 440 ECHOTAPE: COMPANY OVERVIEW

- TABLE 441 AJIT INDUSTRIES: COMPANY OVERVIEW

- TABLE 442 FABO S.P.A.: COMPANY OVERVIEW

- TABLE 443 ADK TAPES: COMPANY OVERVIEW

- TABLE 444 AUTOMOTIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2016-2019 (USD MILLION)

- TABLE 445 AUTOMOTIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2026 (USD MILLION)

- TABLE 446 AUTOMOTIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2016-2019 (MILLION SQUARE METER)

- TABLE 447 AUTOMOTIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE, 2020-2026 (MILLION SQUARE METER)

- TABLE 448 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2016-2019 (USD MILLION)

- TABLE 449 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2026 (USD MILLION)

- TABLE 450 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2016-2019 (MILLION SQUARE METER)

- TABLE 451 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL, 2020-2026 (MILLION SQUARE METER)

- TABLE 452 AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 453 AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION, 2020-2026 (USD MILLION)

- TABLE 454 AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION, 2016-2019 (MILLION SQUARE METER)

- TABLE 455 AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION, 2020-2026 (MILLION SQUARE METER)

- TABLE 456 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 457 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2026 (USD MILLION)

- TABLE 458 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION, 2016-2019 (MILLION SQUARE METER)

- TABLE 459 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION, 2020-2026 (MILLION SQUARE METER)

List of Figures

- FIGURE 1 ADHESIVE TAPES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ADHESIVE TAPES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 ADHESIVE TAPES MARKET SIZE ESTIMATION, BY VALUE

- FIGURE 5 ADHESIVE TAPES MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 ADHESIVE TAPES MARKET SIZE ESTIMATION, BY RESIN TYPE

- FIGURE 7 ADHESIVE TAPES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY END-USE INDUSTRY

- FIGURE 8 COMMODITY ADHESIVE TAPES MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- FIGURE 9 SPECIALTY ADHESIVE TAPES MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- FIGURE 10 ADHESIVE TAPES MARKET: SUPPLY-SIDE FORECAST

- FIGURE 11 SUPPLY-SIDE SIZING OF ADHESIVE TAPES MARKET

- FIGURE 12 ADHESIVE TAPES MARKET: DATA TRIANGULATION

- FIGURE 13 HEALTHCARE END-USE INDUSTRY TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

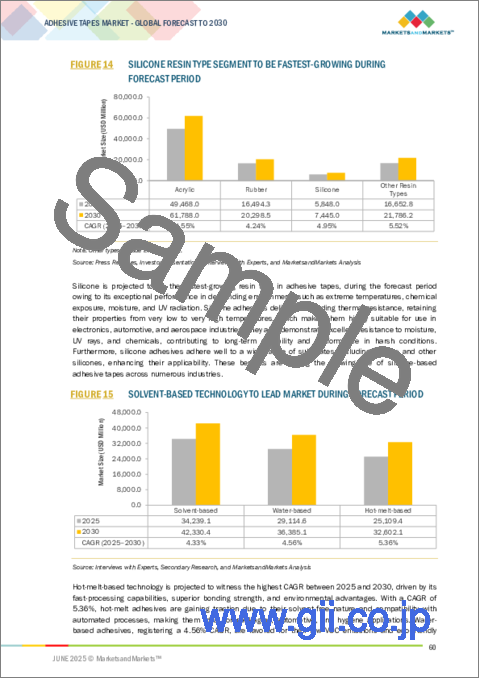

- FIGURE 14 SILICONE RESIN TYPE SEGMENT TO BE FASTEST-GROWING DURING FORECAST PERIOD

- FIGURE 15 SOLVENT-BASED TECHNOLOGY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 PAPER BACKING MATERIAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 SPECIALTY CATEGORY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 19 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES FOR ADHESIVE TAPE MANUFACTURERS

- FIGURE 20 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 CHINA AND ACRYLIC ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 22 POLYPROPYLENE (PP) SEGMENT LED MARKET ACROSS REGIONS

- FIGURE 23 SAUDI ARABIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ADHESIVE TAPES MARKET

- FIGURE 25 ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 ADHESIVE TAPES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE OF ADHESIVE TAPES OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF ADHESIVE TAPES, BY REGION, 2022-2030

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 ADHESIVE TAPES MARKET ECOSYSTEM

- FIGURE 33 EXPORT DATA FOR HS CODE 3919-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 34 IMPORT DATA FOR HS CODE 3919-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 35 PATENTS REGISTERED, 2014-2024

- FIGURE 36 PATENTS APPLIED AND GRANTED FOR ADHESIVE TAPES, 2014-2024

- FIGURE 37 LEGAL STATUS OF PATENTS FILED IN ADHESIVE TAPES MARKET

- FIGURE 38 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 39 IMPACT OF AI/GEN AI ON ADHESIVE TAPES MARKET

- FIGURE 40 ACRYLIC RESIN TO DOMINATE ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- FIGURE 41 SOLVENT-BASED TECHNOLOGY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 PAPER BACKING MATERIAL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 SPECIALTY TAPES CATEGORY TO LEAD ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- FIGURE 44 PACKAGING END-USE INDUSTRY TO LEAD MARKET IN COMMODITY CATEGORY DURING FORECAST PERIOD

- FIGURE 45 HEALTHCARE END-USE INDUSTRY TO LEAD MARKET IN SPECIALTY ADHESIVE TAPES CATEGORY DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO BE LARGEST ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC: ADHESIVE TAPES MARKET SNAPSHOT

- FIGURE 48 EUROPE: ADHESIVE TAPES MARKET SNAPSHOT

- FIGURE 49 NORTH AMERICA: ADHESIVE TAPES MARKET SNAPSHOT

- FIGURE 50 ADHESIVE TAPES MARKET, SHARE OF KEY MARKET PLAYERS, 2024

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 52 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 53 ADHESIVE TAPES MARKET: COMPANY FOOTPRINT

- FIGURE 54 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 55 ADHESIVE TAPES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 56 ADHESIVE TAPES MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 57 ADHESIVE TAPES MARKET: ENTERPRISE VALUATION OF KEY PLAYERS (USD BILLION)

- FIGURE 58 3M: COMPANY SNAPSHOT

- FIGURE 59 TESA SE: COMPANY SNAPSHOT

- FIGURE 60 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 LINTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 NICHIBAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 SCAPA GROUP PLC (MATIV HOLDINGS): COMPANY SNAPSHOT

- FIGURE 65 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

The adhesive tapes market size is projected to reach USD 111.31 billion by 2030 at a CAGR of 4.70% from USD 88.46 billion in 2025. The Asia Pacific is projected to account for the largest share in terms of value of the adhesive tapes market in 2025. Adhesive tapes offer a versatile solution for various applications due to their unique properties, such as flexibility, adhesion, durability, and resistance to environmental factors. In the automotive sector, adhesive tapes with strong bonding properties and high temperature resistance are essential for assembly and surface protection tasks. Similarly, in the packaging industry, tapes with excellent adhesion and tensile strength are crucial for the secure and efficient packaging of goods. As industrialization and urbanization drive demand across sectors like automotive, packaging, electronics, construction, and healthcare, the market for adhesive tapes expands correspondingly. Additionally, ongoing infrastructural development projects, particularly in regions like the Asia Pacific, drive demand for adhesive tapes in construction applications such as bonding, sealing, and insulation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Million Square Meters) |

| Segments | Resin Type, Backing Material, Technology, Category, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"India is forecast to be the fastest-growing adhesive tapes market during the forecast period"

India's expanding manufacturing sector, driven by government initiatives such as "Make in India," has increased the demand for adhesive tapes across various industries, including automotive, packaging, electronics, construction, and healthcare. The automotive sector is witnessing significant growth with increasing production and consumption, thereby boosting the need for adhesive tapes for applications such as bonding, surface protection, and insulation. The rise of e-commerce in India has led to a surge in demand for adhesive tapes for secure packaging during shipping and handling of goods. As more consumers turn to online shopping, there is a heightened need for reliable and efficient packaging solutions, further driving the adhesive tapes market.

"North America is expected to account for the second-largest share of adhesive tapes market in terms of value"

The region's well-established industrial base across sectors like automotive, packaging, electronics, construction, and healthcare drives consistent demand for adhesive tapes. In the automotive industry, adhesive tapes are used for bonding, surface protection, and noise reduction, contributing to the market's growth. The packaging industry in North America relies heavily on adhesive tapes for various applications such as carton sealing, bundling, and labeling. With the increasing prevalence of e-commerce and the demand for efficient packaging solutions, the adhesive tapes market continues to thrive. Advancements in adhesive tape technologies and formulations tailored to meet stringent industry standards and regulations further propel market growth in North America. The region's focus on innovation and sustainability also drives the adoption of eco-friendly adhesive tape solutions.

"China is forecast to be the largest market for adhesive tapes during the forecast period"

China's robust manufacturing sector, often referred to as the "world's factory," generates substantial demand for adhesive tapes across various industries, including automotive, packaging, electronics, construction, and healthcare. The automotive industry in China, for example, relies heavily on adhesive tapes for applications such as bonding, surface protection, and noise dampening. China's booming e-commerce sector has significantly increased the demand for adhesive tapes for secure and efficient packaging during shipping and handling of goods. With the rise of online shopping and the expansion of logistics and delivery services, adhesive tapes play a crucial role in ensuring the integrity of packaged items. China's focus on technological advancements and innovation in adhesive tape formulations and coatings further contributes to market growth. The country's large population and growing disposable income levels also fuel consumption, particularly in sectors like electronics and healthcare, where adhesive tapes are extensively used.

Interviews:

- By Company Type: Tier 1 - 33%, Tier 2 - 40%, and Tier 3 - 27%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 37%, Europe - 23%, Asia Pacific - 26%, Middle East & Africa - 10% and South America - 4%

The key players profiled in the report include 3M Company (US), Avery Dennison Corporation (US), Intertape Polymer Group, Inc. (US), Nitto Denko Corporation (Japan), SCAPA Group PLC (UK), Berry Global Inc. (US), Tesa SE (Germany), Lohmann GMBH & Co. KG (Germany), Saint-Gobain S.A. (France), and Lintec Corporation (Japan), among others.

Research Coverage

This report segments the market for adhesive tapes based on resin type, backing material, technology, category, end-use industry, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the market for adhesive tapes.

Reasons to Buy this Report

This report provides insights on the following pointers:

- Analysis of key drivers (Growing demand from the packaging industry, Increasing adoption in the automotive industry, Improvements in healthcare systems in emerging countries), restraints (Raw material price volatility in adhesive tapes manufacturing), opportunities (Technological innovations in high-performance tapes), and challenges (Supply chain disruptions and raw material shortage) influencing the growth of the adhesive tapes market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the adhesive tapes market.

- Market Development: Comprehensive information about markets - the report analyzes the adhesive tapes market across varied regions.

- Market Diversification: Exclusive information about new products & services, untapped geographies, recent developments, and investments in the adhesive tapes market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like 3M Company (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), and Lintec Corporation (Japan), among others in the adhesive tapes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY-SIDE FORECAST

- 2.3.2 DEMAND-SIDE FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 RISK ASSESSMENT

- 2.8.1 ADHESIVE TAPES MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ADHESIVE TAPES MARKET

- 4.2 ADHESIVE TAPES MARKET, BY REGION

- 4.3 ASIA PACIFIC: ADHESIVE TAPES MARKET, BY RESIN TYPE AND COUNTRY

- 4.4 ADHESIVE TAPES MARKET, BY BACKING MATERIAL AND REGION

- 4.5 ADHESIVE TAPES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand from packaging industry

- 5.2.1.2 E-commerce increasing adoption of adhesive tape films for packaging

- 5.2.1.3 Increasing adoption in automotive industry

- 5.2.1.4 Improvements in healthcare systems in emerging countries

- 5.2.1.5 Increasing use of adhesive tapes in diverse end-use industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Raw material price volatility in adhesive tape manufacturing

- 5.2.2.2 Stringent environmental and regulatory policies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological innovations in high-performance tapes

- 5.2.3.2 Potential substitutes to traditional fastening systems

- 5.2.3.3 Support to European Green Deal for adhesives & sealants

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological barriers to meeting performance standards

- 5.2.4.2 Supply chain disruptions and raw material shortage

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 ADHESIVE TAPE MANUFACTURERS

- 6.1.3 INSPECTION & PACKAGING

- 6.1.4 MARKETING & DISTRIBUTION

- 6.1.5 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF ADHESIVE TAPES OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF ADHESIVE TAPES, BY REGION, 2022-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 ACRYLIC FOAM TAPES FOR ENCLOSED UTILITY TRAILERS

- 6.5.2 ADHESIVE TAPE REPLACES SUCTION CUPS

- 6.5.3 COMPARISON OF MEDICAL ADHESIVE TAPES IN PATIENTS AT RISK OF FACIAL SKIN TRAUMA UNDER ANESTHESIA

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Debonding of smart adhesive tapes

- 6.6.1.2 Nanotechnology

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Adhesive tapes with embedded electronics

- 6.6.3 ADJACENT TECHNOLOGIES

- 6.6.3.1 Self-healing adhesives

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TRADE ANALYSIS

- 6.7.1 EXPORT SCENARIO (HS CODE-3919)

- 6.7.2 IMPORT SCENARIO (HS CODE-3919)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 REACH Regulation (European Union)

- 6.8.2.2 Circular Economy Action Plan (European Union)

- 6.8.2.3 Clean Air Act (US)

- 6.8.2.4 TSCA (Toxic Substances Control Act) (US)

- 6.8.2.5 ISO 9001 and ISO 14001 Standards (Global)

- 6.8.2.6 Medical Device Regulation (MDR) (European Union)

- 6.9 KEY CONFERENCES & EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON ADHESIVE TAPES MARKET

- 6.13 IMPACT OF 2025 US TARIFF - ADHESIVE TAPES MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFFS

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 US

- 6.13.4.2 Europe

- 6.13.4.3 Asia Pacific

- 6.13.5 IMPACT ON END-USE INDUSTRIES

7 ADHESIVE TAPES MARKET, BY RESIN TYPE

- 7.1 INTRODUCTION

- 7.2 ACRYLIC

- 7.2.1 EXCELLENT AGING RESISTANCE AND STRONG ADHESIVE PROPERTIES TO DRIVE MARKET

- 7.3 RUBBER

- 7.3.1 STRONG TACK AND PEEL STRENGTH PROPERTIES TO BOOST MARKET

- 7.4 SILICONE

- 7.4.1 EXCEPTIONAL THERMAL STABILITY AND SUPERIOR CHEMICAL RESISTANCE PROPERTIES TO PROPEL MARKET

- 7.5 OTHER RESIN TYPES

8 ADHESIVE TAPES MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 SOLVENT-BASED

- 8.2.1 EXCEPTIONAL BONDING STRENGTH AND HIGH PERFORMANCE IN CRITICAL APPLICATIONS TO BOOST DEMAND

- 8.3 HOT-MELT-BASED

- 8.3.1 VERSATILITY AND BROAD FORMULATION LATITUDE TO DRIVE MARKET

- 8.4 WATER-BASED

- 8.4.1 INCREASING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS TO PROPEL MARKET

9 ADHESIVE TAPES MARKET, BY BACKING MATERIAL

- 9.1 INTRODUCTION

- 9.2 POLYPROPYLENE (PP)

- 9.2.1 RISING DEMAND FOR FAST-MOVING CONSUMER GOODS TO DRIVE MARKET

- 9.3 PAPER

- 9.3.1 REPULPABILITY TO DRIVE GROWTH

- 9.4 POLYVINYL CHLORIDE (PVC)

- 9.4.1 EXCELLENT FLAME RETARDANCE AND ELECTRICAL INSULATION PROPERTIES TO DRIVE GROWTH

- 9.5 OTHER BACKING MATERIALS

10 ADHESIVE TAPES MARKET, BY CATEGORY

- 10.1 INTRODUCTION

- 10.2 COMMODITY

- 10.2.1 DEMAND FOR RELIABLE AND COST-EFFECTIVE SEALING SOLUTIONS TO FUEL MARKET

- 10.3 SPECIALTY

- 10.3.1 GROWTH OF ELECTRICAL AND ELECTRONICS INDUSTRIES TO BOOST MARKET

11 ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 COMMODITY ADHESIVE TAPES

- 11.2.1 PACKAGING

- 11.2.1.1 Need for cost-effective sealing solutions to drive market

- 11.2.2 MASKING

- 11.2.2.1 Demand from building and construction industry to fuel market

- 11.2.3 CONSUMER & OFFICE

- 11.2.3.1 Increasing demand for creative and organizational solutions to drive market growth

- 11.2.1 PACKAGING

- 11.3 SPECIALTY ADHESIVE TAPES

- 11.3.1 ELECTRICAL & ELECTRONICS

- 11.3.1.1 Rising disposable income in emerging countries to drive market

- 11.3.2 HEALTHCARE

- 11.3.2.1 Growing demand for adhesive tapes in medical devices and surgical instruments to boost market

- 11.3.3 AUTOMOTIVE

- 11.3.3.1 Increasing focus on lightweight hybrid and electric vehicles to boost demand

- 11.3.4 WHITE GOODS

- 11.3.4.1 Demand for enhanced durability and esthetic appeal of appliances to boost market

- 11.3.5 PAPER & PRINTING

- 11.3.5.1 Need for efficient binding and mounting solutions to boost demand

- 11.3.6 BUILDING & CONSTRUCTION

- 11.3.6.1 Growth of housing sector in emerging economies to boost demand

- 11.3.7 RETAIL

- 11.3.7.1 Wide use in product branding and customization to boost market

- 11.3.8 OTHER END-USE INDUSTRIES

- 11.3.1 ELECTRICAL & ELECTRONICS

12 ADHESIVE TAPES MARKET, BY BOND TYPE

- 12.1 INTRODUCTION

- 12.2 TEMPORARY

- 12.2.1 TEMPORARY BOND ADHESIVE TAPES: VERSATILITY TO DRIVE DEMAND ACROSS EVOLVING INDUSTRIAL APPLICATIONS

- 12.3 PERMANENT

- 12.3.1 PERMANENT BOND ADHESIVE TAPES: LONG-TERM SOLUTIONS ACROSS HIGH-PERFORMANCE APPLICATIONS TO FUEL DEMAND

13 ADHESIVE TAPES MARKET, BY BONDING TYPE

- 13.1 INTRODUCTION

- 13.2 SINGLE-SIDED TAPE

- 13.2.1 SINGLE-SIDED ADHESIVE TAPES: BROAD UTILITY AND STEADY DEMAND ACROSS CONVENTIONAL AND INDUSTRIAL APPLICATIONS TO BOOST GROWTH

- 13.3 DOUBLE-SIDED TAPES

- 13.3.1 DOUBLE-SIDED ADHESIVE TAPES: TO DRIVE PRECISION AND ESTHETIC BONDING IN HIGH-GROWTH INDUSTRIES

14 ADHESIVE TAPES MARKET, BY THICKNESS

- 14.1 INTRODUCTION

- 14.2 LESS THAN 20 MICRONS

- 14.2.1 INNOVATIONS IN HEALTHCARE AND ELECTRONICS INDUSTRY TO BOOST MARKET

- 14.3 20-30 MICRONS

- 14.3.1 OPTIMAL THICKNESS FOR VERSATILE APPLICATIONS TO DRIVE GROWTH

- 14.4 30-40 MICRONS

- 14.4.1 AUTOMOTIVE AND ELECTRICAL INDUSTRIES TO BOOST GROWTH

- 14.5 MORE THAN 40 MICRONS

- 14.5.1 CONSTRUCTION, AEROSPACE, AND HEAVY MANUFACTURING TO PROPEL DEMAND

15 ADHESIVE TAPES MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Rapid growth of e-commerce and organized retail to drive market

- 15.2.2 INDIA

- 15.2.2.1 Significant growth of healthcare sector to boost market

- 15.2.3 JAPAN

- 15.2.3.1 Surging demand from automotive industry to boost market

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Advanced electronic manufacturing to fuel market

- 15.2.5 TAIWAN

- 15.2.5.1 Advanced semiconductor and electronics manufacturing to support market growth

- 15.2.6 INDONESIA

- 15.2.6.1 Growing manufacturing sector to boost growth

- 15.2.7 VIETNAM

- 15.2.7.1 Economic growth to lead to market growth

- 15.2.1 CHINA

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Growth of automotive industry to fuel market

- 15.3.2 ITALY

- 15.3.2.1 Rising electric vehicle production to boost growth

- 15.3.3 TURKEY

- 15.3.3.1 Rapid surge in construction and other industries to boost market

- 15.3.4 FRANCE

- 15.3.4.1 Rising healthcare expenditure to propel market

- 15.3.5 NETHERLANDS

- 15.3.5.1 Rise in demand from e-commerce, construction, automotive, and healthcare sectors to boost market

- 15.3.6 UK

- 15.3.6.1 Advanced technological infrastructure and increased R&D to attract foreign investments

- 15.3.7 SPAIN

- 15.3.7.1 Growth of transportation sector and recovery of construction industry to propel demand

- 15.3.1 GERMANY

- 15.4 NORTH AMERICA

- 15.4.1 US

- 15.4.1.1 Increase in demand from automotive and aerospace sectors to drive market

- 15.4.2 CANADA

- 15.4.2.1 Growing investments in sustainable packaging solutions to fuel growth

- 15.4.3 MEXICO

- 15.4.3.1 Rising demand from electronics manufacturing sector to boost growth

- 15.4.1 US

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 GCC COUNTRIES

- 15.5.1.1 UAE

- 15.5.1.1.1 Packaging sector to fuel demand

- 15.5.1.2 Saudi Arabia

- 15.5.1.2.1 Infrastructure development to accelerate demand

- 15.5.1.1 UAE

- 15.5.2 SOUTH AFRICA

- 15.5.2.1 Growth of packaging industry to drive market

- 15.5.1 GCC COUNTRIES

- 15.6 SOUTH AMERICA

- 15.6.1 BRAZIL

- 15.6.1.1 Expansion of e-commerce and packaging industry to boost market

- 15.6.2 ARGENTINA

- 15.6.2.1 Growth of automotive industry to fuel demand

- 15.6.3 COLOMBIA

- 15.6.3.1 Demand from construction industry to propel growth

- 15.6.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- 16.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.5.5.1 Company footprint

- 16.5.5.2 Region footprint

- 16.5.5.3 Resin type footprint

- 16.5.5.4 Technology footprint

- 16.5.5.5 Backing material footprint

- 16.5.5.6 End-use industry footprint

- 16.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.6.1 PROGRESSIVE COMPANIES

- 16.6.2 RESPONSIVE COMPANIES

- 16.6.3 DYNAMIC COMPANIES

- 16.6.4 STARTING BLOCKS

- 16.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.6.5.1 Detailed list of key startups/SMEs

- 16.6.5.2 Competitive benchmarking of key startups/SMEs

- 16.7 BRAND/PRODUCT COMPARISON

- 16.8 VALUATION AND FINANCIAL METRICS

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 EXPANSIONS

- 16.9.3 DEALS

17 COMPANY PROFILES

- 17.1 MAJOR PLAYERS

- 17.1.1 3M

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 TESA SE

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Expansions

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 NITTO DENKO CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Expansions

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 LINTEC CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 MnM view

- 17.1.4.3.1 Right to win

- 17.1.4.3.2 Strategic choices

- 17.1.4.3.3 Weaknesses and competitive threats

- 17.1.5 IPG

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 AVERY DENNISON CORPORATION

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.7 LOHMANN

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.7.3.2 Expansions

- 17.1.8 NICHIBAN CO., LTD.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.9 SCAPA GROUP PLC (MATIV HOLDINGS)

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.10 SAINT-GOBAIN S.A.

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.1 3M

- 17.2 OTHER PLAYERS

- 17.2.1 ADHESIVES RESEARCH

- 17.2.2 SHURTAPE TECHNOLOGIES, LLC

- 17.2.3 ATP ADHESIVE SYSTEMS AG

- 17.2.4 GERGONNE - THE ADHESIVE SOLUTION

- 17.2.5 ORAFOL EUROPE GMBH

- 17.2.6 PPI ADHESIVE PRODUCTS

- 17.2.7 WUHAN HUAXIA NANFANG ADHESIVE TAPES CO., LTD.

- 17.2.8 AMERICAN BILTRITE INC.

- 17.2.9 TERAOKA SEISAKUSHO CO., LTD.

- 17.2.10 ADVANCE TAPES INTERNATIONAL

- 17.2.11 YEM CHIO CO. LTD.

- 17.2.12 DERMAMED COATINGS COMPANY, LLC

- 17.2.13 CCT (COATINGS & CONVERTING TECHNOLOGIES, LLC)

- 17.2.14 ECHOTAPE

- 17.2.15 AJIT INDUSTRIES

- 17.2.16 FABO S.P.A.

- 17.2.17 ADK TAPES

18 ADJACENT/RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 LIMITATIONS

- 18.3 AUTOMOTIVE ADHESIVE TAPES MARKET

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

- 18.3.3 AUTOMOTIVE ADHESIVE TAPES MARKET, BY ADHESIVE TYPE

- 18.3.3.1 Introduction

- 18.3.3.2 Acrylic

- 18.3.3.3 Silicone

- 18.3.3.4 Rubber

- 18.3.3.5 Others

- 18.3.4 AUTOMOTIVE ADHESIVE TAPES MARKET, BY BACKING MATERIAL

- 18.3.4.1 Introduction

- 18.3.4.2 Polypropylene

- 18.3.4.3 Paper

- 18.3.4.4 Polyvinyl chloride

- 18.3.4.5 Others

- 18.3.5 AUTOMOTIVE ADHESIVE TAPES MARKET, BY APPLICATION

- 18.3.5.1 Introduction

- 18.3.5.2 Interior applications

- 18.3.5.3 Exterior applications

- 18.3.5.4 Electric vehicle applications

- 18.3.6 AUTOMOTIVE ADHESIVE TAPES MARKET, BY REGION

- 18.3.6.1 Introduction

- 18.3.6.2 Asia Pacific

- 18.3.6.3 Europe

- 18.3.6.4 North America

- 18.3.6.5 South America

- 18.3.6.6 Middle East & Africa

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS