|

|

市場調査レポート

商品コード

1745105

アビオニクスの世界市場 (~2030年):システム (ナビゲーション・ペイロード&ミッション管理・交通&衝突管理・通信・気象検知・電力&データ管理・フライト管理・電子フライトディスプレイ)・プラットフォーム・据え付け・地域別Avionics Market Systems (Navigation, Payload & Mission Management, Traffic and Collision Management, Communication, Weather Detection, Power & Data management, Flight Management, Electronic Flight Display), Platform, Fit and Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| アビオニクスの世界市場 (~2030年):システム (ナビゲーション・ペイロード&ミッション管理・交通&衝突管理・通信・気象検知・電力&データ管理・フライト管理・電子フライトディスプレイ)・プラットフォーム・据え付け・地域別 |

|

出版日: 2025年06月03日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アビオニクスの市場規模は、2025年の562億2,000万米ドルから、CAGR 16.8%で推移し、2030年には823億3,000万米ドルに成長すると予測されています。

この市場の成長は主に、商業および防衛分野におけるより安全で効率的な航空機への需要の高まりに起因しています。航空会社は、規制基準を満たし燃費効率を向上させるため、旧型機のアビオニクスシステムを最新のものにアップグレードしています。さらに、世界的に新型航空機の生産も着実に増加しています。航空交通の増加や、リアルタイムデータや自動化への需要の高まりも、航空機運用者による先進的なアビオニクスへの投資をさらに促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | フィット、プラットフォーム、システム、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

"プラットフォーム別では、商業航空が予測期間中に最大の規模になる見通し"

世界的に、主要な参入事業者は新たな機会を探るために、先進的な商業航空用アビオニクスシステムの開発に積極的に取り組んでいます。SESAR (Single European Sky ATM Research) や米国のNextGenといった取り組みを含む航空交通管理システムの進化は、より効率的かつ合理化された航空交通運用を支える商業航空アビオニクスシステムの必要性を推進しています。乗客の快適性やエンターテインメントへの関心が高まる中、高度な機内エンターテインメントシステムや接続ソリューションなど、機内体験の向上に貢献するアビオニクスシステムが、商業航空分野の主要な推進要因となっています。

"システム 別では、ナビゲーションシステムが予測期間中に最も高いシェアを占める見込み"

新たな衛星コンステレーションや信号精度の向上を含むGNSS技術の進歩により、これらの改良点を活用し、より正確で信頼性の高い航法を可能にする航法用アビオニクスシステムの需要が高まっています。飛行安全性の向上における地形認識の重要性は、高度な地形認識・警報システム (TAWS) の必要性をさらに推進しています。これらのシステムは、潜在的な地形との衝突について、タイムリーかつ正確な警告を提供することで、航空の安全性を向上させます。

"地域別では、北米が予測期間中の市場を独占する見通し"

北米の堅調な国防予算は軍の近代化を支え、軍用航空機への先進アビオニクスシステムの導入をもたらしています。既存の大規模な航空機保有数を背景に、北米の航空業界ではアビオニクスのアップグレードやレトロフィットに重点が置かれています。航空会社や運航会社は、古い航空機の近代化ソリューションを求めており、性能と進化する規制への準拠を強化するための後付けアビオニクスシステムの需要を促進しています。また、ボーイングやAirbusといった主要な航空機メーカーは次世代航空機プログラムへの投資を継続しており、B737 MAXやA320neoシリーズといった先進的なプラットフォームの開発は、より高性能かつ多機能なアビオニクスシステムにとって新たな機会を創出しています。アビオニクスメーカーと航空宇宙大手との戦略的パートナーシップや協業も、アビオニクス市場の成長に貢献しています。

当レポートでは、世界のアビオニクスの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- 貿易分析

- 価格分析

- エコシステム分析

- バリューチェーン分析

- 主要なステークホルダーと購入基準

- 主な会議とイベント

- 規制状況

- 使用事例の分析

- 運用データ

- 投資と資金調達のシナリオ

- マクロ経済見通し

- AIの影響

- 技術分析

- 米国の2025年の関税

- 部品表

- 総所有コスト

- ビジネスモデル

第6章 業界動向

- 3Dプリンティングと先端材料

- AI

- IoT

- 強化されたビジョンシステム

- 高度な飛行制御システム

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

- 技術ロードマップ

第7章 アビオニクス市場:システム別

- ナビゲーション

- ペイロード・ミッション管理

- 交通・衝突管理

- 通信

- 電力・データ管理

- 気象検知

- フライト管理

- 電子フライトディスプレイ

第8章 アビオニクス市場:プラットフォーム別

- 軍用航空

- 民間航空

- 一般航空

- 特殊任務航空

第9章 アビオニクス市場:据え付け別

- ラインフィット

- レトロフィット

第10章 アビオニクス市場:地域別

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- イタリア

- その他

- アジア太平洋

- PESTLE分析

- インド

- 日本

- オーストラリア

- 韓国

- その他

- 中東

- PESTLE分析

- GCC諸国

- その他

- 世界のその他の地域

- PESTLE分析

- ラテンアメリカ

- アフリカ

第11章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:新興企業・中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- GENERAL ELECTRIC COMPANY

- HONEYWELL INTERNATIONAL INC.

- RTX

- L3HARRIS TECHNOLOGIES, INC.

- THALES

- CURTISS-WRIGHT CORPORATION

- ELBIT SYSTEMS LTD.

- NORTHROP GRUMMAN

- BAE SYSTEMS PLC

- GARMIN LTD.

- TRANSDIGM GROUP

- LEONARDO SPA

- ASTRONAUTICS CORPORATION OF AMERICA

- MEGGITT PLC

- SAFRAN SA

- その他の企業

- UAVIONIX

- AVIDYNE CORPORATION

- ASPEN AVIONICS INC.

- DYNON AVIONICS INC.

- KANARDIA DOO

- TALOS AVIONICS

- TASKEM CORPORATION

- ANODYNE ELECTRONICS MANUFACTURING

- BECKER AVIONICS GMBH

- SHADIN AVIONICS

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 GROWTH OF AIR TRAFFIC, AIRCRAFT FLEET, AND AIRCRAFT DELIVERIES, BY REGION

- TABLE 3 AVERAGE SELLING PRICE OF AVIONICS, BY REGION, 2024 (USD MILLION)

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PLATFORM (%)

- TABLE 6 KEY BUYING CRITERIA, BY PLATFORM

- TABLE 7 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 OPERATIONAL DATA, BY AIRCRAFT TYPE, 2019-2022 (UNITS)

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 EXPECTED CHANGE IN PRICES AND POTENTIAL IMPACT ON END USE

- TABLE 15 BILL OF MATERIALS FOR COMMERCIAL AVIATION PLATFORMS

- TABLE 16 BILL OF MATERIALS FOR MILITARY AVIATION PLATFORMS

- TABLE 17 TOTAL COST OF OWNERSHIP OF AVIONICS

- TABLE 18 BUSINESS MODELS IN AVIONICS MARKET

- TABLE 19 PATENTS ANALYSIS

- TABLE 20 AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 21 AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 22 NAVIGATION SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 23 NAVIGATION SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 24 PAYLOAD & MISSION MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 25 PAYLOAD & MISSION MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 26 TRAFFIC & COLLISION MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 TRAFFIC & COLLISION MANAGEMENT SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 COMMUNICATION SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 29 COMMUNICATION SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 30 POWER & DATA MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 31 POWER & DATA MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 32 WEATHER DETECTION SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 33 WEATHER DETECTION SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 34 FLIGHT MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 35 FLIGHT MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 36 ELECTRONIC FLIGHT DISPLAY SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 ELECTRONIC FLIGHT DISPLAY SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 38 AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 39 AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 40 MILITARY AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 41 MILITARY AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 42 COMMERCIAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 43 COMMERCIAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 44 GENERAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 45 GENERAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 46 SPECIAL MISSION AVIATION: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 47 SPECIAL MISSION AVIATION: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 48 AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 49 AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 50 AVIONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 AVIONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 53 NORTH AMERICA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 55 NORTH AMERICA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: AVIONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: AVIONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 US: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 61 US: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 62 US: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 63 US: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 64 US: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 65 US: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 66 CANADA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 67 CANADA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 68 CANADA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 69 CANADA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 70 CANADA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 71 CANADA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 73 EUROPE: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 77 EUROPE: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 78 EUROPE: AVIONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: AVIONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 UK: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 81 UK: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 82 UK: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 83 UK: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 84 UK: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 85 UK: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 86 FRANCE: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 87 FRANCE: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 88 FRANCE: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 89 FRANCE: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 90 FRANCE: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 91 FRANCE: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 92 GERMANY: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 93 GERMANY: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 94 GERMANY: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 95 GERMANY: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 96 GERMANY: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 97 GERMANY: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 98 ITALY: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 99 ITALY: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 100 ITALY: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 101 ITALY: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 102 ITALY: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 103 ITALY: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 105 REST OF EUROPE: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 106 REST OF EUROPE: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 107 REST OF EUROPE: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 109 REST OF EUROPE: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AVIONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AVIONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 INDIA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 119 INDIA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 120 INDIA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 121 INDIA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 122 INDIA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 123 INDIA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 125 JAPAN: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 126 JAPAN: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 127 JAPAN: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 128 JAPAN: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 129 JAPAN: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 130 AUSTRALIA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 131 AUSTRALIA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 132 AUSTRALIA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 133 AUSTRALIA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 134 AUSTRALIA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 135 AUSTRALIA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH KOREA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 137 SOUTH KOREA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH KOREA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH KOREA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 140 SOUTH KOREA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 141 SOUTH KOREA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST: AVIONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST: AVIONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 SAUDI ARABIA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 157 SAUDI ARABIA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 158 SAUDI ARABIA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 159 SAUDI ARABIA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 160 SAUDI ARABIA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 161 SAUDI ARABIA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 162 UAE: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 163 UAE: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 164 UAE: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 165 UAE: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 166 UAE: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 167 UAE: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 168 REST OF MIDDLE EAST: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 174 REST OF THE WORLD: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 175 REST OF THE WORLD: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 176 REST OF THE WORLD: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 177 REST OF THE WORLD: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 178 REST OF THE WORLD: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 179 REST OF THE WORLD: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 180 REST OF THE WORLD: AVIONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 181 REST OF THE WORLD: AVIONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 183 LATIN AMERICA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 184 LATIN AMERICA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 185 LATIN AMERICA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 187 LATIN AMERICA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 188 AFRICA: AVIONICS MARKET, BY FIT, 2021-2024 (USD MILLION)

- TABLE 189 AFRICA: AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- TABLE 190 AFRICA: AVIONICS MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 191 AFRICA: AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 192 AFRICA: AVIONICS MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 193 AFRICA: AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 194 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 195 AVIONICS MARKET: DEGREE OF COMPETITION

- TABLE 196 REGION FOOTPRINT

- TABLE 197 FIT FOOTPRINT

- TABLE 198 LIST OF START-UPS/SMES

- TABLE 199 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 200 AVIONICS MARKET: PRODUCT LAUNCHES, 2020-2025

- TABLE 201 AVIONICS MARKET: DEALS, 2020-2025

- TABLE 202 AVIONICS MARKET: OTHER DEVELOPMENTS, 2020-2025

- TABLE 203 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 204 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 206 GENERAL ELECTRIC COMPANY: OTHER DEVELOPMENTS

- TABLE 207 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 208 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 210 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 211 RTX: COMPANY OVERVIEW

- TABLE 212 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 RTX: PRODUCT LAUNCHES

- TABLE 214 RTX: DEALS

- TABLE 215 RTX: OTHER DEVELOPMENTS

- TABLE 216 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 217 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 219 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 220 THALES: COMPANY OVERVIEW

- TABLE 221 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 THALES: DEALS

- TABLE 223 THALES: OTHER DEVELOPMENTS

- TABLE 224 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 225 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 227 CURTISS-WRIGHT CORPORATION: OTHER DEVELOPMENTS

- TABLE 228 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 229 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- TABLE 231 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 232 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 234 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 235 BAE SYSTEMS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 BAE SYSTEMS PLC: DEALS

- TABLE 237 BAE SYSTEMS PLC: OTHER DEVELOPMENTS

- TABLE 238 GARMIN LTD.: COMPANY OVERVIEW

- TABLE 239 GARMIN LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 GARMIN LTD.: PRODUCT LAUNCHES

- TABLE 241 GARMIN LTD.: DEALS

- TABLE 242 GARMIN LTD.: OTHER DEVELOPMENTS

- TABLE 243 TRANSDIGM GROUP: COMPANY OVERVIEW

- TABLE 244 TRANSDIGM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 TRANSDIGM GROUP: DEALS

- TABLE 246 TRANSDIGM GROUP: OTHER DEVELOPMENTS

- TABLE 247 LEONARDO SPA: COMPANY OVERVIEW

- TABLE 248 LEONARDO SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 LEONARDO SPA: DEALS

- TABLE 250 ASTRONAUTICS CORPORATION OF AMERICA: COMPANY OVERVIEW

- TABLE 251 ASTRONAUTICS CORPORATION OF AMERICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ASTRONAUTICS CORPORATION OF AMERICA: DEALS

- TABLE 253 ASTRONAUTICS CORPORATION OF AMERICA: OTHER DEVELOPMENTS

- TABLE 254 MEGGITT PLC: COMPANY OVERVIEW

- TABLE 255 MEGGITT PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 MEGGITT PLC: DEALS

- TABLE 257 MEGGITT PLC: OTHER DEVELOPMENTS

- TABLE 258 SAFRAN SA: COMPANY OVERVIEW

- TABLE 259 SAFRAN SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 SAFRAN SA: DEALS

- TABLE 261 SAFRAN SA: OTHER DEVELOPMENTS

- TABLE 262 UAVIONIX: COMPANY OVERVIEW

- TABLE 263 AVIDYNE CORPORATION: COMPANY OVERVIEW

- TABLE 264 ASPEN AVIONICS INC.: COMPANY OVERVIEW

- TABLE 265 DYNON AVIONICS INC.: COMPANY OVERVIEW

- TABLE 266 KANARDIA DOO: COMPANY OVERVIEW

- TABLE 267 TALOS AVIONICS: COMPANY OVERVIEW

- TABLE 268 TASKEM CORPORATION: COMPANY OVERVIEW

- TABLE 269 ANODYNE ELECTRONICS MANUFACTURING: COMPANY OVERVIEW

- TABLE 270 BECKER AVIONICS GMBH: COMPANY OVERVIEW

- TABLE 271 SHADIN AVIONICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AVIONICS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 NAVIGATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 8 COMMERCIAL AVIATION TO ACCOUNT FOR MAXIMUM SHARE IN 2030

- FIGURE 9 LINE FIT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LARGEST MARKET FOR AVIONICS DURING FORECAST PERIOD

- FIGURE 11 INCREASE IN DEMAND FOR INTEGRATED AVIONICS TO DRIVE MARKET

- FIGURE 12 NAVIGATION TO SURPASS OTHER SEGMENTS IN 2025

- FIGURE 13 LINE FIT TO BE LARGER THAN RETROFIT DURING FORECAST PERIOD

- FIGURE 14 COMMERCIAL AVIATION TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 15 UAE TO BE FASTEST-GROWING MARKET FOR AVIONICS DURING FORECAST PERIOD

- FIGURE 16 AVIONICS MARKET DYNAMICS

- FIGURE 17 AIRCRAFT DELIVERIES BY BOEING AND AIRBUS, 2019-2024

- FIGURE 18 AIRCRAFT FLEET SIZE, BY REGION, 2024

- FIGURE 19 AIRCRAFT ACTIVE FLEET, BY AIRCRAFT TYPE, 2024

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 IMPORT DATA FOR HS CODE 8803-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 EXPORT DATA FOR HS CODE 8803-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF AVIONICS, BY REGION, 2021-2024 (USD MILLION)

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PLATFORM

- FIGURE 27 KEY BUYING CRITERIA, BY PLATFORM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 29 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 30 MACROECONOMIC OUTLOOK FOR LATIN AMERICA AND AFRICA

- FIGURE 31 IMPACT OF AI ON DEFENSE SECTOR

- FIGURE 32 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- FIGURE 33 BILL OF MATERIALS FOR COMMERCIAL AVIATION PLATFORMS

- FIGURE 34 BILL OF MATERIALS FOR MILITARY AVIATION PLATFORMS

- FIGURE 35 TECHNOLOGY TRENDS

- FIGURE 36 SUPPLY CHAIN ANALYSIS

- FIGURE 37 PATENT ANALYSIS

- FIGURE 38 INTRODUCTION TO TECHNOLOGY ROADMAP

- FIGURE 39 EVOLUTION OF AVIONICS TECHNOLOGIES

- FIGURE 40 EMERGING TRENDS IN AVIONICS MARKET

- FIGURE 41 AVIONICS MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- FIGURE 42 AVIONICS MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 43 AVIONICS MARKET, BY FIT, 2025-2030 (USD MILLION)

- FIGURE 44 AVIONICS MARKET, BY REGION, 2025-2030

- FIGURE 45 NORTH AMERICA: AVIONICS MARKET SNAPSHOT

- FIGURE 46 EUROPE: AVIONICS MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: AVIONICS MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST: AVIONICS MARKET SNAPSHOT

- FIGURE 49 REST OF THE WORLD: AVIONICS MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 52 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 COMPANY FOOTPRINT

- FIGURE 54 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 55 VALUATION OF PROMINENT PLAYERS

- FIGURE 56 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 57 BRAND/PRODUCT COMPARISON

- FIGURE 58 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 59 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 60 RTX: COMPANY SNAPSHOT

- FIGURE 61 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 62 THALES: COMPANY SNAPSHOT

- FIGURE 63 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 65 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 66 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 67 GARMIN LTD.: COMPANY SNAPSHOT

- FIGURE 68 TRANSDIGM GROUP: COMPANY SNAPSHOT

- FIGURE 69 LEONARDO SPA: COMPANY SNAPSHOT

- FIGURE 70 MEGGITT PLC: COMPANY SNAPSHOT

- FIGURE 71 SAFRAN SA: COMPANY SNAPSHOT

The avionics market is expected to grow from USD 56.22 billion in 2025 to USD 82.33 billion by 2030, registering a CAGR of 16.8%. Market growth can be mainly attributed to the rising demand for safer, more efficient aircraft across commercial and defense sectors. Airlines are upgrading old fleets with modern avionics systems to meet regulatory standards and improve fuel efficiency. Moreover, there is a steady rise in new aircraft production worldwide. Growing air traffic and increasing demand for real-time data and automation further push aircraft operators to invest more in advanced avionics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Fit, Platform, and System and region |

| Regions covered | North America, Europe, APAC, RoW |

"Commercial aviation is expected to be the largest platform in the avionics market during the forecast period."

Globally, major industry players are actively engaged in developing advanced commercial aviation avionics systems to explore emerging opportunities in the avionics market. The evolution of air traffic management systems, including initiatives such as SESAR (Single European Sky ATM Research) and NextGen in the US, is driving the need for commercial avionics systems that can support more efficient and streamlined air traffic operations. With a growing emphasis on passenger comfort and entertainment, avionics systems that contribute to enhanced in-flight experience, such as advanced in-flight entertainment systems and connectivity solutions, are key drivers for the commercial aviation segment.

"Navigation systems are expected to hold the highest share in the avionics market during the forecast period."

Advancements in global navigation satellite system (GNSS) technologies, including new satellite constellations and improved signal accuracy, have increased the demand for navigation avionics systems that can leverage these enhancements for more precise and reliable navigation. The critical importance of terrain awareness in enhancing flight safety further drives the need for sophisticated terrain awareness and warning systems (TAWS). These systems are essential for providing timely and accurate alerts about potential terrain conflicts, thereby improving aviation safety. Additionally, systems that integrate communication and navigation functions promote more efficient and interconnected flight operations.

"North America is expected to dominate the avionics market during the forecast period."

Robust defense budgets in North America support military modernization efforts, leading to the incorporation of advanced avionics systems in military aircraft. With a substantial existing fleet, the North American aviation industry emphasizes avionics upgrades and retrofits. Airlines and operators seek modernization solutions for older aircraft, driving the demand for retrofit avionics systems to enhance performance and compliance with evolving regulations. Additionally, prominent aircraft manufacturers like Boeing and Airbus continually invest in next-generation aircraft programs. The development of advanced platforms, such as the Boeing 737 MAX and Airbus A320neo families, creates opportunities for avionics systems with enhanced capabilities and features. Strategic partnerships and collaborations between avionics manufacturers and aerospace giants also contribute to the growth of the avionics market.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to tier-1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Latin America - 10%, Middle East - 5%, and Rest of the World - 5%

RTX (US), Honeywell International Inc. (US), L3Harris Technologies, Inc. (US), General Electric Company (US), and Thales (France) are among the leading players operating in the avionics market.

Research Coverage

The study covers the avionics market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on platform, system, fit, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their solutions and business offerings, recent developments, and growth strategies.

Key Benefits of Buying this Report:

This report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the avionics market and its subsegments. The report covers the entire ecosystem of the avionics market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, such as rising aircraft production, growing fleets of commercial and military aircraft, increasing adoption of flight management and aircraft computing systems, and the need for enhanced safety and situational awareness in aircraft

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the avionics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as RTX (US), Honeywell International Inc. (US), L3Harris Technologies, Inc. (US), General Electric Company (US), and Thales (France), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to arrive at market size using bottom-up analysis

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AVIONICS MARKET

- 4.2 AVIONICS MARKET, BY SYSTEM

- 4.3 AVIONICS MARKET, BY FIT

- 4.4 AVIONICS MARKET, BY PLATFORM

- 4.5 AVIONICS MARKET, BY COUNTRY

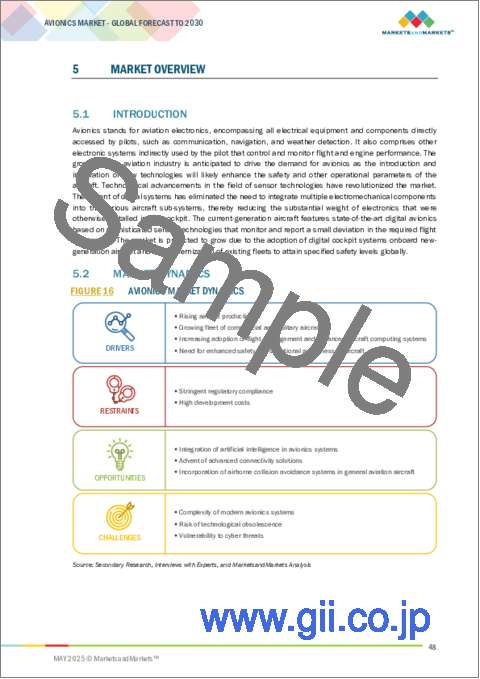

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising aircraft production

- 5.2.1.2 Growing fleet of commercial and military aircraft

- 5.2.1.3 Increasing adoption of flight management and advanced aircraft computing systems

- 5.2.1.4 Need for enhanced safety and situational awareness in aircraft

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory compliance

- 5.2.2.2 High development costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of artificial intelligence in avionics systems

- 5.2.3.2 Advent of advanced connectivity solutions

- 5.2.3.3 Incorporation of airborne collision avoidance systems in general aviation aircraft

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexity of modern avionics systems

- 5.2.4.2 Risk of technological obsolescence

- 5.2.4.3 Vulnerability to cyber threats

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 TRADE ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5.2 INDICATIVE PRICING ANALYSIS FOR AVIONICS SYSTEMS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 REGULATORY LANDSCAPE

- 5.11 USE CASE ANALYSIS

- 5.11.1 INTEGRATION OF MISSION COMPUTERS IN MARITIME PATROL AND SURVEILLANCE AIRCRAFT

- 5.11.2 INTEGRATION OF AIR DATA SOLUTIONS IN ROTORCRAFT

- 5.12 OPERATIONAL DATA

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 MACROECONOMIC OUTLOOK

- 5.14.1 NORTH AMERICA

- 5.14.2 EUROPE

- 5.14.3 ASIA PACIFIC

- 5.14.4 MIDDLE EAST

- 5.14.5 LATIN AMERICA

- 5.14.6 AFRICA

- 5.15 IMPACT OF AI

- 5.15.1 IMPACT OF AI ON DEFENSE SECTOR

- 5.15.2 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- 5.15.3 IMPACT OF AI ON AVIONICS MARKET

- 5.16 TECHNOLOGY ANALYSIS

- 5.16.1 KEY TECHNOLOGIES

- 5.16.1.1 AI-enhanced flight management systems

- 5.16.1.2 Integrated modular avionics

- 5.16.1.3 Software-defined radios

- 5.16.2 COMPLEMENTARY TECHNOLOGIES

- 5.16.2.1 AR-integrated heads-up displays

- 5.16.2.2 Self-healing avionics systems

- 5.16.2.3 Advanced sensor fusion algorithms

- 5.16.3 ADJACENT TECHNOLOGIES

- 5.16.3.1 5G and edge connectivity

- 5.16.3.2 Blockchain

- 5.16.3.3 Digital twin

- 5.16.1 KEY TECHNOLOGIES

- 5.17 US 2025 TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Commercial sector

- 5.17.5.2 Defense sector

- 5.18 BILL OF MATERIALS

- 5.19 TOTAL COST OF OWNERSHIP

- 5.20 BUSINESS MODELS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 3D PRINTING AND ADVANCED MATERIALS

- 6.3 ARTIFICIAL INTELLIGENCE

- 6.4 INTERNET OF THINGS

- 6.5 ENHANCED VISION SYSTEMS

- 6.6 ADVANCED FLIGHT CONTROL SYSTEMS

- 6.7 IMPACT OF MEGATRENDS

- 6.7.1 AUTONOMOUS AIRCRAFT

- 6.7.2 QUANTUM COMPUTING

- 6.8 SUPPLY CHAIN ANALYSIS

- 6.9 PATENT ANALYSIS

- 6.10 TECHNOLOGICAL ROADMAP

7 AVIONICS MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 NAVIGATION

- 7.2.1 CONTINUOUS GROWTH IN AVIATION INDUSTRY TO DRIVE MARKET

- 7.2.1.1 Altimeter

- 7.2.1.2 Analog turn indicator

- 7.2.1.3 Analog heading indicator

- 7.2.1.4 Inertial reference unit

- 7.2.1.5 Air data computer

- 7.2.1.6 Navigation satellite system

- 7.2.1.7 Inertial navigation system

- 7.2.1.8 Instrument landing system

- 7.2.1.9 Distance measuring equipment

- 7.2.1.10 VHF omnidirectional range

- 7.2.1.11 Automatic direction finder

- 7.2.1.12 Automatic dependent surveillance-broadcast

- 7.2.1.13 Multi-mode receiver

- 7.2.1.14 Integrated navigation system

- 7.2.1.15 Others

- 7.2.1 CONTINUOUS GROWTH IN AVIATION INDUSTRY TO DRIVE MARKET

- 7.3 PAYLOAD & MISSION MANAGEMENT

- 7.3.1 MODERNIZATION INITIATIVES FOR AVIATION TO DRIVE MARKET

- 7.3.1.1 Payload management computer

- 7.3.1.2 Mission computer

- 7.3.1.3 Electro-optics

- 7.3.1.4 SONAR

- 7.3.1.5 Radar

- 7.3.1 MODERNIZATION INITIATIVES FOR AVIATION TO DRIVE MARKET

- 7.4 TRAFFIC & COLLISION MANAGEMENT

- 7.4.1 ENHANCED SAFETY PROTOCOLS TO DRIVE MARKET

- 7.4.1.1 Aircraft communications addressing & reporting system

- 7.4.1.2 Collision avoidance system

- 7.4.1 ENHANCED SAFETY PROTOCOLS TO DRIVE MARKET

- 7.5 COMMUNICATION

- 7.5.1 NEW AGE TECHNOLOGIES TO DRIVE MARKET

- 7.5.1.1 Transponder

- 7.5.1.2 Transceiver

- 7.5.1.3 Antenna

- 7.5.1.4 Transmitter

- 7.5.1.5 Receiver

- 7.5.1.6 Datalink & frequency selector

- 7.5.1 NEW AGE TECHNOLOGIES TO DRIVE MARKET

- 7.6 POWER & DATA MANAGEMENT

- 7.6.1 EMPHASIS ON IMPROVING AIRCRAFT PERFORMANCE TO DRIVE MARKET

- 7.6.1.1 Power conversion device

- 7.6.1.2 Cockpit voice recorder

- 7.6.1.3 Flight data recorder

- 7.6.1.4 Data transfer system

- 7.6.1 EMPHASIS ON IMPROVING AIRCRAFT PERFORMANCE TO DRIVE MARKET

- 7.7 WEATHER DETECTION

- 7.7.1 ELEVATED DEMAND FOR PRECISE WEATHER DATA TO DRIVE MARKET

- 7.7.1.1 Weather radar

- 7.7.1.2 Lighting detection sensor

- 7.7.1 ELEVATED DEMAND FOR PRECISE WEATHER DATA TO DRIVE MARKET

- 7.8 FLIGHT MANAGEMENT

- 7.8.1 FOCUS ON OPERATIONAL EFFICIENCY TO DRIVE MARKET

- 7.8.1.1 Flight management computer

- 7.8.1.2 Autopilot computer

- 7.8.1.3 I/o and interface controller

- 7.8.1.4 Analog attitude indicator

- 7.8.1.5 Analog vertical speed indicator

- 7.8.1 FOCUS ON OPERATIONAL EFFICIENCY TO DRIVE MARKET

- 7.9 ELECTRONIC FLIGHT DISPLAY

- 7.9.1 NEED FOR ENHANCED SITUATIONAL AWARENESS TO DRIVE MARKET

- 7.9.1.1 Primary flight display

- 7.9.1.2 Multi-function flight display

- 7.9.1.3 Navigation display

- 7.9.1.4 Others

- 7.9.1 NEED FOR ENHANCED SITUATIONAL AWARENESS TO DRIVE MARKET

8 AVIONICS MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- 8.2 MILITARY AVIATION

- 8.2.1 INVESTMENT IN INNOVATIONS TO DRIVE MARKET

- 8.2.1.1 Combat aircraft

- 8.2.1.2 Military drones

- 8.2.1.3 Training aircraft

- 8.2.1.4 Transport aircraft

- 8.2.1.5 Military helicopters

- 8.2.1 INVESTMENT IN INNOVATIONS TO DRIVE MARKET

- 8.3 COMMERCIAL AVIATION

- 8.3.1 HEIGHTENED DEMAND FOR FUEL OPTIMIZATION TO DRIVE MARKET

- 8.3.1.1 Narrow-body aircraft

- 8.3.1.2 Wide-body aircraft

- 8.3.1.3 Regional jets

- 8.3.1 HEIGHTENED DEMAND FOR FUEL OPTIMIZATION TO DRIVE MARKET

- 8.4 GENERAL AVIATION

- 8.4.1 SURGE IN DEMAND FOR BUSINESS JETS TO DRIVE MARKET

- 8.4.1.1 Business jets

- 8.4.1.2 Light aircraft

- 8.4.1.3 Unmanned aerial mobility (UAM)

- 8.4.1.4 Commercial helicopters

- 8.4.1 SURGE IN DEMAND FOR BUSINESS JETS TO DRIVE MARKET

- 8.5 SPECIAL MISSION AVIATION

- 8.5.1 NEED FOR REAL-TIME DATA COLLECTION TO DRIVE MARKET

- 8.5.1.1 Military aviation

- 8.5.1.1.1 Reconnaissance aircraft

- 8.5.1.1.2 Transport aircraft

- 8.5.1.1.3 Fighter aircraft

- 8.5.1.1.4 Military helicopters

- 8.5.1.2 Commercial aviation

- 8.5.1.2.1 Wide-body aircraft

- 8.5.1.2.2 Narrow-body aircraft

- 8.5.1.2.3 Regional jets

- 8.5.1.2.4 Business & general aviation

- 8.5.1.2.5 Commercial helicopters

- 8.5.1.1 Military aviation

- 8.5.1 NEED FOR REAL-TIME DATA COLLECTION TO DRIVE MARKET

9 AVIONICS MARKET, BY FIT

- 9.1 INTRODUCTION

- 9.2 LINE FIT

- 9.3 RETROFIT

10 AVIONICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Surging investments in electric-powered aircraft for cargo logistics to drive market

- 10.2.3 CANADA

- 10.2.3.1 Advancements in avionics technology to enhance passenger safety to drive market

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 UK

- 10.3.2.1 Continuous evolution of vertical lift airborne technology to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Presence of major aircraft OEMs to drive market

- 10.3.4 GERMANY

- 10.3.4.1 Emphasis on air transportation development to drive market

- 10.3.5 ITALY

- 10.3.5.1 Development and integration of advanced avionics systems to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 INDIA

- 10.4.2.1 Make in India initiative to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Rise of advanced avionics systems to drive market

- 10.4.4 AUSTRALIA

- 10.4.4.1 Adoption of advanced flight management systems to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Presence of low-cost carriers to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GULF COOPERATION COUNCIL (GCC)

- 10.5.2.1 Saudi Arabia

- 10.5.2.1.1 Vision 2030 program to drive market

- 10.5.2.2 UAE

- 10.5.2.2.1 Modernization of key airports to drive market

- 10.5.2.1 Saudi Arabia

- 10.5.3 REST OF MIDDLE EAST

- 10.6 REST OF THE WORLD

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 LATIN AMERICA

- 10.6.2.1 Rapid expansion of aircraft fleet to drive market

- 10.6.3 AFRICA

- 10.6.3.1 Effective pricing strategies to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Fit footprint

- 11.6 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 List of start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of start-ups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GENERAL ELECTRIC COMPANY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 HONEYWELL INTERNATIONAL INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 RTX

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 L3HARRIS TECHNOLOGIES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 THALES

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 CURTISS-WRIGHT CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Other developments

- 12.1.7 ELBIT SYSTEMS LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Other developments

- 12.1.8 NORTHROP GRUMMAN

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Other developments

- 12.1.9 BAE SYSTEMS PLC

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Other developments

- 12.1.10 GARMIN LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Other developments

- 12.1.11 TRANSDIGM GROUP

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Other developments

- 12.1.12 LEONARDO SPA

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 ASTRONAUTICS CORPORATION OF AMERICA

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Other Developments

- 12.1.14 MEGGITT PLC

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Other developments

- 12.1.15 SAFRAN SA

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Other developments

- 12.1.1 GENERAL ELECTRIC COMPANY

- 12.2 OTHER PLAYERS

- 12.2.1 UAVIONIX

- 12.2.2 AVIDYNE CORPORATION

- 12.2.3 ASPEN AVIONICS INC.

- 12.2.4 DYNON AVIONICS INC.

- 12.2.5 KANARDIA DOO

- 12.2.6 TALOS AVIONICS

- 12.2.7 TASKEM CORPORATION

- 12.2.8 ANODYNE ELECTRONICS MANUFACTURING

- 12.2.9 BECKER AVIONICS GMBH

- 12.2.10 SHADIN AVIONICS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS