|

|

市場調査レポート

商品コード

1630478

医療美容の世界市場:製品別、装置タイプ別、施術法別、エンドユーザー別、地域別 - 2030年までの予測Medical Aesthetics Market by Product, Procedure, End User, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療美容の世界市場:製品別、装置タイプ別、施術法別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月20日

発行: MarketsandMarkets

ページ情報: 英文 380 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医療美容の市場規模は、2024年の1,716万米ドルから2030年には353億2,000万米ドルに達し、予測期間中のCAGRは12.8%になると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | 製品別、装置タイプ別、施術法別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

医療美容市場の成長は、いくつかの要因によって促進されています。まず需要面では、低侵襲・非侵襲治療が、副作用リスクの低減や回復期間の短縮など、従来の方法に比べていくつかの利点があるため、ますます需要が高まっています。多機能レーザーや様々な皮膚若返り技術を含む美容技術の進歩は、これらの治療の有効性と精度を高め、より良い結果を生み出し、より多くの人々に恩恵をもたらすことで、より市場にとってより身近で魅力的なものとなるとみられています。美容施術の市場は、発展途上国における可処分所得の増加によって緩和されています。ウェルネス、セルフケア、ソーシャル・メディアを重視する傾向が強まり、若々しさを保つために美容治療を求める人々の需要が高まっています。その他の促進要因としては、様々な問題に対するアンチエイジング・ソリューションを求める先進諸国の高齢化が挙げられます。これらの要因はすべて、医療美容市場の上昇に寄与しています。

医療美容市場は、2023年にフェイシャルエステティック製品の最大シェアを獲得しました。このセグメントは、フェイシャルエステティック製品、美容インプラント、スキンエステティックデバイス、ボディコントゥアリングデバイス、医師が調剤するコスメシューティカルズ、スキンライトナー、スレッドリフト製品、脱毛デバイス、タトゥー除去デバイス、医師が調剤するアイラッシュ製品、ネイル治療レーザーデバイスを扱います。フェイシャル・エステティック製品の大部分は、ボトックスや皮膚充填剤など、顔の若返りのための非侵襲的治療です。これらの製品は、自然な外観で最小限のダウンタイムで効果的な結果をもたらす能力があるため、より好まれています。また、自宅でできる美容施術の需要が高まっているため、市場はさらに成長すると思われます。このような自宅での治療へのシフトは、先進的でユーザーフレンドリーな機器の利用可能性によって可能となり、フェイシャルエステ・ソリューションのアクセシビリティと手頃な価格の拡大に寄与しています。その結果、フェイシャルエステティック製品セグメントは、便利で効果的なエステティック強化に対する消費者の嗜好に従い、最も高い速度で前進する軌道を維持するものとみられています。

当レポートでは、世界の医療美容市場について調査し、製品別、装置タイプ別、施術法別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- アンメットニーズ

- AI/生成AIが医療美容市場に与える影響

第6章 医療美容市場、製品別

- イントロダクション

- フェイシャルエステティック製品

- ボディコントゥアリングデバイス

- 美容インプラント

- 医師が処方する化粧品および美白剤

- スキンエステ機器

- 医師処方のまつ毛ケア製品

- 脱毛器

- タトゥー除去装置

- スレッドリフト製品

- ネイル治療レーザー機器

- ホームケア機器

第7章 医療美容市場、装置タイプ別

- イントロダクション

- スタンドアロン装置

- マルチモーダル装置

- 自宅用装置/セルフユース装置

第8章 美容医療市場、施術法別

- イントロダクション

- 非外科的施術

- 外科手術

第9章 医療美容市場、エンドユーザー別

- イントロダクション

- クリニック、病院、メディカルスパ

- ビューティーセンター

- 在宅ケア

第10章 美容医療市場、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2023年

- 市場シェア分析、2023年

- 主要市場プレーヤーのランキング

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- ABBVIE INC.

- GALDERMA

- JOHNSON & JOHNSON SERVICES, INC.

- BAUSCH HEALTH COMPANIES INC.

- CYNOSURE LUTRONIC

- CUTERA, INC.

- MERZ PHARMA

- LUMENIS BE LTD.

- FOTONA

- AEROLASE CORP.

- SCITON

- BOHUS BIOTECH AB

- RECOSMO

- SHARPLIGHT TECHNOLOGIES INC.

- CANDELA CORPORATION

- ALMA LASERS

- EL.EN. S.P.A.

- INMODE LTD.

- VENUS CONCEPT

- GC AESTHETICS

- その他の企業

- EVOLUS, INC.

- ASCLEPION LASER TECHNOLOGIES

- ASTANZA LASER

- APYX MEDICAL

- HUADONG MEDICINE CO., LTD.

- MEDYTOX INC.

- POLYTECH HEALTH & AESTHETICS GMBH

- REVANCE AESTHETICS

- PHOTOMEDEX

- 2L BIO CO., LTD.

第13章 付録

List of Tables

- TABLE 1 MEDICAL AESTHETICS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MEDICAL AESTHETICS MARKET: RISK ASSESSMENT

- TABLE 3 MEDICAL AESTHETICS MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 COMMERCIALLY AVAILABLE HOME-USE AESTHETIC DEVICES

- TABLE 5 PLASTIC SURGEON FEES IN US, 2022 VS. 2023

- TABLE 6 AVERAGE SELLING PRICE TREND OF INJECTABLES, 2021-2023

- TABLE 7 AVERAGE SELLING PRICE TREND OF ENERGY BASED-DEVICES, BY REGION, 2021-2023 (USD THOUSAND)

- TABLE 8 MEDICAL AESTHETICS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 MEDICAL AESTHETICS MARKET: LASER AND LIGHT-BASED TECHNOLOGIES

- TABLE 10 APPLICATIONS OF RADIOFREQUENCY TECHNOLOGY

- TABLE 11 MEDICAL AESTHETICS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2023

- TABLE 12 IMPORT SCENARIO FOR LASER AESTHETIC DEVICES (HS CODE 854370), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 13 IMPORT SCENARIO FOR LASER (EXCLUDING DIODES) (HS CODE 901320), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 14 EXPORT SCENARIO FOR LASER AESTHETIC DEVICES (HS CODE 854370), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 15 EXPORT SCENARIO FOR LASER (EXCLUDING DIODES) (HS CODE 901320), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 16 MEDICAL AESTHETICS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 CASE STUDY 1: COMMERCIAL PARTNERSHIPS FOR MEDICAL AESTHETIC PRODUCT SALES

- TABLE 18 CASE STUDY 2: DIVISION OF BUSINESS TO MEET CUSTOMER DEMANDS

- TABLE 19 CASE STUDY 3: COLLABORATIONS WITH SMES FOR STREAMLINING LASER-BASED DEVICES

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 25 REGULATORY APPROVALS FOR BODY CONTOURING DEVICES, BY COUNTRY

- TABLE 26 MEDICAL AESTHETICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE OF DEVICE

- TABLE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 29 MEDICAL AESTHETICS MARKET: UNMET NEEDS

- TABLE 30 MEDICAL AESTHETICS MARKET: COMPANIES IMPLEMENTING AI

- TABLE 31 MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 32 MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 33 MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 34 MEDICAL AESTHETICS MARKET FOR BOTULINUM TOXIN, BY REGION, 2022-2030 (USD MILLION)

- TABLE 35 MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 36 MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 37 MEDICAL AESTHETICS MARKET FOR NATURAL DERMAL FILLERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 38 MEDICAL AESTHETICS MARKET FOR SYNTHETIC DERMAL FILLERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 39 CHEMICAL PEEL PROCEDURES PERFORMED WORLDWIDE, 2023

- TABLE 40 MEDICAL AESTHETICS MARKET FOR CHEMICAL PEELS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 41 MEDICAL AESTHETICS MARKET FOR MICRODERMABRASION, BY REGION, 2022-2030 (USD MILLION)

- TABLE 42 FACIAL BONE CONTOURING PROCEDURES PERFORMED WORLDWIDE, 2023

- TABLE 43 MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 44 MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 45 NON-SURGICAL FAT REDUCTION PROCEDURES PERFORMED WORLDWIDE, 2019 VS. 2022 VS. 2023

- TABLE 46 NON-SURGICAL FAT REDUCTION PROCEDURES PERFORMED WORLDWIDE, 2023

- TABLE 47 MEDICAL AESTHETICS MARKET FOR NON-SURGICAL FAT REDUCTION DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 48 CELLULITE REDUCTION PROCEDURES PERFORMED WORLDWIDE, 2023

- TABLE 49 MEDICAL AESTHETICS MARKET FOR CELLULITE REDUCTION DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 50 AGE DISTRIBUTION OF PATIENTS UNDERTAKING LIPOSUCTION PROCEDURES WORLDWIDE, 2023

- TABLE 51 MEDICAL AESTHETICS MARKET FOR LIPOSUCTION DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 52 MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 53 MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 54 MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 55 MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 56 PERCENTAGE OF PLASTIC SURGEONS PERFORMING SILICONE BREAST IMPLANTS WORLDWIDE, 2023

- TABLE 57 MEDICAL AESTHETICS MARKET FOR SILICONE BREAST IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 58 PERCENTAGE OF PLASTIC SURGEONS PERFORMING SALINE BREAST IMPLANTS WORLDWIDE, 2023

- TABLE 59 MEDICAL AESTHETICS MARKET FOR SALINE BREAST IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 60 MEDICAL AESTHETICS MARKET FOR FACIAL IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 61 MEDICAL AESTHETICS MARKET FOR OTHER IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 62 MEDICAL AESTHETICS MARKET FOR PHYSICIAN-DISPENSED COSMECEUTICALS AND SKIN LIGHTENERS, BY REGION, 2022-2030 (USD MILLION)

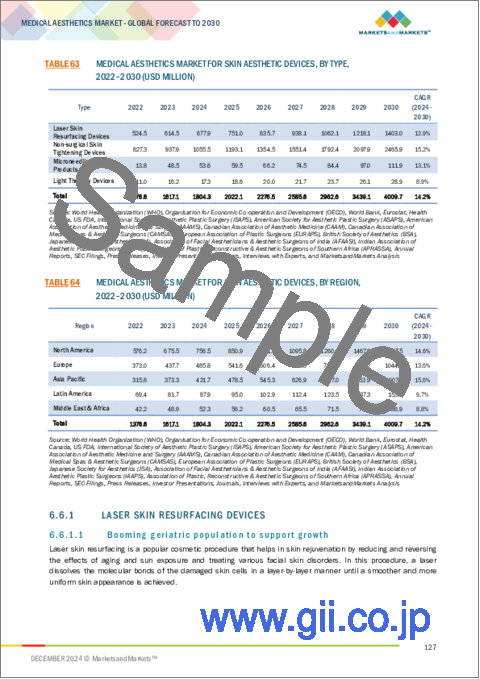

- TABLE 63 MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 64 MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 65 MEDICAL AESTHETICS MARKET FOR LASER SKIN RESURFACING DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 66 NON-SURGICAL SKIN TIGHTENING PROCEDURES PERFORMED WORLDWIDE, 2023

- TABLE 67 MEDICAL AESTHETICS MARKET FOR NON-SURGICAL SKIN TIGHTENING DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 68 MEDICAL AESTHETICS MARKET FOR MICRONEEDLING PRODUCTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 69 MEDICAL AESTHETICS MARKET FOR LIGHT THERAPY DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 70 MEDICAL AESTHETICS MARKET FOR PHYSICIAN-DISPENSED EYELASH PRODUCTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 71 HAIR REMOVAL PROCEDURES PERFORMED WORLDWIDE, 2023

- TABLE 72 MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 73 MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 74 MEDICAL AESTHETICS MARKET FOR LASER HAIR REMOVAL DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 75 MEDICAL AESTHETICS MARKET FOR IPL HAIR REMOVAL DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 76 MEDICAL AESTHETICS MARKET FOR TATTOO REMOVAL DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 77 MEDICAL AESTHETICS MARKET FOR THREAD LIFT PRODUCTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 78 MEDICAL AESTHETICS MARKET FOR NAIL TREATMENT LASER DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 79 MEDICAL AESTHETICS MARKET FOR HOME CARE DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 80 MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE, 2022-2030 (USD MILLION)

- TABLE 81 MEDICAL AESTHETICS DEVICES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 82 MEDICAL AESTHETICS MARKET FOR STANDALONE DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 83 MEDICAL AESTHETICS MARKET FOR MULTIMODAL DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 84 MEDICAL AESTHETICS MARKET FOR AT-HOME/SELF-USE DEVICES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 85 MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 86 MEDICAL AESTHETICS MARKET FOR NON-SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 87 MEDICAL AESTHETICS MARKET FOR ANTI-AGING AND SKIN REJUVENATION, BY REGION, 2022-2030 (USD MILLION)

- TABLE 88 MEDICAL AESTHETICS MARKET FOR TATTOO REMOVAL, BY REGION, 2022-2030 (USD MILLION)

- TABLE 89 MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL, BY REGION, 2022-2030 (USD MILLION)

- TABLE 90 MEDICAL AESTHETICS MARKET FOR LIPOSUCTION, BY REGION, 2022-2030 (USD MILLION)

- TABLE 91 MEDICAL AESTHETICS MARKET FOR OTHER NON-SURGICAL PROCEDURES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 92 MEDICAL AESTHETICS MARKET FOR SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 93 MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 94 MEDICAL AESTHETICS MARKET FOR FACELIFT & BODY LIFT PROCEDURES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 95 MEDICAL AESTHETICS MARKET FOR OTHER SURGICAL PROCEDURES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 96 MEDICAL AESTHETICS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 97 MEDICAL AESTHETICS MARKET FOR CLINICS, HOSPITALS, AND MEDICAL SPAS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 98 MEDICAL AESTHETICS MARKET FOR BEAUTY CENTERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 99 MEDICAL AESTHETICS MARKET FOR HOME CARE SETTINGS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 100 MEDICAL AESTHETICS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 102 NORTH AMERICA: MEDICAL AESTHETICS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE, 2022-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR NON-SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: MEDICAL AESTHETICS MARKET FOR SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: MEDICAL AESTHETICS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 116 US: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 117 US: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 118 US: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 119 US: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 120 US: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 121 US: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 122 US: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 123 CANADA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 124 CANADA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 125 CANADA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 126 CANADA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 127 CANADA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 128 CANADA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 129 EUROPE: MEDICAL AESTHETIC PROCEDURES, BY COUNTRY, 2023

- TABLE 130 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 131 EUROPE: MEDICAL AESTHETICS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 132 EUROPE: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 133 EUROPE: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 134 EUROPE: MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 135 EUROPE: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 136 EUROPE: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 137 EUROPE: MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 138 EUROPE: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 139 EUROPE: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 140 EUROPE: MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE, 2022-2030 (USD MILLION)

- TABLE 141 EUROPE: MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 142 EUROPE: MEDICAL AESTHETICS MARKET FOR NON-SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 143 EUROPE: MEDICAL AESTHETICS MARKET FOR SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 144 EUROPE: MEDICAL AESTHETICS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 145 GERMANY: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 146 GERMANY: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 147 GERMANY: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 148 GERMANY: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 149 GERMANY: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 150 GERMANY: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 151 GERMANY: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 152 UK: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 153 UK: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 154 UK: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 155 UK: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 156 UK: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 157 UK: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 158 UK: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 159 FRANCE: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 160 FRANCE: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 161 FRANCE: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 162 FRANCE: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 163 FRANCE: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 164 FRANCE: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 165 FRANCE: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 166 ITALY: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 167 ITALY: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 168 ITALY: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 169 ITALY: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 170 ITALY: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 171 ITALY: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 172 ITALY: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 173 SPAIN: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 174 SPAIN: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 175 SPAIN: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 176 SPAIN: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 177 SPAIN: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 178 SPAIN: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 179 SPAIN: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 180 BELGIUM: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 181 ROMANIA: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 182 GREECE: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 183 REST OF EUROPE: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 184 REST OF EUROPE: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 186 REST OF EUROPE: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 187 REST OF EUROPE: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 188 REST OF EUROPE: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MEDICAL AESTHETIC PROCEDURES, BY COUNTRY, 2023

- TABLE 190 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 191 ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 198 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 200 ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE, 2022-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 202 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR NON-SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 205 JAPAN: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2022

- TABLE 206 JAPAN: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 207 JAPAN: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 208 JAPAN: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 209 JAPAN: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 210 JAPAN: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 211 JAPAN: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 212 CHINA: ENERGY-BASED DEVICE PROCEDURES, 2023

- TABLE 213 CHINA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 214 CHINA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 215 CHINA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 216 CHINA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 217 CHINA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 218 CHINA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 219 INDIA: MOST COMMON SURGICAL PROCEDURES, 2023

- TABLE 220 INDIA: BODY CONTOURING PROCEDURES CONDUCTED, 2020-2023

- TABLE 221 INDIA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 222 INDIA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 223 INDIA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 224 INDIA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 225 INDIA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 226 INDIA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 227 AUSTRALIA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 228 AUSTRALIA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 229 AUSTRALIA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 230 AUSTRALIA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 231 AUSTRALIA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 232 AUSTRALIA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 233 SOUTH KOREA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 234 SOUTH KOREA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 235 SOUTH KOREA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 236 SOUTH KOREA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 237 SOUTH KOREA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 238 SOUTH KOREA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 239 THAILAND: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 240 MALAYSIA: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 241 BANGLADESH: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 242 REST OF ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 248 LATIN AMERICA: MEDICAL AESTHETIC PROCEDURES, BY COUNTRY, 2023

- TABLE 249 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 250 LATIN AMERICA: MEDICAL AESTHETICS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 252 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 254 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 255 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 256 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR BREAST IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 257 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 258 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 259 LATIN AMERICA: MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE, 2022-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR NON-SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 262 LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 263 LATIN AMERICA: MEDICAL AESTHETICS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 264 BRAZIL: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 265 BRAZIL: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 266 BRAZIL: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 267 BRAZIL: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 268 BRAZIL: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 269 BRAZIL: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 270 BRAZIL: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 271 MEXICO: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 272 MEXICO: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 273 MEXICO: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 274 MEXICO: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 275 MEXICO: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 276 MEXICO: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 277 MEXICO: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 278 ARGENTINA: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 279 COLOMBIA: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 280 PERU: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 281 VENEZUELA: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 282 REST OF LATIN AMERICA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 284 REST OF LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS PROCEDURES, BY COUNTRY, 2023

- TABLE 289 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 290 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR DERMAL FILLERS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: BREAST IMPLANTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE, 2022-2030 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2022-2030 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR NON-SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR SURGICAL PROCEDURES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 304 GCC COUNTRIES: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 305 GCC COUNTRIES: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 306 GCC COUNTRIES: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 307 GCC COUNTRIES: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 308 GCC COUNTRIES: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 309 GCC COUNTRIES: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 310 IRAN: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 311 SYRIA: MOST COMMON MEDICAL AESTHETIC PROCEDURES, 2023

- TABLE 312 REST OF MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET, BY PRODUCT, 2022-2030 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR FACIAL AESTHETIC PRODUCTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR BODY CONTOURING DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR COSMETIC IMPLANTS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR SKIN AESTHETIC DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: MEDICAL AESTHETICS MARKET FOR HAIR REMOVAL DEVICES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 318 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL AESTHETICS MARKET, 2021-2024

- TABLE 319 MEDICAL AESTHETICS MARKET: REGION FOOTPRINT

- TABLE 320 MEDICAL AESTHETICS MARKET: PRODUCT FOOTPRINT

- TABLE 321 MEDICAL AESTHETICS MARKET: TYPE OF DEVICE FOOTPRINT

- TABLE 322 MEDICAL AESTHETICS MARKET: PROCEDURE FOOTPRINT

- TABLE 323 MEDICAL AESTHETICS MARKET: END-USER FOOTPRINT

- TABLE 324 MEDICAL AESTHETICS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 325 MEDICAL AESTHETICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 326 MEDICAL AESTHETICS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 327 MEDICAL AESTHETICS MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 328 MEDICAL AESTHETICS MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 329 ABBVIE INC.: COMPANY OVERVIEW

- TABLE 330 ABBVIE INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 331 ABBVIE INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 332 GALDERMA: COMPANY OVERVIEW

- TABLE 333 GALDERMA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 334 GALDERMA: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 335 GALDERMA: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 336 GALDERMA: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 337 JOHNSON & JOHNSON SERVICES, INC.: COMPANY OVERVIEW

- TABLE 338 JOHNSON & JOHNSON SERVICES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 339 JOHNSON & JOHNSON SERVICES, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 340 BAUSCH HEALTH COMPANIES INC.: COMPANY OVERVIEW

- TABLE 341 BAUSCH HEALTH COMPANIES INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 342 BAUSCH HEALTH COMPANIES INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 343 CYNOSURE LUTRONIC: COMPANY OVERVIEW

- TABLE 344 CYNOSURE LUTRONIC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 345 CYNOSURE LUTRONIC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 346 CYNOSURE LUTRONIC: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 347 CUTERA, INC.: COMPANY OVERVIEW

- TABLE 348 CUTERA, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 349 CUTERA, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 350 CUTERA, INC.: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 351 MERZ PHARMA: COMPANY OVERVIEW

- TABLE 352 MERZ PHARMA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 353 MERZ PHARMA: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 354 MERZ PHARMA: EXPANSIONS, JANUARY 2021- DECEMBER 2024

- TABLE 355 LUMENIS BE LTD.: COMPANY OVERVIEW

- TABLE 356 LUMENIS BE LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 357 LUMENIS BE LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 358 LUMENIS BE LTD.: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 359 FOTONA: COMPANY OVERVIEW

- TABLE 360 FOTONA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 361 FOTONA: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 362 FOTONA: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 363 AEROLASE CORP.: COMPANY OVERVIEW

- TABLE 364 AEROLASE CORP.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 365 AEROLASE CORP.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 366 SCITON: COMPANY OVERVIEW

- TABLE 367 SCITON: PRODUCTS/SOLUTIONS OFFERED

- TABLE 368 SCITON: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 369 BOHUS BIOTECH AB: COMPANY OVERVIEW

- TABLE 370 BOHUS BIOTECH AB: PRODUCTS/SOLUTIONS OFFERED

- TABLE 371 RECOSMO: COMPANY OVERVIEW

- TABLE 372 RECOSMO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 373 SHARPLIGHT TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 374 SHARPLIGHT TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 375 SHARPLIGHT TECHNOLOGIES INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 376 CANDELA CORPORATION: COMPANY OVERVIEW

- TABLE 377 CANDELA CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 378 CANDELA CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 379 CANDELA CORPORATION: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 380 ALMA LASERS: COMPANY OVERVIEW

- TABLE 381 ALMA LASERS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 382 ALMA LASERS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 383 ALMA LASERS: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 384 EL.EN. S.P.A.: COMPANY OVERVIEW

- TABLE 385 EL.EN. S.P.A.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 386 EL.EN. S.P.A.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 387 INMODE LTD.: COMPANY OVERVIEW

- TABLE 388 INMODE LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 389 INMODE LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 390 VENUS CONCEPT: COMPANY OVERVIEW

- TABLE 391 VENUS CONCEPT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 392 VENUS CONCEPT: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 393 GC AESTHETICS: COMPANY OVERVIEW

- TABLE 394 GC AESTHETICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 395 GC AESTHETICS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-DECEMBER 2024

- TABLE 396 GC AESTHETICS: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 397 EVOLUS, INC.: COMPANY OVERVIEW

- TABLE 398 ASCLEPION LASER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 399 ASTANZA LASER: COMPANY OVERVIEW

- TABLE 400 APYX MEDICAL: COMPANY OVERVIEW

- TABLE 401 HUADONG MEDICINE CO., LTD.: COMPANY OVERVIEW

- TABLE 402 MEDYTOX INC.: COMPANY OVERVIEW

- TABLE 403 POLYTECH HEALTH & AESTHETICS GMBH: COMPANY OVERVIEW

- TABLE 404 REVANCE AESTHETICS: COMPANY OVERVIEW

- TABLE 405 PHOTOMEDEX: COMPANY OVERVIEW

- TABLE 406 2L BIO CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL AESTHETICS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MEDICAL AESTHETICS MARKET: YEARS CONSIDERED

- FIGURE 3 MEDICAL AESTHETICS MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 MEDICAL AESTHETICS MARKET: END-USER-BASED MARKET SIZE ESTIMATION

- FIGURE 9 MEDICAL AESTHETICS MARKET: GROWTH PROJECTIONS BASED ON REVENUE IMPACT OF KEY MACRO INDICATORS

- FIGURE 10 MEDICAL AESTHETICS MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 11 MEDICAL AESTHETICS MARKET, BY PRODUCT, 2024 VS. 2030 (USD MILLION)

- FIGURE 12 MEDICAL AESTHETICS MARKET, BY PROCEDURE, 2024 VS. 2030 (USD MILLION)

- FIGURE 13 MEDICAL AESTHETICS MARKET, BY END USER, 2024 VS. 2030 (USD MILLION)

- FIGURE 14 MEDICAL AESTHETICS MARKET, BY REGION, 2024-2030

- FIGURE 15 GROWING ADOPTION OF MINIMALLY INVASIVE AND NON-INVASIVE AESTHETIC PROCEDURES TO DRIVE MARKET

- FIGURE 16 FACIAL AESTHETIC PRODUCTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 CLINICS, HOSPITALS, AND MEDICAL SPAS DOMINATED MARKET IN 2023

- FIGURE 18 ASIA PACIFIC TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 MEDICAL AESTHETICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 REVENUE SHIFT FOR PLAYERS IN MEDICAL AESTHETICS MARKET

- FIGURE 21 AVERAGE SELLING PRICE OF ENERGY-BASED DEVICES, BY TYPE, 2023 (USD THOUSAND)

- FIGURE 22 AVERAGE SELLING PRICE OF INJECTABLES, BY TYPE, 2021-2023 (USD)

- FIGURE 23 AVERAGE SELLING PRICE OF ENERGY-BASED DEVICES, BY KEY PLAYER, 2023 (USD THOUSAND)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF ENERGY-BASED DEVICES, BY REGION, 2021-2023 (USD THOUSAND)

- FIGURE 25 MEDICAL AESTHETICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MEDICAL AESTHETICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 MEDICAL AESTHETICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 29 NUMBER OF DEALS IN MEDICAL AESTHETICS MARKET, BY KEY PLAYER, 2020-2024

- FIGURE 30 VALUE OF DEALS IN MEDICAL AESTHETICS MARKET, BY KEY PLAYER, 2020-2024 (USD)

- FIGURE 31 MEDICAL AESTHETICS MARKET: PATENT ANALYSIS, 2013-2024

- FIGURE 32 MEDICAL AESTHETICS MARKET: IMPORT SCENARIO FOR LASER AESTHETIC DEVICES (HS CODE 854370), 2019-2023

- FIGURE 33 MEDICAL AESTHETICS MARKET: IMPORT SCENARIO FOR LASER (EXCLUDING DIODES) (HS CODE 901320), 2019-2023

- FIGURE 34 MEDICAL AESTHETICS MARKET: EXPORT SCENARIO FOR LASER AESTHETIC DEVICES (HS CODE 854370), 2019-2023

- FIGURE 35 MEDICAL AESTHETICS MARKET: EXPORT SCENARIO FOR LASER (EXCLUDING DIODES) (HS CODE 901320), 2019-2023

- FIGURE 36 MEDICAL AESTHETICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE OF DEVICE

- FIGURE 38 BUYING CRITERIA, BY END USER

- FIGURE 39 AI USE CASES

- FIGURE 40 NORTH AMERICA: MEDICAL AESTHETICS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MEDICAL AESTHETICS MARKET SNAPSHOT

- FIGURE 42 MEDICAL AESTHETICS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2023

- FIGURE 43 ENERGY-BASED AESTHETIC DEVICES MARKET SHARE, 2023

- FIGURE 44 FACIAL AESTHETIC PRODUCTS MARKET SHARE, 2023

- FIGURE 45 COSMETIC IMPLANTS MARKET SHARE, 2023

- FIGURE 46 RANKING OF KEY PLAYERS IN MEDICAL AESTHETICS MARKET, 2023

- FIGURE 47 ENERGY-BASED AESTHETIC DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 48 FACIAL AESTHETIC PRODUCTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 49 COSMETIC IMPLANTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 MEDICAL AESTHETICS MARKET: COMPANY FOOTPRINT

- FIGURE 51 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 52 5-YEAR STOCK BETA OF KEY VENDORS, 2024

- FIGURE 53 MEDICAL AESTHETICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 54 ABBVIE INC.: COMPANY SNAPSHOT (2023)

- FIGURE 55 GALDERMA: COMPANY SNAPSHOT (2023)

- FIGURE 56 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 57 BAUSCH HEALTH COMPANIES INC.: COMPANY SNAPSHOT (2023)

- FIGURE 58 CUTERA, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 59 ALMA LASERS: COMPANY SNAPSHOT (2023)

- FIGURE 60 EL.EN. S.P.A.: COMPANY SNAPSHOT (2023)

- FIGURE 61 INMODE LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 62 VENUS CONCEPT: COMPANY SNAPSHOT (2023)

"The global medical aesthetics market is estimated to reach USD 35.32 Billion by 2030 from USD 17.16 million in 2024, at a CAGR of 12.8% during the forecast period)."

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD) |

| Segments | By Product, Device Type, Procedure, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The growth of the market of medical aesthetics is very high due to several factors. First, from the demand side, minimally invasive and non-invasive treatments are increasingly demanded since they have several advantages over conventional methods, such as a decreased risk of side effects and minimum recovery periods. Advances in aesthetic technologies, including multifunctional lasers and various skin rejuvenation techniques, enhance the effectiveness and precision of these treatments with better results that would benefit more people and make them more accessible and appealing to a larger market. The market for aesthetic procedures has been eased by increased disposable incomes in the developing world. Growing emphasis on wellness, self-care, and social media has increased demand as people seek beauty treatments to stay youthful. Other drivers include an aging population in developed countries looking for anti-aging solutions to a variety of problems. These factors are all contributing to the rise in the medical aesthetics market.

"The facial aesthetic products segment held the largest share of the market in 2023."

The market for medical aesthetics captured the largest share of facial aesthetic products in 2023. This segment deals with facial aesthetic products, cosmetic implants, skin aesthetic devices, body contouring devices, physician-dispensed cosmeceuticals, skin lighteners, thread lift products, hair removal devices, tattoo removal devices, physician-dispensed eyelash products, and nail treatment laser devices. The major portion of facial aesthetic products accounts for non-invasive treatments for facial rejuvenation, such as Botox and dermal fillers. These products are preferred more because of their ability to deliver effective results with minimal downtime in a natural appearance. The market will also experience further growth because of the rising demand for aesthetic procedures that can be done at home. This shift toward at-home treatments, enabled by the availability of advanced, user-friendly devices, is contributing to the growing accessibility and affordability of facial aesthetic solutions. As a result, the facial aesthetic products segment shall remain on track to advance at the highest rate, following consumer preference for convenient and effective aesthetic enhancements.

"The lipolysis segment is projected to register the highest CAGR of the non-surgical procedures by procedure during the forecast period."

The medical aesthetics market is segmented into surgical and nonsurgical procedures. Surgical procedures account for areas of breast augmentation, rhinoplasty, facelifts, body lifts, etc, while non-surgical procedures include anti-aging and skin rejuvenation, tattoo and scar removal, hair removal, lipolysis, and many others. Among these, the lipolysis segment is anticipated to record the highest compound annual growth rate (CAGR) within the non-surgical procedures market from 2024 to 2030. Lipolysis is a non-invasive technique for reducing excess fat that is gaining immense popularity due to its ability to target particular fat deposits without surgery. Consumer spending on cosmetic treatments, especially those that will help achieve body contouring, leads to the rapid growth of this segment. This is because numerous people are opting for more affordable and effective alternatives to traditional surgery. With lipolysis now available in the market, the development of advanced devices that allow for the precise extraction of fats with minimal downtime is further enhancing the demand. An increase in body consciousness with an increased awareness of non-surgical fat-reduction options contributes to the growth of the segment. The lipolysis segment is expected to experience continued growth and remain a key player in the medical aesthetics market across the forecast period as consumers remain focused on swift, efficient, and minimally invasive treatment options

"The market in the Asia Pacific region is expected to witness the highest growth during the forecast period."

The Asia Pacific (APAC) region is anticipated to be the fastest-growing medical aesthetics market over the forecast period, mainly due to the rapid development of healthcare infrastructure, more so in emerging economies such as India and China. Moreover, investment in the respective healthcare sectors of these countries fosters the demand for advanced medical aesthetic systems, including dermatology, body contouring, and facial aesthetics. Additionally, increasing disposable incomes and the fast-expanding middle class in the region are further fueling demand for aesthetic treatments since it's a move toward skin rejuvenation, anti-aging, and cosmetic procedures.

The industry has seen the APAC region become a more significant area of interest for companies involved in medical aesthetics, where there has been an increasing focus on innovative products offered to consumers' changing preferences. Increased clinic, hospital, and medical spa coverage in the region is the accelerator for the adoption of these technologies. Increased awareness and acceptance of aesthetic treatments are expected to fuel the growth of the market soon. The APAC region is very poised to lead the medical aesthetics market with the rising healthcare infrastructure and has numerous opportunities for growth and expansion in the sector.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation: Director-level-25%, C-level-35%, and Others-40%

- By Region: North America-40%, Europe-30%, Asia Pacific-20%, Latin America-5%, Middle East and Africa-5%

The prominent players in the medical aesthetics market are AbbVie Inc. (US), Bausch Health Companies Inc. (Canada & Johnson (US), and others.

Research Coverage

This market is segmented by product, application, end-user, and region. The report discusses drivers, restraints, opportunities, and challenges affecting the medical aesthetic market. It provides the prospects of opportunities and challenges for the stakeholders, along with detailing the competitive landscape of leading players. The micro-markets are further segmented focusing on growth trends, prospects, and the contributions of these trends towards the medical aesthetic market. To this, revenue generation through different market segments shall be forecasted and their respective growth focus put together based on five major geographies.

Key Benefits of Buying this Report

This report is to be profited by new and existing players. It will provide deep information about the medical aesthetic market for them to understand any investment opportunities. The present report provides complete information on the key players and minor players. Hence, this supports effective risk analysis along with informed decisions about investment. Due to the accurate segmentation based on end-users and geographies, this report gives niche-level views of the selected market areas.

Through this report, readers get insightful views into the following parameters:

- Analysis of the key growth drivers, restraints, challenges, and opportunities influencing market growth for the medical aesthetic market. The major driving force behind the medical aesthetic market is an increase in the geriatric population. Another reason driving the growth of the market is the increasing need for accurate, and minimally invasive solutions. With customers becoming highly attuned to non-invasive alternatives, demand for modern and efficient aesthetic solutions, including multifunctional lasers and skin rejuvenation technologies, has seen a significant increase.

- Product Development/Innovation: Advanced technologies, R&D activities, and product launches in the medical aesthetics market.

- Market Development: This report will further present the regional expansion of the medical aesthetics market, focusing on the various emerging market opportunities worldwide.

- Market Diversification: The market is increasingly diversifying due to the development of innovative products, previously untapped markets, and new trends; in addition, because of significant investments in the medical aesthetics industry, contribute to its growth as well as the constant change.

- Competitive Analysis: Exhaustive study of market share, and service offering leading strategies of major players such as AbbVie Inc (US), Alma Lasers (Israel), Cynosure (US), and GALDERMA (Switzerland), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Indicative list of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 VENDOR REVENUE-BASED MARKET ESTIMATION

- 2.2.2 END-USER-BASED MARKET SIZE ESTIMATION

- 2.3 MARKET FORECASTING MODEL

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL AESTHETICS MARKET OVERVIEW

- 4.2 MEDICAL AESTHETICS MARKET, BY PRODUCT

- 4.3 ASIA PACIFIC: MEDICAL AESTHETICS MARKET, BY END USER, 2023 (USD MILLION)

- 4.4 REGIONAL SNAPSHOT OF MEDICAL AESTHETICS MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of minimally invasive and non-invasive aesthetic procedures

- 5.2.1.2 Growing demand for aesthetic treatments among elderly and men

- 5.2.1.3 Rising influence of social media

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risk of infection and safety concerns

- 5.2.2.2 Complex regulatory framework and compliance standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Significant opportunities in emerging economies

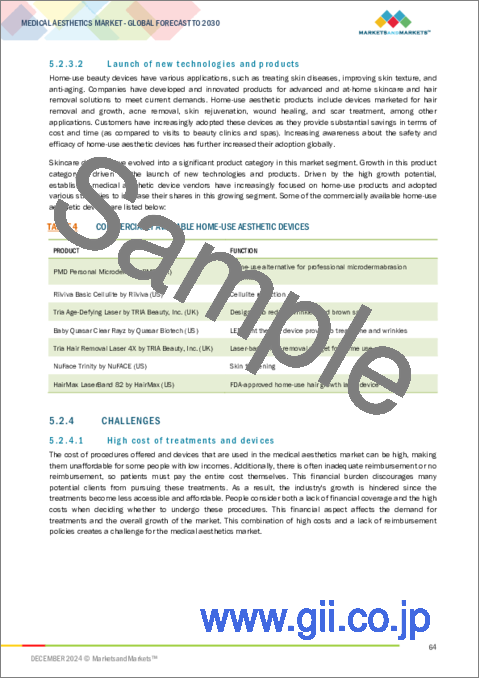

- 5.2.3.2 Launch of new technologies and products

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of treatments and devices

- 5.2.4.2 Social and cultural barriers

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY PRODUCT (ENERGY-BASED DEVICES), 2023

- 5.4.2 AVERAGE SELLING PRICE OF INJECTABLES, BY TYPE, 2021-2023

- 5.4.3 AVERAGE SELLING PRICE OF ENERGY-BASED DEVICES, BY KEY PLAYER, 2023

- 5.4.4 AVERAGE SELLING PRICE TREND OF ENERGY-BASED DEVICES, BY REGION, 2021-2023

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 R&D

- 5.5.2 RAW MATERIAL PROCUREMENT & PRODUCT DEVELOPMENT

- 5.5.3 MARKETING, SALES, AND DISTRIBUTION

- 5.5.4 AFTERMARKET SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Laser and light-based technologies

- 5.9.1.2 Radiofrequency technology

- 5.9.1.3 Ultrasound technology

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 AI-powered skin analysis systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Regenerative medicine and stem cell therapy

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA

- 5.11.1.1 Import scenario for HS code 854370

- 5.11.1.2 Import scenario for HS code 901320

- 5.11.2 EXPORT DATA

- 5.11.2.1 Export scenario for HS code 854370

- 5.11.2.2 Export scenario for HS code 901320

- 5.11.1 IMPORT DATA

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 COMMERCIAL PARTNERSHIPS FOR MEDICAL AESTHETIC PRODUCT SALES

- 5.13.2 DIVISION OF BUSINESS TO MEET CUSTOMER DEMANDS

- 5.13.3 COLLABORATIONS WITH SMES FOR STREAMLINING LASER-BASED DEVICES

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 KEY REGULATORY GUIDELINES

- 5.14.2.1 North America

- 5.14.2.1.1 US

- 5.14.2.1.2 Canada

- 5.14.2.2 Europe

- 5.14.2.2.1 UK

- 5.14.2.2.2 France

- 5.14.2.2.3 Germany

- 5.14.2.3 Asia Pacific

- 5.14.2.3.1 China

- 5.14.2.3.2 Japan

- 5.14.2.3.3 India

- 5.14.2.4 Latin America

- 5.14.2.4.1 Brazil

- 5.14.2.5 Middle East & Africa

- 5.14.2.5.1 UAE

- 5.14.2.1 North America

- 5.14.3 REGULATORY APPROVALS

- 5.15 PORTER'S FIVE FORCE ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 UNMET NEEDS

- 5.18 IMPACT OF AI/GEN AI ON MEDICAL AESTHETICS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN MEDICAL AESTHETIC APPLICATIONS

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.18.5 FUTURE OF AI/GEN AI IN MEDICAL AESTHETICS ECOSYSTEM

6 MEDICAL AESTHETICS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 FACIAL AESTHETIC PRODUCTS

- 6.2.1 BOTULINUM TOXIN

- 6.2.1.1 Growing willingness for Botox process to boost market

- 6.2.2 DERMAL FILLERS

- 6.2.2.1 Natural dermal fillers

- 6.2.2.1.1 Rising use of dermal fillers in facial contouring to support growth

- 6.2.2.2 Synthetic dermal fillers

- 6.2.2.2.1 Need for quick aesthetic enhancements to accelerate growth

- 6.2.2.1 Natural dermal fillers

- 6.2.3 CHEMICAL PEELS

- 6.2.3.1 Increasing availability of wide range of chemical peels to expedite growth

- 6.2.4 MICRODERMABRASION

- 6.2.4.1 Growing use of low-risk and cost-effective resurfacing methods to fuel market

- 6.2.1 BOTULINUM TOXIN

- 6.3 BODY CONTOURING DEVICES

- 6.3.1 NON-SURGICAL FAT REDUCTION DEVICES

- 6.3.1.1 Rise in obesity cases to sustain growth

- 6.3.2 CELLULITE REDUCTION DEVICES

- 6.3.2.1 Increasing focus on appearances to fuel market

- 6.3.3 LIPOSUCTION DEVICES

- 6.3.3.1 Growing awareness about obesity-related health risks to propel market

- 6.3.1 NON-SURGICAL FAT REDUCTION DEVICES

- 6.4 COSMETIC IMPLANTS

- 6.4.1 BREAST IMPLANTS

- 6.4.1.1 Silicone breast implants

- 6.4.1.1.1 Increasing number of promotional efforts and new products by leading companies to aid growth

- 6.4.1.2 Saline breast implants

- 6.4.1.2.1 Reduced cost of breast implants to support growth

- 6.4.1.1 Silicone breast implants

- 6.4.2 FACIAL IMPLANTS

- 6.4.2.1 Growing awareness about benefits of facial implants over other contouring products to drive market

- 6.4.3 OTHER IMPLANTS

- 6.4.1 BREAST IMPLANTS

- 6.5 PHYSICIAN-DISPENSED COSMECEUTICALS AND SKIN LIGHTENERS

- 6.5.1 ONGOING SHIFT TOWARD DEVELOPING SAFER SKIN-LIGHTENING PRODUCTS TO FAVOR GROWTH

- 6.6 SKIN AESTHETIC DEVICES

- 6.6.1 LASER SKIN RESURFACING DEVICES

- 6.6.1.1 Booming geriatric population to support growth

- 6.6.2 NON-SURGICAL SKIN TIGHTENING DEVICES

- 6.6.2.1 Rising popularity of non-invasive methods to speed up growth

- 6.6.3 MICRONEEDLING PRODUCTS

- 6.6.3.1 Reduced discomfort and enhanced skin rejuvenation to augment growth

- 6.6.4 LIGHT THERAPY DEVICES

- 6.6.4.1 Growing use of light therapy for pain management and sleep regulation to boost market

- 6.6.1 LASER SKIN RESURFACING DEVICES

- 6.7 PHYSICIAN-DISPENSED EYELASH PRODUCTS

- 6.7.1 EXPANDING MIDDLE CLASS POPULATION TO ENCOURAGE GROWTH

- 6.8 HAIR REMOVAL DEVICES

- 6.8.1 LASER HAIR REMOVAL DEVICES

- 6.8.1.1 Increasing availability of user-friendly home-use laser devices to spur growth

- 6.8.2 IPL HAIR REMOVAL DEVICES

- 6.8.2.1 Growing interest in cosmetic treatments to fuel market

- 6.8.1 LASER HAIR REMOVAL DEVICES

- 6.9 TATTOO REMOVAL DEVICES

- 6.9.1 NEED FOR MINIMIZED SKIN DAMAGE TO FAVOR GROWTH

- 6.10 THREAD LIFT PRODUCTS

- 6.10.1 RISING PREFERENCE FOR MINIMAL RECOVERY TIME AND QUICK RESULTS TO STIMULATE GROWTH

- 6.11 NAIL TREATMENT LASER DEVICES

- 6.11.1 INCREASING DEMAND FOR QUICK AND PAINLESS PROCEDURE TO PROMOTE GROWTH

- 6.12 HOME CARE DEVICES

- 6.12.1 GROWING DEMAND FOR AFFORDABLE AND CONVENIENT HOME-BASED TREATMENTS TO DRIVE MARKET

7 MEDICAL AESTHETICS MARKET, BY TYPE OF DEVICE

- 7.1 INTRODUCTION

- 7.2 STANDALONE DEVICES

- 7.2.1 INCREASING INNOVATIONS IN ENERGY-BASED TECHNOLOGIES TO DRIVE MARKET

- 7.3 MULTIMODAL DEVICES

- 7.3.1 GROWING AVAILABILITY OF PERSONALIZED CARE AND TAILORED TREATMENT TO PROPEL MARKET

- 7.4 AT-HOME/SELF-USE DEVICES

- 7.4.1 RISING FOCUS ON ENHANCED SKIN HEALTH TO FACILITATE GROWTH

8 MEDICAL AESTHETICS MARKET, BY PROCEDURE

- 8.1 INTRODUCTION

- 8.2 NON-SURGICAL PROCEDURES

- 8.2.1 ANTI-AGING AND SKIN REJUVENATION

- 8.2.1.1 Rising preference for maintaining youthful appearance to promote growth

- 8.2.2 TATTOO REMOVAL

- 8.2.2.1 Increased accessibility to tattoo removal processes to facilitate growth

- 8.2.3 HAIR REMOVAL

- 8.2.3.1 Growing adherence to conventional beauty standards to drive market

- 8.2.4 LIPOSUCTION

- 8.2.4.1 Increased dominance of sedentary lifestyles to encourage growth

- 8.2.5 OTHER NON-SURGICAL PROCEDURES

- 8.2.1 ANTI-AGING AND SKIN REJUVENATION

- 8.3 SURGICAL PROCEDURES

- 8.3.1 BREAST IMPLANTS

- 8.3.1.1 Changing aesthetic preferences to drive market

- 8.3.2 FACELIFT & BODY LIFT PROCEDURES

- 8.3.2.1 Increasing need to reduce visible signs of aging to expedite growth

- 8.3.3 OTHER SURGICAL PROCEDURES

- 8.3.1 BREAST IMPLANTS

9 MEDICAL AESTHETICS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 CLINICS, HOSPITALS, AND MEDICAL SPAS

- 9.2.1 RISING TREND OF MEDICAL TOURISM AND PLASTIC SURGERY TO ENCOURAGE GROWTH

- 9.3 BEAUTY CENTERS

- 9.3.1 GROWING INCLINATION TOWARD CUSTOMIZED TREATMENT TO BOOST MARKET

- 9.4 HOME CARE SETTINGS

- 9.4.1 INCREASING FOCUS ON CONVENIENCE, TREATMENT FLEXIBILITY, AND COST SAVING TO SPUR GROWTH

10 MEDICAL AESTHETICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Growing adoption of advanced treatment procedures to drive market

- 10.2.3 CANADA

- 10.2.3.1 Increasing preference among aging individuals for physical rejuvenation to aid growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Rising social acceptance of medical aesthetic procedures to stimulate growth

- 10.3.3 UK

- 10.3.3.1 Booming cosmetics and beauty industry to accelerate growth

- 10.3.4 FRANCE

- 10.3.4.1 Growing social acceptance of medical aesthetic treatments to fuel market

- 10.3.5 ITALY

- 10.3.5.1 Growing adoption of surgical procedures among young females to boost market

- 10.3.6 SPAIN

- 10.3.6.1 Increasing availability of safe and minimally invasive treatments to augment growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Rising awareness for body contouring treatments to sustain growth

- 10.4.3 CHINA

- 10.4.3.1 Increased availability of cosmetic surgery apps and online services to aid growth

- 10.4.4 INDIA

- 10.4.4.1 Increasing disposable incomes to contribute to market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Favorable government initiatives to promote growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Booming medical tourism to speed up growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Expanding target population base to expedite growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing inflow of medical tourists to favor growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Favorable government policies to propel market.

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL AESTHETICS MARKET

- 11.3 REVENUE ANALYSIS, 2020-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.4.1 ENERGY-BASED AESTHETIC DEVICES MARKET

- 11.4.2 FACIAL AESTHETIC PRODUCTS MARKET

- 11.4.3 COSMETIC IMPLANTS MARKET

- 11.5 RANKING OF KEY MARKET PLAYERS

- 11.6 COMPANY EVALUATION MATRIX, 2023

- 11.6.1 ENERGY-BASED AESTHETIC DEVICES MARKET

- 11.6.1.1 Stars

- 11.6.1.2 Emerging leaders

- 11.6.1.3 Pervasive players

- 11.6.1.4 Participants

- 11.6.2 FACIAL AESTHETIC PRODUCTS MARKET

- 11.6.2.1 Stars

- 11.6.2.2 Emerging leaders

- 11.6.2.3 Pervasive players

- 11.6.2.4 Participants

- 11.6.3 COSMETIC IMPLANTS MARKET

- 11.6.3.1 Stars

- 11.6.3.2 Emerging leaders

- 11.6.3.3 Pervasive players

- 11.6.3.4 Participants

- 11.6.4 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.6.4.1 Company footprint

- 11.6.4.2 Region footprint

- 11.6.4.3 Product footprint

- 11.6.4.4 Type of device footprint

- 11.6.4.5 Procedure footprint

- 11.6.4.6 End-user footprint

- 11.6.5 COMPANY BENCHMARKING: STARTUPS/SMES, 2023

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of startups/SMEs

- 11.6.1 ENERGY-BASED AESTHETIC DEVICES MARKET

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ABBVIE INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and approvals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 GALDERMA

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 JOHNSON & JOHNSON SERVICES, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches and approvals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 BAUSCH HEALTH COMPANIES INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 CYNOSURE LUTRONIC

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 CUTERA, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and approvals

- 12.1.6.3.2 Deals

- 12.1.7 MERZ PHARMA

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.8 LUMENIS BE LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and approvals

- 12.1.8.3.2 Deals

- 12.1.9 FOTONA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and approvals

- 12.1.9.3.2 Expansions

- 12.1.10 AEROLASE CORP.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.11 SCITON

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches and approvals

- 12.1.12 BOHUS BIOTECH AB

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions offered

- 12.1.13 RECOSMO

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions offered

- 12.1.14 SHARPLIGHT TECHNOLOGIES INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches and approvals

- 12.1.15 CANDELA CORPORATION

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches and approvals

- 12.1.15.3.2 Deals

- 12.1.16 ALMA LASERS

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches and approvals

- 12.1.16.3.2 Deals

- 12.1.17 EL.EN. S.P.A.

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches and approvals

- 12.1.18 INMODE LTD.

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product launches and approvals

- 12.1.19 VENUS CONCEPT

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Product launches and approvals

- 12.1.20 GC AESTHETICS

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches and approvals

- 12.1.20.3.2 Deals

- 12.1.1 ABBVIE INC.

- 12.2 OTHER COMPANIES

- 12.2.1 EVOLUS, INC.

- 12.2.2 ASCLEPION LASER TECHNOLOGIES

- 12.2.3 ASTANZA LASER

- 12.2.4 APYX MEDICAL

- 12.2.5 HUADONG MEDICINE CO., LTD.

- 12.2.6 MEDYTOX INC.

- 12.2.7 POLYTECH HEALTH & AESTHETICS GMBH

- 12.2.8 REVANCE AESTHETICS

- 12.2.9 PHOTOMEDEX

- 12.2.10 2L BIO CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS