|

|

市場調査レポート

商品コード

1859657

発電機の世界市場 (~2030年):燃料タイプ (ディーゼル・ガス・LPG・バイオ燃料)・定格出力 (50kW以下・51~280kW・281~500kW・501~2,000kW・2,001~3,500kW・3,500kW超)・用途・エンドユーザー・設計・販売チャネル・地域別Generator Market by Fuel Type (Diesel, Gas, LPG, Biofuel), Power Rating (Up to 50 kW, 51-280 kW, 281-500 kW, 501-2,000 kW, 2,001-3,500 kW, Above 3,500 kW), Application, End User, Design, Sales Channel, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 発電機の世界市場 (~2030年):燃料タイプ (ディーゼル・ガス・LPG・バイオ燃料)・定格出力 (50kW以下・51~280kW・281~500kW・501~2,000kW・2,001~3,500kW・3,500kW超)・用途・エンドユーザー・設計・販売チャネル・地域別 |

|

出版日: 2025年10月22日

発行: MarketsandMarkets

ページ情報: 英文 390 Pages

納期: 即納可能

|

概要

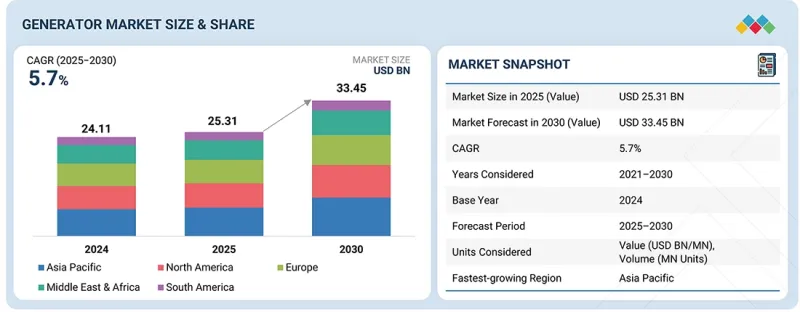

発電機の市場規模は、2025年の253億1,000万米ドルから、予測期間中はCAGR 5.7%で推移し、2030年には334億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) ・数量 (ユニット) |

| セグメント | 燃料タイプ、用途、販売チャネル、設計、エンドユーザー、定格出力、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

無停電で信頼性の高い電力供給への需要の増加、急速な産業化、拡大を続ける製造業が、発電機需要の拡大を後押ししています。さらに、再生可能エネルギーの導入促進やエネルギー効率向上に関する政府の支援政策や優遇措置が、産業・商業分野での導入を促進し、市場全体の成長を加速させています。

"燃料タイプ別では、燃料電池の部門が2025年から2030年の間で最も高いCAGRを記録する見込み"

燃料電池発電機は、高効率かつクリーンな発電を実現できる点から、世界的に注目を集めています。これらのシステムは電気化学的反応によって電力を生成し、排出物が極めて少ないことから、持続可能かつ分散型エネルギー生産の理想的な手段です。燃料電池技術の進歩と再生可能水素の供給拡大が、産業・商業・住宅用途での導入を加速させています。世界各国が脱炭素化とエネルギー転換目標を重視する中、水素燃料電池発電機の需要は今後大幅に増加する見通しです。これらのシステムは、よりクリーンで強靭かつ持続可能な電力インフラの形成において極めて重要な役割を果たしています。

"エンドユーザー別では、商用部門が2025年に第2位のエンドユーザー部門になる見通し"

これは事業活動の継続に不可欠な無停電電力供給の必要性が高まっているためです。IT&通信、医療、データセンター、ホスピタリティ、小売、公共インフラなど、多様な商業分野において、信頼性の高いバックアップ電源の需要が拡大しています。これらの業界では、わずかな停電であっても大きな経済的損失、データ障害、安全上のリスクを引き起こす可能性があるため、発電機は業務の継続性と運用の安定性を確保するための不可欠な設備です。特に電力需要のピーク時や電力網の信頼性が不安定な地域では、発電機の重要性が一層高まっています。安定した連続電力供給を提供することで、発電機は事業資産の保護、ダウンタイムの最小化、運用効率の向上に寄与しており、商業分野全体における生産性維持の要として機能しています。

"アジア太平洋地域では、中国が予測期間中に最も高いCAGRを示す見通し"

中国は、構造的・経済的・人口動態的要因が相まって、世界で最も高い成長率を示す発電機市場となっています。膨大な消費者基盤に加え、国内外の有力メーカーの強力な存在感が市場を牽引しています。急速な都市化と農村から都市への人口移動が進む中で、堅固なインフラ整備への需要が高まり、それに伴い、安定的で信頼性の高い電力供給の確保が不可欠になっています。都市の拡大や産業ゾーンの増加により、連続電力およびバックアップ電力の需要は急速に高まっており、建設現場、製造施設、商業複合施設、エネルギー集約型都市インフラなど、あらゆる分野で発電機の需要が拡大しています。こうした傾向は、中国におけるインフラ開発と産業近代化の推進を支える原動力となっており、同国の発電機市場成長を今後も力強く後押しすると見られています。

当レポートでは、世界の発電機の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズと空白

- 相互接続された市場と分野横断的な機会

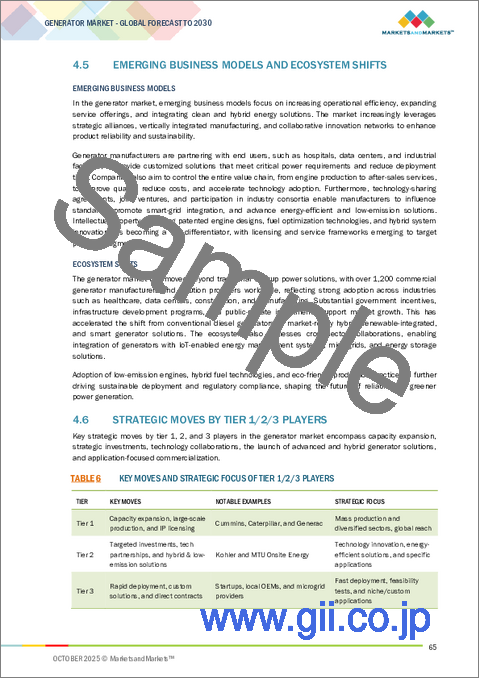

- 新たなビジネスモデルとエコシステムの変化

- ティア1/2/3プレイヤーの戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 2025-2026年の主な会議とイベント

- 顧客の事業に影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税が発電機市場に与える影響

第6章 技術の進歩、AIによる影響、特許、イノベーション、将来の応用

- 主要な新興技術

- 補完的技術

- 技術/製品ロードマップ

- 特許分析

- 将来の応用

- AI/生成AIが発電機市場に与える影響

第7章 持続可能性と規制状況

- 地域の規制とコンプライアンス

- 持続可能性への取り組み

- 持続可能性への影響と規制政策の取り組み

- 認証、ラベル、環境基準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購入の利害関係者と購入評価基準

- 採用の障壁と内部課題

- さまざまなエンドユーザー産業からのアンメットニーズ

- 市場収益性

第9章 燃料別発電機市場

- ディーゼル

- ガス

- LPG

- バイオ燃料

- 石炭ガス

- ガソリン

- プロデューサーガス

- 燃料電池

第10章 発電機市場:設計別

- 据置型

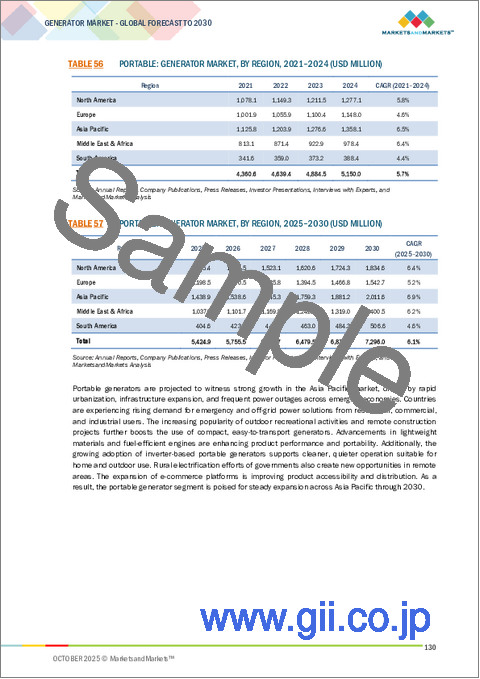

- 可搬型

第11章 発電機市場:出力別

- ~50kW

- ~10kW

- 11~20kW

- 21~30kW

- 31~40kW

- 41~50kW

- 51~280kW

- 281~500kW

- 501~2,000kW

- 2,001~3,500kW

- 3,500KW超

第12章 発電機市場:販売チャネル別

- 直接

- 間接

第13章 発電機市場:用途別

- 待機用 (スタンバイ)

- 主力・連続運転用 (プライム&コンティニュアス)

- ピークシェービング

第14章 発電機市場:エンドユーザー別

- 産業用

- 公益事業/発電

- 石油・ガス

- 化学・石油化学

- 金属・鉱業

- 製造

- 海運

- 建設

- その他

- 住宅

- 商用

- ヘルスケア

- IT・通信

- データセンター

- その他

第15章 発電機市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- ロシア

- フランス

- 英国

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- ニュージーランド

- インドネシア

- その他

- 中東・アフリカ

- GCC

- 南アフリカ

- ナイジェリア

- アルジェリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- CATERPILLAR

- CUMMINS INC.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ROLLS-ROYCE PLC

- GENERAC POWER SYSTEMS, INC.

- WARTSILA

- WACKER NEUSON SE

- SIEMENS ENERGY

- ATLAS COPCO AB

- KIRLOSKAR

- GREAVES COTTON LIMITED

- EVERLLENCE

- BRIGGS & STRATTON

- REHLKO

- AKSA POWER GENERATION

- その他の企業

- HONDA INDIA POWER PRODUCTS LTD.

- DOOSAN PORTABLE POWER

- MULTIQUIP INC.

- TAYLOR GROUP INC.

- AB VOLVO PENTA

- SHANGHAI NEW POWER AUTOMOTIVE TECHNOLOGY COMPANY LIMITED

- DEERE & COMPANY

- AGGREKO

- DENYO CO., LTD

- YANMAR HOLDINGS CO., LTD.