|

|

市場調査レポート

商品コード

1267423

ガラス繊維の世界市場:ガラスの種類別 (Eガラス、ECRガラス、Hガラス、ARガラス、Sガラス)・製品種類別 (グラスウール、直接・組立ロービング、ヤーン、チョップドストランド)・用途別 (複合材料、断熱材)・地域別の将来予測 (2028年まで)Fiberglass Market by Glass Type (E Glass, ECR Glass, H Glass, AR Glass, S Glass), Product Type (Glass Wool, Direct and Assembled Roving, Yarn, Chopped Strand), Application (Composites, Insulation), and Region - Global Forecasts to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ガラス繊維の世界市場:ガラスの種類別 (Eガラス、ECRガラス、Hガラス、ARガラス、Sガラス)・製品種類別 (グラスウール、直接・組立ロービング、ヤーン、チョップドストランド)・用途別 (複合材料、断熱材)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月25日

発行: MarketsandMarkets

ページ情報: 英文 332 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のガラス繊維の市場規模は、2022年の277億米ドルから2028年までに443億米ドルに達し、予測期間中に7.3%のCAGRで成長すると予測されています。

Sガラスは、高性能な種類のガラス繊維で、その優れた強度と剛性で知られており、繊維化と呼ばれる工程を経て、溶けたガラスプールからガラス繊維を引き出すことで作られます。Sガラスは、シリカと酸化マグネシウムの割合が高く、他のガラス繊維よりも優れた特性を備えています。Sガラスは、強度と剛性が重要視される用途に使用される高性能素材です。航空宇宙、防衛、自動車などの産業が高性能な素材を求め続ける中、Sガラスの需要は増加することが予想されます。Sガラスは、強度と耐久性に優れた複合材料の製造に使用できる軽量な材料です。航空宇宙や自動車などの業界では、燃費の向上や排出ガスの削減のために軽量化にますます力を入れているため、Sガラスの使用は増加すると予想されます。

"複合材料用途全体の中で、建設・インフラの最終用途産業が、金額ベースで最大のシェアを占める"

ガラス繊維は、コンクリートの強度や耐久性を向上させるために、補強材として使用されています。ガラス繊維製の補強材は、軽量で耐腐食性に優れているため、鉄製補強材よりも好まれています。また、ガラス繊維断熱材は、断熱性を高めてエネルギー効率を向上させるために、建築で一般的に使用されています。壁、床、天井に簡単に設置でき、費用対効果も高いソリューションです。ガラス繊維はまた、上下水道処理施設、化学処理施設、石油・ガス施設など、さまざまな用途のパイプやタンクの建設に使用されています。ガラス繊維製のパイプやタンクは、軽量で耐腐食性に優れ、耐用年数も長いです。ガラス繊維は、建設・インフラ業界において、軽量性、耐久性、耐腐食性など、多くの利点を備えています。これらの産業が成長を続け、新たな課題に直面する中、ガラス繊維の使用は増加することが予想されます。

"チョップドストランド製品のセグメントが、予測期間中に金額ベースで最も高いCAGRを達成する"

製品種類別では、チョップドストランドのセグメントが、ガラス繊維市場の予測期間中に最も高いCAGRを記録すると予想されます。チョップドストランドガラス繊維は、ガラス繊維補強材の一種で、ガラス繊維を短く切断して樹脂と混合し、複合材料としたものです。チョップドストランドガラス繊維の需要は、主に自動車、航空宇宙、建設、船舶などのさまざまな最終用途産業における補強材としての使用によってもたらされています。これらの産業が成長を続けるにつれ、チョップドストランドガラス繊維の需要も増加すると予想されます。チョップドストランドガラス繊維の成長は、最終用途産業の成長、製造プロセスの進歩、規制要件と密接に結びついています。

"北米地域のガラス繊維市場は、予測期間中に3番目に高い市場シェアを達成する"

2022年の市場シェアは、アジア太平洋が最も大きく、欧州が北米に次いで2番目に大きい市場シェアを占めています。北米市場は今後数年間でかなりの成長を遂げると思われます。世界と北米地域でエネルギー需要が増加しており、より効率的で耐久性のあるガラス繊維材料の必要性が高まっているのが、その理由となっています。ガラス繊維は、軽量化、耐腐食性の向上、性能の強化により、これらの目標の達成に貢献します。新興国市場の開拓という点では、ガラス繊維業界は、変化する市場の要求や規制要件に対応するため、常に進化を続けています。例えば、北米では、より環境的に持続可能で、二酸化炭素排出量の削減に貢献するガラス繊維製品への需要が高まっています。そのため、リサイクル素材の使用や、自動車の燃費を改善できる軽量素材の製造など、新しいガラス繊維製造プロセスや製品の開発が進んでいます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 進化

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 平均販売価格:ガラスの種類別

- 平均販売価格:製品種類別

- 平均販売価格の傾向

- 主な利害関係者と購入基準

- 技術分析

- エコシステム:ガラス繊維市場

- バリューチェーン分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 輸出入の主要市場

- 関税と規制

- 特許分析

- 主な会議とイベント

第6章 ガラス繊維市場:製品種類別

- イントロダクション

- グラスウール

- 直接・組立ロービング

- ヤーン

- チョップドストランド

- その他

第7章 ガラス繊維市場:ガラスの種類別

- イントロダクション

- Eガラス

- ECRガラス

- Hガラス

- ARガラス

- Sガラス

- その他

第8章 ガラス繊維市場:用途別

- イントロダクション

- 複合材料

- 断熱材

第9章 ガラス繊維市場:地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング

- 大手企業の収益分析

- 企業評価マトリックス

- 競合情勢マッピング

- 市場評価フレームワーク

- 主要なスタートアップ/中小企業の競合ベンチマーキング

- 中小企業 (SME) の評価マトリックス

第11章 企業プロファイル

- 主要企業

- CHINA JUSHI CO., LTD.

- OWENS CORNING

- SAINT-GOBAIN

- TAISHAN FIBERGLASS INC. (CTG GROUP)

- CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)

- NIPPON ELECTRIC GLASS CO., LTD.

- 3B-THE FIBREGLASS COMPANY

- TAIWAN GLASS IND. CORP.

- PFG FIBER GLASS CORPORATION (KUNSHAN)

- JOHNS MANVILLE (A BERKSHIRE HATHAWAY COMPANY)

- ASAHI FIBER GLASS CO., LTD.

- KNAUF INSULATION

- AGY

- その他の企業

- SODA SANAYII AS

- FIBTEX PRODUCTS

- DARSHAN SAFETY ZONE

- NITTO BOSEKI CO., LTD.

- KCC CORPORATION

- JIANGSU CHANGHAI COMPOSITE MATERIALS CO., LTD.

- BGF INDUSTRIES, INC.

- ARABIAN FIBERGLASS INSULATION CO., LTD. (AFICO)

- SHREE LAXMI UDYOG

- CHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS)

第12章 付録

The fiberglass market is projected to grow from USD 27.7 billion in 2022 to USD 44.3 billion by 2028, at a CAGR of 7.3% during the forecast period. S-glass is a high-performance type of fiberglass that is known for its exceptional strength and stiffness. It is made by drawing glass fibers from a molten glass pool using a process called fiberization. S-glass is composed of a high percentage of silica and magnesium oxide, giving it superior properties to other fiberglass types. S-glass is a high-performance material that is used in applications where strength and stiffness are critical. As industries such as aerospace, defense, and automotive continue to demand high-performance materials, the demand for S-glass is expected to increase. S-glass is a lightweight material that can be used to produce composite materials that are strong and durable. As industries such as aerospace and automotive increasingly focus on lightweighting to improve fuel efficiency and reduce emissions, the use of S-glass is expected to increase

''In terms of value, construction & infrastructure end-use industry accounted for the largest share of the overall composite application''

Fiberglass is used as a reinforcement material in concrete to improve its strength and durability. Fiberglass reinforcement is often preferred over steel reinforcement due to its lightweight and corrosion-resistant properties. Also, fiberglass insulation is commonly used in construction to provide thermal insulation and improve energy efficiency. It is a cost-effective solution that can be easily installed on walls, floors, and ceilings. Fiberglass is also used to construct pipes and tanks for various applications, such as water and wastewater treatment plants, chemical processing plants, and oil and gas facilities. Fiberglass pipes and tanks are lightweight, corrosion-resistant, and have a long service life. Fiberglass offers many advantages in the construction and infrastructure industry, including lightweight, durability, and corrosion resistance. As these industries continue to grow and face new challenges, the use of fiberglass is expected to increase.

"''In terms of value, chopped strand product segment expected to register highest CAGR during the forecast period''

Based on product type, the chopped strand segment is expected to register the highest CAGR during the forecast period for the fiberglass market. Chopped strand fiberglass is a type of fiberglass reinforcement consisting of glass fibers cut into short lengths and then mixed with a resin to form a composite material. The demand for chopped strand fiberglass is primarily driven by its use as a reinforcement material in various end-use industries, such as automotive, aerospace, construction, and marine. As these industries continue to grow, the demand for chopped-strand fiberglass is also expected to increase. The growth of chopped strand fiberglass is closely tied to end-use industries' growth, manufacturing process advancements, and regulatory requirements.

"During the forecast period, the fiberglass market in North America region is projected to register the third highest market share"

The fiberglass market has been studied in North America, Europe, Asia Pacific, the Middle East, Africa, and South America. Asia Pacific accounted for the largest market share in 2022, whereas Europe accounted for the second-largest market share in 2022, followed by North America. The North American market will experience considerable growth in the next years because there has been an increasing demand for energy worldwide and North American region, which has driven the need for more efficient and durable fiberglass materials. Fiberglass can help achieve these goals by reducing weight, improving corrosion resistance, and enhancing performance. In terms of developments, the fiberglass industry is constantly evolving to meet changing market demands and regulatory requirements. For example, there is a growing demand for fiberglass products in North America that are more environmentally sustainable and can help reduce carbon emissions. This has led to the development of new fiberglass manufacturing processes and products, such as using recycled materials or producing lighter-weight materials that can improve fuel efficiency in vehicles.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Others- 34%

- By Region- North America- 20%, Europe- 25%, Asia Pacific (APAC) - 25%, South America-10%, Middle East & Africa (MEA)-20%

The report provides a comprehensive analysis of company profiles:

Prominent companies include China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group) (China), Chongqing Polycomp International Corp. (CPIC) (China), Nippon Electric Glass Co., Ltd. (Japan), 3B-the fiberglass company (Belgium), among others.

Research Coverage

This research report categorizes the fiberglass market by glass type (E Glass, ECR Glass, H Glass, AR Glass, S Glass), product type (glass wool, direct & assembled roving, yarn, chopped strand), application (composites, insulation) & region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the fiberglass market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the fiberglass market. Competitive analysis of upcoming startups in the fiberglass market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall fiberglass market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand from the construction industry, Increasing demand from the wind energy sector, Rising demand for lightweight materials), restraints (Volatility in raw material prices, Competition from alternative materials), opportunities (Growing demand from emerging economies), and challenges (Limited recycling options, Stringent regulations) influencing the growth of the fiberglass market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the fiberglass market

- Market Development: Comprehensive information about lucrative markets - the report analyses the fiberglass market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the fiberglass industry market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group) (China), Chongqing Polycomp International Corp. (CPIC) (China), Nippon Electric Glass Co., Ltd. (Japan), 3B-the fiberglass company (Belgium), among others in the fiberglass market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 FIBERGLASS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 FIBERGLASS MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 IMPACT OF RECESSION

- 2.4 FORECAST NUMBER CALCULATION

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.4.3 SECONDARY DATA

- 2.4.3.1 Key data from secondary sources

- 2.4.4 PRIMARY DATA

- 2.4.4.1 Key data from primary sources

- 2.4.4.2 Primary interviews with top fiberglass manufacturers

- 2.4.4.3 Breakdown of primary interviews

- 2.4.4.4 Key industry insights

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.6 DATA TRIANGULATION

- FIGURE 5 FIBERGLASS MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.10 RESEARCH LIMITATIONS

- 2.11 RISKS ASSOCIATED WITH FIBERGLASS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 6 GLASS WOOL LED FIBERGLASS MARKET IN 2022

- FIGURE 7 COMPOSITES SEGMENT ACCOUNTED FOR DOMINANT SHARE IN 2022

- FIGURE 8 E-GLASS ACCOUNTED FOR LARGEST SHARE OF FIBERGLASS MARKET IN 2022

- FIGURE 9 ASIA PACIFIC LED FIBERGLASS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN FIBERGLASS MARKET

- FIGURE 10 FIBERGLASS MARKET TO WITNESS HIGH GROWTH IN ASIA PACIFIC BETWEEN 2023 AND 2028

- 4.2 FIBERGLASS MARKET, BY PRODUCT TYPE AND REGION, 2022

- FIGURE 11 ASIA PACIFIC WAS LARGEST MARKET FOR FIBERGLASS IN 2022

- 4.3 FIBERGLASS MARKET, BY APPLICATION, 2022

- FIGURE 12 COMPOSITES SEGMENT LED OVERALL MARKET IN 2022

- 4.4 FIBERGLASS MARKET, BY GLASS TYPE

- FIGURE 13 E-GLASS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.5 FIBERGLASS MARKET GROWTH, BY KEY COUNTRY

- FIGURE 14 INDONESIA TO BE FASTEST-GROWING FIBERGLASS MARKET, 2023-2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 EVOLUTION

- 5.3 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FIBERGLASS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Extensive use of fiberglass in construction & infrastructure industry

- 5.3.1.2 Increased use of fiberglass composites in automotive industry

- TABLE 1 NUMBER OF FUEL CELL ELECTRIC VEHICLES (FCEVS), BY MAJOR COUNTRY/REGION, 2021

- 5.3.2 RESTRAINTS

- 5.3.2.1 Issues associated with glass wool recycling

- 5.3.2.2 Lack of standardization in manufacturing technologies of various fiberglass products

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing number of wind energy capacity installations

- TABLE 2 NEW WIND POWER INSTALLATIONS (ONSHORE), BY REGION, 2022-2027

- 5.3.3.2 Rising demand for composite materials in construction & infrastructure industry in Middle East & Africa

- 5.3.4 CHALLENGES

- 5.3.4.1 Capital-intensive production and complex manufacturing process of fiberglass

- 5.3.4.2 Competition from alternative materials

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 FIBERGLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 BARGAINING POWER OF BUYERS

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 FIBERGLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- TABLE 4 FIBERGLASS MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE, BY PRODUCT TYPE (KEY PLAYERS)

- FIGURE 17 AVERAGE SELLING PRICE OF KEY PLAYERS FOR PRODUCT TYPES (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT TYPE (USD/KG)

- 5.7 AVERAGE SELLING PRICE, BY GLASS TYPE

- FIGURE 18 AVERAGE SELLING PRICE FOR DIFFERENT GLASS TYPES (USD/KG)

- 5.8 AVERAGE SELLING PRICE, BY PRODUCT TYPE

- FIGURE 19 AVERAGE SELLING PRICE BASED ON PRODUCT TYPES (USD/KG)

- 5.9 AVERAGE SELLING PRICE TREND

- TABLE 6 FIBERGLASS: AVERAGE SELLING PRICE TREND IN FIBERGLASS MARKET, BY REGION

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- 5.10.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.11 TECHNOLOGY ANALYSIS

- TABLE 9 FIBERGLASS MANUFACTURING PROCESS

- 5.12 ECOSYSTEM: FIBERGLASS MARKET

- 5.13 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS: FIBERGLASS MARKET

- 5.14 CASE STUDY ANALYSIS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 KEY MARKETS FOR IMPORT/EXPORT

- 5.16.1 JAPAN

- 5.16.2 CHINA

- 5.16.3 TAIWAN

- 5.16.4 US

- 5.16.5 INDIA

- 5.17 TARIFF AND REGULATIONS

- 5.17.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17.2 STANDARDS FOR COMPOSITES IN FIBERGLASS MARKET

- TABLE 14 CURRENT STANDARD CODES FOR FIBERGLASS MARKET

- 5.18 PATENT ANALYSIS

- 5.18.1 INTRODUCTION

- 5.18.2 METHODOLOGY

- 5.18.3 DOCUMENT TYPE

- TABLE 15 FIBERGLASS MARKET: GLOBAL PATENTS

- FIGURE 23 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 24 GLOBAL PATENT PUBLICATION TREND: 2011-2021

- 5.18.4 INSIGHTS

- 5.18.5 LEGAL STATUS OF PATENTS

- FIGURE 25 FIBERGLASS MARKET: LEGAL STATUS OF PATENTS

- 5.18.6 JURISDICTION ANALYSIS

- FIGURE 26 GLOBAL JURISDICTION ANALYSIS, 2016-2021

- 5.18.7 TOP APPLICANTS' ANALYSIS

- FIGURE 27 JOHNS MANVILLE REGISTERED HIGHEST NUMBER OF PATENTS

- 5.18.8 PATENTS BY JOHNS MANVILLE

- 5.18.9 PATENTS BY BOEING COMPANY

- 5.18.10 PATENTS BY OWENS CORNING

- 5.18.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.19 KEY CONFERENCES & EVENTS

- TABLE 16 DETAILED LIST OF CONFERENCES & EVENTS RELATED TO FIBERGLASS AND RELATED MARKETS, 2023-2024

6 FIBERGLASS MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- FIGURE 28 CHOPPED STRAND SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 17 FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 18 FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 19 FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 20 FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 6.2 GLASS WOOL

- 6.2.1 USED AS THERMAL INSULATOR IN RESIDENTIAL WALLS AND CEILINGS TO REDUCE POWER CONSUMPTION

- FIGURE 29 ASIA PACIFIC TO BE LARGEST GLASS WOOL MARKET

- 6.2.2 GLASS WOOL MARKET, BY REGION

- TABLE 21 GLASS WOOL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 GLASS WOOL MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 23 GLASS WOOL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 DIRECT & ASSEMBLED ROVING

- 6.3.1 HIGH DEMAND FROM CONSTRUCTION, INFRASTRUCTURE, AND WIND ENERGY SEGMENTS

- FIGURE 30 ASIA PACIFIC TO BE LARGEST DIRECT & ASSEMBLED ROVING MARKET

- 6.3.2 DIRECT & ASSEMBLED ROVING MARKET, BY REGION

- TABLE 25 DIRECT & ASSEMBLED ROVING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 DIRECT & ASSEMBLED ROVING MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 27 DIRECT & ASSEMBLED ROVING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 28 DIRECT & ASSEMBLED ROVING MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.4 YARN

- 6.4.1 RISING DEMAND FOR ELECTRONICS AND CONSTRUCTION

- FIGURE 31 ASIA PACIFIC TO BE LARGEST YARN MARKET

- 6.4.2 YARN MARKET, BY REGION

- TABLE 29 YARN MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 YARN MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 31 YARN MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 YARN MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.5 CHOPPED STRAND

- 6.5.1 RISING AUTOMOBILE PRODUCTION IN ASIA PACIFIC AND EUROPE

- FIGURE 32 NORTH AMERICA TO BE SECOND-LARGEST CHOPPED STRAND MARKET

- 6.5.2 CHOPPED STRAND MARKET, BY REGION

- TABLE 33 CHOPPED STRAND MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 CHOPPED STRAND MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 35 CHOPPED STRAND MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 CHOPPED STRAND MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.6 OTHERS

- 6.6.1 OTHER PRODUCT TYPES MARKET, BY REGION

- TABLE 37 OTHER PRODUCT TYPES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 OTHER PRODUCT TYPES MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 39 OTHER PRODUCT TYPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 OTHER PRODUCT TYPES MARKET, BY REGION, 2023-2028 (KILOTON)

7 FIBERGLASS MARKET, BY GLASS TYPE

- 7.1 INTRODUCTION

- FIGURE 33 E-GLASS SEGMENT TO LEAD FIBERGLASS MARKET DURING FORECAST PERIOD

- TABLE 41 FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (USD MILLION)

- TABLE 42 FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (KILOTON)

- TABLE 43 FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (USD MILLION)

- TABLE 44 FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (KILOTON)

- 7.2 E GLASS

- 7.2.1 MOST WIDELY USED GLASS TYPE IN FIBERGLASS MARKET

- FIGURE 34 ASIA PACIFIC TO BE LARGEST E-GLASS FIBER MARKET

- 7.2.2 E-GLASS FIBER MARKET, BY REGION

- TABLE 45 E-GLASS FIBER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 E-GLASS FIBER MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 47 E-GLASS FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 E-GLASS FIBER MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.3 ECR-GLASS

- 7.3.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR ECR GLASS

- FIGURE 35 ASIA PACIFIC TO BE LARGEST ECR-GLASS FIBER MARKET

- 7.3.2 ECR-GLASS FIBER MARKET, BY REGION

- TABLE 49 ECR-GLASS FIBER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 ECR-GLASS FIBER MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 51 ECR-GLASS FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 ECR-GLASS FIBER MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.4 H GLASS

- 7.4.1 H GLASS WIDELY USED IN ADVANCED COMPOSITES

- FIGURE 36 NORTH AMERICA TO REGISTER SECOND-HIGHEST GROWTH RATE IN H-GLASS FIBER MARKET

- 7.4.2 H-GLASS FIBER MARKET, BY REGION

- TABLE 53 H-GLASS FIBER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 H-GLASS FIBER MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 55 H-GLASS FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 H-GLASS FIBER MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.5 AR GLASS

- 7.5.1 AR GLASS REPLACING ASBESTOS IN CONSTRUCTION APPLICATION

- FIGURE 37 EUROPE TO BE SECOND-LARGEST AR-GLASS FIBER MARKET

- 7.5.2 AR-GLASS FIBER MARKET, BY REGION

- TABLE 57 AR-GLASS FIBER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 AR-GLASS FIBER MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 59 AR-GLASS FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 AR-GLASS FIBER MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.6 S GLASS

- 7.6.1 EUROPE TO BE LARGEST MARKET FOR S-GLASS SEGMENT

- FIGURE 38 EUROPE TO BE LARGEST S-GLASS FIBER MARKET

- 7.6.2 S-GLASS FIBER MARKET, BY REGION

- TABLE 61 S-GLASS FIBER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 S-GLASS FIBER MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 63 S-GLASS FIBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 S-GLASS FIBER MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.7 OTHERS

- 7.7.1 OTHER GLASS TYPES: FIBERGLASS MARKET, BY REGION

- TABLE 65 OTHER GLASS TYPES: FIBERGLASS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 OTHER GLASS TYPES: FIBERGLASS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 67 OTHER GLASS TYPES: FIBERGLASS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 OTHER GLASS TYPES: FIBERGLASS MARKET, BY REGION, 2023-2028 (KILOTON)

8 FIBERGLASS MARKET, BY APPLICATION

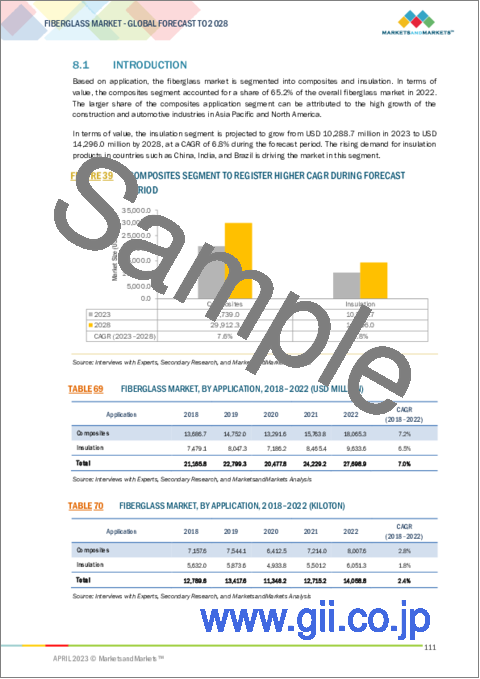

- 8.1 INTRODUCTION

- FIGURE 39 COMPOSITES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 69 FIBERGLASS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 70 FIBERGLASS MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 71 FIBERGLASS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 72 FIBERGLASS MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2 COMPOSITES

- 8.2.1 COMPOSITES ACCOUNTED FOR LARGER MARKET SHARE

- FIGURE 40 ASIA PACIFIC TO BE LARGEST FIBERGLASS COMPOSITES MARKET

- 8.2.2 FIBERGLASS MARKET IN COMPOSITES, BY REGION

- TABLE 73 FIBERGLASS MARKET IN COMPOSITES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 FIBERGLASS MARKET IN COMPOSITES, BY REGION, 2018-2022 (KILOTON)

- TABLE 75 FIBERGLASS MARKET IN COMPOSITES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 76 FIBERGLASS MARKET IN COMPOSITES, BY REGION, 2023-2028 (KILOTON)

- 8.2.3 FIBERGLASS MARKET IN COMPOSITES, BY END-USE INDUSTRY

- TABLE 77 FIBERGLASS MARKET IN COMPOSITES, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 78 FIBERGLASS MARKET IN COMPOSITES, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 79 FIBERGLASS MARKET IN COMPOSITES, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 80 FIBERGLASS MARKET IN COMPOSITES, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.2.3.1 Construction & Infrastructure

- 8.2.3.1.1 Tensile strength and strength-to-weight ratio of fiberglass ideal for this segment

- 8.2.3.1.2 Fiberglass composites market in construction & infrastructure end-use industry, by region

- 8.2.3.1 Construction & Infrastructure

- TABLE 81 FIBERGLASS COMPOSITES MARKET IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 FIBERGLASS COMPOSITES MARKET IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2018-2022 (KILOTON)

- TABLE 83 FIBERGLASS COMPOSITES MARKET IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 84 FIBERGLASS COMPOSITES MARKET IN CONSTRUCTION & INFRASTRUCTURE, BY REGION, 2023-2028 (KILOTON)

- 8.2.3.2 Automotive

- 8.2.3.2.1 Weight reduction, increased processing speed, and low VOC emissions encourage fiberglass adoption

- 8.2.3.2.2 Fiberglass composites market in automotive end-use industry, by region

- 8.2.3.2 Automotive

- TABLE 85 FIBERGLASS COMPOSITES MARKET IN AUTOMOTIVE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 FIBERGLASS COMPOSITES MARKET IN AUTOMOTIVE, BY REGION, 2018-2022 (KILOTON)

- TABLE 87 FIBERGLASS COMPOSITES MARKET IN AUTOMOTIVE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 88 FIBERGLASS COMPOSITES MARKET IN AUTOMOTIVE, BY REGION, 2023-2028 (KILOTON)

- 8.2.3.3 Wind energy

- 8.2.3.3.1 High tensile strength of fiberglass composites driving demand in wind turbine blades manufacturing

- 8.2.3.3.2 Fiberglass composites market in wind energy end-use industry, by region

- 8.2.3.3 Wind energy

- TABLE 89 FIBERGLASS COMPOSITES MARKET IN WIND ENERGY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 90 FIBERGLASS COMPOSITES MARKET IN WIND ENERGY, BY REGION, 2018-2022 (KILOTON)

- TABLE 91 FIBERGLASS COMPOSITES MARKET IN WIND ENERGY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 92 FIBERGLASS COMPOSITES MARKET IN WIND ENERGY, BY REGION, 2023-2028 (KILOTON)

- 8.2.3.4 Electronics

- 8.2.3.4.1 High thermal resistance and electrical conductivity of fiberglass fueling adoption in electronics application

- 8.2.3.4.2 Fiberglass composites market in electronics end-use industry, by region

- 8.2.3.4 Electronics

- TABLE 93 FIBERGLASS COMPOSITES MARKET IN ELECTRONICS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 FIBERGLASS COMPOSITES MARKET IN ELECTRONICS, BY REGION, 2018-2022 (KILOTON)

- TABLE 95 FIBERGLASS COMPOSITES MARKET IN ELECTRONICS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 96 FIBERGLASS COMPOSITES MARKET IN ELECTRONICS, BY REGION, 2023-2028 (KILOTON)

- 8.2.3.5 Aerospace

- 8.2.3.5.1 S-glass and E-glass most widely used glass types in aerospace applications

- 8.2.3.5.2 Fiberglass composites market in aerospace end-use industry, by region

- 8.2.3.5 Aerospace

- TABLE 97 FIBERGLASS COMPOSITES MARKET IN AEROSPACE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 98 FIBERGLASS COMPOSITES MARKET IN AEROSPACE, BY REGION, 2018-2022 (KILOTON)

- TABLE 99 FIBERGLASS COMPOSITES MARKET IN AEROSPACE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 100 FIBERGLASS COMPOSITES MARKET IN AEROSPACE, BY REGION, 2023-2028 (KILOTON)

- 8.2.3.6 Others

- 8.2.3.6.1 Fiberglass composites market in other end-use industries, by region

- 8.2.3.6 Others

- TABLE 101 FIBERGLASS COMPOSITES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 102 FIBERGLASS COMPOSITES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (KILOTON)

- TABLE 103 FIBERGLASS COMPOSITES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 104 FIBERGLASS COMPOSITES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (KILOTON)

- 8.3 INSULATION

- 8.3.1 FIBERGLASS MARKET IN INSULATION, BY END-USE INDUSTRY

- TABLE 105 FIBERGLASS MARKET IN INSULATION, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 106 FIBERGLASS MARKET IN INSULATION, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 107 FIBERGLASS MARKET IN INSULATION, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 108 FIBERGLASS MARKET IN INSULATION, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.1.1 Residential construction

- 8.3.1.1.1 Residential construction segment led fiberglass insulation market

- 8.3.1.1.2 Fiberglass insulation market in residential construction end-use industry, by region

- 8.3.1.1 Residential construction

- TABLE 109 FIBERGLASS INSULATION MARKET IN RESIDENTIAL CONSTRUCTION, BY REGION, 2018-2022 (USD MILLION)

- TABLE 110 FIBERGLASS INSULATION MARKET IN RESIDENTIAL CONSTRUCTION, BY REGION, 2018-2022 (KILOTON)

- TABLE 111 FIBERGLASS INSULATION MARKET IN RESIDENTIAL CONSTRUCTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 112 FIBERGLASS INSULATION MARKET IN RESIDENTIAL CONSTRUCTION, BY REGION, 2023-2028 (KILOTON)

- 8.3.1.2 Non-residential construction

- 8.3.1.2.1 Asia Pacific dominates fiberglass insulation market in non-residential construction

- 8.3.1.2.2 Fiberglass insulation market in non-residential construction end-use industry, by region

- 8.3.1.2 Non-residential construction

- TABLE 113 FIBERGLASS INSULATION MARKET IN NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2018-2022 (USD MILLION)

- TABLE 114 FIBERGLASS INSULATION MARKET IN NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2018-2022 (KILOTON)

- TABLE 115 FIBERGLASS INSULATION MARKET IN NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 116 FIBERGLASS INSULATION MARKET IN NON-RESIDENTIAL CONSTRUCTION, BY REGION, 2023-2028 (KILOTON)

- 8.3.1.3 Industrial

- 8.3.1.3.1 High demand for glass wool fiber to manufacture industrial pipes, power plant boilers, and smoke flues

- 8.3.1.3.2 Fiberglass insulation market in industrial end-use industry, by region

- 8.3.1.3 Industrial

- TABLE 117 FIBERGLASS INSULATION MARKET IN INDUSTRIAL, BY REGION, 2018-2022 (USD MILLION)

- TABLE 118 FIBERGLASS INSULATION MARKET IN INDUSTRIAL, BY REGION, 2018-2022 (KILOTON)

- TABLE 119 FIBERGLASS INSULATION MARKET IN INDUSTRIAL, BY REGION, 2023-2028 (USD MILLION)

- TABLE 120 FIBERGLASS INSULATION MARKET IN INDUSTRIAL, BY REGION, 2023-2028 (KILOTON)

- 8.3.1.4 Others

- 8.3.1.4.1 Fiberglass insulation market in other end-use industries, by region

- 8.3.1.4 Others

- TABLE 121 FIBERGLASS INSULATION MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 122 FIBERGLASS INSULATION MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (KILOTON)

- TABLE 123 FIBERGLASS INSULATION MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 124 FIBERGLASS INSULATION MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (KILOTON)

9 FIBERGLASS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 41 CHINA TO BE FASTEST-GROWING FIBERGLASS MARKET DURING FORECAST PERIOD

- 9.1.1 FIBERGLASS MARKET, BY REGION

- TABLE 125 FIBERGLASS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 126 FIBERGLASS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 127 FIBERGLASS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 128 FIBERGLASS MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 42 NORTH AMERICA: FIBERGLASS MARKET SNAPSHOT

- 9.2.2 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE

- TABLE 129 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (USD MILLION)

- TABLE 130 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (KILOTON)

- TABLE 131 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (KILOTON)

- 9.2.3 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE

- TABLE 133 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 135 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.2.4 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 137 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 139 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.5 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- TABLE 141 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 143 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.6 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY

- TABLE 145 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 147 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.2.6.1 US

- 9.2.6.1.1 US dominates fiberglass market in North America

- 9.2.6.1.2 US: Fiberglass market, by product type

- 9.2.6.1 US

- TABLE 149 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 150 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 151 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 152 US: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.2.6.2 Canada

- 9.2.6.2.1 Presence of well-established aerospace industry fueling demand for fiberglass

- 9.2.6.2.2 Canada: Fiberglass market, by product type

- 9.2.6.2 Canada

- TABLE 153 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 154 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 155 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 156 CANADA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.2.6.3 Mexico

- 9.2.6.3.1 Increase in demand for fiberglass from automotive industry

- 9.2.6.3.2 Mexico: Fiberglass market, by product type

- 9.2.6.3 Mexico

- TABLE 157 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 158 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 159 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 160 MEXICO: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3 ASIA PACIFIC

- 9.3.1 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: FIBERGLASS MARKET SNAPSHOT

- 9.3.2 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE

- TABLE 161 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (KILOTON)

- TABLE 163 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (KILOTON)

- 9.3.3 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE

- TABLE 165 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 166 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 167 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.4 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 169 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 170 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 171 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- TABLE 173 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 175 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.6 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY

- TABLE 177 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 179 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.3.6.1 China

- 9.3.6.1.1 Presence of major fiberglass manufacturers fueling market

- 9.3.6.1.2 China: Fiberglass market, by product type

- 9.3.6.1 China

- TABLE 181 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 182 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 183 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 184 CHINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.2 Japan

- 9.3.6.2.1 Direct & assembled roving segment dominates market in Japan

- 9.3.6.2.2 Japan: Fiberglass market, by product type

- 9.3.6.2 Japan

- TABLE 185 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 186 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 187 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 188 JAPAN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.3 India

- 9.3.6.3.1 Construction industry fueling demand for fiberglass products

- 9.3.6.3.2 India: Fiberglass market, by product type

- 9.3.6.3 India

- TABLE 189 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 190 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 191 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 192 INDIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.4 South Korea

- 9.3.6.4.1 Presence of major electronics companies drives demand for fiberglass

- 9.3.6.4.2 South Korea: Fiberglass market, by product type

- 9.3.6.4 South Korea

- TABLE 193 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 194 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 195 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 196 SOUTH KOREA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.5 Indonesia

- 9.3.6.5.1 Growing urban population and rising disposable income to drive construction industry

- 9.3.6.5.2 Indonesia: Fiberglass market, by product type

- 9.3.6.5 Indonesia

- TABLE 197 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 198 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 199 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 200 INDONESIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.6 Australia

- 9.3.6.6.1 Yarn segment to witness highest growth

- 9.3.6.6.2 Australia: Fiberglass market, by product type

- 9.3.6.6 Australia

- TABLE 201 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 202 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 203 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 204 AUSTRALIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.7 Malaysia

- 9.3.6.7.1 Growing demand from transportation and aerospace industries

- 9.3.6.7.2 Malaysia: Fiberglass market, by product type

- 9.3.6.7 Malaysia

- TABLE 205 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 206 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 207 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 208 MALAYSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.3.6.8 Rest of Asia Pacific

- 9.3.6.8.1 Rest of Asia Pacific: Fiberglass market, by product type

- 9.3.6.8 Rest of Asia Pacific

- TABLE 209 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 211 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4 EUROPE

- 9.4.1 IMPACT OF RECESSION ON EUROPE

- FIGURE 44 EUROPE: FIBERGLASS MARKET SNAPSHOT

- 9.4.2 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE

- TABLE 213 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (USD MILLION)

- TABLE 214 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (KILOTON)

- TABLE 215 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (USD MILLION)

- TABLE 216 EUROPE: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (KILOTON)

- 9.4.3 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE

- TABLE 217 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 218 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 219 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 220 EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.4 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 221 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 222 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 223 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 224 EUROPE: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- TABLE 225 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 226 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 227 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 228 EUROPE: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.6 EUROPE: FIBERGLASS MARKET, BY COUNTRY

- TABLE 229 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 230 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 231 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 232 EUROPE: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.4.6.1 Germany

- 9.4.6.1.1 Growth of automotive and aerospace sectors

- 9.4.6.1.2 Germany: Fiberglass market, by product type

- 9.4.6.1 Germany

- TABLE 233 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 234 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 235 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 236 GERMANY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.6.2 France

- 9.4.6.2.1 Second-largest fiberglass market in Europe

- 9.4.6.2.2 France: Fiberglass market, by product type

- 9.4.6.2 France

- TABLE 237 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 238 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 239 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 240 FRANCE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.6.3 UK

- 9.4.6.3.1 Increase in demand for lightweight and high-performance materials

- 9.4.6.3.2 UK: Fiberglass market, by product type

- 9.4.6.3 UK

- TABLE 241 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 242 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 243 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 244 UK: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.6.4 Italy

- 9.4.6.4.1 Fiberglass market to witness moderate growth with economic recovery of country

- 9.4.6.4.2 Italy: Fiberglass market, by product type

- 9.4.6.4 Italy

- TABLE 245 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 246 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 247 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 248 ITALY: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.6.5 Russia

- 9.4.6.5.1 Leading developer of fiber-reinforced technologies

- 9.4.6.5.2 Russia: Fiberglass market, by product type

- 9.4.6.5 Russia

- TABLE 249 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 250 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 251 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 252 RUSSIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.6.6 Spain

- 9.4.6.6.1 High demand from wind energy sector

- 9.4.6.6.2 Spain: Fiberglass market, by product type

- 9.4.6.6 Spain

- TABLE 253 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 254 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 255 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 256 SPAIN: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.4.6.7 Rest of Europe

- 9.4.6.7.1 Rest of Europe: Fiberglass market, by product type

- 9.4.6.7 Rest of Europe

- TABLE 257 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 258 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 259 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 260 REST OF EUROPE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 IMPACT OF RECESSION ON MIDDLE EAST & AFRICA

- 9.5.2 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE

- TABLE 261 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (KILOTON)

- TABLE 263 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (KILOTON)

- 9.5.3 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE

- TABLE 265 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 267 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.5.4 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 269 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 271 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.5 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- TABLE 273 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 275 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.6 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY

- TABLE 277 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 279 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.5.6.1 Saudi Arabia

- 9.5.6.1.1 Increased investment in infrastructural development

- 9.5.6.1.2 Saudi Arabia: Fiberglass market, by product type

- 9.5.6.1 Saudi Arabia

- TABLE 281 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 282 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 283 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 284 SAUDI ARABIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.5.6.2 UAE

- 9.5.6.2.1 Stringent energy-efficiency regulations

- 9.5.6.2.2 UAE: Fiberglass market, by product type

- 9.5.6.2 UAE

- TABLE 285 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 286 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 287 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 288 UAE: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.5.6.3 Egypt

- 9.5.6.3.1 Increased spending on infrastructure projects

- 9.5.6.3.2 Egypt: Fiberglass market, by product type

- 9.5.6.3 Egypt

- TABLE 289 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 290 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 291 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 292 EGYPT: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.5.6.4 Rest of Middle East & Africa

- TABLE 293 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.6 SOUTH AMERICA

- 9.6.1 IMPACT OF RECESSION ON SOUTH AMERICA

- 9.6.2 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE

- TABLE 297 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (USD MILLION)

- TABLE 298 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2018-2022 (KILOTON)

- TABLE 299 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (USD MILLION)

- TABLE 300 SOUTH AMERICA: FIBERGLASS MARKET, BY GLASS TYPE, 2023-2028 (KILOTON)

- 9.6.3 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE

- TABLE 301 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 302 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 303 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 304 SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.6.4 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- TABLE 305 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 306 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 307 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 308 SOUTH AMERICA: FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.5 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- TABLE 309 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 310 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 311 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 312 SOUTH AMERICA: FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.6 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY

- TABLE 313 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 314 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 315 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 316 SOUTH AMERICA: FIBERGLASS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.6.6.1 Brazil

- 9.6.6.1.1 Growth in automotive industry to fuel fiberglass demand

- 9.6.6.1.2 Brazil: Fiberglass market, by product type

- 9.6.6.1 Brazil

- TABLE 317 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 318 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 319 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 320 BRAZIL: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.6.6.2 Argentina

- 9.6.6.2.1 Increased public spending on construction activities to support growth of fiberglass market

- 9.6.6.2.2 Argentina: Fiberglass market, by product type

- 9.6.6.2 Argentina

- TABLE 321 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 322 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 323 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 324 ARGENTINA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.6.6.3 Colombia

- 9.6.6.3.1 Glass wool accounts for largest share of overall market

- 9.6.6.3.2 Colombia: Fiberglass market, by product type

- 9.6.6.3 Colombia

- TABLE 325 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 326 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 327 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 328 COLOMBIA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

- 9.6.6.4 Rest of South America

- TABLE 329 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (USD MILLION)

- TABLE 330 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2018-2022 (KILOTON)

- TABLE 331 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 332 REST OF SOUTH AMERICA: FIBERGLASS MARKET, BY PRODUCT TYPE, 2023-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 45 SHARES OF TOP COMPANIES IN FIBERGLASS MARKET

- TABLE 333 DEGREE OF COMPETITION: FIBERGLASS MARKET

- 10.3 MARKET RANKING

- FIGURE 46 RANKING OF TOP FIVE PLAYERS IN FIBERGLASS MARKET

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 47 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX

- TABLE 334 COMPANY PRODUCT FOOTPRINT

- TABLE 335 COMPANY TYPE FOOTPRINT

- TABLE 336 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 337 COMPANY REGION FOOTPRINT

- 10.6 COMPETITIVE LANDSCAPE MAPPING

- 10.6.1 STARS

- 10.6.2 PERVASIVE PLAYERS

- 10.6.3 PARTICIPANTS

- 10.6.4 EMERGING LEADERS

- FIGURE 48 FIBERGLASS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2022

- 10.6.5 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN FIBERGLASS MARKET

- 10.6.6 BUSINESS STRATEGY EXCELLENCE

- FIGURE 50 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN FIBERGLASS MARKET

- 10.7 MARKET EVALUATION FRAMEWORK

- TABLE 338 FIBERGLASS MARKET: DEALS, 2018-2023

- TABLE 339 FIBERGLASS MARKET: OTHER DEVELOPMENTS, 2018-2023

- 10.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 340 FIBERGLASS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 341 FIBERGLASS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- FIGURE 51 FIBERGLASS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 CHINA JUSHI CO., LTD.

- TABLE 342 CHINA JUSHI CO., LTD.: COMPANY OVERVIEW

- FIGURE 52 CHINA JUSHI CO., LTD.: COMPANY SNAPSHOT

- 11.1.2 OWENS CORNING

- TABLE 343 OWENS CORNING: COMPANY OVERVIEW

- FIGURE 53 OWENS CORNING: COMPANY SNAPSHOT

- 11.1.3 SAINT-GOBAIN

- TABLE 344 SAINT-GOBAIN: COMPANY OVERVIEW

- FIGURE 54 SAINT-GOBAIN: COMPANY SNAPSHOT

- 11.1.4 TAISHAN FIBERGLASS INC. (CTG GROUP)

- TABLE 345 TAISHAN FIBERGLASS INC. (CTG GROUP): COMPANY OVERVIEW

- 11.1.5 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)

- TABLE 346 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): COMPANY OVERVIEW

- 11.1.6 NIPPON ELECTRIC GLASS CO., LTD.

- TABLE 347 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- FIGURE 55 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

- 11.1.7 3B-THE FIBREGLASS COMPANY

- TABLE 348 3B-THE FIBREGLASS COMPANY: COMPANY OVERVIEW

- 11.1.8 TAIWAN GLASS IND. CORP.

- TABLE 349 TAIWAN GLASS IND. CORP.: COMPANY OVERVIEW

- FIGURE 56 TAIWAN GLASS IND. CORP.: COMPANY SNAPSHOT

- 11.1.9 PFG FIBER GLASS CORPORATION (KUNSHAN)

- TABLE 350 PFG FIBER GLASS CORPORATION (KUNSHAN): COMPANY OVERVIEW

- 11.1.10 JOHNS MANVILLE (A BERKSHIRE HATHAWAY COMPANY)

- TABLE 351 JOHNS MANVILLE (A BERKSHIRE HATHAWAY COMPANY): COMPANY OVERVIEW

- 11.1.11 ASAHI FIBER GLASS CO., LTD.

- TABLE 352 ASAHI FIBER GLASS CO., LTD.: COMPANY OVERVIEW

- 11.1.12 KNAUF INSULATION

- TABLE 353 KNAUF INSULATION: COMPANY OVERVIEW

- 11.1.13 AGY

- TABLE 354 AGY: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 SODA SANAYII AS

- TABLE 355 SODA SANAYII AS: COMPANY OVERVIEW

- 11.2.2 FIBTEX PRODUCTS

- TABLE 356 FIBTEX PRODUCTS: COMPANY OVERVIEW

- 11.2.3 DARSHAN SAFETY ZONE

- TABLE 357 DARSHAN SAFETY ZONE: COMPANY OVERVIEW

- 11.2.4 NITTO BOSEKI CO., LTD.

- TABLE 358 CONTAINMENT SOLUTIONS, INC.: COMPANY OVERVIEW

- 11.2.5 KCC CORPORATION

- TABLE 359 KCC CORPORATION: COMPANY OVERVIEW

- 11.2.6 JIANGSU CHANGHAI COMPOSITE MATERIALS CO., LTD.

- TABLE 360 JIANGSU CHANGHAI COMPOSITE MATERIALS CO., LTD.: COMPANY OVERVIEW

- 11.2.7 BGF INDUSTRIES, INC.

- TABLE 361 BGF INDUSTRIES, INC.: COMPANY OVERVIEW

- 11.2.8 ARABIAN FIBERGLASS INSULATION CO., LTD. (AFICO)

- TABLE 362 ARABIAN FIBERGLASS INSULATION CO., LTD. (AFICO): COMPANY OVERVIEW

- 11.2.9 SHREE LAXMI UDYOG

- TABLE 363 SHREE LAXMI UDYOG: COMPANY OVERVIEW

- 11.2.10 CHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS)

- TABLE 364 CHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS): COMPANY OVERVIEW

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS