|

|

市場調査レポート

商品コード

1409034

ビデオアナリティクスの世界市場 (~2028年):提供サービス・用途 (侵入管理・インシデント検出・交通監視)・展開モデル・タイプ・産業 (重要インフラ・政府&防衛・製造)・地域別Video Analytics Market by Offering, Application (Intrusion Management, Incident Detection, and Traffic Monitoring), Deployment Model, Type, Vertical (Critical Infrastructure, Government & Defense, and Manufacturing) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ビデオアナリティクスの世界市場 (~2028年):提供サービス・用途 (侵入管理・インシデント検出・交通監視)・展開モデル・タイプ・産業 (重要インフラ・政府&防衛・製造)・地域別 |

|

出版日: 2024年01月10日

発行: MarketsandMarkets

ページ情報: 英文 300 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 提供区分・用途・展開モデル・タイプ・産業別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

ビデオアナリティクスの市場規模は、2023年の83億米ドルから、予測期間中は22.3%のCAGRで推移し、2028年には226億米ドルの規模に成長すると予測されています。

セキュリティに対する懸念の高まりと、公共スペース、重要インフラ、商業施設における適切な監視の必要性が、ビデオアナリティクス市場の需要を促進しています。一方、誤報と信頼性の欠如が、ビデオアナリティクス市場の成長にとって重要な課題です。

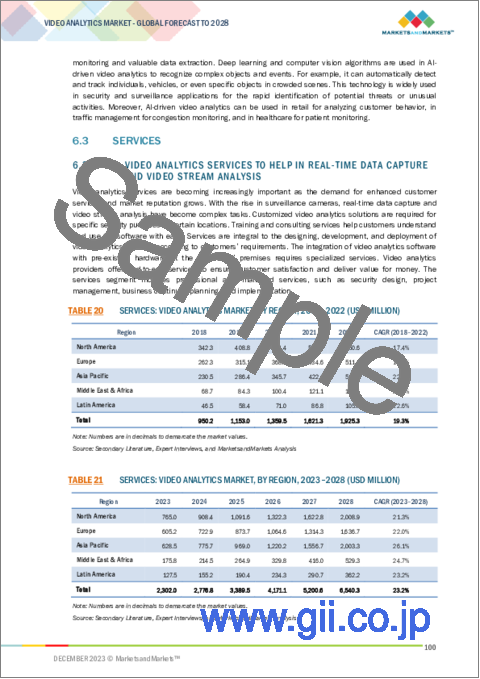

提供区分別では、サービスの部門が予測期間中により高いCAGRで成長する見込みです。ビデオアナリティクスサービスは、顧客サービスの強化や市場の評判に対する需要が高まるにつれて、ますます重要性を増しています。監視カメラの増加に伴い、リアルタイムのデータキャプチャとビデオストリームアナリティクスは複雑な作業となっています。企業は、特定の場所における特定のセキュリティ目的のためにカスタマイズされたビデオアナリティクスソリューションを必要としています。トレーニングやコンサルティングサービスは、顧客がソフトウェアを理解し、簡単に使用するのに役立ちます。サービスは、顧客の要件に応じたビデオアナリティクスシステムの設計、開発、導入に不可欠です。ビデオアナリティクスソフトウェアを顧客の敷地内にある既存のハードウェアと統合するには、専門的なサービスが必要です。ビデオアナリティクスプロバイダーは、顧客の満足度を確保し、価格に見合った価値を提供するために、エンドツーエンドのサービスを提供しています。サービス部門には、セキュリティ設計、プロジェクト管理、事業継続計画、実装などの専門サービスやマネージドサービスが含まれます。

当レポートでは、世界のビデオアナリティクスの市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- エコシステム/市場マップ

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- 購入者に影響を与える動向/ディスラプション

- 主要なステークホルダーと購入基準

- ビジネスモデル分析

- 主要な会議とイベント

第6章 ビデオアナリティクス市場:サービス別

- ソフトウェア

- ビデオコンテンツアナリティクス

- AI主導ビデオアナリティクス

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 ビデオアナリティクス市場:用途別

- インシデント検出

- 侵入管理

- 人数/群衆カウント

- 交通監視

- 自動ナンバープレート認識

- 顔認識

- その他

第8章 ビデオアナリティクス市場:導入モデル別

- オンプレミス

- クラウド

第9章 ビデオアナリティクス市場:タイプ別

- サーバーベース

- エッジベース

第10章 ビデオアナリティクス市場:産業別

- 銀行・金融サービス・保険 (BFSI)

- セキュリティ・不正行為検出

- ATM監視・保護

- 顧客体験・キュー管理

- その他

- 重要インフラ

- 境界セキュリティ・侵入検知

- アクセス制御・身元確認

- セキュリティ・脅威評価

- その他

- 教育

- セキュリティ・安全性

- 訪問者管理

- アクセス制御・身元確認

- その他

- ホスピタリティ・エンターテイメント

- セキュリティ・監視

- 顔認識・アクセス制御

- 群衆管理

- その他

- 製造

- 品質管理・検査

- 労働者の安全・コンプライアンス

- その他

- 政府・防衛

- セキュリティ・監視

- 顔認識・本人確認

- 境界保護

- その他

- 小売

- 紛失防止・セキュリティ

- キュー管理

- 顔認識・アクセス制御

- 輸送・物流

- 交通管理・渋滞監視

- ナンバープレート認識 (LPR)

- その他

- その他

第11章 ビデオアナリティクス市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 製品/ブランドの比較

- 主要参入企業のスナップショット

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 企業の財務指標

- 市場の主な展開

第13章 企業プロファイル

- 主要企業

- AVIGILON

- AXIS COMMUNICATIONS

- CISCO

- HONEYWELL

- IBM

- ALLGOVISION

- GENETEC

- INTELLIVISION

- GORILLA TECHNOLOGY

- EAGLE EYE NETWORKS

- ADT

- INTUVISION

- SECURITAS

- その他の企業

- PURETECH SYSTEMS

- HIKVISION

- DAHUA TECHNOLOGY

- IOMNISCIENT

- NEC

- HUAWEI

- INTELLIGENT SECURITY SYSTEMS

- VERINT SYSTEMS

- VISEUM

- BRIEFCAM

- BOSCH SECURITY SYSTEMS

- I2V

- DIGITAL BARRIERS

- SENSTAR

- QOGNIFY

- IDENTIV

- IPSOTEK

- DELOPT

- SME/スタートアップ

- DRISHTI

- NATIX

- DEEP NORTH

- CRONJ

- MIOVISION

- ACTUATE

- CALIPSA

- CORSIGHT AI

- ARCULES

- CAWAMO

- KOGNIZ

第14章 隣接/関連市場

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Offering, Application, Deployment Model, Type, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

The video analytics market size is expected to grow from USD 8.3 billion in 2023 to USD 22.6 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 22.3% during the forecast period. Growing concerns about security and the need for adequate surveillance in public spaces, critical infrastructure, and commercial establishments drive the demand for the video analytics market. False alarms and lack of reliability are significant challenges for the growth of the video analytics market.

"As per the offering, the services segment is expected to grow at a higher CAGR during the forecast period. "

Video analytics services are becoming increasingly important as the demand for enhanced customer services and market reputation grows. With the rise in surveillance cameras, real-time data capture and video stream analysis have become complex tasks. Businesses require customized video analytics solutions for specific security purposes at certain locations. Training and consulting services help customers understand and use the software with ease. Services are integral to designing, developing, and deploying video analytics systems according to customers' requirements. Integrating video analytics software with pre-existing hardware at the customers' premises requires specialized services. Video analytics providers offer end-to-end services to ensure customer satisfaction and deliver value for money. The services segment includes professional and managed services, such as security design, project management, business continuity planning, and implementation.

"As per vertical, the critical infrastructure vertical to hold second largest market share in 2023."

Critical infrastructure refers to facilities such as oil & gas plants, nuclear power plants, chemical industry sites, and other hazardous locations. These sites can face several issues, such as limited network access, low labor availability, and high-security risks, particularly in remote areas. Video analytics enables continuous monitoring of critical infrastructure. With the increasing demand for highly secure environments and cost-effective video surveillance systems, the adoption of video analytics for critical infrastructure security has significantly increased. At critical sites of infrastructure, continuous monitoring through cameras is necessary. The deployment of high-quality video devices, improved internet bandwidth, and centralized monitoring of multiple cameras have made video analytics software an effective solution for security purposes. Video analytics offers several benefits, including improved perimeter protection and operational efficiency, lower operating expenses, and reduced data storage needs. However, monitoring multiple cameras to detect anomalies such as suspicious behavior and abandoned objects requires a significant workforce.

As per region, Europe is anticipated to witness the second-largest market share during the forecast period.

European countries have adopted video analytics as essential to their overall ICT strategies. These countries use it to improve security, streamline operations, and gain valuable insights from visual data. For instance, cities such as London and Amsterdam have invested significantly in ICT to deploy intelligent video analytics for public safety, traffic management, and event monitoring. By integrating these systems with security surveillance cameras, authorities can efficiently monitor public spaces and respond promptly to security incidents.

Europe has been a target for terror attacks in recent years and will witness more in the coming years. To counter these attacks, governments in European countries are adopting advanced security technologies like video analytics. The region is estimated to have the second-largest share in the video analytics market in 2021 after North America. Countries such as the UK, Germany, and France play a significant role in the European video analytics market, and the trend of adopting video analytics solutions will grow in the coming years.

The breakup of the profiles of the primary participants is given below:

- By Company: Tier I: 20%, Tier II: 25%, and Tier III: 55%

- By Designation: C-Level Executives: 40%, Director Level: 33%, and Others: 27%

- By Region: North America: 32%, Europe: 38%, Asia Pacific: 18%, Rest of World: 12%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the significant vendors offering video analytics software across the globe include Avigilion (Canada), Axis Communications (Sweden), Cisco (US), Honeywell International Inc.( US), IBM (US), AllGoVision Technologies (India), Genetec Inc. (Canada), IntelliVision (US), Gorilla Technology (UK), Eagle Eye Networks (US), ADT (US), intuVision (US), and Securitas AB (Sweden).

Research coverage:

The market study covers the video analytics market across segments. It aims to estimate the market size and the growth potential of this market across different market segments, such as offering, application, deployment model, type, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall video analytics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing investments and focus of governing institutions on public safety, need to utilize and examine unstructured video surveillance data in real time, significant decrease in crime rate due to surveillance cameras, growing need among enterprises to leverage BI and actionable insights for advanced operations, limitations of manual video analysis, government initiatives to enhance public safety infrastructure, reduced cost of video surveilliance equipment and long term ROI, demand for improved video surveillance), restraints (increasing cyberattacks and data theft incidents, government regulations related to CCTV surveillance, nvestments in existing legacy surveillance systems to prevent adoption of new advanced solutions, privacy concerns among citizens, ) opportunities (use of drone based video analytics, emergence of edge technologies and devices to increase the use of video analytics predictive information using video analytics, integration of AI and cloud technologies with video analytics, surging demand for video analytics solutions in non-government sectors, growing use of facial recognition), and challenges (high initial cost of investment, installation, and maintenance, interoperability complexities, adverse weather conditions, problems in isolated and remote locations, false alarm and lack of reliability) influencing the growth of the video analytics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the video analytics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the video analytics market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the video analytics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Avigilion (Canada), Axis Communications (Sweden), Cisco (US), Honeywell International Inc.( US), IBM (US), among others in the video analytics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 VIDEO ANALYTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 VIDEO ANALYTICS MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 VIDEO ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 VIDEO ANALYTICS MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 10 VIDEO ANALYTICS MARKET: DEMAND-SIDE APPROACH

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 11 FASTEST-GROWING SEGMENTS IN VIDEO ANALYTICS MARKET, 2023-2028

- FIGURE 12 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 13 INTRUSION MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 14 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 15 EDGE-BASED SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 GOVERNMENT & DEFENSE VERTICAL TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 17 VIDEO ANALYTICS MARKET: REGIONAL ANALYSIS

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF VIDEO ANALYTICS MARKET

- FIGURE 18 RISING NEED FOR CITY SURVEILLANCE AND IMPLEMENTATION OF SMART CITY INITIATIVES TO DRIVE MARKET

- 4.2 VIDEO ANALYTICS MARKET, BY OFFERING, 2023 VS. 2028

- FIGURE 19 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 VIDEO ANALYTICS MARKET, BY APPLICATION, 2023 VS. 2028

- FIGURE 20 INTRUSION MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 VIDEO ANALYTICS MARKET, BY TYPE, 2023 VS. 2028

- FIGURE 21 SERVER-BASED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023 VS. 2028

- FIGURE 22 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.6 VIDEO ANALYTICS MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 23 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.7 VIDEO ANALYTICS MARKET: REGIONAL SCENARIO, 2023-2028

- FIGURE 24 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: VIDEO ANALYTICS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments and focus of governing institutions on public safety

- 5.2.1.2 Need to utilize and examine unstructured video surveillance data in real time

- 5.2.1.3 Significant decrease in crime rate due to surveillance cameras

- FIGURE 26 TOP TEN COUNTRIES WITH HIGHEST CRIME RATES IN 2022

- 5.2.1.4 Growing need to leverage BI and actionable insights for advanced operations

- 5.2.1.5 Limitations of manual video analysis

- 5.2.1.6 Government initiatives to enhance public safety infrastructure

- 5.2.1.7 Reduced cost of video surveillance equipment and long-term ROI

- 5.2.1.8 Demand for enhanced video surveillance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing cyberattacks and data theft incidents

- 5.2.2.2 Government regulations related to CCTV surveillance

- 5.2.2.3 Investments in existing legacy surveillance systems to prevent adoption of new advanced solutions

- 5.2.2.4 Privacy concerns among citizens

- FIGURE 27 AVERAGE TOTAL COST OF DATA BREACH BY TOP FIVE INDUSTRIES

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of drone-based video analytics

- 5.2.3.2 Emergence of edge technologies and devices to increase use of video analytics

- 5.2.3.3 Predictive information using video analytics

- FIGURE 28 TOP TEN USER GROUPS OF ARTIFICIAL INTELLIGENCE ACROSS ORGANIZATIONS, 2022

- 5.2.3.4 Integration of AI and cloud technologies with video analytics

- FIGURE 29 TOP CLOUD INITIATIVES ACROSS ORGANIZATIONS, 2022

- 5.2.3.5 Surging demand for video analytics solutions in non-government sectors

- 5.2.3.6 Growing use of facial recognition

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial costs of investment, installation, and maintenance

- 5.2.4.2 Interoperability complexities

- 5.2.4.3 Adverse weather conditions

- 5.2.4.4 Connectivity issues in isolated and remote locations

- 5.2.4.5 False alarms and lack of reliability

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: TAITUNG COUNTY INCREASED POLICING AND INVESTIGATION EFFICIENCY WITH BRIEFCAM VIDEO ANALYTICS PLATFORM

- 5.3.2 CASE STUDY 2: SEPHORA BEAUTY OFFERED REAL-TIME VISITOR STATISTICS BY DEPLOYING ALLGOVISION VIDEO ANALYTICS

- 5.3.3 CASE STUDY 3: LINCOLN CENTER IMPROVED INCIDENT RESPONSE, ENHANCED GUEST EXPERIENCE, AND BOOSTED LAW ENFORCEMENT WITH GENETEC SECURITY CENTER

- 5.3.4 CASE STUDY 4: BHARAT OMAN REFINERIES LIMITED OVERCAME SECURITY CHALLENGES IN OIL & GAS SECTOR WITH ALLGOVISION VIDEO ANALYTICS SOLUTION

- 5.3.5 CASE STUDY 5: EDUCATION INSTITUTE AUGMENTED VIDEO SEARCHABILITY DEPLOYING IDENTIV'S SOLUTIONS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 30 VIDEO ANALYTICS MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM/MARKET MAP

- FIGURE 31 VIDEO ANALYTICS MARKET: ECOSYSTEM

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Cybersecurity

- 5.6.1.2 Edge Computing

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Big Data & Analytics

- 5.6.2.2 IoT

- 5.6.2.3 5G

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Cloud Computing

- 5.6.3.2 AI/ML

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY SOFTWARE

- FIGURE 32 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE

- 5.7.2 AVERAGE SELLING PRICE (ASP) OF VIDEO SURVEILLANCE CAMERAS: TOP 3 APPLICATIONS

- FIGURE 33 AVERAGE SELLING PRICE OF VIDEO SURVEILLANCE CAMERAS, TOP 3 APPLICATIONS

- 5.7.3 AVERAGE SELLING PRICE TREND, BY FORM

- TABLE 3 SINGLE UNIT PRICE OF VARIOUS FORMS OF ANALOG CAMERAS

- TABLE 4 SINGLE UNIT PRICE OF VARIOUS FORMS OF IP CAMERAS

- 5.7.4 INDICATIVE PRICING ANALYSIS

- TABLE 5 INDICATIVE PRICING ANALYSIS OF VIDEO ANALYTICS SOLUTIONS

- TABLE 6 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION

- 5.8 PATENT ANALYSIS

- FIGURE 34 LIST OF MAJOR PATENTS FOR VIDEO ANALYTICS

- FIGURE 35 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 7 TOP 10 PATENT APPLICANTS (US)

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 VIDEO ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 PORTER'S FIVE FORCES IMPACT ON VIDEO ANALYTICS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS

- 5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 37 REVENUE SHIFT FOR VIDEO ANALYTICS MARKET

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 END USERS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 39 KEY BUYING CRITERIA FOR END USERS

- TABLE 14 KEY BUYING CRITERIA FOR END USERS

- 5.13 BUSINESS MODEL ANALYSIS

- FIGURE 40 VIDEO ANALYTICS MARKET: BUSINESS MODELS

- 5.14 KEY CONFERENCES AND EVENTS (2023 & 2024)

- TABLE 15 VIDEO ANALYTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

6 VIDEO ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: VIDEO ANALYTICS MARKET DRIVERS

- FIGURE 41 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 16 VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 17 VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOFTWARE

- 6.2.1 NEED TO COLLECT AND ANALYZE CRUCIAL DATA AND INTEGRATE WITH EXISTING CAMERAS TO DRIVE DEMAND FOR VIDEO ANALYTICS SOFTWARE

- TABLE 18 SOFTWARE: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 SOFTWARE: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 VIDEO CONTENT ANALYSIS

- 6.2.2.1 Video content analysis to enhance security, operational efficiency, and decision-making

- 6.2.3 AI-DRIVEN VIDEO ANALYTICS

- 6.2.3.1 AI-driven video analytics to automatically detect and track people and vehicles and enhance security and surveillance

- 6.3 SERVICES

- 6.3.1 VIDEO ANALYTICS SERVICES TO HELP IN REAL-TIME DATA CAPTURE AND VIDEO STREAM ANALYSIS

- TABLE 20 SERVICES: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 SERVICES: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Professional services to help businesses implement, manage, and derive value from video analytics solutions

- 6.3.2.2 Consulting

- 6.3.2.3 Integration & Implementation

- 6.3.2.4 Support & Maintenance

- 6.3.3 MANAGED SERVICES

- 6.3.3.1 Managed services to improve service quality, deliver speed, and enhance cost optimization and quality of service

7 VIDEO ANALYTICS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: VIDEO ANALYTICS MARKET DRIVERS

- FIGURE 42 INTRUSION MANAGEMENT SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 22 VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 23 VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 INCIDENT DETECTION

- 7.2.1 INTELLIGENT TRAFFIC MANAGEMENT TO IDENTIFY AND ALERT UNUSUAL OR PREDEFINED EVENTS WITHIN VIDEO FOOTAGE

- TABLE 24 INCIDENT DETECTION: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 INCIDENT DETECTION: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 INTRUSION MANAGEMENT

- 7.3.1 NEED TO IMPROVE SECURITY AND CRITICAL INFRASTRUCTURE TO FUEL DEMAND FOR INTRUSION MANAGEMENT

- TABLE 26 INTRUSION MANAGEMENT: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 INTRUSION MANAGEMENT: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 PEOPLE/CROWD COUNTING

- 7.4.1 NEED FOR REAL-TIME COUNTING OF VEHICLES AND PEOPLE AND MONITORING AND CONTROLLING CROWD TO DRIVE MARKET

- TABLE 28 PEOPLE/CROWD COUNTING: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 PEOPLE/CROWD COUNTING: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 TRAFFIC MONITORING

- 7.5.1 UNPRECEDENTED GROWTH OF CITY TRAFFIC LEVELS AND NEED TO PREVENT POTENTIAL ACCIDENTS AND OTHER SAFETY HAZARDS TO DRIVE MARKET

- TABLE 30 TRAFFIC MONITORING: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 TRAFFIC MONITORING: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 AUTOMATIC NUMBER PLATE RECOGNITION

- 7.6.1 ANPR TO ENHANCE SECURITY, IMPROVE OPERATIONAL EFFICIENCY, AND SUPPORT VARIOUS APPLICATIONS IN TRANSPORTATION AND LAW ENFORCEMENT

- TABLE 32 AUTOMATIC NUMBER PLATE RECOGNITION: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 AUTOMATIC NUMBER PLATE RECOGNITION: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 FACIAL RECOGNITION

- 7.7.1 FACIAL RECOGNITION TO ACCESS CONTROL, IDENTIFY WANTED INDIVIDUALS, AND IMPROVE OPERATIONAL PERFORMANCE AND MONITORING

- TABLE 34 FACIAL RECOGNITION: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 FACIAL RECOGNITION: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 OTHER APPLICATIONS

- TABLE 36 OTHER APPLICATIONS: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODEL: VIDEO ANALYTICS MARKET DRIVERS

- FIGURE 43 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 38 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 39 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 ON-PREMISES DEPLOYMENT TO HELP PROCESS SENSITIVE AND CONFIDENTIAL DATA VOLUMES AND REDUCE LATENCY

- TABLE 40 ON-PREMISES: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 ON-PREMISES: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 CLOUD-BASED VIDEO ANALYTICS SOLUTIONS TO IMPROVE ACCURACY AND PROVIDE REAL-TIME MONITORING AND ALERTS AND BETTER UTILIZATION OF STAFF

- TABLE 42 CLOUD: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 CLOUD: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 VIDEO ANALYTICS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.1.1 TYPE: VIDEO ANALYTICS MARKET DRIVERS

- FIGURE 44 EDGE-BASED SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 44 VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 45 VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2 SERVER-BASED

- 9.2.1 NEED TO EMBED VIDEO ANALYTICS IN SPECIFIC SERVER AND TRACE AND ANALYZE VIDEO TO BOOST DEMAND FOR SERVER-BASED VIDEO ANALYTICS SOLUTIONS

- FIGURE 45 VIDEO ANALYTICS MARKET: SERVER-BASED IMPLEMENTATION

- TABLE 46 SERVER-BASED: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 SERVER-BASED: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 EDGE-BASED

- 9.3.1 EDGE-BASED VIDEO ANALYTICS SOLUTIONS TO ALERT OPERATORS TO REAL-TIME VIDEO OR AUDIO EVENTS

- FIGURE 46 VIDEO ANALYTICS MARKET: EDGE-BASED IMPLEMENTATION

- TABLE 48 EDGE-BASED: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 EDGE-BASED: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 VIDEO ANALYTICS MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: VIDEO ANALYTICS MARKET DRIVERS

- FIGURE 47 GOVERNMENT & DEFENSE SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 50 VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 51 VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 10.2.1 NEED FOR FRAUD PREVENTION, SECURITY AND SURVEILLANCE, AND ATM MONITORING AND MAINTENANCE TO DRIVE MARKET

- 10.2.2 BFSI: APPLICATION AREAS

- TABLE 52 BFSI: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 BFSI: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.3 SECURITY & FRAUD DETECTION

- 10.2.4 ATM MONITORING & PROTECTION

- 10.2.5 CUSTOMER EXPERIENCE AND QUEUE MANAGEMENT

- 10.2.6 OTHER BFSI

- 10.3 CRITICAL INFRASTRUCTURE

- 10.3.1 CRITICAL INFRASTRUCTURE SOLUTIONS TO OFFER ASSET PROTECTION AND THEFT PREVENTION, PERIMETER SECURITY, AND FACIAL RECOGNITION FOR ACCESS CONTROL

- 10.3.2 CRITICAL INFRASTRUCTURE: APPLICATION AREAS

- TABLE 54 CRITICAL INFRASTRUCTURE: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 CRITICAL INFRASTRUCTURE: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.3 PERIMETER SECURITY & INTRUSION DETECTION

- 10.3.4 ACCESS CONTROL & IDENTITY VERIFICATION

- 10.3.5 SECURITY & THREAT ASSESSMENT

- 10.3.6 OTHER CRITICAL INFRASTRUCTURE

- 10.4 EDUCATION

- 10.4.1 RISING DEMAND FOR INTRUSION DETECTION, CAMPUS SECURITY, AND VISITOR MANAGEMENT TO DRIVE MARKET

- 10.4.2 EDUCATION: APPLICATION AREAS

- TABLE 56 EDUCATION: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 EDUCATION: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.3 SECURITY & SAFETY

- 10.4.4 VISITOR MANAGEMENT

- 10.4.5 ACCESS CONTROL & IDENTITY VERIFICATION

- 10.4.6 OTHER EDUCATION

- 10.5 HOSPITALITY & ENTERTAINMENT

- 10.5.1 NEED FOR ACCESS CONTROL AND IDENTITY VERIFICATION, SURVEILLANCE, AND PEOPLE COUNTING TO DRIVE MARKET

- 10.5.2 HOSPITALITY & ENTERTAINMENT: APPLICATION AREAS

- TABLE 58 HOSPITALITY & ENTERTAINMENT: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 HOSPITALITY & ENTERTAINMENT: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.3 SECURITY & SURVEILLANCE

- 10.5.4 FACIAL RECOGNITION & ACCESS CONTROL

- 10.5.5 CROWD MANAGEMENT

- 10.5.6 OTHER HOSPITALITY & ENTERTAINMENT

- 10.6 MANUFACTURING

- 10.6.1 NEED FOR OPERATIONAL MONITORING, QUALITY CONTROL, WORKPLACE SAFETY, AND SUPPLY CHAIN VISIBILITY TO PROPEL MARKET

- 10.6.2 MANUFACTURING: APPLICATION AREAS

- TABLE 60 MANUFACTURING: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 MANUFACTURING: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6.3 QUALITY CONTROL & INSPECTION

- 10.6.4 WORKER SAFETY & COMPLIANCE

- 10.6.5 OTHER MANUFACTURING

- 10.7 GOVERNMENT & DEFENSE

- 10.7.1 RISING DEMAND FOR PERIMETER SECURITY, INTRUSION DETECTION, FACIAL RECOGNITION, AND CROWD MONITORING TO PROPEL MARKET

- 10.7.2 GOVERNMENT & DEFENSE: APPLICATION AREAS

- TABLE 62 GOVERNMENT & DEFENSE: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 GOVERNMENT & DEFENSE: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7.3 SECURITY & SURVEILLANCE

- 10.7.4 FACIAL RECOGNITION & IDENTITY VERIFICATION

- 10.7.5 PERIMETER PROTECTION

- 10.7.6 OTHER GOVERNMENT & DEFENSE

- 10.8 RETAIL

- 10.8.1 NEED FOR FOOT TRAFFIC ANALYSIS, LOSS PREVENTION, QUEUE MANAGEMENT, AND FACIAL RECOGNITION FOR LOYALTY PROGRAMS TO PROPEL MARKET

- 10.8.2 RETAIL: APPLICATION AREAS

- TABLE 64 RETAIL: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 RETAIL: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8.3 LOSS PREVENTION & SECURITY

- 10.8.4 QUEUE MANAGEMENT

- 10.8.5 FACIAL RECOGNITION AND ACCESS CONTROL

- 10.9 TRANSPORTATION & LOGISTICS

- 10.9.1 RISING DEMAND FOR VEHICLE AND CARGO TRACKING, LICENSE PLATE RECOGNITION, AND SECURITY SURVEILLANCE TO DRIVE MARKET

- 10.9.2 TRANSPORTATION & LOGISTICS: APPLICATION AREAS

- TABLE 66 TRANSPORTATION & LOGISTICS: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 TRANSPORTATION & LOGISTICS: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9.3 TRAFFIC MANAGEMENT & CONGESTION MONITORING

- 10.9.4 LICENSE PLATE RECOGNITION (LPR)

- 10.9.5 OTHER TRANSPORTATION & LOGISTICS

- 10.10 OTHER VERTICALS

- TABLE 68 OTHER VERTICALS: VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 OTHER VERTICALS: VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 VIDEO ANALYTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 48 NORTH AMERICA TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 70 VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: VIDEO ANALYTICS MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 72 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: VIDEO ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 US

- TABLE 84 US: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 85 US: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 86 US: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 87 US: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.2.4 CANADA

- TABLE 88 CANADA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 89 CANADA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 90 CANADA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 91 CANADA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: VIDEO ANALYTICS MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 92 EUROPE: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 93 EUROPE: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 95 EUROPE: VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 EUROPE: VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 97 EUROPE: VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 99 EUROPE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 100 EUROPE: VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 101 EUROPE: VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: VIDEO ANALYTICS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 103 EUROPE: VIDEO ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 UK

- TABLE 104 UK: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 105 UK: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 106 UK: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 107 UK: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.3.4 GERMANY

- TABLE 108 GERMANY: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 109 GERMANY: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 110 GERMANY: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 111 GERMANY: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.3.5 FRANCE

- TABLE 112 FRANCE: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 113 FRANCE: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 114 FRANCE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 115 FRANCE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.3.6 ITALY

- TABLE 116 ITALY: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 117 ITALY: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 118 ITALY: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 119 ITALY: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.3.7 SPAIN

- TABLE 120 SPAIN: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 121 SPAIN: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 122 SPAIN: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 123 SPAIN: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.3.8 REST OF EUROPE

- TABLE 124 REST OF EUROPE: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 125 REST OF EUROPE: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 127 REST OF EUROPE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: VIDEO ANALYTICS MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- TABLE 128 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

- 11.4.3 CHINA

- TABLE 140 CHINA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 141 CHINA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 142 CHINA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 143 CHINA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- TABLE 144 JAPAN: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 145 JAPAN: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 146 JAPAN: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 147 JAPAN: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- TABLE 148 AUSTRALIA & NEW ZEALAND: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 149 AUSTRALIA & NEW ZEALAND: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 150 AUSTRALIA & NEW ZEALAND: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 151 AUSTRALIA & NEW ZEALAND: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.4.6 INDIA

- TABLE 152 INDIA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 153 INDIA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 154 INDIA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 155 INDIA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.4.7 SOUTH KOREA

- TABLE 156 SOUTH KOREA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 157 SOUTH KOREA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 158 SOUTH KOREA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 159 SOUTH KOREA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 160 REST OF ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 164 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 GCC

- TABLE 176 GCC: VIDEO ANALYTICS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 177 GCC: VIDEO ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3.1 Saudi Arabia

- TABLE 178 SAUDI ARABIA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 179 SAUDI ARABIA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 180 SAUDI ARABIA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 181 SAUDI ARABIA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.5.3.2 UAE

- TABLE 182 UAE: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 183 UAE: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 184 UAE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 185 UAE: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.5.3.3 Qatar

- TABLE 186 QATAR: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 187 QATAR: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 188 QATAR: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 189 QATAR: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.5.3.4 Rest of GCC Countries

- TABLE 190 REST OF GCC: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 191 REST OF GCC: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 192 REST OF GCC: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 193 REST OF GCC: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.5.4 SOUTH AFRICA

- TABLE 194 SOUTH AFRICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 195 SOUTH AFRICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 196 SOUTH AFRICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 197 SOUTH AFRICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 198 REST OF MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: VIDEO ANALYTICS MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 202 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 205 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 207 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 209 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 211 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 213 LATIN AMERICA: VIDEO ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.3 BRAZIL

- TABLE 214 BRAZIL: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 215 BRAZIL: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 216 BRAZIL: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 217 BRAZIL: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.6.4 MEXICO

- TABLE 218 MEXICO: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 219 MEXICO: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 220 MEXICO: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 221 MEXICO: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 11.6.5 REST OF LATIN AMERICA

- TABLE 222 REST OF LATIN AMERICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 223 REST OF LATIN AMERICA: VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 224 REST OF LATIN AMERICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 226 OVERVIEW OF STRATEGIES ADOPTED BY KEY VIDEO ANALYTICS VENDORS

- 12.3 REVENUE ANALYSIS

- FIGURE 51 TOP 4 PLAYERS TO DOMINATE MARKET IN LAST 5 YEARS

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 52 SHARE OF LEADING COMPANIES IN VIDEO ANALYTICS MARKET, 2022

- TABLE 227 VIDEO ANALYTICS MARKET: DEGREE OF COMPETITION

- 12.5 PRODUCT/BRAND COMPARISON

- TABLE 228 VENDOR PRODUCTS/BRANDS COMPARISON

- 12.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 53 VIDEO ANALYTICS MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2023

- 12.7 COMPANY EVALUATION MATRIX

- FIGURE 54 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 55 GLOBAL VIDEO ANALYTICS MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.7.5 COMPANY FOOTPRINT

- TABLE 229 COMPANY REGION FOOTPRINT

- TABLE 230 COMPANY VERTICAL FOOTPRINT

- TABLE 231 COMPANY OFFERING FOOTPRINT

- TABLE 232 OVERALL COMPANY FOOTPRINT

- 12.8 START-UP/SME EVALUATION MATRIX

- FIGURE 56 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 57 GLOBAL VIDEO ANALYTICS MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE VENDORS

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 START-UPS/SMES FOOTPRINT

- TABLE 233 START-UP/SME REGIONAL FOOTPRINT

- TABLE 234 START-UP/SME VERTICAL FOOTPRINT

- TABLE 235 START-UP/SME OFFERING FOOTPRINT

- TABLE 236 OVERALL START-UP/SME FOOTPRINT

- 12.8.6 COMPETITIVE BENCHMARKING

- TABLE 237 VIDEO ANALYTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 12.9 COMPANY FINANCIAL METRICS

- FIGURE 58 VALUATION AND FINANCIAL METRICS

- 12.10 KEY MARKET DEVELOPMENTS

- 12.10.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

- TABLE 238 VIDEO ANALYTICS MARKET: PRODUCT LAUNCHES

- 12.10.2 DEALS

- TABLE 239 VIDEO ANALYTICS MARKET: DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- (Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 13.2.1 AVIGILON

- TABLE 240 AVIGILON: COMPANY OVERVIEW

- TABLE 241 AVIGILON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 AVIGILON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 243 AVIGILON: DEALS

- TABLE 244 AVIGILON: OTHERS

- 13.2.2 AXIS COMMUNICATIONS

- TABLE 245 AXIS COMMUNICATIONS: COMPANY OVERVIEW

- FIGURE 59 AXIS COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 246 AXIS COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 AXIS COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 248 AXIS COMMUNICATIONS: DEALS

- TABLE 249 AXIS COMMUNICATIONS: OTHERS

- 13.2.3 CISCO

- TABLE 250 CISCO: COMPANY OVERVIEW

- FIGURE 60 CISCO: COMPANY SNAPSHOT

- TABLE 251 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 CISCO: DEALS

- 13.2.4 HONEYWELL

- TABLE 254 HONEYWELL: COMPANY OVERVIEW

- FIGURE 61 HONEYWELL: COMPANY SNAPSHOT

- TABLE 255 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 257 HONEYWELL: DEALS

- 13.2.5 IBM

- TABLE 258 IBM: COMPANY OVERVIEW

- FIGURE 62 IBM: COMPANY SNAPSHOT

- TABLE 259 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.6 ALLGOVISION

- TABLE 261 ALLGOVISION: COMPANY OVERVIEW

- TABLE 262 ALLGOVISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 ALLGOVISION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 264 ALLGOVISION: DEALS

- 13.2.7 GENETEC

- TABLE 265 GENETEC: COMPANY OVERVIEW

- TABLE 266 GENETEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 GENETEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 268 GENETEC: DEALS

- TABLE 269 GENETEC: OTHERS

- 13.2.8 INTELLIVISION

- TABLE 270 INTELLIVISION: COMPANY OVERVIEW

- TABLE 271 INTELLIVISION: PRODUCTS/SERVICES OFFERED

- TABLE 272 INTELLIVISION: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.9 GORILLA TECHNOLOGY

- TABLE 273 GORILLA TECHNOLOGY: COMPANY OVERVIEW

- FIGURE 63 GORILLA TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 274 GORILLA TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 GORILLA TECHNOLOGY: DEALS

- 13.2.10 EAGLE EYE NETWORKS

- TABLE 276 EAGLE EYE NETWORKS: COMPANY OVERVIEW

- TABLE 277 EAGLE EYE NETWORKS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 278 EAGLE EYE NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 279 EAGLE EYE NETWORKS: DEALS

- TABLE 280 EAGLE EYE NETWORKS: OTHERS

- 13.2.11 ADT

- TABLE 281 ADT: COMPANY OVERVIEW

- FIGURE 64 ADT: COMPANY SNAPSHOT

- TABLE 282 ADT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ADT: DEALS

- 13.2.12 INTUVISION

- TABLE 284 INTUVISION: BUSINESS OVERVIEW

- TABLE 285 INTUVISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 INTUVISION: DEALS

- 13.2.13 SECURITAS

- TABLE 287 SECURITAS: COMPANY OVERVIEW

- FIGURE 65 SECURITAS: COMPANY SNAPSHOT

- TABLE 288 SECURITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SECURITAS: DEALS

- 13.3 OTHER PLAYERS

- 13.3.1 PURETECH SYSTEMS

- 13.3.2 HIKVISION

- 13.3.3 DAHUA TECHNOLOGY

- 13.3.4 IOMNISCIENT

- 13.3.5 NEC

- 13.3.6 HUAWEI

- 13.3.7 INTELLIGENT SECURITY SYSTEMS

- 13.3.8 VERINT SYSTEMS

- 13.3.9 VISEUM

- 13.3.10 BRIEFCAM

- 13.3.11 BOSCH SECURITY SYSTEMS

- 13.3.12 I2V

- 13.3.13 DIGITAL BARRIERS

- 13.3.14 SENSTAR

- 13.3.15 QOGNIFY

- 13.3.16 IDENTIV

- 13.3.17 IPSOTEK

- 13.3.18 DELOPT

- 13.4 SMES/START-UPS

- 13.4.1 DRISHTI

- 13.4.2 NATIX

- 13.4.3 DEEP NORTH

- 13.4.4 CRONJ

- 13.4.5 MIOVISION

- 13.4.6 ACTUATE

- 13.4.7 CALIPSA

- 13.4.8 CORSIGHT AI

- 13.4.9 ARCULES

- 13.4.10 CAWAMO

- 13.4.11 KOGNIZ

- *Details on Business overview, Products/Services/Solutions offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 290 ADJACENT MARKETS AND FORECASTS

- 14.2 LIMITATIONS

- 14.3 VIDEO ANALYTICS MARKET ECOSYSTEM AND ADJACENT MARKETS

- 14.4 FACIAL RECOGNITION MARKET

- 14.4.1 FACIAL RECOGNITION MARKET, BY COMPONENT

- TABLE 291 FACIAL RECOGNITION MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 292 FACIAL RECOGNITION MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- 14.4.2 FACIAL RECOGNITION MARKET, BY APPLICATION

- TABLE 293 FACIAL RECOGNITION MARKET, BY APPLICATION, 2014-2019 (USD MILLION)

- TABLE 294 FACIAL RECOGNITION MARKET, BY APPLICATION, 2019-2025 (USD MILLION)

- 14.4.3 FACIAL RECOGNITION MARKET, BY VERTICAL

- TABLE 295 FACIAL RECOGNITION MARKET, BY VERTICAL, 2014-2019 (USD MILLION)

- TABLE 296 FACIAL RECOGNITION MARKET, BY VERTICAL, 2019-2025 (USD MILLION)

- 14.4.4 FACIAL RECOGNITION MARKET, BY REGION

- TABLE 297 FACIAL RECOGNITION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 298 FACIAL RECOGNITION MARKET, BY REGION, 2019-2025 (USD MILLION)

- 14.5 STREAMING ANALYTICS MARKET

- 14.5.1 STREAMING ANALYTICS MARKET, BY COMPONENT

- TABLE 299 STREAMING ANALYTICS MARKET, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 300 STREAMING ANALYTICS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 14.5.2 STREAMING ANALYTICS MARKET, BY APPLICATION

- TABLE 301 STREAMING ANALYTICS MARKET, BY APPLICATION, 2015-2020 (USD MILLION)

- TABLE 302 STREAMING ANALYTICS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 14.5.3 STREAMING ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 303 STREAMING ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 304 STREAMING ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 14.5.4 STREAMING ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 305 STREAMING ANALYTICS MARKET, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 306 STREAMING ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 14.5.5 STREAMING ANALYTICS MARKET, BY INDUSTRY VERTICAL

- TABLE 307 STREAMING ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 308 STREAMING ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2021-2026 (USD MILLION)

- 14.5.6 STREAMING ANALYTICS MARKET, BY REGION

- TABLE 309 STREAMING ANALYTICS MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 310 STREAMING ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS