|

|

市場調査レポート

商品コード

1376866

分取・プロセスクロマトグラフィの世界市場 (~2028年):タイプ (分取クロマトグラフィ (化学品&試薬・樹脂・カラム・システム・サービス)・プロセスクロマトグラフィ)・エンドユーザー・地域別Preparative and Process Chromatography Market by Type (Preparative Chromatography (Chemicals & Reagents, Resins, Columns, Systems, Services), Process Chromatography), End User & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 分取・プロセスクロマトグラフィの世界市場 (~2028年):タイプ (分取クロマトグラフィ (化学品&試薬・樹脂・カラム・システム・サービス)・プロセスクロマトグラフィ)・エンドユーザー・地域別 |

|

出版日: 2023年11月03日

発行: MarketsandMarkets

ページ情報: 英文 263 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

報告書概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 検討単位 | 金額 (米ドル) |

| セグメント | タイプ・エンドユーザー |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

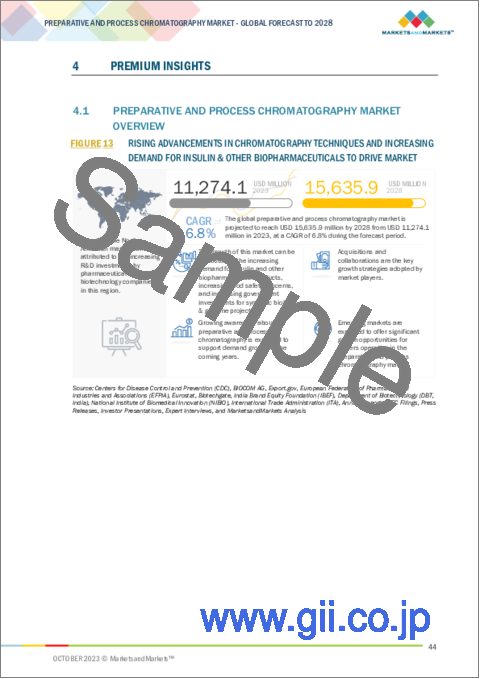

世界の分取・プロセスクロマトグラフィの市場規模は、2023年の113億米ドルから、予測期間中は6.8%のCAGRで推移し、2028年には156億米ドルの規模に成長すると予測されています。

同市場の成長は、オメガ3脂肪酸に対するニーズの高まり、食品の安全性に対する関心の高まり、製薬・バイオテクノロジー関連のR&Dや研究プロジェクトに対する政府による投資などが主な要因となっています。一方で、分取・プロセスクロマトグラフィシステムのコスト高や再生品のアベイラビリティに関連する課題が市場の成長を抑制しています。

タイプ別では、プロセスクロマトグラフィの部門が予測期間中、最大のシェアを示す見通しです。同部門の大きなシェアは、医薬品の製造額が伸びていることと、バイオテクノロジー産業への投資が増加していることに起因しています。また、エンドユーザー別では、製薬&バイオテクノロジーの部門が2022年の市場をリードし、予測期間中も最大のCAGRを示す見通しです。同部門の大きなシェアは、主に研究活動の増加に起因しています。さらに、地域別では、北米地域が予測期間中に最大のシェアを示す見通しです。技術的に高度な分取・プロセスクロマトグラフィ製品の存在と、製薬・バイオテクノロジー業界における進歩の増加が、同地域の成長を支えています。

当レポートでは、世界の分取・プロセスクロマトグラフィの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 価格分析

- バリューチェーン分析

- エコシステム/市場マップ

- ポーターのファイブフォース分析

- サプライチェーン分析

- 関税と規制状況

- 特許分析

- 貿易分析

- 主な会議とイベント

- 顧客の事業に影響を与える動向/ディスラプション

- 主なステークホルダーと購入基準

第6章 分取・プロセスクロマトグラフィ市場:タイプ別

- プロセスクロマトグラフィ

- 分取クロマトグラフィ

第7章 分取・プロセスクロマトグラフィ市場:エンドユーザー別

- 製薬・バイオテクノロジー産業

- 食品・栄養補助食品産業

- 調査

第8章 分取・プロセスクロマトグラフィ市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第9章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオと動向

第10章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- DANAHER

- MERCK KGAA

- BIO-RAD LABORATORIES, INC.

- SARTORIUS AG

- AGILENT TECHNOLOGIES

- SHIMADZU CORPORATION

- WATERS CORPORATION

- DAICEL CORPORATION

- PERKINELMER, INC.

- HITACHI HIGH-TECH CORPORATION

- GL SCIENCES INC.

- REPLIGEN CORPORATION

- TRAJAN SCIENTIFIC AND MEDICAL

- その他の企業

- HAMILTON COMPANY

- KNAUER WISSENSCHAFTLICHE GERATE GMBH

- JASCO

- GILSON, INC.

- RESTEK CORPORATION

- SCION INSTRUMENTS

- OROCHEM TECHNOLOGIES INC.

- SRI INSTRUMENTS

- SEPRAGEN CORPORATION

- TOSOH CORPORATION

- PUROLITE

- BIO-WORKS TECHNOLOGIES AB

- BRUKER CORPORATION

- ACE LABORATORIES LLC

- TELEDYNE ANALYTICAL INSTRUMENTS

第11章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Type and End User |

| Regions covered | North America, Europe, Asia Pacific, Rest of the World |

The global preparative and process chromatography market is projected to reach USD 15.6 billion by 2028 from USD 11.3 billion in 2023, at a CAGR of 6.8% during the forecast period. The growth of this market is majorly driven by growing need for omega-3 fatty acids, rising concerns for food safety, and government investments in pharma & biotech R&D and research projects. However, issues related higher cost of preparative and process chromatography systems and availability of refurbished products restrain the growth of the preparative and process chromatography market.

"Process chromatography segment accounted for the highest market share in the preparative and process chromatography market, by type, during the forecast period."

Based on type, the preparative and process chromatography market is classified into preparative chromatography and process chromatography. Each segment has been further divided based on product and service. The process chromatography segment dominated the market in 2022. The large share of the segment can be attributed to the growing production value of pharmaceutical products and rise in investments in the biotech industry.

"Pharmaceutical & biotechnology industries accounted for the highest CAGR during the forecast period."

Based on the end user, the preparative and process chromatography market is segmented into pharmaceutical & biotechnology industries, food & nutraceutical industries, and research laboratories. The pharmaceutical & biotechnology industries segment dominated the preparative and process chromatography market in 2022. The large share of this segment can be primarily attributed to the rise in research activities.

"The North America segment accounted for the highest market share in the preparative and process chromatography market, by region, during the forecast period."

Based on the region, the global preparative and process chromatography market is categorized into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to witness a high market share during the forecast period. The presence of technologically advanced preparative and process chromatography products and the increasing advancement in the pharmaceutical and biotechnology industries are supporting the growth of the preparative and process chromatography market.

Breakdown of supply-side primary interviews by company type, designation, and region:

- By Company Type: Tier 1 (30%), Tier 2 (48%), and Tier 3 (22%)

- By Designation: C-level (28%), Director-level (33%), and Others (39%)

- By Region: North America (21%), Europe (30%), Asia- Pacific (34%), and RoW (15%)

Prominent companies include Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), Agilent Technologies (US), Shimadzu Corporation (Japan), Waters Corporation (France), Daicel Corporation (Japan), PerkinElmer, Inc. (US), Hitachi High-Tech Corporation (Japan), GL Sciences, Inc. (Japan), Sartorius AG (Germany), Repligen Corporation (US), Trajan Scientific and Medical (Australia), Hamilton Company (US), KNAUER Wissenschaftliche Gerate GmbH (Germany), Gilson, Inc. (US), Restek Corporation (US), SCION Instruments (The Netherlands), Orochem Technologies Inc. (US), Sepragen Corporation (US), JASCO (US), Tosoh Corporation (Japan), Purolite (US), Bio-Works Technologies AB (Sweden), Bruker Corporation (US), ACE Laboratories LLC (US), and Teledyne Analytical Instruments (US).

Research Coverage

This research report categorizes the preparative and process chromatography market by type, end-user, and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the preparative and process chromatography market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the preparative and process chromatography market. Competitive analysis of upcoming startups in the preparative and process chromatography market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall preparative and process chromatography market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the preparative and process chromatography market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the preparative and process chromatography market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the preparative and process chromatography market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the preparative and process chromatography market

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), and Bio-Rad Laboratories, Inc. (US), among others in the preparative and process chromatography market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET - REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC INC.

- FIGURE 6 BOTTOM-UP APPROACH: REVENUE-BASED APPROACH

- 2.2.1 GROWTH FORECAST

- 2.2.2 CAGR PROJECTIONS

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 8 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.5.1 LIMITATIONS

- 2.5.2 RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 10 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET OVERVIEW

- FIGURE 13 RISING ADVANCEMENTS IN CHROMATOGRAPHY TECHNIQUES AND INCREASING DEMAND FOR INSULIN & OTHER BIOPHARMACEUTICALS TO DRIVE MARKET

- 4.2 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT (2022)

- FIGURE 14 PROCESS CHROMATOGRAPHY SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.3 REGIONAL GROWTH OPPORTUNITIES IN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

- FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: REGIONAL MIX

- FIGURE 16 ASIA PACIFIC MARKET TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- 4.5 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

- FIGURE 17 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for insulin and other biopharmaceutical products

- 5.2.1.2 High demand for omega-3 fatty acids

- 5.2.1.3 Increasing food safety concerns

- TABLE 4 PERFORMANCE OF COUNTRIES BASED ON FOOD SECURITY SCORE, 2022

- 5.2.1.4 Increasing government investments in synthetic biology and genome projects

- 5.2.1.5 Increasing use of LC-MS in analytics and research

- TABLE 5 APPLICATIONS OF LC-MS, BY INDUSTRY

- 5.2.1.6 Rising demand for biosimilars

- TABLE 6 KEY BIOLOGICS UNDER THREAT OF PATENT EXPIRY

- 5.2.1.7 Growing demand for disposable prepacked columns

- TABLE 7 ADVANTAGES OF PREPACKED COLUMNS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of instruments

- 5.2.2.2 Presence of alternative methods and techniques

- 5.2.2.3 Availability of refurbished products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for mAbs

- 5.2.3.2 Technological advancements

- 5.2.3.3 Growth opportunities in emerging markets

- 5.2.3.4 Rise of CMOs and CROs in pharmaceutical industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals

- 5.2.4.2 Technical limitations associated with chromatography

- TABLE 8 LIMITATIONS ASSOCIATED WITH CHROMATOGRAPHY

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 PRICING ANALYSIS

- TABLE 9 AVERAGE SELLING PRICES OF KEY PLAYERS (USD)

- TABLE 10 AVERAGE SELLING PRICES OF KEY PRODUCT TYPES

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 19 PREPARATIVE AND PROCESS CHROMATOGRAPHY: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 20 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: ECOSYSTEM MARKET MAP

- 5.6.1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: ROLE IN ECOSYSTEM

- FIGURE 21 KEY PLAYERS IN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 22 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: SUPPLY CHAIN ANALYSIS

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 REGULATORY ANALYSIS

- 5.9.1.1 US

- 5.9.1.2 Europe

- 5.9.1.3 Emerging markets

- 5.9.1 REGULATORY ANALYSIS

- 5.10 PATENT ANALYSIS

- FIGURE 23 PATENT ANALYSIS FOR CHROMATOGRAPHY COLUMNS (JANUARY 2013-DECEMBER 2022)

- 5.10.1 LIST OF KEY PATENTS

- 5.11 TRADE ANALYSIS

- TABLE 12 EXPORT DATA FOR CHROMATOGRAPHS AND ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 13 IMPORT DATA FOR CHROMATOGRAPHS AND ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 KEY CONFERENCES AND EVENTS IN 2023/2024/2025

- TABLE 14 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT IN PREPARATIVE AND PROCESS CHROMATOGRAPHY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- 5.14.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

- TABLE 16 KEY BUYING CRITERIA FOR PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

6 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 17 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 PROCESS CHROMATOGRAPHY

- 6.2.1 PROCESS CHROMATOGRAPHY TO HOLD LARGEST SHARE

- TABLE 18 PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 PROCESS CHROMATOGRAPHY, BY PRODUCT & SERVICE

- TABLE 19 PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- 6.2.2.1 Chemicals & reagents

- TABLE 20 PROCESS CHROMATOGRAPHY CHEMICALS & REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.2 Resins

- TABLE 21 PROCESS CHROMATOGRAPHY RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 PROCESS CHROMATOGRAPHY RESINS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.2.2.1 Affinity resins

- 6.2.2.2.1.1 Wide usage in purification to drive market

- 6.2.2.2.1 Affinity resins

- TABLE 23 PROCESS CHROMATOGRAPHY AFFINITY RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.2.2 Protein A resins

- 6.2.2.2.2.1 Improved efficiency, growing demand, and integration of supply chains to drive market

- 6.2.2.2.2 Protein A resins

- TABLE 24 PROCESS CHROMATOGRAPHY PROTEIN A RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.2.3 Hydrophobic interaction resins

- 6.2.2.2.3.1 Wide applications, high binding capacity to support adoption

- 6.2.2.2.3 Hydrophobic interaction resins

- TABLE 25 PROCESS CHROMATOGRAPHY HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.2.4 Ion exchange resins

- 6.2.2.2.4.1 Product development initiatives by market players to support growth

- 6.2.2.2.4 Ion exchange resins

- TABLE 26 PROCESS CHROMATOGRAPHY ION EXCHANGE RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.2.5 Mixed-mode/Multimode resins

- 6.2.2.2.5.1 Advantages in handling challenging target molecules to drive demand

- 6.2.2.2.5 Mixed-mode/Multimode resins

- TABLE 27 PROCESS CHROMATOGRAPHY MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.3 Columns

- TABLE 28 PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.2.3.1 Prepacked columns

- 6.2.2.3.1.1 Advantages in time and labor management to support demand growth

- 6.2.2.3.1 Prepacked columns

- TABLE 29 PROCESS CHROMATOGRAPHY PREPACKED COLUMNS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.3.2 Empty columns

- 6.2.2.3.2.1 Low cost, easy availability, and convenience to drive demand

- 6.2.2.3.2 Empty columns

- TABLE 30 EMPTY PROCESS CHROMATOGRAPHY COLUMNS OFFERED BY MARKET PLAYERS

- TABLE 31 PROCESS CHROMATOGRAPHY EMPTY COLUMNS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.4 Systems

- 6.2.2.4.1 Increasing demand for insulin and mAbs to drive market

- 6.2.2.4 Systems

- TABLE 32 PROCESS CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2.5 Services

- 6.2.2.5.1 Rising need for equipment qualification and validation to ensure market growth

- 6.2.2.5 Services

- TABLE 33 PROCESS CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

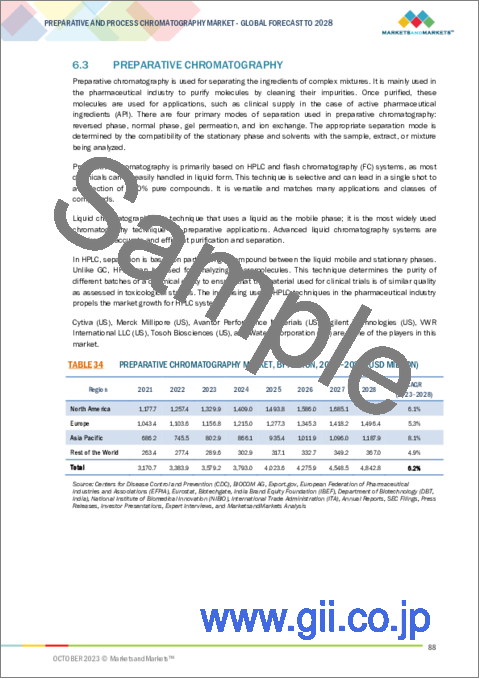

- 6.3 PREPARATIVE CHROMATOGRAPHY

- TABLE 34 PREPARATIVE CHROMATOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1 PREPARATIVE CHROMATOGRAPHY, BY PRODUCT & SERVICE

- TABLE 35 PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- 6.3.1.1 Chemicals & reagents

- 6.3.1.1.1 Rising demand for protein purification to drive market

- 6.3.1.1 Chemicals & reagents

- TABLE 36 PREPARATIVE CHROMATOGRAPHY CHEMICALS & REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.2 Resins

- TABLE 37 PREPARATIVE CHROMATOGRAPHY RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 PREPARATIVE CHROMATOGRAPHY RESINS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.3.1.2.1 Affinity resins

- 6.3.1.2.1.1 Affinity resins to hold large market share

- 6.3.1.2.1 Affinity resins

- TABLE 39 PREPARATIVE CHROMATOGRAPHY AFFINITY RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.2.2 Protein A resins

- 6.3.1.2.2.1 Highly selective binding and purification capabilities to drive adoption

- 6.3.1.2.2 Protein A resins

- TABLE 40 PREPARATIVE CHROMATOGRAPHY PROTEIN A RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.2.3 Hydrophobic interaction resins

- 6.3.1.2.3.1 Rigidity and unique surface chemistry to support adoption in high-throughput applications

- 6.3.1.2.3 Hydrophobic interaction resins

- TABLE 41 PREPARATIVE CHROMATOGRAPHY HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.2.4 Ion exchange resins

- 6.3.1.2.4.1 Selective binding and elution properties to boost demand

- 6.3.1.2.4 Ion exchange resins

- TABLE 42 PREPARATIVE CHROMATOGRAPHY ION EXCHANGE RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.2.5 Mixed-mode/Multimode resins

- 6.3.1.2.5.1 Wide applications in challenging purification processes to drive market

- 6.3.1.2.5 Mixed-mode/Multimode resins

- TABLE 43 PREPARATIVE CHROMATOGRAPHY MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.3 Columns

- TABLE 44 PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.3.1.3.1 Prepacked columns

- 6.3.1.3.1.1 Wide range of formats and sizes to ensure sustained demand

- 6.3.1.3.1 Prepacked columns

- TABLE 45 PREPARATIVE CHROMATOGRAPHY PREPACKED COLUMNS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.3.2 Empty columns

- 6.3.1.3.2.1 Customizability as per specific end-user needs to drive market

- 6.3.1.3.2 Empty columns

- TABLE 46 PREPARATIVE CHROMATOGRAPHY EMPTY COLUMNS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.4 Systems

- TABLE 47 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 48 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.4.1 Liquid chromatography systems

- 6.3.1.4.1.1 Flexibility and functionality to drive adoption

- 6.3.1.4.1 Liquid chromatography systems

- TABLE 49 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.4.2 Other chromatography systems

- TABLE 50 OTHER CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1.5 Services

- 6.3.1.5.1 Continued demand for equipment maintenance and qualification to support growth

- 6.3.1.5 Services

- TABLE 51 PREPARATIVE CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

7 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER

- 7.1 INTRODUCTION

- TABLE 52 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 7.2 PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES

- 7.2.1 INCREASING PHARMA & BIOTECH MANUFACTURING TO DRIVE MARKET

- TABLE 53 R&D EXPENDITURE OF MAJOR PHARMACEUTICAL COMPANIES, 2021 VS. 2022

- TABLE 54 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES, BY REGION, 2021-2028 (USD MILLION)

- 7.3 FOOD & NUTRACEUTICAL INDUSTRIES

- 7.3.1 RISING IMPORTANCE OF CHROMATOGRAPHY IN FOOD ANALYSIS & SEPARATION TO BOOST DEMAND

- TABLE 55 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR FOOD & NUTRACEUTICAL INDUSTRIES, BY REGION, 2021-2028 (USD MILLION)

- 7.4 RESEARCH LABORATORIES

- 7.4.1 RISING USE OF CHROMATOGRAPHY IN RESEARCH TO DRIVE MARKET

- TABLE 56 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR RESEARCH LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

8 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 57 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 27 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SNAPSHOT

- TABLE 58 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2.2 US

- 8.2.2.1 Increasing government investments and funding in biomedical research to support the market growth

- TABLE 65 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 US: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 67 US: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 US: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 69 US: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2.3 CANADA

- 8.2.3.1 Rising use of chromatography in food safety testing to drive market

- TABLE 71 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 72 CANADA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 73 CANADA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 CANADA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 75 CANADA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: RECESSION IMPACT

- TABLE 77 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.2 GERMANY

- 8.3.2.1 Growing biotechnology sector and high drug research to drive market

- TABLE 84 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 GERMANY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 86 GERMANY: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 GERMANY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 88 GERMANY: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Increasing investments in infrastructure development to drive market

- TABLE 90 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 FRANCE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 92 FRANCE: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 FRANCE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 94 FRANCE: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.4 UK

- 8.3.4.1 Rising academia-industry partnerships and research activities to drive market

- TABLE 96 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 UK: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 98 UK: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 UK: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 100 UK: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.5 ITALY

- 8.3.5.1 Growing biotech sector to support market growth

- TABLE 102 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 ITALY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 104 ITALY: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 ITALY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 106 ITALY: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.6 SPAIN

- 8.3.6.1 Availability of research funds and grants in Spain to boost the market growth in Spain

- TABLE 108 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 SPAIN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 110 SPAIN: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 SPAIN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 112 SPAIN: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.7 REST OF EUROPE

- TABLE 114 REST OF EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 28 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SNAPSHOT

- TABLE 120 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.2 CHINA

- 8.4.2.1 Investments by companies in innovative drugs to drive market

- TABLE 127 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 CHINA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 129 CHINA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 CHINA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 131 CHINA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.3 JAPAN

- 8.4.3.1 Government initiatives to drive the market

- TABLE 133 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 JAPAN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 135 JAPAN: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 JAPAN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 137 JAPAN: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.4 INDIA

- 8.4.4.1 Rising emphasis on food safety testing to support demand growth

- TABLE 139 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 INDIA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 141 INDIA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 INDIA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 143 INDIA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.5 REST OF ASIA PACIFIC

- TABLE 145 REST OF ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.5 REST OF THE WORLD

- 8.5.1 REST OF THE WORLD: RECESSION IMPACT

- TABLE 151 REST OF THE WORLD: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 152 REST OF THE WORLD: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 REST OF THE WORLD: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 154 REST OF THE WORLD: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 155 REST OF THE WORLD: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 156 REST OF THE WORLD: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.5.2 LATIN AMERICA

- 8.5.2.1 Growing biosimilar investments in Latin America to drive market

- TABLE 158 LATIN AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.5.3 MIDDLE EAST & AFRICA

- 8.5.3.1 Economic development and high prevalence of chronic conditions to support market growth

- TABLE 164 MIDDLE EAST & AFRICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: PROCESS CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 170 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PREPARATIVE AND PROCESS CHROMATOGRAPHY COMPANIES

- 9.3 REVENUE ANALYSIS

- FIGURE 29 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 9.4 MARKET SHARE ANALYSIS

- FIGURE 30 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RANKING ANALYSIS, BY KEY PLAYER (2022)

- TABLE 171 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DEGREE OF COMPETITION

- 9.5 COMPANY EVALUATION MATRIX

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- FIGURE 31 GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: COMPANY EVALUATION MATRIX, 2022

- 9.5.5 COMPANY FOOTPRINT

- TABLE 172 PRODUCT & SERVICE FOOTPRINT (29 PLAYERS)

- TABLE 173 REGIONAL FOOTPRINT (29 PLAYERS)

- TABLE 174 COMPANY FOOTPRINT (29 PLAYERS)

- 9.6 START-UP/SME EVALUATION MATRIX

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 STARTING BLOCKS

- 9.6.3 RESPONSIVE COMPANIES

- 9.6.4 DYNAMIC COMPANIES

- FIGURE 32 GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 9.6.5 COMPETITIVE BENCHMARKING

- TABLE 175 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 176 PRODUCT & SERVICE FOOTPRINT (START-UPS/SMES)

- TABLE 177 REGIONAL FOOTPRINT (START-UPS/SMES)

- TABLE 178 COMPANY FOOTPRINT (START-UPS/SMES)

- 9.7 COMPETITIVE SCENARIO AND TRENDS

- 9.7.1 PRODUCT LAUNCHES

- TABLE 179 PREPARATIVE AND PROCESS CHROMATOGRAPHY: PRODUCT LAUNCHES, JANUARY 2020- OCTOBER 2023

- 9.7.2 DEALS

- TABLE 180 PREPARATIVE AND PROCESS CHROMATOGRAPHY: DEALS, JANUARY 2020-OCTOBER 2023

- 9.7.3 OTHER DEVELOPMENTS

- TABLE 181 PREPARATIVE AND PROCESS CHROMATOGRAPHY: OTHER DEVELOPMENTS, JANUARY 2020-OCTOBER 2023

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 10.1.1 THERMO FISHER SCIENTIFIC INC.

- TABLE 182 THERMO FISHER SCIENTIFIC INC: COMPANY OVERVIEW

- FIGURE 33 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 10.1.2 DANAHER

- TABLE 183 DANAHER: COMPANY OVERVIEW

- FIGURE 34 DANAHER: COMPANY SNAPSHOT (2022)

- 10.1.3 MERCK KGAA

- TABLE 184 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 35 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 10.1.4 BIO-RAD LABORATORIES, INC.

- TABLE 185 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- FIGURE 36 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- 10.1.5 SARTORIUS AG

- TABLE 186 SARTORIUS AG: COMPANY OVERVIEW

- FIGURE 37 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- 10.1.6 AGILENT TECHNOLOGIES

- TABLE 187 AGILENT TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 38 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2022)

- 10.1.7 SHIMADZU CORPORATION

- TABLE 188 SHIMADZU CORPORATION: COMPANY OVERVIEW

- FIGURE 39 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.8 WATERS CORPORATION

- TABLE 189 WATERS CORPORATION: COMPANY OVERVIEW

- FIGURE 40 WATERS CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.9 DAICEL CORPORATION

- TABLE 190 DAICEL CORPORATION: COMPANY OVERVIEW

- FIGURE 41 DAICEL CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.10 PERKINELMER, INC.

- TABLE 191 PERKINELMER, INC.: COMPANY OVERVIEW

- FIGURE 42 PERKINELMER, INC.: COMPANY SNAPSHOT (2022)

- 10.1.11 HITACHI HIGH-TECH CORPORATION

- TABLE 192 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- FIGURE 43 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.12 GL SCIENCES INC.

- TABLE 193 GL SCIENCES, INC.: COMPANY OVERVIEW

- FIGURE 44 GL SCIENCES, INC.: COMPANY SNAPSHOT (2020)

- 10.1.13 REPLIGEN CORPORATION

- TABLE 194 REPLIGEN CORPORATION: COMPANY OVERVIEW

- FIGURE 45 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.14 TRAJAN SCIENTIFIC AND MEDICAL

- TABLE 195 TRAJAN SCIENTIFIC AND MEDICAL: COMPANY OVERVIEW

- FIGURE 46 TRAJAN SCIENTIFIC AND MEDICAL: COMPANY SNAPSHOT (2022)

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 HAMILTON COMPANY

- 10.2.2 KNAUER WISSENSCHAFTLICHE GERATE GMBH

- 10.2.3 JASCO

- 10.2.4 GILSON, INC.

- 10.2.5 RESTEK CORPORATION

- 10.2.6 SCION INSTRUMENTS

- 10.2.7 OROCHEM TECHNOLOGIES INC.

- 10.2.8 SRI INSTRUMENTS

- 10.2.9 SEPRAGEN CORPORATION

- 10.2.10 TOSOH CORPORATION

- 10.2.11 PUROLITE

- 10.2.12 BIO-WORKS TECHNOLOGIES AB

- 10.2.13 BRUKER CORPORATION

- 10.2.14 ACE LABORATORIES LLC

- 10.2.15 TELEDYNE ANALYTICAL INSTRUMENTS

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS