|

|

市場調査レポート

商品コード

1358284

血液スクリーニングの世界市場:製品別、技術別、エンドユーザー別、地域別 - 予測(~2028年)Blood Screening Market by Product (Reagent & Kits, Instrument, Software), Technology (NAT, (Real-Time PCR), ELISA (Chemiluminescence Immunoassay), Rapid Test, Western Blot), End User (Blood Bank, Hospital), & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 血液スクリーニングの世界市場:製品別、技術別、エンドユーザー別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月02日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の血液スクリーニングの市場規模は、2023年の24億米ドルから2028年までに34億米ドルに達し、予測期間中にCAGRで7.2%の成長が予測されています。

市場の成長は主に、献血への要求の高まり、世界中での献血の増加、増え続ける感染症によって促進されています。しかし、血液スクリーニング機器とキットの高い価格と技術者の不足が、市場の成長を妨げる可能性が高いです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル |

| セグメント | 製品・サービス,技術,エンドユーザー,地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中近東アフリカ |

"予測期間中、製品・サービス別では試薬・キットセグメントが市場でもっとも高い成長率となりました。"

2022年、試薬・キットセグメントが市場でもっとも高い成長率となりました。市場成長の大きな要因は、輸血と献血の増加です。さらに、血液スクリーニング技術の進歩や手術件数の増加が、このセグメントの成長を刺激しています。

"血液銀行セグメントがもっとも高いCAGRを占めました。"

2022年、血液銀行セグメントがもっとも高い成長率を占めました。これは臓器移植手術件数の増加、血液の安全性に関する意識の高まりに起因しています。

"アジア太平洋:もっとも急成長している地域市場"

予測期間にもっともCAGRが高いのはアジア太平洋です。1人当たりの所得の増加、アジア太平洋諸国における地方への私立病院の進出、アジア太平洋諸国における老年人口の増加(および慢性疾患の流行)、地域における高成長市場のプレゼンスなどが、医療支出の増加に寄与しています。また、この地域の良好な規制情勢と低い人件費も市場成長を促進すると予測されます。

当レポートでは、世界の血液スクリーニング市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 血液スクリーニング市場の概要

- 血液スクリーニング市場:製品・サービス別(2023年・2028年)

- 血液スクリーニング市場:技術別(2023年・2028年)

- 血液スクリーニング市場:エンドユーザー別(2023年・2028年)

- 血液スクリーニング市場:地理的な成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- 価格モデルの分析

- 平均販売価格の動向

- 血液スクリーニング製品の平均販売価格:主要企業別

- 特許分析

- 核酸増幅技術の特許分析

- 血液スクリーニング市場:主要特許のリスト

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制情勢

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東

- 貿易分析

- 技術分析

- 主な会議とイベント

- PESTLE分析

- 顧客のビジネスに影響を与える動向/混乱

- 主なステークホルダーと購入基準

- ケーススタディ分析

第6章 血液スクリーニング市場:製品・サービス別

- イントロダクション

- 試薬・キット

- NAT試薬・キット

- ELISA試薬・キット

- その他の試薬・キット

- 器具

- レンタル購入

- 一括購入

- ソフトウェア・サービス

第7章 血液スクリーニング市場:技術別

- イントロダクション

- 核酸増幅検査(NAT)

- 転写媒介増幅(TMA)

- リアルタイムポリメラーゼ連鎖反応(RT-PCR)

- 血清学/イムノアッセイ

- 化学発光イムノアッセイ(CLIA)

- 蛍光イムノアッセイ(FIA)

- 比色イムノアッセイ/ELISA(CI/ELISA)

- 迅速検査

- ウェスタンブロットアッセイ

- 次世代シーケンシング(NGS)

第8章 血液スクリーニング市場:エンドユーザー別

- イントロダクション

- 血液銀行

- 病院

第9章 血液スクリーニング市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州の不況の影響

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカの不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業の戦略

- 収益シェア分析

- 市場シェア分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合ベンチマーキング

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- F. HOFFMANN-LA ROCHE LTD.

- GRIFOLS, S.A.

- ABBOTT LABORATORIES

- BIO-RAD LABORATORIES, INC.

- DIASORIN

- BIOMERIEUX

- BD

- DANAHER (BECKMAN COULTER, INC.)

- HOLOGIC, INC.

- SIEMENS HEALTHINEERS AG

- THERMO FISHER SCIENTIFIC, INC.

- その他の企業

- ORTHO CLINICAL DIAGNOSTICS

- MERCK KGAA

- REVVITY (PART OF PERKINELMER INC.)

- BIO-TECHNE

- GFE

- TRINITY BIOTECH

- J. MITRA & CO. PVT. LTD.

- MINDRAY

- MACCURA BIOTECHNOLOGY CO., LTD.

- IMMUCOR, INC.

- CELLABS

- ABNOVA CORPORATION

- ENZO BIOCHEM, INC.

- TULIP DIAGNOSTICS PVT. LTD.

第12章 付録

The global blood screening market is projected to reach USD 3.4 billion by 2028 from USD 2.4 billion in 2023, at a CAGR of 7.2% during the forecast period. Growth in this market is mainly driven by the growing requirement for donated blood, the rising number of blood donations around the world, and the ever-increasing infectious diseases. However high prices of Blood screening instruments and kits along with scarcity in technicians is likely to hamper the growth of Blood screening market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Product & Service Technology End User Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

"The reagents & kits segment accounted for the highest growth rate in the blood screening market, by product & service, during the forecast period."

The blood screening market is segmented into reagents & kits, instruments, and software & services based on product. In 2022, the reagents & kits segment accounted for the highest growth rate in the blood screening market. Market growth can largely be attributed to rising number of blood transfusions and blood donations. In addition, technological advancements in blood screening technologies and the increasing number of surgeries are stimulating the growth of this segment.

"Blood banks segment accounted for the highest CAGR."

Based on end users, the blood screening market is segmented into blood banks and hospitals. In 2022, the blood banks segment accounted for the highest growth rate. This can be attributed to the growing number of organ transplantation surgeries, and rising awareness about blood safety.

"Asia Pacific: The fastest-growing region blood screening market."

The global blood screening market is divided into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The highest CAGR is anticipated to be recorded over the forecast period in the Asia Pacific region. The rising per capita income, the expansion of private hospitals into rural areas in various APAC countries, the rising geriatric population in several APAC countries (coupled with the rising prevalence of chronic disorders), and the presence of high-growth markets in the region, among other factors, all contribute to rising healthcare spending. The favorable regulatory climate and low labor costs in this region are also anticipated to fuel market growth.

.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level (27%), Director-level (18%), and Others (55%)

- By Region: North America (51%), Europe (21%), Asia- Pacific (18%), Latin America (6%), and Middle East & Africa(4%)

Prominent companies include F. Hoffmann-La Roche Ltd. (Switzerland), Grifols (Spain), Abbott Laboratories, Inc. (US), Bio-Rad Laboratories, Inc. (US), Danaher (Beckman Coulter, Inc.) (US), bioMerieux (France), Hologic (US), Thermo Fisher Scientific, Inc. (US), Becton, Dickinson and Company (US), DiaSorin (Italy), Siemens Healthineers (Germany), QuidelOrtho Corporation (US), Merck KGaA (Germany), Revvity (Earlier known as PerkinElmer Inc.) (US), Bio-Techne Corporation (US), GFE (Germany), Trinity Biotech (Ireland), Mindray (China), Maccura Biotechnology Co., Ltd. (China), Immucor, Inc. (US), Cellabs (Australia), Abnova Corporation (Taiwan), Enzo Biochem, Inc. (US), J. Mitra & Co. Pvt. Ltd. (India) and Tulip Diagnostics (India).

Research Coverage

This research report categorizes the Blood screening market by products & service, technology, end user, and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Blood screening market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the Blood screening market. Competitive analysis of upcoming startups in the Blood screening market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall blood screening market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing number of blood donations, rising infectious diseases and growing technological advancements), restraints (Alternative Technologies), opportunities (Increasing Demand from Emerging Economies in APAC, Increasing collaboration between businesses, industry associations, and government awareness), and challenges (High cost of blood screening products) influencing the growth of the blood screening market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the blood screening market

- Market Development: Comprehensive information about lucrative markets - the report analyses the blood screening market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the blood screening market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like F. Hoffmann-La Roche Ltd. (Switzerland), Grifols (Spain), Abbott Laboratories, Inc. (US), Bio-Rad Laboratories, Inc. (US), Danaher (Beckman Coulter, Inc.) (US), bioMerieux (France), among others in blood screening market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 BLOOD SCREENING MARKET

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- FIGURE 1 BLOOD SCREENING MARKET: RESEARCH DESIGN METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 BLOOD SCREENING MARKET: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 RISK ASSESSMENT

- 2.8.1 RISK ASSESSMENT ANALYSIS

- 2.9 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

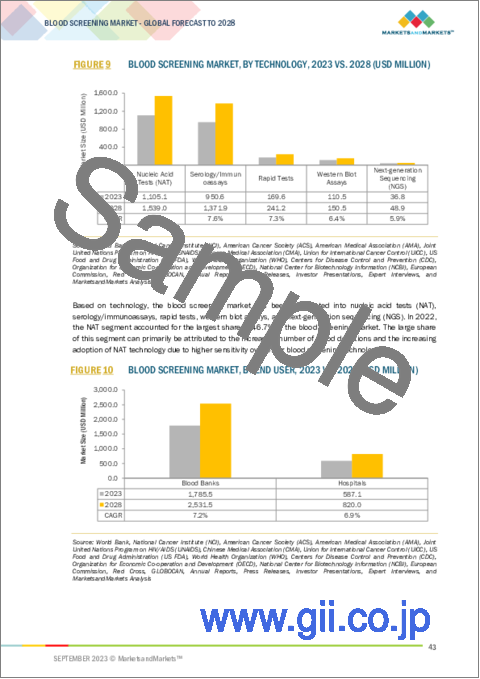

- FIGURE 9 BLOOD SCREENING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BLOOD SCREENING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BLOOD SCREENING MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 BLOOD SCREENING MARKET OVERVIEW

- FIGURE 12 INCREASING NUMBER OF BLOOD DONATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028

- FIGURE 13 REAGENTS & KITS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 BLOOD SCREENING MARKET, BY TECHNOLOGY, 2023 VS. 2028

- FIGURE 14 NUCLEIC ACID TESTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 BLOOD SCREENING MARKET, BY END USER, 2023 VS. 2028

- FIGURE 15 BLOOD BANKS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 BLOOD SCREENING MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- FIGURE 16 ASIA PACIFIC REGION TO REGISTER HIGHEST GROWTH RATE FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 BLOOD SCREENING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing blood donations

- 5.2.1.2 Rising prevalence of infectious diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of blood screening technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising technological advancements

- 5.2.3.2 High growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Usage of low-sensitivity screening tests

- 5.2.4.2 Shortage of skilled laboratory technicians

- 5.3 PRICING ANALYSIS

- 5.3.1 PRICING MODEL ANALYSIS

- TABLE 1 INDICATIVE PRICING ANALYSIS FOR BLOOD SCREENING PRODUCTS

- 5.3.2 AVERAGE SELLING PRICE TREND

- TABLE 2 AVERAGE SELLING PRICE ANALYSIS OF BLOOD SCREENING PRODUCTS

- 5.3.3 AVERAGE SELLING PRICE OF BLOOD SCREENING PRODUCTS, BY KEY PLAYER

- TABLE 3 AVERAGE SELLING PRICE OF BLOOD SCREENING PRODUCTS

- 5.4 PATENT ANALYSIS

- 5.4.1 PATENT ANALYSIS OF NUCLEIC ACID AMPLIFICATION TECHNOLOGIES

- 5.4.2 BLOOD SCREENING MARKET: LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 18 MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASE

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 19 BLOOD SCREENING MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 20 BLOOD SCREENING MARKET: ECOSYSTEM MAP

- 5.7.1 BLOOD SCREENING MARKET: ECOSYSTEM ROLE

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 BLOOD SCREENING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 REGULATORY LANDSCAPE

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 NORTH AMERICA

- 5.9.1.1 US

- 5.9.1.2 Canada

- 5.9.2 EUROPE

- TABLE 9 EUROPE: CLASSIFICATION OF DEVICES

- 5.9.3 ASIA PACIFIC

- 5.9.3.1 China

- 5.9.3.2 Japan

- TABLE 10 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.9.3.3 India

- 5.9.4 LATIN AMERICA

- 5.9.4.1 Brazil

- 5.9.5 MIDDLE EAST

- 5.10 TRADE ANALYSIS

- 5.10.1 TRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

- TABLE 11 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 12 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 13 BLOOD SCREENING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS (2023 -2024)

- 5.13 PESTLE ANALYSIS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14.1 REVENUE SHIFT IN BLOOD SCREENING MARKET

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BLOOD SCREENING PRODUCTS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BLOOD SCREENING PRODUCTS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR BLOOD SCREENING PRODUCTS

- TABLE 15 KEY BUYING CRITERIA, BY PRODUCT & SERVICE

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: OPTIMIZATION OF HBSAG QUANTITATIVE ELISA

- 5.16.2 CASE STUDY 2: CLINICAL EFFICACY OF NAT WITH ELISA

6 BLOOD SCREENING MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- TABLE 16 BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- 6.2 REAGENTS & KITS

- TABLE 17 KEY PRODUCTS FOR REAGENTS & KITS

- TABLE 18 BLOOD SCREENING MARKET FOR REAGENTS & KITS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 19 BLOOD SCREENING MARKET FOR REAGENTS & KITS, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.1 NAT REAGENTS & KITS

- 6.2.1.1 High sensitivity to drive market

- TABLE 20 KEY PRODUCTS FOR NAT REAGENTS & KITS

- TABLE 21 BLOOD SCREENING MARKET FOR NAT REAGENTS & KITS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 BLOOD SCREENING MARKET FOR NAT REAGENTS & KITS, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.2 ELISA REAGENTS & KITS

- 6.2.2.1 Ease of use and cost-effectiveness to drive market

- TABLE 23 KEY PRODUCTS FOR ELISA REAGENTS & KITS

- TABLE 24 BLOOD SCREENING MARKET FOR ELISA REAGENTS & KITS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 25 BLOOD SCREENING MARKET FOR ELISA REAGENTS & KITS, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.3 OTHER REAGENTS & KITS

- TABLE 26 KEY PRODUCTS FOR OTHER REAGENTS & KITS

- TABLE 27 BLOOD SCREENING MARKET FOR OTHER REAGENTS & KITS, BY REGION, 2021-2028 (USD MILLION)

- 6.3 INSTRUMENTS

- TABLE 28 KEY PRODUCTS FOR INSTRUMENTS

- TABLE 29 BLOOD SCREENING MARKET FOR INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 30 BLOOD SCREENING MARKET FOR INSTRUMENTS, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- 6.3.1 RENTAL PURCHASE

- 6.3.1.1 Reduced liability with limited financial losses to propel market

- TABLE 31 BLOOD SCREENING MARKET FOR RENTAL PURCHASE INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- 6.3.2 OUTRIGHT PURCHASE

- 6.3.2.1 Availability of government support to drive market

- TABLE 32 BLOOD SCREENING MARKET FOR OUTRIGHT PURCHASE INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- 6.4 SOFTWARE & SERVICES

- 6.4.1 RISING DEMAND ACROSS EMERGING ECONOMIES TO SUPPORT MARKET GROWTH

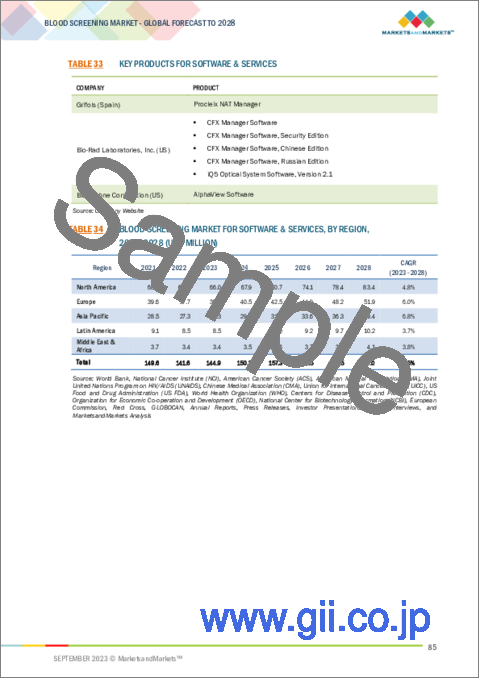

- TABLE 33 KEY PRODUCTS FOR SOFTWARE & SERVICES

- TABLE 34 BLOOD SCREENING MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021-2028 (USD MILLION)

7 BLOOD SCREENING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 35 BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 NUCLEIC ACID TESTS (NAT)

- TABLE 36 KEY PRODUCTS IN NAT MARKET

- TABLE 37 BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- 7.2.1 TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA)

- 7.2.1.1 High sensitivity to support market growth

- TABLE 39 BLOOD SCREENING MARKET FOR TMA, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 REAL-TIME POLYMERASE CHAIN REACTION (RT-PCR)

- 7.2.2.1 Elimination of contamination risks to propel market

- TABLE 40 BLOOD SCREENING MARKET FOR RT-PCR, BY REGION, 2021-2028 (USD MILLION)

- 7.3 SEROLOGY/IMMUNOASSAYS

- TABLE 41 KEY PRODUCTS FOR SEROLOGY/IMMUNOASSAYS

- TABLE 42 BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- 7.3.1 CHEMILUMINESCENT IMMUNOASSAYS (CLIA)

- 7.3.1.1 Ultra-sensitive and automated features to drive market

- TABLE 44 BLOOD SCREENING MARKET FOR CHEMILUMINESCENT IMMUNOASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2 FLUORESCENT IMMUNOASSAYS (FIA)

- 7.3.2.1 Rising demand for safe & stable reagents to propel market

- TABLE 45 BLOOD SCREENING MARKET FOR FLUORESCENT IMMUNOASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.3 COLORIMETRIC IMMUNOASSAYS/ELISA (CI/ELISA)

- 7.3.3.1 Qualitative and quantitative antigen measurement for blood serum to drive market

- TABLE 46 BLOOD SCREENING MARKT FOR COLORIMETRIC IMMUNOASSAYS/ELISA, BY REGION, 2021-2028 (USD MILLION)

- 7.4 RAPID TESTS

- 7.4.1 HIGH EFFICIENCY IN POC DIAGNOSTICS TO PROPEL MARKET

- TABLE 47 KEY PRODUCTS FOR RAPID TESTS

- TABLE 48 BLOOD SCREENING MARKET FOR RAPID TESTS, BY REGION, 2021-2028 (USD MILLION)

- 7.5 WESTERN BLOT ASSAYS

- 7.5.1 ABILITY TO DETECT RETROVIRUS ANTIBODIES TO DRIVE MARKET

- TABLE 49 KEY PRODUCTS FOR WESTERN BLOT ASSAYS

- TABLE 50 BLOOD SCREENING MARKET FOR WESTERN BLOT ASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.6 NEXT-GENERATION SEQUENCING (NGS)

- 7.6.1 EMERGING TECHNOLOGY FOR HIV TESTING TO SUPPORT MARKET GROWTH

- TABLE 51 BLOOD SCREENING MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2021-2028 (USD MILLION)

8 BLOOD SCREENING MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 52 BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 BLOOD BANKS

- 8.2.1 RISING INCIDENCE OF CHRONIC DISEASES TO DRIVE MARKET

- TABLE 53 BLOOD SCREENING MARKET FOR BLOOD BANKS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 HOSPITALS

- 8.3.1 INCREASING SURGICAL PROCEDURES TO PROPEL MARKET

- TABLE 54 BLOOD SCREENING MARKET FOR HOSPITALS, BY REGION, 2021-2028 (USD MILLION)

9 BLOOD SCREENING MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 55 BLOOD SCREENING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 23 NORTH AMERICA: BLOOD SCREENING MARKET SNAPSHOT

- TABLE 56 NORTH AMERICA: BLOOD SCREENING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 US

- 9.2.2.1 Increasing prevalence of HIV and chronic diseases to drive market

- TABLE 64 US: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 65 US: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 US: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 67 US: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 68 US: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 US: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 70 US: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Rising volume of surgical procedures to drive market

- TABLE 71 CANADA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 72 CANADA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 CANADA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 74 CANADA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 75 CANADA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 CANADA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 77 CANADA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- TABLE 78 EUROPE: BLOOD SCREENING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 EUROPE: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 85 EUROPE: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 EUROPE: RECESSION IMPACT

- 9.3.2 GERMANY

- 9.3.2.1 High incidence of cancer to drive market

- TABLE 86 GERMANY: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 87 GERMANY: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 GERMANY: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 89 GERMANY: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 90 GERMANY: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 GERMANY: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 92 GERMANY: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growing cases of HIV to propel market

- TABLE 93 FRANCE: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 94 FRANCE: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 FRANCE: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 96 FRANCE: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 97 FRANCE: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 FRANCE: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 99 FRANCE: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 UK

- 9.3.4.1 Favorable government support for infectious disease screening to drive market

- TABLE 100 UK: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 101 UK: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 UK: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 103 UK: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 104 UK: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 UK: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 106 UK: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Growing number of blood donors to support market growth

- TABLE 107 ITALY: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 108 ITALY: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 ITALY: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 110 ITALY: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 111 ITALY: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 ITALY: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 113 ITALY: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Rising adoption of NAT technology to propel market

- TABLE 114 SPAIN: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 115 SPAIN: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 SPAIN: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 117 SPAIN: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 118 SPAIN: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 SPAIN: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 120 SPAIN: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 121 GDP EXPENDITURE ON HEALTHCARE, BY COUNTRY (%)

- TABLE 122 REST OF EUROPE: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 REST OF EUROPE: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 127 REST OF EUROPE: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: BLOOD SCREENING MARKET SNAPSHOT

- TABLE 129 ASIA PACIFIC: BLOOD SCREENING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- 9.4.2 CHINA

- 9.4.2.1 High burden of infectious diseases to drive market

- TABLE 137 CHINA: KEY MACROINDICATORS

- TABLE 138 CHINA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 139 CHINA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 CHINA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 141 CHINA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 142 CHINA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 CHINA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 144 CHINA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Growing adoption of advanced blood screening technologies to drive market

- TABLE 145 JAPAN: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 146 JAPAN: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 JAPAN: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 148 JAPAN: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 149 JAPAN: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 JAPAN: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 151 JAPAN: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Increasing road accidents to support market growth

- TABLE 152 INDIA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 153 INDIA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 INDIA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 155 INDIA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 156 INDIA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 INDIA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 158 INDIA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increasing cases of leukemia to drive market

- TABLE 159 AUSTRALIA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 160 AUSTRALIA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 AUSTRALIA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 162 AUSTRALIA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 163 AUSTRALIA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 AUSTRALIA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 165 AUSTRALIA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 166 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 173 LATIN AMERICA: BLOOD SCREENING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 LATIN AMERICA: RECESSION IMPACT

- 9.5.2 BRAZIL

- 9.5.2.1 Growing cancer burden to support market growth

- TABLE 181 INCIDENCE OF CANCERS IN BRAZIL, 2020 VS. 2025

- TABLE 182 BRAZIL: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 183 BRAZIL: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 BRAZIL: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 185 BRAZIL: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 186 BRAZIL: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 BRAZIL: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 188 BRAZIL: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 Rising blood donations to support market growth

- TABLE 189 MEXICO: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 190 MEXICO: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 191 MEXICO: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 192 MEXICO: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 193 MEXICO: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 194 MEXICO: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 195 MEXICO: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 196 REST OF LATIN AMERICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RISING SURGICAL PROCEDURES DUE TO CHRONIC DISEASES TO FUEL MARKET

- TABLE 203 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021-2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021-2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES OF KEY PLAYERS

- 10.2.1 BLOOD SCREENING MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

- TABLE 210 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 25 REVENUE SHARE ANALYSIS OF LEADING PLAYERS IN BLOOD SCREENING MARKET

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 BLOOD SCREENING MARKET

- FIGURE 26 MARKET SHARE ANALYSIS BY KEY PLAYER (2022)

- TABLE 211 BLOOD SCREENING MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 LIST OF EVALUATED VENDORS

- 10.5.2 STARS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PERVASIVE PLAYERS

- 10.5.5 PARTICIPANTS

- FIGURE 27 BLOOD SCREENING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 STARTING BLOCKS

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 28 BLOOD SCREENING MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 10.7 COMPETITIVE BENCHMARKING

- 10.7.1 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

- FIGURE 29 BLOOD SCREENING MARKET: PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

- TABLE 212 BLOOD SCREENING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 213 BLOOD SCREENING MARKET: COMPANY PRODUCT & SERVICE FOOTPRINT ANALYSIS

- TABLE 214 BLOOD SCREENING MARKET: COMPANY REGIONAL FOOTPRINT ANALYSIS

- TABLE 215 BLOOD SCREENING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 216 BLOOD SCREENING MARKET: KEY PRODUCT LAUNCHES & APPROVALS (JANUARY 2020-SEPTEMBER 2023)

- 10.8.2 DEALS

- TABLE 217 BLOOD SCREENING MARKET: KEY DEALS (JANUARY 2020-SEPTEMBER 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 F. HOFFMANN-LA ROCHE LTD.

- TABLE 218 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- FIGURE 30 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- 11.1.2 GRIFOLS, S.A.

- TABLE 219 GRIFOLS, S.A.: BUSINESS OVERVIEW

- FIGURE 31 GRIFOLS S.A.: COMPANY SNAPSHOT (2022)

- 11.1.3 ABBOTT LABORATORIES

- TABLE 220 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- FIGURE 32 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- 11.1.4 BIO-RAD LABORATORIES, INC.

- TABLE 221 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 33 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- 11.1.5 DIASORIN

- TABLE 222 DIASORIN: BUSINESS OVERVIEW

- FIGURE 34 DIASORIN: COMPANY SNAPSHOT (2022)

- 11.1.6 BIOMERIEUX

- TABLE 223 BIOMERIEUX: BUSINESS OVERVIEW

- FIGURE 35 BIOMERIEUX: COMPANY SNAPSHOT (2022)

- 11.1.7 BD

- TABLE 224 BD: BUSINESS OVERVIEW

- FIGURE 36 BD: COMPANY SNAPSHOT (2022)

- 11.1.8 DANAHER (BECKMAN COULTER, INC.)

- TABLE 225 DANAHER: BUSINESS OVERVIEW

- FIGURE 37 DANAHER: COMPANY SNAPSHOT (2022)

- 11.1.9 HOLOGIC, INC.

- TABLE 226 HOLOGIC, INC.: BUSINESS OVERVIEW

- FIGURE 38 HOLOGIC, INC.: COMPANY SNAPSHOT (2022)

- 11.1.10 SIEMENS HEALTHINEERS AG

- TABLE 227 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- FIGURE 39 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2022)

- 11.1.11 THERMO FISHER SCIENTIFIC, INC.

- TABLE 228 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 40 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- 11.2 OTHER PLAYERS

- 11.2.1 ORTHO CLINICAL DIAGNOSTICS

- 11.2.2 MERCK KGAA

- 11.2.3 REVVITY (PART OF PERKINELMER INC.)

- 11.2.4 BIO-TECHNE

- 11.2.5 GFE

- 11.2.6 TRINITY BIOTECH

- 11.2.7 J. MITRA & CO. PVT. LTD.

- 11.2.8 MINDRAY

- 11.2.9 MACCURA BIOTECHNOLOGY CO., LTD.

- 11.2.10 IMMUCOR, INC.

- 11.2.11 CELLABS

- 11.2.12 ABNOVA CORPORATION

- 11.2.13 ENZO BIOCHEM, INC.

- 11.2.14 TULIP DIAGNOSTICS PVT. LTD.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS