|

|

市場調査レポート

商品コード

1158141

農業用微生物の世界市場:種類別・機能別 (土壌改良、作物保護)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・適用方法別・剤形別・地域別の将来予測 (2027年まで)Agricultural Microbials Market by Type, Function (Soil Amendment and Crop Protection), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Mode of Application, Formulation, and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 農業用微生物の世界市場:種類別・機能別 (土壌改良、作物保護)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・適用方法別・剤形別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月16日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の農業用微生物の市場規模は、2022年に64億米ドル、2027年には126億米ドルに達する見通しで、予測期間中に14.6%のCAGRで成長すると予測されています。

農業用微生物市場は、持続可能な農業の実践に対する需要増大や、有利な政府規制、高価値作物の需要増加、大手企業による投資拡大といった要因から、指数関数的に成長すると予測されます。微生物にはいくつかの適用方法がありますが、その中でも葉面散布は世界中で最も広く受け入れられている適用方法です。しかし、精密なターゲティングや種子処理に関連した活用状の利点により、最近、世界中で微生物の重要性が拡大しています。

生物農薬の使用は、持続可能な環境で栽培された果物や野菜の購入に対する消費者の信頼を高めています。果物や野菜の栽培において化学農薬の使用を最小限に抑えるよう農家に求める圧力が高まっていることが、需要の増加につながり、生物学的代替物の探求を後押ししています。

"北米地域は、予測期間中に15.0%のCAGRで成長する"

2021年には、北米が最大の市場シェアを占め、欧州とアジア太平洋がそれに続きました。北米の農業用微生物市場は、需要増加の影響により、予測期間中に15.0%のCAGRで成長しています。

"2021年、細菌分野が市場の71.9%と最大シェアを占め、2027年までに14.3%のCAGRで成長する"

農業における最近 (バクテリア) の利用は、バイオ肥料やバイオ農薬の観点から、より高く健康的な収量を持続的に提供するため、増加しています。農業における細菌株の応用は、農薬メーカーの参入や製品の上市数の増加に伴い、増加すると予想されます。

"土壌改良材セグメントは、予測期間中にCAGR12.0%で成長する"

土壌改良剤は、土壌の構造的および生化学的機能を向上させるために使用される製品です。現在、世界中の農地では、厳しい気候条件、侵食、劣化、毒性の増加、水の流出、採掘活動、毒物の沈殿と飽和など、多くの要因が土壌状態の発達を脅かしています。このような状況の中で、傷ついた土壌を癒すために、有機的に管理された土壌の投入量が増加しています。そのため、政府は有機物や生物製剤を、収穫前や収穫後の農場の土壌管理に利用することに力を入れています。

当レポートでは、世界の農業用微生物の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、機能別・剤形別・適用方法別・種類別・作物の種類別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 園芸作物の増産

- 農業用生物製剤の使用の増加

- 先進国市場における有害な化学農薬の採用への抵抗

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- イントロダクション

- 規制機関、政府機関、その他の組織

- 規制の枠組み

- 北米

- 欧州

- アジア太平洋

- 特許分析

- バリューチェーン分析

- 農業用微生物市場のバイヤーに影響を与える動向/混乱

- 市場エコシステム

- 貿易分析

- 価格分析

- 技術分析

- ペプチドベースの植物エキス生物農薬

- 液体バイオ肥料の技術進歩

- ケーススタディ分析

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

- ポーターのファイブフォース分析

第7章 農業用微生物市場:機能別

- イントロダクション

- 土壌改良

- バイオ肥料

- バイオスティミュラント

- 作物保護

- バイオ殺虫剤

- バイオ殺菌剤

- バイオ除草剤

- バイオ殺虫剤

- その他の作物保護機能

第8章 農業用微生物市場:剤形別

- イントロダクション

- 液体

- 懸濁液濃縮物 (SC)

- 乳化性濃縮物

- フロアブル液体

- 乾燥

- 水和剤

- 水分散性顆粒

第9章 農業用微生物市場:適用方法別

- イントロダクション

- 葉面散布

- 土壌処理

- 種子処理

- その他の適用方法

第10章 農業用微生物市場:種類別

- イントロダクション

- 細菌 (バクテリア)

- バシラス属

- リゾビウム属

- その他の細菌

- 菌類

- トリコデル属

- 菌根菌

- その他の菌類

- ウイルス

- 原生動物

第11章 農業用微生物市場:作物の種類別

- イントロダクション

- 穀物

- トウモロコシ

- コムギ

- コメ

- その他の穀物

- 油糧種子・豆類

- ダイズ

- ヒマワリ

- その他の油糧種子・豆類

- 果物・野菜

- 根菜類

- 葉物野菜

- 仁果類

- ベリー

- 柑橘類

- その他の果物・野菜

- その他の種類の作物

第12章 農業用微生物市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- フランス

- ドイツ

- イタリア

- 英国

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 他のアジア太平洋諸国

- 南米

- アルゼンチン

- ブラジル

- 他の南米諸国

- 他の国々 (RoW)

- アフリカ

- 中東

第13章 競合情勢

- 概要

- 市場シェア分析

- 主要企業が採用した戦略

- 主要企業の収益分析

- 主要企業の評価クアドラント

- 企業のフットプリント分析

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売

- 資本取引

- その他の動向

第14章 企業プロファイル

- 主要企業

- BASF SE

- BAYER CROPSCIENCE

- FMC CORPORATION

- SYNGENTA AG

- UPL

- CORTEVA AGRISCIENCE

- NOVOZYMES A/S

- MARRONE BIO INNOVATIONS, INC.

- CHR. HANSEN HOLDING A/S

- ISAGRO S.P.A.

- VALENT BIOSCIENCES LLC

- CERTIS BIOLOGICALS

- BIOWORKS, INC.

- KOPPERT BIOLOGICAL SYSTEMS

- スタートアップ/中小企業/その他の企業

- LALLEMAND INC.

- AGRILIFE BIOSOLUTIONS LTD.

- WILBUR-ELLIS HOLDINGS, INC.

- PIVOT BIO

- VEGALAB SA

- IPL BIOLOGICALS LTD.

- VERDESIAN LIFE SCIENCES

- BIOTALYS

- BIOLOGIC INSECTICIDE, INC.

- PROVIVI

- FYTOFEND S.A.

第15章 隣接・関連市場

- イントロダクション

- 生物農薬市場

- 農業用生物製剤市場

- バイオ肥料市場

第16章 付録

The global agricultural microbials market is estimated to be valued at USD 6.4 billion in 2022. It is projected to reach USD 12.6 billion by 2027, recording a CAGR of 14.6% during the forecast period. The agricultural microbials market is projected to grow at an exponential rate due to factors such as the rise in demand for sustainable agricultural practices, favorable government regulations, an increase in demand for high-value crops, and a rise in the number of investments from key players in this market. Crop protection is the chief function that is targeted by larger companies in the agricultural microbials market. Microbials can be applied in several ways, of which foliar spray is the most widely accepted application mode across the globe. However, precision targeting and application advantages associated with seed treatment have been gaining importance in recent times for microbials across the globe. Controlled release are research institutions and key players exploring another technology to enhance integrated pest management and the sustainability of their products.

The use of biopesticides has increased consumer confidence in purchasing fruits & vegetables cultivated in a sustainable environment. The increasing pressure on farmers for the minimal use of chemical pesticides in the cultivation of fruits & vegetables has led to increased demand and encouraged the exploration of biological alternatives. Organizations such as the WHO and governments of different countries are focusing on decreasing levels of malnutrition, increasing sustainable farming practices, and attaining self-sufficiency in terms of food. This will drive the growth of the agricultural microbials market.

"The North America region is estimated to record a CAGR of 15.0% during the forecast period."

In 2021, North America accounted for the largest market share, followed by Europe and the Asia Pacific, owing to the reduced dependence on chemical pesticides for crop protection in countries such as the US, Canada, Germany, and France. The agricultural microbials market in North America is growing at a CAGR of 15.0% during the forecast period, due to the rising demand in large economies, such as US, Canada, and Mexico countries. These are some of the regions that are experiencing high growth in organic farming, farm conversions from conventional to organic, and the development of newer biological solutions through research. The increasing growth of high-value crops and rising awareness among farmers about the environmental benefits of microbial solutions are expected to provide more scope for market expansion. Moreover, the ongoing R&D activities on newer microbial strains also render a scope for market growth. Government policies adopted by Asia Pacific countries toward sustainable agricultural practices and the support provided for the consumption of microbial products are the major factors driving the growth of this market.

Key players in the agricultural microbials market are BASF SE (Germany), Bayer CropScience (Germany), Sumitomo Chemicals Company Ltd. (Japan), Monsanto Company (US), Corteva (US), Syngenta AG (Switzerland), Certis USA LLC (US), Chr. Hansen Holding A/S (Denmark), Isagro S.p.A. (Italy), UPL Ltd. (India), and Novozymes A/S (Denmark).

The industrial organization and technology of agricultural microbial manufacturing industry are changing rapidly in North America. The US is the fastest-growing agricultural microbials country in North America due to an increase in cultivation. One of the major players of agricultural microbials in North America is FMC Corporation (US). Use of biological products in agriculture is becoming more popular in the region as they increase yield and enhance the quality of crops while lowering the need for chemical fertilizers, pesticides, and herbicides. The climatic variations in some parts of the US, such as California and other western states, have led to the increased use of biologicals by farmers.

"In 2021, the bacteria segment accounted for the largest share of 71.9% of the agricultural microbials market and is projected to grow at a CAGR of 14.3% by 2027."

The application of bacteria in agriculture has increased, in terms of biofertilizers and biopesticides, as these sustainably provide higher and healthy yields. Bacterial strains are easily available in the surrounding environment and can be isolated and reproduced. The application of bacterial strains in agriculture is expected to increase with the entry of agrochemical players and a rise in the number of product launches.

Bacillus species are the most dominant in the agricultural solutions market. Their ability to secrete large quantities (20-25 g/L) of extracellular enzymes has placed them among the most important industrial enzyme producers. New varieties of biological agricultural products are being developed at the desired temperature, pH activity, and stability properties, as this type of bacteria can ferment in the acid, neutral and alkaline pH ranges, and in the presence of thermophiles.

The strain of this bacterium is useful for inhibiting the growth of fungi, Fusarium oxysporum (25-34%). Also, they can cause root elongation for better uptake of nutrients and oxidize sulfate and solubilize phosphate in the soil. The most used microbial pesticides are strains and subspecies of Bacillus spp., such as Bacillus thuringiensis (Bt) and Bacillus subtilis. The control of fungal diseases and pests using pesticides with Bacillus as an active ingredient is an opportunity for furthering the development of the agricultural microbials market.

"The soil amendment segment is projected to grow at a CAGR of 12.0% during the forecast period. The development of effective strains of microorganisms, which efficiently cater to the nutrient deficiencies of the soil and improve crop health, are witnessing increased usage as compared to biostimulants in the market."

Soil amendments are products that are used to improve the structural and biochemical functions of the soil. Presently, a lot of factors are threatening the development of soil conditions in farmlands all over the world, which witness harsh climatic conditions, erosion, degradation, increased toxicity, water runoffs, mining activities, and toxin precipitation and saturation. 25% of the soils in farmlands around the world have already been declared severely deteriorated. Countries are focusing on producing enough food products to at least be able to feed their own populations. For this, they need to increase agricultural output. In this situation, organically managed soils are increasingly imported to heal the damaged soils. Thus, governments are focusing on using organics and biologicals for soil management in farms pre- and post-harvest.

The development of effective strains of microorganisms, such as Bacillus spp. and Rhizobium, which efficiently cater to the nutrient deficiencies of the soil and improve crop health, are witnessing increased usage as compared to biostimulants in the market. Farmers are under pressure to increase the outputs in a sustainable manner, and thus, they are looking for more direct alternatives, which are offered by biofertilizers. They also help in increasing the nutrition in food products and attain the goal of eradicating malnutrition, which is an important issue all over the globe.

Break-up of Primaries:

By Value Chain: Demand side - 41%, Supply side - 59%

By Designation: Managers - 24%, CXOs - 31%, and Executives- 45.0%

By Region: Europe - 29%, Asia Pacific - 32%, North America - 24%, RoW - 15%

Leading players profiled in this report:

- BASF SE (Germany)

- Bayer CropScience (Germany)

- FMC Corporation (US)

- Syngenta AG (Switzerland)

- UPL Ltd. (India)

- Corteva Agriscience (US)

- Novozymes A/S (Denmark)

- Marrone Bio Innovations (US)

- Chr. Hansen Holding A/S (Denmark)

- Isagro S.p.A. (Italy)

- Valent BioSciences (US)

- Certis Biologicals (US)

- BioWorks, Inc. (US)

- Koppert Biological Systems (Netherlands)

- Lallemand Inc. (Canada)

- AgriLife Biosolutions Ltd. (India)

- Wilbur-Ellis Holdings, Inc. (US)

- Pivot Bio (US)

- Vegalab S.A. (US)

- IPL Biologicals (India)

- Verdesian Lifesciences (US)

- Biotalys (Belgium)

- BioLogic Insecticide, Inc. (US)

- Provivi (US)

- Fytofend S.A. (Belgium)

Research Coverage:

The report segments the agriculture microbials market on the basis of type, function, mode of application, formulation, crop type, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the agricultural microbials market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the agricultural microbials market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the agricultural microbials market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AGRICULTURAL MICROBIALS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 AGRICULTURAL MICROBIALS MARKET SIZE ESTIMATION (DEMAND-SIDE)

- FIGURE 5 AGRICULTURAL MICROBIALS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 AGRICULTURAL MICROBIALS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

- FIGURE 7 AGRICULTURAL MICROBIALS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- TABLE 2 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 4 AGRICULTURAL MICROBIALS MARKET SHARE, 2022 VS. 2027

- FIGURE 9 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 REGIONAL SNAPSHOT OF AGRICULTURAL MICROBIALS MARKET

4 PREMIUM INSIGHTS

- 4.1 AGRICULTURAL MICROBIALS MARKET OVERVIEW

- FIGURE 13 RISING DEMAND FOR ORGANIC FOOD PRODUCTS TO DRIVE MARKET

- 4.2 AGRICULTURAL MICROBIALS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 14 EUROPEAN COUNTRIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE AND COUNTRY (2021)

- FIGURE 15 BACTERIA SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.4 AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 FOLIAR SPRAY SEGMENT DOMINATES MARKET

- 4.5 AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 18 DISTRIBUTION OF ORGANIC AGRICULTURAL LAND, BY REGION, 2020 (MILLION HECTARES)

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN PRODUCTION OF HORTICULTURAL CROPS

- FIGURE 19 AREA HARVESTED FOR FRUIT & VEGETABLE PRODUCTION, 2017-2020 (MILLION HECTARES)

- 5.2.2 INCREASING USE OF AGRICULTURAL BIOLOGICALS

- 5.2.3 RELUCTANCE IN ADOPTION OF HARMFUL CHEMICAL PESTICIDES IN DEVELOPED MARKETS

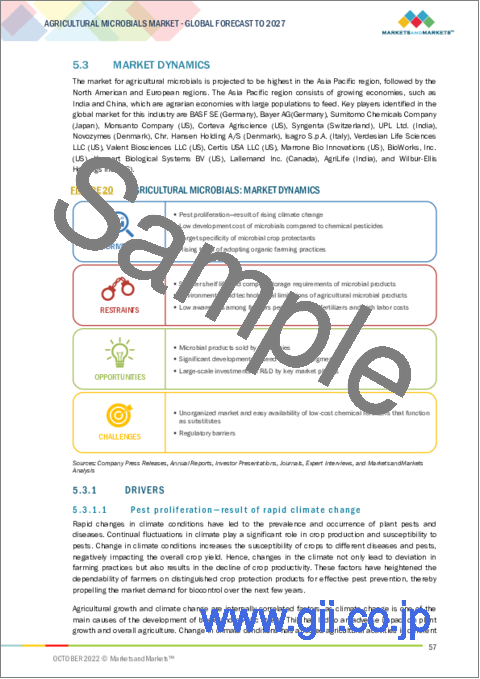

- 5.3 MARKET DYNAMICS

- FIGURE 20 AGRICULTURAL MICROBIALS: MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Pest proliferation-result of rapid climate change

- 5.3.1.2 Low development cost of microbials compared to chemical pesticides

- 5.3.1.3 Target specificity of microbial crop protectants

- 5.3.1.4 Rising trend of adopting organic farming practices

- FIGURE 21 GROWTH OF ORGANIC AGRICULTURAL LAND AND ORGANIC SHARE, 2000-2020 (MILLION HECTARES)

- 5.3.2 RESTRAINTS

- 5.3.2.1 Shorter shelf life and complex storage requirements of microbial products

- 5.3.2.2 Environmental and technological limitations of agricultural microbial products

- 5.3.2.3 Low awareness among farmers pertaining to biofertilizers and high labor costs

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Microbial products sold by companies

- 5.3.3.2 Significant developments in seed treatment segment

- 5.3.3.3 Large-scale investments in R&D by key market players

- 5.3.4 CHALLENGES

- 5.3.4.1 Unorganized market and easy availability of low-cost chemical fertilizers that function as substitutes

- 5.3.4.2 Regulatory barriers

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3 REGULATORY FRAMEWORK

- 6.3.1 NORTH AMERICA

- 6.3.1.1 US

- 6.3.1.2 Canada

- 6.3.2 EUROPE

- 6.3.3 ASIA PACIFIC

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Australia

- 6.3.1 NORTH AMERICA

- 6.4 PATENT ANALYSIS

- FIGURE 22 NUMBER OF PATENTS APPROVED FOR AGRICULTURAL MICROBIALS IN GLOBAL MARKET, 2011-2021

- FIGURE 23 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR AGRICULTURAL MICROBIALS, 2016-2022

- TABLE 10 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURAL MICROBIALS, 2020-2021

- 6.5 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS OF AGRICULTURAL MICROBIALS MARKET: SOURCING AND PRODUCTION KEY CONTRIBUTORS

- 6.6 TRENDS/DISRUPTIONS IMPACTING BUYERS IN AGRICULTURAL MICROBIALS MARKET

- FIGURE 25 DEMAND FOR MICROBIALS SUCH AS NITROGEN-FIXING MICROBES TO IMPROVE CROP QUALITY-NEW HOT BET IN MARKET

- 6.7 MARKET ECOSYSTEM

- FIGURE 26 AGRICULTURAL MICROBIALS: ECOSYSTEM VIEW

- FIGURE 27 AGRICULTURAL MICROBIALS: MARKET MAP

- 6.8 TRADE ANALYSIS

- TABLE 11 IMPORT VALUE OF BIOFERTILIZERS FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 12 EXPORT VALUE OF BIOFERTILIZERS FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- 6.9 PRICING ANALYSIS

- 6.9.1 INTRODUCTION

- 6.9.2 AVERAGE SELLING PRICE ANALYSIS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD/KG)

- FIGURE 28 PRICING ANALYSIS FOR AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD/KG)

- 6.9.3 AVERAGE SELLING PRICE ANALYSIS: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE ANALYSIS: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD/KG)

- 6.9.4 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FUNCTION, 2021 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FUNCTION, 2021 (USD/KG)

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 PEPTIDE-BASED PLANT EXTRACT BIOPESTICIDES

- 6.10.2 TECHNOLOGICAL ADVANCEMENTS FOR LIQUID BIOFERTILIZERS

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 USE CASE 1: INCREASE IN DEMAND FOR EASY-TO-USE INOCULANTS BY CONSUMERS

- 6.11.2 USE CASE 2: UPL LIMITED ANNOUNCED NEW BUSINESS UNIT, NATURAL PLANT PROTECTION (NPP), TO FOCUS ON BIOLOGICAL SOLUTIONS

- 6.12 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 13 AGRICULTURAL MICROBIALS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

- 6.13.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE MODES OF APPLICATION

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE TYPES OF MODES OF APPLICATION

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 DEGREE OF COMPETITION

- 6.14.2 THREAT OF NEW ENTRANTS

- 6.14.3 THREAT OF SUBSTITUTES

- 6.14.4 BARGAINING POWER OF SUPPLIERS

- 6.14.5 BARGAINING POWER OF BUYERS

- 6.14.6 INTENSITY OF COMPETITIVE RIVALRY

7 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- FIGURE 33 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

- TABLE 17 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 18 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 19 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (KILOTONS)

- TABLE 20 AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (KILOTONS)

- 7.2 SOIL AMENDMENT

- 7.2.1 DEVELOPMENT OF EFFECTIVE STRAINS OF MICROORGANISMS SUCH AS BACILLUS SPP. AND RHIZOBIUM

- TABLE 21 SOIL AMENDMENT: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 22 SOIL AMENDMENT: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 23 SOIL AMENDMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 24 SOIL AMENDMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 25 SOIL AMENDMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (KILOTONS)

- TABLE 26 SOIL AMENDMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 7.2.2 BIOFERTILIZERS

- 7.2.2.1 Rising demand for microbials to propel market growth

- TABLE 27 BIOFERTILIZERS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 28 BIOFERTILIZERS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.3 BIOSTIMULANTS

- 7.2.3.1 Ease of application of biostimulants to drive market growth

- TABLE 29 BIOSTIMULANTS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 BIOSTIMULANTS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 CROP PROTECTION

- 7.3.1 RISING DEMAND FOR ORGANIC PRODUCTS AND GROWING AWARENESS AMONG FARMERS REGARDING SUSTAINABLE FARMING TO DRIVE MARKET

- TABLE 31 CROP PROTECTION: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 32 CROP PROTECTION: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 33 CROP PROTECTION: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 34 CROP PROTECTION: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 35 CROP PROTECTION: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (KILOTONS)

- TABLE 36 CROP PROTECTION: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 7.3.2 BIOINSECTICIDES

- 7.3.2.1 Highly target-specific actions of bioinsecticides-based products to support market growth

- TABLE 37 BIOINSECTICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 BIOINSECTICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.3 BIOFUNGICIDES

- 7.3.3.1 Development of new and innovative products with various benefits to drive market

- TABLE 39 BIOFUNGICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 BIOFUNGICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.4 BIOHERBICIDES

- 7.3.4.1 Market in development phase with limited products in portfolio of major players

- TABLE 41 BIOHERBICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 BIOHERBICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

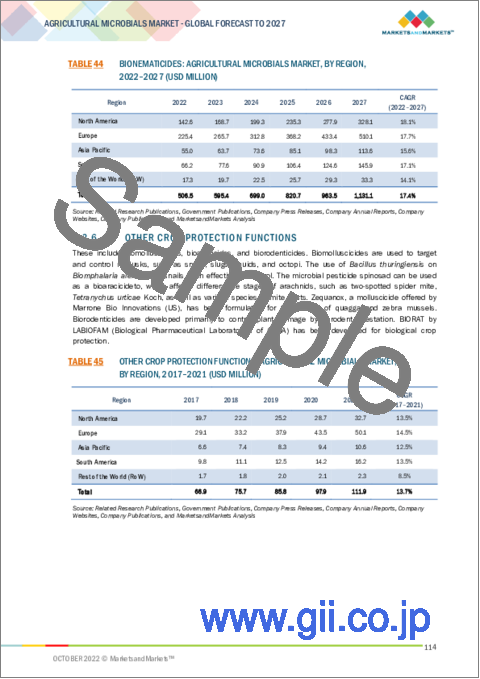

- 7.3.5 BIONEMATICIDES

- 7.3.5.1 Market to witness slow growth due to fewer bionematicidal products available

- TABLE 43 BIONEMATICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 BIONEMATICIDES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.6 OTHER CROP PROTECTION FUNCTIONS

- TABLE 45 OTHER CROP PROTECTION FUNCTIONS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 OTHER CROP PROTECTION FUNCTIONS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION

- 8.1 INTRODUCTION

- FIGURE 34 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022 VS. 2027 (USD MILLION)

- TABLE 47 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 48 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022-2027 (USD MILLION)

- 8.2 LIQUID

- 8.2.1 EASE OF HANDLING AND MASS APPLICABILITY OF LIQUID-BASED AGRICULTURAL MICROBIALS TO DRIVE OVERALL DEMAND

- TABLE 49 LIQUID: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 LIQUID: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 51 AGRICULTURAL MICROBIALS MARKET, BY LIQUID FORMULATION, 2017-2021 (USD MILLION)

- TABLE 52 AGRICULTURAL MICROBIALS MARKET, BY LIQUID FORMULATION, 2022-2027 (USD MILLION)

- 8.2.2 SUSPENSION CONCENTRATES (SC)

- 8.2.2.1 Provide stable suspension when mixed with water

- 8.2.3 EMULSIFIABLE CONCENTRATES

- 8.2.3.1 Most common formulation type for crop protection

- 8.2.4 FLOWABLE LIQUID

- 8.2.4.1 Minimum damage to plant foliage

- 8.3 DRY

- 8.3.1 DRY MICROBIALS LEAST AFFECTED BY SIGNIFICANT INCREASE IN WATER AVAILABILITY

- TABLE 53 DRY: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 54 DRY: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 55 AGRICULTURAL MICROBIALS MARKET, BY DRY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 56 AGRICULTURAL MICROBIALS MARKET, BY DRY FORMULATION, 2022-2027 (USD MILLION)

- 8.3.2 WETTABLE POWDER

- 8.3.2.1 Non-phytotoxicity and prolonged residual activity of wettable powder to drive market

- 8.3.3 WATER-DISPERSIBLE GRANULES

- 8.3.3.1 Low survival rate of microbes-major drawback associated with this formulation

9 AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION

- 9.1 INTRODUCTION

- FIGURE 35 AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 57 AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2017-2021 (USD MILLION)

- TABLE 58 AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- 9.2 FOLIAR SPRAY

- 9.2.1 RISING DEMAND FOR HORTICULTURE CROPS TO DRIVE MARKET

- TABLE 59 FOLIAR SPRAY: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 60 FOLIAR SPRAY: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 SOIL TREATMENT

- 9.3.1 INCREASING DEMAND FOR ORGANIC FOOD TO SUPPORT MARKET GROWTH

- TABLE 61 SOIL TREATMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 62 SOIL TREATMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 SEED TREATMENT

- 9.4.1 HIGH DEMAND FOR SEED COATING IN COMMERCIAL AGRICULTURAL OPERATIONS TO DRIVE MARKET

- TABLE 63 SEED TREATMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 64 SEED TREATMENT: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 OTHER MODES OF APPLICATION

- TABLE 65 OTHER MODES OF APPLICATION: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 66 OTHER MODES OF APPLICATION: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 AGRICULTURAL MICROBIALS MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 36 AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 67 AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 68 AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.2 BACTERIA

- 10.2.1 BACILLUS SPP.

- 10.2.1.1 Bacillus spp. useful for inhibiting growth of fungi

- 10.2.2 RHIZOBIUM SPP.

- 10.2.2.1 Rhizobium spp. influences production of metabolites

- 10.2.3 OTHER BACTERIA

- TABLE 69 BACTERIA: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 70 BACTERIA: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.1 BACILLUS SPP.

- 10.3 FUNGI

- 10.3.1 TRICHODERMA SPP.

- 10.3.1.1 Trichoderma-based products used in fields, nurseries, and horticulture

- 10.3.2 MYCORRHIZAL FUNGI

- 10.3.2.1 Helps enhance crop protection against pathogens

- 10.3.3 OTHER FUNGI

- TABLE 71 FUNGI: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 72 FUNGI: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3.1 TRICHODERMA SPP.

- 10.4 VIRUSES

- 10.4.1 VIRUS SPECIES FIND WIDE RANGE OF APPLICATION IN BIOCONTROL OF DISEASES AND PESTS AFFECTING ORNAMENTAL PLANTS

- TABLE 73 VIRUSES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 74 VIRUSES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 PROTOZOA

- 10.5.1 PROTOZOA IMPORTANT IN MINERALIZING NUTRIENTS

- TABLE 75 PROTOZOA: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 76 PROTOZOA: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE

- 11.1 INTRODUCTION

- FIGURE 37 AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 77 AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 78 AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- 11.2 CEREALS & GRAINS

- TABLE 79 CEREALS & GRAINS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 80 CEREALS & GRAINS: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 81 CEREALS & GRAINS: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 82 CEREALS & GRAINS: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.1 CORN

- 11.2.1.1 Rise in global corn consumption to drive market

- 11.2.2 WHEAT

- 11.2.2.1 Increasing infestation by aphids to result in increased use of microbial crop protection products

- 11.2.3 RICE

- 11.2.3.1 High export demand for rice to drive market

- 11.2.4 OTHER CEREALS & GRAINS

- 11.3 OILSEEDS & PULSES

- TABLE 83 OILSEEDS & PULSES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 84 OILSEEDS & PULSES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 85 OILSEEDS & PULSES: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 86 OILSEEDS & PULSES: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.1 SOYBEAN

- 11.3.1.1 Infestation from root-knot nematodes severe in soybean crops

- 11.3.2 SUNFLOWER

- 11.3.2.1 Preference for sunflower oil and confectionery value of sunflower seed to drive demand

- 11.3.3 OTHER OILSEEDS & PULSES

- 11.4 FRUITS & VEGETABLES

- TABLE 87 FRUITS & VEGETABLES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 88 FRUITS & VEGETABLES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 89 FRUITS & VEGETABLES: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 90 FRUITS & VEGETABLES: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.1 ROOT & TUBER VEGETABLES

- 11.4.1.1 Economic losses due to pests, diseases, and nematodes in root & tuber vegetables to support market growth

- 11.4.2 LEAFY VEGETABLES

- 11.4.2.1 Susceptibility of leafy vegetables to pathogens such as Bacillus subtilis, Myrothecium verrucaria, and Streptomyces lydicus to drive market

- 11.4.3 POME FRUITS

- 11.4.3.1 Effectiveness of biocontrol agents on pome fruits to drive market

- 11.4.4 BERRIES

- 11.4.4.1 Rising demand for berries and their susceptibility to pests to drive market

- 11.4.5 CITRUS FRUITS

- 11.4.5.1 Vulnerability of citrus fruits to post-harvest decay to drive market

- 11.4.6 OTHER FRUITS & VEGETABLES

- 11.5 OTHER CROP TYPES

- TABLE 91 OTHER CROP TYPES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 92 OTHER CROP TYPES: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 AGRICULTURAL MICROBIALS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 38 ITALY TO WITNESS HIGHEST GROWTH IN AGRICULTURAL MICROBIALS MARKET DURING FORECAST PERIOD

- TABLE 93 AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 94 AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 95 AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (KILOTONS)

- TABLE 96 AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (KILOTONS)

- 12.2 NORTH AMERICA

- FIGURE 39 CROP-WISE ORGANICALLY CULTIVATED LAND, 2019 (HECTARES)

- FIGURE 40 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET SNAPSHOT

- TABLE 97 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (KILOTONS)

- TABLE 102 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (KILOTONS)

- TABLE 103 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2017-2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022-2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Presence of leading companies and rising demand for organic products to drive market

- TABLE 115 US: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 116 US: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 117 US: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 118 US: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.2 CANADA

- 12.2.2.1 Growing number of organic farms to drive demand for biofertilizers and biopesticides

- TABLE 119 CANADA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 120 CANADA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 121 CANADA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 122 CANADA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.3 MEXICO

- 12.2.3.1 Growth of commercialized farms and supportive governmental policies to drive market

- TABLE 123 MEXICO: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 124 MEXICO: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 125 MEXICO: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 126 MEXICO: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- TABLE 127 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 128 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 129 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 130 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 131 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (KILOTONS)

- TABLE 132 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (KILOTONS)

- TABLE 133 EUROPE: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 134 EUROPE: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 135 EUROPE: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 136 EUROPE: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 137 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 138 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 139 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2017-2021 (USD MILLION)

- TABLE 140 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 141 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 142 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022-2027 (USD MILLION)

- TABLE 143 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 144 EUROPE: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.1 SPAIN

- 12.3.1.1 Market growth driven by increasing agricultural applications of biopesticides and semiochemicals

- TABLE 145 SPAIN: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 146 SPAIN: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 147 SPAIN: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 148 SPAIN: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.2 FRANCE

- 12.3.2.1 Need for sustainable crop production encouraged farmers to opt for organic practices

- TABLE 149 FRANCE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 150 FRANCE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 151 FRANCE: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 152 FRANCE: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.3 GERMANY

- 12.3.3.1 Early adoption of EU agricultural standards and policies to drive agricultural microbials market

- TABLE 153 GERMANY: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 154 GERMANY: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 155 GERMANY: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 156 GERMANY: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.4 ITALY

- 12.3.4.1 Significant use of microbials in horticulture and development of organic farming practices to support market growth

- TABLE 157 ITALY: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 158 ITALY: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 159 ITALY: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 160 ITALY: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.5 UK

- 12.3.5.1 Changing consumer preferences to drive microbial bioinsecticides segment

- TABLE 161 UK: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 162 UK: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 163 UK: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 164 UK: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.3.6 REST OF EUROPE

- TABLE 165 REST OF EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 166 REST OF EUROPE: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 167 REST OF EUROPE: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 168 REST OF EUROPE: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET SNAPSHOT

- TABLE 169 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 173 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (KILOTONS)

- TABLE 174 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (KILOTONS)

- TABLE 175 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 176 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 177 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 178 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 179 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 180 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2017-2021 (USD MILLION)

- TABLE 182 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 183 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 184 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022-2027 (USD MILLION)

- TABLE 185 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 186 ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Efforts to raise sustainable farming practices to support market

- TABLE 187 CHINA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 188 CHINA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 189 CHINA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 190 CHINA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.2 INDIA

- 12.4.2.1 Supportive efforts of government to promote use of biological products

- TABLE 191 INDIA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 192 INDIA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 193 INDIA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 194 INDIA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Rise in food security and quality concerns among population to drive market for microbials in crop cultivation

- TABLE 195 JAPAN: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 196 JAPAN: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 197 JAPAN: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 198 JAPAN: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.4 AUSTRALIA

- 12.4.4.1 Well-established and strong market conditions support growth of agricultural microbials market

- TABLE 199 AUSTRALIA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 200 AUSTRALIA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 201 AUSTRALIA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 202 AUSTRALIA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.4.5 REST OF ASIA PACIFIC

- TABLE 203 REST OF ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5 SOUTH AMERICA

- TABLE 207 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 208 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 209 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 210 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 211 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (KILOTONS)

- TABLE 212 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (KILOTONS)

- TABLE 213 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 214 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 215 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 216 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 217 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 218 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 219 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2017-2021 (USD MILLION)

- TABLE 220 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 221 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 222 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022-2027 (USD MILLION)

- TABLE 223 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 224 SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.1 ARGENTINA

- 12.5.1.1 Efforts for conservation of agriculture and sustainable land management to support market

- TABLE 225 ARGENTINA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 226 ARGENTINA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 227 ARGENTINA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 228 ARGENTINA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Increasing awareness and adoption of organic methods for cultivation to drive market

- TABLE 229 BRAZIL: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 230 BRAZIL: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 231 BRAZIL: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 232 BRAZIL: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.5.3 REST OF SOUTH AMERICA

- TABLE 233 REST OF SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 234 REST OF SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 235 REST OF SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 236 REST OF SOUTH AMERICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6 REST OF THE WORLD

- TABLE 237 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 238 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 239 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 240 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 241 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (KILOTONS)

- TABLE 242 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (KILOTONS)

- TABLE 243 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 244 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET FOR CROP PROTECTION, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 245 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 246 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET FOR SOIL AMENDMENT, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 247 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2017-2021 (USD MILLION)

- TABLE 248 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY CROP TYPE, 2022-2027 (USD MILLION)

- TABLE 249 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2017-2021 (USD MILLION)

- TABLE 250 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY MODE OF APPLICATION, 2022-2027 (USD MILLION)

- TABLE 251 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2017-2021 (USD MILLION)

- TABLE 252 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2022-2027 (USD MILLION)

- TABLE 253 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 254 REST OF THE WORLD: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6.1 AFRICA

- 12.6.1.1 Large number of organic farmers and supportive government policies to widen scope of agricultural microbials industry

- TABLE 255 AFRICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 256 AFRICA: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 257 AFRICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 258 AFRICA: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Focus on increasing agricultural output with sustainable farming practices and organic alternatives

- TABLE 259 MIDDLE EAST: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2017-2021 (USD MILLION)

- TABLE 260 MIDDLE EAST: AGRICULTURAL MICROBIALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- TABLE 261 MIDDLE EAST: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 262 MIDDLE EAST: AGRICULTURAL MICROBIALS MARKET, BY TYPE, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- TABLE 263 AGRICULTURAL MICROBIALS MARKET: DEGREE OF COMPETITION

- 13.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 42 REVENUE ANALYSIS OF KEY PLAYERS IN AGRICULTURAL MICROBIALS MARKET, 2017-2021 (USD BILLION)

- 13.5 KEY PLAYER EVALUATION QUADRANT

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 43 AGRICULTURAL MICROBIALS MARKET: COMPANY EVALUATION QUADRANT (KEY PLAYERS), 2022

- 13.6 COMPANY FOOTPRINT ANALYSIS

- TABLE 264 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 265 CROP TYPE FOOTPRINT OF COMPANIES

- TABLE 266 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 267 OVERALL FOOTPRINT OF COMPANIES

- 13.7 STARTUP/SME EVALUATION QUADRANT

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 STARTING BLOCKS

- 13.7.3 RESPONSIVE COMPANIES

- 13.7.4 DYNAMIC COMPANIES

- FIGURE 44 AGRICULTURAL MICROBIALS MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 268 AGRICULTURAL MICROBIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 269 AGRICULTURAL MICROBIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- TABLE 270 PRODUCT LAUNCHES, 2017-2022

- 13.9.2 DEALS

- TABLE 271 DEALS, 2017-2022

- 13.9.3 OTHER DEVELOPMENTS

- TABLE 272 OTHER DEVELOPMENTS, 2017-2022

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 BASF SE

- TABLE 273 BASF SE: BUSINESS OVERVIEW

- FIGURE 45 BASF SE: COMPANY SNAPSHOT

- TABLE 274 BASF SE: PRODUCTS OFFERED

- TABLE 275 BASF SE: PRODUCT LAUNCHES

- TABLE 276 BASF SE: DEALS

- 14.1.2 BAYER CROPSCIENCE

- TABLE 277 BAYER CROPSCIENCE: BUSINESS OVERVIEW

- FIGURE 46 BAYER CROPSCIENCE: COMPANY SNAPSHOT

- TABLE 278 BAYER CROPSCIENCE: PRODUCTS OFFERED

- TABLE 279 BAYER CROPSCIENCE: PRODUCT LAUNCHES

- TABLE 280 BAYER CROPSCIENCE: DEALS

- 14.1.3 FMC CORPORATION

- TABLE 281 FMC CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 FMC CORPORATION: COMPANY SNAPSHOT

- TABLE 282 FMC CORPORATION: PRODUCTS OFFERED

- TABLE 283 FMC CORPORATION: PRODUCT LAUNCHES

- TABLE 284 FMC CORPORATION: DEALS

- 14.1.4 SYNGENTA AG

- TABLE 285 SYNGENTA AG: BUSINESS OVERVIEW

- FIGURE 48 SYNGENTA AG: COMPANY SNAPSHOT

- TABLE 286 SYNGENTA AG: PRODUCTS OFFERED

- TABLE 287 SYNGENTA AG: PRODUCT LAUNCHES

- TABLE 288 SYNGENTA AG: DEALS

- 14.1.5 UPL

- TABLE 289 UPL: BUSINESS OVERVIEW

- FIGURE 49 UPL: COMPANY SNAPSHOT

- TABLE 290 UPL: PRODUCTS OFFERED

- TABLE 291 UPL: PRODUCT LAUNCHES

- TABLE 292 UPL: DEALS

- 14.1.6 CORTEVA AGRISCIENCE

- TABLE 293 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- FIGURE 50 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- TABLE 294 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 295 CORTEVA AGRISCIENCE: DEALS

- 14.1.7 NOVOZYMES A/S

- TABLE 296 NOVOZYMES A/S: BUSINESS OVERVIEW

- FIGURE 51 NOVOZYMES A/S: COMPANY SNAPSHOT

- TABLE 297 NOVOZYMES A/S: PRODUCTS OFFERED

- TABLE 298 NOVOZYMES A/S: DEALS

- 14.1.8 MARRONE BIO INNOVATIONS, INC.

- TABLE 299 MARRONE BIO INNOVATIONS, INC.: BUSINESS OVERVIEW

- FIGURE 52 MARRONE BIO INNOVATIONS, INC.: COMPANY SNAPSHOT

- TABLE 300 MARRONE BIO INNOVATIONS, INC.: PRODUCTS OFFERED

- TABLE 301 MARRONE BIO INNOVATIONS, INC.: PRODUCT LAUNCHES

- TABLE 302 MARRONE BIO INNOVATIONS, INC.: DEALS

- TABLE 303 MARRONE BIO INNOVATIONS, INC.: OTHER DEVELOPMENTS

- 14.1.9 CHR. HANSEN HOLDING A/S

- TABLE 304 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- TABLE 305 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 306 CHR. HANSEN HOLDING A/S: DEALS

- 14.1.10 ISAGRO S.P.A.

- TABLE 307 ISAGRO S.P.A.: BUSINESS OVERVIEW

- TABLE 308 ISAGRO S.P.A.: PRODUCTS OFFERED

- TABLE 309 ISAGRO S.P.A.: DEALS

- 14.1.11 VALENT BIOSCIENCES LLC

- TABLE 310 VALENT BIOSCIENCES LLC: BUSINESS OVERVIEW

- TABLE 311 VALENT BIOSCIENCES LLC: PRODUCTS OFFERED

- TABLE 312 VALENT BIOSCIENCES LLC: DEALS

- TABLE 313 VALENT BIOSCIENCES LLC: OTHER DEVELOPMENTS

- 14.1.12 CERTIS BIOLOGICALS

- TABLE 314 CERTIS BIOLOGICALS: BUSINESS OVERVIEW

- TABLE 315 CERTIS BIOLOGICALS: PRODUCTS OFFERED

- TABLE 316 CERTIS BIOLOGICALS: PRODUCT LAUNCHES

- TABLE 317 CERTIS BIOLOGICALS: OTHER DEVELOPMENTS

- 14.1.13 BIOWORKS, INC.

- TABLE 318 BIOWORKS, INC.: BUSINESS OVERVIEW

- TABLE 320 BIOWORKS, INC: PRODUCT LAUNCHES

- 14.1.14 KOPPERT BIOLOGICAL SYSTEMS

- TABLE 321 KOPPERT BIOLOGICAL SYSTEMS: BUSINESS OVERVIEW

- TABLE 322 KOPPERT BIOLOGICAL SYSTEMS: PRODUCTS OFFERED

- TABLE 323 KOPPERT BIOLOGICAL SYSTEMS: DEALS

- 14.2 STARTUPS/SMES/OTHER PLAYERS

- 14.2.1 LALLEMAND INC.

- TABLE 324 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 325 LALLEMAND INC.: PRODUCTS OFFERED

- TABLE 326 LALLEMAND INC.: PRODUCT LAUNCHES

- 14.2.2 AGRILIFE BIOSOLUTIONS LTD.

- TABLE 327 AGRILIFE BIOSOLUTIONS LTD.: BUSINESS OVERVIEW

- TABLE 328 AGRILIFE BIOSOLUTIONS LTD.: PRODUCTS OFFERED

- 14.2.3 WILBUR-ELLIS HOLDINGS, INC.

- TABLE 329 WILBUR-ELLIS HOLDINGS, INC.: BUSINESS OVERVIEW

- TABLE 330 WILBUR-ELLIS HOLDINGS, INC.: PRODUCTS OFFERED

- TABLE 331 WILBUR-ELLIS HOLDINGS, INC.: DEALS

- TABLE 332 WILBUR-ELLIS HOLDINGS, INC.: PRODUCT LAUNCHES

- 14.2.4 PIVOT BIO

- TABLE 333 PIVOT BIO: BUSINESS OVERVIEW

- TABLE 334 PIVOT BIO: PRODUCTS OFFERED

- TABLE 335 PIVOT BIO: DEALS

- 14.2.5 VEGALAB SA

- TABLE 336 VEGALAB SA: BUSINESS OVERVIEW

- TABLE 337 VEGALAB SA: PRODUCTS OFFERED

- 14.2.6 IPL BIOLOGICALS LTD.

- TABLE 338 IPL BIOLOGICALS LTD.: BUSINESS OVERVIEW

- TABLE 339 IPL BIOLOGICALS LTD: PRODUCTS OFFERED

- TABLE 340 IPL BIOLOGICALS LTD.: OTHER DEVELOPMENTS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2.7 VERDESIAN LIFE SCIENCES

- 14.2.8 BIOTALYS

- 14.2.9 BIOLOGIC INSECTICIDE, INC.

- 14.2.10 PROVIVI

- 14.2.11 FYTOFEND S.A.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 BIOPESTICIDES MARKET

- 15.2.1 LIMITATIONS

- 15.2.2 MARKET DEFINITION

- 15.2.3 MARKET OVERVIEW

- 15.2.4 BIOPESTICIDES MARKET, BY SOURCE

- TABLE 341 BIOPESTICIDES MARKET, BY SOURCE, 2018-2021 (USD MILLION)

- TABLE 342 BIOPESTICIDES MARKET, BY SOURCE, 2022-2027 (USD MILLION)

- 15.2.5 BIOPESTICIDES MARKET, BY REGION

- TABLE 343 BIOPESTICIDES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 344 BIOPESTICIDES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 15.3 AGRICULTURAL BIOLOGICALS MARKET

- 15.3.1 LIMITATIONS

- 15.3.2 MARKET DEFINITION

- 15.3.3 MARKET OVERVIEW

- 15.3.4 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION

- TABLE 345 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017-2020 (USD MILLION)

- TABLE 346 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2021-2027 (USD MILLION)

- 15.3.5 AGRICULTURAL BIOLOGICALS MARKET, BY REGION

- TABLE 347 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 348 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 15.4 BIOFERTILIZERS MARKET

- 15.4.1 LIMITATIONS

- 15.4.2 MARKET DEFINITION

- 15.4.3 MARKET OVERVIEW

- 15.4.4 BIOFERTILIZERS MARKET, BY TYPE

- TABLE 349 BIOFERTILIZERS MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 350 BIOFERTILIZERS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 15.4.5 BIOFERTILIZERS MARKET, BY REGION

- TABLE 351 BIOFERTILIZERS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 352 BIOFERTILIZERS MARKET, BY REGION, 2021-2026 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS